Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CHART INDUSTRIES INC | d8k.htm |

Chart Industries, Inc.

Investment Highlights

June 8, 2010

Exhibit 99.1 |

Disclosure

1

Forward-Looking Statements: This presentation includes “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of

1995. The use of words such as “may”, “might”, “should”, “will”, “expect”, “plan”, “anticipate”, “believe”,

“estimate”, “project”, “forecast”, “outlook”,

“intend”, “future”, “potential” or “continue”, and other similar expressions are intended to

identify forward-looking statements. All of these forward-looking statements are based

on estimates and assumptions by our management as of the date of this presentation that,

although we believe to be reasonable, are inherently uncertain. Forward- looking statements

involve risks and uncertainties that could cause the Company’s actual results or circumstances to differ

materially from those expressed or implied by forward-looking statements. These risks and

uncertainties include, among others, the following: the cyclicality of the markets that the

Company serves and the vulnerability of those markets to economic downturns; the negative

impacts of the recent global economic and financial crisis; a delay, significant reduction in or loss of purchases by

large customers; fluctuations in energy prices; competition; our reliance on key suppliers and

potential supplier failures or defects; the modification or cancellation of orders in our

backlog; the impact of the financial distress of third parties; changes in government

healthcare regulations and reimbursement policies; general economic, political, business and market

risks associated with the Company's global operations; fluctuations in foreign currency

exchange and interest rates; potential future charges to income associated with potential

impairment of the Company’s significant goodwill and other intangibles; the Company's ability to

successfully manage its costs, core business resources and growth, including its ability to

successfully acquire and integrate new product lines or businesses and manage operational

expansions; the loss of key employees and deterioration of labor and employee relations; the

pricing and availability of raw materials; the Company's ability to manage its fixed-price contract exposure;

the regulation of our products by the U.S. Food & Drug Administration and other governmental

authorities; additional liabilities related to taxes; the costs of compliance with

environmental, health and safety laws, and potential liabilities under these laws; the impact

of hurricanes and other severe weather; litigation and disputes involving the Company, including product liability, contract,

warranty, pension, intellectual property and employment claims; volatility and fluctuation in the

price of the Company’s stock; and risks associated with our indebtedness. For a discussion

of these and additional risks that could cause actual results to differ from those described in

the forward-looking statements, see disclosure under Item 1A. “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K and other recent filings with the Securities and Exchange Commission,

which should be reviewed carefully. Please consider the Company’s

forward-looking statements in light of these risks. Any forward-looking statement

speaks only as of its date. We undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information, future events or

otherwise, except as required by law. This presentation includes certain non-GAAP financial measures as defined in the Securities and

Exchange Commission’s Regulation G. More information on these non-GAAP financial

measures including EBITDA, and the required reconciliations under Regulation G are set forth in

the Appendix to this presentation. EBITDA, as shown in this presentation and the Appendix,

represents earnings before interest, taxes, depreciation and amortization.

|

SECTION 1

Company Overview |

3

Energy industry is the largest end-user of the Company’s products

#1 or #2 in all primary markets served

Global operations with 12 manufacturing facilities and about 2,500 employees

$592

million

of

sales, $123

million

of

EBITDA

in

2009

Company Overview

Chart Industries is a leading provider of highly engineered cryogenic

equipment for the hydrocarbon, industrial gas, and biomedical markets.

Asia

23%

U.S.

41%

Americas

(Non-US)

