Attached files

| file | filename |

|---|---|

| EX-10.6 - SINO SHIPPING HOLDINGS INC. | c61434_ex10-6.htm |

| EX-10.4 - SINO SHIPPING HOLDINGS INC. | c61434_ex10-4.htm |

| EX-10.5 - SINO SHIPPING HOLDINGS INC. | c61434_ex10-5.htm |

| EX-21 - SINO SHIPPING HOLDINGS INC. | c61434_ex-21.htm |

| EX-23 - SINO SHIPPING HOLDINGS INC. | c61434_ex-23.htm |

| EX-32.2 - SINO SHIPPING HOLDINGS INC. | c61434_ex32-2.htm |

| EX-31.2 - SINO SHIPPING HOLDINGS INC. | c61434_ex31-2.htm |

| EX-31.1 - SINO SHIPPING HOLDINGS INC. | c61434_ex31-1.htm |

| EX-32.1 - SINO SHIPPING HOLDINGS INC. | c61434_ex32-1.htm |

|

|

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

WASHINGTON, D.C. 20549 |

|

|

|

FORM 10-K |

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

For the fiscal year ended December 31, 2009 |

|

OR |

|

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

For the transition period from to . |

Commission File Number 0-9064

|

|

|

|

|

|

SINO SHIPPING HOLDINGS INC. |

|

|

|

|

|

|

(Exact name of Registrant as specified in its Charter) |

||

|

|

|

|

|

|

|

|

|

|

Delaware |

|

|

|

84-0789885 |

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

||||

|

Incorporation or Organization) |

|

Identification No.) |

||||

|

|

|

|

|

|

|

|

|

2L, Gaoyang Building, |

|

|

86-21-5161-5722 |

|

||

|

No. 815 Dong Da Ming Road, |

|

|

|

|

||

|

|

Shanghai, China 200082 |

|

|

(Registrant’s Telephone Number) |

||

|

|

|

|

|

|

||

|

(Address of Principal Executive Offices) |

|

|

||||

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

||

|

None. |

||

|

Securities registered pursuant to Section 12(g) of the Act: |

||

|

|

Common Stock, par value $.0001 per share |

|

|

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes þ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer o |

Accelerated filer o |

|

|

Non-accelerated filer o (Do not check if smaller reporting company) |

Smaller reporting company þ |

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant computed based on the average bid and asked price of the common stock on June 30, 2009 (the last business day of the registrant’s most recently completed second fiscal quarter) was $4,765,080. Shares held by each officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock outstanding as of April 30, 2010 was 24,827,932.

Documents Incorporated by Reference.

None.

2

SINO SHIPPING HOLDINGS INC.

INDEX TO FORM 10-K

3

FORWARD-LOOKING STATEMENTS

Statements in this Annual Report on Form 10-K may be “forward-looking statements” that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by our management. Words such as “believes,” “anticipates,” “expects,” “intends,” “may,” and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. These forward-looking statements are not guarantees of future performance. There are a number of factors, risks and uncertainties that could cause actual results to differ from the expectations reflected in these forward-looking statements, including changes in production of, or demand for, minor bulk commodities, either globally or in particular regions; greater than anticipated levels of vessel newbuilding orders or less than anticipated rates of scrapping of older vessels; changes in trading patterns for particular commodities significantly impacting overall tonnage requirements; changes in the rates of growth of the world and various regional economies; risks incident to vessel operation, including discharge of pollutants; unanticipated changes in laws and regulations; increases in costs of operation; the availability to us of suitable vessels for acquisition or chartering-in on terms we deem favorable; our ability to attract and retain customers; and the risks described under “Risk Factors” or elsewhere in this Annual Report on Form 10-K or in other documents which we file with the Securities and Exchange Commission (“SEC”). In addition, this Annual Report on Form 10-K includes statistical data regarding the shipping industry. We generated some of this data internally, and some was obtained from independent industry publications and reports that we believe to be reliable sources. We have not independently verified the data nor sought the consent of any organizations to refer to their reports in this Annual Report on Form 10-K. We assume no obligation to update or revise any forward-looking statements. Forward-looking statements in this Annual Report on Form 10-K are qualified in their entirety by the cautionary statement contained in this paragraph and in other reports hereafter filed by us with the SEC.

Background.

We were incorporated on February 5, 1979 under the laws of the State of Colorado as Applied Medical Devices, Inc. to engage in the development and sale of medical devices and medical technology. In July 1986, Applied Medical discontinued its business operations and commenced disposing of its business assets. On February 11, 2008, Applied Medical merged with Dalkeith Investments, Inc., a Delaware corporation which was specifically formed for the purpose of accomplishing a reincorporation merger with Applied Medical. On February 11, 2008, the name of our company was changed from “Applied Medical Devices, Inc.” to “Dalkeith Investments, Inc.”

On March 31, 2008, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with Fountainhead Capital Partners Limited (“FHCP”), an entity registered in Jersey (C.I.), Yongchen International Shipping Limited, a company incorporated in Hong Kong (“Yongchen”), Hengzhou International Shipping Limited, a company incorporated in Hong Kong (“Hengzhou”), Yongzheng International Marine Holdings Co., Ltd., a British Virgin Islands company (“Yongzheng”), and each of the other shareholders of Hengzhou (the “Other Shareholders”). Prior to the consummation of the transactions under the Share Exchange Agreement, FHCP owned approximately 56% of our

4

common stock, Yongchen was wholly-owned by Yongzheng, and Hengzhou was approximately 70%-owned by Yongzheng.

Pursuant to the Share Exchange Agreement, Yongzheng transferred all of the issued and outstanding shares of Yongchen capital stock to us, and Yongzheng and the Other Shareholders transferred all of the issued and outstanding shares of Hengzhou capital stock to us, in exchange for 24,525,994 shares of our common stock (the “Share Exchange”). As a result of the Share Exchange, Yongchen and Hengzhou became our wholly-owned subsidiaries, Yongzheng and the Other Shareholders acquired approximately 95% of our common stock, and the businesses of Yongchen and Hengzhou were adopted as our business.

Following the Share Exchange, we filed a Certificate of Ownership and Merger (the “Certificate”) with the Delaware Secretary of State pursuant to which Sino Shipping Holdings Inc., a Delaware corporation and our wholly-owned subsidiary, was merged into our company. As a result of the filing of the Certificate, our name was changed from “Dalkeith Investments, Inc.” to “Sino Shipping Holdings Inc.” effective March 31, 2008.

Overview.

Through our wholly-owned subsidiaries, we provide maritime transportation services through the commercial operation of our vessels. We specialize in transporting minor bulk commodities, including log and forest products, iron and steel products, fertilizer, agricultural products, cement and palm oil, and basic chemical and petrochemical products in China and Southeast Asia. Presently, our revenues are derived substantially from the chartering of our vessels.

Our fleet.

Our fleet currently consists of two shallow-draft bulk carriers. In connection with the Share Exchange, we entered into Ship Contribution Agreements to acquire two chemical tankers, Rong Sheng and Rong Da, in exchange for shares of common stock with a Fair Market Value (as defined in each agreement) equal to the vessel purchase price. Under both agreements, the vessel purchase price equals the vessel’s net realizable value as of the date the vessel is accepted for delivery, as determined by an independent appraiser chosen by our non-employee directors (or as otherwise agreed by FHCP and us), or its total build cost, whichever is lower. Construction of Rong Sheng and Rong Da has ceased, and we cannot assure you that construction will resume.

