Attached files

Table of Contents

As filed with the Securities and Exchange Commission on June 4, 2010.

Registration No. 333-166473

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

THE FRESH MARKET, INC.

(Exact name of registrant as specified in its charter)

| North Carolina (prior to reincorporation) Delaware (after reincorporation) | 5411 | 56-1311233 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

628 Green Valley Road, Suite 500

Greensboro, North Carolina 27408

(336) 272-1338

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lisa Klinger

Executive Vice President and Chief Financial Officer

The Fresh Market, Inc.

628 Green Valley Road, Suite 500

Greensboro, North Carolina 27408

(336) 272-1338

(Name and address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Craig F. Arcella Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019-7475 (212) 474-1000 Fax: (212) 474-3700 |

Robert Evans III Shearman & Sterling LLP 599 Lexington Avenue New York, New York 10022 (212) 848-4000 Fax: (212) 848-7179 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company.

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common Stock, $1.00 par value per share |

$345,000,000 | $24,598.50 | ||

| (1) | Includes shares to be sold upon exercise of the underwriters’ overallotment option. See “Underwriting”. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated June 4, 2010

PROSPECTUS

Shares

The Fresh Market, Inc.

Common Stock

This is The Fresh Market, Inc.’s initial public offering. The selling stockholders, which include certain of our officers, are selling shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. We have applied to list our common stock on The NASDAQ Global Select Market under the symbol “TFM”.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 8 of this prospectus.

| Per Share | Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discount |

$ | $ | ||

| Proceeds, before expenses, to the selling stockholders |

$ | $ |

The underwriters may also purchase up to an additional shares from the selling stockholders, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2010.

Joint Book-Running Managers

| BofA Merrill Lynch | J.P. Morgan | Goldman, Sachs & Co. |

Morgan Stanley

The date of this prospectus is , 2010.

Table of Contents

Table of Contents

Table of Contents

| Page | ||

| 1 | ||

| 8 | ||

| 21 | ||

| 22 | ||

| 23 | ||

| 24 | ||

| 25 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

27 | |

| 48 | ||

| 62 | ||

| 67 | ||

| 84 | ||

| 86 | ||

| 88 | ||

| 92 | ||

| 93 | ||

| Material U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders |

95 | |

| 98 | ||

| 104 | ||

| 104 | ||

| 104 | ||

| F-1 |

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

Dealer Prospectus Delivery Obligation

Until , 2010 (the 25th day after the date of this prospectus), all dealers that effect transactions in our common shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

Table of Contents

This summary contains a brief overview of the key aspects of this offering. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including the risks discussed under “Risk Factors” and the financial statements and notes thereto included elsewhere in this prospectus. Some of the statements in this summary constitute forward-looking statements. See “Special Note Regarding Forward-Looking Statements”.

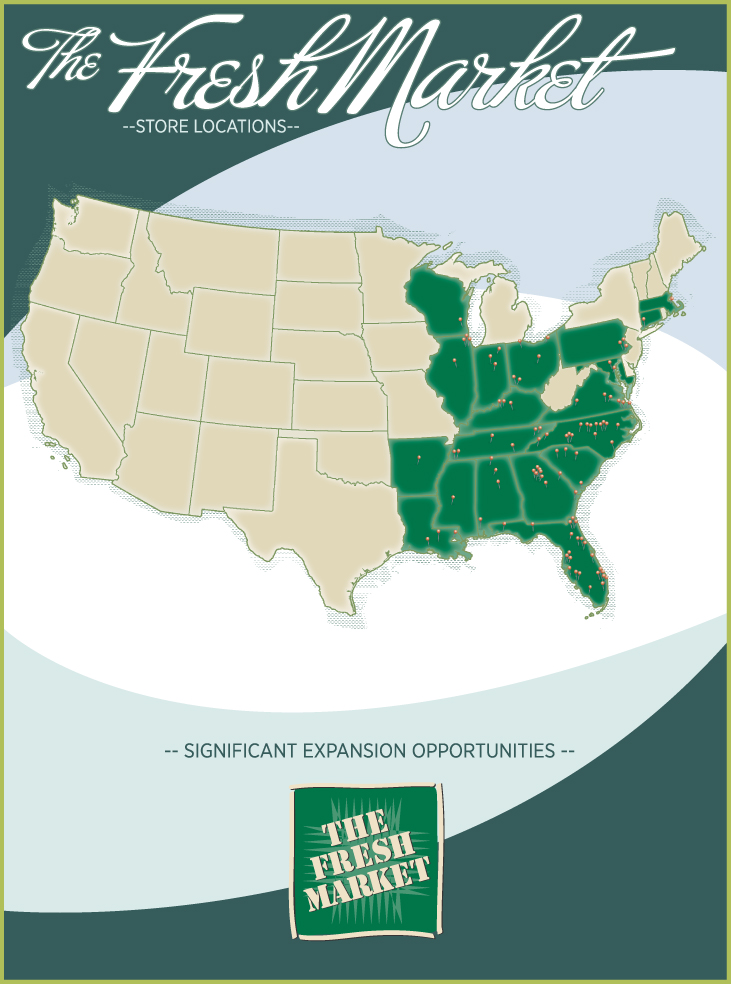

Our Company

The Fresh Market is a high-growth specialty retailer focused on creating an extraordinary food shopping experience for our customers. Since opening our first store in 1982, we have offered high-quality food products, with an emphasis on fresh, premium perishables and an uncompromising commitment to customer service. We seek to provide an attractive, convenient shopping environment while offering our customers a compelling price-value combination. As of June 3, 2010, we operated 95 stores in 19 states, primarily in the Southeast, Midwest and Mid-Atlantic United States.

Our business is characterized by the following key elements:

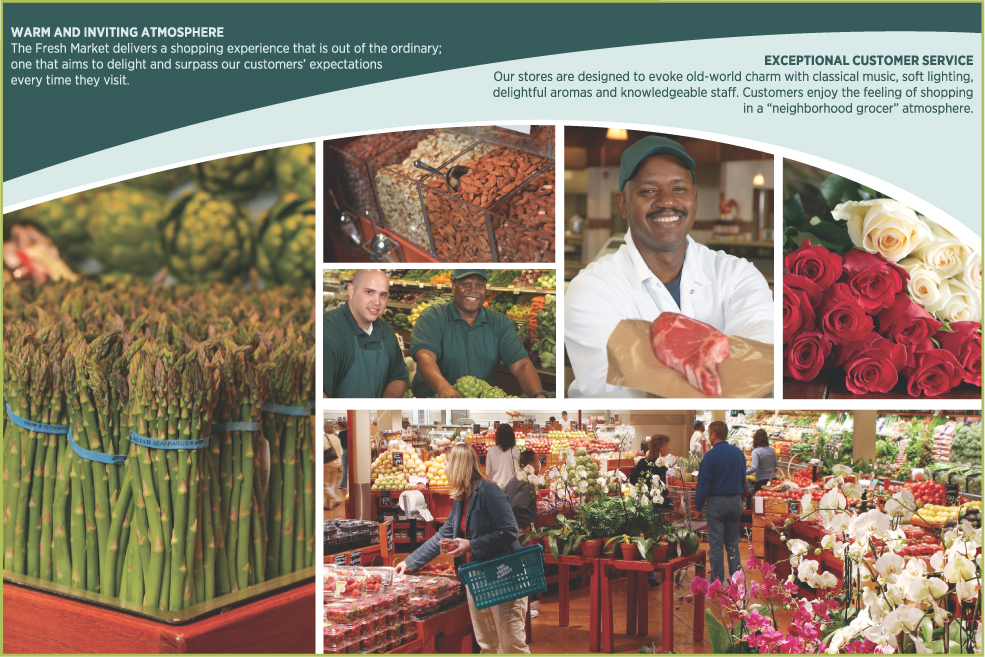

| • | Differentiated food shopping experience. We provide a differentiated shopping experience that generates customer loyalty and favorable word-of-mouth publicity. We combine fresh, carefully-selected, high-quality food products focused on perishable categories, with a level of customer attention that we believe is superior to conventional grocers, and we strive to create a “neighborhood grocer” atmosphere. |

