Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report – June 12, 2010

(Date of earliest event reported)

QEP RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| STATE OF DELAWARE | 000-30321 | 87-0287750 | ||

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

1050 17th Street, Suite 500, Denver, Colorado 80265

(Address of principal executive offices)

Registrant’s telephone number, including area code (303) 672-6961

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement |

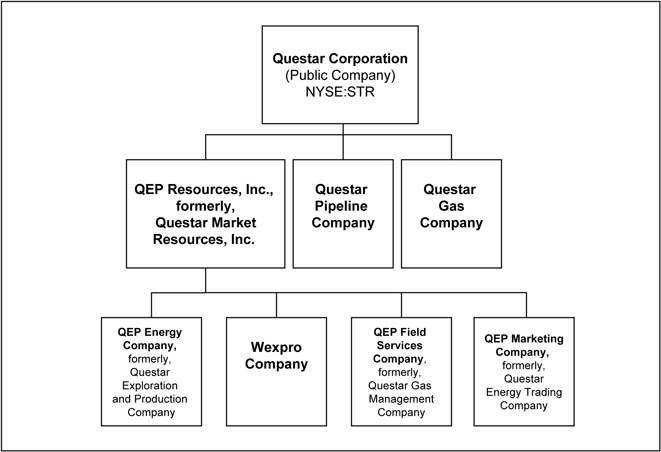

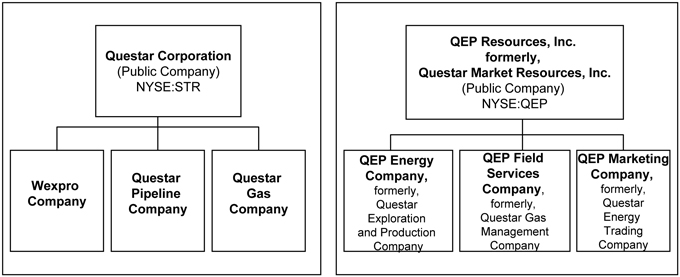

On June 12, 2010, the board of directors of Questar Corporation (“Questar”) formally approved the distribution to Questar’s shareholders (the “Distribution”) of all the shares of common stock, par value $0.01 per share, of Questar’s wholly-owned subsidiary, QEP Resources, Inc. (formerly Questar Market Resources, Inc.)(“QEP” or “we”). QEP generally holds the assets and liabilities associated with Questar’s natural gas exploration and production business, including its midstream natural gas gathering and processing business, and its energy marketing business, which we refer to collectively as the “E&P Business.” The Distribution will be made in accordance with our previously announced plan to separate Questar’s E&P Business from Questar’s regulated utility and pipeline businesses and Wexpro Company (“Wexpro”), which we refer to collectively as the “Questar Business.” Upon the Distribution, Questar’s shareholders will own 100% of the QEP common stock.

A copy of the press release announcing the approval of the Distribution is attached hereto as Exhibit 99.1.

In connection with the Distribution, QEP has entered into the following definitive agreements with Questar that, among other things, set forth the terms and conditions of the Distribution and provide a framework for QEP’s relationship with Questar after the Distribution.

Separation and Distribution Agreement

The Separation and Distribution Agreement (the “Separation Agreement”) sets forth the agreements between QEP and Questar regarding the principal transactions necessary to effect the Distribution.

The Reorganization. Under the terms of the Separation Agreement, Questar and QEP will take all actions necessary to separate the E&P Business from the Questar Business, including the following: (i) QEP will effect a stock split of its common stock so that the number of outstanding shares of QEP common stock is equal to the number of outstanding shares of Questar common stock at the time of the Distribution; (ii) QEP will distribute 100% of the stock of Wexpro to Questar; and (iii) Questar will contribute up to $250 million of equity to QEP.

Conditions to the Distribution. The Distribution is subject to, among other conditions, the satisfaction or waiver by Questar of the following conditions:

| • | QEP shall have filed a registration statement on Form 8-A with the Securities and Exchange Commission (“SEC”), and no stop order shall be in effect with respect thereto; |

| • | the listing of QEP common stock on the NYSE shall have been approved, subject to official notice of issuance; |

| • | the private letter ruling received on April 28, 2010, as supplemented by the supplemental private letter ruling received on June 8, 2010, from the Internal Revenue Service (the “IRS”) with respect to the Distribution (which ruling must be (and was) in form and substance satisfactory to Questar in its sole discretion), shall remain in effect as of the date of the Distribution (the “Distribution Date”); |

| • | Questar shall have received an opinion of Latham & Watkins LLP substantially to the effect that the distribution of the stock of Wexpro by QEP to Questar will qualify under section 355 |

1

| of the Internal Revenue Code of 1986, as amended (the “Code”), and that the Distribution, together with Questar’s contribution of up to $250 million to QEP, will qualify as a reorganization under Sections 355 and 368(a)(1)(D) of the Code; |

| • | any material government approvals and other consents necessary to consummate the Distribution shall have been received; |

| • | the approval of the Distribution by Questar’s board of directors shall not have been revoked or rescinded; |

| • | no order, injunction or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing consummation of the Distribution or any of the transactions related thereto, including the transfers of assets and liabilities contemplated by the Separation Agreement, shall be in effect; and |

| • | QEP shall have the ability to repay any of its outstanding debt obligations that might become due (or need to be repaid) as a result of the Distribution. |

Separation of QEP from Questar. The Separation Agreement provides that, subject to the terms and conditions contained in the Separation Agreement:

| • | Questar (or one of its subsidiaries) will retain or acquire all of the assets and retain or assume all of the liabilities (including whether accrued, contingent or otherwise) primarily related to Questar’s Business, including Wexpro; |

| • | QEP (or one of its subsidiaries) will retain or acquire all of the assets and retain or assume all of the liabilities (including whether accrued, contingent or otherwise) primarily related to the businesses and operations of Questar’s E&P Business, excluding Wexpro; |

| • | Each party or one of its subsidiaries will assume or retain any liabilities (including under applicable federal and state securities laws) relating to, arising out of or resulting from any registration statement or similar disclosure document to the extent such liabilities arise out of, or result from, matters related to businesses, operations, assets or liabilities allocated to such party in the separation; |

| • | Each party or one of its subsidiaries will assume or retain any liabilities relating to, arising out of or resulting from any guarantees relating to its business or secured by its assets; |

| • | Questar and QEP will each assume certain scheduled contingent liabilities, to the extent primarily related to the Questar Business or the E&P Business, respectively; |

| • | The Parties will use the “Distrigas” formula (a formula currently used to allocate indirect costs between affiliates based on each affiliate’s relative share of labor, property, plant and equipment, and gross margin) to allocate certain “unallocated liabilities,” such as general corporate liabilities for the period prior to the Distribution, including liabilities of Questar and its subsidiaries related to, arising out of or resulting from any actions with respect to the Distribution made or brought by any third party; |

| • | Except as otherwise provided in the Separation Agreement or any ancillary agreement, the parties will be responsible for any costs or expenses (including transaction expenses) incurred in connection with the separation in accordance with the terms of the “Distrigas” formula; and, |

2

| • | On or before September 1, 2011, each party shall bill the other party for any remaining amounts owed to such party and the owing party shall make a final “true-up” payment for any outstanding amounts owed to such other party. |

Except as may expressly be set forth in the Separation Agreement or any ancillary agreement, all assets will be sold on an “as is,” “where is” basis and the respective transferees will bear the economic and legal risks that (i) any conveyance will prove to be insufficient to vest in the transferee good title, free and clear of any security interest and (ii) any necessary consents or governmental approvals are not obtained or that any requirements of laws or judgments are not complied with.

