Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AUXILIUM PHARMACEUTICALS INC | d8k.htm |

1

June 2010

(NASDAQ: AUXL)

Exhibit 99.1 |

2

Safe Harbor Statement

We will make various remarks during this presentation that constitute “forward-looking

statements” for purposes of the safe harbor provisions under The Private Securities Litigation

Reform Act of 1995, including statements regarding the opportunities to build shareholder value; the

potential for XIAFLEX to be a blockbuster opportunity; the amount of revenues that XIAFLEX may

generate; the potential for XIAFLEX to be used in multiple indications; the generation of cash through licensing of XIAFLEX in other territories and for new

indications; the Company’s ability to achieve its objectives for the U.S. launch of XIAFLEX for

Dupuytren’s in 2010; the size of the U.S. market for Dupuytren’s; the interpretation of

market research data; interpretation of clinical results, including the efficacy and tolerability of

the Company’s products and product candidates, and recurrence rates; the ability to obtain

reimbursement in the U.S. for XIAFLEX for the treatment of Dupuytren’s and the timing thereof; the timing of new reimbursement codes for XIAFLEX; the Company’s

intention to and the timing of announcing any XIAFLEX U.S. revenues; the Company’s intention to

provide XIAFLEX revenue guidance for the third quarter 2010 when it releases earnings for the

second quarter 2010; the timing of the end-of-phase II meeting and of the initiation of phase III for XIAFLEX for the treatment of Peyronie’s disease; the approval of

the Marketing Authorization Application for XIAFLEX for the treatment of Dupuytren’s contracture

in the European Union; and the Company’s development and operational goals and strategic

priorities for fiscal 2010. All remarks other than statements of historical facts made during this presentation, including but not limited to, statements regarding future

expectations, plans and prospects for the Company, statements regarding forward-looking financial

information and other statements containing the words “believe,” “may,” “could,”

“will,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “expect,” and similar expressions, as they relate to the Company, constitute forward-looking statements. Actual

results may differ materially from those reflected in these forward-looking statements due to

various factors, including general financial, economic, regulatory and political condition

affecting the biotechnology and pharmaceutical industries and those discussed in Auxilium's Annual

Report on Form 10-K for the year ended December 31, 2009 and Auxilium’s Quarterly

Report on Form 10-Q for the period ended March 31, 2010 under the heading "Risk Factors“, which are on file with the Securities and Exchange Commission (the “SEC”)

and may be accessed electronically by means of the SEC’s home page on the Internet at

http://www.sec.gov or by means of the Company’s home page on the Internet at

http://www.auxilium.com under the heading “Investor Relations - SEC Filings.” There may

be additional risks that the Company does not presently know or that the Company currently

believes are immaterial which could also cause actual results to differ from those contained in the forward-looking statements. Given these risks and uncertainties, any or

all of these forward-looking statements may prove to be incorrect. Therefore, you should not rely

on any such factors or forward-looking statements. In addition, forward-looking statements provide the Company’s expectations, plans or

forecasts of future events and views as of the date of this presentation. The Company

anticipates that subsequent events and developments will cause the Company’s assessments to

change. However, while the Company may elect to update these forward-looking statements at

some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the

Company’s assessments as of any date subsequent to the date of this presentation.

|

3

Opportunities to Build Shareholder Value

Note: Seeking partners for Transmucosal film product candidates

® |

4 |

5

XIAFLEX –

Unique, Late-Stage, Blockbuster

Opportunity

•

Potential to be the only effective non-surgical treatment for two high unmet

needs:

Approved on February 2, 2010 for Dupuytren’s Contracture in U.S.

