Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Integrative Health Technologies, Inc. | inti10kex321123109.htm |

| EX-31.1 - EXHIBIT 31.1 - Integrative Health Technologies, Inc. | inti10kex311123109.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2009

INTEGRATIVE HEALTH TECHNOLOGIES, INC.

|

Delaware

|

11-3504866

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

4940 Broadway Suite 201 San Antonio, TX 78209

(Address of principal executive offices) (Zip Code)

(210) 824.4200

(Registrant's telephone number, including area code)

Issued pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

o Large accelerated filer

o Accelerated filer

x Non-accelerated filer

Indicate by check mark whether the registrant is a shell company (defined in Rule 12b-2 of the Act).

o Yes x No

The number of shares outstanding of Integrative Health Technologies, Inc.’s common stock on December 31, 2009 was 40,642,597.

1

INDEX TO FORM 10K

Item 2. Business Mission and History

Mission

Scientific Advisory Board.

Mobile and Stationary DEXA Testing Technology.

Blood Chemistry Testing.

Metabolic Measurement Calorimeter.

The Database of Medical Biomarkers.

History

Available Information

Trading Price History

Dividends

Note Regarding Forward-Looking Statements

Operating Changes

Management’s Activities

Development of Strategic Alliances and Equity Positions

AlgaeCal International, Inc.

Body Solutions Ultra

HealthTech Products, LLC.

Additions to the Company’s Longitudinal Medical Biomarker Database.

Biomedical Testing Technologies.

Published Studies & Manuscripts

Glyconutritional Longitudinal Trials

Publication of Restructuring Body Composition book.

Publication of the AlgaeCal Bone-Health study.

Other Published Studies & Manuscripts.

The Safety and Efficacy of Hydroxycitric Acid Derived from Garcinia

Cambogia: A Literature Review.

Meta Analysis from Source-data on the Short-term Effects of a Glyconutrient

Supplement on Bone Mineral Density.

The Use of Pedometers in Medical and Alternative Care Treatment Plans

Sarcopenia: When Weight Loss is Counter-productive

Comparative Effectiveness Research (CER): Opportunities and Challenges for

the Nutritional Industry

A Combination of L-Arabinose and Chromium Lowers Circulating Glucose and

Insulin Levels After Acute Oral Sucrose Challenge.

A Comparative Effectiveness Research Study of the Safety, Efficacy and

Tolerability of a Plant-sourced Calcium Supplement with a Calcium-

Carbonate Supplement

The Safety and Efficacy of the Body Solutions Weight Loss Plan

Other activities

Income Derived From Testifying as an Expert witness.

Development of a Current Nutritional Science Reference Library with data on Vitamin D3, C-reactive Protein (CRP), Conjugated Linoleic Acid (CLA), and Strontium Ranelate/Citrate

Research & Development R & D of a corporate/institutional Risk Reduction Program

Results of Operations

General and Administrative Expenses

Other Income (Expenses)

Liquidity and Capital Resources

Critical Accounting Policies

2

A. Basis of Presentation

B. Management’s Use of Estimates.

C. Stock-Based Compensation.

D. Valuation of Long-Lived and Intangible Assets.

E. Earnings/(Loss) Per Share.

F. Income Taxes.

G. Related Party Transactions.

Item 8. Subsequent Events (Incorporated into Items 2 and 3)

Exchange of Assets for Liabilities

Quarterly Evaluation of Controls

CEO/CFO Certifications

Disclosure Controls and Internal Controls

Limitations on the Effectiveness of Controls

Scope of the Evaluation

Conclusions

Gilbert R. Kaats, PhD, Chairman of the Board and Chief Executive Officer

Samuel C. Keith, Chief Information Officer and Director

Mr. Ovidio Pugnale, Director

Item 1. Caveats Regarding Forward Looking Statements

The matters discussed in this section and in certain other sections of this Form 10-K contain forward-looking statements within the meaning of Section 21D of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, that involve risks and uncertainties. All statements other than statements of historical information provided herein may be deemed to be forward-looking statements. Without limiting the foregoing, the words "may", "will", "could", "should", "intends", "thinks", "believes", "anticipates", "estimates", "plans", "expects", or the negative of such terms and similar expressions are intended to identify assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this report.

Because the risks factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by IHTI, you should not place undue reliance on any such forward-looking statements. Other factors may be described from time to time in IHTI's other filings with the Securities and Exchange Commission, news releases and other communications. Further, any forward-looking statement speaks only as of the date on which it is made and IHTI undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for IHTI to predict which will arise. In addition, IHTI cannot assess the impact of each factor on IHTI's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Subsequent written and oral forward-looking statements attributable to IHTI or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements set forth above and contained elsewhere in this Annual Report on Form 10-K.

IHTI has been and is currently subject to the informational requirements of the Securities Exchange Act of 1934. In accordance with those requirements, we file reports and other information with the Securities and Exchange Commission. Such reports and other information can be inspected and copied at the public reference facilities maintained by the SEC. Please call the SEC at 1-800-SEC-0330 for more information on the operation of its public reference rooms. The SEC also maintains a Web site that contains reports, proxy and information statements and other materials that are filed through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. All of the Company’s reports, registration statements, proxy and information statements and other information that is filed electronically with the SEC are available on:

http://www.sec.gov/cgi-bin/browse-edgar?company=Integrative+Health+Technologies&CIK=ihht&filenum=&State=&SIC=&owner=include&action=getcompany

3

Item 2. Business Mission and History

Mission. The Company limits its involvement to healthcare entities that can provide products and services that can contribute to the prevention and reduction of the global health problems as reported by the World Health Organization (WHO):

“Nearly 400 million people will die from heart disease, diabetes and other chronic ailments over the next 10 years, but many of those deaths can be prevented by healthier lifestyles, diets and increased physical activity. Exercise and better diets can help prevent 80 percent of premature cases of heart disease, strokes and diabetes. The financial burden from an increasing death toll from such non-communicable diseases will also be enormous. China could spend $558 billion, Russia, $303 billion and India, $236 billion over the next decade treating heart disease, strokes and diabetes. ‘The lives of far too many people in the world are being blighted and cut short by chronic diseases, diseases that can be prevented with healthier diets and increased physical activity’ said Lee Jong-Wook, WHO Director-General.”

To address this global health problem, IHTI’s mission is to use its scientific and testing resources, research and development experience, and financial resources to aid healthcare and nutritional companies in the discovery, testing and marketing of health-enhancing products and technologies. These services include : (1) consulting and networking, (2) independent clinical trials, (3) independent research and development (R & D) of products and technologies, and (4) in exchange for an equity position in the granting company, “in-house” R & D for those companies without adequate funds for R & D. With regard to (4) above, companies in which IHTI obtained an equity position are advised that taking an equity position precludes IHTI from performing “third-party” independent studies, although it can help other independent research organizations and universities conduct trials with the appropriate disclosure.

To accomplish its mission the Company relies heavily on input from its Scientific Advisory Board, its mobile and on-site testing technologies, and its 20-year longitudinal database of over two million medical biomarkers.

Scientific Advisory Board. In accomplishing its mission, the Company relies upon advice and suggestions from its Scientific Advisory Board described below. Resumés and curriculum vitae are available upon request.

