Attached files

| file | filename |

|---|---|

| 8-K - Avantair, Inc | v187445_8k.htm |

SAFE HARBOR

This document contains

forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical fact, including, without limitation, statements

regarding Avantair’s financial position, business strategy, plans, and

Avantair’s management’s objectives and its future operations, and industry

conditions, are forward-looking statements. Although Avantair believes

that the expectations reflected in such forward-looking statements are

reasonable, Avantair can give no assurance that such expectations will

prove to be correct. Important factors that could cause actual results to

differ materially from Avantair’s expectations (“Cautionary Statements”) as

described in Avantair’s public filings include, without limitation, the effect of

existing and future laws and governmental regulations, the results of future

financing efforts, and the political and economic climate of the United

States. All subsequent written and oral forward-looking statements

attributable to Avantair, or persons acting on Avantair’s behalf, are

expressly qualified in their entirety by the Cautionary Statements.

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical fact, including, without limitation, statements

regarding Avantair’s financial position, business strategy, plans, and

Avantair’s management’s objectives and its future operations, and industry

conditions, are forward-looking statements. Although Avantair believes

that the expectations reflected in such forward-looking statements are

reasonable, Avantair can give no assurance that such expectations will

prove to be correct. Important factors that could cause actual results to

differ materially from Avantair’s expectations (“Cautionary Statements”) as

described in Avantair’s public filings include, without limitation, the effect of

existing and future laws and governmental regulations, the results of future

financing efforts, and the political and economic climate of the United

States. All subsequent written and oral forward-looking statements

attributable to Avantair, or persons acting on Avantair’s behalf, are

expressly qualified in their entirety by the Cautionary Statements.

