Attached files

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2010

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

|

||||

|

Commission file number 0-13163

|

||||

|

ACXIOM CORPORATION

(Exact name of registrant as specified in its charter)

|

||||

|

DELAWARE

(State or Other Jurisdiction of Incorporation

or Organization)

|

71-0581897

(I.R.S. Employer Identification No.)

|

|||

|

P.O. Box 8180, 601 E. Third Street,

Little Rock, Arkansas

(Address of Principal Executive Offices)

|

72201

(Zip Code)

|

|||

|

(501) 342-1000

(Registrant’s telephone number, including area code)

|

||||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||||

|

Title of each class

|

Name of each exchange

on which registered

|

|||

|

Common Stock, $.10 Par Value

|

The NASDAQ Stock Market LLC

|

|||

|

Securities registered pursuant to Section 12(g) of the Act: None

|

||||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

||||

|

Yes [X]

|

No [ ]

|

|||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

|

||||

|

Exchange Act.

|

Yes [ ]

|

No [X]

|

||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

||||

|

Yes [X]

|

No [ ]

|

|||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such filings).

|

||||

|

Yes [ ]

|

No [ ]

|

|||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

|

||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

||||

|

Large accelerated filer [X]

|

Accelerated filer [ ]

|

|||

|

Non-accelerated filer [ ]

|

Smaller reporting company [ ]

|

|||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

||||

|

Yes [ ]

|

No [X]

|

|||

|

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing sale price of the registrant’s Common Stock, $.10 par value per share, as of the last business day of the registrant’s most recently completed second fiscal quarter as reported on the NASDAQ National Market was approximately $735,112,886. (For purposes of determination of the above stated amount only, all directors, executive officers and 10% or more shareholders of the registrant are presumed to be affiliates.)

|

||||

|

The number of shares of Common Stock, $.10 par value per share, outstanding as of May 25, 2010, was 79,685,317.

|

||||

2

| Table of Contents | Page | ||

|

Documents Incorporated by Reference ...................................................................................................................

|

4

|

||

|

Part I

|

|||

|

Availability of SEC Filings and Corporate Governance Information; Cautionary Statements..........................

|

4

|

||

| Item 1. |

Business ................................................................................................................................................

|

6

|

|

| Item 1A. |

Risk Factors ..........................................................................................................................................

|

13

|

|

| Item 1B. |

Unresolved Staff Comments ...............................................................................................................

|

17

|

|

| Item 2. |

Properties ..............................................................................................................................................

|

18

|

|

| Item 3. |

Legal Proceedings ...............................................................................................................................

|

20

|

|

|

Part II

|

|||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities .................................................................................................................................

|

20

|

|

| Item 6. |

Selected Financial Data ...........................................................................................................................

|

23

|

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations .....

|

23

|

|

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk ...........................................................

|

23

|

|

| Item 8. |

Financial Statements and Supplementary Data ....................................................................................

|

23

|

|

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure ...

|

23

|

|

| Item 9A. |

Controls and Procedures ........................................................................................................................

|

23

|

|

| Item 9B. |

Other Information ....................................................................................................................................

|

24

|

|

|

Part III

|

|||

| Item 10. |

Directors, Executive Officers and Corporate Governance...............................................................

|

24

|

|

| Item 11. |

Executive Compensation ......................................................................................................................

|

24

|

|

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters...............................................................................................................................

|

24

|

|

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence…………………..

|

24

|

|

| Item 14. |

Principal Accountant Fees and Services ............................................................................................

|

25

|

|

|

Part IV

|

|||

| Item 15. |

Exhibits and Financial Statement Schedules........................................................................................

|

25

|

|

|

Signatures .........................................................................................................................................................................

|

29

|

||

|

Financial Supplement ......................................................................................................................................................

|

F-1 – F-58

|

||

3

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Acxiom’s Proxy Statement for the 2010 Annual Meeting of Shareholders (“2010 Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

PART I

AVAILABILITY OF SEC FILINGS AND CORPORATE GOVERNANCE INFORMATION

Our website address is www.acxiom.com, where copies of documents which we have filed with the Securities and Exchange Commission may be obtained free of charge as soon as reasonably practicable after being filed electronically. Included among those documents are our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. Copies may also be obtained through the SEC’s EDGAR site, or by sending a written request for copies to Acxiom Investor Relations, 601 East Third Street, Little Rock, AR 72201. Copies of all of our SEC filings were available on our website during the past fiscal year covered by this Form 10-K. In addition, at the “Corporate Governance” section of our website, we have posted copies of our Corporate Governance Principles, the charters for the Audit/Finance, Compensation, Executive and Governance/Nominating Committees of the Board of Directors, the codes of ethics applicable to directors, financial personnel and all employees, and other information relating to the governance of the Company.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K, including, without limitation, the items set forth on pages F-3 – F-18 in Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains and may incorporate by reference certain statements that may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended (as amended, the “PSLRA”), and that are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the PSLRA. These statements, which are not statements of historical fact, may contain estimates, assumptions, projections and/or expectations regarding the Company’s financial position, results of operations, market position, product development, growth opportunities, economic conditions, and other similar forecasts and statements of expectation. Forward-looking statements are often identified by words or phrases such as “anticipate,” “estimate,” “plan,” “expect,” “believe,” “intend,” “foresee,” and similar words or phrases. These forward-looking statements are not guarantees of future performance and are subject to a number of factors and uncertainties that could cause the Company’s actual results and experiences to differ materially from the anticipated results and expectations expressed in the forward-looking statements.

Forward-looking statements may include but are not limited to the following:

|

·

|

management’s expectations about the macro economy;

|

|

·

|

that the amounts for restructuring and impairment charges and accruals for litigation will be within estimated ranges;

|

|

·

|

that the cash flows used in estimating the recoverability of assets will be within the estimated ranges; and

|

|

·

|

that items which management currently believes are not material will continue to not be material in the future.

