Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Wendy's Co | form8-k_q12010slides.htm |

First Quarter 2010

Earnings Call & Webcast

Earnings Call & Webcast

May 13, 2010

Opening Comments

John Barker

SVP and Chief Communications Officer

SVP and Chief Communications Officer

2

§ Business Highlights - Roland Smith

− First Quarter 2010

− Strategic Sourcing Group (SSG)

§ Financial Results - Steve Hare

− First Quarter Consolidated Financial Overview

− Cash Flow and Debt Capitalization

− Refinancing

− Stock Repurchase and Dividend

− 2010 Financial Outlook

§ Brand and International Updates - Roland Smith

§ Q&A

Agenda

3

Wendy’s/Arby’s Group Reported Today:

§ First Quarter 2010 Results

§ Balance Sheet Highlights

§ Adjusted EBITDA

§ Selected Financial Highlights for each Brand

§ Form 10-Q

First Quarter 2010

4

Forward-Looking Statements and

Regulation G

Regulation G

This presentation, and certain information that management may discuss in connection with this

presentation, may contain statements that are not historical facts, including, importantly,

information concerning possible or assumed future results of our operations. Those statements

constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the

protection of the safe harbor for forward-looking statements contained in the Reform Act.

presentation, may contain statements that are not historical facts, including, importantly,

information concerning possible or assumed future results of our operations. Those statements

constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the

protection of the safe harbor for forward-looking statements contained in the Reform Act.

Many important factors could affect our future results and could cause those results to differ

materially from those expressed in or implied by our forward-looking statements. Such factors,

all of which are difficult or impossible to predict accurately, and many of which are beyond our

control, include but are not limited to those identified under the caption “Forward-Looking

Statements” in our most recent earnings press release and in the “Special Note Regarding

Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent

Form 10-K and subsequent Form 10-Qs.

materially from those expressed in or implied by our forward-looking statements. Such factors,

all of which are difficult or impossible to predict accurately, and many of which are beyond our

control, include but are not limited to those identified under the caption “Forward-Looking

Statements” in our most recent earnings press release and in the “Special Note Regarding

Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent

Form 10-K and subsequent Form 10-Qs.

In addition, this presentation and certain information management may discuss in connection

with this presentation reference non-GAAP financial measures, such as earnings before

interest, taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP financial measure are in the

Appendix to this presentation, and are included in the earnings release and posted on the

Investor Relations section of our website.

with this presentation reference non-GAAP financial measures, such as earnings before

interest, taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP financial measure are in the

Appendix to this presentation, and are included in the earnings release and posted on the

Investor Relations section of our website.