Promising phase IIb results in Peyronie’s disease

•

Well-characterized mode of action

•

Worldwide rights support growth

Build company in North America

Partnered with Pfizer in EU for Dupuytren’s and Peyronie’s

Opportunity to add additional indications

Rights for other territories or indications could generate additional cash

•

We believe worldwide peak revenues for XIAFLEX could be in excess

of $1 Billion annually |

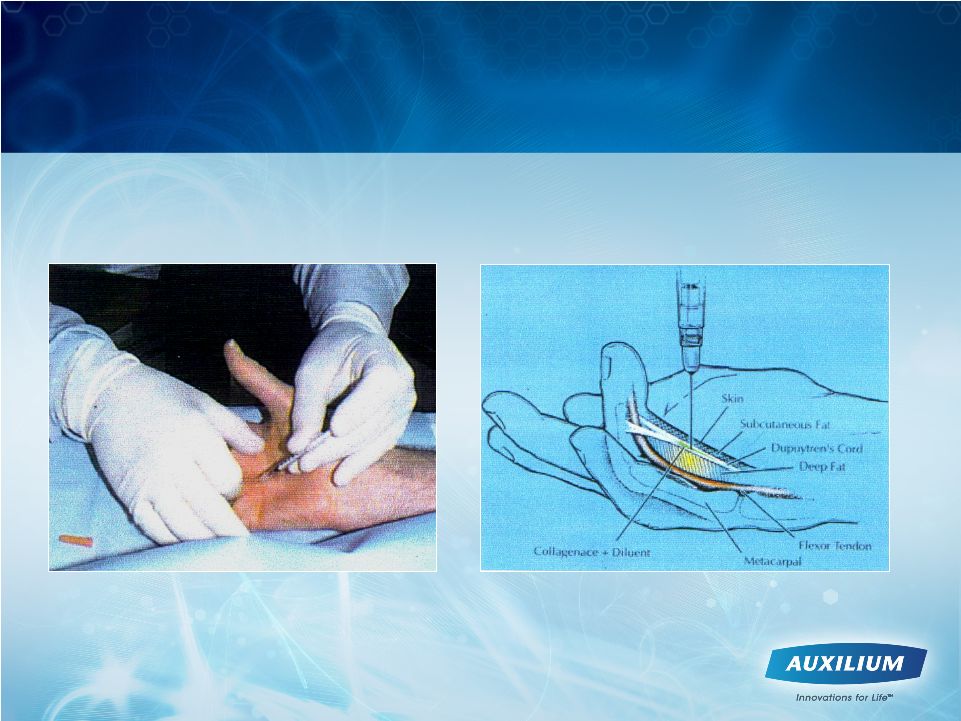

6

•

Excessive collagen deposition in

fascia of hand

•

Nodules represent early, active form

•

Cords develop over time, are palpable,

and result in contractures

•

Quality of life and daily activities can

be significantly affected

•

Surgery has been the current standard of

care and may be reserved for advanced

disease due to unpredictable results,

complications, long recovery and

recurrence/additional surgeries

Dupuytren’s Contracture is Debilitating for Patients

|

7

•

Surgery

•

Needle fasciotomy/

aponeurotomy

•

Amputation