|

Among the factors that may cause actual results and expectations to differ from anticipated results and expectations expressed in such forward-looking statements are the following:

|

·

|

the risk factors described in Part I, “Item 1A. Risk Factors” and elsewhere in this report and those described from time to time in our future reports filed with the Securities and Exchange Commission;

|

|

·

|

the possibility that in the event a change of control of the Company is sought that certain clients may attempt to invoke provisions in their contracts resulting in a decline in revenue and profit;

|

|

·

|

the possibility that the integration of acquired businesses may not be as successful as planned;

|

4

|

·

|

the possibility that the fair value of certain of our assets may not be equal to the carrying value of those assets now or in future time periods;

|

|

·

|

the possibility that sales cycles may lengthen;

|

|

·

|

the possibility that we won’t be able to properly motivate our sales force or other associates;

|

|

·

|

the possibility that we may not be able to attract and retain qualified technical and leadership associates, or that we may lose key associates to other organizations;

|

|

·

|

the possibility that we won’t be able to continue to receive credit upon satisfactory terms and conditions;

|

|

·

|

the possibility that competent, competitive products, technologies or services will be introduced into the marketplace by other companies;

|

|

·

|

the possibility that there will be changes in consumer or business information industries and markets that negatively impact the Company;

|

|

·

|

the possibility that we won’t be able to protect proprietary information and technology or to obtain necessary licenses on commercially reasonable terms;

|

|

·

|

the possibility that there will be changes in the legislative, accounting, regulatory and consumer environments affecting our business, including but not limited to litigation, legislation, regulations and customs relating to our ability to collect, manage, aggregate and use data;

|

|

·

|

the possibility that data suppliers might withdraw data from us, leading to our inability to provide certain products and services;

|

|

·

|

the possibility that we may enter into short-term contracts which would affect the predictability of our revenues;

|

|

·

|

the possibility that the amount of ad hoc, volume-based and project work will not be as expected;

|

|

·

|

the possibility that we may experience a loss of data center capacity or interruption of telecommunication links or power sources;

|

|

·

|

the possibility that we may experience failures or breaches of our network and data security systems, leading to potential adverse publicity, negative customer reaction, or liability to third parties;

|

|

·

|

the possibility that our clients may cancel or modify their agreements with us;

|

|

·

|

the possibility that we will not successfully complete customer contract requirements on time or meet the service levels specified in the contracts, which may result in contract penalties or lost revenue;

|

|

·

|

the possibility that we experience processing errors which result in credits to customers, re-performance of services or payment of damages to customers; and

|

|

·

|

general and global negative economic conditions

|

With respect to the provision of products or services outside our primary base of operations in the United States, all of the above factors apply, along with the difficulty of doing business in numerous sovereign jurisdictions due to differences in scale, competition, culture, laws and regulations.

Other factors are detailed from time to time in periodic reports and registration statements filed with the United States Securities and Exchange Commission. The Company believes that we have the product and technology offerings, facilities, associates and competitive and financial resources for continued business success, but future revenues, costs, margins and profits are all influenced by a number of factors, including those discussed above, all of which are inherently difficult to forecast.

In light of these risks, uncertainties and assumptions, the Company cautions readers not to place undue reliance on any forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information or otherwise.

5

Item 1. Business

Overview

Acxiom is a recognized leader in marketing technology and services that enable marketers to successfully manage audiences, personalize consumer experiences and create profitable customer relationships. Our superior industry-focused, consultative approach combines consumer data and analytics, databases, data integration and consulting solutions for personalized, multichannel marketing strategies. Acxiom leverages over 40 years of experience of data management to deliver high-performance, highly secure, reliable information management services. Founded in 1969, Acxiom is headquartered in Little Rock, Arkansas, USA, and serves clients around the world from locations in the United States, Europe, Asia-Pacific and the Middle East. For more information about Acxiom, visit www.acxiom.com.

Our client base in the U.S. consists primarily of Fortune 1000 companies in the financial services, insurance, information services, direct marketing, media, retail, consumer packaged goods, technology, automotive, healthcare, travel and telecommunications industries. Our solutions are designed to meet the specific needs of our clients in the industries in which they operate. We target organizations that view data as a strategic competitive advantage and an integral component of their business decision-making process. Every day, Acxiom clients benefit from over 40 years of experience serving their information, technology and marketing services needs. We help our clients with:

|

·

|

Recognition of consumers at any touchpoint, leveraging targeting techniques, such as consumer lifestage and retargeting, and creating a single customer view without compromising privacy or security

|

|

·

|

Multichannel marketing solutions for campaign management across multimedia channels, including personalized email, targeted website, banner and other Web advertisements, search engines, mobile devices, digital TV and direct mail

|

|

·

|

Marketing solutions built on our acquisition- and customer-marketing database framework for customer acquisition, customer growth and retention, and multichannel integration

|

|

·

|

Professional consulting that provides analytical tools, household segmentation products, and marketing support infrastructure to help our clients better understand their prospects and customers

|

|

·

|

Large-scale data and systems management through strategic IT infrastructure services

|

|

·

|

Identity verification and risk information, scoring and analytics for fraud and risk management

|

Market Growth Drivers

In today’s technologically advanced and competitive business environment, companies are using vast amounts of customer, prospect and marketplace information to manage their businesses. The information services industry provides a broad range of products and services designed to help companies recognize and engage prospects and customers across the broad spectrum of channels. Acxiom’s consultative capabilities, industry and analytic knowledge, premier data content, and technological innovations combine to enable our clients to efficiently access and manage information throughout the enterprise and on a global scale.

We believe the following trends and dynamics of the information services industry provide us with multiple growth opportunities:

|

·

|

Increasing demand for business intelligence by transforming huge stores of data into insight for real-time and operational decision making

|

|

·

|

Increasingly targeted, interactive and integrated marketing strategies

|

|

·

|

Consumer empowerment that enables individuals to better choose, receive and reject information

|

|

·

|

Technological advances in data management

|

|

·

|

Movement toward multiple communication tools/technology, from search engines to blogs to social networking to addressable TV

|

|

·

|

Consumer privacy, security and fraud management demands

|

|

·

|

Increasing demand for identity verification/authentication

|

|

·

|

Globalization

|

6

Our Sales Growth Strategy

Acxiom’s growth strategy will continue to build on our strengths in the direct and digital information-based marketing arenas, serving the largest companies in nearly all marketing industries in the U.S and, increasingly, internationally.

Our current strategy, which builds on past strategies, includes:

Global – Building a strong base outside the U.S.

Multichannel Focus – Expanding our emphasis on marketing technology and services by combining our data and technology assets, including consumer data, consumer recognition, analytics, client databases, digital and direct marketing strategy, media targeting and delivery optimization to create multichannel, insights-driven solutions that enable marketers to reach audiences with greater certainty. Channels include e-mail, SMS, targeted banner ads, mobile advertising and addressable TV.

Consultative Solutions – Designing programs and approaches, from start to finish, which deliver innovation and new returns on investments (ROIs) designed to add significant value for our clients.

Multi-Industry Emphasis – Extending our expertise in financial services to other sectors and markets.