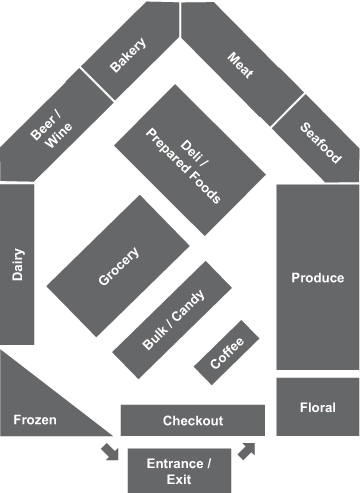

| • | Smaller-box format and flexible real estate strategy. Our stores average approximately 21,000 square feet, compared to the approximately 40,000 to 60,000 square foot stores operated by many conventional supermarkets. Within this relatively smaller size, we focus on higher-margin food categories and strive to deliver a more personal level of service and a more enjoyable shopping experience. |

| • | Disciplined, comprehensive approach to planning and merchandising. We provide comprehensive support to our stores that includes employee training and scheduling, store design and layout, merchandising programs, product sourcing, and numerous inventory management systems, primarily focused on perishables. We believe our disciplined, comprehensive approach allows us to quickly integrate newly-hired employees, deliver predictable financial performance and expand our store base while delivering a consistent shopping experience. |

We believe our high-quality perishable food offerings and smaller, customer-friendly store environment are the key drivers of our differentiated, profitable business model. We strive to offer an extraordinary shopping experience based on quality, consistency, fairness and integrity for our customers and employees.

For the first quarter of 2010, our sales were $220.2 million, an increase of 13.1% from the first quarter of 2009. Our income from operations was $16.1 million in the first quarter of 2010, an increase of 113.6% from the first quarter of 2009. For 2009, our sales were $861.9 million, an increase of 8.0% from 2008. Our income from operations was $53.1 million for 2009, an increase of 43.4% from 2008.

1

Table of Contents

Our Competitive Strengths

We attribute our success in large part to the following competitive strengths:

Outstanding food quality, store environment and customer service. We are dedicated to delivering a superior shopping experience that exceeds our customers’ expectations by offering fresh, premium products and providing a high level of customer service. Our high-quality food offerings are the result of our careful selection of distinct products. Additionally, our stores are designed to delight our customers’ senses with an aesthetically pleasing environment.

Business well positioned for changing consumer trends. We believe that our company is well positioned to capitalize on evolving consumer preferences and other trends currently shaping the food retail industry, which include:

| • | a growing emphasis on the customer shopping experience; |

| • | an increasing consumer focus on healthy eating choices and fresh, quality offerings; |

| • | an improving perception of private-label product quality; and |

| • | an increasing number of older people, a demographic that is expected to account for a disproportionately higher share of food-at-home spending by households. |

Highly-profitable smaller-box format. Since our founding, we have exclusively operated a smaller-box format, which has proven to be highly profitable. Within this format, we focus on higher-margin food categories. Our disciplined, exclusive focus on the smaller-box format leads to consistent execution across our store base, which we believe allows us to generate higher operating margins than conventional supermarkets.

Scalable operations and replicable store model. We believe that our infrastructure, including our management systems and distribution network, enables us to replicate our profitable store format and differentiated shopping experience. We expect this infrastructure to be capable of supporting significant expansion. We outsource substantially all of our logistics functions to third-party distributors or vendors whom we expect to have sufficient capacity to accommodate our anticipated growth. Each of our stores utilizes standard product display fixtures that enable us to successfully replicate our customers’ shopping experience.

Experienced management team with proven track record. Our executive management team has extensive experience across a broad range of industries and is complemented by merchandising and operations management with extensive food retail experience. Our team employs an analytical, data-driven approach to decision-making that is designed to encourage innovation and stimulate continuous improvement throughout the organization.

Our Growth Strategy

We are pursuing several strategies to continue our profitable growth, including:

Expand our store base. We intend to continue to expand our store base and penetrate new markets. We view expansion as a core competency and have more than tripled our store count since 2000. Based upon our operating experience and research conducted for us by The Buxton Company, a customer analytics research firm, we believe that the U.S. market can support at least 500 The Fresh Market stores operating under our current format.

2

Table of Contents

Drive comparable store sales. We aim to increase our comparable store sales by generating growth in the number and size of customer transactions at our existing stores. In order to increase the number of customer transactions at our stores, we plan to continue to offer a differentiated food shopping experience, which we believe leads to favorable word-of-mouth publicity, and provide distinctive, high-quality products to generate new and repeat visits to our stores.

Increase our highly-attractive operating margins. We intend to continue to increase our highly-attractive operating margins through scale efficiencies, improved systems, continued cost discipline and enhancements to our merchandise offerings. Our anticipated store growth will permit us to benefit from economies of scale in sourcing products and will allow us to leverage our existing infrastructure, corporate overhead and fixed costs to reduce labor and supply chain management costs as a percentage of sales.

Risks Affecting Our Business

While we have set forth our competitive strengths and growth strategies above, food retail is a large and competitive industry and our business involves numerous risks and uncertainties. These risks include the possibility that our competitors may be more successful than us at attracting customers.

Investing in our common stock involves substantial risk. The factors that could adversely affect our results and performance are discussed under the heading “Risk Factors” immediately following this summary. Before you invest in our common stock, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors”, including:

| • | We may not be able to successfully implement our growth strategy on a timely basis, or at all, and new stores may place a greater burden on our existing resources and adversely affect our existing business; |

| • | Our new store base, or stores opened or acquired in the future, may not achieve sales and operating levels consistent with our mature store base on a timely basis or at all or may negatively impact our results; |

| • | We face competition in our industry, and our failure to attract customers more successfully than our competitors may have an adverse effect on our profitability and operating results; |

| • | We may be unable to protect or maintain our intellectual property, including our trademarks, which could result in customer confusion and adversely affect our business; |

| • | Our stores rely heavily on sales of perishable products and ordering errors or product supply disruptions may have an adverse effect on our profitability and operating results; and |

| • | We are substantially dependent on a few key third-party vendors to provide logistical services for our stores and a disruption in these relationships may have a negative effect on our results of operations and financial condition. |

3

Table of Contents

Terms Used In This Prospectus

As used in this prospectus, the term “the Berry family” means (1) Ray Berry and the Estate of Beverly Berry; (2) various lineal descendants of Ray Berry and spouses and adopted children of such descendants; (3) various trusts for the benefit of individuals described in clauses (1) and (2) and their trustees; and (4) various entities owned or controlled, directly or indirectly, by the individuals and trusts described in clauses (1), (2) and (3).

