Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CYS Investments, Inc. | d8k.htm |

Investment Outlook

June, 2010

Kevin E. Grant, CFA

President & CEO

Exhibit 99.1 |

1

Forward Looking Statements

This presentation contains forward-looking statements, within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, that are based on management’s beliefs

and assumptions, current expectations, estimates and projections. Such statements,

including information relating to the Company’s expectations for future

financial performance, are not considered historical facts and are considered forward-looking

information

under

the

federal

securities

laws.

This

information

may

contain

words

such

as

“believes,”

“plans,”

“expects,”

“intends,”

“estimates”

or similar expressions.

This information is not a guarantee of the Company’s future performance and

is subject to risks, uncertainties and other important factors that could

cause the Company’s actual performance or achievements to differ materially from those expressed

or implied by this forward-looking information and include, without limitation,

changes in the market value and yield of our assets, changes in interest

rates and the yield curve, net interest margin, return on equity, availability and terms of financing and hedging

and various other risks and uncertainties related to our business and the

economy. Given these uncertainties, you should not rely on

forward-looking information. The Company undertakes no obligations to update any forward-looking information, whether

as a result of new information, future events or otherwise

|

2

CYS Overview

Target Assets

Objective

Senior Management

Focus on Cost

Efficiency

Ample Financing

Sources

Dividend Policy

A Real Estate Investment Trust formed in January 2006

Agency Residential Mortgage Backed Securities

Kevin Grant, CEO, President, Chairman

Frances Spark, CFO

Pay dividends and achieve capital appreciation throughout changing interest rate

and credit cycles

Be the most efficient Agency REIT in the market

Currently

financing

lines

with

25

lenders

Swap agreements with 6 counterparties

Company intends to distribute all or substantially all of its REIT taxable

income Scaled Management Fee: 1.0% to 1.5%

No Incentive Fee |

3

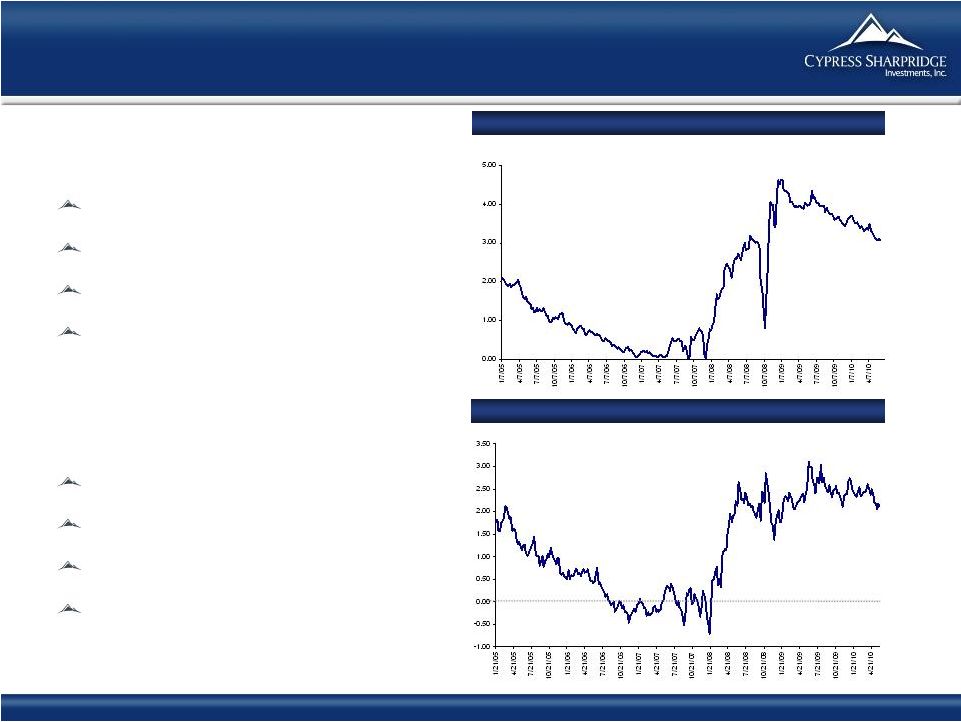

Attractive Environment Likely to Persist

Source: Bloomberg.

