Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

REVIVAL

RESOURCES, INC.

(Name of

Small Business Issuer in its charter)

|

NEVADA

|

1090

|

27-1952702

|

|

(State

or jurisdiction of incorporation or organization)

|

(Primary

Standard Industrial Classification Code Number)

|

(I.R.S.

Employer ID No.)

|

112 North

Curry Street

Carson

City Nevada 89703

(775) 321-8274

(telephone)

(Address

and telephone number of principal executive offices)

State

Agent & Transfer Syndicate, Inc.

112 North

Curry Street

Carson

City Nevada 89703

(775)

882-1013 (telephone)

(Name,

address and telephone number of agent for service)

Copies

to:

Diane D.

Dalmy

Attorney

at Law

8965 W.

Cornell Place

Lakewood,

Colorado 80227

(303)

985-9324 (telephone)

(303)

988-6954 (facsimile)

APPROXIMATE

DATE OF PROPOSED SALE TO THE PUBLIC:

From time

to time after this Registration Statement becomes effective.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933 check the following

box: x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier registration statement for the same

offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company.

(Check one):

1

Large

Accelerated Filer ¨

Accelerated Filer ¨

Non-Accelerated Filer ¨ Smaller Reporting

Company x

CALCULATION OF REGISTRATION

FEE

|

Title

of each class of

securities

to be registered

|

Amount

to

be

registered

|

Proposed

maximum

offering

price per unit

|

Proposed

maximum

aggregate

offering price

|

Amount

of

registration

fee

|

||||

|

Common

|

4,000,000

|

$0.03

[1]

|

$120,000

|

$8.56

[2]

|

[1] No

exchange or over-the-counter market exists for Revival Resources, Inc’s. common

stock. The offering price has been arbitrarily determined and bears

no relationship to assets, earnings, or any other valuation criteria. No

assurance can be given that the shares offered hereby will have a market value

or that they may be sold at this, or at any price.

[2] Fee

calculated in accordance with Rule 457(o) of the Securities Act of 1933, as

amended “Securities Act”. Estimated for the sole purpose of

calculating the registration fee.

The

Registrant hereby amends this Registration Statement on such date or dates as

may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until the Registration Statement shall become effective on

such date as the Commission, acting pursuant to Section 8(a), may

determine.

The

information in this prospectus is not complete and may be changed. We may not

sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities in

any state where the offer or sale is not permitted.

|

PROSPECTUS

|

Subject

To Completion: Dated ______, 2010

REVIVAL

RESOURCES, INC.

4,000,000

shares of common stock, no minimum / 4,000,000 maximum Offered at $0.03 per

share

|

Securities

Being Offered by Revival Resources, Inc.

|

Revival

Resources, Inc. is offering 4,000,000 shares at an offering price of $0.03

per share. There is currently no public market for the common

stock

|

|

|

Minimum

Number of Shares To Be Sold in This Offering

|

None

|

This is a

"self-underwritten" public offering, with no minimum purchase

requirement.

1.

Revival Resources, Inc. is not using an underwriter for this

offering.

2. The

offering expenses shown do not include legal, accounting, printing and related

costs incurred in making this offering. Revival Resources, Inc. will pay all

such costs, which it believes to be $5,700 There is no arrangement to place the

proceeds from this offering in an escrow, trust or similar account.

|

|

Per

Share

(Non

Minimum)

|

If

Maximum Sold by Revival Resources (4,000,000)

|

||||||

|

Price

to Public

|

$

|

0.03

|

$

|

0.03

|

||||

|

Underwriting

Discounts/Commissions

|

0.00

|

0.00

|

||||||

|

Proceeds

to Registrant

|

$

|

0.03

|

$

|

120,000

|

||||

This

offering involves a high degree of risk; see "Risk Factors"

beginning on page 8 to read about factors you should consider before buying

shares of the common stock.

Revival

Resources, Inc. is an exploration stage company and currently has no operations.

There is a high degree of risk involved with any investment in the shares

offered herein. You should only purchase shares if you can afford a loss of your

entire investment. Our independent auditor has issued an audit opinion for

Revival Resources, Inc. which includes a statement expressing substantial doubt

as to our ability to continue as a going concern. As of the date of

this prospectus, our stock is presently not traded on any market or securities

exchange. Further, there is no assurance that a trading market for our

securities will ever develop.

2

These

securities have not been approved or disapproved by the Securities and Exchange

Commission or any state securities commission, nor has the Securities and

Exchange Commission or any state securities commission passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary is a criminal

offense.

The

Date of this Prospectus is ______________, 2010

3

TABLE

OF CONTENTS

|

Page

|

||

|

FORWARD-LOOKING

STATEMENTS

|

5

|

|

|

SUMMARY

INFORMATION

|

6

|

|

|

RISK

FACTORS AND UNCERTAINTIES

|

7

|

|

|

USE

OF PROCEEDS

|

10

|

|

|

DETERMINATION

OF OFFERING PRICE

|

11

|

|

|

DILUTION

|

11

|

|

|

PLAN

OF DISTRIBUTION

|

13

|

|

|

DESCRIPTION

OF SECURITIES

|

13

|

|

|

INTEREST

OF NAMED EXPERTS AND COUNSEL

|

14

|

|

|

DESCRIPTION

OF BUSINESS

|

14

|

|

|

DESCRIPTION

OF PROPERTY

|

16

|

|

|

LEGAL

PROCEEDINGS

|

18

|

|

|

MARKET

FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

|

18

|

|

|

FINANCIAL

STATEMENTS

|

21

|

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS

|

30

|

|

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

36

|

|

|

DIRECTORS,

EXECUTIVE OFFICERS, AND CONTROL PERSONS

|

36

|

|

|

EXECUTIVE

COMPENSATION

|

37

|

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

38

|

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

38

|

|

|

DISCLOSURE

OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT

LIABILITIES

|

38

|

|

|

CORPORATE

GOVERNANCE

|

39

|

|

|

THE

SEC’S POSITION ON INDEMNIFICATION FOR LIABILITIES

|

39

|

|

|

TRANSFER

AGENT AND REGISTRAR

|

39

|

|

|

LEGAL

MATTERS

|

39

|

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

39

|

|

|

GLOSSARY

OF CERTAIN MINING TERMS

|

39

|

|

|

PART

II - INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

43

|

|

|

OTHER

EXPENSES OF ISSUANCE AND DISTRIBUTION

|

43

|

|

|

INDEMNIFICATION

OF DIRECTORS AND OFFICERS

|

43

|

|

|

RECENT

SALES OF UNREGISTERED SECURITIES

|

44

|

|

|

EXHIBITS

|

44

|

|

|

UNDERTAKINGS

|

45

|

|

|

SIGNATURES

|

46

|

4

FORWARD-LOOKING

STATEMENTS

This

prospectus and the exhibits attached hereto contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements concern the Company’s anticipated results and

developments in the Company’s operations in future periods, planned exploration

and development of its properties, plans related to its business and other

matters that may occur in the future. These statements relate to analyses

and other information that are based on forecasts of future results, estimates

of amounts not yet determinable and assumptions of management.