Future Claims. The Separation Agreement provides for the formation of a contingent claim committee, which will have the responsibility for determining whether any newly discovered asset or liability is an asset or liability of Questar or QEP, or is an unallocated asset or unallocated liability which is shared as specified above. The contingent claim committee will be comprised of one representative each from Questar and QEP. Resolution of a matter submitted to the contingent claim committee will require the unanimous approval of the representatives.

Intercompany Accounts. The Separation Agreement provides that, generally, intercompany accounts will be scheduled and either (i) repaid in cash at closing, or (ii) continue in effect post-closing, in which case they will be an obligation of the relevant party and shall become a third-party, and not an intercompany, account.

Bank Accounts. The Separation Agreement provides that all QEP bank and brokerage accounts linked to Questar accounts, and all Questar bank and brokerage accounts linked to QEP accounts, will be “de-linked” prior to the Distribution Date. QEP will establish, prior to the Distribution Date, an independent cash management system and accounts to support its activities.

Trademarks. Except as otherwise specifically provided in any ancillary agreement and subject to certain limitations, the Separation Agreement provides that as soon as reasonably practicable after, and in any event no later than six months following the Distribution, each of QEP and Questar will cease using the trademarks and other intellectual property owned by or associated with the other party, with the exception that Questar will grant to QEP a one-year non-exclusive, royalty free and non-transferable license to use certain of Questar’s trademarks in connection with its internal operations of the E&P Business.

Releases. Except as otherwise provided in the Separation Agreement or any ancillary agreement, each party will release and forever discharge the other party and its respective subsidiaries and affiliates from all liabilities existing or arising from any acts or events occurring or failing to occur or alleged to have occurred or to have failed to occur or any conditions existing or alleged to have existed on or before the separation of QEP from Questar. The releases will not extend to obligations or liabilities under any agreements between the parties that remain in effect following the separation pursuant to the Separation Agreement or any ancillary agreement.

Indemnification. The Separation Agreement provides for cross-indemnities principally designed to place financial responsibility for the obligations and liabilities of QEP’s business with QEP and financial responsibility for the obligations and liabilities of the Questar Business with Questar. Specifically, each party will indemnify, defend and hold harmless the other party, its affiliates and subsidiaries and its officers, directors, employees and agents for any losses arising out of or otherwise in

3

connection with: (i) the liabilities each such party assumed or retained pursuant to the Separation Agreement; (ii) such party’s specified percentage of unallocated liabilities; and (iii) any breach by such party of the Separation Agreement or any ancillary agreement.

Legal Matters. Each party to the Separation Agreement will assume the control of all pending and threatened legal matters related to its own business or assumed or retained liabilities and will indemnify the other party for any liability arising out of or resulting from such assumed legal matters. Each party to a claim will agree to cooperate in defending any claims against both parties for events that took place prior to, on or after the date of the separation of such party from Questar. The parties shall each be responsible for their respective share of all out-of-pocket costs and expenses related thereto.

Insurance. The Separation Agreement provides for the allocation among the parties of benefits under existing insurance policies for occurrences prior to the separation and sets forth procedures for the administration of insured claims. In addition, the Separation Agreement allocates among the parties the right to proceeds and the obligation to incur deductibles under certain insurance policies. In addition, the Separation Agreement provides that Questar will obtain, subject to the terms of the agreement, certain directors and officers insurance policies to apply against certain pre-separation claims, if any.

Further Assurances. To the extent that any transfers contemplated by the Separation Agreement have not been consummated on or prior to the date of the separation, the parties will agree to cooperate to effect such transfers as promptly as practicable following the date of the separation. In addition, the parties will agree to cooperate with each other and use commercially reasonable efforts to take or to cause to be taken all actions, and to do, or to cause to be done, all things reasonably necessary under applicable law or contractual obligations to consummate and make effective the transactions contemplated by the Separation Agreement and the ancillary agreements.

Dispute Resolution. In the event of any dispute arising out of the Separation Agreement, the general counsel or chief legal officer of each of the parties will negotiate for a reasonable period of time to resolve any disputes among the parties. If the parties are unable to resolve disputes in this manner, the disputes will be resolved through binding arbitration.

Other Matters Governed by the Separation Agreement. Other matters governed by the Separation Agreement include access to financial and other information, confidentiality, access to and provision of records and treatment of outstanding guarantees.

Employee Matters Agreement

The Employee Matters Agreement sets forth the agreements between QEP and Questar to allocate liabilities and responsibilities relating to employee compensation and benefits plans and programs and other related matters in connection with the Distribution. These plans and programs include, without limitation, existing qualified retirement obligations, existing health, welfare, and fringe benefit obligations, the treatment of outstanding Questar equity awards, outstanding annual and long-term incentive awards, existing severance obligations, and existing non-qualified deferred compensation obligations. The following is a summary of the material terms of the Employee Matters Agreement:

Establishment of QEP Benefit Plans. In connection with the Distribution, QEP expects to adopt, for the benefit of its employees and former employees, a variety of compensation and employee benefits plans that are generally comparable in the aggregate to those provided to employees immediately prior to the Distribution. With certain possible exceptions, the Employee Matters Agreement provides that as of the close of the Distribution, QEP employees will generally cease to be active participants in, and QEP will generally cease to be a participating employer in, the benefit plans and programs maintained by Questar.

4

Service Credit. In general, QEP will credit each of its employees with his or her service with Questar prior to the Distribution for all purposes under benefit plans maintained by QEP, to the extent that the employees received service credit under the corresponding Questar plans and such crediting does not result in a duplication of benefits.

Liabilities for Compensation and Benefits. As of the Distribution Date, except as specifically provided therein, QEP generally will assume, retain and be liable for all wages, salaries, welfare, incentive compensation and employee-related obligations and liabilities for all current and former employees of its business. Questar will generally retain responsibility for, and will pay and be liable for, all wages, salaries, welfare, incentive compensation and employment-related obligations and liabilities with respect to former Questar employees not associated with QEP’s business and current Questar employees who are not otherwise transferred to employment with QEP in connection with the Distribution. The following is a summary overview of the proposed treatment of certain employee benefits:

| • | Defined-Benefit Pension Plan. The assets and liabilities held in trust attributable to active QEP employees who are participants under the Questar Retirement Plan as of the Distribution Date will be apportioned to the trust of a defined benefit pension plan established by QEP. Certain active QEP employees will cease to accrue benefits under such defined benefit pension plan as of the Distribution Date and will be eligible to participate in a nonqualified deferred compensation plan established by QEP that takes into account the retirement benefits that such employees would have received under the defined benefit pension plan on or after the Distribution Date. The Questar Retirement Plan will retain all liabilities with respect to former QEP employees who are participants therein as of the Distribution Date. |

| • | 401(k) Plan. Account balances held in trust attributable to all active QEP employees under the Questar Employee Investment Plan will be apportioned to the trust of a 401(k) plan established by QEP. The Questar Employee Investment Plan will retain the account balances attributable to former QEP employees as of the Distribution Date. |

| • | Health and Welfare Plans. QEP will establish health and welfare plans that provide benefits which are substantially comparable, in the aggregate, to those provided under the health and welfare plans maintained by Questar. |

| • | Retiree Medical and Life Insurance Benefits. QEP will establish a health and welfare plan that provides retiree medical and life insurance benefits to those QEP employees who are eligible for retiree medical and life insurance benefits under the Questar plan as of the Distribution Date which are substantially comparable, in the aggregate, to those provided under the Questar plan. |

| • | Nonqualified Retirement Plans. QEP will establish nonqualified deferred compensation plans for the benefit of active QEP employees who either have account balances or accrued benefits or were eligible to participate under each of the Questar nonqualified plans immediately prior to the Distribution Date (with terms that are substantially comparable, in the aggregate, to those under the Questar plans). In addition, QEP will cause the nonqualified deferred compensation plan to provide an enhanced supplemental retirement benefit that is based on the retirement benefit that certain QEP employees who were participants in Questar’s Supplemental Executive Retirement Plan would have received under the defined benefit |

