Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d8k.htm |

2010 Investor Day

June 16, 2010

Exhibit 99.1 |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

1

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words

“may,” “believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar

expressions,

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

(the

“Reform

Act”).

These

statements

may

include,

but

are

not

limited

to,

statements

regarding

our

future

operating

results

and

growth, ability to expand and utilize flexibility under our new credit facility,

and the repurchase of our securities.

For all “forward-looking statements,”

the Company

claims the protection of the safe harbor for forward-looking statements

contained in the Reform Act.

Such forward-looking statements involve risks, uncertainties and

other factors which may cause actual results, performance or achievements of the

Company

and

its

subsidiaries

to

be

materially

different

from

any

future

results,

performance or achievements expressed or implied by such forward-looking

statements. These risks, uncertainties and other factors are discussed in the

reports filed by the Company with the Securities and Exchange Commission,

including the most recent reports on Forms 10-K, 10-Q and 8-K,

each as it may be amended from time to time.

The Company disclaims any intent or obligation to update these

forward-looking statements.

FORWARD-LOOKING STATEMENTS |

HIGHLIGHTS

2

•

Significant market opportunity

•

Highly differentiated business model

•

Disciplined and conservative underwriting strategy

•

Successful long-term track record

•

Well positioned to take advantage of growth prospects

|

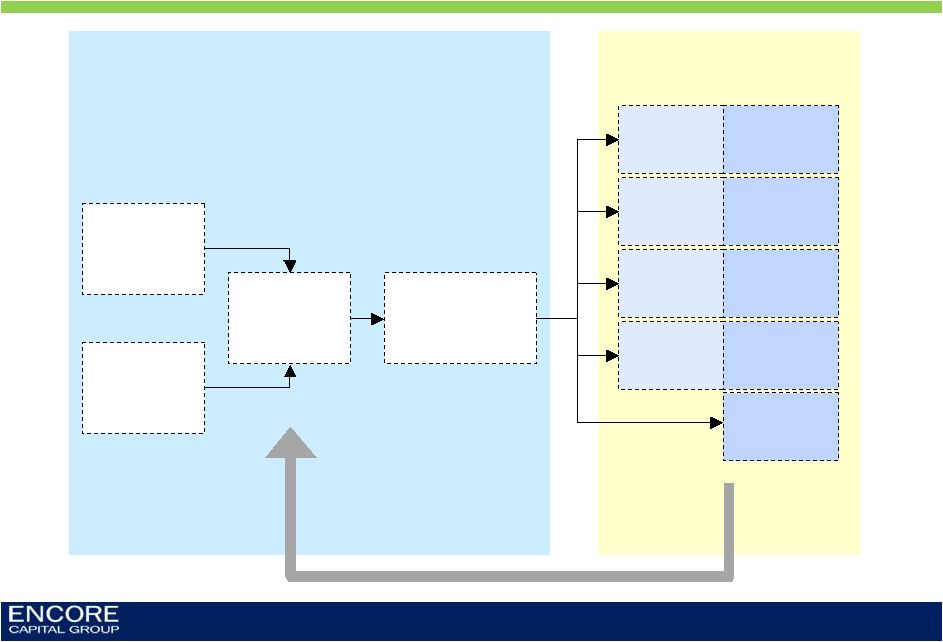

OUR

LONG-TERM FINANCIAL MODEL GIVES THE CONSUMER TIME TO RECOVER

3

CONSUMER

Opens unsecured

credit line,

credit card or

consumer loan

Consumer either

cannot or will not

make payments

ISSUER

Delinquency cycle

(days 30-180)

Attempt

rehabilitation and

escalate

consequences

Consumer is

“charged-off”

by issuer on

day 181

Issuer offers to

sell unsecured,

charged-off

debt to Encore

ENCORE

Price portfolio using

industry-leading models

Based on consumer

behavior at the account level

Focused on willingness and

ability-to-pay

Create liquidation

strategy and set goals

Effort sloping through

empirical and statistical

modeling

Collect debt through the application of

unique collections platforms and unrivaled

collection professionals (84 month window)

Legal

Outsourcing

Call Centers

Direct Mail

Collection Agency

Outsourcing

Sales channel

No/Low effort |

THE

INDUSTRY HAS GONE THROUGH SEVERAL DISTINCT STAGES OVER THE LAST 10 YEARS

4

Demand

Supply

•

Issuers are relatively naïve

about the value of consumer

debt

•

Modest demand for delinquent

consumer paper leads to low

prices

An emerging

market

2002

2004

•

Issuers improve their delinquent credit card

valuation methods

•

The number of buyers increases dramatically

as private equity enters and small players

borrow and invest heavily for growth

•

Buyers

fall

prey

to

the

“winner’s

curse”

as

they price portfolios well outside reasonable

collection expectations

Overconfidence and

irrational pricing

2006

2008

•

As credit markets closed,

buyers were unable to fund

new and existing contracts

•

Consumer charge-off rates

near all-time highs

•

Banks begin to manage the

pace at which they sell

receivables

Significant

opportunity

2010 |

Several competitors are now

known to have overpaid for

portfolios and are in financial

distress or have exited the

industry

Between 2005 and 2007, we

remained disciplined and avoided

high priced portfolios that did not

meet internal hurdle rates

In late 2005, we

established call

center in India

We believe it is the only

successful late-stage

collections platform in India,

at approximately 1/3 the cost

of our U.S. operations

We have maintained our

analytic leadership position,

and have strengthened it,

with novel models and

technologies

Conserved capital until

portfolio prices

decreased to a point

where we could achieve

consistent profitability

Credit markets continue to

offer liquidity only to the best

players in our industry

In 2008, we built and

implemented industry’s

first known ability-to-pay

(Capability) model

In February 2010, we

entered into a new

$327.5 million

revolving credit facility

In 2009, we

ramped up

purchasing to take

advantage of the

favorable market

environment

WE ARE WELL POSITIONED TODAY BECAUSE OF KEY STRATEGIC

DECISIONS WE MADE

5 |

2010

Q1 2009 Q1

Q1 YOY Growth

Variance

$141,267

$26,034

23%

$115,233

Collections

$87,338

$10,892

14%

$76,446

Revenue

$82,588

$18,791

29%

$63,797

Adjusted EBITDA*

$81,632

$25,719

46%

$55,913

Purchases

$0.44

$0.06

16%

$0.38

EPS

($000s, except EPS and ratios)

