Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | d8k.htm |

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Alliance Data

Strategic Outlook

NYSE: ADS

Q2 2010

Exhibit 99.1 |

NYSE:

ADS | Q2 2010 2

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

A Unique Business Model

Alliance Data is the largest and most comprehensive provider of

transaction-based marketing and loyalty solutions.

Three Platforms: One Model |

Alliance Data: ~$300 Billion Market in Play

•

Marketing spend is shifting from traditional mass marketing to data-enabled,

multi-channel direct marketing

•

The digital channel spend directed toward transaction-based, ROI

solutions: •

Strong double-digit growth market

•

Still less than 10% of $300+ billion prize

Traditional

Mass

Marketing

Direct and

Digital

Marketing

47%

36%

DMA 2010 Statistical Fact Book; and

Forrester US Interactive Marketing Forecast 2009

$190 Billion

$128 Billion

Alliance Data’s

Addressable

Market

In 2009 $26B

spent in digital,

and expected to

grow to $40B in

2012

NYSE: ADS | Q2 2010

3

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Sources: ZenithOptimedia for Core Advertising March

2010; |

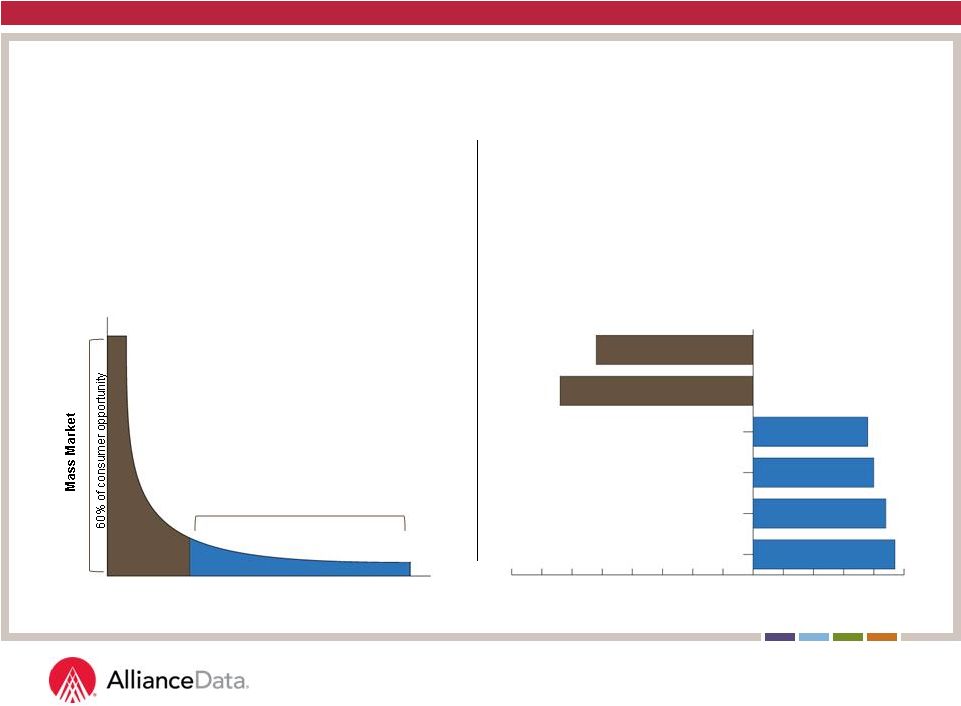

Driving the Shift: The Rise of the Niche Market

•

Highly segmented customer groups are

more difficult to reach

•

ROI-based, data-enabled marketing

programs allow for micro-segmentation to

reach these customers

Source: The Long Tail: Why the Future of Business is Selling Less of

More; Chris Anderson, 2006

Branding

Advertising

Email

Online Ad

Web site

Social Media

-52%

-64%

38%

40%

44%

47%

•

In

face

of

budget

cuts,

CMO’s

shift

spending

to

measureable data-enabled channels

•

Traditional media are losing share and hardest

hit given sheer size of these channels

•

Marketing dollars are moving to interactive

channels as consumers continue their

migration on line

Alliance Data’s

know-how is reaching

micro-customer segments

40% of consumer opportunity

Source: Forrester Research 2009, “Marketing Budgets Suffer Significant

Cuts.” NYSE: ADS | Q2 2010

4

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary |

NYSE:

ADS | Q2 2010 5

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

The Alliance Data End-to-End Solution

Three Platforms, One Model

Strategy/

Creative

Analytics

Distribution

Data/

Database

LoyaltyOne

|

Epsilon

|

Private

Label |

NYSE:

ADS | Q2 2010 6

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

2010 Guidance

($MM, except per share data)

Pro forma

2009

Guidance

2010

%

Change

Revenues

$2,513

$2,762

10%

Adjusted EBITDA

$734

$792

8%

Core EPS

Excluding non-recurring

$5.16

$4.64

$6.00

$6.00

16%

30%

Affirming 2010 Guidance of $6.00 |

NYSE:

ADS | Q2 2010 7

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Alliance Data’s Safe Harbor Statement and

Forward-Looking Statements

This presentation may contain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

Such

statements

may

use

words

such

as

"anticipate," "believe," "estimate," "expect,"

"intend," "predict," "project" and similar expressions as they relate to us or our

management. When we make forward-looking statements, we are basing them on our

management's beliefs and assumptions, using

information

currently

available

to

us.

Although

we

believe

that

the

expectations

reflected

in

the

forward-looking

statements

are

reasonable,

these

forward-looking

statements

are

subject

to

risks,

uncertainties

and

assumptions,

including

those discussed in our filings with the Securities and Exchange Commission.

If one or more of these or other risks or uncertainties materialize, or if our

underlying assumptions prove to be incorrect, actual results may vary

materially from what we projected. Any forward-looking statements contained in this presentation reflect our

current views with respect to future events and are subject to these and other

risks, uncertainties and assumptions relating to our operations, results of

operations, growth strategy and liquidity. We have no intention, and disclaim any obligation, to

update or revise any forward-looking statements, whether as a result of new

information, future results or otherwise. "Safe Harbor" Statement

under the Private Securities Litigation Reform Act of 1995: Statements in this presentation regarding

Alliance Data Systems Corporation's business which are not historical facts are

"forward-looking statements" that involve risks and

uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ from those

contained in the forward-looking statements, see "Risk Factors" in the

Company's Annual Report on Form 10-K for the most recently ended fiscal

year. Risk factors may be updated in Item 1A in each of the Company's Quarterly Reports on Form 10-Q

for each quarterly period subsequent to the Company's most recent Form

10-K |

NYSE:

ADS | Q2 2010 8

©2010 ADS Alliance Data Systems, Inc.

Confidential and Proprietary

Financial Measures

In addition to the results presented in accordance with generally accepted

accounting principles, or GAAP, the Company presents financial measures that

are non-GAAP measures, such as constant currency financial

measures,

adjusted

EBITDA,

adjusted

EBITDA

margin,

core

earnings

and

core

earnings

per

diluted

share.

These non-GAAP financial measures exclude costs associated with the terminated

merger with affiliates of The Blackstone Group and other costs. The Company

believes that these non-GAAP financial measures, viewed in addition to

and not in lieu of the Company’s reported GAAP results, provide useful information to

investors regarding the Company’s performance and overall results of

operations. These metrics are an integral part of the Company’s internal

reporting to measure the performance of reportable segments and the overall

effectiveness of senior management. Reconciliations to comparable GAAP financial measures are

available in the accompanying schedules and on the Company’s website. The

financial measures presented are consistent with the Company’s

historical financial reporting practices. Core earnings and core earnings per

diluted share represent performance measures and are not intended to represent liquidity measures. The

non-GAAP financial measures presented herein may not be comparable to similarly

titled measures presented by other companies, and are not identical to

corresponding measures used in other various agreements or public

filings. |