First Quarter 2010 Highlights

Roland Smith

President & Chief Executive Officer

President & Chief Executive Officer

6

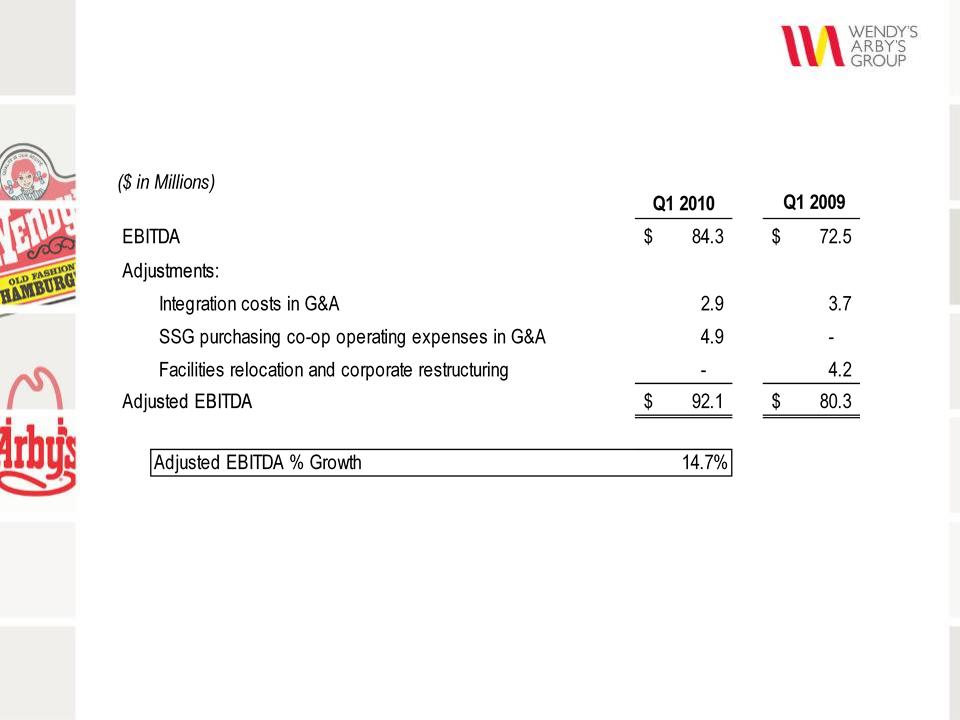

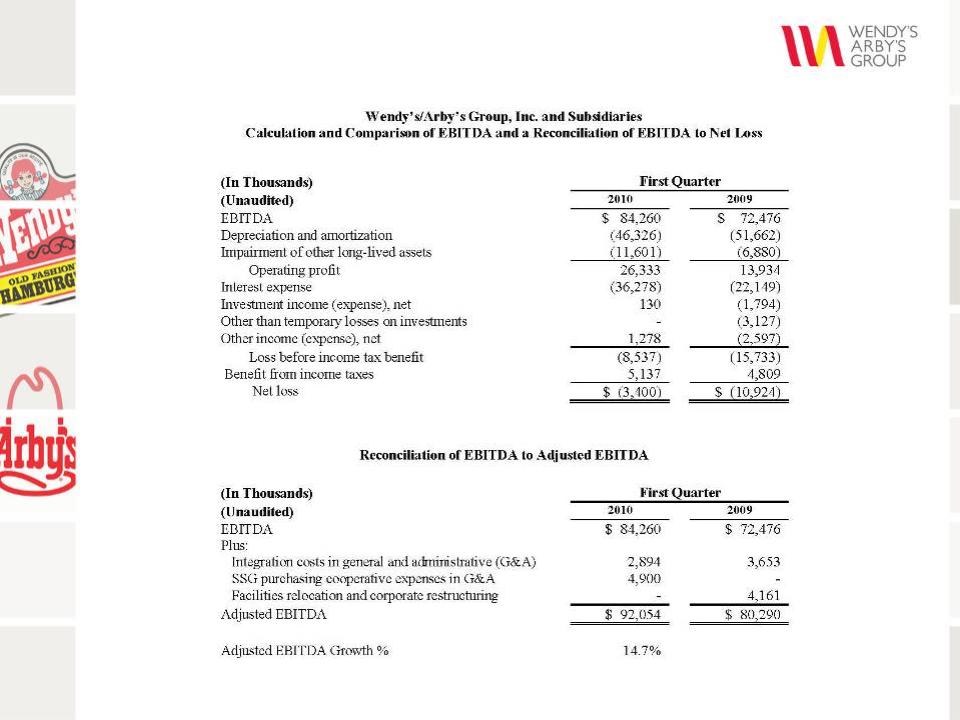

§ Adjusted EBITDA* grew 14.7% to $92.1 million

§ Wendy’s:

− Positive same-store sales

− 430 basis point restaurant margin improvement in

company-operated stores

company-operated stores

§ Arby’s:

– Sales and margins declined at Arby’s

− Focused on turnaround plan to re-energize the brand

− Continued $1 Value Menu rollout

– Transactions improved

*See Appendix.

