Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Railcar Industries, Inc. | d8k.htm |

Exhibit 99.1

American Railcar Industries, Inc.

June 2010 |

Forward

Looking Disclaimer Agile Responsive Innovative

Safe Harbor Statement

This presentation contains statements relating to our expected financial

performance and future business prospects, events and plans that are

forward-looking statements. Forward-looking statements represent the Company’s

estimates and assumptions only as of the date of this presentation. Such statements

include, without limitation, statements regarding our strategic objectives

and long-term strategies, statements regarding our joint ventures,

statements regarding potential improvements in the railcar industry, the potential

for increased order activity, anticipated

future

production

rates

and

any

implication

that

the

Company’s

backlog

may

be

indicative

of

future

sales.

These forward-looking statements are subject to known and unknown risks and

uncertainties that could cause actual results to differ materially from the

results described in or anticipated by our forward-looking statements. Other

potential risks and uncertainties include, among other things: the impact of the

current economic downturn, adverse market conditions and restricted credit

markets, and the impact of the continuation of these conditions; our reliance

upon a small number of customers that represent a large percentage of our revenues

and backlog; the health of and prospects for the overall railcar industry;

our prospects in light of the cyclical nature of the railcar manufacturing

business and the current economic environment; anticipated trends relating to our

shipments, revenues, financial condition or results of operations; our

ability to manage overhead and production slowdowns; the highly competitive

nature of the railcar manufacturing industry; fluctuating costs of raw materials,

including steel and railcar components and

delays

in

the

delivery

of

such

raw

materials

and

components;

fluctuations

in

the

supply

of

components

and

raw

materials

the

Company

uses

in

railcar

manufacturing;

anticipated

production

schedules

for

our

products

and

the

anticipated financing needs, construction and production schedules of our joint

ventures; risks associated with potential joint ventures or acquisitions;

the risk of lack of acceptance of our new railcar offerings by our customers;

the sufficiency of our liquidity and capital resources; the conversion of our

railcar backlog into revenues; compliance with covenants contained in our

unsecured senior notes; the impact and anticipated benefits of any acquisitions we

may complete; the impact and costs and expenses of any litigation we may be subject

to now or in the future; the ongoing

benefits

and

risks

related

to

our

relationship

with

Mr.

Carl

C.

Icahn

(the

chairman

of

our

board

of

directors

and,

through

his

holdings

of

Icahn

Enterprises

LP,

our

principal

beneficial

stockholder)

and

certain

of

his

affiliates;

