Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - QUICKSILVER RESOURCES INC | form8-k.htm |

| EX-99.1 - PRESS RELEASE - QUICKSILVER RESOURCES INC | exh99_1.htm |

Exhibit 10.1

EXECUTION VERSION

ASSET PURCHASE AGREEMENT

BY AND BETWEEN

MARSHALL R. YOUNG OIL CO.,

AS SELLER,

AND

QUICKSILVER RESOURCES INC.,

AS BUYER

DATED

MAY 11, 2010

| TABLE OF CONTENTS | ||

| Page | ||

|

ARTICLE I

|

CERTAIN DEFINITIONS

|

1

|

|

Section 1.1

|

Certain Defined Terms

|

1

|

|

Section 1.2

|

References, Gender, Number

|

1

|

|

ARTICLE II

|

SALE AND PURCHASE

|

1

|

|

ARTICLE III

|

CONSIDERATION AND PAYMENT

|

2

|

|

Section 3.1

|

Consideration

|

2

|

|

Section 3.2

|

Payment

|

3

|

|

Section 3.3

|

Adjustment Period Cash Flow

|

3

|

|

Section 3.4

|

Post Closing Review

|

3

|

|

Section 3.5

|

Severance Tax Refund

|

4

|

|

ARTICLE IV

|

REPRESENTATIONS AND WARRANTIES

|

5

|

|

Section 4.1

|

Representations and Warranties of Seller

|

5

|

|

Section 4.2

|

Representations and Warranties of Buyer

|

8

|

|

ARTICLE V

|

TRANSFER REQUIREMENTS

|

9

|

|

Section 5.1

|

Transfer Requirements

|

9

|

|

Section 5.2

|

Certain Governmental Consents

|

10

|

|

ARTICLE VI

|

COVENANTS OF SELLER AND BUYER

|

10

|

|

Section 6.1

|

General Conveyance

|

10

|

|

Section 6.2

|

Public Announcements | 10 |

|

Section 6.3

|

Further Assurances

|

10

|

|

ARTICLE VII

|

CLOSING

|

11

|

|

Section 7.1

|

Closing

|

11

|

|

Section 7.2

|

Seller’s Closing Obligations

|

11

|

|

Section 7.3

|

Buyer’s Closing Obligations

|

11

|

|

ARTICLE VIII

|

EFFECT OF CLOSING

|

12

|

|

Section 8.1

|

Revenues

|

12

|

|

Section 8.2

|

Expenses

|

12

|

|

Section 8.3

|

Ad Valorem Taxes

|

12

|

|

Section 8.4

|

Payments and Obligations

|

12

|

|

Section 8.5

|

Survival

|

12

|

|

Section 8.6

|

Waiver of Representations and Warranties

|

12

|

|

ARTICLE IX

|

ASSUMPTION AND INDEMNIFICATION

|

13

|

|

Section 9.1

|

Indemnification By Buyer

|

13

|

i

| TABLE OF CONTENTS | ||

| (continued) | ||

| Page | ||

|

Section 9.2

|

Indemnification By Seller

|

13

|

|

Section 9.3

|

Third Party Claims

|

14

|

|

Section 9.4

|

Direct Claims

|

14

|

|

ARTICLE X

|

MISCELLANEOUS

|

14

|

|

Section 10.1

|

Counterparts

|

15

|

|

Section 10.2

|

Governing Law

|

15

|

|

Section 10.3

|

Entire Agreement

|

15

|

|

Section 10.4

|

Expenses

|

15

|

|

Section 10.5

|

Notices

|

15

|

|

Section 10.6

|

Successors and Assigns

|

16

|

|

Section 10.7

|

Headings

|

16

|

|

Section 10.8

|

Amendments and Waivers

|

16

|

|

Section 10.9

|

Appendix, Schedules and Exhibits

|

16

|

|

Section 10.10

|

Interpretation

|

16

|

|

Section 10.11

|

Agreement for the Parties’ Benefit Only

|

17

|

|

Section 10.12

|

Severability

|

18

|

|

Section 10.13

|

Limitation of Damages

|

18

|

ii

EXHIBITS

|

Exhibit 6.1

|

--

|

Conveyance

|

| Exhibit 6.3(A) |

--

|

Notice to BreitBurn |

| Exhibit 6.3 (B) |

--

|

Transfer Agent Letter |

|

Exhibit 7.2(b)

|

--

|

Affidavit of Non-foreign Status

|

|

Exhibit 7.3(b)

|

--

|

Assignment Separate from Certificate |

|

Exhibit 7.3(c)

|

--

|

Partial Assignment of Registration Rights Agreement

|

|

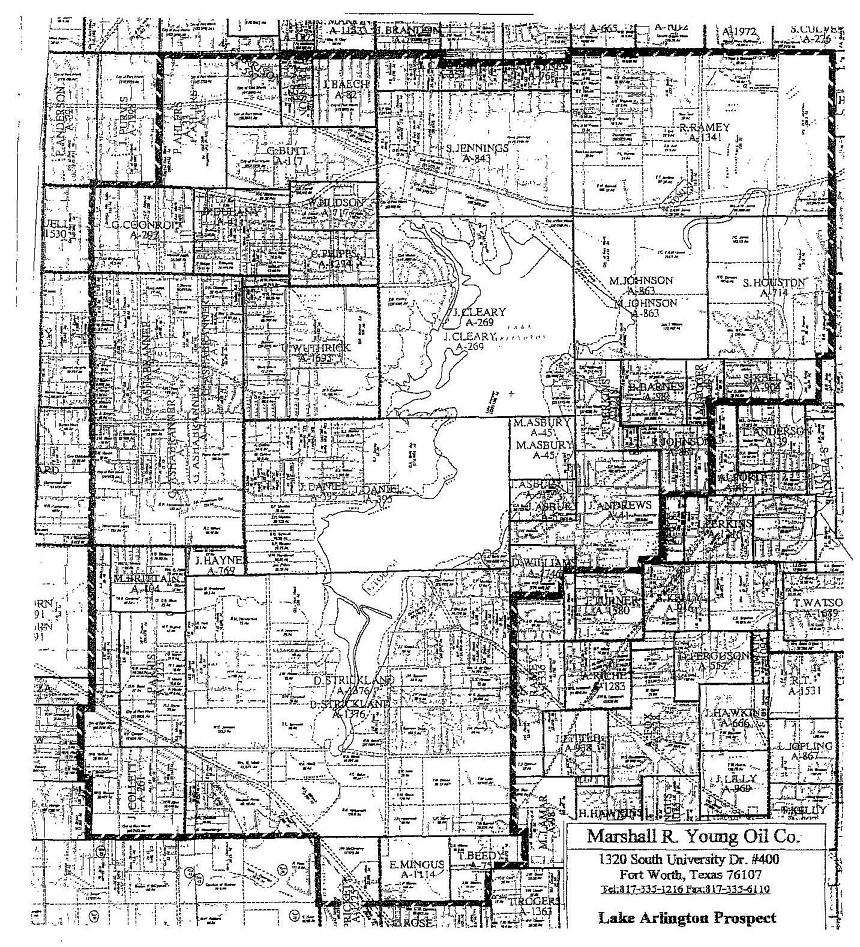

Exhibit A-1

|

--

|

Geographic Area

|

|

Exhibit A-2

|

--

|

Property Schedule

|

SCHEDULES

|

Schedule 4.1(d)

|

--

|

Seller’s Conflicts or Violations

|

|

Schedule 4.1(e)

|

--

|

Seller’s Consents

|

|

Schedule 4.1(f)

|

--

|

Transfer Requirements

|

|

Schedule 4.1(i)

|

--

|

Certain Contracts and Agreements

|

|

Schedule 4.2(d)

|

--

|

Buyer’s Conflicts or Violations

|

|

Schedule 4.2(e)

|

--

|

Buyer’s Consents

|

|

Schedule I

|

--

|

Permitted Overriding Royalty Interests

|

APPENDIX

|

Appendix A

|

--

|

Definitions

|

iii

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) dated May 11, 2010, by and between Marshall R. Young Oil Co., a Delaware corporation (“Seller”), and Quicksilver Resources Inc., a Delaware corporation (“Buyer”). Seller and Buyer shall hereinafter be referred to collectively as the “Parties” and individually as a “Party”.

WHEREAS, Seller owns certain oil and gas properties and related assets; and

WHEREAS, Seller desires to sell to Buyer, and Buyer desires to purchase from Seller, such oil and gas properties and related assets upon the terms and subject to the conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, the Parties agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

Section 1.1 Certain Defined Terms. Unless the context otherwise requires, the respective terms defined in Appendix A attached hereto and incorporated herein shall, when used herein, have the respective meanings therein specified, with each such definition to be equally applicable both to the singular and the plural forms of the term so defined.