Dennis Pullin, MS, Board Chairman and Administrator, Vice President, St. Lukes Episcopal Hospital, Houston, TX.,

Fellow of The American College of Sports Medicine

Harry A. Preuss, MD, Professor of Medicine, Georgetown University, Past President of The American College of Nutrition

Joel Michalek, PhD, Co-chair, Department of Statistics and Epidemiology, Univ of Texas Health Science CTR at San Antonio

Harry A. Croft, MD, Croft Research Group, San Antonio, TX, Distinguished Fellow, American Psychiatric Association

Raul Bastarrachea, MD, Dept Genetic/Metabolic Research, Southwest Foundation for Biomedical Research, San Antonio, TX

William Squires, Jr. PhD, Professor of Biology, Texas Lutheran Univ, Sequin, TX, Fellow Amer College of Sports Medicine

Larry K. Parker, MD, Obstetrician/Gynecologist, Angelton, TX., Fellow of The American College of Sports Medicine

Kristi L. Hobbs, Spiritual/Nutritional Interventions in Developing Countries, Alamo City Mercy Foundation, San Antonio, TX

Mobile and stationary DEXA testing technology. The Company has three mobile and two stationary Dual Energy X-ray Absorptiometry (DEXA) body composition scanning units—an FDA-approved technology and considered the “gold standard” for measurement of total body and regional bone densities, body fat and lean mass. These units generate income from fees charged on-site and mobile testing and in support of grants and research contracts the Company has been awarded. A more detailed description of the technology is available on the Company’s website under the “Testing Technologies” icon.

Blood Chemistry Testing. The Company provides national blood chemistry testing program that includes a 43-item blood chemistry panel with C-reactive Protein and 25 hydroxy Vitamin D blood level tests. A listing and description of these tests and the testing program is available on the Company’s website under the “Testing Technologies” icon.

Metabolic measurement calorimeter. The MedGen Indirect Calorimeter is a handheld, self-calibrating calorimeter that allows for the accurate measurement of oxygen uptake (VO2) that is converted into calorie consumption to determine resting metabolic rate. A description of the metabolic test is available on the Company’s website under the “Testing Technologies” icon.

4

The Database of Medical Biomarkers. The database contains over two million medical measurements that have been acquired over the past 30 years from people of all ages, genders, ethnic backgrounds including over 26,000 Total Body DEXA bone density/body composition tests. Measurements have been acquired from people in every state in the U.S. as well as small samples from Canada, Australia, United Kingdom, Japan, Republic of Korea, Taiwan, Switzerland, New Zealand and South Africa. A description of the database is available on the Company’s website under the “Testing Technologies” icon.

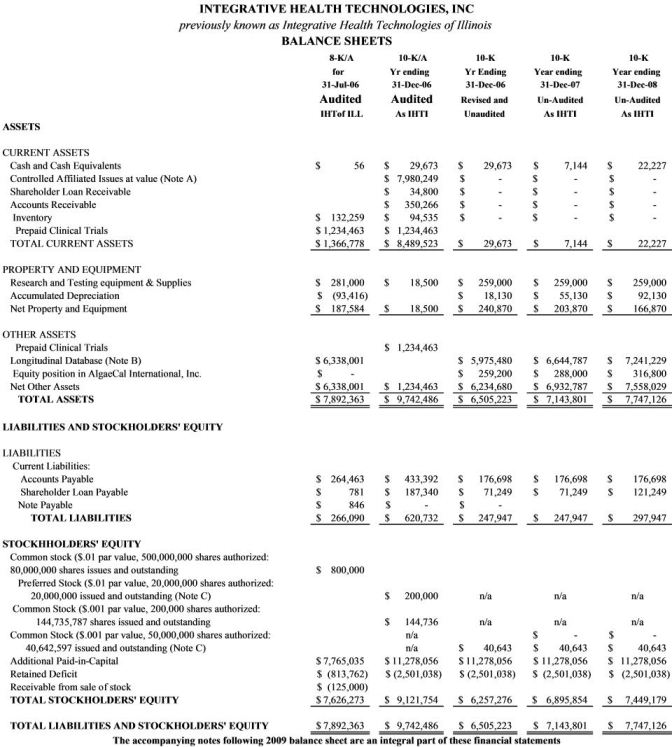

History. The Company (IHTI) was incorporated on August 4, 2004 as a private corporation under the laws of the state of Illinois to provide fee-based clinical trials, R & D, consulting and testing services to the healthcare and nutritional industries. On July 31, 2006, an independent Public Company Accountant Oversight Board (PCAOB) auditor completed a two-year analysis of IHTI’s financial history. The auditor concurred with management’s $5,801,875 valuation of its assets, almost entirely attributable its 15-year, 2-million medical biomarker database. In June 2006 IHTI acquired Senticore, Inc., a public company trading as an over-the-counter stock (SNIO) that had elected to be regulated as a Business Development Company (“BDC”) in accordance with the Investment Company Act of 1940. Details of this acquisition were reported in IHTI’s 10K audited statement for the period ending December 31, 2006 and subsequent quarterly filings in 2007. As a result of a series of SNIO’s failed acquisitions, business losses, questionable issuance of shares for services, collateral surrendered for defaulted loans, the absence of any cash flow or operating profits to defer operating expenses, multiple changes in auditors and accountants, SNIO reported a cumulative net operation loss of ($4,482,091) since its inception in 1999.

On the date of the acquisition SNIO was authorized 200,000,000 common shares, of which 181,145,154 were issued and outstanding. In a complicated series of transactions reported in SNIO’s 2005 annual filing (pgs 33-35), SNIO acquired 7,000,000 (as converted) restricted common shares in Taj Systems, Inc. (Pink Sheets: TJSS) an on-line gambling company; 11,538 shares of Strategic Growth Ventures, Inc. (Pink Sheets: SGWV and 882,353 shares of AdZone Research (OTC: ADZR). SNIO represented that these combined shares were valued at ~$2,000,000 the closing price of the shares on the date of closing. Although the acquired company, SNIO, possessed a number of publicly-traded and privately held securities estimated to have a market value of over $2 million, by the end of the year ending December 31,2006 the market value of these restricted securities dropped precipitously and by the end of 2007 when the could be converted to free-trading shares, they had insignificant value. Therefore, in revised our financials we reported these assets as valueless. Thus, the December 31, 2006 report of $6,222,350 in assets was attributable almost exclusively to the initial valuation and subsequent additions to the database.

Available Information

We make available free of charge, through the Company’s website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and certain other information filed or furnished with the Securities and Exchange Commission, or the SEC, as soon as reasonably practicable after electronically filing, or furnishing such material. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers, including IHTI, that are electronically filed with the SEC at http://www.sec.gov.

Item 3. Markets for Registrant’s Common Stock

Trading Price History. Our common stock is currently traded as a Pink Sheet stock under the symbol IHTI and its current and historical trading price history is available on www.bigcharts.com. These market quotations reflect the high and low closing prices as reflected by the OTC.BB or by prices, without retail mark-up, markdown or commissions and represent actual transactions. Some of the companies that have and are serving as market makers for the stock include Knight Equity Markets, L.P.; Hill Thompson, Magid and Co., Inc.; Stern, Agee and Leach, Inc.; Citigroup Global Markets, Inc.; Newbridge Securities Corporation; Domestic Securities, Inc.; Jefferies and Company, Inc.; Wm. V. Frankel & Co., Inc.; and Bear, Stearns & Co. Inc.

