Attached files

| file | filename |

|---|---|

| EX-2.1 - SHARE EXCHANGE AGREEMENT - Kemiao Garment Holding Group | f8k051210ex2i_ecochild.htm |

| EX-99.1 - AUDITED CONSOLIDATED FINANCIAL STATEMENTS - Kemiao Garment Holding Group | f8k051210ex99i_ecochild.htm |

| EX-16.1 - LETTER FROM RONALD R. CHADWICK, P.C - Kemiao Garment Holding Group | f8k051210ex16i_ecochild.htm |

| EX-99.3 - UNAUDITED PRO FORMA FINANCIAL INFORMATION - Kemiao Garment Holding Group | f8k051210ex99iii_ecochild.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

report (Date of earliest event reported): May 12,

2010

|

ECOCHILD,

INC.

|

||||

|

(Exact

name of registrant as specified in its charter)

|

|

Nevada

|

333-161941

|

N/A

|

||

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(I.R.S.

Employer Identification No.)

|

#401,

8 Men, 13 Lou, Dong Hua Shi Bei Li Zhong Qu,

Chong

Wen Qu, Beijing, P.R. China

(Address

of Principal Executive Offices) (Zip Code)

+86-136-7134-5183

(Issuer

Telephone number, including area code)

(Former

name or former address, if changed since last report)

_____________________

Copies

to:

Gregg

Jaclin, Esq.

Yarona

Y. Liang, Esq.

Anslow

+ Jaclin, LLP

195

Route 9 South, Suite 204

Manalapan,

New Jersey 07726

(732)

409-1212

________________________

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

The

Current Report on Form 8-K contains forward looking statements that involve

risks and uncertainties, principally in the sections entitled “Description of

Business,” “Risk Factors,” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.” All statements other

than statements of historical fact contained in this Current Report on Form 8-K,

including statements regarding future events, our future financial performance,

business strategy and plans and objectives of management for future operations,

are forward-looking statements. We have attempted to identify

forward-looking statements by terminology including “anticipates,” “believes,”

“can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,”

“potential,” “predicts,” “should,” or “will” or the negative of these terms or

other comparable terminology. Although we do not make forward looking

statements unless we believe we have a reasonable basis for doing so, we cannot

guarantee their accuracy. These statements are only predictions and

involve known and unknown risks, uncertainties and other factors, including the

risks outlined under “Risk Factors” or elsewhere in this Current Report on Form

8-K, which may cause our or our industry’s actual results, levels of activity,

performance or achievements expressed or implied by these forward-looking

statements. Moreover, we operate in a very competitive and rapidly

changing environment. New risks emerge from time to time and it is

not possible for us to predict all risk factors, nor can we address the impact

of all factors on our business or the extent to which any factor, or combination

of factors, may cause our actual results to differ materially from those

contained in any forward-looking statements.

We have

based these forward-looking statements largely on our current expectations and

projections about future events and financial trends that we believe may affect

our financial condition, results of operations, business strategy, short term

and long term business operations, and financial needs. These

forward-looking statements are subject to certain risks and uncertainties that

could cause our actual results to differ materially from those reflected in the

forward looking statements. Factors that could cause or contribute to

such differences include, but are not limited to, those discussed in this

Current Report on Form 8-K, and in particular, the risks discussed below and

under the heading “Risk Factors” and those discussed in other documents we file

with the Securities and Exchange Commission that are incorporated into this

Current Report on Form 8-K by reference. The following discussion

should be read in conjunction with our annual report on Form 10-K and our

quarterly reports on Form 10-Q incorporated into this Current Report on Form 8-K

by reference, and the consolidated financial statements and notes thereto

included in our annual and quarterly reports. We undertake no

obligation to revise or publicly release the results of any revision to these

forward-looking statements. In light of these risks, uncertainties

and assumptions, the forward-looking events and circumstances discussed in this

Current Report on Form 8-K may not occur and actual results could differ

materially and adversely from those anticipated or implied in the

forward-looking statement.

You

should not place undue reliance on any forward-looking statement, each of which

applies only as of the date of this Current Report on Form

8-K. Before you invest in our common stock, you should be aware that

the occurrence of the events described in the section entitled “Risk Factors”

and elsewhere in this Current Report on Form 8-K could negatively affect our

business, operating results, financial condition and stock

price. Except as required by law, we undertake no obligation to

update or revise publicly any of the forward-looking statements after the date

of this Current Report on Form 8-K to conform our statements to actual results

or changed expectations.

2

Item 1.01 Entry

Into A Material Definitive Agreement

As more

fully described in Item 2.01 below, on May 12, 2010, Ecochild, Inc. (the

“Company” or “ECOH”) completed the acquisition of AIVtech Holding (Hong Kong)

Limited (“AIVtech”), a company that is in the business of designing,

manufacturing and selling electronic furniture, digital/multimedia speakers, and

LCD/LED television, by means of a share exchange.

On May

12, 2010, we entered into a Share Exchange Agreement (“Exchange Agreement”) by

and among ECOH, AIVtech, and the shareholders of AIVtech (the “AIVtech

Shareholders”). The closing of the transaction (the “Closing”) took place on May

12, 2010 (the “Closing Date”). On the Closing Date, pursuant to the terms of the

Exchange Agreement, we acquired all of the outstanding shares (the “Interests”)

of AIVtech from the AIVtech Shareholders; and AIVtech Shareholders transferred

and contributed all of their Interests to us. In exchange, we (1) issued to the

AIVtech Shareholders, their designees or assigns, an aggregate of 10,375,000

shares (the “ Shares Component”) or 51.88% of the shares of common stock of the

Company issued and outstanding after the Closing (the “Share Exchange”), at

$0.005 per share; and (2) pay cash (the “Cash Component”) of $3,948,125 to the

AIVtech Shareholders. The Cash Component is payable within 12 months

after the Closing as evidenced by the promissory note that is attached as an

exhibit to the Shares Exchange Agreement. The parties understand and acknowledge

that such exchange is based upon an acquisition value of AIVtech at US

$4,000,000, which is agreed and acceptable by all parties. In addition to the

above Shares and Cash component, Jie Zhang, the major shareholder of the Company

before the Closing, agreed to transfer 3,009,000 shares to two shareholders of

AIVtech within 6 months after closing. The two shareholders, the directors and

officers of AIVtech, are (1) Guo Jinlin, to receive 1,770,000 shares, and (2)

Ding Lanbin, through Guo Jin Tong Investment (Hong Kong) Limited, to receive

1,239,000 shares.

A copy of

the Exchange Agreement is included as Exhibit 2.1 to this Current Report and is

hereby incorporated by reference. All references to the Exchange Agreement and

other exhibits to this Current Report are qualified, in their entirety, by the

text of such exhibits.