Section 1.2 References, Gender, Number. All references in this Agreement to an “Article,” “Section,” or “subsection” shall be to an Article, Section, or subsection of this Agreement, unless the context requires otherwise. Unless the context otherwise requires, the words “this Agreement,” “hereof,” “hereunder,” “herein,” “hereby,” or words of similar import shall refer to this Agreement as a whole and not to a particular Article, Section, subsection, clause or other subdivision hereof. Whenever the context requires, the words used herein shall include the masculine, feminine and neuter gender, and the singular and the plural.

ARTICLE II

SALE AND PURCHASE

Subject to the terms and conditions of this Agreement, Seller agrees to sell and convey to Buyer, and Buyer agrees to purchase from Seller, the following described assets and properties (except to the extent constituting Excluded Assets) (collectively, the “Assets”):

(a) The undivided interests specified in the Property Schedule in, to or under the Hydrocarbon Interests described therein and all other interests of Seller in, to or under or derived from any lands (i) covered by or subject to any of the Hydrocarbon Interests described in the Property Schedule or (ii) included in the geographic area described in Exhibit A-1, even though such interests of Seller may be incorrectly described or referred to in, or a description thereof may be omitted from, the Property Schedule (the “Subject Interests”);

(b) All right, title and interest of Seller in and to the lands covered by or subject to the Subject Interests (the “Land”);

(c) All right, title and interest of Seller in and to or derived from the following insofar as the same are attributable to the Subject Interests or any of the other Assets: (i) all rights with respect to the use and occupancy of the surface of and the subsurface depths under the Land; (ii) all agreements and contracts, easements, rights-of-way, servitudes and other estates; (iii) all real and personal property located in or upon the Land or used in connection with the exploration, development or operation of the Subject Interests; and (iv) any and all lease files, title files, land files, division order files, marketing files, well files, production records, seismic, geological, geophysical and engineering data, and all other files, maps and data (in whatever form) arising out of or relating to the Subject Interests or the ownership, use, development, maintenance or operation of the Assets (the “Records”); and

(d) All (i) Hydrocarbons produced from or attributable to the Subject Interests with respect to all periods subsequent to the Effective Time and (ii) proceeds from or of such Hydrocarbons.

ARTICLE III

CONSIDERATION AND PAYMENT

Section 3.1 Consideration.

(a) The consideration for the sale and conveyance of the Assets to Buyer is (x) Sixty-Two Million and No/100 Dollars ($62,000,000) in cash consideration (the “Cash Consideration”) and (y) 4,010,695 Common Units (the “Common Units Consideration”; together with the Cash Consideration being referred to as the “Purchase Price”), as adjusted in accordance with the terms of this Agreement. The “Adjusted Purchase Price” shall be the Purchase Price (i) as adjusted by the Net Cash Flow with respect to the Assets for the Adjustment Period in accordance with Section 3.3 as set forth on the Adjusted Purchase Price Statement, (ii) as adjusted downward by $26,910 on account of Negative Imbalances, (iii) as adjusted downward by $521,000 on account of title matters asserted by Buyer, (iv) as may be adjusted downward on account of Retained Assets as contemplated by Section 5.1, and (v) as adjusted downward by $3,240,988 on account of amounts owed by Seller to Buyer as of December 31, 2009 relating to the maintenance, development and operation of the Assets (and the Parties do hereby acknowledge and agree that, notwithstanding anything provided herein or elsewhere to the contrary, the charges included in such amount are not subject to future contest or challenge by either Party). Any upward or downward adjustment to the Purchase Price be made pursuant to clauses (i), (ii), (iii) and (v) in this Section 3.1(a) shall be made by increasing or decreasing (as applicable) the Common Unit Consideration by a number of Common Units determined by dividing the amount of such adjustment by $14.96 (as so adjusted, the “Adjusted Common Units Consideration”). The downward adjustment to the Purchase Price to be made pursuant to clause (iv) in this Section 3.1(a) shall be made by decreasing the Cash Consideration (as so adjusted, the “Adjusted Cash Consideration”).

(b) Buyer has delivered to Seller a statement (the “Adjusted Purchase Price Statement”) setting forth Buyer’s preliminary determination (the “Initial Adjusted Purchase Price

2

Amount”) of the Adjusted Purchase Price for Seller’s review and approval. The Adjusted Purchase Price Statement is based upon actual information available to Buyer at the time of its preparation and upon Buyer’s good faith estimates and assumptions.

Section 3.2 Payment. At the Closing, Buyer shall (a) deliver to the Seller $20,190,606.90 of the Adjusted Cash Consideration (“Check Amount”) in the form of a cashiers check in such amount payable to the Internal Revenue Service for the benefit of the Estate of William K. Young (the “Cashiers Check”), (b) wire transfer an amount equal to the Adjusted Cash Consideration less the Check Amount in immediately available funds for the benefit of Seller to Texas Capital Bank, ABA No. 111017979, Account No. 2211000142, and (c) deliver to Seller an instrument assigning the Adjusted Common Units Consideration as more fully described in Section 7.3(b).

Section 3.3 Adjustment Period Cash Flow.

(a) The Purchase Price shall be increased or decreased, as the case may be, by an amount equal to the Net Cash Flow with respect to the Assets for the time period (the “Adjustment Period”) beginning at the Effective Time and ending at 7:00 a.m. (local time) on the Closing Date. If the Net Cash Flow with respect to the Assets for the Adjustment Period is a positive number, then the Purchase Price shall be increased by such amount. If the Net Cash Flow with respect to the Assets for the Adjustment Period is a negative number, then the Purchase Price shall be decreased by such amount.

(b) The “Net Cash Flow” shall be the algebraic sum of (i) a positive amount equal to the aggregate amount paid by Seller as Seller’s share of the direct costs or expenses of maintenance, development and operation of the Assets incurred with respect to the Adjustment Period, (ii) a positive amount equal to overhead charges paid under existing operating agreements covering the Assets during the Adjustment Period, (iii) a negative amount equal to the aggregate net proceeds received from or attributable to the sale or disposition of Hydrocarbons produced from the Assets during the Adjustment Period, after deducting, without duplication of any cost or expense taken into account under clause (i) above, applicable severance taxes and the costs of treating, transporting and compressing such Hydrocarbons, and from or attributable to the rental, sale, salvage or other disposition of any other Assets during the Adjustment Period, and (iv) a negative amount equal to the aggregate amount of any costs or expenses incurred under clause (i) above and reimbursed to Seller by any third party.

Section 3.4 Post Closing Review. After the Closing, Buyer shall review the Adjusted Purchase Price Statement and determine the actual Net Cash Flow. On or prior to ninety (90) days after the Closing Date, Buyer shall present Seller with a statement of the actual Net Cash Flow and such supporting documentation as is reasonably necessary to support the Net Cash Flow shown therein (the “Final Adjusted Purchase Price Statement”). Seller will give representatives of Buyer reasonable access to its premises and to its books and records for purposes of preparing the Final Adjusted Purchase Price Statement and will cause appropriate personnel of Seller to assist Buyer and Buyer’s representatives, at no cost to Buyer, in the preparation of the Final Adjusted Purchase Price Statement. Buyer will give representatives of Seller reasonable access to its premises and to its books and records for purposes of reviewing the calculation of Net Cash Flow and will cause appropriate personnel of Buyer to assist Seller

3

and its representatives, at no cost to Seller, in verification of such calculation. The Final Adjusted Purchase Price Statement shall become final and binding on Seller and Buyer as to the Net Cash Flow thirty (30) days following the date the Final Adjusted Purchase Price Statement is received by Seller, except to the extent that prior to the expiration of such thirty (30) day period Seller shall deliver to Buyer notice of its disagreement with the contents of the Final Adjusted Purchase Price Statement. If Seller has timely delivered a notice of disagreement to Buyer, then, upon written agreement between Buyer and Seller resolving all disagreements of Seller set forth in such notice, the Final Adjusted Purchase Price Statement will become final and binding upon Buyer and Seller as to the Net Cash Flow. If the Final Adjusted Purchase Price Statement has not become final and binding by the sixtieth (60) day following its receipt by Seller, then Buyer or Seller may submit any unresolved disagreements of Seller set forth in such notice to Grant Thornton LLP (the “Accounting Referee”) for resolution. Seller and Buyer shall use their respective commercially reasonable efforts to cause the Accounting Referee to render a decision regarding the matters submitted to it within thirty (30) days following submission thereto. The costs of the Accounting Referee shall be borne 50% by Seller and 50% by Buyer. Upon resolution of such unresolved disagreements of Seller, the Final Adjusted Purchase Price Statement shall be final and binding upon Buyer and Seller as to the Net Cash Flow. Within three (3) Business Days after the Final Adjusted Purchase Price Statement becomes final and binding, Seller or Buyer, as appropriate, shall pay to the other Party the amount, if any, by which the Net Cash Flow as shown in the Final Adjusted Purchase Price Statement is less than or exceeds the estimated amount of the Net Cash Flow set forth in the Initial Adjusted Purchase Price Statement, together with interest thereon from the date such payment is so due until the date it is paid at the Agreed Rate. Notwithstanding anything herein provided to the contrary, the Parties acknowledge and agree that the provisions of this Section 3.4 in no way limit the rights and obligations of Seller pursuant to Section 8.1, Section 8.2, Section 8.4 and other provisions of this Agreement.