In 2009, we sold our chemical tanker, Heng Zhou, to an unrelated third party, and we terminated our in-charter agreement for the bulk carrier Heng Shun. In 2010, we terminated our in-charter agreement for the general cargo vessel Agios Spyridon. The following table sets forth information regarding our fleet.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ship |

|

Flag |

|

Year |

|

Type |

|

Owned by |

|

In- |

|

Deadweight |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nan |

|

Sierra |

|

1984 |

|

General |

|

Nanjing |

|

— |

|

7,500 |

|

Qiao |

|

Panama |

|

1991 |

|

General |

|

Yongchen |

|

— |

|

2,850 |

|

Rong |

|

Marshall |

|

Yet to be |

|

Chemical |

|

Hengzhou2 |

|

— |

|

12,800 |

|

Rong Da |

|

Hong |

|

Yet to be |

|

Chemical |

|

Hengzhou2 |

|

— |

|

12,800 |

5

1 Formerly known as Long Xin. In 2008, Long Xin was transferred by Yongchen to our newly-formed Hong Kong subsidiary, Nanjing Shipping Limited, and the vessel was re-named “Nan Jing”. Nan Jing was suspended from operation in the first quarter of 2009 due to reduced demand. Nan Jing resumed operations in the second quarter.

2 Hengzhou has entered into Ship Contribution Agreements pursuant to which it is acquiring Rong Sheng and Rong Da in exchange for shares of common stock. Construction of Rong Sheng and Rong Da has ceased, and we cannot assure you that construction will resume.

Since many countries in the Asia Pacific region, including China, have shallow ports, the use of larger vessels in these countries is frequently limited. Many of these countries also lack adequate infrastructure for loading and discharging cargo. In addition, despite the availability of deep water ports in countries such as Japan, Taiwan and Korea, the high cost of inland transport and mountainous terrain often favor the use of shallow-draft ships which are able to make direct calls to smaller draft-restricted ports. Our shallow-draft vessels are designed with stanchions for the stowage of logs on deck, have cranes fitted on deck for the loading and discharging of cargo in ports which do not have suitable shore facilities, and can access draft-restricted ports which may be closed to other vessels. These features enhance the cargo carrying abilities of our vessels and allow them to call at most relevant ports throughout the Asia Pacific region.

Fleet Management.

Ship owning activities entail three separate functions: (i) the overall strategic management function, which is that of an investment manager and includes the selection, purchase, financing and sale of vessels and the overall supervision of both chartering and vessel technical management; (ii) the technical management function, which encompasses the day to day operation, physical maintenance and crewing of the vessels; and (iii) the commercial management function, which involves obtaining employment for the vessels and managing relations with the charterer.

Our management team exercises direct control over our overall strategic management and commercial management functions, but may, on a case-by-case basis, engage the services of independent brokers in order to obtain employment for our vessels and to manage its relations with our charterers.

The technical management function for our-owned vessels is subcontracted out to a ship manager. Prior to 2008, Shanghai Yongzheng Marine Co., Ltd, a subsidiary of Yongzheng, provided such services. Since January 1, 2008, we have subcontracted such services to an unrelated third party, Rongda International Shipping Management Co., Ltd. The technical management agreement with Rongda is a “cost-plus” contract under which we reimburse all costs incurred by Rongda for the operation of our vessels and Rongda is paid a fixed management fee. We exercise regular controls over Rongda to ensure that the vessels are properly maintained. We may, in the future, use other ship managers if the price and service are more favorable.

Our Business.

Our transportation services are generally provided under two basic types of contractual relationships: time charters and voyage charters.

A time charter involves the hiring of a vessel from its owner for a period of time pursuant to a contract under which the vessel owner places its ship (including its crew and equipment) at the service of the charterer. Under a typical time charter, the charterer periodically pays us a fixed daily charter hire rate and bears all voyage expenses, including the cost of fuel as well as port and canal charges. Subject to

6

certain restrictions imposed by us in the charter contract, the charterer determines the type and quantity of cargo to be carried and the ports of loading and discharging. The technical operation and navigation of the vessel at all times remain our responsibility, including vessel operating expenses, such as the cost of crewing, insuring, repairing and maintaining the vessel, costs of spare parts and supplies, tonnage taxes and other miscellaneous expenses.

Under a voyage charter, the owner of a vessel provides the vessel for the transport of goods between specific ports in return for the payment of an agreed-upon freight per ton of cargo or, alternatively, a specified total amount. The shipowner is responsible for paying both operating costs and voyage costs, and the charterer is typically responsible for any delay at the loading or discharging ports. A single voyage charter is often referred to as a “spot market” charter, which generally lasts from two to ten weeks. Operating vessels in the spot market may afford greater speculative opportunity to capitalize on fluctuations in the spot market — when vessel demand is high we earn higher rates, but when demand is low our rates are lower and potentially insufficient to cover costs. Spot market rates are volatile and are affected by world economics, international events, weather conditions, strikes, governmental policies, supply and demand, and other factors beyond our control. If the markets are especially weak for protracted periods, there is a risk that vessels in the spot market may spend time idle waiting for business, or may have to be “laid up”.

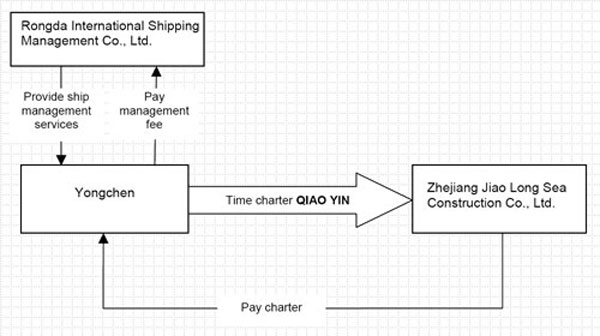

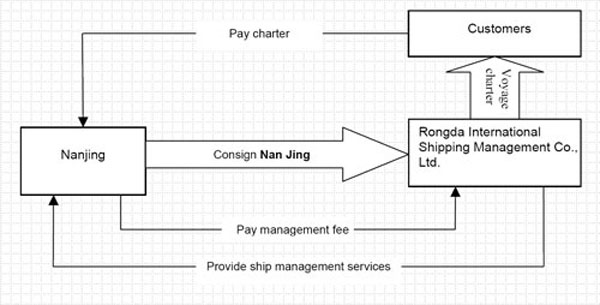

The following table sets forth the type of charters for each of our vessels, and set forth below the table are operational flow diagrams for each of our vessels.

|

|

|

|

|

|

|

|

|

|

|

Ship |

|

Type of |

|

Charterer |

|

Expiration of |

|

Daily Time |

|

|

|

|

|

|

|

|

|

|

|

Qiao Yin |

|

Time |

|

Zhejiang

Jiao Long Sea |

|

July, 2010 |

|

$ 2,200 |

|

Nan Jing |

|

Voyage |

|

Various customers* |

|

n/a |

|

n/a |

* Nan Jing has been consigned to our technical manager, Rongda International Shipping Management Co., Ltd., which in turn is seeking charterers for Nan Jing.

Qiao Yin

7

Nan Jing

Industry and Market.