Any

statements that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions or future

events or performance (often, but not always, using words or phrases such as

“expects” or “does not expect”, “is expected”, “anticipates” or “does not

anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions,

events or results “may”, “could”, “would”, “might” or “will” be taken, occur or

be achieved) are not statements of historical fact and may be forward-looking

statements. Forward-looking statements are subject to a variety of known

and unknown risks, uncertainties and other factors which could cause actual

events or results to differ from those expressed or implied by the

forward-looking statements, including, without limitation:

risks

related to our properties being in the exploration stage;

risks

related our mineral operations being subject to government

regulation;

risks

related to our ability to obtain additional capital to develop our resources, if

any;

risks

related to mineral exploration and development activities;

risks

related to our insurance coverage for operating risks;

risks

related to the fluctuation of prices for precious and base metals, such as gold,

silver and copper;

risks

related to the competitive industry of mineral exploration;

risks

related to our title and rights in our mineral properties;

risks

related to our limited operating history;

risks

related the possible dilution of our common stock from additional financing

activities;

risks

related to potential conflicts of interest with our management;

risks

related to our subsidiaries activities; and

risks

related to our shares of common stock.

This list

is not exhaustive of the factors that may affect our forward-looking statements.

Some of the important risks and uncertainties that could affect forward-looking

statements are described further under the section headings “Risk Factors and

Uncertainties”, “Description of the Business” and “Management’s Discussion and

Analysis” of this prospectus. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those anticipated, believed, estimated

or expected. We caution readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made. We

disclaim any obligation subsequently to revise any forward-looking statements to

reflect events or circumstances after the date of such statements or to reflect

the occurrence of anticipated or unanticipated events.

We

qualify all the forward-looking statements contained in this prospectus by the

foregoing cautionary statements.

You

should rely only on the information contained in this prospectus. We have not

authorized anyone to provide you with information different from the information

contained in this prospectus. The information contained in this prospectus is

accurate only as of the date of this prospectus, regardless of when this

prospectus is delivered or when any sale of our common stock

occurs.

This

summary does not contain all of the information you should consider before

buying shares of our common stock. You should read the entire prospectus

carefully, especially the “Risk Factors and Uncertainties” section and our

consolidated financial statements and the related notes before deciding to

invest in shares of our common stock.

5

SUMMARY

INFORMATION

The

Offering

Revival

Resources, Inc.'s common stock is presently not traded on any market or

securities exchange. 10,000,000 shares of restricted common stock are issued and

outstanding as of the date of this prospectus.

Revival

is offering up to 4,000,000 shares of common stock at an offering price of $0.03

per share. There is currently no public market for the common stock. Revival

intends to apply to have the common stock quoted on the OTC Bulletin Board

(OTCBB). Currently, there is no trading symbol assigned. Revival'

sole Officer and Director owns 10,000,000 shares of Restricted Common Stock. If

Revival is unable to sell its stock and raise money, Revival’s business would

fail as it would be unable to complete its business plan and any investment made

into the Company would be lost in its entirety.

The

purchase of the securities offered through this prospectus involves a high

degree of risk. See section entitled "Risk Factors" on page 7.

Company

History

Unless otherwise indicated, any

reference to Revival or as “we”, “us”, or “our” refers to Revival Resources,

Inc. Revival Resources, Inc. is an exploration stage company that was

incorporated on February 19, 2010, under the laws of the State of Nevada. Our

fiscal year end is March 31. The principal offices are located at 112 North

Curry Street Carson City Nevada 89703 Telephone (775) 321-8274 Fax (775)

546-6003

Since

becoming incorporated, Revival has not made any significant purchases or sale of

assets, nor has it been involved in any mergers, acquisitions or consolidations.

Revival has never declared bankruptcy, it has never been in receivership, and it

has never been involved in any legal action or proceedings.

We are an

exploration stage corporation. We intend to be in the business of

mineral property exploration. We do not own any interest in any

property, but simply have the right to conduct exploration activities on one

property. The property consists of approximately 350 hectares of mining claim

located in the Golden Mining Division situated approximately18 kilometers west

of Invermere, British Columbia Canada. We intend to explore for

lead-zinc, gold, and silver on the property. Currently, we have no further

business planned if mineralized material is not found on the

property.

As of

March 31, 2010, the date of company's last audited financial statements, Revival

has raised $10,000 through the sale of common stock. This sale was a

purchase of 10,000,000 shares by the Company’s sole officer and director

Caroline Swart.

Revival’

current liabilities from inception to March 31, 2010 are $6,364. This expense is

relating to corporate start-up fees. The Company anticipates expense

of $5,700 relating to SEC filing expenses, printing and Transfer Agent fees for

this filing. As of the date of this prospectus, we have not yet generated or

realized any revenues from our business operations. The following financial

information summarizes the more complete historical financial information as

indicated on the audited financial statements of Revival filed with this

prospectus.

Management

Currently,

Revival has one Officer/Director, Caroline Swart. Our sole Officer/Director has

assumed responsibility for all planning, development and operational duties, and

will continue to do so throughout the beginning stages of the business plan.

Other than the Officer/Director, there are no employees at the present time and

there are no plans to hire employees during the next twelve months.

Summary of Financial

Data

|

As

of

March

31 2010

|

||||

|

Revenues

|

$

|

0

|

||

|

Operating

Expenses including Liabilities

|

$

|

6,384

|

||

|

Earnings

(Loss)

|

$

|

(6,364)

|

||

|

Total

Assets

|

$

|

9,980

|

||

|

Working

Capital

|

$

|

3,616

|

||

|

Shareholder’s

Equity

|

$

|

3,616

|

||

6

RISK

FACTORS AND UNCERTAINTIES

An

investment in an exploration stage mining company with no history of operations

such as ours involves an unusually high amount of risk, unknown and known,

present and potential, including, but not limited to the risks enumerated below.

Our

failure to successfully address the risks and uncertainties described below

would have a material adverse effect on our business, financial condition and/or

results of operations, and the trading price of our common stock may decline and

investors may lose all or part of their investment. We cannot assure you

that we will successfully address these risks or other unknown risks that may

affect our business.

Estimates

of mineralized material are forward-looking statements inherently subject to

error. Although resource estimates require a high degree of assurance in the

underlying data when the estimates are made, unforeseen events and

uncontrollable factors can have significant adverse or positive impacts on the

estimates. Actual results will inherently differ from estimates. The unforeseen

events and uncontrollable factors include: geologic uncertainties including

inherent sample variability, metal price fluctuations, variations in mining and

processing parameters, and adverse changes in environmental or mining laws and

regulations. The timing and effects of variances from estimated values cannot be

accurately predicted.