Section 3.5 Severance Tax Refund. Buyer and Seller have applied for severance tax refunds attributable to production from the Assets. Seller will be entitled to all severance tax refunds attributable to times prior to the Effective Time and Buyer shall be entitled to all severance tax refunds attributable to times after the Effective Time.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES

Section 4.1 Representations and Warranties of Seller. Seller represents and warrants to Buyer as follows:

(a) Organization and Qualification. Seller is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has the requisite corporate power to carry on its business as it is now being conducted. Seller is duly qualified to do business, and is in good standing, in each jurisdiction in which the Assets owned, leased or operated by it makes such qualification necessary.

(b) Authority. Seller has all requisite corporate power and authority to execute and deliver this Agreement and to perform its obligations under this Agreement. The

4

execution, delivery and performance of this Agreement and the transactions contemplated hereby have been duly and validly authorized by all requisite corporate action on the part of Seller.

(c) Enforceability. This Agreement constitutes a valid and binding agreement of Seller enforceable against Seller in accordance with its terms, subject to (i) applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws of general application with respect to creditors, (ii) general principles of equity and (iii) the power of a court to deny enforcement of remedies generally based upon public policy.

(d) No Conflict or Violation. Neither the execution and delivery of this Agreement nor the consummation of the transactions and performance of the terms and conditions contemplated hereby by Seller will (i) conflict with or result in any breach of any provision of the certificate of incorporation, bylaws and other similar governing documents of Seller or (ii) except as set forth on Schedule 4.1(d) and in clauses (i) and (ii) of Section 4.1(e), (A) be rendered void or ineffective by or under the terms, conditions or provisions of any agreement, instrument or obligation to which Seller is a party or is subject or by which any of its properties or assets are bound, (B) result in or give rise to (or with notice or the passage of time or both could result in or give rise to) a default, the creation or imposition of any lien, charge, penalty, restriction, security interest or encumbrance or any change in terms, termination, cancellation or acceleration under the terms, conditions or provisions of any Asset (or of any agreement, instrument or obligation relating to or burdening any Asset) or (C) subject to the limitations contained in Section 4.1(c), violate or be rendered void or ineffective under any Law or result in or give rise to (or with notice or the passage of time or both could result in or give rise to) the creation or imposition of any lien, charge, penalty, restriction, security interest or encumbrance on or with respect to any Asset under any Law.

(e) Consents. Except for (i) consents and approvals of assignments by any Governmental Authority that are customarily obtained after Closing, (ii) Transfer Requirements and (iii) the consents, approvals, authorizations, filings or notices expressly described and set forth in Schedule 4.1(e), no consent, approval, authorization or permit of, or filing with or notification to, any Person is required for or in connection with the execution and delivery of this Agreement by Seller or for or in connection with the consummation of the transactions and performance of the terms and conditions contemplated hereby by Seller.

(f) Preference Rights and Transfer Requirements. None of the Assets or any portion thereof is subject to any Preference Right or Transfer Requirements except for the Preference Right and Transfer Requirements expressly identified and set forth on Schedule 4.1(f).

(g) Actions. To Seller’s knowledge, there are no actions, suits, arbitrations, proceedings, investigations or claims pending or threatened relating to or affecting any of the Assets or the transactions contemplated by this Agreement.

(h) Compliance With Laws. Seller has not received any written notice of any violation or alleged violation (or of any fact or circumstance which with notice or the passage of time or both would constitute a violation) of any Law (including any Environmental Laws)

5

applicable to the Assets and, to Seller’s knowledge, the Assets comply in all material respects with all Laws (including any Environmental Laws).

(i) Contracts and Agreements. To Seller’s knowledge, Schedule 4.1(i) sets forth a true and correct description of each contract, agreement or similar arrangement which is included in the Assets or by which any of the Assets is bound and which:

(1) is between Seller on the one hand, and any Affiliate of Seller on the other hand;

(2) is a contract for the sale, purchase, processing or transportation of, or creates a purchase option, right of first refusal or call on, any Hydrocarbons produced from or attributable to the Subject Interests or any other Assets, except those sales, purchase, processing or transportation agreements which can be terminated by Seller and its assigns upon not more than thirty (30) days notice without penalty or detriment to Seller and its assigns;

(3) creates any area of mutual interest with respect to the acquisition by Seller or its assigns of any interest in any Hydrocarbons, lands or assets; or

(4) creates or evidences a Subject Interest, joint operating agreement, unitization agreement, pooling agreement, farmout agreement, farmin agreement, participation agreement, joint venture agreement, tax partnership agreement, partnership agreement or similar agreement.

Seller is in material compliance with all terms and provisions of all contracts or agreements included in or by which any of the Assets is subject. All such contracts and agreements are in full force and effect and, to the knowledge of Seller, there are no violations or breaches thereof or existing facts or circumstances which upon notice or the passage of time or both will constitute a violation or breach thereof by any other party thereto.

(j) Brokerage Fees and Commissions. Neither Seller nor any Affiliate of Seller has incurred any obligation or entered into any agreement for any investment banking, brokerage or finder’s fee or commission in respect of the transactions contemplated by this Agreement for which Buyer or any Affiliate of Buyer shall incur any liability.

(k) Taxes. To Seller’s knowledge, Seller has paid all Taxes on or relating to the Assets, or any production or revenues attributable thereto, except for taxes which are not yet due and payable. Seller is not a non-resident alien or foreign corporation (as those terms are defined in the Code).

(l) Bankruptcy. There are no bankruptcy, reorganization or arrangement proceedings pending against, being contemplated by, or, to Seller’s knowledge, threatened against Seller.

(m) Investment Company. Seller is not an “investment company” or a company “controlled” by an “investment company” within the meaning of the Investment

6

Company Act of 1940, as amended, or is otherwise subject to regulation under or the restrictions of such Act.

(n) Royalties. To Seller’s knowledge, all royalties, overriding royalties and other burdens on production due with respect to the Assets have been timely and properly paid.

(o) Permits. To Seller’s knowledge, all licenses, permits, certificates, orders, approvals and authorizations of Governmental Authority necessary for the ownership or operation of the Assets have been obtained and all such licenses, permits, certificates, orders, approvals and authorizations are in full force and effect and all fees and charges relating thereto have been paid.

(p) Hedging. None of the Assets is subject to or is bound by any futures, hedge, swap, collar, put, call, option or other commodities contract or agreement.

(q) Eligible Holder. Seller is an Eligible Holder.

(r) Investment Intent. Seller is not an underwriter within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). Seller is acquiring the Adjusted Common Units Consideration for its own account, solely for investment and not with a view to, or for resale in connection with, any distribution or public offering thereof within the meaning of the Securities Act and state securities Laws, and shall not resell, distribute or otherwise transfer the Adjusted Common Units Consideration unless such resale, distribution or transfer is in compliance with federal and state securities Laws. Seller understands and acknowledges that (1) the transfer of the Adjusted Common Units Consideration under this Agreement has not been registered under the Securities Act or state securities Law, and (2) the Adjusted Common Units Consideration may not be resold, distributed or otherwise transferred by Seller unless such resale, distribution or transfer is registered under the Securities Act or is made pursuant to an applicable exemption therefrom, and is registered under state securities Law or is made pursuant to an applicable exemption therefrom.

(s) Sophistication and Risk. Seller has knowledge, skill and experience in financial, business and investment matters relating to an investment of this type and is capable of evaluating the merits and risks of such investment and protecting Seller’s interest in connection with the acquisition of the Adjusted Common Units Consideration. To the extent deemed necessary by Seller, Seller has retained, at its own expense, and relied upon, appropriate professional advice regarding the investment, tax and legal merits and consequences of purchasing and owning the Adjusted Common Units Consideration. Seller has the ability to bear the economic risks of Seller’s investment in BreitBurn.

(t) Access to Information. Seller has access to and has reviewed certain of BreitBurn’s filings made pursuant to the Securities Exchange Act of 1934, as amended. These filings are available to the public on the Securities and Exchange Commission’s website and are required to include collectively all material information regarding the business and financial condition of the BreitBurn, its expected plans for future business activities, the attributes of the Adjusted Common Units Consideration and the merits and risks of an investment in the Adjusted Common Units Consideration. Seller hereby acknowledges that, based upon the foregoing, it

7

does not desire any further information to evaluate the merits and risks of an investment in the Adjusted Common Units Consideration.