Item 4. Management's Discussion and Analyses

Note Regarding Forward-Looking Statements

THIS DOCUMENT CONTAINS “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. PROSPECTIVE SHAREHOLDERS SHOULD UNDERSTAND THAT SEVERAL FACTORS GOVERN WHETHER ANY FORWARD - LOOKING STATEMENT CONTAINED HEREIN WILL BE OR CAN BE ACHIEVED. ANY ONE OF THOSE FACTORS COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE PROJECTED HEREIN. THESE FORWARD-LOOKING STATEMENTS INCLUDE PLANS AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS, INCLUDING PLANS AND OBJECTIVES RELATING TO THE PRODUCTS AND THE FUTURE ECONOMIC PERFORMANCE OF THE COMPANY. ASSUMPTIONS RELATING TO THE FOREGOING INVOLVE JUDGMENTS WITH RESPECT TO, AMONG OTHER THINGS, FUTURE ECONOMIC, COMPETITIVE AND MARKET CONDITIONS, FUTURE BUSINESS DECISIONS, AND THE TIME AND MONEY REQUIRED TO SUCCESSFULLY COMPLETE DEVELOPMENT PROJECTS, ALL OF WHICH ARE DIFFICULT OR IMPOSSIBLE TO PREDICT ACCURATELY AND MANY OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY. ALTHOUGH THE COMPANY BELIEVES THAT THE ASSUMPTIONS UNDERLYING THE FORWARD-LOOKING STATEMENTS CONTAINED HEREIN ARE REASONABLE, ANY OF THOSE ASSUMPTIONS COULD PROVE INACCURATE AND, THEREFORE, THERE CAN BE NO ASSURANCE THAT THE RESULTS CONTEMPLATED IN ANY OF THE FORWARD - LOOKING STATEMENTS CONTAINED HEREIN WILL BE REALIZED. BASED ON ACTUAL EXPERIENCE AND BUSINESS DEVELOPMENT, THE COMPANY MAY ALTER IT’S MARKETING, CAPITAL EXPENDITURE PLANS OR OTHER BUDGETS, WHICH MAY IN TURN, AFFECT THE COMPANY'S RESULTS OF OPERATIONS. IN LIGHT OF THE SIGNIFICANT UNCERTAINTIES INHERENT IN THE FORWARD-LOOKING STATEMENTS INCLUDED THEREIN, THE INCLUSION OF ANY SUCH STATEMENT SHOULD NOT BE REGARDED AS A REPRESENTATION BY THE COMPANY OR ANY OTHER PERSON THAT THE OBJECTIVES OR PLANS OF THE COMPANY WILL BE ACHIEVED.

5

The following discussion and analysis should be read in conjunction with the financial statements and Preliminary Note Regarding Forward-Looking Statements provided above. This section also contains reports of activities and results of operations that occurred in the current year up to the filing date of this Form 10K and subsequent to the year ending December 31, 2006. In some cases, the conditions and results of operations are reported without accompanying distinctions between the quarter in which these activities and events occurred.

Operating Changes

Since filing its 10K/A amendment to its annual report for the year ending December 31, 2006 on June 4, 2007, a significant amount of management efforts and resources have been dedicated to resolution of problems it inherited from the previous management of Senticore, Inc. when it functioned as a Business Development Company. These problems have been articulated in our previous filings. However, in our view, those problems have been resolved and the filing of this 10K is management’s commitment to move on with the execution of its current business plan as stated above. No changes have been made in the Company’s investment strategy and operating policies.

Management’s Activities

Since filing its previous 10K, the Company has taken actions to: (1) expand its multi-million measurement Longitudinal Medical Biomarker Database, (2) acquired additional Biomedical Testing Technologies, (3) Published Studies & Manuscripts, (4) updated its Health & Wellness Information and (5) established a Health Information Video Library. A summary of each of these actions is presented below and additional information is available on its website under the 5 matching icons on its website.

Development of Strategic Alliances and Equity Positions

AlgaeCal International. AlgaeCal International is a Canadian Corporation (www.algaecal.com) that markets a calcium supplement for enhancing bone health. AlgaeCal is a plant-sourced form of calcium made by milling whole, live sea algae found on the South American coastline. Besides calcium, this algae also contains 13 other minerals known to play a role in bone health including magnesium, boron, silica, manganese, copper, vanadium and strontium. The algae is harvested live and cold-processed to help preserve the integrity and bio-chemical characteristics of its phytonutrients. Two independent laboratories confirmed AlgaeCal’s nutrient levels and lack of heavy minerals and other contaminating ingredients. A recent in vitro study with AlgaeCal demonstrated that it can serve as a superior calcium supplement compared to the two most commonly used calcium salts, calcium carbonate and calcium citrate. This study demonstrated that AlgaeCal exhibited unique properties compared to calcium carbonate or calcium citrate on a cellular level. Furthermore, safety and toxicological investigations were conducted using AlgaeCal and demonstrated its broad spectrum safety.

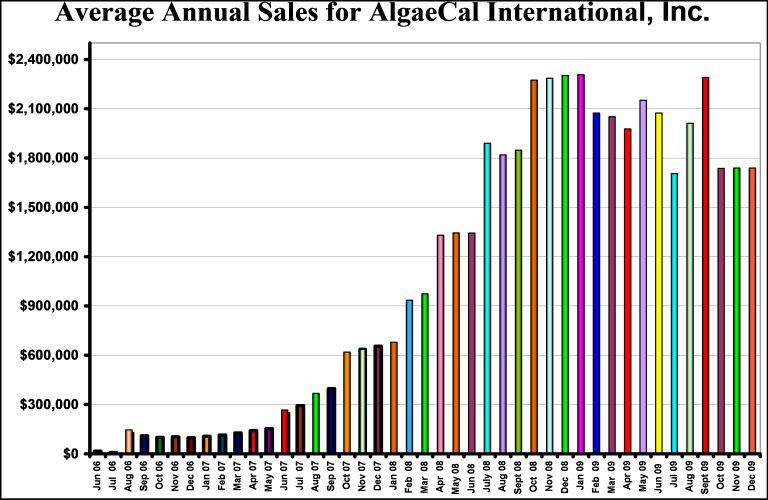

As partial payment for the conduct of a pilot study and literature review, AlgaeCal Inc. provided IHTI with an 8% equity position and a 1% royalty on all gross sales. As shown in the figure below, AlgaeCal lnc’s sales have progressively increased from and initial annual average of $16,459 in June 2006 to $1,739,198 on December 31, 2009 with a total revenue since June 2006 of $4,753,796. IHTI actual cash outlay for conducting the initial pilot study, review of the scientific literature, testing fees, and support provided over the past three years is estimated to be $288,000, excluding estimates of professional time expended by IHTI’s CEO. While the $47,538 revenues received from its 1% royalty represents a small return for its investment, the Company’s invested its capital and resources for its 8% equity position. Although difficult to estimate the value of this 8% equity position, AlgaeCal Inc’s current position is not to sell the company for less than $10,000,000 which would provide a $800,000 return on the Company’s investment of $288,000. We valued this asset at $288,000 in 2007 and are increasing it at 10% per year in 2008 and 2009.

6

Body Solutions Ultra (BSU) . Body Solutions Ultra (BSU) (www.bodysolutionsultra.com) is a resurrection of a previous weight loss company, Body Solutions, that had income in excess of $85 million a years before filing bankruptcy due to mismanagement and making unsubstantiated claims. Patents for the Body Solutions product were purchased by an investment banker and the company was re-formed and re-named as BSU. (See San Antonio Express News article in IHTI’s website under the “Strategic Alliances and Equity Positions” icon entitled: “Body Solutions is Back in Business: Product has new owner, new formula and a toned-down advertising pitch.” IHTI was employed as BSU’s “in-house” R&D company to enhance the product line with evidence-based products and technologies and to insure all claims made by the current BSU management were supported by appropriate and accepted scientific studies. In return for this service, IHTI received a 4% equity position in the company and a $3.00 royalty on the BSU formula. In view of the uncertainty of the weight loss market and the absence of a track record, it is impossible to ascribe a value to this asset at this time. Since this agreement became effective in January 2010, no income was derived in 2009.

HealthTech Products, LLC. A small company marketing the products and technologies that IHTI has evaluated over the years. IHTI holds an 8% with a 5% royalty on gross sales that produced $3,200 in 2009.

Addition to Company’s Longitudinal Medical Biomarker Database. Over the course of the last three years, the Company has continued to audit and correct the millions of entries in its database. It has also increased the number of DEXA and blood chemistry biomarkers and added new measurements. Using the same accounting procedures followed by the independent auditor in her audit the Company’s database in 2006, the Company has increased the value of its database by 11.2 % in 2007, 9.0% in 2008, and 7.0% in 2009. The total body DEXA measurements now exceeds 26,000, representing perhaps the largest number of these tests in any domestic database.

Biomedical Testing Technologies. The Company continued to maintain and upgrade its two stationary and three mobile DEXA testing units making significant improvements to its software and is currently negotiating acquisition of a metabolic testing unit.