The shipping industry is subject to cyclical fluctuations and volatility in charter rates, profitability and vessel values based on changes in shipping capacity supply and demand. The demand for ships is influenced by many factors, including global and regional economic conditions, developments in international trade, changes in seaborne and other transportation patterns, weather patterns, crop yields, armed conflicts, port congestion, canal closures, political developments, embargoes and strikes. It also is influenced by the demand for consumer goods and perishable foodstuffs, dry bulk commodities, crude oil and oil products which, in turn, is affected by many factors, including general economic conditions, commodity prices, environmental concerns, weather, and competition from alternative fuels. The supply of shipping capacity is a function of the delivery of new vessels and the number of older vessels scrapped, converted to other uses, reactivated or lost. Such supply may be affected by regulation of maritime transportation practices by governmental and international authorities. These factors which affect vessel capacity supply and demand are beyond our control. In addition, the nature, timing and degree of changes in the shipping markets in which we operate, as well as future charter rates and values of our vessels, are not readily predictable.

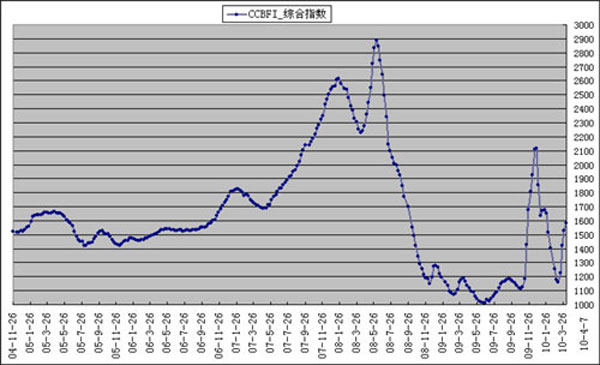

As a result of a cyclical downturn, growing concerns about the marine environment, and new security threats, the global shipping industry faces significant challenges. 2009 was a difficult year for the shipping industry. The financial crisis restricted world trade, resulting in significant drops in freight rates for all types of vessels. We believe many shipping companies have postponed existing orders for new vessels, idled existing vessels, and increased their scrapping programs, all in an effort to reduce costs out and match capacity better to the prevailing demand.

Bulk cargo market. Maritime transportation is fundamental to international trade, being the only practicable and cost-effective means of transporting large volumes of many essential commodities and finished goods. According to the International Maritime Organization (IMO), more than 90% of global trade is achieved through international maritime transport, one of the principal modes of which is bulk cargo transportation. Dry bulk cargoes include major bulk commodities and minor bulk commodities. Major bulk commodities include, for example, iron ore, coal and grain. Minor bulk commodities include,

8

for example, forest products, iron and steel products, fertilizers, agricultural products, ores, minerals and coke, bauxite and alumina, cement, other construction materials and salt.

China Costal Bulk Freight Index:

(Source: Shanghai Shipping Exchange)

Importance of China. China’s increasing role in international trade and its now significant role in the dry bulk commodity transportation market have been fueled by China’s strong economic growth. According to the National Bureau of Statistic of China, China’s nominal GDP has grown from 7.83 trillion Yuan (USD1.15 trillion) in 1998 to 33.54 trillion Yuan (USD 4.92 trillion) in 2009. China’s economic expansion has led to significant growth of import and export volumes. According to the Iron and Steel Statistics Bureau, China was the world’s largest steel exporter in 2006, 2007 and 2008, and ranked fifth in 2009. In addition, in each year from 2004 through 2009, China’s ports have had the highest total annual throughput worldwide.

China’s imports are mostly concentrated in bulk commodities and energy sources. China has been a coal import-only country since 2005, and each year China imports over 200 million cubic meters of timber. We believe China’s demand for bulk commodities to support its growing economy is likely to continue as the population shifts from rural to urban areas necessitating construction, as per capita penetration rates of consumer durables, such as automotives and appliances, increase towards ratios exhibited in Europe and North America, and as preparations for the World Expo 2010 in Shanghai accelerate.

Continuous growth in trade between China and the Member Countries of the Association of Southeast Asian Nations (ASEAN). In November 2002, China and ASEAN leaders signed the China and ASEAN Framework Agreement on Comprehensive Economic Cooperation, and announced that the China and ASEAN Free Trade Area (FTA) would be completed by 2010. Upon completion, the FTA is expected to become the world’s third largest free trade zone (in terms of trade volume) behind the European Union

9

and the North American Free Trade Area. 90% of the commodities and goods within the FTA will be tariff-free.

Import and export trade volume between China and ASEAN countries has grown at a rate of over 30% from 2003 to 2007, and reached US$213.01 billion in 2009. According to the Ministry of Commerce of China statistics, China-ASEAN trade volume increased 80% in January, 2010 over the same period the previous year. China has passed the United States to become the 3rd largest trading partner of ASEAN, just behind Japan and EU. ASEAN countries, as a group, have become the 4th largest trading partner of China. We expect demand for general cargo maritime transportation to continue to increase as trade between China and ASEAN countries continues to grow.

Increasing market demand from palm oil industry in Southeast Asia. Global edible oil material markets are mainly comprised of soybean, palm, sunflower seed and rapeseed oils, among which palm oil has experienced a significant increase in market share during the past ten years. Since 1998, the total global output of palm oil has increased rapidly and, according to Oil World, is estimated to increase to 46 million tons in 2010 (up from 44.3 million tons). Worldwide, there are approximately 20 countries that produce palm oil, with Malaysia and Indonesia accounting for approximately 88% of total annual global output.

Transportation of edible oil requires a vessel with a high degree of cabin cleanliness, such as those offered by IMO type II tankers. An IMO tanker is one that is designed and constructed in accordance with the International Maritime Organization’s (“IMO”) International Code for the Construction and Equipment of Ships Carrying Dangerous Chemicals in Bulks. An IMO type II tanker is a chemical tanker that offers a significant degree of containment to prevent an escape of the vessel’s cargo, whereas IMO type I tankers and IMO type III tankers offer maximum and moderate degrees of containment, respectively. Since 2006, available IMO type II shipping tonnage in the Southeast Asian region has not kept pace with the rapid increase in palm oil trade in that region. The insufficiency, coupled with the gradual elimination of IMO type III single-hull vessels from the market, has resulted in a shortage of edible oil shipping tonnage capacity and, we believe, has created a tremendous market opportunity for maritime shippers with IMO type II tankers in their fleet. Rong Da and Rong Sheng, if constructed, will be IMO type II tankers.

Increasing demand from petrochemical industry. According to the Oil & Gas Journal (January, 2006), since 2003, production of major petrochemical products has been shifting from the United States and western Europe to the Asia Pacific region, Middle East, Latin America and eastern Europe. Indeed, excess production capacity in Asia, especially in China, has caused a supply/demand imbalance in the Asian petrochemical market which we expect to widen in the years ahead. We believe the imbalance has accelerated China’s export of such excess supply to the Far East, generating huge market potential for those in the maritime shipping industry servicing the shipping routes from China to the Far East. Moreover, because petrochemical products typically ship in units weighing approximately 8,000 DWT, we believe chemical tankers exceeding 10,000 DWT, such Rong Da and Rong Sheng, are most suitable for the maritime transportation of the petrochemical products.