(u) Accredited Investor. Seller is an accredited investor as defined in Rule 501(a) of Regulation D promulgated under the Securities Act.

Section 4.2 Representations and Warranties of Buyer. Buyer represents and warrants to Seller as follows:

(a) Organization and Qualification. Buyer is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has the requisite corporate power to carry on its business as it is now being conducted. Buyer is duly qualified to do business, and is in good standing, in each jurisdiction in which the Assets to be acquired by it makes such qualification necessary.

(b) Authority. Buyer has all requisite corporate power and authority to execute and deliver this Agreement and to perform its obligations under this Agreement. The execution, delivery and performance of this Agreement and the transactions contemplated hereby have been duly and validly authorized by all requisite corporate action on the part of Buyer.

(c) Enforceability. This Agreement constitutes a valid and binding agreement of Buyer enforceable against Buyer in accordance with its terms, subject to (i) applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws of general application with respect to creditors, (ii) general principles of equity and (iii) the power of a court to deny enforcement of remedies generally based upon public policy.

(d) No Conflict or Violation. Neither the execution and delivery of this Agreement nor the consummation of the transactions and performance of the terms and conditions contemplated hereby by Buyer will (i) conflict with or result in any breach of any provision of the certificate of incorporation, bylaws and other similar governing documents of Buyer or (ii) except as set forth on Schedule 4.2(d) and in clauses (i) and (ii) of Section 4.2(e), (A) be rendered void or ineffective by or under the terms, conditions or provisions of any agreement, instrument or obligation to which Buyer is a party or is subject or (B) subject to the limitations contained in Section 4.2(c), violate or be rendered void or ineffective under any Law.

(e) Consents. Except for (i) consents and approvals of assignments by any Governmental Authority that are customarily obtained after Closing, (ii) Transfer Requirements and (iii) the consents, approvals, authorizations, filings or notices expressly described and set forth in Schedule 4.2(e), no consent, approval, authorization or permit of, or filing with or notification to, any Person is required for or in connection with the execution and delivery of this Agreement by Buyer or for or in connection with the consummation of the transactions and performance of the terms and conditions contemplated hereby by Buyer.

(f) Actions. To Buyer’s knowledge, there are no actions, suits, arbitrations, proceedings, investigations or claims pending or threatened relating to the transactions contemplated by this Agreement.

8

(g) Brokerage Fees and Commissions. Neither Buyer nor any Affiliate of Buyer has incurred any obligation or entered into any agreement for any investment banking, brokerage or finder’s fee or commission in respect of the transactions contemplated by this Agreement for which Seller or any Affiliate of Seller shall incur any liability.

(h) Qualified Owner. Buyer (i) is qualified to own state oil, gas and mineral leases in all jurisdictions where any of the Subject Interests are located and (ii) has complied with any necessary governmental bonding requirements arising from its ownership of the Assets. The consummation of the transactions contemplated hereby will not cause Buyer to be disqualified as an owner of such leases or to exceed any acreage limitation imposed by any statute, rule, regulation or order of Governmental Authority.

(i) Title to Adjusted Common Units Consideration. Buyer has good and valid title to the Adjusted Common Units Consideration, free and clear of all liens and encumbrances other than those arising under the BreitBurn Partnership Agreement and transfer restrictions imposed by Law. Upon transfer of the Adjusted Common Units Consideration at the Closing, Seller shall acquire all of Buyer’s right, title and interest in the Adjusted Common Units Consideration, free all covenants or restrictions applicable to Buyer or Common Units held by Buyer except (i) covenants applicable to Seller or the Adjusted Common Units Consideration pursuant to the partial assignment of Buyer’s rights and obligations under the BreitBurn Registration Rights Agreement described in Section 7.3(c) of this Agreement and (ii) obligations under the BreitBurn Partnership Agreement applicable to all holders of Common Units generally.

ARTICLE V

TRANSFER REQUIREMENTS

Section 5.1 Transfer Requirements. Prior to the execution hereof, Seller initiated all procedures required to comply with or obtain the waiver of all Transfer Requirements applicable to the transactions contemplated by this Agreement. If a Transfer Requirement applicable to the transactions contemplated by this Agreement is not obtained, complied with or otherwise satisfied prior to the Closing Date, then, at Buyer’s option, any Asset or portion thereof affected by such Transfer Requirement (a “Retained Asset”) shall be held back from the Assets to be transferred and conveyed to Buyer at Closing and the Purchase Price to be paid at Closing shall be reduced by an amount agreed to by the Parties. Any Retained Asset so held back at the initial Closing will be conveyed to Buyer within ten (10) days following the date on which Seller obtains, complies with or otherwise satisfies all Transfer Requirements with respect to such Retained Asset for a purchase price equal to the amount by which the Purchase Price was reduced on account of the holding back of such Retained Asset; provided, however, if all Transfer Requirements with respect to any Retained Asset so held back at the initial Closing are not obtained, complied with or otherwise satisfied within ninety (90) days following the Closing Date, then such Retained Asset shall be eliminated from the Assets and this Agreement; provided that, if Buyer, prior to the expiration of such ninety (90) day period, elects in writing to waive the Transfer Requirements which have not been obtained, complied with or satisfied with respect to such Retained Asset, Seller shall immediately convey such Retained Asset to Buyer for the portion of the Purchase Price withheld with respect thereto. Any subsequent conveyance of a Retained Asset will be subject to all Closing requirements and conditions applicable to the initial

9

Closing hereunder and appropriate adjustments in Net Cash Flow and proration of revenues and expenses will be made to account for any delayed Closing with respect to a Retained Asset.

Section 5.2 Certain Governmental Consents. Seller and Buyer will use their commercially reasonable efforts after Closing to obtain all approvals and consents from the Governmental Authorities that may be required under the terms of (or regulations specifically applicable to) any state leases in connection with the assignment of the Subject Interests therein from Seller to Buyer. To the extent applicable Law prevents complete legal and equitable title to such Subject Interests from being conveyed from Seller to Buyer until such approvals and consents are obtained, Seller shall continue to hold bare legal title to such Subject Interests as nominee for Buyer. As nominee, Seller shall not be authorized to take and shall not take any action with respect to such Subject Interests except to the extent expressly authorized and directed in writing by Buyer. Seller shall not be obligated to incur any expenses in Seller’s capacity as nominee. For purposes of Article IX, Seller and Buyer shall treat and deal with such Subject Interests as if full legal and equitable title to such Subject Interests had passed from Seller to Buyer at Closing; provided that, Buyer shall not be obligated to indemnify or hold harmless Seller for any unauthorized action taken by Seller as nominee of such Subject Interests.

ARTICLE VI

COVENANTS OF SELLER AND BUYER

Section 6.1 General Conveyance. Upon the terms and subject to the conditions of this Agreement, at or prior to the Closing, Seller shall execute and deliver the General Conveyance, in substantially the form attached hereto as Exhibit 6.1 (the “Conveyance”), to Buyer together with all special state assignment forms as may be required by Law to be executed in connection with the conveyance of specific Assets; provided that the terms and provisions of the Conveyance shall control as to any conflict between the Conveyance and any such special assignment forms.

Section 6.2 Public Announcements. Without the prior written approval of the other Party, which approval shall not be unreasonably withheld, no Party will issue, or permit any agent or Affiliate to issue, any press releases or otherwise make, or cause any agent or Affiliate to make, any public statements with respect to this Agreement and the transactions contemplated hereby, except where such release or statement is deemed in good faith by the releasing Party to be required by Law or any national securities exchange, in which case the Party or Parties will use its or their, as the case may be, commercially reasonable efforts to provide a copy to the other Party prior to any release or statement. Nothing in this Section shall prohibit the disclosure by Seller to shareholders, directors, and employees, as may be reasonably necessary to consummate this transaction, so long as such shareholders, directors and employees agree to maintain all information disclosed to them and the transactions contemplated by this Agreement confidential.