Published Studies & Manuscripts

Glyconutritional Longitudinal Trials. This year marks the 14th year of the Company’s involvement in the glyconutritional longitudinal trials discussed in previous filings. Both published and unpublished results of this study have now been incorporated into Dr. Kaats’ (IHTI’s CEO) book, Restructuring Body Composition: How the kind, not the amount, of weight loss defines a pathway to optimal health that was published by Taylor Publishing Company of Dallas, Texas.

7

Publication of Restructuring Body Composition book. In addition to its description of the glyconutritional longitudinal trials, Restructuring provides the reader with a description of the typical measurements used by the Company in the services it provides for the nutritional and healthcare industry. The book is a four-color 294 page hardback that goes well beyond a description of the longitudinal trials providing readers from adolescents to athletes with useful information on the fallacy of using changes in scale weight, as opposed to changes in lean, fat and bone, to evaluate the safety and effectiveness of weight control programs. As one reviewer has commented:

“When scholars write about paradigm shifts in healthcare in the 21st century, re-framing of the significance of body composition changes is certain to be high on the list. Restructuring Body Composition is today’s clarion call for that paradigm shift”.

In view of its relevance to the Company’s mission, a summary of the material presented in each of the chapters is presented below.

Chapter 1: Structure/Function Versus Medical/Disease Claims

The chapter begins with a listing of the U.S. government’s documents that were used to insure the data from the glyconutritional plant polysaccharide longitudinal trials reflected structure and function changes, not prevention, mitigation or cure of diseases. The study was conducted to be consistent with the goals of the NIH’s Strategic Plan “...to promote quality science in dietary supplement research to validate biomarkers of dietary supplement effects…on optimal health and improved performance.” Information is presented on how improvements in body composition (lean, fat and bone) meet the NIH’s goals. Guidance is provided on how to present the findings from the longitudinal trial as structure and function changes and how to avoid misrepresenting the results as disease claims. To help clarify the distinction between the two, the chapter introduces readers to the biomarker of “sarcopenia” and the important role it can play in facilitating “optimal health and improved performance.”

Chapter 2: The Longitudinal Trials

Summarizes in a reader-friendly format, five published studies which are reported in later chapters. Provides Mannatech, Inc’s Press Release for the analysis of the longitudinal trials database.

Chapter 3: DEXA Technology: Measuring Instead of Estimating

Describes the testing technology and the critical nature of utilizing the “gold standard” for research purposes, one that actually mea sures bone, lean, and fat as opposed to estimating it. Presents sample graphs and reports that are generated by the test.

Chapter 4: Fat and Lean: Pivotal Biomarkers of Optimal Health and Longevity

Introduces fat and lean as two vital components of body composition. Discusses obesity, sarcopenia, and the importance of measuring the type of weight lost (fat and lean) as opposed to the amount of weight lost (scale weight.) Presents the Body Composition Improvement index as means of reflecting the positive and negative changes in weight loss interventions, and as a measure of their safety and efficacy. Includes two published studies that compare changes in lean and fat while taking glyconutritional plant polysaccharides. Also includes results of a small randomized double-blinded placebo controlled study.

Chapter 5: Bone Mineral Density: A Pivotal Biomarker of Bone Health

Provides the published bone density study showing improvements in bone density in subjects taking glyconutritional plant polysaccharides as compared to placebo, control groups and other groups of subjects taking other nutritional products. Includes similar results from a small randomized double-blinded placebo controlled study.

Chapter 6: Maintaining Healthy Lipids and CRP Levels

Provides background information on the 43 panel blood tests that were conducted in the longitudinal trials. Brief summaries of each chemistry along with normal ranges are presented. Reports data suggesting glyconutritional plant polysaccharides may reduce systemic inflammation through a reduction of CRP. Presents a published study suggesting that glyconutritional plant polysaccharides facilitate the maintenance of healthy lipid levels.

Chapter 7: The Effect of Glyconutritional Plant Polysaccharides on Quality of Life

Reviews the NIH’s goals and guidance for the conduct of nutritional research and the U.S. Surgeon General’s “call to action” to develop bone-health plans designed to 1) improve nutrition, 2) increase physical activity, and 3) improve health literacy. Major threats to bone health, including the often overlooked effect of dieting on bone health, are reviewed along with a discussion of two bone-health plans that meet the SG’s call to action: one using glyconutritional plant polysaccharides, the other using a nutrient-enhanced plant-sourced form of calcium. Each of these plans are reviewed along with a discussion of unpublished research. The chapter also provides a copy of a published manuscript of a meta-analysis of the effects of glyconutritional plant polysaccharides on bone density that also includes data from a small double-blinded placebo-controlled study.

8

Chapter 8: The Clicker: What Gets Measured and Tracked, Gets Managed

Introduces the pedometer or “clicker” which is used to measure daily activity. The Living at Goal Weight Plan is presented as a tool to maximize the benefits derived from glyconutritional plant polysaccharides. Blank tracking forms and graphs crucial to The Plan are provided and can be reproduced for your use without infringing on the copyright.

Chapter 9: The Glycemic Index and The Glycemic Load

Summarizes the research on how using the glycemic index and the glycemic load can improve weight control and provide other health benefits. Discusses the insulin resistance model and how the its deleterious effects can be countered by eating the types of carbohydrates that produce the lowest rise in glucose. The latest research on glycemic index is presented for about 450 foods. They are color-coded and ranked according to their glycemic load, and are also presented alphabetically.

Chapter 10: Calories: Estimating and Balancing

Introduces a simple and practical approach to calorie estimation through five “Calorie Yardsticks.” Also introduces the Checkbook for Living at Goal Weight©, which is a simple and practical approach to calorie balancing. Blank forms, which can be reproduced for your use, are provided.

The Company also provides periodic “Research Updates” to the material discussed the book to allow readers to remain current on the materials presented in the book. Since the book can provide shareholders with a comprehensive and updated description of the Company’s activities, upon validation of their shares, shareholders can purchase a copy of the book for its actual shipping and handling charge.

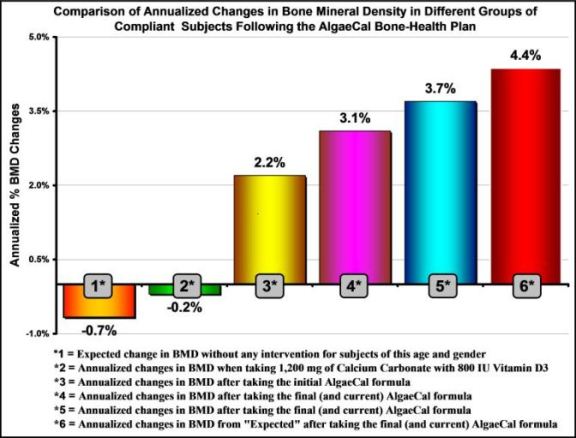

Publication of the AlgaeCal Bone-Health study. The Company’s involvement with this study has been described in previous filings. Since the Company received an 8% equity position and a 1% royalty on gross sales from its conduct of a pilot study, (see Item 5. Selected Financial Information above) the clinical study needed to be conducted by an independent investigator to avoid a conflict of interest. Therefore, the co-chairman of the Department of Epidemiology and Biostatistics, University of Texas Health Science Center at San Antonio, TX served as the Principal Investigator for a clinical trial evaluating the product’s safety and efficacy. The study has now been completed and submitted for publication in a peer-reviewed medical journal. An abstract of the study is provided below and the full manuscript will be made available to shareholders upon acceptance for publication.

Background: Concluding that America’s bone-health is in jeopardy due to increasingly sedentary lifestyles, lack of bone-health information and inadequate nutrition, the U.S. SG issued a “call to action” for the development of bone health plans that incorporated three components: (1) improved health literacy, (2) increased physical activity, and (3) improved nutrition. The recent emphasis on Comparative Effectiveness Research (CER) suggested it was the appropriate study design to respond to the SG’s call to action.

