Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Yellow Corp | d8k.htm |

| EX-99.1 - NEWS RELEASE DATED MAY 24, 2010 - Yellow Corp | dex991.htm |

Investor

Presentation Investor Presentation

May 2010

Exhibit 99.2 |

2

Discussion Topics

Discussion Topics

•

New Directors and Annual Shareholder Meeting

•

Multi-Employer Pension Reform

•

Operating Improvement

•

Cost Reductions

•

Capital Structure

•

2010 Expectations |

3

New Directors / Annual Shareholder Meeting

New Directors / Annual Shareholder Meeting

Effective May 11, 2010, the Board of Directors elected Marnie S.

Gordon, Beverly K. Goulet, Mark E. Holliday, John A. Lamar,

Eugene I. Davis, Dennis E. Foster and William L. Trubeck to fill

the

vacancies left by the resigning directors

Teresa Ghilarducci has been nominated by the International

Brotherhood of Teamsters per the July 2009 amendment to our labor

agreement

Annual Shareholder meeting June 29, 2010 |

4

Multi-Employer Pension Reform

Multi-Employer Pension Reform

•

Temporary relief in the form of amortization extension is expected

to pass soon

•

The joint labor management coalition has conducted hundreds of

Capitol Hill visits

•

Congress hears our message, and the issue has bipartisan

support

•

Senate HELP Committee hearing set for May 27 on multi-employer

pension plans |

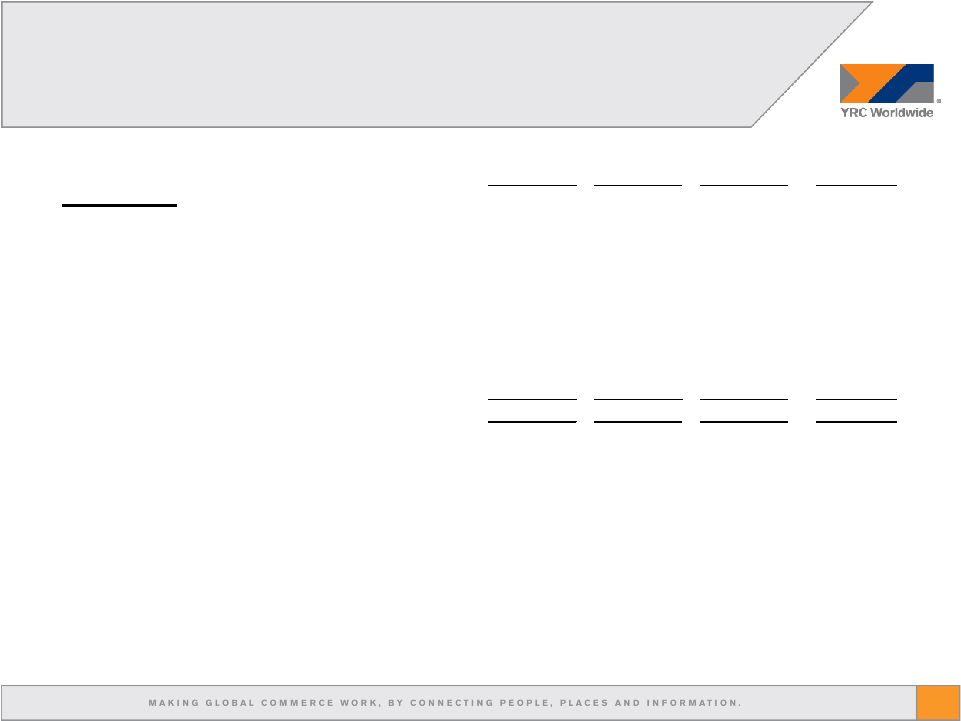

2010

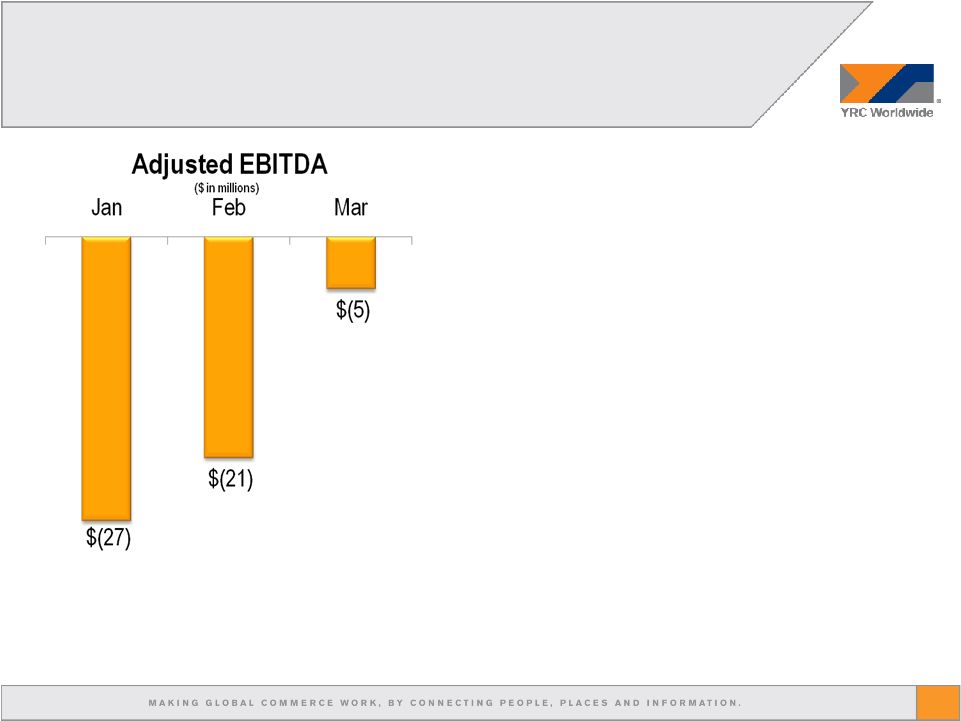

Consolidated Operating Trends 2010 Consolidated Operating Trends

5

Adjusted EBITDA is a non-GAAP measure that reflects the company’s earnings

before interest, taxes, depreciation, and amortization expense, and further

adjusted for letter of credit fees and other items as defined in the company’s Credit Agreement. Adjusted EBITDA is used for internal

management purposes as a financial measure that reflects the company’s core

operating performance and is used by management to measure compliance with

financial covenants in the company’s Credit Agreement. This financial measure should not be construed as a better measurement than

operating income as defined by generally accepted accounting principles. See Pages

13 and 14 for a reconciliation of consolidated and segment GAAP

measures to non-GAAP financial measures.