First Quarter 2010 Business Overview

7

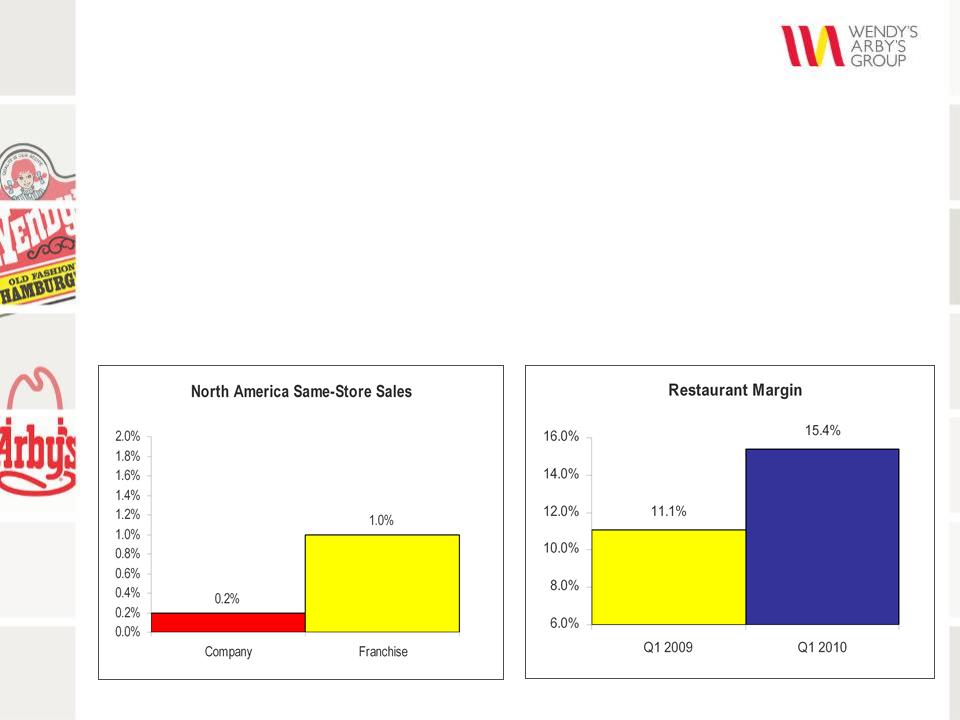

Wendy’s First Quarter 2010 Results

§ North America systemwide same-store sales increased 0.8%

− Same-store sales among strongest in the industry

− Impacted by severe weather in February

§ 430 basis point restaurant margin increase

8

Wendy’s First Quarter 2010

Marketing Calendar

January

February

March

Premium

Fish Fillet

99¢

9

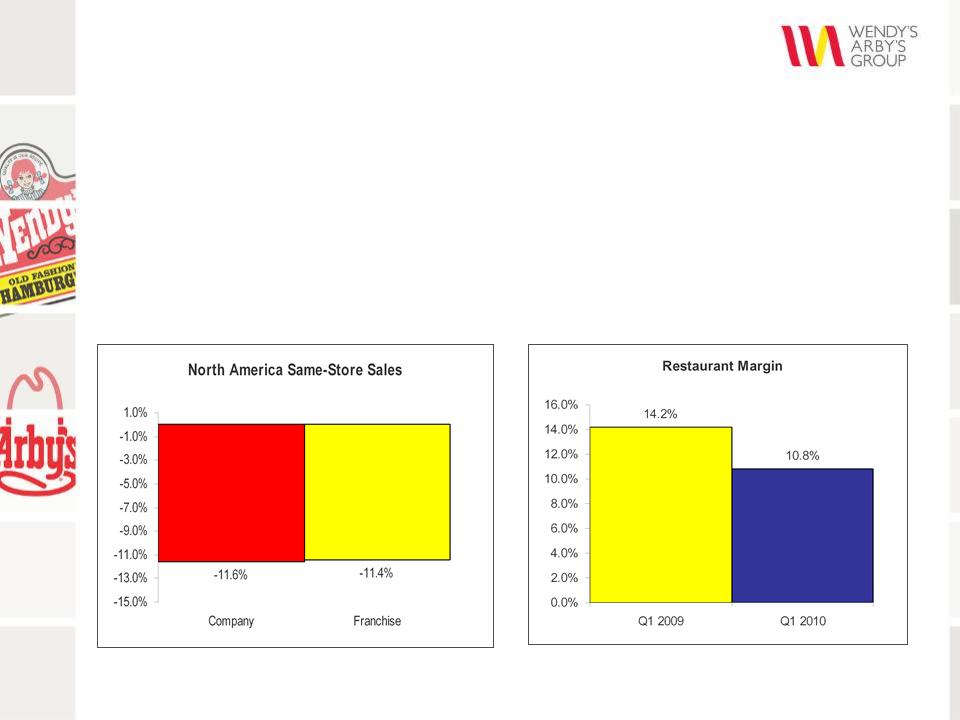

Arby’s First Quarter 2010 Results

§ North America systemwide same-store sales declined 11.5%

§ Margin decreased due to sales deleveraging

10

January

February

March

Premium

Cod

Arby’s First Quarter 2010

Marketing Calendar

11

§ Formed a new independent purchasing cooperative,

Strategic Sourcing Group Co-op, LLC (SSG)

Strategic Sourcing Group Co-op, LLC (SSG)