6%

RoW

12%

Europe

18%

2009 Sales by Segment

Energy

63%

BioMedical

15%

General

Industrial

22%

2009 Sales by Region

2009 Sales by End-User

Energy &

Chemicals

43%

Distribution

& Storage

42%

BioMedical

15% |

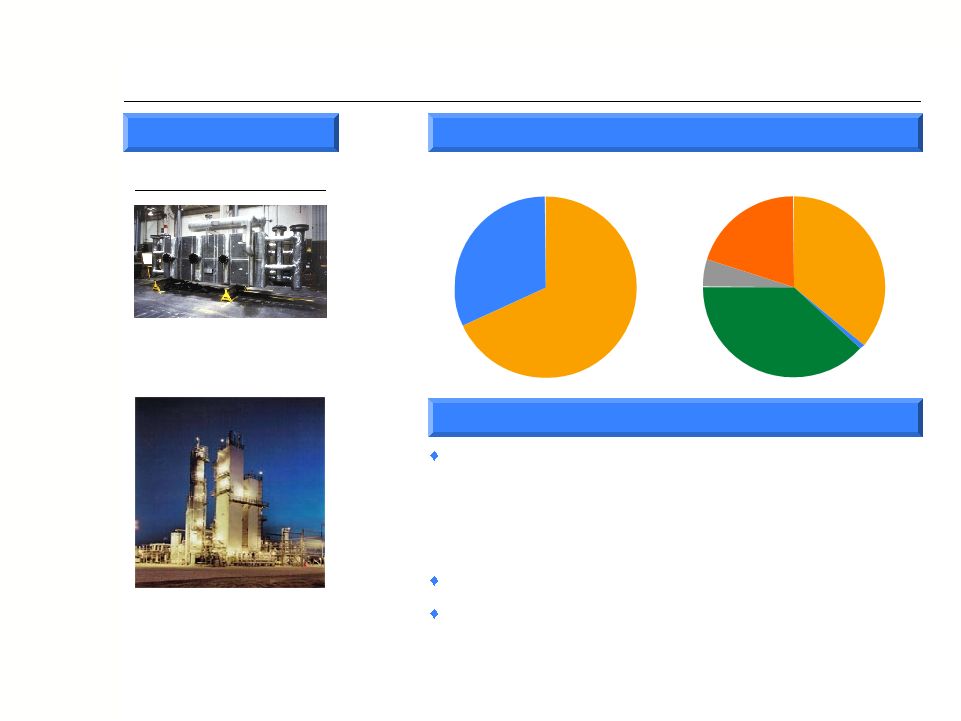

E&C Segment Overview

4

Heat Exchanger

Cold Box

Production

Heat

Exchangers

68%

Cold Boxes and

LNG VIP

32%

2009 Sales by Product/Region

Highlights

Leading provider of heat exchangers and cold boxes critical

to LNG, Olefin petrochemicals and natural gas processing

markets

–

Separation, liquefaction and purification of hydrocarbon and

industrial gases

Leading market positions domestically and internationally

One of three global suppliers of mission-critical LNG and

LNG liquefaction equipment

Selected Products

Americas

(Non-US)

5%

RoW

20%

Asia

38%

U.S.

36%

Europe

1% |

D&S Segment Overview

5

2009 Sales by Product/Region

Highlights

46% of 2009 segment sales derived from products used in

energy applications

Manufacturing strategically located near growing end

markets and lower-cost countries

–

Positioned to capitalize on strong expected growth in Asia and

Eastern Europe

–

Continued investment in key global manufacturing facilities

Bulk

MicroBulk

Distribution

Storage

Selected Products

Satellite

LNG

Storage

Bulk Storage

Systems

46%

Packaged Gas

Systems

22%

VIP, Systems

and Components

6%

Parts, Repair and On-

Site Service

11%

Beverage Liquid

CO

²

Systems

8%

LNG Terminals

and Vehicle Fuel

Systems 7%

Americas

(Non-US)

7%

RoW

5%

Asia

13%

U.S.