•

Sequential improvement continues into April

•

April at adjusted EBITDA break even

•

Expect YRCW adjusted EBITDA positive in

2Q10

•

Expect Regional segment to be operating

income positive in 2Q10

•

Volume growth, revenue mix management

and cost actions |

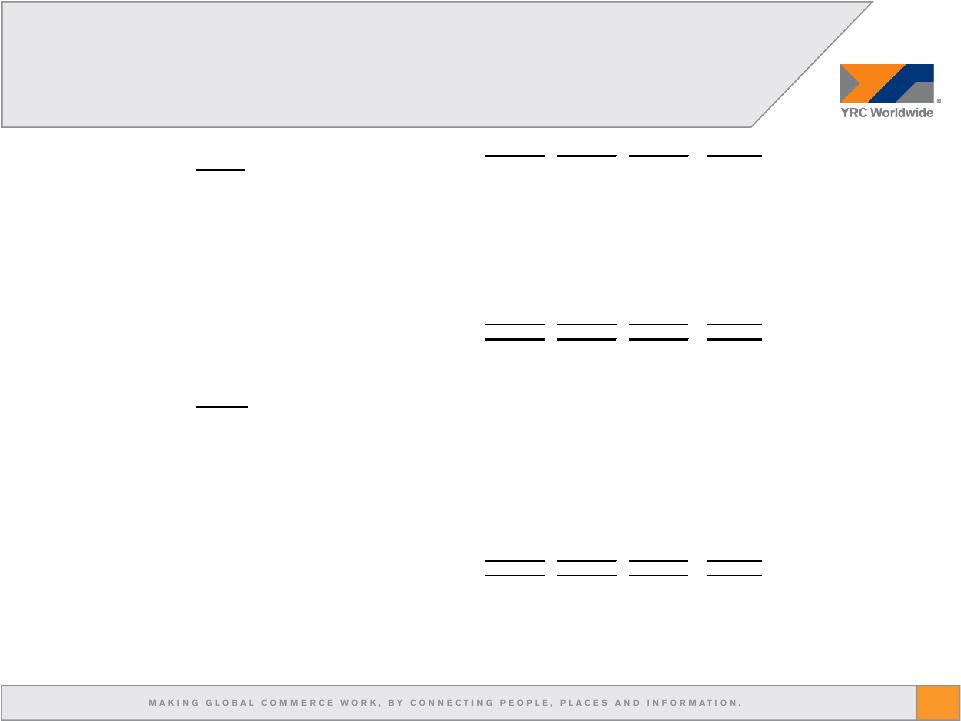

6

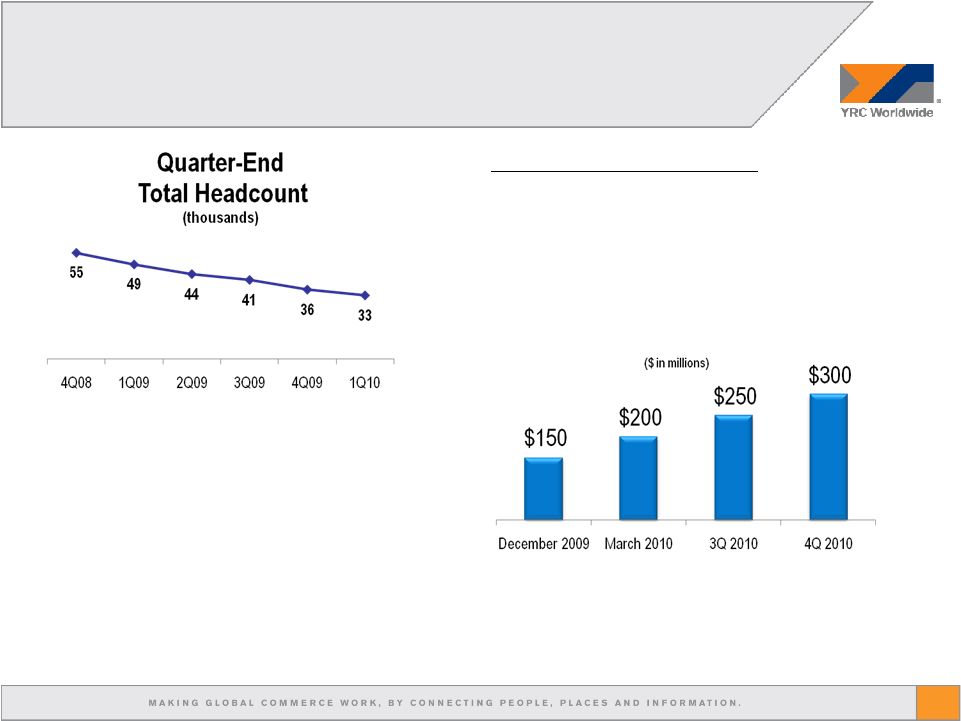

Total Headcount Scaling / 2010 Cost Out

Total Headcount Scaling / 2010 Cost Out

Note: Above 2010 cost out program is incremental to 3Q09 results; 4Q09 and

1Q10 as reported benefit was $15 million and $40 million respectively; $300

million run rate cost outs exclude benefits from network changes; 4Q09 network

consolidations expected to produce $20 million annual run rate benefit in

2010. 2010 Cost Out –

Run Rate

•

SG&A reductions

•

Operational process improvements

•

Safety improvements

•

Successfully scaling headcounts

•

Streamlined organization

•

Process improvements |

7

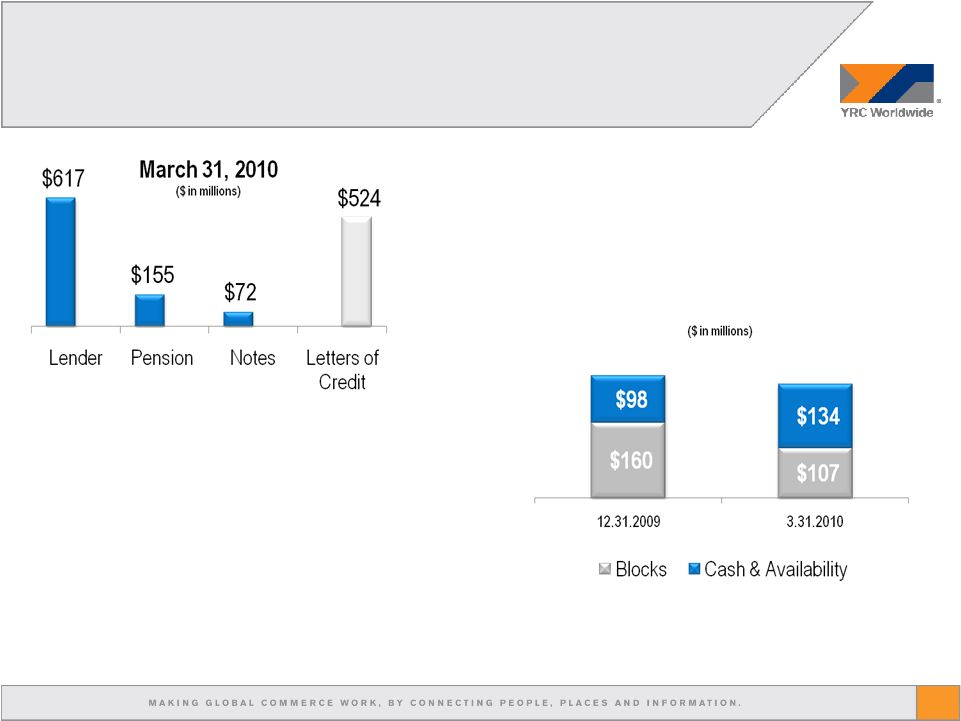

Debt / Liquidity

Debt / Liquidity

•

Debt is primarily lender borrowings and

letters of credit obligations

•

Credit agreement matures August 2012

•

364-day asset-backed securitization facility

matures October 2010

•

New block requires two-thirds lender vote

•

Liquidity required to fund working capital to

support sequential revenue growth

Note: Cash maturities of $844 million at March 31, 2010 consist of $72M notes (new

6% notes of $50M and remaining 5% and 3.375% notes of $22M); $155M pension