Our growth strategy includes four primary components:

|

1.

|

Leveraging the depth of Acxiom’s client relationships for increased cross-sell offerings using multiple marketing channels:

|

|

·

|

Increased focus on designing and recommending integrated multi-element solutions (vs. single-point solutions)

|

|

·

|

Penetration into identified gaps in services provided to existing clients

|

|

·

|

Development of new multichannel strategies to increase the scope of Acxiom’s offerings for each client

|

|

·

|

Identification of new industry, geography and product growth areas

|

|

·

|

Aggressive customer sales opportunity management

|

|

2.

|

Developing more standardized market-driven and solution-driven products and services:

|

|

·

|

Productizing our marketing offerings, leveraging our vast case study experiences

|

|

·

|

Identifying and cultivating new industry-specific solutions

|

|

·

|

Better packaging multi-product solution offerings to appeal to clients and prospects

|

|

·

|

Standardizing technical product bundlings for operational scale

|

|

3.

|

Improving operational effectiveness in all aspects of our business by:

|

|

·

|

Centralizing our technology architecture and development functions to drive standards and consistency

|

|

·

|

Driving down unit costs by leveraging “Centers of Excellence” both onshore and offshore

|

|

·

|

Enforcing centralized and prioritized investment across research/development, mergers/acquisitions and infrastructure programs

|

|

·

|

Driving “leaner” practices across client accounts as well as internal business processes

|

|

|

4.

|

Strengthening the culture and mindset of “One Culture, One Team, One Company” by:

|

|

·

|

Disciplined account planning and business management functions

|

|

·

|

Rigorous pursuit review processes with cross-organizational sign-offs

|

|

·

|

A stronger matrix leadership structure to support our organizational model and foster collaboration

|

7

Our Competitive Strengths

Using primarily the following competencies, Acxiom seeks to capitalize on market trends to drive growth. These competencies also represent competitive differentiators that we believe uniquely position us to deliver high-value solutions to our clients.

We help our clients transform information into insight to improve their marketing and business results. Our ability to deliver the right data to the right place at the right time enhances our clients’ marketing, risk management, and business decisions. Those abilities revolve around our:

|

·

|

Global multichannel marketing capabilities that can be integrated to form full solutions with measurable ROI

|

|

·

|

Consumer insight products, including data and segmentation

|

|

·

|

Data integration, management and delivery capabilities

|

|

·

|

Information systems technology and management

|

|

·

|

Fraud/risk management and identity authentication

|

We believe we have the most comprehensive and accurate collection of U.S. consumer, property and telephone marketing data available from a single supplier. Our InfoBase-X® consumer database contains more than 40 billion data elements and covers almost all households in the U.S. We also have strong “reference” data assets – information that clients use for non-marketing purposes, including data used in our employment screening and risk management solution.

We originated the term “Customer Data Integration” (CDI) and believe we are unmatched in our ability to transform and integrate massive amounts of data. We believe our CDI capabilities, combined with related real-time customer recognition software and infrastructure, constitute the leading solution for companies seeking to better integrate their customer data and engage broader audiences across all devices and channels.

As information grows at unprecedented rates and its value increases, companies face a growing need to effectively manage the massive data volumes and transform the information into meaningful insights that drive business results. As one of the world’s largest processors of data, processing well over a trillion records per month, Acxiom’s IT services are well positioned to help information-intensive companies.

We help companies optimize their IT infrastructures, reduce costs and transform information into meaningful intelligence. We achieve this by delivering standardized computing platforms, innovative technology solutions, best-in-class processes and expertise in data management that we believe is unrivaled by any competitor.

The growth of e-commerce and companies’ needs for consumer information mean that we must work even harder to assure that our history of privacy leadership translates to adequate protection of consumer information. We actively promote a set of effective privacy guidelines for the direct marketing, e-commerce, risk management and information industries as a whole. Industry-wide compliance helps address privacy concerns across the globe. Furthermore, we are certified under the European Union safe harbor and contractually comply with other international data protection requirements to ensure the continued ability to process information across borders. We have a dedicated team in place to oversee our compliance with the privacy regulations that govern our business activities in the various countries in which we operate.

The U.S. Congress continues to debate privacy legislation, and there are many different types of privacy legislation pending in the 50 states. In most of the non-U.S. locations in which we do business, legislation restricting the collection and use of personal data already exists. We expect this trend to continue and that privacy legislation in various forms will be implemented in both the U.S. and abroad. We are supportive of legislation that codifies the current industry guidelines of notice and opt-out regarding whether a consumer’s personal information is shared with independent third parties for marketing purposes. We also support legislation requiring all custodians of sensitive information to deploy reasonable information security safeguards to protect that information.

8

Business Segments

Acxiom reports segment information consistent with the way we internally disaggregate our operations to assess performance and to allocate resources. In fiscal 2010 our business segments consisted of Information Services and Information Products. The Information Services segment includes the Company’s global lines of business for CDI, Multichannel Marketing Services, Infrastructure Management Services and Consulting Services. The Information Products segment is comprised of the Company’s global Consumer Insights and Risk Mitigation Products lines of business and the U.S. Background Screening Products line of business. We evaluate performance of the segments based on segment operating income, which excludes certain gains, losses and other items. Information concerning the financial results of our fiscal year 2010 business segments is included in note 18 of the Notes to Consolidated Financial Statements and in Management’s Discussion and Analysis of Financial Condition and Results of Operations, which are attached to this Annual Report as part of the Financial Supplement.

Information Services develops, sells and delivers industry-tailored solutions globally through integration of products, services and consulting. Those services include the design and creation of marketing databases and data warehouses; data integration and customer-recognition systems; marketing applications; list processing; and information technology services.

Information Products develops and sells all global data products, including segmentation products and domestic fraud and risk mitigation products as well as online advertising products. For decades, Acxiom has been a leader in creating and making advances in data and segmentation products. Today these include InfoBase-Xâ,, a customer-centric foundation for all marketing needs with the largest collection of U.S. consumer information available in one source; PersonicXâ, the industry-leading household segmentation and visualization system; and Acxiom Relevance-Xâ , an online advertising network that lets marketers reach the consumers most likely to be interested in their particular product or service.

Financial information about geographic areas in which we operate, including revenues generated in foreign countries and long-lived assets located in foreign countries, is set forth in note 16, “Foreign Operations” of the Notes to Consolidated Financial Statements, which is attached to this Annual Report as part of the Financial Supplement.

Seasonality and Inflation

Historically our traditional direct marketing operations experience their lowest revenue in the first quarter of each fiscal year. In order to minimize the impact of these fluctuations, we continue to seek long-term strategic partnerships with more predictable revenues. Revenue from clients who have long-term contracts with the Company (defined as two years or longer), as a percentage of consolidated revenue, was approximately 77% in fiscal 2010 compared to 75% in fiscal 2009 and 74% in fiscal 2008.