2

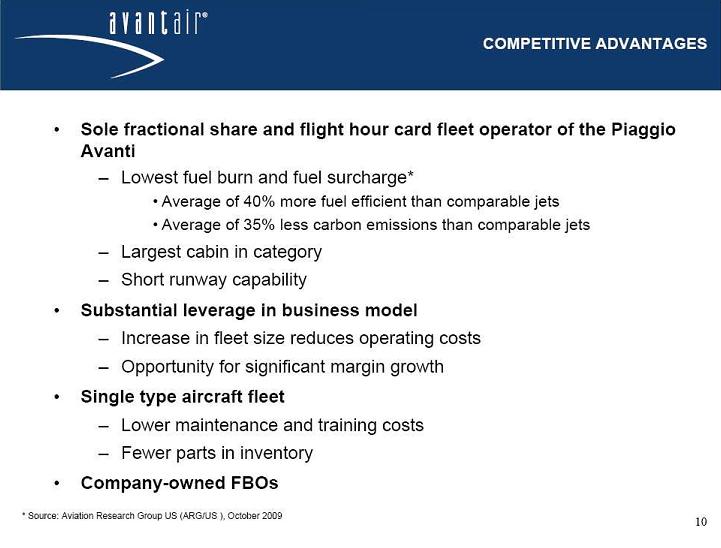

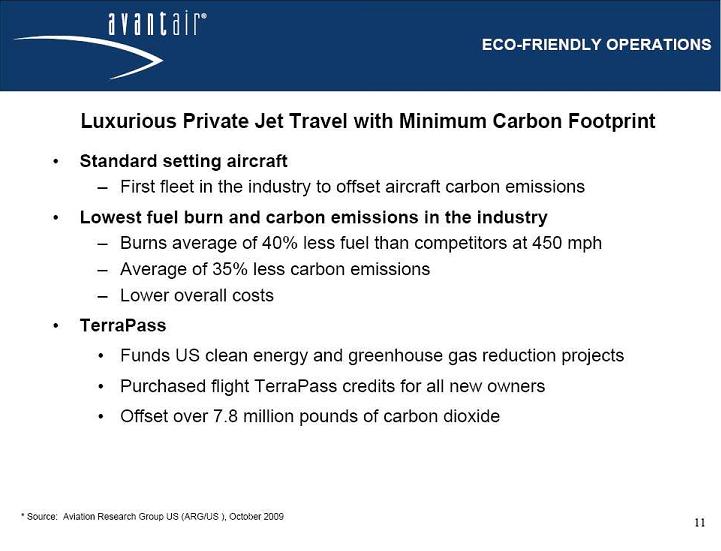

INVESTMENT

HIGHLIGHTS

Sole North American fleet provider

of flight hour time cards and

fractional shares in the Piaggio Avanti aircraft - the roomiest,

quietest, safest and most fuel efficient aircraft with the lowest

operating cost in the light jet category

fractional shares in the Piaggio Avanti aircraft - the roomiest,

quietest, safest and most fuel efficient aircraft with the lowest

operating cost in the light jet category

Compelling secular and economic

drivers spurring demand for

lower-cost alternatives within the private aviation market

lower-cost alternatives within the private aviation market

New innovative Axis Club Membership

bridges the gap between the

financial commitment of a fractional share and flight hour time cards

financial commitment of a fractional share and flight hour time cards

Business model offers path to

sustainable profitability

3

EXPERIENCED MANAGEMENT

TEAM

Steven F.

Santo

Chief Executive Officer

Chief Executive Officer

Avantair Founder

Former Assistant District Attorney

in NY

Former Managing Partner, Fields,

Silver & Santo

Former CEO of Skyline Aviation,

aircraft leasing company

Pilot for 20 years

Over 1,000 flight hours in the

Piaggio Avanti

Richard Pytak

Chief Financial Officer

Former Treasurer at Gibraltar

Industries

Former Senior Manager at

PricewaterhouseCoopers

Kevin Beitzel

Chief Operating Officer

Former Executive VP of Maintenance

and Operations

Over 20 years experience in aviation

industry

16 years with US Airways

4

OUR BUSINESS

AVANTAIR PROGRAM

SUMMARY

5

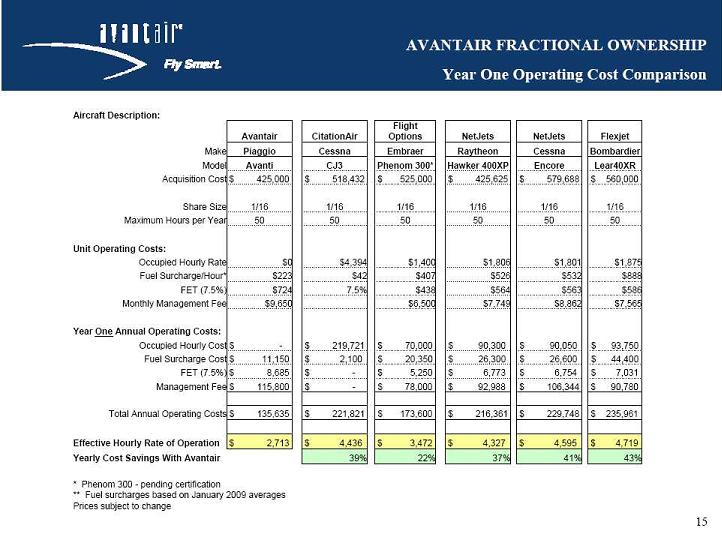

Avantair Fractional

Ownership

Hourly Operating

Cost*:

$2,610

(1/16th share)

$2,610

(1/16th share)

Program Highlights:

One-time acquisition cost; no

hourly cost

hourly cost

Customizable fractional share sizes

5-year term

No restricted travel days

Expanded Primary Service Area

Lower operating cost per

hour

than other fractional programs

than other fractional programs

AXIS Club Membership

By Avantair

Hourly Operating Cost*:

$3,725 - $4,440

Program Highlights:

One-time membership fee

Tiered membership options to fit

customer travel needs

customer travel needs

3-year term

No restricted travel days

Expanded Primary Service Area

Fractional conversion and

upgrade options available

upgrade options available

Edge Time Card

Hourly Operating Cost*:

$4,515

(25 hour card)

Program Highlights:

All inclusive, one-time cost

15 or 25 hour cards available

12-month term

Only 10 restricted travel days per

year

year

Expanded Primary Service Area

Conversion options

available

* Includes FET

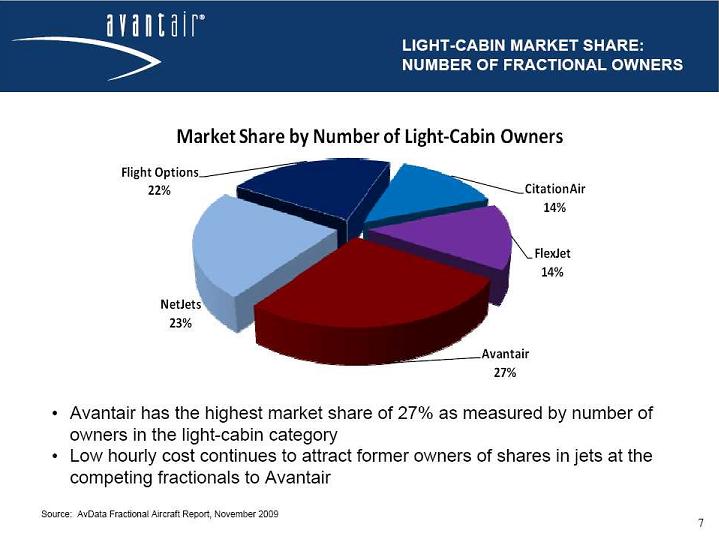

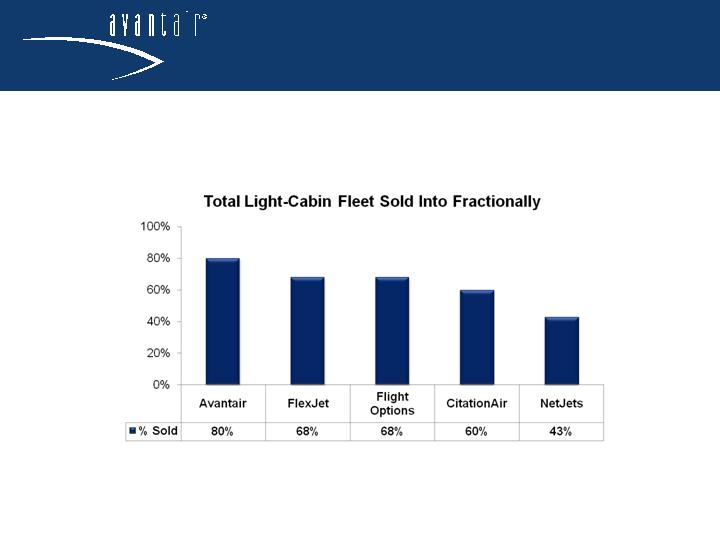

TOTAL LIGHT-CABIN FLEET SOLD INTO

FRACTIONALLY

Avantair’s fleet has the highest

sold-to-in-service ratio of 80% among the

top five fractional players in the light-cabin fleet category

top five fractional players in the light-cabin fleet category

Source: AvData Fractional

Aircraft Report, November 2009

9

PIAGGIO AVANTI

AIRCRAFT

AIRCRAFT

FLEET SUMMARY

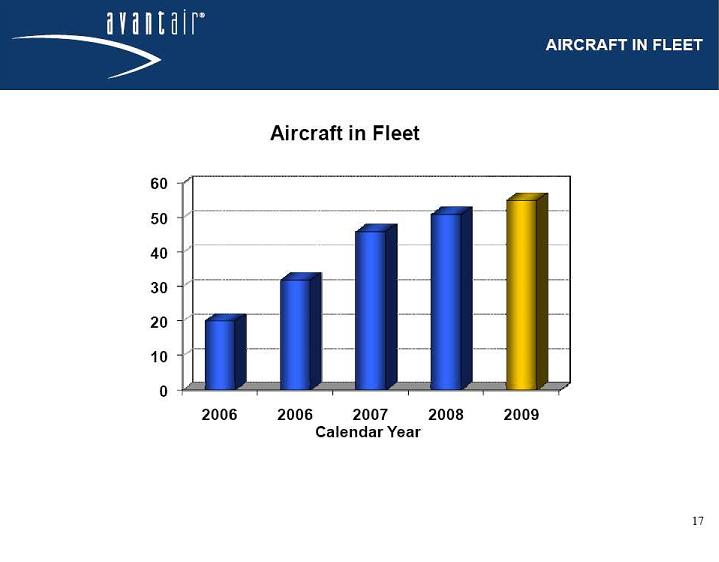

Fleet Statistics

55 aircraft in fleet

4 new Piaggio Avanti II aircraft

added to Avantair’s operating

certificate in February 2010

certificate in February 2010

52 additional Piaggio Avanti

aircraft on order through 2013

Realize economies of scale due to

larger fleet size

Reduces non-revenue repositioning

flights and charter costs

Leverages existing infrastructure

Fixed Base Operations in three key

hubs provide operating and

maintenance efficiencies and lower fuel costs

maintenance efficiencies and lower fuel costs

13

THE PIAGGIO AVANTI

As the best value in the private

aircraft industry, the Piaggio Avanti

offers an unparalleled combination of comfort, speed, performance,