(1) As of June 4, 2010

5/1 Hybrid

Net

Interest

Margin:

1/05

–

6/10

6/4/10

5 Year Swap vs 1 Month

LIBOR:

1/05

–

6/10

6/4/10

Mortgage Yields Currently Attractive

Par-Priced

5/1

hybrid

rates

now

3.50

(1)

30

Year

fixed

rates

now

4.30%

(1)

15

Year

fixed

rates

now

3.60%

(1)

Hedging costs remain reasonable

Steep Curve

Creates significant positive carry

Significant ROE

Hedge flexibility very important

No signs of inflation |

4

0.000

0.500

1.000

1.500

2.000

2.500

3.000

3.500

4.000

4.500

5.000

Wide Spreads Create Good Environment

Source: Bloomberg.

Note: Spreads

calculated

as:

(i)

5/1

Hybrids

Index

–

50/50

3-Year

Swaps/LIBOR,

and

(ii)

5/1

Hybrids

Index

–

1-Month

LIBOR

Index.

5/1

Hybrids

Hedged

with

Swaps:

1/05

–

6/10

Simple “Carry

Trade”

Borrow Short/

Lend Long

Hedged Hybrids

(i)

Unhedged Hybrids

(ii)

6/4/10

CYS

Investment Strategy |

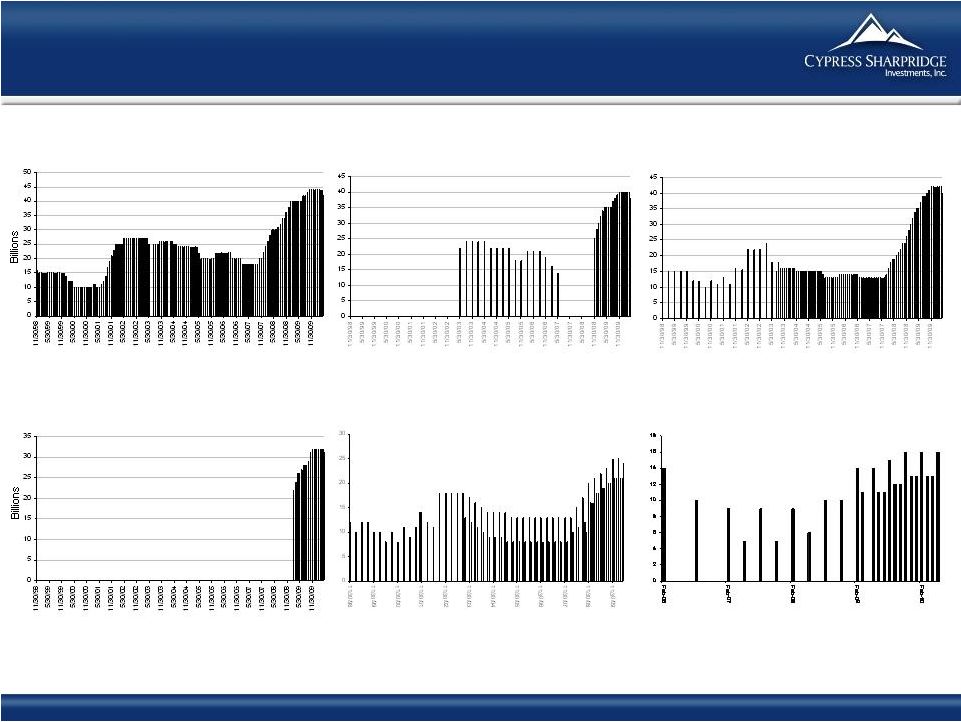

10