OUR STRATEGIC DECISIONS LED TO STRONG Q1 RESULTS

6

* Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA

to be a meaningful indicator of operating performance and uses it as a measure to

assess the operating performance of the Company. See Reconciliation of Adjusted

EBITDA to GAAP Net Income at the end of the presentation. |

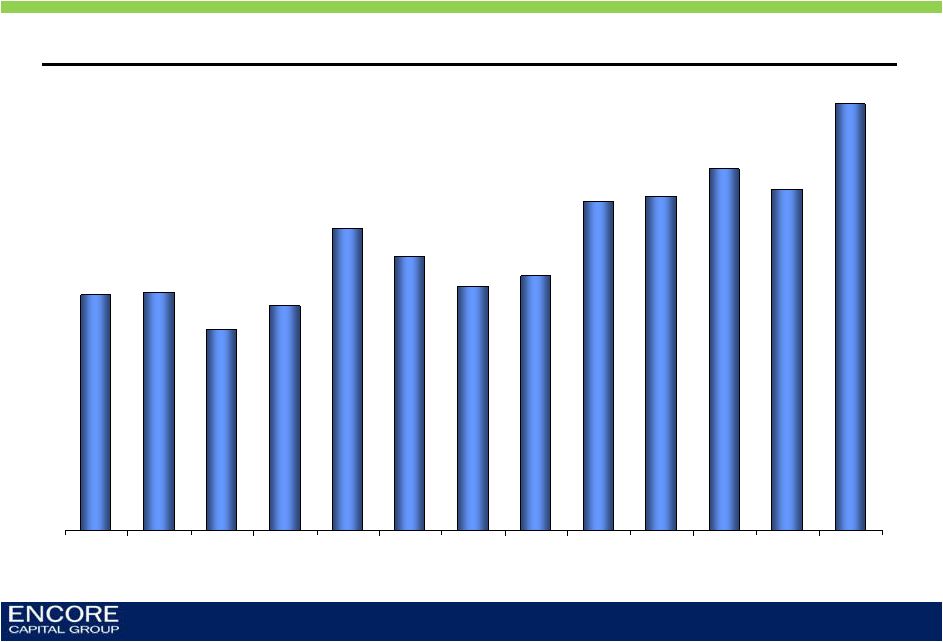

2010

MARKS

OUR

10

TH

CONSECUTIVE

YEAR

OF

INCREASING

COLLECTIONS

7

Quarterly gross collections

($ millions)

$141.3

$87.6

$90.5

$104.4

$115.2 |

$45.6

$46.1

$39.0

$43.5

$58.5

$53.0

$47.3

$49.3

$63.8

$64.7

$70.0

$66.1

$82.6

Q1 07

Q2 07

Q3 07

Q4 07

Q1 08

Q2 08

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

WE ARE INCREASING OUR OPERATING CASH FLOWS (ADJUSTED EBITDA)

AT A FASTER RATE THAN COLLECTIONS

Adjusted EBITDA* by quarter

($ millions)

* Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA

to be a meaningful indicator of operating performance and uses it as a measure to

assess the operating performance of the Company. See Reconciliation of Adjusted

EBITDA to GAAP Net Income at the end of the presentation. 8

|

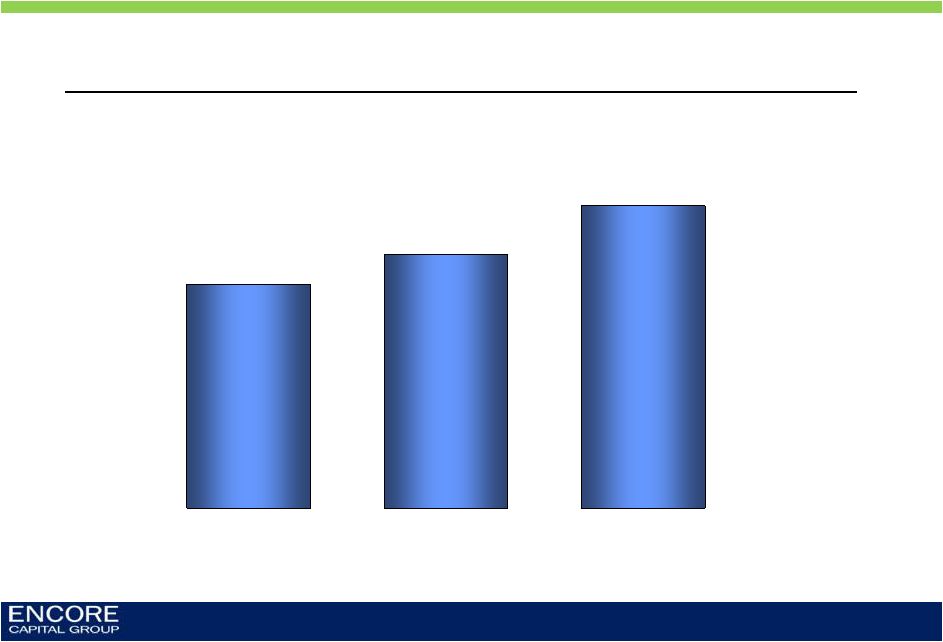

Full

year purchases for 2008 and 2009; Estimate for 2010 ($ millions)