§ Negotiates contracts for non-branded supplies and services

for both Wendy’s and Arby’s, such as equipment, kitchen

smallwares, furnishings, menuboards and signs, as well as

utilities and restaurant-level contract services

for both Wendy’s and Arby’s, such as equipment, kitchen

smallwares, furnishings, menuboards and signs, as well as

utilities and restaurant-level contract services

§ Commitment to fund $4.9 million of operating expense,

which was recorded as a charge in the First Quarter of 2010

and will be paid over a 24-month period

which was recorded as a charge in the First Quarter of 2010

and will be paid over a 24-month period

Strategic Sourcing Group

Financial Overview

Steve Hare

Chief Financial Officer

13

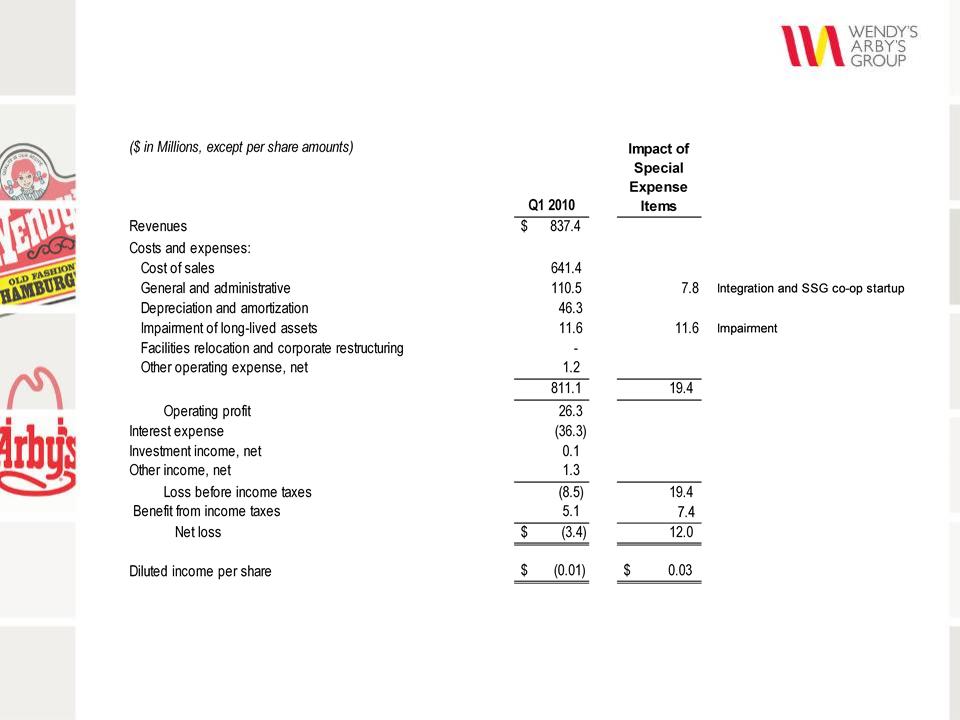

First Quarter 2010 Consolidated

Operating Results

Operating Results

14

*See Appendix.