RISKS ASSOCIATED WITH

REVIVAL RESOURCES, INC:

Because

our auditors have issued a going concern opinion, there is substantial

uncertainty we will continue activities in which case you could lose your

investment.

Our

auditors have issued a going concern opinion. This means that there is

substantial doubt that we can continue as an ongoing business for the next

twelve months. As such we may have to cease activities and you could lose your

entire investment.

There

is no assurance that we can establish the existence of any mineral reserve in

commercially exploitable quantities. Until we can do so, we cannot earn any

revenues from this property and if we do not do so we will lose all of the funds

that we expend on exploration. If we do not discover any mineral reserve in a

commercially exploitable quantity, our business would fail and any investment

made would be lost in its entirety.

We have

not established any mineral reserve according to recognized reserve guidelines

on any property we intend to explore, nor can there be any assurance that we

will be able to do so. [A mineral reserve is defined by the Securities and

Exchange Commission in its Industry Guide

(http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part

of a mineral deposit, which could be economically and legally extracted or

produced at the time of the reserve determination.]

The

probability of an individual prospect ever having a "reserve" that meets the

requirements of the Securities and Exchange Commission's Industry Guide 7 is

extremely remote; in all probability our mineral property does not contain any

'reserve' and any funds that we spend on exploration will probably be lost. Even

if we do eventually discover a mineral reserve on one or more of our properties,

there can be no assurance that they can be developed into producing mines and

extract those minerals. Both mineral exploration and development involve a high

degree of risk and few properties, which are explored, are ultimately developed

into producing mines.

The

commercial viability of an established mineral deposit will depend on a number

of factors including, by way of example, the size, grade and other attributes of

the mineral deposit, the proximity of the mineral deposit to infrastructure such

as a smelter, roads and a point for shipping, government regulation and market

prices. Most of these factors will be beyond our control, and any of them could

increase costs and make extraction of any identified mineral deposit

unprofitable.

Mineral

operations are subject to applicable law and government regulation. Even if we

discover a mineral reserve in a commercially exploitable quantity, these laws

and regulations could restrict or prohibit the exploitation of that mineral

reserve. If we cannot exploit any mineral reserve that we might discover on our

properties, our business may fail.

Both

mineral exploration and extraction require permits from various foreign,

federal, state, provincial and local governmental authorities and are governed

by laws and regulations, including those with respect to prospecting, mine

development, mineral production, transport, export, taxation, labor standards,

occupational health, waste disposal, toxic substances, land use, environmental

protection, mine safety and other matters. There can be no assurance that

we will be able to obtain or maintain any of the permits required for the

continued exploration of our mineral properties or for the construction and

operation of a mine on our properties at economically viable costs. If we cannot

accomplish these objectives, our business could face difficulty and/or

fail.

7

We

believe that we are in compliance with all material laws and regulations that

currently apply to our activities but there can be no assurance that we can

continue to do so. Current laws and regulations could be amended and we might

not be able to comply with them, as amended. Further, there can be no assurance

that we will be able to obtain or maintain all permits necessary for our future

operations, or that we will be able to obtain them on reasonable terms. To the

extent such approvals are required and are not obtained, we may be delayed or

prohibited from proceeding with planned exploration or development of our

mineral properties.

Environmental

hazards unknown to us, which have been caused by previous or existing owners or

operators of the properties, may exist on the properties in which we hold an

interest. At the date of this Prospectus, the Company is not aware of any

environmental issues or litigation relating to any of its current or former

properties.

Future

legislation and administrative changes to the mining laws could prevent us from

exploring our properties.

New

provincial and Canadian federal laws and regulations, amendments to existing

laws and regulations, administrative interpretation of existing laws and

regulations, or more stringent enforcement of existing laws and regulations,

could have a material adverse impact on our ability to conduct exploration and

mining activities. Any change in the regulatory structure making it more

expensive to engage in mining activities could cause us to cease

operations.

If

we establish the existence of a mineral reserve on our property in a

commercially exploitable quantity, we will require additional capital in order

to develop the property into a producing mine. If we cannot raise this

additional capital, we will not be able to exploit the reserve, and our business

could fail.

If we do

discover mineral reserves in commercially exploitable quantities on our

property, we will be required to expend substantial sums of money to establish

the extent of the reserve, develop processes to extract it and develop

extraction and processing facilities and infrastructure. Although we may derive

substantial benefits from the discovery of a major deposit, there can be no

assurance that such a resource will be large enough to justify commercial

operations, nor can there be any assurance that we will be able to raise the

funds required for development on a timely basis. If we cannot raise the

necessary capital or complete the necessary facilities and infrastructure, our

business may fail.

Mineral

exploration and development is subject to extraordinary operating risks. We do

not currently insure against these risks. In the event of a cave-in or similar

occurrence, our liability may exceed our resources, which would have an adverse

impact on our Company.

Mineral

exploration, development and production involve many risks, which even a

combination of experience, knowledge and careful evaluation may not be able to

overcome. Our operations will be subject to all the hazards and risks inherent

in the exploration, development and production of resources, including liability

for pollution, cave-ins or similar hazards against which we cannot insure or

against which we may elect not to insure. Any such event could result in work

stoppages and damage to property, including damage to the environment. We do not

currently maintain any insurance coverage against these operating hazards. The

payment of any liabilities that arise from any such occurrence would have a

material, adverse impact on our Company.

Third

parties may challenge our rights to our mineral properties or the agreements

that permit us to explore our properties may expire if we fail to timely renew

them and pay the required fees.

In

connection with the acquisition of our mineral properties, we sometimes conduct

only limited reviews of title and related matters, and obtain certain

representations regarding ownership. These limited reviews do not

necessarily preclude third parties from challenging our title and, furthermore,

our title may be defective. Consequently, there can be no assurance that

we hold good and marketable title to all of our mining concessions and mining

claims. If any of our concessions or claims were challenged, we could

incur significant costs and lose valuable time in defending such a challenge.

These costs or an adverse ruling with regards to any challenge of our

titles could have a material adverse affect on our financial position or results

of operations. There can be no assurance that any such disputes or

challenges will be resolved in our favor.

We are

not aware of challenges to the location or area of any of our mining claims.

There is, however, no guarantee that title to the claims will not be challenged

or impugned in the future.

8

Our

management has no technical training and no experience in mineral activities and

consequently our activities, earnings and ultimate financial success could be

irreparably harmed.

Our

management has no technical training and experience with exploring for,

starting, and operating a mine. With no direct training or experience in these

areas, management may not be fully aware of many of the specific requirements

related to working within the industry. Management's decisions and choices may

not take into account standard engineering or managerial approaches mineral

exploration companies commonly use. Consequently, our activities, earnings and

ultimate financial success could suffer irreparable harm due to management's

lack of experience in the industry.

Our

success is dependent on current management, who may be unable to devote

sufficient time to the development of our business; this potential limitation

could cause the business to fail.

