Attached files

| file | filename |

|---|---|

| EX-31.1 - EX311 - LAS VEGAS GAMING INC | ex311.htm |

| EX-32.1 - EX321 - LAS VEGAS GAMING INC | ex321.htm |

| EX-21.1 - EX211 - LAS VEGAS GAMING INC | ex211.htm |

| EX-31.2 - EX312 - LAS VEGAS GAMING INC | ex312.htm |

| EX-10.47 - EX1047 - LAS VEGAS GAMING INC | ex1047.htm |

| EX-10.38 - EX1038 - LAS VEGAS GAMING INC | ex1038.htm |

| EX-10.43 - EX1043 - LAS VEGAS GAMING INC | ex1043.htm |

| EX-10.35 - EX1035 - LAS VEGAS GAMING INC | ex1035.htm |

| EX-10.44 - EX1044 - LAS VEGAS GAMING INC | ex1044.htm |

| EX-10.34 - EX1034 - LAS VEGAS GAMING INC | ex1034.htm |

| EX-10.46 - EX1046 - LAS VEGAS GAMING INC | ex1046.htm |

| EX-10.33 - EX1033 - LAS VEGAS GAMING INC | ex1033.htm |

| EX-10.45 - EX1045 - LAS VEGAS GAMING INC | ex1045.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

X

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

||||||||||

|

For

the fiscal year ended

|

December

31, 2009

|

||||||||||

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|||||||||||

|

For

the transition period from

|

to

|

||||||||||

|

Commission

file number

|

000-30375

|

||||||||||

|

Las

Vegas Gaming, Inc.

|

|||||||||||

|

(Exact

name of Registrant as specified in its charter)

|

|||||||||||

|

Nevada

|

88-0392994

|

||||||||||

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

||||||||||

|

3980

Howard Hughes Parkway, Suite 450, Las Vegas, Nevada

|

89169

|

||||||||||

|

(Address

of principal executive offices)

|

(Zip

Code)

|

||||||||||

|

Registrant’s

telephone number, including area code:

|

(702)

871-7111

|

||||||||||

|

Securities

registered under Section 12(b) of the Act:

|

|||||||||||

|

Title

of each class

|

Name

of each exchange on which registered

|

||||||||||

|

Securities

registered under Section 12(g) of the Act:

|

|||||||||||

|

Common

Stock Series A, $.001 par value

|

|||||||||||

|

(Title

of each class)

|

|||||||||||

|

(Title

of each class)

|

|||||||||||

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. Yes o No

x

|

|||||||||||

|

Indicate

by check mark if the registrant is not required to file reports pursuant

to Section 13 or Section 15(d) of the Act. Yes o No

x

|

|||||||||||

|

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes x No

o

|

|||||||||||

|

Indicate

by check mark if the disclosure of delinquent filers pursuant to Item 405

of Regulation S-K (§229.405 of this chapter) is not contained in herein,

and will not be contained, to the best of the registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K. o

|

|||||||||||

|

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

Large

accelerated filer o Accelerated

filer o

Non-accelerated

filer o (do

not check if smaller reporting company) Smaller

reporting company x

|

|||||||||||

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes o

No x

|

|||||||||||

|

State

the aggregate market value of the voting and non-voting common equity held

by non-affiliates computed by reference to the price at which the common

equity was last sold, or the average bid and asked price of such common

equity, as of the last business day of the registrant’s most recently

completed second fiscal quarter. $37,435,372

|

||

|

Indicate

the number of shares outstanding of each of the registrant’s classes of

common stock, as of the latest practicable date.

|

||

|

Common

Stock Series A, $.001 par value

|

14,974,149

shares as of December 31, 2009

|

|

|

Documents

Incorporated By Reference:

|

||

|

ITEM

1.

|

1

|

|

| ITEM 1A. |

|

17

|

|

ITEM

1B.

|

17

|

|

|

ITEM

2.

|

17

|

|

|

ITEM

3.

|

17

|

|

|

ITEM

4.

|

18

|

|

|

ITEM

5.

|

|

19

|

|

ITEM

6.

|

22

|

|

|

ITEM

7.

|

22

|

|

|

ITEM

7A.

|

28

|

|

|

ITEM

8.

|

|

28

|

|

ITEM

9.

|

|

52

|

|

ITEM

9A.

|

52

|

|

|

ITEM

9B.

|

53

|

|

|

ITEM

10.

|

54

|

|

|

ITEM

11.

|

|

54

|

|

ITEM

12.

|

54

|

|

|

ITEM

13.

|

54

|

|

|

ITEM

14.

|

54

|

|

| ITEM 15. |

55

|

__________________________

PlayerVision,

RoutePromo, NumberVision, WagerVision, AdVision, Nevada Numbers, The Million

Dollar Ticket, and Nevada Keno are some of our trademarks. This

Annual Report on Form 10-K contains trademarks and trade names of other parties,

corporations and organizations.

PART

I

ITEM 1. BUSINESS.

Overview

During

2009 we continued to focus our development efforts on our proprietary

application delivery system, known as PlayerVision. Through our

PlayerVision system, we offer gaming operators the ability to increase the

productivity of their existing gaming machines by delivering additional wagering

opportunities, customer service enhancements, entertainment applications, games,

and other content to their existing gaming machines, such as slot machines,

poker machines, and video lottery terminals. Our PlayerVision system

is flexible and compatible with virtually all gaming machines currently produced

by all major manufacturers. As a result, we view every gaming machine

as a revenue opportunity for our PlayerVision system. Since we plan

to offer an option to acquire PlayerVision at little or no up front capital cost

to casino operators in exchange for a recurring licensing fee, we expect to

provide operators with an ability to increase significantly the earning power

and functionality of their gaming machines with little or no financial

risk. In addition, we are currently a leading supplier of keno and

bingo games, systems, and supplies.

The

PlayerVision system consists of proprietary software that runs on our own

hardware as well as other vendors’ server-based application delivery systems

such as the sbX Experience Management System from International Gaming

Technology (“IGT”). Our ability to deliver applications through our

own delivery system as well as that of other server-based gaming systems

provides our customers with the ability to achieve 100% gaming floor coverage

without the need to replace their existing machines. Our system gives

our customers a transition path from legacy machines to server-based

gaming.

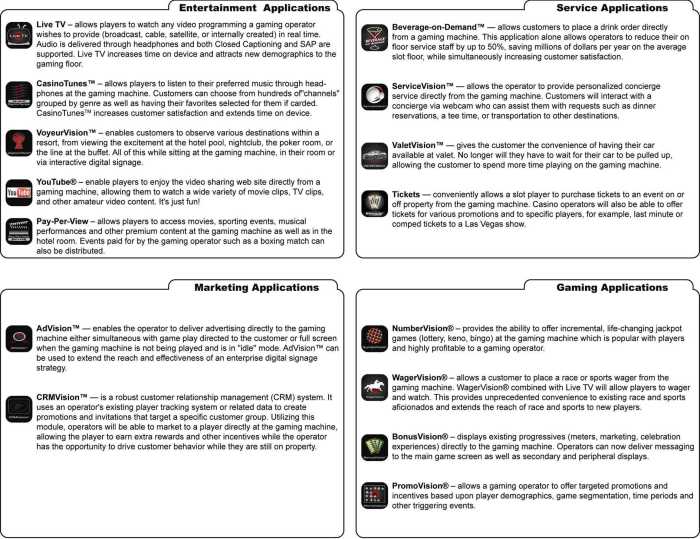

There are

four delivery channels related to PlayerVision

functionality: service, marketing, entertainment and

gaming. Each application group addresses a specific cost reduction,

revenue enhancing application set, player experience or operator control

feature, including “Beverage-on-Demand”, NumberVision and WagerVision - turning

each gaming machine into a multi-tasking touch-point for the customer who will

see more, do more and - as a result - play more.

