Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Vitamin Shoppe, Inc. | dex231.htm |

| EX-5.1 - OPINION OF KIRKLAND & ELLIS LLP - Vitamin Shoppe, Inc. | dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 18, 2010

Registration No. 333-166718

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

VITAMIN SHOPPE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5400 | 11-3664322 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2101 91st Street

North Bergen, New Jersey 07047

Telephone: (201) 868-5959

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James M. Sander, Esq.

Vitamin Shoppe, Inc.

Vice President, General Counsel and Secretary

2101 91st Street

North Bergen, New Jersey 07047

Telephone: (201) 868-5959

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Christian O. Nagler, Esq. Kirkland & Ellis LLP 601 Lexington Avenue New York, NY 10022 Tel: (212) 446-4800 Fax: (212) 446-4900 |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue, Suite 1000 New York, NY 10022-4802 Tel: (212) 906-1200 Fax: (212) 751-4864 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| ¨Large accelerated filer | ¨Accelerated filer | xNon-accelerated filer (Do not check if smaller reporting company) |

¨Smaller reporting company |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Amount to be Registered (1) |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price (2) |

Amount of Registration Fee (3) | ||||

| Common stock, par value $0.01 per share |

7,171,768 |

$23.40 |

$167,819,372 |

$11,965.53 | ||||

| (1) | Includes 935,448 shares of common stock issuable upon exercise of an option to purchase additional shares granted to the underwriters. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices for the registrant’s common stock on May 11, 2010. |

| (3) | $10,607 was previously paid on May 10, 2010. The difference of $1,358.53 is being submitted herewith. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated May 18, 2010

PROSPECTUS

6,236,320 Shares

Vitamin Shoppe, Inc.

Common Stock

The selling stockholders identified in this prospectus, including our principal stockholder and certain members of our management, are offering up to 6,236,320 shares of common stock of Vitamin Shoppe, Inc. and will receive all of the proceeds from the offering. We will not receive any proceeds from the offering. See “Principal and Selling Stockholders.”

Our common stock is listed and currently traded on the NYSE under the symbol “VSI.” On May 17, 2010 the last reported sale price of our common stock was $25.14 per share.

| Per Share | Total | |||||

| Public offering price |

$ | $ | ||||

| Underwriting discounts and commissions |

$ | $ | ||||

| Proceeds to the Selling Stockholders, before expenses |

$ | $ | ||||

The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 935,448 shares from them at the public offering price less the underwriting discounts and commissions.

Investing in our common stock involves a high degree of risk. See “Risk factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about 2010.

Joint Book-Running Managers

| J.P.Morgan | BofA Merrill Lynch | Barclays Capital |

Co-Managers

| Stifel Nicolaus | Baird | Piper Jaffray |

The date of this prospectus is , 2010

Table of Contents

Table of Contents

| 1 | ||

| 6 | ||

| 8 | ||

| 14 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| 17 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 | |

| 41 | ||

| 56 | ||

| 61 | ||

| 79 | ||

| 81 | ||

| 83 | ||

| 88 | ||

| 90 | ||

| 93 | ||

| 100 | ||

| 100 | ||

| 100 | ||

| F-1 |

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by us or information to which we have referred you. We have not, the selling stockholders have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, the selling stockholders are not, and the underwriters are not, making an offer to sell, or soliciting an offer to buy, these securities in any jurisdiction where such offer, sale or solicitation is not permitted. You should assume that the information appearing in this prospectus and any free writing prospectus prepared by us is accurate only as of its respective date. Our business, financial condition, results of operations and prospects may have changed since such date.

Table of Contents

This summary highlights material information regarding the offering contained elsewhere in this prospectus, but may not contain all of the information that may be important to you. As used herein, the “Company,” “we,” “us” and “our” refer to “Vitamin Shoppe, Inc.” References to “VMS” mean vitamins, minerals, herbs, supplements, sports nutrition and other health and wellness products. You should read this entire prospectus, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes thereto, before deciding whether to invest in our common stock.

Overview

We are a leading specialty retailer and direct marketer of vitamins, minerals, herbs, supplements, sports nutrition and other health and wellness products. For each of the past five years, we have been the fastest growing national VMS specialty retailer while maintaining our position as the second largest in retail sales in our industry. We market over 700 different nationally recognized brands as well as our proprietary Vitamin Shoppe, BodyTech and MD Select brands. We believe we offer the greatest variety of products among VMS retailers with approximately 8,000 stock keeping units (“SKUs”) offered in our typical store and an additional 12,000 SKUs available through our Internet and other direct sales channels. We target the dedicated, well-informed VMS consumer and differentiate ourselves by providing high quality products at competitive prices in an educational and high-touch customer service environment. We believe our extensive product offerings, together with our well-known brand name and emphasis on product education and customer service, help us bond with our target customer and serve as a foundation for strong customer loyalty.

We sell our products through two business segments: retail and direct. In our retail segment, we have leveraged our successful store economic model by opening a total of 169 new stores from the beginning of fiscal year 2006 through fiscal year 2009. As of April 27, 2010, we operated 457 stores in 37 states and the District of Columbia, located in high-traffic regional retail centers. In our direct segment, we sell our products directly to consumers through our websites, primarily www.vitaminshoppe.com, and our catalog. Our websites and our catalog complement our in-store experience by extending our retail product offerings and by enabling us to access customers outside our retail markets and those who prefer to shop online.

We have grown our net sales from $486.0 million in fiscal year 2006 to $674.5 million in fiscal year 2009, representing a compound annual growth rate (“CAGR”) of 11.5%. We have achieved positive comparable store sales for 16 consecutive years (prior to which we did not track comparable store sales) and have grown our retail sales from $407.5 million in 2006 to $596.3 million in 2009, representing a CAGR of 13.5%. We believe our industry performs well through economic cycles, and we have generated comparable store sales increases of 5.2% and 6.2% in 2009 and 2008, respectively, and 6.2% and 5.1% for the three months ended March 27, 2010 and March 28, 2009, respectively.

Industry

According to the Nutrition Business Journal (“NBJ”), sales of nutritional supplements in the United States in 2008 were approximately $25.2 billion, representing a 4.9% CAGR between 2001 and 2008. The NBJ forecasts 4.5% average annual growth for U.S. nutritional supplement sales through 2014. We believe that one of the primary trends driving the industry is consumption by the over-50 demographic, including Baby Boomers (those born between 1946 and 1964), who seek to improve their health and wellness and treat and prevent disease and illness. According to the U.S. Census, the total U.S. population of people 50 and older is expected to increase to 115 million people in 2018 from 94 million people in 2008, representing a CAGR of 2.1%, which is more than twice the overall population growth rate.

1

Table of Contents

According to the NBJ, growth in the U.S. nutritional supplement industry is expected to be led by the specialty supplements and sports nutrition product categories. Based on NBJ forecasts, from 2009 to 2014, the U.S. specialty supplements product category is expected to grow approximately 38% faster than the overall industry, and the sports nutrition product category is expected to grow approximately 29% faster than the overall industry. Our sales are concentrated in these fastest-growing categories. Grouped in a manner consistent with NBJ’s data, the specialty supplements and sports nutrition product categories represented 26.9% and 29.1%, respectively, of our fiscal 2009 net sales.

