Attached files

| file | filename |

|---|---|

| EX-4.6 - Fuer International Inc. | v188653_ex4-6.htm |

| EX-2.1 - Fuer International Inc. | v188653_ex2-1.htm |

| EX-4.5 - Fuer International Inc. | v188653_ex4-5.htm |

| EX-2.2 - Fuer International Inc. | v188653_ex2-2.htm |

| EX-10.15 - Fuer International Inc. | v188653_ex10-15.htm |

| EX-10.14 - Fuer International Inc. | v188653_ex10-14.htm |

| EX-10.18 - Fuer International Inc. | v188653_ex10-18.htm |

| EX-10.16 - Fuer International Inc. | v188653_ex10-16.htm |

| EX-10.17 - Fuer International Inc. | v188653_ex10-17.htm |

|

|

|

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_____________________________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of

Report:

(Date of

earliest event reported)

June

16, 2010

____________________________

FOREX365,

INC.

(Exact

name of registrant as specified in charter)

Nevada

(State or

other Jurisdiction of Incorporation or Organization)

|

0-53436

(Commission

File Number)

|

84-0290243

(IRS

Employer

Identification

No.)

|

North

Neiwei Road,

Fulaerji

District, Qiqihar,

Heiloingjiang,

China, 161041

(Address

of Principal Executive

Offices

and zip code)

(86) 452-6919150

(Registrant’s

telephone

number,

including area code)

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of registrant under any of the following

provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

¨ Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR

240.14a-12(b))

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The

statements contained in this Form 8-K that are not purely historical are

forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. These include statements about the Registrant’s expectations,

beliefs, intentions or strategies for the future, which are indicated by words

or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “the

Registrant believes,” “management believes” and similar words or phrases. The

forward-looking statements are based on the Registrant’s current expectations

and are subject to certain risks, uncertainties and assumptions. The

Registrant’s actual results could differ materially from results anticipated in

these forward-looking statements. All forward-looking statements included in

this document are based on information available to the Registrant on the date

hereof, and the Registrant assumes no obligation to update any such

forward-looking statements.

Item

1.01 Entry into a Material Definitive

Agreement.

On June

16, 2010, Forex365, Inc. (the “Company”), a company incorporated in Nevada,

entered into a Share Exchange Agreement (the “Exchange Agreement”) with China

Golden Holdings, Ltd., a company organized under the laws of the British Virgin

Islands (“China Golden”), the shareholders of China Golden (the “Shareholders”),

who together owned shares constituting 100% of the issued and

outstanding common shares of China Golden (the “China Golden Shares”).

Pursuant to the terms of the Exchange Agreement, the Shareholders transferred to

the Company all of the China Golden Shares in exchange for the issuance of

11,550,392 shares (the “Shares”) of our common stock (the “Share Exchange”). As

a result of the Share Exchange, China Golden became our wholly-owned subsidiary

and the Shareholders acquired approximately 96.47% of our issued and outstanding

stock.

On June

17, 2010, we entered into a securities purchase agreement (the “Purchase

Agreement”) with Allied Merit International Investment Inc. (the “Investor”) for

the sale of an aggregate of 1,018,868 common shares (the “Investor Shares”), and

warrants to purchase 873,315 common shares of the Company, for aggregate gross

proceeds equal to $2,500,000 (the “Offering”). In connection with the Offering,

we also entered into a registration rights agreement (the “Registration Rights

Agreement”) with the Investor, in which we agreed to file a registration

statement (the “Registration Statement”) with the Securities and Exchange

Commission (the “SEC”) within 60 calendar days of the Closing Date of the

Offering to register for resale the Investor Shares and the shares underlying

the warrants (which are further described in Item 3.02), and to have the

Registration Statement become effective within 150 days of the Closing Date of

the Offering.

A copy of

the Exchange Agreement is incorporated herein by reference and filed as Exhibit

2.1 to this Form 8-K. The description of the transactions contemplated by the

Exchange Agreement set forth herein does not purport to be complete and is

qualified in its entirety by reference to the full text of the exhibit filed

herewith and incorporated by this reference.

On June 9, 2010, the Registrant’s

Articles of Incorporation were amended to effect a 1 for 64 reverse stock split

and so that the authorized shares of common stock shall remain at 200,000,000

and the authorized shares of blank check preferred stock shall remain at

10,000,000 with a par value of $.001 per share. The Registrant effected the

amendments in connection with the consummation of the transactions contemplated

by that certain Share Exchange Agreement pursuant to which the Registrant

acquired all of the issued and outstanding shares of stock of China Golden

Holdings, Ltd., as previously described in Item 5.01.

Item

2.01 Completion of Acquisition or Disposition of

Assets

On the

Closing Date of the Exchange Agreement, we consummated the transactions

contemplated by the Exchange Agreement, pursuant to which we acquired all of the

issued and outstanding shares of stock of China Golden Holdings, Ltd. in

exchange for the issuance in the aggregate of 11,550,392 of the Shares to the

Shareholders. Information regarding the acquired entity is included below under

Item 5.01 Changes in Control of the Registrant.

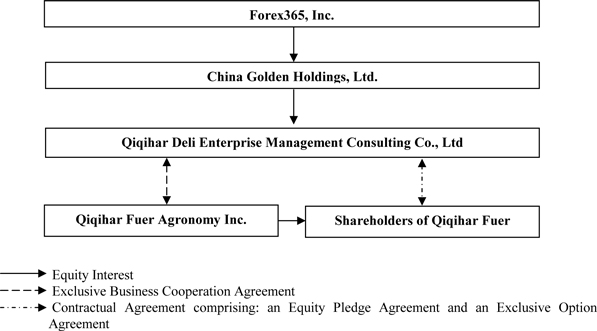

China

Golden, with its subsidiaries, engages in the production and distribution of

hybrid seeds and fertilizer products. The Company operates only through its

subsidiary, Qiqihar Deli Enterprise Management Consultancy Co., Ltd. (“Deli”), a

wholly foreign owned enterprise (“WFOE”) located in Heilongjiang Province of the

People’s Republic of China (“PRC”) and incorporated under the laws of PRC. On

March 25, 2010, Qiqihar Deli entered into a series of contractual agreements

with Qiqihar Fuer Agronomy Inc (“Fuer”), a company incorporated under the laws

of the PRC, and its two shareholders, in which Deli effectively assumed

management of the business activities of Fuer and has the right to appoint all

executives and senior management and the members of the board of directors of

Fuer. The contractual arrangements are comprised of a series of agreements,

including a Consulting Services Agreement, Operating Agreement, Proxy Agreement,

and Option Agreement, through which Deli has the right to advise, consult,

manage and operate Fuer for an annual fee in the amount of Fuer’s yearly net

profits after tax. Additionally, Fuer’s Shareholders have pledged their rights,

title and equity interest in Fuer as security for Deli to collect consulting and

services fees provided to Fuer through an Equity Pledge Agreement.(the afore

mentioned contractual agreements and the Share Pledge Agreement to be

collectively referred to as “Contractual Agreements”) In order to further

reinforce Deli’s rights to control and operate Fuer, Fuer’s shareholders have

granted Deli the exclusive right and option to acquire all of their equity

interests in Fuer through an Option Agreement. As all of the companies are under

common control, this has been accounted for as a reorganization of entities and

the financial statements have been prepared as if the reorganization had

occurred retroactively.