Section 6.3 Further Assurances. Seller and Buyer each agrees that, from time to time, whether before, at or after the Closing Date, each of them will execute and deliver or cause their respective Affiliates to execute and deliver such further instruments of conveyance and transfer and take such other action as may be reasonably necessary to carry out the purposes and intents of this Agreement. Any separate or additional assignment of the Assets or any portion thereof

10

required pursuant to this Section 6.3 (a) shall evidence the conveyance and assignment of the Assets made or intended to be made in the Conveyance, (b) shall not modify or be deemed to modify any of the terms, covenants and conditions set forth in the Conveyance and (c) shall be deemed to contain all of the terms and provisions of the Conveyance, as fully as though the same were set forth at length in such separate or additional assignment. In addition, Buyer covenants and agrees with Seller that, promptly after the Closing, Buyer shall request (a) BreitBurn or its transfer agent to register the Adjusted Common Units Consideration in the name of Seller and (b) BreitBurn to issue to Seller certificates representing the Adjusted Common Units Consideration. Buyer shall also use commercially reasonable efforts promptly following the Closing to increase its existing bond with the City of Arlington relating to the oil and gas lease dated October 18, 2006 from the City of Arlington (QRI File No. TX4390156.00) by $125,000 (or issue a new bond to the city for $125,000) in order to allow the City of Arlington to release Seller’s bond of $125,000 in favor of the city relating to such lease. Finally, Buyer hereby confirms that it has delivered to BreitBurn the notice attached hereto as Exhibit 6.3(A) and that it shall execute at the Closing and deliver to JP Morgan Chase Bank, NA (“JP Morgan”) for the prompt delivery by JP Morgan (along with the certificate representing all of the Common Units owned by Buyer prior to the Closing) to BreitBurn’s transfer agent, the letter attached hereto as Exhibit 6.3(B).

ARTICLE VII

CLOSING

Section 7.1 Closing. The Closing shall be held on the Closing Date at 10:00 a.m., Fort Worth, Texas time, at the offices of Buyer, or at such other time or place as Seller and Buyer may otherwise agree in writing.

Section 7.2 Seller’s Closing Obligations. As conditions precedent to Buyer’s obligation to consummate the Closing, Seller shall execute and deliver, or cause to be executed and delivered, to Buyer the following at the Closing:

(a) The Conveyance;

(b) The Affidavit of Non-foreign Status substantially in the form attached as Exhibit 7.2(b);

(c) Letters in lieu of division and transfer orders executed by Seller relating to the Subject Interests in form reasonably necessary to reflect the conveyances contemplated hereby;

(d) The Records; and

(e) Such other documents as may be reasonably necessary to convey all of Seller’s interests in the Assets to Buyer in accordance with the terms and provisions of this Agreement.

Section 7.3 Buyer’s Closing Obligations. As conditions precedent to Seller’s obligation to consummate the Closing, Buyer shall, at the Closing, (i) deliver, or cause to be delivered, the (a) Cashiers Check and (b) Adjusted Cash Consideration less the Check Amount in

11

immediately available funds to the bank account provided in Section 3.2 and (ii) execute and deliver, or cause to be executed and delivered, to Seller the following:

(a) The Conveyance;

(b) An instrument assigning the Adjusted Common Units Consideration to Seller substantially in the form attached as Exhibit 7.3(b); and

(c) Partial assignment of Buyer’s rights and obligations under the BreitBurn Registration Rights Agreement with respect to the Adjusted Common Units Consideration substantially in the form attached as Exhibit 7.3(c) (the “Partial Assignment of Registration Rights Agreement”).

ARTICLE VIII

EFFECT OF CLOSING

Section 8.1 Revenues. After Closing, all proceeds, accounts receivable, notes receivable, income, revenues, monies and other items included in or attributable to the Excluded Assets shall belong to and be paid over to Seller.

Section 8.2 Expenses. After Closing, all accounts payable and other costs and expenses with respect to the Assets that are attributable to the period prior to the Effective Time shall be the obligation of and be paid by Seller.

Section 8.3 Ad Valorem Taxes. Buyer shall be responsible for payment of ad valorem taxes assessed against any Assets for 2010.

Section 8.4 Payments and Obligations. If monies are received by any Party which, under the terms of this Agreement, belong to another Party, the same shall immediately be paid over to the proper Party. If an invoice or other evidence of an obligation is received which under the terms of this Agreement is partially the obligation of Seller and partially the obligation of Buyer, then the Parties shall consult each other and each shall promptly pay its portion of such obligation to the obligee.

Section 8.5 Survival. The representations and warranties of the Parties contained in Article IV of this Agreement shall survive the Closing indefinitely; provided, however, the representations and warranties of (a) Seller contained in Section 4.1(k) shall survive for the applicable period of limitations and (b) Seller contained in Sections 4.1(f) through (j) and Sections 4.1(l) through (u) and Buyer contained in Section 4.2(f) thru (i) shall survive for twelve (12) months after the Closing Date. All of the covenants and agreements made by each Party in this Agreement shall survive the consummation of the transactions contemplated herein and shall continue in full force and effect after the Closing indefinitely until all obligations with respect to any such covenants are fulfilled in their entirety.

Section 8.6 Waiver of Representations and Warranties. The express representations and warranties of Seller contained in this Agreement or in any agreement to be delivered by Seller pursuant hereto are exclusive and are in lieu of, and Seller expressly disclaims and negates and Buyer hereby waives, any other representation or warranty, express, statutory, implied, or

12

otherwise. Seller does not make or provide, and Buyer hereby waives, any warranty or representation, express or implied, as to the quality, merchantability, fitness for a particular purpose, or of conformity to models or samples of materials. The items of personal property, equipment, improvements, fixtures and appurtenances conveyed as part of the Assets are sold, and Buyer accepts such items “AS IS, WHERE IS AND WITH ALL FAULTS”.

ARTICLE IX

ASSUMPTION AND INDEMNIFICATION

Section 9.1 Indemnification By Buyer. FROM AND AFTER THE CLOSING DATE AND SUBJECT TO SECTION 9.2, BUYER SHALL ASSUME THE ASSUMED LIABILITIES AND SHALL INDEMNIFY AND HOLD HARMLESS SELLER, ITS AFFILIATES AND THE PRESENT AND FORMER DIRECTORS, OFFICERS, EMPLOYEES AND AGENTS OF SELLER AND ITS AFFILIATES, AND EACH OF THE HEIRS, EXECUTORS, SUCCESSORS AND PERMITTED ASSIGNS OF ANY OF THE FOREGOING (COLLECTIVELY, THE “SELLER INDEMNIFIED PARTIES”) FROM AND AGAINST ANY AND ALL (A) ASSUMED LIABILITIES INCURRED BY OR ASSERTED AGAINST ANY OF THE SELLER INDEMNIFIED PARTIES, INCLUDING, WITHOUT LIMITATION, ANY ASSUMED LIABILITY BASED ON NEGLIGENCE OR STRICT LIABILITY OF THE SELLER INDEMNIFIED PARTIES OR ANY OTHER THEORY OF LIABILITY, WHETHER IN LAW OR EQUITY (OTHER THAN THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY OF THE SELLER INDEMNIFIED PARTIES) OR (B) COVERED LIABILITIES RESULTING FROM ANY MISREPRESENTATION, BREACH OF WARRANTY OR NONFULFILLMENT OF ANY COVENANT OR AGREEMENT ON THE PART OF BUYER HEREUNDER.

Section 9.2 Indemnification By Seller. FROM AND AFTER THE CLOSING DATE, SELLER SHALL INDEMNIFY AND HOLD HARMLESS THE BUYER, ITS AFFILIATES AND THE PRESENT AND FORMER DIRECTORS, OFFICERS, EMPLOYEES AND AGENTS OF BUYER AND ITS AFFILIATES, AND EACH OF THE HEIRS, EXECUTORS, SUCCESSORS AND PERMITTED ASSIGNS OF ANY OF THE FOREGOING (COLLECTIVELY, THE “BUYER INDEMNIFIED PARTIES”) FROM AND AGAINST ANY AND ALL COVERED LIABILITIES RESULTING FROM (A) ANY MISREPRESENTATION, BREACH OF WARRANTY OR NONFULFILLMENT OF ANY COVENANT OR AGREEMENT ON THE PART OF SELLER HEREUNDER OR (B) THE OWNERSHIP, USE, CONSTRUCTION, MAINTENANCE OR OPERATION OF (i) ANY OF THE EXCLUDED ASSETS OR ANY OTHER ASSET EXCLUDED OR ELIMINATED FROM THIS AGREEMENT AND (ii) THE ASSETS PRIOR TO THE EFFECTIVE TIME, EXCEPT TO THE EXTENT BUYER, AS THE OPERATOR OF THE ASSETS, IS RESPONSIBLE FOR THE COVERED LIABILITY AS A RESULT OF BUYER BEING IN BREACH OF AND LIABLE PURSUANT TO THE EXPRESS TERMS OF THE OPERATING AGREEMENT DATED JUNE 2, 2006, BY AND BETWEEN SELLER AND BUYER COVERING THE ASSETS (THE “JOA”), AND PROVIDED THE CLAIM FOR INDEMNIFICATION IS MADE WITHIN ONE YEAR FROM THE DATE OF THE CLOSING. SELLER SHALL BE ENTITLED TO ALL RIGHTS AND DEFENSES IT

13

HAS UNDER THE JOA AS A RESULT OF BUYER BEING IN BREACH OF AND LIABLE UNDER THE EXPRESS TERMS OF THE JOA.