WE ARE REINVESTING CASH BACK INTO THE BUSINESS THROUGH

INCREASED PURCHASING VOLUMES

$230.3

$300.0

$256.6

2008

2009

2010E

9 |

Collection sites’

direct cost per dollar collected

A MAJOR CONTRIBUTOR TO THE IMPROVING CASH FLOW IS OUR LOWER

CALL CENTER COST STRUCTURE, DRIVEN BY EXPANSION INTO INDIA

10 |

THE

INCREASED CONTRIBUTION FROM INDIA TRANSLATES INTO SIGNIFICANT ANNUAL COST

SAVINGS 11

Collections from all call centers

India

contribution

10%

19%

30%

40%

($ millions)

$126

$157

$186

~$250 |

$892

$1,063

$1,160

$1,240

Y/E 2007

Y/E 2008

Y/E 2009

Q1 2010

Estimated remaining gross collections

($ millions)

NOT ONLY HAVE WE IMPROVED OPERATING RESULTS, WE HAVE ALSO

ADDED SIGNIFICANTLY TO THE COMPANY’S EMBEDDED VALUE

12 |

WE

HAVE BEEN ABLE TO ACCOMPLISH THIS WITH MODEST LEVERAGE, LEAVING ROOM FOR FUTURE

EXPANSION 13

Estimated remaining net collections

($ millions, Q1 2010)

$1,240

Gross Estimated

Remaining

Collections

($496)

40% Cost to

Collect

$667

Net Estimated

Remaining

Collections

Taxes (40% Rate)

($77)

* DTL = Deferred Tax Liability

$327

Net Debt + DTL*

$17

$310

Net

Debt

DTL*

We are 2Xover-

collateralized |

$-

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

$2,500

$2,750

AND WE BELIEVE THAT OUR CURRENT ESTIMATE OF REMAINING

COLLECTIONS IS CONSERVATIVE GIVEN OUR HISTORY

14

Cumulative collections (initial expectation vs. actual)

($ millions, Jan 01 –

Mar 10)

Actual cash

collections

Initial

projections |

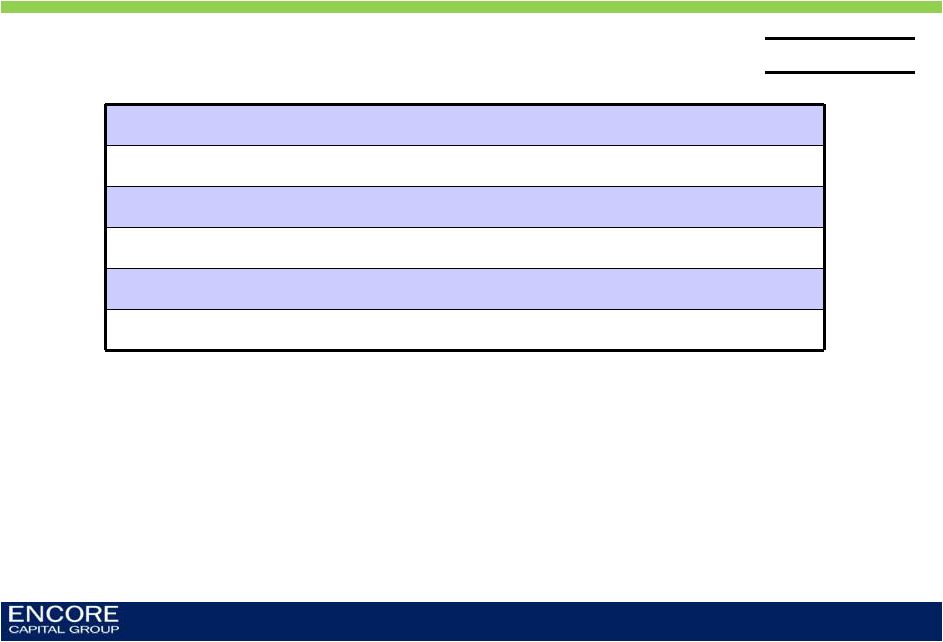

WE

APPLY THIS SAME CONSERVATISM IN OTHER AREAS 15

Our general

financial approach

is conservative,

and reinforces our

efforts to reduce

risk, build future

value, and set the

standard for our

industry

PORTFOLIO

LIQUIDATION

ESTIMATES

TAX REVENUE

RECOGNITION

COVENANT

COMPLIANCE |

WE

HAVE SIGNIFICANT ROOM TO GROW THE BUSINESS 16

($ millions)

Cash flow leverage ratio

Debt

Trailing 4-quarter adjusted EBITDA

Debt/Adj. EBITDA [Maximum 1.75x]

Minimum net worth

Total stockholders' equity

Minimum net worth

Excess room

Interest coverage ratio

Trailing 4-quarter EBIT

Trailing 4-quarter consolidated interest expense

EBIT/Interest expense [Minimum 2.0x]

311.3

211.1

1.47

195.9

146.2

49.7

47.2

15.6

3.0

2009

303.1

264.6

1.15

243.1

183.0

60.1

69.9

16.2

4.3

*Not adjusted for ASC 470-20, prior to 2009

*

*

*

Q1 2010

318.0

283.4

1.12

257.2

188.5

68.7

72.5

16.4

4.4

2008

Based on our

cash flow and

LTM Adj.