Objective: To compare changes in BMD between three different bone-health plans and with age- and gender-adjusted pre-established expected changes and within-group changes as a function of compliance levels, volunteer bias and attrition.

Method: A total of 274 adults aged 18-25 received a DXA scan, 158 (Grp 1) of whom volunteered and followed an initial bone-health plan that included a plant-sourced 720 mg calcium supplement (AlgaeCal) supplemented with 72 mg of magnesium, 800 IU of Vitamin D3, and 1.5 mg of Vitamin K2 as MK-4, and 680 grams of strontium citrate and . Upon completion of the study, a second group (Grp 2) of 80 subjects followed the same enrollment procedure, 51 (Grp 2) of whom volunteered and followed the identical plan, but with a modified AlgaeCal supplement containing 756 mg calcium, 350 mg magnesium, 1,600 IU of Vitamin D3 and 100mcg of Vitamin K2 as MK-7. In both groups, comparisons were made between baseline BMDs in volunteers vs. non-volunteers, drop-outs vs. completers, and compliant vs. partially compliant subjects. Within-group changes in BMD were made in both groups between baseline/ending BMDs, non-intervention expected changes using national norms, and between compliant and partially compliant subjects. Comparisons of changes in BMD between the two study groups were made in baseline/ending BMDs, partially compliant subjects, and compliant subjects. To evaluate safety, within-group comparisons were made between 43 baseline and ending blood chemistries and a self-reported quality of life (QOL) inventory. Upon completion of the second study, an additional 50 subjects were enrolled (Grp 3) to compare changes in Grp 1 & 2 with one of the most frequently used bone-health supplements containing 800 IU of Vitamin D3 and 1,200 mg of calcium carbonate.

9

Results: As shown in the graphic above, no significant differences were found in baseline BMDs between the three study groups, and nor in baseline BMDs between volunteers vs. non-volunteers, or between drop-outs vs. completers. Grps 1 & 2 had increased BMD levels compared to: expected changes [Grp 1: 1.15%, p=0.001; Grp 2: 2.79%, p=0.001]; changes from baseline [Grp 1: 0.48%, p=0.14; Grp 2: 2.18%, p<0.001]; and compliant vs. partially compliant subjects [p=0.001 and p=0.003 respectively]. Compared to subjects in Grp-1, Grp-2 subjects had a greater increase in BMD between: baseline/ending (p=0.005, partially compliant subjects (p=0.005) but, not in compliant subjects (p=0.12). In Grp 3, within BMD changes from baseline were not significant (p=0.45). Both Grp 1 & 2 had greater changes in baseline/ending BMD than Grp 3 (p=0.01 and p=0.001, respectively). There were no clinically significant changes in blood chemistries or self-reported quality of life in any of the three groups.

Conclusion: In the two groups following the bone-health plan for six months BMD increased significantly from baseline, were significantly greater than expected changes, and were significantly greater than a group taking calcium carbonate and D3. In both groups following the plan, efficacy was supported by a significant difference between compliant and partially compliant subjects. These increases in BMD were unaffected by volunteer bias or attrition. Modification made to the nutritional composition of the bone-health supplement led to greater increases in BMD. No adverse effects were reported in either group. It was concluded that following the bone-health plan as described above can lead to significant improvements in bone health.

Other Published Studies & Manuscripts. All publications and manuscripts cited below are available on the Company’s website under the icon, “Publishes Studies & Manuscripts”

TITLE: The Safety and Efficacy of Hydroxycitric Acid Derived from Garcinia cambogia: A Literature Review.

INVESTIGATORS: Stohs SJ, Phd; Preuss HG, MD; Ohia SE, PhD; Kaats GR, PhD; Keen CL, PhD; Williams LD, PhD; Burdock GA, PhD.

PUBLICATION: The Journal of the American Botanical Council. Number 85, Feb-April 2010

TITLE: Meta Analysis from Source-data on the Short-term Effects of a Glyconutrient Supplement on Bone Density.

INVESTIGATORS: Kaats GR, Keith SC, Keith PL.

PUBLICATION: The Original Internist. 2008. Vol 15, No 4, 195-208.

TITLE: The Use of Pedometers in Medical and Alternative Care Treatment Plans

INVESTIGATORS: Kaats GR, Preuss HG, Keith SC, Keith PL.

PUBLICATION: The Original Internist. 2008. Vol 15, No. 3, 126-131

TITLE: Sarcopenia: When weight loss is counter-productive

INVESTIGATORS: Preuss HG, Perricone N, Boyd SC, Bagchi D, Keith SC, Kaats GR

PUBLICATION: The Original Internist. 2007. Vol 14, No. 4, 160-197.

10

TITLE: Comparative Effectiveness Research (CER): Opportunities and Challenges for the Nutritional Industry

INVESTIGATORS: Gilbert R. Kaats, PhD, FACN; Harry G. Preuss, MD, MACN, CNS; and Robert B. Leckie,

M.Eng., LL.B.

PUBLICATION: Journal of the American College of Nutrition, 2009. Vol. l28, No.3, 234-237.

TITLE: A Combination of L-Arabinose and Chromium Lowers Circulating Glucose and Insulin Levels After Acute

Oral Sucrose Challenge.

INVESTIGATORS: Gilbert R. Kaats, PhD, FACN; Samuel C. Keith, BBA; Patti L. Keith, BBA;Robert B. Leckie,

M.Eng., LL.Nicholas V. Perricone MD, FACN, CNS; Harry G. Preuss, MD, MACN, CNS

PUBLICATION: Submitted for publication in 2009 to The Nutrition Journal.

TITLE: A Comparative Effectiveness Research Study of the Safety, Efficacy and Tolerability of a Plant-sourced

Calcium Supplement with a Calcium-Carbonate Supplement

INVESTIGATORS: Gilbert R. Kaats, PhD, FACN, Harry G. Preuss, MD, MACN, CNS,

PUBLICATION: Technical Report, 2009.

TITLE: The Safety and Efficacy of the Body Solutions Weight Loss Plan: An Executive Summary

INVESTIGATORS: Gilbert R. Kaats, PhD, FACN, Harry G. Preuss, MD, MACN, CNS, Samuel C. Keith, BBA;

Patti L. Keith, BBA

PUBLICATION: Technical Report.

Other activities

Income Derived from Testifying as an Expert witness. During 2009, Dr. Kaats billed $13,043 for testifying as a weight loss expert.

Development of a Current Nutritional Science Reference Library

This information is available on the Company’s website under the icon, Current Nutritional Science Reference Library. It provides summaries or complete articles of the latest research studies on nutritional products including:

Vitamin D (A test being marketed by IHTI). A number of recent studies, including data from the U.S. Centers for Disease Control, have suggested increased levels of vitamin D, (almost three times the recommended levels of 800 IUs) may provide a variety of health and disease prevention benefits without increased adverse effects. Recent studies have shown that difficulty in losing weight and accumulation of excess fat in muscle tissue may be due to low blood levels of Vitamin D. These findings add to the explosion of research suggesting measures of Vitamin D blood levels can predict the risk for, and severity of, a wide range of diseases and health conditions. As one example, The Harvard Health Publication reports that measurements of blood levels of vitamin D reveal low levels can contribute to many chronic conditions including:: coronary artery disease, heart failure, Statin-related muscle pain, high blood pressure, infections, falls, broken bones breast cancer, prostate cancer, depression, type-2 diabetes, osteoporosis, asthma and memory loss. The Harvard publication also suggests that “Supplements are the simplest, safest way to get vitamin D.” But before getting more sunlight and taking Vitamin D3 supplements, start by determining how much Vitamin D3 you should be taking is to have your Vitamin D blood level measured (a test now being marketed by IHTI)..