Competitive Strengths

We believe we are well positioned to capitalize on the favorable VMS industry dynamics as a result of the following competitive strengths:

Most Extensive Product Selection, Including a Strong Assortment of Proprietary Brands. We believe we have the most complete and authoritative merchandise assortment and market the broadest product selection in the VMS industry, with over 20,000 competitively priced SKUs from a combination of over 700 different nationally recognized brands and our proprietary brands. Our proprietary brand merchandise accounted for approximately 25% of our net sales in fiscal 2009, and provides our customers the opportunity to purchase VMS products at a great value while affording us higher gross margins.

Value-Added Customer Service. We believe we offer the highest degree of customer service in the VMS retail industry, aided by the deep product knowledge of our experienced store associates. We place a strong emphasis on employee training and customer service and view our sales associates as health and wellness information stewards who educate our customers while assisting them with their product selections.

Highly Refined Real Estate Strategy. We apply demanding criteria to our retail site selection. We locate our stores exclusively in attractive stand-alone locations or endcap (corner) positions in retail centers. We believe that the location and visibility of our real estate is our single most effective and efficient customer acquisition strategy.

Attractive, Loyal Customer Base. We have a large and growing base of loyal customers who proactively manage their long-term health and wellness through the use of supplements. Our no-fee Healthy Awards Program promotes brand loyalty among our customers and allows our customers to earn points redeemable for future purchases, approximately 74% of which are redeemed annually.

Multi-Channel Retailer. We are a multi-channel retailer, distributing products through our retail stores, our websites and our catalog, enabling us to access customers outside our retail markets and those who prefer to shop online. This business model affords us multiple touch points with our customers, which allows us to gather data and communicate with them in person, through our call center and via the web.

Experienced Management Team with Proven Track Record. We have assembled a management team across a broad range of disciplines with extensive experience in building leading national specialty retailers.

For additional information, see the section of this prospectus entitled “Business—Competitive Strengths.”

2

Table of Contents

Growth Strategies

We plan to execute several strategies in the future to promote our revenue growth, capture market share and drive operating income growth, including:

Expand Our Store Base. We believe we have a highly attractive economic model for our new stores. We plan to continue to expand our store base over the next five years, which we believe will complement the maturation of the 169 stores we have opened since January 1, 2006. Based upon our operating experience and research conducted by The Buxton Company, we are confident that the U.S. VMS market can support over 900 Vitamin Shoppe stores operating under our current format.

Grow Our Loyal Customer Base. We plan to continue to grow our loyal customer base by enhancing our marketing initiatives and leveraging our direct business.

Continue to Improve Store Productivity. We plan to generate higher sales productivity through refined merchandising and pricing initiatives.

Continue to Invest in Education and Knowledge of Our Employees. We believe we provide the most comprehensive training program in the VMS industry and that our sales associates’ ability to provide greater, value-added assistance to our customers helps us deliver a differentiated retail experience.

For additional information, see the section of this prospectus entitled “Business—Growth Strategies.”

Risk Factors

An investment in our common stock is subject to a number of risks and uncertainties. Before investing in our common stock, you should carefully consider the following, as well as the more detailed discussion of risk factors and other information included in this prospectus:

| • | unfavorable publicity or consumer perception of our products and any similar products distributed by other companies could cause fluctuations in our operating results and could have a material adverse effect on our reputation, resulting in decreased sales; |

| • | our substantial indebtedness could adversely affect our financial health; |

| • | we may incur material product liability claims, which could increase our costs and adversely affect our reputation, sales and operating income; |

| • | we may not be able to obtain insurance coverage in the future at current rates or at all; and |

| • | compliance with new and existing governmental regulations could increase our costs significantly and adversely affect our operating income. |

Recent Developments

On March 30, 2010, we entered into a three year agreement with a West Coast third party logistics facility to service our stores in the western United States.

On April 21, 2010, we announced our intention to redeem $25.0 million of our Second Priority Senior Secured Floating Rate Notes due 2012 (the “Notes”), which will be financed with borrowings under our 2009 Revolving Credit Facility. The redemption will be consummated by May 21, 2010, and will result in approximately $1.0 million (pre-tax) savings in interest expense on an annual basis, as well as a charge of approximately $0.6 million (pre-tax) to loss on extinguishment of debt, as a result of certain write-offs related to the redemption, during the second quarter of the 2010 fiscal year.

3

Table of Contents

On April 21, 2010, we amended our revolving credit facility (as amended, the “2009 Revolving Credit Facility”), increasing the maximum credit limit by $20.0 million to $70.0 million. In addition, in connection with the aforementioned West Coast facility agreement, the 2009 Revolving Credit Facility was amended to accommodate the allocation of our inventory between our New Jersey distribution center and the West Coast logistics facility.

During the first quarter of 2010, the Company’s comparable store sales increased 6.2% over the prior year. This favorable trend has continued in the second quarter of 2010, as comparable store sales increases for the first seven weeks of the second quarter of 2010 have exceeded the comparable store sales increases for the first quarter of 2010. Our results for the first seven weeks of the second quarter are preliminary and subject to change. Our results for the first seven weeks of the second quarter are not necessarily indicative of the results that may be expected for the entire fiscal second quarter.

Investment by Irving Place Capital Partners II, L.P.

We were acquired in November 2002 by Irving Place Capital Partners II, L.P. (formerly Bear Stearns Merchant Banking Partners II, L.P.) and its affiliates and other investors. Following this offering Irving Place Capital Partners II, L.P. and certain of its affiliates, which we refer to collectively as “IPC,” will own approximately 35.9% of our common stock, or 32.5% if the underwriters’ option to purchase additional shares is fully exercised.

Our Corporate Structure

Our current corporate structure is as follows: Vitamin Shoppe, Inc., the issuer of the common stock offered hereby, owns all of the common stock of Vitamin Shoppe Industries Inc. Vitamin Shoppe, Inc. has no operations of its own. All of our operating assets are held by Vitamin Shoppe Industries Inc. and its direct wholly owned subsidiary, VS Direct Inc. (“Direct”). Prior to the completion of our initial public offering in November 2009, and the renaming of VS Holdings, Inc. to Vitamin Shoppe, Inc., VS Holdings, Inc. was a direct wholly owned subsidiary of VS Parent, Inc., our former parent company. During October 2009 VS Parent, Inc. was merged into VS Holdings, Inc. with VS Holdings, Inc. being the surviving corporation (the “Merger”). The Merger resulted in an approximate 1.8611-for-one split of our common stock. In addition, the warrants and common stock issued by VS Parent, Inc. became warrants and common stock of VS Holdings, Inc. and the preferred stock of VS Parent, Inc. converted into preferred stock of VS Holdings, Inc., which transferred all participating rights (accumulated dividends in arrears) to VS Holdings, Inc. Subsequent to the forgoing, VS Holdings, Inc. was renamed “Vitamin Shoppe, Inc.” We refer to these transactions as our “2009 Corporate Reorganization.”

Corporate and Other Information

Our executive offices are located at 2101 91st Street, North Bergen, New Jersey 07047, and our telephone number is (201) 868-5959. Our principal website address is www.vitaminshoppe.com. Information contained on any of our websites does not constitute part of this prospectus.

The Vitamin Shoppe and BodyTech are some of our registered trademarks. Other brand names or trademarks appearing in this prospectus are the property of their respective owners. Solely for convenience, our trademarks and tradenames referred to in this prospectus are without the ® symbol, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensors to these trademarks and tradenames.

Some of the market and industry data and other statistical information used throughout this prospectus are based on independent industry publications including the 2009 Supplement Business Report issue of the NBJ, government publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources referred to above. The industry forecasts and projections are based on industry surveys and management’s experience in the industry, and we cannot give you any assurance that any of the projected results will be achieved.