and the additional risk factors described in our filings with the Securities and

Exchange Commission. We expressly disclaim any duty to provide updates to

any forward-looking statements made in this presentation, whether as a result

of new information, future events or otherwise. |

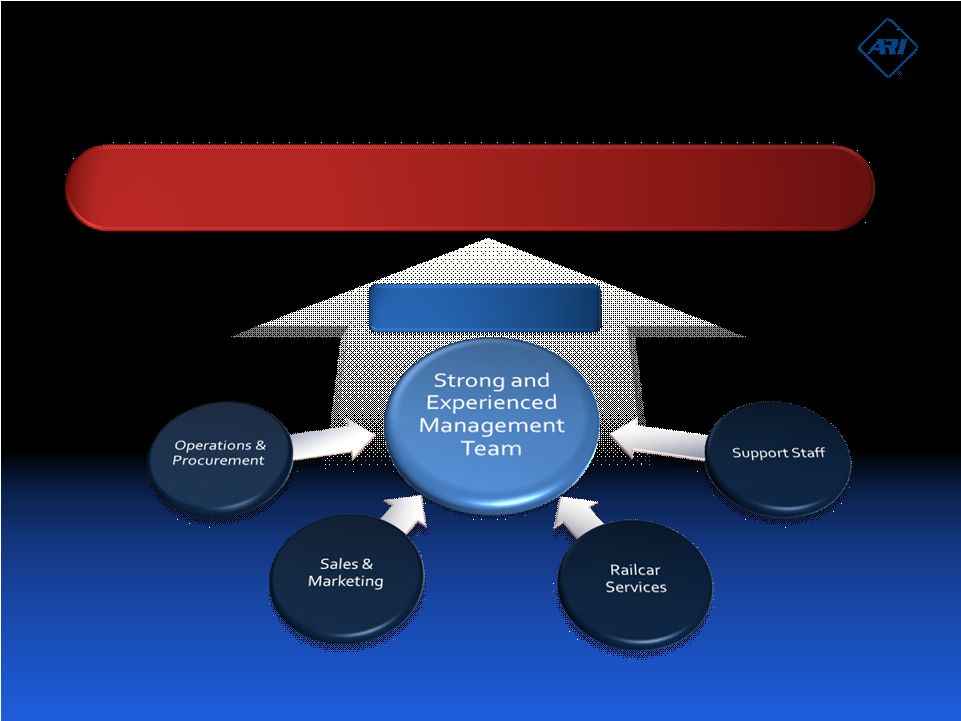

Leadership

James Cowan –

President and CEO

Dale C. Davies –

Sr. Vice President and CFO

Chief Executive Officer since April 2009

Executive Vice President and Chief Operating Officer

from December 2005 –

April 2009

30 years of industry experience

President and COO –

Maverick Tube Corporation

President and CEO –

Vallurec

and Mannesmann

Chief Financial Officer since June 2008

Vice President Finance from June 2005 –

June 2008

30+ years finance and manufacturing experience

Director Portfolio Analysis –

Solutia, Inc.

Corporate

Manager

Business

Analysis

–

Monsanto

Co.

Agile Responsive Innovative |

Our

senior operations management team has an average of over 25 years of relevant

industry experience Management Team

Agile Responsive Innovative

Leadership |

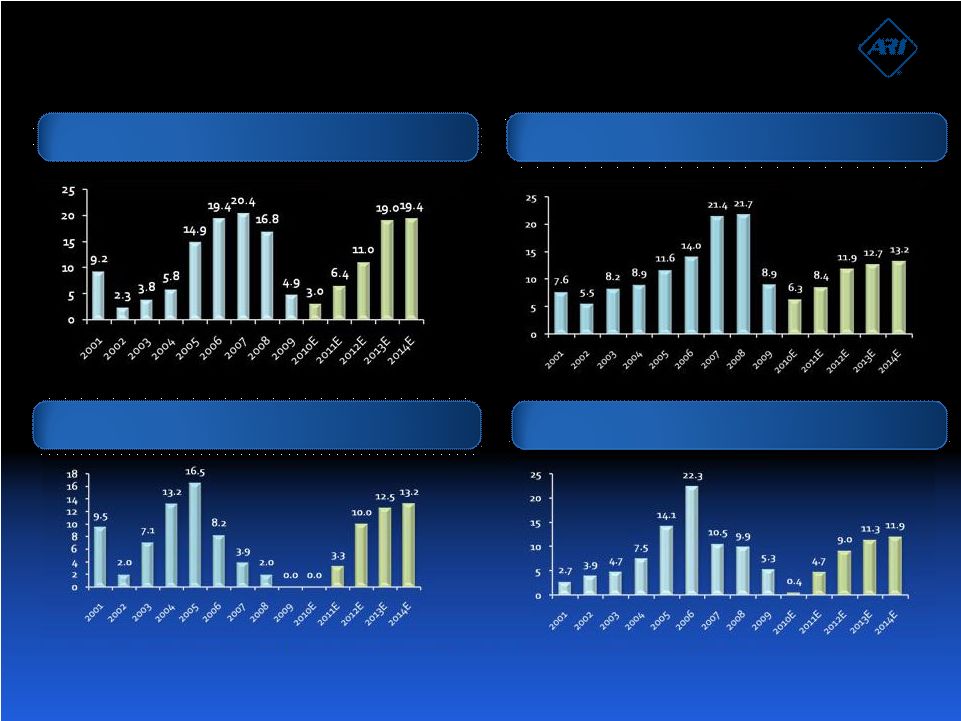

Cyclical

Industry Trends Source: Global Insight Freight Car Outlook.