Principal Executive Offices

The Fresh Market, Inc. was incorporated in North Carolina in July 1981 and will be reincorporated in Delaware immediately prior to the completion of this offering. Our principal executive offices are located at 628 Green Valley Road, Suite 500, Greensboro, North Carolina 27408, and our telephone number at this address is (336) 272-1338. Our website is www.thefreshmarket.com. Information on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus.

Industry and Market Data

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market opportunity, is based on information from independent industry organizations, such as The Nielsen Company (“Nielsen”), Nielsen TDLinx and 2009 Progressive Grocer Market Research, McKinsey & Company, the Food Marketing Institute, The Buxton Company and other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us based on such data and our knowledge of such industry and markets, which we believe to be reasonable. We have not independently verified any third-party information. While we believe the market opportunity information included in this prospectus is generally reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors”. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

We use The Fresh Market and The Fresh Market logo, among others, as our trademarks. This prospectus may refer to brand names, trademarks, service marks and trade names of other companies and organizations, and these brand names, trademarks, service marks and trade names are the property of their respective owners.

4

Table of Contents

The Offering

| Selling stockholders |

The Berry family and certain of our officers. |

| Shares offered by the selling stockholders |

shares. |

shares if the underwriters exercise their overallotment option in full.

| Shares to be outstanding immediately after this offering |

shares. |

| Voting rights |

One vote per share. |

| Use of proceeds |

The selling stockholders will receive all of the net proceeds from the sale of the shares offered hereby. We will not receive any proceeds from this offering. |

| Dividend policy |

We currently expect to retain future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying any cash dividends after the consummation of this offering. The declaration and payment of future dividends to holders of our common stock will be at the discretion of our board of directors and will depend upon many factors, including our financial condition, earnings, legal requirements, restrictions in our debt agreements and other factors our board of directors deems relevant. |

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors”, together with all of the other information set forth in this prospectus, before deciding to invest in shares of our common stock. |

| The NASDAQ Global Select Market listing |

We have applied to list our common stock on The NASDAQ Global Select Market under the symbol “TFM”. |

Unless we indicate otherwise, the number of shares to be outstanding after this offering assumes a for stock split, which will occur prior to the consummation of this offering.

5

Table of Contents

Summary Financial Information and Other Data

The following tables set forth our summary financial information and other data, as well as certain pro forma information that reflects our for stock split and our conversion from an S-corporation to a C-corporation.

The historical balance sheet data as of December 31, 2008 and 2009, and the historical statement of income data for the years ended December 31, 2007, 2008 and 2009 have been derived from our audited financial statements, which are included elsewhere in this prospectus. The historical balance sheet data as of December 31, 2007 has been derived from our audited balance sheet as of December 31, 2007, which is not included in this prospectus. Our financial statements as of and for the year ended December 31, 2009 were audited by Ernst and Young LLP, independent registered public accounting firm, and our financial statements as of and for the years ended December 31, 2007 and 2008 were audited by Grant Thornton LLP, independent registered public accounting firm. Our historical results are not necessarily indicative of results to be expected for any future period.

The historical balance sheet data as of March 28, 2010 and the historical statement of income data for the quarters ended March 29, 2009 and March 28, 2010 have been derived from our unaudited financial statements included elsewhere in this prospectus. The historical balance sheet data as of March 29, 2009 has been derived from our unaudited financial statements that are not included in this prospectus. The unaudited financial statements have been prepared on a basis consistent with our audited financial statements and, in the opinion of management, include all adjustments that management considers necessary for the fair presentation of the information for the unaudited periods. Interim results are not necessarily indicative of results that may be expected for any future period.

The information presented below should be read in conjunction with “Capitalization”, “Selected Historical Financial and Other Data”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, our audited financial statements and related notes and our unaudited financial statements and related notes, which are included elsewhere in this prospectus.

| Year Ended | Quarter Ended | |||||||||||||||||

| December 31, 2007 |

December 31, 2008 |

December 31, 2009 |

March 29, 2009 (unaudited) |

March 28, 2010 (unaudited) | ||||||||||||||

| (dollars in thousands) | ||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||

| Sales |

$ | 728,414 | $ | 797,805 | $ | 861,931 | $194,727 | $ | 220,217 | |||||||||

| Cost of goods sold |

506,458 | 554,969 | 585,360 | 133,960 | 148,448 | |||||||||||||

| Gross profit |

221,956 | 242,836 | 276,571 | 60,767 | 71,769 | |||||||||||||

| Selling, general and administrative expenses |

164,731 | 180,765 | 191,250 | 42,784 | 47,940 | |||||||||||||

| Store closure and exit costs |

2,151 | 562 | 4,361 | 3,779 | 168 | |||||||||||||

| Depreciation |

19,163 | 24,482 | 27,880 | 6,647 | 7,516 | |||||||||||||

| Income from operations |

35,911 | 37,027 | 53,080 | 7,557 | 16,145 | |||||||||||||

| Interest expense |

5,469 | 5,267 | 3,806 | 990 | 675 | |||||||||||||

| Other (income) expense, net |

(48 | ) | (123 | ) | (236 | ) | 5 | — | ||||||||||

| Income before provision for income taxes |

30,490 | 31,883 | 49,510 | 6,562 | 15,470 | |||||||||||||

| Provision for state income taxes |

201 | 326 | 308 | 81 | 175 | |||||||||||||

| Net income |

$ | 30,289 | $ | 31,557 | $ | 49,202 | $ | 6,481 | $ | 15,295 | ||||||||

6

Table of Contents

| Year Ended | Quarter Ended | |||||||||||||||

| December 31, 2007 |

December 31, 2008 |

December 31, 2009 |

March 29, 2009 (unaudited) |

March 28, 2010 (unaudited) | ||||||||||||

| (dollars in thousands, | ||||||||||||||||

| Pro Forma Data (unaudited): |

||||||||||||||||

| Income before provision for income taxes |

$ | 30,490 | $ | 31,883 | $ | 49,510 | $ | 6,562 | $ | 15,470 | ||||||

| Pro forma provision for income taxes(1) |

11,919 | 12,489 | 19,299 | 2,559 | 6,033 | |||||||||||

| Pro forma net income(1) |

$ | 18,571 | $ | 19,394 | $ | 30,211 | $ | 4,003 | $ | 9,437 | ||||||

| Pro forma net income per share(1)(2) |

||||||||||||||||

| Basic |

||||||||||||||||

| Diluted |

||||||||||||||||

| Pro forma dividends per share(2) |

||||||||||||||||

| Shares used in computation of pro forma net income per share, basic and diluted, and pro forma dividends per share(2) |

