Attached files

| file | filename |

|---|---|

| 8-K - L-1 IDENTITY SOLUTIONS 8-K 6-8-2010 - L-1 IDENTITY SOLUTIONS, INC. | mm06-0810_8k.htm |

EXHIBIT 99.1

Morgan

Joseph 2010 Best Ideas

Conference

June

9, 2010

Strategic

Objectives

• L-1

is the premier identity management Company delivering customized

and interoperable

solutions and services that meet any ID program requirement

solutions and services that meet any ID program requirement

– L-1 remains at the

forefront of the latest advances in multi-modal biometric recognition

capabilities as a

means to uniquely identify individuals

means to uniquely identify individuals

– L-1 advanced

technologies are used to produce the most secure identification documents

possible that

serve as proof of identity

serve as proof of identity

– Today government

consulting services address the most important areas of security and

intelligence

and L-1 will expand capabilities into new areas such as language analysis

and L-1 will expand capabilities into new areas such as language analysis

• Practice

strong operational, program and financial discipline

– Exceptional program

performance in support of customer’s vision

– Achieve organic

growth in the 10-15% range

annually

– Profitable, with

solid margins and strong cash flow

• Strategic

alternatives update

– As L-1 has

disclosed, L-1 and its financial advisors are continuing their discussions with

a number of

interested parties as part of the previously announced strategic alternative process

interested parties as part of the previously announced strategic alternative process

– L-1 is satisfied

with the progress of the process to date

2

3

L-1

Market Position Today

• Providing

industry- leading

solutions and services to solve ID

management challenges for

customers in 40 countries

– Multi-biometric

recognition (finger, face, iris,

full hand, vein)

full hand, vein)

