Attached files

| file | filename |

|---|---|

| EX-10.5 - GENERAL RELEASE AGREEMENT WITH PAUL SUK - Li3 Energy, Inc. | v184525_ex10-5.htm |

| EX-10.4 - SPLIT-OFF AGREEMENT FOR MYSTICA CANDLE - Li3 Energy, Inc. | v184525_ex10-4.htm |

| EX-21.1 - SUBSIDIARIES OF REGISTRANT - Li3 Energy, Inc. | v184525_ex21-1.htm |

| EX-10.14 - ENGAGEMENT LETTER WITH MARIN MANAGEMENT SERVICES - Li3 Energy, Inc. | v184525_ex10-14.htm |

| EX-10.17 - NOTO SHARE PURCHASE AGREEMENT - Li3 Energy, Inc. | v184525_ex10-17.htm |

| EX-10.16 - MASTER OPTION AGREEMENT WITH LACUS MINERALS - Li3 Energy, Inc. | v184525_ex10-16.htm |

| EX-10.15 - ASSIGNMENT AGREEMENT WITH PUNA LITHIUM - Li3 Energy, Inc. | v184525_ex10-15.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): May 14, 2010

Li3

Energy, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-127703

|

20-3061907

|

|

(State

or Other Jurisdiction

|

(Commission

File

|

(I.R.S.

Employer

|

|

of

Incorporation)

|

Number)

|

Identification

Number)

|

Av.

Pardo y Aliaga 699 Of. 802

San

Isidro, Lima, Peru

(Address

of principal executive offices, including zip code)

(51)

1-212-1040

(Registrant’s

telephone number, including area code)

Copy

to:

Adam S.

Gottbetter, Esq.

Gottbetter

& Partners, LLP

488

Madison Avenue, 12th Floor

New York,

NY 10022

Phone: (212)

400-6900

Facsimile: (212)

400-6901

(Former name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Table

of Contents

|

Forward-Looking

Statements

|

1

|

||

|

Item 8.01

|

Other

Events

|

2

|

|

|

Explanatory

Note

|

2

|

||

|

Description

of Business

|

3

|

||

|

Description

of Properties

|

21

|

||

|

Risk

Factors

|

21

|

||

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

34

|

||

|

Security

Ownership of Certain Beneficial Owners and Managment

|

37

|

||

|

Directors,

Executive Officers, Promoters and Control Persons

|

40

|

||

|

Executive

Compensation

|

44

|

||

|

Certain

Relationships and Related Transactions

|

44

|

||

|

Market

Price of and Dividends on Common Equity and Related Stockholder

Matters

|

45

|

||

|

Recent

Sales of Unregistered Securities

|

46

|

||

|

Description

of Securities

|

47

|

||

|

Legal

Proceedings

|

51

|

||

|

Indemnification

of Directors and Officers

|

51

|

||

|

Item 9.01

|

Financial

Statements and Exhibits.

|

52

|

|

|

Signatures

|

55

|

||

|

Exhibit Index

|

56

|

||

FORWARD-LOOKING

STATEMENTS

This

report contains “forward-looking statements.” All statements other

than statements of historical facts included in this Quarterly Report on Form

10-Q, including without limitation, statements in this Management’s Discussion

and Analysis of Financial Condition and Results of Operations regarding our

financial position, estimated working capital, business strategy, the plans and

objectives of our management for future operations and those statements preceded

by, followed by or that otherwise include the words “believe”, “expects”,

“anticipates”, “intends”, “estimates”, “projects”, “target”, “goal”, “plans”,

“objective”, “should”, or similar expressions or variations on such expressions

are forward-looking statements. We can give no assurances that the assumptions

upon which the forward-looking statements are based will prove to be correct.

Because forward-looking statements are subject to risks and uncertainties,

actual results may differ materially from those expressed or implied by the

forward-looking statements. There are a number of risks, uncertainties and other

important factors that could cause our actual results to differ materially from

the forward-looking statements, including, but not limited to, our ability to

identify appropriate corporate acquisition and/or joint venture opportunities in

the lithium mining sector and to establish the technical and managerial

infrastructure, and to raise the required capital, to take advantage of, and

successfully participate in such opportunities; future economic conditions;

political stability; and lithium prices.

Except as

otherwise required by the federal securities laws, we disclaim any obligations

or undertaking to publicly release any updates or revisions to any

forward-looking statement contained in this Report to reflect any change in our

expectations with regard thereto or any change in events, conditions or

circumstances on which any such statement is based.

1

Item

8.01 Other Events

EXPLANATORY

NOTE

Li3

Energy, Inc. (the “Company,” “we,” “us,” or “our”) is an exploration stage

mining company whose principal focus is identification, acquisition and

development of lithium brine properties in the Americas.

We were

incorporated on June 24, 2005, in Nevada as Mystica Candle Corp. We

were originally in the business of manufacturing, marketing and distributing

soy-blend scented candles and oils, but we could not continue with those

business operations because of a lack of financial results and

resources. We have redirected our focus, therefore, towards

identifying and pursuing options regarding the development of a new business

plan and direction.

In 2008

we engaged in discussions with NanoDynamics, Inc., a Delaware corporation

(“NanoDynamics”), regarding a possible business combination with NanoDynamics,

and with the permission of NanoDynamics, we changed our name to NanoDynamics

Holdings, Inc. to facilitate these discussions. We determined not to

proceed with that business combination, however.

On

October 19, 2009, we changed our name to Li3 Energy, Inc., to reflect our plans

to focus our business strategy on the energy sector and related lithium mining

opportunities in North and South America.

On

February 23, 2010, we acquired 100% of the assets of the Loriscota, Suches and

Vizcachas Projects located respectively in the Regions of Puno, Tacna and

Moquegua, Peru. These projects consist solely of mineral claims and

have, and have had, no operations or revenues.

Prior to

this acquisition, we were a “shell company” (as such term is defined in Rule

12b-2 under the Securities Exchange Act of 1934, as amended). We

believe that as a result of the acquisition we have ceased to be a shell

company. Since exiting “shell company” status, we have acquired

certain additional assets and agreements, as described in this Current

Report.

The

information contained in this report, together with the information contained in

our Annual Report on Form 10-K for the fiscal year ended June 30, 2009, and our

subsequent Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K,

as filed with the Securities and Exchange Commission, constitute the current

“Form 10 information” necessary to satisfy the conditions contained in Rule

144(i)(2) under the Securities Act of 1933, as amended.

2

DESCRIPTION

OF BUSINESS

Overview

Li3

Energy is an exploration stage mining company whose principal focus is

identification, acquisition, and development of lithium brine properties in the

Americas.

|

|

·

|

We

have closed on the purchase of options to acquire a 100% beneficial

interest in association placer mining claims covering up to approximately

60,600 acres in Big Smoky Valley near Tonopah in west central Nevada,

USA.

|

|

|

·

|

We

have also acquired mineral claims prospective for lithium and potassium

that cover a total area of 19,500 acres in

Peru.

|

|

|

·

|

We

have signed a definitive agreement for the purchase of options to acquire

an 85% beneficial interest in (a) lithium brine properties covering

approximately 70,000 acres in Argentina and (b) salt-mining claims on some

of the same salars covering approximately 9,000 acres that may be acquired

pursuant to certain options.

|

|

|

·

|

We

have signed a definitive agreement for the purchase of an Argentinean

corporation which beneficially owns a one hundred percent (100%) interest

in 2,995 acres also situated on promising brine salars in

Argentina.

|

|

|

·

|

We

have also signed a letter of intent to purchase options to acquire up to

an aggregate 80% interest in eleven lithium brine properties covering

123,000 acres in Chile.

|

|

|

·

|

In

addition, we have signed another letter of intent to acquire mineral

claims on approximately 4,250 acres of lithium brine assets in

Argentina.

|

Each of

these completed or pending acquisitions is described in more detail

below.