safety and efficiency.

offers an unparalleled combination of comfort, speed, performance,

safety and efficiency.

14

REALIZING

EFFICIENCIES

18

Fleet expansion drives recurring

maintenance and management fees

$18.3 million for fiscal 2010 third

quarter, up 1.7% year-over-year

Leverage opportunities

Fewer repositioning flights

Fewer charters

Decrease in overall costs of flight

operations

Superior flight optimization

technology

Fully integrated in March 2010

Increasing utilization, 3% utility

gain within third quarter of fiscal 2010

Automated flight tracking,

scheduling and adding new legs to the trips

provide increasing efficiencies

provide increasing efficiencies

FINANCIAL

SECTION

SECTION

NON-GAAP MEASURES

24

The following table reflects the

reconciliation of income from operations prepared in conformity with generally

accepted accounting principles

(GAAP) to the non-GAAP financial measure of adjusted non-GAAP income from operations.

(GAAP) to the non-GAAP financial measure of adjusted non-GAAP income from operations.

Reconciliation of GAAP

Financial Measures to Non-GAAP Financial Measures

Three Months Ended March

31,

Three Months

Ended

December 31,

2009

Ended

December 31,

2009

2010

2009

GAAP income from operations

$ 500,888

$ 3,248,183

$ 1,394,863

Subtract:

Vendor service reimbursement

-

(2,951,867)

-

Gain on sale of assets

-

-

(849,584)

