Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLEGHENY ENERGY, INC | d8k.htm |

Citigroup

Conference

June 7-8, 2010

Exhibit 99.1 |

2

Table of Contents

Page

Page

I.

COMPANY OVERVIEW

V.

OUTLOOK

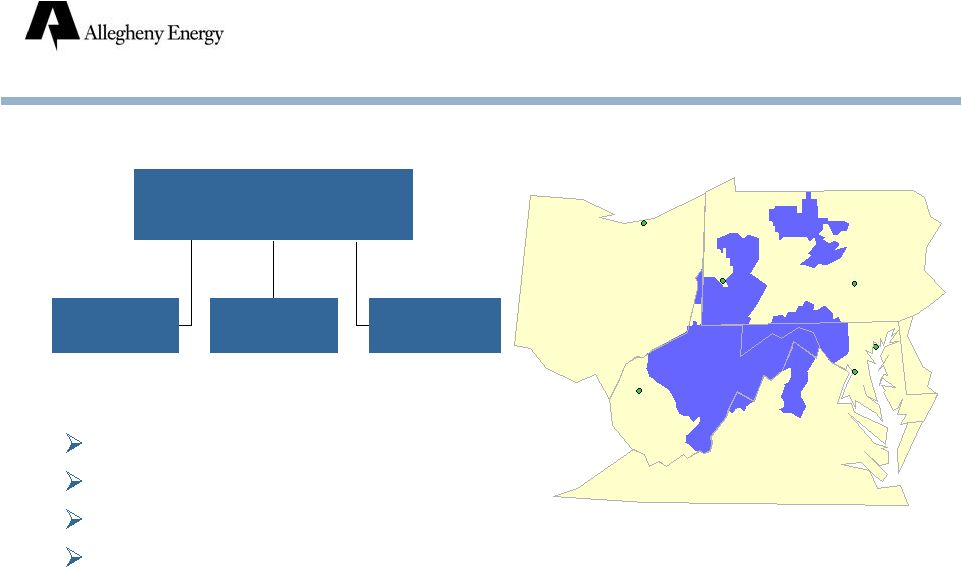

Primary businesses

6

Merchant generation formulas

38

Service area

7

Outlook: Consolidated

39

Overview

8

Outlook: Merchant generation

40-45

Quality and costs

9-11

Outlook: Utility operations

46

Business units

12

Outlook: Transmission expansion

47

Outlook: Depreciation

48

II.

MERCHANT GENERATION

Capital expenditures

49

Overview

13

Outlook: Interest, other

50

Current market conditions

14-19

Risks and challenges

51

Generation hedged

20

VI.

Pennsylvania rates

21-22

MERGER

Power procurement schedule (PA/MD)

23

Overview

52

Coal

24-26

Fuel Mix

53

Environmental controls

27

Scale and Scope

54

Plant availability

28

Timeline

55

VII.

III.

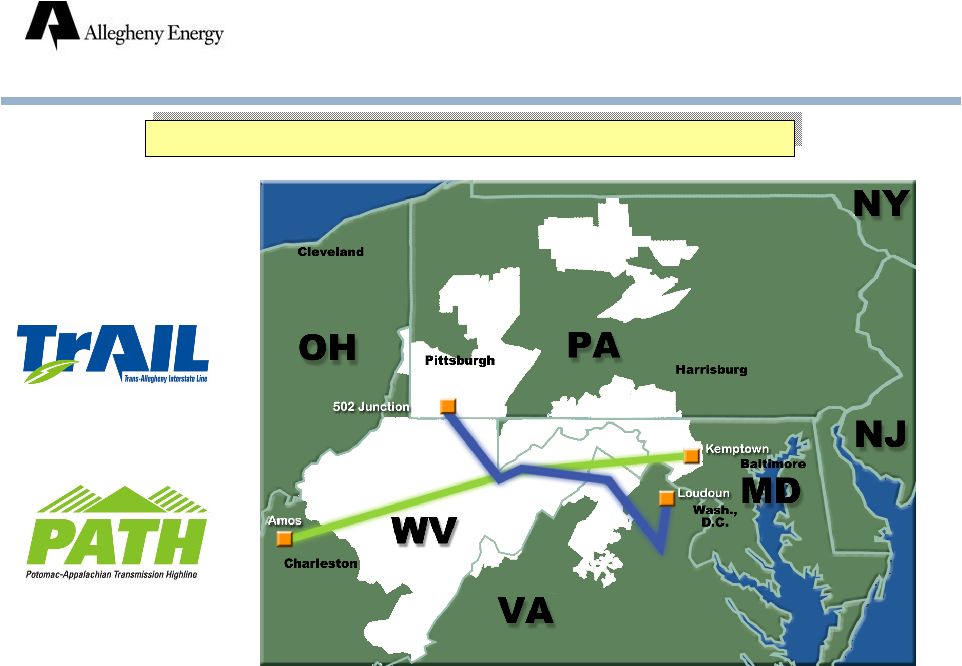

TRANSMISSION EXPANSION

SUPPLEMENTAL MATERIAL

Overview

29

EPS and EBITDA

57-58

Capital expenditures

30

Cash flow

59

Growing rate base

31

Credit ratings

60

TrAIL

construction update

32

IV.

UTILITY OPERATIONS

Overview

33

Revenue mix

34

Capital structures and ROE's

35

Growing rate base

36

Competitive rates

37 |

3

Forward-Looking Statements

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

In addition to historical information, this presentation contains a number of

"forward-looking statements" as defined in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements involve estimates,

expectations, and projections and, as a result, are subject to risks and uncertainties.

Forward-looking statements often may be identified by the use of words such as

anticipate, expect, project, intend, plan, believe and words and terms of

similar substance used in connection with any discussion of future plans, actions or

events. However, the absence of these or similar words does not mean

that any particular statement is not forward-looking. Forward-looking

statements in this presentation may relate to, among other matters: regulatory issues,

including but not limited to environmental regulation, and the status of retail

generation service supply competition in states served by Allegheny’s delivery

business,

Allegheny

Power;

financing

plans;

market

demand

for

energy,

the

cost

and

availability

of

raw

materials,

including

coal

and

natural

gas,

and

Allegheny’s ability to enter into, modify and enforce long-term fuel

purchase agreements; provider-of-last resort and power supply contracts; results of

litigation; results of operations; internal controls and procedures; capital

expenditures; status and condition of plants and equipment; changes in

technology and their effects on the competitiveness of Allegheny’s generation

facilities; work stoppages by Allegheny’s unionize employees; capacity

purchase

commitments;

statements

about

the

benefits

of

the

proposed

merger

involving

Allegheny

and

FirstEnergy,

including

future

financial

and

operating results; Allegheny’s and FirstEnergy’s plans, objectives,

expectations and intentions; the expected timing of completion of the transaction; and

other statements relating to the merger that are not historical facts. There

can be no assurance that actual results will not materially differ from

expectations. Actual results have varied materially and unpredictably from past

expectations. Factors that could cause actual results to differ materially

include, among others, the following: the results of regulatory proceedings,

including proceedings related to rates; plant performance and unplanned

outages; volatility and changes in the price and demand for energy and capacity and

changes in the value of financial transmission rights; volatility and changes

in the price of coal, natural gas and other energy-related commodities; Allegheny’s ability to enter into, modify and enforce supplier performance

under long-term fuel purchase agreements; the ability and willingness of

counterparties to satisfy their financial and performance obligations; changes in

the weather and other natural phenomena; changes in Allegheny’s requirements

for, and the availability and price of, emission allowances; changes in

industry

capacity,

development

and

other

activities

by

Allegheny’s

competitors;

changes

in

market

rules,

including

changes

to

the

participant

rules

and

tariffs for PJM Interconnection, LLC and defaults by other market participants; the

loss of any significant customers or suppliers; changes in both customer usage

and customer switching behavior and their resulting effects on existing and future load requirements; dependence on other electric transmission and

gas transportation systems and their constraints on availability; environmental

regulation; changes in other laws and regulations applicable to Allegheny, its

markets or its activities; changes in the underlying inputs and assumptions, including market conditions used to estimate the fair values of commodity

contracts; complications or other factors that make it difficult

or impossible to obtain necessary lender consents or regulatory

authorizations on a timely

basis; recent and any future disruptions in the financial markets and changes in

access to capital markets; the availability of credit; actions of rating

agencies; inflationary and deflationary trends and interest rate

trends; the effect of accounting pronouncements issued periodically by accounting

standard-setting bodies; entry into, any failure to consummate, or any

delay in the consummation of, contemplated asset sales or other strategic

transactions;

the

likelihood

and

timing

of

the

completion

of

the

proposed

merger

with

FirstEnergy,

the

terms

and

conditions

of

any

required

regulatory

approvals of the proposed merger, the impact of the proposed merger on

Allegheny’s employees and the potential diversion of management’s time and

attention

from

ongoing

business

during

this

time

period;

general

economic

conditions;

and

other

risks,

including

the

continuing

effects

of

global

instability, terrorism and war. Additional risks and uncertainties are identified and

discussed in Allegheny's reports and registration statements filed with the

Securities and Exchange Commission. Risks and uncertainties associated with the merger are more fully discussed in the preliminary joint proxy

statement/prospectus that is included in the Registration Statement on Form S-4

(Registration No. 333-165640) that was filed by FirstEnergy with the SEC in

connection with the merger. Additional risks and uncertainties associated with the

merger are identified and discussed in Allegheny’s and FirstEnergy’s

reports filed with the SEC and available at the SEC’s

website at www.sec.gov. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

document. Allegheny disclaims any obligation to update its forward-looking statements to reflect events

or circumstances after the date of this presentation, except as may be required by

law. |

4

Forward-Looking Statements

Certain information in this presentation is based upon an internal model that

incorporates assumptions regarding future market conditions, including power

and commodity prices, demand conditions, and the operating performance and

dispatch characteristics of our generating facilities, among other

factors. Many of these assumptions are based upon highly variable market

factors outside of our control and ultimately may differ significantly from the

assumptions currently included in our model. As a result, our model and the

related forward-looking information included in this presentation are

subject to change. The information in this presentation that is derived from our

internal model is based in part on market conditions, forward prices and our hedged

position as of March 31, 2010. We intend to update this information on a

quarterly basis. ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed merger, FirstEnergy filed a Registration Statement on

Form S-4 (Registration No.