– Biometric solutions

utilized for managing

world’s largest and most complex identity

databases

world’s largest and most complex identity

databases

– Government services

design, develop and

implement and run sophisticated global

networks and IT systems

implement and run sophisticated global

networks and IT systems

– More than 2B

identity documents produced

to date with L-1 solutions

to date with L-1 solutions

– Largest civilian

enrollment network in the

U.S. and Canada

U.S. and Canada

Evolution

of Identity Management

Identity

Related

Issues Emerge

Issues Emerge

Markets

Converge to

Meet the

Challenge

Converge to

Meet the

Challenge

L-1

Emerges

as the First

Pure-Play

Provider

as the First

Pure-Play

Provider

4

Security

Defense

Intelligence

Technology

Market

Fundamentals

5

• Attractive

identity market fundamentals

– $5B

global market, significant

domestic / international growth

opportunities

opportunities

– Industry analysts

expect market growth

of 15 - 20% annually

through 2017

through 2017

– Global market

expected to be >$9B by 2014 with

significant

growth in law enforcement, military, National ID, State and Local

and transportation markets

growth in law enforcement, military, National ID, State and Local

and transportation markets

• Government

consulting services address the

highly fragmented $45B U.S. Intelligence

services market

highly fragmented $45B U.S. Intelligence

services market

Customers

and Markets

Markets

Served

• U.S. and

foreign

military services

military services

• Law enforcement

and

public safety

public safety

• Border

management

• Civilian

programs

• Critical

infrastructure

Diverse

Customer Base

%

of FY09 Rev by Customer

S&L

33%

33%

Intel

30%

30%

DoD

10%

10%

Int’l

7%

7%

DHS

6%

6%

Other

7%

7%

DoS

7%

7%

6

Market-Leading

Technology

• 400

leading patents and applications in six areas

related to identity

related to identity

– Fundamental

biometric algorithms in face, finger, iris, skin,

3D modalities

3D modalities

– System architecture

for scalability of matching and fusion

– Imaging technology

for biometric capture

– Mobile biometric

technology

– Securing and

producing credentials

– Methodology and

process patents for a wide range of ID solutions and

applications

applications

7

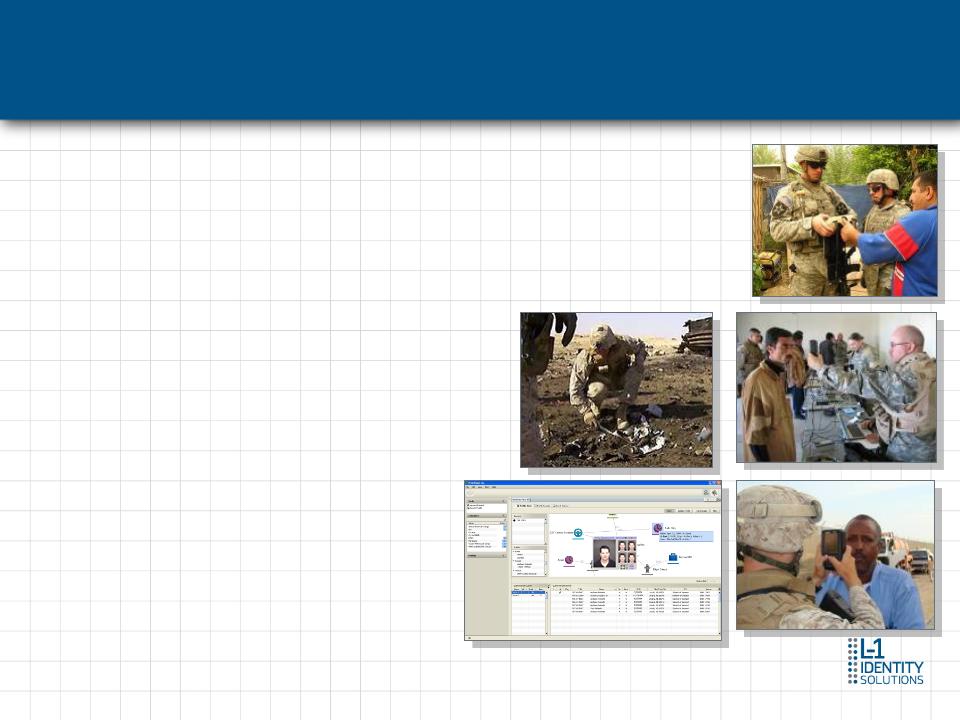

U.S.

and Foreign Military Services

8

• Solutions and

services trusted by American and foreign

military services, defense and intelligence agencies to

determine ally from enemy and establish identity

dominance in areas of conflict

military services, defense and intelligence agencies to

determine ally from enemy and establish identity

dominance in areas of conflict

• Solution

components

– Protecting

military personnel and

civilian populations

civilian populations

– Denying

anonymity to adversaries

– Assuring

information superiority

• Programs of

note

– U.S.

Department of Defense (DoD)

Next Generation ABIS

Next Generation ABIS

– U.S. Armed Forces

rely on HIIDE and

PIER; more than 13,000 units are in

the theater of operation today

PIER; more than 13,000 units are in

the theater of operation today

– European

Ministries of Defense

incorporate the L-1 ABIS for multi-biometric enrollment, watchlist

management and forensics / latent analysis capabilities

incorporate the L-1 ABIS for multi-biometric enrollment, watchlist

management and forensics / latent analysis capabilities

9

Law

Enforcement and Public Safety

• L-1

technology and services are trusted solutions for law enforcement

efforts and address public safety concerns of government agencies

efforts and address public safety concerns of government agencies

• Solution

components

– Identity

data

management for inter- and intra-agency information sharing for

criminal

processing, crime solving and crime prevention

processing, crime solving and crime prevention

– Criminal

processing from an officer’s

initial encounter of a potential suspect on the street through

incarceration and eventual parole

incarceration and eventual parole

– Crime

solving

forensic analysis and investigative tools

– Crime

prevention through identifying

known criminals in real-time before they can do harm

– Enrollment

services remove the burden of

civilian fingerprinting from police stations

– Advanced Concepts

improves public

safety information technology systems and networks

9

Border

Management

• Solutions and

services that facilitate faster and more

secure border crossings

secure border crossings

• Solution

components

– Enrolling,

issuing and authenticating travel documents

– Facilitating

faster and safer frequent travel

– Traveler

screening

– Securing

restricted areas

• Programs of

note

– DHS contracts:

transportation / Homeland Security

– Exclusive provider -

U.S.

Border Crossing Card,

Passport Card; sole source production - U.S. Passport

Passport Card; sole source production - U.S. Passport

– Face recognition

platform supports

U.S. Visa applicant

processing and U.S. Passport services

processing and U.S. Passport services

– Solutions used at

more than 50

UAE border locations

– Many international

customs

and immigration border

checkpoints

– Automated

Border Control for ePassport

Holders

10

Civilian

Programs

• Solutions

and services help safeguard a wide range of civil programs

from identity-related fraud

from identity-related fraud

• Solution

components

– Performing

background checks for government licenses and permits

– Enrolling and

verifying participants in government

entitlement programs

entitlement programs

– Issuing secure

identity documents

• Programs

of note

– HAZPrint,

TWIC

– Andhra Pradesh

Ration Cards, India

– UN World Food

Program

– Produce more than 80

percent of U.S.