debt; and $617M lender debt ($388M revolver/ $111M term Loan/ $118M ABS). Non-cash maturity obligation related to sale/leaseback debt (per

GAAP balance sheet) of $320M is satisfied by transfer of title to underlying real estate

at the inception of the initial sale and leaseback transaction. |

8

Authorized

Outstanding

@ 3.31.2010

(1)

$70M

6% Notes

$.43/share

(2)

Options /RSU’s

@ 12.31.2009

(3)

Teamster

Options

$.48/share

(4)

Remaining

@ 3.31.2010

(5)

Common Shares

2 billion

1.054 billion

202 million

18 million

264 million

462 million

Range of shareholder-approved post-split number of shares:

@ 1:25

80 million

42 million

8 million

1 million

11 million

18 million

@ 1:5

400 million

211 million

40 million

4 million

53 million

92 million

Common Shares and Post-Split Range

•

Shareholder-approved reverse stock split range of ratios is 1:25 to 1:5

•

Timing and ratio at discretion of the YRCW Board

(1) Per 10K / A (all of the YRCW convertible class A preferred stock has converted to

common stock) (2) Pro forma amounts, assuming all notes are issued and

converted; conversion rate $.43 per share for par value plus interest and make whole paid in shares

(3) Per 2009 10K; includes existing Teamster and non-union options from 2009

(4) Per 8K March 2010; new Teamster equity-based awards issued as stock appreciation

rights, pending shareholder approval of options ; strike price $.48 per share

(5) Per 2009 note exchange offer the 5% management equity award program is approximately

67 million shares and is subject to shareholder approval; net remaining shares approximately 400 million.