Treatment Options Historically Limited to Invasive

Surgery with Significant Recuperation or Are

Unapproved and Ineffective

•

Non-surgical options

>

Splinting

>

Physical therapy

>

Corticosteroids |

8

XIAFLEX Offers the First Nonsurgical Treatment

for Dupuytren’s Contracture |

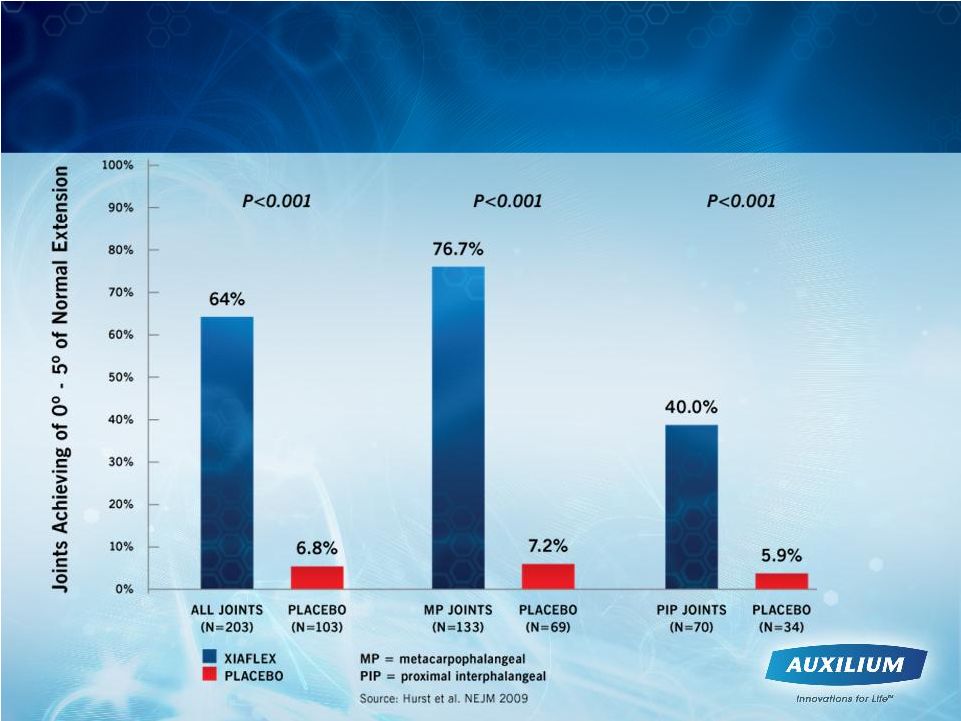

A

Significant Number of Dupuytren’s Contracture

Patients Benefited from Treatment with XIAFLEX

9 |

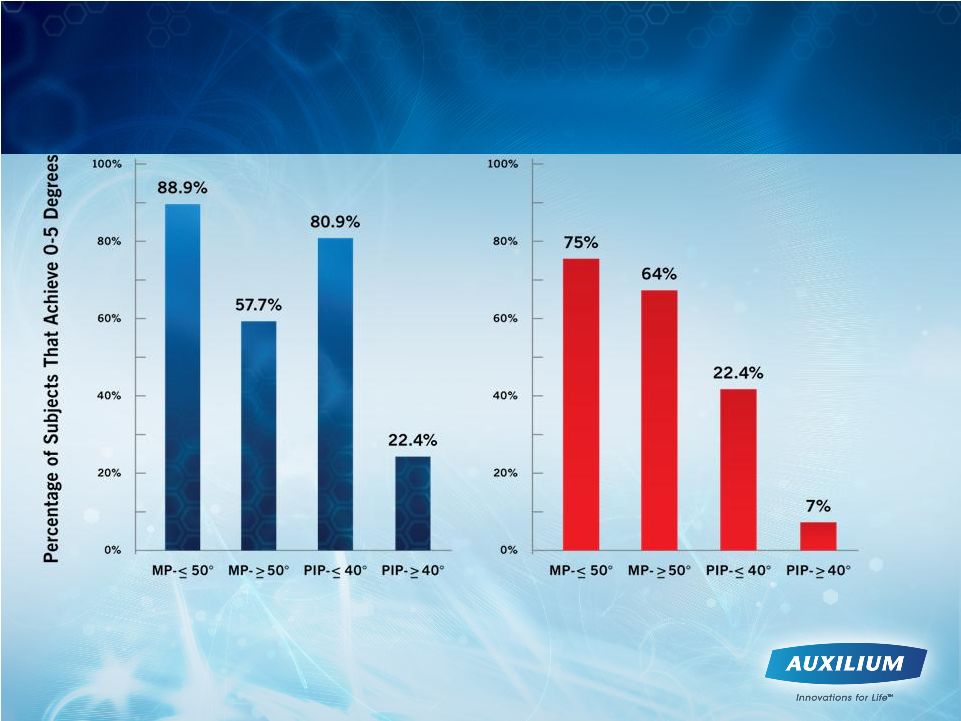

10

Early Intervention with XIAFLEX May Be the

Most Effective Treatment Approach

Hurst et al. NEJM 2009

N=248

N=125

Keith Denkler, M.D. Plast. Reconstr. Surg., 115802, 2005

Dupuytren’s

Fasciectomies

in 60 Consecutive Digits using lidocaine

with

epinepherine

and no tournequet |

11

•

Most treatment related adverse events were mild or moderate in

intensity and resolved without intervention within a median of 10

days across studies

•

Serious Adverse Events possibly related to treatment were limited in

number (10 in total; 0.39% of >2600 injections)