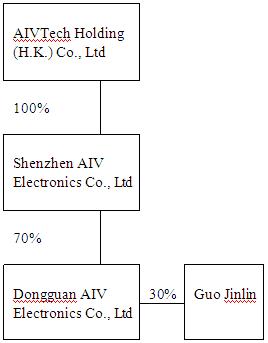

AIVtech

owns 100% of ShenZhen AIV Electronics Company Limited (“Shenzhen AIVtech”), and

ShenZhen AIVtech owns 70% of DongGuan AIV Electronics Company Limited (“Dongguan

AIVtech”). Pursuant to the Exchange Agreement, AIVtech became a wholly-owned

subsidiary of the Company, and the Company own 100% of ShenZhen AIVtech through

AIVtech, and 70% of DongGuan AIVtech through ShenZhen AIVtech.

The

directors of the Company have approved the Exchange Agreement and the

transactions contemplated under the Exchange Agreement. The directors of AIVtech

have approved the Exchange Agreement and the transactions contemplated

thereunder.

As a

further condition of the Share Exchange, Jie Zhang resigned as the sole officer

and director of the Company, and JinLin Guo, YiLin Shi and TeLi Liao were

appointed as the new officers of the Company, effective immediately at the

Closing. In addition, JinLin Guo and YiLin Shi have been appointed as the new

directors of the Company, effective immediately at the Closing.

The Share

Exchange transaction is discussed more fully in Section 2.01 of this Current

Report. The information therein is hereby incorporated in this Section 1.01 by

reference.

Item 2.01 Completion

of Acquisition or Disposition of Assets

CLOSING

OF EXCHANGE AGREEMENT

As

described in Item 1.01 above, on May 12, 2010, we acquired AIVtech, which is the

parent company of two operating subsidiaries engages in designing, manufacturing

and selling of electronic furniture, digital/ multimedia speakers, and LCD/LED

television in the People’s Republic of China (“China” or the “PRC”), in

accordance with the Exchange Agreement. The closing of the

transaction took place on May 12, 2010. On the Closing Date, pursuant to the

terms of the Exchange Agreement, we acquired all the Interests of AIVtech from

the AIVtech Shareholders; and the AIVtech Shareholders transferred and

contributed all of their Interests to us. In exchange, we (1) issued to the

AIVtech Shareholders, their designees or assigns, an aggregate of 10,375,000

shares or 51.88% of the shares of common stock of the Company issued and

outstanding, at $0.005 per share, on a fully-diluted basis as of and immediately

after the Closing; and (2) made a cash payment of $3,948,125 to the

Shareholders. The Cash Component is payable by the Company as

follows: the full amount of $3,948,125 is payable within 12 months after the

Closing as evidenced by the promissory note that is attached as an exhibit to

the Shares Exchange Agreement. A copy of the Share Exchange Agreement is filed

as Exhibit 2.1 to this Current Report. The parties understand and acknowledge

that such exchange is based upon an acquisition value of AIVtech at US

$4,000,000, which is agreed and acceptable by all parties. In addition to the

above Shares and Cash Component, Jie Zhang, current major shareholder of the

Company, agrees to transfer 3,009,000 shares to two active shareholders of

AIVtech within 6 months after closing. The two active shareholders, who are also

the management team of AIVtech, are (1) Jinlin Guo, to receive 1,770,000 shares,

and (2) Lanbin Ding, through Guo Jin Tong Investment (Hong Kong) Limited, to

receive 1,239,000 shares. Following the Share Exchange, there are 20,000,000

shares of common stock issued and outstanding.

3

AIVtech,

through its subsidiaries, primarily engages in designing, manufacturing and

selling of electronic furniture, digital/ multimedia speakers, and LCD/LED

television. AIVtech was incorporated with limited liability under the laws of

Hong Kong and owns 100% of the issued and outstanding capital stock of ShenZhen

AIVtech, a company organized under the PRC laws. ShenZhen AIVtech owns 70% of

the issued and outstanding capital stock of DongGuan AIVtech, which is also a

PRC company. Pursuant to the Exchange Agreement, AIVtech became a wholly-owned

subsidiary of the Company, and through AIVtech, the Company owns 100% of

ShenZhen AIVtech and 70% of DongGuan AIVtech.

The

Company was a “shell company” (as such term is defined in Rule 12b-2 under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”)) immediately

before the completion of the Share Exchange. Accordingly, pursuant to

the requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the

information that would be required if the Company were filing a general form for

registration of securities on Form 10 under the Exchange Act, reflecting the

Company’s common stock, which is the only class of its securities subject to the

reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon

consummation of the Share Exchange, with such information reflecting the Company

and its securities upon consummation of the Share Exchange.

BUSINESS

Overview

AIVTech

was incorporated on November 4, 2005 under the laws of Hong Kong, is a holding

company with subsidiaries engaged in manufacturing casual furniture audio

series, multimedia speakers, and LED. Shenzhen AIVtech was incorporated on April

9, 2009 under the laws of the People’s Republic of China. Dongguan AIVtech was

organized in December of 2009 under the laws of the PRC. AIVtech, through

ShenZhen AIVtech and DongGuan AIVtech, engages in the business of designing,

manufacturing and selling electronic furniture, digital/ multimedia speakers,

and LCD/LED television under its own products brand – AIV, which stands for

Audio & Interactive Video. Besides its own AIV brand, AIVtech also

specializes in both OEM (Original Equipment Manufacturing) and ODM (Original

Design Manufacturing) services.

Our

mission is to become a global company with world-wide recognized brand that

provides premium and high quality products to consumers. AIVtech integrates two

traditional industries, which are electronics industry and furniture industry,

into a one new industry – electronic furniture industry.

We

generate revenues solely from the sales of electronic furniture and digital/

multimedia speakers. The production of LCD/LED television started in late April

2010. Our net sales revenues for the fiscal year ended December 31, 2009 which

was $38,469,185 represented an 85.41% growth from the fiscal year ended December

31, 2008 with net sales revenues of $20,748,580. Our fiscal year 2009

net income was $7,475,931; an increase of 91.88% compared with our fiscal year

2008 net income of $3,896,160.

Historical

Sales & Income Summary

|

Fiscal Year Ended

December 31,

|

||||||||||||

|

Summary Consolidated

|

2009

|

2008

|

Growth

|

|||||||||

|

Statement of Operations:

|

(audited)

|

(audited)

|

%

|

|||||||||

|

Sales,

Net

|

$ | 38,469,185 | $ | 20,748,580 | 85.41 | % | ||||||

|

Gross

Profit

|

10,404,846 | 5,609,133 | 85.50 | % | ||||||||

|

Net

Income

|

7,475,931 | 3,896,160 | 91.88 | % | ||||||||

4

Organization

& Subsidiaries

AIVtech

organizational structure was developed to permit the infusion of foreign capital

under the laws of the PRC and to maintain an efficient tax structure, as well as

to foster internal organizational efficiencies. The Company’s organization

structure post-Share Exchange is summarized in the figure below:

Products

At

present, the company classifies its products into 3 main categories: Electronic

Furniture, Multimedia/ Digital Speaker and LCD/LED Television.