Conjugated linoleic acid (CLA). CLA stands for “conjugated linoleic acid”. It is a fatty acid known for promoting good health. This was first identified in 1978 while and it provoked a surge of research and scientific studies into the benefits of CLA as a fat reducer. After looking at decades of research scientists have found that CLA may in fact help the body to deposit less fat, build more muscle and may even help prevent fat cells from refilling.

C-Reactive Protein (CRP) (A test being marketed by IHTI). Studies are consistent and impressive and regarding the new C-reactive protein (CRP) blood test; the level of this sensitive protein in the bloodstream correlates with the level of inflammation, which is the best known predictor of heart attack, more important than your cholesterol level, blood pressure or your family history. Inflammation plays a key role in diabetes, Alzheimer's disease, Parkinson's disease, some forms of cancer and many other conditions including Insulin Resistance. The level of CRP is measured by a blood test and is fairly stable over days to weeks. Increased levels of CRP levels are associated with infections, bronchitis, bladder, prostate and even dental or periodontal infections which may explain the association between dental health and cardiovascular health. High levels are also associated with severe arthritis, colitis, lupus, insulin resistance, insulin resistance syndrome, overweight and obesity, medications (particularly hormone supplements, such as estrogens found in hormone replacement therapy) and chronic severe allergies may also be a cause of systemic inflammation.

11

Strontium Ranelate and Strontium Citrate.

Strontium ranelate is an effective and well-tolerated treatment for postmenopausal osteoporosis. It has been shown to provide relatively quick and sustained protection from bone fractures. Concurrently, it also has been shown to produce sustained increases in bone mineral density (BMD). These bone-health effects have been found initially in 3-year studies and more recently in a 5-year study. Additionally, no significant adverse effects have been reported with long-term use of Strontium Ranelate.

We could find no studies suggesting that Ranelate itself had any effect on bone-health, raising questions as to what purpose it served when adding it to Strontium. These studies have led to the use of the non-pharmaceutical dietary supplement, Strontium Citrate, since there are some studies suggesting that citrate may improve bone health. Although there are not sufficient studies to suggest that Strontium Citrate can provide the same bone-health and anti-fracture effects of Strontium Ranelate, our own preliminary research in the AlgaeCal study provided encouraging results.

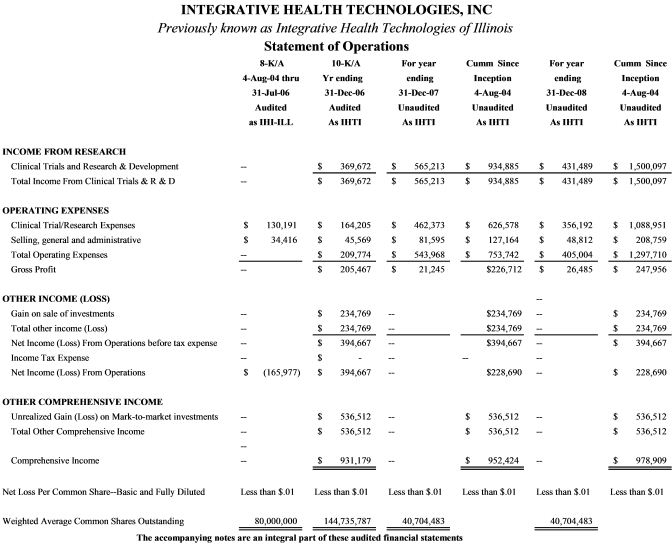

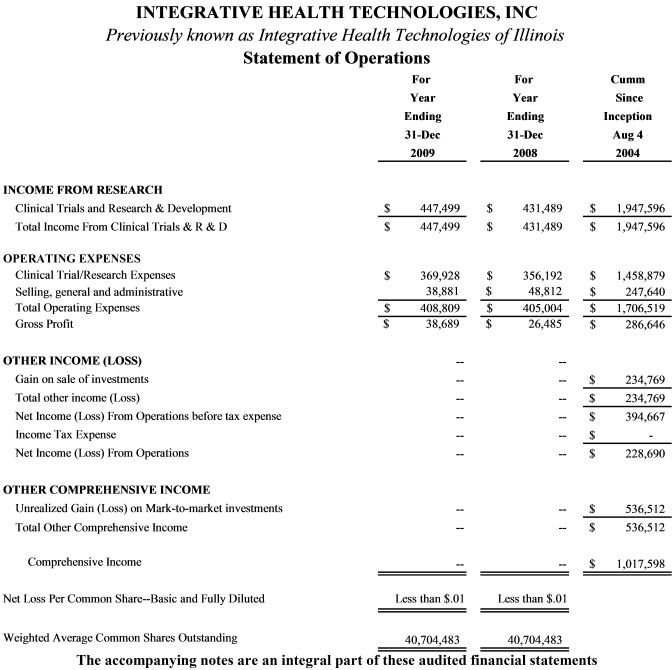

Results of Operations

The financial results of our operation during this quarter are summarized under FINANCIAL HIGHLIGHTS above and in the financial statements provided below.

General and Administrative Expenses

We had no selling, general and administrative expenses other than those shown below.

Other Income (Expenses)

All income and expenses received from the June 2006 acquisition through the date of this filing are reflected in previous filings and in the financial statements shown below.

Liquidity and Capital Resources

From inception (Jan 1999) through June 3, 2006, the Company funded its cash operating requirements through the sale of its common stock and loans. That policy was abandoned upon IHT’s acquisition of Senticore, Inc. in June 2006. From June 2006 to the date of this filing the Company has sold no additional shares. Any sale of the stock the Company currently holds will be used exclusively for operating capital.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the U.S., or GAAP, requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In recording transactions and balances resulting from business operations, the Company uses estimates based on the best information available. The Company uses estimates for such items as depreciable lives and the amortization period for deferred income. The Company revises the recorded estimates when better information is available, facts change or actual amounts can be determined. These revisions can affect operating results.

The critical accounting policies and use of estimates are discussed in and should be read in conjunction with the annual consolidated financial statements and notes included in the latest 10-KSB, as filed with the SEC.

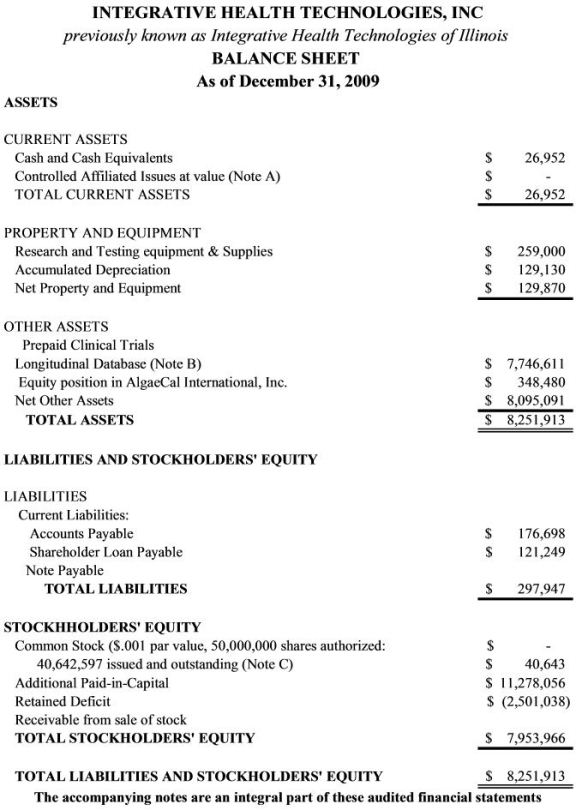

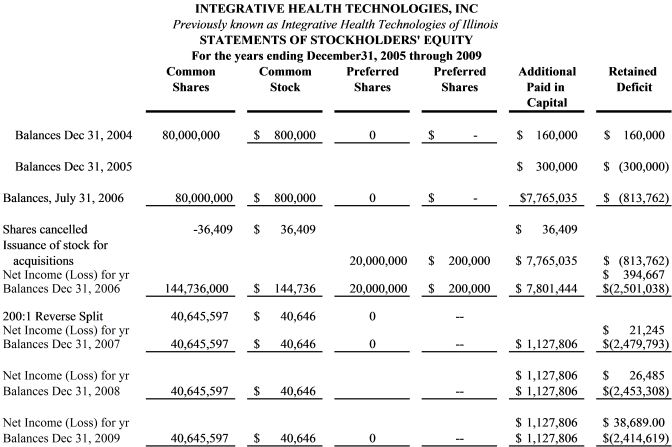

Item 5. Selected Financial Data

Item 7, Notes to financial statements, applies to these selected financial data as well as to Item 6. Financial Statements.