333-165640) with the SEC that includes a preliminary joint proxy statement of

Allegheny and FirstEnergy and that also constitutes a preliminary prospectus

of FirstEnergy. Allegheny and FirstEnergy will mail the definitive joint proxy

statement/prospectus to their respective shareholders. Allegheny and

FirstEnergy urge investors and shareholders to read the definitive joint proxy

statement/prospectus regarding the proposed merger when it becomes available, as

well as other documents filed with the SEC, because they will contain important

information. You may obtain copies of all documents filed with the SEC

regarding this proposed transaction, free of charge, at the SEC’s website

(www.sec.gov). You may also obtain these documents, free of charge, from

Allegheny’s website (www.alleghenyenergy.com) under the tab

“Investors” and then under the heading “SEC

Filings.” You may also

obtain these documents, free of charge, from FirstEnergy’s website

(www.firstenergycorp.com) under the tab “Investors”

and then under the heading “Financial Information”

and then under the item “SEC Filings.”

PARTICIPANTS IN THE MERGER SOLICITATION

FirstEnergy, Allegheny and their respective directors, executive

officers and certain other members of management

and employees may be soliciting proxies from Allegheny and FirstEnergy shareholders

in favor of the merger and related matters. Information regarding the persons

who may, under the rules of the SEC, be deemed participants in the

solicitation of Allegheny and FirstEnergy shareholders in connection with the proposed merger is set forth in the

preliminary joint proxy statement/prospectus contained in the above-referenced

Registration Statement on Form S-4. You can find information about

Allegheny’s executive officers and directors in its definitive proxy statement filed with

the SEC on March

19, 2010 and Annual Report on Form 10-K filed with the SEC on March

1, 2010. You can find

information about FirstEnergy’s executive officers and directors in its

definitive proxy statement filed with the SEC on April

1, 2010 and Annual Report on Form 10-K filed with the SEC on February

19, 2010. Additional information about

Allegheny’s executive officers and directors and FirstEnergy’s executive

officers and directors can be found in the above-referenced Registration

Statement on Form S-4. You can obtain free copies of these documents from Allegheny

and FirstEnergy using the website information above. |

5

Non-GAAP Financial Measures

This presentation includes non-GAAP financial measures as defined in the

Securities and Exchange Commission’s Regulation G. Where noted,

the

presentation

shows

certain

financial

information

on

an

“as

adjusted”

basis,

to

exclude

the

effect

of

certain

items

as

described

herein.

By

presenting “as adjusted”

results, management intends to provide investors with a better understanding of

the core results and underlying trends from which to consider past

performance and prospects for the future. Users

of

this

financial

information

should

consider

the

types

of

events

and

transactions

for

which

adjustments

have

been

made.

“As

adjusted”

information

should

not

be

considered

in

isolation

or

viewed

as

a

substitute

for,

or

superior

to,

net

income

or

other

data

prepared

in

accordance

with

GAAP

as

measures

of

our

operating

performance

or

liquidity.

In

addition,

the

“as

adjusted”

information

is

not

necessarily

comparable

to

similarly titled measures provided by other companies.

Pursuant

to

the

requirements

of

Regulation

G,

reconciliations

of

non-GAAP

financial

measures

in

this

presentation

to

the

most

directly

comparable GAAP measures are contained herein or within our earnings release and

the tables attached thereto, which, together with this presentation,

are

available

on

our

Investors

page

at

We have not included reconciliations of the forward-looking non-GAAP

financial measures included in this presentation to the most directly

comparable GAAP financial measures, because it is not possible to predict in the

manner necessary for a quantitative reconciliation the amount of the items

that we would remove from GAAP earnings, such as unrealized gains or losses on our economic hedges. The probable significance

of providing these forward-looking non-GAAP financial measures without the

directly comparable GAAP financial measures is that the non-GAAP

financial measures may be materially different from the corresponding, actual GAAP

financial measures. .

www.alleghenyenergy.com |

6

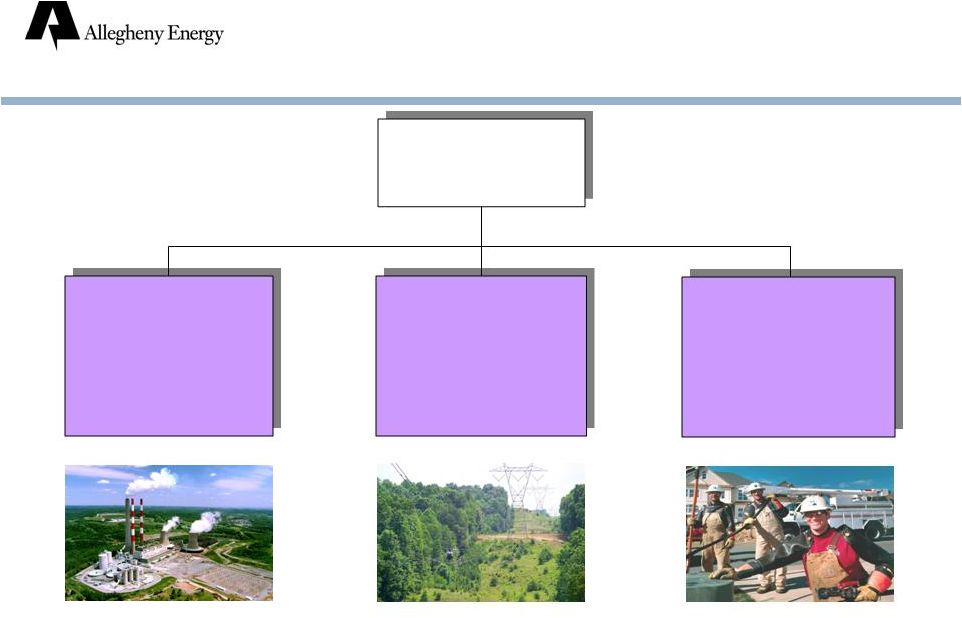

Primary Businesses

Output for 12 months ended December 31, 2009. Customers include

about 102,000 customers in VA.

Sale of VA distribution operations was completed on June 1, 2010.

