Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - SPORT CHALET INC | ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - SPORT CHALET INC | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - SPORT CHALET INC | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended March 28, 2010

OR

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to .

Commission file number: 0-20736

Sport Chalet, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 95-4390071 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

| One Sport Chalet Drive, La Cañada, California | 91011 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (818) 949-5300

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on Which Registered: | |

| Class A Common Stock, $0.01 par value | The NASDAQ Stock Market LLC | |

| Class B Common Stock, $0.01 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | [ ] | Accelerated filer | [ ] | ||

| Non-accelerated filer | [ ] | Smaller reporting company | [ X ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

The aggregate market value of Class A Common Stock and Class B Common Stock held by non-affiliates of the registrant as of September 27, 2009, was approximately $10.5 million based upon the closing sale prices of Class A Common Stock and Class B Common Stock on that date.

At June 17, 2010, there were 12,413,490 shares of Class A Common Stock outstanding and 1,775,821 shares of Class B Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2010 annual meeting of stockholders are incorporated by reference into Part III of this Report. The proxy statement will be filed with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year ended March 28, 2010.

|

Item

|

Page

|

|

|

PART I

|

||

|

1.

|

||

|

1A.

|

||

|

1B.

|

||

|

2.

|

||

|

3.

|

||

|

4.

|

||

|

PART II

|

||

|

5.

|

||

|

6.

|

||

|

7.

|

||

|

7A.

|

||

|

8.

|

||

|

9.

|

||

|

9A(T).

|

||

|

9B.

|

||

|

PART III

|

||

|

10.

|

||

|

11.

|

||

|

12.

|

||

|

13.

|

||

|

14.

|

||

|

PART IV

|

||

|

15.

|

||

PART I

This Annual Report on Form 10-K contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements relating to trends in, or representing management’s beliefs about, our future strategies, operations and financial results, as well as other statements including words such as “believe,” “anticipate,” “expect,” “estimate,” “predict,” “intend,” “plan,” “project,” “will,” “could,” “may,” “might” or any variations of such words or other words with similar meanings. Forward-looking statements are made based upon management’s current expectations and beliefs concerning trends and future developments and their potential effects on the Company. You are cautioned not to place undue reliance on forward-looking statements as predictions of actual results. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Further, certain forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Actual results may differ materially from those suggested by forward-looking statements as a result of risks and uncertainties which are discussed in further detail under “Item 1A. Risk Factors.” We do not assume, and specifically disclaim, any obligation to update any forward-looking statements, which speak only as of the date made.

General Overview

Sport Chalet, Inc. (referred to as the “Company,” “Sport Chalet,” “we,” “us,” and “our” unless specified otherwise) is a leading operator of 55 full-service, specialty sporting goods stores in California, Nevada, Arizona and Utah, comprising a total of over two million square feet of retail space. As of March 28, 2010, we had 34 locations in Southern California, nine in Northern California, three in Nevada, eight in Arizona and one in Utah. These stores average approximately 41,000 square feet in size. In addition, we have a Team Sales Division and an ECommerce store at sportchalet.com. Originally we were incorporated in California and we reincorporated as a Delaware corporation in 1992. Our executive offices are located at One Sport Chalet Drive, La Cañada, California 91011, and our telephone number is (818) 949-5300.

Operating History

In 1959, Norbert Olberz, our founder (the “Founder”), purchased a small ski and tennis shop in La Cañada, California. A focus on providing quality merchandise with outstanding customer service was the foundation of Norbert’s vision. As a true pioneer in our industry, Norbert’s goal was to:

|

|

·

|

See things through the eyes of the customer;

|

|

|

·

|

Do a thousand things a little bit better;

|

|

|

·

|

Not be the biggest, but the best;

|

|

|

·

|

Be the image of the sportsperson; and

|

|

|

·

|

Create ease of shopping.

|

Over the last 51 years, Sport Chalet has grown into a chain of 55 specialty sporting goods stores serving California, Nevada, Arizona and Utah, with a Team Sales Division and an ECommerce store.

Our growth had historically focused on Southern California; but since 2001 we have expanded our scope to all of California and to Nevada, Arizona and Utah, as well as ECommerce. Generally, our new stores were located with the intent of strengthening our focus on Southern California or in areas characterized by a large number of housing developments. We opened seven new stores in fiscal 2008, 11 new stores in the last three years and 20 in the last five years. In fiscal 2009, we opened four new stores, relocated one existing store and re-launched our website. We did not open any new stores in fiscal 2010 and currently do not anticipate opening new stores in fiscal 2011. We are using this respite to analyze and evaluate our current real estate portfolio to ensure that we manage our capital investment in the most efficient means possible. In addition, we are focused on our ECommerce store as our best method of establishing a national footprint.

Store openings have had a favorable impact on sales volume, but have negatively affected profit in the short term. New stores tend to have higher costs in the early years of operation, due primarily to increased promotional costs and lower sales on a per employee basis until the store matures. As the store matures, sales tend to level off and expenses decline as a percentage of sales. We believe our stores historically have required three to four years to attract a stable, mature customer base; but, because of our relatively low number of stores and changing economic conditions, reliable statistical trends are not available and there can be no assurance that our newer stores will mature at that rate.

1

Recent History

Our stores are located in states that are among those hardest hit by the downturn in the housing and credit markets, increased unemployment and bankruptcies. Our sales are largely dependent on the level of consumer spending in the geographic regions surrounding our stores. A recession in the general economy or uncertainties regarding future economic prospects that affect consumer spending habits in our market areas are having, and may continue to have, a materially adverse effect on our results of operations.

Our comparable store sales growth had been positive for the four fiscal years prior to fiscal 2008. The severe downturn in the macroeconomic environment caused comparable store sales to decline 12.4% in fiscal 2009, and as a result we incurred a net loss of $52.2 million, or $3.70 per diluted share for fiscal 2009. During fiscal 2009, we began aggressively taking action by examining our practices, assumptions, models and costs in an effort to modify our business model to make the Company more efficient. Continuing into fiscal 2010, we focused on improving liquidity and reducing operating expenses through the following core initiatives:

|

|

·

|

Secured an amendment to our loan agreement and temporarily increased availability an additional $10 million.

|

|

|

·

|

Renegotiated lease terms to reduce base rent and add percentage rent based on sales and clauses permitting us to terminate leases on stores which do not obtain specified minimum sales levels (“kick-out clauses”).

|

|

|

·

|

Communicated with all vendors regularly to make sure they were fully aware of the challenges we faced and continued their support.

|

|

|

·

|

Improved inventory management and aggressively reduced aged inventory, thereby providing fresher merchandise in our stores.

|

|

|

·

|

Significantly increased payroll efficiency in our stores and distribution center, thereby delivering lower spend per customer while maintaining the customer experience.

|

|

|

·

|

Initiated significant reductions in corporate overhead related to personnel and discretionary spending.

|

As a result of these initiatives, we reduced markdowns $11.0 million, rent $3.7 million, labor $9.9 million, advertising $5.8 million, professional fees $3.3 million and other expenses $5.1 million during fiscal 2010 as compared to fiscal 2009, and our net loss for fiscal 2010 was reduced to $8.3 million, or $0.59 per diluted share, compared to a net loss of $52.2 million or $3.70 per diluted share, for fiscal 2009.