The

Contractual Arrangements are such that Deli, and ultimately the Company,

have the ability to substantially influence the daily operations and financial

affairs of Fuer, in addition to being able to appoint Fuer's senior executives

and approve all

matters requiring stockholder approval. The structure of the Contractual

Agreements is such that Fuer is effectively a variable interest entity

(“VIE”) of Deli. Accordingly, the Company through its wholly-owned China Golden

subsidiary and their wholly owned Deli subsidiary consolidates Fuer's results of

operation, assets and liabilities in their financial statements.

2

The

Company was a “shell company” (as such term is defined in Rule 12b-2 under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”)) immediately

before the completion of the Share Exchange. Accordingly, pursuant to the

requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the information

that would be required if the Company were filing a general form for

registration of securities on Form 10 under the Exchange Act, reflecting the

Company’s Ordinary Shares, which is the only class of its securities subject to

the reporting requirements of Section 13 or Section 15(d) of the Exchange Act

upon consummation of the Share Exchange, with such information reflecting the

Company and its securities upon consummation of the Share Exchange.

Item

3.02 Unregistered Sales of Equity Securities

As more

fully described in Item 1.01 above, on June 17, 2010, one day after the Share

Exchange, we consummated a private offering of 1,018,868 Investor Shares, for

aggregate gross proceeds equal to $2,500,000. In addition to the Investor

Shares, the Company issued to the Investor warrants to purchase 873,315 shares

at a price per share of $2.58. The warrants are for a term of 3-years and have a

cashless exercise feature.

The

issuance of the Shares and the warrants was exempt from registration pursuant to

either Section 4(2) of, or Regulation D or Regulation S promulgated under, the

Securities Act of 1933, as amended (“Securities Act”).

A copy of

the Purchase Agreement and the Registration Rights Agreement are incorporated

herein by reference and filed as Exhibit 2.2 and Exhibit 10.14, respectively, to

this Form 8-K. The descriptions of the Purchase Agreement and the Registration

Rights Agreement do not purport to be complete and are qualified in their

entirety by reference to the full text of the exhibits filed herewith and

incorporated by this reference.

Item

5.01 Changes

in Control of Registrant.

On June

16, 2010, we consummated the transactions contemplated by the Exchange

Agreement, pursuant to which we acquired all of the issued and outstanding

shares of stock of China Golden in exchange for the issuance in the aggregate of

11,550,392 of the Shares to the Shareholders, or 96.47% of the shares issued and

outstanding on a fully diluted basis immediately after the merger. The issuance

of the Shares was exempt from registration pursuant to either Section 4(2),

Regulation D or Regulation S promulgated under, the Securities Act.

Other

than the transactions and agreements disclosed in this Form 8-K, we know of no

arrangements which may result in a change in control.

No

officer, director, promoter, or affiliate has, or proposes to have, any direct

or indirect material interest in any asset proposed to be acquired by us through

security holdings, contracts, options, or otherwise.

3

FORM

10 DISCLOSURE

Our

Corporate Structure

We were

incorporated under the laws of the State of Nevada on February 8, 1984. On June

16, 2010 we entered into a share exchange agreement with China Golden Holdings,

Ltd.(“China Golden”), and became its sole shareholder.

China

Golden, incorporated in British Virgin Island on November 30, 2009, conduct its

business through its wholly owned subsidiary QiqihaDeli Enterprise Management

Consulting Co., Ltd.(“Deli”). Through a series of contractual agreements

(“Contractual Agreements”) entered into on March 25, 2010, Qiqihar Fuer Agronomy

Inc. (“Fuer”) was accounted for as a variable interest entity.

Qiqihar

Fuer, established in 2003, is a leading manufacturer and supplier of seeds and

fertilizer product in Northeastern China. It aims to become a regional seed

giant with up to date development capability of new seeds varieties and vertical

integration of materials production and chain store operation. The company

diversified its operation by providing quality fertilizers and plant regulator

products.

Our corporate structure is described in

the chart below:

Description

of the Contractual Agreements:

Exclusive Business Cooperation

Agreement. Pursuant to the exclusive business cooperation agreement

between Deli and Fuer, Deli has the exclusive right to provide to Fuer general

business operation services, including nomination of Fuer’s senior management

Under this agreement, Deli owns the intellectual property rights developed or

discovered through research and development, in the course of providing the

Services, or derived from the provision of the Services. Fuer shall pay

consulting service fees in Renminbi (“RMB”) to Deli that is equal to all of

Fuer’s profits as defined in the Equity Pledge Agreement. The Agreement is valid

for 10 years and can be extended solely with Deli’s discretion.

Equity Pledge Agreement.

Pursuant to the Equity Pledge Agreement, Fuer’s Shareholders pledged all

of their equity interests in Fuer to Deli to guarantee Fuer’s performance of its

obligations under the consulting services agreement. If Fuer or Fuer’s

Shareholders breach their respective contractual obligations, Deli, as pledgee,

will be entitled to certain rights, including the right to sell the pledged

equity interests. Fuer’s Shareholders also agreed that upon occurrence of any

event of default, Deli shall be granted an exclusive, irrevocable power of

attorney to take actions in the place and stead of the Fuer’s Shareholders to

carry out the security provisions of the equity pledge agreement and take any

action and execute any instrument that Deli may deem necessary or advisable to

accomplish the purposes of the equity pledge agreement. Fuer’s Shareholders

agreed not to dispose of the pledged equity interests or take any actions that

would undermine Deli’s interest. The equity pledge agreement will expire unless

all payments due under the Exclusive Business Cooperation Agreement have been

fulfilled.

4

Exclusive Option Agreement.

Pursuant to the Exclusive Option Agreement, Fuer’s Shareholders

irrevocably granted Deli, or its designated person, an exclusive option to

purchase, to the extent permitted under PRC law, all or part of the equity

interests in Fuer for the cost of the initial contributions to the registered

capital of Fuer or the minimum amount of consideration permitted by applicable

PRC law. Deli or its designated person has sole discretion to decide when to

exercise the option, whether in part or in full. The term of this agreement

shall last for 10 years, and shall be renewed at Deli’s election, unless

terminated in accordance with this agreement.

Business

Overview

Fuer is a

leading regional provider of field seeds and fertilizers in Northeastern China.

Fuer has a sales network which covers key provinces, cities, counties and towns

within the region. Our products can directly reach 3,430 sales outlets through

1,094 distributors. Fuer has 214 staff members and 64 temporary workers, among

which 27 are research and technical staff and 75 are with the sales team. The Company has signed contracts with

breeding bases of 16,474

acres, with an annual

production capacity of 20,000,000 kg. We have two

fertilizer production

lines, with an annual

production capacity of 50,000 tons. Currently, the Company has 4 seed

variety rights, 1 product patent application on fertilizer, and over 40

registered trademarks.

The

Company had annual revenue growth of 39.07% in 2009 as compared to 2008, and a

25.38% increase in revenue for the first quarter of 2010, as compared to the

same quarter of 2009. The Company is expecting future growth by introducing

advanced and improved seeds and fertilizer product, and expansion of its network

of direct sales stores.

|

|

For the quarters ended

March 31,

|

For the years ended

December 31,

|

||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

|

Unaudited

|

Unaudited

|

Audited

|

Audited

|

||||||||||||

|

|

($ in thousands)

|

($ in thousands)

|

||||||||||||||

|

Summary of Historical

Income

|

||||||||||||||||

|

Sales

|

$ | 15,307 | $ | 12,208 | $ | 16,168 | $ | 11,626 | ||||||||

|

Gross

profit

|

6,317 | 5,106 | 6,699 | 4,761 | ||||||||||||

|

Net income

|

$ | 5,032 | $ | 3,626 | $ | 2,938 | $ | 2,053 | ||||||||

Highlight

Features

Leading seeds provider in

northeastern China - Fuer was ranked the 4th largest

seed provider in Heilongjiang Province, China in 2006. Since its establishment

in 2003, Fuer has been providing quality seeds and fertilizers to the local

farmers, and has great brand loyalty in northeastern China, which is one of the

most important grain production bases in China.