Section 9.3 Third Party Claims. If a claim by a third party is made against a Seller Indemnified Party or a Buyer Indemnified Party (an “Indemnified Party”), and if such party intends to seek indemnity with respect thereto under this Article IX, such Indemnified Party shall promptly notify Buyer or Seller, as the case may be (the “Indemnitor”), in writing of such claim. The Indemnitor shall have thirty (30) days after receipt of such notice to undertake, conduct and control, through counsel of its own choosing and at its own expense, the settlement or defense thereof, and the Indemnified Party shall cooperate with it in connection therewith; provided that the Indemnitor shall permit the Indemnified Party to participate in such settlement or defense through counsel chosen by such Indemnified Party, however, the fees and expenses of such counsel shall be borne by such Indemnified Party. So long as the Indemnitor, at Indemnitor’s cost and expense, (1) has undertaken the defense of, and assumed full responsibility for all Covered Liabilities with respect to, such claim, (2) is reasonably contesting such claim in good faith, by appropriate proceedings, and (3) has taken such action (including the posting of a bond, deposit or other security) as may be necessary to prevent any action to foreclose a lien against or attachment of the property of the Indemnified Party for payment of such claim, the Indemnified Party shall not pay or settle any such claim. Notwithstanding compliance by the Indemnitor with the preceding sentence, the Indemnified Party shall have the right to pay or settle any such claim, provided that in such event it shall waive any right to indemnity therefor by the Indemnitor for such claim. If, within thirty (30) days after the receipt of the Indemnified Party’s notice of a claim of indemnity hereunder, the Indemnitor does not notify the Indemnified Party in writing that it elects, at Indemnitor’s cost and expense, to undertake the defense thereof and assume full responsibility for all Covered Liabilities with respect thereto, or gives such notice and thereafter fails to contest such claim in good faith or to prevent action to foreclose a lien against or attachment of the Indemnified Party’s property as contemplated above, the Indemnified Party shall have the right to contest, settle or compromise the claim but shall not thereby waive any right to indemnity therefor pursuant to this Agreement.

Section 9.4 Direct Claims. If an Indemnified Party is entitled to indemnity under Section 9.1 or 9.2 for a claim or other matter which does not involve a third party claim, and if Buyer or Seller intends to seek indemnity on behalf of an Indemnified Party with respect thereto by or from an Indemnitor pursuant to Section 9.1 or 9.2, then the Party electing to seek indemnity on behalf of an Indemnified Party shall promptly transmit to the Indemnitor a written notice describing in reasonable detail the nature of such claim or other matter, the Indemnified Party’s best estimate of the Covered Liabilities attributable to such claim or other matter (which shall not constitute an admission or be binding in any respect) and the basis for the Indemnified Party’s entitlement to indemnification under Section 9.1 or 9.2, as the case may be. If the Indemnitor does not notify the Party who sent such notice within 30 days from its receipt of such notice that the Indemnitor does not dispute such claim for indemnity, the Indemnitor shall be deemed to have disputed such claim.

ARTICLE X

MISCELLANEOUS

14

Section 10.1 Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and shall become effective when one or more counterparts have been signed by each of the Parties and delivered to the other Party.

Section 10.2 Governing Law. THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF TEXAS WITHOUT REFERENCE TO THE CONFLICT OF LAW PRINCIPLES THEREOF.

Section 10.3 Entire Agreement. This Agreement (including the Conveyance, the Partial Assignment of Registration Rights Agreement and other agreements expressly contemplated by or incorporated herein) and the Appendix, Schedules and Exhibits hereto, and instruments referred to therein, contain the entire agreement between the Parties with respect to the subject matter hereof and there are no agreements, understandings, representations or warranties between the Parties other than those set forth or referred to herein.

Section 10.4 Expenses. Buyer shall be responsible for all recording fees relating to the filing of instruments transferring title to Buyer from Seller. Seller shall be responsible for (a) all recording and other fees relating to title curative documents, (b) any sales Taxes which may become due and owing by reason of the sale of the Assets hereunder, (c) all transfer, stamp, documentary and similar Taxes imposed on the Parties with respect to the property transfer contemplated pursuant to this Agreement and (d) all income and other Taxes incurred by or imposed on Seller with respect to the transactions contemplated hereby. All other costs and expenses incurred by each Party in connection with all things required to be done by it hereunder, including attorney’s fees, accountant fees and the expense of title examination, shall be borne by the Party incurring same.

Section 10.5 Notices. All notices hereunder shall be sufficiently given for all purposes hereunder if in writing and delivered personally, sent by documented overnight delivery service or, to the extent receipt is confirmed, by United States Mail, telecopy, telefax or other similar electronic transmission service to the appropriate address or number as set forth below. Notices to Seller shall be addressed as follows:

Marshall R. Young Oil Co.

1320 S. University Drive, No. 400

Fort Worth, Texas 76107

Attention: Greg Wilson

Telecopy No: (817) 335-4843

With a copy to (which shall not constitute notice hereunder):

Harris, Finley & Bogle, P.C.

777 Main Street, Suite 3600

Fort Worth, Texas 76102-5341

Attention: William G. Bredthauer

Telecopy No: (817) 333-1195

15

or at such other address and to the attention of such other Person as Seller may designate by written notice to Buyer. Notices to Buyer shall be addressed to:

Quicksilver Resources Inc.

777 West Rosedale Street

Fort Worth, Texas 76104

Attention: John C. Cirone, Senior Vice President and General Counsel

Telecopy No.: (817) 665-5021

With a copy to (which shall not constitute notice hereunder):

Fulbright & Jaworski L.L.P.

Fulbright Tower

1301 McKinney, Suite 5100

Houston, Texas 77010

Attention: Deborah A. Gitomer

Telecopy No: (713) 651-5246

or at such other address and to the attention of such other Person as Buyer may designate by written notice to Seller.

Section 10.6 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and permitted assigns. Neither this Agreement nor the obligations of any Party shall be assignable or transferable by such Party without the prior written consent of the other Party.

Section 10.7 Headings. The headings to Articles, Sections and other subdivisions of this Agreement are inserted for convenience of reference only and will not affect the meaning or interpretation of this Agreement.

Section 10.8 Amendments and Waivers. This Agreement may not be modified or amended except by an instrument or instruments in writing signed by the Party against whom enforcement of any such modification or amendment is sought. Any Party may, only by an instrument in writing, waive compliance by another Party with any term or provision of this Agreement on the part of such other Party to be performed or complied with. The waiver by any Party of a breach of any term or provision of this Agreement shall not be construed as a waiver of any subsequent breach.

Section 10.9 Appendix, Schedules and Exhibits. The Appendix and all Schedules and Exhibits hereto which are referred to herein are hereby made a part hereof and incorporated herein by such reference.

Section 10.10 Interpretation. In construing this Agreement:

(a) Examples shall not be construed to limit, expressly or by implication, the matter they illustrate;

16

(b) The word “includes” and its derivatives means “includes, but is not limited to” and corresponding derivative expressions;

(c) A defined term has its defined meaning throughout this Agreement and each exhibit, attachment, and schedule to this Agreement, regardless of whether it appears before or after the place where it is defined;

(d) Each of the Appendix and each Exhibit and Schedule to this Agreement is a part of this Agreement, but if there is any conflict or inconsistency between the main body of this Agreement and the Appendix or any Exhibit or Schedule, the provisions of the main body of this Agreement shall prevail; and

(e) No consideration shall be given to the fact or presumption that one Party had a greater or lesser hand in drafting this Agreement.

Section 10.11 Agreement for the Parties’ Benefit Only. Except as specified in Article IX, which is also intended to benefit and to be enforceable by any of the Indemnified Parties, this Agreement is not intended to confer upon any Person not a Party any rights or remedies hereunder, and no Person, other than the Parties or the Indemnified Parties, is entitled to rely on any representation, warranty, covenant or agreement contained herein (provided, however, that any claim for indemnity hereunder on behalf of an Indemnified Party must be made and administered by a Party).

Section 10.12 Severability. If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule of law or public policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any adverse manner to any Party. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the Parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in an acceptable manner to the end that the transactions contemplated hereby are fulfilled to the extent possible.