EBITDA, our

leverage ratio

would allow

us to increase

total debt to

$495 million

Covenant analysis |

MARKET

DYNAMICS HAVE INFLUENCED OUR APPROACH TO THE BUSINESS 17

Charge-offs

remain

elevated

Consumer

credit continues

to experience

losses at near

record levels

Supply more

closely

managed by

the issuers

Demand

increasing, albeit

slowly

Few players with

access to

significant

amounts of capital

Continued exit of

large players, but

others starting to

gain traction

Consumer

performance

remains predictable

Our models continue

to predict consumer

behavior with a high

degree of accuracy

Significant

regulatory and

legislative scrutiny

Both in our industry

and in the financial

services sector at

large |

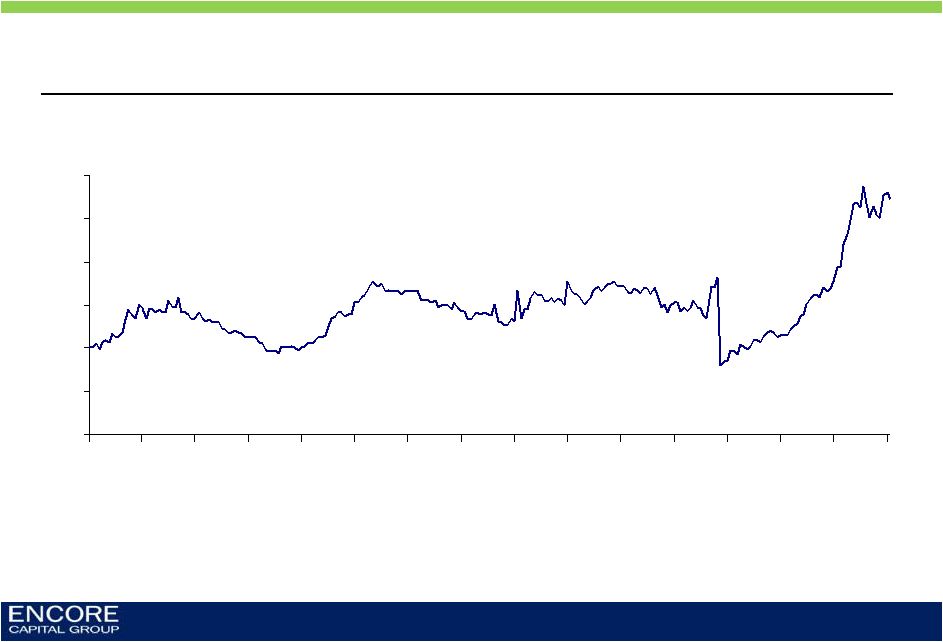

Moody’s Credit Card Charge-off Index

18

CHARGE-OFFS REMAIN NEAR HISTORICAL PEAKS

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Mar-90

Jul-91

Nov-92

Mar-94

Jul-95

Nov-96

Mar-98

Jul-99

Nov-00

Mar-02

Jul-03

Nov-04

Mar-06

Jul-07

Nov-08

Mar-10 |

4.3%

4.3%

4.5%

5.3%

9.8%

12.5%

12.6%

9.0%

6.5%

7.0%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

PRICING IS UP MODERATELY IN 2010 AND WE ARE STILL DEPLOYING

CAPITAL AT VERY PROFITABLE LEVELS

19

Pricing trend from one issuer through time

(% on a dollar of face)

Active market buyer

Intentionally absent

EXAMPLE |

THE

AVAILABLE DATA AROUND THE AVERAGE CONSUMER SHOWS THAT THEY REMAIN

CHALLENGED 20

High mortgage defaults

Near all-time high unemployment rate

Low consumer sentiment

Volatile consumer price index

Source: Federal Reserve, University of Michigan, U.S. Bureau of Labor Statistics

|

HOWEVER, OUR CONSUMERS’