Diversification in product

portfolio - The Company maintains great competitiveness due to its

diversified product portfolio among corn, rice and soybean, as well as

fertilizers. In the northeastern China, climates are different from region to

region and year to year in terms of temperature. The Company provides seed

product which can adapt to all major weather conditions in the region, and

therefore has strong resistance to changes in climate. Furthermore, our

fertilizer products enhance our profitability after the selling season of seed

products which effectively reduces the concentration risk within our product

portfolio. Production of certain crops among our farmer customers fluctuates

greatly from year to year. Our well built product portfolio enabled us to

maintain stable profitability through the past years.

5

Diversified sales channels -

The Company was the first seed provider to launch its brand stores in

northeastern China. As of March, 2010 we have opened 5 direct sales stores and

over 43 franchise stores. The new sales channel will flatten our sales network

and boost our profitability. With the help of our branded stores, we are able to

provide better sales services and launch more accurate marketing

campaigns.

Strong growth potential in China’s

agriculture market – Pursuant to the statistics of the Food and

Agriculture Organization of the United Nations (“FAO”), China’s seed market

ranked 2nd in the

world, immediately following the United States. In terms of quantity, seeds

consumption in China ranks 1st

worldwide. The underlying reason is the low seeds price, and the farmers’

tradition to use harvest crop as seeds for the next cultivation period. The

seeds used by farmers are generally inferior to hybrid seeds from providers, as

features of the hybrid seeds devolved in their descendants, which made them

unprofitable to be grown. We believe it is a great opportunity to enhance

profitability by providing quality seeds, and consistent introduction of

improved seed varieties.

Abundant acquisition opportunities in

the industry - At present, there are over 9,000 licensed seed companies

and over 10,000 providers of fertilizer, pesticides, germicides and herbicides

in China. Among these enterprises, however, there are less than 100 state owned

large companies and regional leading companies, such as Fuer, that has

registered capital of over $4.3 million. The small companies controls certain of

the regional markets and a few of the regional product patents. As the PRC

government encourages the concentration of the industry, there are great

opportunities for us to expand our sales and product line by means of acquiring

quality companies in target regions.

Product

Portfolio

China’s

seed market was estimated to be over $4 billion, most of which is the field

seeds market. Northeastern China, which consists of Heilongjiang, Jilin and

Liaoning Provinces, is one of the most important regions for China’s food

safety. In 2008, 30.70% of China’s corn, 40.45% of China’s beans, and 13.56% of

China’s rice was supplied by these provinces.

Fuer

controls exclusive authorization or patents to provide 10 corn seeds, 19 soybean

seeds and 14 rice seeds that adapt to different accumulate temperature zones in

Northeastern China. Field seed products contributed to over 79.74% of our total

revenue in 2009.

Humic

acid fertilizers have multiple functions, which included boosting plant growth,

improving soil quality, accelerating crop growth and early ripeness, enhancing

crops’ capabilities of cold-resistance, drought-tolerance,

saline-alkali-resistance, and resistance to wind and sand, increasing crop

yields, as well as improving qualities of fruits and vegetables. Currently, Fuer

produces and distributes five types of common and special humic acid foliar

fertilizers under brand “Fuer 655” which enjoy a wide market base in Northeast

China.

The

weather in Northeast China is cold. In spring, this area is frequently hit by

cold snaps, resulting in quick and large temperature drops. As seeds lose

activity in low temperature, their germination rates will drop greatly.

Cold-resistant agents can greatly improve seeds’ resistance to low temperature,

increasing germination rates and per-acre yield. Fuer launched the “Qianjinding

Series” plant cold-resistance additive, which contains intermediates extracted

from Abies sibirica. The additive can improve seeds’ cold-resistance abilities,

which can efficiently increase crop yields in high latitude areas and improve

the production of out-of-season vegetables in other areas.

In order

to enrich our agricultural material products lines, we signed an OEM agreement

with Qingdao Fuer Agronomy Pesticide Co., Ltd. in 2006 and consigned it to

produce basic pesticide products. Fuer then distributes these products under the

“Fuer Brand”. Currently, we are selling 39 types of pesticide products around

China.

|

|

Fiscal Year Ended December

31,

|

|||||||||||||||

|

Amounts

expressed in

|

2009

|

2008

|

||||||||||||||

|

USD

|

Revenue

|

% of total

revenue

|

Revenue

|

% of total

revenue

|

||||||||||||

|

Corn seeds

|

$ | 10,544,282 | 65.22 | % | $ | 6,232,071 | 53.60 | % | ||||||||

|

Soybean

seeds

|

1,287,337 | 7.96 | % | 1,825,048 | 15.70 | % | ||||||||||

|

Rice

seeds

|

1,062,094 | 6.57 | % | 1,317,461 | 11.33 | % | ||||||||||

|

Pesticides

|

247,012 | 1.53 | % | 271,507 | 2.34 | % | ||||||||||

|

Vegetables

seeds

|

419,325 | 2.59 | % | 100,810 | 0.87 | % | ||||||||||

|

Fertilizers

|

2,308,656 | 14.28 | % | 1,624,836 | 13.98 | % | ||||||||||

|

Plant

additives

|

299,715 | 1.85 | % | 254,338 | 2.19 | % | ||||||||||

|

Total

|

$ | 16,168,421 | 100 | % | $ | 11,626,071 | 100 | % | ||||||||

6

Operation

Sales

& Marketing

Sales

Team

Our major

markets include the provinces of Heilongjiang, Jilin, Liaoning and East Inner

Mongolia in China. In 2009, the revenue in these areas accounted for 93% of the

Company’s total revenue. By the end of the first quarter of 2010, we have

established 5 wholly-owned stores, 43 franchised stores, and distribute to 1,094

distributors and 3,430 sales outlets in these areas. Revenue from sales to

distributors and our franchised stores accounted for approximately 90% of the

total revenue. The Company is now trying to set up a strong selling network in

the existing markets, extend depth and width of distribution channels, and seek

development opportunities in other provinces.

At

present, our sales team consists of 75 staff, mainly responsible for developing

and maintaining channel relations, managing orders from distributors, collecting

distributors’ inventory information, sending latest market information to the

Company, drafting and implementing promotion plans in promotion areas, as well

as providing post sales services.

Channel

Currently,

the Company sells products through distributors, 43 franchised stores, and our

sales hall together with 5 stores directly operated by the Company. The Company

renews sales agreements with distributors each year. As of March 31, 2010, we

provide our product to 1,094 distributors and indirectly to about 3,430 sales

outlets all over the country.

We have a

300 square meter sales hall on the first floor of our office building, 5 direct

sales stores and over 43 franchised stores in Heilongjiang Province. We provide

sales consultants to the stores and offer advisory services and recommendations

to farmers.

