Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chesapeake Lodging Trust | d8k.htm |

6/10/2010

Exhibit 99.1 |

1

Disclaimer

6/10/2010

We make forward-looking statements in this presentation that are subject to risks and

uncertainties. These forward-looking statements include information about possible or

assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words “believe,”

“expect,” “anticipate,” “estimate,” “plan,”

“continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. Statements

regarding the following subjects, among others, may be forward-looking by their nature: our

business and investment strategy, including our ability to identify suitable properties to

acquire; our forecasted operating results; completion of any pending transactions; our ability to obtain adequate debt or equity financing to

complete acquisitions and to maintain future financing arrangements; market trends in our industry,

interest rates, real estate values, the debt securities markets or the general economy; our

expected leverage levels; and our expectations for economic trends and recoveries, and the impact of those on the lodging industry

generally and the market segments in which we intend to operate, in particular.

The forward-looking statements are based on our beliefs, assumptions and expectations of our

future performance, taking into account all information currently available to us. You should

not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result

of many possible events or factors, not all of which are known to us. If a change occurs, our

business, financial condition, liquidity and results of operations may vary materially from

those expressed in our forward-looking statements. Additionally, the following factors could cause actual results to vary from our forward-

looking statements:

changes in our business or investment strategy;

availability to us, and the terms of, capital for use in our future growth;

our ability to reach agreement with prospective sellers and acquire additional hotel properties on

favorable terms or at all; the extent to which the general U.S. or international economy recovers, and the resultant effect on

our industry and the market segments in which we operate; the degree and nature of

our competition; availability of and our ability to retain qualified personnel;

our ability to maintain our qualification as a REIT;

general volatility of the capital markets and the market price of our common shares;

actions and initiatives of the U.S. government, changes to U.S. government policies and the execution

and impact of these actions, initiatives and policies; changes in interest rates; and

the other factors discussed in our IPO prospectus, including those set forth under the sections

titled “Risk factors,” “Management’s discussion and analysis of financial

condition and results of operations” and “Our business.” Any forward-looking statement speaks only as of the date on which it is made. Except as required

by law, we are not obligated to, and do not intend to, publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise.

This presentation may contain statistics and other data that may have been obtained from or compiled

from information made available by third-party service providers.

|

2

Key Investment Highlights

Extensive industry relationships including strategic relationship with

Hyatt to drive pipeline

Experienced

management

team

with

strong

public

company

track

record

Improving industry fundamentals

Growth-oriented capital structure/favorable valuation

Compelling market opportunity validated by recent acquisitions and

current pipeline

6/10/2010 |

3

Who We Are and What We Have Done

Recently formed lodging REIT that went public in January 2010

Raised gross proceeds of $180.2M in public and private offerings

Pending revolving credit facility with capacity up to $115.0M

Committed $183.0M of proceeds to purchase three hotels:

Hyatt Regency Boston

498 rooms

Hilton Checkers LA

188 rooms

Courtyard Anaheim

153 rooms

Led by experienced senior management and strong board

6/10/2010 |

4

Veteran Management Team & Diverse and Experienced Board

Veteran Management Team

Experienced management team led by James Francis, CEO & President, Doug

Vicari, EVP & CFO, Rick Adams, SVP & CIO, and Graham Wootten, SVP

& CAO Management has experience over several market cycles, through a

variety of industry conditions and platforms

Team worked successfully together previously at Highland Hospitality

Lodging industry experience in excess of 20 years

Diverse and Experienced Board

5 independent board members, with 2 former Highland Hospitality members:

Thomas Natelli, Non-Executive Chairman (former Highland member)

Thomas Eckert, Independent Trustee

John Hill, Independent Trustee (former Highland member)

George McKenzie, Independent Trustee

Jeffrey Nuechterlein, Independent Trustee

Strong corporate governance with a focus on delivering shareholder value

Independent non-executive Chairman

Board will be elected annually

Broad real estate/public company experience

6/10/2010 |

5

Highland Hospitality IPO and related

transactions on 12/16/2003

2003 to 2007 –

Purchased 30 hotels for

approximately $1.3 billion:

Portfolio included Hyatt, Westin, Marriott and

Hilton hotels

Implemented value-added renovation and

capital programs

Built an outstanding team and corporate culture

Experienced management team with

outstanding staff support

Accomplished Board of Directors with

effective oversight role

–

Ranked 2nd in corporate governance in

lodging REITs by Real Estate Portfolio

magazine

¹

2007 –

Strategic exit from public markets

through sale to JER at $19.50/share

Highland Hospitality Track Record

1

Source: Real Estate Portfolio magazine; July/August 2005 issue

2

Source: FactSet

3

Represents share price performance following Highland Hospitality’s exit from

the market on 7/17/07 through 1/14/10 7/17/2007:

Sale to

JER at $19.50/share

Ticker

Change

LHO

(52.4%)

DRH

(51.7%)

HST

(48.4%)

SHO

(67.1%)

12/16/2003:

IPO at

$10.00/share

Note: Represents total return at $19.50 per share received at the time of sale to

JER for one share purchased at the IPO price of $10.00 per share (assuming

reinvestment of all cash dividends paid by Highland on its common stock for

all periods following its IPO in additional shares of common stock on the

dividend payment dates) Highland

Hospitality

–

Share

price

performance

²

Selected Peer Share

Price

Performance

³

Highland

Hospitality

–

Background

6/10/2010 |

6

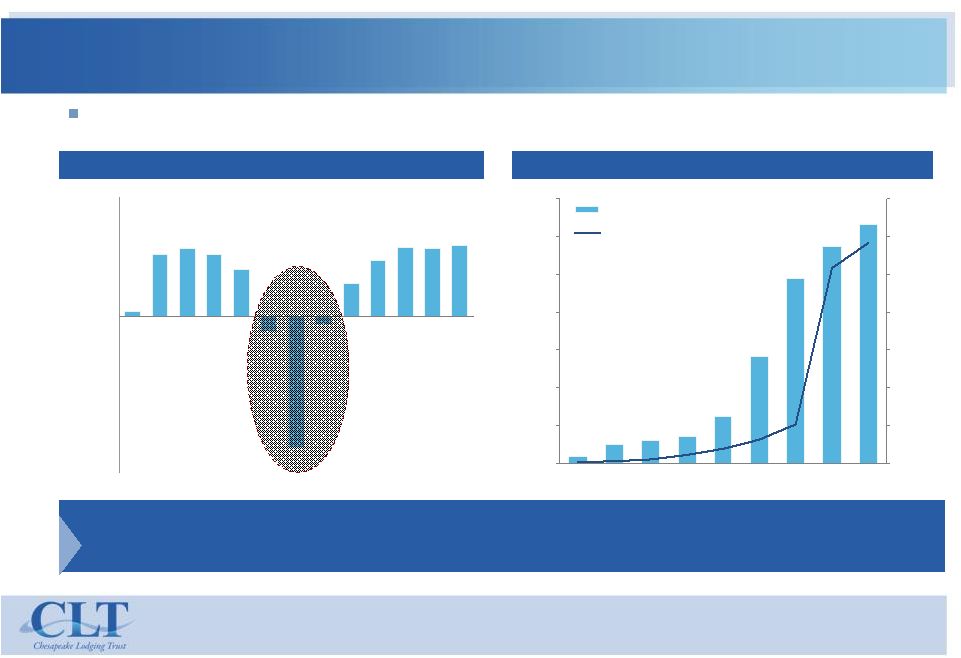

Record Levels Of Transaction Activity (2003 –

2009)

1

Source: Commercial Mortgage Alert for total U.S. CMBS issuance including lodging-related

issuance 2

Sources: Property level transactions: HVS; Corporate Privatizations: SNL Financial LC. Property level

transaction volume includes only transactions greater than $10mm.

U.S.

Hotel

Transaction

Activity

(2003

–

2009)

-

$bn

²

U.S.