Agile Responsive Innovative

Shipments of New Freight Railcars |

Industry

Trends Note:

We

have

built

and

sold

a

prototype

intermodal

railcar

and

aluminum

coal

railcar

bottom

discharge

rotary

dump,

and

have

the

ability

to

build

these

products

at

our

railcar

manufacturing

facilities.

Covered Hopper Delivery Trends

Tank Railcar Delivery Trends

Intermodal Delivery Trends

Aluminum Coal Railcar Delivery Trends

Agile Responsive Innovative

Source: Global Insight Freight Car Outlook. |

Freight

Railcar Market Overview Our

Company’s

focus

is

in

the

two

largest

segments

of

the

railcar

industry:

covered

hopper

and

tank

railcars,

which

accounted

for

66%

of

the

new

freight

railcars

delivered

in

the

12

months

ended

March

31,

2010.

Industry Railcar Backlog as of 3/31/2010

Industry Railcar Deliveries TTM 3/31/2010

Agile Responsive Innovative

Source: Global Insight Freight Car Outlook. |

Key Railcar

Markets Hopper Railcars –

Second largest product

segment of new shipments in the railcar industry.

Product offerings include carbon or

stainless steel railcars that can carry:

Plastic pellet

Grain (including DDG)

Cement

Food service

Tank Railcars -

Largest product segment

of new shipments in the railcar industry.

Product offerings include general

service or pressurized, coiled, lined

and insulated and capable of

transporting:

Chemicals

Propane

Ethanol

Asphalt

Corn Syrup

Agile Responsive Innovative |

Agile Responsive Innovative

ARI’s

Footprint |

Main

Facilities •

Strategic locations

•

Near customers and major rail lines

•

Flexible and vertically integrated facilities

•

Produce multiple railcar types

•

Painting/lining capabilities

•

Rolling mill and fabrication plant

•

Non-union workforce

•

Ability to change manpower quickly to control cost

•

Railcar Components

•

Wheel and axle assembly plant

•

Tank head press

•

Component manufacturing facilities with extensive railcar

component product line

•

Aluminum and steel foundry plants

•

Axle Manufacturing Joint Venture (Axis, LLC)

•

Castings Joint Venture (Ohio Castings, LLC)

Agile Responsive Innovative

Flexible Railcar Manufacturing Plants

Component Manufacturing Plants |

Preferential

Access to Components Vertically integrated supply chain provides ARI cost

savings Manufacture valves, discharge outlets, manway

covers, and valve

body castings for industrial and railroad customers

Maintain extensive joint venture and other strategic sourcing

arrangements

Ohio Castings, LLC (ARI 33% owner)

Joint venture that manufactures bolsters, sideframes,

couplers, yokes

Axis, LLC (ARI 42% owner)

Joint venture that manufactures railcar axles

Agile Responsive Innovative |

Agile Responsive Innovative

Freight Railcar Joint Ventures

Axis, LLC

•

Axle manufacturing joint

venture

•

Produces and ships axles

both domestically and

internationally

•

ARI owns 42%

•

Located next to ARI’s

Paragould railcar facility

Ohio Castings, LLC

•

Castings Manufacturing

Joint Venture

•

Capacity to Produce

sideframes, bolsters and

other railcar components

•

ARI owns 33%

•

Located in Alliance, Ohio |

Agile Responsive Innovative

Passenger Railcar Joint Venture

US Railcar Company, LLC

•

Passenger Railcar Manufacturing Joint

Venture

•

DMUs (Diesel Multiple Units) |

International

Joint

Ventures

Amtek

Railcar Industries, Private

Limited

•

Indian Railcar Manufacturing Joint

Venture

•

ARI owns 50%

•

Facility to be constructed

•

Expected first production 3Q-11

Agile Responsive Innovative |

Complementary Railcar Services to Diversify Revenue Mix

Integrated offering provides ARI with insights into customers’