Allegheny

Energy

Merchant

Generation

Coal-fired, PJM

26.0 million MWH

Transmission

Expansion

TrAIL, PATH,

other projects

Utility

Operations

1.6 million customers,

regulated generation |

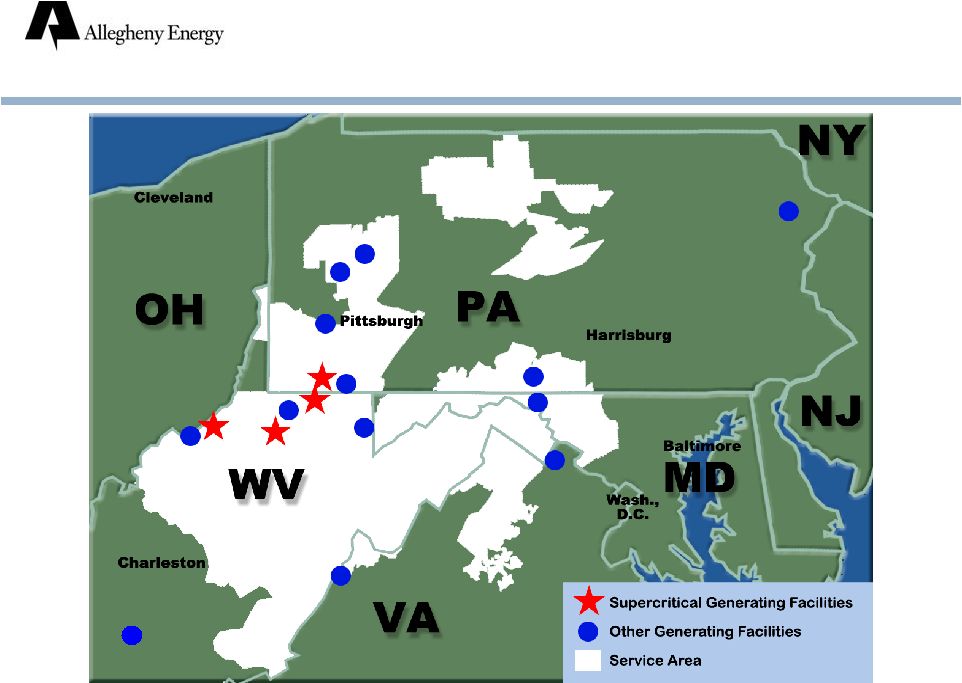

7

Service Area and

Generation Facilities |

8

Focused on quality and costs

Merchant generation well-positioned for a recovering

economy

Growing rate base in transmission and utility

businesses

Merger with FirstEnergy scheduled for completion in

first half 2011

Overview |

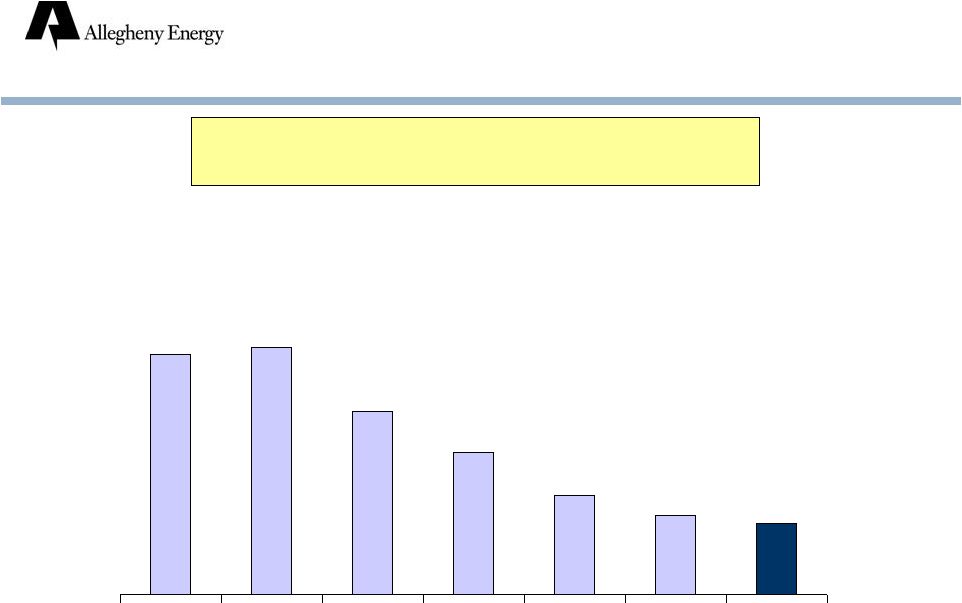

9

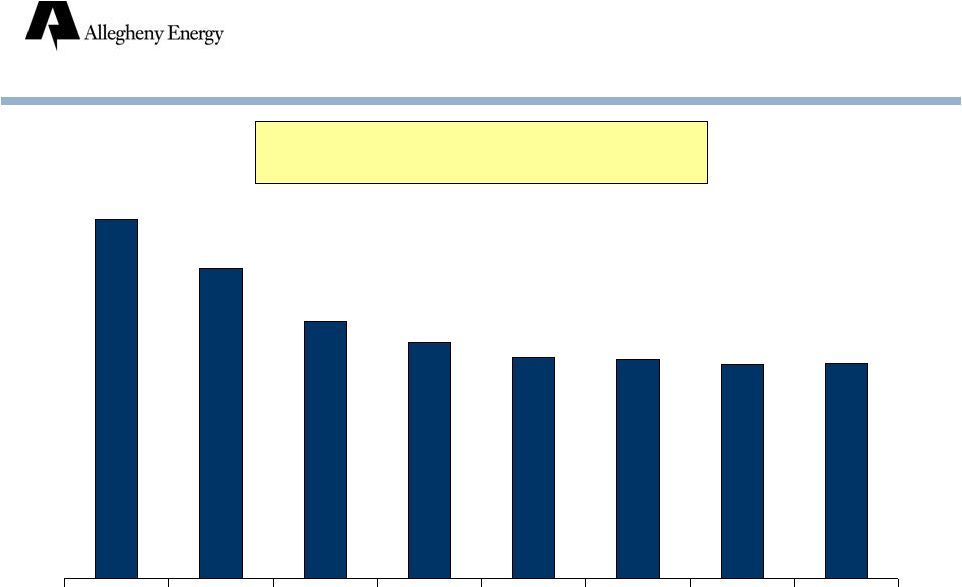

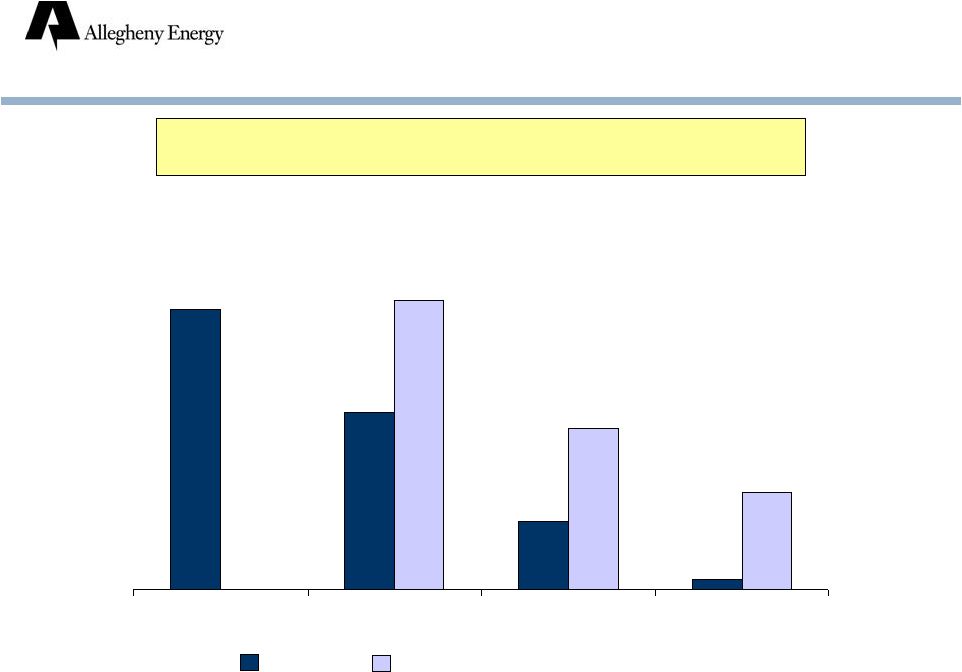

OSHA Recordable Incident Rate

Allegheny Power

Focused on Quality

and Costs

4.76

4.91

3.64

2.81

1.96

1.56

1.40

2003

2004

2005

2006

2007

2008

2009

Safety has improved from 3rd quartile in 2001

to top quartile. |

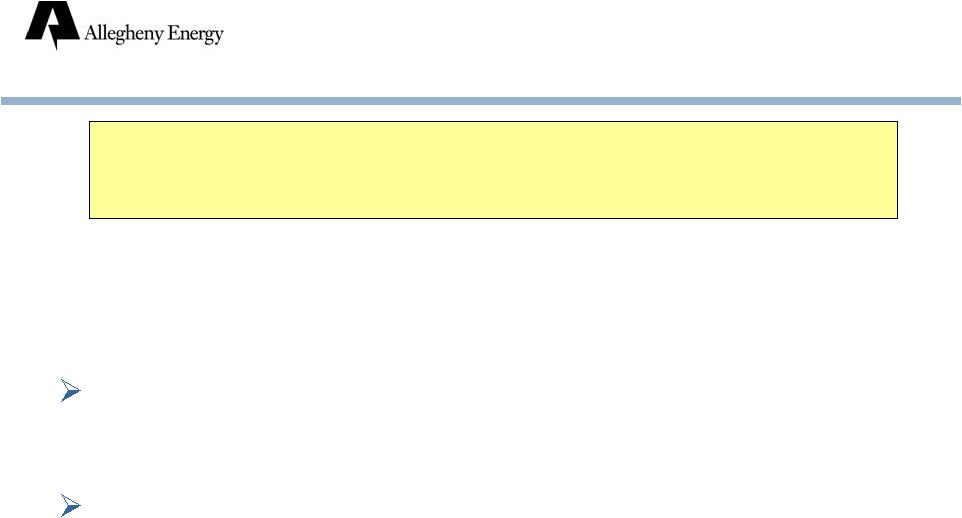

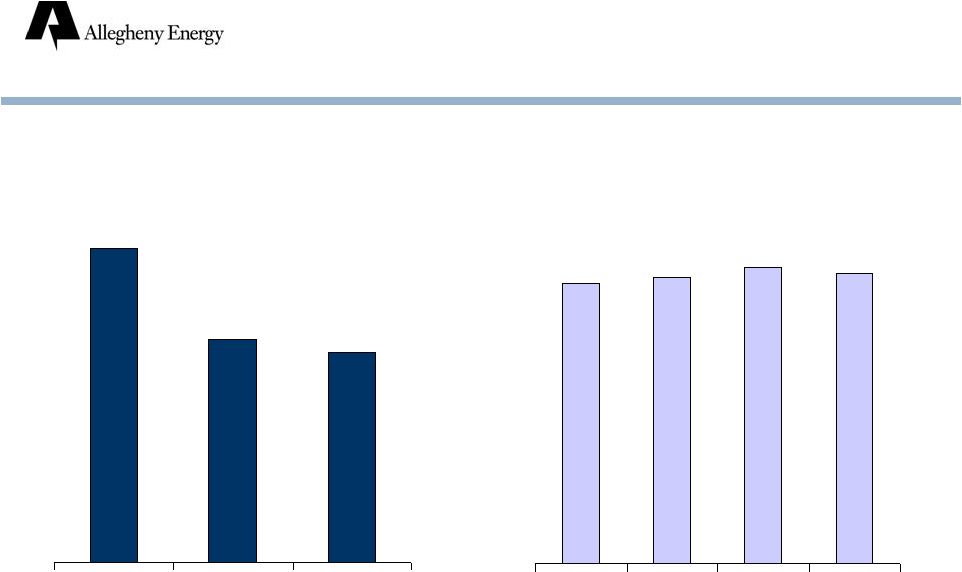

10

Focused on Quality

and Costs

$1,166

$799

$735

$686

$682*

$665*

$668*

$965

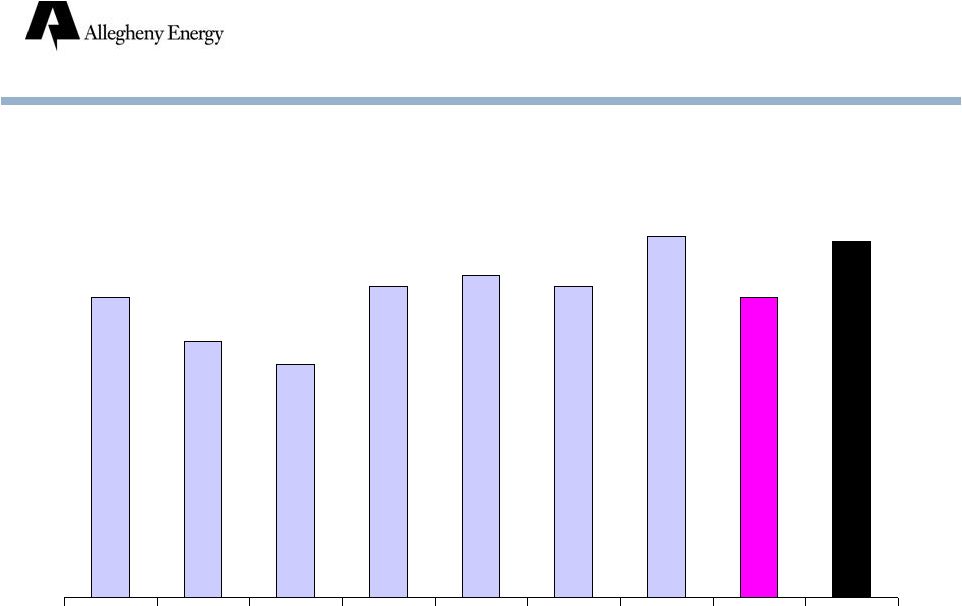

Operations and Maintenance Expense

($ millions)

*

2007-2009

exclude

amounts

formulaically

recovered

(2007

-

$5;

2008

-

$10,

2009

-

$19)

2002

2003

2004

2005

2006

2007

2008

2009

Costs have been held virtually

unchanged for four years. |

11

Customer Satisfaction

Commercial/industrial: ranked first in northeastern

US for five consecutive years (TQS Research)

Residential: ranked top quartile (American

Customer Service Institute)

Focused on Quality

and Costs

“Allegheny Energy improved in every area that was measured, and

was in the top 10 nationally in six of the seven ranking criteria.”

