Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BNC BANCORP | d8k.htm |

BNC Bancorp

Gulf South Bank

Conference

May 5, 2010

Exhibit 99.1 |

Forward-Looking Statements

2

This presentation contains forward-looking statements relating to the

financial condition, results of operations and business of BNC

Bancorp and its subsidiary Bank of North Carolina. These forward-looking

statements involve risks and uncertainties and are based on the beliefs

and assumptions of the management of BNC Bancorp, and the

information available to management at the time that this presentation was prepared.

Factors that could cause actual results to differ materially from those

contemplated by such forward-looking statements include, among

others, the following: (i) general economic or business conditions, either nationally

or regionally, may be less favorable than expected, resulting in, among

other things, a deterioration in credit quality and/or a reduced

demand for credit or other services; (ii) changes in the interest rate environment may

reduce net interest margins and/or the volumes and values of loans made or

held as well as the value of other financial assets held; (iii)

competitive pressures among depository and other financial institutions may

increase significantly; (iv) legislative or regulatory changes, including

changes in accounting standards, may adversely

affect

the

businesses

in

which

BNC

Bancorp

is

engaged;

(v)

local,

state

or

federal

taxing

authorities

may take tax positions that are adverse to BNC Bancorp; (vi) adverse

changes may occur in the securities markets; (vii) competitors of

BNC Bancorp may have greater financial resources and develop products that

enable them to compete more successfully than BNC Bancorp; (viii) costs or

difficulties related to the integration of Beach First National

Bank (“Beach First”) may be greater than expected; (ix) expected cost

savings associated with our acquisition of Beach First may not be fully

realized or realized within the expected time frame; and (x)

deposit attrition, customer loss or revenue loss following our acquisition of Beach First

may be greater than expected. Additional factors affecting BNC

Bancorp and Bank of North Carolina are discussed in BNC

Bancorp’s filings with the Securities and Exchange Commission (the “SEC”), Annual

Report on Form 10-K, its Quarterly Reports on Form 10-Q and its

Current Reports on Form 8-K. Please refer

to

the

Securities

and

Exchange

Commission’s

website

at

www.sec.gov

where

you

can

review

those

documents. BNC Bancorp does not undertake a duty to update any

forward-looking statements made during this presentation.

|

Quality

Competence

Discipline

3 |

BNC Bancorp Highlights

•

11

th

largest

bank

headquartered

in

North

Carolina

(7

th

Pro

forma

with

Beach

First)

•

$1.63 billion in assets as of March 31, 2010

•

Annual Regulatory Exam completed in Q1 2010

•

90% of historic growth has been organic

•

History of strong core earnings and declared dividends

•

Profitable every quarter since 1994

•

Excellent branch locations and market presence across key markets

•

Strong

market

share

in

key

markets

across

BNC

core

markets

along

I-85

/

I-40

/

I-77

/

I-73

corridors

•

Slower price value appreciation and therefore less severe downturn in

property values •

Recent expansion into coastal South Carolina through FDIC assisted

purchase of Beach First National Bank

•

Strong asset quality

•

NPAs/Assets of 2.04% at Q1 2010 versus peer median of 3.58%

•

Well reserved with Allowance for Loan Losses / Total Loans of 1.60% as of

March 31, 2010, up from the 1.44% reported at March 31, 2009 and

consistent with the 1.60% of total loans outstanding at December

31, 2009 •

Most

of

the

credit

team

endured

the

real

estate

downturns

of

the

80s

and

90s;

the

team

has

perspective, experience, and seasoned judgment

•

Continued profitability in Q1 2010

•

Net income to common shareholders of $886,000, or $0.12 per share, an

increase of 1% from Q1 2009

•

Net interest margin of 3.47%, a 36-basis-point increase from a

year prior •

Declared a quarterly dividend in Q1 2010 of $0.05 per share

4 |

Franchise Overview:

Consistent Growth and Profitability

5

Note:

Acquired

SterlingSouth

Bank

in

Greensboro

($160

million

in

assets)

in

July,

2006,

as

well

as

Beach

First

National

Bank

(approximately

$614

million

in

assets)

from

the

FDIC

as

receiver

in

April

2010.