Year Treasury Note Auctions 11/98 –

5/10

Treasury Auction Volume Exploding

2 Year Treasury Note Auctions

2/00 –

5/10

3 Year Treasury Note Auctions

2/00 –

5/10

Source: Bloomberg, US Treasury

5 Year Treasury Note Auctions

2/00 –

5/10

7 Year Treasury Note Auctions

2/00 –

5/10

30 Year Treasury Note Auctions

2/00 –

5/10

5 |

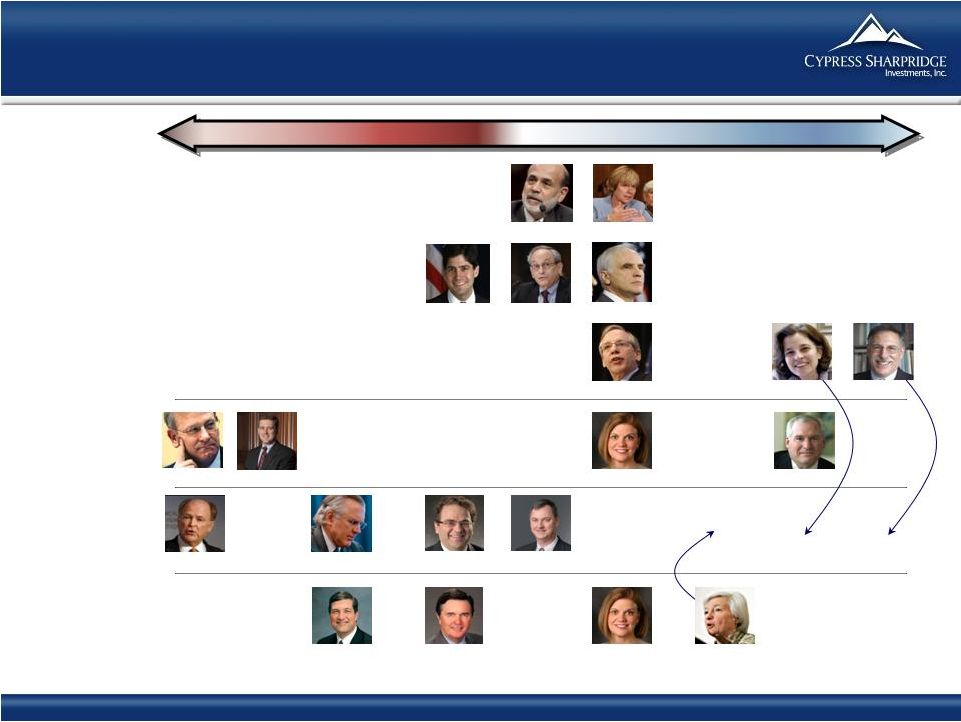

Fed

Board to Become More Dovish Hawkish

Dovish

Neutral

Hoenig

Bullard

Plosser

Fisher

Lacker

Duke

Tarullo

Evans

Dudley

Pianalto

Warsh

Kohn

Kocherlakota

Lockhart

Pianalto

Yellen

Rosengren

Raskin

Diamond

Bernanke

Obama Nominees

Governors

2010 Voters

2011 Voters

2012 Voters

6

Source: Bank of America Merrill Lynch, Bloomberg, Wall Street Journal, Indiana University,

Marketwatch, Thomson Reuters, Federal Reserve Bank of Atlanta, Federal Reserve Bank of Chicago,

Federal Reserve Bank of Cleveland, Maryland Consumer Rights Coalition, Boston Globe, Businessweek, Newsweek, Washington Post, CNBC.