PAYMENT BEHAVIOR AND OUR

PERFORMANCE REMAIN CONSISTENT

21

Metric

Recent trend

•

Payer rates

•

Slightly upward

•

Average payment size

•

Stable

•

Single vs. multi-payers

•

More payment plans

•

Broken payer rates

•

Mild improvement

•

Settlement rates

•

Upward trend |

OUR

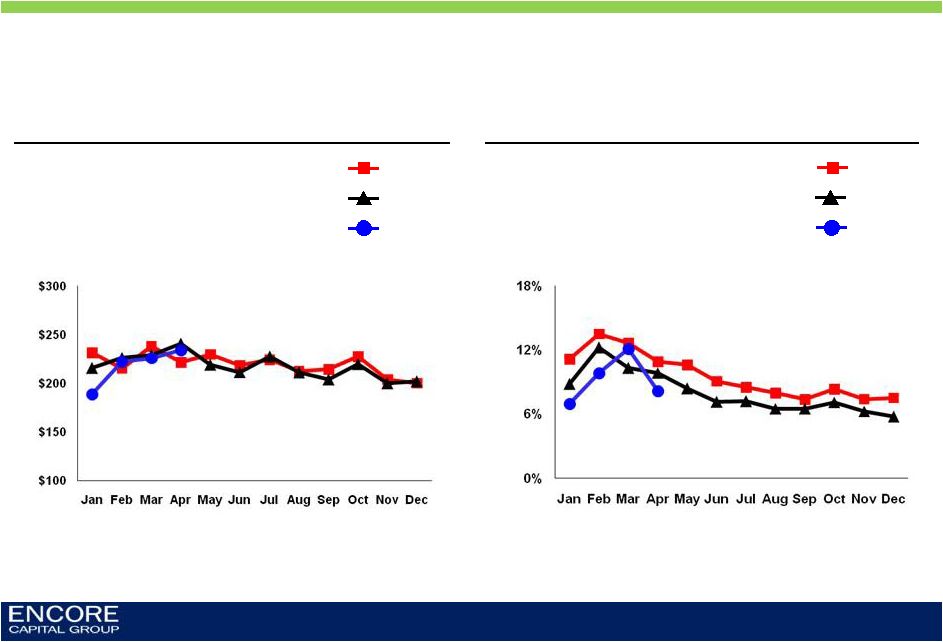

OVERALL PAYER RATES HAVE IMPROVED 22

Overall payer rate for all active inventory

2008

2009

2010 |

AVERAGE PAYMENT SIZE REMAINS CONSISTENT, EVEN AS PAYMENT PLANS

CONTINUE TO BE THE NORM

23

Average payment size for all paying accounts

2008

2009

2010

Single settlement payers as a percentage of

total payers

2008

2009

2010 |

OUR

CONSUMERS ARE HONORING THEIR OBLIGATIONS AND SETTLING THEIR ACCOUNTS AT

CONSTANT RATES 24

Overall broken payer rate, excluding settled

accounts through time

2008

2009

2010

Legal settlement rate

2008

2009

2010 |

WE ARE

POSITIONED TO RESPOND TO THE CHANGING REGULATORY ENVIRONMENT

25

Technology

Proprietary software platforms allow the company to make

changes as new regulations and laws emerge

Sophisticated software and analytics platforms ensure that

all data-driven activities are compliant

Data management

Expanded legal and quality assurance teams partner with training

department to keep account managers abreast of changes

Training

Zero tolerance policy in place to address errors by account

managers

Self-discipline |

WE

ALSO LOOK FOR WAYS TO BOTH PROTECT AND PARTNER WITH OUR CONSUMERS ACROSS A

RANGE OF OPERATIONAL ACTIVITIES 26

Operational practices

Activity

•

Interest policy

•

Discounts

•

Outbound

communication

•

Work segmentation

•

We do not charge interest during the course of payment plans to

improve the likelihood that a consumer will be able to fulfill their

obligations

•

We consistently provide significant discounts to consumers in an

effort to establish a mutually beneficial negotiation

•

It is our policy not to leave messages on answering machines

(unless previous contact made) or intentionally contact third-

parties

out

of

respect

for

our

consumers’

privacy

•

We use our suite of powerful analytic scores to identify those

consumers that are unable to repay their obligations, and we

proactively choose to forgo all work effort either temporarily or

permanently |

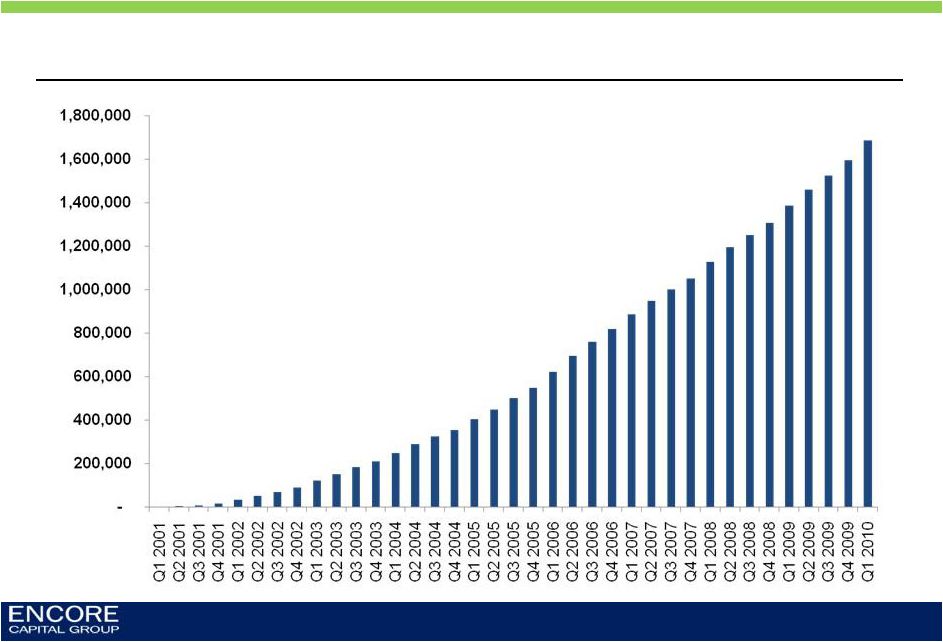

THESE

PRACTICES HAVE ALLOWED US TO EFFECTIVELY WORK WITH MILLIONS OF CONSUMERS

Consumers with whom we have partnered to retire their debt (cumulative)