Revival

is heavily dependent on our sole Officer and Director, Caroline

Swart. If something were to happen to her, it would greatly delay its

daily operations until further industry contacts could be established.

Furthermore, there is no assurance that suitable people could be found to

replace Ms. Swart. In that instance, Revival may be unable to further its

business plan.

Additionally,

Ms. Swart is employed outside of Revival. Ms. Swart has been and

continues to expect to be able to commit approximately 10 hours per week of her

time, to the development of our business for the next twelve months. If

management is required to spend additional time with her outside employment, she

may not have sufficient time to devote to Revival, and as a result Revival would

be unable to develop its business plan.

Because title to the property is

held in the name of another person, if he transfers the property to someone

other than us, we will cease activities.

Title to

the property upon which we intend to conduct exploration activities is not held

in our name. Title to the property is recorded in the name of Danial Wessels

whom has an agreement with the Company for exploration upon the property. If the

owner transfers the property to a third person, the third person will obtain

good title and we will have nothing. If this should occur, we will subsequently

not own any property and we will have to cease all exploration

activities.

RISKS ASSOCIATED WITH THIS

OFFERING:

Because

we have only one officer and director who is responsible for our managerial and

organizational structure, in the future, there may not be effective disclosure

and accounting controls to comply with applicable laws and regulations which

could result in fines, penalties and assessments against the

Company.

We

currently have only one officer and director, Caroline Swart. As

such, she is solely responsible for our managerial and organizational structure

which will include preparation of disclosure and accounting controls under the

Sarbanes-Oxley Act of 2002. When these controls are implemented, she will be

responsible for the administration of the controls. Should she not have

sufficient experience, she may be incapable of creating and implementing the

controls which may cause the Company to be subject to sanctions and fines by the

Securities Exchange.

If

we complete a financing through the sale of additional shares of our common

stock in the future, then shareholders will experience dilution.

The most

likely source of future financing presently available to us is through the sale

of shares of our common stock. Any sale of common stock will result in dilution

of equity ownership to existing shareholders. This means that if we sell shares

of our common stock, more shares will be outstanding and each existing

shareholder will own a smaller percentage of the shares then outstanding. To

raise additional capital we may have to issue additional shares, which may

substantially dilute the interests of existing shareholders. Alternatively, we

may have to borrow large sums, and assume debt obligations that require us to

make substantial interest and capital payments.

Because there is no public trading

market for our common stock, you may not be able to resell your

stock.

There is

currently no public trading market for our common stock. Therefore there is no

central place, such as stock exchange or electronic trading system to resell

your shares.

There

is currently no market for Revival’s common stock, but if a market

for our common stock does develop, our stock price may be volatile.

There is

currently no market for Revival's common stock and there is no assurance that a

market will develop. If a market develops, it is anticipated that the market

price of Revival's common stock will be subject to wide fluctuations in response

to several factors including:

9

|

·

|

The

ability to complete the development of Revival’s anticipated exploration

plan;

|

|

|

·

|

The

market price of the commodities Revival anticipates exploring and mining;

and

|

|

|

·

|

The

ability to hire and retain competent personal in the

future.

|

While

Revival expects to apply for quotation on the OTC Bulletin Board (OTCBB), we may

not be approved, and even if approved, we may not be approved for trading on the

OTCBB; therefore shareholders may not have a market to sell their shares, either

in the near term or in the long term, or both.

We can

provide no assurance to investors that our common stock will be traded on any

exchange or electronic quotation service. While we expect to apply to the OTC

Bulletin Board, we may not be approved to trade on the OTCBB, and we may not

meet the requirements for listing on the OTCBB. If we do not meet the

requirements of the OTCBB, our stock may then be traded on the "Pink Sheets,"

and the market for resale of our shares would decrease dramatically, if not be

eliminated.

Revival has limited financial

resources at present, and proceeds from the offering may not be used to fully

develop its business.

Revival

has limited financial resources at present; as of March 31 it had $9,980 of cash

on hand with liabilities of $6,364. If it is unable to develop its

business plan, it may be required to divert certain proceeds from the sale of

Revival's stock to general administrative functions. If Revival is required to

divert some or all of proceeds from the sale of stock to areas that do not

advance the business plan, it could adversely affect its ability to continue by

restricting the Company's ability to become quoted on the OTCBB; advertise and

promote the Company and its products; travel to develop new marketing, business

and customer relationships; and retaining and/or compensating professional

advisors.

Because our securities are subject

to penny stock rules, you may have difficulty reselling your

shares.

Our

shares are penny stocks are covered by section 15(g) of the Securities Exchange

Act of 1934 which imposes additional sales practice requirements on

broker/dealers who sell the Company's securities including the delivery of a

standardized disclosure document; disclosure and confirmation of quotation

prices; disclosure of compensation the broker/dealer receives; and, furnishing

monthly account statements. For sales of our securities, the broker/dealer must

make a special suitability determination and receive from its customer a written

agreement prior to making a sale. The imposition of the foregoing additional

sales practices could adversely affect a shareholder's ability to dispose of his

stock.

Because

we do not have an Escrow or Trust Account for Investor’s Subscriptions, if we

file for Bankruptcy Protection or are forced into Bankruptcy Protection,

Investors will lose their entire investment.

Invested

funds for this offering will not be placed in an escrow or trust account.

Accordingly, if we file for bankruptcy protection or a petition for involuntary

bankruptcy is filed by creditors against us, your funds will become part of the

bankruptcy estate and administered according to the bankruptcy laws. As such,

you will lose your investment and your funds will be used to pay creditors and

will not be used for the sourcing and sale of promotional

products.

These

risk factors, individually or occurring together, would likely have a

substantially negative effect on Revival's business and would likely cause it to

fail.

USE

OF PROCEEDS

Our

offering is being made on a self-underwritten basis - no minimum of shares must

be sold in order for the offering to proceed. The offering price per share is

$0.03. There is no assurance that we will raise the full $120,000 as

anticipated.

The

following table below sets forth the uses of proceeds assuming the sale of 25%,

50%, 75% and 100% of the securities offered for sale in this offering by the

company. For further discussion see Plan of Operation.

