Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-34172

Fresenius Kabi Pharmaceuticals Holding, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 98-0589183 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |

| Else-Kroener-Strasse 1 61352 Bad Homburg v.d.H. Germany |

||

| (Address of principal executive offices) | (Zip Code) | |

+49 (6172) 608 0

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address or Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 3, 2010, all of the shares of the registrant’s common stock were held by Fresenius Kabi AG.

Table of Contents

Fresenius Kabi Pharmaceuticals Holding, Inc.

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS |

Fresenius Kabi Pharmaceuticals Holding, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| March 31, 2010 |

December 31, 2009 |

|||||||

| (in thousands, except share data) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 10,693 | $ | 10,469 | ||||

| Accounts receivable, net |

90,197 | 85,517 | ||||||

| Inventories |

213,975 | 212,065 | ||||||

| Prepaid expenses and other current assets |

20,241 | 31,606 | ||||||

| Current receivables from related parties |

2,014 | 1,219 | ||||||

| Income taxes receivable |

18,238 | 51,963 | ||||||

| Deferred income taxes |

19,335 | 18,880 | ||||||

| Total current assets |

374,693 | 411,719 | ||||||

| Property, plant and equipment, net |

124,626 | 129,784 | ||||||

| Intangible assets, net |

496,486 | 506,215 | ||||||

| Goodwill |

3,664,371 | 3,664,371 | ||||||

| Deferred financing costs |

122,088 | 117,166 | ||||||

| Other non-current assets, net |

9,534 | 29,430 | ||||||

| Total assets |

$ | 4,791,798 | $ | 4,858,685 | ||||

| Liabilities and stockholder’s equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 45,661 | $ | 53,238 | ||||

| Accrued liabilities |

63,761 | 57,320 | ||||||

| Current payables to related parties |

14,769 | 9,914 | ||||||

| Accrued intercompany interest |

48,307 | 47,141 | ||||||

| Current portion of long-term debt |

76,475 | 76,475 | ||||||

| Current portion of intercompany debt |

371,325 | 441,511 | ||||||

| Total current liabilities |

620,298 | 685,599 | ||||||

| Long-term debt |

875,219 | 844,969 | ||||||

| Deferred income taxes, non-current |

35,712 | 77,593 | ||||||

| Fair value of interest rate swaps with Parent and affiliates |

59,858 | 53,188 | ||||||

| Intercompany notes payable to Parent and affiliates |

2,612,596 | 2,591,693 | ||||||

| CVR payable |

24,488 | 48,976 | ||||||

| Other non-current liabilities |

17,939 | 17,591 | ||||||

| Total liabilities |

4,246,110 | 4,319,609 | ||||||

| Stockholder’s equity: |

||||||||

| Common stock - $0.001 par value; 1,000 shares authorized in 2010 and 2009; 1,000 shares issued and outstanding in 2010 and 2009 |

— | — | ||||||

| Additional paid-in capital |

900,501 | 900,379 | ||||||

| Accumulated deficit |

(330,964 | ) | (342,830 | ) | ||||

| Accumulated other comprehensive loss |

(23,849 | ) | (18,473 | ) | ||||

| Total stockholder’s equity |

545,688 | 539,076 | ||||||

| Total liabilities and stockholder’s equity |

$ | 4,791,798 | $ | 4,858,685 | ||||

See accompanying notes to condensed consolidated financial statements

3

Table of Contents

Fresenius Kabi Pharmaceuticals Holding, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2010 | 2009 | |||||||

| (in thousands) | ||||||||

| Net revenue |

$ | 216,199 | $ | 192,197 | ||||

| Cost of sales |

118,433 | 92,177 | ||||||

| Gross profit |

97,766 | 100,020 | ||||||

| Operating expenses: |

||||||||

| Research and development |

5,596 | 6,699 | ||||||

| Selling, general and administrative |

27,689 | 23,454 | ||||||

| Amortization of merger related intangibles |

9,163 | 9,163 | ||||||

| Total operating expenses |

42,448 | 39,316 | ||||||

| Income from operations |

55,318 | 60,704 | ||||||

| Interest expense |

(17,649 | ) | (39,309 | ) | ||||

| Intercompany interest expense |

(57,471 | ) | (52,555 | ) | ||||

| Unrealized gain (loss) in the fair value of contingent value rights |

24,488 | (3,265 | ) | |||||

| Interest income and other, net |

3,477 | 6,325 | ||||||

| Income (loss) before income taxes |

8,163 | (28,100 | ) | |||||

| Income tax benefit |

(3,703 | ) | (16,995 | ) | ||||

| Net income (loss) |

$ | 11,866 | $ | (11,105 | ) | |||

See accompanying notes to condensed consolidated financial statements

4

Table of Contents

Fresenius Kabi Pharmaceuticals Holding, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2010 | 2009 | |||||||