Section 10.13 Limitation of Damages. NOTWITHSTANDING ANYTHING CONTAINED HEREIN TO THE CONTRARY, IN NO EVENT SHALL ANY PARTY AND/OR ITS AFFILIATES BE LIABLE FOR ANY CONSEQUENTIAL, SPECIAL, INDIRECT OR PUNITIVE DAMAGES CLAIMED BY A PARTY OR ANY SELLER INDEMNIFIED PARTIES OR BUYER INDEMNIFIED PARTIES ARISING FROM OR RELATING TO (A) ANY ACTIONS FOR INDEMNIFICATION UNDER SECTION 9.1 OR SECTION 9.2, AS THE CASE MAY BE, (B) ANY ACTIONS RELATING TO ANY BREACH BY A PARTY IN THE EVENT OF A TERMINATION OF THIS AGREEMENT PURSUANT TO ARTICLE XIII OR (C) ANY OTHER BREACH OR ALLEGED BREACH OF THIS AGREEMENT; PROVIDED, HOWEVER, THAT THE FOREGOING SHALL NOT BAR RECOVERY BY ONE PARTY AGAINST ANOTHER PARTY FOR COVERED LIABILITIES HEREUNDER TO THE EXTENT SUCH COVERED LIABILITIES ARE OWED BY THE CLAIMING PARTY TO AN UNAFFILIATED THIRD PARTY (WHICH

17

SHALL NOT INCLUDE ANY SELLER INDEMNIFIED PARTIES OR BUYER INDEMNIFIED PARTIES).

[SIGNATURE PAGE FOLLOWS]

18

IN WITNESS WHEREOF, this Agreement has been signed by or on behalf of each of the Parties as of the day first above written.

| SELLER: | |||

|

MARSHALL R. YOUNG OIL CO.,

a Delaware corporation

|

|||

| By: | /s/ Shannon E. Y. Ray | ||

| Shannon E. Y. Ray | |||

| President | |||

| By: | /s/ George M. Young | ||

| George M. Young | |||

| Chairman | |||

| BUYER: | |||

|

QUICKSILVER RESOURCES INC.,

a Delaware corporation

|

|||

| By: | /s/ Glenn Darden | ||

| Glenn Darden | |||

| President and Chief Executive Officer | |||

Signature Page to Asset Purchase Agreement

APPENDIX A

Attached to and made a part of that certain

Asset Purchase Agreement dated May 11, 2010,

by and between Marshall R. Young Oil Co., as “Seller”, and

Quicksilver Resources Inc., as “Buyer”

DEFINITIONS

“Accounting Referee” shall be as defined in Section 3.4.

“Adjusted Cash Consideration” shall be defined in Section 3.1(a).

“Adjusted Common Units Consideration” shall be as defined in Section 3.1(a).

“Adjustment Period” shall be as defined in Section 3.3(a).

“Adjusted Purchase Price” shall be as defined in Section 3.1(a).

“Adjusted Purchase Price Statement” shall be as defined in Section 3.1(b).

“Affiliate” shall mean, as to the Person specified, any Person controlling, controlled by or under common control with such specified Person. The concept of control, controlling or controlled as used in the aforesaid context means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of another, whether through the ownership of voting securities, by contract or otherwise.

“Agreed Rate” shall mean an annual rate of interest equal to the lesser of (i) eight percent (8%) and (ii) the maximum rate of interest allowed by Law.

“Agreement” shall be as defined in the preamble to the Asset Purchase Agreement.

“Assets” shall be as defined in Article II.

“Assumed Liabilities” shall mean all Covered Liabilities arising out of or attributable to the ownership, use, construction, maintenance or operation of the Assets before or after the Effective Time other than those for which Buyer is entitled to indemnification pursuant to Section 9.2.

“BreitBurn” shall mean BreitBurn Energy Partners L.P., a Delaware limited partnership.

“BreitBurn Partnership Agreement” shall mean the First Amended and Restated Limited Partnership Agreement of BreitBurn Energy Partners L.P., dated as of October 10, 2006, as amended.

“BreitBurn Registration Rights Agreement” shall mean the Registration Rights Agreement between Buyer and BreitBurn, dated as of November 1, 2007, as amended.

Appendix A, Page 1

“Buyer” shall be as defined in the preamble to this Agreement.

“Buyer Indemnified Parties” shall be as defined in Section 9.2.

“Cash Consideration” shall be as defined in Section 3.1(a).

“Cashiers Check” shall be as defined in Section 3.2.

“Check Amount” shall be as defined in Section 3.2.

“Closing” shall be the consummation of the transactions contemplated by Article VII.

“Closing Date” shall mean (i) May 11, 2010, or (ii) such other date as may be mutually agreed to by Seller and Buyer.

“Code” shall mean the Internal Revenue Code of 1986, as amended, and any successor thereto, together with all regulations promulgated thereunder.

“Common Units” shall mean the common unit representing limited partnership interests issued by BreitBurn that are registered under Section 12(b) of the Securities Exchange Act of 1934, as amended, and are listed for trading on the NASDAQ Global Select Market.

“Common Units Consideration” shall be as defined in Section 3.1(a).

“Conveyance” shall be as defined in Section 6.1.

“Covered Liabilities” shall mean any and all debts, losses, liabilities, duties, claims, damages, obligations, payments (including, without limitation, those arising out of any demand, assessment, settlement, judgment or compromise relating to any actual or threatened actions, suits, arbitrations, proceedings or investigations), Taxes, costs and expenses (including, without limitation, any attorneys’ fees and any and all expenses whatsoever incurred in investigating, preparing or defending any actions, suits, arbitrations, proceedings or investigations), matured or unmatured, absolute or contingent, accrued or unaccrued, liquidated or unliquidated, known or unknown, including, without limitation, any of the foregoing arising under, out of or in connection with any actions, suits, arbitrations, proceedings or investigations, any order or consent decree of any Governmental Authority, any award of any arbitrator, or any Law, contract, commitment or undertaking.

“Effective Time” shall mean 7:00 a.m., Central Standard Time, on January 1, 2010.

“Eligible Holder” means a person or entity qualified to hold an interest in oil and gas leases on federal lands. As of the date hereof, Eligible Holder means: (1) a citizen of the United States; (2) a corporation organized under the laws of the United States or of any state thereof; (3) a public body, including a municipality; or (4) an association of United States citizens, such as a partnership or limited liability company, organized under the laws of the United States or of any state thereof, but only if such association does not have any direct or indirect foreign ownership, other than foreign ownership of stock in a parent corporation organized under the laws of the United States or of any state thereof. For the avoidance of doubt, onshore mineral

Appendix A, Page 2

leases or any direct or indirect interest therein may be acquired and held by aliens only through stock ownership, holding or control in a corporation organized under the laws of the United States or of any state thereof.

“Environmental Laws” shall mean all Laws relating to (i) the control of any pollutant or potential pollutant or protection of the air, water, land or the environment, (ii) solid, gaseous or liquid waste generation, handling, treatment, storage, disposal or transportation or (iii) exposure to hazardous, toxic, explosive, corrosive or other substances alleged to be harmful. “Environmental Laws” shall include, but not be limited to, the Clean Air Act, 42 U.S.C. § 7401 et seq., the Clean Water Act, 33 U.S.C. § 1251 et seq., the Resource Conservation Recovery Act, 42 U.S.C. § 6901 et seq., the Superfund Amendments and Reauthorization Act, 42 U.S.C. § 11001 et seq., the Water Pollution Control Act, 33 U.S.C. § 1251 et seq., the Safe Drinking Water Act, 42 U.S.C. § 300f et seq. and the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. § 9601 et seq.

“Excluded Assets” shall mean the following:

(a) all deposits, cash, checks, funds and accounts receivable attributable to Seller’s interest in the Assets with respect to any period of time prior to the Effective Time;

(b) all (i) Hydrocarbons produced from or attributable to the Subject Interests with respect to all periods prior to the Effective Time, and (ii) proceeds from or of such Hydrocarbons;

(c) all receivables and cash proceeds which were expressly taken into account and for which credit was given in the determination of Net Cash Flow pursuant to Section 3.3, as adjusted pursuant to Section 3.4; and

(d) the Permitted Overriding Royalty Interests.

“Final Adjusted Purchase Price Statement” shall be as defined in Section 3.4.

“Governmental Authority” shall mean (i) the United States of America, (ii) any state, county, municipality or other governmental subdivision within the United States of America and (iii) any court or any governmental department, commission, board, bureau, agency or other instrumentality of the United States of America or of any state, county, municipality or other governmental subdivision within the United States of America.

“Hydrocarbons” shall mean crude oil, natural gas, casinghead gas, coalbed methane, distillate, condensate, natural gas liquids and other liquid or gaseous hydrocarbons and carbon dioxide.

“Hydrocarbon Interests” shall mean (i) leases affecting, relating to or covering any Hydrocarbons and the leasehold interests and estates in the nature of working or operating interests under such leases, as well as overriding royalties, net profits interests, production payments, carried interests, rights of recoupment and other interests in, under or relating to such leases, (ii) fee interests in Hydrocarbons, (iii) royalty interests in Hydrocarbons, (iv) any other interest in Hydrocarbons in place, (v) any economic or contractual rights, options or interests in

Appendix A, Page 3

and to any of the foregoing, including, without limitation, any farmout or farmin agreement affecting any interest or estate in Hydrocarbons, and (vi) any and all rights and interests attributable or allocable thereto by virtue of any pooling, unitization, communitization, production sharing or similar agreement, order or declaration.