First Quarter 2010 EBITDA and

Adjusted EBITDA*

Adjusted EBITDA*

15

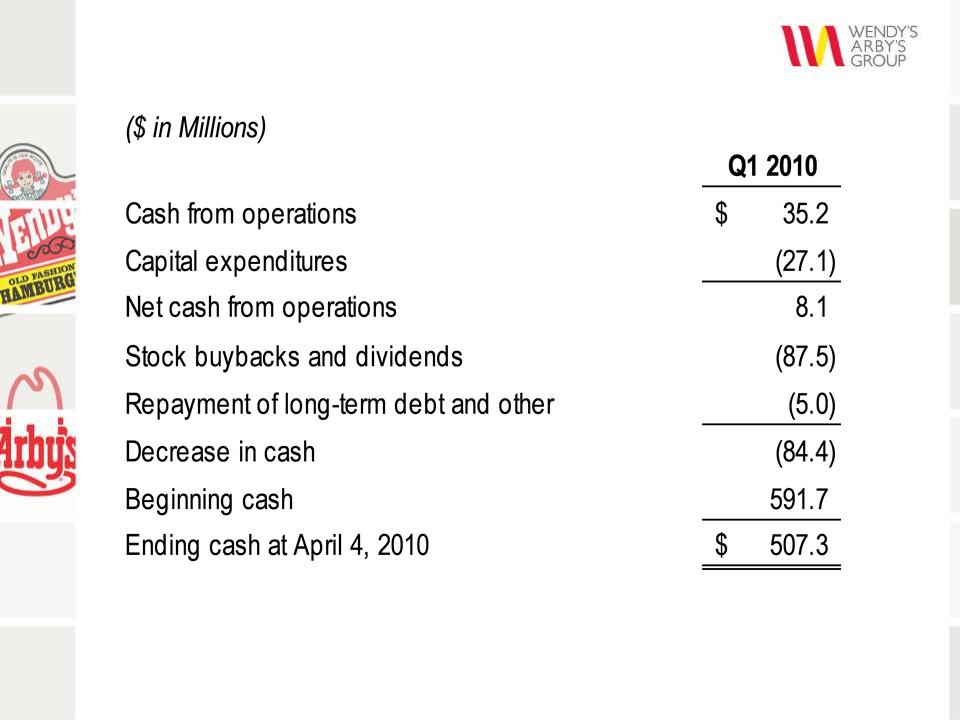

Cash Flow - First Quarter 2010

16

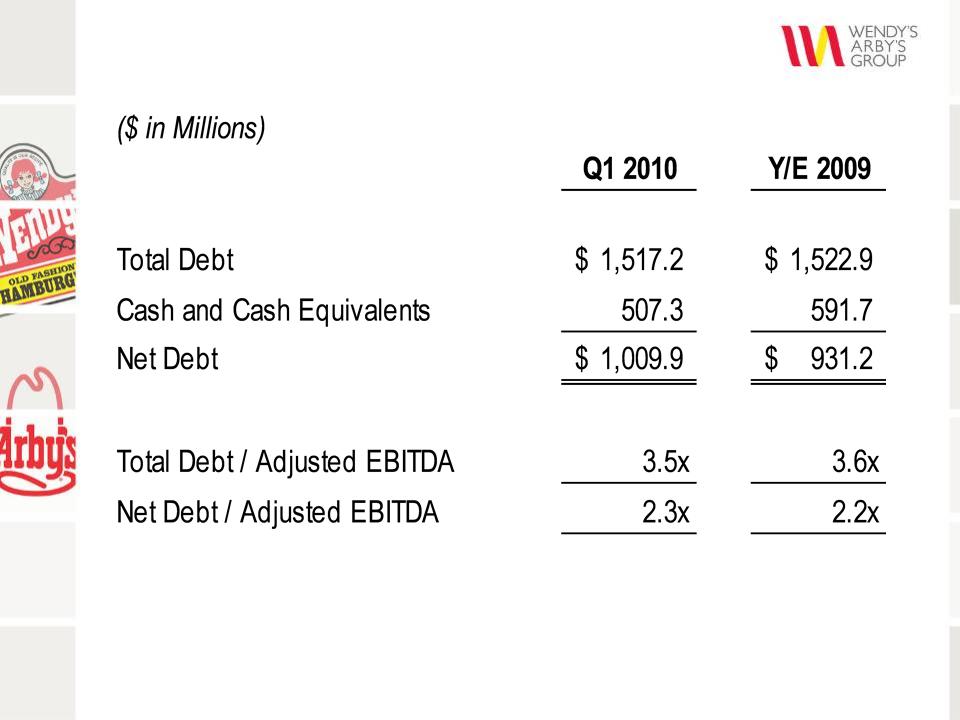

Debt Capitalization

17

§ Planning to enter into a new $650 million Senior Secured

Credit Facility

Credit Facility

– $150 million Revolver

– $500 million Term Loan

§ The proceeds of the Term Loan will be used to:

– Refinance existing term loan of $251 million

– Refinance 6.25% senior notes due 2011 of $200 million

§ Enhances flexibility and addresses medium term debt

maturities

maturities

§ Potential annual interest expense savings

Refinancing

18

§ Stock Repurchase

– $250 million authorized for stock repurchases

– As of May 7, 2010, 40 million common stock shares

repurchased for $190.2 million, at an average per share

price of $4.76

repurchased for $190.2 million, at an average per share

price of $4.76

– Company may repurchase additional shares as market

conditions warrant through January 2, 2011

conditions warrant through January 2, 2011

§ Quarterly Cash Dividend

– $0.015 per share

– Payable on June 15, 2010 to stockholders of record as of

June 1, 2010

June 1, 2010

Stock Repurchase and Dividend

19

Financial Outlook

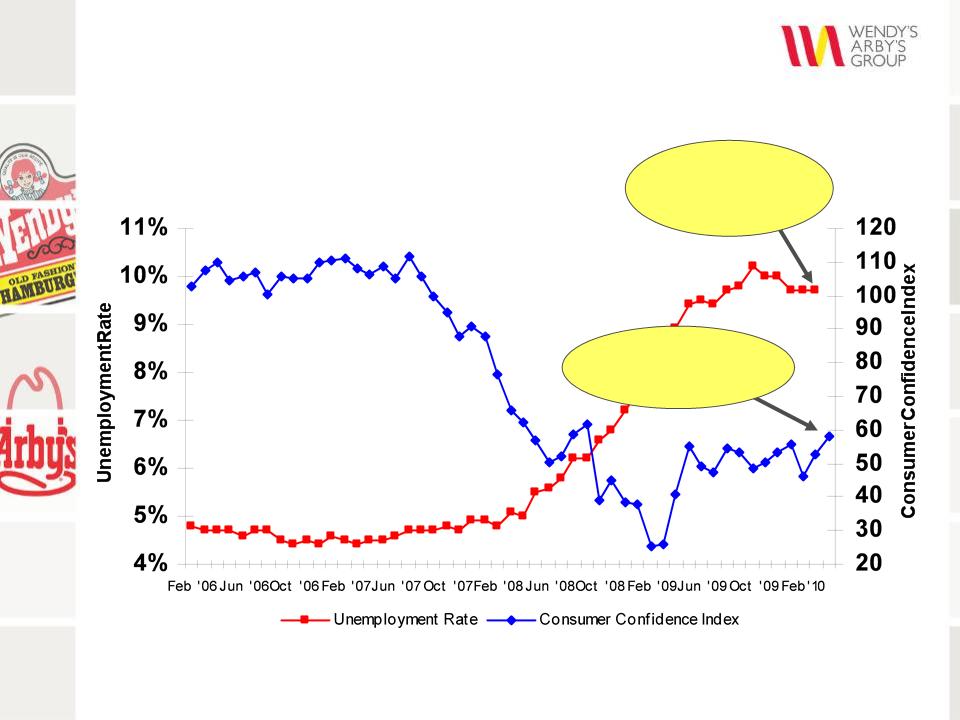

Source: U.S. Bureau of Labor Statistics, The Conference Board

Unemployment rate

remains high at 9.7%

Confidence improved in

March and April

March and April

U.S. Unemployment Rate Remains High, but Consumer Confidence

Improved in March and April

Improved in March and April

20

§ Positive Same-store Sales at Wendy’s

§ Negative Same-store Sales at Arby’s, but Improving

Year-over-Year

Year-over-Year

§ Continued G&A Savings

§ Total Capital Expenditures of $165 Million

– Open 12 new Wendy’s

– Remodel 100 Wendy’s and 100 Arby’s

§ Low-to-Mid Single Digit Growth in Adjusted EBITDA

– Excludes effect of 53rd week ($14 million in 2009)