needs and a

revenue stream not dependent on railcar production cycle

Railcar repair & refurbishment

light/heavy railcar repairs

exterior painting

interior lining and cleaning

safety valve testing

railcar inspections

wheel and axle replacement

railcar certification

Railcar fleet management services

mileage accounting

rolling stock taxes

regulatory compliance

engineering services

online service access

maintenance planning

Corporate Headquarters

Full service Shops

Mini Shop/Mobile Units

Agile Responsive Innovative

ARI Railcar Services Offering

Repair Locations |

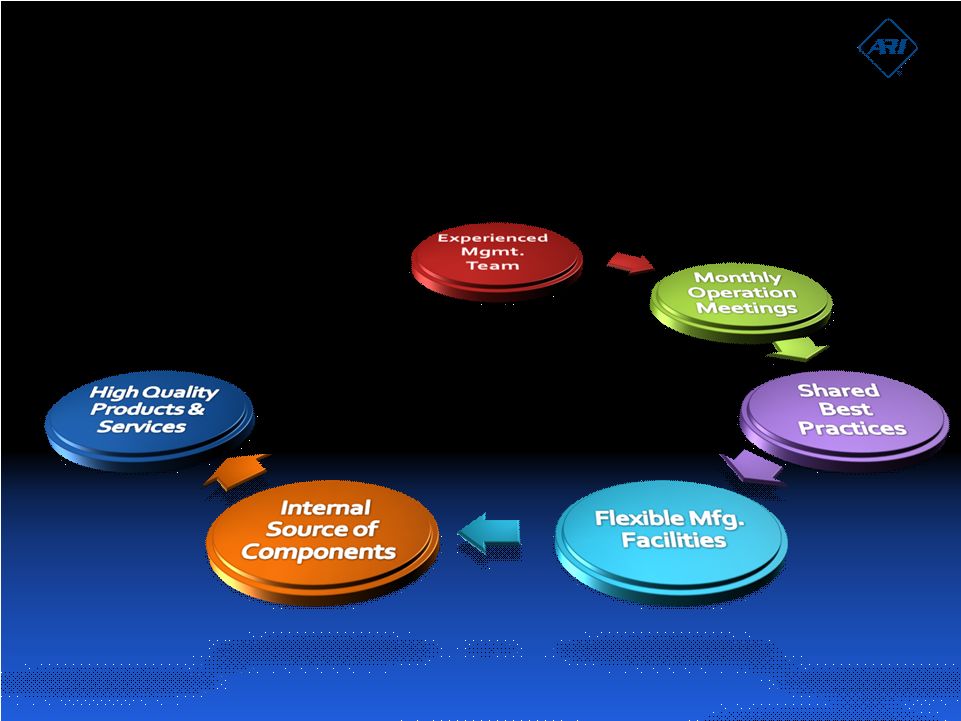

ARI’s

Key Processes Open communication among executives,

management and plant personnel allows for

efficient operations and all employees striving

to achieve one common goal of providing a

high quality product or service that exceeds

our customers’

expectations.