[Missing

In

addition to the PlayerVision applications identified above, it is our mission to

develop new applications that will position PlayerVision as a platform for a

variety of new multimedia and gaming functions.

Historically,

we have been one of the leading suppliers of keno and bingo games, systems, and

supplies, a relatively small market associated with nominal growth and smaller

companies. Our current principal business is the delivery of new,

linked-progressive, mega jackpot games to the worldwide gaming

industry. However, to date, we have devoted a significant portion of

our resources toward the development, regulatory approval, and marketing of our

PlayerVision system. In comparison to the keno and bingo market, we

believe that the potential market for our PlayerVision system, i.e., the gaming machine

market, is much larger and more dynamic. While we continue to provide

equipment, supplies and games for use by our customers in the keno and bingo

segments of the gaming industry, subject to our ability to continue as a going

concern, addressed below, we expect these revenues will continue to decline as

we focus on the deployment of PlayerVision. PlayerVision has not had

a significant revenue effect on our financial statements to date. Due

primarily to our focus on the development of our PlayerVision system and other

factors, we have incurred expenses in excess of our revenue and have generated

losses to date.

In May

2009, we received approval for nine software applications on our robust and

scalable PlayerVision 3 platform from the Nevada Gaming Control Board

laboratory. These software applications include Beverage-on-Demand,

ServiceVision, VoyeurVision, Live TV, AdVision, YouTube, CasinoTunes,

ValetVision, and BurstVision. We will submit these same applications

for Gaming Laboratories International (GLI) approval, an independent accredited

testing laboratory, in the third quarter of 2010.

Based on

the foregoing, and other than the insignificant revenue realized from our early

adoption agreements, and subject to economic uncertainties discussed herein, and

our ability to continue as a going concern, as discussed below, we expect to

begin to realize more significant revenue from our PlayerVision system during

the third quarter of 2010. This would mark a significant shift in the

type of revenue recognized by us. The anticipated revenue would be

from the installation of our nine software applications on the PlayerVision 3

platform in the United States, primarily Nevada for now. No assurance

can be given, however, that we will begin installing our PlayerVision 3

applications or begin realizing revenue from our PlayerVision system during the

third quarter of 2010 or at all.

We expect

to continue to incur losses for the remainder of 2010, and we expect to face

competition from larger, more formidable competitors as we attempt to enter the

gaming machine market. Due to continuing expenses related to our

PlayerVision system, we plan to continue to rely on funds from third party

financing sources, if available, in addition to funds from operations to sustain

our operations in 2010.

We are

presently unable to satisfy our obligations as they come due and do not have

enough cash to sustain our anticipated working capital requirements for the

remainder of 2010. Unless we obtain third-party financing or

otherwise raise capital through the sale of assets or otherwise in the near

future, we will be unable to continue as a going concern.

Industry

Overview

The

domestic and global gaming markets have grown rapidly and consistently over most

of the last decade despite some slowdown in the past two years due to the

macroeconomic recession. This growth has generally brought increased social and

political acceptance of legalized gaming throughout many diverse societies. As a

result, there is a rising public sector/municipal dependency on gaming revenues

for funding of programs and projects that would not otherwise

exist. In the United States in 2007, the gaming industry was a $92.2

billion business consisting of casinos spread throughout 48 states. In addition,

many jurisdictions are currently pushing for liberalization of existing gaming

legislation and introduction of new regulations designed to augment sources of

gaming tax revenue. Twelve states now allow commercial (non-tribal)

gaming, compared to only two in 1980.

The

conventional wisdom that the gaming industry is recession-proof has been

challenged over the last 24 months. However, recent economic pressures have

prompted new efforts to legalize casino gaming and to liberalize gaming laws to

fill fiscal gaps. Furthermore, in the current environment, operators

are pressured to extract the most out of existing operations by enhancing the

competitiveness of their slot machine floor at minimal investment rather than

deploying cash into new or expanded equipment or facilities. While historical

U.S. trends suggest a resilient recovery will eventually be at hand, through our

PlayerVision product we expect to offer the casino operator a product that will

enhance the gaming machine’s productivity while simultaneously enhancing the

customer’s playing experience – all with little or no money up

front.

PlayerVision

can also be deployed outside the United States. Casinos in

jurisdictions such as Macau, Western and Central Europe, South Korea, Singapore,

Australia, Japan, Vietnam, Taiwan, and the Philippines should be attracted to

our product. However, we will need to get approval from the relevant

regulatory bodies prior to a roll out of PlayerVision in these

jurisdictions.

1.7

million EGMs (Electronic Gaming Machines or slot machines as they are commonly

referred to) were installed worldwide as of the end of 2009, with approximately

50% in North America. These machines represent the gaming industry's most

resilient and predictable revenue stream and usually comprise well over 50% of

total gaming revenue for the typical casino operator. The historical EGM

replacement cycle of 5-6 years will likely be stretched out over the next few

years as the recession works its way out of the world

economy. However, new technology may disrupt the normal replacement

cycle. The last such technology was the "Ticket-In-Ticket-Out"

revolution in 2000. We believe the next such revolution will be Server-Based

Gaming, which allows operators to manage casino floors more effectively and

efficiently. It will also usher into the gaming industry the art of

multi-tasking as the EGM will now be able to provide the player several

experiences concurrently with gambling on the next pull of the handle (or more

typically, the next push of the button).

Increased

popularity and social acceptance of gaming as a leisure activity is also fueling

the growth of server-based gaming. According to the 2008 American Gaming

Association Survey of Casino Entertainment, 84% of Americans believe that casino

gaming is an acceptable activity for themselves or others, an increase of 5%

since 2006. The simplicity and instant appeal of EGMs versus other gambling

opportunities create familiarity and adoption across the board, characterized by

ease-of-use and informality. EGMs have demonstrated greater appeal than any

other gaming activity. Additionally, technology has become a significant part of

the gaming experience, allowing for more innovative content and customer

convenience. A new younger player demographic translates into a multi-tasking

"user interface" that creates new revenue opportunities.

As the

gaming machine base continues to grow we believe that our target market will

continue to expand. We believe that a consistent need for improvement

in gaming activities and demand for greater entertainment value for players will

give us the ability to market PlayerVision aggressively and to provide gaming

operators with a single solution to introduce additional functionality without a

wholesale replacement of their existing gaming machines.