TQS Research, October 2009

|

12

Merchant generation

Unregulated generation (primarily Allegheny Energy

Supply, LLC)

Transmission expansion

TrAIL

PATH

PJM transmission reliability projects

Utility operations

Monongahela Power (WV) -

transmission, distribution,

generation

Potomac Edison (WV, MD, VA) -

transmission,

distribution

West Penn (PA) -

transmission, distribution

Business Units |

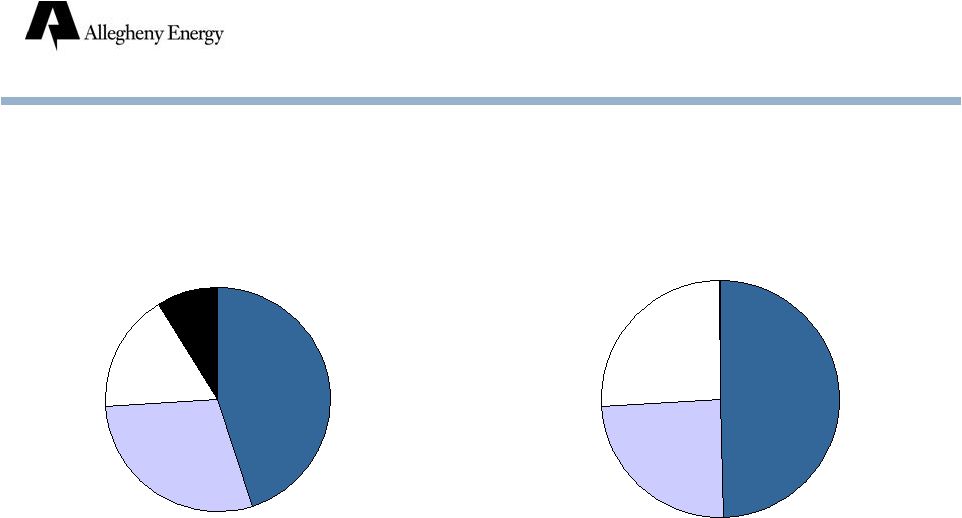

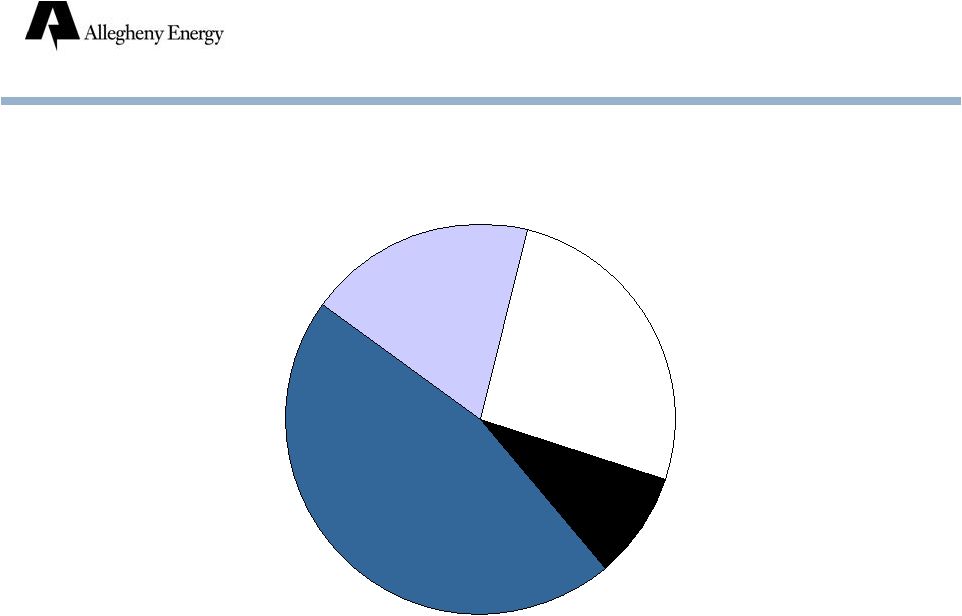

13

Merchant Generation:

Overview

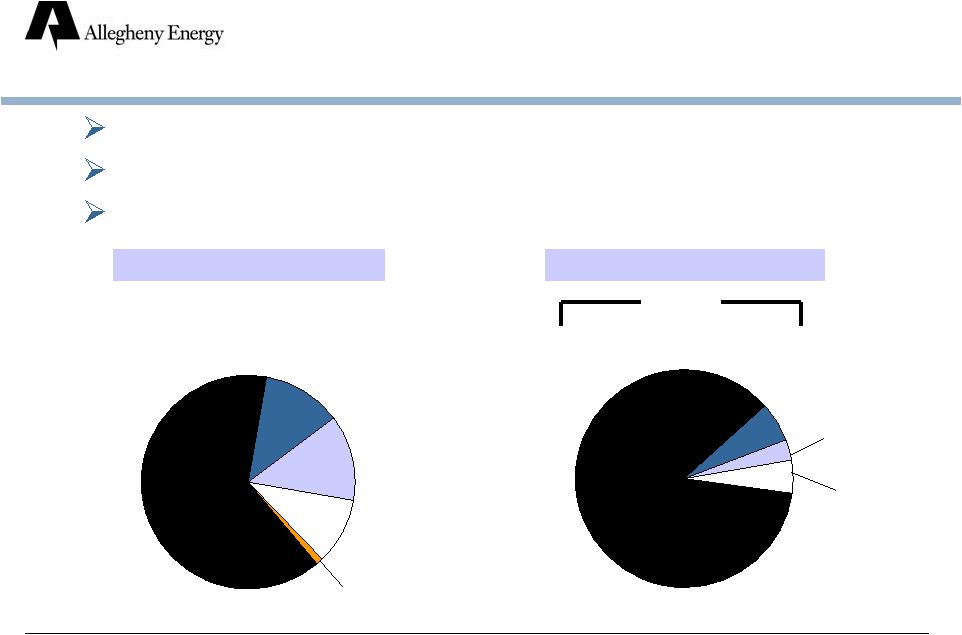

Capacity (MW)*

* Capacity as of December 31, 2009. Output for 12 months ended December 31,

2009. Capacity: over 7,000 MW*

Primarily base load coal-fired plants

Located in PJM (13 states)

Output (MWH)*

Hydro

10%

Gas

13%

Supercritical

Coal

64%

Other Coal

12%

Oil

1%

Supercritical

Coal

86%

Gas

3%

Hydro and

Other

5%

Other Coal

6%

Coal

92% |

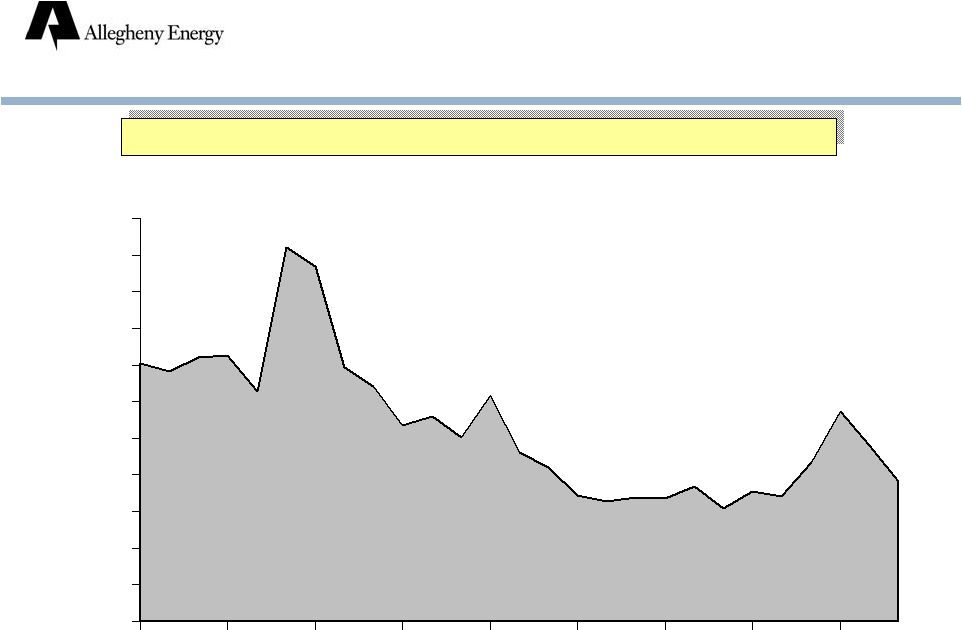

14

Merchant Generation:

Spot Power Prices

PJM Western Hub

($/MWH round-the-clock)

Jan.

08

June

08

Dec.

08

June

09

Dec.

09

Mar.