10

|

If

25% of

|

If

50% of

|

If

75% of

|

If

100% of

|

|||||||||||||

|

Shares

Sold

|

Shares

Sold

|

Shares

Sold

|

Shares

Sold

|

|||||||||||||

|

GROSS

PROCEEDS FROM THIS OFFERING

|

$

|

30,000

|

$

|

60,000

|

$

|

90,000

|

$

|

120,000

|

||||||||

|

Less:

OFFERING EXPENSES

|

||||||||||||||||

|

SEC

Filing Expenses

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

||||||||

|

Printing

|

$

|

500

|

$

|

500

|

$

|

500

|

$

|

500

|

||||||||

|

Transfer

Agent

|

$

|

3,700

|

$

|

3,700

|

$

|

3,700

|

$

|

3,700

|

||||||||

|

SUB-TOTAL

|

$

|

5,700

|

$

|

5,700

|

$

|

5,700

|

$

|

5,700

|

||||||||

|

Less: PHASE

I

|

||||||||||||||||

|

Soil

Geochem./soil grid samples

|

$

|

6,000

|

$

|

8,500

|

$

|

11,000

|

$

|

14,000

|

||||||||

|

Geologist

|

$

|

8,500

|

$

|

12,500

|

$

|

17,000

|

$

|

22,500

|

||||||||

|

Geo-technician

|

$

|

3,500

|

$

|

6,000

|

$

|

9,500

|

$

|

12,500

|

||||||||

|

Assays

|

$

|

500

|

$

|

1,000

|

$

|

5,500

|

$

|

9,500

|

||||||||

|

Travel

|

$

|

1,500

|

$

|

1,500

|

$

|

3,000

|

$

|

5,000

|

||||||||

|

Reports

|

$

|

500

|

$

|

500

|

$

|

1,500

|

$

|

2,500

|

||||||||

|

SUB-TOTAL

|

$

|

20,500

|

$

|

30,000

|

$

|

47,500

|

$

|

66,000

|

||||||||

|

|

||||||||||||||||

|

Less: PHASE

II

|

||||||||||||||||

|

Geological

Interpretation/Mapping

|

$

|

0

|

$

|

7,800

|

$

|

12,000

|

$

|

14,500

|

||||||||

|

MAG-VLF

Survey

|

$

|

0

|

$

|

11,000

|

$

|

14,000

|

$

|

19,000

|

||||||||

|

Data

Reduction Report

|

$

|

0

|

$

|

1,500

|

$

|

3,300

|

$

|

3,800

|

||||||||

|

SUB-TOTAL

|

$

|

0

|

$

|

20,300

|

$

|

29,300

|

$

|

37,300

|

||||||||

|

Less:

ADMINISTRATION EXPENSES

|

||||||||||||||||

|

Office,

Telephone, Internet

|

$

|

0

|

$

|

0

|

$

|

1,500

|

$

|

3,000

|

||||||||

|

Legal

and Accounting

|

$

|

3,500

|

$

|

4,000

|

$

|

6,000

|

$

|

8,000

|

||||||||

|

SUB-TOTAL

|

$

|

3,500

|

$

|

4,000

|

$

|

7,500

|

$

|

11,000

|

||||||||

|

TOTALS

|

$

|

30,000

|

$

|

60,000

|

$

|

90,000

|

$

|

120,000

|

||||||||

The

above figures represent only estimated costs.

Legal and

accounting fees refer to the normal legal and accounting costs associated with

filing this Registration Statement under the 1933 Act as amended and maintaining

the status of a Reporting Company.

A total

of $10,000 has been raised from the sale of stock to our sole Officer and

Director - this stock is restricted and is not being registered in this

offering. The offering expenses associated with this offering are believed to be

$5,700. As of March 31 2010, Revival had a balance (less outstanding checks) of

$9,980 in cash with liabilities of $6,364. This will allow Revival to pay the

entire expenses of this offer from cash on hand.

One of

the purposes of the offering is to create an equity market, which allows Revival

to more easily raise capital, since a publicly traded company has more

flexibility in its financing offerings than one that does not.

DETERMINATION

OF OFFERING PRICE

There is

no established market for the Registrant's stock. Revival’ offering price for

shares sold pursuant to this offering is set at $0.03. Our existing shareholder,

our Officer /Director, paid $0.001 per share. The additional factors that were

included in determining the sales price are the lack of liquidity (since there

is no present market for Revival’ stock) and the high level of risk considering

the lack of operating history of Revival.

DILUTION

The price

of the current offering is fixed at $0.03 per share. This price is significantly

greater than the price paid by the Company’s sole officer and director for

common equity since the Company’s inception on February 19, 2010. The Company’s

sole officer and director paid $0.001 per share, a difference of $0.029 per

share lower than the share price in this offering.

Dilution

represents the difference between the offering price and the net tangible book

value per share immediately after completion of this offering. Net tangible book

value is the amount that results from subtracting total liabilities and

intangible assets from total assets. Dilution arises mainly as a result of our

arbitrary determination of the offering price of the shares being offered.

Dilution of the value of the shares you purchase is also a result of the lower

book value of the shares held by our existing stockholders. The following tables

compare the differences of your investment in our shares with the investment of

our existing stockholders.