–

4 SAEs

were tendon and ligament damage

•

No deaths, clinically meaningful changes in grip strength, arterial

injuries or nerve injuries related to XIAFLEX reported

•

No clinically meaningful changes in laboratory values

•

No clinically meaningful systemic allergic reactions

XIAFLEX Was Well-Tolerated in Phase III Studies |

12

Contracture Recurrence Affects Patients

•

The earliest reports of recurrence for surgery were seen in 22% of

female

and

19%

of

male

Dupuytren’s

contracture

patients

at

a

mean

of

12

months

following

fasciectomy

1

.

Additionally,

a

rate

of

up

to

34%

has

been

reported

within

the

first

2

years

following

surgery

2

.

•

Abstract

for

a

prospective

trial

comparing

needle

fasciotomy

to

open

fasciectomy

reported

a

recurrence

rate

for

needle

fasciotomy

of

85%

at

a mean

of

2.3

years

3

.

•

XIAFLEX Long term extension study of phase III trials will follow

recurrence rates up to 5 years. 2 year data now available.

(1) Anwar et al., The Journal of Hand Surgery, Vol. 32A No. 9 November 2007 ;

1423-1428 (2) Leclercq

C. Epidemiology. In: Tubiana

R, Leclercq

C, Hurst LC, Badalamente

MA, Mackin

EJ, eds, Dupuytren’s

disease.

Martin Dunitz

Ltd, London, 2000;239-249.

(3) A.L. Van Rijssen, 2010 International Symposium on Dupuytren’s

Disease |

13

Two Year Recurrence Rate of 19.3% for

XIAFLEX

®

in Dupuytren’s

Contracture

All Joints

MP Joints

PIP Joints

Patients from All Phase III Studies (n=950)

1,568

920

648

Patients Enrolled in Extension Study (n=634)

1,065

641

424

Patients Successfully Treated and Enrolled in Extension

Study (n=474)

619*

449*

170

Joints with Recurrence (n/%)

(119/618)

19.3%

(61/448)

13.6%

(58/170)

34.1%

Note: No patients at Year 2 had been retreated with commercial XIAFLEX

* One patient had unrelated hand surgery and post-operative bandaging prevented an

accurate assessment of recurrence at 2 years |

14

Launch Update Through

May 2010 |

15

•

Position XIAFLEX as a paradigm changing non-surgical

treatment alternative for physicians, payers and patients

•

Achieve high awareness among targeted physicians and

diagnosed patients

•

Get

targeted

physicians

through

the

sales

cycle

–

from

interest

to

injection to reimbursement

•

Educate and assist physician offices with unfamiliar

reimbursement processes at each step of the way

Key Objectives for U.S. XIAFLEX Launch in 2010 |

16

First Commercial Patient Injected

Patient with 50 degree

MP cord pre injection

Post manipulation –

Able to lay hand flat

on table

Post injection and

pre manipulation

Individual results may vary.

See Hurst et al. NEJM 2009 |

1.

Dupuytren’s

Disease

–

Tubiana,

LeClerq,

Hurst, Badalamente, Mackin

2.

SDI Claims Data Based Projections

3.

Medicare Data Based Projections (BESS

database used, Medicare 5% database also

used to validate numbers)

4.

Auxilium

Research

(Patient Segmentation,

Forecast Research, WK/AMA Databases)

Sources:

We Believe that Targeting the Eligible Patient

Population Should Drive Development of the U.S.