In

November and December 2009, we raised gross proceeds from private placements of

equity of $3,500,000 to fund acquisition, due diligence and initial

exploration.

Our

strategic plan is to explore and develop our existing projects and to identify

additional opportunities and generate new projects with near-term production

potential, with the goal of becoming a significant player in the lithium

industry.

The

Company believes that successful execution of the first phase of its strategic

acquisition program will establish Li3 Energy as a major holder of prime lithium

brine acreage in Chile, Argentina, Peru and the United States among junior

lithium explorers.

Lithium

and Lithium Mining

Lithium

is the lightest metal. It is a soft, silver white metal and belongs

to the alkali group of elements, which includes sodium, potassium, rubidium,

caesium and francium. The chemical symbol for lithium is “Li,” and its atomic

number is 3.

3

Like the

other alkali metals, lithium has a single valence electron that is easily given

up to form a cation (positively charged ion). Because of this, it is a good

conductor of both heat and electricity and highly reactive, though it is the

least reactive of the alkali metals. Lithium possesses a low

coefficient of thermal expansion (which describes how the size of an object

changes with a change in temperature) and the highest specific heat capacity (a

measure of the heat, or thermal energy, required to increase the temperature of

a given quantity of a substance by one unit of temperature) of any solid

element.

No other

metal is as lightweight, better at holding a charge or as good at dissipating

heat as Lithium. These properties make lithium an excellent material for

manufacturing batteries (lithium-ion batteries). According to the

U.S. Geological Survey’s “Mineral Commodity Summaries 2010,” batteries accounted

for 23% of lithium end-usage globally, and we expect demand for lithium from the

battery segment to grow along with demand for such

batteries. Although lithium markets vary by location, global

end-usage was estimated by the U.S. Geological Survey as

follows: ceramics and glass, 31%; batteries, 23%; lubricating

greases, 10%; air treatment, 5%; continuous casting, 4%; primary aluminum

production, 3%; and other uses, 24%. Lithium use in batteries

expanded significantly in recent years, because rechargeable lithium batteries

are being used increasingly in portable electronic devices and electrical

tools.

As

mentioned earlier, lithium belongs to the alkali group of metals. This group of

metals is typically extracted from solutions called brines, which are associated

with evaporite deposits. Lithium is also contained in the mineral

spodumene, which occurs in a rock called pegmatite. To a lesser

extent lithium occurs as a component of certain clay minerals

Historically,

and especially during the period leading up to and during World War II, lithium

was designated a strategic metal, heavily used in the aircraft industry because

it is light and strong. During this period the mineral spodumene (a lithium

aluminum silicate) was mined by open pit hard rock mining methods and processed

to recover the lithium. During the post-war period, lithium

production from the higher cost hard rock mines was replaced by the lower cost

extraction of lithium from the mineral rich brines associated with evaporite

deposits. Evaporite deposits occur in environments characterized by arid

conditions with extremely high evaporation rates. This environment typically

occurs at high altitudes, greater than 12,000 feet above sea level, so evaporite

deposits occur in only a very few locations in the world, including China (the

province of Qinghai and the Autonomous Region of Tibet); the Puna Plateau, a

high altitude plateau covering part of Argentina, Chile, Bolivia and the

southern portion of Peru; and in a small region in Nevada, which is the core of

what is called the Great Basin of the western United States. Over 70%

of the world’s lithium is produced from the brines associated with the evaporite

deposits on the Puna Plateau of South America.

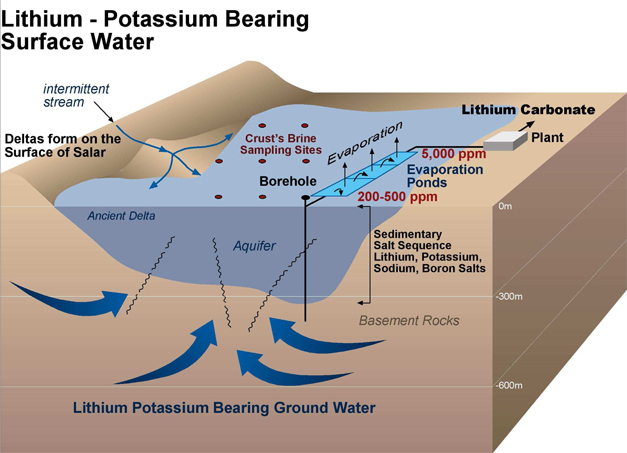

Brine

extraction (mining) and the recovery of lithium and other economic compounds is

analogous to pumping water from an aquifer, but instead of fresh water, the

water contains a variety of mineral salts in solution, including lithium,

potassium (K), magnesium (Mg) and sodium (Na). This form of “mining”

is much more efficient, cost effective and environmentally friendly than open

pit mining. Lithium production from spodumene can typically cost in

the range of $4,300 to $4,800 per metric ton of lithium carbonate and is a

process that is highly sensitive to energy costs. On the other hand,

lithium production from brines can be accomplished at costs in the range of

$2,200 to $2,600 per metric ton of lithium carbonate. However, the

processing cost can vary by a wide range, depending largely on:

4

|

|

·

|

lithium

concentration in the particular

brine;

|

|

|

·

|

evaporation

rates at the site, which determine how quickly the brine can be

concentrated; and

|

|

|

·

|

the

balance of other minerals in the brine, which effects the degree of

processing needed to remove

impurities.

|

Lithium

in Batteries

Lithium

demand is being driven by its increasing use in the batteries of portable

consumer electronics, including mobile phones and laptop computers, and in a

range of industrial applications including ceramics and

lubricants. The most dramatic increase in demand is being spurred by

auto makers racing to bring lithium-ion battery powered and hybrid electric cars

to market.

A

lithium-ion battery (Li-ion battery) is a type of rechargeable battery in which

lithium ions move from the anode (negative terminal) to the cathode (positive

terminal) during discharge, and from the cathode to the anode when

charging. Lithium-ion batteries are one of the most popular types of

battery, because they have one of the best energy-to-weight ratios, no memory

effect (the effect in which certain other rechargeable batteries lose their

maximum energy capacity if they are repeatedly recharged after being only

partially discharged) and a slow loss of charge when not in use.

Rechargeable

battery materials used in electric vehicles include lead-acid (traditional “wet”

and gel or “valve regulated”), nickel-cadmium, nickel-metal-hydride,

lithium-ion, lithium-ion polymer, and, less commonly, zinc-air and molten

salt. Ideally, a battery for an electric car needs to be light,

small, energy dense, quick to recharge, relatively inexpensive, long lasting,

and safe. Today’s electric and hybrid vehicles are primarily powered

by nickel-metal-hydride (NiMH) batteries. NiMH batteries are safe,

abuse-tolerant and offer much longer life cycles than older lead-acid batteries,

while providing reasonable energy density. However, NiMH

batteries are more expensive than lead-acid batteries, as a result of the high

nickel content.

Li-ion

batteries have a higher energy density than most other types of

rechargeables. A Li-ion battery can achieve power density of 100-170

watt hours (Wh) per kilogram (kg) of weight, versus NiMH’s 30-80

Wh/kg. This means that for their size or weight they can store more

energy than other rechargeable batteries. Li-ion batteries also operate at

higher voltages than other rechargeables, typically about 3.7 volts for Li-ion

vs. 1.2 volts for NiMH or NiCd. This means a single cell can often be

used rather than multiple NiMH or NiCd cells.

Finally,

Li-ion batteries have a lower self discharge rate than other types of

rechargeable batteries. This means that once they are charged they

will retain their charge for a longer time than other types of rechargeable

batteries. NiMH and NiCd batteries can lose anywhere from 1-5% of

their charge per day, (depending on the storage temperature) even if they are

not installed in a device. Li-ion batteries, on the other hand, can retain most

of their charge even after months of storage.