4

Table of Contents

The Offering

| Common stock offered by the selling stockholders |

6,236,320 shares |

| Use of proceeds |

The selling stockholders will receive all of the proceeds from this offering, and we will not receive any proceeds from the sale of shares in this offering. The selling stockholders include members of our management and certain of our other equity holders. Irving Place Capital Partners II, L.P., is our principal stockholder and is a selling stockholder in this offering. See “Principal and Selling Stockholders.” |

| Dividends |

We do not anticipate paying any cash dividends in the foreseeable future. |

| Risk Factors |

See “Risk Factors” beginning on page 8 for a discussion of some of the factors you should carefully consider before deciding to invest in shares of our common stock. |

| Conflict of Interest |

Under FINRA Rule 2720, we are considered an affiliate of J.P. Morgan Securities Inc. because J.P. Morgan Securities Inc. has an economic interest in approximately 21% of our common stock outstanding as of April 30, 2010. See “Underwriting—Conflict of Interest.” Certain affiliates of J.P. Morgan Securities, Inc. will receive a portion of the proceeds of this offering. See “Principal and Selling Stockholders.” |

| New York Stock Exchange symbol |

“VSI.” |

5

Table of Contents

Summary Consolidated Financial Data

The following table sets forth summary consolidated financial data for Vitamin Shoppe, Inc. as of the dates and for the periods indicated. Our fiscal years end on the last Saturday in December. The statement of operations data for the fifty-two weeks ended December 26, 2009 (“Fiscal 2009”), fifty-two weeks ended December 27, 2008 (“Fiscal 2008”), and the fifty-two weeks ended December 29, 2007 (“Fiscal 2007”), have been derived from our audited consolidated financial statements and notes thereto included in this prospectus. The statement of operations data for the three months ended March 27, 2010, and for the three months ended March 28, 2009, and the balance sheet data as of March 27, 2010, have been derived from our unaudited condensed consolidated financial statements included in this prospectus, which, in our opinion, contain adjustments which are of a normal recurring nature and which we consider necessary to present fairly our financial position and results of operations at such dates and for such periods. Results for the three months ended March 27, 2010, are not necessarily indicative of the results that may be expected for the entire fiscal year.

The summary consolidated financial data below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Use of Proceeds” and our financial statements and notes thereto included in this prospectus.

| Three Months Ended | Year Ended | |||||||||||||||||||

| March 27, 2010 |

March 28, 2009 |

December 26, 2009 |

December 27, 2008 |

December 29, 2007 |

||||||||||||||||

| (data presented in thousands, except for share and per share data) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 191,613 | $ | 172,555 | $ | 674,495 | $ | 601,540 | $ | 537,872 | ||||||||||

| Cost of goods sold |

126,599 | 115,543 | 457,573 | 405,659 | 360,346 | |||||||||||||||

| Gross profit |

65,014 | 57,012 | 216,922 | 195,881 | 177,526 | |||||||||||||||

| Selling, general and administrative expenses |

46,942 | 43,941 | 173,144 | 158,713 | 143,544 | |||||||||||||||

| Related party expenses |

— | 370 | 2,446 | 1,523 | 1,365 | |||||||||||||||

| Income from operations |

18,072 | 12,701 | 41,332 | 35,645 | 32,617 | |||||||||||||||

| Extinguishment of debt and other (1) |

552 | — | 2,016 | — | — | |||||||||||||||

| Interest expense, net |

2,927 | 5,007 | 18,636 | 21,137 | 22,045 | |||||||||||||||

| Income before provision for income taxes |

14,593 | 7,694 | 20,680 | 14,508 | 10,572 | |||||||||||||||

| Provision for income taxes |

5,867 | 3,132 | 8,014 | 6,341 | 3,792 | |||||||||||||||

| Net income |

8,726 | 4,562 | 12,666 | 8,167 | 6,780 | |||||||||||||||

| Preferred stock dividends in arrears |

— | 2,577 | 7,692 | 9,279 | 9,105 | |||||||||||||||

| Net income (loss) available to common stockholders |

$ | 8,726 | $ | 1,985 | $ | 4,974 | $ | (1,112 | ) | $ | (2,325 | ) | ||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

26,692,983 | 14,175,906 | 16,238,338 | 14,175,906 | 14,175,906 | |||||||||||||||

| Diluted |

27,708,463 | 15,969,484 | 17,748,371 | 14,175,906 | 14,175,906 | |||||||||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

$ | 0.33 | $ | 0.14 | $ | 0.31 | $ | (0.08 | ) | $ | (0.16 | ) | ||||||||

| Diluted |

$ | 0.31 | $ | 0.12 | $ | 0.28 | $ | (0.08 | ) | $ | (0.16 | ) | ||||||||

| Other Operating Data: |

||||||||||||||||||||

| Average net sales per comparable store |

$ | 389 | $ | 405 | $ | 1,424 | $ | 1,458 | $ | 1,437 | ||||||||||

| Comparable store sales growth (2) |

6.2 | % | 5.1 | % | 5.2 | % | 6.2 | % | 6.2 | % | ||||||||||

| Average square footage per store |

3.7 | 3.7 | 3.7 | 3.7 | 3.7 | |||||||||||||||

6

Table of Contents

| (1) | For the first fiscal quarter of 2010, extinguishment of debt includes $0.3 million for the write-off of the related portion of deferred financing fees and a portion of the unrecognized loss on our terminated interest rate swap of $0.2 million, related to the redemption of a portion of our Notes during January 2010. For Fiscal 2009 extinguishment of debt includes $0.4 million for the premium on the repurchase of a portion of our Notes, along with the write-off of the related portions of deferred financing fees and a portion of the unrecognized loss of our terminated interest rate swap of $0.7 million and $0.6 million, respectively, as well as a $0.3 million write-off of deferred financing fees related to the repayment of our former revolving credit facility which was terminated in September 2009. |

| (2) | A store is included in comparable store sales after 410 days of operation. |

7

Table of Contents

Any investment in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this prospectus, before buying shares of our common stock.

Risks Relating to Our Business and Industry

Unfavorable publicity or consumer perception of our products and any similar products distributed by other companies could cause fluctuations in our operating results and could have a material adverse effect on our reputation, resulting in decreased sales.

We are highly dependent upon consumer perception regarding the safety and quality of our products, as well as similar products distributed by other companies. Consumer perception of products can be significantly influenced by adverse publicity in the form of published scientific research, national media attention or other publicity, whether or not accurate, that associates consumption of our products or any other similar products with illness or other adverse effects, or questions the benefits of our or similar products or that claims that any such products are ineffective. A product may be received favorably, resulting in high sales associated with that product that may not be sustainable as consumer preferences change. Future scientific research or publicity could be unfavorable to our industry or any of our particular products and may not be consistent with earlier favorable research or publicity. Such research or publicity could have a material adverse effect on our ability to generate sales. For example, sales of some of our products, such as those containing Ephedra, were initially strong, but decreased as a result of negative publicity and an ultimate ban by the Food and Drug Administration (“FDA”). As a result of the above factors, our operations may fluctuate significantly from quarter-to-quarter and year to year.

Our substantial indebtedness could adversely affect our financial health.