State driver’s licenses

State driver’s licenses

– National IDs and

Voter Registration Cards

– Passports /

ePassports

11

Critical

Infrastructure

• Solution

components

– Performing

pre-employment background checks

§ Financial

services firms, healthcare organizations,

educational institutions, casinos and gaming

educational institutions, casinos and gaming

– Using

biometrics to control access to buildings

– Protecting

information systems from cyber attack

• Programs

of note

– Major

banks /

enrollment services for FINRA submissions

– Texas

Board of Educator certification / enrollment

services

– World’s

largest casino in Macao / finger and 3D

face

access control

access control

– A

large international retailer / face

recognition

– Global

transportation companies / government

consulting

services

services

12

• Solutions

combine industry-leading ABIS® software

with advanced biometric readers, capture and

authentication devices, access control units

with advanced biometric readers, capture and

authentication devices, access control units

– Mobile

identification devices (HIIDEÔ, PIER Ô, IBIS)

– Access control

systems

– Iris recognition

systems

– Finger / full hand

solutions (single, dual and

tenprint fingers; palm, full hand)

tenprint fingers; palm, full hand)

– Face

solutions

– Multi-biometric

stations

• Playing

an integral role in the world’s largest identity-

related programs

related programs

– Search and match

capabilities for the DoD

ABIS system

– DoS

Visa issuance program - 85 million record

database

– More than

13,000

mobile devices fielded in areas of

conflict

– De-duplication of

>80 million records in the world’s

largest

biometric and demographic de-duplication exercise - India

biometric and demographic de-duplication exercise - India

13

Biometric

Solutions

14

14

ABIS®

System Solutions Platform

14

15

Secure

Credentialing Solutions

• Secure

end-to-end processes and advanced technologies used by

thousands of government customers worldwide to produce the most

secure identity documents possible

thousands of government customers worldwide to produce the most

secure identity documents possible

– Driver’s Licenses,

Enhanced Driver’s Licenses (EDLs)

– Passports, U.S.

