Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Iridium Communications Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - Iridium Communications Inc. | dex991.htm |

Exhibit 99.2

Iridium Communications Inc.

Comprehensive Plan for Iridium’s Next-Generation Constellation

June 2, 2010

Disclaimer

Safe Harbor Statement

This presentation contains statements about future events and expectations known as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We have based these statements on our current expectations and the information currently available to us.

Forward-looking statements in this presentation include statements regarding expected Iridium NEXT project costs and deployment schedule; the availability, adequacy and terms of the Iridium NEXT financing, the expected duration of the existing constellation and the transition to the Iridium NEXT constellation and features of the Iridium NEXT system. Other forward-looking statements can be identified by the words “anticipates,” “may,” “can,” “believes,” “expects,” “projects,” “intends,” “likely,” “will,” “to be” and other expressions that are predictions of or indicate future events, trends or prospects. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Iridium to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, uncertainties regarding overall Iridium NEXT costs, including Euro currency exchange risks, the company’s ability to finalize the Iridium NEXT financing, potential delays in the Iridium NEXT deployment, levels of demand for mobile satellite services (MSS), and the company’s ability to maintain the health, capacity and content of its satellite constellation, as well as general industry and economic conditions, and competitive, legal, governmental and technological factors. Other factors that could cause actual results to differ materially from those indicated by the forward-looking statements include those factors listed under the caption “Risk Factors” in the company’s Annual Report on Form 10-K for the year ended December 31, 2009, filed with the Securities and Exchange Commission on March 16, 2010. There is no assurance that Iridium’s expectations will be realized. If one or more of these risks or uncertainties materialize, or if Iridium’s underlying assumptions prove incorrect, actual results may vary materially from those expected, estimated or projected.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to release publicly any revisions to any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

| 2 |

|

| 3 |

|

Today’s Announcement

Iridium announces comprehensive plan for Iridium NEXT constellation and financing

Iridium signs agreement with Thales Alenia Space (TAS) for next generation constellation after a comprehensive competitive process

$2.1B(1) contract for 81 satellites

First launch scheduled during Q1 2015

Coface, France’s export credit agency (ECA), has issued a ‘Promise of Guarantee’ which commits to cover 95% of $1.8B facility

Iridium expects attractive and flexible terms on the facility consistent with ECA financings

Coface guarantee is not conditional on Iridium raising additional debt or equity

1) Computed at a Euro to USD exchange rate of 1.23

| 4 |

|

Our Company

Satellite voice and data solutions for enterprise & government

The only provider offering 100% worldwide coverage

Unique, resilient mesh satellite architecture

66 satellite Low Earth Orbit (LEO) constellation plus in-orbit spares for reliable service through NEXT replacement

~359,000 billable subscribers at March 31, 2010

Anchor U.S. DoD customer—23% of revenue for Q1 2010(1)

Complements terrestrial communications solutions

Less than 10% of the earth’s surface is served by terrestrial wireless and wireline

Key Markets: maritime, aviation, handheld, government, machine-to-machine (M2M)

Low and high speed data services growing rapidly

1) Includes direct and indirect DoD revenues and revenues from certain other governmental entities through the DoD gateway.

| 5 |

|

Iridium NEXT Costs

We have signed a contract (Authorization to Proceed) with TAS to immediately begin work on the development phase while Iridium completes financing

Iridium NEXT build to include 81 satellites, up from original 72

66 operational satellites to replace current constellation

| 6 |

|

in-orbit spare satellites |

9 ground spares available as part of a hybrid insurance strategy for eventual launch

Contract is “Fixed Price” to be financed through internal cash flows and $1.8B Coface-backed credit facility being syndicated by French and other major international banks and financial institutions

Total cost for Iridium NEXT expected to be approximately $2.9B(1), to be spent through 2017 when Iridium NEXT will be fully deployed

Scale of Iridium NEXT project enables unique ability to insure through cost effective combination of traditional and self insurance

Final costs will be locked in after financial close depending on the prevailing Euro exchange rate

| (1) |

|

Computed at a Euro to USD exchange rate of 1.23 |

| 6 |

|

Benefits of Thales Alenia Space as our NEXT Prime

TAS experience in LEO satellites and commercial space expertise demonstrated through its advanced technical design and system plan

TAS to use a consortium of suppliers from 11 countries

Provides for best in class development throughout program

TAS agreement ensures opportunity for U.S. government secondary payloads on Iridium NEXT