||||||||||||||||

| Other Operating Data (unaudited): |

||||||||||||||||

| Number of stores at end of period |

77 | 86 | 92 | 86 | 94 | |||||||||||

| Comparable store sales growth for period(3) |

4.5% | (1.5)% | (1.1)% | (8.0)% | 4.4% | |||||||||||

| Gross square footage at end of period (in thousands) |

1,584 | 1,811 | 1,955 | 1,820 | 2,003 | |||||||||||

| Average comparable store size (gross square feet)(4) |

19,786 | 20,641 | 20,936 | 20,890 | 21,095 | |||||||||||

| Comparable store sales per gross square foot during period(4) |

$ | 533 | $ | 498 | $ | 472 | $ | 112 | $ | 112 | ||||||

| Balance Sheet Data (end of period): |

||||||||||||||||

| Total assets |

$ | 187,695 | $ | 233,550 | $ | 235,541 | $ | 231,184 | $ | 238,951 | ||||||

| Total long-term debt(5) |

$ | 92,670 | $ | 130,000 | $ | 98,200 | $ | 121,250 | $ | 90,900 | ||||||

| Total stockholders’ equity(5) |

$ | 34,242 | $ | 37,905 | $ | 68,302 | $ | 44,635 | $ | 75,592 | ||||||

| (1) | We historically have been treated as an S-corporation for U.S. federal income tax purposes. As a result, our income has not been subject to U.S. federal income taxes or state income taxes in those states where S-corporation status is recognized. In general, the corporate income or loss of an S-corporation is allocated to its stockholders for inclusion in their personal federal income tax returns and state income tax returns in those states where S-corporation status is recognized. In connection with this offering, our S-corporation status will terminate and we will become subject to additional entity-level taxes that will be reflected in our financial statements. Pro forma provision for income taxes reflects combined federal and state income taxes on a pro forma basis, as if we had been treated as a C-corporation, using blended statutory federal and state income tax rates of 39.1%, 39.2% and 39.0% in 2007, 2008 and 2009, respectively, and 39.0% and 39.0% in the quarters ended March 29, 2009 and March 28, 2010, respectively. These tax rates reflect the sum of the federal statutory rate and a blended state rate based on our calculation of income apportioned to each state for each period. |

| (2) | Pro forma net income per share, pro forma dividends per share, shares used in computation of pro forma net income per share, basic and diluted, and pro forma dividends per share are calculated after giving effect to the for stock split. |

| (3) | Our practice is to include sales from a store in comparable store sales beginning on the first day of the sixteenth full month following the store’s opening. When a store that is included in comparable store sales is remodeled or relocated, we continue to consider sales from that store to be comparable store sales. There may be variations in the way that our competitors calculate comparable or “same store” sales. As a result, data in this prospectus regarding our comparable store sales may not be comparable to similar data made available by our competitors. |

| (4) | Average comparable store size and comparable store sales per gross square foot are calculated using the gross square footage and sales for stores included within our comparable store base for each month during the given period. |

| (5) | We have declared certain dividends subsequent to the quarter ended March 28, 2010, which are discussed in full under “Dividend Policy”. As a result of these subsequent dividends and certain borrowings made to finance them, adjusted balances of long-term debt and total stockholders’ equity would have been $108,514 and $57,978, respectively, as of March 28, 2010. |

7

Table of Contents

This offering and an investment in our common stock involve a high degree of risk. You should consider carefully the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase shares of our common stock. In addition to the risks described below, there could be other events or developments in the future that we have not currently anticipated that may adversely affect our results of operations or business prospects. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flow and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

We may not be able to successfully implement our growth strategy on a timely basis or at all. Additionally, new stores may place a greater burden on our existing resources and adversely affect our existing business.

Our continued growth depends, in large part, on our ability to open new stores and to operate those stores successfully. Successful implementation of this strategy depends upon, among other things:

| • | the identification of suitable sites for store locations; |

| • | the negotiation of acceptable lease terms; |

| • | the ability to continue to attract customers to our stores largely through favorable word-of-mouth publicity, rather than through conventional advertising; |

| • | the hiring, training and retention of skilled store personnel; |

| • | the identification and relocation of experienced store management personnel; |

| • | the effective management of inventory to meet the needs of our stores on a timely basis; |

| • | the availability of sufficient levels of cash flow or necessary financing to support our expansion; and |

| • | the ability to successfully address competitive merchandising, distribution and other challenges encountered in connection with expansion into new geographic areas and markets. |

We, or our third party vendors, may not be able to adapt our distribution, management information and other operating systems to adequately supply products to new stores at competitive prices so that we can operate the stores in a successful and profitable manner. We do not participate in many of the traditional marketing activities of conventional food retailers, but instead rely primarily on favorable word-of-mouth publicity to drive sales. We cannot assure you that we will continue to grow through new store openings or through favorable word-of-mouth publicity in the future. Although we believe, based upon our experience and research conducted by a third-party research firm, that the U.S. market can support at least 500 The Fresh Market stores operating under our current format, we anticipate that it will take years to grow our store count to that number. We cannot assure you that we will grow our store count to at least 500 stores. Additionally, our proposed expansion will place increased demands on our operational, managerial and administrative resources. These increased demands could cause us to operate our existing business less effectively, which in turn could cause deterioration in the financial performance of our existing stores. Further, new store openings in markets where we have existing stores may result in reduced sales volumes at our existing stores in those markets. If we experience a decline in

8

Table of Contents

performance, we may slow or discontinue store openings, or we may decide to close stores that we are unable to operate in a profitable manner. In the past ten years, we have closed two stores before the expiration of their primary lease terms. If we fail to successfully implement our growth strategy, including by opening new stores, our financial condition and operating results may be adversely affected.

Our new store base, or stores opened or acquired in the future, may not achieve sales and operating levels consistent with our mature store base on a timely basis or at all or may negatively impact our results.

We have actively pursued new store growth in existing and new markets and plan to continue doing so in the future. Our growth continues to depend, in part, on our ability to open and operate new stores successfully. New stores may not achieve sustained sales and operating levels consistent with our mature store base on a timely basis or at all. This may have an adverse effect on our financial condition and operating results. In addition, if we acquire stores in the future, we may not be able to successfully integrate those stores into our existing store base and those stores may not be as profitable as our existing stores.

We cannot assure you that our new store openings will be successful or result in greater sales and profitability for the company. New stores build their sales volume and their customer base over time and, as a result, generally have lower gross margin rates and higher operating expenses, as a percentage of sales, than our more mature stores. There may be a negative impact on our results from a lower contribution of new stores, along with the impact of related pre-opening and applicable store management relocation costs. Any failure to successfully open and operate new stores in the time frames and at the costs estimated by us could result in a decline of the price of our common stock.

Our inability to maintain or improve levels of comparable store sales could cause our stock price to decline.

We may not be able to maintain or improve the levels of comparable store sales that we have experienced in the recent past. In addition, our overall comparable store sales have fluctuated in the past and will likely fluctuate in the future. A variety of factors affect comparable store sales, including consumer preferences, competition, economic conditions, pricing, in-store merchandising-related activities and our ability to source and distribute products efficiently. In addition, many specialty retailers have been unable to sustain high levels of comparable store sales growth during and after periods of substantial expansion. These factors may cause our comparable store sales results to be materially lower than in recent periods, which could harm our business and result in a decline in the price of our common stock.