In March,

2010, the Company started its reformation of existing sales channels by creating

a branded store network. There will be two types of branded stores: wholly owned

stores and franchised stores. The franchised stores should be decorated

according to our unified customer image design and provide unified brand

information to farmers. We set sales targets with each franchise store before

each sales period. We will provide product to our franchised stores with lower

prices, which are determined by our sales department. By April 2010, we had

established 43 franchised stores.

Franchise

Stores

In the

past, distribution channels of agricultural materials in China were mainly

Supply and Marketing Cooperatives set up by the government. After 1980s, these

supply and marketing enterprises

were gradually privatized. As a number of

private enterprises began

to do business in this area, market competition was intense and

disorganized. In the past 10 years, fake seeds and fake fertilizers that did

harm to farmers frequently appeared. In addition, as the distribution channels

of agricultural materials are in chaos and the products they sell are of all

shapes and colors, farmers are not able to accurately select quality

agricultural materials. In addition, we estimate that the channel cost is

greater than 40% of the sales price to our end users.

7

The

Company launched its branded store program in March, 2010, aiming at enhancing

channel efficiency and brand awareness by downward integration of sales

channels. Under the program, we will establish direct sales stores in the most

important sales region, and convert our distributors into our franchise store

cooperators. At the preliminary stage of our branded store program, we sold our

products to the franchised stores at lower prices. The franchised stores are

required to concentrate their marketing efforts only on our product, and report

its inventory level timely to the Company. We believe our stores will enhance

our profitability by reducing cost of sales channel. We will be able to control

the terminal sales of our product, and provide a unified product price to our

customers. With unified store decoration and integrated marketing efforts, we

will be able to attract farmers to join our membership, so as to enhance our

brand awareness and loyalty, and maintain a customer database which will enable

us to provide post sales services to our target customers.

We have

set up 5 direct stores and 43 franchise stores in Heilongjiang Province. We

planned to expand our branded stores in Northeastern China.

Target

Customers

The

Company’s major customer groups for seed products are located in Heilongjiang,

Jilin and Northeast Inner Mongolia. These customers primarily plant corn, rice

and soybean. These farmers are scattered in various towns and villages. They

usually own tens of hectares of contracted land, suitable for using modern

farming methods. For these farmers, seed quality is the most important factor in

choosing seeds. They are able to afford relatively higher prices. These farmers

will also purchase high quality humic acid fertilizers and cold-resistant

regulators to increase yields and reduce losses caused by cold snaps in

spring.

Farmers

usually distinguish seeds quality by indices like germination rate and per-acre

yield. But these indices may be easily affected by various natural factors,

farming levels and abrupt natural disasters, so farmers mainly rely on products

brands, planting results of the previous year and promotions to choose seeds.

Farmers are very cautious in selecting crop varieties, so they will not change

to other varieties easily. Usually, they will make comparisons between different

varieties by trial planting and use the trial results to make planting plans for

the next year.

Since

2003, the Company has been providing high quality products and has established a

reputation and brand loyalty in Northeastern China. We will continue to extend

market reach in bordering provinces and cities with our brand and product

advantages.

Pricing

We

usually determine our product prices in December and January. When the yearly

pricing begins, salespersons from our sales department gather prices of

competing products. The Company then established trail prices and sell seeds at

the trial prices. The final selling prices will be set after several rounds of

trial selling. Usually, once the prices are set, they will not be easily

changed.

The

Company determines prices of products sold to distributors and at our branded

stores. When there are significant changes in supply and demand of seeds,

fertilizers and pesticides, the Sales Department will work out a price

adjustment plan and implement it with approval of our General Manager for

approval.

Seasonality

Winter in

the provinces of Heilongjiang, Jilin and Northeast Inner Mongolia is long and

cold. Temperature drops to below 0 centigrade from September to

October and will not rise to above 0°C until April to May of the next

year. Farmers can only plant crops once a year. They usually plant seeds in May

and harvest from July to September.

Subject to the cultivation seasonality,

we purchases raw seeds from our contracted seed breeders from late November till

next January, and produce our seed product in the same period. Sales of the seed

product to our

distributors are from late

December until the next March or April. Generally, we render our

distributors with credit

periods of 30

days.

8

Our

fertilizer, pesticides, germicides and herbicides products are sold from late

March until June. We start our production of fertilizers and forward our orders

for pesticides, germicides and herbicides one month before the sales

period.

Post-Sales

Support

Our

salespersons and technical staff regularly promote advanced production

management methods, fertilizers and pesticides using strategic communications

with product users, help them improve yields. There are two regular professional

staffs working on our sales supporting hotline. In peak season, the Research and

Development Department will send 5 to 8 technical staff to work on the hotline

24 hours a day. Meanwhile, these service staffs also help users by

answering all types of questions on our website.

Advertising & Promotion

Strategies

We make

advertising and publicity plans, and on-site marketing plans for the coming year

in November. We launch marketing campaigns shortly before our sales period

begins.

Send Publicity Materials - We

make tailored publicity newspapers, books and periodicals to different markets,

building Fuer Brand by promoting advanced agricultural philosophy. Our

Publishing Department is responsible for collecting or writing articles on

agricultural information and techniques, and spreading Fuer’s advanced

agricultural concepts to consumers. We publish newspapers, books and periodicals

every November. Leaflets will be directly sent to local farmers by salespersons,

while newspapers and periodicals will be sent to sales outlets through

distributors for farmers to read.

Advertisement - We usually

launch large-scale advertising campaigns in “golden hours”, which is generally

from 19:00 to 22:00 in each day, on local television channels of key sales areas

from November to June. We invite well-known rural actors as our products

spokesperson and have received good market feedback. As of December 31, 2009,

our advertising expenses accounted for 0.54% of total sales revenue of the

year.

Conference Marketing - The

Sales Department regularly sends a professional team to attend key exhibitions

of the industry, and establish relations with national large-scale enterprises

and key clients. In 2009, we attended many seeds exhibition and selling

meetings.

Activity Marketing - The

Company holds marketing activities in key areas every sales season. The

activities will be planned and carried out by local business managers.

Activities include discounts, professional lectures and outdoor

exhibitions.

Research &

Development

Fuer has

cooperative relationships with a number of research academies and institutes and

has a priority to purchase their research achievements involving seeds. We

cooperate with over 10 agricultural academies and institutes, including

Heilongjiang Academy of Agricultural Sciences, Qiqihar University and Heihe Agricultural Institute. Meanwhile, we

have invited Professor Su Jun, Deputy Dean of the

Heilongjiang Academy of Agricultural Sciences, and Mr. Ding Dong, Head of

Heilongjiang Inspection Center of Fertilizers, Pesticides, Germicides, and

Herbicides, to serve as our technology consultant for research on new seed

varieties and fertilizers.

So far,

Fuer has set up a sound process for purchasing seed variety rights. Every

quarter, our Research and Development Center

regularly communicates with the aforesaid academies and institutes to keep

abreast of new seeds development projects and obtain firsthand lab data. The

Vice Manager of the Research and Development Center

will then carry out evaluations on seeds that will pass assessment on provincial

level, and submit a detailed Seed Variety Purchase Plan to the Assessment

Committee based on the Seed Variety Rights Purchase Plan made by the General

Manager. The detailed purchase plan shall be strictly carried out after approval

by the General Manager.

9

In 2005, Fuer began to conduct research

and development on hybrid corn by optimization of seed-parent line development. In the following two

years, we developed our Fudan No. I, II, III Corn, which

have been examined and approved in Heilongjiang Province and recognized in

neighboring provinces. Our independent research and development of hybrid seeds

is conducted in accordance with traditional hybrid procedures, with the parent

plant provided by the national or local seeds reserve centers.