11

Existing Stockholders if all

of the Shares are

Sold

|

Price

per share

|

$ | 0.03 | ||

|

Net

tangible book value per share before offering

|

$ | 0.0004 | ||

|

Potential

gain to existing shareholders

|

$ | 120,000 | ||

|

Net

tangible book value per share after offering

|

$ | 0.0083 | ||

|

Increase

to present stockholders in net tangible book value per share after

offering

|

$ | 0.008 | ||

|

Capital

contributions

|

$ | 120,000 | ||

|

Number

of shares outstanding before the offering

|

10,000,000 | |||

|

Number

of shares after offering held by existing stockholders

|

10,000,000 | |||

|

Existing

Stockholders Percentage of ownership after offering

|

71.4 | % |

Purchasers of Shares in this

Offering if all Shares Sold

|

Price

per share

|

$ | 0.03 | ||

|

Net

tangible book value per share after offering

|

$ | 0.0083 | ||

|

Increase

in net tangible book value per share after offering

|

$ | 0.008 | ||

|

Dilution

per share

|

$ | 0.0217 | ||

|

Capital

contributions by purchasers of shares

|

$ | 120,000 | ||

|

Capital

contributions by existing stock holders

|

$ | 10,000 | ||

|

Percentage

capital contributions by purchasers of shares

|

92 | % | ||

|

Percentage

capital contributions by existing stockholders

|

8 | % | ||

|

Anticipated

net offering proceeds

|

$ | 114,300 | ||

|

Number

of shares after offering held by public investors

|

4,000,000 | |||

|

Total

shares issued and outstanding

|

14,000,000 | |||

|

Purchasers

of shares percentage of ownership after offering

|

28.6 | % | ||

|

Existing

stockholders percentage of owner ship after offering

|

71.4 | % |

Purchasers

of Shares in this Offering if 75% of Shares Sold

|

Price

per share

|

$ | 0.03 | ||

|

Net

tangible book value per share after offering

|

$ | 0.0067 | ||

|

Increase

in net tangible book value per share after offering

|

$ | 0.006 | ||

|

Dilution

per share

|

$ | 0.023 | ||

|

Capital

contributions by purchasers of shares

|

$ | 90,000 | ||

|

Capital

contributions by existing stock holders

|

$ | 10,000 | ||

|

Percentage

capital contributions by purchasers of shares

|

90 | % | ||

|

Percentage

capital contributions by existing stockholders

|

10 | % | ||

|

Anticipated

net offering proceeds

|

$ | 84,300 | ||

|

Number

of shares after offering held by public investors

|

3,000,000 | |||

|

Total

shares issued and outstanding

|

13,000,000 | |||

|

Purchasers

of shares percentage of ownership after offering

|

23 | % | ||

|

Existing

stockholders percentage of ownership after offering

|

77 | % |

Purchasers of Shares in this

Offering if 50% of Shares Sold

|

Price

per share

|

$ | 0.03 | ||

|

Net

tangible book value per share after offering

|

$ | 0.0047 | ||

|

Increase

in net tangible book value per share after offering

|

$ | 0.004 | ||

|

Dilution

per share

|

$ | 0.025 | ||

|

Capital

contributions by purchasers of shares

|

$ | 60,000 | ||

|

Capital

contributions by existing share holders

|

$ | 10,000 | ||

|

Percentage

capital contributions by purchasers of shares

|

85.7 | % | ||

|

Percentage

capital contributions by existing stock holders

|

14.3 | % | ||

|

Anticipated

net offering proceeds

|

$ | 54,300 | ||

|

Number

of shares after offering held by public investors

|

2,000,000 | |||

|

Total

shares issued and outstanding

|

12,000,000 | |||

|

Purchasers

of shares percentage of ownership after offering

|

16.7 | % | ||

|

Existing

stockholders percentage of ownership after offering

|

83.3 | % |

12

Purchasers of Shares in this

Offering if 25% of Shares Sold

|

Price

per share

|

$ | 0.03 | ||

|

Net

tangible book value after offering

|

$ | 0.0025 | ||

|

Increase

in net tangible book value per share after offering

|

$ | 0.002 | ||

|

Dilution

per share

|

$ | 0.027 | ||

|

Capital

contributions by purchasers of shares

|

$ | 30,000 | ||

|

Capital

contributions by existing share holders

|

$ | 10,000 | ||

|

Percentage

capital contributions by purchasers of shares

|

75 | % | ||

|

Percentage

capital contributions by existing stock holders

|

25 | % | ||

|

Anticipated

net offering proceeds

|

$ | 24,300 | ||

|

Number

of shares after offering held by public investors

|

1,000,000 | |||

|

Total

shares issued and outstanding

|

11,000,000 | |||

|

Purchasers

of shares percentage of ownership after offering

|

9.1 | % | ||

|

Existing

stockholders percentage of ownership after offering

|

90.9 | % |

PLAN

OF DISTRIBUTION

The

offering consists of a maximum number of 4,000,000 common shares being offered

by Revival at $.03 per share with no minimum offering requirement.

Company

Offering

Revival

is offering for sale common stock. If Revival is unable to sell its stock and

raise money, it will not be able to complete its business plan and will

fail.

In

connection with the Company’s selling efforts in the offering, Caroline Swart

our sole officer and director will be selling shares on the Company’s behalf.

Our sole officer and director will not register as a broker-dealer pursuant to

Section 15 of the Exchange Act, but rather will rely upon the “safe harbor”

provisions of Rule 3a4-1 under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from

the broker-dealer registration requirements of the Exchange Act for persons

associated with an issuer that participate in an offering of the issuer’s

securities. Ms. Swart is not subject to any statutory disqualification, as that

term is defined in Section 3(a)(39) of the Exchange Act. Ms. Swart will not be

compensated in connection with her participation in the offering by the payment

of commissions or other remuneration based either directly or indirectly on

transactions in our securities. Ms. Swart is not, nor has she been within the

past 12 months, a broker or dealer, and she is not, nor has she been within the

past 12 months, an associated person of a broker or dealer. At the end of the

offering, Ms. Swart will continue to primarily perform substantial duties for

the Company or on its behalf otherwise than in connection with transactions in

securities. Ms. Swart will not participate in selling an offering of securities

for any issuer more than once every 12 months other than in reliance on Exchange

Act Rule 3a4-1(a)(4)(i) or (iii).

Our

Common Stock is currently considered a "penny stock" under federal securities

laws (Penny Stock Reform Act, Securities Exchange Act Section 3a (51(A)) since

its market price is below $5.00 per share. Penny stock rules generally impose

additional sales practice and disclosure requirements on broker-dealers who sell

or recommend such shares to certain investors.

Broker-dealers

who sell penny stock to certain types of investors are required to comply with

the SEC's regulations concerning the transfer of penny stock. If an exemption is

not available, these regulations require broker-dealers to: make a suitability

determination prior to selling penny stock to the purchaser; receive the

purchaser's written consent to the transaction; and, provide certain written

disclosures to the purchaser. These rules may affect the ability of

broker-dealers to make a market in, or trade our shares. In turn, this may make

it very difficult for investors to resell those shares in the public

market.

DESCRIPTION

OF SECURITIES

General

The

authorized capital stock consists of 75,000,000 shares of common stock at a par

value of $0.001 per share. We plan to offer 4,000,000 common shares

at a price of $0.03 per share. We will not sell any of the 4,000,000

common shares until the registration statement is deemed effective.

Common

Stock

As of

March 31, 2010, there are 10,000,000 shares of common stock issued and

outstanding. 10,000,000 shares are held by our Officer / Director,

Caroline Swart.

13

Holders

of common stock are entitled to one vote for each share on all matters submitted

to a stockholder vote. Holders of common stock do not have cumulative voting

rights. Therefore, holders of a majority of the shares of common stock voting

for the election of directors can elect all of the directors. Holders of common

stock representing a majority of the voting power of Revival’ capital stock

issued and outstanding and entitled to vote, represented in person or by proxy,

are necessary to constitute a quorum at any meeting of company stockholders. A

vote by the holders of a majority of the outstanding shares is required to

effectuate certain fundamental corporate changes such as liquidation, merger or

an amendment to the articles of incorporation.

Holders

of common stock are entitled to share in all dividends that the board of

directors, in its discretion, declares from legally available funds. In the

event of liquidation, dissolution or winding up, each outstanding share entitles

its holder to participate pro rata in all assets that remain after payment of

liabilities and after providing for each class of stock, if any, having

preference over the common stock. Holders of the common stock have no

pre-emptive rights, no conversion rights and there are no redemption provisions

applicable to the common stock.

Shareholders

Each

shareholder has sole investment power and sole voting power over the shares

owned by such shareholder.

INTERESTS

OF NAMED EXPERTS AND COUNSEL

No expert

or counsel named in this prospectus as having prepared or certified any part of

this prospectus or having given an opinion upon the validity of the securities

being registered or upon other legal matters in connection with the registration

or offering of the common stock was employed on a contingency basis, or had, or

is to receive, in connection with the offering, a substantial interest, direct

or indirect, in the registrant or any of its parents or subsidiaries. Nor was

any such person connected with the registrant or any of its parents or

subsidiaries as a promoter, managing or principal underwriter, voting trustee,

director, officer, or employee.