5

Ideal

Brine Conditions

The most

important metrics when evaluating lithium brine resources are:

|

|

1)

|

lithium

content;

|

|

|

2)

|

evaporation

rate;

|

|

|

3)

|

magnesium

to lithium ratio;

|

|

|

4)

|

potassium

content; and

|

|

|

5)

|

sulphate

to lithium ratio.

|

The boron

content is also important, as it allows for the production of another saleable

product, boric acid.

The

lithium concentration in the brines is typically measured in parts per million

(ppm) or weight percentage. The higher the lithium concentration the

better. However, high local evaporation rates can compensate for

lower lithium concentrations.

Providing

that lithium contents are high enough, the magnesium to lithium (Mg:Li) ratio is

another important chemical feature in assessing favorable brine chemistry and

the ultimate economic viability of a site at an early stage. The

lower the ratio the better, as a high ratio means that, during the evaporation

process, an increasing amount of lithium will be trapped (“entrained”) in the

magnesium salts when they crystallize early. This will ultimately

lead to a lower lithium recovery rate and thus less

profitability. High Mg:Li ratios also generally mean that more soda

ash reagent is required during the processing of the brine (as described below)

and, therefore, may add significantly to costs.

The

potassium (K) concentration in the brines is typically measured as a weight

percentage. The higher the K concentration the better.

The lower

the sulphate (SO4) to

lithium ratio in the final lithium brine pond, the more the brine will be

amenable to lithium extraction via the conventional solar evaporation

process. This is because lithium sulphate (Li2SO4) is highly

soluble and so, to the extent that it is able to form, the lithium recovery will

suffer.

Key

Stages of Lithium Recovery

The most

economic way to recover lithium from a salar (a dry lake or salt flat) is by

solar evaporation. However, the process is subject to natural

conditions, and the evaporation rate, relative humidity, wind velocity,

temperature and brine composition have a tremendous influence on the solar pond

requirements and in turn on pumping and settling rates to meet production

quotas.

6

Each

lithium recovery process has a unique design based on the concentrations of Li,

Na, K, Mg, calcium (Ca) and SO4 in the

brine, and, although there may be some similarities, each salar has its own

customized methodology for optimum recovery due to the varying ionic

concentrations. Wells are drilled, and the mineral rich brine is

pumped to the surface into a series of large shallow ponds of increasing

concentration. As water evaporates, the concentration of minerals in

solution increases. The brine evaporates over an 18-24 month period

until it has a sufficient concentration of lithium salts. At that

point, the concentrate is shipped by truck or pipelined to processing plants

where it is converted to usable salt products. In the plant, sodium

carbonate (soda ash) is added to precipitate lithium carbonate, which is dried

and shipped to end users to be further processed into pure lithium

metal. The by-products such as potassium chloride (potash), sodium

borate (borax) and other salts may also be recovered and sold to end

users.

The

primary reagents used to produce lithium from brine are lime and soda ash. Both

substances are natural materials, commonly used in many processes and have no

detrimental environmental effect when used properly. Other than solar energy,

only minor amounts of fuels are consumed in the production process (pumping the

brines into the ponds, etc.).

Potentially

economic salts produced from the salar brine are NaCl, carnallite, sylvinite and

bischoffite, as well as the final end-point brine. The chemical pond

to pond process from the brine feed from the salar to the end-point brine ready

for the processing plant is as follows:

|

|

·

|

Calcium

Chloride (CaCl2) is

added at the beginning in the first pond in order to precipitate out most

of the sulphate (SO4) in

the form of gypsum (CaSO4). Removal

of the sulphate is important, as it is detrimental in downstream

processing. Furthermore, the gypsum itself has multiple uses

from agriculture to construction.

|

|

|

·

|

In

the next two ponds and after solar evaporation, sylvinite will begin to

precipitate, which is a combination of table salt and potash

(KCl). The sylvinite can be harvested and sent to a froth

flotation circuit to produce

potash.

|

|

|

·

|

Finally,

the sequential ponding process moves to the lithium ponds until the

end-point brine is sufficiently rich in lithium. The lithium is

still largely in the final ponds, because it is extremely soluble (likes

to stay dissolved in solution), although there will be some lithium

entrained in Mg and K salts in previous

ponds.

|

7

Global

Market

We

believe that the lithium mining industry is just under $1 billion in market size

in terms of annual sales of lithium carbonate, and is characterized by a high

degree of geographic and corporate concentration. In 2008, Chile produced 46% of

the lithium carbonate worldwide, while Argentina and Australia produced 14% and

23%, respectively.

At the

World Lithium Supply and Markets 2009 conference in Santiago, Chile, the world’s

top three lithium producers, Sociedad Quimica y Minera de Chile SA (“SQM”),

Chemetall Lithium and FMC Lithium, along with research groups TRU Group and

Roskill, presented an outlook for lithium. According to the forecast, world

lithium demand is expected to grow as much as three-fold in just over ten years.

Growth is driven by secondary (rechargeable) batteries and electric vehicle (EV)

batteries. Current demand for lithium, measured as lithium carbonate equivalent

(LCE), is around 110,000 metric tons per annum (tpa). This is

expected to rise to around 250,000 to 300,000 tpa in 2020 driven by rechargeable

batteries and EV batteries, according to the outlook. Lithium

carbonate is approximately 18.9% lithium by weight, so each metric ton of LCE

includes approximately 189 kilograms of lithium.

8

As part

of the American Recovery and Reinvestment Act of 2009, the U.S. Department of

Energy funded $2.4 billion in grants to accelerate the development of United

States manufacturing capacity for batteries and electric-drive components and

for the deployment of electric-drive vehicles. The grants, designed to help

launch an advanced battery industry in the United States, represent the single

largest investment in advanced battery technology for hybrid and electric-drive

vehicles ever made. Lithium-ion battery technology figured prominently in the

grant awards, with approximately $940 million in grant money received by lithium

battery materials suppliers, lithium battery manufacturers and a lithium battery

recycler. While we do not expect to receive any of this grant money

directly, we believe that it may positively influence demand for lithium,

generally.

According

to the U.S. Geological Survey (USGS), Chile is the leading lithium producer in

the world. Argentina, China, and the United States are also major

producers. The 2010 edition of the USGS Mineral Commodity Summaries

gives the following estimated world lithium mine production and reserves (in

metric tons of lithium content), including the footnoted information:

|

Mine

production

|

Reserves1

|

|||||||||||

|

2008

|

2009

(est.)

|

|||||||||||

|

United

States

|

Withheld

|

Withheld

|

38,000 | |||||||||

|

Argentina

|

3,170 | 2,200 | 800,000 | |||||||||

|

Australia

|

6,280 | 4,400 | 580,000 | |||||||||

|

Brazil

|

160 | 110 | 190,000 | |||||||||

|

Canada

|

690 | 480 | 180,000 | |||||||||

|

Chile

|

10,600 | 7,400 | 7,500,000 | |||||||||

|

China

|

3,290 | 2,300 | 540,000 | |||||||||

|

Portugal

|

700 | 490 |

Not

available

|

|||||||||

|

Zimbabwe

|

500 | 350 | 23,000 | |||||||||

|

World

total (rounded)

|

325,400 |

2

|

318,000 |

2

|

9,900,000 | |||||||

Identified

lithium resources3 total

2.5 million metric tons in the United States and approximately 23 million metric

tons in other countries. Among the other countries, identified lithium resources

for Bolivia and Chile total 9 million metric tons and in excess of 7.5 million

metric tons, respectively. Argentina and China each contain approximately 2.5

million metric tons of identified lithium resources.

|

1

|

Reserves

means that part of the reserve base which could be economically extracted

or produced. The term reserves need not signify that extraction facilities

are in place and operative. Reserves include only recoverable materials.