As of March 27, 2010, we had $120.1 million of outstanding indebtedness (excluding capital leases). Our substantial indebtedness could have important consequences to you. For example, it could:

| • | make it more difficult for us to satisfy our obligations with respect to our indebtedness; |

| • | increase our vulnerability to general adverse economic, industry and competitive conditions; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| • | limit our ability to borrow additional funds. |

Additionally, despite our current indebtedness levels, the agreements governing our outstanding debt upon consummation of the offering would allow us to incur substantially more debt. This could further exacerbate the risks associated with our substantial leverage.

We may incur material product liability claims, which could increase our costs and adversely affect our reputation, sales and operating income.

As a retailer and direct marketer of products designed for human consumption, we are subject to product liability claims if the use of our products is alleged to have resulted in injury or include inadequate instructions for use or inadequate warnings concerning possible side effects and interactions with other substances. Most of

8

Table of Contents

our products are vitamins, minerals, herbs and other ingredients that are classified as foods or dietary supplements and are not subject to pre-market regulatory approval in the United States. Our products could contain contaminated substances, and some of our products contain ingredients that do not have long histories of human consumption. Previously unknown adverse reactions resulting from human consumption of these ingredients could occur. While we attempt to manage these risks by obtaining indemnification agreements and insurance, our insurance policies may not be sufficient or available and/or third parties may not satisfy their commitments to us. A product liability claim against us could result in increased costs and could adversely affect our reputation with our customers, which in turn could adversely affect our financial performance. See “Business—Legal Proceedings.”

We may not be able to obtain insurance coverage in the future at current rates.

Our current insurance program is consistent with both our past level of coverage and our risk management policies. While we believe we will be able to obtain product liability insurance in the future, because of increased selectivity by insurance providers we may only be able to obtain such insurance at increased rates and/or with reduced coverage levels which could reduce our income from operations.

Compliance with new and existing governmental regulations could increase our costs significantly and adversely affect our operating income.

The processing, formulation, manufacturing, packaging, labeling, advertising and distribution of our products are subject to federal laws and regulation by one or more federal agencies, including the FDA, Federal Trade Commission (“FTC”), the Department of Agriculture (“DOA”) and the Environmental Protection Agency (“EPA”). These activities are also regulated by various state, local and international laws and agencies of the states and localities in which our products are sold. Regulations may prevent or delay the introduction, or require the reformulation, of our products, which could result in lost sales and increased costs to us. The FDA may not accept the evidence of safety for any new ingredients that we may want to market, may determine that a particular product or product ingredient presents an unacceptable health risk, may determine that a particular statement of nutritional support on our products, or that we want to use on our products, is an unacceptable drug claim or an unauthorized version of a food “health claim,” or the FDA or the FTC may determine that particular claims are not adequately supported by available scientific evidence. Any such regulatory determination would prevent us from marketing particular products or using certain statements on our products which could adversely affect our sales of those products. The FDA also could require us to remove a particular product from the market. For example, in April 2004, the FDA banned the sale of products containing Ephedra. We stopped selling Ephedra-based products in June 2003. Sales of products containing Ephedra amounted to approximately $10.9 million, or 4% of our net sales, in 2002. Any recall or removal of products we sell could result in additional costs to us and the loss of future sales from any products that we are required to remove from the market. Any such product recalls or removals could also lead to liability and substantial costs. Delayed product introduction, product recalls or similar issues as a result of governmental regulation may arise from time to time, which may have a material adverse effect on our sales and operating results.

In addition, from time to time, Congress, the FDA, the FTC or other federal, state, local or foreign legislative and regulatory authorities may impose additional laws or regulations that apply to us, repeal laws or regulations that we consider favorable to us or impose more stringent interpretations of current laws or regulations. We are not able to predict the nature of such future laws, regulations, repeals or interpretations or to predict the effect additional governmental regulation, when and if it occurs, would have on our business in the future. Such developments could require reformulation of certain products to meet new standards, recalls or discontinuance of certain products not able to be reformulated, additional record-keeping requirements, increased documentation of the properties of certain products, additional or different labeling, additional scientific substantiation, adverse event reporting or other new requirements. Any such developments could increase our costs significantly and could have a material adverse effect on our business, financial condition and results of operations. For example, legislation has been passed by Congress to, among other things, impose substantial new

9

Table of Contents

regulatory requirements for dietary supplements, including adverse event reporting, and post-market surveillance requirements, which could raise our costs and negatively impact our business. In addition, the FDA has adopted rules on good manufacturing practices (“GMP”) in manufacturing, packaging, or holding dietary ingredients and dietary supplements, which apply to the products we distribute. These regulations will require dietary supplements to be prepared, packaged and held in compliance with stricter rules, and require quality control provisions similar to those in the drug GMP regulations. We or our third-party manufacturers may not be able to comply with the new rules without incurring additional expenses, which could be significant. See “Business—Government Regulation.”

We rely on contract manufacturers to produce all of the Vitamin Shoppe and BodyTech branded products we sell. Disruptions in our contract manufacturers’ systems or losses of manufacturing certifications could adversely affect our sales and customer relationships.

Our contract manufacturers produce 100% of our Vitamin Shoppe and BodyTech branded products. Any significant disruption in those operations for any reason, such as regulatory requirements and loss of certifications, power interruptions, fires, hurricanes, war or threats of terrorism could adversely affect our sales and customer relationships.

Increase in the price and shortage of supply of key raw materials could adversely affect our business.

Our products are composed of certain key raw materials. If the prices of these raw materials were to increase significantly, it could result in a significant increase to us in the prices our contract manufacturers and third-party manufacturers charge us for our Vitamin Shoppe and BodyTech branded products and third-party products. Raw material prices may increase in the future and we may not be able to pass on such increases to our customers. A significant increase in the price of raw materials that cannot be passed on to customers could have a material adverse effect on our results of operations and financial condition. In addition, if we no longer are able to obtain products from one or more of our suppliers on terms reasonable to us or at all, our revenues could suffer. We purchased approximately 6% of our total merchandise from Nature’s Value during Fiscal 2009, one of the suppliers of our Vitamin Shoppe and BodyTech branded products. Events such as the threat of terrorist attacks or war, or the perceived threat thereof, may also have a significant impact on raw material prices and transportation costs for our products. In addition, the interruption in supply of certain key raw materials essential to the manufacturing of our products, may have an adverse impact on our supplier’s ability to provide us with the necessary products needed to maintain our customer relationships and an adequate level of sales.

We rely on a single warehouse and distribution facility to distribute all of the products we sell. Disruptions to our warehouse and distribution facility could adversely affect our business.

Our warehouse and distribution operations are currently concentrated in a single location adjacent to our corporate headquarters in New Jersey. Any significant disruption in our distribution center operations for any reason, such as a flood, fire or hurricane, could adversely affect our product distributions and sales until such time as we are able to secure an alternative distribution method. In addition, the west coast distribution facility, which we expect to add to our operations during the second half of Fiscal 2010, will not sufficiently meet our distribution requirements in the event of a major disruption to our primary facility.

Our new store base, or any stores opened in the future, may not achieve sales and operating levels consistent with our mature store base on a timely basis or at all. In addition, our growth strategy includes the addition of a significant number of new stores each year. We may not be able to successfully implement this strategy on a timely basis or at all, and our business could be adversely affected if we are unable to successfully negotiate favorable lease terms.