Dian D

Dalmy of Lakewood, Colorado, an independent legal counsel, has provided an

opinion on the validity of Revival Resources, Inc.’s issuance of common stock

and is presented as an exhibit to this filing.

The

financial statements included in this Prospectus and in the Registration

Statement have been audited by Seale and Beers CPAs of 50 Jones Blvd

Suite 202 Las Vegas NV 89107 Phone (888) 727-8251 fax (888) 782-2351 to the

extent and for the period set forth in their report (which contains an

explanatory paragraph regarding Revival' ability to continue as a going concern)

appearing elsewhere herein and in the Registration Statement, and are included

in reliance upon such report given upon the authority of said firm as experts in

auditing and accounting.

DESCRIPTION

OF BUSINESS

General

Revival

Resources, Inc. was incorporated on February 19, 2010, in the state of Nevada.

Revival has never declared bankruptcy, it has never been in receivership, and it

has never been involved in any legal action or proceedings. Since becoming

incorporated, Revival has not made any significant purchase or sale of assets,

nor has it been involved in any mergers, acquisitions or consolidations. Revival

is not a blank check registrant as that term is defined in Rule 419(a)(2) of

Regulation C of the Securities Act of 1933, since it has a specific business

plan or purpose.

We intend

to commence operations as an exploration stage company. We will be engaged in

the exploration of mineral properties with a view to exploiting any mineral

deposits we discover. We own an option to acquire an undivided 100%

beneficial interest in a mineral claim in located in the Golden Mining Division

situated approximately18 kilometers west of Invermere,

B.C. Canada. The claims are about 350 hectares named the Pretty Girl 4

tenure. We do not have any current plans to acquire interests in additional

mineral properties, though we may consider such acquisitions in the

future.

Unless

otherwise indicated, any reference to Revival, or “we”, “us”, “our”, etc. refers

to Revival Resources, Inc.

Our

Competition

Both the

mineral exploration and drilling industries are intensely competitive in all

phases. In our mineral exploration activities, we will compete with many

companies possessing greater financial resources and technical facilities than

us for the acquisition of mineral concessions, claims, leases and other mineral

interests as well as for the recruitment and retention of qualified employees.

We must overcome significant barriers to enter into the business of

mineral exploration as a result of our limited operating history.

Similarly,

in our drilling business, our competition includes many companies with

significantly greater experience, larger client bases, and substantially greater

financial resources. There are significant barriers to entry including large

capital requirements and the recruitment and retention of qualified, experienced

employees.

14

We cannot

assure you that we will be able to compete in any of our business areas

effectively with current or future competitors or that the competitive pressures

faced by us will not have a material adverse effect on our business, financial

condition and operating results.

Our

Office

The

principal offices are located at 112 North Curry Street Carson City Nevada

89703, Telephone (775) 321-8274 Facsimile (775)546-6003

Our

Employees

Other

than our officer and director, Caroline Swart, we have no

employees. Assuming financing can be obtained, management expects to

secure the services of consultants as necessary to implement our business

plan.

Regulation

Canadian

jurisdictions allow a mineral explorer to claim a portion of available Crown

lands as its exclusive area for exploration by depositing posts or other visible

markers to indicate a claimed area. In British Columbia the process of posting

the area, known as staking is done online at www.mtonline.gov.bc.ca. The claim

was staked by Danial Wessels. The claim is recorded in the name of Danial

Wessels.

Under

British Columbia, law title to British Columbia mining claims can only be held

by British Columbia residents. In the case of corporations, title must be held

by a British Columbia corporation. Since we are an American corporation, we can

never possess legal mining claim to the land. In order to comply with the law we

would have to incorporate a British Columbia wholly owned subsidiary-corporation

and obtain audited financial statements. We believe those costs would be a waste

of our money at this time since the legal costs of incorporating a subsidiary

corporation, the accounting costs of audited financial statements for the

subsidiary corporation, together with the legal and accounting costs of

expanding this registration statement would cost many thousands of dollars.

Accordingly, we have elected not to create the subsidiary at this time, but will

do so if mineralized material is discovered on the property and the Company

exercises its option agreement.

In the

event that we find reserves of mineralized material and the mineralized material

can be economically extracted, we will form a wholly owned British Columbia

subsidiary corporation and Mr. Wessels will transfer title to the property to

the wholly owned subsidiary corporation. Should Mr. Wessels transfer title to

another person and that deed is recorded before we record our documents, that

other person will have superior title and we will have no title. In that event,

we will have to cease or suspend operations. However, Mr. Wessels will be liable

to us for monetary damages for breach of his fiduciary duty to us. If that

occurs, we would sue Mr. Wessels for the loss of our investment.

All

Canadian lands and minerals which have not been granted to private persons are

owned by either the federal or provincial governments in the name of Her

Majesty. Un-granted minerals are commonly known as Crown minerals. Ownership

rights to Crown minerals are vested by the Canadian Constitution in the province

where the minerals are located. In the case of the company's property, that is

the Province of British Columbia. In the nineteenth century the practice of

reserving the minerals from fee simple Crown grants was established. Legislation

now ensures that minerals are reserved from Crown land dispositions. The result

is that the Crown is the largest mineral owner in Canada, both as the fee simple

owner of Crown lands and through mineral reservations in Crown grants. Most

privately held mineral titles are acquired directly from the Crown. The

company's property is one such acquisition. Accordingly, fee simple title to the

company's property resides with the Crown.

The

company's claims are mining leases issued pursuant to the British Columbia

Mineral Act. The lessee has exclusive rights to mine and recover all of the

minerals contained within the surface boundaries of the lease continued

vertically downward.

The

property is unencumbered, that is there are no claims, liens, charges or

liabilities against the property, and there are no competitive conditions that

are the action of some unaffiliated third party, which could affect the

property. Further, there is no insurance covering the property and we believe

that no insurance is necessary since the property is unimproved and contains no

buildings or improvements.

Overview

of Our Mineral Exploration Business

Mineral

exploration is essentially a research activity that does not produce a product.

Successful exploration often results in increased project value that can

be realized through the optioning or selling of the claimed site to larger

companies. As such, we intend to acquire properties which we believe have

potential to host economic concentrations of minerals. These acquisitions

have and may take the form of mining claims on provincial land, or leasing

claims, or private property owned by others. An “unpatented” mining claim

is an interest that can be acquired to the mineral rights on open lands of the

provincially owned public domain. Claims are staked in accordance with the

rules and regulations pursuant to laws of British Columbia established by the

Ministry of Energy, Mines and Petroleum Resources.

15

We plan

to perform basic geological work to identify specific drill targets on the

properties, and then collect subsurface samples by drilling to confirm the

presence of mineralization (the presence of economic minerals in a specific area

or geological formation). We may enter into joint venture agreements with

other companies to fund further exploration work. By such prospects, we

mean properties that may have been previously identified by third parties,

including prior owners such as exploration companies, as mineral prospects with

potential for economic mineralization. Often these properties have been

sampled, mapped and sometimes drilled, usually with indefinite results.