The reserves base is that part of an identified resource that meets

specified minimum physical and chemical criteria related to current mining

and production practices, including those for grade, quality, thickness,

and depth. The reserve base is the in-place demonstrated (measured plus

indicated) resource from which reserves are estimated. It may encompass

those parts of the resources that have a reasonable potential for becoming

economically available within planning horizons beyond those that assume

proven technology and current economics. The reserve base includes those

resources that are currently economic (reserves), marginally economic

(marginal reserves), and some of those that are currently subeconomic

(subeconomic resources).

|

|

2

|

Excludes

U.S. production.

|

9

|

3

|

Identified

resources are resources whose location, grade, quality, and quantity are

known or estimated from specific geologic evidence. Identified resources

include economic, marginally economic, and subeconomic

components.

|

Our

Projects

Nevada

On March

12, 2010, pursuant to an Asset Purchase Agreement, dated as of February 16, 2010

(the “Nevada APA”), with Next Lithium Corp., an Ontario corporation, and Next

Lithium (Nevada) Corp., a Nevada corporation (together, “Next Lithium”), we

purchased all of Next Lithium’s interests in and rights under (a) an agreement

dated October 30, 2009 (the “CSV, LM and MW Option Agreement”), pursuant to

which Geoxplor Corp, a Nevada corporation (“Geoxplor”), has granted to Next

Lithium the sole, exclusive and irrevocable right and option (the “CSV, LM and

MW Option”), exercisable in the manner described in the CSV, LM and MW Option

Agreement, to acquire a 100% beneficial interest in the placer mining claims

known as the CSV Placer Mineral Claims, LM Placer Mineral Claims and MW Placer

Mineral Claims; and (b) an agreement dated October 30, 2009 (the “BSV Option

Agreement,” and, together with the CSV, LM and MW Option Agreement, the “Option

Agreements”), pursuant to which Geoxplor has granted to Next Lithium the sole,

exclusive and irrevocable right and option (the “BSV Option,” and, together with

the CSV, LM and MW Option, the “Options”), exercisable in the manner described

in the BSV Option Agreement, to acquire a 100% beneficial interest in the placer

mining claims known as the BSV Placer Mineral Claims; as well as all associated

rights and records.

Upon our

becoming the owner of a 100% interest in the CSV Placer Mineral Claims, LM

Placer Mineral Claims and MW Placer Mineral Claims, in accordance with the CSV,

LM and MW Option Agreement, we shall pay Geoxplor a 3.0% net smelter return

royalty on the proceeds from production of all ores, minerals, metals,

concentrates and mineral resources (an “NSR”) derived from mining operations on

the related properties. We may, at any time after the date of grant

of the NSR and up to the date of commencement of commercial production on such

properties, purchase all or any portion of such NSR from Geoxplor for $3 million

or the applicable portion thereof. Similarly, upon our becoming the

owner of a 100% interest in the BSV Placer Mineral Claims, in accordance with

the BSV Option Agreement, we shall pay Geoxplor a 3.0% NSR derived from mining

operations on the related properties. We may, at any time after the

date of grant of the NSR and up to the date of commencement of commercial

production on such properties, purchase all or any portion of such NSR from

Geoxplor for $3 million or the applicable portion thereof.

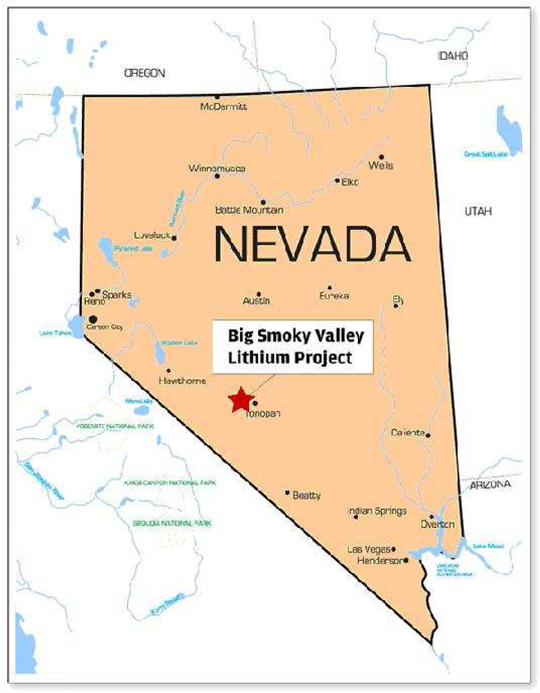

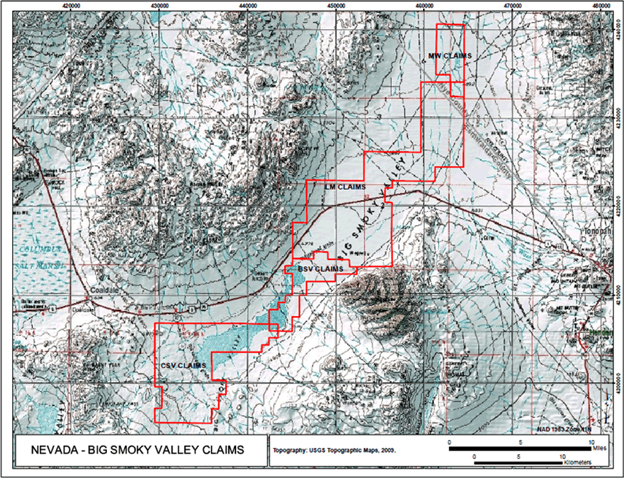

The CSV

Placer Mineral Claims, LM Placer Mineral Claims, MW Placer Mineral Claims and

BSV Placer Mineral Claims (the “Nevada Claims”) cover up to approximately

60,600 acres in Big Smoky Valley near Tonopah in west central

Nevada. Below are maps showing the location of the Nevada

Claims.

10

11

Mineral

deposit properties in Nevada are located either by lode or placer

claims.

Mineral

deposit properties subject to lode claims include classic veins or lodes having

well-defined boundaries in rock. They also include other rock in-place bearing

valuable minerals and may be broad zones of mineralized rock.

Mineral

deposit properties subject to placer claims include all those deposits not

subject to lode claims. Originally, these included only deposits of

unconsolidated materials, such as sand and gravel, containing free gold or other

minerals.

During

the 1970’s and 1980’s, the United States Geological Survey (“USGS”) carried out

a series of regional reconnaissance geological programs, including sampling and

drilling in Big Smoky Valley. As part of the USGS drill program, one hole was

drilled on the property covered by the Nevada Claims and a second hole was

drilled a short distance west. Both holes were reported to have intersected

geochemically anomalous concentrations of lithium in the brines, with grades up

to 365 parts per million. The exact location of these holes cannot be confirmed,

and as the reconnaissance program was designed to obtain regional geologic

information, the focus was geology not the intersection of aquifers, which may

or may not contain brine. However, these holes did confirm that the geologic

setting of the Big Smoky Valley is the same as the adjacent valley hosting the

Silver Peak Lithium brine mine operated by Chemitall. Gravity surveys over the

region also confirmed the existence of various structures that may have created

a favorable environment, which potentially could host commercially viable

lithium-rich brines. To date, however, we have no systematic brine sampling on

the Li3 properties in Big Smoky Valley.

12

Under the

terms of the Nevada APA, we acquired the Options and associated rights in

exchange for 4,000,000 restricted shares of our common stock. The

Nevada APA contains customary representations, warranties and indemnifications

by Next Lithium. 2,500,000 of these shares of our common stock will

be held in escrow for one year against any indemnifiable liabilities that may

arise. If the shares of our common stock retained by Next Lithium

cannot be resold under Rule 144 under the Securities Act of 1933 without

restriction at any time following the 13th month after closing due to our status

as a former “shell” company and our failure to file required reports with

the Securities and Exchange Commission, and not because of any fault of Next

Lithium, then we must register such shares for resale under the Securities

Act.

Also on

February 16, 2010, we, Next Lithium and Geoxplor entered into (a) an amendment

to each of the Option Agreements and (b) a consent to assignment, in which

Geoxplor consented to the assignment of the Option Agreements by Next Lithium to

us.

