Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Future Holdings Corp /TX/ | d8k.htm |

EFH Corp.

2010 Spring Investor Meetings

Discussion Deck

May 2010

Exhibit 99.1 |

1

Safe Harbor Statement

This

presentation

contains

forward-looking

statements,

which

are

subject

to

various

risks

and

uncertainties.

Discussion

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

management's

current

projections,

forecasts,

estimates

and

expectations

is

contained

in

EFH Corp.'s filings with the Securities and Exchange Commission (SEC).

Regulation G

This

presentation

includes

certain

non-GAAP

financial

measures.

A

reconciliation

of

these

measures

to

the

most

directly

comparable

GAAP

measures is included in the appendix to this presentation.

|

2

2

nd

largest

competitive

electric generator in US

Largest lignite/coal and

nuclear baseload

generation fleet in Texas

Low-cost lignite reserves

Largest T&D utility in

Texas

High-growth service

territory

Constructive regulatory

regime

Largest retail

electricity provider in

Texas

Strong customer value

proposition

The largest power generator, retail electricity provider and transmission &

distribution utility in Texas.

Energy Future Holdings Overview |

3

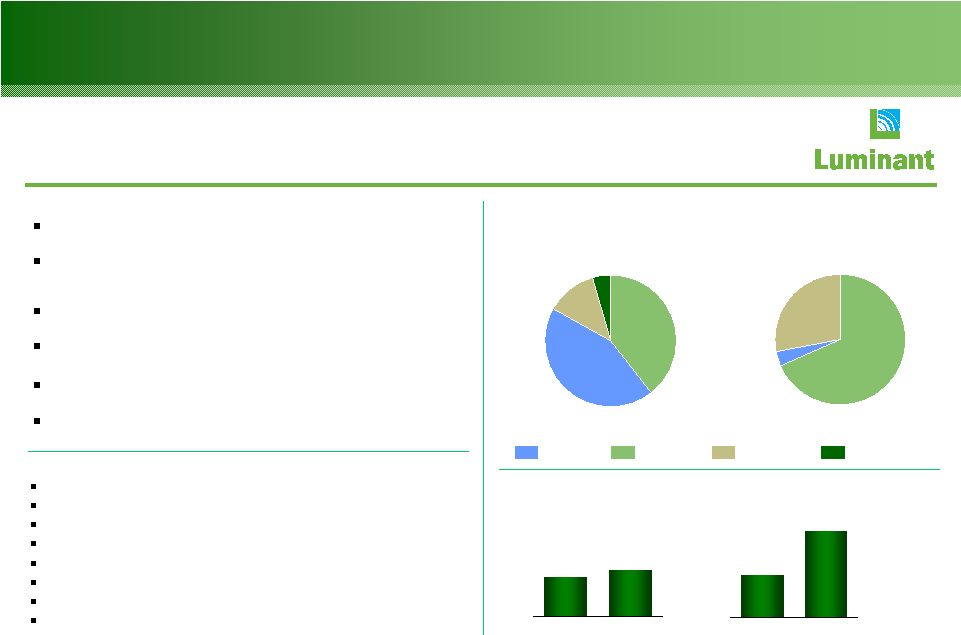

28%

68%

4%

Luminant Overview

Business Profile

Generation

Baseload around-the-clock assets that dispatch at low heat rate

levels

~1,400 MW of new coal-fueled capacity achieved substantial

completion in 2009 and ~800 MW expected to achieve substantial

completion in mid-2010

Low-cost

lignite

reserves

-

Luminant

mines

~20

million

tons

of

lignite annually

Liquidity-light natural gas hedging program designed to provide

cash flow security

Voluntary

SO

²

and

NO

x

emissions

reduction

program

expected

to

reduce emissions below US averages

Comanche Peak expansion through Mitsubishi partnership may

provide a low-cost nuclear growth option

13%

39%

44%

4%

Coal

Gas

Nuclear

Generating

capacity

¹

As of 3/31/10; MW

Total

generation

²

3/31/10

³

;

GWh

18,319 MW

70,735 GWh

New Build-Coal

Safety

Wholesale power prices

Baseload reliability

Mining operations

Fuel costs

O&M costs

Operational excellence/continuous improvement

Stable competitive market

Value Drivers

1.50

1.27

Lignite

Delivered

PRB

2.79

1.38

Lignite

Delivered

PRB

Lignite/coal vs. PRB fuel cost

4

07-09 Average; $/MMBtu

13E; $/MMBtu

Installed nameplate capacity. Includes ~800 MW of new coal-fueled generation under

construction, 1,953 MW of mothballed gas plant capacity, 655 MW of gas plant capacity currently

in Reliability Must Run (RMR) status with ERCOT and 1,856 MW of gas plant capacity (1,933 MW of installed nameplate capacity) related to four gas units that Luminant

expects to mothball in September 2010.

Excludes purchased power

Twelve months ended 3/31/10

Total lignite and PRB fuel expense excluding emissions

1

2

3

4

Luminant is the largest power generator in Texas. |

4

Luminant Areas of Focus –

2010

Safety

Industry leading performance at plants and mines

Operations

Ramp up performance of Sandow 5 and Oak Grove 1 and mid-year substantial

completion of Oak Grove 2

Top decile/quartile availability at Comanche Peak and existing coal plants

Further embed “Luminant Operating System”

and drive improvement through Balance

of Plant initiative

Drive continuous improvement at mines

Development

Continue to advance Comanche Peak 3 & 4 options

Explore opportunities for new technologies, including wind, solar, next generation

coal and new demand sources such as plug-in hybrid electric vehicles

(PHEV) Risk Management

Continue effective and efficient hedging program that is intended to secure cash

flows |

5

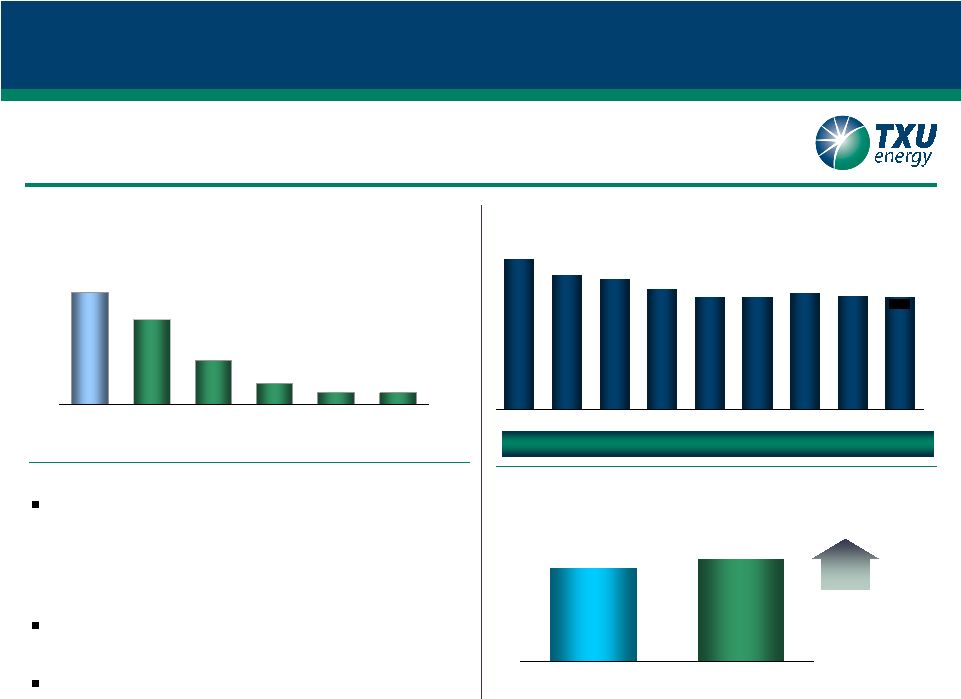

TXU Energy Overview

TXU Energy is the largest electricity retailer in Texas.

Value Drivers

Strong customer value proposition

•

High brand recognition in Texas competitive areas

•

Competitive retail offers

•

Innovative products and services

•

Committed to low-income customer assistance

•

Latest Customer Care Platform (SAP)

Balance Sheet

•

Combined TCEH risk management and liquidity

efficient capital structure

Margins (5–10% net)

1.8

0.7

0.4

0.2

0.2

1.4

TXU Energy

Reliant

Direct

Energy

Stream

Energy

Ambit

First Choice

Source: Latest available company filings, TXU Energy estimates.

Business Profile

Residential customers/meters

At 3/31/10; millions

Sources: NERC, ERCOT

2.0

1.8

US Average

ERCOT

11%

TXU Energy total residential customers

2002-2009 & 3/31/10; end of period, thousands

1,849

1,862

1,914

1,850

1,982

2,145

2,207

2,477

1,856

2002

2003

2004

2005

2006

2007

2008

2009

3/31/10

TXU Energy has maintained market share since 2006.