27 |

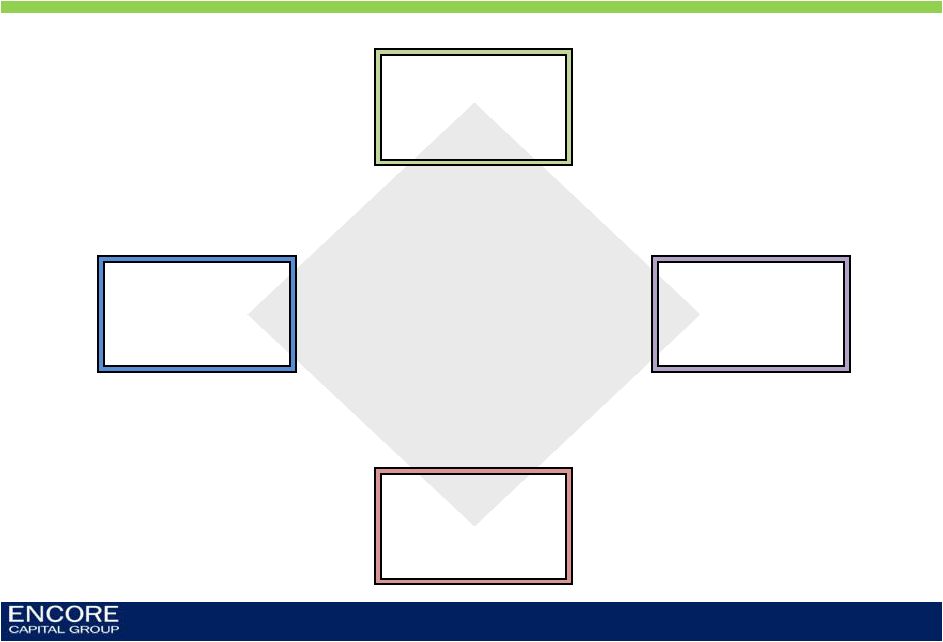

ENCORE’S

STRATEGIC

PILLARS

COST

LEADERSHIP

PRINCIPLED

INTENT

CONSUMER

INTELLIGENCE

ANALYTIC

STRENGTH

OUR OPERATIONAL SUCCESS IS BASED UPON FOUR STRATEGIC PRIORITIES

28 |

|

Strong partnership

opportunities

with

willing

and able consumers

Our attempts to contact or

work with consumers are

typically

ignored,

and

the

legal

option becomes necessary

Hardship

strategies

Offer

significant discounts

and plans

that accommodate

many small payments

Remind consumers of their

obligation

through

legal

communications

Focus on

payment plans and

opportunities to build longer

relationships

with consumers

Willingness to pay

Is the debtor willing to resolve the debt on fair terms?

HIGH

HIGH

LOW

LOW

OUR ANALYTIC INSIGHT ALLOWS US TO MATCH OUR COLLECTION

APPROACH TO THE INDIVIDUAL CONSUMER’S PAYMENT BEHAVIOR

30 |

2006

Behavioral science and

macroeconomics

2000

Early statistical

modeling

•

Hired first statisticians

•

Created account-level

valuation model

•

Created 1

st

and 2

nd

generation forecasting

models

•

Created 1

st

generation

operational models (mail

channel and call center)

•

Introduced Capability-

Willingness framework

•

Developed industry’s first

ability-to-pay model

•

Developed account level,

activity-based cost

database

•

Developed 3

rd

generation

forecasting model

•

Created industry-leading

legal model

•

Developed 3

rd

generation

valuation model

•

Developed

2

nd

generation

mail and call center models

2009

Strategy and optimization

2003

Forecasting and

predictive modeling

OUR LEVEL OF SOPHISTICATION HAS SIGNIFICANTLY INCREASED OUR

COMPETITIVE ADVANTAGE

31 |

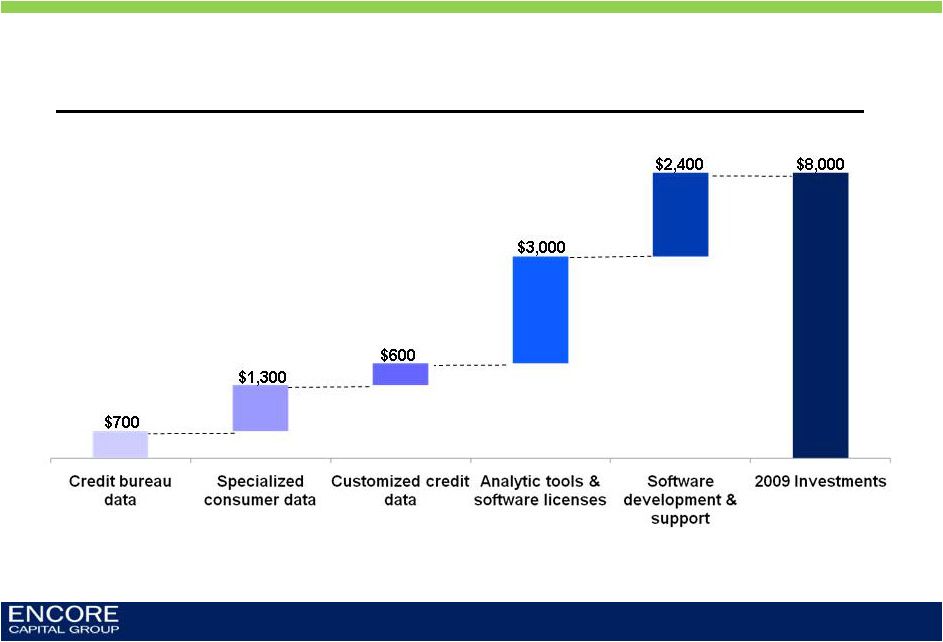

AS

HAVE OUR INVESTMENTS IN DATA AND TECHNOLOGY 32

Investments to support consumer analytics (2009 only)

($000s) |

Core competency in understanding the

payer behavior of distressed consumers

Cross-channel

coordination

and optimization

Consumer

behavior

research

Market data

and insight

Portfolio

valuation

Pre-purchase

model

No effort

Legal

Outsourcing

Legal effort

model with

Capability

Call

Centers

Call effort

model with

Capability

Direct

Mail

Letter effort

model with

Capability

Collection

Agency

Outsourcing

Agency effort

model with

Capability

Collections operations that

optimize effort and profitability

OUR ANALYTIC REACH EXTENDS FROM PRE-PURCHASE THROUGHOUT OUR

ENTIRE OWNERSHIP PERIOD

33

Continuous feedback between

operations and valuation |

Collections lift over deciles, comparing Encore’s ability-to-pay model

against both competitor scores and random servicing strategies

Commercial score 1

Random

servicing

Commercial score 2

Encore

AND IS SUPERIOR TO WHAT CAN BE ACQUIRED COMMERCIALLY

34 |

OUR

SUCCESS IN INDIA IS A TESTAMENT TO OUR PERSEVERANCE 35

2006

Year of

growing pains

•

Only working low

balance accounts

•

Limited connection to

the U.S.