At-the-market program announced on May 4, 2010 for up to $103 million of

shares of common stock. |

2010

Expectations 2010 Expectations

•

YRCW positive adjusted EBITDA in 2Q

•

Regional Transportation segment operating income positive in 2Q

•

Gross capital expenditures of approximately $50 million

•

Real estate sales in the range of $25 to $50 million

•

Sale and financing leasebacks of up to $50 million, primarily in

the

second half of the year

•

Interest expense in the range of $40 to $45 million per quarter,

with cash interest of $10 million to $12 million per quarter

•

Effective income tax rate of 2%

9 |

10

Forward-Looking Statements

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange

Act

of

1934,

as

amended.

The

words

“believe,”

“expect,”

“continue,”

and

similar

expressions

are

intended

to

identify

forward-looking

statements.

It

is

important to note that the company’s actual future results could differ materially

from those projected in such forward-looking statements because of a number of

factors, including (among others) our ability to generate sufficient cash flows and

liquidity to fund operations, which raises substantial doubt about our ability to

continue

as

a

going

concern,

inflation,

inclement

weather,

price

and

availability

of

fuel,

sudden

changes

in

the

cost

of

fuel

or

the

index

upon

which

the

company

bases

its fuel surcharge, competitor pricing activity, expense volatility, including (without

limitation) expense volatility due to changes in rail service or pricing for rail

service, ability to capture cost reductions, changes in equity and debt markets, a

downturn in general or regional economic activity, effects of a terrorist attack, labor

relations, including (without limitation) the impact of work rules, work stoppages,

strikes or other disruptions, any obligations to multi-employer health, welfare and

pension plans, wage requirements and employee satisfaction, and the risk factors that are

from time to time included in the company’s reports filed with the SEC. The

company’s expectations regarding the impact of, and the service and operational improvements and collateral and cost reductions due to, the integration of

Yellow

Transportation and Roadway, improved safety performance, right-sizing the network,

consolidation of support functions, the company’s credit ratings and the

timing of achieving the improvements and cost reductions could differ materially from

actual improvements and cost reductions based on a number of factors,

including

(among

others)

the

factors

identified

in

the

preceding

and

following

paragraphs,

the

ability

to

identify

and

implement

cost

reductions

in

the

time

frame

needed

to achieve these expectations, the success of the company’s operating plans and

programs, the company’s ability to successfully reduce collateral

requirements for its insurance programs, which in turn is dependent upon the

company’s safety performance, ability to reduce the cost of claims through claims

management,

the

company’s

credit

ratings

and

the

requirements

of

state

workers’

compensation

agencies

and

insurers

for

collateral

for

self-insured

portions

of

workers’

compensation programs, the need to spend additional capital to implement cost reduction

opportunities, including (without limitation) to terminate, amend or renegotiate

prior contractual commitments, the accuracy of the company’s estimates of its spending requirements, changes in the company’s strategic direction, the

need to replace any unanticipated losses in capital assets, approval of the affected

unionized employees of changes needed to complete the integration under the

company’s union agreements, the readiness of employees to utilize new combined

processes, the effectiveness of deploying existing technology necessary to

facilitate

the

combination

of

processes,

the

ability

of

the

company

to

receive

expected

price

for

its

services

from

the

combined

network

and

customer

acceptance

of

those services.

The

company’s

expectations

regarding

its

ability

to

satisfy

Nasdaq

listing

requirements

for

minimum

bid

price

of

the

company’s

common

stock

are

only

its

expectations

regarding

this

matter.