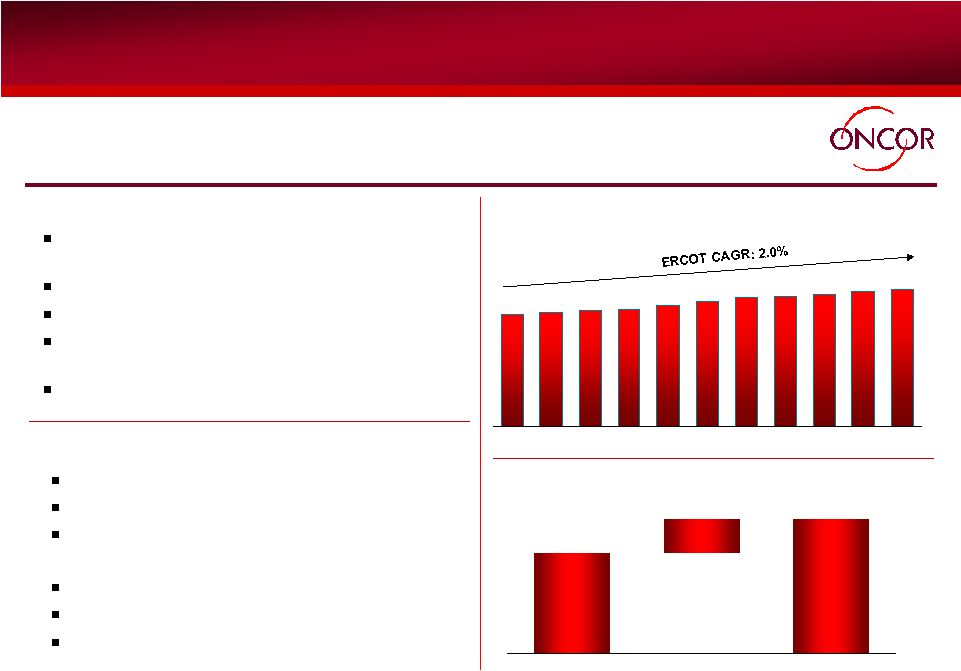

Projected annual demand growth

US avg. and ERCOT; CAGR (2008A-2018E) |

6

TXU Energy Areas of Focus –

2010

Profitable Growth

Deliver customer-based value proposition

Expand profitable residential market share and add profitable business

markets customers

Customer Care Transformation

Enhance customer experience through effective utilization of people, process

and technology

Risk Management

Accurate forecasting of customer needs

Active management and monitoring of procurement position to align with

changing market conditions |

7

T&D

CREZ

Total

Supportive regulatory environment

10.25% authorized ROE

Expedited capital expenditure recovery

(transmission and AMS)

Low operating costs per customer

Strong demand growth vs. US average

Top quartile reliability (SAIDI) and safety

Oncor Overview

Value Drivers

Business Profile

Oncor is the largest transmission & distribution utility in Texas.

6

th

largest

US

transmission

&

distribution

company

Low costs and high reliability

No commodity position

Accelerated recovery of investments in

advanced meters and transmission

$1.3

billion

¹

CREZ

investment

Sources: ERCOT, CDR Report, December 2009

Projected peak demand growth

08-18E; GW

5.2

1.3

3.9

Capital expenditure estimates

08–12E;

$ billions

Based on ERCOT estimates. As a result of the selection of final routes for 3 default and 9

priority lines and additional costs not included in original ERCOT estimates, Oncor estimates that

the cost of these projects will exceed the ERCOT estimate by $220 million.

Minimum capital spending of $3.6 billion over a five-year period, including AMS

1

2

²

62

64

65

67

69

71

72

73

75

76

63

2008A

2009A

2010E

2011E

2012E

2013E

2014E

2015E

2016E

2017E

2018E |

8

Oncor Areas of Focus –

2010

Safety and reliability

AMS

Full deployment of advanced meters expected by 2012 (over 900,000

meters installed through April 2010)

Capital investment of ~$690 million

Recovery through monthly surcharge over 11 years, began January 2009

(~$2.19 per month for average residential customer)

CREZ

Obtain CCNs

for remaining subsequent projects

Continue construction, engineering, right-of-way acquisition and other

permitting activities

On-time completion of projects |

Appendix –

Additional Slides and

Regulation G Reconciliations

9 |

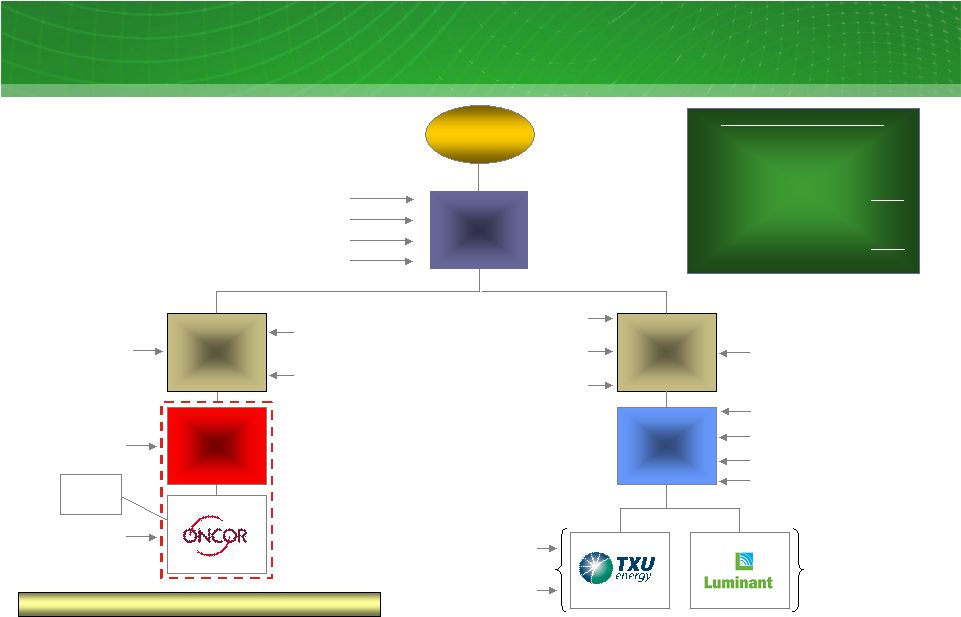

10

EFH Corp. Debt Structure

1

Summary

diagram

includes

unamortized

discounts

and

premiums

and

excludes

subsidiaries

of

EFH

that

are

not

subsidiaries

of

Energy

Future

Intermediate

Holding

Company

or

Energy

Future

Competitive

Holdings

Company,

including

TXU

Receivables

Company,

which

buys

receivables

from

TXU

Energy

and

sells

undivided

interests

in

such

receivables

under

the

TXU

receivables

program.

2

March 31, 2010 balances adjusted to include the effects of a debt repurchase and

debt exchanges in April 2010 that resulted in the issuance of an additional $66 million of EFH Corp. 10% Senior Secured Notes and

acquisition of $5 million of EFH Corp. 10.875% Notes, $75 million of EFH Corp.

11.25/12.00% PIK Toggle Notes and $17 million of TCEH 10.50/11.25% PIK Toggle Notes.

3

Excludes short term borrowings related to the accounts receivables program.

4

Other

debt

includes

a

financing

lease

of

an

indirect

subsidiary

of

EFH

as

well

as

a

capital

lease

for

IT

equipment

at

EFH.

5

Includes

securitization

bonds

issued

by

Oncor

Electric

Delivery

Transmission

Bond

Company

LLC

and

Oncor’s

Revolving

Credit

Facility

that

had

a

balance

of

$756

million

as

of

March

31,

2010.

6

Cash

and

cash

equivalents

and

restricted

cash

(non

regulated)

as

of

March

31,

2010.

Investor Group

EFH

$1.9 billion Pre-Merger Notes

Guarantor of $0.7

billion EFH Senior

Secured Notes

$5.8 billion of debt

5

Energy Future

Intermediate

Holding

Company

Energy Future

Competitive

Holdings

Company

TCEH

Oncor Electric

Delivery Holdings

Ring-fenced entities

Guarantor of $6.8 billion TCEH Cash

Pay/PIK Toggle Notes and $4.5 billion

EFH

Cash

Pay/PIK

Toggle

Notes

Guarantor of TCEH Sr. Secured

Facilities and Commodity

Collateral Posting Facility (CCP)

$0.1 billion of Pre-Merger Notes

Guarantors of $6.8 billion

TCEH Cash Pay/PIK

Toggle Notes

Guarantors of TCEH Sr.