A)

Electronic Furniture

|

a)

Video Gaming Chairs with Built-in Speakers and

Vibration

|

Video

game lovers are the target customers for this product series. It can be applied

to different video game consoles such as XBOX360 and PS3. It has 3D games’ sound

and vibration function. This stylish electronic furniture is taking the video

game lovers to another level of enjoyment and giving the video game accessories

a new fashion.

b)

Leisure Furniture with Built-in Audio/Video System

This is a

product series for home entertainment and leisure. The existing products include

Rocker Chair and Cabinet with Built-in Speakers and Audio System, TV Stands with

Built-in Audio/ Video System, etc. It is designed for consumers who love modern

stylish electronic products.

5

B)

Multimedia/ Digital Speakers

C)

LCD/LED Televisions

Market

Summary

AIVtech,

through ShenZhen AIVtech and DongGuan AIVtech, engages in the business of

designing, manufacturing and selling (1) electronic furniture, (2) digital/

multimedia speakers, and (3) LCD/LED television under its own products brand

AIV.

International

Market

Electronic

Furniture: fAudio gaming chair grows very fast in the electronic

furniture industry. It targets the audio-visual entertainment, especially the

video game markets. The audio gaming chair was recognized as one of the best

peripherals for video game by CNN in 2008. In conformity with the need for

innovation which is the trend in this industry, the new furniture audios

launched by AIV in 2005incorporate the Video Gaming Chair with Built-in Speakers

and Vibration, as well as the Leisure Furniture with Built-in Audio/ Video

System. The new product became popular after its debut in the European and the

U.S. markets in 2006. The product has also developed a market in China,

Australia and Southeast Asia countries. There are still many potential markets

waiting to be explored.

6

Multimedia/

Digital Speakers: At present, the global speakers market is dominated by a

certain number of manufacturers with large production capacity and leading

technologies. These manufacturers mainly operate in the United States, Japan and

European countries.

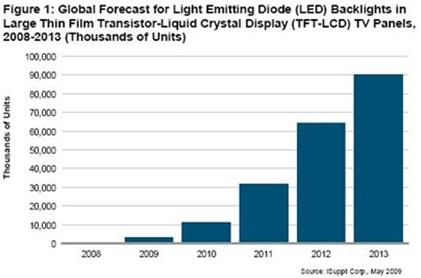

LED/LCD

Television: According to a conservative estimation by Display Bank, the number

of LEDs to be sold globally each year will be more than 15 million units in

2010, and 25 million and 50 million in 2011 and 2012 respectively.

Chinese Domestic

Market

Furniture

audios: The video game especially the online video game industry started late in

China but it is growing rapidly. Since 2000, its annual growth rate has exceeded

50%. Nowadays, more and more video game companies are entering into the Chinese

market with many large companies also establishing branch offices or studios in

China. Due to the huge potential of the industry, our gaming chair has a great

market prospect.

Multimedia/

Digital Speakers: China is the country with the largest production and

distribution of multimedia/ digital speakers in the world. The Pearl River Delta

region of China is the location of speaker manufacturers which produce 70%of the

world’s speakers. Most of these manufacturers are original equipment

manufacturers with no brands of their own and depend solely on exports. The

co-existence of genuine and counterfeit products reflects the current real

situation of the Chinese speakers industry. However, the speakers market is

relatively stable and also promising. The innovation of both the products and

business model are the key factors to success for the domestic speaker

manufacturers.

LED/LCD

Television: According to a survey by the Consumption Electronic Products

Investigation Office of the China Electronic Chamber of Commerce, 75% of the

domestic television consumers pay attention to LED products and 34% of them have

plans to purchase LED products in 2010.

Raw

Materials and Suppliers

Electronics

components, Wooden Boxes, Modules, Frames, AC converters and other basic

components are our main raw materials to produce electronic furniture,

multimedia/ digital speakers, and LED/LCD televisions. The Company purchases all

of its other raw materials and component parts from a variety of sources, none

of which is believed by the Company to be a dominant supplier. Alternative

sources of supply are believed to be available to the Company. Our

top five (5) raw material suppliers are listed as below:

7

|

Suppliers

|

Raw

Materials Supplied

|

Percentage

of Total Supply in 2009

|

||||

|

ShenZhen

HuiKe Sound Box Co., Ltd.

|

Wooden

boxes

|

15.74 | % | |||

|

ShenZhen

YuanMao Electronic Accessories Co., Ltd.

|

AC

converters

|

15.12 | % | |||

|

ShenZhen

QuanXin Plastic Cement Products Co., Ltd.

|

Covers

|

9.90 | % | |||

|

ShenZhen

JingXun Software Communication Technology Co., Ltd.

|

Modules

|

8.17 | % | |||

|

FengShun

MingYin Electronics Co., Ltd.

|

Frames

|

7.54 | % | |||

|

Total

|

56.47 | % | ||||

Marketing/Sales

and Customers

Sales

breakdown: The sales of our furniture audio products counted for 80% of the

total sales in our fiscal years ended December 31, 2008 and 2009. The sales of

our multimedia/digital speakers counted for 20% of the total sales in our fiscal

years ended December 31, 2008 and 2009. AIVtech started the production of LED

products in late April, 2010.

Marketing

and Sales Strategies:

1) Make

full use of the global resources and media to promote our products and brand,

and positively participate in international exhibitions and expos;

2)

Provide multipoint-to-point services to main customers, establish flagship

stores, and focus on developing new products;

3)

Integrate and complete the distribution network, improve the marketing

strategies by assisting the main distributors on a constant basis, and expand

the domestic market shares;

4)

Establish strong cooperation relationship with furniture and other related

enterprises, combine the advantages of the furniture and electronic industries,

and share the resources and market;

5)

Cooperate with large import and export enterprises on the promotion of our

products and investment opportunities;

6) Work

closely with our domestic and international OEM/ODM customers.

Sales

Channels: we have built a stable sales network in China. The sales network

includes general distributors in each province. The general distributors have

the rights to choose their own sub-distributors. Due to the high

performance-price ratio and good quality of the products, our Company has

accumulated a group of highly-qualified distributors, making sure a good

domestic sales network.

Sales

Cycle: At present, our accounts receivables term for its main customers are 60

to 120 day, for some customers are 30 to 60 days, and the average term is about

90 days.

Top 5

Customers and their percentage of Company’s total sales revenue:

DaKang

Holding Group Co., Ltd.—47.28%

AnJi

ChaoYa Furnitures Co., Ltd.—14.47%

GuangDong

GuangHong Import & Export Co., Ltd.—10.19%

BeiJing

HuaQi Info-Digit Technology Co., Ltd.—7.66%

AnJi

WeiYu Furnitures Co., Ltd.—4.13%

8

Market

Shares and Competitors

We

believe that our products do not compete directly with any other company with

respect to its entire range of products. However, our products compete with some

branded products within their product category as well as privately labeled

products sold by retailers, including some of our OEM/ ODM

customers.

Our

electronic furniture competes with Pyramat, Actona and other smaller

manufacturers. Our products own 60% of the international market

shares since 2006. In varying degrees, depending on the product category

involved, we compete on the basis of style, price, quality, comfort and brand

name prestige and recognition, among other considerations.