Coface support provides for attractive and flexible financing terms

Contract cost will to be locked into fixed U.S. dollars at initial disbursement of financing

7

Iridium NEXT Prime Selection

TAS to develop and manufacture the Iridium NEXT spacecraft to replace the current satellite fleet

TAS offers the best comprehensive solution for Iridium in terms of design, functionality, price, schedule and financing

Initial launch scheduled during Q1 2015

Current fleet expected to provide commercially acceptable service through transition to Iridium NEXT

Fully compatible with current constellation to simplify network transition and network continuity to existing customers

Iridium NEXT features:

Doubles current Iridium subscriber capacity for long term growth

Supports higher data speeds - enabling the most competitive price points in the industry

Capable of supporting future product enhancements - software upgradability

Designed to host secondary payloads - in discussion with numerous potential candidates

Will maintain Iridium’s unique architecture and its advantages

8

Transition from Current Constellation to Iridium NEXT

All Iridium segments (space/system control, ground, subscriber) will evolve incrementally and seamlessly from current constellation to Iridium NEXT

Space segment will operate transparently throughout the transition period

Iridium NEXT satellite vehicles (SVs) will be fully compatible and interoperable with current constellation SVs

As Iridium NEXT SVs are launched, they will take the place of the current constellation SVs on a satellite-for-satellite basis

System control segment will be capable of commanding and controlling both current constellation and Iridium NEXT SVs; constellation will be operated as a single entity regardless of Iridium NEXT vs. current constellation SV makeup

Ground segment (gateways, TT&C sites) incremental migration towards a new Teleport Network (TPN) architecture is already underway

For Iridium NEXT, functional distinction between gateways and TT&C functionality will become blurred – subscriber traffic can be grounded to any TPN site, and commanding of the constellation can be performed from any site

Existing subscriber segment (handsets, data devices, services, etc.) will be fully compatible with Iridium NEXT satellites

New subscriber devices will be developed to take advantage of new and unique Iridium NEXT system capabilities

9

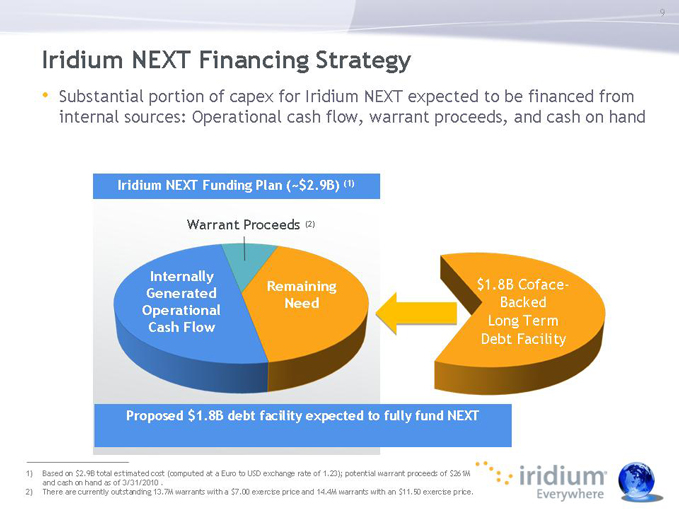

Iridium NEXT Financing Strategy

Substantial portion of capex for Iridium NEXT expected to be financed from internal sources: Operational cash flow, warrant proceeds, and cash on hand

Iridium NEXT Funding Plan (~$2.9B) (1)

Warrant Proceeds (2)

Internally

Remaining $1.8B Coface-

Generated

Need Backed

Operational

Long Term

Cash Flow

Debt Facility

Proposed $1.8B debt facility expected to fully fund NEXT

1) Based on $2.9B total estimated cost (computed at a Euro to USD exchange rate of 1.23); potential warrant proceeds of $261M and cash on hand as of 3/31/2010.

2) There are currently outstanding 13.7M warrants with a $7.00 exercise price and 14.4M warrants with an $11.50 exercise price.

10

Timetable for Closing

Syndication underway now; we expect to finalize this summer

In the interim, Iridium provided TAS with Authorization to Proceed (ATP) to begin development using Iridium funds

Estimated payments of $53M(1) through August 1, 2010

Renewable for an additional 3 month period

ATP expenses incurred will be eligible for financing under the credit facility

Keeps Iridium on track for first launch during Q1 2015

Will provide an update to financing facility once facility is complete

1) 1 Approximately 60% of payments in Euros and have been translated at 1.23