Our

Strategy

Our

strategy is to provide the premier enhancement system for the installed base of

gaming machines by delivering additional wagering opportunities, cost saving

opportunities, promotions, games, and other content on existing gaming machines

and delivering those same applications over the newer server-based deliver

systems and gaming machines. No assurance can be given, however, that

we will be successful. In order to achieve this objective, we are

pursuing the following strategies:

|

·

|

Increased Revenue Potential

for Operators. Our sales effort stresses the ability of our

PlayerVision system to provide gaming operators with the opportunity to

increase significantly the earning power and functionality of their gaming

machines. Since our PlayerVision system directly interfaces with the

existing video, audio, and printing functions of the machine, we are able

to use the machine’s existing video screen (or attached alternatives) to

deliver additional games, promotions, additional wagering opportunities,

and other forms of entertainment. If desired by our customers, we have a

kiosk driven ticket redemption system featuring its own accounting system

separate and apart from the main slot accounting system. We can

also provide alternative viewing options if the casino operator would

prefer not to use the main screen.

|

|

·

|

Compelling Patron Experience.

We expect to offer PlayerVision as a single multimedia delivery

system for a wide range of content directly on the existing screens of

gaming machines. By adding PlayerVision, a gaming machine is transformed

from a single use, single wager option into a multimedia experience that

can deliver to the player extra wagering opportunities and targeted,

promotional content in addition to traditional slot play. Through

PlayerVision, the operator will be able to enhance the functionality of

its existing EGMs and deliver targeted gaming opportunities and

promotional content to players. In exchange, the player will

receive an enhanced playing experience, information about promotions,

entertainment, and dining opportunities, and the opportunity to win

jackpots and other prizes.

|

|

·

|

Reduce operating costs.

Through our Beverage on Demand feature, an operator may be able to

cut its drink delivery costs approximately in

half.

|

|

·

|

Low Operator Risk. As

an alternative, we expect to offer the gaming operators the ability to

substantially reduce operating cost, extend the replacement cycle and

increase significantly the earning power and functionality of their

existing gaming machines at little or no up front capital cost. This

strategy involves installing PlayerVision at little or no up front capital

cost to gaming operators in exchange for recurring software license

fees.

|

|

·

|

New Applications. We

plan to continue the development of innovative applications to be

delivered through our PlayerVision system. To date, we have designed our

PlayerVision system to deliver advertisements, multimedia content, casino

services, promotional materials, and wagering

opportunities. Since PlayerVision engages the existing video,

audio and printing functions of the gaming machine, and since our kiosk

driven ticket redemption system features its own path to the slot

accounting system, we believe that our PlayerVision system can be used as

a platform to deliver a wide array of casino services, multimedia or

gaming content directly to patrons.

|

PlayerVision

is a single, flexible, and dynamic platform that can be used to deliver casino

services, multimedia or gaming content developed either by us or third parties.

Because of the integration of PlayerVision with all of the functions of the

gaming machine, we expect that PlayerVision can be used by gaming operators to

control all aspects of their gaming machines. By establishing our PlayerVision

system as the premier enhancement system for the installed base of gaming

machines, we believe that we will be able to establish a significant barrier to

entry for any potential competitors.

PlayerVision

System

Through

PlayerVision, players will at once enjoy a multi-wagering/multi-tasking

immersive experience that results in a substantial increase in percentage of

wallet for the operator. A powerful retrofit solution, we expect that

PlayerVision will enable operators to reduce operating costs and increase

efficiencies for both new and legacy gaming floors, featuring:

|

·

|

On-the-fly

machine "customization" by casino and customer at minimal cost, using

existing slot screens for a variety of innovative

applications;

|

|

·

|

Increased

time on device with added wagering and targeted

marketing;

|

|

·

|

Beverage-on-demand,

allowing reduced head count with improved player experience;

and

|

|

·

|

On-demand

multimedia offering private access to shows, products and

services.

|

We expect

to offer PlayerVision at a little to no up front capital cost to the operator in

exchange for recurring license fees, thereby increasing earning power and

functionality of gaming machines without financial risk.

Slot

operations serve as the primary source of revenue in almost any gaming

operation. In need of sources of incremental revenue and cost savings, the

industry is primed for a technology that utilizes the processing power now

available through server-based environments. By installing off-the-shelf CPUs

into any EGM (a 30-minute process), PlayerVision converts a single-use slot

machine into a multi-dimensional revenue generator and cost container. We

believe we are the developer/owner of some of the most significant intellectual

property/technology in the industry related to deployment of server-based gaming

applications. No assurances can be given that the deployment of

server-based gaming applications will be successful or that our intellectual

property/technology will play a significant role in server-based gaming

applications.

Casino

Games

We offer

two keno games, Nevada Numbers and The Million Dollar Ticket, and collect

royalties on several bingo style games. The revenue generated from our casino

games is primarily based on collecting per ticket or per game fees from our

various customers. On March 31, 2009, our contract with Treasure

Island to maintain the $3.9 million base jackpot bankroll for Nevada Numbers and

The Million Dollar Ticket expired, and we shut down the games as a

result. We expect to restart the games as soon as we find funding for

the $3.9 million base jackpot.

Nevada

Numbers

Nevada

Numbers is a variation of classic keno, which prior to its shutdown noted above

has been played in many casinos in Nevada. Keno is a game in which

bets are made and recorded on a keno ticket. This ticket contains 80 numbered

squares that correspond exactly to 80 numbered balls in a selection hopper. A

player marks a ticket to play between two and 20 different numbers. The keno

operator then draws 20 out of the 80 numbers and displays the results throughout

the casino. The more numbers that match, the more money the player wins. Payout

awards vary from casino to casino and depend on the amounts

wagered.

Nevada

Numbers differs from classic keno in that fewer numbers (five rather than 20)

are drawn and a “linked’’ or “progressive’’ component has been added. We linked

together the play of Nevada Numbers at multiple casinos so that players at

several different locations all choose numbers that are matched to the same

five-number draw. In addition, Nevada Numbers featured a starting jackpot of

$5.0 million that was progressive, in that it grew with the purchase of each

Nevada Numbers ticket and could be won at each draw. Any winner of

the Nevada Numbers progressive jackpot will be paid the amount of the

progressive meter in equal installments over a period of 20 years. At

our sole discretion, we may offer the winner an option to receive a discounted

value immediately. The process of linking games and creating a

progressive jackpot provided an enticement to players because of the potential

for a life-changing event.

Although

Nevada Numbers has traditionally been limited to the keno lounges of casinos, we

are taking measures to expand its visibility. First, we have

incorporated Nevada Numbers as part of NumberVision. Through

NumberVision, we propose to position Nevada Numbers as a dynamic game that will

give players the opportunity to win a progressive jackpot of at least $5.0

million. Second, subject to regulatory approval of NumberVision, we will market

the game to third-party race and sports books for use on their existing wagering

terminals.

The

Million Dollar Ticket

Based on

the classic keno game, The Million Dollar Ticket offers the chance to win $1.0

million and a progressive jackpot. In order to win the $1.0 million and the

progressive jackpot, the player must pick 10 numbers correctly out of 20 drawn

from a pool of 80. As stated previously, we shut down this game on

March 31, 2009 and will restart when we receive funding for the

jackpot.

Super

Bingo Games

Super

Bingo Games are odds-based bingo games with life-changing prizes that are

offered as side bets to existing bingo games. We offer these games at

various jackpot levels-as high as $50,000 in some cases. We purchase

insurance for the larger jackpots. Our Super Games are structured so

that the bingo operator is guaranteed a profit for each wager

made. We have placed Super Bingo Games in four Nevada casinos and ten

non-Nevada locations.