| (in thousands) | ||||||||

| Cash flows from operating activities: |

||||||||

|

Net income (loss) |

$ | 11,866 | $ | (11,105 | ) | |||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

||||||||

| Depreciation |

5,132 | 5,190 | ||||||

| Amortization |

9,389 | 6,848 | ||||||

| Amortization of merger related intangibles |

9,163 | 9,163 | ||||||

| Write-off of deferred financing fees |

— | 14,661 | ||||||

| Gain on non-cash foreign currency transactions |

(3,262 | ) | (6,188 | ) | ||||

| Change in fair value contingent value rights |

(24,488 | ) | 3,265 | |||||

| Stock-based compensation |

122 | 58 | ||||||

| (Gain) loss on disposal of property, plant and equipment |

(625 | ) | 374 | |||||

| Deferred income taxes |

(38,755 | ) | 13,396 | |||||

| Other non-cash charges |

475 | 854 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Accounts receivable, net |

(4,680 | ) | (9,553 | ) | ||||

| Inventories |

(1,910 | ) | (25,922 | ) | ||||

| Current receivables from related parties |

(795 | ) | (14,002 | ) | ||||

| Income taxes receivable |

33,725 | (32,219 | ) | |||||

| Prepaid expenses and other current assets |

2,011 | (7,064 | ) | |||||

| Other non-current assets |

158 | 27,806 | ||||||

| Intercompany payable to Parent and affiliates |

3,328 | (2,129 | ) | |||||

| Accrued intercompany interest |

1,166 | 30,357 | ||||||

| Other non-current liabilities |

348 | (6 | ) | |||||

| Accounts payable and accrued liabilities |

(1,807 | ) | 14,036 | |||||

| Intercompany payable to Parent and affiliates, non-current |

— | (12,437 | ) | |||||

| Net cash provided by operating activities |

561 | 5,383 | ||||||

| Cash flows from investing activities: |

||||||||

| Purchases of property, plant and equipment |

(2,308 | ) | (3,739 | ) | ||||

| Purchases of other non-current assets |

— | (2,500 | ) | |||||

| Proceeds from sale of fixed assets |

2,732 | — | ||||||

| Proceeds from note receivable from Parent |

— | 33,800 | ||||||

| Cash paid for Fresenius merger |

— | (2,000 | ) | |||||

| Net cash provided by investing activities |

424 | 25,561 | ||||||

| Cash flows from financing activities: |

||||||||

| (Payments) borrowings under unsecured credit facility, net |

(70,000 | ) | 30,500 | |||||

| Proceeds of borrowings under secured credit facility, net |

80,000 | — | ||||||

| Payments of deferred financing costs |

(12,217 | ) | (64,277 | ) | ||||

| Net cash used in financing activities |

(2,217 | ) | (33,777 | ) | ||||

| Effect of exchange rates on cash and cash equivalents |

1,456 | (784 | ) | |||||

| Net increase (decrease) in cash and cash equivalents |

224 | (3,617 | ) | |||||

| Cash and cash equivalents, beginning of period |

10,469 | 8,441 | ||||||

| Cash and cash equivalents, end of period |

$ | 10,693 | $ | 4,824 | ||||

5

Table of Contents

| Three Months Ended March 31, | ||||||||

| 2010 | 2009 | |||||||

| (in thousands) | ||||||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash received/ (paid) during the period for: |

||||||||

| Interest |

$ | (65,927 | ) | $ | (35,116 | ) | ||

|

Income taxes |

$ | (539 | ) | $ | (1,770 | ) | ||

|

Supplemental schedule of noncash investing and financing activities: |

||||||||

| Deferred financing fees paid on Company’s behalf |

$ | 1,526 | $ | — | ||||

See accompanying notes to condensed consolidated financial statements

6

Table of Contents

FRESENIUS KABI PHARMACEUTICALS HOLDING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2010

(Unaudited)

(1) Summary of Significant Accounting Policies

Basis of Presentation

On September 10, 2008, APP Pharmaceuticals, Inc. (“APP” or “the Predecessor”) became a direct, wholly-owned operating subsidiary of Fresenius Kabi Pharmaceuticals Holding, Inc. (“FKP Holdings” or “the Company”) and an indirect wholly-owned subsidiary of Fresenius SE (“Fresenius” or “the Parent”) a societas europaea organized under the laws of the European Union and Germany, upon completion of the merger (the “Merger”) of a wholly-owned subsidiary of FKP Holdings (“Merger Sub”) with and into APP pursuant to the Agreement and Plan of Merger dated July 6, 2008 (the “Merger Agreement”) by and among Fresenius, FKP Holdings, Merger Sub and APP.