10

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

$110

Spot prices have decreased sharply since June 2008. |

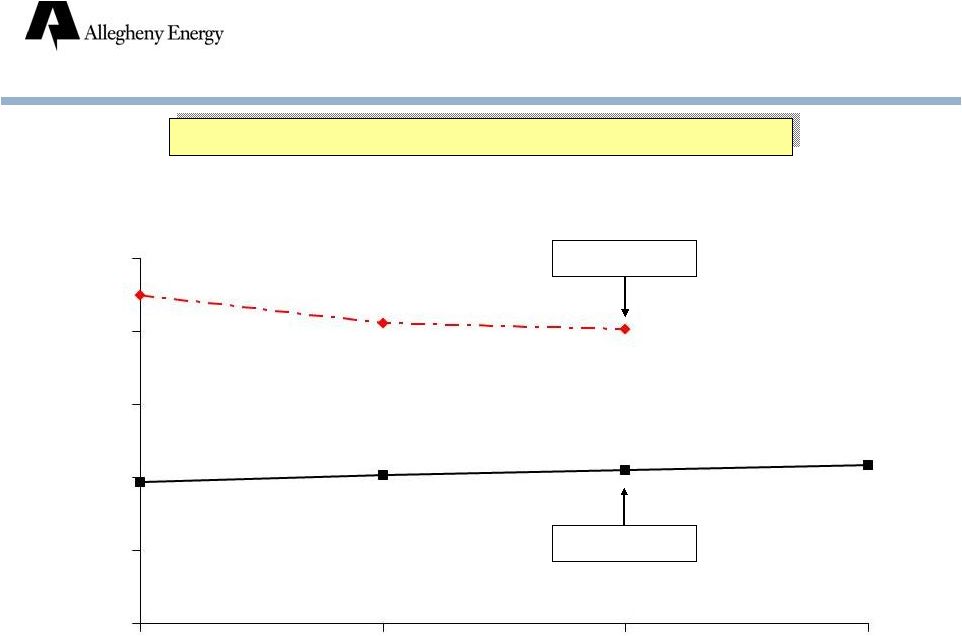

15

Merchant Generation:

Forward Power Prices

PJM Western Hub

($/MWH round-the-clock)

June 2008

March 2010

$0

$20

$40

$60

$80

$100

2009

2010

2011

2012

2011 forward prices have decreased by nearly 50%. |

16

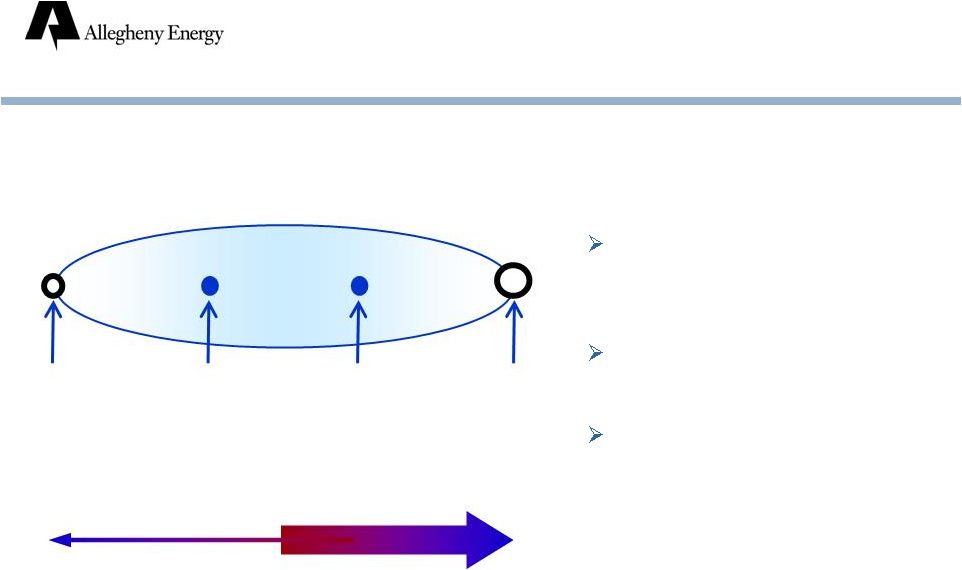

AEP

Dayton

Hub

APS

Zone

PJM

W. Hub

AYE

Generator

Nodes

Transmission

Less Congestion

More Congestion

Each plant sells all its output

at its generator node price in

PJM energy market

APS Zone: legacy retail

customer base

Due to transmission

congestion, plants’

realized

energy prices tend to be

closer to AEP-Dayton Hub

today than to PJM W. Hub

PJM Western Hub, AYE Plants

and AEP-Dayton Hub |

17

Key drivers:

Amount and location of supply and demand

Capability of transmission system

Marginal cost of unit(s) that respond to meet demand and resolve

transmission constraints

Basis Differential

Gas strongly influences

prices, especially on

peak

Located in a coal-dominated

region of PJM

Prices typically below W. Hub

Located in a coal-dominated

region of PJM

Prices typically below W. Hub

Less liquid than W. Hub

PJM WESTERN HUB

AYE SUPERCRITICAL

PLANTS

AEP-DAYTON HUB

Basis differential is the difference between PJM energy

prices at two locations. |

18

2011

2012

2013

2010

As of March 31, 2010

$ per MWH, round-the-clock

Forward Prices and

Basis Differentials

($5.45)

($5.89)

($4.89)

($4.97)

AEP-Dayton

Hub

PJM W. Hub

Basis

Differential

-$10

$0

$10

$20

$30

$40

$50 |

19

Merchant Generation:

Power Hedge Margin

2010 Power Hedge Margin

($/MWH; estimates as of March 31, 2010)

Margin:

$4/MWH

$110 million*

* Based on 2010 power hedge volume of 27.8 million MWH

$55

$51

Average Contract Price

Estimated Market Value

Power hedges substantially protect 2010 financial results.

|

20

55%

30-50%

21%

0-30%

80-90%

87%

Actual Target by Year-End

2010 3%

Merchant Generation: Well-Positioned

For a Recovering Economy

% of Projected Coal-Fired Output

as of June 1, 2010

2010

2011

2012

2013

Allegheny is positioned to benefit from higher power

prices which should accompany economic recovery. |

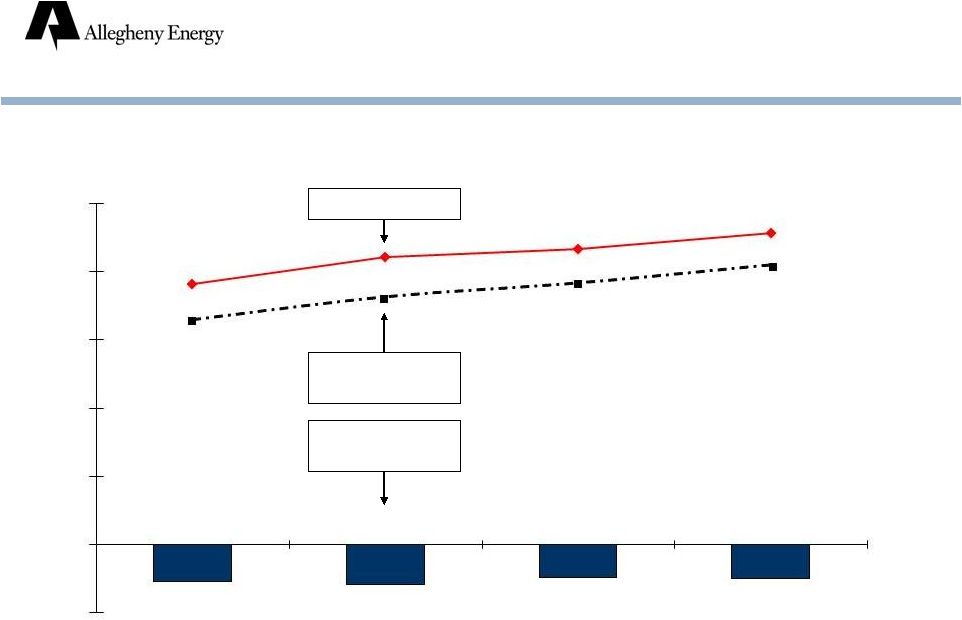

21

Pennsylvania POLR Rate

$ per MWH

Cumulative Increase in

Pre-Tax Operating Income

$ millions; estimates

Increasing Pennsylvania

Generation Rates

$0

$50

$100

$150

$200

$250

$300

2009

2010

$20

$25

$30

$35

$40

$45

$50

$55

2008

2009

2010 |

22

Transitioning to Market:

Pennsylvania

West Penn Power

Pennsylvania Power Procurement

APRIL 2009

JUNE 2009

OCT. 2009

JAN. 2010

MAY 2010

Average weighted retail generation price ($/MWH):

Residential

$72.80

$71.64

$65.29

$62.27

$59.39

Non-residential

$75.40

$67.24

$65.26

$63.38

Projected increase in 2011 residential bill

8.5%

10.6%

9.6%

8.5%

4.1%

PJM Western Hub forward price ($/MWH)

1

$55

$57

$53

$51

$47

1

Round-the-clock,

energy-only

price

at

time

bids

were

submitted.

For

17

months

beginning

January

1,

2011.

AUCTIONS |

23

Power Procurement Schedule:

Pennsylvania and Maryland

MWH thousands

AUCTION DATE

2010

2011

2012

2013

TOTAL

June

11,

2010

-

MD

165

250

320

100

835

October

22,

2010

-

PA

-

7,285

765

180

8,230

October

29,

2010

-

MD

60

115

-

-

175

January

14,

2011

-

MD

-

150

-

-

150

January

20,

2012

-

PA

-

-

2,000

1,400

3,400

April

20,

2012

-

PA

-

-

1,900

1,300

3,200

Spot

Purchases

-

PA

-

1,850

8,100

3,350

13,300 |

24

Merchant Generation:

Coal Contracts

Contracted & Priced*

Contract Price*

($/ton)

*

As

of

March

31,

2010.

Contract

price

includes

delivery

costs

averaging

$8-10/ton.

$55

$56

$58

$57

2009

2010

2011

2012

99%

70%

66%

2010

2011

2012 |

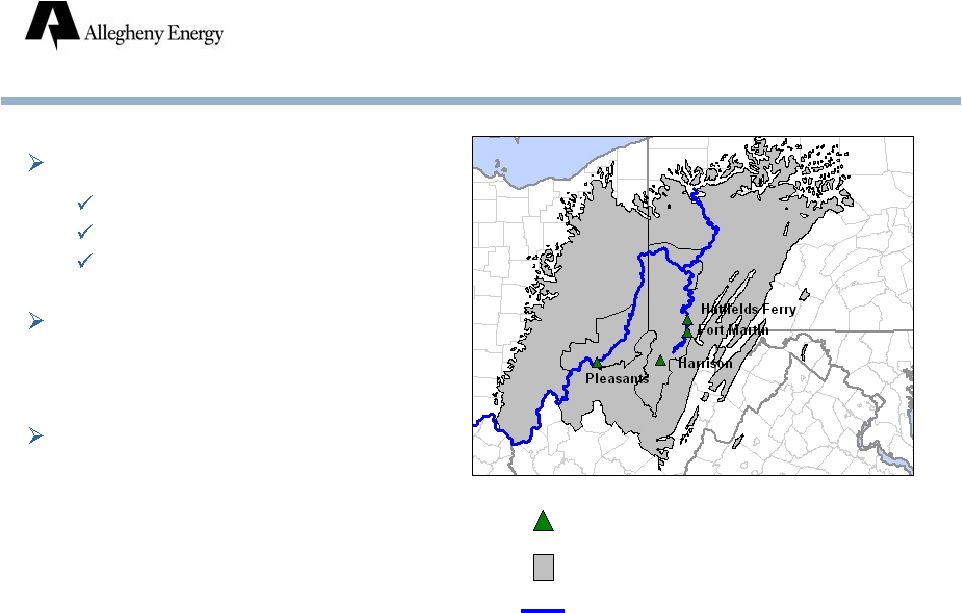

25

Adjacent to reserves, rivers

Low transportation costs

Flexible procurement

Competing suppliers

A natural partner for

independent mines in need of an

“anchor”

purchaser

Contract costs in line with

operating costs of leading

producers

Location: Favorable for

Coal Procurement

Supercritical coal generation facilities

Northern Appalachian coal basin

Rivers |

26

Coal Type and

Delivery Methods

2010

(merchant; estimates)

Northern App.