Comparable store sales decreased 8.3% for fiscal 2010, but improved each consecutive quarter and the fourth quarter marked our first increase in comparable store sales after ten consecutive quarters of negative comparable store sales. Comparable store sales by quarter for the past three fiscal years are set forth in the following table:

|

Quarter

|

||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | |||||||||||||

|

FY 2010

|

5.7% | (10.8%) | (12.4%) | (14.7%) | ||||||||||||

|

FY 2009

|

(17.7%) | (15.4%) | (6.7%) | (11.1%) | ||||||||||||

|

FY 2008

|

(8.8%) | (6.9%) | (2.2%) | 1.3% | ||||||||||||

2

While the comparable store sales increase in the fourth quarter of fiscal 2010 reflects a positive change in trends, we remain focused on continued improvement through the following:

|

|

·

|

Continuing to improve the functionality and efficiency of sportchalet.com by leveraging our business partners’ significant knowledge in their areas of expertise.

|

|

|

·

|

Continually refining the way each store is merchandised so as to best fit to its individual store market area and customer base through information provided by our Action Pass customer relationship program.

|

.

|

|

·

|

Increasing utilization of our growing Action Pass membership to create ever more effective marketing vehicles.

|

|

|

·

|

Continuing to refine and expand our Team Sales Division by attracting new universities and leagues as customers, while focusing on continuous profitability improvements through more efficient manufacturing and embellishment processes.

|

|

|

·

|

Recommitment to ensuring we have the best trained merchandise and specialty services employee experts throughout our Company.

|

|

|

·

|

Continuing toward the full utilization of our information systems to understand our business better and to improve efficiency in both inventory and overall operating costs.

|

Although no assurance can be given about the ultimate impact of these initiatives or of the overall economic climate, we believe these initiatives, combined with the exit or diminished capacity of many key specialty competitors in our marketplace, will position us for better results in the future as the economy improves.

Stores and Merchandising

Our prototype store is 42,000 square feet in size and showcases every merchandise and service category with the feel of a specialty shop all contained under one roof. The full-service approach to customer service and product knowledge is enhanced by fixtures which feature specific technical, performance and lifestyle brands. Each shop is staffed by trained sales associates with expertise in the merchandise they sell, permitting us to offer our customers a high level of product knowledge and service from the beginner to the advanced sports enthusiast.

Our prototype format boasts a natural and outdoor-feel color scheme, clear-coated fixtures, 30-foot clear ceilings, large sport-specific graphics, a training pool for SCUBA and water sports instruction and demonstrations, and a 100 foot shoe wall, among other features. We have retro-fitted ten mature stores to conform to the prototype as much as was practical. For both new stores and remodels, we continually update our prototype format to remain competitive. While we have taken advantage of unusual building layouts in the past, and when appropriate may do so in the future, we will utilize as many standard prototype design elements as possible. We evaluate stores for remodel based on each store’s age and competitive situation, as well as how much the landlord will contribute to our required improvements. Future store remodeling plans will depend upon several factors, including, but not limited to, general economic conditions, competitive trends and the availability of capital. As of March 28, 2010, 78% of our store base is based on our prototype.

Our stores feature a number of distinct, specialty sports and lifestyle categories, offering a large assortment of quality brand name merchandise at competitive prices. The stores include traditional sporting goods merchandise (e.g., footwear, apparel and other general athletic products) and core specialty merchandise such as snowboarding, skateboarding, mountaineering and SCUBA. The merchandise appeals to both beginner and expert users. Using our investments in technology, we tailor each store’s merchandise mix to appeal to our customers in each market. Generally, our stores are open seven days a week, typically from 9:30 a.m. to 9:30 p.m. Monday through Friday, 9:00 a.m. to 9:00 p.m. Saturday, and 10:00 a.m. to 7:00 p.m. on Sunday.

3

Our stores offer over 50 services for the sports enthusiast, including backpacking, canyoneering and kayaking instruction, custom golf club fitting and repair, snowboard and ski rental and repair, SCUBA training and certification, SCUBA boat charters, team sales, racquet stringing, and bicycle tune-up and repair. Although the revenues generated by these support services are not material, these services further differentiate us from our competitors.

The following table illustrates our merchandise assortment of hardlines, which are durable items, and softlines, which are non-durable items suchas apparel and footwear, as a percentage of total net sales for each of the last three fiscal years:

|

Fiscal year

|

|||||||||||

|

2010

|

2009

|

2008

|

|||||||||

|

Hardlines

|

53% | 53% | 52% | ||||||||

|

Apparel

|

26% | 27% | 28% | ||||||||

|

Footwear

|

21% | 20% | 20% | ||||||||

|

Total

|

100% | 100% | 100% | ||||||||

ECommerce

Prior to December 2008, Sport Chalet had an online store that was operated and managed by GSI Commerce, Inc. (“GSI”). Since 1999, GSI had created and operated all aspects of the sportchalet.com shopping experience, including fulfillment and purchasing. Sport Chalet received a license fee based on a percentage of sales generated by the website. The licensing fee was not material to total revenues.

In March 2009, we re-launched our website at sportchalet.com, providing a fully integrated online/offline shopping experience for customers. The site is currently managed by Sport Chalet employees and displays the complete selection of merchandise available in Sport Chalet stores. The new site also presents information about all the services available in our stores and provides product selection tools, advice and community sharing technologies. In developing this new ECommerce strategy, we leveraged our significant investments in infrastructure and systems including SAP, Epicor, High Jump and MarketMax/SAS. We also partnered with leading technology providers to maximize the opportunity including:

|

|

·

|

MarketLive – for the ECommerce platform and website hosting. The MarketLive solution includes value added technology services from Endeca, Omniture and Scene7.

|

|

|

·

|

Sapient Interactive – for site design, build and technical integration.

|

|

|

·

|

Shopatron – for order management, payment processing, customer support, and enabling of in-store pickup.

|

|

|

·

|

Baazarvoice – for customer ratings and reviews.

|

|

|

·

|

Experian Cheetah Mail – for email campaign management.

|

Purchases made online are shipped from the distribution center or our stores, leveraging our inventory investment. Customers also have the option to complete purchases online and have merchandise available for in-store pickup. Additionally, in conjunction with Enterprise Selling, a direct to customer service, any merchandise item in any store is available for direct shipping to the customer at any other store, their home or business. The website supports the redemption of the same gift cards and Action Pass rewards as may be redeemed in our stores.

Team Sales Division

We operate our Team Sales Division in a facility located in Van Nuys, California. Team Sales serves as a full service, vertically integrated team dealer offering in-house embellishment, silk screen, embroidery and custom art work on uniforms, footwear and equipment. The Team Sales customer base is generally comprised of universities, high schools, athletic teams, youth sports leagues, booster clubs and recreational organizations. We utilize an outside commissioned sales force to serve our customers. Team Sales offers a unique added value by establishing an early relationship between our customers at all skill levels and ages and our Sport Chalet brand and retail stores.