FKP Holdings is a Delaware corporation and an indirect wholly-owned subsidiary of Fresenius. FKP Holdings was formed on July 2, 2008, and prior to the Merger had not carried on any activities or operations except for those activities incidental to its formation and in connection with the transactions related to the Merger. Following the Merger, the assets and business of FKP Holdings consisted exclusively of those of APP prior to the Merger.

The Company incurred indebtedness in connection with the Merger, the aggregate proceeds of which were sufficient to pay the aggregate Merger consideration, repay a portion of the Company’s then outstanding indebtedness and pay fees and expenses related to the Merger. The Company also issued contingent value rights (“CVRs”) to the holders of APP common stock and the holders of stock options and restricted stock issued by APP prior to the Merger. The term “Transactions” refers to, collectively, (1) the Merger, (2) the incurrence of the initial merger-related indebtedness, and (3) the issuance of the CVRs. Fresenius has committed to the Company that it will provide financial support to FKP Holdings sufficient for it to satisfy its obligations and debt service requirements arising under the Company’s existing financing instruments that were incurred in connection with the Merger as they come due until at least January 1, 2011.

Certain prior period balances have been reclassified to conform to the presentation adopted in the current period.

Principles of Consolidation

The unaudited condensed consolidated financial statements of FKP Holdings include: (a) the assets, liabilities and results of operations of FKP Holdings, and (b) the assets, liabilities and results of operations of APP and its wholly owned subsidiaries (Pharmaceutical Partners of Canada, Inc. and APP Pharmaceuticals Manufacturing, LLC). All material intercompany balances and transactions have been eliminated in consolidation. APP is a wholly owned subsidiary of FKP Holdings, which itself is a wholly-owned subsidiary of its sole stockholder Fresenius Kabi AG. Fresenius Kabi AG is a wholly-owned subsidiary of Fresenius.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements. Estimates may also affect the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Recent Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2010-06 that requires additional disclosures about (1) the different classes of assets and liabilities measured at fair value, (2) the valuation techniques and inputs used, (3) the sensitivity of fair value measurements to changes in assumptions, and (4) transfers between the three levels of the fair value hierarchy. The disclosures about purchases, sales , issuances, and settlements relating to Level 3 measurements are effective for fiscal years beginning after December 15, 2010, and for the interim periods within those fiscal years. The Company is currently evaluating the impact of adopting this guidance but does not anticipate it will have a material impact on our results of operations or financial condition. All other requirements of this ASU were effective in interim and annual periods beginning after December 15, 2009. The adoption of this guidance had no impact on our condensed consolidated financial statements.

In June 2009, the FASB issued ASU 2009-17, which eliminates the exceptions to the rules requiring consolidation of qualifying special-purpose entities (the “QSPE”), which means more entities will be subject to consolidation assessments and reassessments. The guidance also requires ongoing reassessment of whether a company is the primary beneficiary of a variable interest entity (“VIE”) and clarifies characteristics that identify a VIE. In addition, additional disclosures about a company’s involvement with a VIE and any significant changes in risk exposure due to that involvement are required. This guidance was effective for the Company beginning in 2010, and its adoption of this guidance had no impact on our condensed consolidated financial statements.

7

Table of Contents

(2) Merger with APP

On September 10, 2008, FKP Holdings completed the Merger, following which APP became a wholly-owned subsidiary of FKP Holdings. The results of APP’s operations have been included in the consolidated financial statements of FKP Holdings since September 10, 2008. APP is a fully-integrated pharmaceutical company that develops, manufactures and markets injectable pharmaceutical products with a primary focus on the oncology, anti-infective, anesthetic/analgesic and critical care markets. APP manufactures a comprehensive range of dosage formulations, and its products are used in hospitals, long-term care facilities, alternate care sites and clinics within North America. The Merger was an important step in Fresenius’ growth strategy, because it enabled Fresenius to gain entry to the U.S. pharmaceuticals market and to achieve a leading position in the global I.V. generics industry. The North American platform also provides further growth opportunities for Fresenius’ existing product portfolio.

The aggregate consideration paid in the Merger was $4,908.1 million (including assumed APP debt), comprised as follows (in millions):

| Purchase of outstanding common stock (cash portion) |

$ | 3,702.7 | |

| Buy-out of restricted stock units and stock options under stock compensation plans |

27.7 | ||

| Estimated fair value of CVRs |

158.4 | ||

| Direct acquisition costs |

21.8 | ||

| Fair value of consideration paid |

3,910.6 | ||

| Assumption of APP debt |

997.5 | ||

| Total aggregate consideration |

$ | 4,908.1 | |

The CVRs were issued on the acquisition date and trade on the NASDAQ capital market (“NASDAQ”) under the symbol “APCVZ”. The fair value of the CVRs at the date of the acquisition was estimated based on the average of their closing prices for the five trading days following the acquisition. Direct costs of the acquisition include investment banking fees, legal and accounting fees and other external costs directly related to the acquisition. Approximately $2.0 million in costs related to the acquisition were paid in the quarter ended March 31, 2009.