Prosperous shipping market between mainland China and Taiwan. With the implementation of Cross-Strait Sea Transport Agreement signed by the Association for Relations Across the Taiwan Straits and the Taiwan-based Straits Exchange Foundation on November 4, 2008, ships can sail directly to Taichung and Keelung in Taiwan from six mainland ports including Shanghai, Fuzhou and Xiamen. Prior to such implementation, vessels were routed via Hong Kong or Japan. Eventually 63 ports on the mainland and 11 in Taiwan will be opened for direct shipments. Cross-Taiwan strait economic and trade activity has increased since the agreement was signed, generating enormous demand for direct sea carriage of passengers and goods.

10

Competitive Strengths.

Experienced management team. We are led by a team of senior managers and industry professionals with extensive experience in maritime shipping in the Asia Pacific market, including experience in market analysis, chartering, vessel operations, technical management and crewing, safety and quality management, vessel sale and purchase, shipbuilding and repair, vessel finance and insurance.

Strong customer relationships and a reputation for high quality service. We believe that we have developed a reputation as a reliable provider of ships and comprehensive services. Our professionals often work directly with shippers of commodity products to develop tailored solutions for their transportation needs. Our goal is to enable our customers to make their sales decisions with a certainty that we can fulfill their maritime transportation needs rapidly and reliably. We believe that our on-going commitment to providing this level of service and availability is an important factor in developing and maintaining strong relationships with our customers, and that these relationships place us in a favorable position to obtain high levels of repeat business as well as early access to information concerning our customers’ future vessel needs.

Strong relationships with service providers and suppliers. We believe we have strong relationships with most of our major suppliers, including our technical management company, insurance providers and shipbuilders. We work with our technical management company to obtain crew who are experienced in the operation and maintenance of vessels in international trades. Many of the crew used by us have worked on our vessels for a number of years. This is particularly important to our company and our customers since we each depend on the efficient operation of our vessels and the effective management of the broad spectrum of requirements in the numerous load and discharge ports, such as hold cleaning, inspections and crane surveys.

Our Strategy.

We intend to deliver sustainable growth and long-term stockholder value by leveraging our competitive strengths through the following strategies:

Focus on routes between China and ASEAN countries by setting up offices in major port cities and providing value added services. We intend to set up offices in major port cities in Southeast Asia to strengthen our connection with local consignors, shipping forwarders, importers and exporters, and to develop new routes between China and ASEAN countries. We also plan to provide value-added services, such as floating crane carrier service in some Southeast Asia ports, which can lower the cost of loading and discharging and enhance our competitive advantage in the region.

Expand into China coastal shipping market. We intend to expand into China’s coastal shipping market to capitalize on the domestic trade boom expected from China’s stimulus plan.

Enhance our comprehensive customer service offering. We intend to further develop the breadth and flexibility of our services to meet our customers’ transport needs. Working closely with our customers, we will seek to become an increasingly important component in their overall freight and logistics activities. Our objective is to have suitable tonnage readily available to service their maritime cargo business whenever they require such tonnage. To achieve this, we believe we need to maintain a significant fleet of modern vessels that provide the service and operational flexibility that our customers require. We also intend to offer our customers increasing ability to manage their overall freight needs and their exposure to changes in freight rates by remaining flexible over the size of the cargo we are willing to take and the periods for which we are willing to charter ships in and out.

11

Develop and broaden our customer base. To date, we have been successful in attracting high quality customers. We are handling an increasing amount of their cargo business as demand for bulk commodities expands, and we intend to achieve further penetration of our customer base as their cargo transportation needs to grow. Additionally, we believe that our on-going commitment to providing high quality services should allow us to expand our customer base. We believe this will give us greater access to premium cargo trades, back-haul cargoes, and repeat business.

Expand our fleet to meet growing customer demand. We are strategically committed to the expansion of our fleet to meet the growing needs of our existing and potential new customers. Through active tonnage procurement programs, including new vessel purchases, secondhand acquisitions and disposals, and chartering in and out vessels, we intend to maintain an appropriate balance between (i) the expected demand for our services, opportunities in the market, and managing seasonal fluctuations in charter rates and the industry’s inherent cyclicality, and (ii) the size and profile of our fleet. We intend to focus on maintaining a fleet of modern, shallow-draft, well-designed vessels since we believe that such vessels are best-suited to our customers’ requirements, provide operational efficiencies, and should place us in a favorable position to obtain competitive charter rates for a high percentage of our vessels and to benefit from increases in vessel resale values.

Increase primary trades and back-haul cargoes. We intend to expand our activities in, and market share of, front-haul trades that pay premium rates. We also expect to secure a growing volume of back-haul cargoes which should enable us to improve our capacity utilization.

Customers.

Our customers currently include large Asian companies such as Great Morning Shipping Co., Ltd, Link Chance International Ltd, Manuchar Hong Kong Ltd, Pesco Oil Storage Corp., Popular Mart Co., Ltd, and Zhejiang Jiao Long Maritime Engineering Co., Ltd. Our assessment of a charterer’s financial condition and reliability is an important factor in negotiating employment for our vessels. We expect to charter our vessels to major trading houses (including commodities traders), publicly traded companies, reputable vessel owners and operators, major producers and government-owned entities rather than to more speculative or undercapitalized entities. We evaluate the counterparty risk of potential charterers based on our management’s experience in the shipping. In 2009, the combined revenue of top five customers accounted for about 98% of our total revenue.

Employees.

As of December 31, 2009, we had nine staff employees and four senior management officers. None of our employees is represented by a union. We believe our relations with our employees are good.

We obtain crew for each of our vessels from our shipping management company. Crew members are not employees of our company. The number of crew currently working on each of our vessels are as follows:

|

|

|

|

|

Vessel Name |

|

Number of Crew |

|

|

|

|

|

Qiao Yin |

|

12 |

|

Nan Jing |

|

22 |

Intellectual Property.

We do not have any patents, licenses or trademarks on which our business is substantially dependent.

12

Competition.

The international shipping industry is highly competitive and fragmented with many market participants. Competition varies primarily according to the kind of commodity being shipped and the nature of the contractual relationship.

We primarily compete with privately-owned fleets of dry bulk vessels. According to Drewry Shipping Consultants, in the first half of 2009 there were approximately 6,850 dry bulk carriers aggregating approximately 426 million DWT. Ownership of these vessels was divided among approximately 1,400 mainly private independent dry bulk vessel owners, with no one shipping group owning or controlling more than 5% of the world dry bulk fleet.

We compete for voyage charters on the basis of price as well as vessel location, size, age and condition and our reputation as an owner and operator. Similarly, the time charter market is price sensitive and depends on our ability to demonstrate the high quality of our vessels and operations to chartering customers. However, because of the longer term commitment, we believe customers entering time charters typically are more concerned than spot charterers about the environmental and operational risks associated with older vessels. Consequently, owners of large modern fleets have gained a competitive advantage over owners of older fleets, particularly in the time charter market.

Environmental and Other Regulations.

Industry Regulations.

Our business is materially affected by government regulation in the form of international conventions, national, state and local laws and regulations, and laws and regulations of the flag nations of our vessels, including laws relating to the discharge of materials into the environment, and laws that require us to maintain operating standards for all of our vessels that emphasize operational safety, quality maintenance, and continuous training of our officers and crews. Because such conventions, laws and regulations are often revised, we are unable to predict the ultimate costs of complying with such conventions, laws and regulations. Under certain regulations, a vessel owner may be liable for property and environmental damages, and all of its assets could be subject to claim for such damages. Moreover, in certain jurisdictions, under the “sister ship” doctrine, all of the affiliates in a fleet of ships may be liable for damages caused by, or debts incurred with respect to, a ship owned by one affiliate, and the ships and other assets of all the affiliates may be subject to attachments.