Secured Facilities and CCP

$6.8 billion TCEH Cash Pay/PIK

Toggle Notes

$21.6 billion Sr. Secured Facilities

~20%

Minority

Investor

$4.5 billion EFH Cash Pay/PIK Toggle Notes

$1.5 billion of other debt

$0.0 billion of CCP

Debt Outstanding ($ billions)

As of 3/31/10 Pro-forma

2

EFH

$ 7.2

EFIH

0.2

EFCH

0.1

TCEH

3

29.9

Total debt (non regulated)

37.4

Cash and cash equivalents

6

(1.3)

Restricted cash

6

(1.2)

Net debt (non regulated)

$34.9

EFH

Corp.

debt

structure

1

As of 3/31/10 Pro-forma

2

;

$ billions

As of March 31, 2010, the EFH Corp. leverage ratio was 9.1x

$0.7 billion EFH Senior Secured Notes

$0.2 billion Senior

Secured Notes

Guarantor of $4.5

billion EFH Cash Pay/

PIK Toggle Notes

Guarantor of $0.7 billion EFH

Senior Secured Notes

$0.09

Other

debt

4 |

11

TCEH Amendments/Consents

In Q3 2009, TCEH received positive support (60%+ vote) from its

secured lenders to amend its Credit Agreement.

These amendments provide additional debt capacity to de-lever

TCEH and provide a vehicle for 2014 TCEH maturity extensions.

Credit Agreement Amendments

Ability to Extend Revolver/Term Loan B

Ability to use unlimited 1st lien Post 2014 bonds and loans to retire

Term Loan B at par

Trade

$1.25

billion

1st

lien

Accordion

for

additional

$4

billion

2nd

lien capacity at TCEH for refinancing purposes

Exclude 2nd lien debt at TCEH from Maintenance Covenant

calculation

Allow for up to $750 million 1st lien Secured Bond Offering under

Accordion |

12

EFH Corp. and EFIH Exchange Offers

In November 2009, EFH Corp. and EFIH completed a SEC-registered

debt-for-debt exchange.

Exchange Offer Summary

In the exchange, EFH Corp. sought to issue up to an aggregate

$3.0 billion of new EFH Corp. and EFIH 9.75% Senior Secured

Notes due 2019 for ~$4.5 billion aggregate EFH Corp. Legacy

notes and EFH and TCEH Cash-Pay/PIK Toggle Notes (LBO

notes)

Ultimately, ~$350 million of Legacy and LBO notes was

exchanged for ~$250 million aggregate new EFH Corp. and EFIH

9.75% Senior Secured Notes |

13

EFH Corp. New Financing Accomplished

In January 2010, EFH Corp. successfully issued $500 million of

Senior Secured Notes maturing in 2020 in a private offering.

New Debt Issuance Summary

10% coupon, EFH Corp. Senior Secured Notes due 2020, priced

at par

The initial $300 million offering was upsized to $500 million

Proceeds from this offer will be used for general or other

corporate purposes, including working capital needs,

investment in business initiatives, capital expenditures and

prepayment or repurchase of outstanding debt |

14

EFH Corp. Exchanges and Purchases

In March and April 2010, EFH Corp. completed the following debt-

for-debt exchanges and open market repurchases.

March

Issued $34 million EFH Corp. 10% Senior Secured Notes due 2020

in exchange for $20 million EFH Corp. PIK Toggle Notes and $27

million TCEH PIK Toggle Notes, capturing $13 million of discount

April

Purchased $5 million EFH Corp. 10.875% Cash-Pay Notes for $3.8

million cash from the net proceeds of the January 2010 $500 million

issuance, capturing ~$1 million of discount

Issued $66 million aggregate EFH Corp. 10% Senior Secured Notes

due 2020 in exchange for $75 million aggregate EFH Corp. PIK

Toggle Notes and $17 million aggregate TCEH PIK Toggle Notes,

capturing $26 million of discount

EFH Corp. continually seeks opportunities to enhance its financial

flexibility. |

15

B+ (+2)

B+ (+2)

Caa3 (-2)

Sr. Secured

Fitch

S&P

Moody’s

EFIH

B+ (+2)

B+ (+2)

Caa3 (-2)

Sr. Secured

Stable

Stable

Stable

Oncor Outlook

Negative

Negative

Negative

EFH Outlook

AAA

BBB+ (+8)

BBB+ (+8)

CCC (-2)

CCC (-2)

CCC (-2)

B+ (+2)

CCC (-2)

CCC (-2)

CCC (-2)

B-

(0)

B-

AAA

BBB (+7)

BBB-

(+6)

CCC (-2)

CCC (-2)

B-

(0)

B+ (+2)

CCC (-2)

CCC (-2)

CCC (-2)

B (+1)

B-

Aaa

Baa1 (+9)

Caa3 (-2)

Caa3 (-2)

Caa2 (-1)

B1 (+3)

Caa3 (-2)

Caa3 (-2)

Caa3 (-2)

Caa3 (-2)

Caa1

Secured Notes

Oncor Issuer Rating

EFH Issuer Rating

Unsecured

Cash Pay/PIK Toggle

Credit Facilities (secured)

EFCH

Sr. Unsec

(Pre–merger)

Cash Pay/PIK Toggle

EFH Corp.

TCEH

Secured

Oncor Transition Bonds

Pre-merger

PCRBs

Issuer / Security

Issuer/Debt Ratings Summary

Indicates change in rating since 1/31/10

Issuer/Debt ratings for EFH Corp. and its subsidiaries

As of 4/30/10; rating agencies credit ratings

Note: Parenthetical amounts represent change in ratings notches from EFH Issuer

Rating. |

16

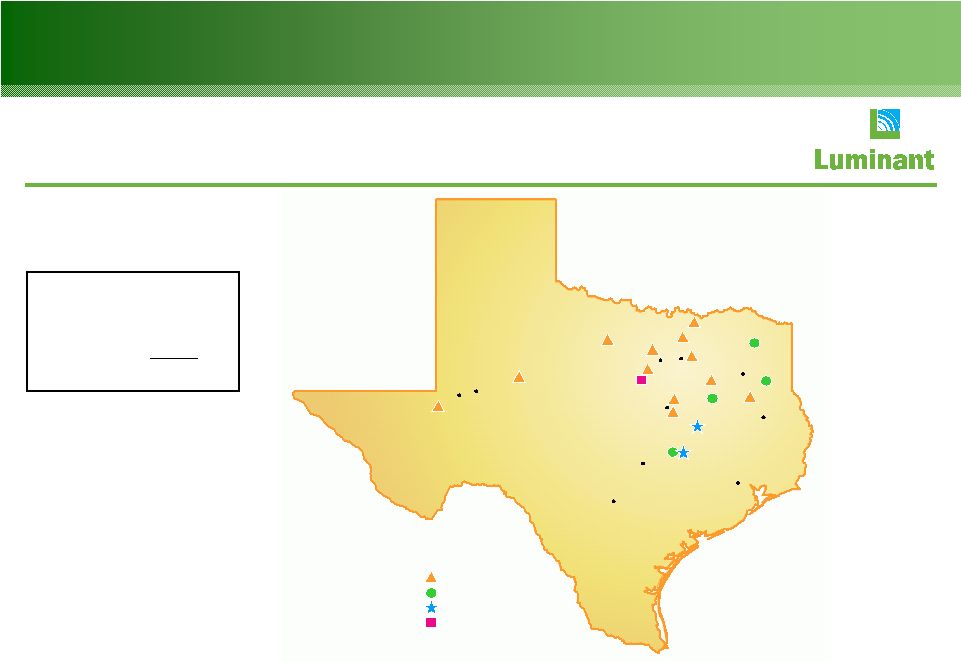

Luminant Generation Facilities

Generation capacity in ERCOT

At 3/31/10; MW

Nuclear

2,300 MW

Lignite/coal

7,217

Lignite –

new

1

800

Natural gas

2

8,002

Total

18,319 MW

HOUSTON

SAN ANTONIO

AUSTIN

WACO

MIDLAND

LUFKIN

ODESSA

DALLAS

TYLER

FORT

WORTH

Power Plants

Natural gas

Lignite/coal

Lignite, new build

Nuclear

1

Represents approximately 800 MW of new lignite-fueled generation

under construction that is expected to achieve substantial completion in mid-2010.

