Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BLOCKBUSTER INC | d8k.htm |

Blockbuster Inc.

Annual Meeting of Stockholders

June 2010

Exhibit 99.1 |

| 2

Disclosure Regarding Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements may also be included from time to time in our other public

filings, press releases, our website and oral and written presentations by management.

Specific forward-looking statements can be identified by the fact that they do not relate strictly to

historical or current facts and include, without limitation, words such as “may,”

“will,” “expects,” “believes,” “anticipates,”

“plans,” “estimates,” “projects,” “predicts,” “targets,” “seeks,” “could,” “intends,” “foresees” or the

negative of such terms or other variations on such terms or comparable terminology. Similarly,

statements that describe our strategies, initiatives, objectives, plans or goals are

forward-looking. These forward-looking statements are based on management’s current intent, belief,

expectations, estimates and projections. These statements are not guarantees of future

performance and involve risks, uncertainties, assumptions and other factors that are difficult

to predict. Therefore, actual results may vary materially from what is expressed in or

indicated by the forward-looking statements. The risk factors set forth under “Item 1A. Risk Factors”

in our Annual Reports on Form 10-K and other matters discussed from time to time in our filings

with the Securities and Exchange Commission, including the “Disclosure Regarding

Forward-Looking Information” and “Risk Factors” sections of our Quarterly

Reports on Form 10-Q, among others, could affect future results, causing these results to

differ materially from those expressed in our forward-looking statements.

In the event that the risks disclosed in our public filings and those discussed above cause results to

differ materially from those expressed in our forward-looking statements, our business,

financial condition, results of operations or liquidity could be materially adversely affected

and investors in our securities could lose part or all of their investments. Accordingly,

our investors are cautioned not to place undue reliance on these forward-looking statements

because, while we believe the assumptions on which the forward-looking statements are based are

reasonable, there can be no assurance that these forward-looking statements will prove to be

accurate. Further, the forward-looking statements included in this presentation and those included from time

to time in our other public filings, press releases, our website and oral and written

presentations by management are only made as of the respective dates thereof. We

undertake no obligation to update publicly any forward-looking statement in this

presentation or in other documents, our website or oral statements for any reason, even if new

information becomes available or other events occur in the future.

|

3

Financial Accomplishments

Recapitalization: a work in progress…

Eliminated final $24 million in letters of credit (“LCs”) related

to Viacom

In total, released approximately $70 million in restricted

cash

from

LCs

to

enhance

liquidity

Completed two successful refinancing actions during an

extremely challenging credit market

$250 million amended revolving credit facility in May 2009

$675 million 11.75% senior secured notes offering,

reducing 2010 amortization payments by over $300 million

and extending debt maturities

Reduced G&A by $306 million for the full year of 2009

Maintained capital expenditures at $30 million per year

Continued to aggressively manage working capital

Refinancing

Eliminated LC

Related to Viacom

Operational Efficiencies

Revenue share

Improved credit terms

Studio Cooperation |

4

Progress on Recapitalization

We

have

made

progress

in

our

efforts

to

recapitalize

the

balance

sheet

and

continue to explore all possible options

Current Stakeholders

11.75% Senior Secured Notes

Due 2014

9% Senior Subordinated Notes

Due 2012

7.5% Convertible Preferred

Common A

Common B

Hollywood studios

Potential Strategic Investors

Technology

Media Distribution (cable /

satellite / telecom)

With a number of offers and counter-offers, it requires considerable

time to explore and assess all possible options |

5

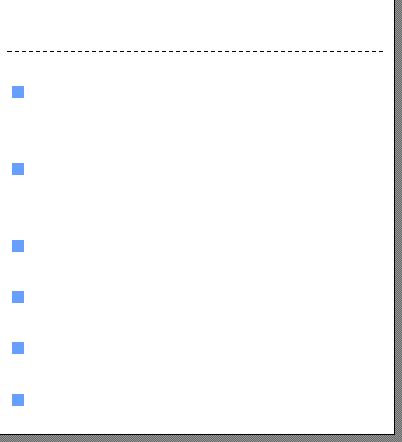

Integrated Approach Addresses Evolving Customer Needs

Consumers demand the entertainment experience deliver on several

functional

needs, and our integrated approach best addresses them

“New

Blockbuster”

Convenience

1

“I can get what I want, when I

want –

on my own schedule”