Since the beginning of 2006 through Fiscal 2009, we have opened 169 new stores in existing and new markets. Historically, our new stores have reached sales that are consistent with our mature stores over the course of a three to four year period. New stores opened since the beginning of 2006, or any new stores to be opened in the future, may not achieve sales and operating levels consistent with our mature store base in this time frame or

10

Table of Contents

at all. The failure of our new store base to achieve sales and operating levels consistent with our mature store base on a timely basis will have an adverse effect on our financial condition and operating results. As of April 27, 2010, we leased 457 stores along with our corporate headquarters and distribution facility. The store leases are generally for a term of ten years and we have options to extend most leases for a minimum of five years. Our business, financial condition, and operating results could be adversely affected if we are unable to continue to negotiate acceptable lease and renewal terms.

In addition, our growth continues to depend, in part, on our ability to open and operate new stores successfully. The success of this strategy depends upon, among other things, the identification of suitable sites for store locations, the negotiation of acceptable lease terms, the hiring, training and retention of competent sales personnel, and the effective management of inventory to meet the needs of new and existing stores on a timely basis. Our proposed expansion will also place increased demands on our operational, managerial and administrative resources. These increased demands could cause us to operate our business less effectively, which in turn could cause deterioration in the financial performance of our existing stores. Further, our new store openings may result in reduced net sales volumes in the direct channel, as well as in our existing stores in those markets. We expect to fund our expansion through cash flow from operations and, if necessary, by borrowings under our 2009 Revolving Credit Facility. If we experience a decline in performance, we may slow or discontinue store openings. If we fail to successfully implement these strategies, our financial condition and operating results may be adversely affected.

If we fail to protect our brand name, competitors may adopt tradenames that dilute the value of our brand name.

We may be unable or unwilling to strictly enforce our trademark in each jurisdiction in which we do business. In addition, because of the differences in foreign trademark laws concerning proprietary rights, our trademarks may not receive the same degree of protection in foreign countries as they do in the United States. Also, we may not always be able to successfully enforce our trademarks against competitors, or against challenges by others. Our failure to successfully protect our trademarks could diminish the value and efficacy of our past and future marketing efforts, and could cause customer confusion and potentially adversely affect our sales and profitability. Moreover, we may be subject to intellectual property litigation and infringement claims, which could cause us to incur significant expenses or prevent us from selling or using some aspect of our products.

Our ability to continue to access credit on the terms previously obtained for the funding of our operations and capital projects may be limited due to the deterioration of the credit markets.

The credit markets and the financial services industry continue to experience a period of significant disruption characterized by the bankruptcy, failure, collapse or sale of various financial institutions, increased volatility in securities prices, severely diminished liquidity and credit availability and a significant level of intervention from the United States and other governments. Continued concerns about the systemic impact of potential long-term or widespread recession, energy costs, geopolitical issues, the availability and cost of credit, the global commercial and residential real estate markets and related mortgage markets and reduced consumer confidence have contributed to increased market volatility and diminished expectations for most developed and emerging economies. As a result of these market conditions, the cost and availability of credit has been and may continue to be adversely affected by illiquid credit markets and wider credit spreads.

Due to current economic conditions, we cannot be certain that funding for our capital and operating needs on a long term basis will be available from our existing financial institutions and the credit markets if needed, and if available, to the extent required, and on acceptable terms. Our 2009 Revolving Credit Facility matures in September 2013, which we feel should cover our foreseeable liquidity needs. However, if we cannot obtain sufficient funding when needed, or on acceptable terms, we may be unable to continue our current rate of growth and store expansion, which may have an adverse effect on our revenues and results of operations.

11

Table of Contents

Recent legislation regarding healthcare may adversely impact our results of operations

We currently provide medical and dental insurance benefits to substantially all of our full-time employees. The Patient Protection and Affordable Care Act, signed into law in March 2010, may cause the cost of providing medical insurance to our employees to increase. We may not be able to pass these costs on to our customers, which could have an adverse impact on our results of operations and cash flows.

Risks Relating to the Shares and this Offering

Shares eligible for future sale may cause the market price of our common stock to decline, even if our business is doing well.

Sales of substantial amounts of our common stock in the public market after this offering, or the perception that these sales may occur, could adversely affect the price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. Our amended and restated certificate of incorporation authorizes us to issue 400,000,000 shares of common stock and we have 27,047,234 shares of common stock issued and outstanding as of April 30, 2010. As of April 30, 2010, there were a total of 3,439,710 options outstanding, of which 2,665,074 were vested and 41,563 were available for grant under the Amended and Restated 2006 Stock Option Plan of Vitamin Shoppe, Inc. (the “2006 Plan”). In addition, 137,051 shares of restricted stock and 350,223 options were outstanding and 897,223 shares were available for grant under the Vitamin Shoppe 2009 Equity Incentive Plan (the “2009 Plan”), and 200,000 shares were issuable under the 2010 Employee Stock Purchase Plan (“ESPP”) as of April 30, 2010. Upon completion of this offering, approximately 10.2 million shares of our common stock will be subject to lock-up agreements with the underwriters, restricting the sale of such shares for 90 days after the date of this prospectus (subject to extension). These lock-up agreements are subject to a number of exceptions and holders may be released from these agreements without prior notice at the discretion of underwriters. See “Shares Eligible for Future Sale.” Some of our stockholders are entitled, subject to limited exceptions, to demand registration rights with respect to the registration of shares under the Securities Act of 1933, as amended (the “Securities Act”). By exercising their registration rights, and selling a large number of shares, these holders could cause the price of our common stock to decline. An estimated 10.3 million shares of common stock will be entitled to demand registration rights 90 days after completion of this offering (subject to extension).

Our stock price may continue to be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the price at which you purchase them.

The initial public offering of our common stock was completed in November 2009 at a price of $17.00 per share. There has been a public market for our common stock for only a short period of time. An active, liquid and orderly market for our common stock may not be sustained, which could depress the trading price of our common stock. An inactive market may also impair our ability to raise capital to continue to fund operations by selling shares. In addition, the market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control.

Approximately 35.9% of our voting power will be controlled by one principal stockholder whose interests may conflict with those of our other stockholders.

Upon completion of this offering, affiliates of IPC will hold approximately 35.9% of our voting power. As a result of their ownership, IPC will continue to have significant influence in the consideration of all matters requiring the approval of our stockholders and/or our board of directors. This influence may also have the effect of delaying or preventing a change in control of our company or discouraging others from making tender offers for our shares, which could prevent stockholders from receiving a premium for their shares.

12

Table of Contents

Our amended and restated certificate of incorporation provides that IPC and its affiliates are not required to offer corporate opportunities of which they become aware to us and could therefore offer such opportunities instead to other companies including portfolio companies of IPC.

In addition, pursuant to a securityholders agreement between us, IPC and certain of our other stockholders, for so long as IPC owns at least 25% of our outstanding capital stock, the other stockholders party thereto will vote to elect to our board of directors three representatives designated by IPC. See “Certain Relationships and Related Party Transactions—Securityholders Agreement.” Our certificate of incorporation also provides that for so long as IPC owns at least 33 1/3% of the votes entitled to be cast by our then-outstanding common stock, we will not, among other things, enter into certain significant transactions without the prior consent of IPC. See “Description of Capital Stock—Provisions Relating to Control by IPC.”

We do not currently intend to pay dividends on our common stock, and as a result, your only opportunity to achieve a return on your investment is if the price of our common stock appreciates.

We have not declared or paid any cash dividends on our common stock and we do not expect to declare or pay any cash dividends on our common stock in the foreseeable future. In addition, our senior credit facility may limit our ability to declare and pay cash dividends on our common stock. For more information, see “Dividend Policy.” As a result, your only opportunity to achieve a return on your investment in us will be if the market price of our common stock appreciates and you sell your shares at a profit. The market price for our common stock after this offering might never exceed the price that you pay for our common stock in this offering.