Under the

CSV, LM and MW Option Agreement, as amended, we paid to Geoxplor $311,607 on the

closing of the acquisition under the Nevada APA, subject to a $50,000 hold back

for a period of 12 months, conditioned on registration of all of the CSV Placer

Mineral Claims, LM Placer Mineral Claims and MW Placer Mineral Claims. For each

such claim (other than certain claims that are lode claims and certain claims

that are on land withdrawn by the Secretary of the Interior for a solar energy

study area) that is unable to be registered for any reason prior to the end of

such period, $500 will be forfeited by Geoxplor out of the $50,000 hold

back. In addition, on the closing of the acquisition under the Nevada

APA, Next Lithium assigned to Geoxplor 500,000 of the 4,000,000 restricted

shares of our common stock received by Next Lithium under the Nevada

APA. These 500,000 shares assigned to Geoxplor will carry “piggyback”

registration rights until the earlier of: (a) February 16, 2012 or (b) the date

on which all such shares may immediately be sold under Rule 144 during any

ninety- (90-) day period.

Under the

BSV Option Agreement, as amended, we were required to pay to Geoxplor $100,000

on April 30, 2010. In addition, on the closing of the

acquisition under the Nevada APA, Next Lithium assigned to Geoxplor 1,000,000 of

the 4,000,000 restricted shares of our common stock received by Next Lithium

under the Nevada APA. These 1,000,000 shares assigned to Geoxplor

carry “piggyback” registration rights until the earlier of: (a) February 16,

2012 or (b) the date on which all such shares may immediately be sold under Rule

144 during any ninety- (90-) day period.

We have

begun the permitting process for an exploration program, expect to begin the

program in the second half of calendar year 2010, and anticipate that such

program will include surface sampling, regional and detailed seismic surveys,

and diamond drilling and pumping tests. We estimate that the exploration program

will yield preliminary results by the end of calendar year

2010.

13

Peru

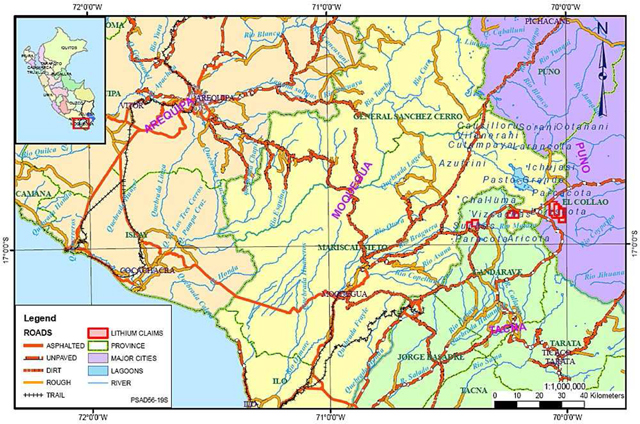

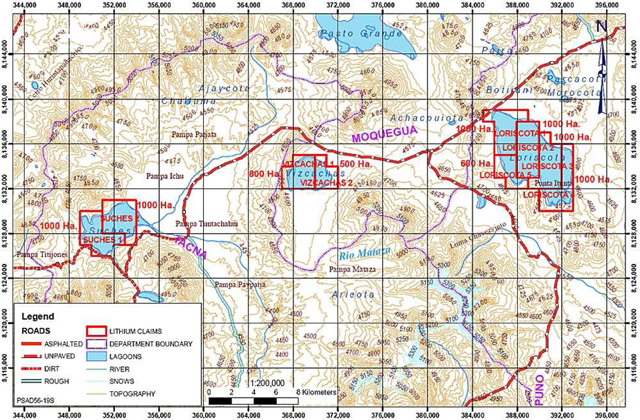

On

February 23, 2010, we acquired 100% of the assets of the Loriscota, Suches and

Vizcachas Projects located respectively in the Regions of Puno, Tacna and

Moquegua, Peru, from a private owner. The aggregate purchase price for these

assets was $50,000.

These

projects are prospective for lithium and potassium and comprise nine mineral

claims that cover a total area of 19,500 acres at an elevation of 14,000 feet

(approximately 4,300 meters) above sea level. The projects are in recently

reinterpreted areas previously studied by the Peruvian Mining Ministry in 1981,

whose survey concluded that the projects contain high lithium and potassium

values. Subsequent to the Mining Ministry’s survey, preliminary sampling was

conducted on these projects and found to contain similar lithium values reported

in the evaporite deposits in the southern parts of the Puna, some of which are

currently under development for commercial production.

We

believe that these Peruvian projects have excellent exploration and resource

potential given the encouraging result of the reconnaissance work completed by

the Peruvian Mining Ministry. However, to date there has been no systematic

brine sample reported on the prospective Li3 properties in Peru.

The maps

below show the project area and the locations of the Loriscota, Suches and

Vizcachas mineral claims.

14

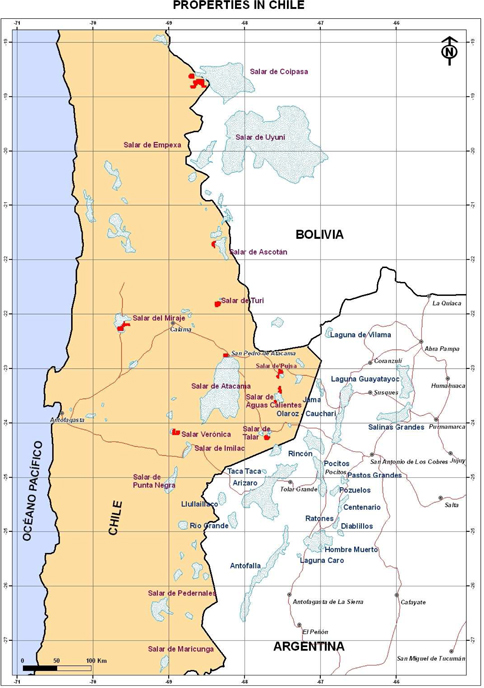

Chile

We have

signed a letter of intent to acquire the assets of Puna Lithium Corporation

(“Puna”). Puna has an option to acquire up to an aggregate eighty percent (80%)

interest in nine salars covering 123,000 acres on the Puna Plateau of Chile,

including the Salar de Atacama where SQM currently has two large production

facilities, one producing lithium carbonate and lithium hydroxide and the other

producing potassium sulphate and boric acid. The Salar de Atacama currently

contains the highest economic lithium concentrations known in the world as well

as some of the lowest processing costs due to its low magnesium content, high

evaporation rates and ability to operate year round.

To date

there has been no systematic brine sample reported on the prospective Li3

properties in Chile

The

transaction is subject to legal and financial due diligence by us and

negotiation of definitive documentation. The letter of intent contains, and any

definitive agreement will likely contain, customary exclusivity provisions and

other conditions to closing. There can be no assurance that this transaction

will be consummated.

15

The map

below shows the location of our prospective lithium properties in Chile as the

red shaded areas.

16

Argentina

(A) Puna Lithium

Transaction

Pursuant

to an Assignment Agreement dated as of March 12, 2010 (the “Assignment

Agreement”), we purchased all Puna’s interests in and rights under a letter of

intent dated November 23, 2009, as amended (the “Letter of Intent”), entered

into by and among Puna, Lacus Minerals S.A., an Argentinean corporation

("Lacus"), and the shareholders of Noto Energy S.A. ("Noto" and “Noto

Shareholders,” as applicable).

After the

assignment of the Letter of Intent under the Assignment Agreement, on March 12,

2010, we entered into a certain Master Option Agreement with Lacus (the “Master

Option Agreement”), for the acquisition of three options (collectively, the

“Options”), exercisable in the manner described in the Master Option Agreement,

to acquire up to an aggregate of eighty-five percent (85%) interest in: (a)

approximately 70,000 acres situated on prospective brine salars in Argentina,

known as Rincón,

Centenario and Pocitos (the “Master Lacus Properties”); and (b) salt-mining

claims on approximately 9,000 additional acres in Areas of Mutual Interest (as

defined below) on some of those same salars (the “Third Parties Properties” and,

together with the Master Lacus Properties, the “Lacus Properties”) that may be

acquired upon exercise of two options (collectively, the “Third Parties

Options”).