– Excludes investment spending on Wendy’s breakfast

Financial Outlook 2010

Brand and International Update

Roland Smith

President & Chief Executive Officer

President & Chief Executive Officer

22

Wendy’s 2nd & 3rd Quarter 2010

Marketing Calendar

Marketing Calendar

April

May

June

Q3

23

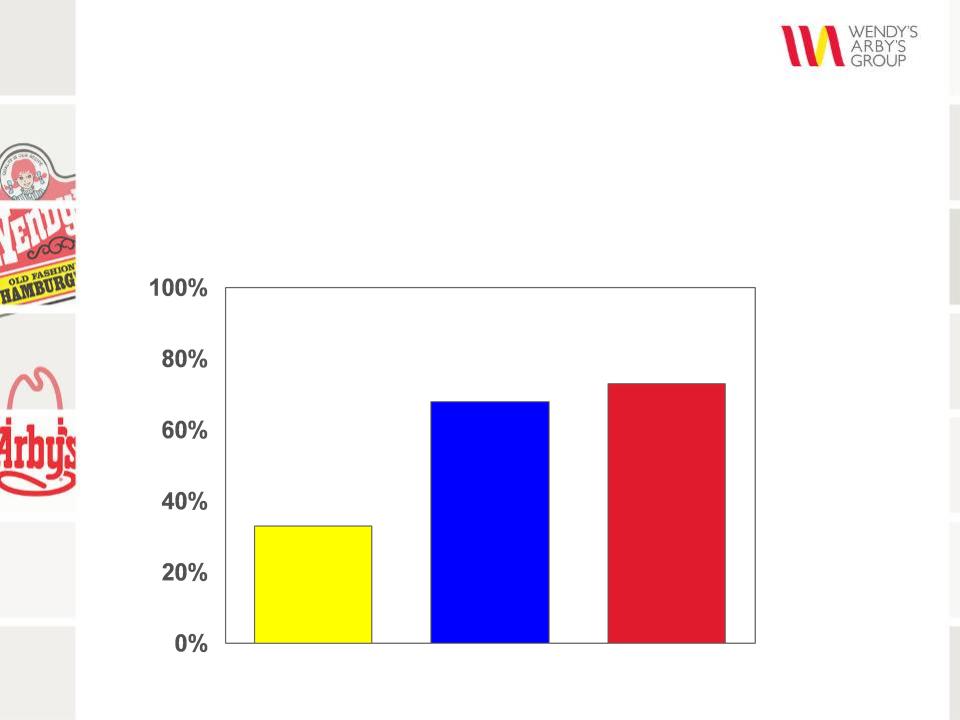

§ Steady Improvement in Operations Excellence

– Number of “A” and “B” stores increased by 5 points

Wendy’s Continuing to Improve

Restaurant Operations

Q1 2008

Q4 2009

Q1 2010

33%

68%

73%

24

§ 100 remodels in 2010

– Focusing on “Curve” and “Tower” upgrades

Curve

Tower

Wendy’s Remodel Update

26

§ “Real, Quality, Fresh” Positioning

§ Key Initiatives

– 2010 First Quarter: Tested new menu

and simplified operations

and simplified operations

– 2010 Second and Third Quarters: Beginning to

introduce new menu in 3 existing breakfast

markets

introduce new menu in 3 existing breakfast

markets

– 2010 Fourth Quarter: Plan to expand into

additional company and franchise markets

additional company and franchise markets

– Late 2011: begin national introduction

Wendy’s Breakfast Update

26

§ Execute Turnaround Plan:

– Hire an experienced President

– Expand value strategy

– Validate brand positioning

– Increase media efficiency

– Improve advertising effectiveness

– Revitalize product innovation

– Launch a three-year remodeling program

Arby’s 2010 Initiatives

27

§ Quick-Service Restaurant Industry

Veteran Returns Home to the

Arby’s Brand

Veteran Returns Home to the

Arby’s Brand

§ Extensive Experience Leading

Successful, High Performance

Organizations

Successful, High Performance

Organizations

– President of Church’s Chicken

– President and CEO of Susan G. Komen

– CEO of Catalytic Ventures

– Market Research Manager for the Arby’s

franchise marketing association (AFA)

franchise marketing association (AFA)