In addition, a variety of government and private entities subject our vessels to both scheduled and unscheduled inspections. These entities include the local port authorities, classification societies, flag state administrations (country of registry) and charterers, particularly terminal operators. Certain of these entities require us to obtain permits, licenses and certificates for the operation of our vessels. Failure to maintain necessary permits or approvals could require us to incur substantial costs or to temporarily suspend the operation of one or more of our vessels.

Some countries have laws or practices which restrict the carriage of cargoes depending upon the nationality of a vessel or its crew or the origin or destination of the vessel, as well as other considerations relating to particular national interests. We cannot predict the effect that such laws or practices may have on our ability to obtain cargoes.

International Maritime Organization (IMO) regulations. The International Maritime Organization, or IMO, has negotiated international conventions that impose liability for oil pollution in international waters and in a signatory’s territorial waters. The IMO adopted Annex VI to the International Convention for the Prevention of Pollution from Ships to address air pollution from ships.

13

Annex VI set limits on sulfur oxide and nitrogen oxide emissions from ship exhausts, and prohibits deliberate emissions of ozone depleting substances such as chlorofluorocarbons. Annex VI also includes a global cap on the sulfur content of fuel oil, and allows for special areas to be established with more stringent controls on sulfur emissions. We believe our vessels are in compliance with Annex VI.

The operation of our vessels also is affected by the requirements set forth in the IMO’s Management Code for the Safe Operation of Ships and Pollution Prevention (the “ISM Code”). The ISM Code requires ship owners to develop and maintain an extensive “Safety Management System” that includes the adoption of a safety and environmental protection policy setting forth instructions and procedures for safe operation and describing procedures for dealing with emergencies. The failure of a ship owner to comply with the ISM Code may subject such owner to increased liability, may decrease available insurance coverage for the affected vessels, and may result in a denial of access to, or detention in, certain ports. All of the vessels in our operating fleet are ISM Code-certified.

Other rules, international conventions and regulations adopted by the IMO include:

|

|

|

|

|

|

• |

International Convention for the Safety of Life at Sea (as amended by the International Ship and Port Facilities Security Code), which prescribes a series of regulations meant to detect security threats and protect the safety of a vessel and its crew; and |

|

|

|

|

|

|

• |

International Convention on Standards of Training, Certification and Watchkeeping for Seafarers, which prescribes a series of regulations pursuant to which seafarers of all ranks must be trained and certificated in order to be able to carry out their respective duties on board vessels. |

We have developed policies and procedures intended to ensure our compliance with these laws, regulations and rules, and we believe that all of our vessels are in compliance.

Inspection by Classification Societies. Every seagoing merchant vessel must be “classed” by a classification society. The classification society certifies that the vessel is “in class,” signifying that the vessel has been built and is being maintained in accordance with the rules of the classification society, and complies with applicable rules and regulations of the vessel’s country of registry and the international conventions of which that country is a member. In addition, where inspections are required by international conventions and corresponding laws and ordinances of a flag state, the classification society will conduct such inspections on application or by official order, acting on behalf of the authorities concerned. The classification society, on request, also may undertake such other inspections that are required by regulations and requirements of the flag state. These inspections are subject to agreements made between the vessel’s classification society and the flag state concerned.

For maintenance of the class, regular inspections are required to be performed as follows:

|

|

|

|

|

|

• |

Annual Surveys: For seagoing ships, annual inspections are conducted for the hull and the machinery, including the electrical plant, safety equipment, communication equipment and any special equipment classed, at intervals of approximately 12 months from the date of commencement of the class period indicated in the certificate. |

|

|

|

|

|

|

• |

Intermediate Surveys: Intermediate inspections (which are more extensive than annual inspections) of the vessels’ structure and equipment are conducted in conjunction with the second or third annual inspection. |

|

|

|

|

|

|

• |

Class Renewal Surveys: Class renewal surveys, also known as special surveys, are carried out for the ship’s hull and the machinery, including the electrical plant, safety equipment, |

14

|

|

|

|

|

|

|

communications equipment and for any special equipment classed, at five-year intervals from the vessel’s certification. At the special inspection, a thorough examination of the vessel is conducted, including ultrasonic gauging to determine the thickness of the steel structures. If the thickness fails to meet class requirements, the classification society will prescribe steel renewals. Substantial amounts of money may have to be spent for steel renewals to pass a special inspection if the vessel has suffered excessive wear and tear. |

|

|

|

|

|

|

• |

Continuous Surveys: On application by a ship owner, the inspections required for class renewal may be split according to an agreed schedule to be carried out over the entire period of the class certificate. It is common for this process to be applied to the vessel’s machinery, known as a continuous machinery inspection. All areas subject to inspection as defined by the classification society are required to be inspected at least once per five-year class period, unless shorter intervals between inspections are prescribed. All of the vessels within our fleet undergo continuous machinery inspections. |

|

|

|

|

|

|

• |

Docking Surveys: Vessels also are required to be dry-docked twice within the five-year inspection cycle, with a maximum of 36 months between inspections, for inspection of the underwater parts and for repairs related to inspections. An in-water inspection may be permitted in lieu of a dry-docking for the intermediate inspection, although the vessel must carry out a dry-docking in conjunction with a class renewal inspection. |

If any defects are found by the classification inspector during any inspection of a ship, the inspector may require an immediate repair to be carried out. If, however, the inspector considers it safe for the vessel to continue in service without an immediate repair, the inspector will issue a condition of class which will require the defect to be rectified by the ship owner within prescribed time limits. Any conditions of class must be repaired at the time of the class renewal inspection.

All of our vessels are certified as being “in class” by Bureau Veritas International Register, International Register of Shipping, and Isthmus Bureau of Shipping, each of which are members of the International Association of Classification Societies.

Insurance.

Our business is subject to normal hazards associated with owning and operating vessels in international trade. The operation of ocean going vessels carries an inherent risk of catastrophic marine disaster, including oil spills and other environmental accidents, property loss or damage, cargo loss or damage, and business interruption due to mechanical failures, adverse weather conditions, human error, political action, hostilities, piracy, labor strikes, and other circumstances or events. Not all risks can be insured against, and our policies have certain deductibles for which we are responsible. We also cannot assure that any specific claim will be paid. We believe, however, that our current insurance coverage is adequate to protect us against normal accident-related risks involved in the conduct of our business. Our principal insurance policies include:

|

|

|

|

|

Hull and machinery insurance. This insurance includes coverage for damage to a vessel’s hull and machinery in a collision or from basic perils of the sea. Our coverage includes the risk of actual or constructive total loss for our owned fleet. Each vessel is insured for at least its fair market value, with a deductible that, depending on the vessel, is either a fixed amount or the greater of a fixed amount or a percentage of the actual loss incurred. If we charter-in any vessels, the owners of those vessels will likely be responsible for maintaining insurance thereon. We do not maintain time charter liability insurance. |