2

Includes seven mothballed units (1,953 MW) not currently available for

dispatch, 655 MW for two units currently in RMR status with ERCOT and 1,856 MW of gas plant capacity (1,933 MW

of installed nameplate capacity) related to four gas units that

Luminant expects to mothball in September 2010. |

17

0

4

8

12

16

0

10

20

30

40

50

60

70

80

Cummulative

MWs

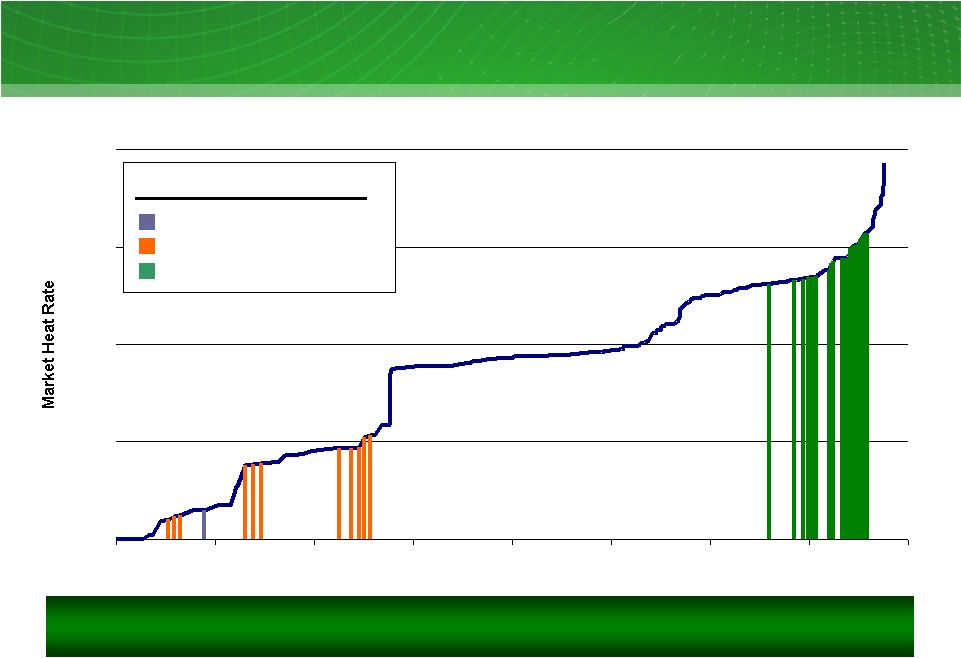

1

Summer

2010

ERCOT

supply

stack

-

indicative

Luminant

plants

are

typically

on

the

“book-ends”

of

the

supply

stack.

ERCOT’s

marginal price is set by natural gas in most hours of the year.

Luminant nuclear plant

Luminant lignite/coal plants

Luminant

gas

plants

¹

Legend

ERCOT Supply Stack

1

Excludes 1,953 MW of mothballed gas plant capacity. Includes 655 MW of gas plant capacity

currently in RMR status with ERCOT and 1,856 MW of gas plant capacity (1,933 MW of installed

nameplate capacity) related to four gas units that Luminant expects to mothball in September 2010.

Sources: ERCOT and Energy Velocity ®,

Ventyx |

18

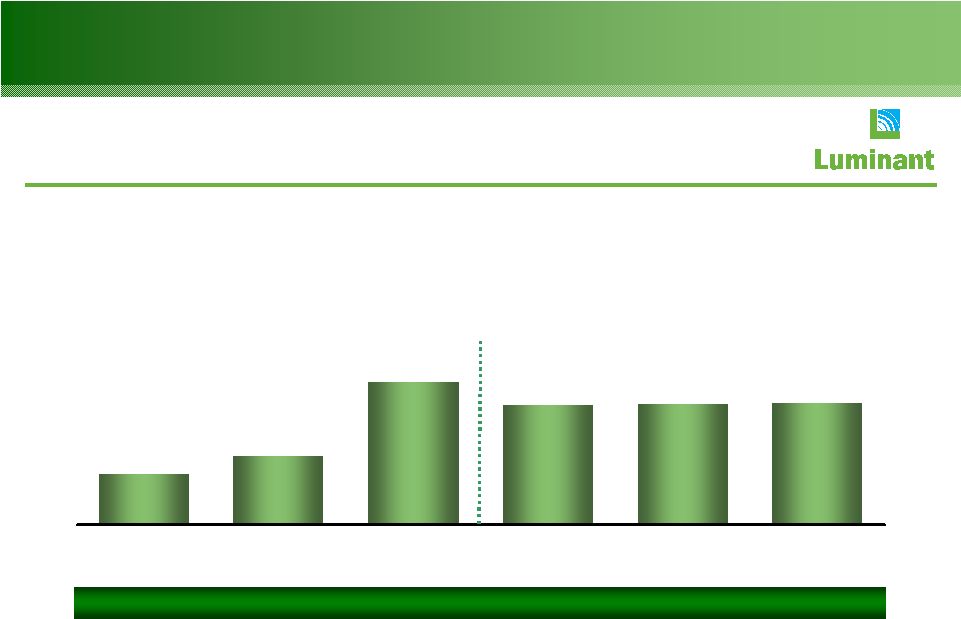

Existing Fleet Baseload

Capital Expenditures

234

318

660

556

560

566

02–03

04–05

06–07

08

09

10E

Baseload

capital

expenditures

1

02–09; 10E; $ millions

Merger Close

1

Baseload capital expenditures excluding any capital expenditures for development of Oak Grove and

Sandow 5, new mine development, environmental retrofit program and other development related

capital expenditures. Includes new build sustaining capital expenditures for Oak Grove and Sandow 5 for

2010 only.

Luminant needs to drive sustained high performance at the optimal investment level.

|

19

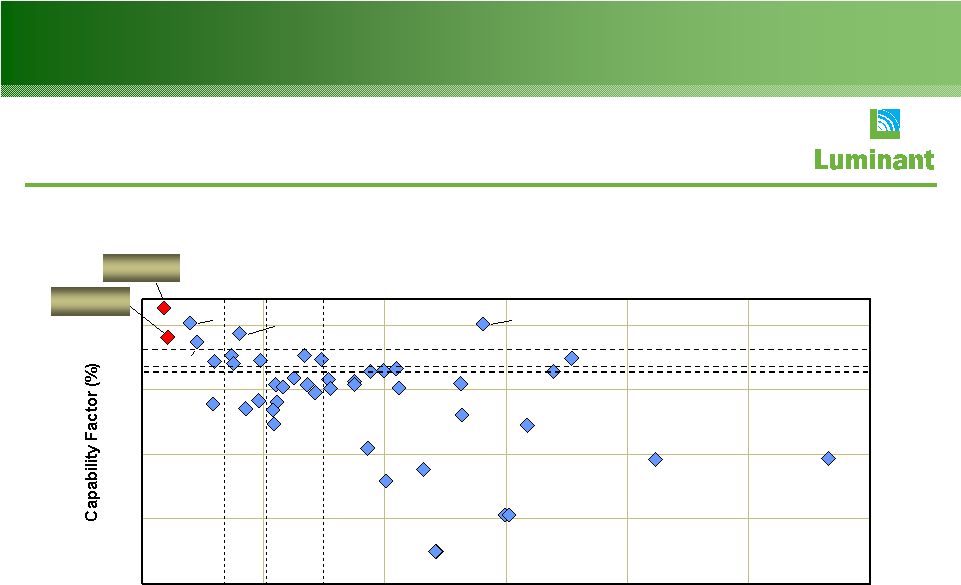

Nuclear Reliability And Cost Benchmarks

1

Benchmarking peer set defined as 18 month fuel cycle U.S. nuclear plants (42 plants