Although we cannot accurately determine the amounts attributable to inflation, we are affected by inflation through increased costs of compensation, and other operating expenses. If inflation were to increase over the low levels of recent years, the impact in the short run would be to cause an increase in costs, which we would attempt to pass on to clients, although there is no assurance we would be able to do so. Generally, the effects of inflation in recent years have been offset by technological advances, economies of scale and other operational efficiencies.

Clients

Our client base consists primarily of Fortune 1000 companies in the financial services, insurance, information services, direct marketing, media, retail, consumer packaged goods, technology, automotive, healthcare, travel and telecommunications industries.

Our 10 largest clients represented approximately 32% percent of our revenue in fiscal 2010. No single client accounted for more than 10 percent of the revenues of the Company as a whole or 10% of the revenues of any individual business segment during the last fiscal year. We seek to maintain long-term relationships with our clients. Many of our clients typically operate under contracts with initial terms of at least two years. We have historically experienced high retention rates among our clients.

9

Sales and Marketing

Our global sales and marketing organizations are focused on ensuring that clients and prospects understand that only Acxiom is equipped with the data assets, technology and intellectual capital required to implement fully integrated marketing and business solutions across multiple channels with readily measurable results.

Our centralized sales force is focused exclusively on new business development across all markets – primarily new clients and new lines of business with existing clients. Additionally, we have associates in account management roles in our market industry groups who are focused on revenue growth within existing accounts as well as leading implementations and service delivery.

Our global marketing organization has actively promoted our ability to integrate services across the interactive channels now in use globally. In keeping with external market dynamics, our marketing teams have been increasingly focused on merging online and offline channels for greater market impact.

Pricing

Given the diverse nature of the markets and industries it serves, we deploy a number of pricing techniques designed to yield acceptable margins and returns on invested capital. In its top-tier markets, a substantial portion of Acxiom’s revenue is generated from highly customized, outsourced solutions in which prices are dictated by the scope, complexity, nature of assets deployed and service levels required for the individual client engagements. For its mid-tier markets, Acxiom offers pre-packaged or standard solutions for which prices are driven by standard rates applied to the volumes and frequencies of client inputs and outputs. Our product offerings, such as consumer data or data hygiene, are priced under a transactional model and others are priced under a subscription or license model. Acxiom’s consulting and analytical services are typically priced per engagement, using a professional services model or on a fee per model basis.

Competition

We believe we are the U.S. leader in a competitive field of expertise. Within the industry, we compete against data content providers, database marketing service providers, analytical data application vendors, enterprise software providers, systems integrators, consulting firms, advertising agencies, list brokerage/list management firms, and teleservices companies. Many firms offer a limited number of services within a particular geographic area, and several are national or international companies that offer a broad array of information services. However, we do not know of any single competitor that offers our entire range of products and services and has the ability to integrate these services effectively for interactive marketing.

In the U.S. services arena, we compete primarily with in-house information technology departments of current and prospective clients, as well as firms that provide data warehousing and database services, mailing list processing and consulting services. Competition is based on the quality and reliability of products and services, industry and technological expertise, historical success, ability to develop customized solutions for clients, processing capabilities and price.

In the U.S. products sector, we compete with two types of firms: data providers and list providers. Competition is based on the quality and comprehensiveness of the information provided, the ability to deliver the information in products and formats that our clients need and, to a lesser extent, the pricing of information products and services.

In the IT management market, competition is based on technical expertise and innovation, financial stability, past experience with the provider, marketplace reputation, cultural fit, quality and reliability of services, project management capabilities, processing environments and price.

In Europe, we face similar competition as in the U.S. in terms of scope and type. While there is a broader range of competitors across Europe, particularly for customer data, the major competitors in both the services and the products markets are very similar to those in the U.S.

10

In Australia and New Zealand, our competitors in the services arena are predominantly well-established local businesses or companies’ in-house IT departments; however, some large global competitors have begun to offer their services in these countries. Our competitors in the products arena are generally local Australian and New Zealand companies, with the exception of one global business-to-business data provider.

In China, where we have had a presence since 2004, the competition is fragmented, with only a few local firms providing similar services. Well-known global providers, however, have recently been attracted by the potential of the Chinese market and appear to be investing heavily.

Maintaining technological competitiveness in our data products, processing functionality, software systems and services is key to our continued success. Our ability to continually improve our current processes and to develop and introduce new products and services is essential in order to maintain our competitive position and meet the increasingly sophisticated requirements of our clients. If we fail to do so, we could lose clients to current or future competitors, which could result in decreased revenues, net income and earnings per share.

Our industry has experienced a variety of business combinations that consolidate our competitors. The possibility of the consolidation or merger of companies who might combine forces to create a single-source provider of multiple services to the marketplace in which we compete could result in increased price competition for us which would negatively affect our business results. As noted above, we currently compete against numerous providers of a single service or product in several separate market spaces. Since we offer a larger variety of services than many of our current competitors, we have been able to successfully compete against them in most instances. However, the dynamics of the marketplace could be significantly altered if some of the single-service providers were to combine with each other to provide a wider variety of services.

The complexity and uncertainty regarding the development of new technologies affect our business greatly, as does the loss of market share through competition, or the extent and timing of market acceptance of innovative products and technology. We are also potentially affected by:

|

·

|

Longer sales cycles for our solutions due to the nature of that technology as an enterprise-wide solution;

|

|

·

|

The introduction of competent, competitive products or technologies by other companies;

|

|

·

|

Changes in the consumer and/or business information industries and markets, including the decline in the use of direct mail marketing and the ever-increasing use of alternative marketing channels such as online advertising, which could result in lower profit margins;

|

|

·

|

The ability to protect our proprietary information and technology or to obtain necessary licenses on commercially reasonable terms; and

|

|

·

|

The impact of changing legislative, judicial, accounting, regulatory, cultural and consumer environments in the geographies where our products and services are deployed.

|

Employees

Acxiom employs approximately 6,400 employees (associates) worldwide. No U.S. associates are represented by a labor union or are the subject of a collective bargaining agreement. To the best of management’s knowledge, approximately 20 associates are elected members of work councils representing Acxiom associates in the EU. Acxiom has never experienced a work stoppage and believes that its employee relations are good.

11

Executive Officers of the Registrant

Acxiom’s executive officers, their current positions, ages and business experience are listed below. They are elected by the board of directors annually or as necessary to fill vacancies or to fill new positions. There are no family relationships among any of the officers.