Our inability to maintain or increase our operating margins could adversely affect the price of our stock.

We intend to continue to increase our operating margins through scale efficiencies, improved systems, continued cost discipline and enhancements to our merchandise offerings. If we are unable to successfully manage the potential difficulties associated with store growth, we may not be able to capture the scale efficiencies that we expect from expansion. If we are not able to continue to capture scale efficiencies, improve our systems, continue our cost discipline and enhance our merchandise offerings, we may not be able to achieve our goals with respect to operating margins. In addition, if we do not adequately refine and improve our various ordering, tracking and allocation systems, we may not be able to increase sales and reduce inventory shrinkage. As a result, our operating margins may stagnate or decline, which could adversely affect the price of our stock.

Economic conditions that impact consumer spending could materially affect our business.

The global economic crisis and the ongoing economic uncertainty continue to negatively affect consumer confidence and discretionary spending. Our results of operations may be materially affected by changes in overall economic conditions that impact consumer confidence and spending, including discretionary spending. This risk may be exacerbated if customers choose lower-cost alternatives in response to economic conditions. We cannot assure you that various governmental activities to stabilize the markets and stimulate the economy will restore consumer confidence or change spending habits. Future economic conditions affecting

9

Table of Contents

disposable consumer income such as employment levels, business conditions, changes in housing market conditions, the availability of credit, interest rates, tax rates, fuel and energy costs and other matters could reduce consumer spending or cause consumers to shift their spending to lower-priced competitors. In addition, increases in utility, fuel and commodity prices could affect our cost of doing business by increasing the cost of illuminating and operating our stores and the transportation costs borne by our third-party service providers, which they may seek to recover through increased prices charged to us. We may not be able to recover these rising costs through increased prices charged to our customers and these increased prices may exacerbate the risk of customers choosing lower-cost alternatives. As a result, our results of operations could be materially adversely affected.

We face competition in our industry, and our failure to compete successfully may have an adverse effect on our profitability and operating results.

Food retail is a competitive industry. Our competition varies and includes national, regional and local conventional supermarkets, national superstores, alternative food retailers, natural foods stores, smaller specialty stores, and farmers’ markets. Each of these stores competes with us on the basis of product selection, product quality, customer service, price or a combination of these factors. In addition, some competitors are aggressively expanding their number of stores or their product offerings. In their new or remodeled stores, our competitors often increase the space allocated to perishable food and specialty food categories, which are our core categories. Some of these competitors may have been in business longer or may have greater financial or marketing resources than we do and may be able to devote greater resources to sourcing, promoting and selling their products. As competition in certain areas intensifies or competitors open stores within close proximity to one of our stores, our results of operations may be negatively impacted through a loss of sales, reduction in margin from competitive price changes or greater operating costs. Further, any attempt by a competitor to copy or mimic our smaller-box format or operating model could materially impact our business, results of operations and financial condition by causing a decrease in our market share and our sales and operating results.

We may be unable to protect or maintain our intellectual property, including The Fresh Market trademark, which could result in customer confusion and adversely affect our business.

We believe that our intellectual property has substantial value and has contributed significantly to the success of our business. In particular, our trademarks, including our registered The Fresh Market, Experience the Food and TFM trademarks, are valuable assets that reinforce our customers’ favorable perception of our stores.

From time to time, third parties have used names similar to ours, have applied to register trademarks similar to ours and, we believe, have infringed or misappropriated our intellectual property rights. Third parties have also, from time to time, opposed our trademarks and challenged our intellectual property rights. We respond to these actions on a case-by-case basis. The outcomes of these actions have included both negotiated out-of-court settlements as well as litigation.

As part of our ongoing efforts to protect our intellectual property rights, on February 2, 2010, we filed a Notice of Opposition with the United States Patent and Trademark Office (the “USPTO”) in response to an application filed by Associated Food Stores, Inc. (“Associated”), which operates supermarkets under the name “A Fresh Market” in Utah, to register the trademark “A Fresh Market”. Associated subsequently filed an answer and counterclaim on March 15, 2010, in which it, among other things, seeks to cancel our registered The Fresh Market trademark and related design mark, alleging that those marks are generic names for the goods and services for which they are registered. We deny Associated’s claims and intend to defend our trademarks in these proceedings. As such, on April 26, 2010, we filed a motion to dismiss the counterclaims made by Associated and to strike certain affirmative defenses raised by Associated. The USPTO has not issued a decision with respect to these matters. We refer to the currently pending proceedings as the “Associated Proceedings”.

We cannot assure you that the steps we have taken to protect our intellectual property rights are adequate, that our intellectual property rights can be successfully defended and asserted in the future or that third

10

Table of Contents

parties will not infringe upon or misappropriate any such rights. Our trademark rights and related registrations may continue to be challenged in the future and could be canceled or narrowed, including as a result of being found generic in the Associated Proceedings or other actions. Our failure to successfully retain trademark protection could prevent us in the future from challenging third parties who use names and logos similar to our trademarks, which may in turn cause customer confusion, negatively affect customers’ perception of our stores and products, and adversely affect our sales and profitability. Moreover, intellectual property proceedings and infringement claims could cause significant management distractions and have a negative impact on our business.

Our success depends upon our ability to source and market new products to meet our high standards and customer preferences and our ability to offer our customers an aesthetically pleasing shopping environment.

Our success depends on our ability to source and market new products that both meet our standards for quality and appeal to customers’ preferences. A small number of our employees, including our in-house merchants, are primarily responsible for both sourcing products that meet our high specifications and identifying and responding to changing customer preferences. Failure to source and market such products, or to accurately forecast changing customer preferences, could lead to a decrease in the number of customer transactions at our stores and a decrease in the amount customers spend when they visit our stores. In addition, the sourcing of our products is dependent, in part, on our relationships with our vendors. If we are unable to maintain these relationships we may not be able to continue to source products at competitive prices that both meet our standards and appeal to our customers. We also attempt to create a pleasant and appealing shopping experience. If we are not successful in creating a pleasant and appealing shopping experience we may lose customers to our competitors. If we do not succeed in maintaining good relationships with our vendors, introducing and sourcing new products that consumers want to buy or are unable to provide a pleasant and appealing shopping environment or maintain our level of customer service, our sales, operating margins and market share may decrease, resulting in reduced profitability.

Our stores rely heavily on sales of perishable products, and ordering errors or product supply disruptions may have an adverse effect on our profitability and operating results.

We have a significant focus on perishable products. Sales of perishable products accounted for approximately two-thirds of our total sales in 2009. We rely on various suppliers and vendors to provide and deliver our perishable product inventory on a continuous basis. We could suffer significant product inventory losses in the event of the loss of a major supplier or vendor, disruption of our distribution network, extended power outages, natural disasters or other catastrophic occurrences. We have implemented certain systems to ensure our ordering is in line with demand. We cannot assure you, however, that our ordering system will always work efficiently, in particular in connection with the opening of new stores, which have no, or a limited, ordering history. If we were to over-order, we could suffer inventory losses, which would negatively impact our operating results. Furthermore, we could suffer significant product inventory losses in the event of the loss of a major supplier or vendor, disruption of our distribution network, extended power outages, natural disasters or other catastrophic occurrences.

