Attached files

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 10-K/A-3

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For Fiscal Year Ended August 31, 2007

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______________________ TO _______________________

Commission File # 000-52268

ASIAN DRAGON GROUP INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

98-0418754

(IRS Employer Identification Number)

1312 North Monroe Street, Suite 108, Spokane, Washington 99201

(Address of principal executive offices) (Zip Code)

(509) 252-8428

(Registrant’s telephone no., including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act: Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated file.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter:

Based on the closing price on December 13, 2007 of $1.11, the aggregate market value of the 32,325,000 common shares held by non-affiliates was $35,880,750.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 38,275,000 Common shares were outstanding as of December 14, 2007.

Documents incorporated by reference: As noted in Item 15.

NOTE:

The Company has determined that an amount of $9,679,407 recorded as Exploration License payments in the original financial statements for fiscal 2007 should not have been expensed for the year ended August 31, 2007. These financial statements reflect a removal of these expenses for fiscal 2007 and this re-filed Annual Report on Form 10-K/A-3 is based on a re-audit of the Company's financial statements for the year ended August 31, 2007 and includes a new 'Report of Independent Registered Public Accounting Firm' for the year ended August 31, 2007.

ASIAN DRAGON GROUP INC.

(an Exploration Stage Company)

Table of Contents

PART I

ITEM 1. DESCRIPTION OF BUSINESS

General

Asian Dragon was established to develop projects which focus on China’s growing precious and base metals reserves and markets.

Investors should be aware there is no assurance that a commercially viable mineral deposit exists on any of the properties for which we are purchasing exploration licenses, and that further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Background

Asian Dragon Group Inc. (“Asian Dragon”, “ADG”, “we”, the “Registrant”, or the “Company”) was incorporated in Nevada on June 11, 2003 and on August 10, 2006 filed Articles of Amendment with the Nevada Secretary of State to change its name to Asian Dragon Group Inc.

On August 15, 2003, ADG acquired 100% of the issued and outstanding shares of Galaxy Telnet S.R.L. (“Galaxy Telnet”) a company incorporated under the laws of Romania under a stock exchange agreement between ADG and Galaxy Telnet dated as of October 31, 2003. Before this transaction, a former director was the sole shareholder of Galaxy Telnet. Before the acquisition of Galaxy Telnet, we did not conduct business.

We had anticipated Galaxy Telnet would be able to exploit the introduction of Voice Over Internet telecommunications services in Romania. Unfortunately this initiative was unsuccessful. As a consequence, on June 8, 2006 the Board authorized the wind-up of Galaxy Telnet. During the balance of the fiscal 2006 all affairs of the Galaxy Telnet were finalized and on August 23, 2006 it was de-registered as a corporate entity in Romania. As required by United States generally accepted accounting principles (“GAAP”), all financial information regarding Galaxy Telnet has been recorded in the financial statements as a discontinued operation. Additionally, when ADG closed Galaxy Telnet it became required under GAAP to reset the development stage period as an exploration period with a start date of August 15, 2006, the date of the dissolution of the subsidiary. The following discussion and analysis covers material changes in the financial condition of Asian Dragon from August 15, 2006 without the inclusion of its terminated subsidiary.

The Company’s common stock is traded in the NASD Over-The-Counter market under the symbol “AADG” and the Company is also listed on the Frankfurt Stock Exchange under the trading symbol “P2J1”.

Our fiscal year end is August 31st.

Business Development

Asian Dragon has developed it business by using World Fortune Enterprise Inc. (“WFEI”) as its Agent. The nature of the business arrangement between Asian Dragon and WFEI is based upon: (i) WFEI acting as Asian Dragon’s Agent in China to source exploration opportunities; (ii) WFEI executing contracts with partners in China which provide access to certain exploration opportunities based upon certain payment schedules; and (iii) WFEI entering agreements with Asian Dragon to sell to Asian Dragon, based on certain

payment schedules, the exploration licenses which WFEI has contracted to acquire. Under its current Exploration Agreements (attached herein as Exhibits 10.1, 10.2 and 10.3), Asian Dragon has no recourse on WFEI in the event that WFEI were to fail to meet its contractual obligations to flow funds WFEI receives from Asian Dragon through to WFEI’s Chinese Partners, or if WFEI were to fail to meet any other non-monetary obligations.

At present Asian Dragon has not acquired any of the Exploration Licenses which are referenced in its Agreements. Such acquisitions will occur upon Asian Dragon completing all payments under its Exploration Agreements with WFEI; and WFEI fulfilling all requirements under WFEI’s agreements with it Chinese Partners.

Exploration Licenses

Exploration/Concession rights are administered by the Ministry of Land and Resources in the Henan Province of the People’s Republic of China (PRC). There are Provincial and Federal bodies, with each Provincial body overseeing its own jurisdiction. The Company plans to follow and adheres to “The Mineral of Resources Law of PRC” and “China’s Policy on Mineral Resources (2003)” to administer exploration concession/mineral rights in PRC.

These can be found at:

China's Policy on Mineral Resources (2003):

http://english.gov.cn/official/2005-07/28/content_17963.htm

Mineral of Resources Law of PRC:

http://english1.mofcom.gov.cn/aarticle/lawsdata/chineselaw/200211/20021100053807.html

The Company has entered agreements to purchase 70% interests in each of six different mineral exploration licenses in China. The sites relating to these licenses are as follows: Jinjishan, Loning, Luanchuan Mozigou, Lushi Jiashapa, Xiayu Fanggelewan, and the Xiaowagou.

Jinjishan Site and Concentration Plant

The Jinjishan License consists of an Exploration License on a contiguous 28.3 sq km property located in the Northwest part of the Luoning County, Henan Province, PRC in the Changshui community. The Jinjishan Plant is located in the same area and we note that the formerly operating Jinjishan Plant, and other infrastructure and buildings acquired in each of our Exploration License purchases to date entirely, and without exception, have no value from an accounting or operational perspective due to age and state of repair.

The Company entered into an agreement with World Fortune Enterprise Inc. to acquire a 70% interest in the Jinjishan License and a 100% interest in the Jinjishan Concentration Plant. Under the agreement the Company assumed the payment responsibilities of World Fortune for the Jinjishan Interests.

The terms of the Jinjishan Agreement require payments of $2,500,000 for the Jinjishan License and $800,000 for the Jinjishan Concentration Plant, for total consideration of $3,300,000. The Jinjishan Agreement acknowledged the Company provided payments totaling US$1,792,593 to August 29, 2007 (inclusive of a payment of US$600,000 toward the Jinjishan Plant) and required further investment by the Company as follows: (i) US$500,000 by October 1, 2007; (ii) US$500,000 by March 1, 2008; and (iii) US$500,000 by October 1, 2008.

World Fortune does not own the interests referenced in its agreement with Asian Dragon. World Fortune has an agreement with Luoyang Canadian United Mining Ltd. (“LCUML”) for those interests. LCUML owns the rights for the interests in the Xiaoquinling region of China, which were purchased from the Luoyang Jinjishan Gold Mine Company (“Luoyang Jinjishan”). World Fortune has represented that when they eventually assign the rights to Asian Dragon, those rights will be free and clear of all transfer, assignment, liens, charges, or encumbrances of any kind. World Fortune has also represented that when the option is exercised, it will have the right and authority to transfer the rights to Asian Dragon.

It is also anticipated WFEI, in its role as Asian Dragon’s China Agent, will aid the Company in establishing a Chinese Registered Subsidiary which will be wholly owned by Asian Dragon. The mineral rights under this agreement will ultimately be transferred into this subsidiary.

Asian Dragon, WFEI, LCUML, and Luoyang Jinjishan are all independent parties and are dealing at arm’s length in these arrangements.

Asian Dragon is not a party to the agreement between World Fortune and LCUML, nor a party to the agreement between LCUML and Luoyang Jinjishan which previously owned the rights and may have little or no recourse on LCUML or Luoyang Jinjishan, in the event that the purchase agreement does not comply with their agreements with each other or World Fortune. However, Asian Dragon has received an attorney’s letter from Mr. Tian Huiquing, Kunda Law Office, Hunan, China stating that the agreements are valid. Transfer of any rights in any of the above agreements will not be complete until all payments are completed.

Asian Dragon issued 250,000 shares of its common stock to World Fortune on August 29, 2007 and an additional one million shares to World Fortune nominees in regards to this agreement.