5

| pension plan established by QEP had they continued to accrue benefits thereunder on or after the Distribution Date (as described above). QEP’s nonqualified plans will assume the liability with respect to active QEP employees who are participants in the Questar nonqualified plans as of the Distribution Date. The Questar nonqualified plans will retain all liabilities with respect to former QEP employees who are participants therein as of the Distribution Date. |

| • | Equity Awards. Outstanding stock options and restricted stock awards to purchase Questar stock immediately prior to the Distribution Date will be adjusted and bifurcated into stock options and restricted stock awards to purchase Questar and QEP stock, respectively, for employees of both companies. The vesting of such awards will not accelerate by reason of the Distribution and each company’s equity plan will provide that service with the other will count as service with it for the purpose of determining vesting and termination dates under its equity plan. QEP will adopt a long-term stock incentive plan with terms that are substantially comparable, in the aggregate, to those under the Questar long-term stock incentive plan. |

| • | Annual Cash Incentive Awards. QEP will establish annual cash incentive plans for the benefit of QEP employees with terms that are substantially comparable, in the aggregate, to those under the Questar annual cash incentive plans. With respect to the outstanding awards granted under Questar’s annual cash incentive plan for the year ended December 31, 2010, QEP will assume the liability for such awards granted to QEP employees and Questar will retain the liability for such awards granted to Questar employees as of the Distribution Date. |

| • | Long-Term Cash Incentive Awards. With respect to the outstanding awards granted under Questar’s long-term cash incentive plan, QEP will assume the liability for such awards granted to QEP employees and Questar will retain the liability for such awards granted to Questar employees. Outstanding awards granted to each QEP employee for the 2009-2011 and 2010-2012 performance periods will, as of the Distribution Date, be converted from an award payable in cash to an award of restricted shares of QEP stock to be granted under QEP’s long-term stock incentive plan. Outstanding awards granted to each Questar employee for the 2009-2011 and 2010-2012 performance periods will, as of the Distribution Date, be converted from an award payable in cash to an award of restricted shares of Questar stock to be granted under Questar’s long-term stock incentive plan. QEP will establish a long-term cash incentive plan with terms that are substantially comparable, in the aggregate, to those under the Questar long-term cash incentive plan. |

| • | Severance Plan. QEP will establish an executive severance plan for the benefit of QEP executives with terms that are substantially comparable, in the aggregate, to those under the Questar executive severance plan. |

| • | Executive Compensation Arrangements. Certain executives who are currently employees of Questar will cease to be employees of Questar and become executives and employees of QEP as of the Distribution Date. QEP may enter into an employment agreement or other compensatory arrangement with any such executive and be responsible for all liabilities and obligations thereunder following the Distribution Date. Questar will cease to have any liability or obligation under any employment agreement or other compensatory arrangement with respect to any such executive following the Distribution Date. |

| • | Director Deferred Compensation Plan. QEP will establish a nonqualified deferred compensation plan for the benefit of its directors who have account balances or were eligible to participate in Questar’s deferred compensation plan for directors immediately prior to the |

6

| Distribution Date (with terms that are substantially comparable, in the aggregate, to those under the Questar plan). The QEP deferred compensation plan for directors will assume any liabilities under the Questar deferred compensation plan for directors who are participants in the Questar plans as of the Distribution Date. |

Tax Matters Agreement

The Tax Matters Agreement (the “Tax Matters Agreement”) governs QEP’s and Questar’s respective rights, responsibilities, and obligations after the Distribution with respect to the filing of tax returns and the payment of taxes, including ordinary course of business taxes and taxes, if any, incurred as a result of any failure of the Distribution to qualify as a tax-free distribution under Sections 355 and 368(a)(1)(D) of the Code.

In addition, the Tax Matters Agreement generally obligates both QEP and Questar to comply with the representations made in the IRS private letter ruling and in the tax opinion of Latham & Watkins LLP and not to take any action (except as expressly provided in the Tax Matters Agreement) that is inconsistent with or could otherwise affect the qualification of the Distribution as a tax-free distribution under Code Sections 368(a)(1)(D) and 355. If such qualification is disallowed, in whole or in part, then any liability for taxes as a result of such disallowance shall be divided between Questar and QEP in proportion to their respective fair market values as of the Distribution Date (as defined below); provided that if the failure to satisfy the requirements of Code Sections 368(a)(1)(D) and 355 is solely the result of action taken by either Questar or QEP subsequent to the Distribution, including acquisitions of the stock of Questar, QEP or Wexpro which violate the requirements of Code Section 355(e), the responsible party shall be fully liable for and shall indemnify the other party against any taxes resulting from such failure.

Transition Services Agreement

The Transition Services Agreement (the “Transition Services Agreement”) provides that if the Distribution occurs, Questar and QEP will provide certain services to each other for a specified period following the Distribution. The services to be provided by Questar to QEP generally include services related to human resources, including benefits and information systems, services for insurance management, SEC reporting, Form 4 administration, financial matters (including income taxes, internal audits, tax preparation, treasury and cash management services and enterprise portfolio matters), stock option administration and FERC compliance. The services to be provided by QEP to Questar generally include services related to medical plan administration and environmental services for Wexpro. The recipient of any services will generally pay an agreed upon arm’s length service charge and reimburse the provider any out-of-pocket expenses, including the cost of any third-party consents required. The Transition Services Agreement will generally require the services to be provided until the earlier of (i) December 31, 2011, or (ii) such earlier date (per service) on twenty days written notice prior to the first day of the following month, after which time the obligation to provide such services will terminate.

Copies of the Separation Agreement, Employee Matters Agreement, Tax Matters Agreement and Transition Services Agreement are incorporated herein by reference as Exhibits 2.1, 10.1, 10.2 and 10.3, respectively, to this Current Report on Form 8-K, and statements herein regarding such agreements are qualified by reference to the complete agreements.

7

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Director Compensation Program

On June 12, 2010, the board of directors of QEP (the “Board”) approved the following compensation for non-employee directors of QEP:

| Annual Retainer: | $50,000 | |

| Annual Restricted Stock Grant: | Determined by dividing $100,000 by the fair market value of a share of QEP common stock on the date of grant | |

| Committee Retainers: | ||

| Chair, Audit Committee and |

||

| Chair, Compensation Committee |

$15,000 | |

| Chair, Governance Committee |

$10,000 | |

| Committee Membership: |

||

| Audit Committee |

$7,500 | |

| Governance Committee, and |

||

| Compensation Committee |

$5,000 | |

| Board Meeting Fee: | $2,000 (per day) | |

| Committee Meeting Fee: | $1,100 ($1,500 for Chair) | |

| Telephone Attendance: | $600 (Committee Meeting – $800 Chair) |

Deferred Compensation Plan for Directors

Non-employee directors may receive their fees in cash or they may defer receipt of those fees and have them credited with interest as if invested in long-term certificates of deposit or be accounted for with “phantom shares” of QEP stock pursuant to the QEP Deferred Compensation Plan for Directors. Non-employee directors may defer their restricted stock grant in the form of “phantom shares” of QEP stock which are subject to the same vesting schedule that would otherwise apply to the restricted stock grant. Payments of phantom share balances are made in cash upon specified distribution events subject to compliance with Section 409A of the Code. Deferred fees and/or phantom stock may constitute or provide for a deferral of compensation subject to Section 409A of the Code, and there may be certain tax consequences if the requirements of Section 409A of the Code are not met.