|

7

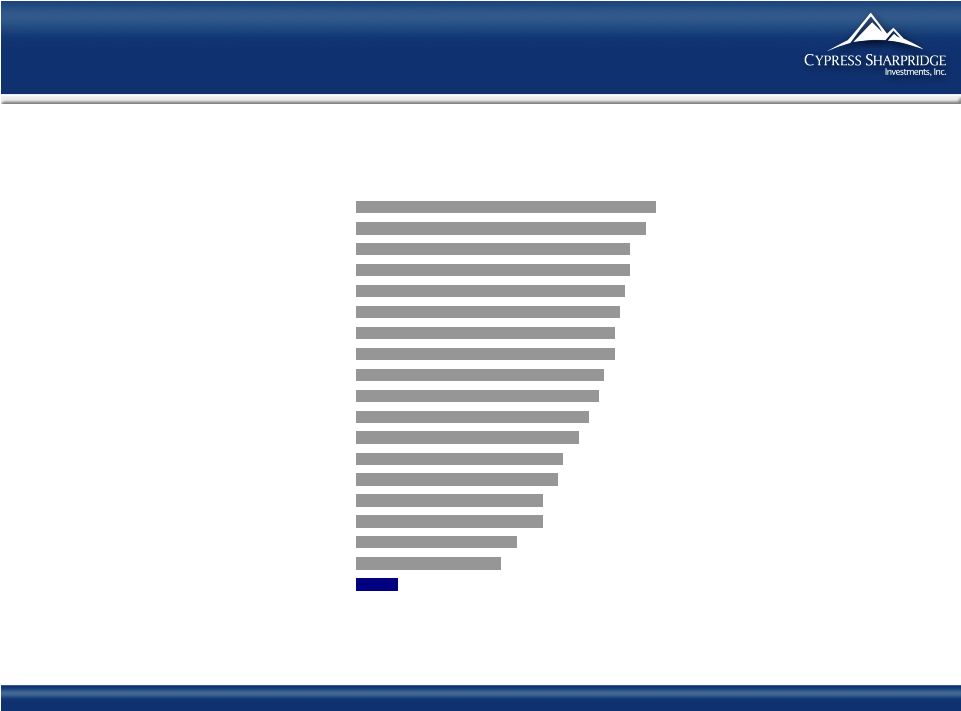

The Next 30 (78?) Months…

Cabinet Appointees with Private Sector Experience

¹

Source: JP Morgan Global Wealth Management

8%

28%

31%

36%

36%

39%

40%

43%

45%

47%

48%

50%

50%

51%

52%

53%

53%

56%

58%

Obama

Kennedy

Carter

T. Roosevelt

Clinton

Taft

Hoover

Ford

Johnson

Coolidge

Harding

F.D. Roosevelt

Truman

Wilson

G.H.W. Bush

Nixon

G.W. Bush

Reagan

Eisenhower

1

Secretaries of State, Commerce, Treasury, Agriculture, Interior, Labor, Transportation, Energy,

Housing and Urban Development |

8

Economic Recovery Below Normal Pace

S&P/Case-Shiller U.S. National Home Price Indices

1988 –

Present

% Change -

Year to Year

Capacity Utilization: Manufacturing

1968 –

Present

%

Unemployment Rate

1940-present

%

Source: S&P, Fiserv, and Macromarkets LLC / Haver Analytics, BLS |

9

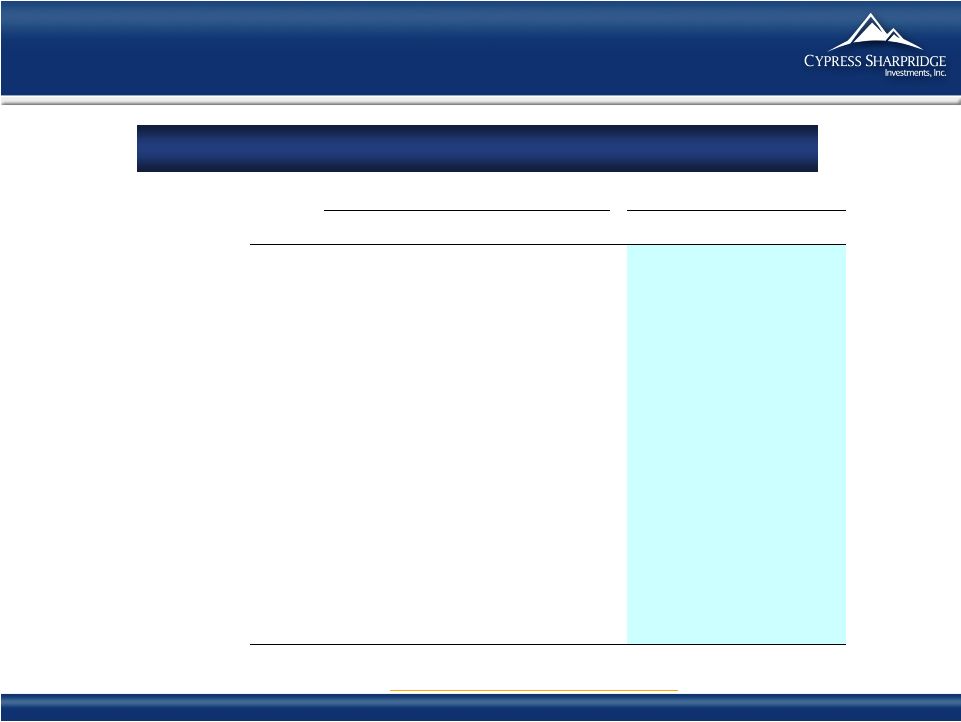

Portfolio Characteristics

CYS Portfolio Characteristics

Source: Company data as of March 31, 2010; Bloomberg

(1)