Passport Cards, Border Crossing Cards

– Voter Registration,

National, Universal/Unique and WHTI Compliant Tribal ID Cards

• Solutions

– Secure front and

back office processes

– Remote

services

– Self-service

kiosks

– Biometric

recognition software

– Automated knowledge

and road skills testing

– Secure production

systems

– Documents

authentication

• Produced

over two billion secure credentials to-date

– 85 million driver’s

licenses annually

• Over

80% of U.S. states use L-1 for secure driver’s license

16

Enrollment

Services

• Enrollment

services capture and submit biometric data and other information

required for processing civilian applications for government-issued ID cards,

Visas and Passports, permits and other entitlement benefits

required for processing civilian applications for government-issued ID cards,

Visas and Passports, permits and other entitlement benefits

– Approx. 6M people

processed to date; 2M annually

– Largest network in

the U.S. and Canada

with more than 1,000 locations

with more than 1,000 locations

• Complete

outsourced solution

– Secure self-service

Web portal

– Customized data

collection and enrollment

– Convenient locations

near applicant populations

– Direct electronic

channeling and response

– Integration with

employee records

• Wide

range of customers

– More than

5,000

educational institutions and charitable / volunteer organizations

– Nurses, doctors,

home

health care and nursing facility

workers

– Commercial drivers /

TSA HAZPrint endorsement; Maritime workers /

TWIC card

– Regulated

industries such as national

banks, brokerage firms and financial institutions

– Government

humanitarian, health and welfare program enrollment

17