Results

from

the

Beach

First

deal

are

not

reflected

in

this

table. |

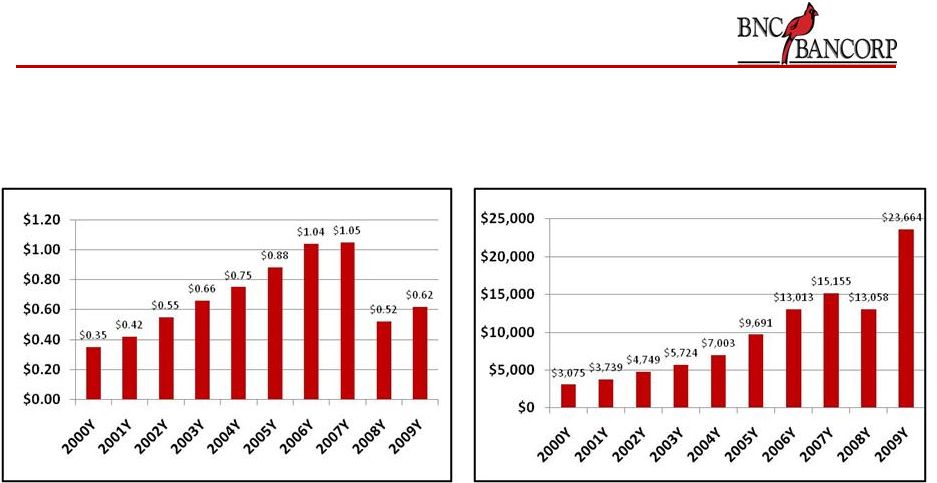

Franchise Overview:

Consistent Growth and Profitability

6

Note: Dollars in millions except per share data

Earnings per Share

Pre-Tax Pre-Provision Net

Revenues |

Franchise Overview:

Branch Locations and Market Overview

7

•

24 locations in North Carolina and South Carolina

•

17 locations along the 1-85/ I-40/ I-77/ I-73 corridors

in North Carolina •

7 additional locations in South Carolina acquired through the Beach First

National Bank P&A:

1

in

North

Myrtle

Beach,

3

in

Myrtle

Beach,

1

in

Pawleys

Island,

and

2

in

Hilton

Head

Bank of North Carolina

Offices

BNC Bank Offices |

North Carolina Franchise Overview:

Market Demographics and Position

8

•

Growth Markets:

•

Concord, NC in Cabarrus County; Population: 66,300; The

population of Concord more than doubled during the 10-year

period from 1990 to 2000; Population growth of 18% since

2000 •

Lake Norman Area; Includes Mooresville, Huntersville, Davidson and

Cornelius; Population: Approximately 91,000;

Population growth 47.2% since 2000; Demographics exceed National

and State Averages for wealth, income, and education

•

Both

markets

considered

Metro

Charlotte,

population

of

more

than

1.5

million

Deposit data as of June 30, 2009

Source:

FDIC,

ESRI

(U.S.

Census),

www.city-data.com,

SNL

Financial

County

Market

Rank

Number of

Branches

Deposits in

Market

Deposit

Market

Share (%)

Total

Population

2009

Projected Population

Change 2009-2014 (%)

Median HH

Income 2009

($)

Projected HH Income

Change 2009-2014 (%)

Guilford

5

6

632,132

6.53

476,896

6.49

56,264

6.83

Davidson

1

4

551,631

26.32

159,673

3.32

47,411

3.68

Randolph

9

1

47,412

2.59

142,555

4.11

47,059

6.67

Rowan

10

1

40,161

2.72

139,607

3.71

46,826

4.56

Forsyth

13

2

36,534

0.20

349,532

6.96

55,686

4.55

Cabarrus

11

2

24,256

1.19

173,392

14.81

60,301

6.82

Iredell

18

1

12,871

0.57

160,602

14.54

53,943

2.14

BNC Bancorp Franchise

17

1,344,997

1,602,257

5.26

48,721

5.36

Weighted Average State of North Carolina

9,370,242

8.13

51,418

4.31

National

309,731,508

4.63

54,719

4.06 |

Overview of South Carolina Franchise

•

Beach First National Bank was founded in 1996

•

The parent holding company, Beach First National Bancshares, Inc., was

previously traded on the NASDAQ under the symbol

“BFNB” •

Beach First National Bank served the Grand Strand and Hilton Head Island

markets with seven banking offices

•

Branch locations include 3 in Myrtle Beach, 1 in North Myrtle Beach, 2 in

Hilton Head, and 1 in Pawleys

Island

•

Voted

“Best

Community

Bank”

in

Myrtle

Beach

2

of

the

last

3

years

by

the

Myrtle

Beach Herald

•

Strong deposit market and retail following

•

#1 ranked market share in Myrtle Beach, according to 2009 data provided by

SNL Financial

•

Overall 19th deposit market share in the state of South Carolina

•

Attractive deposit mix

•

Minimal brokered deposits (approximately 5% of total deposits)