12

13

14

15

16

17

ITEM 7. NOTES TO FINANCIAL STATEMENTS

A. Revisions to previous financial statements. After reviewing the regulations on reverse mergers and discussing these requirements with the SEC, the Company (IHTI) determined that the historical financial statements prior to the acquisition should be those of the accounting acquirer. For periods prior to the reverse acquisition, the equity of the legal entity should be the historical equity of the accounting acquirer, prior to the transaction, retroactively restated to reflect the number of shares the accounting acquirer received in the business combination. Therefore, the historical information provided in this filing is based on that of the acquirer, Integrative Health Technologies of Illinois, a non-public private corporation begun in 2004. In concurrence with SEC accounting division, the May 2007 reverse split was and retroactively applied to the acquisition date. Additionally, since IHTI withdrew its agreement to be regulated as a Business Development Company (BDC) in May 2007, IHTI’s historical accounting financial information is being reported as if it was only an operating company, not a BDC, from the date of the acquisition. These procedures will also be followed when the Company files its quarterly and annual reports for 2010.

B. Basis of Presentation. Our accompanying unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the instructions to Form 10-Q and Article 6 of Regulation S-X of the Securities and Exchange Commission (the "SEC"). Accordingly, these financial statements do not include all of the footnotes required by generally accepted accounting principles. In our opinion, all adjustments (consisting of normal and recurring adjustments) considered necessary for a fair presentation have been included. The balance sheet at December 31, 2006 has been derived from the un-audited financial statements due to the unavailability of adequate books and records in the current year as well as in previous years provided to the current management since the merger and reorganization agreement in June 2006. While we are confident that the financial information reported from the closing until the end of this fiscal year, all financial information reported prior to June 3, 2006 should be viewed with caution and as our best estimates from the information available to us.

C. Management’s Use of Estimates. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements. The reported amounts of revenues and expenses during the reporting period may be affected by the estimates and assumptions we are required to make. Actual results could differ from our estimates.

D. Stock-Based Compensation. No stock-based compensation has been paid since the June 2006 acquisition of Senticore, Inc.

E. Valuation of Long-Lived and Intangible Assets. The recoverability of long-lived assets requires considerable judgment and is evaluated on an annual basis or more frequently if events or circumstances indicate that the assets may be impaired. As it relates to definite life intangible assets, we apply the impairment rules as required by SFAS No. 121, "Accounting for the Impairment of Long-Lived Assets and Assets to be Disposed Of" as amended by SFAS No. 144, which also requires significant judgment and assumptions related to the expected future cash flows attributable to the intangible asset. The impact of modifying any of these assumptions can have a significant impact on the estimate of fair value and, thus, the recoverability of the asset.

F. Earnings/(Loss) Per Share. We compute net earnings/(loss) per share in accordance with SFAS No. 128 "Earnings per Share” (“SFAS No. 128”) and SEC Staff Accounting Bulletin No. 98 ("SAB 98"). Under the provisions of SFAS No. 128 and SAB 98, basic net earnings/(loss) per share is computed by dividing the net earnings/(loss) available to common stockholders for the period by the weighted average number of common shares outstanding during the period. Diluted net earnings/(loss) per share is computed by dividing the net earnings/(loss) for the period by the weighted average number of common and common equivalent shares outstanding during the period. For this purpose, each share of Series A Convertible Preferred Stock was treated as 400 common equivalent shares.

G. Income Taxes. In its Form 10-KSB for the fiscal year ending 2002 the Company reported that it had available net operating loss carry-forwards for income tax purposes of approximately $82,400. In its Form 10-KSB/A for the fiscal year ending 2003 the company reported a “…net operating loss carry-forwards of approximately $494,500”. However, while the Company failed to file its 2003, 2004 and 2005 tax returns, its net operating losses during these years will most likely significantly increase these carry-forwards precluding any taxes due for these years. Even with the limitation posed by “change in control” or the Company’s failure to file the required IRS Forms 1099 for these years, it is doubtful that the Company will owe any taxes. The Company has employed a CPA to file these taxes and we are now aggressively seeking sufficient records and general ledgers to file these tax returns and the required IRS Forms 1099 associated with the filings.

H. Related Party Transactions. All shares received from Senticore in conjunction with IHTI’s acquisition, have been disposed of or have been deemed valueless.

Item 8. Subsequent Events. Significant and material events and transaction subsequent to this filing have been reported in this filing.

18

Item 9.Quantitative and Qualitative Disclosures about Market Risk

Uncertainties of the effects of unresolved issues inherited from the previous management Since taking over management of the Company on June 3, 2006, current management has uncovered a number of issues that were unresolved by the previous management, some of which are contrary to representations made in the Closing and Merger and Reorganization Agreement. Although we believe that we have resolved these issues, some may have been overlooked. Investors bear the risk that all unresolved issues inherited from previous management have yet to be identified. There is also a risk that some or all of these issues may be incapable of resolution. There is also a risk that some or all of these issues may be more serious than they appear at this time, or they may be more costly to resolve than expected, or both.

Item 10.Controls and Procedures

Quarterly Evaluation of Controls. As of the end of the period covered by this report, we evaluated the effectiveness of the design and operation of (i) our disclosure controls and procedures ("Disclosure Controls"), and (ii) our internal control over financial reporting ("Internal Controls"). This evaluation ("Evaluation") was performed by our Chairman and Chief Executive Officer, Gilbert R. Kaats, ("CEO/CFO"). In this section, we present the conclusions of our CEO/CFO based on and as of the date of the Evaluation, (i) with respect to the effectiveness of our Disclosure Controls, and (ii) with respect to any change in our Internal Controls that occurred during the most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect our Internal Controls.

CEO/CFO Certifications

Attached to this annual report, as Exhibits 31.1 and 31.2, are certain certifications of the CEO/CFO, which are required in accordance with the Exchange Act and the Commission's rules implementing such section (the "Rule 13a-14(a)/15d-14(a) Certifications"). This section of the annual report contains the information concerning the Evaluation referred to in the Rule 13a-14(a)/15d-14(a) Certifications. This information should be read in conjunction with the Rule 13a-14(a)/15d-14(a) Certifications for a more complete understanding of the topic presented.

Disclosure Controls and Internal Controls

Disclosure Controls are procedures designed with the objective of ensuring that information required to be disclosed in our reports filed with the Commission under the Exchange Act, such as this annual report, is recorded, processed, summarized and reported within the time period specified in the Commission's rules and forms. Disclosure Controls are also designed with the objective of ensuring that others make material information relating to the Company known to the CEO/CFO, particularly during the period in which the applicable report is being prepared. Internal Controls, on the other hand, are procedures which are designed with the objective of providing reasonable assurance that (i) our transactions are properly authorized, (ii) the Company's assets are safeguarded against unauthorized or improper use, and (iii) our transactions are properly recorded and reported, all to permit the preparation of complete and accurate financial statements in conformity with accounting principals generally accepted in the United States.