The current geographic concentration of our stores creates an exposure to local economies, regional downturns or severe weather or catastrophic occurrences that may materially adversely affect our financial condition and results of operations.

We currently operate 23 stores in Florida, making Florida our largest market and representing approximately 24% of our total stores, with two additional stores expected to open in Florida in the fourth quarter of 2010. We also have store concentration in North Carolina and Georgia, operating 15 stores and 9 stores in those states, respectively. As a result, our business is currently more susceptible to regional conditions than the operations of more geographically diversified competitors, and we are vulnerable to economic downturns in those regions. Any unforeseen events or circumstances that negatively affect these areas could materially adversely affect our revenues and profitability. These factors include, among other things, changes in demographics and population.

11

Table of Contents

Severe weather conditions and other catastrophic occurrences in areas in which we have stores or from which we obtain products may materially adversely affect our results of operations. Such conditions may result in physical damage to our stores, loss of inventory, closure of one or more of our stores, inadequate work force in our markets, temporary disruption in the supply of products, delays in the delivery of goods to our stores and a reduction in the availability of products in our stores. Any of these factors may disrupt our businesses and materially adversely affect our financial condition and result of operations.

Our business could be harmed by a failure of our information technology, administrative or outsourcing systems.

We rely on our information technology, administrative and outsourcing systems to effectively manage our business data, communications, supply chain, order entry and fulfillment and other business processes. The failure of our information technology, administrative or outsourcing systems to perform as we anticipate could disrupt our business and result in transaction errors, processing inefficiencies and the loss of sales and customers, causing our business to suffer. In addition, our information technology and administrative and outsourcing systems may be vulnerable to damage or interruption from circumstances beyond our control, including fire, natural disasters, systems failures, viruses and security breaches, including breaches of our transaction processing or other systems that could result in the compromise of confidential customer data. Any such damage or interruption could have a material adverse effect on our business, cause us to face significant fines, customer notice obligations or costly litigation, harm our reputation with our customers, require us to expend significant time and expense developing, maintaining or upgrading our information technology, administrative or outsourcing systems or prevent us from paying our suppliers or employees, receiving payments from our customers or performing other information technology, administrative or outsourcing services on a timely basis. Recently, data security breaches suffered by well-known companies and institutions have attracted a substantial amount of media attention, prompting new federal and state laws and legislative proposals addressing data privacy and security, as well as increased data protection obligations imposed on merchants by credit card issuers. As a result, we may become subject to more extensive requirements to protect the customer information that we process in connection with the purchase of our products.

We are substantially dependent on a few key third-party vendors to provide logistical services for our stores, including services related to inventory replenishment and the storage and transportation of many of our products. A disruption in these relationships or a key distribution center may have a negative effect on our results of operations and financial condition.

We currently rely upon independent third-party service providers for all product shipments to our stores. In particular, we rely on one third-party service provider to provide key services related to inventory management, warehousing and transportation, and, as a result, much of our inventory is stored at a single warehouse maintained by this provider. See “Business—Sourcing and Distribution”. Products sourced and distributed through this provider accounted for approximately 56% of the merchandise we purchased during 2009, and, therefore, our relationship with this provider is important to us. Although we have not experienced difficulty in our inventory management, warehousing and transportation to date with this third-party service provider, interruptions could occur in the future. Further, although we expect that this third-party vendor, and our other key vendors, will have sufficient capacity to accommodate our anticipated growth, it or they may not have the resources or desire to do so. Any significant disruptions in our relationship with this provider or the single distribution center this provider uses to service our stores, or our relationships with our other key vendors, including due to their inability to accommodate our growth, would make it difficult for us to continue to operate our existing business or pursue our growth plans until we execute replacement agreements or develop and implement self-distribution processes. While we believe that other third-party service providers could provide similar services on reasonable terms, they are limited in number and we cannot assure you that we would be able to find a replacement distributor on a timely basis or that such distributor would be able to fulfill our demands on commercially reasonable terms, which could have a material adverse effect on our results of operations and financial condition.

12

Table of Contents

We may experience negative effects to our reputation from real or perceived quality or health issues with our food products, which could have an adverse effect on our operating results.

We believe customers count on us to provide them with fresh, high-quality food products. Concerns regarding the safety of our food products or the safety and quality of our food supply chain could cause shoppers to avoid purchasing certain products from us, or to seek alternative sources of food, even if the basis for the concern is outside of our control. Adverse publicity about these concerns, whether or not ultimately based on fact, and whether or not involving products sold at our stores, could discourage consumers from buying our products and have an adverse effect on our operating results. Furthermore, the sale of food products entails an inherent risk of product liability claims, product recall and the resulting negative publicity. Food products containing contaminants could be inadvertently distributed by us and, if processing at the consumer level does not eliminate them, these contaminants could result in illness or death. We cannot assure you that product liability claims will not be asserted against us or that we will not be obligated to perform product recalls in the future.

Any lost confidence on the part of our customers would be difficult and costly to reestablish. Any such adverse effect could be exacerbated by our position in the market as a purveyor of fresh, high-quality food products and could significantly reduce our brand value. Issues regarding the safety of any food items sold by us, regardless of the cause, could have a substantial and adverse effect on our sales and operating results.

The loss of key employees could negatively affect our business.

A key component of our success is the experience of our officers and the employees who are responsible for our merchandising and operations departments. These employees have extensive experience in our industry and are familiar with our business, systems and processes. The loss of services of one or more of our key employees could have a material adverse effect on our operations. We do not maintain key person insurance on any employee. In addition, none of our key employees is subject to non-competition or non-solicitation obligations.

Our continued success is also dependent upon our ability to attract and retain qualified store managers to meet our future growth needs. We face intense competition for qualified managers, many of whom may have offers from competing employers. We may not be able to attract and retain necessary managers to operate our business.

Union attempts to organize our employees could negatively affect our business.

None of our employees are currently subject to a collective bargaining agreement. As we continue to grow, and enter different regions, unions may attempt to organize all or part of our employee base at certain stores or within certain regions. Responding to such organization attempts may distract management and employees and may have a negative financial impact on individual stores, or on our business as a whole.

Our management has limited experience managing a public company and our current resources may not be sufficient to fulfill our public company obligations.

Following the completion of this offering, we will be subject to various regulatory requirements, including those of the Securities and Exchange Commission (the “SEC”) and The NASDAQ Stock Market. These requirements include record keeping, financial reporting and corporate governance rules and regulations. Our management team has limited experience in managing a public company and, historically, has not had the resources typically found in a public company. Our internal infrastructure may not be adequate to support our increased reporting obligations and we may be unable to hire, train or retain necessary staff and may be reliant on engaging outside consultants or professionals to overcome our lack of experience or employees. Our business could be adversely affected if our internal infrastructure is inadequate, we are unable to engage outside consultants or are otherwise unable to fulfill our public company obligations.