Agile Responsive Innovative |

Agile Responsive Innovative

Growth History

2006

2007

2008

2009

•January IPO

•Purchase of Custom

Steel

•Fabrication facility at

Paragould

•Capacity expansion at

Marmaduke

•New Flexible railcar

production line at

Marmaduke

became

operational

•Formed Axis, LLC Joint

Venture for axle

manufacturing

•Wheel & Axle Assembly

Shop begins operation

•Tank Head Press

began operation

•Formed Joint Venture

for India railcar

production

•Record Revenue of

$800 million, record

EBITDA* and record

railcar shipments of

nearly 8,000

•Sarnia Repair paint

and lining shop

expansion

•Longview Repair tank

railcar lining shop

expansion

•Start up of Axis, LLC

Joint Venture

*

Please

see

reconciliation

of

net

earnings

to

EBITDA

on

exhibit

A. |

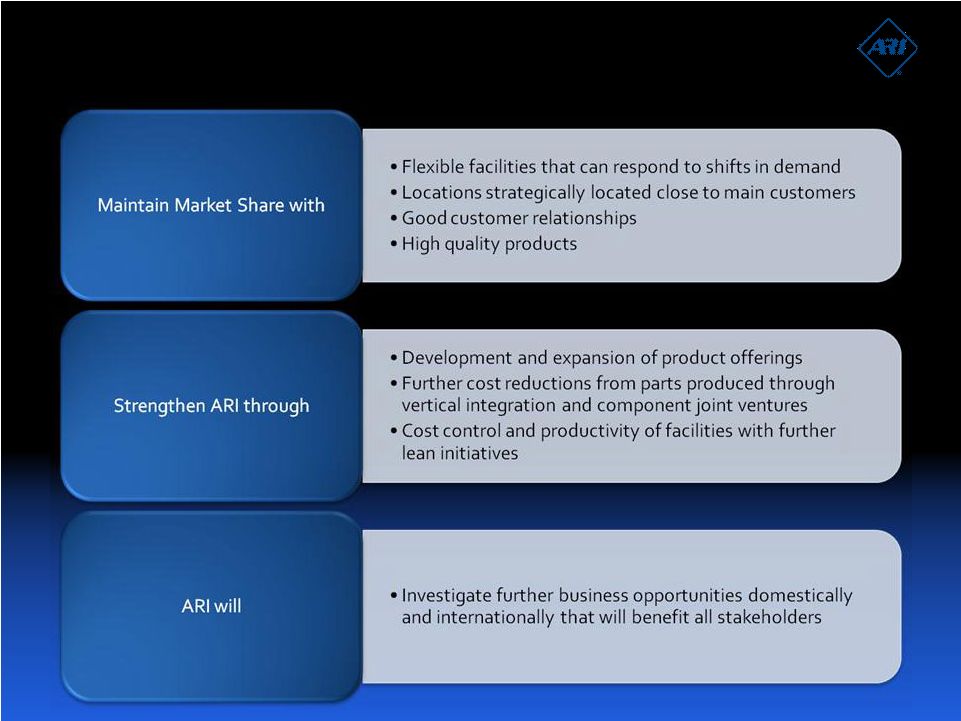

Objectives

and Long-Term Strategies Agile Responsive Innovative

|

•Formed Joint

Venture to

produce DMUs

•

India Joint Venture

construction to

begin

2010

•

Evaluating CIS

opportunities

•

Expect to produce

DMU railcars

•

India Joint Venture

operations start-up

expected

2011

Growth Projects

Agile Responsive Innovative |

Repair Expansions

Axis, LLC Joint Venture

Tank Head Press

Marmaduke

Expansion

New Car Types Introduced

India Joint Venture

DMU Joint Venture

Potential CIS Opportunities

Growth and Cost Reduction Initiatives

Agile Responsive Innovative

Wheel & Axle Assembly

*

Please

see

reconciliation

of

net

earnings

to

EBITDA

on

exhibit

A. |

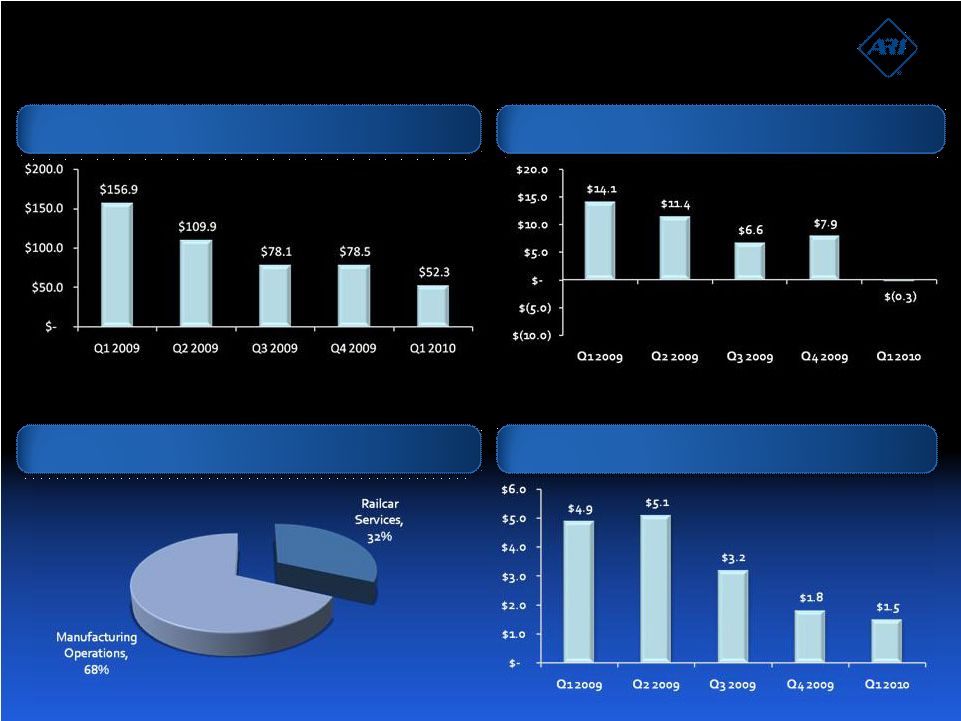

Agile Responsive Innovative

Our Financial History

Revenue ($mil)

Segment Revenue (2009)

EBITDA ($mil) *