4

Marketing and Advertising

Historically, we have generated our marketing and advertising campaigns in-house, with production support from outside vendors as needed. The campaigns are designed to reflect our strategic direction through our brand and product offerings, as well as communicate a focused and consistent theme/event calendar through media including email, the internet, special events, direct mail, radio and magazines. Our marketing leverage has been boosted by vendor payments under cooperative marketing arrangements as well as vendor participation in sponsoring events, clinics and athletes’ appearances. In fiscal 2010, we significantly enhanced our online presence with a complete redesign of sportchalet.com and new initiatives focused on driving consumers to the new website and building ongoing relationships with our Action Pass customers. We also seek to strengthen our position as a leading sporting goods retailer in our markets through high-profile sponsorships with teams and organizations such as the world champion Los Angeles Lakers, University of Southern California, University of California, Los Angeles, Los Angeles and Disneyland Marathons, Association of Volleyball Professionals and Element YMCA Skate Camp, while raising our profile in communities where we do business with contributions to local teams and leagues through our Team Sales Division.

The launch of the new sportchalet.com in March 2009 marked the introduction of an ECommerce strategy to better connect with our customers, capture additional market share through an online and offline shopping experience, and raise familiarity with Sport Chalet. As traditional forms of media become less relevant and effective, this platform has allowed us to leverage our vendors’ creative resources and web-ready content to our advantage. Unlike traditional media, there is less lead time involved and a social connection can be established with customers, similar to the store experience. By internally managing the website, we are able to better control product assortments, specialty services featured and branding opportunities offered. The new site is supported with a program of online ads combined with search engine marketing and optimization to build awareness of Sport Chalet with online shoppers, especially around key promotional periods.

Our customer relationship program, Action Pass, continues to grow following its rollout in November 2007, now with over one million members. In addition to earning points for each purchase redeemable towards future purchases, Action Pass members have access to exclusive merchandise, appearances by athletes, trips and specialty services related to their particular sporting interest. The program allows us to develop marketing vehicles targeted at specific customers to create excitement around product launches, new technologies and new services. We are forming stronger relationships with our customers as we actively solicit Action Pass members’ feedback regarding their decision to shop at Sport Chalet and perceptions of our store environment, product selection, and pricing. This allows us to understand our customers’ purchasing habits and shopping carts. We use this information to respond to our customers’ shopping preferences and patterns with continuous improvement in merchandise assortments, category adjacencies and other marketing initiatives across our entire network of stores. Additionally, we are not obligated to long term advertising schedules, which can be expensive, and we believe this to be a more efficient way to use vendor support.

Seasonality

The market for retail sporting goods is seasonal in nature. As with many other retailers, our business is heavily affected by sales of merchandise during the Holiday season. In addition, our product mix has historically emphasized cold weather sporting goods merchandise, particularly Winter-sports related products. In recent years, our third fiscal quarter, which includes the Holiday season, represented approximately 30% of our annual net sales. Winter-related products and services represent approximately 16% of our annual net sales and have ranged from 25% to 30% of sales in our fourth fiscal quarter. We anticipate this seasonal trend in sales will continue. We attempt to respond to changes in mid-season weather by maintaining flexibility in product placement at the stores and the marketing of product offerings. See “Item 1A. Risk Factors – Seasonal fluctuations in the sales of sporting goods could cause our annual operating results to suffer.”

5

Purchasing and Distribution

In order to provide a full line of specialty and sporting goods brands and a wide selection, we purchase merchandise from approximately 1,000 vendors. Vendor payment terms typically range from 30 to 120 days from our receipt, and there are no long-term purchase commitments. Our largest vendor, Nike, Inc., accounted for approximately 10% of our total inventory purchases for fiscal 2010, slightly higher than fiscal 2009, and our ten largest vendors collectively accounted for approximately 40% of our total purchases during fiscal 2010.

For merchandise planning and allocation we use the SAS Marketmax software solution. This software includes merchandise planning, open-to-buy management, assortment planning, store clustering, high performance forecasting, performance analysis and allocation. We allocate merchandise to our stores based on trends and statistical modeling maximizing flow-through at our distribution center. We believe this technology package allows us to better plan and forecast our business and leverage the information to optimize store assortments and merchandise allocations.

For replenishment we use a system from JDA Software Group, Inc. The JDA E3 system consists of three modules: (i) warehouse replenishment, which manages purchases from vendors, (ii) store replenishment, which manages shipments from the warehouse to stores, and (iii) network optimization, which synchronizes the two systems. In addition, we use the JDA Consumer Outlook and Pinpoint seasonal profile software to help identify, create and manage the seasonal trends of our merchandise. Currently, we use the E3 system to manage approximately 54% of our total inventory. The remaining 46% of the inventory purchases are managed by the SAS Marketmax software.

With our EDI capabilities, we provide sell through information by individual item size, color, and store to our key merchandise suppliers so that they can better forecast our inventory needs and we can better refine our assortments by store.

We operate one distribution center, a 326,000 square foot facility located in Ontario, California. The distribution center serves as the primary receiving, distribution and warehousing facility. A minimal amount of merchandise is shipped directly by vendors to our stores. Most of the product received at the distribution center is processed by unpacking and verifying the contents received and then sorting the contents by store for delivery. Some of the product received at the distribution center is pre-packaged and pre-ticketed by the vendor so it can be immediately cross-docked to trucks bound for the stores. Due to the efficiencies cross-docking creates, we encourage vendors to pre-package their merchandise in a floor-ready manner. Some of the merchandise is held at the distribution center for future allocation to the stores based on current sales trends as directed by our computerized replenishment and allocation systems to optimize inventory levels. We believe that the advantages of a single distribution center include reduced individual store inventory levels and better use of store floor space, timely inventory replenishment of store inventory needs, consolidated vendor returns, and reduced transportation costs. Common carriers deliver merchandise to our stores.

Epicor Enterprise Selling software replaced our manual processes of locating and transferring products for a customer in fiscal 2008. In the event we do not stock a particular item in a store, this software allows us to quickly locate the item in another location, including our distribution center, and complete the sale by accepting payment from the customer and shipping merchandise from the most optimal location to the customer’s preferred destination.

Information Systems

Historically we have used a “best of breed” approach to information systems. All systems communicated with a legacy system that was the centralized data repository and the primary financial system. As part of our comprehensive review of internal control over financial reporting and also to enhance our ability to grow, the legacy system has been replaced effective March 31, 2008.

In October 2006, we selected mySAP2005 ERP from SAP as the replacement system and began the implementation process. Selecting SAP was based on a strategic decision to focus future resources on a single-vendor ERP solution. Our analysis had revealed that recent improvements in SAP’s solutions provided robust retail functions, and we anticipate that future releases will provide additional support for improved retail business processes. This decision will eventually permit us to enjoy the efficiencies of a fully integrated solution without the overhead generally associated with interfacing systems in a multi-vendor solution.