•

Favorable long-term demographics

9 |

South Carolina Franchise Overview:

Market Demographics and Position

10

Deposit data as of June 30, 2009

Source:

FDIC,

ESRI

(U.S.

Census),

www.city-data.com,

SNL

Financial

•

Growth Markets:

•

Myrtle

Beach

MSA

represents

approximately

pro

forma

22.7%

of

the

BNC

franchise

•

Projected

population

growth

in

South

Carolina

franchise

of

14.5%

between

2009

and

2014, including projected population growth of 16.2% in the Myrtle Beach

MSA •

Myrtle Beach MSA previously experienced 34.5% population growth from

2000-2009 •

Additionally, Beaufort County projects population growth of approximately

11.6% between 2009 and 2014

County

Market

Rank

Number of

Branches

Deposits in

Market

Deposit

Market

Share (%)

Total

Population

2009

Projected Population

Change 2009-2014 (%)

Median HH

Income 2009

($)

Projected HH Income

Change 2009-2014 (%)

Horry

4

4

436,554

7.84

264,423

16.22

46,996

4.1

Beaufort

15

2

96,472

2.72

157,963

11.64

62,527

1.16

Georgetown

10

1

43,662

3.71

62,931

4.08

45,158

6.12

BNC Bancorp Franchise

7

576,688

485,317

14.54

49,455

3.76

Weighted Average State of South Carolina

4,524,760

6.1

48,210

4.74

National

309,731,508

4.63

54,719

4.06 |

Franchise Overview:

Q1 2010 Financial Highlights

11

•

Net income of $1.39 million for Q1 2010

•

Diluted EPS of $0.12. Continued record of profitability every

quarter since 1994 •

Increase in Net Interest Income of 10.8% from a year prior

•

NPAs/Assets of 2.04%, well below regional peer group median of 3.58%, and

the SNL Bank Index components average of 3.46%

•

Continued progress towards our core deposit growth initiatives, with an

overall year over year increase in deposits of 5% since Q1

2009 •

Interest

bearing

demand

deposits

and

savings

increased

by

$146.6

million

•

Retailed time deposits increased by $134.3 million

•

Wholesale time deposits decreased by $221.7 million year over year

|

CD Portfolio:

Extending in a Low Rate Environment

12

(In thousands)