Limitations on the Effectiveness of Controls

Our management does not expect that our Disclosure Controls or our Internal Controls will prevent all error and all fraud. A control system, no matter how well developed and operated, can provide only reasonable, but not absolute assurance that the objectives of the control system are met. Further, the design of the control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of a system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated objectives under all potential future conditions. Over time, control may become inadequate because of changes in conditions, or because the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Scope of the Evaluation

The CEO/CFO's evaluation of our Disclosure Controls and Internal Controls included a review of the controls' (i) objectives, (ii) design, (iii) implementation, and (iv) the effect of the controls on the information generated for use in this annual report. In the course of the Evaluation, the CEO/CFO sought to identify data errors, control problems, acts of fraud, and they sought to confirm that appropriate corrective action, including process improvements, was being undertaken. This type of evaluation is done on a quarterly basis so that the conclusions concerning the effectiveness of our controls can be reported in our quarterly reports on Form 10-Q and annual reports on Form 10-K. The overall goals of these various evaluation activities are to monitor our Disclosure Controls and our Internal Controls, and to make modifications if and as necessary. Our external auditors also review Internal Controls in connection with their audit and review activities. Our intent in this regard is that the Disclosure Controls and the Internal Controls will be maintained as dynamic systems that change (including improvements and corrections) as conditions warrant.

19

Among other matters, we sought in our Evaluation to determine whether there were any significant deficiencies or material weaknesses in our Internal Controls, which are reasonably likely to adversely affect our ability to record, process, summarize and report financial information, or whether we had identified any acts of fraud, whether or not material, involving management or other employees who have a significant role in our Internal Controls. This information was important for both the Evaluation, generally, and because the Rule 13a-14(a)/15d-14(a) Certifications, Item 5, require that the CEO/CFO disclose that information to our Board (audit committee), and to our independent auditors, and to report on related matters in this section of the annual report. In the professional auditing literature, "significant deficiencies" are referred to as "reportable conditions". These are control issues that could have significant adverse affect on the ability to record, process, summarize and report financial data in the financial statements. A "material weakness" is defined in the auditing literature as a particularly serious reportable condition where the internal control does not reduce, to a relatively low level, the risk that misstatement cause by error or fraud may occur in amounts that would be material in relation to the financial statements and not be detected within a timely period by employee in the normal course of performing their assigned functions. We also sought to deal with other controls matters in the Evaluation, and in each case, if a problem was identified; we considered what revisions, improvements and/or corrections to make in accordance with our ongoing procedures.

Conclusions

Based upon the Evaluation, the Company's CEO/CFO has concluded that, subject to the limitations noted above, our Disclosure Controls are effective to ensure that material information relating to the Company is made known to management, including the CEO/CFO, particularly during the period when our periodic reports are being prepared, and that our Internal Controls are effective to provide reasonable assurance that our financial statements are fairly presented in conformity with accounting principals generally accepted in the United States. Additionally, there has been no change in our Internal Controls that occurred during our most recent fiscal quarter that has materially affected, or is reasonably likely to affect, our Internal Controls.

Item 11. Directors and Executive Officers of the Registrant

Gilbert R. Kaats, PhD, Chairman of the Board and Chief Executive Officer

As of the closing, Gilbert R. Kaats, PhD became Chairman of the Board of Directors and Chief Executive Officer of the Company. Dr. Kaats has a PhD in behavioral psychology and is currently the executive director of Health and Medical Research Center, an independent research entity that conducts clinical trials and provides consulting for health-enhancing products and technologies for the health care and nutritional supplement industries. Grantors for these studies have included some of the largest nutritional and dietary supplement companies in the world, at least one of which has commissioned a 10-year longitudinal trial. Over the past 35 years, Dr. Kaats has developed networking relationships with many companies and individuals that will enhance his contributions to the Company into which the Research Center is merging, with respect to the Healthcare and Nutrition Industries. In addition to his research background, Dr. Kaats served in the United States Air Force from 1954 until he retired as Lieutenant Colonel in 1974. While in the Air Force, Dr. Kaats received a B.A. in psychology, with High Honors, from the University of Maryland in 1964; an M.A. in psychology from George Washington University in 1965; and a Ph.D. in psychology from the University of Colorado in 1969.

During his 20-year military career, he served for five years on the Presidential Flight as a navigator on Air Force Two and subsequently as an associate professor and Director of Research at the Air Force Academy. During the Viet Nam conflict, he served as a combat crew navigator and received the Air Medal with three oak leaf clusters. He completed his career on a General Officer's staff where he was responsible for the development and supervision of the Air Force’s programs for equal opportunity and treatment, race relations, rehabilitation of substance abusers, training of substance abuse counselors, and other behavior modification programs. A highly decorated officer, Dr. Kaats has, from the beginning of his Air Force career, occupied positions of leadership and management that have provided him with experiences that are relevant to both the business and scientific worlds.

Samuel C. Keith, Chief Information Officer and Director

Sam Keith graduated from the University of the Incarnate Word with a Business Administration degree in Management Information Systems. He began his career with Mueller and Associates in San Antonio, Texas as a staff accountant. He prepared tax returns for corporations, partnerships and individuals. He installed and trained clients on PC computer and accounting system. He continued his career into network and system management for the national chain of La Quinta Motor Inns, where he aided in system upgrades and installations for over 200 hotel units. In 1994, he began working with Health and Medical Research, a contract research organization that conducts clinical trials and provides consulting for health-enhancing products and technologies for the health care and nutritional supplement industries. Among his responsibilities as Assistant Director, he coordinated all the company’s IT needs, managed clinical trials, developed and administered the company’s 20-year biomarker database, and maintained the biomedical testing equipment which included mobile and static x-ray, ultrasound, and metabolic units.

20

In 2004, he accepted the position of Practice Administrator for Alamo Neurosurgical Institute, a start-up neurosurgery practice. From the inception of the practice, he established and managed the physician contracts, insurance contracts, billing and collections, hospital relations, marketing, and human resources. He also implemented a paperless medical office utilizing the latest electronic medical record (EMR) and electronic billing software. He was offered the positions of CIO, Director of Integrative Health Technologies, Inc. and CEO of Health & Medical Research, Inc. in February 2006 and currently holds those positions now.

Mr. Ovidio Pugnale, Director

Ovidio Pugnale was born in Northern Italy in 1933 and immigrated to America in 1935 with his mother and sister. He grew up in Northeastern Ohio where he attended the same public school for all 12 years. Mr. Pugnale entered the United States Air Force in 1954 as an Aviation Cadet and retired in 1980 as a Colonel. During his career, he accumulated nearly 7,000 hours of flying time as a Navigator and as an Aircraft Commander on B-52s. He also served as B-52 squadron commander, as Deputy Commander for Operations for 68 th Strategic Bombardment Wing and Director for Computer Operations for Air Force Logistic Command.

Upon retirement from the Air Force, he entered the business world as a Plant Manager and later buyer of that business. He bought two other highly successful businesses and integrated them into the existing business. In 1997, his business was a part of a merger/acquisition and eventual IPO. He is currently working with his son to develop a videography business. Mr. Pugnale graduated from the Air War College, earned an undergraduate degree from the University of Omaha and an MBA from Auburn University.

Item 12. Security Ownership of Certain Beneficial Owners and Management Owners of 5% or more of the common stock (as converted after the reverse split) of Integrative Health Technologies, Inc.

There are only three beneficial owners of 5% or more of the Company stock known at this time:

Gilbert R. Kaats, PhD, CEO; 121 Newbury Terrace, San Antonio, TX 78209 owns 16,000,000 shares representing 38.5% of the Company’s stock. Shirlie Kaats, (same address) owns 5,000,000 shares representing 12% of the Company’s stock. Thus, together they own 50.5% of the Company’s stock.

Item 13. Unregistered Sale of Equity Securities and Use of Proceeds. None

Item 14. Defaults Upon Senior Securities. None.

Item 15. Submission of Matters to a Vote of Security Holders. None

Item 16. Other Information. None.

Item 17. Exhibits And Reports On Form 10-K. Other than EXHIBITS 31.1 and 32.1 below, no additional exhibits are filed.

21

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SIGNATURE | TITLES | DATE |

| /s/ Gilbert R. Kaats | Chairman, CEO and Chief Financial Officer | April 5, 2010 |

22