6

Store systems use the Retail Store 3.0 Suite of applications from Epicor Retail Systems that include a Returns Management application, and IBM SurePOS hardware. Epicor Enterprise Selling was added in fiscal 2008. The processing of debit/credit card authorization allows on-line debit and signature capture. A rental program is also a part of the store system. For merchandise planning and allocation we use the SAS Marketmax software solution. Merchandise replenishment is controlled by E3 software from JDA. The distribution center uses warehouse management software from HighJump Software.

Our inventory systems track purchasing, sales and inventory transfers down to the lowest level of detail, individual items by size, color and store, which allow us to identify and project trends and replenishment needs on a timely basis.

Recapitalization Plan

In September 2005, our stockholders approved a recapitalization plan designed to facilitate the orderly transition of control from our Founder to certain members of management and to increase financial flexibility for the Company and its stockholders. The recapitalization plan consisted of (1) the reclassification of each outstanding share of common stock as 0.25 share of Class B Common Stock, (2) the issuance of seven shares of Class A Common Stock for each outstanding share of Class B Common Stock and (3) the transfer of a portion of the Founder’s ownership to Craig Levra, Chairman and Chief Executive Officer, and Howard Kaminsky, Executive Vice President - Finance, Chief Financial Officer and Secretary. The recapitalization doubled our total number of shares outstanding. Therefore, the recapitalization plan had the same effect on earnings per share as a 2-for-1 stock split. Shares transferred by the Founder to Messrs. Levra and Kaminsky were treated as a contribution to the Company’s capital with the offsetting charge as compensation expense.

Trademarks and Trade Names

We use the “Sport Chalet” name as a service mark in connection with our business operations. We have registered “Sport Chalet” as a federal service mark with the United States Patent and Trademark Office, along with the mark “Action Pass,” among others. We also own additional common law trademarks and service marks which are used in commerce without dispute.

Industry and Competition

The market for retail sporting goods is highly competitive, fragmented and segmented. We compete with a variety of other retailers, including the following:

|

|

·

|

specialty stores and independent dealers;

|

|

|

·

|

internet retailers and catalog merchandisers;

|

|

|

·

|

vendor owned stores;

|

|

|

·

|

high end department stores;

|

|

|

·

|

big box sporting goods chains; and

|

|

|

·

|

mass merchandisers, club stores and discount stores.

|

Beginning in 2008, the retail industry was severely impacted by the weak macroeconomic environment. Several competitors have closed stores, including Sierra Snowboard, Busy Body, Active Ride Shops, Chick’s Sporting Goods, Joe’s, Sportsman’s Warehouse and independent retailers. Other competitors may have greater financial resources than we do, or better name recognition in regions into which we have recently or might seek to expand. Specialty retailers often have the advantage of a lower cost structure and a smaller "footprint" that can be located in shopping centers and strip malls, offering more customer convenience. We also compete with big box sporting goods chains with more purchasing power, but with less emphasis on customer service and specialty services, which often choose to compete on price.

7

We have distinguished ourselves from our competitors by our emphasis on customer service and specialty services, and by providing a broader selection of higher-end specialty items that require such service and expertise. We believe that our broad selection of high quality name brands and numerous specialty items at competitive prices, showcased by our well-trained sales associates, differentiates us from all of our competitors.

Employees

As of March 28, 2010, we had a total of approximately 3,000 (down from 3,200 at March 29, 2009 and 4,300 at March 30, 2008) full and part-time employees, 2,700 of whom were employed in our stores and 300 of whom were employed in warehouse and delivery operations or in corporate office positions. None of our employees are covered by a collective bargaining agreement. We operate with an open door policy and encourage and welcome the communication of our employees’ ideas, suggestions and concerns and believe this contributes to our strong employee relations. Generally, each store employs a general manager, two to three assistant managers, who along with supervisors and department heads oversee the sales associates in customer service, merchandising, and operations. Additional part-time employees are typically hired during the Holiday and other peak seasons.

We are committed to the growth and training of our employees in order to provide “The Experts” in product knowledge and service to our customers. We conduct specialty universities, consisting of off-site technical training and product demonstrations provided by our vendors for our employees. All of these universities are recorded for follow-up training online, and we continuously provide individual category training on an individual store basis. This training prepares our employees to become certified in particular sports or activities, while at the same time reducing employee turnover. In addition, our “Certified Pro” program encourages employees to attend product-line-specific clinics and receive hands-on training to improve technical product and service expertise. Only after completing all of the clinics and training and passing specific tests, may an associate be considered a Certified Pro. Certified Pro certification is offered in 20 different service disciplines and is a requirement for new associates in their areas of expertise. Being knowledgeable and informed allows our work force to meet the customer's needs and enhance their shopping experience.

Additional Information

The Company makes available free of charge through our website, sportchalet.com, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as soon as reasonably practicable after those reports are filed with or furnished to the Securities and Exchange Commission (“SEC”).

The public may read any of the items we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding the Company and other issuers that file electronically with the SEC at www.sec.gov.

8

Our short-term and long-term success is subject to many factors that are beyond our control. Stockholders and prospective stockholders in the Company should consider carefully the following risk factors, in addition to the information contained in this report. This Annual Report on Form 10-K contains forward-looking statements, which are subject to a variety of risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors including those set forth below.

We have a history of losses which could continue in the future.

We have reported losses in each of the last three fiscal years and have an accumulated deficit of $10.8 million as of March 28, 2010. There can be no assurance that we will report net income in any future period.

The limited availability under our revolving credit facility may result in insufficient working capital.

Our credit facility with Bank of America, N.A. (the “Lender”) provides for advances up to $45.0 million to the Company, increasing to $70.0 million, from September 1st of each year through December 31st of each year, and up to an additional $10.0 million currently is available to the Company through a special advance facility. The amount available under the special advance facility will be reduced by $2.5 million on the first day of each month commencing on July 1, 2010, and the special advance facility will terminate on October 1, 2010. The amount we may borrow under this credit facility is limited to a percentage of the value of eligible inventory, minus certain reserves. Our obligation to the Lender is presently secured by a first priority lien on substantially all of our non-real estate assets. A significant decrease in eligible inventory due to our vendors’ unwillingness to ship us product, the aging of inventory, an unfavorable inventory appraisal or other factors, could have an adverse effect on our borrowing capabilities under our credit facility, which may adversely affect the adequacy of our working capital.

If cash generated by operations does not result in a sufficient level of unused borrowing capacity, our current operations could be constrained by our ability to obtain funds under the terms of our revolving credit facility. In such a case, we would need to seek other financing alternatives with our bank or other sources. Additional financing may not be available at terms acceptable to us, or at all. Failure to obtain financing in such circumstances may require us to significantly curtail our operations.

In the event of a significant decrease in availability under our credit facility, we may have insufficient working capital to continue to operate our business as it has been operated, or at all.

The covenants in our revolving credit facility may limit future borrowings to fund our operations.

Our credit facility with our Lender is subject to an EBITDA covenant that requires us to exceed certain monthly amounts as defined in the Fourth Amendment to the Amended and Restated Loan and Security Agreement. There can be no assurance that there will not be an event of default and additional financing may not be available at terms acceptable to us, or at all. Failure to obtain financing in such circumstances may require us to significantly curtail our operations.