CMBS

Issuance

(2003

–

2009)

-

$bn

¹

$78

$93

$169

$203

$230

$12

$3

$0

$50

$100

$150

$200

$250

2003

2004

2005

2006

2007

2008

2009

$5.5

$12.1

$17.7

$23.1

$49.3

$4.3

$788 billion of CMBS issued

High

volume

of

lodging

transactions

were

fueled

by

record

levels

of

debt

financing

available

to

the

commercial real estate industry

$114.1

billion of hotel assets purchased

$2.1

6/10/2010

$8.6

$13.2

$16.3

$12.4

$4.5

$6.7

$36.9

$4.8

$0.7

$3.5

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

$50.0

$55.0

$60.0

$65.0

2003

2004

2005

2006

2007

2008

2009

Corporate Privatizations ($52.3bn)

Property Level Transactions ($61.7bn) |

7

High Leverage + Significant RevPAR

Decline = Opportunity

U.S.

Distressed

Hotel

Loans

Volume

(3/2008

–

3/2010)

²

0.5%

7.8%

8.6%

7.8%

5.9%

(1.9%)

(16.7%)

(1.0%)

4.1%

7.0%

8.7%

8.6%

8.9%

(20.0%)

(15.0%)

(10.0%)

(5.0%)

0.0%

5.0%

10.0%

15.0%

2003

2004

2005

2006

2007

2008

2009

2010E

2011E

2012E

2013E

2014E

2015E

U.S.

RevPAR

Annual

%

Change

(2003A

–

2015E)

¹

We believe declining cash flows and valuations combined with high levels of property

debt are leading

to

increasing

levels

of

foreclosures,

restructurings

and

distressed

hotel

sales

We believe current industry dynamics will create attractive opportunities to acquire

high quality hotel properties, at prices well below replacement costs, with

attractive yields and significant upside potential

$31.6

$28.7

$2.5

$3.0

$3.6

$6.2

$14.2

$24.4

$0.8

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

3 / 08

6 / 08

9 / 08

12 / 08

3 / 09

6 / 09

9 / 09

12 / 09

3 / 10

0

200

400

600

800

1,000

1,200

1,400

Distressed Hotel Loans ($bn)

Number of Distressed Hotel Loans

6/10/2010

1

Source: 2003A-2009A: Smith Travel Research, 2010E-2015E: HVS

2

Source: © Real Capital Analytics, Inc. (www.rcanalytics.com). Note: Distress includes loans in

