Attached files

| file | filename |

|---|---|

| EX-10.2 - EX102 - THC Therapeutics, Inc. | ex10_2.htm |

| EX-10.1 - EX101 - THC Therapeutics, Inc. | ex10_1.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 3, 2010

Aviation Surveillance Systems, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada |

333-145794 |

20-0164981 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

701 Xuang Mi Hu Road, Xi Yuan, Futian, Shenzhen, P.R.C. |

n/a |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: 086-13828-766-488

|

_____________________________________________

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

|

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1 – Registrant’s Business and Operations

Item 1.01 – Entry Into A Material Definitive Agreement

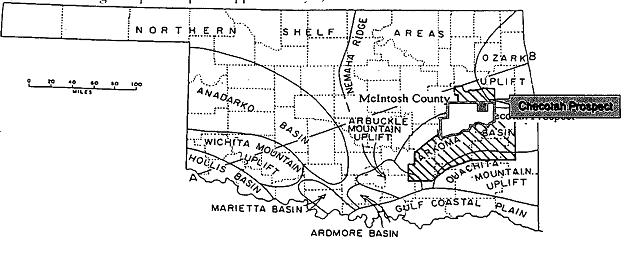

On June 3, 2010, we acquired, by way of an assignment, an option to purchase the working interest in a group of oil and gas leases covering approximately 4,480 acres in McIntosh County, Oklahoma known as the Checotah Field Development Project (the “Checotah Project”). The seller of the leasehold interests is Shale Gas Partners,

LLC. In addition, our option includes the purchase of a natural gas gathering, treatment, and pipeline system located within the Checotah Project. The seller of the natural gas gathering system is Checotah Pipeline, LLC.

We will require substantial additional financing in order to exercise our option to purchase the Checotah Project and the related natural gas equipment, to pursue our development plan for the project, and to sustain substantial future business operations for any significant period of time. Under our agreement, a $20,000 initial deposit will

be required and we must commit to investing funds in the total amount of $6,500,000 in the exploration and development of the project. In addition, our initial investment upon closing of the transaction must be a minimum of $1,500,000. We do not currently have funds sufficient to make the initial required deposit, to fund the initial required investment or to begin any of the required exploration or development on the project. We plan to seek additional debt and/or equity capital, but we do not have

any firm arrangements for financing and we may not be able to obtain financing when required, in the amount necessary to fund our contemplated operations, or on terms that are financially feasible. There are substantial risks that we will be unable to raise funds sufficient to exercise the option, that we will be unable to conclude a satisfactory formal purchase and sale agreement, and/or that we will be unable to raise significant funds with which to undertake exploration and development.

2

The Checotah Project

The Checotah Project consists of oil and gas leases that comprise 4,480 acres held by production within the Checotah AMI located in McIntosh County, Oklahoma. The project contains eleven existing natural gas wells together with various natural gas gathering, treating, and pipeline equipment. The acreage held by production (“HBP”)

in each section within the project is as follows:

|

Section |

8-11N-17E |

639.51 |

|

Section |

9-11N-17E |

640.00 |

|

Section |

19-12N-17E |

581.60 |

|

Section |

20-12N-17E |

514.38 |

|

Section |

30-12N-17E |

495.19 |

|

Section |

27-12N-17E |

639.99 |

|

Section |

36-12N-16E |

640.00 |

|

Various |

329.33 | |

|

Total HBP |

4,480.00 |

Our option on the Checotah Project also includes the right to purchase all right, title and interest in any future leasing and development in the Checotah AMI, which comprised approximately 23,000 acres.

Our option also includes the purchase certain natural gas gathering, pipeline, and processing equipment located within the Checotah Project, including:

|

· |

Gas gathering system consisting of eight miles of buried 4” poly-pipe. |

|

· |

Gas treatment facilities along the gathering system to the sales point. |

|

· |

Checotah compression station and sales point to Enogex low pressure line. |

|

· |

Water disposal through buried 2” poly-pipe with pumps and permitted water injection wells. |

|

· |

Enogex CDP, 2”meter run (no meter) |

|

· |

500 gallon polyethylene liquid tank |

|

· |

Dehydration Unit – Large unit. |

3

Location and Exploration Potential of the Checotah Project

The Checotah gas prospect area lies within that portion of Eastern Oklahoma underlain by the north flanks of the Arkoma basin. The area has potential for discovery of unconventional gas reservoirs in the underexplored lands of McIntosh County, Oklahoma. The prospect covers 4 townships and is designed from an overview of the gas shale potential

of thick deposits of Mississippian Caney and Devonian Woodford shale at average depths of approximately 3,000 feet below surface and the overlying CBM zones with an average midpoint depth of approximately 1,200 feet. The leasehold consists of a contiguous area, suitable to support a large scale, unconventional gas development project.

Development of shale gas across the Checotah project requires the drilling of vertical wells on 80 acre spacing and commingling the Woodford and Caney Shales. These vertical wells will allow for additional gas production to be commingled from multiple pay zones found from shallow CBM. Further, conventional reservoirs of the Atoka and Gilcrease

formations may be discovered.

The area has previously recovered oil and gas reserves located in shallow Pennsylvanian sandstone reservoirs. While drilling deeper wells, logs indicate black shales which have regionally been shown to produce gas. Subsequent mapping indicates that the gas shales contain zones of low density and high resistivity with an assumed high total

organic content. While not typically considered as productive intervals, these black shales are regionally undergoing intense exploration efforts. As with many shale basins, early indications appear promising, while stabilized long term flow rates have not yet been established.

The Checotah Project currently contains eleven (11) completed natural gas wells which would be acquired as part of the project in the event we are able to exercise our option to purchase the leasehold interests and related equipment.

4

Terms and Conditions of Our Option On The Checotah Project

Our option on the Checotah Project calls for an initial deposit of $20,000 upon signing of a formal purchase and sale agreement. The option calls for a sixty (60) day due diligence period following the signing of formal purchase and sale agreements and the option requires closing within ten (10) days after the end of the due diligence

period. Upon closing of a formal purchase and sale agreement, we will be required to invest a minimum of $6,500,000 in the exploration and development of the project in accord with a project budget to be developed and mutually agreed upon with the sellers of the project. In addition, our initial investment upon closing of the transaction must be a minimum of $1,500,000. The current owner of the leasehold property will retain a twenty-five percent (25%) ownership interest following the closing. In

addition, the current owner of the natural gas gathering system with retain a twenty-five percent (25%) ownership interest in the equipment following the closing.

As discussed above, will require substantial additional financing in order to exercise our option to purchase the Checotah Project and the related natural gas equipment, to fund the required initial deposit and initial investment, and to undertake substantial exploration and development activities on the project. We currently do

not have any firm arrangements for such financing and we may not be able to obtain financing when required.

The foregoing is a summary of the material terms of the Letter of Intent regarding the Checotah Project and the related Assignment, which should be reviewed in its entirety for further detail.

SECTION 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

The exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

|

Exhibit Number |

Description |

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Aviation Surveillance Systems, Inc.

/s/ Eden Ho

Eden Ho

President, Chief Executive Officer

Date: June 3, 2010