If our vendors do not provide sufficient quantities of products, our net sales may suffer and hinder our return to profitability.

We purchase merchandise from approximately 1,000 vendors. Although only one vendor accounted for approximately 10% of our total inventory purchases for fiscal 2010, our dependence on principal vendors involves risk. Our ten largest vendors collectively accounted for approximately 40% of our total purchases during fiscal 2010. If there is a disruption in supply from a principal vendor for any reason, including concern over our position with our Lender, we may be unable to obtain merchandise that we desire to sell and that consumers desire to purchase. A vendor could discontinue selling products to us at any time for reasons that may or may not be within our control. Our net sales may decline and hinder our return to profitability if we are unable to promptly replace a vendor who is unwilling or unable to satisfy our requirements with a vendor providing equally appealing products. Moreover, many of our vendors provide us with incentives, such as return privileges, volume purchase allowances and cooperative marketing arrangements. A decline or discontinuation of these incentives could also negatively impact our results of operations.

9

If we are unable to effectively manage and expand our alliances and relationships with selected suppliers of brand name products, we may be unable to effectively execute our strategy to differentiate ourselves from our competitors.

As part of our focus on product differentiation, we have formed strategic alliances and exclusive relationships with selected suppliers to market products under a variety of well-recognized brand names. If we are unable to manage and expand these alliances and relationships or identify alternative sources for comparable products, we may not be able to effectively execute product differentiation.

A downturn in the economy has affected consumer purchases of discretionary items, significantly reducing our net sales and profitability.

The retail industry historically has been subject to substantial cyclical variations. The merchandise sold by us is generally a discretionary expense for our customers. The current downturn in the general economy and uncertainties regarding future economic prospects that affect consumer spending habits are having, and are likely to continue for some time to have, a materially adverse effect on our results of operations. We have sustained operating losses and negative comparable store sales for the past three fiscal years. In the event sales decline at a rate greater than anticipated to support the loan covenants, we may have insufficient working capital to continue to operate our business as it has been operated, or at all.

No assurance can be given that we will be successful in reducing operating expenses and controlling costs in an amount sufficient to return to profitability.

In our efforts to reduce operating expenses and improve liquidity, we have reviewed all of our store leases and are obtaining rent reductions and lease modifications from our landlords. Additionally, we are evaluating our operating expenses, such as store labor, corporate overhead and advertising, and continue to implement cost reductions. No assurance can be given that by reducing operating expenses and controlling costs we will return to profitability. Any failure to successfully reduce an adequate amount of operating expenses and control costs could constrain our ability to continue to operate our business.

We may need to record additional impairment losses in the future if our stores' operating performance does not improve.

We continually review all our stores' operating performance and evaluate the carrying value of their assets in relation to their expected future cash flows. In those cases where circumstances indicate that the carrying value of the applicable assets may not be recoverable, we record an impairment loss related to the long-lived assets. We incurred a non-cash impairment charge of $10.9 million, $10.7 million and $2.1 million in fiscal 2010, fiscal 2009 and fiscal 2008, related to six, nine and two stores, respectively. If our newer stores' operating performance does not improve in the future or our existing stores’ operating performance continues to deteriorate in the future, the carrying value of our stores' assets may not be recoverable in light of future expected cash flows. Additionally, our newer stores may not mature at a rate in line with our expectations or past experience. This may result in our need to record additional impairment losses in certain markets where our stores operate and could have a materially adverse effect on our business, financial condition and results of operations.

Intense competition in the sporting goods industry could limit our growth and reduce our profitability.

The sporting goods business and the retail environment are highly competitive, and we compete with local, regional and national specialty stores and independent retailers, internet retailers and catalog merchandisers, vendor owned stores, high end department stores, big box sporting goods chains, mass merchandisers, club stores, and discount stores. A number of our competitors are larger and may have greater resources. No assurance can be given that a diminished competitive environment due to the exit of key competitors throughout the marketplace will allow us to improve our business and increase our overall profitability.

10

Our future operations may be dependent on the availability of additional financing.

We may not be able to fund our future operations or react to competitive pressures if we lack sufficient funds. Unexpected conditions could cause us to be in violation of our Lender’s operating covenants as occurred in fiscal 2009. Although we have restructured our bank credit facility and we believe we have sufficient cash available through our bank credit facility and cash from operations to fund existing operations for the foreseeable future, we cannot be certain that additional financing will be available in the future if necessary.

Because our stores are concentrated in the western portion of the United States, we are subject to regional risks.

Currently, most of our stores are located in Southern California and the remaining are located in Northern California, Nevada, Arizona and Utah. Accordingly, we are subject to regional risks, such as the economy, weather conditions, natural disasters and government regulations. For example, warm Winter weather in the resorts frequented by our customers has affected sales in the third quarter of the most recent fiscal year. When the region suffers an economic downturn, such as declines in the housing and credit markets, increased unemployment and bankruptcies, which has been strongly felt in California, Arizona and Nevada, or when other adverse events occur, historically there has been an adverse effect on our sales and profitability. In addition, many of our vendors rely on the Ports of Los Angeles and Long Beach to process our shipments. Any disruption or congestion at the ports could impair our ability to adequately stock our stores. Several of our competitors operate stores across the United States and, thus, are not as vulnerable to such regional risks.

If we are unable to predict or react to changes in consumer demand, we may lose customers and our sales may decline.

If we fail to anticipate changes in consumer preferences, we will experience lower net sales, higher inventory markdowns and lower margins. Products may or may not appeal to a broad range of consumers whose preferences cannot be predicted with certainty. These preferences are also subject to change. Specialty sporting goods are often subject to short-lived trends, such as the short-lived popularity of wheeled footwear. Apparel is significantly influenced by the latest fashion trends and styles. Our success depends upon the ability to anticipate and respond in a timely manner to trends in specialty merchandise and consumers’ participation in sports on an individual market basis. Failure to identify and respond to these changes may cause net sales to decline. In addition, because we generally make commitments to purchase products from vendors up to nine months in advance of the proposed delivery, misjudging the market may cause us to over-stock unpopular products and force inventory markdowns that could have a negative impact on profitability, or cause us to have insufficient inventory of a popular item that can be sold at full markup.

Failure to protect the integrity and security of our customers’ information could expose us to litigation and materially damage our standing with our customers.

The increasing costs associated with information security — such as increased investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud — could cause our business and results of operations to suffer materially. While we are taking significant steps to protect customer and confidential information, there can be no assurance that advances in computer capabilities or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. More specifically, as Action Pass, our customer relationship program, continues to grow, our exposure and risk increase as well. If any such compromise of our information security were to occur, it could have a material adverse effect on our reputation, business, operating results and financial condition and may increase the costs we incur to protect against such information security breaches.

11

As a result of the current economic downturn, we have delayed opening new stores. Continued growth is uncertain and subject to numerous risks.