Keno

and Bingo Systems and Supplies

The

worldwide keno system market is limited and has been declining for several

years. We are attempting to invigorate the market and gain an additional share

of the market by enhancing our keno system through the addition of several new

games and features to the platform.

Keno and

bingo supplies sales contribute significantly to our revenue, but consist of low

margin items, including crayons, various paper products, and ink.

Other

Businesses

We also

generate revenue through various keno participation agreements and the

maintenance of our equipment under service contracts.

|

·

|

Nevada Keno and Related

Participation Agreements. Through agreements with participating

casinos, we offer Nevada Keno, a “satellite-linked’’ traditional keno game

played in multiple casinos. We are currently operating Nevada

Keno in three casinos. However, we believe we will soon be

operating in 2-3 more. However, no assurances can be given that

we will operate Nevada Keno in additional

casinos. Additionally, principally in Nebraska, we provide

equipment in return for a share in the revenue generated in various keno

salons.

|

|

·

|

Service Contracts. Most

of our customers that purchase keno and bingo equipment also purchase a

service contract from us to provide routine maintenance for the

equipment.

|

|

·

|

RoutePromo. RoutePromo

is designed to deliver promotional tickets or vouchers to players upon the

occurrence of an event specified by the operator, such as hitting a

four-of-a-kind or better on a video poker machine. The key

feature of RoutePromo is its ability to recognize a specified event

generated by the game and deliver the programmed response to the specified

event.

|

RoutePromo

is designed to work as follows:

|

·

|

first,

the operator specifies the events that will trigger RoutePromo, such as a

four-of-a- kind or better on a video poker

machine;

|

|

·

|

second,

upon the occurrence of the specified event, RoutePromo is activated and a

message is sent to the gaming machine to issue a promotional ticket or

voucher;

|

|

·

|

third,

the gaming machine alerts the player and prints the free promotional

ticket or voucher; and

|

|

·

|

fourth,

the gaming machine returns to its original

state.

|

We

currently charge a fixed monthly fee for the ability to offer

RoutePromo.

Through

our agreement with United Coin Machine Company, the largest slot route operator

in Nevada, we developed a variation of our keno game called The Million Dollar

Ticket, known as the Gamblers Bonus Million Dollar Ticket, to be used in

conjunction with RoutePromo. Gamblers Bonus Million Dollar Ticket is

a free promotional game that gives players the chance to win various prizes,

including a $1.0 million grand prize, by matching numbers on their promotional

tickets with numbers picked in a random weekly drawing. Under our

agreement, we are obligated to provide software, hardware, and support to United

Coin for the game. In addition, we are financially responsible for

the payouts associated with the game. In return, United Coin is

obligated to pay us $1.25 for each ticket distributed. During the

second quarter of 2008, we rolled out Gamblers Bonus Million Dollar Ticket at

approximately 100 United Coin route locations. On January 31, 2009,

we closed down the game with United Coin because there was little interest among

bar owners and convenience store owners to offer an expensive promotion in

difficult economic times.

Manufacturing

We

outsource the manufacturing of the various components of our PlayerVision 3

system to Apple, Hitachi, and various other key suppliers. Lead times

for certain key components can be as long as eight weeks.

Marketing

and Distribution

PlayerVision

As part

of our objective to provide the leading single multimedia and game delivery

system, we have started to implement a plan that will market our PlayerVision

system to customers through direct and indirect channels. Our plan involves the

following steps:

|

·

|

Direct Sales Efforts.

Through the hiring of additional personnel to our sales and

marketing staff, we will market PlayerVision to operators located

primarily in North America and to Native American tribes. As part of our

direct sales efforts, we attend trade shows, such as G2E in Las Vegas,

Nevada.

|

|

·

|

Strategic Partnerships.

We supplement our direct sales efforts by targeting third-party

distributors and regional operators. IGT and Ebet are key

examples of entities that we expect will be distributing our

product. By forming strategic relationships with these parties,

we hope to gain access to smaller and more fragmented markets around the

globe and secure the broadest placement for

PlayerVision.

|

We plan

to conduct all of our sales and marketing efforts from our headquarters in Las

Vegas, Nevada. Although we do not have any current plans to open any

sales offices, we will review the need for such additional offices in response

to the needs of our customers and our strategic partners.

Casino

Games

We

license our games directly to casinos. We make initial contacts

through the mailing of marketing materials, referrals, or direct solicitation by

our employees and marketing agents. We promote licensed games to the

general public using various types of media, including billboards, newspapers,

magazines, radio, and television. Advertising within a particular

casino may include advertisement on strategically placed LCDs, table tents,

flyers, signs on the tops of gaming machines, and show cards to stimulate

curiosity and game play.

Keno

and Bingo Systems and Supplies.

We are

one of the world’s few keno equipment suppliers. Most sales in this

area result from unsolicited inquiries or direct solicitation of customers by

our sales staff. The marketplace for bingo equipment, electronic

playing devices, and supplies in Nevada is relatively small, consisting of

approximately 40 potential customers. However, we believe that the

recent introduction of wireless gaming devices into the marketplace in Nevada

and other jurisdictions may increase the potential market for bingo-related

products. No assurance can be given that the market for bingo-related

products will increase. Direct sales to the casino are the primary

means of sale for these products. The marketplace for gaming supplies

is large and geographically dispersed. Our primary marketing tool is

a catalog that we periodically distribute to our customers and potential

customers.

Competition

PlayerVision

System

We

encounter significant competition in the market for innovative gaming

technologies that deliver interactive gaming, animated content, and

cross-promotional opportunities to gaming operators. The key competitive factors

are functionality, accuracy, reliability, and pricing. We believe

that PlayerVision is a single, integrated solution because of the

following:

|

·

|

PlayerVision

uses the existing primary screen of the gaming machine or a smaller

secondary video screen or a mounted side

screen;

|

|

·

|

PlayerVision

engages the existing video, audio and printing functions of the gaming

machine regardless of the

manufacturer;

|

|

·

|

PlayerVision

involves little or no up front capital cost to gaming operators;

and

|

|

·

|

PlayerVision

delivers a broad range of

functionalities.

|

We are

unaware of any other product that delivers casino services, multimedia and

gaming content through the existing various screens of gaming

machines. Although we face competition from products that use smaller

secondary video screens and cost thousands of dollars, such as iView developed

by Bally Systems and NexGen developed by IGT, we expect to be able to deliver

content for little or no up front capital cost and deliver the content directly

to the patron through all existing screens rather than just an auxiliary

2x6-inch screen.

Since we

are able to use all existing screens of a gaming machine, as well as its

existing video, audio and printing functions, we expect to offer to gaming

operators a solution that requires little or no up front capital cost, involves

minimal installation time, and interfaces with virtually all gaming

machines. In addition, although there are products that deliver

advertising or promotional content through secondary video screens installed

onto gaming machines, we do not believe that there are currently any products

that can deliver the additional wagering opportunities that PlayerVision can or

any products that can provide an expandable platform for additional content on

the existing screens of gaming machines.

Nevertheless,

there is no guarantee that PlayerVision will be accepted in the

marketplace. Many of our potential competitors possess substantially

greater financial, technical, marketing, and other resources than we do, which

affords them competitive advantages over us. As a result, our

competitors may introduce products that have advantages over PlayerVision in

terms of features, functionality, ease of use, and revenue producing

potential. If we are unable to compete effectively, or incur any

delays, either regulatory or otherwise, in our ability to fully introduce

PlayerVision, our operations and financial condition may be adversely

affected.