Our

multimedia/digital speakers and LED/ LCD television products compete with

numerous international branded products like Sony, Panasonic, Samsung, Phillips

and LG, etc. Due to the lower costs and labor expenses in Asia Pacific regions,

many international speaker manufacturers are establishing plants in Asia. This

allows large manufacturers to compete with local manufacturers in pricing. Right

now, the Company has a global market share of only about 0.3% on

multimedia/digital speaker products. The Company did not start the production of

LED/LCD television until late April, 2010, and the general availability of

contract manufacturers also allows the ease of access by new comers. Many of our

competitors are larger in scale, have been in existence for a longer period of

time, have achieved greater recognition for their brand names, have captured

greater market shares and/or have substantially greater financial, distribution,

marketing and other resources than we do. We are not sure whether we can compete

against them right now or in the future, or that competitive pressures will have

a material adverse effect on our business, financial condition and results of

operations.

Business

Model

The

Company conducts its quality management in strict compliance with ISO9001

international quality management standard. The Company believes that quality,

cost control and efficiency are the three components to the Company's

competitiveness; that integrity, innovation and values are the three components

to the Company's management philosophy; and that people, environment and

technology are the three components to the Company's design

philosophy.

1)

Achieve the new integration of electronic and furniture industries, and persist

in regarding innovation as the strategy of industry development;

2) Ensure

a steady and healthy expansion or growth of the Company, and build a long

lasting well known national brand by setting up flagship stores on main

cities;

3) Create

a beneficial-to-all situation among the Company, staff, shareholders, customers,

partners and the society by providing quality products with competitive

prices.

Growth

Strategy

We intend

to grow our business by improving our marketing, financial, production and human

resource management:

Marketing

Management

1) Keep

improving the product quality and raise the brand image and awareness. Turn AIV

into a brand and image that represents innovation, value and

quality;

9

2) Keep

ensuring the innovation of new products and the integration of multi-elements

and avoid the vicious circle caused by cost competitiveness;

3) Make

full use of global resources and media (such as Alibaba.com) to promote our

products and brand, and positively participate in international exhibitions and

expos;

4)

Provide multipoint-to-point services to main customers, establish flagship

stores in main cities, and focus on developing new products;

5)

Integrate and complete the distribution network, improve the marketing

strategies by assisting the main distributors on a constant basis, and expand

the domestic market shares;

6)

Establish strong cooperation relationship with furniture, electronics and other

related enterprises, combine the advantages of the furniture and electronic

industries, and share the resources and market;

7)

Cooperate with large import & export enterprises on the promotion of our

products together and investment opportunities together;

8) Work

closely with our domestic and international OEM/ODM customers;

9) Create

and enter into new markets by customizing our products for internet cafés,

karaoke bars, private VIP clubs, corporate offices, and other entities demanding

for the entertainment audio/video system.

Financial

Management

1)

Establish a standard cost control system, execute the cost budget management

policy and complete the ERP (Enterprise Resource Planning) management system for

cost control purposes.

2)

Complete the financing capital chain. With multiple financing channels, the

Company ensures the stabilization of its capital chain and the efficient use of

its proceeds which improve its business transactions.

Production

Management

a) PMC

(Product Material Control) Management. The Company strengthens the management of

PMC production plan and the material control system. The improvement of the

material and plan management capacities is the key to a successful

management.

|

·

|

Production

Plan Management: all the elements involved in this management should be

precise and detailed, from the origin of the plan information (such as

sales and prediction), organization of the plan outline, the relationship

between production plan and the amount of time spent, the production cycle

to the arrangement of the production

period.

|

|

·

|

Plan

and Material Control Management: all the elements involved in this

management should be managed strictly, from the origin of the MRP

(Material Requirement Planning) data, product sheet and material list, the

execution and control of the material requirement plan, product material

cost management to the material management of production field, to ensure

the Company's material cycle, cost and consumption be always under the

ideal condition.

|

b) Field

Management. The Company does not allow any waste of resources such as material,

labor, time, space, energy and transportation. It also adopts effective

management systems to control and manage the key processes such as flow-chart,

instruction tracing, shipment, field 7S (Seiri, Seiton,Seiso, Shitsuke, Safety,

Speed and Saving) and lean production, to ensure the production field is running

at full load.

10

Human Resources

Management

The

Company promotes the SOP (Standard Operation Procedure) and establishes the KPI

(Key Performance Indication) check system to make our human capital more

valuable. It persists in the principle of benefit sharing and has established

scientific incentive mechanisms to attract talents. Through this mechanism, the

Company has possessed a team of elites on technology development, market

exploration, operation management and quality management.

Environmental

Protection

Compliance

with national, provincial or local provisions which have been enacted or adopted

regulating the discharge of materials into the environment, or otherwise

relating to the protection of the environment have not had, nor are they

expected to have, any material effect on the capital expenditures, earnings or

competitive position of the Company. The Company uses and generates certain

substances and wastes that are or can be regulated or may be deemed hazardous

under certain national, provincial or local regulations with respect to the

environment.

Properties

Our

corporate headquarter is located at Suite A1305, 13th

Floor, East Building Phase II, High-Tech Plaza, Tian An Cyber Park, Futian

District, Shenzhen, China. The corporate headquarter office is approximately 371

square meters, and is leased from the individual owner of the property for RMB

22,268, or approximately USD 3,275, every month. The lease is scheduled to

expire in March 2011.

Our

manufacturing factory is located at AIV Industrial Park, No.78, Wenquan South

Road, Xihu District, Shilong town, Dongguan, China. The factory building is

approximately 21509 square meters, and is leased from DongGuan Mei Da Decorating

& Design Works Company Limited for RMB 222,587, or approximately USD 32,733,

every month from April 4, 2010 to April 3, 2011. The lease is scheduled to

expire in April 3, 2015.

The

post-merger assets of the Company and its subsidiaries on a consolidated basis

include cash, accounts receivable from customers, inventories, equipments and

dues from related parties.

Employees

As of the

date hereof, we have approximately 602 full-time employees. The breakdown of our

employees is as follows:

|

Management

Staff

|

56

|

|||

|

R&D

Staff

|

29

|

|||

|

Sales

Staff

|

9

|

|||

|

Manufacturing

Staff

|

508

|

|||

|

Total

|

602

|

RISK

FACTORS

You

should carefully consider the risks described below together with all of the

other information included in this report before making an investment decision

with regard to our securities. The statements contained in or

incorporated herein that are not historic facts are forward-looking statements

that are subject to risks and uncertainties that could cause actual results to

differ materially from those set forth in or implied by forward-looking

statements. If any of the following risks actually occurs, our business,

financial condition or results of operations could be harmed. In that case, you

may lose all or part of your investment.

11

Risks

Relating to Our Business

The

effects of the recent global economic slowdown may continue to have a negative

impact on our business, results of operations or financial

condition.

The

recent global economic slowdown has caused disruptions and extreme volatility in

global financial markets, increased rates of default and bankruptcy, and

declining consumer and business confidence, which has led to decreased levels of

consumer spending. These macroeconomic developments have and could continue to

negatively impact our business, which depends on the general economic

environment and levels of consumer spending in the PRC and other parts of the

world that affect not only the ultimate consumer, but also retailers, who are

our primary direct customers. As a result, we may not be able to maintain or

increase our sales to existing customers, make sales to new customers, or

maintain or improve our earnings from operations as a percentage of net sales.