Months to reset

(2)

Q1 2010

(3)

Interest Only loans

Par Value

Asset Type

(in thousands)

Cost

Price

MTR

1

Coupon

CPR

2

I/O Loans

3

Short Reset ARMs

203,252

$

101.35

$

104.10

$

10.0

3.9%

29.6%

50.0%

Hybrid ARMs

472,427

101.03

104.31

47.6

4.4%

32.8%

60.0%

Fixed Rate

1,055,675

101.58

103.22

NA

4.5%

12.3%

1.2%

Total/Weighted-Average

1,731,354

$

101.40

$

103.62

$

36.3

4.4%

22.0%

23.0%

Interest Rate Swaps

740mm

2.4 Year

2.03%

Weighted Average |

10

CYS Exposure to FNMA/FHLMC Buyouts: Very Limited

FNMA 120 Day Delinquency Buckets

; Company data as of March 31, 2010

Per March 1 2010 FNMA Press Release

CYS Exposure

MBS Product

Year of

Issuance

Coupon <

4.5%

4.5% -

5%

5% -

5.5%

5.5% -

6%

6 -

6.5%

Face Value

(millions)

% of Total

Assets

Implied

Reinvestment Need

(millions)

30 Year (CL-prefix)

2009

0.02%

0.03%

0.17%

0.60%

1.59%

-

2008

1.33%

0.78%

1.81%

3.43%

7.07%

22

1.2%

1.56

2007

2.39%

3.22%

4.87%

6.52%

11.03%

-

2006

4.91%

2.74%

4.70%

6.72%

9.40%

-

2005

2.32%

1.99%

3.47%

5.72%

10.57%

-

15 & 10 Year (CI & CN-prefixes)

2009

0.01%

0.04%

0.13%

0.19%

0.46%

452

25.0%

0.16

2008

0.38%

0.35%

0.55%

0.83%

1.69%

44

2.4%

0.37

2007

1.44%

1.11%

1.34%

1.84%

3.04%

-

2006

1.24%

1.85%

1.67%

2.43%

3.62%

-

2005

0.86%

1.09%

1.60%

2.97%

5.72%

-

Interest Only

2009

0.00%

0.00%

0.55%

0.63%

0.93%

2008

0.00%

7.36%

5.09%

8.31%

13.22%

2007

0.00%

5.39%

13.08%

15.72%

22.56%

13

0.7%

2.93

2006

0.00%

2.08%

7.78%

12.75%

18.40%

2005

0.00%

6.80%

5.48%

10.00%

14.15%

ARMs: Amortizing

2009

0.03%

0.50%

1.02%

0.00%

0.00%

142

7.9%

0.04

2008

1.91%

3.73%

5.36%

9.62%

36.05%

22

1.2%

1.18

2007

2.76%

4.53%

11.29%

13.37%

11.94%

-

2006

29.09%

7.44%

10.96%

15.03%

21.08%

-

2005

16.19%

7.83%

9.87%

17.28%

6.60%

-

2004 and earlier

4.46%

4.20%

4.76%

7.57%

1.59%

98

5.4%

4.37

ARMs: Interest Only

2009

0.06%

0.16%

0.86%

5.61%

0.00%

166

9.2%

0.10

2008

6.22%

5.24%

6.54%

10.14%

18.74%

-

2007

10.20%

13.84%

17.45%

25.22%

32.25%

45

2.5%

11.35

2006

20.86%

11.23%

14.58%

21.36%

29.71%

30

1.7%

6.41

2005

14.41%

12.37%

12.86%

25.11%

12.95%

32

1.8%

3.96

2004 and earlier

8.55%

6.71%

6.24%

15.80%

11.51%

5

0.3%

0.43

-

-

-

-

$

$

Source: FNMA March 1 2010 Press Release, CYS Investments, Inc. refer to:

http://WWW.fanniemae.com/newsreleases/2010/4960.jhtml

|

11

Attractive Repo Market Dynamics

Money Market Funds Awash in Cash

Assets remain very high

Flight to quality on asset mix

Agency RMBS a major beneficiary

Source: Bloomberg. Market data as of June 4, 2010.