Also on

March 12, 2010, we entered into a certain Share Purchase Agreement with the Noto

Shareholders (the “Share Purchase Agreement”) for the acquisition of one hundred

percent (100%) of the issued and outstanding shares of Noto, an Argentinean

corporation which beneficially owns a one hundred percent (100%) interest over

2,995 acres also situated on promising brine salars in Argentina, known as

Cauchari (the “Noto Properties” and, together with the Lacus Properties, the

"Properties").

These

Properties are located mid-way between SQM’s producing brine mines on Salar de

Atacama in Chile and FMC’s producing mine on Hombre Muerto Salar in Argentina,

the fifth largest lithium producer in the world.

Under the

Assignment Agreement, we acquired the Letter of Intent and associated rights in

exchange for 8,000,000 restricted shares of our common stock, which payment is

subject – among other customary conditions – to closing under the Master Option

Agreement. The Assignment Agreement contains customary representations,

warranties and indemnifications by Puna. If the shares of our common stock

retained by Puna cannot be resold under Rule 144 under the Securities Act of

1933 without restriction at any time following the 13th month after closing due

to our status as a former “shell” company and our failure to file required

reports with the Securities and Exchange Commission, and not because of any

fault of Puna, then we must register such shares for resale under the Securities

Act. Moreover, the shares to be granted to Puna will carry “piggyback”

registration rights until the earlier of: (a) Mach 12, 2012 or (b) the date on

which all such shares may immediately be sold under Rule 144 during any 90-day

period.

17

Under the Master Option Agreement, we

would acquire on closing, the Options for an aggregate amount of $700,000 and

the obligation to complete a minimum of $3.7 million in work commitments in

respect to the Master Lacus Properties through the one year anniversary of the

closing date. The Master Option Agreement contains customary representations,

warranties and indemnifications by Lacus, and closing thereunder is subject to

customary conditions to closing, which is expected to occur on or prior to June

10, 2010. There can be no assurance, however, that the closing will

occur.

Provided

that we successfully acquire and maintain the Options, they will give us the

rights, respectively: (i) subject to certain conditions, to acquire (the “First

Option”), within 30 days of our delivery of the Feasibility Plan (as defined in

the Master Option Agreement) to Lacus (which is due no later than 18 months

after the closing), a 55% beneficial interest in and to the Lacus Properties in

exchange for $650,000 and the grant to Lacus of a 45% beneficial interest in any

other acreage consisting of lithium and potash mining properties which are in an

early stage of exploration outside of the Master Lacus Properties but within the

Centenario, Pocitos and Rincón Salars (any “Area of Mutual Interest”), including

without limitation the Third Parties Lacus Properties; (ii) subject to certain

conditions, to acquire, within 60 days of our delivery of the Feasibility Study

(as defined in the Master Option Agreement) to Lacus, an additional 20%

beneficial interest in the Master Lacus Properties and any Areas of Mutual

Interest in exchange for $2.2 million; and (iii) subject to certain conditions,

to acquire, within 30 days of our providing certain evidence of sufficient

financing to commence Commercial Production (as defined in the Master Option

Agreement), an additional 10% beneficial interest in the Master Lacus Properties

and any Areas of Mutual Interest in exchange for $5 million. Pursuant to the

Master Option Agreement, we are responsible to pay all future payments scheduled

to be made by Lacus under the Third Parties Options, which will amount to

approximately $300,000 over the next 12 months and another $600,000 over the six

months immediately thereafter, unless and until the Executive Committee,

consisting of one member nominated by us and one by Lacus, determines not to

exercise the Third Parties Options. In the event the First Option is terminated

without our exercising it, we will be required to transfer our entire interest

in any Areas of Mutual Interest to Lacus on a sunk cost basis and take certain

other actions in connection with the transfer of operational control of the

prospects from us to Lacus.

Under the

Share Purchase Agreement, we would acquire on closing, one hundred percent

(100%) of the issued and outstanding shares of Noto, for an aggregate of

$300,000. The Share Purchase Agreement contains customary representations,

warranties and indemnifications by Noto Shareholders, and closing thereunder is

subject – among other customary conditions to closing – to closing under the

Master Option Agreement.

(B) Rincón

South Transaction

In

addition to the Puna Lithium transaction referred to above, we have signed a

letter of intent dated as of January 28, 2010, with a private Argentinean

company to acquire additional lithium brine assets in the Puna region of

Argentina. The prospective location, known as the Rincón South Property (“Rincón South”), covers approximately

4,250 acres, comprising 18 claims on the southern portion of the Salar de

Rincón, located adjacent

to an advanced lithium brine pumping and production project owned by The

Sentient Group, and which was previously developed by Rincón Lithium Limited, a subsidiary

of Admiralty Resources NL, of Australia. The proposed Rincón South transaction is subject

to our geological, engineering, legal and financial due diligence. The letter of

intent contains, and any formal agreement will likely contain, customary

exclusivity provisions and other conditions to closing.

18

The map

below shows the location of our prospective lithium properties in Argentina as

the red shaded areas.

19

There has

been no systematic brine sample reported on our prospective Centenario, Pocitos,

Cauchari and Rincón

properties. However, over the years reconnaissance brine sampling by

various parties indicates that these salars contain elevated assays of lithium,

potassium, magnesium and boron. Statistically, these results

are not sufficient to determine the resource potential of the salars; however,

the results are significant in that they provide strong support that

further exploration is warranted to define the resource potential of each

salar.

In April

2010, we launched our lithium exploration program on the Properties. This

results-driven exploration is expected to include brine sampling, a reflective

seismic survey, drilling, pumping, hydro-geological and evaporation tests

followed by the preparation of a preliminary economic assessment on properties

of merit.

Competition

We are a

mineral resource exploration company. We compete with other mineral resource

exploration companies for financing, personnel and equipment and for the

acquisition of mineral properties. Many of the mineral resource exploration

companies with whom we compete have greater financial and technical resources

than those available to us. Accordingly, these competitors may be able to spend

greater amounts on acquisitions of mineral properties of merit, on exploration

of their mineral properties and on development of their mineral properties. In

addition, they may be able to afford more geological expertise in the targeting

and exploration of mineral properties. This competition could result in

competitors having mineral properties of greater quality and interest to

prospective investors who may finance additional exploration and/or development.

This competition could adversely impact on our ability to finance further

exploration and to achieve the financing necessary for us to develop our mineral

properties.

Compliance with Government

Regulation

We are

committed to complying with and are, to our knowledge, in compliance with, all

governmental and environmental regulations applicable to our company and our

properties. Permits from a variety of regulatory authorities are required for

many aspects of mine operation and reclamation. We cannot predict the extent to

which these requirements will affect our company or our properties if we

identify the existence of minerals in commercially exploitable quantities. In

addition, future legislation and regulation could cause additional expense,

capital expenditure, restrictions and delays in the exploration of our

properties.

Research and Development

Expenditures

We have

incurred no research and development expenditures over the last fiscal year and

do not anticipate significant future research and development

expenditures.

Employees

We

currently have five part-time employees, including our Chief Executive Officer,

and we engage several consultants, including our Interim Chief Financial

Officer.

20

We engage

contractors from time to time to consult with us on specific corporate affairs

or to perform specific tasks in connection with our exploration

programs.

Subsidiaries

We

currently have one subsidiary, Li3 Energy Peru SRL, through which we hold our

Peruvian assets, and we are in the process of forming an Argentine subsidiary to

hold our Argentine assets.

Intellectual

Property

We do not

own, either legally or beneficially, any patent or trademark nor any material

license, and are not dependent on any such rights.

DESCRIPTION

OF PROPERTIES

The

information set forth above under “Business” relating to the Company’s

properties is incorporated herein by reference.