Certain provisions of our corporate governing documents and Delaware law could discourage, delay, or prevent a merger or acquisition at a premium price.

Certain provisions of our organizational documents and Delaware law could discourage potential acquisition proposals, delay or prevent a change in control of our company, or limit the price that investors may be willing to pay in the future for shares of our common stock. For example, our certificate of incorporation and by-laws permit us to issue, without any further vote or action by the stockholders, up to 250,000,000 shares of preferred stock in one or more series and, with respect to each series, to fix the number of shares constituting the series and the designation of the series, the voting powers (if any) of the shares of the series, and the preferences and relative, participating, optional, and other special rights, if any, and any qualifications, limitations, or restrictions of the shares of the series. See “Description of Capital Stock—Antitakeover Effects of Provisions of the Certificate of Incorporation and Bylaws” and “—Antitakeover Legislation.”

13

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that do not directly or exclusively relate to historical facts. As a general matter, forward-looking statements are those focused upon anticipated events or trends and expectations and beliefs relating to matters that are not historical in nature. The words “believe,” “expect,” “plan,” “intend,” “estimate” or “anticipate” and similar expressions, as well as future or conditional verbs such as “will,” “should,” “would,” and “could,” often identify forward-looking statements. Such forward-looking statements are subject to uncertainties and factors relating to our operations and business environment, any of which are difficult to predict and many of which are beyond our control. These uncertainties and factors could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements.

The following uncertainties and factors, among others (including those set forth under “Risk Factors”), could affect future performance and cause actual results to differ materially from those expressed in or implied by forward-looking statements:

| • | unfavorable publicity or consumer perception of our products; |

| • | the impact of our substantial indebtedness on our financial health; |

| • | our continued ability to effectively manage and defend litigation matters pending, or asserted in the future, against us, including product liability claims; |

| • | our ability to obtain insurance coverage at current rates or at all; |

| • | compliance with government regulations; |

| • | our ability to maintain and to enter into key purchasing, supply and outsourcing relationships; |

| • | changes in our raw material costs; |

| • | increases in fuel prices; |

| • | disruptions to our warehouse and distribution facility; |

| • | the ability of our new store base to achieve sales and operating levels consistent with our mature store base; |

| • | pricing of our products; |

| • | the maturation of our stores opened since 2006; |

| • | our ability to protect our brand name; |

| • | our ability to renew our current leases and enter into new leases on terms acceptable to us; |

| • | the successful implementation of other strategic initiatives, including, without limitation, opening new stores and improving the functionality of our websites; and |

| • | our ability to continue to access credit on terms previously obtained for the funding of our operations and capital projects. |

14

Table of Contents

The selling stockholders will receive all of the proceeds from this offering. We will not receive any proceeds from the sale of shares of our common stock in this offering. We will pay the expenses, other than underwriting discounts and commissions, associated with the sale of shares by the selling stockholders. However, the underwriters have agreed to reimburse us for certain of our expenses in connection with this offering. The selling stockholders include our principal stockholder, IPC and members of management. Certain affiliates of J.P. Morgan Securities, Inc. will receive a portion of the proceeds of this offering. See “Principal and Selling Stockholders.”

We have not declared or paid any cash dividends on our common stock since the acquisition of our company by IPC in November 2002. We currently expect to retain future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. Our ability to pay cash dividends on our common stock is limited by the covenants of our credit facility and may be further restricted by the terms of any of our future debt or preferred securities.

We have only one authorized class of common equity, which is our common stock. As of April 30, 2010, we had 36 holders of record.

Our common stock has been listed on The New York Stock Exchange (“NYSE”) under the symbol “VSI” since our initial public offering completed on November 2, 2009, at $17.00 per share. Prior thereto, there was no public market for our common stock. The following table sets forth the high and low sales prices of our common stock per share, as reported by The NYSE.

| High | Low | |||||

| Fiscal Year Ended December 26, 2009 |

||||||

| November 2, 2009 through December 26, 2009 |

$ | 23.09 | $ | 17.51 | ||

| Fiscal Year Ending December 25, 2010 |

||||||

| 1st Quarter ended March 27, 2010 |

$ | 24.00 | $ | 19.31 | ||

| March 28, 2010 through May 17, 2010 |

$ | 27.71 | $ | 20.92 | ||

15

Table of Contents

The table below sets forth our cash and cash equivalents and capitalization as of March 27, 2010.

The table below should be read in conjunction with our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| As of March 27, 2010 |

||||

| Cash and cash equivalents |

$ | 12,162 | ||

| Obligations under capital lease, net of current portion of $1,595 |

$ | 1,953 | ||

| Second Priority Senior Secured Floating Rate Notes |

100,106 | |||

| Total long-term debt (1) |

102,059 | |||

| Common stock: $0.01 par value; 400,000,000 shares authorized and 26,849,710 shares of common stock issued and outstanding on March 27, 2010. |

268 | |||

| Additional paid-in-capital |

212,171 | |||

| Accumulated other comprehensive loss |

(535 | ) | ||

| Retained earnings |

33,332 | |||

| Total stockholders’ equity |

245,236 | |||

| Total capitalization |

$ | 347,295 | ||

| (1) | Total long-term debt excludes debt outstanding under our 2009 Revolving Credit Facility of $20.0 million, which is classified as a current liability on our consolidated balance sheet. |

16

Table of Contents

SELECTED CONSOLIDATED FINANCIAL DATA

Our fiscal years end on the last Saturday in December and are designated by the calendar year in which the fiscal year ends. As used herein, the term “Fiscal” with respect to years 2006, 2007, 2008 and 2009 refers to the 52-week period ending on the last Saturday in December of such year. The term “Fiscal 2005” refers to the 53-week period ended December 31, 2005. With respect to any other year, the term “Fiscal” refers to the 52-week or 53-week period, as applicable, ended on the last Saturday in December of such year. Results for the periods presented represent the results of Vitamin Shoppe, Inc. and its subsidiary.

The following table sets forth selected historical consolidated financial information for the Company for the periods presented. The statement of operations data for Fiscal 2009, Fiscal 2008 and Fiscal 2007 and the balance sheet data as of Fiscal 2009 and Fiscal 2008 have been derived from the audited financial statements included in this prospectus. The balance sheet data as of Fiscal 2007, Fiscal 2006 and Fiscal 2005, and the statements of operations data for Fiscal 2006 and Fiscal 2005, have been derived from our consolidated financial statements which are not included in this prospectus. The statements of operations data for the three months ended March 27, 2010 and for the three months ended March 28, 2009, and the balance sheet data as of March 27, 2010 have been derived from our unaudited condensed consolidated financial statements included in this prospectus, which, in our opinion, contain adjustments which are of a normal recurring nature, which we consider necessary to present fairly our financial position and results of operations at such dates and for such periods. The balance sheet data as of March 28, 2009 has been derived from our unaudited condensed consolidated financial statements which are not included in this prospectus. Results for the three months ended March 27, 2010 are not necessarily indicative of the results that may be expected for the entire fiscal year.

The selected historical consolidated financial data below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and notes thereto included in this prospectus.