Subsequent to year-end on December 12, 2007, with the mutual consent of WFEI, the agreement was replaced with the “Jinjishan Agreement” which clarified certain terminology in the predecessor agreements. This agreement is attached herein as Exhibits 10.1. WFEI has provided Asian Dragon with an undertaking that it has extinguished all rights to any payments under the predecessor agreements and has acknowledged that it has recorded all cash and share payments made under the predecessor agreements as payments respectively under the Jinjishan Agreement, the Loning Agreement, and the Fuding Agreement.

Effective December 2, 2008, the Company determined it would be unable to raise sufficient capital to meet contractual payment obligations under three exploration property purchase agreements it had

entered. As such, the Board approved a resolution which authorized the Company to abandon its current exploration initiatives in China and cancel the Agreements it had signed with World Fortune

Enterprise Inc., such cancellations to be effective December 2, 2008. Additionally, the Company cancelled the FGLW-XWG Transfer Agreement (dated April 30, 2008) which had assigned some of the Company’s rights under the Fuding (Revised) Agreement to its subsidiary Asian Dragon Silver Inc., such cancellation was also effective December 2, 2008.

Loning Site

The Loning License consists of an Exploration License on a 9.1 sq km property located in the Xiaoqinling Region, PRC, and three km southwest of the Jinjishan License.

The Company entered into an agreement with World Fortune effective August 29, 2007, to acquire a 70% interest in the Loning License. Under the Loning Agreement, The Company assumed the payment responsibilities of World Fortune for the Loning License.

The Loning Agreement requires total payments by the Company of $1,510,000, of which $1,000,000 is to be expended by the Company for exploration purposes. The Loning Agreement acknowledged The Company has provided payments totaling US$400,000 to August 29, 2007 and required further investment by the Company as follows: (i) US$110,000 by March 1, 2008; (ii) US$500,000 by September 30, 2008; and (iii) US$500,000 by September 30, 2009.

World Fortune does not own the interests referenced in its agreement with Asian Dragon. World Fortune has an agreement with Henan Yunfeng Resource of Mining Development Co. (“Yunfeng”) for those interests. However, Yunfeng does not own the rights, but has entered into a purchase agreement with the Luoyang Longyu Jinmen Mines Limited Company (“Jinmen”) for the interests in the Xiaoquinling region of China. World Fortune has represented that when they eventually assign the rights to Asian Dragon, those rights will be free and clear of all transfer, assignment, liens, charges, or encumbrances of any kind. World Fortune has also represented that when the option is exercised, it will have the right and authority to transfer the rights to Asian Dragon.

It is also anticipated WFEI, in its role as Asian Dragon’s China Agent, will aid the Company in establishing a Chinese Registered Subsidiary which will be wholly owned by Asian Dragon. The mineral rights under this agreement will ultimately be transferred into this subsidiary.

Asian Dragon, WFEI, Yunfeng, and Jinmen are all independent parties and are dealing at arm’s length in these arrangements.

Asian Dragon is not a party to the agreement between World Fortune and Yunfeng nor a party to the agreement between Yunfeng and Jinmen which owns the rights to the interests in the Xiaoquinling region of China and may have little or no recourse on Yunfeng or Jinmen, in the event that the purchase agreement does not comply with their agreements with each other or World Fortune. However, Asian Dragon has received an attorney’s letter from Mr. Tian Huiquing, Kunda Law Office, Hunan, China stating that the agreements are valid. Transfer of any rights in any of the above agreements will not be complete until all payments are completed.

Asian Dragon issued 250,000 shares of its common stock to World Fortune on August 29, 2007 and an additional one million shares to World Fortune nominees in regards to this agreement.

Subsequent to year-end on December 12, 2007, with the mutual consent of WFEI, the agreement was replaced with the “Loning Agreement” which clarified certain terminology in the predecessor agreements. This agreement is attached herein as Exhibits 10.2. WFEI has provided Asian Dragon with an undertaking that it has extinguished all rights to any payments under the predecessor agreements and has acknowledged that it has recorded all cash and share payments made under the predecessor agreements as payments respectively under the Jinjishan Agreement, the Loning Agreement, and the Fuding Agreement.

Effective December 2, 2008, the Company determined it would be unable to raise sufficient capital to meet contractual payment obligations under three exploration property purchase agreements it had

entered. As such, the Board approved a resolution which authorized the Company to abandon its current exploration initiatives in China and cancel the Agreements it had signed with World Fortune

Enterprise Inc., such cancellations to be effective December 2, 2008. Additionally, the Company cancelled the FGLW-XWG Transfer Agreement (dated April 30, 2008) which had assigned some of the Company’s rights under the Fuding (Revised) Agreement to its subsidiary Asian Dragon Silver Inc., such cancellation was also effective December 2, 2008.

Luanchuan Mozigou Molybdenum Site

Lushi Jiashapa Vanadium Site

Luoning Xiayu Fanggelewan Silver-Lead Site

XWG Silver-Lead Site

The MZG License consists of an Exploration License on a 14.09 sq km property located in the Jiaohe Village of Luanchuan County, Henan Province, PRC. The JSP License consists of an Exploration License on an 8.3 sq km property located in the area of Wenguxiang to Dashihe in Lushi County, Henan Province, PRC. The FGLW License consists of a 1.75 sq km exploration license located approximately 240 km west of Zhengzhou and 80 km west of Luoyang. The XWG License consists of a 2.13 sq km exploration license located in the area of Xiayu, Henan Province, PRC.

The Company entered into an agreement with World Fortune effective August 29, 2007, to acquire a 51% interest in the Fuding exploration licenses. Under the Fuding Agreement, the Company will assume the payment responsibilities of World Fortune for the various rights and interests.

The Fuding Agreement requires total consideration of $10,000,000. The Fuding Agreement acknowledged the Company provided an initial payment of $2,730,000 and required further payments as follows: $1,270,000 on October 1, 2007; $2,000,000 before March 1, 2008; $2,000,000 on June 1, 2008; and $2,000,000 on October 1, 2008.

A secondary component of the Fuding Agreement are two options whereby World Fortune can, at its sole discretion, increase its ownership purchase of the Fuding Rights by 19% to a total of 70% (this being 100% of Fuding’s 70% August 8, 2007 interest in the Fuding Licenses) in return for additional payments of US$10,000,000 each for two 9.5% ownership increases. The payment schedule for this secondary component includes payment by World Fortune to Fuding of:

(i) US$10,000,000 – by June 1, 2008 for an additional 9.5% interest;

and/or

(ii) US$10,000,000 – by June 1, 2009 for an additional 9.5% interest

World Fortune does not own the interests referenced in its agreement with Asian Dragon. World Fortune has an agreement with Luoning Fuding Mining Development, Ltd. (“Fuding”) for those interests. However, Fuding does not own the rights, but has entered into purchase agreements for those rights with the following four companies (collectively referenced herein as “the Fuding Rights Holders”): (i) in respect of the Luanchuan Mozigou Molybdenum Site: the Henan Geological Investigating Bureau of General Bureau Sino-Petrochemical Geological Mine; (ii) in respect of the Lushi Jiashapa Vanadium Site: the Lushi Geological Investigating Research Office; (iii) in respect of the Luoning Xiayu Fanggelewan Silver-Lead Site: the Luoning Xiayu Fanggelewan Mining Limited Company; and (v) in respect of the XWG Silver-Lead Site: the Lingbao Yida Mining Company. World Fortune has represented that when they eventually assign the rights to Asian Dragon, those rights will be free and clear of all transfer, assignment, liens, charges, or encumbrances of any kind. World Fortune has also represented that when the option is exercised, it will have the right and authority to transfer the rights to Asian Dragon.

It is also anticipated WFEI, in its role as Asian Dragon’s China Agent, will aid the Company in establishing a Chinese Registered Subsidiary which will be wholly owned by Asian Dragon. The mineral rights under this agreement will ultimately be transferred into this subsidiary.

Asian Dragon, WFEI, Fuding, and the Fuding Rights Holders are all independent parties and are dealing at arm’s length in these arrangements.

Asian Dragon is not a party to the agreement between World Fortune and Fuding, nor a party to the agreement between Fuding and the Fuding Rights Holders and may have little or no recourse should Fuding or the Fuding Rights Holders not comply with their agreements with each other or World Fortune. However, Asian Dragon has received an attorney’s letter from Mr. Tian Huiquing, Kunda Law Office, Hunan, China stating that the agreements are valid. Transfer of any rights in any of the above agreements will not be complete until all payments are completed.