•

High attrition and low

performance

147 staff

2005

Journey

begins

33 staff

2007

First taste

of success

•

Shifted to higher balance

accounts drives strong

performance

•

Started competing with

U.S. on paper of similar

balance and age

207 staff |

AS A

RESULT, THE INDIA TEAM IS NOW AN INTEGRAL PART OF THE COMPANY

36

2010

Enabling

future growth

•

India now accounting for

more than 40% of all call

center collections

•

Fundamentally improved

internal cost to collect

•

Enhancing our ability to

purchase portfolios and

win new bankruptcy

servicing contracts

900+ staff

2008

Accelerating

confidence

and trust

•

Successfully ramped

up hiring without

compromising

performance

•

New work groups

established

•

Meaningfully

reduced attrition

333 staff

2009

Expansion

of influence

and impact

•

Significant involvement

in collection strategy

•

Built analytics, IT and

bankruptcy servicing

teams

•

Invested in world-class

facility

625 staff |

Monthly gross collections (India)

($ millions)

THE GREATEST EVIDENCE OF THIS CAN BE SEEN IN THE DRAMATIC

INCREASE IN MONTHLY CONTRIBUTION

37

Nov

-

Jan

-

Mar

-

May

-

Jul

-

Sep

-

Nov

-

Jan

-

Mar

-

May

-

Jul

-

Sep

-

Nov

-

Jan

-

Mar

-

May

-

Jul

-

Sep

-

Nov

-

Jan

-

Mar

-

May

-

Jul

-

Sep

-

Nov

-

Jan

-

Mar

- |

GOING

FORWARD, WE ARE FOCUSED ON MAINTAINING PERFORMANCE AND TAKING A LEADING ROLE IN

COLLECTION INNOVATION 38

Expertise

and process

support for

corporate

initiatives

Sustain

strengths

as we grow

Push

innovation

Co-create

global

synergies |

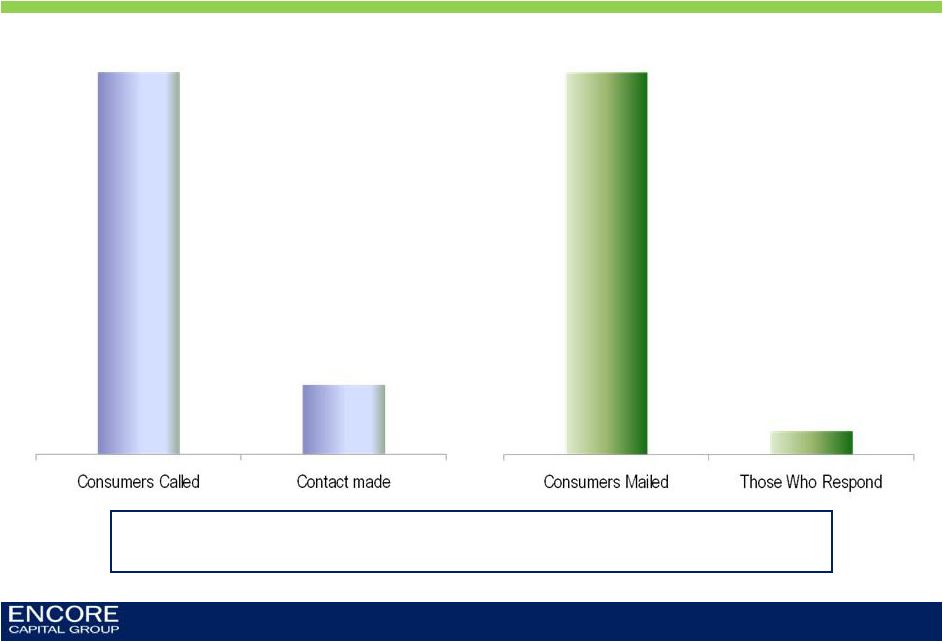

ONE OF

OUR GREATEST CHALLENGES IS THAT OUR CONSUMERS GENERALLY DO NOT RESPOND TO OUR

ATTEMPTS TO CONTACT THEM 39

7.22M in 2009

18.1% or 1.30M

7.20M in 2009

6.1% or 440K

As

a

result,

we

often

find

ourselves

with

no

recourse

other

than

to

pursue

litigation, a decision we do not take lightly |

56.4

57.2

Q1 09

Q1 10

Legal collections and costs as a percentage of collections

53.1%

46.2%

$

$

($ millions)

OUR SUCCESS IN THE CHANNEL VALIDATES OUR DECISION TO PURSUE THIS

STRATEGY AND WE ARE BECOMING MORE EFFICIENT OVER TIME

40 |

SUMMARY

41

•

Favorable supply and demand dynamics are expected to drive a

strong purchasing year

•

Strong financial performance is expected to continue

•

Operational and financial leverage is increasing, largely due to

our

successful operating center in India

•

Insights revealed through rigorous analytics inform our strategy

and allow for a closer partnership with consumers |

QUESTIONS & ANSWERS |

APPENDIX |

APPENDIX: ENCORE IS A LEADING PLAYER IN THE DEBT RECOVERY

INDUSTRY

Distressed consumer debt

purchasing

(95% of revenue)

•Purchase

and

collection

of

charged-off

consumer

receivables (primarily credit

card)

•Robust

business

model

emphasizing consumer

intelligence and operational

specialization

•Invested

~$1.5B

to

acquire

receivables with a face value

of ~$46B

•Acquired

~29MM

consumer

accounts since inception

Bankruptcy servicing

(5% of revenue)