17

Table of Contents

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||

| March 27, 2010 |

March 28, 2009 |

December 26, 2009 |

December 27, 2008 |

December 29, 2007 |

December 30, 2006 |

December 31, 2005 |

||||||||||||||||||||||

| (data presented in thousands, except for share and per share data and number of stores) | ||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||

| Net sales |

$ | 191,613 | $ | 172,555 | $ | 674,495 | $ | 601,540 | $ | 537,872 | $ | 486,026 | $ | 436,463 | ||||||||||||||

| Cost of goods sold |

126,599 | 115,543 | 457,573 | 405,659 | 360,346 | 326,523 | 290,243 | |||||||||||||||||||||

| Gross profit |

65,014 | 57,012 | 216,922 | 195,881 | 177,526 | 159,503 | 146,220 | |||||||||||||||||||||

| Selling, general and administrative expenses |

46,942 | 43,941 | 173,144 | 158,713 | 143,544 | 128,821 | 126,514 | |||||||||||||||||||||

| Related party expenses |

— | 370 | 2,446 | 1,523 | 1,365 | 1,356 | 1,799 | |||||||||||||||||||||

| Income from operations |

18,072 | 12,701 | 41,332 | 35,645 | 32,617 | 29,326 | 17,907 | |||||||||||||||||||||

| Extinguishment of debt and other (1) |

552 | — | 2,016 | — | — | (366 | ) | 11,573 | ||||||||||||||||||||

| Interest expense, net |

2,927 | 5,007 | 18,636 | 21,137 | 22,045 | 21,788 | 19,386 | |||||||||||||||||||||

| Income (loss) before provision (benefit) for income taxes |

14,593 | 7,694 | 20,680 | 14,508 | 10,572 | 7,904 | (13,052 | ) | ||||||||||||||||||||

| Provision (benefit) for income taxes |

5,867 | 3,132 | 8,014 | 6,341 | 3,792 | 3,242 | (5,063 | ) | ||||||||||||||||||||

| Income (loss) before cumulative effect of accounting change |

8,726 | 4,562 | 12,666 | 8,167 | 6,780 | 4,662 | (7,989 | ) | ||||||||||||||||||||

| Cumulative effect of accounting change |

— | — | — | — | — | — | 2,280 | |||||||||||||||||||||

| Net income (loss) |

8,726 | 4,562 | 12,666 | 8,167 | 6,780 | 4,662 | (5,709 | ) | ||||||||||||||||||||

| Preferred stock dividends in arrears |

— | 2,577 | 7,692 | 9,279 | 9,105 | 8,412 | 7,771 | |||||||||||||||||||||

| Net income (loss) available to common stockholders |

$ | 8,726 | $ | 1,985 | $ | 4,974 | $ | (1,112 | ) | $ | (2,325 | ) | $ | (3,750 | ) | $ | (13,480 | ) | ||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||||||||||

| Basic |

26,692,983 | 14,175,906 | 16,238,338 | 14,175,906 | 14,175,906 | 14,175,906 | 14,175,906 | |||||||||||||||||||||

| Diluted |

27,708,463 | 15,969,484 | 17,748,371 | 14,175,906 | 14,175,906 | 14,175,906 | 14,175,906 | |||||||||||||||||||||

| Net income (loss) per share: |

||||||||||||||||||||||||||||

| Basic |

$ | 0.33 | $ | 0.14 | $ | 0.31 | $ | (0.08 | ) | $ | (0.16 | ) | $ | (0.26 | ) | $ | (0.95 | ) | ||||||||||

| Diluted |

$ | 0.31 | $ | 0.12 | $ | 0.28 | $ | (0.08 | ) | $ | (0.16 | ) | $ | (0.26 | ) | $ | (0.95 | ) | ||||||||||

| Other Financial Data: |

||||||||||||||||||||||||||||

| Depreciation and amortization of fixed and intangible assets |

$ | 5,414 | $ | 5,078 | $ | 21,095 | $ | 17,483 | $ | 14,882 | $ | 13,728 | $ | 13,020 | ||||||||||||||

| Operating Data: |

||||||||||||||||||||||||||||

| Number of stores at end of period |

453 | 418 | 438 | 401 | 341 | 306 | 275 | |||||||||||||||||||||

| Net sales per store (2) |

$ | 373 | $ | 363 | $ | 1,361 | $ | 1,303 | $ | 1,355 | $ | 1,332 | $ | 1,317 | ||||||||||||||

| Comparable store sales growth (3) |

6.2 | % | 5.1 | % | 5.2 | % | 6.2 | % | 6.2 | % | 6.6 | % | 0.1 | % | ||||||||||||||

| Average square footage per store |

3.7 | 3.7 | 3.7 | 3.7 | 3.7 | 3.7 | 3.7 | |||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Working capital |

$ | 62,451 | $ | 56,635 | $ | 50,416 | $ | 52,285 | $ | 51,175 | $ | 38,248 | $ | 28,268 | ||||||||||||||

| Total assets |

475,687 | 463,124 | 469,257 | 463,705 | 428,330 | 411,670 | 408,601 | |||||||||||||||||||||

| Total debt, including capital lease obligations |

123,654 | 186,326 | 123,946 | 186,382 | 165,000 | 171,500 | 177,127 | |||||||||||||||||||||

| (1) | For the first fiscal quarter of 2010, extinguishment of debt includes $0.3 million for the write-off of the related portion of deferred financing fees and a portion of the unrecognized loss of our terminated interest rate swap of and $0.2 million, related to the redemption of a portion of our Notes during January 2010. For Fiscal 2009 extinguishment of debt includes $0.4 million for the premium on the repurchase of a portion of our Notes, along with the write-off of the related portions of deferred financing fees and a portion of the unrecognized loss of our terminated interest rate swap of $0.7 million and $0.6 million, respectively, as well as a $0.3 million write-off of deferred financing fees related to the repayment of our former revolving credit facility which was terminated in September 2009. For |

18

Table of Contents

| Fiscal 2005 extinguishment of debt includes $11.1 million of expenses related to the repayment of our previous debt upon our issuance of our Notes (which consists of $7.7 million of original issue discount related to the allocation of value to the warrants and Vitamin Shoppe, Inc. (formerly VS Holdings, Inc.) Preferred Stock and $3.4 million of deferred financing fees from the previous debt), as well as $0.4 million in expense relating to our interest rate swap. |

| (2) | Net sales per store is calculated by dividing retail net sales by the number of stores open at the end of the period. |

| (3) | A store is included in comparable store sales after 410 days of operation. |

19

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of our Financial Condition and Results of Operations should be read in conjunction with the consolidated financial statements and notes thereto included in this prospectus. The discussion in this section contains forward-looking statements that are based upon current expectations. The forward-looking statements contained herein include, without limitation, statements concerning future revenue sources and concentration, gross profit margins, selling and marketing expenses, research and development expenses, general and administrative expenses, capital resources, additional financings or borrowings and additional losses and are subject to risks and uncertainties including, but not limited to, those discussed below and elsewhere in this prospectus that could cause actual results to differ materially from the results contemplated by these forward-looking statements. We also urge you to carefully review the information set forth in “Special Note Regarding Forward-Looking Statements” and “Risk Factors.”

Overview

We are a leading specialty retailer and direct marketer of vitamins, minerals, herbs, supplements, sports nutrition and other health and wellness products. For each of the past three years, we have been the second largest in retail sales and the fastest growing national VMS specialty retailer. We market over 700 different nationally recognized brands as well as our proprietary Vitamin Shoppe, BodyTech and MD Select brands. We believe we offer the greatest variety of products among VMS retailers with approximately 8,000 SKUs offered in our typical store and an additional 12,000 SKUs available through our Internet and catalog direct sales channels. Our broad product offering enables us to provide our target customers with a selection of products not readily available at other specialty VMS retailers or mass merchants, such as supermarkets and drugstore chains. We target the dedicated, well-informed VMS consumer and differentiate ourselves by providing high quality products at competitive prices in an educational and high-touch customer service environment. We believe our extensive product offering, together with our well-known brand name and emphasis on product education and customer service, help us bond with our target customer and serve as a foundation for strong customer loyalty.