Accordingly, such acquired projects will either have some prior

exploration history or will have strong similarity to a recognized geologic ore

deposit model. Geographic emphasis will be placed on the western United

States. The focus of our activity will be to acquire properties that we believe

to be undervalued; including those that we believe to hold previously

unrecognized mineral potential.

Our

current mineral property Pretty Girl 4 is owned by an affiliate which the

Company has an option to purchase in the future. This agreement is held by

Danial Wessels and the Company. Our strategy with properties deemed to be

of higher risk or those that would require very large exploration expenditures

is to present them to larger companies for joint venture. Our joint

venture strategy is intended to maximize the abilities and skills of the

management group, conserve capital, and provide superior leverage for investors.

If we present a property to a major company and they are not interested,

we will continue to seek an interested partner.

DESCRIPTION

OF PROPERTY

The

principal offices are located at 112 North Curry Street Carson City Nevada

89703. The telephone number is (775) 321-8274 the fax number is (775)

546-6003. Revival’ management does not currently have policies regarding the

acquisition or sale of real estate assets primarily for possible capital gain or

primarily for income. Revival does not presently hold any investments or

interests in real estate, investments in real estate mortgages or securities of

or interests in persons primarily engaged in real estate

activities.

We own an

option to the mineral exploration rights relating to the six mineral claims in

the Pretty Girl 4 claim group. We do not own any real property

interest in the claims or any other property.

Summary of Revival’s Mineral

Exploration Prospects

The

Company plans to explore and potentially develop the mineral claims in the

Pretty Girl 4 mineral claim group in British Columbia, Canada. The Pretty Girl 4

group consists of six claims, 4 are contiguous claims, two nearby claims and one

reverted crown grant (totaling 350 hectares) in the Golden Mining Division

situated approximately 18 kilometers west of Invermere, B.C. The pertinent claim

data is as follows:

_____________________________________________________

CLAIM

NAME LOT NO.

__________________________

|

Sitting

Bull

|

4097

|

__________________________

|

Mary

G.

|

4098

|

__________________________

|

Colorado

|

4099

|

_______________________

|

Mabel

R

|

5103

|

__________________________

|

Alice

|

5350

|

__________________________

The

company has optioned the mineral titles to the Pretty Girl 4 tenure which

includes Mabel R, Alice, Mary G, Sitting Bull and Colorado mining

claims, registered

collectively as the Pretty Girl 4 claims. The company plans to explore these

claims and develop potential precious metal reserves. To date, the company's

operations have been limited to research, acquiring the mineral titles to this

group of claims and organizational activities, such as preparing this

prospectus. We have not begun our exploration program. To date, no minerals

reserves have been developed and we have generated no revenues from our

operations.

16

We have

no plans to change our business activities or to combine with another business

and are not aware of any events or circumstances that might cause us to change

our plans. We have no revenues, have achieved losses since inception, have no

operations, have been issued a going concern opinion and rely upon the sale of

our securities to funds operations.

Claim

Revival

acquired one mineral tenure, Pretty Girl 4, in British Columbia, Canada by

entering into an Option Agreement on the same from Danial Wessels, an affiliate.

The tenure (claims) is located within the Golden Mining Division of the British

Columbia Ministry of Energy, Mines and Petroleum Resources. It is comprised of

14 units (one unit represent 25 hectares), for a total of 350 hectares. The

claim is identified as follows:

| Tenure Number | Claim Name | Issue Date | |

| 753362 | Pretty Girl 4 | April 27 2010 |

The

company plans to explore this property for mineralized deposits of zinc, copper,

silver and gold. The company cannot provide any assurance or guarantee that

substantial reserves of any of the above minerals will be found on the

property.

On April

27, 2010, Revival Resources entered into an Option Agreement with, an affiliate,

Mr. Danial Wessels and he grants to the company the sole and exclusive right and

option to acquire an undivided 100%of the right, title and interest of Mr.

Wessels in and to the claim. This agreement is subject to consideration of the

following:

(a) The

company, or its permitted assigns, incurring exploration expenditure on the

claims of a minimum of $12,500 on or before April 30, 2011

(b) The

company, or its permitted assigns, incurring exploration expenditures on the

claims of a further $45,000 (for aggregate minimum exploration expenses of

$57,500) on or before April 30, 2012 and

(c) Upon

exercise of the Option, Revival Resources agrees to pay Mr. Wessels,

commencing July 1, 2013, the sum off $35,000 per annum for so

long as Revival Resources, or its permitted assigns, holds any interest in the

claims.

To date

we have not performed any work on the claim nor have we spent any money on

exploration and development activities. We cannot provide any assurance

whatsoever that the claims will ever be productive.

Location,

Access and Description

These

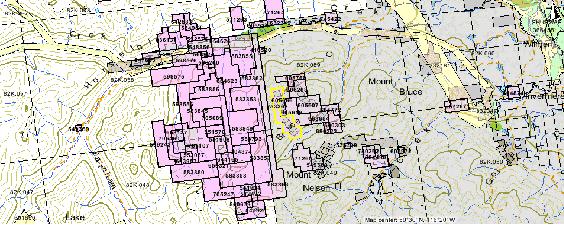

claims are located approximately 18 kilometers due west of Invermere, BC Canada.

The claims occupy a large spur between Law Creek to the north and Bruce Creek to

the south. The property lies within NTS map sheet 82K049 and 82K059 at latitude

50(degree) 31'north, longitude 116(degree) 18'west.

Overview

of Regulatory, Economic and Environmental Issues

Canadian

jurisdictions allow a mineral explorer to claim a portion of available Crown

lands as its exclusive area for exploration by depositing posts or other visible

markers to indicate a claimed area. The process of posting the area is known as

staking.

17

All

Canadian lands and minerals which have not been granted to private persons are

owned by either the federal or provincial governments in the name of Her

Majesty. Un-granted minerals are commonly known as Crown minerals. Ownership

rights to Crown minerals are vested by the Canadian Constitution in the province

where the minerals are located. In the case of the company's property, that is

the Province of British Columbia. In the nineteenth century the practice of

reserving the minerals from fee simple Crown grants was established. Legislation

now ensures that minerals are reserved from Crown land dispositions. The result

is that the Crown is the largest mineral owner in Canada, both as the fee simple

owner of Crown lands and through mineral reservations in Crown grants. Most

privately held mineral titles are acquired directly from the Crown. The

company's property is one such acquisition. Accordingly, fee simple title to the

company's property resides with the Crown.

Underground

metal mines generally involve higher grade ore bodies. Less tonnage is

mined underground, and generally the higher grade ore is processed in a mill or

other refining facility. This process results in the accumulation of waste

by-products from the washing of the ground ore. Mills require associated