Asian Dragon issued 250,000 shares of its common stock to World Fortune on August 29, 2007 and an additional one million shares to World Fortune nominees in regards to this agreement.

Subsequent to year-end on December 12, 2007, with the mutual consent of WFEI, the agreement was replaced with the “Fuding Agreement” which clarified certain terminology in the predecessor agreements. This agreement is attached herein as Exhibits 10.3. WFEI has provided Asian Dragon with an undertaking that it has extinguished all rights to any payments under the predecessor agreements and has acknowledged that it has recorded all cash and share payments made under the predecessor agreements as payments respectively under the Jinjishan Agreement, the Loning Agreement, and the Fuding Agreement.

Subsequent to year end, the Company made a payment of $800,000 to WFEI of which $499,407 was applied as full payment of the October 1, 2007 Jinjishan commitment and $300,593 was applied to the October 1, 2007 Fuding commitment. The Company did not fulfill its entire payment for the Fuding installment and as of October 1, 2007 the Company was in default as to $802,585 toward the Fuding Agreement. A discussion was held with Fuding regarding this matter and Fuding agreed to extend the payment schedule to accommodate this default. No damages were claimed by Fuding.

Subsequent to year end on December 12, 2007, WFEI provided Asian Dragon with an undertaking that it has extinguished all rights to any payments under the Jinjishan Rights Agreement, the Loning Rights Agreement, and the Fuding Rights Agreement (collectively the “Predecessor Agreements”), in favor of revised agreements signed that day, and acknowledged that it has recorded all cash and share payments made under the Predecessor Agreements as payments respectively under the Jinjishan Agreement, the Loning Agreement, and the Fuding Agreement.

Effective December 2, 2008, the Company determined it would be unable to raise sufficient capital to meet contractual payment obligations under three exploration property purchase agreements it had

entered. As such, the Board approved a resolution which authorized the Company to abandon its current exploration initiatives in China and cancel the Agreements it had signed with World Fortune

Enterprise Inc., such cancellations to be effective December 2, 2008. Additionally, the Company cancelled the FGLW-XWG Transfer Agreement (dated April 30, 2008) which had assigned some of the Company’s rights under the Fuding (Revised) Agreement to its subsidiary Asian Dragon Silver Inc., such cancellation was also effective December 2, 2008.

During the fourth quarter of fiscal 2007, the Company also determined it would not proceed with its plans for the Tiepuling 819# and 846# Mining Center Sections project.

General

We note the Company has acquired along with certain licenses infrastructure including buildings and a formerly operating concentration mill. This entire infrastructure, without exception, has no value from an accounting or operational perspective due to its age and state of repair.

At present the Licenses described below have no carrying value for accounting purposes because Asian Dragon does not yet have full title to each. The information which follows is meant to provide the reader of this Report with full information regarding the Company’s initiatives.

The basis and duration of our mineral rights, surface rights, claims or concessions is as follows:

The Company is acquiring the subsurface rights for various different minerals. Chinese Mineral Laws limit the Exploration License for 3 years prior to being converted to a Prospect License for another 3 years. After this time period has expired the mineral property must apply for a Mining License for production. The terms for the duration of the Mining License is subject to the proven reserves and the annual production rate. The mineral property is eventually returned to the government if the Exploration License or the Prospect License expires without renewal. The Mining License also expires at the end of the term unless more reserves are proven to apply for an extension.

All six sites have exploration licenses that have been obtained from a Provincial body, The Ministry of Land and Resources.

Identifying information pertaining to the Exploration Licenses is as follows:

|

Site Name

|

Claim Number

|

Date of Recording

|

Expiration Date

|

|||

|

Jinjishan

|

4100000720228

|

6/23/2007

|

6/22/2008

|

|||

|

Loning

|

4100000610057

|

1/24/2006

|

1/23/2008

|

|||

|

Mozigou

|

4100000630173

|

4/11/2006

|

3/1/2008

|

|||

|

Jiashapa

|

4100000630457

|

8/26/2006

|

8/22/2008

|

|||

|

Fangglewan

|

4100000640631

|

12/24/2006

|

12/5/2007

|

|||

|

Xiaowagou

|

4100000620556

|

11/7/2006

|

12/30/2007

|

In order to retain the claims or leases, the following payments must be made per the noted schedules:.

As outlined above, the Company must complete full payment as per the payment schedules outlined in the agreements to retain the claims and/or leases, These are as follows:

Jinjishan

The terms of the Jinjishan Agreement require payments of $2,500,000 for the Jinjishan License and $800,000 for the Jinjishan Plant, for total consideration of $3,300,000. The Jinjishan Agreement acknowledged The Company provided payments totaling US$1,792,593 to August 29, 2007 (inclusive of a payment of US$600,000 toward the Jinjishan Plant) and required further investment by The Company as follows: (i) US$500,000 by October 1, 2007; (ii) US$500,000 by March 1, 2008; and (iii) US$500,000 by October 1, 2008.

Loning

The Loning Agreement requires total payments by the Company of $1,510,000, of which $1,000,000 is to be expended by the Company for exploration purposes. The Loning Agreement acknowledged the Company has provided payments totaling US$400,000 to August 29, 2007 and required further investment by the Company as follows: (i) US$110,000 by March 1, 2008; (ii) US$500,000 by September 30, 2008; and (iii) US$500,000 by September 30, 2009.

Fuding

The Fuding Agreement requires total consideration of $10,000,000. The Fuding Agreement acknowledged the Company provided an initial payment of $2,730,000 and required further payments as follows: $1,270,000 on October 1, 2007; $2,000,000 before March 1, 2008; $2,000,000 on June 1, 2008; and $2,000,000 on October 1, 2008.

A secondary component of the Fuding Agreement are two options whereby World Fortune can, at its sole discretion, increase its ownership purchase of the Fuding Rights by 19% to a total of 70% (this being 100% of Fuding’s 70% August 8, 2007 interest in the Fuding Licenses) in return for additional payments of US$10,000,000 each for two 9.5% ownership increases. The payment schedule for this secondary component includes payment by World Fortune to Fuding of:

(i) US$10,000,000 – by June 1, 2008 for an additional 9.5% interest;

and/or

(ii) US$10,000,000 – by June 1, 2009 for an additional 9.5% interest

In summary, the areas covered by the Exploration Licenses are as follows:

|

Property Name

|

Claim Area

|

|

|

Jinjishan

|

28.29 km2

|

|

|

Loning

|

9.40 km2

|

|

|

Mozigou

|

14.09 km2

|

|

|

Jiashapa

|

8.30 km2

|

|

|

Fangglewan

|

1.75 km2

|

|

|

Xiaowagou

|

2.13 km2

|

All the exploration license sites have been visited and examined by a Canadian independent professional geologist with international experience, Mr. Christian Derosier, M.Sc., D.Sc., P. Geo. a member of The Canadian Institute of Mines and Metallurgy since 1976 and the Ordre des Géologues du Québec (No 129).

Jinjishan Site

The Jinjishan Site is an exploration property located in the Luoning County, Henan Province, People’s Republic of China. The exploration site consists of contiguous 28.3 sq km Exploration License located in the northwest part of Luoning County. More precisely it is located in the west part of the Henan Province and in the northwest part of the Luoning County and in the Changshui community. The closest important city is Luoning. Luoning is situated at about 1300 km WNW of Shanghai, 1300 km SSW of Beijing, 270 km west of Zhengzhou the provincial capital and 130 km west of Luoyang, the Prefecture of the Luoning County. Access to the Jinjishan Property is provided on a 120 km large paved road which runs southwesterly to the city of Luoning. From Luoning, a paved road leads southwesterly to the town of Changshui and from that locality a recently paved road leads northwesterly to the Jinjishan village and then to the Jinjishan site. The distance from Changshui to the property is approximately 10 km. This road also links Luoning to Lushi, another important city to the southwest. In Chinese, Jinjishan means the Golden Pheasant Mountain.

Loning Site

The Loning Site consists of a 9.1 sq km Exploration License and is located 2 km Southwest of Asian Dragon's Jinjishan Site with easy access via the paved highway that runs East/West of the North side of Luoning County.