Our company was founded as a single store in New York, New York in 1977. Our Vitamin Shoppe branded products were introduced in 1989. We were acquired in November 2002 by IPC and other investors.

Segment Information

We sell our products through two business segments: retail and direct.

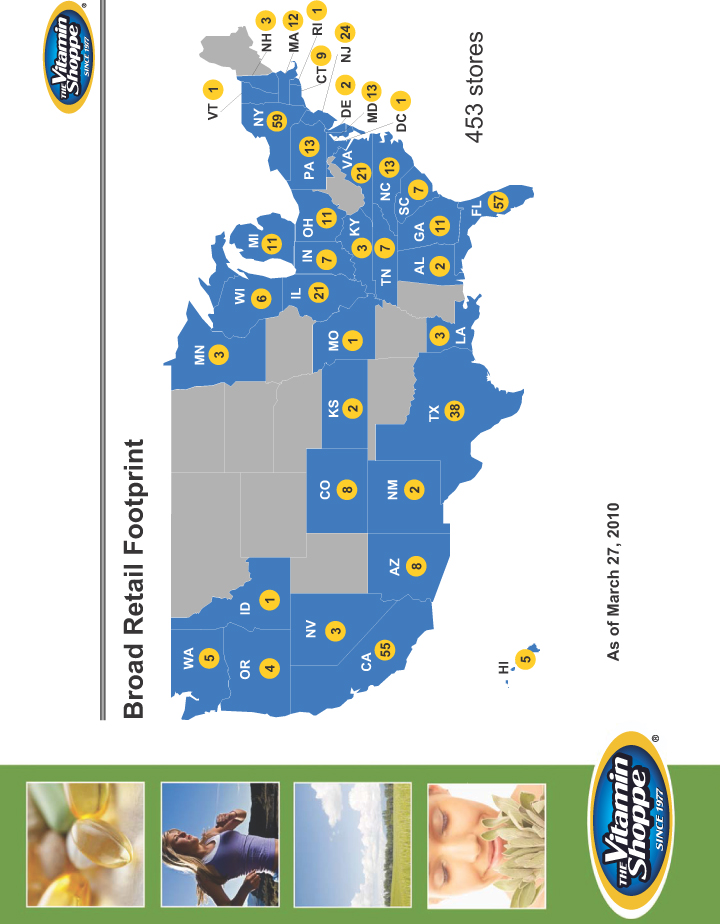

Retail

Since the beginning of Fiscal 2006 through Fiscal 2009, we have leveraged our successful store economic model by opening a total of 169 new stores. Over the past five years, we have expanded our presence in our existing markets as well as entered many new markets such as California, Texas, Michigan and Hawaii. As of March 27, 2010, we operated 453 stores in 37 states and the District of Columbia located in high-traffic regional centers. In the first three months of Fiscal 2010, our retail segment generated net sales of $169.1 million, representing a 11.5% increase over the first three months of Fiscal 2009 retail net sales of $151.6 million. We have achieved positive comparable store sales for 16 consecutive years (prior to which we did not track comparable store sales), including comparable store sales growth of 5.2% and 6.2% in 2009 and 2008, respectively, and 6.2% and 5.1% for the three months ended March 27, 2010 and March 28, 2009, respectively. In Fiscal 2009, our retail segment generated net sales of $596.3 million, representing a 14.1% increase over Fiscal 2008 retail net sales of $522.5 million. From Fiscal 2006 to Fiscal 2009, we have grown our net sales in our retail segment at approximately a 13.5% CAGR. From Fiscal 2006 to Fiscal 2009, we have grown our store base at a 6.4% CAGR.

20

Table of Contents

Direct

We sell our products directly to consumers through our websites, primarily www.vitaminshoppe.com. Our websites and our catalog complement our in-store experience by extending our retail product offerings with an additional 12,000 SKUs that are not available in our stores and enable us to access customers outside our retail markets and those who prefer to shop online. Catalog sales were not material in Fiscal 2009, and are expected to remain immaterial in the future, as customers migrate to our website and stores. In Fiscal 2009 we increased the number of active online customers, defined by shopping frequency and annual dollars spent, by approximately 60,000 to more than 460,000. In the first three months of Fiscal 2010, our direct segment generated net sales of $22.6 million representing a 7.8% increase over the first three months of Fiscal 2009 direct net sales of $20.9 million. In Fiscal 2009, the direct segment generated net sales of $78.2 million representing a 1.0% decrease over Fiscal 2008 direct net sales of $79.0 million.

Trends and Other Factors Affecting Our Business

The VMS industry in the U.S. is highly fragmented, and based on information from the NBJ and public filings with the SEC, no single industry participant accounted for more than 5% of total industry sales in 2008. Retailers of VMS products primarily include specialty retailers and mass merchants, such as drugstores and supermarkets. The specialty retailers typically cater to the more sophisticated VMS customer by focusing on selection and customer service, while the mass merchants generally offer a limited assortment comprised of more mainstream products with less customer care. Specialty retailers comprised the largest segment of the market in 2008, with 37% market share, sales in which are forecasted to grow by 4.7% annually through 2014, according to the NBJ.

According to the NBJ, growth in the U.S. nutritional supplement industry from 2006 through 2008 has been led by specialty supplements, which have grown due to increasing popularity of condition-specific products, including glucosamine / chondroitin (for joint health), homeopathics (for miscellaneous conditions), fish oils (for cardiovascular health), Coenzyme Q10 (CoQ10) (for energy and cardiac health), vitamin D (for bone support through better calcium absorption) and probiotics (for digestive health). Consumers use nutritional supplements to improve their lifestyles, support specific health conditions, and keep themselves feeling younger and more active. According to the NBJ from 2009 to 2014, the U.S. specialty supplement product category is expected to grow at a 5.9% CAGR, or approximately 38% faster than the overall industry. The specialty supplements product category represented 17.9% of the total U.S. nutritional supplement industry in 2008. By way of comparison, specialty supplements, the fastest growing product category in the VMS industry, generated 26.9% of our Fiscal 2009 net sales. We over-index our concentration in specialty supplements to focus on target customers who emphasize health and wellness as part of their lifestyle.

Sports nutrition products represented approximately 10.8% of the total U.S. nutritional supplement industry in 2008. By way of comparison, sports nutrition products, grouped in a manner consistent with NBJ’s data, generated approximately 29.1% of our Fiscal 2009 net sales. We believe our sports nutrition offering emphasizes products such as protein powders which appeal to our customers’ emphasis on health and wellness rather than products taken in conjunction with a body building regimen. From 2009 to 2014, the sports nutrition product category is expected to grow at a 5.5% CAGR, representing the second fastest growing product category in the VMS industry.

We believe that one of the primary trends driving the growth in the industry is the aging U.S. population. The total U.S. population of people 50 and older is expected to increase to 115 million people in 2018 from 94 million people in 2008, a CAGR of 2.1%, which is more than twice the overall population growth rate. The aging Baby Boomer generation comprises a significant and increasing part of the 50 and older population.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

21

Table of Contents