/ 66 units BWR & PWR) 2

Source: EUCG May 2009 release for cost and WANO for Capability Factors

3

2007

$/MWh

adjusted

for

steam

generator

replacement

75

80

85

90

95

10

15

20

25

30

35

40

$/MWh

Braidwood

Byron

STP

Decile

Quartile

Median

Decile

Quartile

Median

Nuclear capability factor & O&M

06–08 percent and $/MWh

Ginna

CPNPP 06-08

94.07

CPNPP 09

96.3 |

20

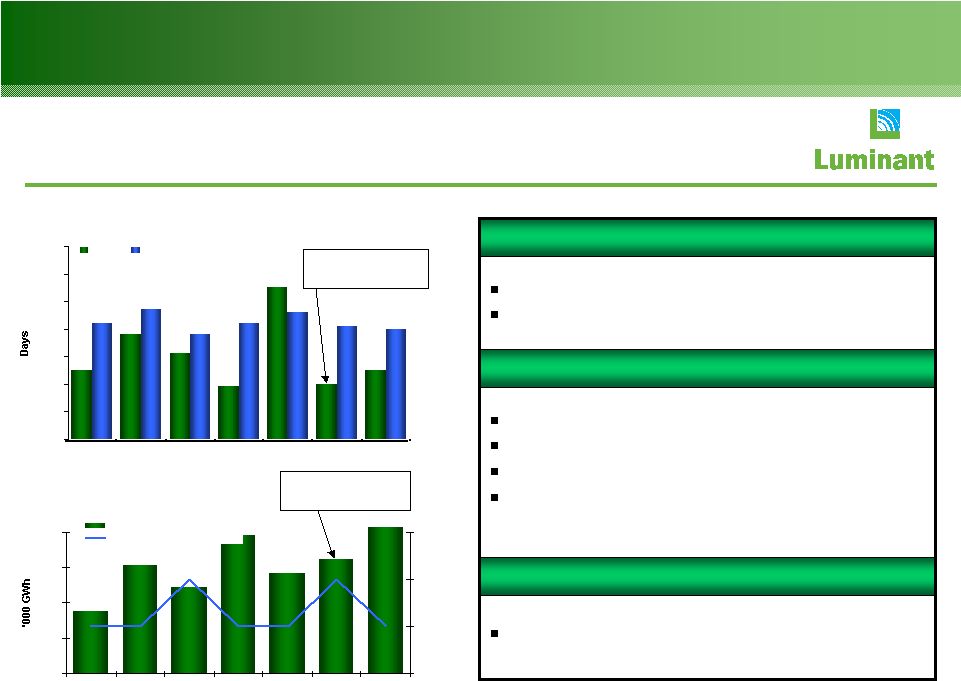

Impact of Refueling Outages

Avg. nuclear

fleet

refueling

outage

duration

¹

-

18

month cycle units

03-09; days

Nuclear fleet output

03-09; thousand GWh

2010 outage was 24 days

2010 Refueling Outage Impact

2008 reflects 2 refueling outages

2008 outages were 19 days and 21 days

2009 outage was 25 days

2009 generation includes 110 GWh

ERCOT-driven backdown

2008-2009 Refueling Outage Impact

18 months

Duration: ~18-25 days

Nuclear Refueling Cycle

World record steam

generator outage

World record steam

generator outage

0

10

20

30

40

50

60

70

2003

2004

2005

2006

2007

2008

2009

²

EFH

Industry

16

17

18

19

20

2003

2004

2005

2006

2007

2008

2009

0

1

2

3

EFH

# of Refueling Outages

2005 and 2008 were dual refueling outage years; this graph shows the average outage duration for each

of those years. Industry based on early release data from Electric Utility Cost Group (EUCG)

1

2 |

21

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

40

50

60

70

80

90

High-Performance Coal Operator

Luminant

vs.

US

coal

fleet

net

capacity

factors

¹

Percent

Top decile

84.7%

Top quartile

79.8%

Luminant vs. US coal fleet O&M

$/MWh

Top decile

3.3

Top quartile

4.0

Luminant has industry leading performance relative to other coal-fueled

generators. Luminant 06–08 fleet avg. = 84.7 %

Luminant 08 fleet = 83.2%

Source: GKS

Luminant 06–08 fleet avg. = 3.11

Luminant 08 fleet = 3.29

1

Benchmarking net capacity factors based on GADS.

Luminant

09 fleet = 81.4%

Luminant

09 fleet = 3.74 |

22

High-Performance Coal Operator

65%

70%

75%

80%

85%

90%

95%

100%

2004

2005

2006

2007

2008

EFH

Industry

Consistent high performance

Average

coal

fleet

capacity

factor

¹

04-08; percent

Range

of

coal

unit

2-year

capacity

factors

²

04-08; percent

45%

50%

55%

60%

65%

70%

75%

80%

85%

90%

95%

100%

EFH (9)

AYE (10)

DYN (4)

EIX (8)

MIR (2)

NRG (9)

RRI (6)

Operator (# of Units)

Range

5 Yr Average

Based on unscrubbed merchant units greater than 450 MW. Industry total excludes EFH plants.

2

Includes merchant units greater than 450 MW.

Source: Velocity Suite (Energy Velocity)

1 |

23

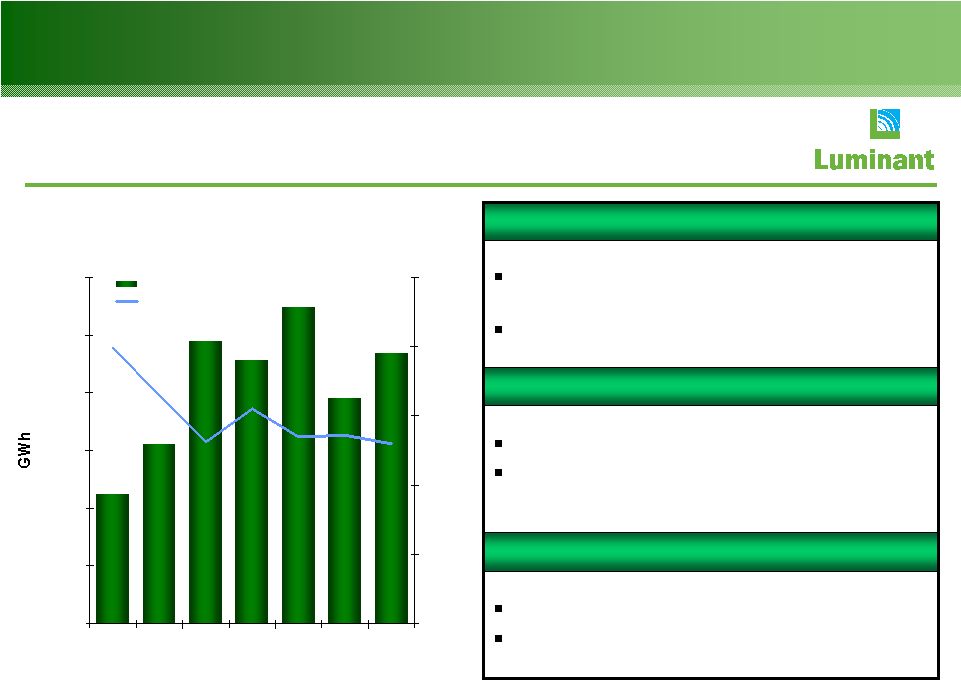

Coal Fleet Output

41,000

42,000

43,000

44,000

45,000

46,000

47,000

2003

2004

2005

2006

2007

2008

2009

0

50

100

150

200

250

Net Gen

# of PO Days

2009 reflects 130 planned outages days

2009 average major outage duration was

45 days

2009 Planned Outage Impact

2008 reflects 136 planned outages days

2008 average major outage duration was

48 days

2008 Planned Outage Impact

3 or 4 year overhaul cycle depending on

unit

Duration is scope dependent

Coal Fleet Planned Outage Cycle

Coal fleet output

03-09; GWh

1

1

2009 includes 1,443 GWh of new build generation (Sandow 5 and Oak Grove 1 units).

|

24

Nuclear Expansion

HEAVY INDUSTRIES, LTD.

Luminant is pursuing the construction of a next-generation nuclear

facility by

…

Project includes two nuclear generation units each having approximately 1,700 MW

(gross) capacity, and is currently ranked 5th (first alternate) for DOE

grants. …partnering with

…partnering with

a world-class

a world-class

equipment provider…

equipment provider…

…

…

and leveraging existing

and leveraging existing

site, water rights and

site, water rights and

leadership team.

leadership team. |

25

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

0

4

8

12

16

20

0

500

1,000

1,500

2,000

2,500

3,000

3,500

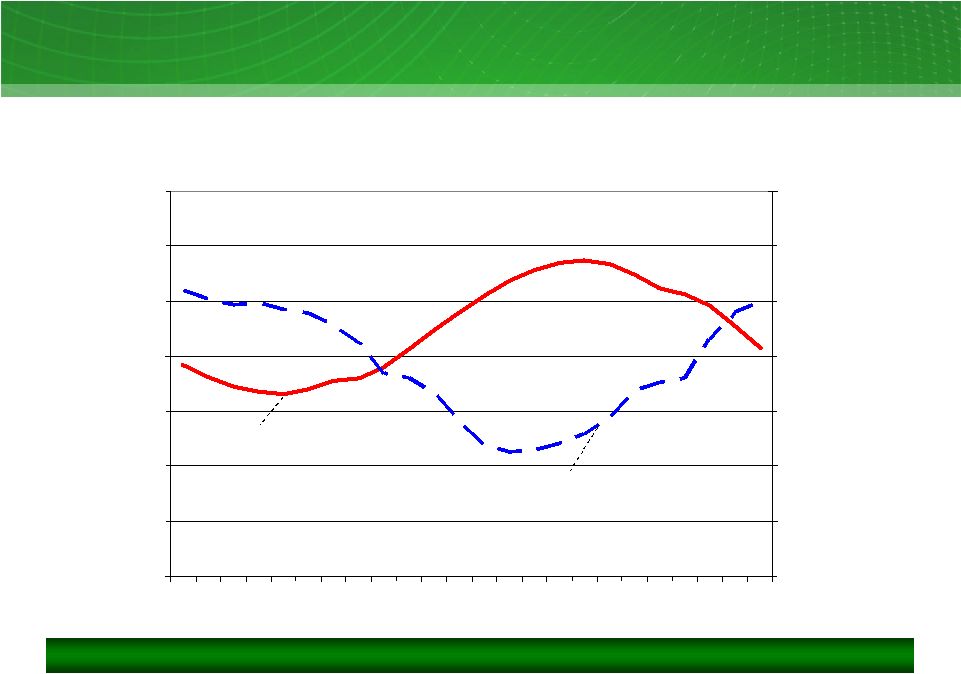

ERCOT Average Daily Profile of Load and Wind

Source: ERCOT

ERCOT average daily profile of load and wind output

August 09; mixed measures

Wind operating characteristics necessitate additional resources for

reliability. Average

Load

Average

Wind Output

Hour

Load

(aMW)