Fuding Sites:

Luanchuan Mozigou (MZG) Molybdenum Site

The Luanchuan Mozigou Molybdenum Site (“MZG”) is located in Jiaohe Village of Luanchuan County, Henan Province, China. MZG contains an Exploration License comprised of 14.09 sq km with a 4 sq km aspect of the site running the same northwest-southeast trend as China Molybdenum, all aspects of this mineralized zone trend which extend over a 60 km “saddle” bordering Luanchuan and Lushi County.

Lushi Jiashapa (JSP) Vanadium Site

The Lushi Jiashapa Vanadium Site (“JSP”) is located in the area of Wenguxiang to Dashihe of Lushi County, Henan Province, China. JSP contains an Exploration License comprised of 8.3 sq km with an approximate 1 km wide by 8 km long covered east-west trend mineralized zone which extends over a 42 km area that sometimes widens up to 3 km.

Luoning Xiayu Fanggelewan (FGLW) Silver-Lead Site

The Luoning Xiayu Fanggelewan Site (“FGLW”) is located in the area of Xiayu, Henan Province, China. FGLW holds an Exploration License on an area of 1.75 sq km covering a series of long veins in a northeast-southwest trend. The site is located approximately 240 km west of Zhengzhou, the provincial capital, and 80 km west of Luoyang, the Prefecture of Luoning County.

Xiaowagou (XWG) Silver-Lead Site

The Xiaowagou Silver Lead Site ("XWG") is located in the area of Xiayu, Henan Province, China. XWG holds a 2.13 sq km Exploration License. The site is located approximately 240 km west of Zhengzhou, the provincial capital, and 80 km west of Luoyang, the prefecture of Luoning County.

Information about Henan Province

Topography

Henan Province is in the transitional area between the second and third steps of China’s fourstep terrain rising from east to west, with rolling mountains over 1000 metres above sea level in its western and plain areas and 100 metres or lower in its eastern region. Mountainous regions comprise 44.3 percent of its total area, and the plains, 55.7 percent. The highest summit of the Henan Province is the Laoyacha mountain (2413.8m) in Lingbao City. The province’s lowest point is 23.2m and is found at the point where the Huaihe River leaves the province. Henan Province is surrounded by four mountain ranges: the Taihang, Funiu, Tongbai and Dabie, which stand in its north, west and south areas, leaving subsidence basins in the intermittent area. In its middle and eastern parts there is a vast fluvial plain created by the Yellow, Huaihe and Huo He rivers.

Four rivers run across Henan, the Yellow River, Huo He River, Weihe River and Hanshui River, with the Huo He River valley covering up to 53 percent of the province. The southwestern portion is part of the Yangtze River Basin that flows to the west to the Yellow Sea. There are no significant lakes. In the project area, the relief north of the Luo He (Blue river) basin is hilly and shows relatively deep valleys running northwest with an elevation gradient reaching 200m. The highest summit of the region is the Quanbao Shan culminating at 2080 metres.

Infrastructure

Because the population of Henan exceeds 92.5 million (2000 census), the province requires good infrastructure and has strict laws concerning soil occupation (agriculture) and urbanization extensions. Road, railway and telecommunication networks are well developed in this area.

Major road ways in Henan include the Kaifeng-Luoyang Expressway, the Zhengzhou-Luoyang Expressway, the Anyang-Xinxiang Expressway, the Xuchang-Luohe Expressway, the Luoyang-Sanmenxia Expressway and the Sanmenxia-Lingbao Expressway. This last section is part of China’s longest expressway linking Lianyungang (Jiangsu Province) in the east, with Horgos (Xinjiang Region) to the northwest. This provides a connection to neighboring Shaanxi. Most of these expressways have toll gates but the cost for traveling is reasonable. Zhengzhou is a major rail transport centre in China, as well as the location of the main railway manufacturers. The Beijing-Guangzhou line, the Jiaozuo-Zhicheng line and the Beijing-Kowloon railways cross the province from north to south.

Other railways include the Lanzhou-Lianyungang, the Jiaozuo-Xinxiang-Heze and the Mengmiao-Baofeng/Luohe-Fuyang lines run through Henan from west to east. The Euro-Asia Land Bridge (Lianyungang to Rotterdam) also passes through the city. Traffic is heavy on these railways with the circulation of numerous

passenger trains but also with considerable number of trains transporting coal between the Henan collieries and the numerous thermal power plants. With rich coal resources, Henan acts as a centre for thermal power generation in China. In 1999, the installed generating capacity in Henan reached 14.8MWh, ranking the ninth in the country. Power stations have been constructed at major cities in Zhengzhou, Kaifeng, Luoyang, Pingdingshan, Anyang, Hebi, Xinxiang, Jiaozuo and Sanmenxia. Major river transport is also easily accessible. Henan has airports in Zhengzhou, Luoyang and Nanyang and international flight services are available at Zhengzhou. Chartered flights to Hong Kong and Macau are also available.

Three of the nation’s first-class optical cables and three microwave trunk lines run through the province, making it possible for Henan to have automatic long-distance transmission, digital long-distance routes and program-controlled telephone switchboards throughout the province. Its telephone exchange capacity has reached 11.2 million circuits, with 9.38 million telephone users, 3.11 million mobile phone users and 1.1 million Internet users. Telecommunications services are growing rapidly. In the first quarter of 2001, there were 1.7 million subscribers for mobile phone services, ranked ninth in the country. Recently, Henan has opened a new broadband IP network that is among the largest in China. Cellular phone communications are available in the most remote areas of the Province. The Jinjishan mining property is covered by the cellular phone network.

Henan has water reserves of 4.84 Mkw, of which 3.23 Mkw can be exploited. By the end of 2000, there were 2394 reservoirs in the province and 4.6 Mha of land were irrigated. In the Jinjishan area, water supply and sewage system, electric service for residential and industrial use supply are presently available on site. Manpower can easily be found in the area. Luoning, only 40 km from the property, is large enough and with sufficient industry to have machine and repair shops capable of major repairs.

Climate

Located between the northern sub-tropical zone and warm temperate zone, Henan Province has four distinctive seasons with complicated weather conditions. Luoning is situated in the middle of a WSW trending valley in north-central China which has an elevation of 300-1000 metres. Because it is surrounded by loess plains, and upland areas and mountains exceeding 4000 metres to the south, the climate is dominated by long intervals of light winds which tend to result in hazy and rather dry atmospheric conditions. The climate is, on average, about 5°C warmer than Beijing and slightly drier. January is the coldest time of year with temperatures in the city dropping to - 5°C at night and rising only + 5°C during the day. July is the hottest month with average temperatures of 27°C and a range of 22° -33°C during the day. Luoning receives approximately 58 cm of precipitation per year, with July through September being the wettest period receiving nearly 30 cm of rain during this period. The period December through January is quite dry receiving a total of 2.3 cm of precipitation during this period. As a result of its climate, travelers to Luoning have a reduced risk of contracting malaria, cholera, Japanese encephalitis or other diseases which may be common in coastal regions.

Population and Services

Henan Province covers an area of 16,700 sq km and during the last census (2000), the population was estimated to be 92.5 million. It has a large population with only a moderate land area. As a consequence, the population density is relatively high, with 554 people per sq km. The provincial capital is Zhengzhou (pop. 6.3 million). Major centres are Nanyang (pop. 10.5 million), Luoyang (pop. 6.1 million), Xinxiang (pop. 5.3 million), Jiaozuo (pop. 3.2 million) and Keifeng (pop. 4.6 million). The region is rich in land resources, in mineral resources, in plant and animal resources, but much of the resources per capita are lower than China’s average. The eastern part of the province is a major grain and cotton producer. Other agricultural products include corn, soya bean, beans, canola, potatoes and peanuts. Specialties include Lingbao dates, Huiyang day lilies and common carp.

Major industries include food processing, coal, metallurgy, machinery, chemicals, petroleum refining, building materials, textiles and electronics. Zhengzhou is a major distribution centre in central China. It is known for its array of wholesale markets, including agricultural and a building materials wholesale markets. There are many places of interest and historic sites in Henan so tourism resources are also abundant. Well known tourist sites include a number of Shang ruins in or near Zhengzhou, Yin Dynasty ruins (latter part of the Shang era) in Anyang in the northeastern part of the province, the Shaolin Temple in Dengfeng and the White Horse Temple in Luoyang.

Vegetation

Henan is an important producer of the country’s wheat, corn, cotton, tobacco leaves and oil plants. In the project region, the south of the Luohe basin, the forest is clear and mostly composed of pine and deciduous trees.