John A. Meyer, age 53, is the Company’s Chief Executive Officer and President. Mr. Meyer joined the Company in February 2008. From 2003 - 2008 he was employed by Alcatel-Lucent, a global communications network firm, as president of the Alcatel-Lucent Services Group, in which position he was responsible for more than $6 billion in annual revenue and the management of more than 20,000 people. The group he led designed, implemented and managed some of the most sophisticated communications networks in the world. Prior to joining Lucent, Mr. Meyer was employed for nearly 20 years at Electronic Data Systems Corporation (EDS), where he held a number of positions including head of the Northeast business in the United States and president of the Europe, Middle East and Africa region. He served in the U.S. Air Force from 1979 to 1983 as a flight commander, achieving the rank of captain. Mr. Meyer serves as chairman of the advisory board of the College of Information Sciences and Technology at Pennsylvania State University and serves on the governing board of the Direct Marketing Association. He is also a member of the board of directors of the Arkansas Arts Center and the Arkansas Symphony Orchestra. He holds an MBA with honors in quantitative methods from the University of Missouri and a bachelor’s degree in management from Pennsylvania State University.

John A. Adams, age 55, is the Company’s Chief Operating Officer and Executive Vice President and is responsible for directing the operational areas of the business which include the market facing industry units, Europe and Asia Pacific, service development and delivery, and information technology. He joined Acxiom May 2008. Previously Mr. Adams was executive vice president of customer solutions for Eclipsys, a healthcare information software and services vendor. In that capacity, he was responsible for the company’s outsourcing and hosting units as well as a number of administrative functions. From 2003 – 2004, he served as chief financial officer for Exult, Inc., a human resources business process outsourcing company that was subsequently sold to Hewitt Associates during Mr. Adams’ tenure. From 2000 – 2003 Mr. Adams served as chief financial officer and vice president of AT&T Business Services, a subsidiary of AT&T Corporation. In this role, he led a successful restructuring of the subsidiary’s operations. Prior to that, Mr. Adams was employed by EDS for 15 years, serving most recently as vice president and controller, in which capacity he oversaw the accounting and finance functions for EDS worldwide. Mr. Adams, a British citizen, is a member of the Institute of Chartered Accountants in England and Wales. He holds a bachelor’s degree with honors in economics from the University of Exeter, England.

Christopher W. Wolf, age 48, is the Company’s Chief Financial Officer and Executive Vice President. He joined Acxiom in 2007 and is responsible for all aspects of Acxiom’s financial management. He has over 20 years experience as a financial executive and consultant to companies in the marketing, retail and technology sectors. He most recently served as an independent consultant, providing consultation on financial reporting, Sarbanes-Oxley compliance, corporate governance, capital structure, mergers and acquisitions, and tax planning to a variety of public and private entities. From 2005 - 2006, Mr. Wolf served as CFO of NiuTech LLC, an internet marketing services company, where he was responsible for the accounting, financial planning and analysis, treasury, and risk management activities of the company. From 1996 - 2004, Mr. Wolf was employed in various finance and tax positions with Catalina Marketing Corporation, culminating in his service as chief financial officer from 2002 - 2004. He also served as executive vice president from 2003 - 2004; senior vice president from 2002 - 2003; vice president –finance and treasurer from 2000 - 2002; executive director of tax, treasury and international finance from 1998 - 2000; senior director of tax and international finance from 1997 - 1998; and senior director of tax from 1996 - 1997. Prior to joining Catalina, Mr. Wolf served for 10 years as a tax manager and consultant for Arthur Andersen & Co. He is a certified public accountant and holds a master’s degree in accounting from the University of North Carolina and a bachelor’s degree in the same field from Florida State University.

Jerry C. Jones, age 54, is the Company’s Chief Legal Officer, Senior Vice President and Assistant Secretary. He joined Acxiom in 1999 and is responsible for leading the strategy and execution of mergers and alliances, assists in the Company’s strategic initiatives, and oversees legal matters. Prior to joining Acxiom, he was employed for 19 years as an attorney with the Rose Law Firm in Little Rock, Arkansas, representing a broad range of business interests. He was a member of the board of directors of Entrust, Inc. until it was purchased by private investors in 2009, and he is chairman of the board of the Arkansas Virtual Academy, a statewide online public school. Mr. Jones holds a juris doctorate degree and a bachelor’s degree in public administration from the University of Arkansas.

12

Shawn M. Donovan, age 47, is the Company's Senior Vice President Global Sales. He joined Acxiom in 2008 and is responsible for sales and sales support operations. In this role, he leads the teams directly responsible for developing new business and supporting the growth of existing accounts through consultative, value-based selling. Prior to joining Acxiom, he was employed by EDS where he most recently was vice president of Banking & Capital Markets for the financial services industry. In his 20 years at EDS, Mr. Donovan served in numerous sales and sales leadership roles and was often enlisted to create or reinvigorate large sales organizations responsible for billions of dollars in revenue. He holds a bachelor’s degree in public administration from George Mason University.

Cindy K. Childers, age 50, is the Company's Senior Vice President – Human Resources. She joined Acxiom in 1985. In her current role, Ms. Childers leads strategic planning and execution in the areas of human resources, business culture, organizational effectiveness, associate development, recruiting and talent management. Previously, she served as leader of the financial services business unit and oversaw all of the financial and accounting functions of the Company. Before joining Acxiom, she was a certified public accountant in audit and tax for KPMG Peat Marwick. Ms. Childers holds a bachelor’s degree in business administration from the University of Central Arkansas.

Michael N. Darviche, age 49, is the Company’s Chief Marketing Officer and Senior Vice President. He joined Acxiom in February 2009 and is responsible for the Company’s global product marketing, marketing communications, sales support, strategy and business development activities. In 2006 he founded and served as CEO of Flash Capital Systems, a data and technology customer-monitoring services company. He was a senior vice president for Citi 360, a data business division of Citigroup, where he led strategy, sales and marketing from 2004 - 2005. From 2001 – 2003 Mr. Darviche was the managing director at Marsh, Inc., a global insurance/brokerage firm, where he was responsible for global e-business and digital products and platforms. Prior to that, Mr. Darviche was a co-founder and general manager of Bigfoot Interactive, one of the world’s first e-marketing service providers, after beginning his career as a direct marketer at American Express. He serves on the board of the Greenburgh Nature Center, an environmental education center in New York. He also serves in an advisory capacity to The LEAGUE, an internet-based education curriculum business in New Jersey. Mr. Darviche holds a master’s degree in business administration from Harvard Business School and a bachelor’s degree in economics from Tufts University.

Item 1A. Risk Factors

The risks described below could materially and adversely affect our business, financial condition and results of future operations. These risks are not the only ones we face. Our business operations could also be impaired by additional risks and uncertainties that are not presently known to us or that we currently consider immaterial.