We modify humic fertilizer formulas for crops of different production conditions in

different stages. Our

Marketing Department and Fertilizers Production Department screen potential

market opportunities and set Research and Development targets based on feedback from our sales person; the Fertilizer Technique Division will

be in charge of preliminary research and development. New fertilizer

varieties will be put into trial production after examination; we will start

large-scale distribution after the field test. Limited by plant growth

periods, the whole process

can be finished within 6 to 8 months.

Production

Seeds

We adopt

the “Company + Farmer” Mode and conduct production through farmers who have

signed contracts with us. When we sign contracts with these farmers, we

introduce them to purchase seeds for breeding from qualified agricultural

institutes. When the crops are mature, we will make arrangements to purchase

seeds they have produced. Farmers will bear the delivery cost. We process the

raw seeds for sale in accordance with our production plan. During growth period

and flowering period, we regularly send technical staffs to monitor the growing

situations of crops in each production field, and provide timely technical

guidance to farmers. We require our technical staffs to provide timely guidance

to farmers on problems appearing during crop growth and recommend our fertilizer

and pesticide products to farmers. In 2009, our contracted production fields reached 16,474 acres, together with a production capacity of approximately 16,087 tons.

Fertilizers

Our

production line can produce 3,000 tons of liquid fertilizers and 50,000 tons of

solid fertilizers every year. By establishing and implementing strict operating

rules, we have reduced impact of human factor on products quality. Key

production processes are monitored closely by our technicians.

The

Market

Grain Supply Pressure

Challenges China’s Strategic Security

Decreasing

Arable Land and Increasing Population Threatens China’s Grain

Supply

China has

the largest population in the world. As of July, 2009, China’s population

reached 1.339 billion (excluding the population of the Hong Kong and Macao

Special Administrative Regions and the Taiwan Province), or 22% of the world’s

population. China’s overall population density is 139 persons per square

kilometer, far higher than that of the USA, whose overall population density is

33 persons per square kilometer.

According

to data provided by relevant government authorities, China’s population

increased by 54 million or 4.21% from 2002 to 2008. The 11th

Five-Year Plan shows: China’s total population will be controlled at 1.37

billion in 2010 and 1.46 billion in 2020; and China’s population will reached

the peak of about 1.5 billion in around 2033. By then arable land per capita in

China will decrease to 0.21 acre.

In the

past five years, China's annual grain consumption was about 500 million tons.

China’s grain consumption in 2009 is estimated to be 525 million tons. It is

forecasted that annual grain consumption will surge to 580 million tons in 2033,

when gain production will be 501.6 million tons. In recent years, the increasing

speed of grain output is slower than that of grain consumption.

.

10

China’s

arable land is only 7% of the world’s arable land. According to statistics,

China’s arable land stood at 321.4 million acres in 1996, ranking fourth in the

world, only lower to the United States, Russia and India. However, according to

the FAO, China’s arable land per capita is only 0.23 acre, which is 19.83% of

the United States and 85.57% of India, ranking 110 among more than 190

nations in the world. Due to agricultural restructuring, returning cultivated

land into forest and grass projects, damages from natural disasters and

nonagricultural construction purposes, arable land is decreasing each year. As

per the National Statistic Bureau of China, the total arable land in 2007 had

decreased to 300.8 million acres, with annualized rate of 0.6%. Arable

land per capita decreased to 0.22 acre, only 40% of the world

average.

Increase

in Grain Output relies on extensive use of fertilizers and improvement of hybrid

seeds.

China has

been relying on extensive consumption of resources to sustain its grain supply.

In 2007, fertilizer consumption per hectare reached 0.34 ton, a 26.83% increase

as compared with 2000 and 192.03% increase as compared with 1990. It is

estimated rice production consumed over 50% of water resources in China. As

fertilizers are made from fossil energy and other minerals that are not

renewable, supply of fertilizers is threatened by decreasing resources, which

will fundamentally strike China’s grain supply. Due to fertilizer residues

accumulation, soil condition deteriorated year by year. The extensive use of

fertilizers also results in contamination of river and lakes, causing serious

ecology disasters.

According

to FAO, the world average of 25% increase in grain output per acre was

contributed to by improved seeds, while this ratio reached 40% in certain

developed countries. Therefore introducing new seed varieties is the only way

for China to sustain its food supply.

Seeds market ranked

2nd in the world, but still has

great potential

Scale of

China’s seed market fluctuated around 12.5 million tons or $4.39 billion, which

is 200% of US seed market in terms of volume but 50% in terms of dollar amount

of market scale. Compared with developed countries, China’s seed market is

promising because:

Consumption of commercial seed

products is still far below world average - According to FAO, over 70% of

seeds used in the world were commercial seed products. In the developed

countries, this rate would even surpass 90%. In China, however, only 38.5% of

seeds used were provided by commercial seeds producing companies, while the

remaining 61.5% was satisfied by seeds bred by the individual farmers, which is

inferior as compared with commercial seeds.

Low seed price – Low seed

prices were primarily resulted from out of date hybrid seed products. As patent

of such products expire, small seed companies are willing to produce such

product and then compete with low prices. In contrast, with its exclusive

product line, Fuer provides its quality seed products at price higher than

industry average. We believe it is quality rather than price that is the most

important feature in competition.

Staled production method – Low

seed prices also result from staled seed processing techniques. At present, few

companies in China are able to control quality of every single kernel of its

products. The processing technique directly leads to lower germination rate as

compared with production from the world’s leading seed companies.

Barrier of entry for foreign seed

giants – According to the legislation of PRC, a foreign entity or

person is only approved to hold 49% of any field seed provider. New seeds

introduced from foreign enterprises are subject to trial test for 5 to 8

cultivation periods, which is about 3 to 4 years.

Summary of China’s Field

Crops Production

Farmers

with cultivation rights are the main forces in China’s agricultural industry.

According to statistics given by National Bureau of Statistics of the PRC, the

planting area of grain crops in China was 245.62 million acres with rice, wheat,

corn and soybean taking up 26.67%, 22.13%, 24.21% and 12.98%

respectively.

11

From 2003

to 2007, the planting areas of all major grains increased. The planting area of

corn increased the most. As corn is widely used as food and feed and has vast

application prospect in bio-diesel, the planting area of corn increased 22.48%

from 2003 to 2007. Increased due to the increasing domestic demand for grain,

the planting area of rice and wheat grew by 9.10% and 7.84%, respectively. As

China’s population keeps growing and demand for grain keeps increasing, the

planting areas of the aforesaid crops will continue to increase.

Our major

seeds include corn, rice, soybean and vegetables, primarily distributed in

Heilongjiang and Jilin Province. According to the State Bureau of Statistics,

the planting areas in these two provinces are:

Planting

Areas of Major Grain Crops in Heilongjiang & Jilin in 2007(Unit:thousand

acres)

|

Rice

|

Wheat

|

Corn

|

Soybean

|

|||||

|

Jilin

|

1,628

|

14

|

7,222

|

1,529

|

||||

|

Heilongjiang

|

|

5,908

|

|

590

|

|

8,881

|

|

10,686

|

Corn

Corn is

the second largest grain in China. Its planting area in 2007 is 29.48 million

hectare and its annual production volume has reached 150 million tons. Both the

planting area and production volume rank No. 2 in the world. The main production

areas of corn in China are Heilongjiang, Jilin, Liaoning, Inner Mongolia, Hebei,

Henan and Shandong Provinces. The downstream industry chain of corn is long,

covering planting, breeding, food, chemical engineering and pharmaceuticals. FAO

statistics shows that about 69% of corn in China is used as livestock feed in

2007. In developed countries, this can be as high as 80%. Corn is essential in

development of the livestock industry. In recent years, the total volumes of

corn for food and corn for feed have been growing steadily, thanks to the

prevalence of bio-diesel techniques and other corn deep-processing technologies.