Regional geology

China is subdivided into a number of geological domains which reflects current modeling of China’s evolution over time. The model is largely based on continental accretion with attendant tectonism and subduction. Movement by the Siberian Plate to the North and the Pacific-Philippines plates to the Southeast were major factors in China’s geological evolution. Henan is located on and near the southern boundary of the North China Domain and the Kunlun-Qinling Domain which represents an easterly trending structural corridor to the south of which lies the South China Domain. The early development of the Kunlun-Qinling Domain was as a shallow elongated basin separating the stable platforms to the North and South. The Variscan tectonic phase saw the final closure of the Qinling-Kunlun basin and was marked by weakening and southwards migrating volcanism, but also witnessed the most active phase of acid (granitic) intrusive activity. During the early to middle Mesozoic, volcanism was weak and intrusive activity was generally restricted to the structural breaks and shear zones which defined the margins of basins lying between mountain belts. This magmatism was predominately reflected in the emplacement of associations composed of quartz monzonite, monzogranite, syenite, granodiorite and syenogranite. During the late Mesozoic, volcanism increased and was intense locally as the circum-west Pacific magmatic belt developed. Most of this is represented by a rhyolite-dacite-andesite association together with trachyandesite-trachyte associations and alkali basalt-basaltic andesite associations. A few alkaline basic to ultrabasic rocks are present locally. Syenogranite, monzogranite, quartz monzonite, tonalite and granodiorite was emplaced at this time together locally with high level (hypabyssal) porphyries. Volcanism continued during the Cenozoic, and a few volcanoes have been active. The Axkol volcano in southern Yutian was active in 1951. These volcanic rocks generally comprise olivine basalt, alkali basalt, pyroxene andesite, picritediabase, quartz monzonite, aegirine-augite-quartz syenite and aegirine-albite granite. Gold mineralization in the Luoning area is hosted within the Kunlun-Qinling Domain or mobile belt.

The Kunlun-Qinling Domain

The parent rocks with Proterozoic sequences in the Qinling-Kunlun mobile belt were largely calc-alkaline volcano-sedimentary rocks. Having commonly undergone moderate to high grade metamorphism, these sequences are now represented by 2-mica amphibole gneisses, amphibolite, granulite, migmatite, marble, and phyllite. Some of these rocks have been dated at 2,820-2,160 Ma (zircon age). Most generally however, metamorphic grade ranges from lower greenschist to upper amphibolite facies and lower greenschist grade metamorphism prevails in some areas, notably in the North Qin Ling Mountains where mica schists were derived from a thick volcano-flysch carbonate formation. The belt is therefore a highly complex melange of juxtaposed stratigraphic units.

The magmatic geology of the mobile belt is also complex with nine magmatic stages and five magmatic belts. Most of the magmas generated were anatectic melts. The earliest sets of rocks included basalt-dacite-rhyolite

bimodal associations, basalt-andesite calc-alkaline associations, basalt-rhyolite associations and spilite-quartz keratophyre associations. The middle Proterozoic saw a Sibaoan magmatism culminating in widespread tholeiitic series (basalt-andesite-dacite) volcanism and spilite rhyolite rift volcanism accompanied by calc-alkaline granitic plutonism. Magmatism waned during the late Proterozoic.

The most active period of intrusive and volcanic activity was during the middle to late Paleozoic, when the Qinling-Kunlun Ocean was closing, and thus Caledonian rocks are well developed in the mobile belt. Basalt-andesite-rhyolite, basalt-rhyolite, alkali basalt-trachyte-pseudoleucite phonolite and spilitic volcanic activity characterized most of the belt. Four granitic intrusive belts were active at this time within which the intrusive associations included granodiorite-monzogranite, tonaliteplagiogranite, diorite-tonalite-granodiorite, monzogranite-syenogranite, diorite-tonalite and alkali granite-diabase and syenite, as well as two-feldspar alaskite and Kfeldspar alaskite found locally in the southern part of the belt.

The tectonic history of the Qinling-Kunlun mobile belt is complex and a large part of the reason why magmatism was so widespread and so protracted. The belt is subdivided into four major units which developed at three different periods of times. In addition to this, there are 20 second-order tectonic units. The complexity of this mobile belt is partially attributable to the existence of an earlier fracture zone, the Jinningian Juncture Zone, which formed during the late Proterozoic and along which the Qinling-Kunlun mobile belt largely propagated during the late Paleozoic and the north and south China blocks collided. The four major units of the Qinling-Kunlun mobile belt which were active during the Proterozoic are:

1) the southern margin of the North China Plate;

2) the Qinling-Qilian mobile belt;

3) the Paleo-Tethys mobile belt; and,

4) the northern margin of the South China plate.

During the medial Proterozoic, the southern sub-domain of the North China Plate was the northern sub-belt of the Jinningian Juncture. At this time, the northern subdomain of the South China plate bordered the paleo Qinling- Kunlun ocean. The subdomains on the north and south margins were complex structural zones undergoing protracted deformation and containing the remnants of pre-existing paleoblocks. The sub-domains are now divided into three second-order units on the north margin and eight second-order units on the south which encompass areas of localized uplift as well as localized sedimentary basins.

The Qinling-Qilian mobile belt (subdomain) is traceable for 3,000 km along a northwest trend, and is located in the east-central section of the Qinling-Kunlun structural belt (Figure No 7). To the west it abuts the Altun fracture zone and to the east it merges with the NE-trending Tancheng-Lujiang Fracture Zone. From the late Proterozoic through the Silurian, this belt underwent recurring extension and collision leading to rifting and closure. The Paleo-Tethys Mobile Belt to the south of the Qinling-Qilian mobile belt is a continental margin fold belt which contains a sea trough system of graben and horst structures similar to the Qinling-Qilian mobile belt.

The area is underlain by a series of rocks that are of upper greenschist to amphibolite metamorphic grade. Based on the aforementioned structural hierarchy, it is believed that the Jinjishan area falls into the Qilian-North Qinling Fold System. The fold system is superimposed on the area north of the Qinling-Kunlun Juncture Zone. It is composed of a layered metamorphic basement sequence of mobile-type sediments which, from base to top, is composed of early Proterozoic upper greenschist to upper amphibolite grade geosynclinal metasediments, medial to late Proterozoic arc-basin formations and late Proterozoic to early Cambrian post-orogenic epicontinental formations composed of tillite and carbonate rocks, with localized volcanic strata as well as phosphatic and Mn-bearing rocks. These rocks were deposited in an expanding trough which reached culminated during the medial Ordovician.

The Silurian-Devonian was the main period of closing as NE-directed movement of the South China Block resulted in subduction of the trough area during the Carboniferous. Final closure of the Tethys basin occurred as a west to east scissoring at the end of the Carboniferous.

Gold mineralization

Gold has been mined in China for more than 4,000 years. In the area, mining probably began during the Tang Dynasty (618-907 AD). Local miners exploited visible gold which was present on the weathering surface of veins exposed on the mountain sides. This area was the marketing centre to which the Emperor’s men would be sent to purchase gold from the local miners. Historical artifacts suggest that the largest nuggets were 200-300 grams.

In western Henan Province, Team One of the provincial Ministry of Land and Resources (“MOLAR”) discovered gold mineralization during the 1960’s through general geological mapping and regional geochemical sampling. This revelation directly influenced mineral exploration policy and activities in Henan and Shaanxi Provinces. Although, long recognized as a source for gold, the depletion of easily non visible gold in the Luoning area tended to discourage further activity until the 1960’s when modern exploration commenced with regional scale geological mapping and geochemical sampling programs.

The Xiao Qinling gold province, located between Tongguan in Shaanxi and Lingbao in Henan province is currently the second largest gold producing area in China. Annual production is about 15 – 23 tonnes Au. The Xiao Qinling area is underlain by gneiss, marble, quartzite, migmatite, and amphibolite of the Late Archean Taihua Group. Indosinian alkalic porphyries and dykes (213 –202 My) and Yanshanian granites are widespread. The Wenyu granite intruded the central part of the gold- rich area, and is exposed over an area of about 20 sq km.

Regional structures are dominated by the E –W-trending, north-dipping, >60-km-long Maxundao deep fault zone (from Tongguan to Lingbao). It was originally a compressional feature, but shows evidence for late extension. A series of large gold deposits, with total resources of 300 – 450 t Au, occur at intersections of second-order WNW – EW striking faults with NE and NW striking faults to the north of the first-order Maxundao fault zone.