We

sublease approximately 800 square feet of office space in Lima, Peru from Loreto

Resources Corporation, a Nevada Corporation whose Chief Executive Officer and

Interim Chief Financial Officer are also our Chief Executive Officer and Interim

Chief Financial Officer. Our sublease payments are at Loreto Resources

Corporation’s cost in proportion to our share of the total space, and will total

$20,764 for 2010. The lease provides for a three percent annual rent increase

and expires on September 30, 2011.

RISK

FACTORS

An

investment in shares of our common stock is highly speculative and involves a

high degree of risk. We face a variety of risks that may affect our operations

or financial results and many of those risks are driven by factors that we

cannot control or predict. Before investing in our common stock you should

carefully consider the following risks, together with the financial and other

information contained in this Report. If any of the following risks actually

occurs, our business, prospects, financial condition and results of operations

could be materially adversely affected. In that case, the trading price of our

common stock would likely decline and our stockholders may lose all or a portion

of their investments in us. Only those investors who can bear the risk of loss

of their entire investment should consider investing in our common

stock.

21

RISKS

RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

We

are an exploration stage company and have minimal current revenues. Our business

plan depends on our ability to explore for and develop mineral reserves and

place any such reserves into extraction. Because we have a limited operating

history, it is difficult to predict our future performance.

Although

we were formed in June 2005, we have been and continue to be an exploration

stage company. Therefore, we have limited operating and financial history

available to help potential investors evaluate our past performance and the

risks of investing in us. Moreover, our limited historical financial results may

not accurately predict our future performance. Companies in their initial stages

of development present substantial business and financial risks and may suffer

significant losses. As a result of the risks specific to our new business and

those associated with new companies in general, it is possible that we may not

be successful in implementing our business strategy.

We have

generated no revenues to date and do not anticipate generating any revenues for

the foreseeable future. Our activities to date have been limited to capital

formation, organization, and development of our business. We have yet to

generate positive earnings and there can be no assurance that we will ever

operate profitably. Our success is significantly dependent on a successful

exploration, mining and production program. Our operations will be subject to

all the risks inherent in the establishment of a developing enterprise and the

uncertainties arising from the absence of a significant operating history. We

may be unable to locate exploitable quantities of mineral resources or operate

on a profitable basis. We are in the exploration stage and potential investors

should be aware of the difficulties normally encountered by enterprises in the

exploration stage. If our business plan is not successful, and we are not able

to operate profitably, investors may lose some or all of their investment in our

Company.

The proposed

transactions discussed in this Report that have not been consummated are subject

to various conditions and/or further agreement among the parties, and may

ultimately not be consummated on the terms described herein, or at

all.

We

discuss in this Report certain proposed transactions that have not yet been

consummated, including letters of intent and definitive purchase agreements to

acquire mineral interests. There can be no assurance that any such letter of

intent will progress to definitive agreements or that the conditions to closing

of any such definitive agreement will be satisfied and a closing held. For

reasons that may be within or beyond our control, such transactions may never

come to fruition. Nonetheless, we spend funds and management’s attention on

pursuing such transactions which may materially adversely affect our liquidity

and results of operations.

All

of our properties are in the exploration stage. Investment in exploration

projects increases the risks inherent in our mining activities. There is no

assurance that we can establish the existence of any mineral resource on any of

our properties in commercially exploitable quantities, and our mining operations

may not be successful.

We have

not established that any of our mineral properties contains any meaningful

levels of mineral reserves. There can be no assurance that that future

exploration and mining activities will be successful.

22

A mineral

reserve is defined by the SEC in its Industry Guide 7 (which can be viewed at

http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part

of a mineral deposit which could be economically and legally extracted or

produced at the time of the reserve determination. There can be no assurance

that we will ever establish any mineral reserves.

Even if

we do eventually discover a meaningful mineral reserve on one or more of our

properties, there can be no assurance that we will be able to develop our

properties into producing mines and extract those resources. Both mineral

exploration and development involve a high degree of risk and few properties

which are explored are ultimately developed into producing mines. Furthermore,

we cannot be sure that an overall exploration success rate or extraction

operations within a particular area will ever come to fruition and, in any

event, production rates inevitably decline over time.The commercial viability of

an established mineral deposit will depend on a number of factors including, by

way of example, the size, grade and other attributes of the mineral deposit, the

proximity of the resource to infrastructure such as a smelter, roads and a point

for shipping, government regulation and market prices. Most of these factors

will be beyond our control, and any of them could increase costs and make

extraction of any identified mineral resource unprofitable.

We

have limited financial resources and may not be able to fund our anticipated

exploration activities. If we are unable to fund our exploration activities, our

potential profitability will be adversely affected.

Our

anticipated exploration activities may require financial resources in excess of

our current working capital. If we are not able to finance our exploration

activities, then we will be unable to identify commercially exploitable

resources even if present on our properties. If we fail to adequately support

our exploration activities, it could have a material adverse effect on our

results of operations and the market price of our shares. There can be no

assurance that capital will be available to us when needed, on favorable terms

or at all.

Mineral

operations are subject to applicable law and government regulation. Even if we

discover a mineral resource in a commercially exploitable quantity, these laws

and regulations could restrict or prohibit the exploitation of that mineral

resource.

Both

mineral exploration and extraction require permits from various foreign,

federal, state, provincial and local governmental authorities and are governed

by laws and regulations, including those with respect to prospecting, mine

development, mineral production, transport, export, taxation, labor standards,

occupational health, waste disposal, toxic substances, land use, environmental

protection, mine safety and other matters. There can be no assurance that we

will be able to obtain or maintain any of the permits required for the continued

exploration of our mineral properties or for the construction and operation of a

mine on our properties at economically viable costs.

We

believe that we are in compliance with all material laws and regulations that

currently apply to our activities but there can be no assurance that we can

continue to remain in compliance. Current laws and regulations could be amended

and we might not be able to comply with them, as amended. Further, there can be

no assurance that we will be able to obtain or maintain all permits necessary

for our future operations, or that we will be able to obtain them on reasonable

terms. To the extent such approvals are required and are not obtained, we may be

delayed or prohibited from proceeding with planned exploration or development of

our mineral properties.

23

If

we establish the existence of a mineral resource on any of our properties in a

commercially exploitable quantity, we will require additional capital in order

to develop the property into a producing mine. If we are unable to obtain

additional funding, our business operations will be harmed and if we do obtain

additional financing, existing shareholders may suffer substantial

dilution.

If we do

discover mineral resources in commercially exploitable quantities on any of our

properties, we will be required to expend substantial sums of money to establish

the extent of the resource, develop processes to extract it and develop

extraction and processing facilities and infrastructure. Although we may derive

substantial benefits from the discovery of a major deposit, there can be no

assurance that such a resource will be large enough to justify commercial

operations, nor can there be any assurance that we will be able to raise the

funds required for development on a timely basis.

We have

raised some capital to date, including through the sale of equity securities,

but we currently do not have any contracts or firm commitments for additional

financing. There can be no assurance that additional financing will be available

in amounts or on terms acceptable to us, if at all. An inability to obtain

additional capital would restrict our ability to grow and could diminish our

ability to continue to conduct our business operations. If we are unable to

obtain additional financing, we will likely be required to curtail exploration

and development plans and possibly cease operations. Any additional equity

financing may involve substantial dilution to then existing

shareholders.

Newer

battery and/or fuel cell technologies could decrease demand for lithium over

time.

Many

materials and technologies are being researched and developed with the goal of

making batteries lighter, more efficient, faster charging and less expensive.

Some of these technologies could be successful and could impact demand for

lithium batteries in personal electronics, electric and hybrid vehicles and

other applications. Advances in nanotechnology, in particular, offer the

prospect of significantly better batteries in the future. For example,

researchers at Stanford University have recently demonstrated ultra-lightweight,

bendable batteries and supercapacitors made from paper coated with ink made of

carbon nanotubes and silver nanowires; the material charges and discharges very

quickly, making it potentially especially useful in hybrid and electric

vehicles, which need rapid power for acceleration and would benefit from quicker

charging than is available with current technologies. We cannot predict which

new technologies may ultimately prove to be commercializable and on what time

horizon. While lithium battery technology is currently among the best available

for electronics, vehicles and other applications, commercialized battery

technologies that offer superior weight, capacity, charging time and/or cost

could significantly adversely affect the demand for lithium in the future and

thus could significantly adversely impact our prospects and future

revenues.