49%

Europe

26% |

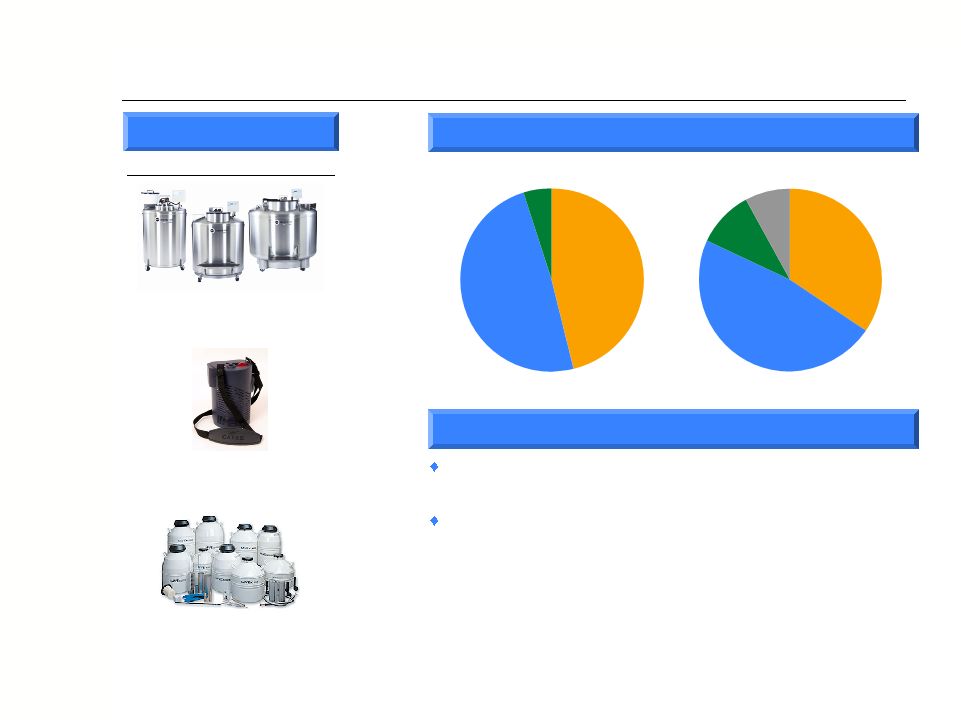

BioMedical

Segment Overview

6

2009 Sales by Product/Region

Highlights

Strong expected growth in oxygen respiratory therapy and

biomedical research, led by international markets

End markets include:

–

Home healthcare and nursing home

–

Hospitals and long-term care

–

Biomedical and pharmaceutical research

–

Animal breeding

Portable Oxygen

Lab Storage

Stainless Steel Freezer

End-Use Consumption

Respiratory

Therapy

Systems

46%

Other

5%

Biological

Storage

Systems

49%

Selected Products

Americas

(Non-US)

9%

U.S.

34%

Europe

47%

Asia

10% |

SECTION 2

Chart Investment Highlights |

Summary of Investment Highlights

8

* Source: International Energy Agency - World Energy Outlook 2009, Reference

relating to energy; differences would arise should governments change energy

policies

Scenario. Based on assumption that governments do not change their

policies End markets are positioned to recover with strong energy demand

–

Energy demand recently forecasted to expand 40% between now and 2030*

–

Global investment of $26 trillion, over $1 trillion/year, is needed to keep up with demand*