13

Table of Contents

The terms of our revolving credit facility may restrict our current and future operations, which could adversely affect our ability to respond to changes in our business and to manage our operations.

Our revolving credit facility contains, and any additional debt financing we may incur would likely contain, covenants that restrict our operations, including limitations on our ability to grant liens, incur additional debt, pay dividends, redeem our common stock, make certain investments and engage in certain merger, consolidation or asset sale transactions. A failure by us to comply with the covenants or financial ratios contained in our revolving credit facility could result in an event of default, which could adversely affect our ability to respond to changes in our business and manage our operations. Upon the occurrence of an event of default, the lenders could elect to declare all amounts outstanding to be due and payable and exercise other remedies as set forth in the unsecured revolving credit facility. If the indebtedness under our revolving credit facility were to be accelerated, our future financial condition could be materially adversely affected.

We will require significant capital to fund our expanding business, which may not be available to us on satisfactory terms or at all.

To support our expanding business and pursue our growth strategy, we will utilize significant amounts of cash generated by our operations to pay our lease obligations, build out new store space, purchase inventory, pay personnel, further invest in our infrastructure and facilities, and pay for the increased costs associated with operating as a public company. We primarily depend on cash flow from operations and borrowings under our revolving credit facility to fund our business and growth plans. If our business does not generate sufficient cash flow from operations to fund these activities, and sufficient funds are not otherwise available to us under our revolving credit facility, we may need additional equity or debt financing. If such financing is not available to us, or is not available to us on satisfactory terms, our ability to operate and expand our business or to respond to competitive pressures would be limited and we could be required to delay, significantly curtail or eliminate planned store openings or operations or other elements of our growth strategy.

We may incur additional indebtedness in the future which could adversely affect our financial health and our ability to react to changes to our business.

We may incur additional indebtedness in the future. Any increase in the amount of our indebtedness could require us to divert funds identified for other purposes for debt service and impair our liquidity position. If we cannot generate sufficient cash flow from operations to service our debt, we may need to refinance our debt, dispose of assets or issue equity to obtain necessary funds. We do not know whether we will be able to take any of such actions on a timely basis, on terms satisfactory to us or at all.

Our level of indebtedness has important consequences to you and your investment in our common stock. For example, our level of indebtedness may:

| • | require us to use a substantial portion of our cash flow from operations to pay interest and principal on our debt, which would reduce the funds available to us for working capital, capital expenditures and other general corporate purposes; |

| • | limit our ability to pay future dividends; |

| • | limit our ability to obtain additional financing for working capital, capital expenditures, expansion plans and other investments, which may limit our ability to implement our business strategy; |

| • | heighten our vulnerability to downturns in our business, the food retail industry or in the general economy and limit our flexibility in planning for, or reacting to, changes in our business and the food retail industry; or |

14

Table of Contents

| • | prevent us from taking advantage of business opportunities as they arise or successfully carrying out our plans to expand our store base and product offerings. |

We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us in amounts sufficient to enable us to make payments on our indebtedness or to fund our operations.

Risks Related to This Offering

No market currently exists for our common stock. We cannot assure you that an active trading market will develop for our common stock.

Prior to this offering, there has been no public market for shares of our common stock. We cannot predict the extent to which investor interest in our company will lead to the development of a trading market on The NASDAQ Global Select Market or otherwise, or how liquid that market might become. If an active market does not develop, you may have difficulty selling any shares of our common stock that you purchase in this initial public offering. The initial public offering price for the shares of our common stock will be determined by negotiations between us, the selling stockholders and the representatives of the underwriters, and may not be indicative of prices that will prevail in the open market following this offering.

If our stock price declines after this offering, you could lose a significant part of your investment.

The market price of our stock may be influenced by many factors, some of which are beyond our control, including those described above in “—Risks Related to Our Business” and the following:

| • | the failure of securities analysts to cover our common stock after this offering; |

| • | changes in financial estimates by securities analysts; |

| • | the inability to meet the financial estimates of analysts who follow our common stock; |

| • | strategic actions by us or our competitors; |

| • | announcements by us or our competitors of significant contracts, acquisitions, joint marketing relationships, joint ventures or capital commitments; |

| • | variations in our quarterly operating results and those of our competitors; |

| • | general economic and stock market conditions; |

| • | risks related to our business and our industry, including those discussed above; |

| • | changes in conditions or trends in our industry, markets or customers; |

| • | terrorist acts; |

| • | future sales of our common stock or other securities; and |

| • | investor perceptions of the investment opportunity associated with our common stock relative to other investment alternatives. |

As a result of these factors, investors in our common stock may not be able to resell their shares at or above the initial offering price or may not be able to resell them at all. These broad market and industry factors

15

Table of Contents

may materially reduce the market price of our common stock, regardless of our operating performance. In addition, price volatility may be greater if the public float and trading volume of our common stock is low.

Future sales, or the perception of future sales, of our common stock may depress the price of our common stock.

The market price of our common stock could decline significantly as a result of sales of a large number of shares of our common stock in the market after this offering, including shares that might be offered for sale by the Berry family. The sales, or the perception that these sales might occur, could depress the market price. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate.

Upon completion of this offering, we will have shares of common stock outstanding. The shares of common stock offered in this offering will be freely tradable without restriction under the Securities Act of 1933, as amended (the “Securities Act”), except for any shares of common stock that may be held or acquired by our directors, executive officers and other affiliates (including the Berry family), the sale of which will be restricted under the Securities Act.

After this offering, the Berry family will have rights to require us to file registration statements registering additional sales of shares of common stock or to include sales of such shares of common stock in registration statements that we may file for ourselves or other stockholders. In order to exercise these registration rights, the Berry family must satisfy the conditions discussed in “Shares Eligible for Future Sale—Registration Rights”. Subject to compliance with applicable lock-up restrictions, shares of common stock sold under these registration statements can be freely sold in the public market. In the event such registration rights are exercised and a large number of shares of common stock are sold in the public market, such sales could reduce the trading price of our common stock. These sales also could impede our ability to raise future capital. Additionally, we will bear all expenses in connection with any such registrations (other than stock transfer taxes and underwriting discounts or commissions). See “Shares Eligible for Future Sale—Registration Rights”.

In connection with this offering, we, our directors and executive officers and the Berry family have each agreed to lock-up restrictions, meaning that we and they and their permitted transferees will not be permitted to sell any shares of our common stock for 180 days after the date of this prospectus, subject to the exceptions discussed in “Shares Eligible for Future Sale—Lock-Up Arrangements”, without the prior consent of Merrill Lynch, Pierce, Fenner & Smith Incorporated. Although we have been advised that there is no present intention to do so, Merrill Lynch, Pierce, Fenner & Smith Incorporated may, in its sole discretion and without notice, release all or any portion of the shares of our common stock from the restrictions in any of the lock-up agreements described above. See “Underwriting”.

Also, in the future, we may issue shares of our common stock in connection with investments or acquisitions. The amount of shares of our common stock issued in connection with an investment or acquisition could constitute a material portion of our then outstanding shares of our common stock.

Our costs will increase significantly as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations.