In the past ten years, corn price in China increased continuously as the

application area of corn gradually grew and market demand for corn has steadily

increased.

Farmers

in Northeast China plant crop once a year. The planting area in Heilongjiang,

Jilin, Liaoning and Inner Mongolia totaled 10,748,300 hectare, 36.46% of the

national area in 2007. Corn yields were 55,651,400 tons, 36.54% of the national

volume.

Rice

The

planting area of rice takes up approximately 26.67% of the total planting area

for grains in China. The volume of rice production takes up 50% of the total

production volume of grains. Rice accounts for more than 50% of commodity

grains. In 2007, the planting area of rice reached 28,918,800 hectare,

production volume reached 186 million tons. The consumption of rice was about

178 million tons, among which 147 million tons was used for feed. The Chinese

government purchases rice from farmers every year and sets minimum purchase

price. With growing prices and increasing incomes, the government has raised the

selling price for rice for several times in the last six year. Farmers have more

and more enthusiasm for planting rice.

Heilongjiang

Province is one of the important and best quality rice planting areas in China.

Farmers plant late rice once a year. Farmers in Jilin and Liaoning also plant

rice. The plant area of rice in the three northeastern provinces was 3,583,700

hectare, 12.39% of the total planting area in China. The production volume in

these three provinces was 22,420,200 tons, 13.02% of the national

volume.

Soybean

Soybean

is a traditional Chinese food, usually used for making various soybean products,

soybean oil, sauce and protein. Soybean residue or powder can also be used as

feed for livestock. In 2007, the total volume of soybean production in China was

17,200,000 tons. China’s soybean industry is threatened by low-priced

genetically modified soybeans from the United States. According to statistics

provided by the General Administration of Customs, the soybean import volume was

30,820,000 tons, which was 1.79 times the total domestic production volume in

2007. The soybean import volume surged to 42,550,000. As the soybean planting

and processing industry has been controlled by foreign enterprises, the China

Soybean Industry Association applied to the State Council for protecting

domestic soybean planting industry. If the government passes policies to protect

soybean industry, soybean production volume will steadily recover.

12

Heilongjiang

Province is the main soybean production area in China. In the northern part of

Heilongjiang and Inner Mongolia Province, soybean is the only applicable field

crop. Farmers plant soybean once a year. In 2007, the planting area of soybean

reached 4,099,400 hectare and the total production volume was 4,426,700 tons,

25.73% of the national volume.

Industry Policy &

Regulation

Agricultural

Material Industry Policy

The Chinese government pointed out in

the

National Grain Security Program for

Medium and Long-Term (2008-2020) to guide and encourage agriculture-related

enterprises and farmers cooperative economic organizations to conduct

technological innovation and promotion activities, actively providing technology

services to farmers. The

government also put forward the “Seed Project” to enhance the improvement of seed

varieties and increase efforts in breeding quality seeds, vigorously promoting the development

of seed Industry. The government will provide subsidies to large seed companies through tax preference

and policy-related loans to improve their competitiveness in competing with international seed

giants.

In addition, the Ministry of Agriculture

made it clear in the Opinion on Deepening the

Promotion of Rural Reform and Innovation of

Agricultural Operation System that the government will encourage the

development of new agricultural materials distribution model, i.e. chain store

retailing system. The Opinion clearly points that China will develop

agricultural chain stores

with great efforts to change the chaotic situation in agricultural materials

distribution channels, reduce prices of agricultural materials, ensure quality

of agricultural materials, and enhance government’s supervising abilities in the

circulation link of agricultural

materials.

New

Seed Varieties Approval Policy

The

Chinese government has been implementing strict control over the seed industry.

Every new seed variety has to be examined and approved by relevant state or

provincial government authority before it is approved to be sold in the market.

A seed variety which has been approved in one province can only be sold within

that province. Seed products must gain approval from other provinces before it

can be sold in these provinces. A seed variety can be sold nationwide after it

gains state-level approval. The examining and approval process usually takes 5

to 8 crop-growth periods.

Genetically

modified crops not only need to obtain the aforesaid approval, but also need to

get production approvals from the Security Management Office of Gene

Modification of the Ministry of Agriculture.

Chinese

distributors of seed products from other countries have to apply to the Ministry

of Agriculture for approvals. The examination and approval process is the same

as that of seeds.

Summary of Humic Fertilizers

Market in China

According

to the National Bureau of Statistic of China, in the past three decades, China

relied greatly on fertilizers to boost grain yields. In 2005, the production

volume of fertilizers in China reached 48,300,000 tons, accounting for 33% of

the world’s volume. It is predicted that the total production volume of

fertilizers in China will surge to 50 million tons by 2015. From 1980 to 2007,

annual consumption of fertilizers increased from 12,694,000 tons to 51,078,000

tons, representing a growth rate of 302.38% and a compound annual growth rate of

5.10%.

Compared

with traditional fertilizers, compound fertilizers contain more nutrients and

little accessory constituents and own fine physical properties, which are very

important in balancing fertilization, improving fertilizer use efficiency, and

ensuring high and stable yields. From 1980 to 2007, annual consumption of

compound fertilizers increased from 272,000 tons to 15,030,000 tons,

representing a compound annual growth rate of 15.41%. Currently, compound

fertilizers consumption accounts for 29.43% of all fertilizers consumption. It

is predicted that demand for compound fertilizers will reach 25 million tons in

2015. We estimated that the market scale of compound fertilizers would reach $50

billion in 2009.

13

Because

traditional fertilizers have been used for a long time, the quality of arable

land in China keeps declining. Soil crust and decrease in soil quality have

become key factors that restrict grain yields growth in China (National Grain Security Program for

Medium and Long-Term (2008-2020)). According to information provided by

the Organization for Economic Co-operation and Development in 2006, China’s

government invested 1.6% of the Gross Domestic Product into environmental

protection, including improving agricultural environment. The government was

also considering providing subsidies to farmers in order to encourage farmers to

adopt advanced agricultural production materials and improve farming

techniques.

Humic

acid compound fertilizer, humic acid and its related products have multiple

functions. Farmers can increase crop yields with small amounts of foliar

fertilizer and water flush fertilizer, both based on humic acid. Foliar

fertilizer and water flush fertilizer can effectively reduce consumption of

traditional fertilizers, alleviate soil crust, decrease the remaining amount of

unused Nitrogen, Phosphorus and Potassium in soil, and meanwhile improve

fertilizers efficiency, crops’ drought resistance ability, as well as products

quality.

Industry

Overview:

Seed Industry in China is

Highly Fragmented

China’s

seed industry is extremely fragmented. According to statistics, there are over

9,000 licensed seed companies. But less than 100 of them are deemed as scaled

seed companies with registered capital greater than $4.3 million. The seed

providers can be divided as:

Small seed companies

distribute their products within cities. Such companies control few

seed patents and a regional distribution network. Such companies are not able to

maintain sufficient control of product quality, and they are mostly low priced

competitors. In 2006, the government enhanced entrance barrier to the seed

industry by raising registered capital of existing companies and new companies

to $73,000. We expect this trend will be continued in the future.