A market leader

–

Leading market position in all segments

–

Significant sustainable competitive advantages

–

Strong balance sheet with significant liquidity

Aggressive response to the economic downturn

–

Cost management made a priority along with operations excellence

–

Flexible cost structure provides the ability to quickly

downsize SG&A and plant overhead costs

–

Work force levels down 27% from 2008 levels excluding recent acquisitions

–

Have emerged more strongly positioned

Continued growth initiatives

–

Five acquisitions completed since 2006

–

Expect continued acquisition activity due to strong balance sheet and liquidity

Strong track record of maximizing operating efficiencies and growth

–

14% sales compound annual growth rate (“CAGR”) 2003 through 2009

–

23% EBITDA CAGR 2003 through 2009 |

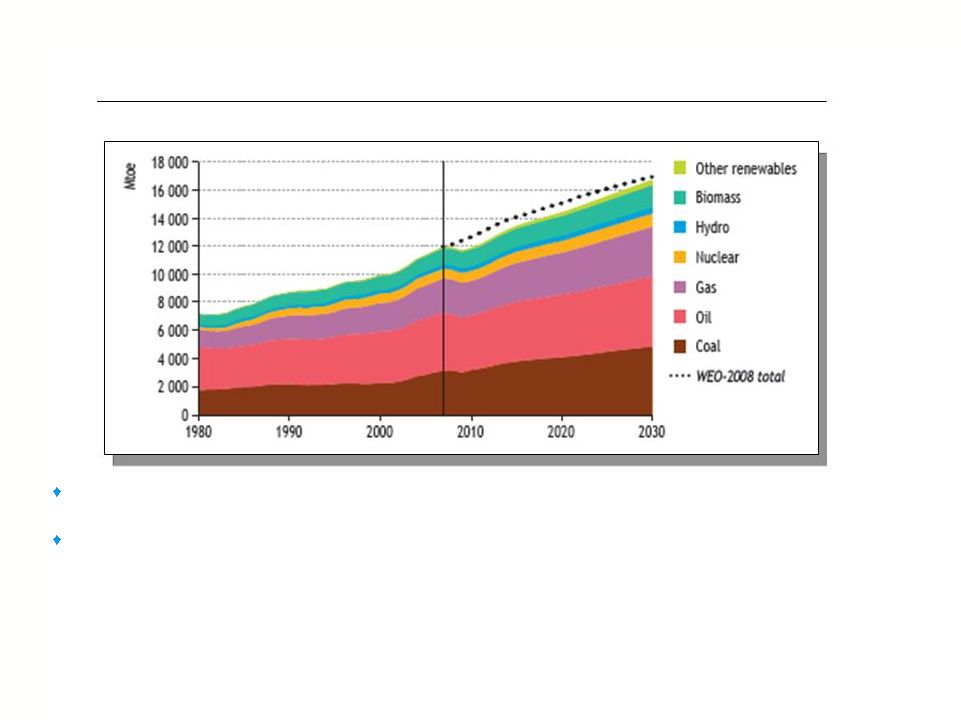

9

World primary demand for natural gas expands on average by 1.5% per

year. The biggest increases occur in the

Middle

East,

China

and

India.