The QEP Deferred Compensation Plan for Directors provides terms that are substantially comparable, in the aggregate, to those under Questar’s deferred compensation plan for directors. The QEP Deferred Compensation Plan for Directors will assume the liability under Questar’s deferred compensation plan for directors who are participants in the Questar plan as of the Distribution Date. These directors will (i) have their Questar phantom stock bifurcated into QEP and (for a limited period through December 31, 2011) Questar phantom stock in the same manner as holders of Questar restricted stock will be treated in the Distribution, and (ii) have any amounts deemed invested in phantom shares of Questar stock converted into phantom shares of QEP stock and (for a limited period through December 31, 2011) Questar stock in the same manner as actual Questar stockholders will be treated in the Distribution.

This description of the QEP Deferred Compensation Plan for Directors is qualified in its entirety by the terms of the plan, a copy of which is attached as Exhibit 10.4 and is incorporated herein by reference.

8

2009 Director Compensation

Fees received by individual members of the Board during 2009 for service as a member of Questar’s board of directors are set forth below:

| Name (a) |

Fees Earned or Paid in Cash ($)1 (b) |

Stock Awards ($)2,3 (c) |

Total ($) (h) | |||

| Phillips S. Baker, Jr. |

80,900 | 99,064 | 179,964 | |||

| L. Richard Flury |

94,000 | 99,064 | 193,064 | |||

| James A. Harmon |

82,000 | 99,064 | 181,064 | |||

| Robert E. McKee III |

98,400 | 99,064 | 197,464 | |||

| M. W. Scoggins |

88,000 | 99,064 | 187,064 |

| 1 | Some directors deferred this amount pursuant to Questar’s deferred compensation plan for directors as described above. |

| 2 | On February 9, 2010, all directors of Questar received a grant of restricted stock or phantom restricted stock. |

| 3 | Directors who were members of the Questar board of directors had the following aggregate options and unvested stock awards or phantom shares as of December 31, 2009: |

| Name |

Number of Vested Option Shares* |

Number of Restricted Shares |

Number of Vested Phantom Shares |

Number of Unvested Phantom Shares | ||||

| Phillips S. Baker, Jr. |

0 | 5,815 | 0 | 0 | ||||

| L. Richard Flury |

14,000 | 2,800 | 6,582 | 3,015 | ||||

| James A. Harmon |

14,000 | 5,899 | 2,600 | 0 | ||||

| Robert E. McKee III |

14,000 | 0 | 3,982 | 5,815 | ||||

| M. W. Scoggins |

0 | 0 | 3,982 | 5,815 |

| * | None of the directors has unvested options. |

Director Stock Ownership Guidelines

The Board has adopted stock ownership guidelines for outside directors of two-times their annual fees after a director has served for five years on the Board. Phantom stock units count toward the total shares held. All directors currently comply with those guidelines. Directors also participate in QEP’s Business Accident Insurance Plan which provides a benefit of up $150,000 to the survivor of any director who dies, is totally disabled or suffers dismemberment due to an accident while traveling on business for QEP.

Mr. Keith O. Rattie

In addition to all other annual retainers and fees payable to a non-employee director, QEP’s non-executive chairman of the board, Keith O. Rattie, will be paid an annual retainer of $200,000, so long as Mr. Rattie is the chairman of the board. In addition, subject to the consummation of the Distribution, under the 2010 Long-Term Stock Incentive Plan, QEP will grant Mr. Rattie a number of restricted stock

9

units determined by dividing $1,000,000 by the fair market value of a share of QEP common stock on the date of grant, and dividend equivalents on such restricted stock units with respect to the ordinary quarterly cash dividends paid on QEP common stock, according to the terms and conditions set forth in an award agreement. Subject to Mr. Rattie’s continued service on the Board, the restricted stock units and associated dividend equivalents will vest ratably on an annual basis over three years, subject to accelerated vesting upon the occurrence of certain events as set forth in the award agreement. Each vested restricted stock unit represents the right to receive one unrestricted, fully transferrable share of QEP common stock.

Certain Relationships and Related-Person Transactions

There are no relationships or related-person transactions between QEP and any of its directors or officers that are required to be disclosed pursuant to federal securities laws. QEP requires all executive officers and directors to report to the vice president, compliance, any event or anticipated event that might qualify as a related-person transaction pursuant to Section 404(b) of Regulation S-K. The vice president, compliance would then report those transactions to the Audit Committee. QEP also collects information from questionnaires sent to officers and directors early each year that are designed to reveal related-person transactions. If a report or questionnaire shows a potential related-person transaction, it will be investigated in accordance with the QEP’s Business Ethics and Compliance Policy. QEP’s Audit Committee will review pending and ongoing transactions to determine whether they conflict with the best interests of QEP, impact a director’s independence or conflict with the QEP’s Business Ethics and Compliance Policy. If a related-person transaction is completed, the Committee will determine whether rescission of the transaction, disciplinary action or reevaluation of a director’s independence is required.

Appointment of Executive Officers

On June 12, 2010, the following individuals were appointed as executive officers of QEP:

| Name |

Title | |

| Charles B. Stanley | President and Chief Executive Officer | |

| Richard J. Doleshek | Executive Vice President, Chief Financial Officer and Treasurer | |

| Jay B. Neese | Executive Vice President | |

| Perry H. Richards | Senior Vice President, QEP Field Services | |

| Eric L. Dady | Vice President and General Counsel | |

| Abigail L. Jones | Vice President, Compliance, Corporate Secretary and Assistant General Counsel | |

Adoption of Executive Compensation Program

On June 12, 2010, the Board approved a variety of benefit plans for employees of QEP effective as of the Distribution, including certain benefit plans that cover QEP’s executive officers.

Employment Agreements

On June 12, 2010, the Board approved employment agreements with Messrs. Charles B. Stanley and Richard J. Doleshek.

10

Under Mr. Stanley’s employment agreement, Mr. Stanley will serve as QEP’s President and Chief Executive Officer and as a member of QEP’s board of directors. The term of the employment agreement is three years, unless terminated earlier by either party in accordance with the provisions therein. Mr. Stanley will receive an annual base salary of $720,000 and is eligible to participate in a QEP annual cash bonus program, under which his target bonus will equal at least ninety percent (90%) of his annual base salary. Mr. Stanley is also entitled to participate in QEP’s long-term cash bonus plan, under which his target bonus will be at least equal to that provided to any other officer. Mr. Stanley is also entitled to other benefits, including participation in the QEP 401(k), health and welfare plans, executive severance plan, deferred compensation plan, and supplemental executive retirement plan. Mr. Stanley is entitled to receive equity awards at least equal to that provided to any other QEP officer, which equity awards will permit Mr. Stanley to exercise any vested options for at least 30 days following the termination of his employment, unless a longer period is otherwise specified.

Mr. Stanley’s employment agreement provides that if his employment terminates during the term due to death or disability, he will receive up to two (2) months of base salary and a lump sum equal to his target bonuses under the cash bonus plans in which he participates, for the performance periods that began during the term of the employment agreement. Additionally, equity granted to Mr. Stanley under the employment agreement will accelerate and vest in full (provided that any Conversion Awards will vest in accordance with their terms). If Mr. Stanley’s employment is terminated either by QEP without “cause” or by Mr. Stanley for “good reason” (as such terms are defined in the employment agreement), (a) he will receive a payment equal to three (3) times his base salary, (b) he will receive a payment equal to three times the amount of the annual cash bonus(es) that he actually received under QEP’s annual bonus plan(s) (or where applicable, under an Questar annual bonus plan(s)) in the year immediately prior to his termination, and (c) any equity granted to him by QEP under the employment agreement will accelerate and become fully vested (provided that any Conversion Awards will vest in accordance with their terms). Because of Mr. Stanley’s participation in the Executive Severance Compensation Plan, upon a qualifying termination following a change in control, Mr. Stanley will receive the greater of the severance payment due him under his employment agreement or under the Executive Severance Compensation Plan, but not both.