From west to east in the Xiao Qinling gold province, gold deposits hosted in rocks of the Taihua Group are concentrated in three goldfields within a 60 x15 km corridor, 2 – 15 km north of the Maxundao fault (the Tongyu and Yanzhihe deposits), Wenyu (the Wenyu, Dongchuang, Sifangou and Yangzhaiyu deposits and Dahu (Dahu and Linghu deposits ) goldfields.

A series of 4 to 20 m wide and >4 km long quartz veins lie within second-order faults. Lesser amounts of gold occur in altered rocks along ductile – brittle shear zones and in breccia bodies. More than 1,200 gold bearing quartz veins have been discovered in this part of the Qinling gold province. Ores are noted to contain pyrite, galena, sphalerite and minor magnetite, scheelite, wolframite, molybdenite, stibnite, pyrrhotite and gold. The gangue minerals comprise quartz, calcite, ankerite, minor rutile, barite, siderite and fluorite. The alteration halos around quartz veins or shear zones comprise mainly quartz, sulphide minerals, white mica and carbonate minerals, with lesser chlorite, epidote and biotite.

A few large gold deposits in areas of Proterozoic basement in the Xiao Qinling area, such as Kangshan, Shanggong and Qiyugou, are controlled by a group of NE striking faults and shear zones, which are the second-order structures to another major E –W striking fault zone. The Shanggong(>30 t Au) and Kangshan (>20 t Au) deposits are located in the 33km-long, NE trending Kangshan – Qiliping ductile – brittle shear, south and parallel to the Huo He valley.

Mineralization is hosted in Mesoproterozoic felsic to intermediate volcanic rocks. The steeply dipping mineralized zones are 250 to 750 m long and 1 to 2.8 m wide veins filling brittle structures, lenses in tension gashes, alteration bands along shear zones and brecciated country rock. The ores commonly contain anomalous Ag, Te, and Pb concentrations. Alteration halos around the mineralized zones are characterized by a 1 to 3 m wide proximal sulphide –ankerite –muscovite zone, a 1 to 20 m wide pyrite – ankerite – muscovite – chlorite transitional zone and a 50 m wide distal chlorite-calcite zone.

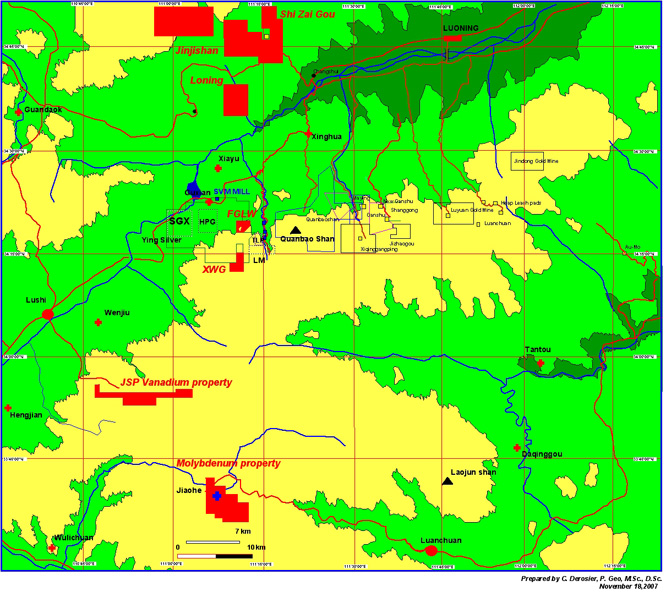

Map of Locations

Based upon the reports of our geologist, a brief geological justification for each of the exploration projects is as follows:

Jinjishan

It is concluded that the property has merit in two ways. At first, taking into consideration that the F-2 to F15 veins, as well as the adjacent F-1 Mine, have been artisanally mined for over seven and a half years, Vein Mining and Milling Operation have given a reasonable profit. Secondary, taking into account the potential of the rest of the veins found to date on the property. Economical gold values obtained from within the F-3 through F-10 veins, greatly increase the potential of the property.

The economic potential of the Jinjishan property is considered very good as the currently known mineralized veins have attractive grades and mineralized veins are being located on an ongoing basis without the use of modern exploration techniques. In 2004 there were 10 known veins and today there are 16 veins located on the property.

Fanggelewan

There are more than eleven identified mineralized veins located on the Fanggelewan Property area. Lengths of the known veins vary from 200 to 2 000 m. with widths varying from 1.0 to 5.0 metres. They are generally oriented at 030˚ and have a dip of 60-80˚ to the NW.

The mineralized veins P1 and P2 are strictly confined within alteration zones along the faults. They undulate and possess pinch and swell characteristics to the extent that they often pinch-out and re-appear in both strike and dip directions.

The other nine veins which are temporarily excluded of the resource calculation because limited work had been executed on them, present length, width and thickness similar mineralization and grade than the others.

Xiaowagou

There are more than seven identified mineralized veins located on the Xiaowagou Property area. Lengths of the known veins vary from 270 to 1 080 m. with widths varying from 1.0 to 5.0 metres. They are generally oriented at 030˚ and have a dip of 60-76˚ to the NW. The S-12, S-16 and S-17 veins have been well-explored by using trenching and tunneling and have had estimates of resources and reserves prepared for them by the No 6 Team.

The vein system strike sub parallel to the Tieluping system. The mineralized veins are strictly confined within alteration zones along the faults. They undulate and possess pinch and swell characteristics to the extent that they often pinch-out and re-appear in both strike and dip directions.

The other four veins which are temporarily excluded of the resource calculation because limited work had been executed on them, present length, width and thickness similar mineralization and grade than the others.

Of particular interest for the Xiaowagou Project, the Tieluping (TLP) property, which is immediately adjacent to the East, shows vein systems that are much wider than any of the other deposits found to date in the area. Some veins attain widths of up to 19.12 m with grades up to 1 102 g/T Ag and 19.4 % Pb, as reported by the Sixth Team of Henan Nonferrous Geological Bureau in their detailed 1995 exploration report.

To date we have not had reports prepared for the Loning, Mozigou or Jiashapa sites and as such there are no professionally prepared recommendations or budgets for these properties.

Breakdowns of the exploration timetable and budget, including estimated amounts that will be required for each exploration activity, such as geophysics, geochemistry, surface sampling, drilling, and other expenses for each prospect are as follows:

Jinjishan

|

Phase I

|

US$

|

|||

|

Line cutting (GPS surveyed stations): 400km@$ 100/km

|

$ | 40,000 | ||

|

Magnetometer survey: 400 km @ $ 100.00/km

|

40,000 | |||

|

I.P.Survey: n=1 to 6, a= 50 m; 60 km @ $ 1 000 /km

|

60,000 | |||

|

Prospecting:

|

20,000 | |||

|

Geology: 30 days @ $ 850.00 /d

|

25,000 | |||

|

Sampling and Assaying: 400 samples $ 100 / sample

|

40,000 | |||

|

Supervision and Report:

|

20,000 | |||

|

Travelling and accommodation:

|

15,000 | |||

|

Administration and financing:

|

25,000 | |||

|

Contingencies:

|

15,000 | |||

|

Total Phase I

|

$ | 300,000 | ||

|

Phase II Mining evaluation and Infrastructures improvement

|

||||

|

Adit and drift evaluation: 60 days @2 000.00 /day

|

$ | 120,000 | ||

|

Mill improvement, repairs and maintenance:

|

100,000 | |||

|

Buildings:

|

50,000 | |||

|

Laboratory:

|

200,000 | |||

|

Scale:

|

50,000 | |||

|

Computer and softwares: data treatment:

|

50,000 | |||

|

Bulk sampling and processing: 20 000 tonnes

|

200,000 | |||

|

Mine geology: 30 days @ $ 850.00/day

|

25,500 | |||

|

Sampling and Assaying: 400 samples @ $ 100.00/sample

|

40,000 | |||

|

Supervision and Report:

|

60,000 | |||

|

Administration and financing

|

60,000 | |||

|

Contingencies:

|

44,500 | |||

|

Total Phase II

|

$ | 1,000,000 | ||

|

Phase III Diamond drilling campaign

|

||||

|

Access infrastructure:

|

$ | 40,000 | ||

|

Drilling: NQ core size: 5500 m @ $ 145.45 /m

|

800,000 | |||

|

Assaying 700 samples @ $ 100/s

|

70,000 | |||

|

Geology logging: 71 days@ $ 850.00 /d

|

60,000 | |||

|

Supervision and resource estimate:

|

100, 000 | |||

|

Administration and financing:

|

70,000 | |||

|

Contingencies:

|

60, 000 | |||

|

Total of Phase III

|

$ | 1,200,000 | ||

|

GRAND TOTAL

|

$ | 2,500,000 | ||

The Company’s geologist Mr. Christian Derosier is of the opinion that the property has sufficient merit to justify this program and the budget as proposed. Another financial effort will be necessary for the execution of a feasibility study.