Keno

and Bingo Systems and Supplies.

The keno

and bingo systems and supplies industry is characterized by limited

competition. We compete primarily with other companies that provide

keno and bingo systems, including electronic systems, keno, bingo supplies, and

related services. In addition, we compete with other similar forms of

entertainment, including casino gaming, other forms of Class II gaming, and

lotteries. Our key competitor is XpertX in the keno market. We

compete by providing superior service, lower prices, innovative games, and a

quality fully functional keno system.

Research

and Development

Our

research and development efforts focus on developing new applications for our

PlayerVision system and reducing its cost. During 2008 we considerably expanded

our internal R&D effort by employing 5 new software engineers, one of which

became our Chief Technical Officer in March 2008. We layed off all of

our software engineers in December 2009 in order to conserve cash. We

will hire software engineers back to work when we raise significant

capital. We plan to engage, from time to time, independent

consultants and advisors to assist us.

Intellectual

Property and Other Proprietary Rights

We hold

several patents, including a patent related to Nevada Numbers. We

have been recently issued a patent for “closed loop,” a key application in our

PlayerVision technology. In addition, we have several more patents

pending with respect to the PlayerVision system and certain of its various

applications. We also hold several trademarks filed with the state of

Nevada and the U.S. Patent and Trademark Office, including trademark rights to

PlayerVision, Nevada Numbers and The Million Dollar Ticket, and other

intellectual property that is protected by federal copyright and trade secret

laws.

We rely

on the proprietary nature of our intellectual property, primarily in the form of

patent protection, for development of our products. We believe that

our success depends in part on protecting our intellectual

property. If we cannot protect our intellectual property against the

unauthorized use by others, our competitive position could be

harmed.

The risks

associated with our intellectual property, include the following:

|

·

|

The

inability of intellectual property laws to protect our intellectual

property rights;

|

|

·

|

Attempts

by third parties to challenge, invalidate, or circumvent our intellectual

property rights;

|

|

·

|

The

unauthorized use by third parties of information that we regard as

proprietary despite our efforts to protect our proprietary

rights;

|

|

·

|

The

independent development of similar

technology;

|

|

·

|

The

inability to protect our intellectual property rights in foreign

jurisdictions; and

|

|

·

|

A

lack of adequate capital to defend and protect our intellectual

property.

|

We may

not be able to obtain effective patent, trademark, service mark, copyright, and

trade secret protection in every country in which our products are

used. We may find it necessary to take legal action to enforce or

protect our intellectual property rights or to defend against claims of

infringement, and such actions may be unsuccessful. In addition, we

may not be able to obtain a favorable outcome in any intellectual property

litigation. Significant amounts could be expended to defend and

protect our intellectual property. Moreover, our competitors may

develop products or technologies similar to ours without infringing on our

intellectual property rights.

Government

Regulation

We are

subject to regulation by governmental authorities in most jurisdictions in which

we operate. Gaming regulatory requirements vary from jurisdiction to

jurisdiction, and obtaining licenses and findings of suitability for our

officers, directors, and principal stockholders, registrations, and other

required approvals with respect to us, our personnel, and our products are time

consuming and expensive. Generally, gaming regulatory authorities

have broad discretionary powers and may deny applications for or revoke

approvals on any basis they deem reasonable. We have approvals that

enable us to conduct our business in numerous jurisdictions, subject in each

case to the conditions of the particular approvals. These conditions

may include limitations as to the type of game or product we may sell or lease,

as well as limitations on the type of facility, such as riverboats, and the

territory within which we may operate, such as tribal nations.

Jurisdictions

in which we, and specific personnel, where required, have authorizations with

respect to some or all of our products and activities include New Jersey,

Nevada, Arizona, Nebraska, Oregon, Washington, and Montana. In

addition to these jurisdictions, we have authorizations with respect to certain

Native American tribes throughout the United States that have compacts with the

states in which their tribal dominions are located or operate or propose to

operate casinos. These tribes may require suppliers of gaming and

gaming-related equipment to obtain authorizations.

Overview

Gaming Devices and Equipment.

We sell or lease products that are considered to be “gaming devices’’ or

“gaming equipment’’ in jurisdictions in which gaming has been

legalized. Although regulations vary among jurisdictions, each

jurisdiction requires various licenses, findings of suitability, registrations,

approvals, or permits for companies and their key personnel in connection with

the manufacture and distribution of gaming devices and equipment.

Associated Equipment. Some of

our products fall within the general classification of “associated

equipment.’’ “Associated equipment’’ is equipment that is not

classified as a “gaming device,’’ but which has an integral relationship to the

conduct of licensed gaming. Regulatory authorities in some jurisdictions have

the discretion to require manufacturers and distributors to meet licensing or

suitability requirements prior to or concurrently with the use of associated

equipment. In other jurisdictions, the regulatory authorities must

approve associated equipment in advance of its use at licensed

locations. We have obtained approval of our associated equipment in

each jurisdiction that requires such approval and in which our products that are

classified as associated equipment are sold or used.

Regulation of Officers, Directors,

and Stockholders. In many jurisdictions, any officer or director is

required to file an application for a license, finding of suitability, or other

approval and, in the process, subject himself or herself to an investigation by

those authorities. As for stockholders, any beneficial owner of our

voting securities or other securities may, at the discretion of the gaming

regulatory authorities, be required to file an application for a license,

finding of suitability, or other approval and, in the process, subject himself

or herself to an investigation by those authorities. The gaming laws

and regulations of most jurisdictions require beneficial owners of more than 5%

of our outstanding voting securities to file certain reports and may require our

key employees or other affiliated persons to undergo investigation for licensing

or findings of suitability.

In the

event a gaming jurisdiction determines that an officer, director, key employee,

stockholder, or other personnel of our company is unsuitable to act in such a

capacity, we will be required to terminate our relationship with such person or

lose our rights and privileges in that jurisdiction. This may have a

materially adverse effect on us. We may be unable to obtain all the

necessary licenses and approvals or ensure that our officers, directors, key

employees, affiliates, and certain other stockholders will satisfy the

suitability requirements in each jurisdiction in which our products are sold or

used. The failure to obtain such licenses and approvals in one

jurisdiction may affect our licensure and approvals in other

jurisdictions. In addition, a significant delay in obtaining such

licenses and approvals could have a material adverse effect on our business

prospects.

Regulation

and Licensing – Nevada

The

manufacture, sale, and distribution of gaming devices for use or play in Nevada

or for distribution outside of Nevada, the manufacturing and distribution of

associated equipment for use in Nevada, and the operation of gaming machine

routes and inter-casino linked systems in Nevada are subject to the Nevada

Gaming Control Act and the regulations promulgated thereunder and various local

ordinances and regulations. These activities are subject to the

licensing and regulatory control of various Nevada gaming authorities, including

the Nevada Gaming Commission, the Nevada State Gaming Control Board, and various

local, city, and county regulatory agencies, collectively referred to as the

Nevada Gaming Authorities.