Under Mr. Doleshek’s employment agreement, Mr. Doleshek will serve as the Executive Vice President, Chief Financial Officer and Treasurer of QEP. The term of the employment agreement is three years, unless terminated earlier by either party in accordance with the provisions therein. Mr. Doleshek will receive an annual base salary of $470,000 and is eligible to participate in a QEP annual cash bonus program, under which his target bonus will equal at least ninety percent (90%) of his annual base salary. Mr. Doleshek is also entitled to participate in QEP’s long-term cash bonus plan, under which his target bonus will not be less than $500,000. Mr. Doleshek is also entitled to other benefits, including participation in the QEP 401(k), health and welfare plans, executive severance plan, deferred compensation plan, and supplemental executive retirement plan. Mr. Doleshek is entitled to receive equity awards, to be granted in QEP’s sole discretion.

Mr. Doleshek’s employment agreement provides that if his employment terminates during the term due to death or disability, he will receive up to two (2) months of base salary and a lump sum equal to his target bonuses under the cash bonus plans in which he participates, for the year of his death or disability. Additionally, equity granted to Mr. Doleshek under the employment agreement will accelerate and vest in full (provided that any Conversion Awards will vest in accordance with their terms). If Mr. Doleshek’s employment is terminated either by QEP without “cause” or by Mr. Doleshek for “good reason” (as such terms are defined in the employment agreement), (a) he will receive a payment equal to three (3) times his base salary, (b) he will receive a payment equal to three times the amount of the annual cash bonus(es) that he actually received under QEP’s annual bonus plan(s) (or where applicable, under an Questar annual bonus plan(s)) in the year immediately prior to his termination, and (c) any equity granted

11

to him by QEP under the employment agreement will accelerate and become fully vested (provided that any Conversion Awards will vest in accordance with their terms). Because of Mr. Doleshek’s participation in the Executive Severance Compensation Plan, upon a qualifying termination following a change in control, Mr. Doleshek will receive the greater of the severance payment due him under his employment agreement or under the Executive Severance Compensation Plan, but not both.

This description of the employment agreements between QEP and each of Messrs. Stanley and Doleshek is qualified in its entirety by the terms of the respective employment agreement, copies of which are attached as Exhibits 10.5 and 10.6 and are incorporated herein by reference.

Compensation Discussion and Analysis.

Objectives. QEP’s executive compensation program is designed to:

| • | Attract, motivate, and retain the management talent required to achieve QEP objectives; |

| • | Focus management efforts on both short-term and long-term drivers of shareholder value; |

| • | Tie a significant portion of executive compensation to QEP’s long-term stock-price performance and thus shareholder returns; |

| • | Foster a results-oriented culture while enhancing QEP’s reputation for ethics and integrity; and |

| • | Create balance across multiple financial and operating metrics and time periods, thus supporting sound risk management. |

Components. Compensation for named executive officers is comprised of the following major components:

| • | Base salary; |

| • | Annual Management Incentive Plan II (“AMIP II”); |

| • | Long-term Cash Incentive Plan (“LTCIP”); |

| • | Restricted stock and/or stock-option grants under the 2010 Long-term Stock Incentive Plan (“LTSIP”); |

| • | Executive Severance Compensation Plan; |

| • | Employee benefits, including retirement, health and welfare benefits; and |

| • | Nonqualified deferred compensation plans, including the Deferred Compensation Wrap Plan and the Supplemental Executive Retirement Plan. |

Compensation Philosophy and Role of Compensation Committee. To attract, motivate and retain the executive talent required to achieve corporate objectives, the Compensation Committee of the Board (the “Compensation Committee”) believes it must offer key executives a competitive compensation package comprised of fixed and variable short-term and long-term components. The following table summarizes the role each component plays in the total compensation package:

|

Compensation Component

|

||||||

|

Base Salary |

• |

Provide a fixed and market-based level of compensation to pay for an executive’s responsibility, relative expertise and experience.

| ||||

|

Annual Cash Incentive |

||||||

|

• AMIP II |

• |

Motivate and reward executives for achieving annual financial and operating goals that are aligned with shareholder and stakeholder interests.

| ||||

12

|

Long-term Incentives |

||||||

|

•

•

• |

Restricted stock under LTSIP

Stock options under LTSIP

Long-term cash incentive awards under LTCIP |

•

•

•

•

• |

Deliver the majority of named executive officer compensation through long-term incentives aligned with shareholder interests;

Motivate and reward the achievement of long-term strategic QEP objectives;

Recognize and reward QEP’s performance relative to industry peers over multi-year time periods;

Encourage long-term executive share ownership; and

Encourage executive retention by establishing multi-year incentive awards.

| |||

|

Benefits |

||||||

|

•

•

• |

Retirement

Health care

Other security benefits (life, disability) |

•

•

• |

Provide a tax-efficient means for employees to build financial security in retirement;

Provide minimum income protection against certain risks; and

Reward extended service with QEP.

| |||

|

Termination Benefits |

||||||

|

• |

Executive Severance Compensation Plan |

• |

Provide a competitive level of income protection.

| |||

To ensure that executive compensation remains consistent with QEP’s objectives, the Compensation Committee will routinely:

| • | Retain independent compensation consultants to: (a) review, critique and propose changes in compensation practices when necessary to maintain alignment with the above-listed objectives; (b) conduct and analyze market surveys; and (c) provide input on compensation actions for QEP’s top officers; |

| • | Review and approve AMIP II participants, objectives and performance targets; |

| • | Review QEP’s consolidated financial results and the financial and operating results of QEP’s major business units; |

| • | Evaluate the individual performance of the named executive officers; |

| • | Consider internal relative pay; and |

| • | Develop and approves annual and long-term compensation for QEP’s executive officers. |

The Compensation Committee has not adopted a separate process for reviewing tally sheets of executive officer compensation. Instead, the Compensation Committee will review total executive compensation on a regular basis several times during the year. The Compensation Committee will analyze each component of every named executive officer’s compensation and examine total compensation for each such executive to ensure that the individual components and the total compensation satisfy the objectives described above. The Compensation Committee will consider how it measures, evaluates and benchmarks all compensation components for executives. The intent is to ensure that each executive’s compensation remains competitive within the relevant segment of the natural gas industry, adjusted as appropriate for individual factors such as the officer’s experience and expertise. In addition to market-survey data, the Compensation Committee will consider job performance, responsibilities, and advancement potential when setting compensation for each of the named executive officers.

The compensation philosophy of QEP is, at present, substantially comparable, in the aggregate, to that of Questar, as described in the proxy statement filed in connection with Questar’s May 18, 2010 annual meeting of stockholders.

Compensation Philosophy. In 2010, the Management Performance Committee of Questar’s board of directors (the “Questar Committee”) approved compensation for the officers of QEP. The compensation philosophy of QEP is, at present, substantially comparable, in the aggregate, to that of Questar, as described in the proxy statement filed in connection with Questar’s May 18, 2010 annual meeting of stockholders.

13

The Questar Committee, with help from its compensation consultant, Hewitt Associates, LLC (“Hewitt”) conducted market surveys to estimate the 25th, 50th and 75th percentiles for total compensation for executive officers. The Questar Committee defined total compensation as: base salary + AMIP II target + LTCIP target + grant-date value of restricted stock and/or stock options (Equity Awards). The Questar Committee in general targets the market 50th percentile for each named executive officer.

How QEP Determines the External Benchmarks for Named Executive Officers. The Compensation Committee will consider the relative size of companies in the industry peer group in its evaluation of market data. The Compensation Committee will also review officer compensation in relation to general-industry peers, a group of companies, selected by Hewitt, in other industries with median revenue similar to QEP. The Compensation Committee will not base compensation decisions for named executive officers on the pay of general-industry peers; rather it will use this group as an indicator of executive compensation trends and practices.