Fanggelewan

|

Phase I Surface Exploration

|

US$

|

|||

|

Line cutting (GPS surveyed stations): 30 km@$ 200/km

|

$ | 6,000 | ||

|

Access, infrastructure: 15 days @ $ 3000.00 /d

|

45,000 | |||

|

Magnetometer Survey: 30 km @ $ 180.00/km

|

5,400 | |||

|

Infinitem Survey: 20 km @ $ 2 080 /km

|

41,600 | |||

|

Gravity Survey: 30 km @ $ 700/ km

|

21,000 | |||

|

Prospecting, trenching and Underground sampling

|

25,000 | |||

|

Sampling and Assaying: 350 samples $ 200 / sample

|

70,000 | |||

|

Geology: 30 days @ $ 950.00 /d

|

28,500 | |||

|

Supervision and Report:

|

32,000 | |||

|

Travelling and accommodation:

|

18,000 | |||

|

Administration and financing:

|

29,000 | |||

|

Contingencies:

|

28,500 | |||

|

Total Phase I

|

$ | 350,000 | ||

|

Phase II

|

||||

|

Diamond drilling

|

||||

|

Access infrastructure:

|

$ | 40,000 | ||

|

Drilling: NQ core size: 6 000 m @ $ 180.00 /metre

|

1,080,000 | |||

|

Assaying 550 samples @ $ 100 /sample

|

55,000 | |||

|

Geology logging: 80 days@ $ 950.00 /day

|

76,000 | |||

|

Underground evaluation

|

||||

|

Tunneling, drifting and raise boring on four Veins:

|

400,000 | |||

|

Tunneling on C29 and C30 Veins:

|

150,000 | |||

|

Supervision and resource estimate:

|

125,000 | |||

|

Travelling and accommodation:

|

42,000 | |||

|

Administration and financing:

|

99,000 | |||

|

Contingencies:

|

83,000 | |||

|

Total of Phase II

|

$ | 2,150,000 | ||

|

GRAND TOTAL

|

$ | 2,500,000 | ||

The character of the Xiayu Fanggelewan property is of sufficient merit to justify the recommended two-phase, success contingent, work program. Any potential successive work will require a thorough compilation and evaluation of results obtained following the completion of Phases I and II.

Xiaowagou

|

Phase I Surface Exploration

|

||||

|

Line cutting (GPS surveyed stations): 28 km@$ 200/km

|

$ | 5,600 | ||

|

Access, infrastructure: 18 days @ $ 3000.00 /d

|

54,000 | |||

|

Magnetometer Survey: 28 km @ $ 160.00/km

|

4,500 | |||

|

Infinitem Survey: 20 km @ $ 2 080 /km

|

41,600 | |||

|

Gravity Survey: 20 km @ $ 680/ km

|

13,600 | |||

|

Prospecting, trenching and Underground sampling

|

20,000 | |||

|

Sampling and Assaying:250 samples $ 200 / sample

|

50,000 | |||

|

Geology: 30 days @ $ 900.00 /d

|

27,000 | |||

|

Supervision and Report:

|

30,000 | |||

|

Travelling and accommodation:

|

15,000 | |||

|

Administration and financing:

|

26,100 | |||

|

Contingencies:

|

26,600 | |||

|

Total Phase I

|

$ | 314,000 | ||

|

Phase II

|

||||

|

Diamond drilling

|

||||

|

Access infrastructure:

|

$ | 40,000 | ||

|

Drilling: NQ core size: 5500 m @ $ 160.00 /metre

|

$ | 880,000 | ||

|

Assaying 550 samples @ $ 100 /sample

|

$ | 55,000 | ||

|

Geology logging: 70 days@ $ 900.00 /day

|

$ | 63,000 | ||

|

Underground evaluation

|

||||

|

Tunnelling, drifting and raise boring on S-12, S-16

|

||||

|

and S-17 Veins:

|

$ | 250,000 | ||

|

Tunnelling on S-11, S13, S-14 and S15 Veins:

|

$ | 150,000 | ||

|

Supervision and resource estimate:

|

$ | 100,000 | ||

|

Travelling and accommodation:

|

$ | 39,000 | ||

|

Administration and financing:

|

$ | 52,000 | ||

|

Contingencies:

|

$ | 57,000 | ||

|

Total of Phase II

|

$ | 1,686,000 | ||

|

GRAND TOTAL

|

$ | 2,000,000 |

The plans for our program phases are briefly as follows:

Jinjishan

First Phase

The first phase will comprise, in addition to a grid line, a magnetometer survey over the entire Exploration License, an I.P. survey on the prime geological, structural and metallogenic targets, followed by a trenching and pitting program. Pits and trenches will be sampled and samples will be assayed. A QC/QA control program will be applied. A budget of US$300,000 is projected for this task.

Second phase

The second phase which can be carried out at the same time than the First Phase will cover the mine evaluation. It will comprise an evaluation of the adits and drifts, mill improvement, laboratory and scale construction, building repairs and improvements, bulk sampling of the different veins with underground workings. Bulk samples will be treated at the mill but several tonnes will be used to conduct several metallurgic testings in order to improve the recovery and separation of metals. A budget of US$700, 000 is projected for the second phase.

Third Phase

The third phase will consist in an exploration and definition drilling campaign from surface and underground. Access for the drilling equipment to the different parts of the permit will be improved. Diamond drill holes will test all the selected geological and geophysical anomalies. Since the targets are not already defined, we can only attribute an allowance. Testing the deep extension of known veins will require longer holes. It is recommended to bore NQ core size holes. Positive results obtained from the three phases will necessitate more definition drilling and geostatistical studies. A budget of US$ 1, 200,000 has been estimated for the third phase.

Fanggelewan

Phase I Surface surveys

1. Assess known mineral occurrences (Au, Cu, Ag, etc.) for economic potential with detailed mapping, rock geochemistry and some trenching; 2. Carry out ground-based magnetometric, gravimetric and I.P. surveys on the property along lines oriented NW-SE and at 100 m apart. Readings for the magnetometer survey will be taken at a 12.5 m interval while for the I.P. survey, they will be taken at a 25 m spacing, reduced to 12.5 m spacing when an anomaly is picked-up.

Phase II Exploration at depth

1. Diamond Drilling

Continue exploration with diamond drilling. This work must be supported by geological and geochemical studies, and possibly geophysics, to define controls on potential mineralization and guide further exploration. Since the targets are not already totally defined, we can only attribute an allowance. It is recommended to bore NQ core size holes.

2. Underground exploration

On C29, C30, C3 C32 and C6 Veins, limited drifting and raise boring can be made in order to better delineate the known investigated veins. This will also permit an access to the underground drilling equipment for the drilling of some development drill holes. This work can be executed in parallel with the drilling from surface.

Xiaowagou

Phase I Surface surveys

1. Assess known mineral occurrences (Au, Cu, Ag, etc.) for economic potential with detailed mapping, rock geochemistry and some trenching; 2. Carry out ground-based magnetometric and I.P. surveys on the property along lines oriented NW-SE and at 100 m apart. Readings for the magnetometer survey will be taken at a 12.5 m interval while for the I.P. survey, they will be taken at a 25 m spacing, reduced when an anomaly is picked-up to 12.5 m spacing.

Phase II Exploration at depth

1. Diamond Drilling Continue exploration with diamond drilling. This work must be supported by geological and geochemical studies, and possibly geophysics, to define controls on potential mineralization and guide further exploration. Since the targets are not already totally defined, we can only attribute an allowance. It is recommended to bore NQ core size holes.

2. Underground exploration

On S-12, S16 and S-17 Veins, limited drifting and raise boring can be made in order to better delineate the known investigated veins. This will also permit an access to the underground drilling equipment for the drilling of some development drill holes. This work can be executed parallely to the drilling from surface. Underground reconnaissance on S-11, S13, S-14 and S15.