The laws,

regulations, and supervisory practices of the Nevada Gaming Authorities are

based upon declarations of public policy with the following

objectives:

|

·

|

preventing

any direct or indirect involvement of any unsavory or unsuitable persons

in gaming or the manufacture or distribution of gaming devices at any time

or in any capacity;

|

|

·

|

strictly

regulating all persons, locations, practices, and activities related to

the operation of licensed gaming establishments and the

manufacturing or distribution of gaming devices and

equipment;

|

|

·

|

establishing

and maintaining responsible accounting practices and

procedures;

|

|

·

|

maintaining

effective controls over the financial practices of licensees, including

requirements covering minimum procedures for internal fiscal controls and

safeguarding assets and revenue, reliable recordkeeping, and periodic

reports to be filed with the Nevada Gaming

Authorities;

|

|

·

|

preventing

cheating and fraudulent practices;

and

|

|

·

|

providing

and monitoring sources of state and local revenue based on taxation and

licensing fees.

|

Change in

such laws, regulations, and procedures could have an adverse effect on our

operations.

We are

registered with the Nevada Gaming Commission as a publicly traded corporation,

or a Registered Corporation. We are also licensed in Nevada as a

manufacturer and distributor of gaming devices and as an operator of an

inter-casino linked system. We have obtained from the Nevada Gaming

Authorities the various authorizations they require to engage in manufacturing,

distribution, and inter-casino linked system activities in

Nevada. The regulatory requirements set forth below apply to us as a

Registered Corporation and as a manufacturer, distributor, and operator of an

inter-casino linked system. Our gaming approvals and licenses are also

conditioned to allow the Chairman of the Nevada State Gaming Control Board or

his designee to order us to cease any gaming activities if the Chairman

determines that the minimum bankroll requirements set forth in the Nevada Gaming

Control Act are not being met.

All

gaming devices that are manufactured, sold, or distributed for use or play in

Nevada, or for distribution outside of Nevada, must be manufactured by licensed

manufacturers and distributed and sold by licensed distributors. The

Nevada Gaming Commission must approve all gaming devices manufactured for use or

play in Nevada before distribution or exposure for play. The Chairman

of the Nevada State Gaming Control Board must administratively approve

associated equipment before it is distributed for use in

Nevada. Inter-casino linked systems must also be approved by the

Nevada Gaming Commission. The approval process for an inter-casino

linked system includes rigorous testing by the Nevada State Gaming Control

Board, a field trial, and a determination as to whether the inter-casino linked

system meets standards that are set forth in the regulations of the Nevada

Gaming Commission. On November 19, 2001, we received the final approval of the

Nevada Gaming Commission for our inter-casino linked system known as Nevada

Numbers. In November 2007, we received final approval from Nevada for

our AdVision and Live TV software applications on the PlayerVision 2 platform on

IGT Game King Machines only. In May 2009, we received approval for

nine software applications on our PlayerVision 3 platform from the Nevada Gaming

Control Board. These software applications include

Beverage-on-Demand, ServiceVision, VoyeurVision, Live TV, AdVision, YouTube,

CasinoTunes, ValetVision, and BurstVision. In addition, the Nevada

Gaming Control Act requires any person, such as our company as an operator of an

inter-casino linked system, that receives a share of gaming revenue from a

gaming device operated on the premises of a licensee, to remit and be liable to

the licensee for that person’s proportionate share of the license fees and tax

paid by the licensee. The gross revenue fees for non-restricted

locations are 6.75% of gross revenue, which is equal to the difference between

amounts wagered by casino players and payments made to casino

players. Significant increases in the fixed fees or taxes currently

levied per machine or the fees currently levied on gross revenue could have a

material adverse effect on our operations.

As a

gaming licensee (a “Registered Corporation”), we are periodically required to

submit detailed financial and operating reports to the Nevada Gaming Commission

and furnish any other information the Nevada Gaming Commission may

require. No person may receive any percentage of gaming revenue from

us without first obtaining authorizations from the Nevada Gaming

Authorities.

The

Nevada Gaming Authorities may investigate any individual who has a material

relationship to, or material involvement with, us in order to determine whether

such individual is suitable or should be licensed as a business associate of a

gaming licensee. Our officers, directors, and certain key employees

are required to file applications with the Nevada Gaming Authorities and may be

required to be licensed or found suitable by the Nevada Gaming

Authorities. The Nevada Gaming Authorities may deny an application

for licensing for any cause that they deem reasonable. A finding of

suitability is comparable to licensing. Both require submission of

detailed personal and financial information, which is followed by a thorough

investigation. The applicant for licensing or a finding of

suitability must pay all the costs of the investigation. Changes in

licensed positions must be reported to the Nevada Gaming

Authorities. In addition to their authority to deny an application

for a finding of suitability or licensure, the Nevada Gaming Authorities have

the power to disapprove a change in corporate position.

If the

Nevada Gaming Authorities were to find an officer, director, or key employee

unsuitable for licensing or unsuitable to continue having a relationship with

us, we would have to sever all relationships with that person. In

addition, the Nevada Gaming Commission may require us to terminate the

employment of any person who refuses to file appropriate applications.

Determinations of suitability or of questions pertaining to licensing are not

subject to judicial review in Nevada.

We are

required to submit detailed financial and operating reports to the Nevada Gaming

Commission. In addition, we are required to report to or have

approved by the Nevada Gaming Commission substantially all material loans,

leases, sales of securities, and similar financing transactions.

Should we

be found to have violated the Nevada Gaming Control Act, the licenses we hold

could be limited, conditioned, suspended, or revoked. In addition, we

and the persons involved could be required to pay substantial fines, at the

discretion of the Nevada Gaming Commission, for each separate violation of the

Nevada Gaming Control Act. The limitation, conditioning, or

suspension of any of our licenses could, and revocation of any license would,

materially adversely affect our manufacturing, distribution, and inter-casino

linked system operations.

Regulation of Security Holders.

Any beneficial holder of our voting securities, regardless of the number

of shares owned, may be required to file an application, be investigated, and

have his or her suitability as a beneficial holder of our voting securities

determined if the Nevada Gaming Commission finds reason to believe that such

ownership would otherwise be inconsistent with the declared policies of the

state of Nevada. The applicant must pay all costs of investigation

incurred by the Nevada Gaming Authorities in conducting any such

investigation.

The

Nevada Gaming Control Act requires any person that acquires beneficial ownership

of more than 5% of a Registered Corporation’s voting securities to report the

acquisition to the Nevada Gaming Commission. It also requires

beneficial owners of more than 10% of a Registered Corporation’s voting

securities to apply to the Nevada Gaming Commission for a finding of suitability

within 30 days after the Chairman of the Nevada State Gaming Control Board mails

a written notice requiring such filing. Under certain circumstances,

an “institutional investor,’’ as defined in the Nevada Gaming Control Act, which

acquires more than 10%, but not more than 25%, of the Registered Corporation’s

voting securities may apply to the Nevada Gaming Commission for a waiver of such

finding of suitability if such institutional investor holds the voting

securities for investment purposes only. An institutional investor

that has obtained a waiver may, in certain circumstances, own more than 25%, but

not more than 29% of a Registered Corporation’s voting securities for a limited

period of time and maintain the waiver.