New

power

generation

stations

absorb

45%

of

the

increase. *

Cumulative energy investment needs amount to $26 trillion in

2008-2030. The power transmission, distribution

and generation sectors require 53% of total investment, and gas supply

infrastructure requires 20%.* Energy Trends

World Primary Energy Demand by Fuel*

* Source: International Energy Agency – World Energy Outlook

2009, Reference Scenario

Reference Scenario based on assumption that governments do

not change their policies relating to energy; differences would

arise should governments change energy policies |

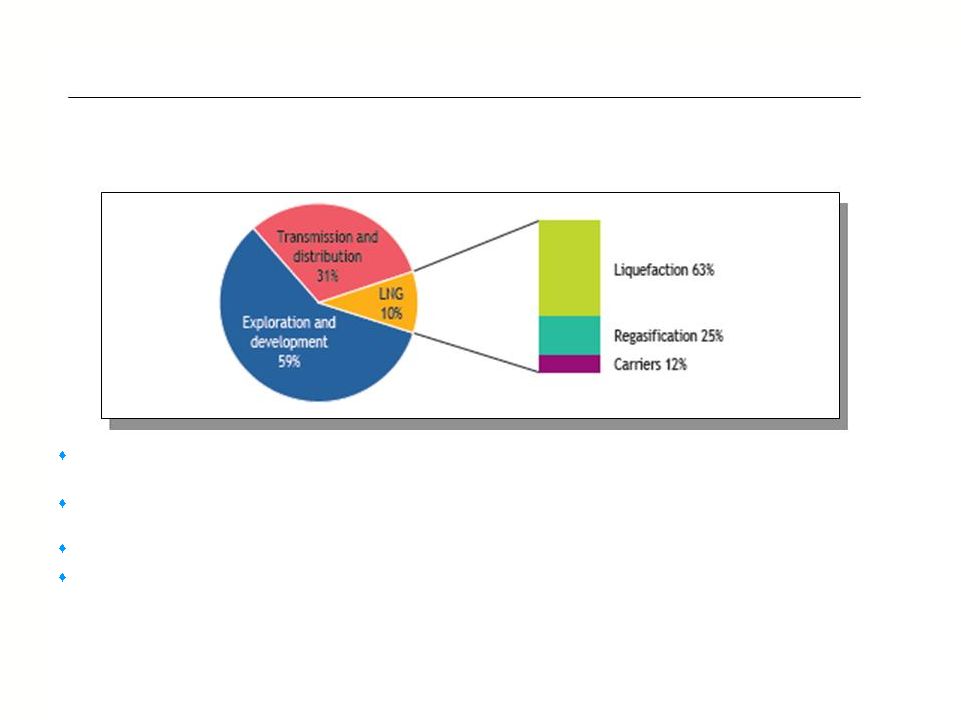

10

Energy Trends

Cumulative Investment in Gas-Supply Infrastructure by Activity,

2008-2030* Total Investment over Period: $5.1 trillion

“Overall global Capex on LNG facilities for the 2010-2014 period is forecast to total over

$108 billion – a growth of 10% relative to the 2005-2009 period.”

Source: Douglas-Westwood World LNG Market Report 2010-2014

- (12/3/2009)

“Global gas demand is likely to rise by 25%, while the use of LNG is set to surge by 40% by

2020.” Source: ExxonMobil

quoted at CWC World LNG Summit, Barcelona - (12/2/2009)

$220 billion annual investment into the entire gas-supply infrastructure is needed through 2030 *

More than half of the global gas investment is needed in non-OECD countries (primarily in Eastern