Since our inception, we have experienced periods of rapid growth. No assurance can be given that we will be successful in maintaining or increasing our sales in the future. Any future growth in sales will require additional working capital and may place a significant strain on our management, information systems, inventory management and distribution facilities. Any failure to timely enhance our operating systems, or unexpected difficulties in implementing such enhancements, could have a material adverse effect on our results of operations.

In addition, growth depends on a strategy of opening new, profitable stores in existing markets and in new regional markets. The ability to successfully implement this growth strategy could be negatively affected by any of the following:

|

|

·

|

suitable sites may not be available for leasing;

|

|

|

·

|

we may not be able to negotiate acceptable lease terms;

|

|

|

·

|

we might not be able to hire and retain qualified store personnel; and

|

|

|

·

|

we might not have the financial resources necessary to fund our expansion plans.

|

We face additional challenges in entering new markets, including consumers’ lack of awareness of the Company, difficulties in hiring personnel and problems due to our unfamiliarity with local real estate markets and demographics. New markets may also have different competitive conditions, consumer tastes and discretionary spending patterns than our existing markets. To the extent that we are not able to meet these new challenges, sales could decrease and operating costs could increase. Furthermore, a decline in our overall financial performance, increased rents or any other adverse effects arising from the commercial real estate market in our geographical markets may adversely affect our growth. There can be no assurance that we will possess sufficient funds to finance the expenditures related to growth, that new stores can be opened on a timely basis, that such new stores can be operated on a profitable basis, or that such growth will be manageable.

If we lose key management or are unable to attract and retain talent, our operating results could suffer.

We depend on the continued service of our senior management. The loss of the services of any key employee could hurt our business. Also, our future success depends on our ability to identify, attract, hire, train and motivate other highly skilled personnel. Failure to do so may adversely affect future results.

Seasonal fluctuations in the sales of our merchandise and services could cause our annual operating results to suffer.

Our sales volume increases significantly during the Holiday season as is typical with other retailers. In addition, our product mix has historically emphasized cold weather merchandise increasing the seasonality of our business. In recent years, our third fiscal quarter, which includes the Holiday season, represented approximately 30% of our annual net sales. Winter-related products represent approximately 16% of our annual net sales and have ranged from 25% to 30% of our fourth fiscal quarter. We anticipate this seasonal trend in sales will continue. The operating results historically have been influenced by the amount and timing of snowfall at the resorts frequented by our customers. An early snowfall often has influenced sales because it generally extends the demand for Winter apparel and equipment, while a late snowfall may have the opposite effect. Ski and snowboard vendors require us to make commitments for purchases of apparel and equipment by early Spring for Fall delivery, and only limited quantities of merchandise can be reordered during the Fall. Consequently, we place our orders in the Spring anticipating snowfall in the Winter. If the snowfall does not at least provide an adequate base or occurs late in the season, or if sales do not meet projections, we may be required to mark down our Winter apparel and equipment.

12

Our quarterly operating results may fluctuate substantially, which may adversely affect our business.

We have experienced, and expect to continue to experience, a substantial variation in our net sales and operating results from quarter to quarter. We believe that the factors which influence this variability of quarterly results include general economic and industry conditions that affect consumer spending, changing consumer demands, the timing of our introduction of new products, the level of consumer acceptance of each new product, the seasonality of the markets in which we participate, the weather and actions of competitors. Accordingly, a comparison of our results of operations from period to period is not necessarily meaningful, and our results of operations for any period are not necessarily indicative of future performance.

Declines in the effectiveness of marketing could cause our operating results to suffer.

Our marketing campaigns historically relied on direct mail, radio, newspaper, magazines and more recently, email and the internet. Also our marketing leverage has been boosted by vendor payments under cooperative marketing arrangements as well as vendor participation in sponsoring events, clinics and athletes’ appearances. Our recent strategy shift significantly enhanced our online presence with a complete redesign of sportchalet.com and new initiatives focused on driving consumers to the new website and building ongoing relationships with our Action Pass customers. We are directly marketing to individual customers based on their personal shopping information through the customer relationship program. No assurance can be given that our recent shift in marketing strategy will be successful in connecting with our customers, capturing additional market share through a fully integrated online and offline shopping experience, and raising familiarity with Sport Chalet. We are relatively new to and have fewer resources than our competitors in the ECommerce arena and our results may not meet our expectations. In addition, no assurance can be given that what we learn from our Action Pass members about their shopping preferences and patterns will increase our ability to apply this learning to decisions about assortments, category adjacencies, and other marketing initiatives across our entire network of stores.

Problems with our information systems could disrupt our operations and negatively impact our financial results.

Our ability to successfully manage inventory levels and our centralized distribution system largely depends upon the efficient operation of our computer hardware and software systems. We use management information systems to track inventory information at the store level, replenish inventory from our warehouse, and aggregate daily sales information, among other things. These systems and our operations are vulnerable to damage or interruption from:

|

|

·

|

earthquake, fire, flood and other natural disasters;

|

|

|

·

|

power loss, computer systems failures, internet and telecommunications or data network failure, operator negligence, improper operation by or supervision of employees, physical and electronic loss of data and similar events; and

|

|

|

·

|

computer viruses, penetration by hackers seeking to disrupt operations or misappropriate information and other breaches of security.

|

We seek to minimize these risks by the use of backup facilities and redundant systems. Nevertheless any failure that causes an interruption in our operations or a decrease in inventory tracking could result in reduced net sales.

We are controlled by our Founder and management, whose interests may differ from other stockholders.

As of June 17, 2010, Norbert Olberz, the Company's founder, Craig Levra, the Company’s Chairman and Chief Executive Officer, and Howard Kaminsky, the Company’s Chief Financial Officer, owned approximately 20%, 33% and 12%, respectively, of the voting power of the Company’s outstanding voting Class A and Class B Common Stock. Messrs. Olberz, Levra and Kaminsky effectively have the ability to control the outcome on all matters requiring stockholder approval, including, but not limited to, the election and removal of directors, and any merger, consolidation or sale of all or substantially all of the Company’s assets, and to control the Company’s management and affairs. Transactions may be pursued that could enhance Messrs. Olberz, Levra and Kaminsky’s interests in the Company while involving risks to the interests of the Company’s other stockholders, and there is no assurance that their interests will not conflict with the interests of the Company’s other stockholders.

13

The price of our Class A Common Stock and Class B Common Stock may be volatile.

Our Class A Common Stock and Class B Common Stock are thinly traded making it difficult to sell large amounts. The market prices of our Class A Common Stock and Class B Common Stock are likely to be volatile and could be subject to significant fluctuations in response to factors such as quarterly variations in operating results, operating results which vary from the expectations of securities analysts and investors, changes in financial estimates, changes in market valuations of competitors, announcements by us or our competitors of a material nature, additions or departures of key personnel, future sales of Class A Common Stock and Class B Common Stock and stock volume fluctuations. Also, general political and economic conditions such as a recession or interest rate fluctuations may adversely affect the market price of our Class A Common Stock and Class B Common Stock.

From time to time the Class A Common Stock has traded significantly lower than the Class B Common Stock, and there can be no assurance as to the relative trading prices of the Class A Common Stock and the Class B Common Stock.