Government

Services

Advanced

Concepts

Information Technology

Information Technology

§

Cyber

security

§

Information assurance

§

Systems engineering

§

Telecommunications R&D

§

Public safety consulting

SpecTal

Intelligence Services

Intelligence Services

§

Intelligence

analysis

§

Operations support

§

Training

§

Information technology

§

Physical security

§

Language analysts

§ Systems

engineering and integration

§

GEOINT and MASINT science

§

Intelligence analysis

§

Operations capabilities

• More

than 1,000 specialists,

most holding top security

clearances, expected to grow

by 15 percent in 2010

most holding top security

clearances, expected to grow

by 15 percent in 2010

• Intelligence

playing larger

and more important role in

fighting the War on Terror

and more important role in

fighting the War on Terror

McClendon

Engineering & Analytical

Financial

Review

19

** Reflects

the midpoint

of the guidance range

***

Organic growth represents the increase in revenues in the latest period,

expressed as a percentage; it excludes revenues from businesses acquired both in

the

latest period and the prior period

latest period and the prior period

****

Actual results may differ from estimated results, which are subject to the risks

and uncertainties disclosed in the Company's filings with the Securities

and

Exchange Commission

Exchange Commission

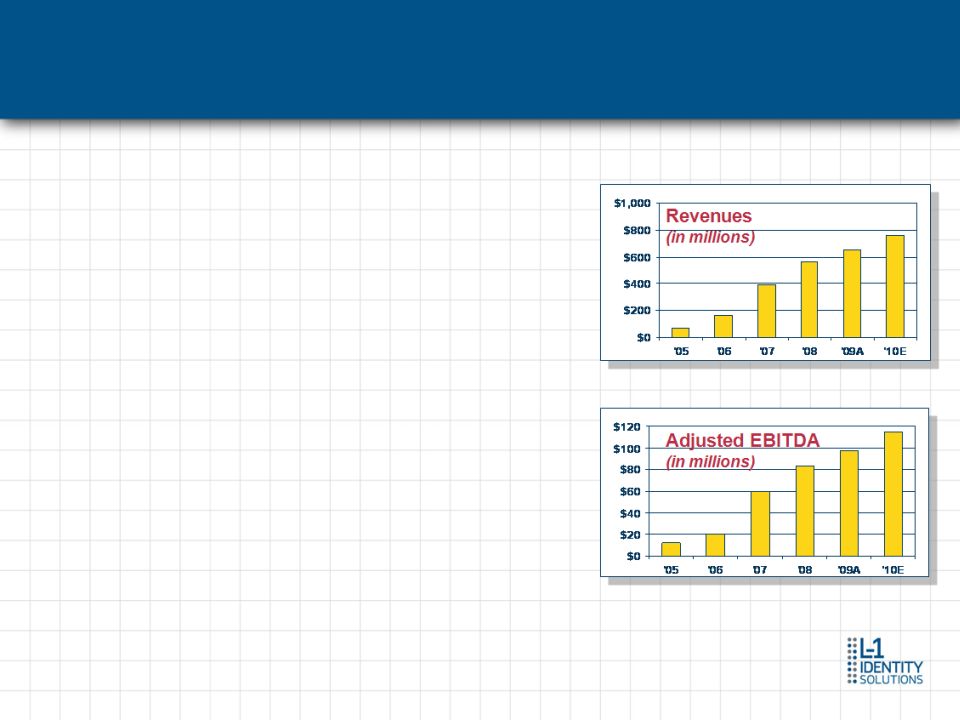

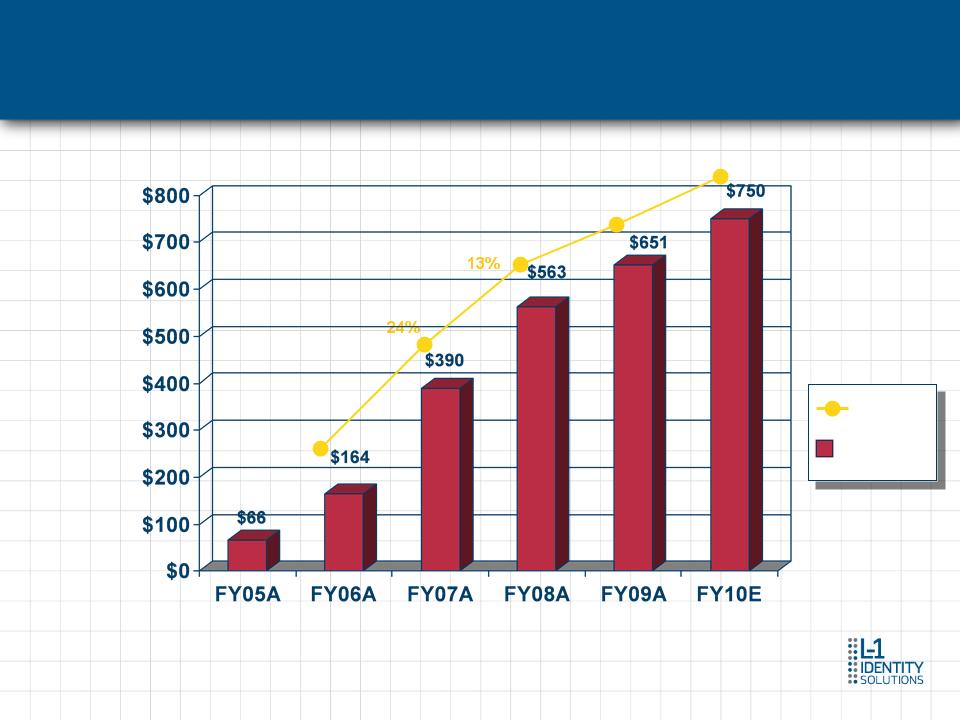

Strong

Revenue and Organic Growth

Five

Year Revenue CAGR - 63%

$

in Millions

Organic

Growth***

Growth***

Revenue

**

****

6%

15%

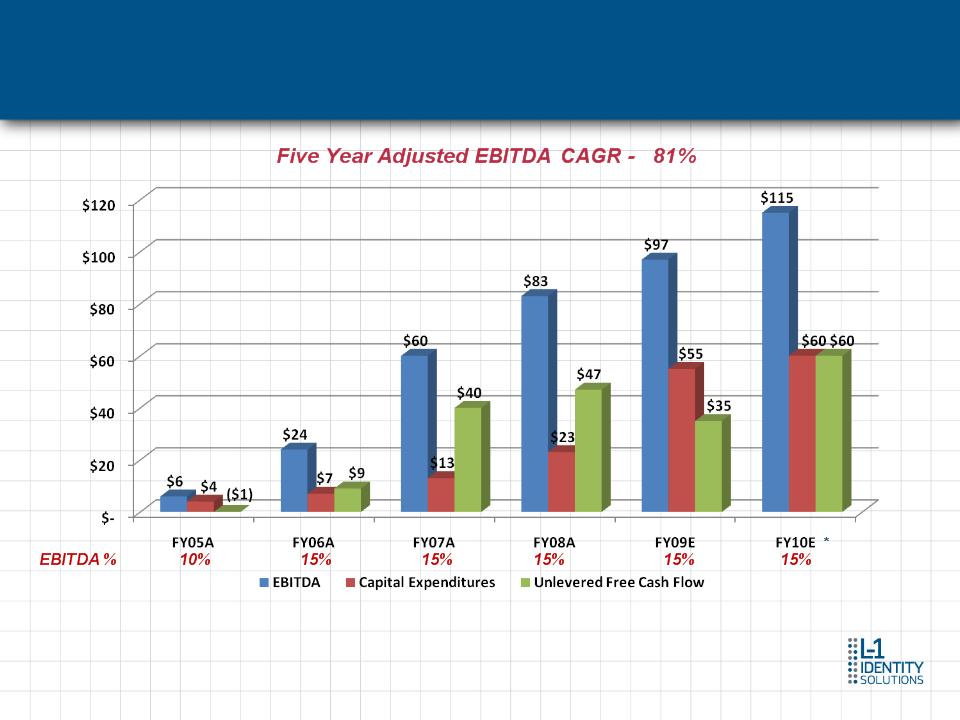

Solid

Adjusted EBITDA and Strong Cash Generation

($

in millions)