The

closing

bid

price

of

the

company’s

common

stock

depends

on

many

factors,

including

without

limitation,

actual

or

expected

fluctuations in the company’s operating results, changes in general economic

condition or conditions in the company’s industry generally, changes in conditions in

the

financial

markets,

the

effect

of

any

issuance

of

additional

shares

of

the

company’s

common

stock

and

whether

the

company’s

board

of

directors

effects

a

reverse

stock

split

and

the

timing

of,

and

the

reverse

stock

split

ratio

for,

any

reverse

stock

split

approved

by

the

board. |

11

Forward-Looking Statements

Forward-Looking Statements

The

company’s

expectations

regarding

its

ability

to

close

on

the

remaining

$20.2

million

of

6%

notes

are

only

its

expectations

regarding

this

matter.

The

closing

of

the

second $20.2 million of the 6% notes is subject to a number of conditions, including

(among others), a determination of the outcome of the company’s litigation with

respect to its outstanding 5% and 3.375% contingent convertible notes.

The

company’s

expectations

regarding

its

ability

to

raise

new

capital

in

the

equity

markets,

including

through

at-the-market

transactions,

are

only

its

expectations

regarding this matter.

Whether the company is able to raise new capital is dependent upon a number of factors

including (among others) the trading price and volume of the company’s common

stock and the company reaching agreement with interested investors and closing such transactions on negotiated terms and conditions,

including (without limitation) any closing conditions that investors may require.

The company’s expectations regarding shareholder approval of the Second Union

Employee Option Plan and an increase in the shares available for issuance from the

company’s

2004

Long-Term

Incentive

and

Equity

Award

Plan

are

only

its

expectations

regarding

this

matter.

To

be

approved

by

the

Company’s

shareholders,

the

plans must be approved by a majority of the votes cast, in person or by proxy, at a

shareholder meeting. If shareholders approve the option plan, the stock

appreciation rights granted to union employees in March 2010 will terminate. If

shareholders do not approve the option plan by February 28, 2011, the stock options

will terminate and the market price per share in excess of the $0.48 strike price per

stock appreciation right would be cash-settled upon their exercise, which can occur

beginning March 1, 2011.

The

company’s

expectations

regarding

the

timing

and

degree

of

market

share

growth

are

only

its

expectations

regarding

these

matters.

Actual

timing

and

degree

of

market share growth could differ based on a number of factors including (among others)

the company’s ability to persuade existing customers to increase shipments

with the company and to attract new customers, and the factors that affect revenue

results (including the risk factors that are from time to time included in the

company’s reports filed with the SEC).

The

company’s

expectations

regarding

multi-employer

pension

plan

reform

are

only

its

expectations

regarding

this

matter.

The

impact

to

the

company

and

the

multi-

employer

pension

plans

to

which

it

contributes

of

such

reform

is

subject

to

a

number

of

conditions,

including

(among

others)

whether

Congress

passes

legislation

to

reform multi-employer pension plans and the timing of, and provisions included in,

such legislation. The company’s expectations regarding its capital

expenditures are only its expectations regarding this matter. Actual expenditures could differ materially based on a

number of factors, including (among others) the factors identified in the preceding and

following paragraphs. |

12

Forward-Looking Statements

Forward-Looking Statements

The company’s expectations regarding future asset dispositions and sale and

financing leasebacks of real estate are only its expectations regarding these matters.

Actual dispositions and sale and financing leasebacks will be determined by the

availability of capital and willing buyers and counterparties in the market and the

outcome of discussions to enter into and close any such transactions on negotiated terms

and conditions, including (without limitation) usual and ordinary closing

conditions such as favorable title reports or opinions and favorable environmental

assessments of specific properties. The company’s expectations regarding interest and fees (including any deferred

amounts) are only its expectations regarding these matters. Actual interest and

fees (including any deferred amounts) could differ based on a number of factors,

including (among others) the company’s expected borrowings under the

company’s credit agreement and the ABS facility, which is affected by revenue and

profitability results and the factors that affect revenue and profitability results

(including the risk factors that are from time to time included in the company’s

reports filed with the SEC), and the company’s ability to continue to defer the

payment of interest and fees pursuant to the terms of the company’s credit

agreement, ABS facility and pension fund contribution deferral agreement, as

applicable.