•Process

secured

consumer

bankruptcy accounts for

leading auto lenders and

other financial institutions

•Proprietary

software

dedicated to bankruptcy

servicing

•Operational

platform

that

integrates lenders, trustees,

and consumers

44 |

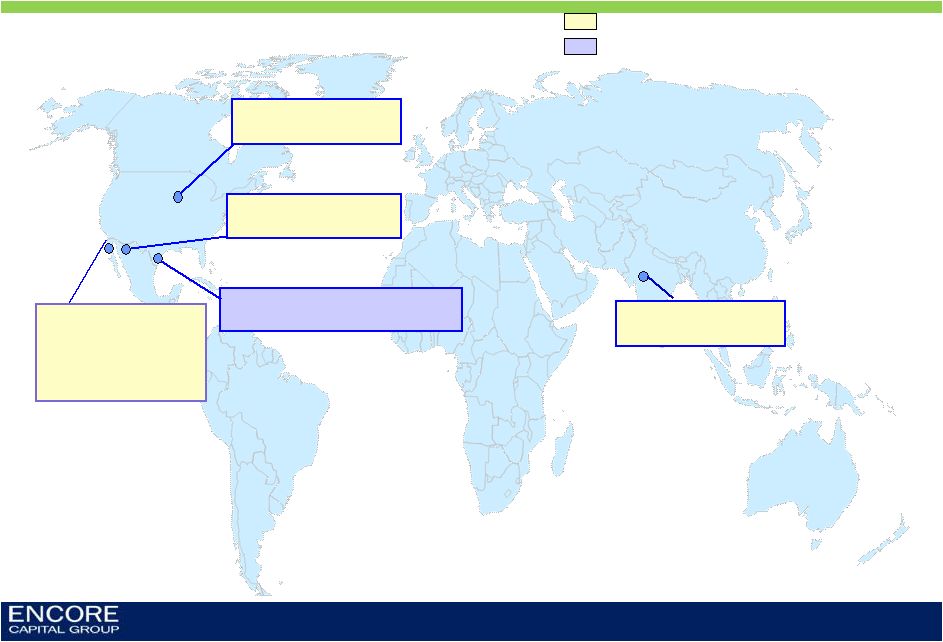

APPENDIX: WE OPERATE IN FIVE DIFFERENT SITES ACROSS THE U.S. AND

INDIA

45

San Diego,

CA

•

Headquarters

•

Call center

site

St Cloud,

MN

•

Call center site

Arlington, TX

•

Bankruptcy servicing

Phoenix, AZ

Delhi, India

Defaulted consumer debt purchasing

Bankruptcy servicing business

•

Call center site

•

Call center site |

APPENDIX: AT THE PEAK OF THE CYCLE, WE WILL GENERATE PAYMENTS

FROM FEWER THAN 1% OF OUR ACCOUNTS PER MONTH

46

Portfolio Face Amount

$15,000,000

Average Balance

$3,000

Number of Accounts

5,000

Purchase Factor

$0.05

Purchase Price

$750,000

Projected Return (2.7x)

$2,025,000

Only requires 20% payers, at a 67.5% settlement rate, to achieve

expected returns over a seven year period. This equates to:

–

Year 1: ~ 7.0% (350 consumers)

–

Year 2: ~ 5.5% (270 consumers)

–

Year 3: ~ 4.5% (220 consumers)

–

Year 4: ~ 2.0% (100 consumers)

–

Years 5+: ~1.0% (60 consumers)

ILLUSTRATIVE |

Cumulative Collections through March 31, 2010 (000’s)

Year

of

Purchase

Purchase

Price

<2004

2004

2005

2006

2007

2008

2009

2010

Total

CCM

<2004

$284,164

$517,451

$192,940

$144,775

$109,379

$50,708

$26,777

$16,345

$3,139

$1,061,514

3.7

2004

101,329

39,400

79,845

54,832

34,625

19,116

11,363

2,140

241,321

2.4

2005

192,591

66,491

129,809

109,078

67,346

42,387

7,721

422,832

2.2

2006

141,969

42,354

92,265

70,743

44,553

7,425

257,340

1.8

2007

204,298

68,048

145,272

111,117

20,888

345,325

1.7

2008

227,935

69,049

165,164

35,578

269,791

1.2

2009

254,127

96,529

55,927

152,456

0.6

2010

81,621

8,354

8,354

0.1

Total

$1,488,034

$517,451

$232,340

$291,111

$336,374

$354,724

$398,303

$487,458

$141,172

$2,758,933

1.9

APPENDIX A: CUMULATIVE COLLECTIONS BY PORTFOLIO VINTAGE

47 |

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note:

The

periods

3/31/07

through

12/31/08

have

been

adjusted

to

reflect

the

retrospective

application

of

ASC

470-20

3/31/07

6/30/07

9/30/07

12/31/07

3/31/08

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

3/31/10

GAAP net income, as reported

4,991

(1,515)

4,568

4,187

6,751

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

10,861

Interest expense

4,042

4,506

4,840

5,260

5,200

4,831

5,140

5,401

4,273

3,958

3,970

3,959

4,538

Contingent interest expense

3,235

888

-

-

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

11,733

-

-

-

-

-

-

-

-

-

-

-

Provision for income taxes

3,437

(1,031)

1,315

2,777

4,509

4,225

2,408

(1,442)

5,973

4,166

5,948

4,609

6,490

Depreciation and amortization

869

840

833

810

722

766

674

652

623

620

652

697

673

Amount applied to principal on receivable portfolios

28,259

29,452

26,114

29,498

40,212

35,785

35,140

46,364

42,851

48,303

49,188

47,384

58,265

Stock-based compensation expense

801

1,204

1,281

1,001

1,094

1,228

860

382

1,080

994

1,261

1,049

1,761

Adjusted EBITDA

45,634

46,077

38,951

43,533

58,488

52,997

47,250

49,262

63,797

64,682

70,023

66,103

82,588

APPENDIX B: RECONCILIATION OF ADJUSTED EBITDA

48 |