Remaining Maturity

2009

2008

2007

2006

2005

2004

2003

Maturities Less than 1 Year

310,447

637,363

487,770

394,084

166,420

129,837

72,584

Maturities 1+ to 2 Years

95,144

97,304

52,699

116,673

123,929

58,509

32,774

Maturities 2+ to 5 Years

212,908

77,444

13,114

8,017

21,813

17,330

7,724

Maturities 5+ to 15 Years

32,610

5,974

6,155

6,471

5,954

-

-

Total CD's

651,109

818,085

559,738

525,245

318,116

205,676

113,082

Weighted

Avg

Remaining

Maturity

20.42

9.43

7.58

9.66

14.55

12.00

11.86

Weighted Avg

Rate

2.81%

3.24%

4.84%

4.75%

3.72%

2.46%

2.04%

% of CD's Less than 1 Year

47.7%

77.9%

87.1%

75.0%

52.3%

63.1%

64.2%

December 31,

Low

Rate

Environment-Extending

Low Rate Environment-Extending

High Rate Environment

Reducing Duration |

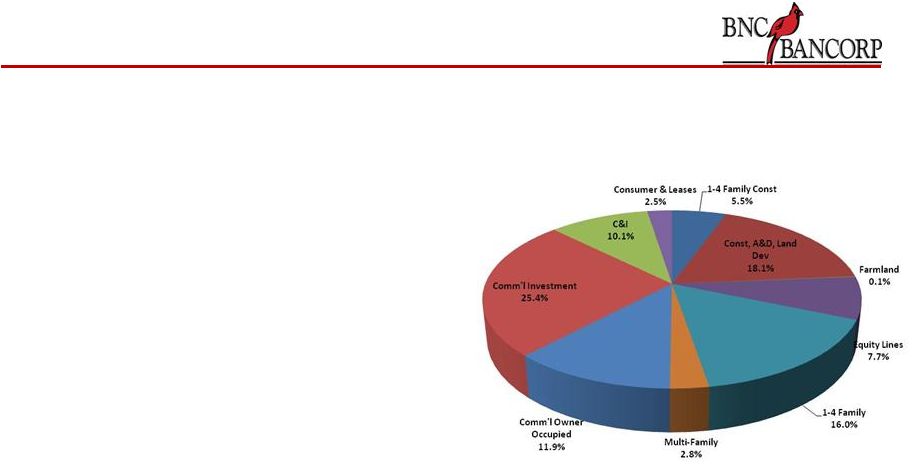

Diversified Loan Portfolio

13

1

Peer financial data as of December 31, 2009; regulatory data.

Represents most recent data available at the time of this

presentation. Loan Composition -

$1.09 billion

7,334 Loans

•

Small average loan balance: $148,490

•

Strong loan quality

•

NPLs

/ Loans of 1.18% as of Q1 2010 versus peers of

3.06%

1

•

Experienced credit team with average tenure of >

25 years and experience through various economic

and credit cycles

•

Construction, Acquisition and Development, and

Land Portfolio has been reduced 26% over the last

18 months from $306M to $227M

•

Residential and Commercial A&D balances have been

reduced 42%, or $28 million over the 18 month period

•

Credit Risk Management has been engaged by the

Audit Committee to perform independent credit

review semi-annually

•

10 Year Relationship

•

Upon completion, CRM reports directly to a joint

meeting of the Audit and Loan Committees of the

Board of Directors

•

Also been instrumental in providing credit training,

policy maintenance, and comprehensive underwriting

tools |

Loan Portfolio and Asset Quality:

Superior Asset Quality Relative to Peers

14

Note:

Peers

include

publicly

traded

banks

with

assets

between

$1

and

$3

billion

in

NC,

SC,

WV

and

VA

(SCBT,

VCBI,

CHCO,

UBSH,

FCBC,

FNBN,

YAVY,

NBBC,

CFNL,

SCMF,

CBKN,

SMMF,

EVBS,

CRFN,

MBRG,

PEBK,

FOFN,

FSBK,

ECBE,

and

CSBC)

Source:

SNL

Financial

and

BNC

Bancorp

filings

NPAs

+ 90 Days Delinquent / Assets

Reserves / Loans

NPAs

+ 90 Days Delinquent / Equity + Reserves

Net Charge-Offs / Average Loans |

Loan Portfolio and Asset Quality:

Credit Quality Statistics

15

Balances as of March 31, 2010

(In thousands)

Loan Type

Current Balance

% of Total

Balance

Non-Accrual

Loans

Non-Accrual /

Current Balance

OREO

30-89 Days

Delinq.

90+ Days

Delinq.

Year-to-Date

Charge-offs

1-4 Family Const

$44,690

5.5%

$1,117

0.07%

$0

$912

$0

$395

Const, A&D, Land Dev

181,778

18.1%

907

0.76%

16,556

458

0

419

Farmland

864

0.1%

0

0.00%

0

0

0

0

Equity Lines

79,563

7.7%

413

0.02%

0

44

0

92

1-4 Family

186,379

16.0%

1,683

0.13%

1,736

1,192

0

191

Multi-Family

30,172

2.8%

0

0.00%

0

0

0

0

Comm'l Owner Occupied

142,539

11.9%

1,989

0.02%

0

259

0

55

Comm'l Investment

288,081

25.4%

2,389

0.02%

2,034

16

0

1,190

C&I

111,251

10.1%

4,036

0.08%

0

59

0

410

Consumer & Leases

23,303

2.5%

8

0.01%

0

10

0

124

Total

$1,088,620

100.0%

$12,542

1.12%

$20,326

$2,950

$0

$2,876 |

Loan Portfolio and Asset Quality:

Construction, A&D and Land Loan Portfolio

16

Balances as of March 31, 2010

(Dollars in millions)