Adjusted non-GAAP income from

operations

operations

$ 500,888

$ 296,316

$ 545,279

NON-GAAP MEASURES

25

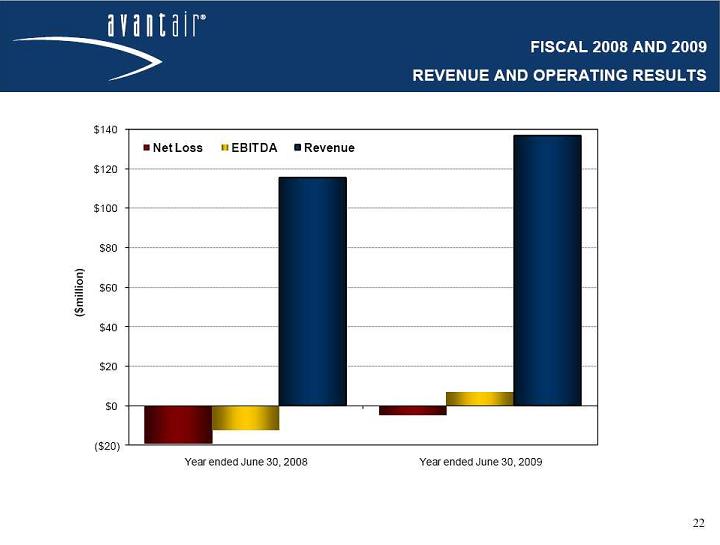

Reconciliation of GAAP Net Income

(Loss) to EBITDA and Adjusted EBITDA

Three Months Ended

March 31,

Twelve Months Ended

June 30,

2010

2009

2009

2008

Net Loss:

$

(773,504)

$ 1,822,233

$

(4,460,921)

$ (18,882,065)

Add:

Depreciation and

amortization

1,314,870

1,240,262

5,233,250

3,624,710

Interest expense

1,281,626

1,439,661

5,942,221

3,661,227

Subtract:

Interest and other

income

(7,234)

(13,711)

(48,921)

(482,

918)

EBITDA

1,815,758

4,488,445

$

6,665,629

$ (12,079,046

Subtract:

Vendor service reimbursement

--

(2,951,867)

Adjusted EBITDA

$ 1,815,758

$ 1,536,578

The following table reflects the

reconciliation of GAAP net income (loss) to the non-GAAP financial measures of

EBITDA and to adjusted

EBITDA:

EBITDA:

The Company believes that the use of

the non-GAAP financial measure of adjusted non-GAAP income from operations is

useful to investors as it

eliminates a non-recurring vendor service reimbursement recognized in the third quarter of fiscal 2009 and a non-recurring gain from the sale of an

asset recognized in the second quarter of fiscal 2010 in order to provide information that is directly comparable to our current year financial

statements.

eliminates a non-recurring vendor service reimbursement recognized in the third quarter of fiscal 2009 and a non-recurring gain from the sale of an

asset recognized in the second quarter of fiscal 2010 in order to provide information that is directly comparable to our current year financial

statements.

The Company believes that EBITDA is

useful to investors as it excludes certain non-cash expenses that do not

directly relate to the operation of

aircraft and that adjusted EBITDA is useful as it eliminates a nonrecurring vendor service reimbursement recognized in 2009 in order to provide

information that is directly comparable to our current year EBITDA.

aircraft and that adjusted EBITDA is useful as it eliminates a nonrecurring vendor service reimbursement recognized in 2009 in order to provide

information that is directly comparable to our current year EBITDA.

These measures are supplements to

generally accepted accounting principles used to prepare the Company’s financial

statements and should not

be viewed as a substitute for GAAP measures. In addition, the Company’s non-GAAP measures may not be comparable to non-GAAP measures

of other companies.

be viewed as a substitute for GAAP measures. In addition, the Company’s non-GAAP measures may not be comparable to non-GAAP measures

of other companies.