An

institutional investor is deemed to hold voting securities for investment

purposes if the voting securities were acquired and are held in the ordinary

course of its business as an institutional investor and were not acquired and

are not held for the purpose of causing, directly or indirectly (1) the election

of a majority of the members of the board of directors of the Registered

Corporation; (2) any change in the Registered Corporation’s corporate charter,

bylaws, management, policies, or operations or those of any of its gaming

affiliates; or (3) any other action that the Nevada Gaming Commission finds to

be inconsistent with holding the Registered Corporation’s voting securities for

investment purposes only. Activities which are not deemed to be inconsistent

with holding voting securities for investment purposes only include (a) voting

on all matters voted on by stockholders; (b) making financial and other

inquiries of management of the type normally made by securities analysts for

informational purposes and not to cause a change in management, policies or

operations; and (c) other activities the Nevada Gaming Commission may determine

to be consistent with investment intent. If the beneficial holder of

voting securities that must be found suitable is a corporation, partnership, or

trust, it must submit detailed business and financial information, including a

list of beneficial owners. The applicant is required to pay all costs

of investigation.

Any

person who fails or refuses to apply for a finding of suitability or a license

within 30 days after being ordered to do so by the Nevada Gaming Commission or

the Chairman of the Nevada State Gaming Control Board may be found

unsuitable. The same restrictions apply to a record owner if the

record owner, after request, fails to identify the beneficial

owner. Any stockholder of a Registered Corporation found unsuitable

and that holds, directly or indirectly, any beneficial ownership in the voting

securities beyond such period of time as the Nevada Gaming Commission may

specify for filing any required application may be guilty of a criminal offense.

Moreover, the Registered Corporation will be subject to disciplinary action if,

after it receives notice that a person is unsuitable to be a stockholder or to

have any other relationship with the Registered Corporation, it (i) pays that

person any dividend on its voting securities; (ii) allows that person to

exercise, directly or indirectly, any voting right conferred through securities

ownership; (iii) pays remuneration in any form to that person for services

rendered or otherwise; or (iv) fails to pursue all lawful efforts (including, if

necessary, the immediate purchase of said voting securities for cash at fair

value) to require such unsuitable person to completely divest all voting

securities held.

The

Nevada Gaming Commission, in its discretion, may require the holder of any debt

security of a Registered Corporation to file applications, be investigated, and

be found suitable to own the debt security of a Registered Corporation if the

Nevada Gaming Commission finds reason to believe that such ownership would

otherwise be inconsistent with the declared policies of the state of

Nevada. If the Nevada Gaming Commission determines that a person is

unsuitable to own such security, it may sanction the Registered Corporation,

which sanctions may include the loss of its approvals if, without the prior

approval of the Nevada Gaming Commission, it: (i) pays to the unsuitable person

any dividend, interest, or other distribution; (ii) recognizes any voting right

of such unsuitable person in connection with such securities; (iii) pays the

unsuitable person remuneration in any form; or (iv) makes any payment to the

unsuitable person by way of principal, redemption, conversion, exchange,

liquidation, or similar transaction.

Regulation of Capital Stock.

We are required to maintain current stock ledgers in Nevada that may be

examined by the Nevada Gaming Authorities at any time. If any securities are

held in trust by an agent or by a nominee, the record owner may be required to

disclose the identity of the beneficial owner to the Nevada Gaming

Authorities. A failure to make such disclosure may be grounds for

finding the record owner unsuitable. We are also required to render

maximum assistance in determining the identity of the beneficial owners of our

securities. The Nevada Gaming Commission has the power to require us

to imprint our stock certificates with a legend stating that the securities are

subject to the Nevada Gaming Control Act. To date, the Nevada Gaming

Commission has not imposed such a requirement on us.

We may

not make a public offering of our securities without the prior approval of the

Nevada Gaming Commission if the securities or proceeds are to be used to

construct, acquire, or finance gaming facilities in Nevada or to retire or

extend obligations incurred for such purposes. Such approval, if

given, does not constitute a finding, recommendation, or approval by the Nevada

Gaming Commission or the Nevada State Gaming Control Board as to the accuracy or

adequacy of the prospectus or the investment merit of the offered securities,

and any representation to the contrary is unlawful. Any offer by us

to sell common stock will require the review of, and prior approval by, the

Nevada Gaming Commission.

Changes in Control. Changes

in control of a Registered Corporation through merger, consolidation, stock or

asset acquisitions, management or consulting agreements, or any act or conduct,

by which anyone obtains control, may not lawfully occur without the prior

approval of the Nevada Gaming Commission. Entities seeking to acquire

control of a Registered Corporation must meet the strict standards established

by the Nevada State Gaming Control Board and the Nevada Gaming Commission prior

to assuming control of a Registered Corporation. The Nevada Gaming

Commission also may require persons that intend to become controlling

stockholders, officers, or directors, and other persons who expect to have a

material relationship or involvement with the acquired company, to be

investigated and licensed as part of the approval process.

The

Nevada legislature has declared that some corporate acquisitions opposed by

management, repurchases of voting securities, and corporate defense tactics

affecting Nevada corporate gaming licensees, and Registered Corporations that

are affiliated with those operations, may be injurious to stable and productive

corporate gaming. The Nevada Gaming Commission has established a

regulatory scheme to minimize the potentially adverse effects of these business

practices upon Nevada’s gaming industry and to further Nevada’s policy

to:

|

·

|

assure

the financial stability of corporate gaming licensees and their

affiliates,

|

|

·

|

preserve

the beneficial aspects of conducting business in the corporate form,

and

|

|

·

|

promote

a neutral environment for the orderly governance of corporate

affairs.

|

In

certain circumstances, approvals are required from the Nevada Gaming Commission

before the Registered Corporation can make exceptional repurchases of voting

securities above market price and before a corporate acquisition opposed by

management can be consummated. The Nevada Gaming Control Act also

requires prior approval of a plan of recapitalization proposed by the Registered

Corporation’s board of directors in response to a tender offer made directly to

the Registered Corporation’s stockholders for the purpose of acquiring control

of the Registered Corporation.

License Fees and Taxes.

License fees and taxes, computed in various ways depending on the type of

gaming or activity involved, must be paid to the state of Nevada and to the

counties and cities in which gaming operations are conducted. These

fees and taxes, depending upon their nature, are payable monthly, quarterly, or

annually and are based upon either a percentage of the gross revenue received or

the number of gaming devices operated. Annual fees are also payable

to the state of Nevada for renewal of licenses as an operator of a gaming

machine route, manufacturer, and/or distributor.

Any

person who is licensed, required to be licensed, registered, required to be

registered, or who is under common control with any such persons, collectively,

“Licensees,’’ and who proposes to become involved in a gaming venture outside of

Nevada, is required to deposit with the Nevada State Gaming Control Board, and

thereafter maintain, a revolving fund in the amount of $10,000 to pay the

expenses of investigation by the Nevada State Gaming Control Board of his or her

participation outside of Nevada. The revolving fund is subject to increase or

decrease at the discretion of the Nevada Gaming

Commission. Thereafter, Licensees are required to comply with certain

reporting requirements imposed by the Nevada Gaming Control

Act. Licensees also are subject to disciplinary action by the Nevada

Gaming Commission if they knowingly violate any laws of the foreign jurisdiction

pertaining to the non-Nevada gaming operations, fail to conduct the foreign

gaming operations in accordance with the standards of honesty and integrity

required of Nevada gaming operations, engage in activities or enter into

associations that are harmful to the state of Nevada or its ability to collect

gaming taxes and fees, or employ, contract with, or associate with, a person in

the non-Nevada operations who has been denied a license or finding of

suitability in Nevada on the ground of unsuitability.