% of Total

Loans

3/31/2010

9/30/2008

18-Month Change

CONSTRUCTION, A&D, LAND

20.9%

$227.4

$306.2

-25.7%

Residential Construction

19.7%

44.7

89.3

-49.9%

Presold

7.7%

17.6

19.2

-8.3%

Speculative

11.9%

27.1

70.1

-61.3%

Loan size - Over $400,000

3.9%

8.8

25.3

-65.2%

Loan size - $200,000 to $400,000

4.9%

11.1

26.6

-58.3%

Loan size - Under $200,000

3.2%

7.2

18.2

-60.4%

Commercial Construction

18.9%

43.0

65.8

-34.7%

Loan size $5.0 to $8.0 million

0.0%

0.0

0.0

0.0%

Loan size $3.0 to $5.0 million

5.3%

12.0

31.8

-62.3%

Loan size $1.0 to $3.0 million

8.9%

20.2

19.6

3.1%

Loan size - under $1 million

4.7%

10.8

14.4

-25.0%

Residential and Commercial A&D

16.9%

38.5

66.0

-41.7%

Loan size $5.0 to $6.0 million

5.1%

11.6

5.6

107.1%

Loan size $3.0 to $5.0 million

3.3%

7.6

17.4

-56.3%

Loan size $1.0 to $3.0 million

6.8%

15.4

31.3

-50.8%

Loan size - under $1 million

1.7%

3.9

11.7

-66.7%

Land

44.5%

101.2

85.1

18.9%

Residential Buildable Lots

17.9%

40.6

26.6

52.6%

Commercial Buildable Lots

7.6%

17.3

13.8

25.4%

Land held for development

12.4%

28.2

30.0

-6.0%

Raw and Agricultural Land

6.6%

15.1

14.7

2.7% |

Loan Portfolio and Asset Quality:

Commercial Real Estate Portfolio

17

Balances as of March 31, 2010

(Dollars in millions)

% of Total

Loans

3/31/2010

9/30/2008

18-Month Change

COMMERCIAL REAL ESTATE

42.4%

$461.2

$340.2

35.6%

Multi-Family

6.5%

30.2

10.8

179.6%

Churches

3.6%

16.4

13.4

22.4%

Retail

66.6%

307.2

217.7

41.1%

Owner Occupied

19.3%

89.0

66.8

33.2%

Investment

47.3%

218.2

150.9

44.6%

Loan size - $5.0 to $6.0 million

8.9%

40.9

12.1

238.0%

Loan size - $3.0 to $5.0 million

7.7%

35.5

19.1

85.9%

Loan size - $1.0 to $3.0 million

15.7%

72.6

59.4

22.2%

Loan size - under $1 million

15.0%

69.2

60.3

14.8%

Industrial

22.4%

103.5

93.0

11.3%

Owner Occupied

7.9%

36.3

34.5

5.2%

Investment

14.6%

67.2

58.5

14.9%

Loan size - $5.0 to $6.0 million

1.1%

5.1

5.1

0.0%

Loan size - $3.0 to $5.0 million

0.7%

3.3

3.5

-5.7%

Loan size - $1.0 to $3.0 million

6.5%

29.9

22.9

30.6%

Loan size - under $1 million

6.3%

28.9

27.0

7.0%

Other

0.8%

3.9

5.3

-26.4% |

Loan Portfolio and Asset Quality:

Non-Owner Occupied CRE Portfolio

18

Diversified, Small Concentrations

Balances as of March 31, 2010

(Dollars in Thousands)

Property Type

Current Exposure

% of CRE

Non-Owner

Occupied

% of Total

Loans

Office - Professional & Management

$47,112

16.4%

4.3%

Retail Centers

32,116

11.2%

3.0%

Hotels and Motels - National Chains

34,630

12.1%

3.2%

Manufacturing and Industrial

26,773

9.3%

2.5%

Office Multi-use

23,422

8.2%

2.2%

Showroom Space

8,068

2.8%

0.7%

Restaurants

19,349

6.7%

1.8%

Residential Buildings and Dwellings

11,380

4.0%

1.0%

Miniwarehouses and Self-Storage Units

13,903

4.8%

1.3%

New & Used Car Dealers

10,911

3.8%

1.0%

Office - Finance & Insurance

8,112

2.8%

0.7%

Office - Medical

10,906

3.8%

1.0%

Child Day Care Services

7,092

2.5%

0.7%

Automotive Repair & Care

5,810

2.0%

0.5%

Golf Courses and Country Clubs

4,011

1.4%

0.4%

Retail Single-Use

14,003

4.9%

1.3%

Non-Profits/Government

1,756

0.6%

0.2%

Construction Industry

5,092

1.8%

0.5%

Wholesale Trade - Single Use

2,688

0.9%

0.2%

Total CRE - Non-Owner Occupied

287,133

100.0%

26.4%

Office: No deal larger than $4mm

Retail: No deal larger than $5mm

Strong Credit-Tenant Deals

Hotels: Diversified by Area

Examples:

Hilton Garden Inn

Holiday Inn Express

Hampton Inn

Restaurants: National Chain-

Credit Tenants

Examples:

Bojangles-

multiple locations

IHOP |

19

Quality

Competence

Discipline |

Experienced Management

•

Strong culture of management and employee ownership

•

Experienced and established management team with average tenure of more

than 25 years •

Insider ownership of more than 19.7%

20

Name

Prior

Experience

Years of

Experience

Current Position

W. Swope Montgomery, Jr.

Wachovia,

SunTrust

39

President &

Chief Executive Officer

Richard D. Callicutt II

Wachovia,

FirstUnion

29

Executive Vice President &

Chief Operating Officer

David Spencer

KPMG,

FirstSouth Bank

25

Executive Vice President &

Chief Financial Officer

Tom Nelson

Bank of

America

25

Chief Credit Officer

Reid Marks

Bank of

America

34

Commercial Banking

Manager |

Veteran Credit Team

21

Red denotes those in banking during real estate problems of early

`80s •

Experienced credit team with average tenure of greater than 25 years and

experience through various economic and credit cycles

Name

Title at BNC

Experience, Positions Held

Years of Banking

Experience

Tom Nelson

Chief Credit Officer

Bank of America, Credit Policy and Underwriting, Former USMC

Aviator 25

Larry Brown

Sr

Credit

Officer

-

Corporate

Wachovia Bank. Commercial Lending, Area Credit Officer

43

Janet Helms

Sr

Credit

Officer

-

South

Region

Wachovia Bank/First Union. Commercial RE Underwriting

26

Mike Thomas

Sr

Credit

Officer

-

Real

Estate

BB&T,

Credit

Admin

-

Real

Estate

Development

23

Daren Fuller

Sr

Credit Info Officer

LSB, Credit Administration

17

Link Ward

Sr

Credit

Officer

-

Consumer

BB&T, Wachovia

21

Ben Parks

Credit Review

Wachovia, Bank of America

40

Amy Likens

Sr

Credit

Analyst

-

South

Region

Wachovia, Senior Loan Review and Risk Officer

21

Christine O'Brien

Sr

Credit

Analyst

-

Triad

Region

First Charter, Commercial Loan Analyst Manager

12

Reid Marks

Triad Comm

Banking Mgr

Bank of America, Commercial and Middle Market President

34

Bill Connolly

Concord City Executive

BB&T, SouthTrust, FirstCharter, Business Banking Exec of NC

36

Dana Ritchie

Harrisburg City Executive

CCB (SunTrust), Commercial Lending

35

Earl Snipes

Thomasville City Executive

LSB, Senior Commercial Lender

33

Heather Grossnickle

Greensboro City Executive

SunTrust, BB&T, BofA, Regional Commercial Team Manager

29

Mark Lewis

Salisbury City Executive

Wachovia, CCB (SunTrust), Commercial Loan Manager

25

John Bencini

High Point City Executive

High Point Bank, Commercial Banking Manager

19

Rob Ellenburg

Mooresville City Executive

First Charter, SouthTrust, City Executive Lake Norman Region

11

Randy Carda

High Point Commercial Banker

First Citizens, BB&T, Credit Policy Officer, Market Executive

21

Bill McMurray

Lexington Region Executive

First Union, Market President, Commercial Banking Mgr

38

Brent Bridges

Triad Region Commercial Bkg

Wachovia, BofA, City Executive, Commercial Banking Mgr

30

Jim Bowman

Triad Commercial Real Estate

Centura, 1st Home Federal, Manager, A&D and Construction

36 |

Core Deposit Growth Initiatives

22

•

Retail Banking

•

In early 2009, hired seasoned Retail Banking Manager from Wachovia

•

Creating consistency in delivery, service, products, and sales throughout

the retail footprint

•

Creating greater levels of accountability and rewards for

performance •

Treasury Services

•

In mid 2008, hired seasoned Treasury Services Professional from

Wachovia •

Previous clients included major US municipalities

•

Hired four calling officers with Treasury experience to market this

platform •

Additionally, Beach First has a strong treasury group which has been very

successful in the property management and HOA sectors in market

•

Private Banking

•

In second quarter of 2009, hired seasoned premiere banking manager from

Bank of America

•

Recruiting premier and private bankers for the affluent markets of

Greensboro, Concord, and Lake Norman areas

•

Goals per Banker: $60 million in core deposits, $40 million in executive