We historically have operated our business as a private company. As a public company, we will incur additional legal, accounting, compliance and other expenses that we have not incurred as a private company. After this offering, we will become obligated to file with the SEC annual and quarterly information and other reports that are specified in Section 13 and other sections of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, we will also become subject to other reporting and corporate governance requirements, including certain requirements of The NASDAQ Stock Market, and certain provisions of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the regulations promulgated thereunder, which will impose

16

Table of Contents

significant compliance obligations upon us. We will need to institute a comprehensive compliance function; establish internal policies; ensure that we have the ability to prepare financial statements that are fully compliant with all SEC reporting requirements on a timely basis; design, establish, evaluate and maintain a system of internal controls over financial reporting in compliance with Sarbanes-Oxley; involve and retain outside counsel and accountants in the above activities and establish an investor relations function.

Sarbanes-Oxley, as well as rules subsequently implemented by the SEC and The NASDAQ Stock Market, have imposed increased regulation and disclosure and have required enhanced corporate governance practices of public companies. Our efforts to comply with evolving laws, regulations and standards in this regard are likely to result in increased administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. These changes will require a significant commitment of additional resources. We may not be successful in implementing these requirements, and implementing them could materially adversely affect our business, results of operations and financial condition. In addition, if we fail to implement the requirements with respect to our internal accounting and audit functions, our ability to report our operating results on a timely and accurate basis could be impaired. If we do not implement such requirements in a timely manner or with adequate compliance, we might be subject to sanctions or investigation by regulatory authorities, such as the SEC or The NASDAQ Stock Market. Any such action could harm our reputation and the confidence of investors and customers in our company and could materially adversely affect our business and cause our share price to fall.

Failure to establish and maintain effective internal controls in accordance with Section 404 of Sarbanes-Oxley could have a material adverse effect on our business and stock price.

As a public company, we will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of Sarbanes-Oxley, which will require annual management assessments of the effectiveness of our internal control over financial reporting and a report by our independent registered public accounting firm that addresses the effectiveness of internal control over financial reporting. During the course of our testing, we may identify deficiencies that we may not be able to remediate in time to meet our deadline for compliance with Section 404. Testing and maintaining internal control can divert our management’s attention from other matters that are important to the operation of our business. We also expect the regulations to increase our legal and financial compliance costs, make it more difficult to attract and retain qualified officers and members of our board of directors, particularly to serve on our audit committee, and make some activities more difficult, time consuming and costly. We may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 or our independent registered public accounting firm may not be able or willing to issue an unqualified report on the effectiveness of our internal control over financial reporting. If we conclude that our internal control over financial reporting is not effective, we cannot be certain as to the timing of completion of our evaluation, testing and remediation actions or their effect on our operations because there is presently no precedent available by which to measure compliance adequacy.

In connection with this offering we reviewed our accounting policies. As part of this review, and in connection with audits of our financial statements for certain prior periods, our independent registered public accountants identified three material weaknesses in our internal control over financial reporting related to our accounting for (1) compensated absences of our employees, which we had not been accruing over the service period during which the entitlement was earned, (2) license revenue with respect to sales of sushi, and (3) the reversal of certain non-cash compensation expenses in 2007 which, based on the timing of formal documentation, should have been recorded in 2008. We corrected these accounting treatments during the current year and restated prior year financial statements to reflect these changes.

If we are unable to conclude that we have effective internal control over financial reporting, our independent auditors are unable to provide us with an unqualified report as required by Section 404 or we are

17

Table of Contents

required to restate our financial statements, we may fail to meet our public reporting obligations and investors could lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock.

We will be a “controlled company” within the meaning of The NASDAQ Stock Market rules, and, as a result, will rely on exemptions from certain corporate governance requirements that provide protection to stockholders of other companies.

Upon completion of this offering, the Berry family will own more than 50% of the total voting power of our common shares for the election of directors and we will be a “controlled company” under The NASDAQ Stock Market corporate governance standards. As a controlled company, certain exemptions under The NASDAQ Stock Market standards will free us from the obligation to comply with certain corporate governance requirements of The NASDAQ Stock Market, including the requirements:

| • | that a majority of our board of directors consists of “independent directors”, as defined under the rules of The NASDAQ Stock Market; |

| • | that our director nominees be selected, or recommended for our board of directors’ selection, either (1) by a majority of independent directors in a vote by independent directors, pursuant to a nominations process adopted by a board resolution, or (2) by a nominating and governance committee comprised solely of independent directors with a written charter addressing the nominations process; and |

| • | that the compensation of our executive officers be determined, or recommended to the board for determination, by a majority of independent directors in a vote by independent directors, or a compensation committee comprised solely of independent directors. |

Accordingly, for so long as we are a “controlled company”, you will not have the same protections afforded to stockholders of companies that are subject to all of The NASDAQ Stock Market corporate governance requirements.

Prior to this offering, we were treated as an S-corporation under Subchapter S of the Internal Revenue Code, and claims of taxing authorities related to our prior status as an S-corporation could harm us.

In connection with this offering our S-corporation status will terminate and we will be treated as a C-corporation under Subchapter C of the Internal Revenue Code of 1986, as amended, which is applicable to most corporations and treats the corporation as an entity that is separate and distinct from its stockholders. If the unaudited, open tax years in which we were an S-corporation are audited by the Internal Revenue Service, and we are determined not to have qualified for, or to have violated, our S-corporation status, we will be obligated to pay back taxes, interest and penalties, and we do not have the right to reclaim tax distributions we have made to our stockholders during those periods. These amounts could include taxes on all of our taxable income while we were an S-corporation. Any such claims could result in additional costs to us and could have a material adverse effect on our results of operations and financial condition.

We will enter into tax indemnification agreements with the Berry family and could become obligated to make payments to them for any additional federal or state income taxes assessed against them for fiscal periods prior to the completion of this offering.

We historically have been treated as an S-corporation for U.S. federal income tax purposes. In connection with this offering, our S-corporation status will terminate and we will thereafter be subject to federal and increased state income taxes. In the event of an adjustment to our reported taxable income for a period or periods prior to termination of our S-corporation status, our existing stockholders could be liable for additional

18

Table of Contents

income taxes for those prior periods. Therefore, we will enter into tax indemnification agreements with our existing stockholders prior to or upon consummation of this offering. Pursuant to the tax indemnification agreements, we will agree that upon filing any tax return (amended or otherwise), or in the event of any restatement of our taxable income, in each case for any period during which we were an S-corporation, we will make a payment to each stockholder equal to the excess, if any, of (i) such stockholder’s estimated tax liability (including any interest and penalties), calculated as if such stockholder would be taxable on its allocable share of our taxable income at the highest Federal, state and local tax rates over (ii) the amount we previously distributed to such stockholder in respect of taxes for the relevant period. We will also agree to indemnify the stockholders for losses, costs or expenses (including reasonable attorneys’ fees) arising out of any claim under the agreements.

After this offering, the Berry family will continue to have substantial control over us and will maintain the ability to control the election of directors and other matters submitted to stockholders for approval, which will limit your ability to influence corporate matters and may result in actions that you do not believe to be in our interests or your interests.