When setting compensation for each key executive, the Questar Committee, with advice from Hewitt, defined the relevant peer group. Because Mr. Doleshek’s employment with Questar started in May 2009, the Questar Committee used the data previously utilized to determine his predecessor’s compensation. Additionally, the Questar Committee focused on creating sufficient value to attract a qualified candidate for the CFO position

Industry Peer Companies – Corporate Peer, E&P and Gas and Pipeline Groups. To arrive at compensation values for 2010, the Questar Committee designated all of the companies listed below as peer companies for QEP executives.

Cabot Oil & Gas Corporation

Cimarex Energy Company

EOG Resources, Inc.

Forest Oil Corporation

Newfield Exploration Company

Noble Energy, Inc.

Pioneer Natural Resources Company

Plains Exploration & Production Company

Quicksilver Resources, Inc.

Range Resources Corporation

Southwestern Energy Company

Whiting Petroleum Corporation

The Williams Companies, Inc.

The Compensation Committee will set annual base salary, AMIP II target, LTCIP target and equity awards for all key executives. Hewitt and QEP’s Human Resources Department will assist in the collection and analysis of peer-company data.

Base Salaries. The Questar Committee did and the Compensation Committee will establish base salaries for executives by considering their scope of responsibilities, performance, and competitive market compensation paid by other companies in the executive’s peer group. The Compensation Committee will review base salaries for QEP’s named executive officers on at least an annual basis. When setting salaries, the Compensation Committee will consider market information for the executive’s relevant peer group, along with individual factors and internal comparisons with other QEP officers. The Questar Committee did and the Compensation Committee will use proxy data and information provided by Hewitt to obtain information about the base salaries paid by peers.

14

Incentive Compensation. QEP’s named executive officers will participate in AMIP II which provides for certain annual cash incentive awards that are intended to qualify as “qualified performance-based compensation” within the meaning of Section 162(m) of the Code when QEP becomes subject to Section 162(m) of the Code. Those officers will also receive equity awards pursuant to the LTSIP. The Compensation Committee intends to put a substantial portion of each officer’s compensation at risk. AMIP II payouts will be tied to annual financial and operating goals to be set by the Board at the beginning of the plan year. LTCIP payouts will be tied to total shareholder returns relative to a pre-set group of peer companies over a three-year period. Together these programs will motivate participating executives to focus on total shareholder return over the longer-term. AMIP II and LTCIP are cash plans that can award amounts from zero to a predetermined maximum depending on QEP’s results. The Compensation Committee has not implemented a clawback provision for incentive compensation, but will review compensation trends as appropriate. The Compensation Committee believes that its approach effectively aligns the executive officers’ interests with shareholder interests.

AMIP II. Under AMIP II, QEP sets separate performance targets for each major business unit. These business-unit targets are tied to key consolidated financial and operating goals. Each year, the Compensation Committee will review and approve the specific annual performance targets for QEP as a whole, and for each major subsidiary. The performance targets are set at the beginning of each year after a review of that year’s budget and the prior-year actual results. Targets are generally at or above the Board-approved budget for the year. The QEP performance objectives for 2010 relate to QEP’s achievement of a certain level of earnings before interest, depreciation, amortization, taxes and exploration expense and certain production measures.

QEP will calculate an overall payout factor, which can range from zero to 200% based on actual results compared to the measures. Each officer’s target bonus is multiplied by the respective payout factor to determine the payment. The maximum cash payment to any officer under the terms of AMIP II is capped at $4,000,000. Each officer’s target bonus is a percentage of his annual base salary in effect on March 1 of the performance year. The Compensation Committee, in its sole discretion, can reduce the cash award otherwise payable to an officer. Neither the Compensation Committee nor QEP may increase the cash award otherwise payable under the AMIP II formula.

AMIP II provides terms that are substantially comparable, in the aggregate, to those under the Questar Corporation Annual Management Incentive Plan II (“Questar AMIP II”). With respect to the outstanding awards granted under Questar’s AMIP II for the year ended December 31, 2010, QEP will assume the liability for such awards granted to QEP employees and Questar will retain the liability for such awards granted to Questar employees as of the Distribution Date.

On June 12, 2010, the Compensation Committee approved the following target bonuses for 2010 with respect to each executive officer:

| Executive Officer |

Target* | ||

| Charles B. Stanley |

90 | % | |

| Richard J. Doleshek |

90 | % | |

| Jay B. Neese |

70 | % | |

| Perry H. Richards |

47.5 | % | |

| Eric L. Dady |

40 | % |

| * | This percentage includes the Market Resources Employee Incentive Plan (“MREIP”) which applies a 12.5% target. The MREIP applies to all employees (except those classified as temporary or occasional part-time) who work for QEP’s subsidiaries and are scheduled to work at least 20 hours per week. |

15

This description of the AMIP II is qualified in its entirety by the terms of the plan, a copy of which is attached as Exhibit 10.7 and is incorporated herein by reference.

2009 Questar AMIP II. In 2009, the performance components and targets for the Questar AMIP II were as follows:

| Questar Market Resources |

Target | ||

| Questar Corporation earnings per share |

$ | 2.70 | |

| Business unit net income total 1 (millions) |

$ | 384 | |

| Questar Exploration and Production production volumes (Bcfe) |

185 | ||

| Questar Pipeline |

Target | ||

| Questar Corporation earnings per share |

$ | 2.70 | |

| Questar Pipeline net income (millions) |

$ | 55 | |

| Operating and maintenance expenses per decatherm of contract demand |

$ | 16.5 | |

| Achievement of specific strategies and operational initiatives |

3 of 5 affirmative answers | ||

| Questar Gas |

Target | ||

| Questar Corporation earnings per share |

$ | 2.70 | |

| Questar Gas net income (millions) |

$ | 40.5 | |

| Questar Gas customer satisfaction (1-7 scale) |

6.1 | ||

| Questar Gas annual operating and maintenance expenses per customer |

$ | 140 | |

| Safety performance 2 |

3.65 | ||

| 1 | The Questar Exploration and Production component QEP’ net income was indexed to commodity prices as of January 29, 2009. |

| 2 | “Safety performance” shows an average of injuries per 100 employees and preventable accidents per 1 million miles driven. |

Because Mr. Doleshek’s employment with Questar started in May 2009, he was not eligible to participate in the Questar AMIP II for 2009. In order to ensure that his incentives were tied to the same key financial and operating metrics as other officers, Questar’s board or directors authorized a 2009 bonus program for Mr. Doleshek that utilized the same performance metrics as those used for his predecessor in the Questar AMIP II for 2009. The non-equity incentive compensation listed for Mr. Doleshek in the Summary Compensation Table was derived by using these metrics.

In February 2010, the Questar Committee determined the 2009 Questar Market Resources payout to be 160% of its target amount while Questar Pipeline paid out 140% of its target amount and Questar Gas paid out 152% of its target amount.

The LTCIP. The LTCIP will tie compensation for key executives to total shareholder return relative to a mix of peer companies over a longer-term (three-year) performance period. Payouts from the LTCIP, if any, will be based on the respective QEP’s total shareholder return (“TSR”) compared with a group of peer companies.

16

QEP will calculate three-year TSR as the sum of the closing December stock price in the last year of the performance period, plus dividends paid over the full performance period, divided by the average December stock price in the month prior to the start of the performance period. The average December stock price is the simple average closing price for each trading day in December. QEP will then rank its three-year TSR among the peer companies to determine the TSR Rank Multiplier. The payout based on rank is multiplied by the ratio of the stock price at the end of the three-year period divided by the stock price at the beginning of the three-year period (“Stock Appreciation Multiplier”). Participants earn the maximum bonus if QEP has the highest TSR of its peer group. Participants earn the target bonus if QEP’s TSR ranks at the midpoint of the peer group. If QEP’s TSR for the performance period places it in the bottom third of the group, no bonus is paid under the LTCIP. There are currently three outstanding performance periods: 2008 through 2010, 2009 through 2011, and 2010 through 2012.