If the global economic slowdown continues for a significant period or continues

to worsen, our results of operations, financial condition, and cash flows could

be materially adversely affected.

Our

results of operations are cyclical and could be adversely affected by

fluctuations in the raw material.

We are

largely dependent on the cost and supply of raw materials such as electronic

accessories and the selling price of our products, which are determined by

constantly changing and volatile market forces of supply and demand as well as

other factors over which we have little or no control. These other factors

include:

|

•

|

competing

demand for the raw materials,

|

|

•

|

environmental

and conservation regulations, and

|

|

•

|

economic

conditions,

|

We cannot

assure you that all or part of any increased costs experienced by us from time

to time can be passed along to consumers of our products, in a timely manner or

at all.

Substantially

all of our business, assets and operations are located in the PRC.

Substantially

all of our business, assets and operations are located in PRC. The economy of

PRC differs from the economies of most developed countries in many respects. The

economy of PRC has been transitioning from a planned economy to a

market-oriented economy. Although in recent years the PRC government has

implemented measures emphasizing the utilization of market forces for economic

reform, the reduction of state ownership of productive assets and the

establishment of sound corporate governance in business enterprises, a

substantial portion of productive assets in PRC is still owned by the PRC

government. In addition, the PRC government continues to play a significant role

in regulating industry by imposing industrial policies. It also exercises

significant control over PRC’s economic growth through the allocation of

resources, controlling payment of foreign currency-denominated obligations,

setting monetary policy and providing preferential treatment to particular

industries or companies. Some of these measures benefit the overall economy of

PRC, but may have a negative effect on us.

Our

management has no experience in managing and operating a public company. Any

failure to comply or adequately comply with federal securities laws, rules or

regulations could subject us to fines or regulatory actions, which may

materially adversely affect our business, results of operations and financial

condition.

Our

current management has no experience managing and operating a public company and

relies in many instances on the professional experience and advice of third

parties including its attorneys and accountants. Failure to comply or adequately

comply with any laws, rules, or regulations applicable to our business may

result in fines or regulatory actions, which may materially adversely affect our

business, results of operation, or financial condition and could result in

delays in achieving the development of an active and liquid trading market for

our stock.

Our

business and the success of our products could be harmed if we are unable to

maintain our brand image.

Our

success to date has been due in large part to the strength of the AIV brand, and

to a lesser degree, the reputation of our brand. If we are unable to timely and

appropriately respond to changing consumer demand, our brand name and brand

image may be impaired. Even if we react appropriately to changes in consumer

preferences, consumers may consider our brand image to be outdated and affect

our business.

12

We

need to manage growth in operations to maximize our potential growth and achieve

our expected revenues and our failure to manage growth will cause a disruption

of our operations resulting in the failure to generate revenue at levels we

expect.

In order

to maximize potential growth in our current and potential markets, we believe

that we must expand our producing operations. This expansion will place a

significant strain on our management and our operational, accounting, and

information systems. We expect that we will need to continue to improve our

financial controls, operating procedures, and management information systems. We

will also need to effectively train, motivate, and manage our employees. Our

failure to manage our growth could disrupt our operations and ultimately prevent

us from generating the revenues we expect.

We

cannot assure you that our growth strategy will be successful which may result

in a negative impact on our growth, financial condition, results of operations

and cash flow.

One of

our strategies is to establish our own flagship stores in main cities. However,

many obstacles to entering such new markets exist including, but not limited to,

established companies in such existing markets in the PRC. We cannot, therefore,

assure you that we will be able to successfully overcome such obstacles and

establish our products in any additional markets. Our inability to implement

this organic growth strategy successfully may have a negative impact on our

growth, future financial condition, results of operations or cash

flows.

If

we need additional capital to fund our growing operations, we may not be able to

obtain sufficient capital and may be forced to limit the scope of our

operations.

If

adequate additional financing is not available on reasonable terms, we may not

be able to expand our production lines and we would have to modify our business

plans accordingly. There is no assurance that additional financing will be

available to us.

In

connection with our growth strategies, we may experience increased capital needs

and accordingly, we may not have sufficient capital to fund our future

operations without additional capital investments. Our capital needs will depend

on numerous factors, including (i) our profitability; (ii) the release of

competitive products by our competition; (iii) the level of our investment in

research and development; and (iv) the amount of our capital expenditures,

including acquisitions. We cannot assure you that we will be able to obtain

capital in the future to meet our needs.

In recent

years, the securities markets in the United States have experienced a high level

of price and volume volatility, and the market price of securities of many

companies have experienced wide fluctuations that have not necessarily been

related to the operations, performances, underlying asset values or prospects of

such companies. For these reasons, our securities can also be expected to be

subject to volatility resulting from purely market forces over which we will

have no control. If we need additional funding we will, most likely, seek such

funding in the United States (although we may be able to obtain funding in the

PRC) and the market fluctuations affect on our stock price could limit our

ability to obtain equity financing.

If we

cannot obtain additional funding, we may be required to: (i) limit our

expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate

capital expenditures. Such reductions could materially adversely affect our

business and our ability to compete.

Even if

we do find a source of additional capital, we may not be able to negotiate terms

and conditions for receiving the additional capital that are favorable to us.

Any future capital investments could dilute or otherwise materially and

adversely affect the holdings or rights of our existing shareholders. In

addition, new equity or convertible debt securities issued by us to obtain

financing could have rights, preferences and privileges senior to the units. We

cannot give you any assurance that any additional financing will be available to

us, or if available, will be on terms favorable to us.

13

Need

for additional employees.

The

Company’s future success also depends upon its continuing ability to attract and

retain highly qualified personnel. Expansion of the Company’s business and the

management and operation of the Company will require additional managers and

employees with industry experience, and the success of the Company will be

highly dependent on the Company’s ability to attract and retain skilled

management personnel and other employees. There can be no assurance that the

Company will be able to attract or retain highly qualified personnel.

Competition for skilled personnel in the construction industry is significant.

This competition may make it more difficult and expensive to attract, hire and

retain qualified managers and employees.

Our

ability to compete could be jeopardized ff we are unable to protect our

intellectual property rights or if we are sued for intellectual property

infringement.

We

believe that our product brand and trademark, AIV, and other proprietary rights

are important to our success and our competitive position. We use trademarks on

some of our products and believe that having distinctive marks that are readily

identifiable is an important factor in creating a market for our goods, in

identifying us and in distinguishing our goods from the goods of others. We

consider our trademarks to be among our most valuable assets. We believe that

our trademarks are generally sufficient to permit us to carry on our business as

presently conducted. While we vigorously protect our trademarks against

infringement, we cannot assure you that we will be able to secure patents or

trademark protection for our intellectual property in the future or that

protection will be adequate for future products.