24

Mineral

exploration and development is subject to extraordinary operating risks. We do

not currently insure against these risks. In the event of a cave-in or similar

occurrence, our liability may exceed our resources, which could have an adverse

impact on our Company.

Mineral

exploration, development and production involve many risks which even a

combination of experience, knowledge and careful evaluation may not be able to

overcome. Our operations will be subject to all the hazards and risks inherent

in the exploration for mineral resources and, if we discover a mineral resource

in commercially exploitable quantity, our operations could be subject to all of

the hazards and risks inherent in the development and production of resources,

including liability for pollution, cave-ins or similar hazards against which we

cannot insure or against which we may elect not to insure. Any such event could

result in work stoppages and damage to property, including damage to the

environment. We do not currently maintain any insurance coverage against these

operating hazards. The payment of any liabilities that arise from any such

occurrence would have a material adverse impact on our Company.

Lithium

prices are subject to dramatic and unpredictable fluctuations.

We expect

to derive revenues, if any, either from the sale of our mineral resource

properties or from the extraction and sale of lithium ore. The price of those

commodities has fluctuated widely in recent years, and is affected by numerous

factors beyond our control, including international, economic and political

trends, expectations of inflation, currency exchange fluctuations, interest

rates, global or regional consumptive patterns, speculative activities and

increased production due to new extraction developments and improved extraction

and production methods. The effect of these factors on the price of base and

precious metals, and therefore the economic viability of any of our exploration

properties and projects, cannot accurately be predicted.

Market

conditions deteriorated for lithium-based products in 2009. Among other

things:

|

|

·

|

sales

volumes for the major lithium producers were reported to be down between

15% and 42% by mid-2009;

|

|

|

·

|

consumption

by lithium end-use markets for batteries, ceramics and glass, grease, and

pharmaceuticals all

decreased;

|

|

·

|

a

major spodumene producer in Canada closed its mine owing to market

conditions; and

|

|

|

·

|

the

leading lithium producer in Chile announced it would lower its lithium

prices by 20% in 2010.

|

There can

be no assurance that market conditions will rebound in the near term or ever, or

that they will not deteriorate further.

25

The

mining industry is highly competitive, and we face competition from many

established domestic and foreign companies. We may not be able to

compete effectively with these companies.

The

markets in which we operate are highly competitive. The mineral

exploration, development, and production industry is largely

un-integrated. We compete against numerous well-established national

and foreign companies in every aspect of the mineral mining

industry. Some of our competitors have longer operating histories and

greater technical facilities, and significantly greater recognition in the

market and financial and other resources, than we. We may not compete

effectively with other exploration companies in locating and acquiring mineral

resource properties, and customers may not buy any or all of the mineral

products that we expect to produce.

Because

we are small and do not have much capital, we may have to limit our exploration

and developmental mining activity which may result in a loss of your

investment.

Because

we are a small exploration stage company and do not have much capital, we must

limit our exploration and production activity. As such, we may not be

able to complete an exploration program that is as thorough as we would

like. In that event, existing reserves may go

undiscovered. Without finding reserves, we cannot generate revenues

and you may lose any investment you make in our shares.

Compliance

with environmental and other government regulations could be costly and could

negatively impact production.

Our

operations are subject to numerous federal, state and local laws and regulations

governing the operation and maintenance of our facilities and the discharge of

materials into the environment or otherwise relating to environmental

protection. These laws and regulations may:

|

|

·

|

require

that we acquire permits before commencing extraction

operations;

|

|

|

·

|

restrict

the substances that can be released into the environment in connection

with mining and extraction

activities;

|

|

|

·

|

limit

or prohibit mining activities on protected areas such as wetland or

wilderness areas; and

|

|

|

·

|

require

remedial measures to mitigate pollution from former operations, such as

dismantling abandoned production

facilities.

|

Under

these laws and regulations, we could be liable for personal injury and clean-up

costs and other environmental and property damages, as well as administrative,

civil and criminal penalties. We do not believe that insurance

coverage for environmental damages that occur over time is available at a

reasonable cost, and we do not maintain any such insurance. Also, we

do not believe that insurance coverage for the full potential liability that

could be caused by sudden and accidental environmental damages is available at a

reasonable cost. Accordingly, we may be subject to liability or we

may be required to cease production (subsequent to any commencement) from

properties in the event of environmental damages.

26

We

may be unable to amend the mining claims that we are seeking to acquire to cover

the primary minerals that we plan to develop.

Our

business plan revolves around acquisition, exploration and development of

lithium brine properties. However, we may pursue this goal by

acquiring salt-mining claims and/or options or other interests in salt-mining

claims (for example, the Third Parties Options) or other types of claims, that

we intend to seek to have amended to cover lithium extraction. There

can be no assurance that we will be successful in amending any such claims

timely, economically or at all.

We

may have difficulty managing growth in our business.

Because

of the relatively small size of our business, growth in accordance with our

long-term business plans, if achieved, will place a significant strain on our

financial, technical, operational and management resources. As we

increase our activities and the number of projects we are evaluating or in which

we participate, there will be additional demands on our financial, technical,

operational and management resources. The failure to continue to

upgrade our technical, administrative, operating and financial control systems

or the occurrence of unexpected expansion difficulties, including the

recruitment and retention of required personnel could have a material adverse

effect on our business, financial condition and results of operations and our

ability to timely execute our business plan.

If

we are unable to keep our key management personnel, then we are likely to face

significant delays at a critical time in our corporate development and our

business is likely to be damaged.

Our

success depends upon the skills, experience and efforts of our management and

other key personnel, including our Chief Executive Officer. As a

relatively new company, much of our corporate, scientific and technical

knowledge is concentrated in the hands of a few individuals. We do

not have employment agreements with any of our employees, including our Chief

Executive Officer. Nor do we maintain key-man life insurance on any

of our management or other key personnel. The loss of the services of

one or more of our present management or other key personnel could significantly

delay our exploration and development activities as there could be a learning

curve of several months or more for any replacement

personnel. Furthermore, competition for the type of highly skilled

individuals we require is intense and we may not be able to attract and retain

new employees of the caliber needed to achieve our

objectives. Failure to replace key personnel could have a material

adverse effect on our business, financial condition and operations.

Each

of our Chief Executive Officer and our Interim Chief Financial Officer has other

substantial business activities that limit the amount of time that he can devote

to managing our business.

Our Chief

Executive Officer, Luis Saenz, currently serves as the President of another

publicly traded company – Loreto Resources Corporation – and our Interim Chief

Financial Officer, Eric E. Marin, currently serves as the Interim Chief

Financial Officer of that same company. Accordingly, these officers

are only able to devote a portion of their time to our

activities. This may make it more difficult for our management to

respond quickly and completely to challenges and opportunities that we may

encounter, may limit our ability to timely consummate strategic transactions and

may have an adverse effect on our results of operations.

27

Difficult

conditions in the global capital markets may significantly affect our ability to

raise additional capital to continue operations.

The

ongoing worldwide financial and credit upheaval may continue

indefinitely. Because of reduced market liquidity, we may not be able

to raise additional capital when we need it. Because the future of

our business will depend on our ability to explore and develop the mineral

resources on our existing properties and the completion the acquisition of one

or more additional mineral resource properties for which, most likely, we will

need additional capital, we may not be able to complete such development and

acquisition projects or develop or acquire revenue producing

assets. As a result, we may not be able to generate income and, to

conserve capital, we may be forced to curtail our current business activities or

cease operations entirely.

Being

a public company has increased our expenses and administrative

workload.

As a