Scaled seed enterprises in

China mainly sell seeds which have been improved by using hybrid techniques.

Especially in the field crops, most seeds used for planting are seeds improved

through hybrid. These large-scale enterprises, such as Fuer have the ability to

obtain new hybrid seed patents, and effectively control product

quality.

International seed

companies are only

permitted to control 49% interest in any entity that engages in production

of field seeds. Their selling of seeds is conducted mainly through joint

ventures with the scaled seed companies. They are only competing with hybrid

products, as China prohibits sales and distribution of genetically modified field crop

seeds.

Disintegration

of research and distribution

At present, most improvement and research on new seeds

is conducted by state owned

institutions. The institutions were targeted at inventing plants that fit for

local agricultural

conditions. Few Chinese companies are able to research on

their own. Generally all

product patents in China are purchased form research institutions. The companies

purchase such patent by auction or provide cash support to the researchers. The

barrier between research

and distribution hampers conversion from patent to product, as well as

improvement of the seed industry.

The Company has maintained steady

cooperation with local institutions, such as Heilongjiang Academy of Agriculture

Science and Heihe Institution of Agriculture. We will

subsidize the research program if feasibility is established, in exchange for preemptive and price

rebates of the patent or

long term exclusive franchise rights over the new seed

variety.

14

Field Seed

Market of northeastern

China

Agriculture production in northeastern

China differs greatly from other regions. Crops are planted and harvested once a

year. The region is divided into different zones according to temperature and

rainfalls. Heilongjiang, the largest and the most important agricultural

province in the region, is

divided into 6 accumulated

temperature zones. Accumulated temperature is calculated by adding the average

temperatures of each day when the daily average temperature is higher than 15

centigrade. Zones 1-3

represents south part of the province, and are fit for corn and rice. Zone 4,

represents the north part of the province, and are

fit for growth of soybean and certain corn varieties. Zone 5-6, where

accumulated temperature is lower than 2,000 centigrade, is fit for growth of soybeans.

Temperature zones are not always the same. In some years, when the weather is

colder than average years, farmers in southern zones would be forced to

cultivate the crops which are applicable for higher temperature zones.

Companies that do not have a broad product

portfolio would be adversely affected by changes in climate, and fluctuation in

production of certain field crops.

Genetically

Modified Crops in China

At present, China prohibits production

and distribution of genetically modified crops. The Chinese

have been adverse toward genetically modified crops (“GM crops”). People are more suspicious about

safety of the GM crops

since 2 GM corn varieties were granted safety license in November,

2009. With regards to the short history of GM crops, there are no

clear results about safety of the GM crops to humans and nature. In the United

States and Europe, GM crops

are not allowed to be

made directly edible for

human consumption.

However, as China’s pressure for maintaining food supply and the diminishing

potential of hybrid technology continues, it is certain the government will open

a window for GM crops in the future, but have not in the recent past

years.

The

Humic

Fertilizer Industry

Producers of compound

fertilizers including

plant nutrition regulators are mainly traditional fertilizers producers.

China’s fertilizer industry is very fragmented. As of 2007, a total of 2,800

enterprises have reported to the Ministry of Agriculture for record, among which

164 are humic acid producers. The majority of these humic acid producers produce

fertilizers in traditional workshops, which cannot guarantee products quality.

Many companies even do not have compound fertilizer production licenses and

fertilizer registration certificates. We believe that most products in the

current market are not able to provide the targeted solutions for different

growth phases of crops, which is not effective in increasing yields. As China

strictly controls import and export of fertilizers, large international

fertilizer companies have not entered into China’s seed market.

Strategy

Enhancing Cooperative

Research and

Development and

Purchase of Seed Variety Rights:

We are

planning to intensify our communication and cooperation with our existing

partner agriculture research institutes and such institutes in other provinces.

We intend to become more active in participating in research programs of hybrid

seeds that fits our target market and the buyout of the outcomes as we expand to

other provinces in China. We are also determined to build our own research

team with the latest knowledge of breeding new field seeds.

Expanding Network of Our

Branded Stores

In the next 3 years, we intend to focus

our sales channel on our new direct stores and enroll more franchised stores in

our market, so as to enhance our profitability and customer loyalty. We will

establish customer membership and databases to trace the habit of each customer

for more accurate marketing efforts and improve customer service. We believe

this business will make use of our existing advantages in quality products and

well known brands, and create advantages in integrated and controlling sales

network.

15

Participating in Research of

GM Crops and Build our Own Research Team

The Company has been aware of the

future trends that GM crops will be accepted by the Chinese government. As

current efforts of GM seeds are concentrated on the seeds for southern part of

China, we will seek opportunities to cooperate with universities and institutes

to develop GM crops that adapt to the climate in northeastern China, especially

in the Heilongjiang Province to solidify our leadership in this

market.

Acquiring Quality Seed and

Fertilizer Enterprises

We believe seed patent and brand

awareness are the only important factors for us to solidify our market share and

enter into new provincial markets. We will seek to acquire companies with

product patent or distribution channels that fit our expansion plans. We are

also seeking to privatize local agricultural research institutes to enhance our

research and development

capabilities.

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING

STATEMENTS

Certain

statements made in this report may constitute “forward-looking statements on our current expectations and

projections about future events.” These forward-looking statements

involve known or unknown risks, uncertainties and other factors that may cause

our actual results, performance, or achievements to be materially different from

any future results, performance or achievements expressed or implied by the

forward-looking statements. In

some cases you can identify forward-looking statements by terminology such as

“may,” “should,” “potential,” “continue,” “expects,” “anticipates,” “intends,”

“plans,” “believes,” “estimates,” and similar expressions. These

statements are based on our current beliefs, expectations, and assumptions and

are subject to a number of risks and uncertainties. Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, levels of activity, performance or

achievements. These forward-looking statements are made as of the date of this

report, and we assume no obligation to update these forward-looking statements

whether as a result of new information, future events, or otherwise, other than

as required by law. In light of these assumptions, risks, and uncertainties, the

forward-looking events discussed in this report might not occur and actual

results and events may vary significantly from those discussed in the

forward-looking statements.

Overview

We are a

leading Chinese agricultural material company providing quality hybrid corn

seeds, soybean seeds, rice seeds and fertilizer product to farmers in the

northeastern China, which is the most important agriculture region in the

country. Through our 1,094 distributors and 3,430 outlets, we distribute our

products to 58 million farmers located in Heilongjiang, Jilin, and northeastern

Inner Mongolia and to the rest of China. Our seed products are breed with our

exclusively contracted breeders in Heilongjiang, Jilin, and northeastern Inner

Mongolia.

Historical

Developments

Since

establishment, we have endeavored to develop new products. In 2005, we purchased

a humic fertilizer patent from China Institute of Agriculture, and have

developed a series of products based on the patent that adapt to different

environment and soil conditions in different area of northeastern China. In

2007, we participated in the China Spark Program, a plan for developing new

agricultural techniques and product lead by the Ministry of Science and

Technology of PRC, and invented cold proof additives for seeds. The additive

will be launched in 2010.

During

the past 7 years, Fuer has been diligent on product quality and successfully

elevated our brand reputation and attained a solid customer base. We were

granted “the Most Respect Enterprise Award” in 2007 by the China Academy of

Humic Acid Industry. In 2008, we were certified under ISO 9001 and

14001.