– Vice President Product Development &

Strategic Planning for AFA

Strategic Planning for AFA

Arby’s New President

Hala Moddelmog

Hala Moddelmog

28

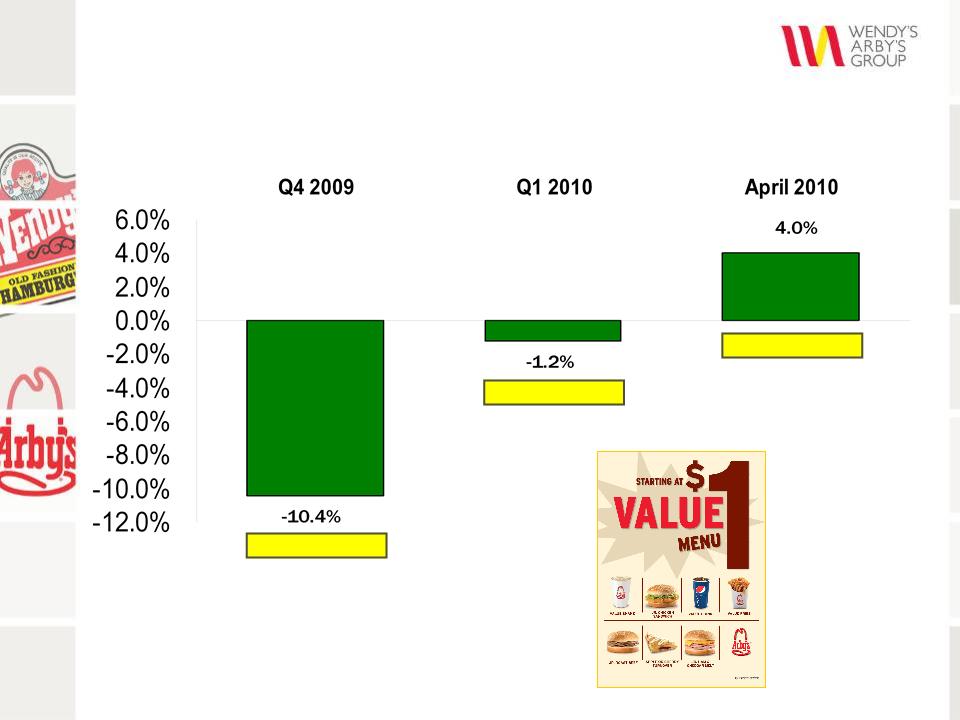

SSS = -8.4%

SSS = -11.6%

SSS = -12.6%

Arby’s Value Strategy Driving

Transaction Improvement

Transaction Improvement

29

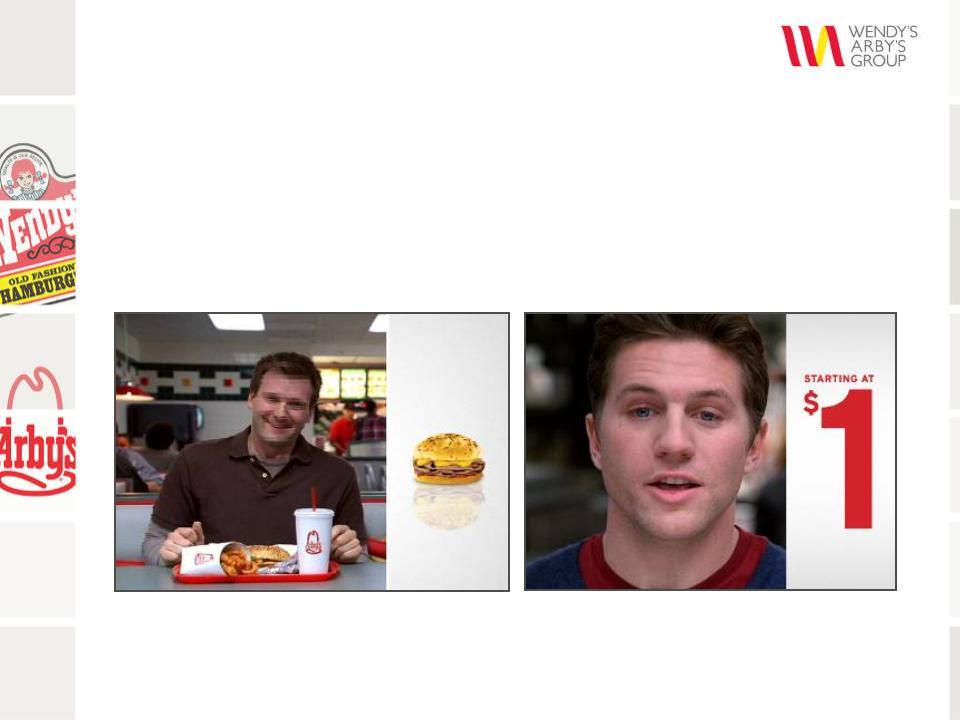

§ Increased National Media Rate from 1.2% to 2.4%

§ Revised Creative to Focus on Quality Products and

Value

Value

Arby’s Media and Advertising

30

Arby’s 2nd & 3rd Quarter 2010

Marketing Calendar

Marketing Calendar

April

May

June

Beef ‘n Cheddar

Prime Cut™ Chicken

Q3

National Advertising

(4/11-5/8)

National

Advertising

Advertising

(7/18-8/14)

31

Pinnacle Remodel

Arby’s Remodel Update

New Pinnacle

§ 100 Remodels in 2010

§ Three-year Remodeling Program

32

§ First dual-branded Wendy’s and

Arby’s restaurant opened in

Dubai on May 11, 2010

Arby’s restaurant opened in

Dubai on May 11, 2010

§ Al Jammaz Group (franchisee)

planning to open approximately

80 dual brand restaurants over

the next 10 years in the Middle

East

planning to open approximately

80 dual brand restaurants over

the next 10 years in the Middle

East

– Initial focus on development in

United Arab Emirates

United Arab Emirates

Dual-Branded Restaurant in Dubai

International Update

33

§ Opened Second New Restaurant

in Singapore

in Singapore

– Kopitiam franchisee plans to open

35 total restaurants over 10 years

35 total restaurants over 10 years

§ 2010 Plans

– Existing franchisees expected to

open 35 to 45 new restaurants

open 35 to 45 new restaurants

– Targeting development agreements

for approximately 400 restaurants

for approximately 400 restaurants

– Plan to enter 3 to 4 new countries

– Identifying new franchise partner for

Japan

Japan

New Wendy’s Restaurant in Singapore

New Wendy’s Restaurant in Mexico

International Update

34

§ Strong First Quarter 2010 Adjusted EBITDA* Growth

of 14.7%

of 14.7%

§ On Track with Wendy’s Brand Revitalization and Margin

Improvement

Improvement

§ Early Stage Turnaround for Arby’s

§ Formation of Strategic Sourcing Group

§ Long-Term Growth from New Investments

– Breakfast, Remodels and International

§ Returning Capital to Stockholders

§ Deliver Low-to-Mid Single Digit Growth in 2010

Adjusted EBITDA

Adjusted EBITDA

*See Appendix.

Summary

35

Upcoming Events

§ Stockholder Meeting - May 27 in New York

§ Oppenheimer Conference - June 29-30 in Boston

§ Analyst Day - November 18 in Dublin, OH

www.wendysarbys.com

Q&A

Appendix

38