*Actual

results may differ from estimated results, which are subject to the risks and

uncertainties

disclosed in the Company's filings with the Securities and Exchange Commission

disclosed in the Company's filings with the Securities and Exchange Commission

20

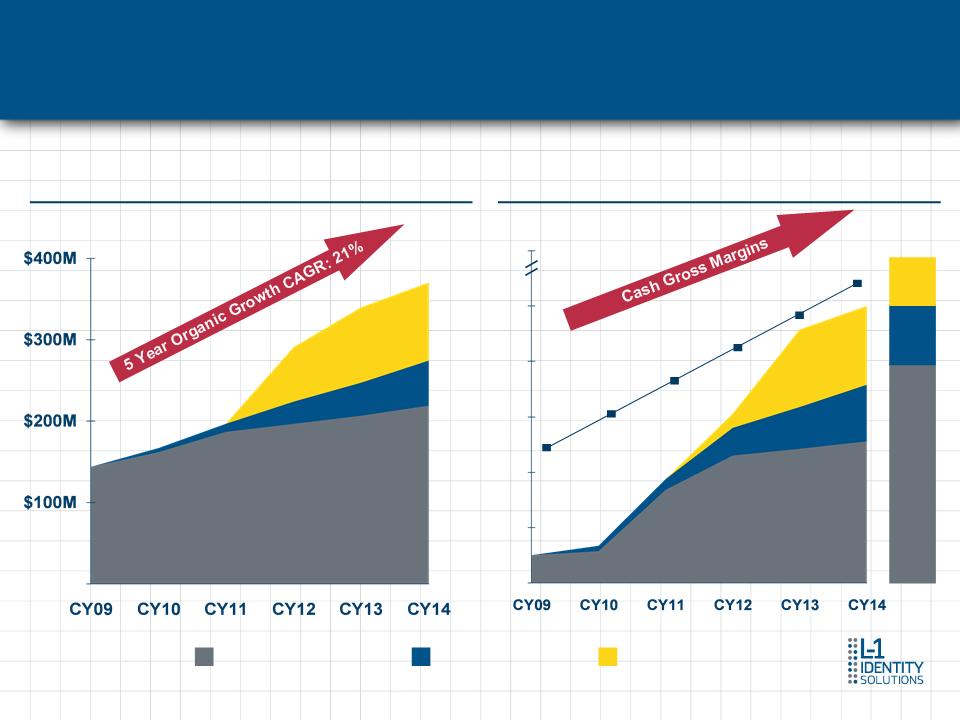

DMV

Franchise

L-1’s

commitment to investing in its DMV franchise yields strong organic growth,

visibility, cash flows

and access to valuable adjacent markets

and access to valuable adjacent markets

DMV

Revenues

Base

Card Issuance

DMV

Cash Flows*

* Cash

Gross Margins Less Capex

Web

Portal Kiosk

Real ID

Per Card

5

Year

Cum

Cum

48%

50%

54%

56%

57%

58%

$200M

$150M

$100M

$50M

$600M

21

22

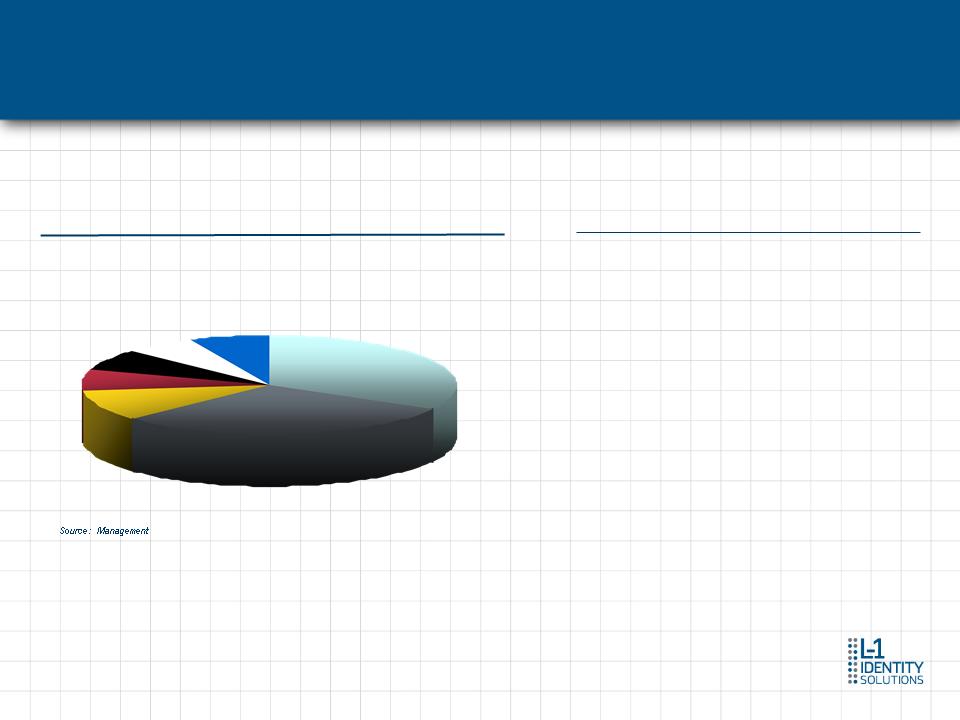

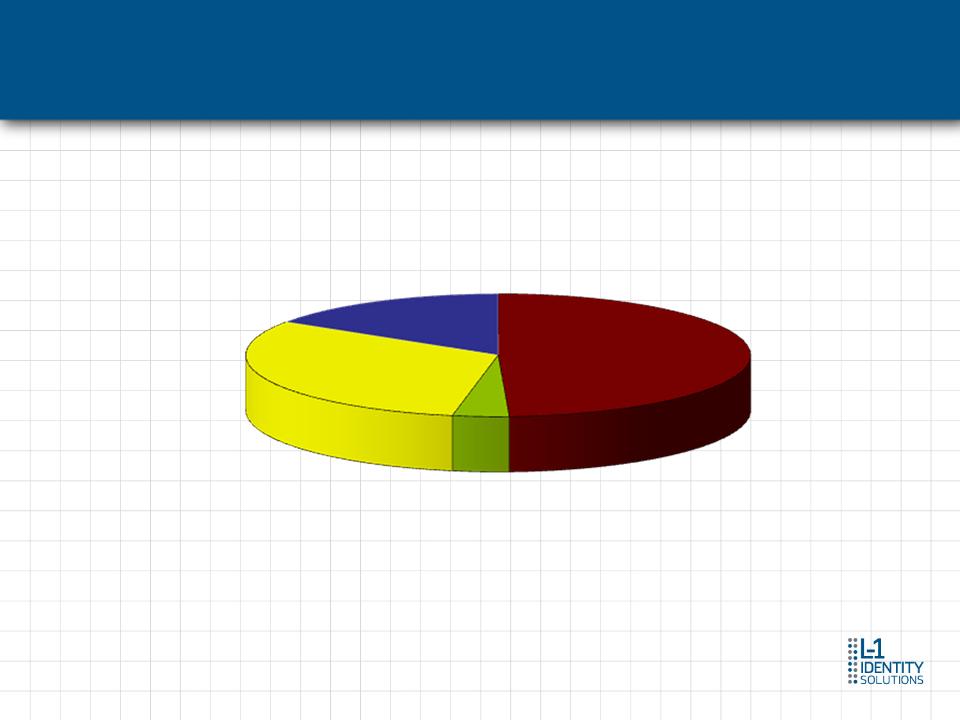

Diverse

Backlog

Enrollment

Services

Secure

Credentialing

Biometric

Solutions

Government

Consulting Services

17%

47%

4%

32%

Approximately

$1.3 Billion of Total Backlog

23

Safe

Harbor Statement

This

presentation contains forward-looking statements that involve risks and

uncertainties. Forward-looking

statements in this document and those made from time to time by L-1 Identity Solutions, Inc. through its

senior management are made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements reflect the Company's current views based on

management's beliefs and assumptions and information currently available. Forward-looking statements

concerning future plans or results are necessarily only estimates, and actual results could differ materially

from expectations. Certain factors that could cause or contribute to such differences include, among other

things, the availability of government funding for L-1's products and solutions and the unpredictable nature

of working with government customers, L-1’s federal, state, local and international contract awards and the

size and timing of such awards, L-1’s performance on existing and future contracts, general economic and

political conditions and other factors affecting spending by customers, generally. Additional risks and

uncertainties are described in the Securities and Exchange Commission filings of L-1 Identity Solutions,

including its Form 10-K for the year ended December 31, 2009. L-1 Identity Solutions expressly disclaims any

intention or obligation to update any forward-looking statements.

statements in this document and those made from time to time by L-1 Identity Solutions, Inc. through its

senior management are made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements reflect the Company's current views based on

management's beliefs and assumptions and information currently available. Forward-looking statements

concerning future plans or results are necessarily only estimates, and actual results could differ materially

from expectations. Certain factors that could cause or contribute to such differences include, among other

things, the availability of government funding for L-1's products and solutions and the unpredictable nature

of working with government customers, L-1’s federal, state, local and international contract awards and the

size and timing of such awards, L-1’s performance on existing and future contracts, general economic and