In

addition, the laws of foreign countries where we source and distribute our

products may not protect intellectual property rights to the same extent as do

the laws of the PRC. We cannot assure you that the actions we have taken to

establish and protect our trademarks and other intellectual property rights

outside the PRC will be adequate to prevent imitation of our products by others

or, if necessary, successfully challenge another party’s counterfeit products or

products that otherwise infringe on our intellectual property rights on the

basis of trademark infringement. Continued sales of these products could

adversely affect our sales and our brand and result in the shift of consumer

preference away from our products. We may face significant expenses and

liability in connection with the protection of our intellectual property rights

outside the PRC, and if we are unable to successfully protect our rights or

resolve intellectual property conflicts with others, our business or financial

condition could be adversely affected.

Our

failure to comply with increasingly stringent environmental regulations and

related litigation could result in significant penalties, damages and adverse

publicity for our business.

In recent

years, the government of China has become increasingly concerned with the

degradation of China’s environment that has accompanied the country’s rapid

economic growth. In the future, we expect that our operations and

properties will be subject to extensive and increasingly stringent laws and

regulations pertaining to, among other things, the discharge of materials into

the environment and the handling and disposition of wastes (including solid and

hazardous wastes) or otherwise relating to protection of the environment.

Failure to comply with any laws and regulations and future changes to them may

result in significant consequences to us, including civil and criminal

penalties, liability for damages and negative publicity. We cannot

assure you that additional environmental issues will not require currently

unanticipated investigations, assessments or expenditures, or that requirements

applicable to us will not be altered in ways that will require us to incur

significant additional costs.

We

will incur significant costs to ensure compliance with United States corporate

governance and accounting requirements.

We will

incur significant costs associated with our public company reporting

requirements, costs associated with newly applicable corporate governance

requirements, including requirements under the Sarbanes-Oxley Act of 2002 and

other rules implemented by the Securities and Exchange Commission. We expect all

of these applicable rules and regulations to significantly increase our legal

and financial compliance costs and to make some activities more time consuming

and costly. We also expect that these applicable rules and regulations may make

it more difficult and more expensive for us to obtain director and officer

liability insurance and we may be required to accept reduced policy limits and

coverage or incur substantially higher costs to obtain the same or similar

coverage. As a result, it may be more difficult for us to attract and retain

qualified individuals to serve on our board of directors or as executive

officers. We are currently evaluating and monitoring developments with respect

to these newly applicable rules, and we cannot predict or estimate the amount of

additional costs we may incur or the timing of such costs.

14

We

may not be able to meet the accelerated filing and internal control reporting

requirements imposed by the Securities and Exchange Commission resulting in a

possible decline in the price of our common stock and our inability to obtain

future financing.

As

directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No.

33-8934 on June 26, 2008, the Securities and Exchange Commission adopted rules

requiring each public company to include a report of management on the company’s

internal controls over financial reporting in its annual reports. In

addition, the independent registered public accounting firm auditing a company’s

financial statements must also attest to and report on management’s assessment

of the effectiveness of the company’s internal controls over financial reporting

as well as the operating effectiveness of the company’s internal controls.

Commencing with its annual report for the year ending December 31, 2010, we will

be required to include a report of management on its internal control over

financial reporting. The internal control report must include a

statement

|

·

|

Of

management’s responsibility for establishing and maintaining adequate

internal control over its financial

reporting;

|

|

·

|

Of

management’s assessment of the effectiveness of its internal control over

financial reporting as of year end;

and

|

|

·

|

Of

the framework used by management to evaluate the effectiveness of our

internal control over financial

reporting.

|

Furthermore,

in the following year, our independent registered public accounting

firm is required to file its attestation report separately on our

internal control over financial reporting on whether it believes that we have

maintained, in all material respects, effective internal control over financial

reporting.

While we

expect to expend significant resources in developing the necessary documentation

and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there

is a risk that we may not be able to comply timely with all of the requirements

imposed by this rule. In the event that we are unable to receive a

positive attestation from our independent registered public accounting firm with

respect to our internal controls, investors and others may lose confidence in

the reliability of our financial statements and our stock price and ability to

obtain equity or debt financing as needed could suffer.

In

addition, in the event that our independent registered public accounting firm is

unable to rely on our internal controls in connection with its audit of our

financial statements, and in the further event that it is unable to devise

alternative procedures in order to satisfy itself as to the material accuracy of

our financial statements and related disclosures, it is possible that we would

be unable to file our Annual Report on Form 10-K with the Securities and

Exchange Commission, which could also adversely affect the market price of our

securities and our ability to secure additional financing as

needed.

The

transaction involves a reverse merger of a foreign company into a domestic shell

company, so that there is no history of compliance with United States securities

laws and accounting rules.

In order

to be able to comply with United States securities

laws, AIVtech prepared its financial statements for the first time

under U.S. generally accepted accounting principles and recently had its initial

audit of its financial statements in accordance with Public Company

Accounting Oversight Board (United States). As the Company does not

have a long term familiarity with U.S. generally accepted accounting

principles, it may be more difficult for it to comply on a timely basis with SEC

reporting requirements than a comparable domestic company.

15

The

loss of the services of our key employees, particularly the services rendered by

JinLin Guo, our CEO and Chairman and YiLin Shi, our CFO and director, could harm

our business.

Our

success depends to a significant degree on the services rendered to us by our

key employees. If we fail to attract, train and retain sufficient

numbers of these qualified people, our prospects, business, financial condition

and results of operations will be materially and adversely affected. In

particular, we are heavily dependent on the continued services of JinLin Guo,

our CEO and Chairman and YiLin Shi, our CFO and director. The loss of any key

employees, including members of our senior management team, and our inability to

attract highly skilled personnel with sufficient experience in our industry

could harm our business.

Risks

Relating to the People's Republic of China

Certain

political and economic considerations relating to the PRC could adversely affect

our company.

The PRC

is transitioning from a planned economy to a market economy. While the PRC

government has pursued economic reforms since its adoption of the open-door

policy in 1978, a large portion of the PRC economy is still operating under

five-year plans and annual state plans. Through these plans and other economic

measures, such as control on foreign exchange, taxation and restrictions on

foreign participation in the domestic market of various industries, the PRC

government exerts considerable direct and indirect influence on the economy.

Many of the economic reforms carried out by the PRC government are unprecedented

or experimental, and are expected to be refined and improved. Other political,

economic and social factors can also lead to further readjustment of such

reforms. This refining and readjustment process may not necessarily have a

positive effect on our operations or future business development. Our operating

results may be adversely affected by changes in the PRC’s economic and social

conditions as well as by changes in the policies of the PRC government, such as

changes in laws and regulations (or the official interpretation thereof),

measures which may be introduced to control inflation, changes in the interest

rate or method of taxation, and the imposition of restrictions on currency

conversion in addition to those described below.

The

recent nature and uncertain application of many PRC laws applicable to us create

an uncertain environment for business operations and they could have a negative

effect on us.

The PRC

legal system is a civil law system. Unlike the common law system, the civil law

system is based on written statutes in which decided legal cases have little

value as precedents. In 1979, the PRC began to promulgate a comprehensive system

of laws and has since introduced many laws and regulations to provide general

guidance on economic and business practices in the PRC and to regulate foreign

investment. Progress has been made in the promulgation of laws and regulations

dealing with economic matters such as corporate organization and governance,

foreign investment, commerce, taxation and trade. The promulgation of new laws,

changes of existing laws and the abrogation of local regulations by national

laws could have a negative impact on our business and business

prospects.