2

Choice/Variety

“I get the RIGHT movie plus I

have choices in how I get it”

3

Service/No Hassle

“I want an experience which does

not detract from leisure time”

4

Cost/Value

“I get value from renting when it

meets all my needs” |

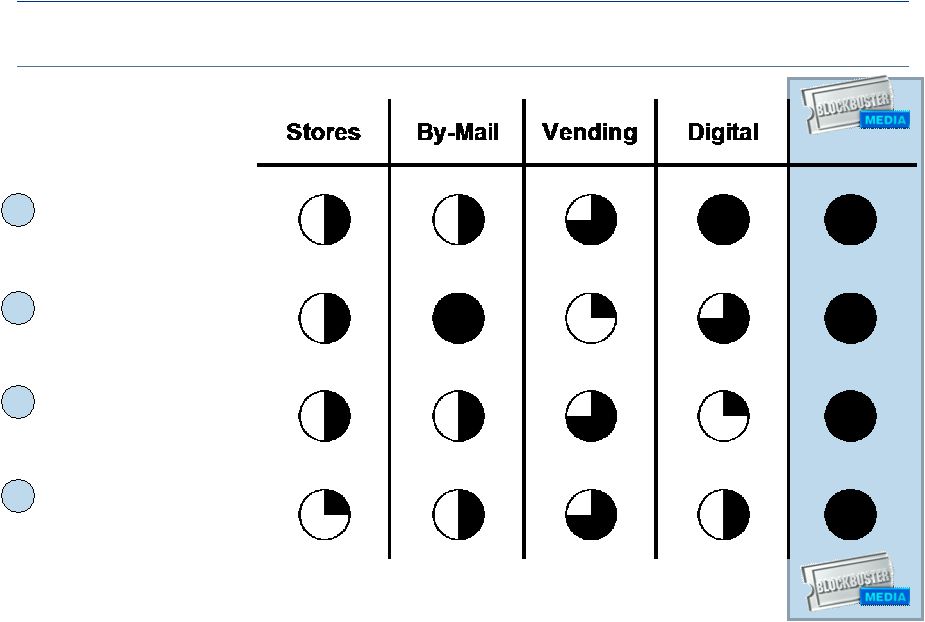

6

Window…

28-day advantage with three major studios, simplified pricing and

improved our product assortment

Store Accomplishments |

7

By-Mail

Launched games by-mail roll out, established new strategic partnerships,

launched Direct Access and improved website |

8

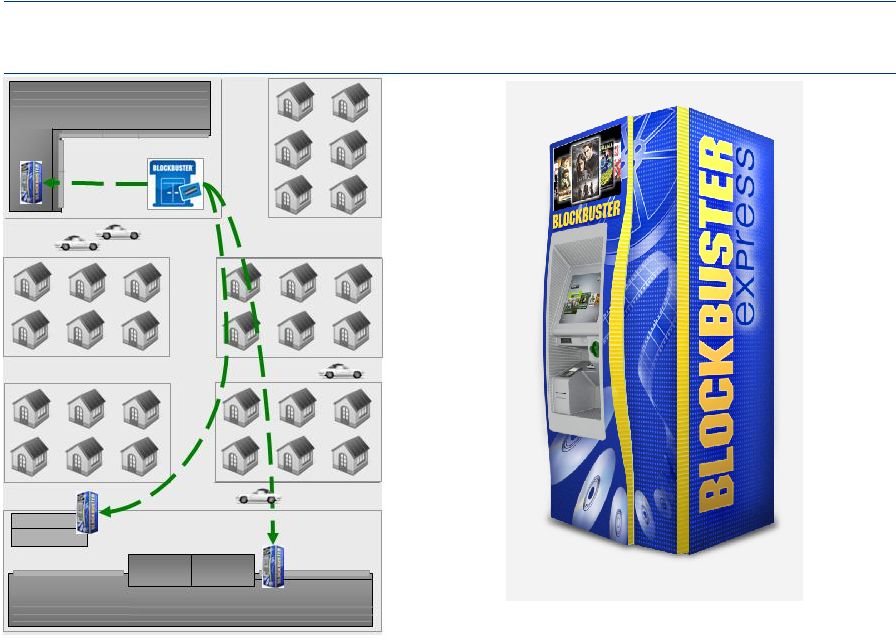

Future Stores with Automated Retail

…over 5,000 automated retail locations deployed to date, digital download

testing underway and retail titles available in July

|

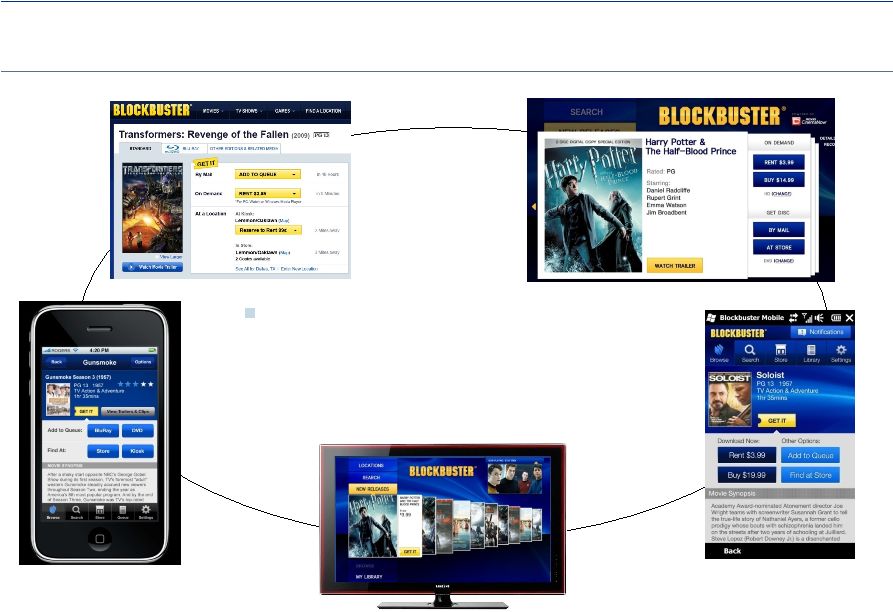

9