The company’s expectations regarding its effective tax rate are only its

expectations regarding this rate. The actual rate could differ materially based on a number

of factors, including (among others) variances in pre-tax earnings on both a

consolidated and business unit basis, variance in pre-tax earnings by jurisdiction,

impacts on our business from the factors described above, variances in estimates on

non-deductible expenses, tax authority audit adjustments, change in tax rates

and availability of tax credits. The company’s expectations regarding the continued support of its stakeholders are

only its expectations regarding this matter. Whether the company’s

stakeholders continue to support the company including (among other things) to continue

deferral arrangements in 2011 or to restructure obligations owed to such

stakeholders is subject to a number of conditions including (among other things) the outcome of discussions with such stakeholders, whether requested

support meets their requirements and the factors identified in the preceding paragraphs.

The company’s expectations regarding liquidity are only its expectations regarding

this matter. Actual liquidity levels will depend upon (among other things) the

company’s operating results, the timing of its receipts and disbursements, the

company’s access to credit facilities or credit markets, the company’s ability to

continue to defer interest and fees under the company’s credit agreement and ABS

facility and interest and principal under the company’s contribution deferral

agreement, the continuation of the existing union wage reductions and temporary cessation

of pension contributions, and the factors identified in the preceding paragraphs.

|

Operating

Loss to Adjusted EBITDA Operating Loss to Adjusted EBITDA

13

Adjusted EBITDA margin is Adjusted EBITDA divided by operating revenue expressed as

a percentage. $ in millions

Jan '10

Feb '10

Mar '10

Q1 '10

Consolidated

Operating revenue

323

$

329

$

412

$

1,063

$

Operating loss

(49)

$

(42)

$

(146)

$

(237)

$

Depreciation and amortization

17

17

18

52

Equity based compensation expense

1

1

108

110

Letter of credit expense

3

3

3

9

Losses on property disposals, net

-

-

9

9

Impairment charges

-

-

5

5

Other, net

1

-

(2)

(1)

Adjusted EBITDA

(27)

$

(21)

$

(5)

$

(53)

$

Adjusted EBITDA margin

-8.4%

-6.4%

-1.2%

-5.0% |

Operating

Loss to Adjusted EBITDA Operating Loss to Adjusted EBITDA

14

Workdays are the number of calendar days during each quarter exclusive of weekends

and holidays. Adjusted EBITDA margin is Adjusted EBITDA divided by operating

revenue expressed as a percentage. Adjusted EBITDA per workday is Adjusted

EBITDA divided by the workdays. $ in millions

Jan '10

Feb '10

Mar '10

Q1 '10

National

Workdays

20.0

20.0

23.0

63.0

Operating revenue

203

$

206

$

254

$

663

$

Operating loss

(39)

$

(33)

$

(113)

$

(185)

$

Depreciation and amortization

9

9

9

27

Equity based compensation expense

-

-

83

83

Letter of credit expense

3

2

2

7

(Gains) losses on property disposals, net

(1)

-

6

5

Impairment charges

-

-

3

3

Other, net

-

1

(1)

-

Adjusted EBITDA

(28)

$

(21)

$

(11)

$

(60)

$

Adjusted EBITDA margin

-13.8%

-10.2%

-4.3%

-9.0%

Adjusted EBITDA per workday - $000s

(1,400)

$

(1,050)

$

(478)

$

(952)

$

Regional

Workdays

20.0

20.0

24.5

64.5

Operating revenue

92

$

93

$

124

$

309

$

Operating loss

(6)

$

(5)

$

(29)

$

(40)

$

Depreciation and amortization

5

5

6

16

Equity based compensation expense

-

-

24

24

Letter of credit expense

-

1

1

2

Losses on property disposals, net

1

-

3

4

Impairment charges

-

-

2

2

Other, net

-

-

-

-

Adjusted EBITDA

-

$

1

$

7

$

8

$

Adjusted EBITDA margin

0.0%

1.1%

5.6%

2.6%

Adjusted EBITDA per workday - $000s

-

$

50

$

286

$

124

$ |