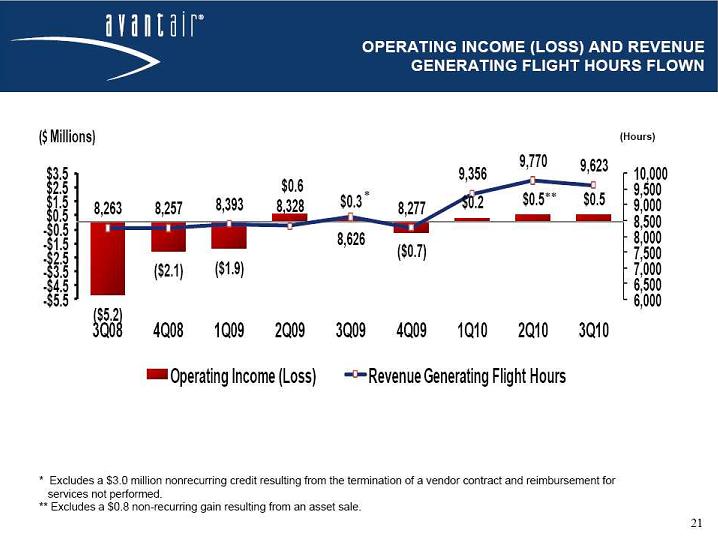

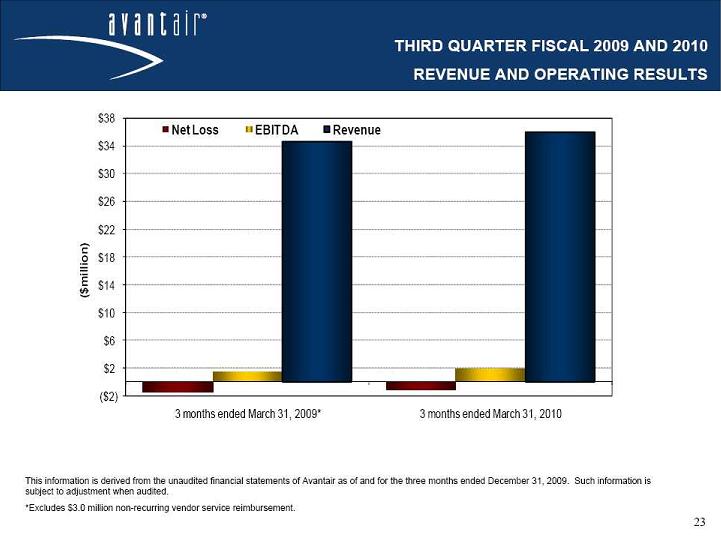

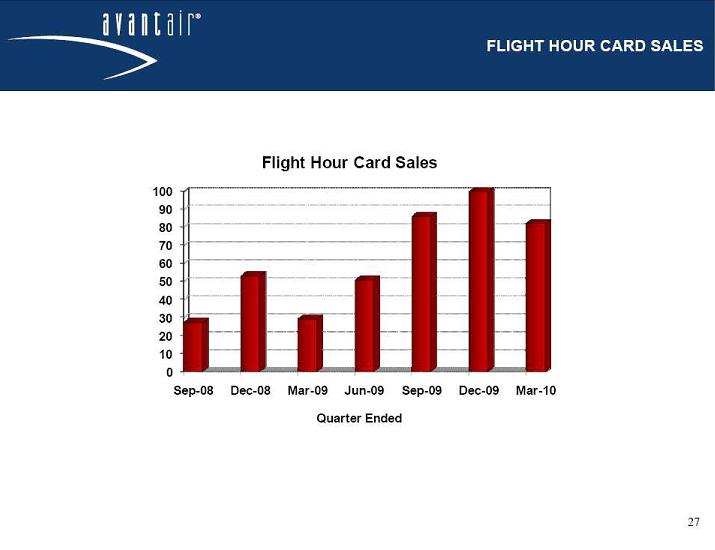

FISCAL THIRD QUARTER 2010

HIGHLIGHTS

Total revenues increased YOY and on

a sequential quarter basis to $36.0 million.

Revenue generating flight hours

flown reached a new third quarter record, increasing

11.5% to 9,623 hours, from 8,627 for the third quarter of fiscal 2009. This compares with

9,770 revenue generating flight hours flown in the fiscal 2010 second quarter.

11.5% to 9,623 hours, from 8,627 for the third quarter of fiscal 2009. This compares with

9,770 revenue generating flight hours flown in the fiscal 2010 second quarter.

During the Company’s seasonally

slowest sales quarter, flight hour cards sold increased

183% to 82 for the third quarter of fiscal 2010, from 29 flight hour cards sold during the

third quarter of fiscal 2009.

183% to 82 for the third quarter of fiscal 2010, from 29 flight hour cards sold during the

third quarter of fiscal 2009.