Europe/Eurasia, Asia and the Middle East) *

* Source: International Energy Agency – World Energy Outlook

2009, Reference Scenario

Reference Scenario based on assumption that governments do

not change their policies relating to energy; differences would

arise should governments change energy policies |

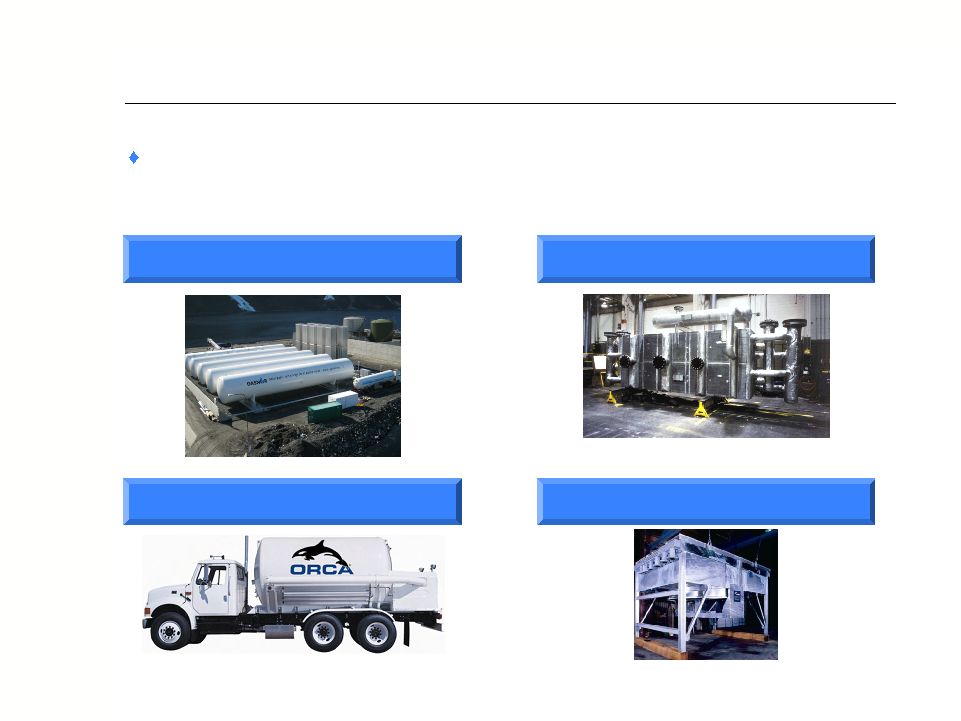

11

Natural gas is increasing its penetration as a viable transportation fuel due to

its high energy density, lower costs, and low emissions

Chart

provides

products

/

solutions

for

the

full

LNG

value

chain

from

LNG

terminal equipment / liquefiers to on-board fuel tanks

Technical and proprietary innovation with numerous patents granted in our

LNG products

Energy Trends |

Leading Proprietary Technology and Designs

12

Take advantage of leading proprietary technology and designs through new

product development

Satellite LNG Storage

Brazed Aluminum Heat

Exchangers

MicroBulk

Air Cooled Heat Exchangers |

Growth Initiatives

13

Current economic environment continues to provide acquisition opportunities for

Companies with strong balance sheets and more than adequate liquidity, such

as Chart

Chart’s acquisition criteria

–

Global niche engineered equipment, systems or aftermarket business

–

Fit with Chart value proposition including product/technology synergies

–

#1 or potential to become #1 within existing or adjacent growth markets

–

Geographic expansion or cost savings synergies

Completed five acquisitions since 2006

–

Cooler Service – air cooled heat exchangers – 2006

–

Flow Instruments – flow meter systems – 2008

–

Tri-Thermal – heat exchanger aftermarket parts – 2009

–

Golden Phoenix – biological storage containers – 2009

–

Covidien – liquid oxygen therapy systems -

2009 |

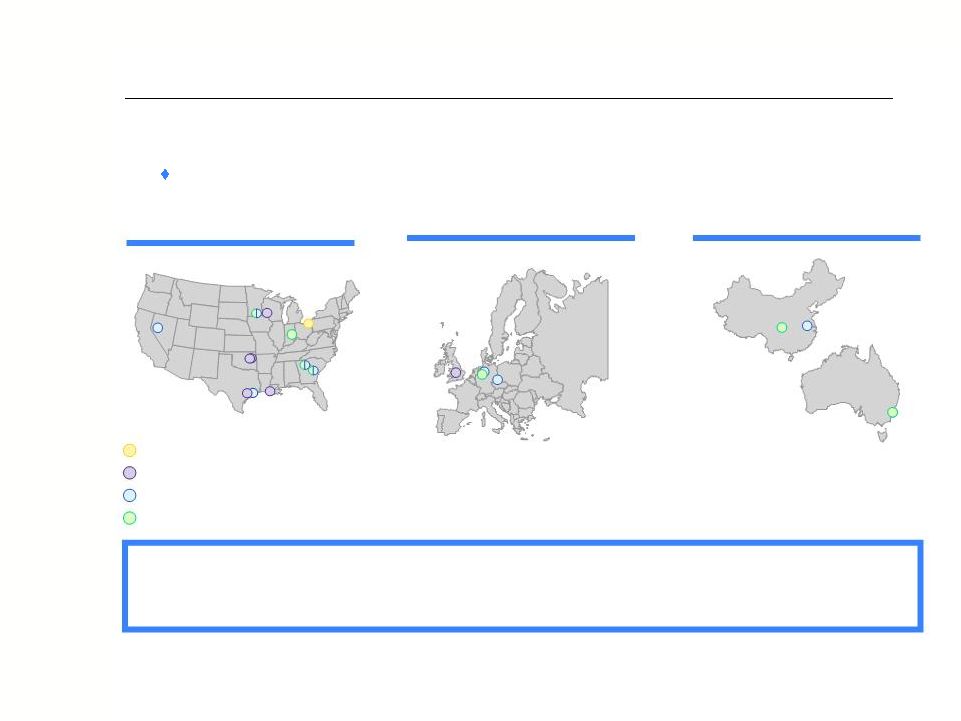

Global Manufacturing and Distribution Platform

14

Operating

leverage

provides

the

flexibility

to

expand

and

reduce

capacity

as needed with minimal capital expenditures

Manufacturing facilities are strategically located in lower-cost countries and

near centers of demand

Corporate

Energy & Chemicals

Distribution & Storage

BioMedical

Total:

Manufacturing:

Europe

Asia-Pacific

12

8

4

2

3

2

North America |

SECTION 3

Financial Overview |

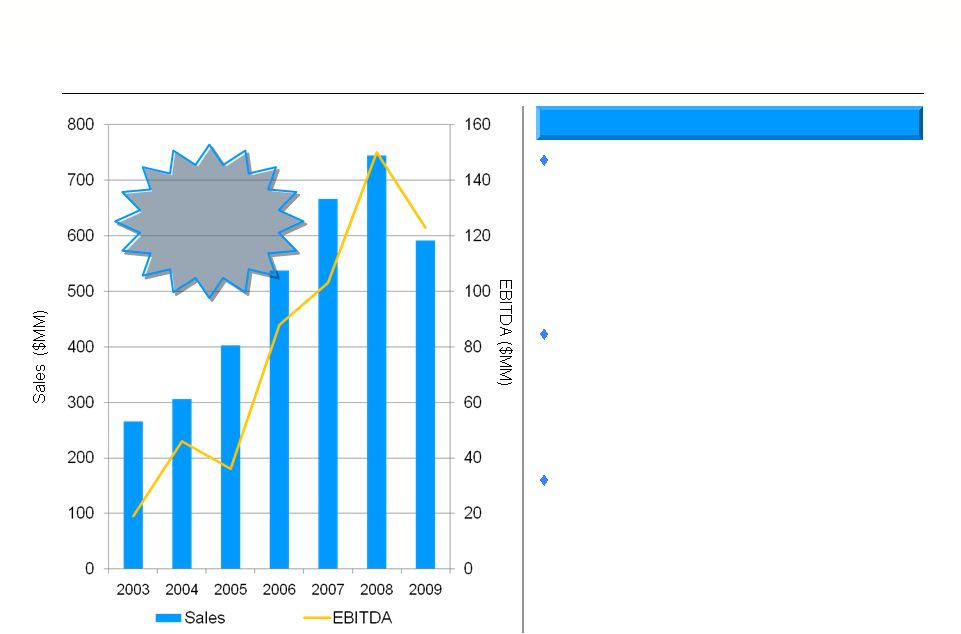

Strong Track Record of Successful Execution

16

Drivers of Growth

Distribution & Storage

–

Expanding aftermarket business

–

Global relationships with major industrial gas

companies

–

Well positioned in areas of expected growth

–

Alternative fuel opportunities with LNG

Energy & Chemicals

–

Significant exposure to expected global

energy demand growth

–

Environmental legislation and alternative

energy opportunities

BioMedical

–

Liquid oxygen growth in emerging markets

–

Increasing biological research expenditures

–

Aging demographic

CAGR

(2003-2009)

Sales 14%

EBITDA 23%

(1)

(2)

(1)

EBITDA includes non-recurring costs of $24 million for the acquisition of Chart Industries by

First Reserve.

(2)

EBITDA includes non-recurring costs of $7 million for stock compensation expense due to

secondary stock offering.