Failure to keep up with rapidly changing technologies and marketing practices could cause our products and services to become less competitive.

The complexity and uncertainty regarding the development of new technologies affect our business greatly, as does the loss of market share through competition, and the extent and timing of market acceptance of innovative products and technology. We are also potentially affected by:

|

·

|

Longer sales cycles for our solutions due to the nature of that technology as an enterprise-wide solution;

|

|

·

|

The introduction of competent, competitive products or technologies by other companies;

|

|

·

|

Changes in the consumer and/or business information industries and markets, including the decline in the use of direct mail marketing and the ever-increasing use of alternative marketing channels such as online advertising, which could result in lower profit margins for the Company;

|

13

|

·

|

The ability to protect our proprietary information and technology or to obtain necessary licenses on commercially reasonable terms; and

|

|

·

|

The impact of changing legislative, judicial, accounting, regulatory, cultural and consumer environments in the geographies where our products and services are deployed.

|

Maintaining technological competitiveness in our data products, processing functionality, software systems and services is key to our continued success. Our ability to continually improve our current processes and to develop and introduce new products and services is essential in order to maintain our competitive position and meet the increasingly sophisticated requirements of our clients. If we fail to do so, we could lose clients to current or future competitors, which could result in decreased revenues, net income and earnings per share.

Changes in legislative, judicial, regulatory, cultural or consumer environments relating to consumer privacy or information collection and use may affect our ability to collect and use data.

There could be a material adverse impact on our business due to the enactment of legislation or industry regulations, the issuance of judicial interpretations, or simply a change in customs, arising from the increasing public concern over consumer privacy issues. In the U.S., both the Congress and the legislatures of various states have recently focused their attention on matters concerning the collection and use of consumer data. In most of the non-U.S. locations in which we do business, legislation restricting the collection and use of personal data already exists. Many times restrictions are placed on the use of data upon the occurrence of unanticipated events that rapidly drive the adoption of legislation or regulation. Restrictions could be placed upon the collection, management, aggregation and use of information, which could result in a material increase in the cost of collecting some kinds of data. In the U.S. the general data collection regime is that non-sensitive data is usable so long as the person does not affirmatively “opt-out” of the collection. In Europe the reverse is true. If the European model were adopted in the U.S. it would lead to less data being available and at a higher cost. It is also possible that we could be prohibited from collecting or disseminating certain types of data, which could in turn materially adversely affect our ability to meet our clients’ requirements, potentially resulting in decreased revenues, net income, and earnings per share.

We could experience a breach of the confidentiality of the information we hold or of the security of our computer systems.

We operate extremely complex computer systems that contain personally identifiable data. Unauthorized third parties could attempt to gain entry to such systems for the purpose of stealing data or disrupting the systems. We believe that we have taken adequate measures to protect them from intrusion, but in the event that our efforts are unsuccessful we could suffer significant harm. Further, we handle large quantities of personally identifiable information that must be maintained on a confidential basis. In the event the confidentiality of such information was compromised, we could suffer significant harm.

Data suppliers might withdraw data from us, leading to our inability to provide products and services to our clients which could lead to decreases in our operating results.

Much of the data that we use is either purchased or licensed from third parties. We compile the remainder of the data that we use from public record sources. We could suffer a material adverse effect if owners of the data we use were to withdraw the data from us. Data providers could withdraw their data from us if there is a competitive reason to do so, or if legislation is passed restricting the use of the data, or if judicial interpretations are issued restricting use of data. If a substantial number of data providers were to withdraw their data, our ability to provide products and services to our clients could be materially adversely impacted, which could result in decreased revenues, net income and earnings per share.

The nature and volume of our customer contracts may affect the predictability of our revenues.

While approximately 77% of our total revenue is currently derived from clients who have long-term contracts (defined as contracts with initial terms of two years or more), these contracts have been entered into at various times and therefore some of them are in the latter part of their terms and are approaching their originally scheduled expiration dates. If renewed by the customer, the terms of the renewal contract may not have a term as long as, or may otherwise be on terms less favorable than, the original contract. Revenue from customers with long-term contracts is not necessarily “fixed” or guaranteed as portions of the revenue from these customers is volume-driven or project-related. With respect to the portion of our business that is not under long-term contract, revenues are less predictable and are almost completely volume-driven or project-related. Therefore, we must engage in continual sales efforts to maintain revenue stability and future growth with these customers. In addition, if a significant customer fails to renew a contract, our business could be negatively impacted if additional business is not obtained to replace the business which was lost.

14

Our operations outside the U.S. subject us to risks normally associated with international operations.

During the last fiscal year, we received approximately 14% of our revenues from business outside the United States. As part of our growth strategy, we plan to continue to pursue opportunities outside the U.S. and in order to do this we must continue to strengthen our foreign operations, hire additional personnel, and continue to identify and execute beneficial strategic alliances. To the extent that we are unable to do these things in a timely manner, our growth, if any, in non-U.S. revenues will be limited and our operating results could be materially adversely affected. In general, each of our foreign locations is expected to fund its own operations and cash flows, although periodically funds may be loaned or invested from the U.S. to the foreign subsidiaries. Therefore, exchange rate movements of foreign currencies may have an impact on our future costs or on future cash flows from foreign investments. We have not entered into any foreign currency forward exchange contracts or other derivative instruments to hedge the effects of adverse fluctuations in foreign currency exchange rates. Additional risks inherent in our non-U.S. business activities generally include, among others, potentially longer accounts receivable payment cycles, the costs and difficulties of managing international operations, potentially adverse tax consequences, and greater difficulty enforcing intellectual property rights. The various risks which are inherent in doing business in the United States are also generally applicable to doing business outside of the United States and may be exaggerated by the difficulty of doing business in numerous sovereign jurisdictions due to differences in culture, laws and regulations.

Loss of data center capacity or interruption of telecommunication links could adversely affect our business.

Our business is heavily dependent upon highly complex data processing capability. Our ability to protect our data centers against damage or interruption from fire, power loss, telecommunications failure or other disasters is critical to our future. The online services we provide are dependent on links to telecommunication providers. We believe we have taken reasonable precautions to protect our data centers and telecommunication links from events that could interrupt our operations. Any damage to our data centers or any failure of our telecommunications links that causes interruptions in our operations could materially adversely affect our ability to meet our clients' requirements, which could result in decreased revenues, net income, and earnings per share.

Failure to favorably negotiate or effectively integrate acquisitions or alliances could adversely affect our business.