Other

Jurisdictions

All other

jurisdictions that have legalized gaming require various licenses,

registrations, findings of suitability, permits, and approvals of manufacturers

and distributors of gaming devices and equipment as well as licensure provisions

related to changes in control. In general, such requirements involve

restrictions similar to those of Nevada.

For

gaming device and system approvals, most jurisdictions in the United States,

including most Native American tribes and state regulatory agencies, accept

testing results from GLI, a leading private gaming device and systems testing

laboratory. GLI also provides testing services for over 400 gaming

regulatory bodies worldwide. GLI has already approved NumberVision,

AdVision and Live TV on our PlayerVision2 platform. We expect to

submit for approval all of our software applications on the PlayerVision 3

platform to GLI sometime during the third quarter of 2010. If

necessary, we also plan to apply directly for approvals from those jurisdictions

that do not accept GLI testing results for certain devices and systems, such as

New Jersey, Pennsylvania, and Montana.

Federal

Regulation

The

Federal Gambling Devices Act of 1962, or the Federal Act, makes it unlawful, in

general, for any person to manufacture, transport, or receive gaming machines,

gaming machine type devices, and components across state lines or to operate

gaming machines unless that person has first registered with the Attorney

General of the United States. We have registered and must renew our

registration annually. In addition, the Federal Act imposes various record

keeping and equipment identification requirements. Violation of the Federal Act

may result in seizure and forfeiture of the equipment, as well as other

penalties.

Application

of Future or Additional Regulatory Requirements

In the

future, we intend to seek the necessary registrations, licenses, approvals, and

findings of suitability for us, our products, and our personnel in other

jurisdictions throughout the world where significant sales of our products are

expected to be made. However, we may be unable to obtain these

registrations, licenses, approvals, or findings of suitability, which if

obtained may be revoked, suspended, or conditioned. In addition, we

may be unable to obtain on a timely basis, or to obtain at all, the necessary

approvals of our future products as they are developed, even in those

jurisdictions in which we already have existing products licensed or

approved. If a registration, license, approval or finding of

suitability is required by a regulatory authority and we fail to seek or do not

receive the necessary registration, license, approval or finding of suitability,

we may be prohibited from selling our products for use in that jurisdiction or

may be required to sell our products through other licensed entities at a

reduced profit.

Employees

As of

December 31, 2009, we had 27 full-time employees, 13 of whom were involved in

keno and bingo operations, 1 of whom was involved in engineering and research

and development, 4 of whom were involved in sales, and 9 of whom were involved

in finance and administration. With the implementation of our new business focus

on our PlayerVision system and upon receipt of sufficient funding, we anticipate

an increase in employees dedicated to developing and growing this business in

the third quarter of 2010. Our employees are not subject to any

collective bargaining agreement with us. We have never experienced a work

stoppage, and we believe our employee relations to be good.

Corporate

History

We were

incorporated in the State of Nevada on April 28, 1998.

ITEM 1A. RISK FACTORS.

Not

required.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not

applicable.

ITEM 2. PROPERTIES.

Our

corporate headquarters and our PlayerVision business is located at 3980 Howard

Hughes Parkway, Suite 450, Las Vegas, Nevada 89169 and comprised of

approximately 8,300 square feet of office space under a favorable sublease

agreement through July 31, 2011. This space adequately meets our

facility and capacity requirements. Our bingo and keno headquarters

are located at 4000 West Ali Baba, Suite D, Las Vegas, Nevada 89118, which is

comprised of approximately 4,800 square feet of office space and 5,700 square

feet of warehouse space under a month-to-month sublease. We had a

Reno, Nevada office consisting of approximately 7,500 square feet under an

executed lease that expires in 2013. Due to our poor financial

condition, we have broken the lease and moved from the facility and are in final

settlement negotiations with the landlord. We also lease an Omaha,

Nebraska service office consisting of approximately 900 square feet of space

under a month-to-month lease.

ITEM 3. LEGAL

PROCEEDINGS

On

September 15, 2008, Steven Brandstetter and J & S Gaming filed a lawsuit

against us, among other defendants, in Department 11 of the Nevada Eighth

Judicial District Court captioned Brandstetter, et al. v. Bally Gaming, Inc., et

al., case no. 08-A-571641-C alleging against us claims of breach of contract,

misrepresentation, breach of fiduciary duty and unjust enrichment regarding a

non-disclosure agreement executed in May 2002 pertaining to the plaintiffs’

gaming concepts. In August 2009, a Motion of Summary Judgment was

granted and the case was dismissed.

On August

26, 2009, a lawsuit was filed by Adline Network Holdings, LLC, a Georgia

Corporation, Adline Media LLC, a Georgia Limited liability company, Adline

Network LLC, a Georgia limited liability company, and Sam Johnson, a former

officer and employee, alleging breach of an Acquisition Agreement, breach of a

Consulting Agreement, breach of a covenant of good faith and fair dealing,

negligent misrepresentation, common law fraud (fraud in the

inducement/fraudulent misrepresentation), 10b-5 securities violations and

declaratory relief. In response to our Motion to Dismiss filed on

October 16, 2009, the plaintiffs filed a first amended

complaint. Since then, the plaintiffs have filed a second amended

complaint with essentially the same allegations, but naming the Chairman of the

Board, the Chief Executive Officer, and Chief Financial Officer individually in

the lawsuit also. We are unable to estimate minimum costs, if any, to

be incurred by us upon the ultimate disposition of this matter and, accordingly,

no provision has been made.

On

December 22, 2009, a lawsuit was filed by Zak Khal, a former officer and

employee of the Company alleging a severance benefit of $100,000 and unused

vacation time of $29,135 are owed him and additional damages in excess of

$10,000 to be specifically determined at trial. We are vigorously

defending this lawsuit and are unable to estimate minimum costs, if any, to be

incurred by us upon the ultimate disposition of this matter and, accordingly, no

provision has been made.

On April

26, 2010, a lawsuit was filed by 990 Rock LLC, the landlord for our Reno office

space for breaching the lease agreement which provided for a total monthly rent

payment of $11,123 through April 30, 2013. The landlord alleges that

they spent $335,735 on tenant improvements prior to our

occupancy. The plaintiff is alleging damages in excess of

$10,000. We are unable to estimate minimum costs to be incurred by us

upon the ultimate disposition of this matter and, accordingly, no provision has

been made.

ITEM 4. SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No

matters were submitted to a vote of our security holders during the fourth

quarter of the fiscal year ended December 31, 2009.

PART

II

ITEM 5. MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our

authorized capital stock consists of 90,000,000 shares of common stock, par

value $0.001 per share, and 10,000,000 shares of preferred stock, par value

$0.001 per share, that may be issued in one or more series.

Common

Stock

Our Board

of Directors has designated two series of common stock, one referred to as

“Common Stock’’ and the other referred to as “Common Stock Series

A.” As of December 31, 2009, there were no shares of our Common Stock

outstanding and 14,974,149 shares of our Common Stock Series A outstanding held

of record by 580 stockholders. There is no active market for our

Common Stock or our Common Stock Series A.

Each

share of Common Stock and Common Stock Series A has identical rights and

privileges in every respect. Each holder of either Common Stock or