Currency

conversion could adversely affect our financial condition.

The PRC

government imposes control over the conversion of Renminbi into foreign

currencies. Under the current unified floating exchange rate system, the

People’s Bank of China publishes an exchange rate, which we refer to as the PBOC

exchange rate, based on the previous day’s dealings in the inter-bank foreign

exchange market. Financial institutions authorized to deal in foreign currency

may enter into foreign exchange transactions at exchange rates within an

authorized range above or below the PBOC exchange rate according to market

conditions.

Pursuant

to the Foreign Exchange Control Regulations of the PRC issued by the State

Council which came into effect on April 1, 1996, and the Regulations on the

Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which

came into effect on July 1, 1996, regarding foreign exchange control, conversion

of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs,

for use on current account items, including the distribution of dividends and

profits to foreign investors, is permissible. FIEs are permitted to convert

their after-tax dividends and profits to foreign exchange and remit such foreign

exchange to their foreign exchange bank accounts in the PRC. Conversion of

Renminbi into foreign currencies for capital account items, including direct

investment, loans, and security investment, is still under certain restrictions.

On January 14, 1997, the State Council amended the Foreign Exchange Control

Regulations and added, among other things, an important provision, which

provides that the PRC government shall not impose restrictions on recurring

international payments and transfers under current account items.

16

Enterprises

in the PRC (including FIEs) which require foreign exchange for transactions

relating to current account items, may, without approval of the State

Administration of Foreign Exchange, or SAFE, effect payment from their foreign

exchange account or convert and pay at the designated foreign exchange banks by

providing valid receipts and proofs.

Convertibility

of foreign exchange in respect of capital account items, such as direct

investment and capital contribution, is still subject to certain restrictions,

and prior approval from the SAFE or its relevant branches must be

sought.

Furthermore,

the Renminbi is not freely convertible into foreign currencies nor can it be

freely remitted abroad. Under the PRC’s Foreign Exchange Control Regulations and

the Administration of Settlement, Sales and Payment of Foreign Exchange

Regulations, Foreign Invested Enterprises are permitted either to repatriate or

distribute its profits or dividends in foreign currencies out of its foreign

exchange accounts, or exchange Renminbi for foreign currencies through banks

authorized to conduct foreign exchange business. The conversion of Renminbi into

foreign exchange by Foreign Invested Enterprises for recurring items, including

the distribution of dividends to foreign investors, is permissible. The

conversion of Renminbi into foreign currencies for capital items, such as direct

investment, loans and security investment, is subject, however, to more

stringent controls.

Exchange

rate volatility could adversely affect our financial condition.

Since

1994, the exchange rate for Renminbi against the United States dollar has

remained relatively stable, most of the time in the region of approximately

RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it

would begin pegging the exchange rate of the Chinese Renminbi against a number

of currencies, rather than just the U.S. dollar and, the exchange rate for the

Renminbi against the U.S. dollar became RMB8.02 to $1.00. If we decide to

convert Chinese Renminbi into United States dollars for other business purposes

and the United States dollar appreciates against this currency, the United

States dollar equivalent of the Chinese Renminbi we convert would be reduced.

There can be no assurance that future movements in the exchange rate of Renminbi

and other currencies will not have an adverse effect on our financial

condition.

Since

our assets are located in the PRC, any dividends of proceeds from liquidation

are subject to the approval of the relevant Chinese government

agencies.

Our

operating assets are located inside the PRC. Under the laws governing Foreign

Invested Enterprises in the PRC, dividend distribution and liquidation are

allowed but subject to special procedures under the relevant laws and rules. Any

dividend payment will be subject to the decision of the board of directors and

subject to foreign exchange rules governing such repatriation. Any liquidation

is subject to the relevant government agency’s approval and supervision as well

as the foreign exchange control. This may generate additional risk for our

investors in case of dividend payment and liquidation.

It

may be difficult to affect service of process and enforcement of legal judgments

upon our company and our officers and directors because they reside outside the

United States.

As our

operations are presently based in the PRC and our director and officer resides

in the PRC, service of process on our company and such director and officer may

be difficult to effect within the United States. Also, our main assets are

located in the PRC and any judgment obtained in the United States against us may

not be enforceable outside the United States.

Due

to various restrictions under PRC laws on the distribution of dividends by our

PRC Operating Companies, we may not be able to pay dividends to our

stockholders.

The

Wholly-Foreign Owned Enterprise Law (1986), as amended and The Wholly-Foreign

Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law

of the PRC (2006) contain the principal regulations governing dividend

distributions by wholly foreign owned enterprises. Under these regulations,

wholly foreign owned enterprises may pay dividends only out of their accumulated

profits, if any, determined in accordance with PRC accounting standards and

regulations. Additionally, such companies are required to set aside a certain

amount of their accumulated profits each year, if any, to fund certain reserve

funds. These reserves are not distributable as cash dividends except in the

event of liquidation and cannot be used for working capital purposes. The PRC

government also imposes controls on the conversion of RMB into foreign

currencies and the remittance of currencies out of the PRC. We may experience

difficulties in completing the administrative procedures necessary to obtain and

remit foreign currency for the payment of dividends from the Company’s

profits.

17

Furthermore,

if our subsidiaries in China incur debt on their own in the future, the

instruments governing the debt may restrict its ability to pay dividends or make

other payments. If we or our subsidiaries are unable to receive all of the

revenues from our operations through these contractual or dividend arrangements,

we may be unable to pay dividends on our common stock.

The

Chinese government exerts substantial influence over the manner in which we must

conduct our business activities.

We are

dependent on our relationship with the local government in the province in which

we operate our business. Chinese government has exercised and continues to

exercise substantial control over virtually every sector of the Chinese economy

through regulation and state ownership. Our ability to operate in China may be

harmed by changes in its laws and regulations, including those relating to

taxation, environmental regulations, land use rights, property and other

matters. We believe that our operations in China are in material compliance with

all applicable legal and regulatory requirements. However, the central or local

governments of these jurisdictions may impose new, stricter regulations or

interpretations of existing regulations that would require additional

expenditures and efforts on our part to ensure our compliance with such

regulations or interpretations. Accordingly, government actions in the future,

including any decision not to continue to support recent economic reforms and to

return to a more centrally planned economy or regional or local variations in

the implementation of economic policies, could have a significant effect on

economic conditions in China or particular regions thereof, and could require us

to divest ourselves of any interest we then hold in Chinese

properties.

Future

inflation in China may inhibit our ability to conduct business in China. In

recent years, the Chinese economy has experienced periods of rapid expansion and

high rates of inflation. Rapid economic growth can lead to growth in the money

supply and rising inflation. If prices for our products rise at a rate that is

insufficient to compensate for the rise in the costs of supplies, it may have an

adverse effect on profitability. These factors have led to the adoption by

Chinese government, from time to time, of various corrective measures designed

to restrict the availability of credit or regulate growth and contain inflation.