|

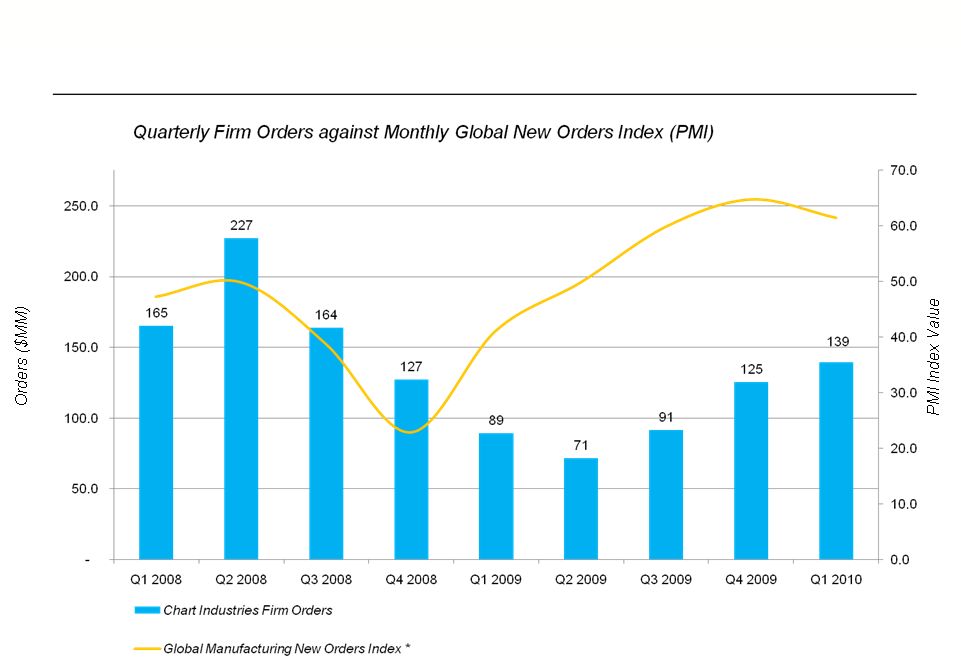

2010 Outlook -

Improving Order Trends

17

* Source: JP Morgan Global Manufacturing PMI |

2010 Outlook -

Senior Credit Facility Refinancing

Chart has refinanced its current senior secured capital structure, putting in

place a new $200 million senior secured credit facility

-

$135 million Senior Secured Revolver

-

$65 million Senior Secured Term Loan, 10% amortizing annually

-

Five year term, with a scheduled maturity date of May 2015

The refinancing achieved the following for Chart:

-

Extends

maturity

profile,

as

prior

revolving

facility

was

due

to

expire

in

October

2010

-

Improves liquidity

-

Maintains modest total and net leverage

-

Expected to reduce future interest expense with new lower amortizing term loan

18 |

19

2010 Outlook -

Summary

We continue to see an improving global market in all of our business segments as

evidenced by the continued order improvement.

Continue to pursue strategic accretive acquisitions to expand product and service

offerings. First quarter results were in line with our

expectations. 2010 will be a transition year as we rebuild backlog as

markets continue to recover. -

Margins are lower in our E&C business due to excess industry capacity and the

drawn out return of large capital projects.

Based on first quarter performance, current backlog and order expectations, we

reaffirm our previously announced guidance for 2010 with a sales forecast

of $530 to $560 million and earnings of $0.40 to $0.60 per diluted

share. -

Benefits from recent acquisitions are expected to provide over $60 million in

revenues during 2010. -

This guidance includes approximately $0.20 per diluted share related to expected

restructuring and acquisition costs associated with recently completed

acquisitions, as well as the write-off of deferred financing costs

associated with the Senior Credit Facility refinancing. -

Excluding

these

charges,

earnings

would

be

expected

to

fall

in

a

range

of

$0.60

to

$0.80

per

diluted

share. |

SECTION 4

Conclusion |

Positioned on Strong and Stable Platform for Growth

Flexible Manufacturing Platform

–

Ability to ramp up or scale back production as demand fluctuates

–

Necessary capacity expansion/contraction is easily attainable

–

Proven ability to implement cost-savings measures during periods of sharp

decline Very strong balance sheet

–

Significant improvement in net debt position

–

Substantial free cash flow growth

–

Continued ability to invest in and take advantage of growth opportunities

Stable business model

–

Attractive industry with long-term customer relationships

–

Solid platform with worldwide presence and leading market positions in all

segments –

Significant sustainable competitive advantages

Positioned for continued significant growth as markets recover

–

Strong track record of maximizing operating efficiencies and growth

21

Chart represents a unique investment opportunity to capitalize on the return

of strong growth in the markets it serves, particularly natural gas processing

|

APPENDIX

Reconciliation of Net Income to EBITDA |

Reconciliation of Net Income to EBITDA

23

($ In Millions)

2003

2004

2005

2006

2007

2008

2009

Net Income (Loss)

$ (7)

$ 23

$ 8

$ 27

$ 44

$ 79

$ 61

Interest expense, net

12

5

10

25

22

18

16

Income tax expense

3

10

7

13

17

30

23

Depreciation and amortization

11

8

11

23

20

23

23

EBITDA

$ 19

$ 46

$ 36

$ 88

$ 103

$ 150

$ 123

Years Ended December 31,

EBITDA represents earnings before interest, taxes, depreciation and

amortization. EBITDA is not intended to represent cash flow from

operations as defined by U.S. GAAP and should not be used as an alternative

to net income or as an indicator of operating performance. |

|