15

|

|

|

|

|

Protection and Indemnity (“P&I”) Insurance. P&I insurance includes coverage for oil pollution, damage to docks and other installations, and coverage against third-party liabilities encountered in our commercial operations (include loss or damage of goods). It also includes coverage for the death, injury or illness of our crew, and for the costs of towage, salvage and other fees (include debris removal). Our P&I insurance is provided by mutual marine insurance associations or “P&I Clubs.” P&I Clubs are formed by shipowners to provide protection from large financial losses to one member by contribution towards the loss by all members. We are subject to potential additional premiums for prior years due to funding requirements and coverage shortfalls of the P&I Clubs in the event claims exceed available funds and reserves. We also are subject to future premium increases based on prior year underwriting loss experience. Currently, insurance on our owned fleet includes coverage for pollution claims, death, injury or illness of crew, and cargo damage, all of which is subject to coverage limits and deductibles. |

WHERE YOU CAN FIND MORE INFORMATION

We maintain a website at www.n-ssh.com. The information contained on our website is not included as a part of, or incorporated by reference into, this Annual Report on Form 10–K. We make available free of charge through our website our Annual Reports on Form 10–K, Quarterly Reports on Form 10–Q and Current Reports on Form 8–K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after electronically filing such material with, or furnishing such material to, the Securities and Exchange Commission. Further, we will provide free copies of any of our SEC filings upon request. Copies of our filings with the SEC may be requested through the “investor relations” section of our website, or by calling our offices at 86-21-5161-5722. In addition, because we are subject to the informational requirements of the Securities Exchange Act, we file reports, proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the SEC’s public reference room located at 100 F Street, N.E. Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at (800) SEC-0330. In addition, we are required to file electronic versions of those materials with the SEC through the SEC’s EDGAR system. The SEC also maintains a web site at http://www.sec.gov, which contains reports, proxy statements and other information regarding registrants.

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of these risks occur, our business, financial condition, operating results and cash flows could be materially adversely affected and the trading price of our common stock could decline.

Risk Factors Relating to the Shipping Industry

Costs and revenues in the shipping industry are volatile. The shipping industry historically has experienced volatility in freight rates, the cost of fuel oil, the cost and availability of crew, port charges, currency exchange rates, and vessel charter rates and values due to, among other things, changes in the level and pattern of global economic activity and the highly competitive nature of the world shipping industry. Changes to marine regulatory regimes in the ports at which our vessels call also may cause our costs to fluctuate.

16

Our revenue is influenced by a number of factors that are difficult to predict, including global and regional economic conditions, developments in international trade, changes in seaborne and other transportation patterns, weather patterns, port congestion, canal closures, political developments, armed conflicts, acts of terrorism, embargoes, and strikes. Demand for our transportation services is influenced by the demand for the goods we ship, including iron and steel products, agricultural products, and log and forest products, which in turn is affected by general economic conditions, commodity prices and competition. A decrease in demand for these products could adversely affect our results of operations.

Our revenue also is influenced by fluctuations in shipping capacity. The supply of shipping capacity is a function of the size of the existing global fleet, its operational efficiency, the impact of port congestion, the delivery of new vessels and the number of older vessels scrapped, in lay-up, converted to other uses, deactivated or lost. The factors influencing the supply of vessel capacity are outside our control, and a significant increase in such supply could have a material adverse effect on our business, financial position and results of operations.

Our business depends to a significant degree on the stability and continued growth of the Asian economies. Economic growth in China has caused unprecedented demand for raw materials and other products that are transported by ocean freight. The growth of the Chinese economy has stimulated growth in other Asian economies as well. Any pronounced slowdown or decline in the Chinese economy could be expected to have significant adverse effects on the economies of other Asian countries and on the demand for our services, and could be expected to result in declines in freight rates and on the value of our vessels. We expect that a significant decline in the Asian economies would have a material adverse effect on our results of operations.

High or volatile oil prices could adversely affect the global economy and our results of operations. If oil prices remain high for an extended period of time or experience prolonged volatility, the global economy could weaken significantly. Global recession or depression would significantly reduce the demand for ocean freight while our fuel costs would be increasing. A significant reduction in the demand for ocean freight would have a material adverse impact on our results of operations and financial condition. In addition, our results of operations would be adversely affected if we were unable to pass increased fuel costs on to our customers.

We operate in a highly competitive industry. We employ our vessels in highly competitive markets that are capital-intensive and highly fragmented. Competition arises primarily from other vessel owners, many of whom have substantially greater financial and other resources than us. Competition for the transportation of cargo by sea is intense and depends on numerous factors including price, location, size, age, and condition of the vessel and the acceptability of the vessel and its operators. Due, in part, to the highly fragmented market, competitors with greater resources could enter our market and operate larger fleets through consolidation or acquisitions, and may be able to offer lower rates and higher quality vessels than we are able to offer. If we are unable to compete successfully, it would have a material adverse effect on our business, financial position and results of operations.

We operate in a highly-regulated industry. Our business is materially affected by government regulation in the form of international conventions, national, state and local laws and regulations, and laws and regulations of the flag nations of our vessels, including laws relating to the discharge of materials into the environment, and laws that require us to maintain operating standards for all of our vessels that emphasize operational safety, quality maintenance, continuous training of our officers and crews. Complying with these laws, conventions, and regulations may entail significant expenses, including expenses for ship modifications, special surveys, and new equipment, and expenses in meeting maintenance and inspection requirements, in changing operating procedures, in developing contingency arrangements for potential contamination by vessels, and in obtaining insurance coverage. In addition, pursuant to such laws, governmental and other agencies may mandate that we obtain permits, licenses and

17

certificates in connection with our operations. Some countries in which we operate have laws that restrict the carriage of cargoes depending on the registry of a vessel, the nationality of its crew and prior and future ports of call, as well as other considerations relating to particular national interest. Port authorities in various jurisdictions may demand that repairs be made before allowing a vessel to sail, even though the vessel may be certified as “in class” and in compliance with all relevant maritime conventions. Additional laws and regulations may be adopted which could limit our ability to do business and which could have a material adverse effect on our business, financial position and results of operations. Our failure to comply with applicable laws, ordinances and regulations may subject us to increased liability, may invalidate existing insurance coverage or decrease available insurance coverage for the affected vessels, and may result in a denial of access to, or detention in, certain ports, all of which could materially adversely affect our results of operations and liquidity.

In certain countries where we operate, we are subject to various federal, state or local environmental laws, ordinances and regulations that impose obligations to clean up environmental contamination resulting from a discharge of oil or hazardous substances, such as a discharge of fuel. We also may be held liable to a governmental entity or to third parties in connection with such contamination. Liability under certain of these laws has been interpreted to be strict, joint and several, and subject to very limited statutory defenses. The costs of investigation, remediation or removal of such substances and damages resulting from such releases could be substantial and could adversely affect our results of operations.

Risk associated with the shipping industry could affect our business and reputation, which could adversely affect our results of operations and stock price. The involvement of our vessels in a marine disaster or environmental mishap could harm our reputation as a safe and reliable vessel owner and operator, and could have a material adverse effect on our financial condition and results of operations and adversely affect our stock price.