Provisions in the Company's charter documents could discourage a takeover that stockholders may consider favorable.

As of June 17, 2010, Norbert Olberz, the Company's founder, Craig Levra, the Company’s Chairman and Chief Executive Officer, and Howard Kaminsky, the Company’s Chief Financial Officer, owned approximately 20%, 33% and 12%, respectively, of the voting power of the Company’s outstanding voting Class A and Class B Common Stock. The holder of a share of Class B Common Stock is entitled to one vote on each matter presented to the stockholders whereas the holder of a share of Class A Common Stock has 1/20th of one vote on each matter presented to the stockholders. Subject to the Class A protection provisions described below, Messrs. Olberz, Levra and Kaminsky will be able to sell shares of Class A Common Stock and use the proceeds to purchase additional shares of Class B Common Stock, thereby increasing their collective voting power. Subject to the prohibition on the grant, issuance, sale or transfer of Class B Common Stock to Messrs. Levra and Kaminsky, the Company will also be able to issue Class B Common Stock (subject to the applicable rules of the NASD and the availability of authorized and unissued shares of Class B Common Stock) to persons deemed by the Board of Directors to be preferable to a potential acquirer, thereby diluting the voting power of that potential acquirer. The Class A protection provisions in the Company's Certificate of Incorporation could also make acquisition of voting control more expensive by requiring an acquirer of 10% or more of the outstanding shares of Class B Common Stock to purchase a corresponding proportion of Class A Common Stock.

The Company's Certificate of Incorporation contains certain other provisions that may have an "anti-takeover" effect. The Company's Certificate of Incorporation does not provide for cumulative voting and, accordingly, a significant minority stockholder could not necessarily elect any designee to the Board of Directors. As a result of these provisions in the Company's Certificate of Incorporation, stockholders of the Company may be deprived of an opportunity to sell their shares at a premium over prevailing market prices and it would be more difficult to replace the directors and management of the Company.

We may be subject to periodic litigation that may adversely affect our business and financial performance.

We may be subject to lawsuits resulting from injuries associated with the use of the products or services we sell, employment matters or violations of government regulations. There is a risk that claims or liabilities will exceed our insurance coverage. In addition, we may be unable to retain adequate liability insurance in the future. An unfavorable outcome or settlement in any such proceeding could, in addition to requiring us to pay any settlement or judgment amount, increase our operating expense as a consequence and cause damage to our reputation.

14

Changes in accounting standards and subjective assumptions, estimates and judgments related to complex accounting matters could significantly affect our financial results.

Accounting principles generally accepted in the United States and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, such as revenue recognition; lease accounting; the carrying amount of property and equipment, inventories and deferred income tax assets are highly complex and may involve many subjective assumptions, estimates and judgments by management. Changes in these rules or their interpretation or changes in underlying assumptions, estimates or judgments could significantly change our reported or expected financial performance.

Terrorist attacks or acts of war may harm our business.

Terrorist attacks may cause damage or disruption to our employees, facilities, information systems, vendors and customers, which could significantly impact net sales, costs and expenses and financial condition. The potential for future terrorist attacks, the national and international responses to terrorist attacks, and other acts of war or hostility may cause greater uncertainty and cause us to suffer in ways that we currently cannot predict. Our geographical focus in California, Nevada, Arizona and Utah may make us more vulnerable to such uncertainties than other comparable retailers who may not have similar geographical concentration.

We rely on one distribution center and any disruption could reduce our sales.

We currently rely on a single distribution center in Ontario, California. Any natural disaster or other serious disruption to this distribution center due to fire, earthquake or any other cause could damage a significant portion of our inventory and could materially impair both our ability to adequately stock our stores and our sales and profitability.

We may pursue strategic acquisitions, which could have an adverse impact on our business.

We may from time to time acquire complementary companies or businesses. Acquisitions may result in difficulties in assimilating acquired companies, and may result in the diversion of our capital and our management’s attention from other business issues and opportunities. We may not be able to successfully integrate operations that we acquire, including their personnel, financial systems, distribution, operations and general store operating procedures. If we fail to successfully integrate acquisitions, our business could suffer. In addition, the integration of any acquired business, and their financial results, into ours may adversely affect our operating results. We currently do not have any agreements with respect to any such acquisitions.

Our comparable store sales will fluctuate and may not be a meaningful indicator of future performance.

Changes in our comparable store sales results could affect the price of our Class A Common Stock and Class B Common Stock. A number of factors have historically affected, and will continue to affect, our comparable store sales results, including: competition, our new store openings and remodeling, general regional and national economic conditions, actions taken by our competitors, consumer trends and preferences, changes in the shopping centers in which we are located, new product introductions and changes in our product mix, timing and effectiveness of promotional events, lack of new product introductions to spur growth in the sale of various kinds of sports equipment, and weather. Our comparable store sales may vary from quarter to quarter, and an unanticipated decline in revenues or comparable store sales may cause the price of our Class A Common Stock and Class B Common Stock to fluctuate significantly.

15

A regional or global health pandemic could severely affect our business.

A health pandemic is a disease that spreads rapidly and widely by infection and affects many individuals in an area or population at the same time. If a regional or global health pandemic were to occur, depending upon its location, duration and severity, our business could be severely affected. Customers might avoid public places in the event of a health pandemic, and local, regional or national governments might limit or ban public gatherings to halt or delay the spread of disease. A regional or global health pandemic might also adversely impact our business by disrupting or delaying production and delivery of products in our supply chain and by causing staffing shortages in our stores.

Global warming could cause erosion of both our Winter and Summer seasonal businesses over a long-term basis.

Changes to our environment, whether natural or man-made, could cause significant disruption in both air temperature and snowfall, limiting our ability to capitalize on one of our core competencies, the Winter business. In addition, lack of proper snowfall could have a negative impact on our fishing and lake-focused water sports businesses, as these rely on streams, rivers, and lakes to be at adequate depth and clarity in order to provide enjoyable experiences for our customers.

Not applicable.

At March 28, 2010, we had 55 store locations. Swimming pool facilities for SCUBA and kayaking instruction are located in 33 of the 55 store locations The following table details key information on our store locations by region:

|

Year

|

% of Total

|

|||||||||

|

Region

|

Entered

|

Number of Stores

|

Number of Stores

|

|||||||

|

Southern California

|

1959

|

34 | 62 | % | ||||||

|

Northern California

|

2003

|

9 | 16 | % | ||||||

|

Arizona

|

2005

|

8 | 15 | % | ||||||

|

Nevada

|

2001

|

3 | 5 | % | ||||||

|

Utah

|

2007

|

1 | 2 | % | ||||||

|

Total

|

55 | 100 | % | |||||||

We lease all of our existing store locations. The leases for most of the existing stores are for approximately ten-year terms plus multiple option periods under non-cancelable operating leases with scheduled rent increases. The leases provide for contingent rent based upon a percentage of sales in excess of specified minimums. If there are any free rent periods, they are accounted for on a straight line basis over the lease term, beginning on the date of initial possession, which is generally when we enter the space and begin the construction build-out. The amount of the excess of straight line rent expense over scheduled payments is recorded as a deferred rent liability. Construction allowances and other such lease incentives are recorded as deferred credits, and are amortized on a straight line basis as a reduction of rent expense over the lease term. All of the leases obligate us to pay costs of maintenance, utilities, and property taxes.