political conditions and other factors affecting spending by customers, generally. Additional risks and

uncertainties are described in the Securities and Exchange Commission filings of L-1 Identity Solutions,

including its Form 10-K for the year ended December 31, 2009. L-1 Identity Solutions expressly disclaims any

intention or obligation to update any forward-looking statements.

24

Defined

Financial Terms

Adjusted

EBITDA

L-1

Identity Solutions uses Adjusted EBITDA as a non-GAAP financial performance

measurement. Adjusted

EBITDA is calculated by adding back to net income (loss) interest, income taxes, impairments of long-lived

assets and goodwill, depreciation, amortization, stock-based compensation expense, including retirement plan

contributions settled, or to be settled, in common stock. Adjusted EBITDA is provided to investors to

supplement the results of operations reported in accordance with GAAP. Management believes Adjusted

EBITDA is useful to help investors analyze the operating trends of the business and to assess the relative

underlying performance of businesses with different capital and tax structures. Management believes that

Adjusted EBITDA provides an additional tool for investors to use in comparing L-1 Identity Solutions financial

results with other companies that also use Adjusted EBITDA in their communications to investors. By

excluding non-cash charges such as impairments of long-lived assets and goodwill, amortization, depreciation

and stock-based compensation, as well as non-operating charges for interest and income taxes, investors can

evaluate the Company's operations and can compare its results on a more consistent basis to the results of

other companies. Management also uses Adjusted EBITDA to evaluate potential acquisitions, establish internal

budgets and goals, and evaluate performance of its business units and management.

EBITDA is calculated by adding back to net income (loss) interest, income taxes, impairments of long-lived

assets and goodwill, depreciation, amortization, stock-based compensation expense, including retirement plan

contributions settled, or to be settled, in common stock. Adjusted EBITDA is provided to investors to

supplement the results of operations reported in accordance with GAAP. Management believes Adjusted

EBITDA is useful to help investors analyze the operating trends of the business and to assess the relative

underlying performance of businesses with different capital and tax structures. Management believes that

Adjusted EBITDA provides an additional tool for investors to use in comparing L-1 Identity Solutions financial

results with other companies that also use Adjusted EBITDA in their communications to investors. By

excluding non-cash charges such as impairments of long-lived assets and goodwill, amortization, depreciation

and stock-based compensation, as well as non-operating charges for interest and income taxes, investors can

evaluate the Company's operations and can compare its results on a more consistent basis to the results of

other companies. Management also uses Adjusted EBITDA to evaluate potential acquisitions, establish internal

budgets and goals, and evaluate performance of its business units and management.