The calculation is as follows: Target Award x TSR Rank Multiplier x Stock Appreciation Multiplier = LTCIP Payout. The maximum payment under the LTCIP for any performance period is currently capped at $8,000,000.

With respect to the outstanding awards granted under Questar’s Long-Term Cash Incentive Plan (“Questar LTCIP”), QEP will assume the liability for such awards granted to QEP employees and Questar will retain the liability for such awards granted to Questar employees. Outstanding awards granted to each QEP employee for the 2009-2011 and 2010-2012 performance periods will, as of the Distribution Date, be converted from an award payable in cash to an award of restricted shares of QEP stock to be granted under QEP’s long-term stock incentive plan. The LTCIP provides terms that are substantially comparable, in the aggregate, to those under the Questar LTCIP.

The peer group for the Questar LTCIP that was used to determine the payout for 2009 included a mix of E&P, pipeline, utility and integrated natural gas companies as set forth below:

| Cabot Oil and Gas Company | Noble Energy, Inc. | |

| Chesapeake Energy Corporation | Northwest Natural Gas Company | |

| El Paso Corporation | ONEOK, Inc. | |

| Energen Corporation | Pioneer Natural Resources Company | |

| EOG Resources, Inc. | Plains Exploration & Production Company | |

| Equitable Resources, Inc. | St. Mary Land & Exploration Company | |

| Forest Oil Corporation | Southwestern Energy Company | |

| National Fuel Gas Company | Ultra Petroleum Corporation | |

| Newfield Exploration Company | The Williams Companies, Inc. |

Questar made payments under the Questar LTCIP to the named executive officers for the 2007-2009 period in February 2010, and the amounts are reflected in the Summary Compensation Table (along with amounts paid under the Questar AMIP II) in column (g). Questar’s average annual TSR for that period was 2%, which ranked 11th out of the 19 peer companies.

This description of the LTCIP is qualified in its entirety by the terms of the plan, a copy of which is attached as Exhibit 10.8 and is incorporated herein by reference.

The LTSIP. The LTSIP is intended to (1) help attract and retain key executives and (2) ensure that executive officers have a significant incentive to manage QEP to maximize long-term shareholder returns. The value of the grant to each executive will be tied to the Compensation Committee’s estimate of the market for that position, adjusted to take into account performance, retention, the executive’s pay relative to other QEP executives and other factors deemed by the Compensation Committee to be appropriate.

17

The Compensation Committee will utilize both restricted stock and stock options as equity incentive tools. The Compensation Committee will recommend and the Board will approve such restricted stock and option grants.

The vesting schedule of the restricted stock grants generally extends over a three-year period, starting the year after the date of grant with one third of the shares vesting in each of the remaining years, subject to the optionee’s continued employment with QEP. These shares do not automatically vest upon retirement.

QEP plans to make annual equity grants in February.

QEP’s policies do not permit the backdating of stock options or the alteration of the exercise price after the grant date. As set forth in the LTSIP, the Board sets the option price at the time the option is granted, and that price cannot be less than the closing price of QEP’s common stock on the date of grant.

The Compensation Committee has established a stock-ownership guideline for each named executive officer that is a multiple of his base salary. Under the guidelines, all named executive officers are required to own shares having a value of at least two times their annual base salary, except in Mr. Stanley’s case, six times his base salary, and in Mr. Doleshek’s case, three times his base salary. These guidelines are intended to align the named executive officers’ interests with those of shareholders, while allowing them some opportunity to diversify their holdings. Phantom stock units attributable to an executive’s holdings in the QEP Deferred Compensation Wrap Plan are counted toward the total.

Restricted Stock Grants under the LTSIP. On June 12, 2010, the Board approved the following grants of restricted stock under the LTSIP to key contributors to the QEP spin-off, including grants to four of the named executive officers listed below. The vesting schedule of the restricted stock grants extends over a three-year period, starting two years after the date of grant with one third of the shares vesting in each of the remaining years, subject to the executive’s continued employment with QEP.

| QEP Officers |

Job Title |

Restricted Stock Value* | |||

| Charles B. Stanley |

President and Chief Executive Officer | $ | 900,000 | ||

| Richard J. Doleshek |

Executive Vice President, Chief Financial Officer and Treasurer | $ | 600,000 | ||

| Jay B. Neese |

Executive Vice President | $ | 500,000 | ||

| Eric L. Dady |

Vice President and General Counsel | $ | 200,000 | ||

| Perry H. Richards |

Senior Vice President, QEP Field Services | $ | 150,000 | ||

| * | The number of restricted shares of QEP common stock to be granted to each executive will be determined by dividing the Restricted Stock Value (as indicated above) by the fair market value of a share of QEP common stock on the date of grant, expected to be on or about July 1, 2010. |

Material Terms of LTSIP. The LTSIP provides terms that are substantially comparable, in the aggregate, to those under Questar’s long-term stock incentive plan. The material terms of the LTSIP are summarized below.

18

General. The LTSIP generally authorizes the Compensation Committee to provide equity-based compensation in the form of stock options (both incentive stock options (ISOs) and non-qualified stock options), stock appreciation rights (SARs), performance shares, restricted stock, restricted stock units, stock unit awards, and Conversion Awards (as defined below) to eligible members of the Board and employees and consultants of QEP and its affiliates, subject to the terms and conditions set forth therein.

Administration. The Compensation Committee administers the LTSIP unless otherwise determined by the full Board. Members of the Compensation Committee are “Non-Employee Directors” (as that term is defined in Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and “outside directors” as that term is defined for purposes of Section 162(m) of the Code. The Compensation Committee has broad authority to administer and interpret the LTSIP, including the authority to determine who is eligible to receive a grant under the LTSIP and to determine the specific provisions of each grant, including the number of shares of QEP common stock covered by each grant. The Compensation Committee also has the authority to make or change any rules for the administration of the LTSIP, and in certain circumstances to accelerate the vesting of outstanding awards.

Eligibility. Persons eligible to participate in the LTSIP include employees and consultants of QEP and its affiliates and non-employee members of the Board. Any person who (i) holds stock options or restricted stock awards to purchase shares of Questar common stock that are outstanding immediately prior to the Distribution Date will receive, in connection with the adjustment by Questar of such awards as a result of the Distribution, grants of stock options or restricted stock awards under the LTSIP, or (ii) holds certain cash awards under the Questar LTCIP immediately prior to the Distribution Date will receive a grant of restricted stock awards under the LTSIP, in each case pursuant to the Employee Matters Agreement (collectively, the Conversion Awards).

Limitation on Awards and Shares Available. The aggregate number of shares of QEP common stock which may be issued pursuant to awards granted under the LTSIP is 15,000,000, plus the number of shares of QEP common stock that are covered by the Conversion Awards. The shares of QEP common stock covered by the LTSIP may be authorized but unissued shares or shares reacquired by QEP, including shares purchased in the open market.

If an award (including any Conversion Award) is forfeited or cancelled or otherwise expires for any reason without having been exercised or settled, or is settled through issuance of consideration other than shares, the shares subject to those awards will be added back to the LTSIP and will again be available for issuance under the LTSIP. However, shares that are: (i) subject to a stock option or a stock-settled SAR and were not issued upon the net settlement or net exercise of such stock option or SAR, (ii) delivered to or withheld by QEP to pay the exercise price of a stock option or the withholding taxes related to any award, or (iii) repurchased on the open market with the proceeds of a stock option exercise, will count against the shares available for issuance under the LTSIP and not be available for new awards under the LTSIP.