High inflation may in the future cause Chinese government to impose controls on

credit and/or prices, or to take other action, which could inhibit economic

activity in China, and thereby harm the market for our products.

Risks

Relating to Our Securities

In

order to raise sufficient funds to expand our operations, we may have to issue

additional securities at prices which may result in substantial dilution to our

shareholders.

If we

raise additional funds through the sale of equity or convertible debt, our

current stockholders’ percentage ownership will be reduced. In addition, these

transactions may dilute the value of our securities outstanding. We may have to

issue securities that may have rights, preferences and privileges senior to our

common stock. We cannot provide assurance that we will be able to raise

additional funds on terms acceptable to us, if at all. If future financing is

not available or is not available on acceptable terms, we may not be able to

fund our future needs, which would have a material adverse effect on our

business plans, prospects, results of operations and financial

condition.

Our

securities have not been registered under the Securities Act, and cannot be sold

without registration under the Securities Act or any exemption from

registration.

Our

securities should be considered a long-term, illiquid investment. Our securities

have not been registered under the Securities Act, and cannot be sold without

registration under the Securities Act or any exemption from registration. In

addition, our securities are not registered under any state securities laws that

would permit their transfer. Because of these restrictions and the absence of an

active trading market for the securities, a shareholder will likely be unable to

liquidate an investment even though other personal financial circumstances would

dictate such liquidation.

18

We

are not likely to pay cash dividends in the foreseeable future.

We

currently intend to retain any future earnings for use in the operation and

expansion of our business. Accordingly, we do not expect to pay any cash

dividends in the foreseeable future, but will review this policy as

circumstances dictate. Should we determine to pay dividends in the future, our

ability to do so will depend upon the receipt of dividends or other payments

from our PRC operating subsidiary may, from time to time, be subject to

restrictions on its ability to make distributions to us, including restrictions

on the conversion of RMB into U.S. dollars or other hard currency and other

regulatory restrictions.

We

may be subject to the penny stock rules which will make our securities more

difficult to sell.

If we are

able to obtain a listing of our securities on a national securities exchange, we

may be subject in the future to the SEC’s “penny stock” rules if our securities

sell below $5.00 per share. Penny stocks generally are equity securities

with a price of less than $5.00. The penny

stock rules require broker-dealers to deliver a standardized risk disclosure

document prepared by the SEC which provides information about penny stocks and

the nature and level

of risks in the penny

stock market. The broker-dealer must also provide the

customer with current bid and offer

quotations for the penny stock, the compensation of the broker-dealer and its

salesperson, and monthly account

statements

showing the market value of each penny stock held in the customer’s account. The

bid and offer quotations, and the broker-dealer and salesperson compensation

information must be given to the customer orally or in writing prior to

completing the transaction and must be given to the customer in writing before

or with the customer’s confirmation.

In

addition, the penny stock rules require that prior to a transaction, the broker

dealer must make a special written determination that the penny stock

is a suitable investment for the purchaser

and receive the purchaser's written agreement to the transaction.

The penny stock rules are burdensome and may

reduce purchases of any offerings and reduce the trading activity for our

securities. As long as our securities

are

subject to the penny stock rules, the holders of such securities may find it

more difficult to sell their securities.

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS

AND

RESULTS OF OPERATIONS

Our

discussion includes forward-looking statements based upon current expectations

that involve risks and uncertainties, such as our plans, objectives,

expectations and intentions. Actual results and the timing of events could

differ materially from those anticipated in these forward-looking statements as

a result of a number of factors, including those set forth under the Risk

Factors, Cautionary Notice Regarding Forward-Looking Statements and Business

sections in this 8-K. We use words such as “anticipate,” “estimate,” “plan,”

“project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,”

“will,” “should,” “could,” and similar expressions to identify forward-looking

statements.

COMPANY

OVERVIEW

AIVtech,

through ShenZhen AIVtech and DongGuan AIVtech, engages in the business of

designing, manufacturing and selling electronic furnitures, digital/ multimedia

speakers, and LCD/LED televisions under its own products brand – AIV, which

stands for Audio & Interactive Video. Besides its own AIV brand, AIVtech

also specializes in the OEM (Original Equipment Manufacturing) and ODM (Original

Design Manufacturing) services.

19

RESULTS

OF OPERATIONS

Results of Operations for

the Year ended December 31, 2009 Compared to the Year ended December 31,

2008

The

following tables set forth key components of our results of operations for the

periods indicated, in US dollars, and key components of our revenue for the

period indicated, in US dollars. The discussion following the table is based on

these results.

|

Year

Ended December 31,

|

||||||||||||

|

2009

|

2008

|

|||||||||||

|

Sales,

net

|

$ | 38,469,185 | $ | 20,748,580 | ||||||||

|

Cost

of sales

|

28,064,339 | 15,139,447 | ||||||||||

|

Gross

profit

|

10,404,846 | 5,609,133 | ||||||||||

|

Operating

income/(expenses)

|

||||||||||||

|

Selling,

general and administrative expenses

|

2,078,011 | 1,712,783 | ||||||||||

|

Income

from Operations

|

8,326,835 | 3,896,350 | ||||||||||

|

Other

income/(expenses)

|

||||||||||||

|

Interest

income

|

9,834 | 5,826 | ||||||||||

|

Non

operating expenses

|

- | (6,016 | ) | |||||||||

|

Finance

costs

|

(30,079 | ) | - | |||||||||

|

Profit

before income tax

|

8,306,590 | 3,896,160 | ||||||||||

|

Income

taxes

|

(830,659 | ) | - | |||||||||

|

Net

income

|

$ | 7,475,931 | $ | 3,896,160 | ||||||||

|

Comprehensive

income

|

||||||||||||

|

Net

Income

|

$ | 7,475,931 | $ | 3,896,160 | ||||||||

|

Other

Comprehensive Income

|

||||||||||||

|

Foreign

currency translation adjustment

|

(12,339 | ) | 274,298 | |||||||||

|

Total

comprehensive income

|

$ | 7,463,592 | $ | 4,170,458 | ||||||||

Net Sales/

Revenue:

Net sales

increased by $17,720,605 or 85.41%, from $20,748,580 for the year ended December

31, 2008 to US$38,469,185 for the year ended December 31, 2009. Our

overall net sales increased because of the increase of the sales

network.

Cost of sales:

Cost of

sales increased by $12,924,892, or 85.37%, from $15,139,447 for the year ended

December 31, 2008 to US$28,064,339 for the year ended December 31,

2009. The increase in cost of sales is in line of the increase in

revenue as mentioned above.

Gross profit:

Gross

profit increased by $4,795,713, or 85.50%, from $5,609,133 for the year ended

December 31, 2008 to US$10,404,846 for the year ended December 31,

2009. The gross profit margin for year 2009 was about 27.05%, as compared

to 27.03% for year 2008.This is due to slight reduction in raw material costs

for the year.

20

Operating

Expenses:

Operating

expenses were $1,712,783 for the year ended December 31, 2008, compared to

$2,078,011 for the year ended December 31, 2009. The operating expense in

2009 was increased by 21.32% as compared to 2008, due to the increase in

selling, general and administrative expenses during the year.

Income