EBITDA (results from operations

before interest, taxes, depreciation and amortization) of

$1.8 million, compared with adjusted EBITDA of $1.5 million, which excludes a one-time,

non-recurring $3.0 million vendor service reimbursement in the third quarter of fiscal

2009.

$1.8 million, compared with adjusted EBITDA of $1.5 million, which excludes a one-time,

non-recurring $3.0 million vendor service reimbursement in the third quarter of fiscal

2009.

Operating income increased to

$501,000, compared with adjusted non-GAAP operating

income of $296,000, which excludes a one-time, non-recurring $3.0 million vendor service

reimbursement in the third quarter of fiscal 2009. The cost per revenue hour was reduced

significantly following the addition of four new aircraft to Avantair’s operating certificate in

mid-February.

income of $296,000, which excludes a one-time, non-recurring $3.0 million vendor service

reimbursement in the third quarter of fiscal 2009. The cost per revenue hour was reduced

significantly following the addition of four new aircraft to Avantair’s operating certificate in

mid-February.

As of March 31, 2010, Avantair had

cash and cash equivalents of $7.3 million, compared

with cash and cash equivalents of $3.8 million as of June 30, 2009.

with cash and cash equivalents of $3.8 million as of June 30, 2009.

26

-

-

FINANCIAL MODEL

Fractional shares:

Fractional share sales are paid in

cash up front with revenue amortized over 60

months

months

Approximately $1 million gross

profit per fractionalized aircraft

Maintenance and management fees

provide recurring monthly revenues

Growth in fractional shares add

incremental monthly fees on growing base

AXIS Club Membership:

Membership fee is paid in cash up

front with revenue amortized over 36 months

Membership fee may be applied

towards the purchase of a fractional share

Edge and AXIS Time Cards:

Edge and Axis flight hour time card

sales are paid in cash up front with revenue

recognized when hours are used

recognized when hours are used

28

AVANTAIR KEY

TAKEAWAYS

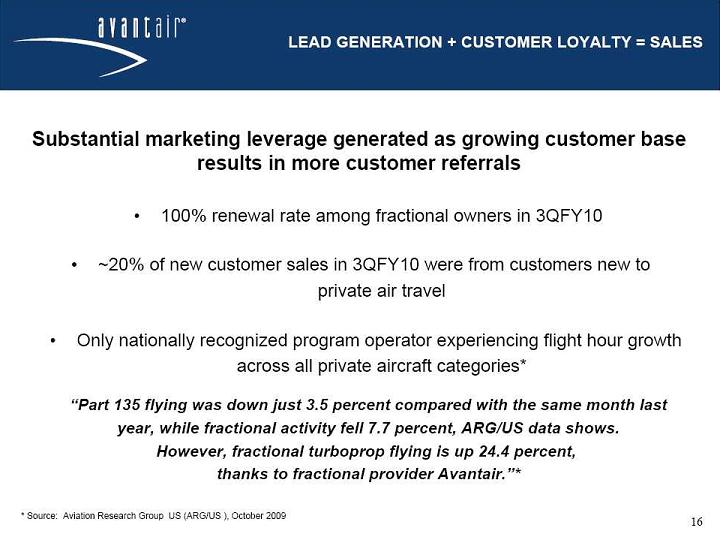

Superior growth rate relative to

private aviation market; Avantair continues

to gain market share

to gain market share

Taking market share from competitors

Gaining new customers

Defensible competitive advantages -

Piaggio Avanti is technologically

superior to other light jets and is exclusive to Avantair

superior to other light jets and is exclusive to Avantair

Recurring revenue stream via

fractional share and Axis membership sales

Substantial operating leverage

inherent to business model, expected to

lead to sustainable profitability

lead to sustainable profitability

29

Avantair,

Inc.

(OTCBB: AAIR)

Headquartered in

Clearwater, FL

727.538.7910

www.avantair.com