Wind Output

(MW) |

26

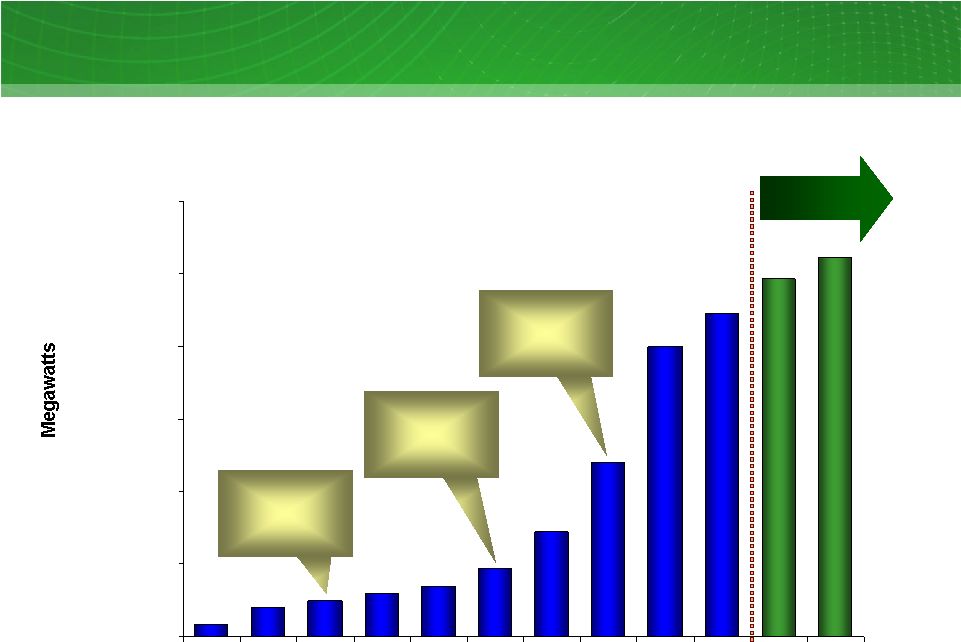

Texas Wind Additions

0

2,000

4,000

6,000

8,000

10,000

12,000

Pre 01

01

02

03

04

05

06

07

08

09

10E

11E

RPS

¹

Target

of 2,880 MW

by 2009

RPS

¹

Target

of 5,880 MW

by 2015

CREZs

Designated

ERCOT

SGIA

²

Cumulative wind capacity additions in Texas

Pre-01 -

09;10E -

11E; MW

1

Renewable Portfolio Standard

2

Signed Generation Interconnect Agreement

Source: ERCOT

–

January

2010

System

Planning

Report

to

the

Reliability

and Operations Subcommittee |

27

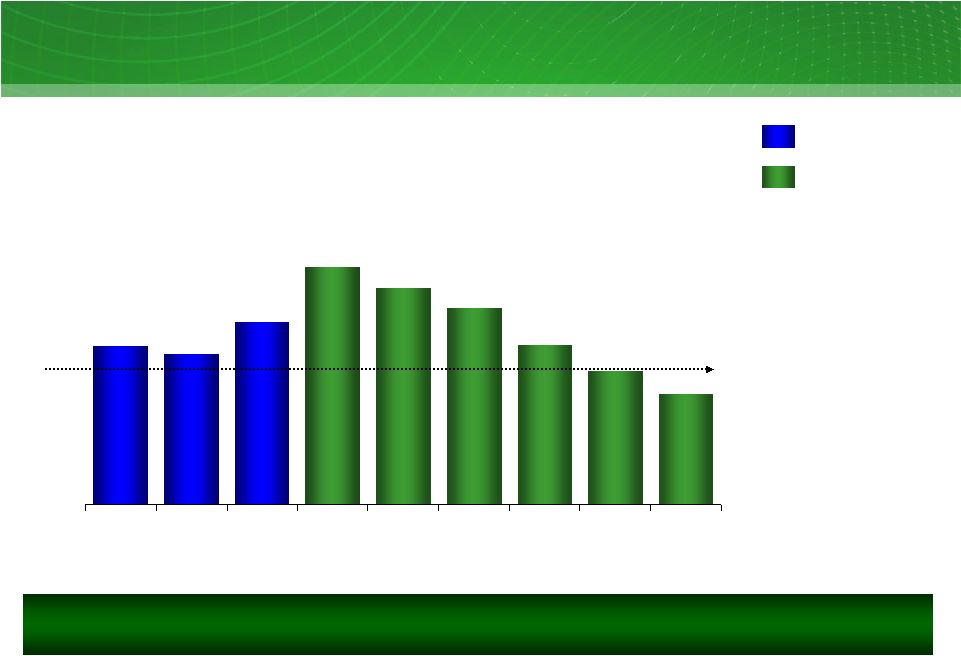

ERCOT Reserve Margins

ERCOT reserve margin

07-09; 10E-15E; percent

15

14

17

22

20

18

15

12

10

0

5

10

15

20

25

07

08

09

10E

11E

12E

13E

14E

15E

December

2009

²

1

Source: ERCOT (reserve margin projection prior to summer peak and based on the

reserve margin formula in effect at the time) 2

Source: ERCOT CDR as of December 2009

The ERCOT market currently appears to be reasonably positioned to support

Texas’

needs through 2013.