L-1

Identity Solutions considers Adjusted EBITDA to be an important indicator of the

Company's operational

strength and performance of its business and a useful measure of the Company's historical and prospective

operating trends. However, there are significant limitations to the use of Adjusted EBITDA since it excludes

interest income and expense, impairments of long lived assets and goodwill, stock based compensation

expense, including retirement plan contributions settled, or to be settled, in common stock and income taxes,

all of which impact the Company's profitability, as well as depreciation and amortization related to the use of

long term assets which benefit multiple periods. L-1 Identity Solutions believes that these limitations are

compensated by providing Adjusted EBITDA only with GAAP net income (loss) and clearly identifying the

difference between the two measures. Consequently, Adjusted EBITDA should not be considered in isolation or

as a substitute for net income (loss) presented in accordance with GAAP. Adjusted EBITDA as defined by the

Company may not be comparable with similarly named measures provided by other entities.

strength and performance of its business and a useful measure of the Company's historical and prospective

operating trends. However, there are significant limitations to the use of Adjusted EBITDA since it excludes

interest income and expense, impairments of long lived assets and goodwill, stock based compensation

expense, including retirement plan contributions settled, or to be settled, in common stock and income taxes,

all of which impact the Company's profitability, as well as depreciation and amortization related to the use of

long term assets which benefit multiple periods. L-1 Identity Solutions believes that these limitations are

compensated by providing Adjusted EBITDA only with GAAP net income (loss) and clearly identifying the

difference between the two measures. Consequently, Adjusted EBITDA should not be considered in isolation or

as a substitute for net income (loss) presented in accordance with GAAP. Adjusted EBITDA as defined by the

Company may not be comparable with similarly named measures provided by other entities.

25

Defined

Financial Terms

Backlog

L-1's

backlog represents sales value of firm orders for products and services not yet

delivered

and for long term executed contractual arrangements (contracts, subcontracts, and customer

commitments), the estimated future sales value of estimated product shipments, transactions

processed and services to be provided over the term of the contractual arrangements,

including renewal options expected to be exercised. L-1 may not realize the full amount of

revenues reflected in backlog because L-1 is subject to the risks that clients may modify or

terminate projects and contracts and may decide not to exercise contract options or the

estimate of quantities may not.

and for long term executed contractual arrangements (contracts, subcontracts, and customer

commitments), the estimated future sales value of estimated product shipments, transactions

processed and services to be provided over the term of the contractual arrangements,

including renewal options expected to be exercised. L-1 may not realize the full amount of

revenues reflected in backlog because L-1 is subject to the risks that clients may modify or

terminate projects and contracts and may decide not to exercise contract options or the

estimate of quantities may not.

Unlevered

Free Cash Flow

Unlevered

free cash flow represents cash flow from operating activities, plus cash

interest

expenses and cash income taxes, less capital expenditures. L-1 believes unlevered free cash

flow is a useful measure for assessing the company's liquidity, its ability to meet debt service

requirements and making acquisitions. Unlevered free cash flow is not necessarily comparable

to similar measures used by other entities and is not a substitute for GAAP measures of

liquidity such as cash flows from operating.

expenses and cash income taxes, less capital expenditures. L-1 believes unlevered free cash

flow is a useful measure for assessing the company's liquidity, its ability to meet debt service

requirements and making acquisitions. Unlevered free cash flow is not necessarily comparable

to similar measures used by other entities and is not a substitute for GAAP measures of

liquidity such as cash flows from operating.

26

Defined

Financial Terms

CAGR

Compound

Annual Growth Rate (CAGR) is the year-over-year

growth rate of an investment over a specified period of time. It is

calculated by taking the nth root of the total percentage growth

rate, where n is the number of years in the period being

considered.

growth rate of an investment over a specified period of time. It is

calculated by taking the nth root of the total percentage growth

rate, where n is the number of years in the period being

considered.

Organic

Growth

Organic

growth represents the increase in revenues in the current

period, expressed as a percentage. It excludes businesses

acquired in 2008 for both 2008 and 2009.

period, expressed as a percentage. It excludes businesses

acquired in 2008 for both 2008 and 2009.