In our efforts to reduce operating expenses and improve liquidity, we have reviewed our store leases and obtained rent reductions and lease modifications from our landlords. These negotiations have included renegotiating base rent, revising some of our leases to contain percentage rent clauses, which obligate us to pay rents based on a percentage of sales rather than fixed amounts, and amending certain leases to feature kick-out clauses, which allow us to terminate the lease at our option at a specified date if contractually specified minimum sales volumes are not exceeded. We did not open any new stores in fiscal 2010 and currently do not anticipate opening new stores in fiscal 2011. We are using this respite to analyze and evaluate our current real estate portfolio to ensure that we manage our capital investment in the most efficient means possible.

16

We lease from corporations controlled by Norbert Olberz, our Founder, our corporate office space in La Cañada and our stores in La Cañada, Huntington Beach and Porter Ranch, California. We have incurred rental expense to the Founder of $3.2 million, $2.8 million and $2.5 million in fiscal 2010, 2009 and 2008, respectively.

Management believes that the occupancy costs under the leases with corporations controlled by the Founder described above are no higher than those which would be charged by unrelated third parties under similar circumstances.

From time to time, the Company is involved in various routine legal proceedings incidental to the conduct of its business. Management does not believe that any of these legal proceedings will have a material adverse impact on the business, financial condition or results of operations of the Company, either due to the nature of the claims, or because management believes that such claims should not exceed the limits of the Company’s insurance coverage.

By letter dated May 14, 2008, an attorney for a former employee has asserted claims for sexual harassment by a former supervisor during the former employee’s one year of employment. The former employee alleges being subjected to verbal and physical harassment. The former employee is seeking compensatory damages and punitive damages, attorneys' fees and costs. The dispute was submitted for resolution to an arbitrator and the hearing before the arbitrator is in October 2010. We are not able to evaluate the likelihood of an unfavorable outcome nor can we estimate a range of potential loss in the event of an unfavorable outcome at the present time. If resolved unfavorably to us, this litigation could have a material adverse effect on our financial condition.

17

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Price for Common Shares

Pursuant to the stockholder approved recapitalization plan that established two classes of common stock, on September 21, 2005, each outstanding share of common stock was reclassified into 0.25 share of Class B Common Stock. On September 30, 2005, the Company made a non-taxable stock dividend of seven shares of Class A Common Stock for each one outstanding share of Class B Common Stock. The recapitalization doubled our total number of shares outstanding and, therefore, had the same impact on earnings per share as a 2-for-1 stock split. Our Class A Common Stock and Class B Common Stock are traded on the Nasdaq Global Market System under the symbol “SPCHA” and “SPCHB,” respectively. The following table reflects the range of high and low sale prices of our Class A Common Stock and Class B Common Stock for the periods indicated:

|

Class A

|

Class B

|

|||||||||||||||

|

FY 2011

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

Q1*

|

$ | 3.49 | $ | 2.21 | $ | 3.63 | $ | 2.51 | ||||||||

|

Class A

|

Class B

|

|||||||||||||||

|

FY 2010

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

Q4

|

$ | 2.84 | $ | 1.75 | $ | 3.43 | $ | 2.00 | ||||||||

|

Q3

|

$ | 2.45 | $ | 1.51 | $ | 4.61 | $ | 2.32 | ||||||||

|

Q2

|

$ | 2.17 | $ | 1.23 | $ | 4.95 | $ | 2.01 | ||||||||

|

Q1

|

$ | 2.50 | $ | 0.16 | $ | 3.41 | $ | 0.54 | ||||||||

|

Class A

|

Class B

|

|||||||||||||||

|

FY 2009

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

Q4

|

$ | 0.50 | $ | 0.16 | $ | 0.95 | $ | 0.41 | ||||||||

|

Q3

|

$ | 2.70 | $ | 0.30 | $ | 3.37 | $ | 0.50 | ||||||||

|

Q2

|

$ | 4.75 | $ | 2.91 | $ | 4.58 | $ | 3.15 | ||||||||

|

Q1

|

$ | 5.63 | $ | 4.20 | $ | 5.25 | $ | 4.25 | ||||||||

|

*through June 17, 2010

|

||||||||||||||||

On June 17, 2010, the closing price of our Class A Common Stock and Class B Common Stock as reported by Nasdaq was $2.65 and $2.80, respectively. Stockholders are urged to obtain current market quotations for the Class A Common Stock and Class B Common Stock.

Approximate Number of Holders of Common Shares

The number of stockholders of record of our Class A Common Stock and Class B Common Stock as of June 15, 2010 was 138 and 127, respectively (excluding individual participants in nominee security position listings), and as of that date, we estimate that there were approximately 1,000 beneficial owners for Class A Common Stock and 800 beneficial owners for Class B Common Stock holding stock in nominee or “street” name.

18

Performance Graph

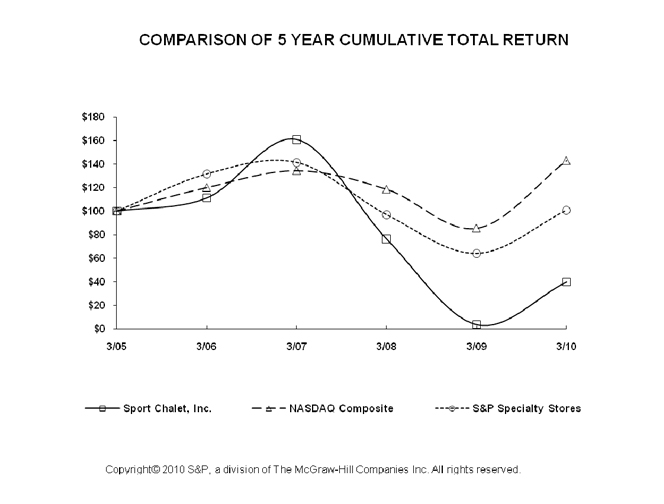

The following graph compares the yearly percentage change in cumulative total stockholder return of the Company's common stock during the period from March 31, 2005 to March 28, 2010 with (i) the cumulative total return of the Nasdaq Composite Stock Market Index and (ii) the cumulative total return of the S&P Specialty Stores Index. The comparison assumes $100 was invested on March 31, 2005 in the common stock and in each of the foregoing indices and the reinvestment of dividends through March 28, 2010. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

In September 2005, the stockholders of the Company approved amendments to the Company's Certificate of Incorporation that resulted in the reclassification of each outstanding share of common stock as 0.25 share of Class B Common Stock and the issuance of seven shares of Class A Common Stock for each outstanding share of Class B Common Stock. For the period commencing on September 30, 2005, the Company has added the share price of one share of Class B Common Stock and seven shares of Class A Common Stock in calculating its cumulative total return for purposes of the following graph.