Year

Targeted minimum

reserve margin is 12.5%

Actuals

¹

% |

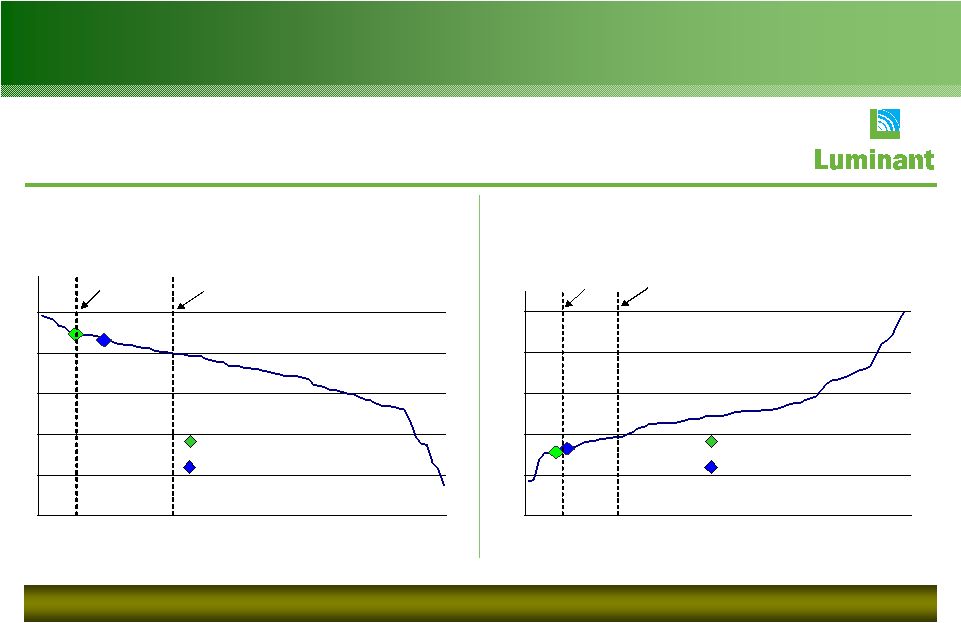

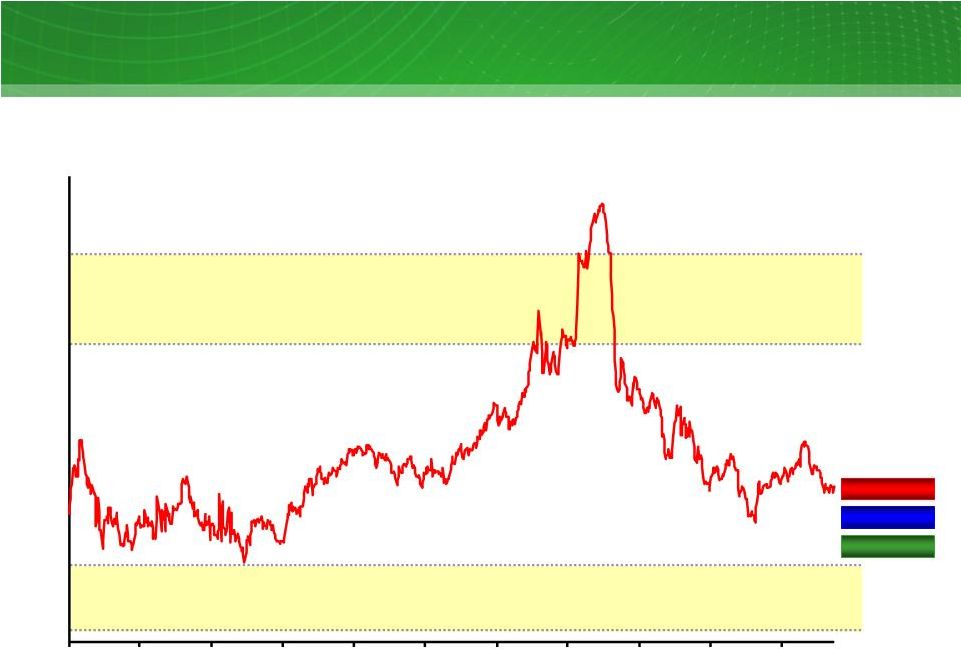

28

Historical Forward NYMEX Natural Gas Prices

2014 Historical NYMEX Gas Prices

$/MMBtu

Potential Future Hedge Range

(at Current Friction Costs)?

Potential Buyback Gas Hedge Range?

Cal14: $7.16

CERA: $6.75

Ventyx: $7.05

Illustrative example

5.0

6.0

7.0

8.0

9.0

10.0

11.0

Jan-06

May-06

Sep-06

Jan-07

May-07

Sep-07

Jan-08

May-08

Sep-08

Jan-09

May-09 |

29

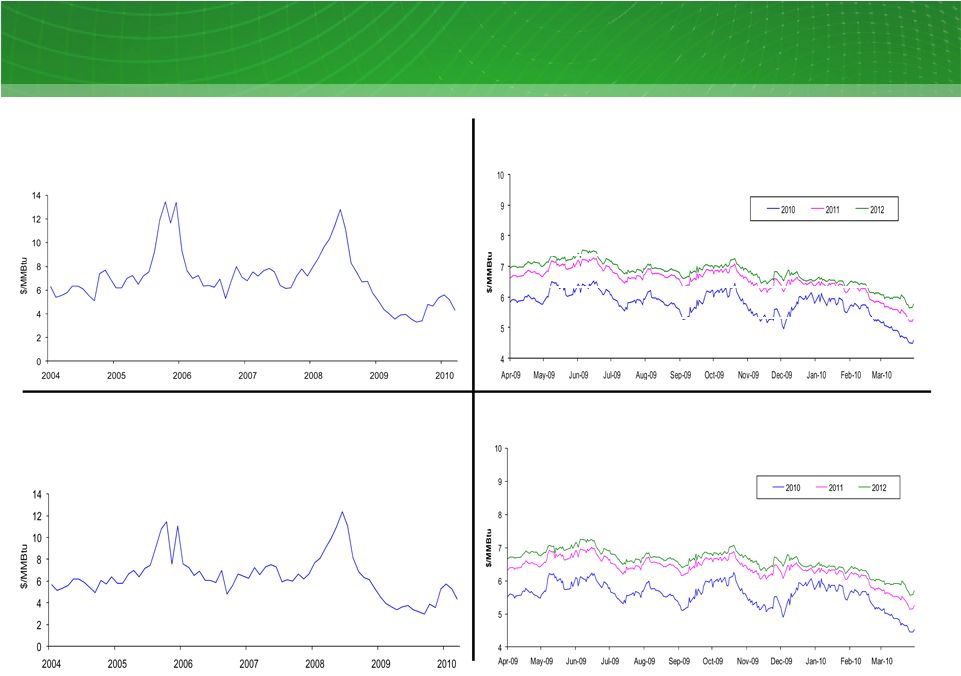

29

Houston

Ship

Channel

settled

natural

gas

prices

¹

Jan 04-Mar 10; $/MMBtu

Market Price Snapshot

NYMEX

forward

natural

gas

prices

2,3

2010-2012; $/MMBtu

NYMEX

settled

natural

gas

prices

¹

Jan 04-Mar 10; $/MMBtu

Houston

Ship

Channel

forward

natural

gas

prices

2,3

2010-2012; $/MMBtu

1

Settled prices are monthly averages

2

Forward

prices

reflect

market

observable

quotes

during

the

12

months

ended

March

31,

2010

for

the

following

delivery

periods:

2010,

2011

and

2012

3

2010 represents weighted average of settled NYMEX or HSC prices and balance of year

forward prices $/

MMBtu |

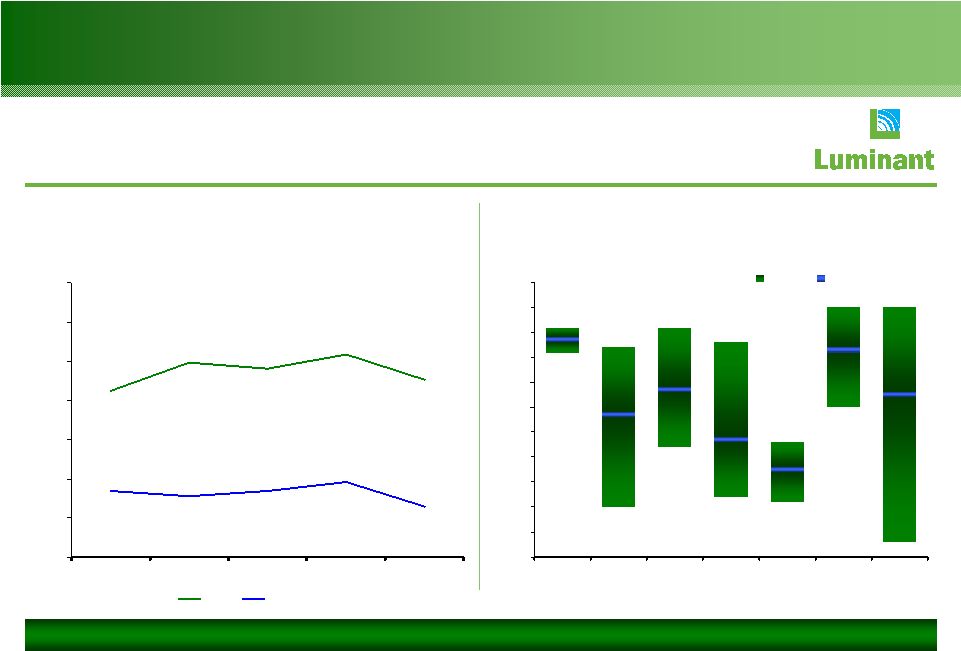

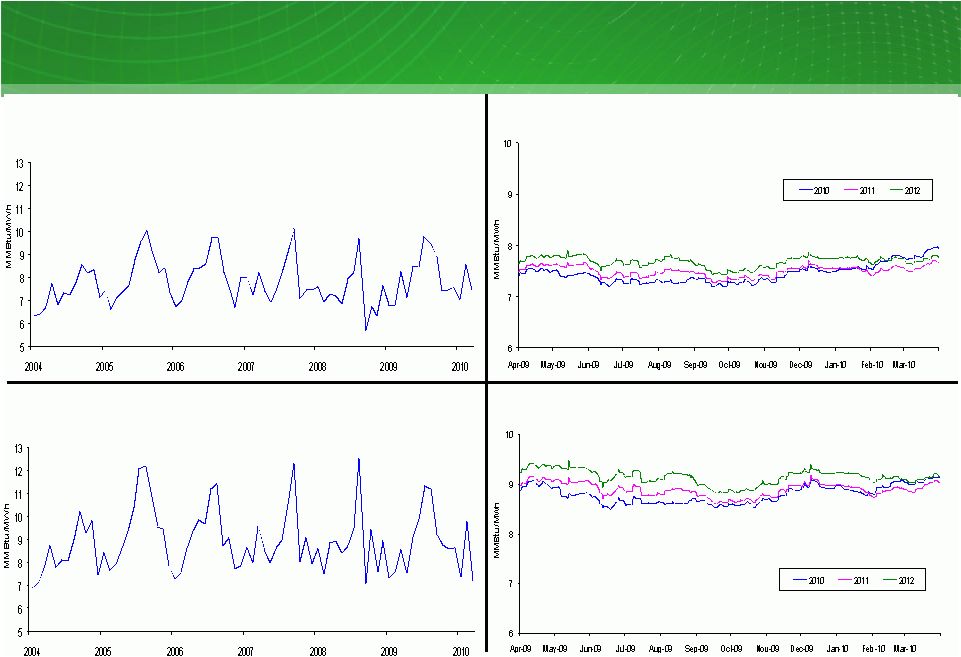

30

30

Market Price Snapshot

ERCOT

North

Zone

7x24

settled

heat

rate

1,2

Jan 04-Mar 10; MMBtu/MWh

ERCOT

North

Zone

7x24

forward

heat

rate

1,3,4

2010-2012; MMBtu/MWh

ERCOT

North

Zone

5x16

forward

heat

rate

1,3,4

2010-2012; MMBtu/MWh

ERCOT

North

Zone

5x16

settled

heat

rate

1,2

Jan 04-Mar 10; MMBtu/MWh

1

Market heat rate calculated by dividing 7x24 and 5x16 power prices, as appropriate,