In Jan

2010, the Company was recognized as a “High-tech Enterprise” by the state

government, which entitled us to favor upon enterprise income tax.

16

Factors

Affecting our Results of Operations

Shrinking Arable Land and

Growing Population

China is

facing great stress upon its food supply. Arable land in China is shrinking as a

result of construction of buildings and basic facilities, desertification, soil

pollution, and urbanization. Nevertheless, Chinese population is expecting to

keep rising until 2033, reaching 1.5 billion people. China has to lean on

extensive use of fertilizer and high yield hybrid grain seeds to maintain

sufficient food supply.

Great Potential in the Seeds

Market

Farmers

in China use a great portion of seeds from the output of previous year for the

need in the next year. According to National Bureau of Statistics of China, in

2008, only 38.5% of seeds used were supplied by seeds companies, compared to

world average of 70% and over 90% in developed countries, which creates a market

of $4 billion. Additionally, seeds price in China are generally 5 to 8 times the

grain price, compared to 15 to 25 times in the developed countries.

Low Industry Concentration

and Abundant Acquisition Opportunities

At

present, the seed products are supplied by over 7,000 seeds providers, a great

majority of which are low scale and do not control up to date seed patents.

Seeds market concentration is far below the developed countries. Historically,

the government of China has raised entrance barrier for seeds companies by means

of registered capital threshold. The movement has created great merger and

acquisition opportunities. We believe this trend will continue in the

future.

Adverse Attitude Toward

Genetically Modified Seeds

Though

years have passed since genetic modification technique were adopted in seed

production, safety of genetically modified grain is still unproved. It is

estimated that cultivation of genetically modified plant would impact gene

stability of surrounding natural plants, and the health of creatures that eat

them. At present, both the EU and the United States have not approved

genetically modified crops edible for humans. Though 2 varieties of genetically

modified corn seed was granted Safety Certificates from Committee of food safety

of the Ministry of Agriculture of the PRC, they still await for further

approvals for commercial selling, as clarified by the state authority. It still

takes years for genetically modified grain to be accepted by

customers.

Ongoing Urbanization and

Growing Disposable Income Boost Demand For Meat and Corn.

In China,

urban residents consume more meat products than rural residents per capita. With

urbanization in the past decade, meat output has increased with compound annual

growth rate of 1.17% from 2000 to 2007. Corn is the most widely used among

grains for feeding poultry and livestock, for it accumulates more carbohydrate

with more efficient photosynthesis process. Therefore grain production increased

with compound annual growth rate of 4.63% in the same period. It is reasonable

that corn cultivation will continue growing in the future as China’s

urbanization rate and disposable income grow.

Results

of Operations

The

following table sets forth certain information regarding our results of

operations.

|

For the Quarters Ended

March 31,

|

For the

Years Ended December 31,

|

|||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

Unaudited

|

Unaudited

|

Audited

|

Audited

|

|||||||||||||

|

($ in thousands)

|

($ in thousands)

|

|||||||||||||||

|

Statements of Operations

Data

|

||||||||||||||||

|

Sales

|

$

|

15,307

|

$

|

12,208

|

$

|

16,168

|

$

|

11,626

|

||||||||

|

Cost of goods

sold

|

8,990

|

7,102

|

9,469

|

6,865

|

||||||||||||

|

Gross

profit

|

6,317

|

5,106

|

6,699

|

4,761

|

||||||||||||

|

General and

administrative

|

285

|

178

|

1,342

|

833

|

||||||||||||

|

Sales and

marketing

|

123

|

60

|

1,346

|

1,119

|

||||||||||||

|

Operating and administrative

expenses

|

408

|

238

|

2,688

|

1,952

|

||||||||||||

|

Income from continuing

operations

|

5,909

|

4,868

|

4,011

|

2,809

|

||||||||||||

|

Other income

(expenses)

|

10

|

(33

|

)

|

(78

|

)

|

(63

|

)

|

|||||||||

|

Income tax

expenses

|

887

|

1,209

|

995

|

693

|

||||||||||||

|

Net income

|

$

|

5,032

|

$

|

3,626

|

$

|

2,938

|

$

|

2,053

|

||||||||

17

Year

Ended December 31, 2009 compared to December 31, 2008

Sales

Our sales

consist primarily of revenues generated from sales of corn seeds, rice seeds,

soybean seeds, fertilizers and agricultural chemical products. Sales increased

by approximately $4.54 million, or 39.07%, from approximately $11.63 million in

2008 to approximately $16.17 million in 2009. This increase was primarily

attributable to expanding our market areas and distribution network throughout

Northeastern China, increased demand for our corn seed products and strong

market acceptance of our products. In addition, our inventories increased

approximately $1.26 million, or approximately 19.52%, from approximately $6.46

million as of December 31, 2008 to approximately $7.72 million as of December

31, 2009. This increase was primarily attributable to increased production in

accordance with the seed breeding plan made in the second quarter of 2009 and

production plan of fertilizer and germicides, pesticides, and herbicides to meet

the growing demand for our products.

The

following table sets forth information regarding the sales of our principal

products during the fiscal years ended December 31, 2009 and 2008:

|

2009

|

2008

|

|||||||||||||||||||||||

|

Product name

|

Quantity

|

Amount

|

% of

|

Quantity

|

Amount

|

% of

|

||||||||||||||||||

|

(Kg’000)

|

($’000)

|

Sales

|

(Kg’000)

|

($’000)

|

Sales

|

|||||||||||||||||||

|

Corn Seeds

|

10,758 | 10,544 | 65.22 | % | 6,600 | 6,232 | 53.60 | % | ||||||||||||||||

|

Soybean

Seeds

|

1,418 | 1,287 | 7.96 | % | 1,775 | 1,825 | 15.70 | % | ||||||||||||||||

|

Rice Seeds

|

1,402 | 1,062 | 6.57 | % | 1,672 | 1,317 | 11.33 | % | ||||||||||||||||

|

Vegetable

Seeds

|

293 | 419 | 2.59 | % | 31 | 101 | 0.87 | % | ||||||||||||||||

|

Fertilizers

|

4,142 | 2,309 | 14.28 | % | 3,664 | 1,625 | 13.98 | % | ||||||||||||||||

|

Plant Regulators

|

574 | 300 | 1.85 | % | 516 | 254 | 2.18 | % | ||||||||||||||||

|

Germicides, Pesticides and

Germicides

|

418 | 247 | 1.53 | % | 605 | 272 | 2.34 | % | ||||||||||||||||

The

fluctuation in average sales price per kilogram of corn seeds, soybean seeds and

rice seeds, as reflected in the table, is relatively small and primarily

attributable to the market competition and demand for the products. As

vegetable seeds differ greatly from each other, average selling price decreased

drastically as more vegetable seeds product with low unit price was

sold during 2009. Average selling prices of fertilizers, plant additives,

germicides, pesticide and herbicides are generally caused by increase in sales

of high margin product. The following table shows sales price per kilogram by

product for 2009 and 2008 and the percentage change in the sales price per

kilogram.

|

Average Price

Per Kilogram

|

Percentage

Change

|

|||||||||||

|

Product

|

2009

|

2008

|

||||||||||

|

Corn Seeds

|

$

|

0.98

|

$

|

0.94

|

3.80

|

%

|

||||||

|

Soybean

Seeds

|

0.91

|

1.03

|