Digital Opportunities –

Blockbuster On Demand

Integrated in more than 70 different consumer electronic devices

and launched

mobile… |

10

Blockbuster On Demand –

Multi-Screen Availability

Blockbuster can leverage brand across channels

to deliver content anyway, anywhere

–

Utilize customer database

–

Realize supply chain efficiencies

–

Deliver superior customer experience

Blockbuster’s multi-channel integration will enable the company to deliver

one customer view through multiple channels and universal “Get

It” functionality |

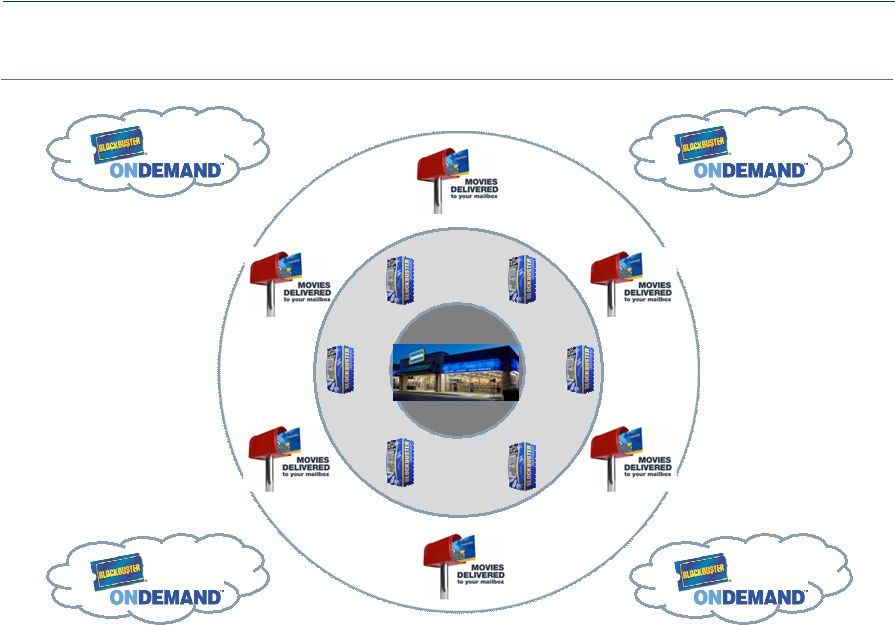

11

Blockbuster: Anytime and Anywhere…

Blockbuster’s mission is to become the preferred choice for convenient access

to media entertainment -

anytime, anywhere –

with stores at the epicenter |

Thank you for your ongoing support |