by Houston Ship Channel natural gas prices 2

Settled prices are monthly averages

3

Forward prices reflect market observable quotes during the 12 months ended March

31, 2010 for the following delivery periods: 2010, 2011 and 2012 4

2010 represents weighted average of settled North Zone 7x24 or 5x16 heat rates and

balance of year forward heat rates |

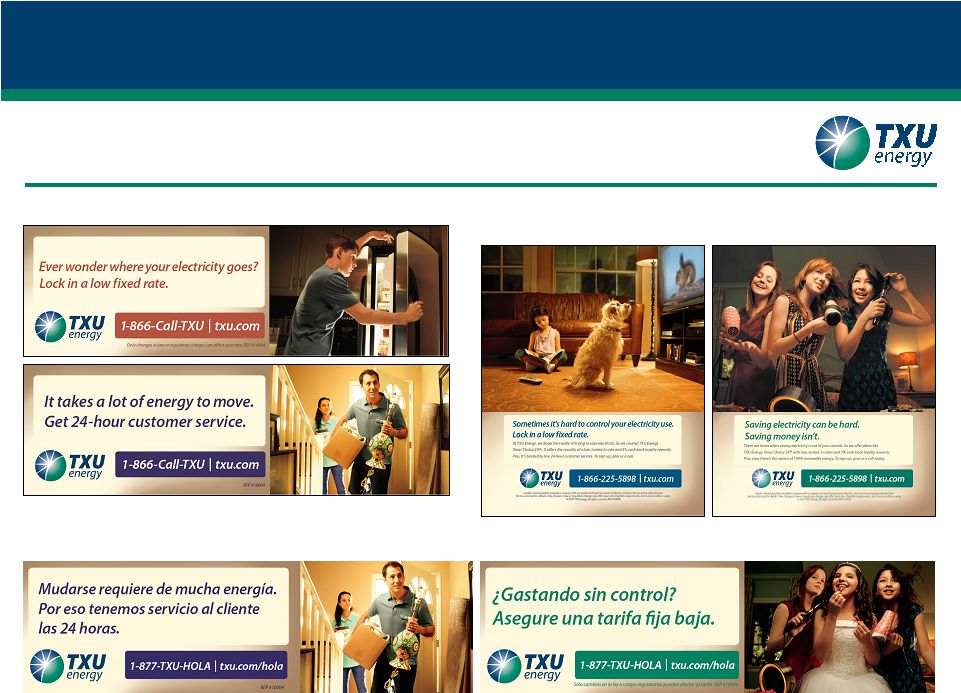

31

Mass Media in Market

Outdoor –

Spanish Language

Outdoor –

English Language

Print –

English Language

TXU Energy Marketing Campaign |

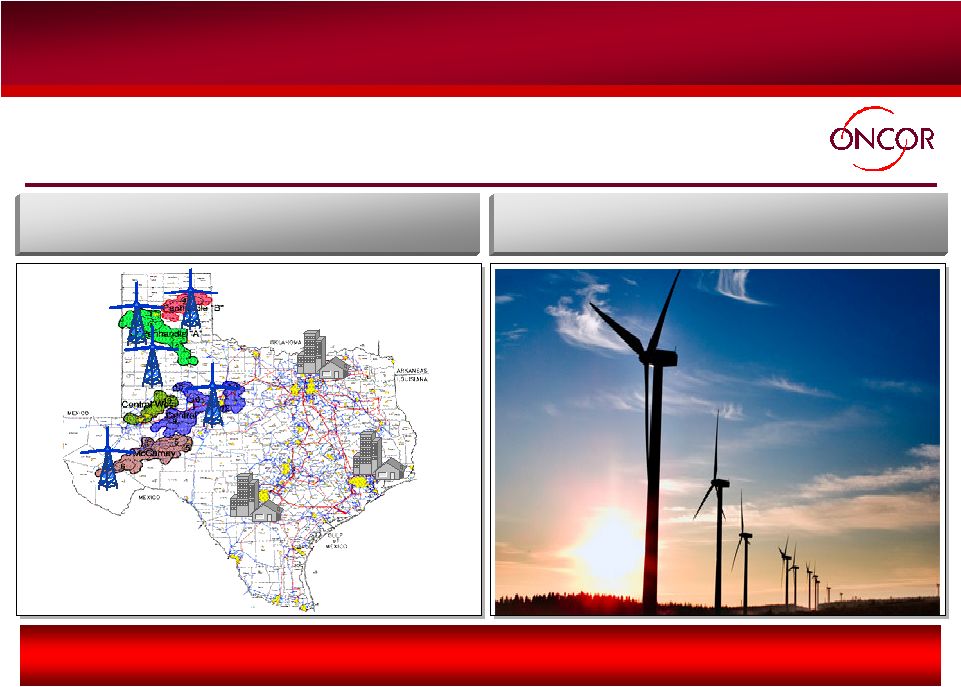

32

New Oncor Infrastructure

…to support the continued buildout of

…to

support the continued buildout of to support the continued

buildout of wind capacity in Texas

wind capacity in Texas

Oncor’s investment in CREZ will receive accelerated recovery,

consistent with other transmission investment, mitigating regulatory delay.

Oncor

expects

to

invest

~$1.3

billion

on

new

CREZ-related transmission lines…

1

Based on ERCOT estimates. As a result of the selection of final routes for 3 default and 9

priority lines and additional costs not included in original ERCOT estimates, Oncor estimates

that the cost of these projects will exceed the ERCOT estimate by $220 million.

1 |

33

Oncor Demand-Side Management

Oncor is leading the largest advanced metering initiatives deployment in the US with

a commitment to have 3.4 million meters installed by 2012 (over 900,000 meters

installed through April 2010)

Oncor recovers its investment through a

PUC -approved surcharge

Customer monitoring of consumption

“Smart”

appliances

Dynamic pricing

Oncor’s

energy

efficiency

filing

has

been

approved

and

is

reflected

in

rates.

Oncor to deploy ~$690 million of capital

for advanced metering

initiatives…

…that will

enable key DSM initiatives 1

Public Utility Commission of Texas.

1 |

34

Table 1: EFH Corp. Net Debt Reconciliation

As of March 31, 2010 Pro-forma

$ millions

34,902

(1,152)

(1,328)

37,382

36,879

250

253

3/31/10

(27)

-

4

(31)

(31)

-

-

Pro-forma

Adjust.

34,875

Net debt

(1,152)

Restricted cash

(1,324)

Cash and cash equivalents

Less:

36,848

Long-term debt, less amounts due currently

253

Short-term borrowings

250

Long-term debt due currently

37,351

Total debt

3/31/10

Pro-forma

Description

1

Pro-forma adjustment reflects the April issuance of $66 million EFH Corp. 10%

Senior Secured Notes due 2020 in exchange for $92 million of EFH Corp. and

TCEH PIK Toggle Notes and $5 million of EFH Corp. 10.875% Cash Pay Notes purchased

for $3.8 million cash. 2

Excludes $393 million at TXU Receivables Company related to the accounts receivable

securitization program. 1

2

1 |

35

Table 1: TCEH Total Debt Reconciliation

As of March 31, 2010 Pro-forma

$ millions

29,909

29,424

232

253

3/31/10

(17)

(17)

-

-

Pro-forma

Adjust.

29,407

Long-term debt, less amounts due currently

253

Short-term borrowings

232

Long-term debt due currently

29,892

Total debt

3/31/10

Pro-forma

Description

1

Pro-forma adjustment reflects the April issuance of EFH Corp. 10% Senior

Secured Notes due 2020 in exchange for $17 million of TCEH Toggle Notes.

2

Excludes $393 million at TXU Receivables Company related to the accounts receivable

securitization program. 1

2

1 |

36

Table 3: Oncor Total Debt Reconciliation

As of March 31, 2010

$ millions

4,972

Long-term debt, less amounts due currently

756

Short-term borrowings

109

Long-term debt due currently

5,837

Total debt

3/31/10

Description |

37

EFH Corp. Investor Relations Contacts

Rima Hyder

Director, Investor Relations

214-812-5090

rima.hyder@energyfutureholdings.com

Bill Huber

Investor Relations Manager

214-812-2480

william.huber@energyfutureholdings.com |