Market to Its Full Potential

17 |

18

XIAFLEX Launch Strategy is Tailored to

Customer Needs

•

~ 7,000 target physicians

–

Hand surgeons, plastic surgeons, orthopedic surgeons, general

surgeons, rheumatologists

•

~ 100 field based personnel

–

Sales reps, sales managers, and reimbursement specialists

•

Medical science liaisons

–

Key opinion leader and regional opinion leader support

|

19

Access to Physicians

•

Since launch in late March, majority of physicians called

upon receptive to meeting with our sales reps

•

Significant time being spent with office staff –

Calls can

typically run from 30 minutes to 3 hours

•

Changing a treatment paradigm takes time |

Unique Sales Cycle for Targeted Physicians

Physician Interest,

Training & Enrollment

Successful XIAFLEX

XPERIENCE

20 |

21

Changing Treatment Paradigm and Reimbursement

Cycle May Drive Physician Adoption Rate

Prior to treatment decision Physician must go through:

•Awareness

•Interest

•Training / Enrollment into XIAFLEX XPERIENCE program

•Reimbursement education / comfort

•Patient Identification / counseling

11 –

21 weeks from treatment decision through receipt of payment

possible |

22

•

Accounts need customized support every step of the way

•

Miscellaneous J and CPT codes being used; component