foreclosure, bankruptcy, and restructured/modified statuses |

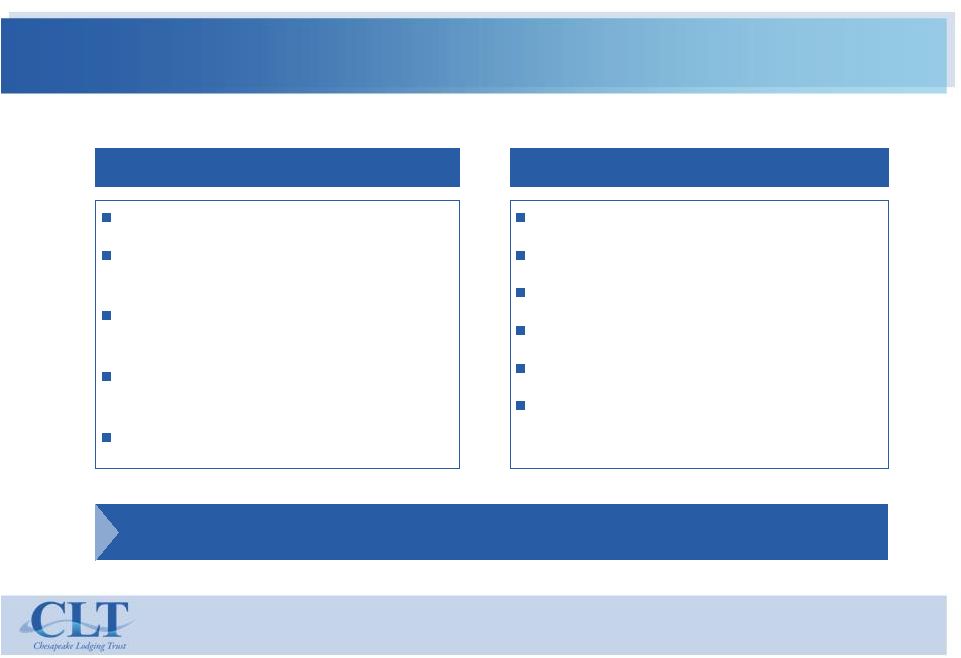

8

Current Environment Will Create Attractive Acquisition

Opportunities

Universe of Sellers

High property and corporate level leverage

Severe recent decline in operating

performance

Insufficient cash flow available to address

debt service and capital requirements

Debt balance in excess of current property

values

Capital requirements from brands and

management companies

Existing public and private hotel owners

National and regional banks

Insurance companies and pension funds

Branded hotel companies

Real estate mezzanine debt investors

CMBS special servicers

Drivers

Management believes opportunities will be created to acquire hotel properties from

both opportunistic sellers and financially distressed

owners/participants 6/10/2010 |

9

Upper-upscale segment

Hyatt

®

and

Hyatt

Regency

®

Hilton

®

Marriott

®

Renaissance

®

Sheraton

®

Westin

®

Upscale hotels in unique locations

Hyatt

Place

®

Courtyard

by

Marriott

®

Hilton

Garden

Inn

®

Independent boutique hotels in unique locations

Markets

Segments

Top 25 Metropolitan Statistical Areas (“MSAs”)