As part of our growth strategy we may continue to acquire other complementary businesses, products and technologies or enter into joint ventures or similar strategic relationships. While we believe we will be able to successfully integrate recently acquired businesses into our existing operations, there is no certainty that future acquisitions or alliances will be consummated on acceptable terms or that we will be able to integrate successfully the services, content, products and personnel of any such transaction into our operations. In addition, any future acquisitions, joint ventures or similar relationships may cause a disruption in our ongoing business and distract our management. There is also no assurance that we would derive the revenue improvements, cost savings and other intended benefits of any such transaction. The occurrence of any of these events could result in decreased revenues, net income and earnings per share.

Our traditional direct marketing business could be negatively affected by rising postal costs, the green movement and the shift to alternative marketing channels, including online communications.

Postal rate increases are now expected to occur every year. The most recent increase in the U.S. became effective in May 2009. Although the USPS has indicated that no rate increase will occur in 2010, rates are anticipated to rise annually at approximately the rate of inflation. As they rise, we expect to see increased pressure on direct mailers to leverage digital and other forms of online communication and to mail fewer pieces.

15

Those in the traditional direct mail business, as well as the postal service, are under growing pressure to reduce their impact on the environment. It is uncertain at this time what either marketers or the postal service will do to lessen their impact. From a postal service perspective, the actions to be taken may involve changing certain aspects of mail service that would negatively affect direct marketers. From a marketer’s perspective, such actions could have the same effect as increased rates, thereby causing them to mail fewer pieces.

We are actively investing in multichannel marketing services in addition to maintaining our ability to continue servicing traditional direct mail customers and expect to offset some of the declining revenues associated with regular mail. This dual focus could, however, result in the loss of business with some direct mailers, thereby negatively affecting us by decreasing the amount of processing services our clients purchase from us, which could result in lower revenues, net income and earnings per share.

Industry consolidations could result in increased competition for our products and services.

Our industry has experienced a variety of business combinations that have consolidated our competitors. The possibility of the consolidation or merger of companies who might combine forces to create a single-source provider of multiple services to the marketplace in which we compete could result in increased price competition for us which would negatively affect our business results. We currently compete against numerous providers of a single service or product in several separate market spaces. (See the discussion above under “Competition.”) Since we offer a larger variety of services than many of our current competitors, we have been able to successfully compete against them in most instances. However, the dynamics of the marketplace could be significantly altered if some of the single-service providers were to combine with each other to provide a wider variety of services.

Processing errors or delays in completing service level requirements for our clients could result in negative financial consequences.

Processing errors could result in the issuance of credits to clients, the re-performance of work, and/or the payment of damages. Likewise, the failure to meet contractual service level requirements or to meet specified goals with contractual timeframes could result in monetary penalties or lost revenue.

Our engagements with certain clients, particularly those with long-term, fixed-priced agreements, may not be profitable.

The pricing and other terms of our client contracts, particularly our long-term IT outsourcing agreements, require us to make estimates and assumptions at the time we enter into these contracts that could differ from actual results. These estimates reflect our best judgments regarding the nature of the engagement and our expected costs to provide the contracted services. Any increased or unexpected costs or unanticipated delays in connection with the performance of these engagements, including delays caused by factors outside our control, could make these contracts less profitable or unprofitable, which would have an adverse affect on our profit margin. Our exposure to this risk increases generally in proportion to the scope of the client contract and is higher in the early stages of such a contract. In addition, a majority of our IT outsourcing contracts contain some fixed-price, incentive-based or other pricing terms that condition our fee on our ability to meet defined goals. Our failure to meet a client's expectations in any type of contract may result in an unprofitable engagement which could adversely affect our operating results.

Our ability to recover significant up-front capital investments required by certain client contracts is subject to risks.

A few of our client contracts require significant investment in the early stages which is expected to be recovered through billings over the life of the contract. These contracts often involve the construction of new computer systems and communications networks and the development and deployment of new technologies. Substantial performance risk exists in each contract with these characteristics, and some or all elements of service delivery under these contracts are dependent upon successful completion of the development, construction and deployment phases. Failure to recover such capital investments could materially adversely affect our operating results.

16

Failure to attract and retain qualified employees could adversely affect our business.

Competition for qualified technical, sales and other personnel is often intense, and we periodically are required to pay premium wages to attract and retain good employees. There can be no assurance that we will be able to continue to hire and retain sufficient qualified management, technical, sales and other employees necessary to conduct our operations successfully.

Deterioration of economic conditions could negatively impact our business.

Our business may be adversely affected by changes in national or global economic conditions, including inflation, interest rates, availability of capital markets, consumer spending rates, and the effects of governmental initiatives to manage economic conditions. Any such changes could adversely affect our customers’ desire and ability to engage our services, thereby negatively affecting our financial results.

The recent disruptions in credit and other financial markets and deterioration of national and global economic conditions, could, among other things:

|

·

|

make it more difficult or costly for us to obtain financing for our operations or investments or to refinance our debt in the future;

|

|

·

|

cause our lenders to depart from prior credit industry practice and make more difficult or expensive the granting of any technical or other waivers under our credit agreements to the extent we may seek them in the future;

|

|

·

|

impair the financial condition of some of our customers and suppliers, thereby increasing customer bad debts;

|

|

·

|

decrease the value of our investments in equity and debt securities;

|

|

·

|

impair the financial viability of our insurers.

|

Item 1B. Unresolved Staff Comments

Not applicable.

[THIS SPACE LEFT BLANK INTENTIONALLY]

17

Item 2. Properties

Acxiom is headquartered in Little Rock, Arkansas with additional locations around the United States. We also have operations in Europe, Asia-Pacific and the Middle East. In general, our facilities are in good condition, and we believe that they are adequate to meet our current needs. We do not anticipate that any substantial additional properties will be required for our existing business during fiscal year 2011. The table below sets forth the location, ownership and general use of our principal properties currently being used by each business segment.