CAPEX

*Adjusted to exclude short-term investment activity and stock based

compensation expense. Please see reconciliation of net earnings to EBITDA on

Exhibit A. |

Agile Responsive Innovative

Quarterly Financial Comparison

Revenue ($mil)

Segment Revenue (Q1 2010)

EBITDA ($mil) *

CAPEX

*Adjusted to exclude short-term investment activity and stock based

compensation expense. Please see reconciliation of net earnings to EBITDA on

Exhibit A. |

2004

2005

2006

2007

2008

2009

Net (loss) earnings

$ 1,921

$ 14,768

$ 35,204

$ 37,264

$ 31,382

$ 15,458

Income tax (benefit) expense

2,191

9,356

20,752

22,104

18,403

6,568

Interest expense

3,667

4,846

1,372

17,027

20,299

20,909

Interest income

(4,422)

(1,658)

(1,504)

(13,829)

(7,835)

(6,613)

Depreciation

5,865

6,521

10,674

14,085

20,148

23,405

EBITDA

$ 9,222

$ 33,833

$ 66,498

$ 76,651

$ 82,397

$ 59,727

Expense related to stock option

compensation

$

-

$

- $ 8,116

$ 1,628

$ 109

$

- Expense (income) related to stock

appreciation rights compensation

-

-

-

299

(47)

1,174

Gain on asset conversion, net

-

-

(4,323)

-

-

-

Retirement benefit plan expense

-

10,911

-

-

-

-

Other (income) loss on short-term

investment activity

-

-

-

-

(3,657)

(20,858)

Adjusted EBITDA

$ 9,222

$ 44,744

$ 70,291

$ 78,578

$ 78,802

$ 40,043

Exhibit

A –

EBITDA Reconciliation

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Net (loss) earnings

$ 2,726

$ 1,132

$ 1,092

$ 10,508

$ (7,023)

Income tax (benefit) expense

1,743

724

(1,223)

5,324

(4,396)

Interest expense

5,140

5,136

5,286

5,347

5,321

Interest income

(1,183)

(1,802)