loans, $50 million in investment product referrals

|

Leverage Transaction Highlights

23

•

Bought Government Agency MBS at attractive yields and at prices between 98

and 102

•

Purchased municipal securities with strong underlying ratings and AAA

insurance •

Assured Guaranty and Texas School District Fund as primary insurers

•

Funded overnight initially, which acted as a hedge to our Prime based loan

portfolio

•

Lead bank in structuring a funding transaction that allowed BNC to lock in

five year UNSECURED funding at an effective cost of 2.95%

•

Earnings have helped cover cost of CPP dividends, provision and continuing

efforts to build infrastructure with exceptional talent

•

Unsecured funding allowed BNC to pay off $300 million in FHLB borrowings,

thus reducing the FHLB stock requirement by $10 million

•

Increased on-balance sheet liquidity from 9% to 30% during a time when

liquidity is a priority for safety and soundness

|

24

Quality

Competence

Discipline |

FDIC Assisted Transaction Timeline

25

August 2009

–

Met with Banks Street Partners, LLC (BSP) to discuss assisted transaction

opportunities September 2009

–

BSP and management presents to BNC Board of Directors modeling on

specific potential transactions; BSP engaged as financial

advisor October 2009

–

Company

engages Womble

Carlyle in Atlanta as special legal counsel; face-to-face

discussions held with state and federal regulators

October 2009-January 2010

–

Company explores offensive capital opportunities

November

2009-

DD&F Consulting engaged to begin assisting Functional Leaders with

strategic plans for takeover weekend and post FDIC deal

integration January 2010 to March 2010

–

BNC management meets with various winners of previous FDIC

transactions to better understand the bid preparation methodology and the

necessary infrastructure build to meet loss share and workout

requirements. February 2010

–

Bank of North Carolina’s regulatory exam is completed

March 2010

–

Management and BSP evaluate Beach First National Bank assisted

transaction and decide to pursue first bid

Final Month

•Team of 12 employees conduct

week-long onsite due diligence at Beach First National Bank

headquarters

•Management evaluates pro forma balance

sheet and arrives at final bid

•Transaction completed

|

Strategic Rationale For Beach First Deal

•

Earn our way through the credit cycle

•

Immediately accretive to earnings per share and tangible book value per

share •

Opportunity to enhance core earnings

•

Improves funding mix. Strong core deposit growth opportunities

•

Protect our balance sheet

•

Loss-share agreement protects Bank of North Carolina on acquired

loans •

Higher pro forma capital levels at both the bank and holding company

•

Strong balance sheet liquidity

•

Prepare for the future

•

Expands Bank of North Carolina’s presence into South Carolina

•

Presents opportunity to grow core deposit franchise

•

Future opportunities for growth due to continued market disruption

26 |

On the Offensive

27

•

Beach First transaction is evidence of BNC’s plan to be an

opportunistic and disciplined consolidator in the banking

industry •

Managements sees multiple attractive opportunities in our current and

contiguous markets

•

Envision building a larger franchise through a combination of strong

organic growth and opportunistic transactions which can provide

meaningful franchise value

•

BNC acknowledges that offensive capital may be required from time to time

to fund certain of these opportunities. Management has

resisted raising excessive offensive capital at depressed valuation

metrics over the past eighteen months. •

Contingent capital for specific transactions provides a win-win for

existing and new shareholders

•

Will consider non-contingent capital raises that can be supported by

known organic growth opportunities |

The Place to

Be, for All the Right Reasons No Customer, Employee, Director, or Financial

Representation is worth compromising the Integrity

of our Organization. The Integrity of BNC is its most

cherished Asset. |