|

Location

|

Held

|

Use

|

Business Segment

|

|

United States:

|

|||

|

Conway, Arkansas

|

Eleven facilities held in fee

|

Data center; office space

|

Information Services and Information Products

|

|

Fayetteville, Arkansas

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Little Rock, Arkansas

|

Two buildings held in fee

|

Principal executive offices; office space; data center

|

Information Services and Information Products

|

|

Foster City, California

|

Lease

|

Office space

|

Information Services

|

|

Broomfield, Colorado

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Cape Coral, Florida

|

Lease

|

Office space

|

Information Products

|

|

Chicago, Illinois

|

Lease

|

Data center; office space

|

Information Services

|

|

Downers Grove, Illinois

|

Lease

|

Data center; office space

|

Information Services

|

|

Elk Grove Village, Illinois

|

Lease

|

Data center

|

Information Services

|

|

Shoreview, Minnesota

|

Lease

|

Office space

|

Information Services

|

|

New York, New York

|

Two leased offices

|

Office space

|

Information Services and Information Products

|

|

Fairlawn, Ohio

|

Lease

|

Office space

|

Information Products

|

|

Independence, Ohio

|

Lease

|

Office space

|

Information Products

|

|

Memphis, Tennessee

|

Lease

|

Office space

|

Information Services

|

|

Nashville, Tennessee

|

Lease

|

Office space

|

Information Services

|

18

|

Europe:

|

|||

|

London, England

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Normanton, England

|

Lease

|

Data center; office space

|

Information Services and Information Products

|

|

Sunderland, England

|

Lease

|

Data center; fulfillment service center; office space; warehouse space

|

Information Services and Information Products

|

|

Teddington, England

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Paris, France

|

Lease

|

Data center; office space

|

Information Services and Information Products

|

|

Frankfurt, Germany

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Munich, Germany

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Amsterdam, Netherlands

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Gdansk, Poland

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Warsaw, Poland

|

Lease

|

Office space

|

Information Services and Information Products

|

|

Australia:

|

|||

|

Sydney, Australia

|

Lease

|

Office space

|

Information Services

|

|

China:

|

|||

|

Shanghai, China

|

Lease

|

Office space

|

Information Services

|

|

Nantong, China

|

Lease

|

Data center; office space

|

Information Services

|

|

Saudi Arabia:

|

|||

|

Jeddah, Saudi Arabia

|

Lease

|

Office space

|

Information Services and

Information Products

|

19

Item 3. Legal Proceedings

The Company is involved in various claims and litigation matters that arise in the ordinary course of the business. None of these, however, are believed to be material in their nature or scope, except those incorporated by reference under this Part I, Item 3.

Please refer to the discussion of certain legal proceedings pending against the Company in the Financial Supplement to this Annual Report on Form 10-K, Notes to Consolidated Financial Statements, Note 11 Commitments and Contingencies, Legal Matters, which discussion is incorporated herein by reference.

Item 4. Reserved

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

The outstanding shares of Acxiom’s common stock are listed and traded on NASDAQ and trade under the symbol ACXM. The following table reflects the range of high and low sales prices of Acxiom’s common stock as reported by Dow Jones & Company, Inc. for each quarter in fiscal 2010 and 2009.

|

Fiscal 2010

|

High

|

Low

|

Dividend Declared

|

||

|

Fourth Quarter

|

$ 18.74

|

$ 13.50

|

-

|

||

|

Third Quarter

|

14.41

|

9.07

|

-

|

||

|

Second Quarter

|

10.20

|

7.76

|

-

|

||

|

First Quarter

|

12.59

|

7.25

|

-

|

||

|

Fiscal 2009

|

High

|

Low

|

Dividend Declared

|

||

|

Fourth Quarter

|

$ 10.76

|

$ 7.06

|

-

|

||

|

Third Quarter

|

12.93

|

6.35

|

-

|

||

|

Second Quarter

|

15.11

|

10.91

|

$.06

|

||

|

First Quarter

|

15.10

|

10.46

|

$.06

|

Holders

As of May 24, 2010 the approximate number of record holders of the Company’s common stock was 2,100.

Dividends

In November 2008, the board of directors suspended dividend payments on the Company’s common stock. Prior to that, dividends of $.06 per share were paid in the first two quarters of fiscal year 2009. The board may reconsider reinstituting dividend payments in the future but has no plans to reinstate them in the short term.

20

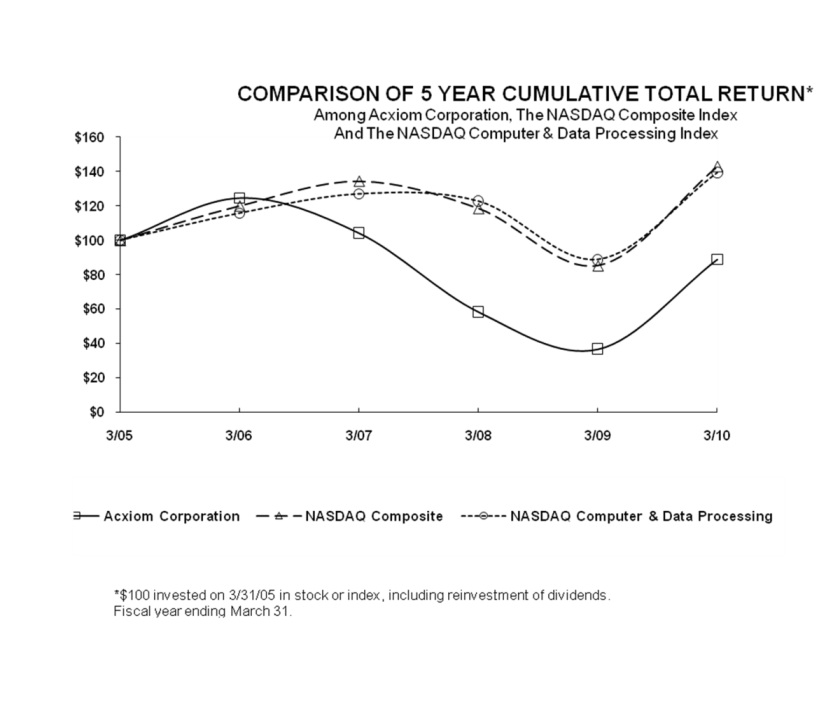

Performance Graph

The following graph compares the cumulative five-year total return to shareholders on Acxiom's common stock relative to the cumulative total returns of the NASDAQ Composite index and the NASDAQ Computer & Data Processing index. The graph assumes that the value of the investment in the company's common stock and in each of the indexes (including reinvestment of dividends) was $100 on March 31, 2005, and tracks it through March 31, 2010.

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

21

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

Not applicable.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table contains information about our common stock which may be issued upon the exercise of options under our existing equity compensation plans as of the end of fiscal 2010 (March 31, 2010):

|

Plan category

|

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

|

Number of securities

available for future issuance

under equity compensation

plans (excluding securities

reflected in column (a))

|

||

|

(a)

|

(b)

|

(c)

|

|||

|

Equity compensation plans approved by stockholders

|

10,103,5321

|

$20.57

|

4,654,740

|

||

|

Equity compensation plans not approved by stockholders

|

265,0002

|

11.19

|

54,884

|

||

|

10,368,532

|

$20.33

|

4,709,624

|

|||

|

1

|

This figure represents stock options issued under approved stock option plans, 112,997 of which options were assumed in connection with our acquisitions of May & Speh, Inc. in 1998 and Digital Impact, Inc. in 2006.

|

||||

|

2

|