Scrubber

60%

Northern App.

26%

PRB

4%

Illinois

10%

Rail

8%

Truck

13%

Conveyor

23%

Barge

56% |

27

SCRUBBERS

SCRs

(SO

2

)

(NO

X

)

Harrison

Pleasants

Hatfield

Ft. Martin

Environmental Controls

All supercritical coal units have scrubbers. |

28

Supercritical Coal Plants

(merchant and regulated)

Plant Availability

Top

Quartile

82%

78%

76%

83%

84%

83%

87.5%

82%

87%

2002

2003

2004

2005

2006

2007

2008

2009 |

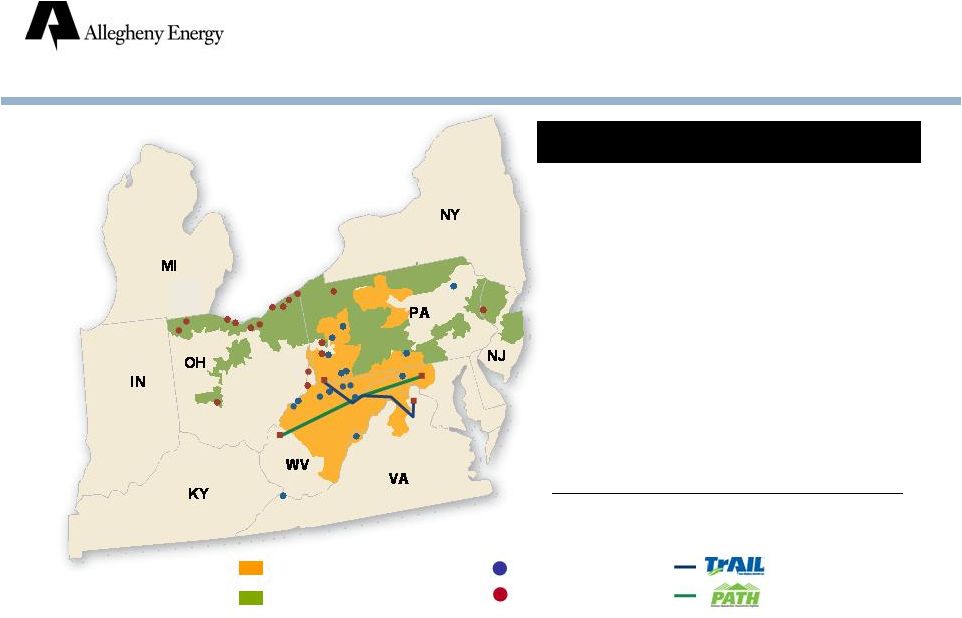

29

Transmission Expansion:

Overview

Allegheny is investing $2.6 billion in these projects.

|

30

($ millions; cash basis)

*

Totals exclude AFUDC and capitalized interest. PATH represents

Allegheny’s portion of project costs.

FERC-approved equity ratio = 50%

Transmission Expansion

APPROVED

ROE

PROJECT

TOTAL

2008

2009

2010

2011

TrAIL

12.7%

$ 925*

$67

$384

$357

$80

Other projects

11.7-12.7%

425*

37

72

102

63

PATH

14.3%

1,200*

8

44

21

59

CAPITAL EXPENDITURES

Incentive returns have been approved by FERC. |

31

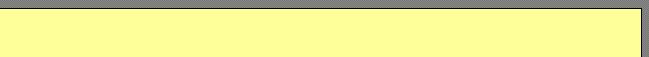

Growing Rate Base:

Transmission Expansion

Rate Base

Year-End; $ billions

$0.2

$0.8

$1.2

$1.3

$2.0

//

TrAIL

Other PJM

PATH

(Allegheny portion)

Note: Assumes weighted average ROE based on rates for TrAIL (12.7%), Other

(11.7-12.7%), and PATH (14.3%). 2008

2009

2010

2011

2014

Rate base is projected to nearly triple from 2009 to 2014.

|

32

% Complete

Rights of way

96%

Substation construction

95-100%

Towers constructed

67%

Line installed

23%

As of May 2010

Transmission Expansion:

TrAIL Construction Update |

33

Utility Operations:

Overview

In 4 states (PA, WV, MD, VA)

1.6 million electric customers

Retail sales: 42.0 million MWH

Regulated generation: over 2,700 MW (84% coal)

Allegheny Power

West Penn

Power

Monongahela

Power

Potomac

Edison

VIRGINIA

CHARLESTON

OHIO

HARRISBURG

MARYLAND

KENTUCKY

PENNSYLVANIA

CLEVELAND

BALTIMORE

PITTSBURGH

WASHINGTON, DC

WEST

VIRGINIA

Sales for 12 months ended December 31, 2009. Capacity as of December 31,

2009. Customers and sales include VA. Sale of VA distribution

operations was completed on June 1, 2010. |

34

Utility Operations:

Retail Revenue Mix, 2009

By State

By Customer Class

Residential

51%

Industrial

25%

Commercial

24%

* Sale of VA distribution operations was completed on June 1, 2010.

PA

45%

WV

29%

MD

17%

VA*

9% |

35

Authorized Capital Structures

and ROE’s

*

Includes $154 of VA distribution assets. Sale of VA distribution operations was

completed on June 1, 2010.

STATE

RATE BASE

($ millions;

12/31/09)

APPROVED

EQUITY RATIO

APPROVED

ROE

RATIO/ROE

APPROVED ON

WV

$1,426

46%

10.5%

May 2007

PA

1,028

46

11.5

Dec. 1994

MD

446

44

11.9

Feb. 1993

VA

192*

46

11.5

March 1995

TOTAL

$3,092 |

36

Potomac Edison*

West Penn

Mon Power

//

$2.9

$2.9

$3.9

$3.2

$3.5

Growing Rate Base:

Utility Operations

Year-end; $ billions

*

Excludes VA distribution assets for all periods

Note:

Includes capital expenditures for PA Act 129 plan as originally proposed ($174

million in 2010, $102 million in 2011, $44 million in 2012, $23 million in

2013 and $16 million in 2014). 2008

2009

2010

2011

2014 |

37

Utility Operations:

Competitive Rates

National

Average =

11.65 ¢/kWh

Residential Rates

¢/kWh as of January 1, 2010

*

Sale of VA distribution operations was completed on June 1, 2010.

9.29

9.18

10.37

9.58

12.90

8.61

10.19

13.91

Pennsylvania

West Virginia

Maryland

Virginia*

Allegheny Power

State Average |

38

Unhedged

energy margin:

Unhedged

energy revenues

-

hedged

coal

expense

-

unhedged

coal

expense

-

other

fuel

related

Unhedged

net revenue:

Unhedged

energy margin + capacity +

ancillaries + other net revenues

Unhedged

EBITDA:

Unhedged

net revenues -

operating expenses

Power hedge margin:

(Average contract price -

estimated market value) x

power hedge volume

Adjusted EBITDA:

Unhedged

EBITDA + power hedge margin

Merchant Generation Outlook:

Formulas |

39

($ millions adjusted pre-tax; estimates as of 03/31/10)

2010 Outlook

Change from

2009

12/31

Actual

Better (Worse)

Adjusted EBITDA:

Merchant generation

578

$

(55)

$

(46)

$

Utility operations

540

4

(54)

Transmission expansion

65

71

2

Other

(2)

(1)

-

Depreciation

(282)

(46)

1

Interest

(258)

(49)

(1)

2010 Earnings

Increase (Decrease) |

40

Merchant Generation:

2010 Outlook

($ millions adjusted pre-tax; estimates as of 03/31/10)

2009

Actual

Adjusted EBITDA:

Merchant generation

578

$

(55)

$

(46)

$

Key drivers:

Unhedged

energy

margin

3

$

(220)

$

Capacity

56

7

Other

(4)

(5)

Operating expenses

(10)

(5)

Power hedge margin

(99)

178

Change from

2010 Earnings

Increase (Decrease)

12/31

Better (Worse) |

41

1

Excludes volumes from Buchanan and volumes consumed by pumping at Bath County.

2

The expected realized price received from PJM at the generator.

3

Includes emissions, lime, urea, natural gas, other fuels, OVEC purchased power, and

Bath County pumping costs. 4

Includes ancillaries, Kern River, and other miscellaneous income.

5

Includes O&M, taxes other than income, and other income.

Note: numbers may not add due to rounding

Merchant Generation:

Key Drivers of EBITDA

Estimates as of 03/31/10 -

$ millions unless stated

2009

Actual

2010

Change vs

2009

Total

generation

volume

(TWh)

1

26

33

7 TWh

PJM Western Hub RTC price ($/MWh)

39

$

40

$

Basis and shaping ($/MWh)

(3)

(5)

Realized

energy

price

($/MWh)

2

36

$

35

$

$ (1) / MWh

Unhedged

energy revenues

937

$

1,173

$

Coal expense

(552)

(754)

Other

fuel

related

3

(162)

(193)

Unhedged

energy margin

223

$

226

$

3

$

Capacity

356

412

56

Other

net

revenues

4

83

79

(4)

Unhedged

net revenues

662

$

716

$

Operating

expenses

and

other

5

(293)

(303)

(10)

Unhedged

EBITDA

369

$

413

$

44

$

|

42

1

Includes POLR obligations, marketing contracts, and financial hedges.