There are no current detailed plans to conduct exploration on the Loning, Mozigou, and Jiashapa properties. Mr. Christian Derosier, the Company's independent qualified person has visited and evaluated these properties, but has not yet completed a technical report for them.

The Company is exploring and evaluating all avenues through which to provide funding including private investment and debt financing.

Mr. Christian Derosier, M.Sc., D.Sc., P. Geo. will be conducting any proposed exploration work. He has been a member of The Canadian Institute of Mines and Metallurgy since 1976 and the Ordre des Géologues du Québec (No 129).

Detailed sampling provides a basis for the quality estimate or grade of a mineral discovery. A brief description of the sample collection, sample preparation, and the analytical procedures used to develop our analytical results is as follows. Addition the following discloses the Quality Assurance/Quality Control (QA/QC) protocols developed for the exploration program:

Jinjishan

No aspect of the sample preparation or analyses was conducted by an employee, officer, director or associate of the Company.

All samples collected by mine personnel are bagged in canvas bags without security enclosures. The samples are retained in the mine office until such time as sufficient numbers are present to warrant a trip to the local laboratory. No preparation is carried out on site. It is Mr. Christian Derosier’s belief that the mine staff are conscientious individuals and the site does not require elaborate security procedures. The mine is an integral industrial unit having no real concern for sample loss as samples can be easily replaced. Security will be an issue for the Company to handle if and when an exploration or confirmation drilling program begins as the Company will be forced to employ Western-style best practices standards. The Company will probably also wish to increase the overall quality of the sample database through maintaining a computerized sample record. Depending on the laboratory used by the Company, some level of sample preparation may be justified on site to reduce shipping costs.

In 2006, Mr. Derosier visited the Chinese Laboratory which is used by several of the Luoning County mines for the analysis of run of mine samples. The mine submits a relatively low number of samples per year to the lab and the analyses are used only as a general guide to mine development. As it is usual for China, gold assays are by aqua regia digestion on a finely pulverized charge which is not fired before digestion. As a result, the instrumental AA gold determination which follows is potentially reflective of a partial digestion of the gold contained in the sample. Mr. Derosier has not investigated lab performance further as he believed at the time of the short visit that a sample population collected for characterization studies would be too small to yield meaningful results. However, if the lab is to be used in the future, comparative analyses should be made using an accredited facility.

As a footnote, however, it is noted that the comments given by Mr. Derosier’s laboratory (IPLChimitec, Val d’Or, Quebec) about the quality of results obtained from the Chinese laboratories is considered fair and determined if inaccuracies exist from the Chinese assaying procedures, the introduced errors are relatively small.

Where the major laboratories are concerned, analytical procedures in China generally meet North American standards, and the results of Mr. Derosier’s comparisons of data derived from Chinese labs and Canadian labs in the past have shown good agreement. However, we do recognize that local practices for gold assaying can result in compromised data due to the use of an aqua regia digestion on charges which have not been fired. In such cases, aqua regia is potentially a partial digestion, thus introducing the possibility of gold contents being underreported.

Encapsulated gold in resistive base metal sulphide minerals, in secondary (oxide and silicate) base metal minerals and in silicates require s a more robust digestion involving the use of hydrofluoric acid (a 4-acid digestion), or alternatively, sample roasting.

Mr. Derosier learned that some of the companies are relying on their own labs for grade control analyses. We learned that the gold determinations, after an aqua regia digestion, were made colourimetrically. This is clearly not to western standards. Mr. Derosier does not know the extent to which the mines rely on these data to guide modifications of milling techniques to ensure optimum recovery of gold, however, it does open the potential opportunity for the Company to have a significant impact on modifying procedures and improving recoveries.

Before using a local laboratory, the Company plans to check all aspects of laboratory practice including sample log-in procedures, sample preparation, procedures, general cleanliness, the use of wash rock in crushers and pulverizers, the use of lab standards, duplicates and blanks for quality control and quality assurance purposes, the laboratory information management system, security measures and sample storage facilities.

Considering the early level of exploration on the Jinjishan property, the limitations of the geological materials sampled, and the limitations of the geochemical and geophysical methods employed, the reliability and density of the current exploration data are considered sufficient to support the interpretations made

Fanggelewan

The Company has not conducted any geochemical or drill hole sampling on the Xiayu Fanggelewan Project.

During the two visits of the property by Mr. Derosier, channel samples were taken in the adits and drifts and representative grab samples were picked-up on the stockpiles and waste piles. These samples were put in plastic bags with proper identification and sealed. Samples were delivered to the C.M.I. laboratory in Luoyang City by the Mr. Derosier.

Mr. Derosier visited the Chinese Laboratory located in Luoyang City which is used by several of the Luoning County mines for the analysis of run of mine samples. There are assay laboratories in Chengde and Beijing. The mine submits a relatively low number of samples per year to the lab and the analyses are used only as a general guide to mine development. As it is usual for China, gold assays are by aqua regia digestion on a finely pulverized charge which is not fired before digestion. As a result, the instrumental AA gold determination which follows is potentially reflective of a partial digestion of the gold contained in the sample.

Mr. Derosier has investigated lab performance with a sample population collected from different gold and base metal mines, for characterization studies. Duplicate samples were sent to the ALS-Chemex laboratory in Vancouver, B.C., Canada. Results obtained in Canada were similar to 10% higher than the Chinese labs.

Comments given by Mr. Derosier’s laboratory (ALS-Chemex, Val d’Or, Quebec) about the quality of results obtained from the Chinese laboratories is considered fair and has determined if inaccuracies exist from the Chinese assaying procedures, the introduced errors are relatively small.

Where the major laboratories are concerned, analytical procedures in China generally meet North American standards, and the results of comparisons of data derived from Chinese labs and Canadian labs in the past have shown good agreement. However, we do recognize that local practices for gold assaying can result in compromised data due to the use of an aqua regia digestion on charges which have not been fired. In such cases, aqua regia is potentially a partial digestion, thus introducing the possibility of gold contents being under-reported. Encapsulated gold in resistive base metal sulphide minerals, in secondary (oxide and silicate) base metal minerals and in silicates requires a more robust digestion involving the use of hydrofluoric acid (a 4-acid digestion), or alternatively, sample roasting.

Mr. Derosier has learned that some of the companies are relying on their own labs for grade control analyses. We learned that the gold determinations, after an aqua regia digestion, were made colourimetrically. This is clearly not to western standards. Mr. Derosier does not know the extent to which the mines rely on these data to guide modifications of milling techniques to ensure optimum recovery, however, it does open the potential opportunity for the Company to have a significant impact on modifying procedures and improving recoveries. Before using a local laboratory, the Company plans to check all aspects of laboratory practice including sample log-in procedures, sample preparation procedures, general cleanliness, the use of wash rock in crushers and pulverizers, the use of lab standards, duplicates and blanks for quality control and quality assurance purposes, the laboratory information management system, security measures and sample storage facilities.

At this time, the Company has not implemented any Quality Assurance/ Quality Control (QA/QC) procedure.

During the Mr. Derosier’s sampling, a great care was applied in order to eliminate contamination. Bags were identified and immediately sealed. Mr. Derosier transported the samples to the Chinese lab in Luoyang and participated in the recording and storage of samples before the analysis.

Xiaowagou

The Company has not conducted any geochemical or drill hole sampling on the Xiao Wa Gou Project.

During the two visits of the property by Mr. Derosier, channel samples were taken in the adits and drifts and representative grab samples were picked-up on the stockpiles and waste piles. These samples were put in plastic bags with proper identification and sealed. Samples were delivered to the C.M.I. laboratory in Luoyang City by Mr. Derosier.

Mr. Derosier visited the Chinese Laboratory located in Luoyang City which is used by several of the Luoning County mines for the analysis of run of mine samples. There are assay laboratories in Chengde and Beijing. The mine submits a relatively low number of samples per year to the lab and the analyses are used only as a general guide to mine development. As it is usual for China, gold assays are by aqua regia digestion on a finely pulverized charge which is not fired before digestion. As a result, the instrumental AA gold determination which follows is potentially reflective of a partial digestion of the gold contained in the sample. Mr. Derosier has investigated lab performance with a sample population collected from different gold and base metal mines, for characterization studies. Duplicate samples were sent to the ALS-Chemex laboratory in Vancouver, B.C., Canada. Results obtained in Canada were similar to 10% higher than the Chinese labs.