High barrier to entry markets with limited supply

growth

Markets with solid demand growth due to multiple

demand generators, including corporate, convention,

leisure and government

Chesapeake’s Hotel Investment Strategy

Investment focus will primarily be on upper-upscale hotels in major business,

airport and convention markets in the United States and, on a selective

basis, premium select-service hotels

6/10/2010 |

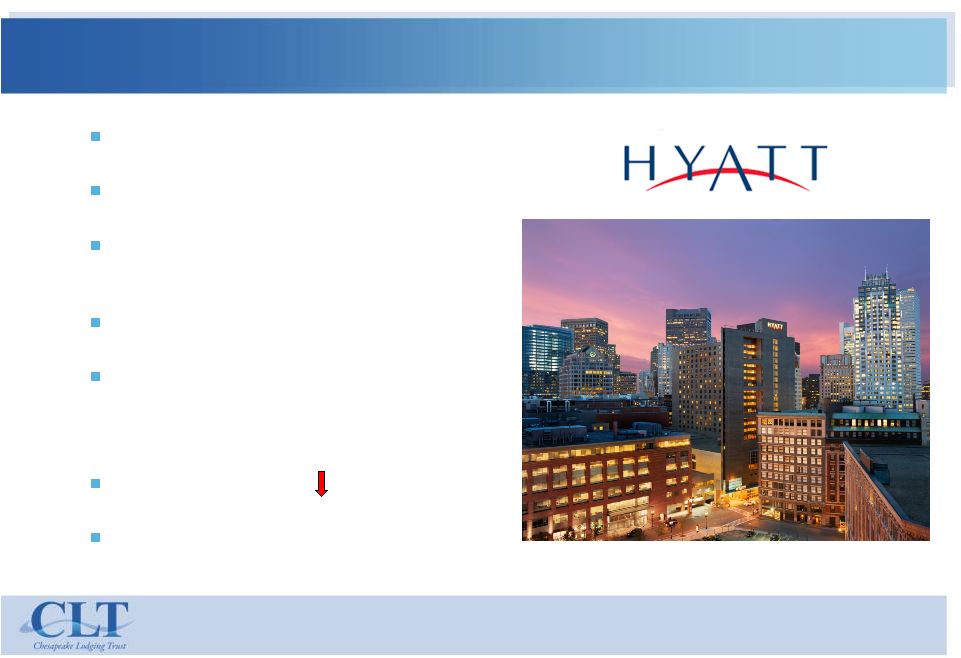

10

Strategic Sourcing Agreement with Hyatt

Hyatt commitment

Alignment of interest with widely recognized

hospitality company with industry-leading hotel

brands

IPO investment of $8.5M or 4.8% of Chesapeake's

outstanding common equity

3-year sourcing agreement intended to deliver

benefits to both companies

Preferred manager relationship with pre-

negotiated agreements

Hyatt retains right to manage or franchise in

certain situations

We believe the strategic Sourcing Agreement with Hyatt will enhance our ability to

execute

our business strategy

6/10/2010 |

11

Extensive Industry Relationships Create A Strong

Sourcing Platform

Public REITs

Hyatt

sourcing agreement

Other global branded hotel

companies

(Marriott, Starwood,

Hilton, etc.)

Commercial real estate

and

hotel brokers

Chesapeake

Investment

Opportunities

Independent third-party

management companies

Private equity funds and

other institutional owners

Lenders such as national

and regional banks,

insurance companies, &

mezzanine debt investors

CMBS special

servicers

6/10/2010 |

12

Completed Acquisition –

Hyatt Regency Boston

$112 million purchase price ($225,000 per key)

Full-service, upper-upscale

Boston, Massachusetts (located within Boston’s

Financial District and the Downtown Crossing)

498 rooms

Contemporary guestrooms and suites with more

than 20,000 sq. ft. of meeting and function space,

including a 5,000 sq. ft. grand ballroom

Peak-to-Trough

NOI

¹

:

40%

Purchased from Hyatt

1

Peak and trough represent 2007 and 2009, respectively

6/10/2010 |

13

Completed Acquisition –

Hilton Checkers Los Angeles

$46 million purchase price ($245,000 per key)

Full-service, Four-Diamond, upper-upscale

Los Angeles, California (located in the heart of the

financial and business district)

188 rooms

Recognized as the only deluxe, European-styled

boutique property in downtown LA

Peak-to-Trough

NOI

¹

:

30%

1

Peak and trough represent 2008 and 2009, respectively

6/10/2010 |

14

Pending Acquisition –

Courtyard Anaheim at Disneyland

Resort

$25 million purchase price ($163,000 per key)

Select-service, upscale

Anaheim, California (one block from the Anaheim

Convention Center and four blocks from the

Disneyland Resort)

153 rooms

Contemporary public spaces with guestrooms

averaging over 400 sq. ft. with 18 larger family

friendly “kid suites”

Peak-to-Trough

NOI

¹

:

25%

1

Peak and trough represent 2007 and 2009, respectively

6/10/2010 |

15

Pipeline

One

hotel

under

signed

LOI

(over

$75M

with

400+

rooms;

top

5

market)

LOIs

issued on 3 additional hotels for approximately $80M total

Pipeline activity continues to increase each month

Actively

working

on

an

additional

15

–

20

targets

with

over

5,000

rooms

6/10/2010

Disclaimer: Our ability to complete the acquisitions in our pipeline depends on many factors,

including our ability to reach agreements with the prospective sellers, satisfactory diligence

reviews and our access to sufficient funding. We cannot assure that any of these deals will be completed. |

16

Lodging Industry Fundamentals

Lodging industry is cyclical and has historically rebounded following economic

downturns In 2008, the lodging industry began experiencing a significant

downturn 2009

RevPAR

declined

16.7%

¹

for

the

full

year,

a

significantly

larger

decline

than

the

two

most

recent

lodging industry downturns in 1991 and 2001/2002

2010

RevPAR

is

expected

to

decline

slightly

¹

,

however,

lodging

demand

has

recently

begun

showing

signs of improvement as the economy recovers and business fundamentals stabilize

New supply leading into this downturn was moderate compared to the last two

downturns and is expected

to

remain

constrained

²

Lodging

industry

has

experienced

prolonged

RevPAR

growth

following

past

industry

downturns

1991:

9

consecutive

years

of

annual

RevPAR

growth

totaling

44.5%

³

2001/2002:

5

consecutive

years

of

annual

RevPAR

growth

totaling

33.5%

³

We believe that the expected growth in demand, coupled with a supply constrained

environment can result in

significant

RevPAR

growth

HVS

projects

total

RevPAR

growth

of

43.2%

4

through

2015

1

Source:

2009A:

Smith

Travel

Research,

2010E:

HVS

2

Source:

1998A

–

2009A:

Smith

Travel

Research,

20010E

–

2015E:

HVS

3

Source:

1992A

–

2002A:

Smith

Travel

Research

4

Source:

2010E

–

2015E:

HVS;

represents

total

growth

rate

between

2010

–

2015

based

on

projected

RevPAR

6/10/2010 |

17

Low Supply Growth Coupled With High Demand Creates

RevPAR

Growth

U.S. RevPAR, Room Supply, and Room Demand Annual % change

(1988 –

2015E)

Source: 1988A-2009A: Smith Travel Research, 2010E-2015E: HVS

6/10/2010

(17.5%)

(12.5%)

(7.5%)

(2.5%)

2.5%

7.5%

12.5%

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010E

2011E

2012E

2013E

2014E

2015E

RevPAR

Supply

Demand |

18

$30

$35

$40

$45

$50

$55

$60

$65

$70

1988

1991

1994

1997

2000

2003

2006

2009

600

650

700

750

800

850

900

950

1,000

1,050

1,100

1988

1991

1994

1997

2000

2003

2006

2009

Strong Sustained Growth Through Multiple Business Cycles

U.S.

Room

Demand

–

Annual

Aggregate

Room

Nights

(millions)

Source: 1988A-2009A: Smith Travel Research

U.S.

Annual

RevPAR

–

Each

RevPAR

peak

has

been

at

a

higher

level

than

the

prior

peak

6/10/2010 |

19

2010 Industry Trends: Stabilization Has Begun

Statistic

% Change

Y-O-Y

Occupancy

53.6%

3.0%

ADR

$96.73

(3.4)%

RevPAR

$51.82

(0.6)%

Supply

2.7%

Demand

5.7%

Source: Smith Travel Research

April 2010 YTD

6/10/2010

Statistic

% Change

Y-O-Y

Occupancy

58.1%

5.3%

$97.81

ADR

(1.6)%

RevPAR

$56.86

3.7%

Supply

2.6%

Demand

8.1%

March & April 2010 |

20

Growth-oriented Capital Structure With No Legacy Issues

Clean

balance

sheet/No

legacy

issues

Revolving credit facility to be put in place to provide flexibility and additional

growth capital $85 million with accordion up to $115 million

Initial maturity in 2012 with one-year extension option

Debt financing policy

Target overall debt level of up to 50% of aggregate hotel purchase prices

Intend to utilize secured property level mortgages

Dividend policy

Pay out a minimum of 90% of REIT taxable income

Expect to pay cash dividends out of current income

Chesapeake

will

have

no

legacy

issues

and

be

able

to

focus

on

sourcing,

underwriting

and

acquiring high-quality hotel properties

6/10/2010 |

21

Purchasing Power/Capacity

Net IPO Proceeds

169

$

Revolving Credit Facility

85

Less: Working Capital

(5)

Less: Completed and Pending Acquisitions

Hyatt Regency Boston

(112)

Hilton Checkers Los Angeles

(46)

Courtyard Anaheim at Disneyland Resort

(25)

Completed and Pending Acquisitions

(183)

Net

66

$

Plus: Incremental Leverage (45%)

30

Gross

96

$

($ in millions)

6/10/2010 |

22

Key Investment Highlights

Extensive industry relationships including strategic relationship with

Hyatt to drive pipeline

Experienced

management

team

with

strong

public

company

track

record

Improving industry fundamentals

Growth-oriented capital structure/favorable valuation

Compelling market opportunity validated by recent acquisitions and

current pipeline

6/10/2010 |