LIBOR

vs

Fed

Funds:

10/07

–

6/10

Money

Market

Fund

Assets:

8/01

-

6/10

Lower Spreads Reduce Funding Costs and

Improved Availability

TARP

TSLF and TALF

Fed funds target rate: 0 to 0.25%

6/7/10

($ in billions)

(%)

6/4/10 |

12

Non-Agency Legacy Assets Recovering

Source: Company data as of March 31, 2010.

CYS’

CLO & RESIX Securities

CLO Market has improved

Non-Agency assets represent approximately 74 cents of Book Value

Q1 Market appreciation of $4.5mm or 24 cents of Book Value

CLO Cash Distributions expected to resume

RESIX securities likely to be extinguished

Market

Value

NAV at

Market

(per share)

NAV

at Face Value

(per share)

Remaining

Life

CLO

$13.8 MM

$0.73

$1.75

8.3 years

RESIX

$0.1 MM

$0.01

$0.31

28.1 years

Total

$13.9 MM

$0.74

$2.06 |

13

History of Transparent and Consistent

Financial Reporting

CYS uses Financial Reporting for Investment Companies

CYS

financial

reporting

–

Best

in

Class

Schedule of investments

NAVs

have reflected mark-to-market accounting since inception

No OCI account on balance sheet

Realized and unrealized losses taken through income statement

Losses expensed in period incurred

Competitors likely to move closer to CYS’

financial reporting standards

when FASB declares SOP 07-1 effective

Potential to create meaningful adjustments for the other companies

|

14

Historical Financials

(1)

Includes interest income on Agency RMBS and non-Agency securities.

(2)

Net

income

excluding

net

realized

gain

(loss)

on

investments

and

swap

contracts

and

net

unrealized

appreciation

(depreciation)

on

investments

and

swap

contracts.

(3)

Calculated

by

dividing

total

interest

income

from

Agency

RMBS

by

average

Agency

RMBS.

(4)

Calculated by dividing total interest expense, including net swap interest income

(expense) by average repurchase agreements. (5)

Calculated by subtracting average cost of funds & hedge from average yield on

Agency RMBS. (6)

Calculated by dividing total liabilities by net assets.

3/31/2010

12/31/2009

Income Statement Data

Investment Income – Interest Income (1)

$16,936.9

$15,767.5

Total expenses

3,217.8

3,102.6

Net Investment Income

13,719.1

12,664.9

Net gain (loss) from investments

6,464.3

(4,320.5)

Net gain (loss) from swap contracts

(10,040.2)

(1,307.5)

Net Income (Loss)

$10,143.2

$7,036.9

Net Income (Loss) Per Common Share (diluted)

$0.54

$0.37

Distributions per Common Share

$0.55

$0.55

Non-GAAP Measure

Core Earnings (2)

$10,424.7

$9,688.0

Non-GAAP Reconciliation

NET INCOME

$10,143.2

$7,036.9

Net (gain) loss from investments

($6,464.3)

$4,320.4

Net unrealized (appreciation) depreciation on swap contracts

$6,745.8

($1,669.3)

Core Earnings

$10,424.7

$9,688.0

Balance Sheet Data

Cash and Cash Equivalents

$775.7

$1,889.7

Total Assets

$1,840,877.9

$1,866,196.3

Repurchase Agreements

$1,487,589.2

$1,372,707.6

Net assets

$244,446.2

$244,291.0

Net assets per common share

$13.03

$13.02

Key Portfolio Statistics

Average Yield on Agency RMBS (3)

3.86%

4.01%

Average Cost of Funds & Hedge (4)

1.14%

1.21%

Interest Rate Spread Net of Hedge (5)

2.72%

2.80%

Leverage Ratio (at period end) (6)

6.5:1

6.6:1

Quarter Ended |

15

Financial Highlights

Steep yield curve and attractive spreads in target assets

Tailwinds likely to continue

Reinvestment needs relatively low

Non-Agency assets recovering

Investment Company accounting provides transparency |

16

Kevin E. Grant, CFA

President & CEO

Investment Outlook

June, 2010 |