“Indemnified Party” shall be as defined in Section 9.3.

“Indemnitor” shall be as defined in Section 9.3.

“Initial Adjusted Purchase Price Amount” shall be as defined in Section 3.1(b).

“JOA” shall be as defined in Section 9.2.

“JPMorgan” shall be as defined in Section 6.3.

“Land” shall be as defined in subsection (b) of Article II.

“Law” shall mean any applicable statute, law, ordinance, regulation, rule, ruling, order, restriction, requirement, writ, injunction, decree or other official act of or by any Governmental Authority.

“Negative Imbalance” shall mean, respectively as to each Property Subdivision to which the Subject Interests are attributable and without duplication, the sum (expressed in MMBtus) of (i) the aggregate make-up, prepaid or other volumes of natural gas that Seller was obligated as of the Effective Time, on account of prepayment, advance payment, take-or-pay, gas balancing or similar obligations, to deliver from the Subject Interests attributable to such Property Subdivision after the Effective Time without then or thereafter being entitled to receive full payment therefor (proportionately reduced to the extent Seller will be entitled to receive partial payment therefor) and (ii) the aggregate pipeline or processing plant imbalances or overdeliveries for which Seller is obligated to pay or deliver natural gas or cash as of the Effective Time to any pipeline, gatherer, transporter, processor, co-owner or purchaser in connection with any other natural gas attributable to the Subject Interests.

“Net Cash Flow” shall be as defined in Section 3.3(b).

“Net Revenue Interest” shall mean an interest (expressed as a percentage or decimal fraction) in and to all Hydrocarbons produced and saved from or attributable to a Property Subdivision.

“Partial Assignment of Registration Rights Agreement” shall be as defined in Section 7.3(c).

“Parties” and “Party” shall be defined in the preamble to this Agreement.

“Permitted Overriding Royalty Interests” shall mean the overriding royalty interests conveyed by Seller in the assignments described in Schedule I.

“Person” shall mean any Governmental Authority or any individual, firm, partnership, corporation, joint venture, trust, unincorporated organization or other entity or organization.

Appendix A, Page 4

“Preference Right” shall mean any right or agreement that enables or may enable any Person to purchase or acquire any Asset or any interest therein or portion thereof as a result of or in connection the execution or delivery of this Agreement or the consummation or performance of the terms and conditions contemplated by this Agreement.

“Property Schedule” means Exhibit A-2 attached to and made a part of this Agreement.

“Property Subdivision” shall mean each well location, well, well completion or other subdivision of property described or referenced in Part II of the Property Schedule. The Property Subdivision with respect to any well, well location, well completion, or multiple well completion referenced in the Property Schedule shall include the spacing unit for such well, well location or well completion.

“Purchase Price” shall be as defined in Section 3.1(a).

“Records” shall be as defined in subsection (c)(iv) of Article II.

“Retained Asset” shall be as defined in Section 5.1.

“Securities Act” shall be as defined in Section 4.1(r).

“Seller” shall be as defined in the preamble to this Agreement.

“Seller Indemnified Parties” shall be as defined in Section 9.1.

“Subject Interests” shall be as defined in subsection (a) of Article II.

“Taxes” shall mean all federal, state and local taxes or similar assessments or fees, together with all interest, fines, penalties and additions thereto.

“Transfer Requirement” shall mean any consent, approval, authorization or permit of, or filing with or notification to, any Person which must be obtained, made or complied with for or in connection with any sale, assignment, transfer or encumbrance of any Asset or any interest therein in order (i) for such sale, assignment, transfer or encumbrance to be effective, (ii) to prevent any termination, cancellation, default, acceleration or change in terms (or any right thereof from arising) under any terms, conditions or provisions of any Asset (or of any agreement, instrument or obligation relating to or burdening any Asset) as a result of such sale, assignment, transfer or encumbrance, or (iii) to prevent the creation or imposition of any lien, charge, penalty, restriction, security interest or encumbrance on or with respect to any Asset (or any right thereof from arising) as a result of such sale, assignment, transfer or encumbrance; excluding, however, from the definition of Transfer Requirements consents and approvals of assignments by any Governmental Authority (other than consents and approvals by any Governmental Authority in connection with the assignment of any lease from a city or county that is included in the Subject Interests) that are customarily obtained after closing the transactions of this nature.

“Working Interest” shall mean the percentage of costs and expenses attributable to the maintenance, development and operation of a Property Subdivision.

Appendix A, Page 5

EXHIBIT 6.1

Attached to and made a part of that certain Asset Purchase Agreement

dated May 11, 2010, by and between

MARSHALL R. YOUNG OIL CO., as “Seller”, and

QUICKSILVER RESOURCES INC., as “Buyer”

GENERAL CONVEYANCE

THIS GENERAL CONVEYANCE (this “Conveyance”) executed by MARSHALL R. YOUNG OIL CO. a Delaware corporation (“Assignor”), whose address is 1320 S. University Drive, No. 400, Fort Worth, Texas 76107, to QUICKSILVER RESOURCES INC., a Delaware corporation (“Assignee”), whose address is 777 West Rosedale Street, Fort Worth, Texas 76104, dated effective at 7:00 a.m. (Central Standard Time) on January 1, 2010 (said hour and day hereinafter called the “Effective Time”).

ARTICLE 1

CONVEYANCE OF ASSETS

Assignor, for Ten and No/100 Dollars ($10.00) and other good and valuable consideration in hand paid by Assignee, the receipt and sufficiency of which consideration are hereby acknowledged and confessed, by these presents does hereby GRANT, BARGAIN, SELL, CONVEY, ASSIGN, TRANSFER, SET OVER AND DELIVER unto Assignee, the following described assets and properties (except to the extent constituting Excluded Assets) (collectively, the “Assets”):

(a) The undivided interests specified in Exhibit A in, to or under the Hydrocarbon Interests (hereinafter defined) described therein and all other interests of Assignor in, to or under or derived from any lands (i) covered by or subject to any of the Hydrocarbon Interests described in Exhibit A or (ii) included in the geographic area described in Exhibit A-1, even though such interests of Assignor may be incorrectly described or referred to in, or a description thereof may be omitted from, Exhibit A (the “Subject Interests”);

(b) All right, title and interest of Assignor in and to the lands covered by or subject to the Subject Interests (the “Land”);

(c) All right, title and interest of Assignor in and to or derived from the following insofar as the same are attributable to the Subject Interests or any of the other Assets: (i) all rights with respect to the use and occupancy of the surface of and the subsurface depths under the Land, (ii) all agreements and contracts, easements, rights-of-way, servitudes and other estates, (iii) all real and personal property located in or upon the Lands or used in connection with the exploration, development or operation of the Subject Interests, and (iv) any and all lease files, title files, land files, division order files, marketing files, well files, production records, seismic, geological, geophysical and engineering data, and all other files, maps and data (in whatever form) arising out of or relating to the Subject Interests or the ownership, use, development, maintenance or operation of the other Assets; and

Exhibit 6.1, Page 1 of 8

(d) All (i) Hydrocarbons produced from or attributable to the Subject Interests with respect to all periods subsequent to the Effective Time and (ii) proceeds from or of Hydrocarbons produced from or attributable to the Subject Interests with respect to all periods subsequent to the Effective Time.

For purposes of this Conveyance, the term “Hydrocarbon Interests” means (i) leases affecting, relating to or covering any crude oil, natural gas, casinghead gas, coalbed methane, distillate, condensate, natural gas liquids and other liquid or gaseous hydrocarbons and carbon dioxide (collectively, “Hydrocarbons”) and the leasehold interests and estates in the nature of working or operating interests under such leases, as well as overriding royalties, net profits interests, production payments, carried interests, rights of recoupment and other interests in, under or relating to such leases, (ii) fee interests in Hydrocarbons, (iii) royalty interests in Hydrocarbons, (iv) any other interest in Hydrocarbons in place, (v) any economic or contractual rights, options or interests in and to any of the foregoing, including, without limitation, any farmout or farmin agreement affecting any interest or estate in Hydrocarbons, and (vi) any and all rights and interests attributable or allocable thereto by virtue of any pooling, unitization, communitization, production sharing or similar agreement, order or declaration.

There is excluded from this Conveyance and the Assets and reserved unto Assignor the following described interests, rights and properties (the “Excluded Assets”):

(a) all deposits, cash, checks, funds and accounts receivable attributable to Assignor’s interest in the Assets with respect to any period of time prior to the Effective Time;

(b) all (i) Hydrocarbons produced from or attributable to the Subject Interests with respect to all periods prior to the Effective Time, and (ii) proceeds from or of Hydrocarbons produced from or attributable to the Subject Interests with respect to all periods prior to the Effective Time;