Marine claimants could arrest our vessels, which could interrupt our cash flow. Under general maritime law in many jurisdictions, crew members, tort claimants, claimants for breach of certain maritime contracts, vessel mortgagors, suppliers of fuel, materials, goods and services to a vessel, and shippers and consignees of cargo may be entitled to a maritime lien against a vessel for unsatisfied debts, claims or damages. In many circumstances, a maritime lien holder may bring an action to enforce its lien by “arresting” a vessel and commencing foreclosure proceedings. In some jurisdictions, under the “sister ship” theory of liability, a claimant may arrest the vessel subject to the claimant’s maritime lien as well as any “associated” vessel owned or controlled by the legal or beneficial owner of that vessel. The arrest of one or more of our vessels could result in a loss of our cash flow or require us to pay substantial amounts to have the arrest lifted, and could adversely affect our customer relationships by interrupting our sailing schedule.

Governments could requisition one or more of our vessels during a period of war or emergency, resulting in a loss of earnings. A government could requisition one or more of our vessels for title or for hire. Requisition for title occurs when a government takes control of a vessel and becomes its owner, while requisition for hire occurs when a government takes control of a vessel and effectively becomes its charterer at dictated charter rates. Generally, requisitions occur during periods of war or emergency, although governments may elect to requisition vessels in other circumstances. Although we would be entitled to compensation in the event of a requisition of one or more of our vessels, the amount and timing of payment would be uncertain. Government requisition of one or more of our vessels could have a material adverse effect on our cash flows and results of operations.

Acts of piracy on ocean-going vessels have recently increased in frequency, which could adversely affect our business. Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea. Recently, the frequency of piracy incidents has

18

increased significantly. If these piracy attacks result in regions in which our vessels are deployed being characterized by insurers as “war risk” zones or Joint War Committee “war and strikes” listed areas, premiums payable for such coverage could increase significantly and such insurance coverage may be more difficult to obtain. In addition, crew costs, including employing onboard security guards, could increase in such circumstances. We may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on us. In addition, detention hijacking as a result of an act of piracy against our vessels, or an increase in cost, or unavailability of insurance for our vessels, could have a material adverse impact on our business, financial condition and results of operations.

Risks Factors Relating to Our Business

We depend upon a limited number of customers for a large part of our revenue. For the year ended December 31, 2009, the combined revenue of top five customers accounted for about 98% of our total revenue. Losing any of these customers may result in the unemployment of our vessels and could have a material adverse effect on our results of operations and cash flows.

As our fleet ages, the risks associated with older vessels could adversely affect our operations. In general, the costs to maintain an oceangoing vessel in good operating condition increase with the age of the vessel. One of our operational vessels is almost 20 years old, and the other is more than 25 years old. We estimate that the economic useful life of our vessels is approximately 30 years, depending on market conditions, the type of cargo being carried and the level of maintenance. Older vessels may develop unexpected mechanical and operational problems despite adherence to regular survey schedules and proper maintenance. Due to improvements in engine technology, older vessels typically are less fuel-efficient than more recently constructed vessels. Cargo insurance rates increase with the age of a vessel. Governmental regulations and safety or other equipment standards related to the age of vessels may require expenditures for alterations of, or the addition of new equipment to, our vessels and may restrict the type of activities in which our vessels may engage. We cannot assure you that we will be able to operate our vessels profitably during the remainder of their projected useful lives, or that we will be able to sell our owned-vessels profitably when we no longer can utilize them in our fleet.

Vessel dry-dockings could adversely affect our cash flow and results of operations. Our vessels must be dry-docked two times every five years to coincide with special survey cycles. In addition, we may need to reposition our vessels and charter-in outside vessels to accommodate our dry-docking schedule and business needs. The loss of earnings while the vessels are being dry-docked, the repositioning of our vessels in response to the dry-dockings, the costs of the dry-dockings, and the possible charter-in expense in response to the dry-dockings could have a material adverse effect on our cash flows and results of operations.

Our vessels may suffer damage and we may need to unexpectedly dry-dock a vessel, which could adversely affect our operations. If a vessel suffers damage, it may need to be repaired at a dry-docking facility. The costs of dry-dock repairs are unpredictable and can be substantial. The loss of earnings while the vessel is being repaired and our other vessels are being repositioned in response to the unexpected dry-docking, as well as the actual costs of the repairs, could have a material adverse effect on our cash flows and results of operations. We may not have insurance that is sufficient to cover all of these costs or losses.

We may not be able to acquire additional vessels at favorable prices. Part of our current business strategy includes growing through the acquisition of additional vessels, both new and secondhand. Acquisitions of new vessels often require the expenditure of substantial sums in the form of down payments and progress payments during the construction phase. If we are unable to complete

19

payments under any of our newbuildings contracts, we may forfeit all or a portion of the down payments and progress payments made with respect to such contracts. There can be no assurance that the contracted newbuildings will be completed on schedule or at all. Delays in the delivery of, or failure to deliver, one or more of such vessels could have an adverse effect on our business, financial position and results of operations.

In the secondhand market, we must devote significant time and resources to identifying and inspecting suitable vessels. Secondhand vessels generally carry no warranties from their sellers or manufacturers. In addition, our inspections of secondhand vessels prior to purchase would not normally provide us with the same knowledge about the vessel’s condition as we would have if the vessel had been built for or operated by us. Secondhand vessels may have conditions or defects that were not known to us when we bought the vessel and that may require us to undertake costly repairs. These repairs may require us to put a vessel into dry-dock, which would reduce our fleet utilization. The costs of dry-dock repairs are unpredictable and can be substantial. The loss of earnings while our vessels were being repaired and repositioned, as well as the actual cost of those repairs, would decrease our income from operations. We may not have insurance that is sufficient to cover all of these costs or losses and may have to pay dry-docking costs not covered by our insurance. Our future operating results could be adversely affected if some of the secondhand vessels do not perform as we expect.

We also intend to expand the size of our fleet by in-chartering vessels. We may not be able to in charter suitable vessels at acceptable rates and charter periods. If our fleet decreases below the number of vessels needed to meet our commitments or the cost of in-chartering vessels increases above pre-determined prices, we may suffer losses.

We cannot assure you that we will identify and acquire a sufficient quantity of vessels to support our growth strategy, or that we will be able to acquire suitable vessels at favorable prices. A significant decrease in the number of vessels in our fleet could adversely affect our ability to market our fleet and could have a material adverse effect on our business, financial position and results of operations.

The market value of vessels can and will fluctuate significantly. Market values of vessels are highly volatile and will continue to fluctuate depending on numerous factors, including economic and market conditions affecting the shipping industry and prevailing charter hire rates, vessel supply and rates of vessel scrapping, competition from other shipping companies and other modes of transportation, the type, size and age of vessels, applicable governmental regulations and the cost of new ship buildings. If the market value of our fleet declines, we may not be able to obtain additional financing on terms that are acceptable to us or at all in connection with future vessel acquisitions or for other purposes. In addition, if the book value of a vessel is impaired due to unfavorable market conditions, or if we sell a vessel at a price below its book value, that decline would result in a loss that would adversely affect our operating results.