and bundled approaches are being accepted

•

C-code for institutional use will be effective July 1, 2010

•

CMS has recommended a J-Code for XIAFLEX which will

be effective January 1, 2011

•

CPT code specific to XIAFLEX may come in 2012

Reimbursement Processes Are New to Target

Physicians |

23

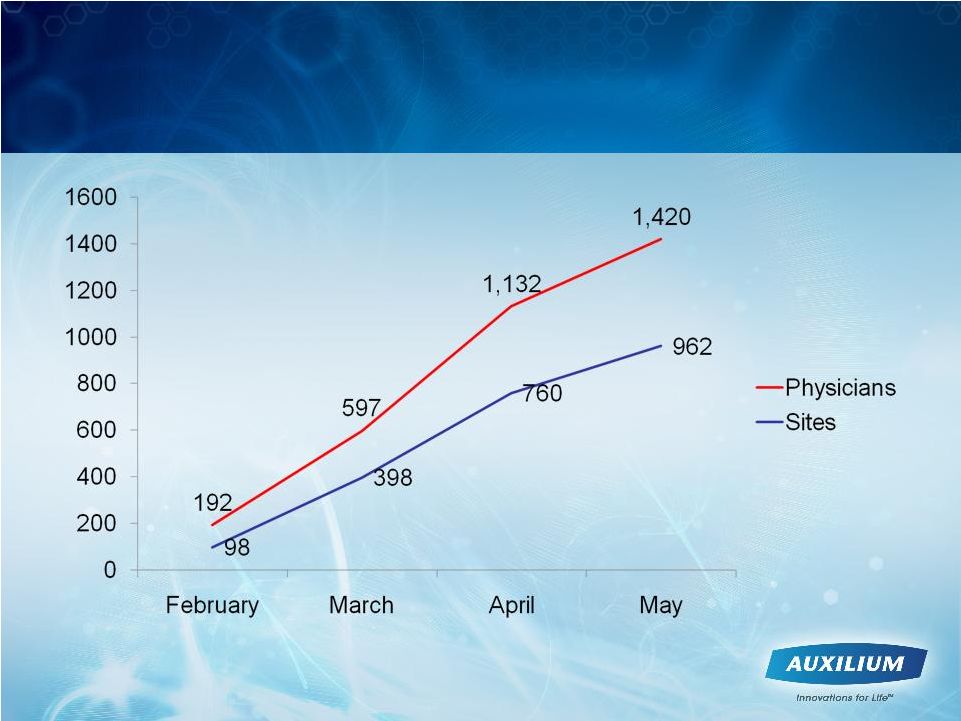

Leading Indicators Trending Positively

-

Over 1,400 physicians and 900 sites have enrolled in XIAFLEX

XPERIENCE program |

24

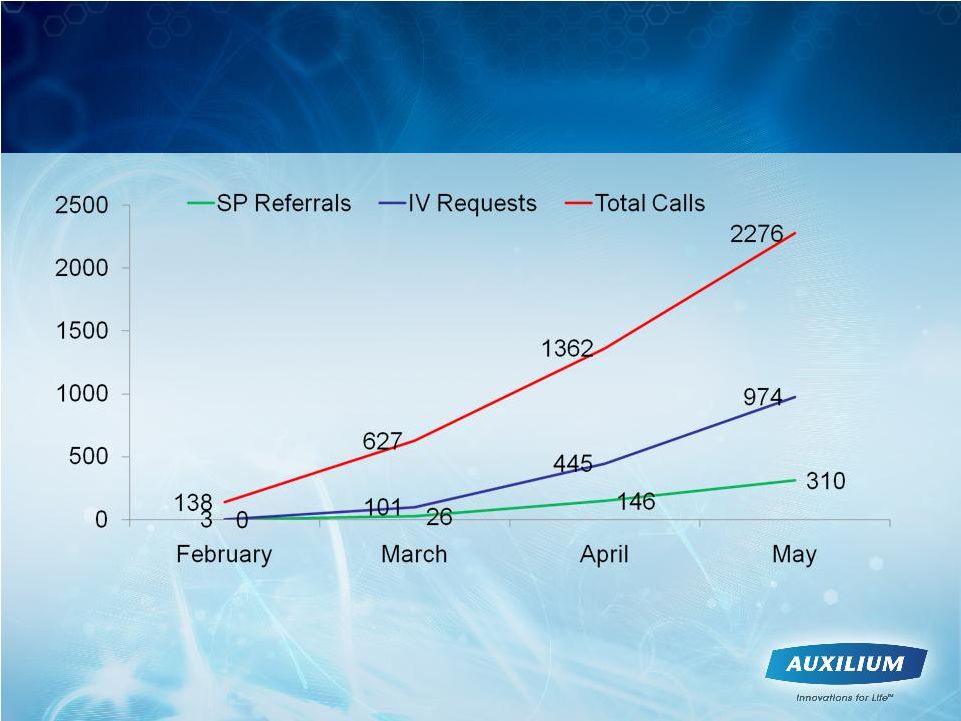

Leading Indicators Trending Positively

-

Cumulative Call Center Volume

Note: SP = Specialty Pharmacy; IV = Insurance Verification

|

25

Leading Indicators Trending Positively

-

Sites that have ordered XIAFLEX |

26

Approximately 87% of insured lives have access

to XIAFLEX |

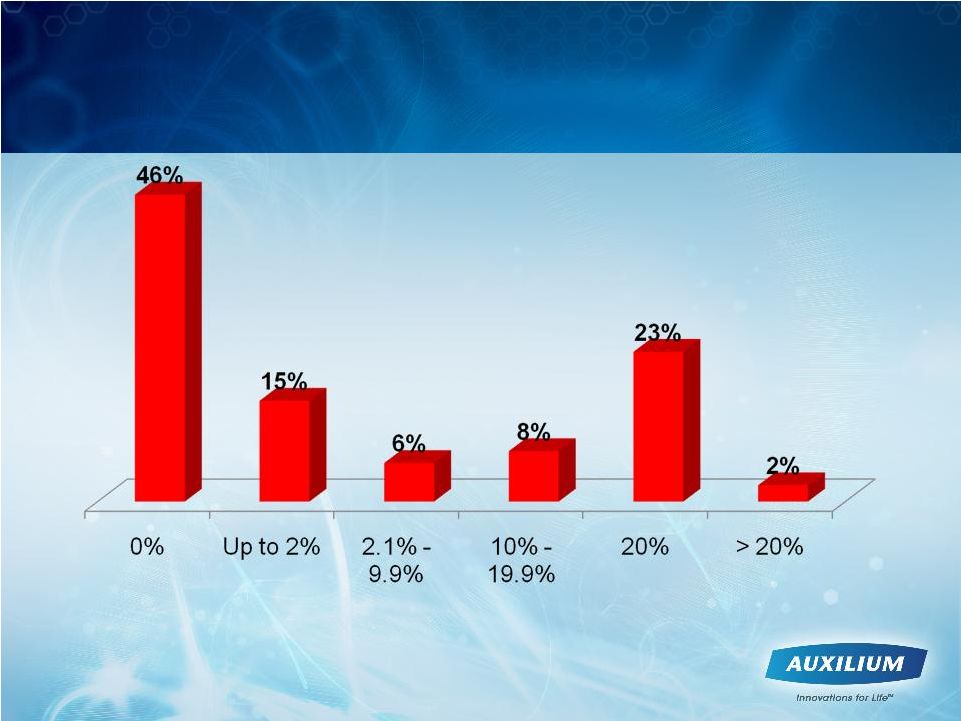

27

Out of Pocket Costs In Line With Our

Expectations

Source: Data processed by AUXL call center through May 31, 2010

A significant portion of patients paying

20% and above have a secondary

insurance, which may cover a portion of

this cost

% Of Treatment Cost Paid by Patient |

28

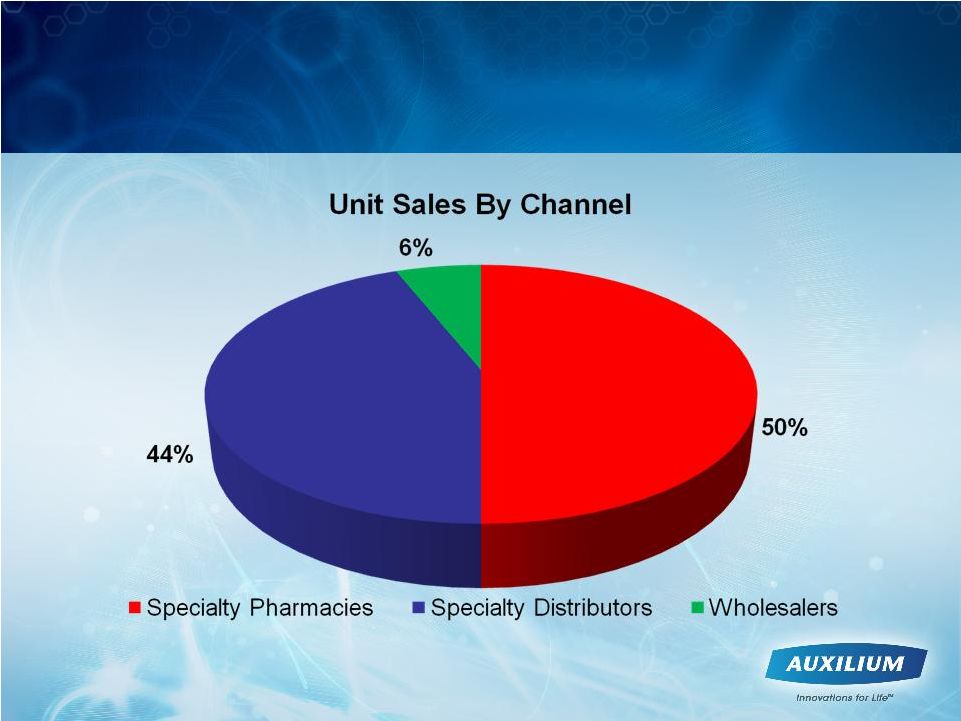

Distribution Network is Operating Smoothly |

29

We Believe Launch Strategy Is Sound:

•

Product efficacy and safety are consistent with clinical data

•

Access to targeted physicians is good.

•

Usage is characterized by “test driving”, which is typical for

paradigm changing treatment

•

Payers willing to provide access to drug and procedures

•

All distribution channels active and operating as expected

•

Leading indicators trending positively |

30

Auxilium’s Plan to Provide Visibility on

XIAFLEX Launch

•

We will pre-release Q2 revenues in early July

•

On Q2 earnings call we will provide revenue

guidance for Q3

•

We will continue to provide quarterly revenue

guidance through 2010 |

31

Strategic Corporate Priorities in 2010

•

Execute the launch in the U.S. for XIAFLEX in Dupuytren’s

contracture;

•

Support Pfizer in the ongoing regulatory review of the EMA

Dupuytren’s submission and prepare for their potential EU

approval;

•

Commence phase III for XIAFLEX in Peyronie’s disease,

assuming a successful End-of phase 2 meeting scheduled with

FDA in June;

•

Prioritize our development of additional pipeline indications for

XIAFLEX; and,

•

Continue to maximize Testim revenues while vigorously

defending our intellectual property. |

32

Opportunities to Build Shareholder Value

Note: Seeking partners for Transmucosal film product candidates

®

® |