Other than with respect to Conversion Awards, the maximum number of shares that can be the subject of stock options and SARs granted to any single participant in a given year is 1,000,000. All shares reserved for issuance under the LTSIP may be issued as ISOs. Except with respect to Conversion Awards, the maximum award of that may be paid to any “covered employee,” within the meaning of Section 162(m) of the Code, for any performance period is $10,000,000, if paid in cash, or 500,000 shares of QEP common stock, if paid in QEP common stock.

Awards. The LTSIP provides for the grant of stock options (both ISOs and non-qualified stock options), SARs, performance shares, restricted stock, restricted stock units, stock unit awards, and Conversion Awards.

19

Stock Options. Stock options, in the form of ISOs and nonqualified stock options, may be granted pursuant to the LTSIP. The option exercise price of all stock options granted pursuant to the LTSIP will not be less than 100% of the fair market value of QEP common stock on the date of grant. Stock options may be subject to such vesting and exercisability conditions as determined by the Compensation Committee. In no event may a stock option have a term extending beyond the tenth anniversary of the date of grant. ISOs granted to any person who owns, as of the date of grant, stock possessing more than ten percent of the total combined voting power of all classes of QEP stock, however, will have an exercise price that is not less than 100% of the fair market value of QEP common stock on the date of grant and may not have a term extending beyond the fifth anniversary of the date of grant. The aggregate fair market value of the shares with respect to which options intended to be ISOs are exercisable for the first time by an employee in any calendar year may not exceed $100,000, or such other amount as the Code provides, without being treated as nonqualified stock options. At the time of grant, the Compensation Committee will determine whether a participant may exercise a stock option after the participant’s termination of service with QEP which will be reflected in the terms of the applicable option award agreement. Upon a participant’s exercise of a stock option, payment of the total option price may be made in the form of cash or its equivalent; any other method permitted by the Compensation Committee as reflected in the option award agreement, including, but not limited to, the delivery to QEP of a number of shares of common stock already owned by the participant for such time as determined by the Compensation Committee that have a fair market value equal to the total option price; and, if permitted by the Compensation Committee, a combination of methods.

SARs. A SAR entitles its holder, upon exercise of all or a portion of the SAR, to receive from QEP an amount determined by multiplying the difference obtained by subtracting the exercise price per share of the SAR from the fair market value on the date of exercise of the SAR by the number of shares with respect to which the SAR has been exercised, subject to any limitations imposed by the Compensation Committee. SARs may be granted independently from or in tandem with a stock option. The exercise price per share subject to a SAR will be set by the Compensation Committee, but may not be less than 100% of the fair market value on the date the SAR is granted. The Compensation Committee determines the period during which the right to exercise the SAR vests in the holder. At the time of grant, the Compensation Committee will determine whether a participant may exercise a SAR and its tandem option after the participant’s termination of service with QEP which will be reflected n the terms of the applicable award agreement. Payment of the SAR may be in cash, shares, or a combination of both, as determined by the Compensation Committee.

Performance Shares. Awards of performance shares are denominated in a number of shares of QEP common stock and may be linked to any one or more performance criteria determined appropriate by the Compensation Committee, in each case on a specified date or dates or over any period or periods determined by the Compensation Committee. The Compensation Committee will determine whether performance shares are intended to qualify as “qualified performance-based compensation” within the meaning of Section 162(m) of the Code. Following is a brief discussion of these qualification requirements under Section 162(m) of the Code.

The Compensation Committee may grant awards to employees who are or may be “covered employees,” as defined in Section 162(m) of the Code, that are intended to be performance-based compensation within the meaning of Section 162(m) of the Code in order to preserve the deductibility of these awards for federal income tax purposes. Participants are only entitled to receive payment for a Section 162(m) performance-based award for any given performance period to the extent that pre-established performance goals set by the Compensation Committee for the period are satisfied. These pre-established performance goals must be based on one or more of the following performance criteria: total shareholder return; return on assets, return on equity, or return on capital employed; measures of

20

profitability such as earnings per share, corporate or business unit net income, net income before extraordinary or one-time items or earnings before interest and taxes or earnings before interest, taxes, depreciation and amortization, earnings before interest, depreciation, amortization, taxes and exploration expense; cash flow from operations; gross or net revenues or gross or net margins; levels of operating expense or other expense items reported on the income statement; measures of customer satisfaction and customer service; safety; annual or multi-year average reserve growth, production growth or production replacement either absolute or on an appropriate per unit basis (e.g., reserve or production growth per diluted share); efficiency or productivity measures such as annual or multi-year average finding costs, absolute or per unit operating and maintenance costs, lease operating expenses, inside-lease operating expenses, operating and maintenance expense per decatherm or customer or fuel gas reimbursement percentage; satisfactory completion of a major project or organizational initiative with specific criteria set in advance by the Committee defining “satisfactory;” debt ratios or other measures of credit quality or liquidity; production and production growth; and strategic asset sales or acquisitions in compliance with specific criteria set in advance by the Compensation Committee.

At the time such performance goals are established, the Compensation Committee may determine that the performance goals will be adjusted to account for any unusual items or specified events or occurrences during the performance period. In addition, unless otherwise provided by the Compensation Committee at the time the time the performance goals are established, the performance goals will be adjusted to exclude the effect of any of the following events that occur during the performance period: asset write-downs; litigation, claims, judgments or settlements; the effect of changes in tax law, accounting principles or other such laws or provisions affecting reported results; accruals for reorganization and restructuring programs; material changes to invested capital from pension and post-retirement benefits-related items and similar non-operational items; and any extraordinary, unusual, non-recurring or non-comparable items as described in Accounting Principles Board Opinion No. 30, as described in management’s discussion and analysis of financial condition and results of operations appearing in QEP’s annual report to stockholders for the applicable year, or as publicly announced by QEP in a press release or conference call relating to QEP’s results of operations or financial condition for a completed quarterly or annual fiscal period.

For all awards intended to qualify as performance-based compensation, such determinations will be made by the Compensation Committee within the time prescribed by, and otherwise in compliance with, Section 162(m) of the Code.

Restricted Stock. A restricted stock award is the grant of shares of QEP common stock at a price determined by the Compensation Committee, which shares are nontransferable and may be subject to substantial risk of forfeiture until specific conditions are met. Conditions may be based on continuing service to QEP or achieving performance goals. During the period of restriction, all shares of restricted stock will be subject to restrictions and vesting requirements, as provided by the Compensation Committee. The restrictions will lapse in accordance with a schedule or other conditions determined by the Compensation Committee. Restricted stock may not be sold or encumbered until all restrictions are terminated or expire.

Restricted Stock Units. A restricted stock unit award provides for the issuance of QEP common stock at a future date upon the satisfaction of specific conditions set forth in the applicable award agreement. The Compensation Committee will specify the dates on which the restricted stock units will become fully vested and non-forfeitable, and may specify such conditions to vesting as it deems appropriate, including conditions based on achieving performance goals or other specific criteria, including service to QEP. The Compensation Committee will specify, or permit the restricted stock unit holder to elect, the conditions and dates upon which the shares underlying the restricted stock units will be issued, which dates may not be earlier than the date as of which the restricted stock units vest and

21

which conditions and dates will be subject to compliance with Section 409A of the Code. On the distribution dates, QEP will transfer to the participant one unrestricted, fully transferable share of its common stock for each restricted stock unit scheduled to be paid out on such date and not previously forfeited. The Compensation Committee will specify the purchase price, if any, to be paid by the participant to QEP for such shares of its common stock. Restricted stock units may constitute or provide for a deferral of compensation subject to Section 409A of the Code, and there may be certain tax consequences if the requirements of Section 409A of the Code are not met.