(1,925)

(1,703)

(730)

Depreciation

5,644

5,969

5,864

5,928

5,915

EBITDA

$ 14,070

$ 11,159

$ 9,094

$ 25,404

$ (913)

Expense related to stock option compensation

$

-

$

-

$

-

$

-

$

- Expense (income) related to stock appreciation

rights compensation

(35)

236

651

322

700

Gain on asset conversion, net

-

-

-

-

-

Retirement benefit plan expense

-

-

-

-

-

Other (income) loss on short-term investment

activity

96

(13)

(3,115)

(17,826)

(81)

Adjusted EBITDA

$ 14,131

$ 11,382

$ 6,630

$ 7,900

$ (294)

Annual Reconciliation

Quarterly Reconciliation

In Thousands, unaudited |

EBITDA

represents

net

earnings

(loss)

before

income

tax

expense,

interest

expense

(income),

net

of

depreciation

of

property,

plant

and

equipment.

The

Company

believes

EBITDA

is

useful

to

investors

in

evaluating

ARI’s

operating

performance

compared

to

that

of

other

companies

in

the

same

industry.

In

addition,

ARI’s

management

uses

EBITDA

to

evaluate

operating

performance.

The

calculation

of

EBITDA

eliminates

the

effects

of

financing,

income

taxes

and

the

accounting

effects

of

capital

spending.

These

items

may

vary

for

different

companies

for

reasons

unrelated

to

the

overall

operating

performance

of

a

company’s

business.

EBITDA

is

not

a

financial

measure

presented

in

accordance

with

U.S.

generally

accepted

accounting

principles

(U.S.

GAAP).

Accordingly,

when

analyzing

the

Company’s

operating

performance,

investors

should

not

consider

EBITDA

in

isolation

or

as

a

substitute

for

net

earnings

(loss),

cash

flows

from

operating

activities

or

other

statements

of

operations

or

statements

of

cash

flow

data

prepared

in

accordance

with

U.S.

GAAP.

Our

calculation

of

EBITDA

is

not

necessarily

comparable

to

that

of

other

similarly

titled

measures

reported

by

other

companies.

Adjusted

EBITDA

represents

EBITDA

before

share

based

compensation

expense

(income)

related

to

stock

appreciation

rights

(SARs),

and

before

gains

or

losses

on

investments

and

derivative

instruments.

We

believe

that

Adjusted

EBITDA

is

useful

to

investors

evaluating

our

operating

performance,

and

management

also

uses

Adjusted

EBITDA

for

that

purpose.

Our

SARs

(which

settle

in

cash)

are

revalued

each

quarter

based

upon

changes

in

our

stock

price.

Management

believes

that

eliminating

the

expense

(income)

associated

with

our

stock

based

compensation,

investments

and

derivates

allows

us

and

our

investors

to

understand

better

our

operating

results

independent

of

financial

changes

caused

by

the

fluctuating

price

and

value

of

our

common

stock,

investments

and

derivative

instruments.

Adjusted

EBITDA

is

not

a

financial

measure

presented

in

accordance

with

U.S.

GAAP.

Accordingly,

when

analyzing

our

operating

performance,

investors

should

not

consider

Adjusted

EBITDA

in

isolation

or

as

a

substitute

for

net

earnings

(loss),

cash

flows

from

operating

activities

or

other

statements

of

operations

or

statements

of

cash

flow

data

prepared

in

accordance

with

U.S.

GAAP.

Our

calculation

of

Adjusted

EBITDA

is

not

necessarily

comparable

to

that

of

other

similarly

titled

measures

reported

by other companies.

Exhibit

A –

EBITDA Reconciliation |

Key Investment

Considerations Increasing

International

Presence

Quality

Leader

Flexible

Manufacturing

Established

Largest

Freight Railcar

Segments

Skilled

Railcar

Mfg.

Workforce

Agile Responsive Innovative |

Agile Responsive Innovative |