2

Volume weighted contract price, including energy, capacity, ancillaries, congestion,

and shaping. 3

Volume weighted market price as of 3/31/10 including energy, capacity, ancillaries,

congestion, and shaping. 4

Difference between average contract price and contract market value multiplied by

power hedge volume. Note: numbers may not add due to rounding

Merchant Generation:

Key Drivers of EBITDA

Estimates as of 03/31/10 -

$ millions unless stated

2009

Actual

2010

Change

vs

2009

Unhedged

EBITDA

369

$

413

$

44

$

Power hedge volume (TWh)

1

27

28

Average contract price ($/MWh)

2

55

$

55

$

Estimated market value ($/MWh)

3

47

51

Power hedge margin ($/MWh)

8

$

4

$

Power hedge margin

4

209

$

110

$

(99)

Adjusted EBITDA

578

$

523

$

(55)

$ |

43

Note: For period 2010-2012 power volumes, % power hedged, and % coal priced are

based upon 3/31/10 production forecasts which are subject to change; coal

contract prices include delivery costs Merchant Generation:

Key Drivers of EBITDA

1

Includes supplemental auctions

Estimates as of 03/31/10 -

$ millions unless stated

2009

Actual

2010

2011

2012

POWER VOLUMES

Coal-fired generation (TWh)

24.4

32.1

33.1

32.4

Total generation (TWh)

26.0

33.5

34.5

33.8

POWER HEDGES

% of coal-fired generation hedged

N/A

87%

41%

11%

Volumes (TWh)

26.7

27.8

13.7

3.7

Average contract price ($/MWh)

55

$

55

$

58

$

55

$

Estimated market value ($/MWh)

47

51

50

51

Power hedge margin ($ millions)

209

$

110

$

112

$

14

$

COAL CONTRACTS

% of coal burn priced

N/A

99%

70%

66%

Volumes priced (tons)

10.1

13.0

9.5

8.6

Contract price ($/ton)

55

$

56

$

58

$

57

$

CAPACITY REVENUES

1

Capacity (MW)

6,335

6,293

6,218

6,228

Price ($/MW-day)

154

$

179

$

138

$

56

$

Revenues ($ millions)

356

$

412

$

313

$

127

$ |

44

Merchant Generation:

Forward Market Data

Note: broker estimates

1

SO2

allowance

to

ton

of

emission

ratio

–

2009

=

1:1

and

2010-2012

=

2:1

Actual

Balance

As of 03/31/10

2009

2010

2011

2012

POWER

($/MWh)

PJM West Hub RTC

38.75

$

38.08

$

42.04

$

43.32

$

AEP Dayton Hub RTC

32.98

32.63

36.15

38.43

NATURAL GAS

($/MMBtu)

Henry Hub NYMEX

3.92

$

4.27

$

5.34

$

5.79

$

COAL

($/ton)

-

excludes transportation

NAPP mid SO2

N/A

$63

$68

$72

NAPP high SO2

N/A

$48

$52

$55

EMISSIONS

($/allowance)

SO2

1

82

$

29

$

28

$

26

$

NOx

-

ozone season

302

45

33

N/A

NOx

-

annual

1,382

450

343

138 |

45

1

Change

in

pre-tax

income

=

(Total

generation

volume

–

power

hedge

volume

–

Bath

pumping

annual volume of approximately 1.5 TWh) x realized energy price sensitivity

($/MWh) 2

Cost of each emission allowance adjusted by same percentage

Note: does not reflect potential dispatch changes, load changes, changes in basis,

or correlations between variables; all sensitivities reflect hedge positions

and production forecasts as of 03/31/10

Merchant Generation:

Sensitivities

Change in adjusted pre-tax income ($ millions)

2010

2011

2012

REALIZED

ENERGY

PRICE

1

+ $10/MWh

35

$

193

$

286

$

COAL PRICE

+ $10/ton

(2)

(41)

(45)

SO2

/

NOX

ALLOWANCE

PRICES

2

+ 100%

2

(4)

(1) |

46

Utility Operations:

2010 Outlook

($ millions adjusted pre-tax; estimates as of 03/31/10)

1

Subject to change pending outcome of review of lower cost compliance

alternative 2

Excludes gain from sale of VA Distribution

2009

Actual

Adjusted EBITDA:

Utility operations

540

$

4

$

(54)

$

Key drivers:

WV base rate settlement

20

$

(33)

$

Winter storms -

1st quarter

(20)

(29)

WV storm recovery

5

5

Recovery of securitized interest & depreciation

17

-

PA Act 129

1

-

(10)

Load growth

5

5

PE VA operations

2

(24)

5

Non-formulaic O&M

(2)

1

Other

3

2

Change from

2010 Earnings

Increase (Decrease)

Better (Worse)

12/31 |

47

Transmission Expansion:

2010 Outlook

($ millions adjusted pre-tax; estimates as of 03/31/10)

Change from

2009

12/31

Actual

Better (Worse)

Adjusted EBITDA:

Transmission expansion

65

$

71

$

2

$

2010 Earnings

Increase (Decrease) |

48

Depreciation:

2010 Outlook

($ millions adjusted pre-tax; estimates as of 03/31/10)

Change from

2009

12/31

Actual

Better (Worse)

Depreciation

(282)

$

(46)

$

1

$

Key drivers:

Scrubber (Ft. Martin)

(21)

$

-

$

Scrubber (Hatfield)

(19)

-

Other

(6)

1

2010 Earnings

Increase (Decrease) |

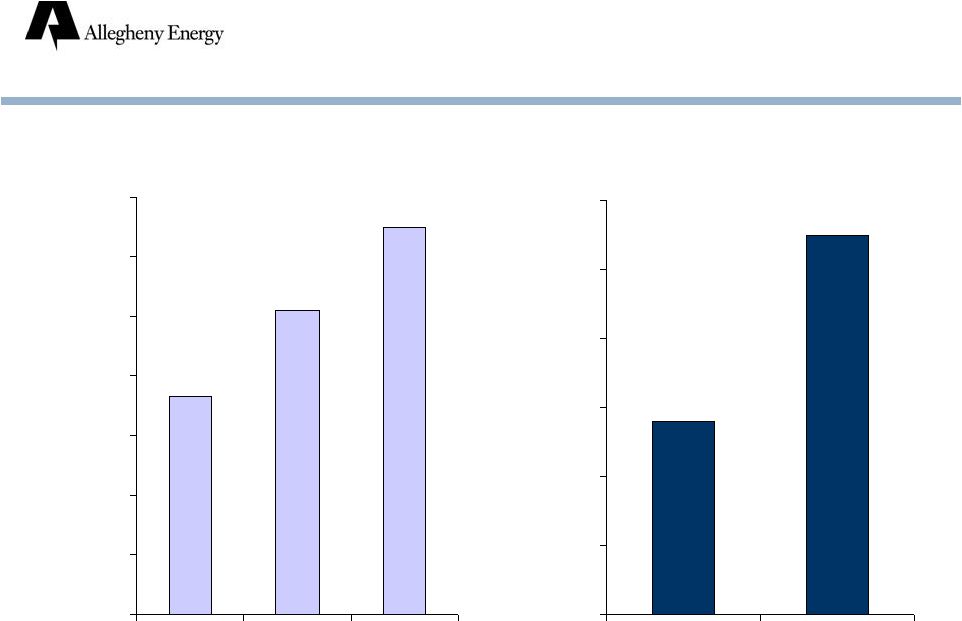

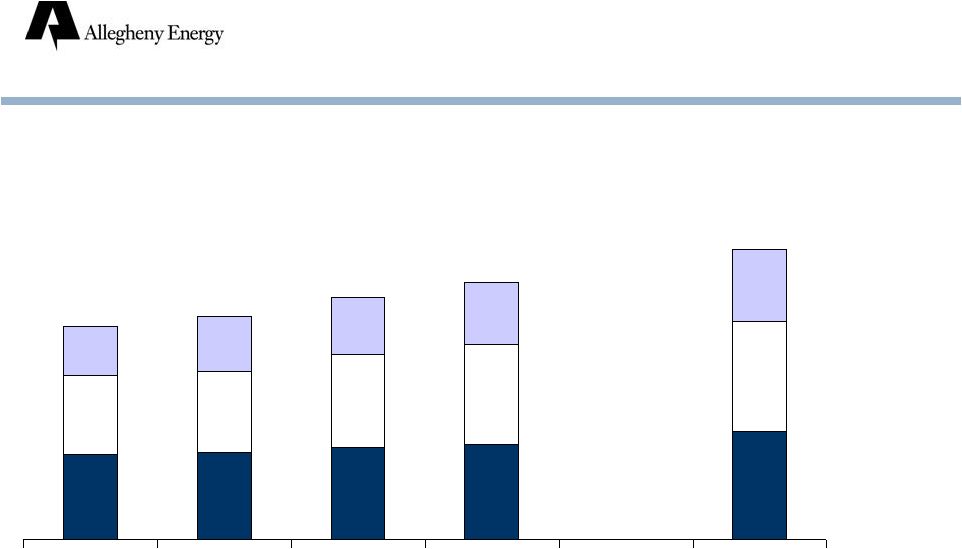

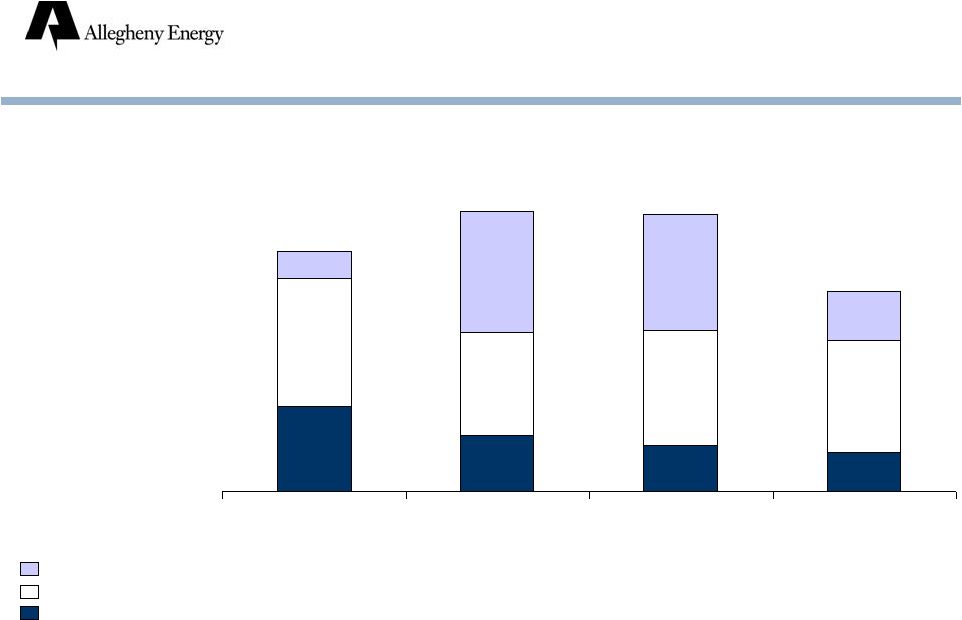

49

Transmission expansion

$112

$499

$480

$202

Utility Operations

532

420

477

460

Merchant generation

347

233

187

161

$ millions; cash basis

Capital Expenditures

$991

$1,152

$823

$1,144

NOTE:

includes securitized scrubber capital expenditures, Allegheny’s portion

of PATH, and expenditures for PA Act 129 plan (as originally proposed) which

were $174 million in 2010 and $102 million in 2011. 2008

2009

2010

2011 |

50

Interest:

2010 Outlook

($ millions adjusted pre-tax; estimates as of 03/31/10)

* Subject to formulaic recovery

Change from

2009

12/31

Actual

Better (Worse)

Interest

(258)

$

(49)

$

(1)

$

Key drivers:

Securitized interest

5

$

*

2

$

Capitalized interest

(21)

(1)

Transmission

(20)

*

5

Other

(13)

(7)

2010 Earnings

Increase (Decrease) |

51

Strength of economic recovery

Gas prices

Environmental regulations

Climate change legislation

PATH approvals

Merger approvals

Risks and Challenges |

52

Significant benefits to shareholders

Premium

Dividend increase

Diversifies fuel mix by adding nuclear capacity

Provides greater scale and scope

Strong business portfolio, excellent growth

opportunities

FirstEnergy Merger |

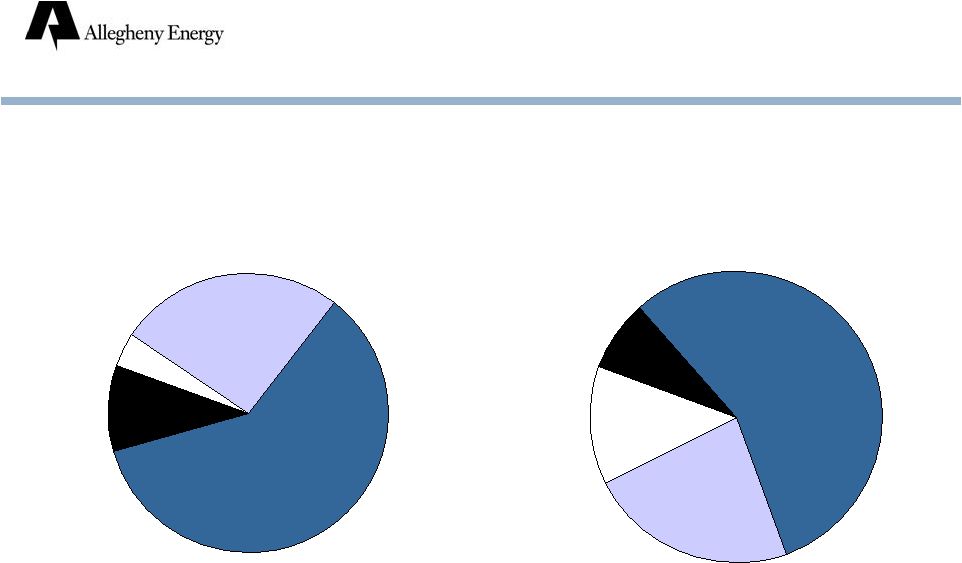

53

FirstEnergy Merger:

Diversifies Fuel Mix

Coal: Unscrubbed

19%

Coal: Scrubbed

46%

Natural Gas

9%

Non-Emitting

26%

Combined Generation Capacity

December 31, 2009

1

Includes nuclear, wind and hydro

1 |

54

FirstEnergy Merger:

Greater Scale and Scope

Revenue

$16.4 billion

Electric Customers

6.1 million

Rate Base

$10.8 billion

Total Generation

24 GW

Competitive Generation

21 GW

Service Territory

67,000 sq miles

Employees

~17,750

FirstEnergy Service Territory

Allegheny Service Territory

FirstEnergy Plants

Allegheny Plants

Combined Statistics |

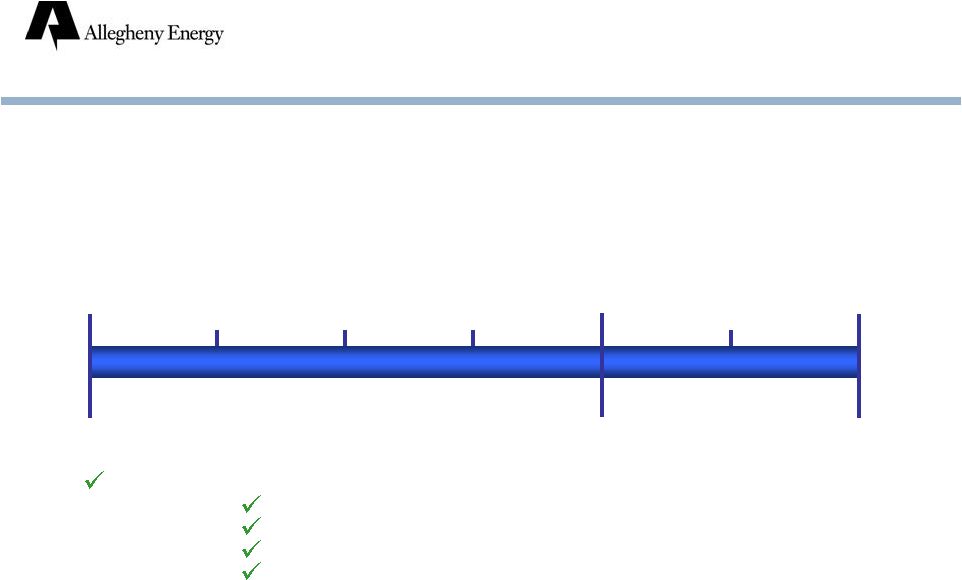

55

FirstEnergy Merger:

Timeline

Announced

merger,

filed S-4

Filed with:

FERC

PA

WV

MD

VA

Shareholder

meetings

Complete merger

2010

2011

Q1

Q4

Q2

Q3

Q1

Q2 |

Supplemental Information |

57

Earnings (Loss) Per Share

As Reported

As Adjusted

As Reported

As Adjusted

2003:

Q1

$

(0.46)

$

(0.32)

2007:

Q1

$

0.65

$

0.65

Q2

(1.82)

(0.23)

Q2

0.45

0.45

Q3

(0.40)

0.11

Q3

0.67

0.67

Q4

(0.11)

(0.14)

Q4

0.65

0.46

Year

(2.80)

(0.37)

Year

2.43

2.26

2004:

Q1

$

0.25

$

(0.03)

2008:

Q1

$

0.80

$

0.80

Q2

(0.31)

(0.21)

Q2

0.91

0.45

Q3

(2.40)

0.37

Q3

0.52

0.54

Q4

0.48

0.22

Q4

0.10

0.51

Year

(1.83)

0.47

Year

2.33

2.30

2005:

Q1

$

0.29

$

0.39

2009:

Q1

$

0.79

$

0.67

Q2

(0.12)

0.08

Q2

0.43

0.41

Q3

0.21

0.45

Q3

0.45

0.59

Q4

0.02

0.02

Q4

0.64

0.66

Year

0.40

0.94

Year

2.31

2.33

2006:

Q1

$

0.67

$

0.68

2010:

Q1

$

0.52

$

0.61

Q2

0.18

0.22

Q3

0.65

0.56

Q4

0.38

0.37

Year

1.89

1.83 |

58

EBITDA

As Reported

As Adjusted

As Reported

As Adjusted

2003:

Q1

$

77.6

$

92.9

2007:

Q1

$

312.6

$

312.6

Q2

(203.5)

150.1

Q2

263.8

263.8

Q3

117.3

225.3

Q3

308.6

308.6

Q4

197.4

185.6

Q4

242.9

243.6

Year

156.8

634.9

Year

1,128.0

1,131.1

2004:

Q1

$

247.8

$

175.5

2008:

Q1

$

323.1

$

323.1

Q2

110.3

122.0

Q2

371.4

244.1

Q3

243.2

243.2

Q3

258.6

262.6

Q4

312.7

221.8

Q4

152.0

268.3

Year

914.0

762.5

Year

1,105.3

1,098.3

2005:

Q1

$

261.3

$

261.3

2009:

Q1

$

360.6

$

328.2

Q2

210.6

192.7

Q2

247.8

243.2

Q3

254.7

274.2

Q3

278.7

297.0

Q4

162.1

162.1

Q4

320.3

312.4

Year

888.6

890.2

Year

1,207.6

1,181.0

2006:

Q1

$

322.1

$

322.1

2010:

Q1

$

300.8

$

324.9

Q2

193.7

193.7

Q3

286.3

286.3

Q4

234.7

234.7

Year

1,036.8

1,036.8

$ millions |

59

($1,200)

($700)

($200)

$300

$800

Cash Flow

$ millions

*

Adjusted cash from operations net of capital expenditures excluding securitization

and project financings.

2004

2007

2006

2005

2008

2009

Cash From

Operations

Capital

Expenditures

Free Cash

Flow* |

60

Credit Ratings

Baa3

Ba3

B3

Moody’s

BBB-

BB-

CCC+

S&P

Senior Unsecured Debt

Baa2

Baa3

B1

Moody’s

BBB

BBB-

B

S&P

Senior Secured Debt

AE Supply

Ba1

Ba2

B2

Moody’s

BB+

BB-

CCC+

S&P

Senior Unsecured Debt

BBB-

BB+

B

S&P

Corporate Family Rating

AYE, Inc.

April

2010

2006

2003 |