Our customers may default on their contractual obligations. We operate in a highly fragmented market, and our customer base is diverse. Although we try to ensure that we do business with high quality customers as frequently as possible, we cannot assure you that all of our business will be transacted with such customers. Often, there is limited financial information available about our customers. As a result, counterparty risk is largely assessed on the basis of their reputation in the market place, and there can be no assurance that any of our customers can fulfill their obligations under the contracts we enter into with them. Potential risks associated with a defaulting counterparty include non-payment of freight and hire, and the cost of shipping cargo to its destination if it was already loaded on our vessel at the time of the default. In the case of a default on a time-chartered vessel, additional costs such as port expenses and stevedoring costs may be incurred. There can be no assurance that our customers will not default on their obligations under our contracts with them. Any such default may have a material adverse effect on our business, financial position and results of operations.

20

Our insurance may be insufficient to cover the inherent operational risks associated with our business, and we may be unable to maintain our existing insurance coverage. The operation of any oceangoing vessel carries with it an inherent risk of sinking, collision, and other marine disasters, environmental mishaps, property losses or damages, and interruption caused by mechanical failure, human error, political action, labor strikes, adverse weather conditions and other circumstances or events. Any such circumstance or event could result in a loss of revenues, liabilities or increased costs. We cannot assure you that any insurance we maintain would be sufficient to cover the cost of damages or the loss of income resulting from a vessel being removed from operation, or that any insurance claims would be paid. Any significant loss or liability for which we are not insured, or for which our insurers fail to pay us, could have a material adverse effect on our financial condition. In addition, the loss of a vessel would adversely affect our cash flows and results of operations. In addition, stricter environmental regulations may result in increased costs for, or the unavailability of, insurance against the risks of environmental damage or pollution. We cannot assure you that we will be able to procure adequate insurance coverage at commercially reasonable rates in the future.

We may experience fluctuations in our operating results. Our operating results are highly dependent on the prevailing charter rates in a given time period. Charter rates are based, in part, on supply and demand, and are extremely competitive. Significant fluctuations in charter rates may result in significant fluctuations in the earnings of our vessels. If rates were to decrease significantly, or if we do not successfully arrange charters for our vessels, our earnings could be adversely impacted.

Our operating results also may be adversely affected by increases in our operating expenses. The potential risks that may add to overall expenses include unexpected labor strikes, severe weather conditions, lengthy quarantines, mechanical failures or human error (including revenue lost in off-hire days), arrest action against our vessels due to failure to pay debts, unexpected repairs and increases in bunker costs.

Acts of god, acts of war, terrorist attacks, epidemics and other events could adversely affect our business. Our business is subject to general economic and social conditions around the world, particularly in the Asia Pacific region. Natural disasters, epidemics, acts of god and other events which are beyond our control may adversely affect local economies, infrastructures and livelihoods. Our business, operating results and financial position may be adversely affected if such disasters, acts or events occur, even if they occur in areas in which we do not directly operate.

Acts of war may cause damage or disruption to our business, employees, facilities, markets and our customers, any of which could materially impact our revenues, costs of operations, overall results and financial condition or share price. The potential for war also may cause uncertainty and cause our business to suffer in ways that we cannot currently predict. Our present geographic focus on Asia may make us vulnerable in the event of increased tension or hostilities in many countries including China, Taiwan or North Korea. The agreements pursuant to which we may time charter in or time charter out a vessel typically contain a war cancellation clause exercisable by either party to the agreement.

Terrorist attacks, such as the attacks on the United States on September 11th, and the United States’ on-going response to these attacks, as well as the threat of future terrorist attacks, continue to cause uncertainty in the world financial markets. The recent conflicts in Iraq and Afghanistan may lead to additional acts of terrorism and armed conflict around the world, which may contribute to further economic instability in the global financial, energy and commodities markets. These uncertainties and instabilities may adversely affect our business, financial position and results of operations.

We are exposed to currency and interest rate fluctuations. The currency for all our financial reporting is US dollars. Because we generate nearly all our revenues in US dollars, but incur some of our

21

costs, expenses and capital expenditures in other currencies, exchange rate fluctuations could adversely affect our results of operations. A change in exchange rates could lead to fluctuations in reported net income due to changes in the value of these currencies relative to the US dollar. In addition, if some or all of the debt that may be incurred by us may bear interest at floating rates, increases in interest rates could increase our interest expenses and adversely affect our results of operations.

Our business depends substantially on the continuing efforts of our executive officers and our ability to maintain a skilled labor force, and our business may be severely disrupted if we lose their services. Our future success depends substantially on the continued services of our executive officers, especially Mr. Xinyu Zhang, our Chief Executive Officer. We do not have an employment agreement with Mr. Zhang, and we do not maintain key man life insurance on any of our executive officers. In addition, Mr. Zhang does not devote his full business time and attention to our business. If one or more of our executive officers are unable or unwilling to continue in their present positions, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. We cannot assure you, however, that we will be able to readily replace any departing executive officers, if at all.

Our future success also depends, to a significant extent, on our ability to attract, train and retain qualified personnel. Recruiting and retaining capable personnel, particularly those with expertise in the maritime shipping industry, are vital to our success. There is substantial competition for qualified personnel, and there can be no assurance that we will be able to attract or retain our personnel. If we are unable to attract and retain qualified employees, our business may be materially and adversely affected.

We may not be able to grow or to effectively manage our growth. A principal focus of our strategy is to grow by expanding our existing customer relationships, developing new customer relationships, and taking advantage of changing market conditions, which may include changing the composition of our fleet, expanding or changing our geographic focus, entering into new strategic alliances or engaging in the seaborne transportation of other commodities. Our future growth will depend upon a number of factors, some of which we cannot control. These factors include our ability to:

|

|

|

|

|

|

• |

identify suitable secondhand vessels or new vessels for purchase, and to integrate any acquired vessels successfully with our existing operations; |

|

|

|

|

|

|

• |

identify businesses engaged in managing, operating, or owning bulk carriers for acquisition; |

|

|

|

|

|

|

• |

improve our operating and financial systems and controls; |

|

|

|

|

|

|

• |

hire, train and retain qualified personnel to manage and operate our growing business and fleet; and |

|

|

|

|

|

|

• |

identify new markets and trade routes. |

The failure to manage any of these factors effectively could adversely affect our business, financial position and results of operations.

All of our revenue is derived from operations outside the U.S. and may be adversely affected by actions taken by foreign governments or other forces or events over which we have no control. We derive all of our revenue from operations in Asia. Our profitability will be affected by changing economic, political and social conditions in this region. In particular, our operations may be affected by war, terrorism, expropriation of vessels, the imposition of taxes, increased regulation or other circumstances, any of which could reduce our profitability, impair our assets or cause us to curtail our operations.

22

Risks Factors Relating to Our Company

FHCP believes its put option is currently exercisable and has sent us notice of exercise.

In connection with the Share Exchange Agreement, we entered into an Investor Rights Agreement with FHCP pursuant to which, among other things, we granted FHCP the right to put up to 250,000 of its shares of our company’s stock to us at a price of $1.70 (as adjusted for stock splits, stock dividends and the like). FHCP has advised us that it believes the put exercise period commenced April 2, 2010, and sent us notice of exercise of the put with respect to all 250,000 shares for an aggregate price of $425,000. We believe the put exercise period commences April 2, 2011. We have had discussions with FHCP in attempt to resolve the matter, but no such resolution has been reached to date. If we are unable to resolve the matter, FHCP may sue us to enforce their exercise of the put option. If litigation is commenced, it could result in substantial expense to us and a diversion of our efforts, and we cannot assure you that we will prevail. If we are unsuccessful in our defense of the matter it could have a material adverse effect on our company.