On September 8, 2009, the Board of Directors of FKP Holdings formally approved management’s plan to close the Barceloneta, Puerto Rico manufacturing facility and transfer production operations to existing Company plants in the United States. This action is consistent with the Company’s objective to lower overall manufacturing costs and to strengthen the Company’s long-term competitive position. The closure is expected to be substantially completed by mid 2010. Various plans to lower the Company’s overall manufacturing costs, including the closure of the Puerto Rico manufacturing facility along with the transfer of its production operations to existing Company plants in the United States, were under consideration from the date of the acquisition and, accordingly, the decision to close this facility resulted in various adjustments to the estimated amounts assigned to certain assets acquired, liabilities assumed and residual goodwill in connection with the APP acquisition, associated tax effects were also recorded in purchase accounting.

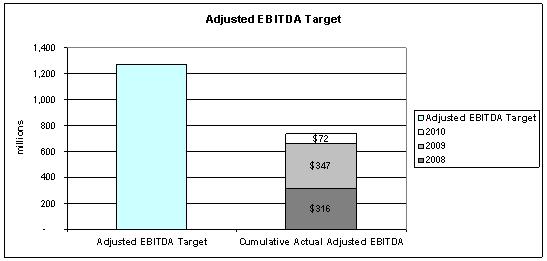

(3) Adjusted EBITDA Calculation for Contingent Value Rights

In connection with the Merger, each APP shareholder was issued one contingent value right of FKP Holdings for each share held. The CVRs are intended to give holders an opportunity to participate in any excess Adjusted EBITDA, as defined in the CVR Indenture, generated by FKP Holdings during the three years ending December 31, 2010, referred to as the “CVR measuring period,” in excess of a threshold amount. Each CVR represents the right to receive a pro rata portion of an amount equal to 2.5 times the amount by which cumulative Adjusted EBITDA of APP and FKP Holdings and their subsidiaries on a consolidated basis, exceeds $1.267 billion for the three years ending December 31, 2010. If Adjusted EBITDA for the CVR measuring period does not exceed this threshold amount, no amounts will be payable on the CVRs and the CVRs will expire valueless. The maximum amount payable under the CVR Indenture is $6.00 per CVR. The cash payment on the CVRs, if any, will be determined after December 31, 2010, and will be payable June 30, 2011, except in the case of a change of control of FKP Holdings, which may result in an acceleration of any payment. The acceleration payment, if any, is payable within six months after the change of control giving rise to the acceleration payment.

The CVRs do not represent equity, or voting securities of FKP Holdings, and they do not represent ownership interests in FKP Holdings. Holders of the CVRs are not entitled to any rights of a stockholder or other equity or voting securities of FKP Holdings, either at law or in equity. Similarly, holders of CVRs are not entitled to any dividends declared or paid with respect to any equity security of FKP Holdings. A holder of a CVR is entitled only to those rights set forth in the CVR Indenture. Additionally, the right to receive amounts payable under the CVRs, if any, is subordinated to all senior obligations of FKP Holdings.

8

Table of Contents

Because any amount payable to the holders of CVRs must be settled in cash, the CVRs are classified as liabilities in the accompanying condensed consolidated financial statements. The estimated fair value of the CVRs at the date of acquisition was included in the cost of the acquisition. At each reporting date, the CVRs are marked-to-market based on the closing price of a CVR as reported by NASDAQ, and the change in the fair value of the CVRs for the reporting period is included in the statements of operations. At March 31, 2010 and December 31, 2009, the carrying value of the CVR liability was approximately $24.5 million and $49.0 million, respectively.

(4) Inventories

Inventories are valued at the lower of cost or market as determined under the first-in, first-out, or FIFO method, as follows (in thousands):

| For the Period Ended | ||||||||||||||||||||

| March 31, 2010 | December 31, 2009 | |||||||||||||||||||

| Approved | Pending Regulatory Approval |

Total Inventory | Approved | Pending Regulatory Approval |

Total Inventory | |||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Finished goods |

$ | 75,417 | 16,276 | $ | 91,693 | $ | 70,551 | 16,733 | $ | 87,284 | ||||||||||

| Work in process |

39,265 | 1,751 | 41,016 | 27,934 | 1,499 | 29,433 | ||||||||||||||

| Raw materials |

75,998 | 5,268 | 81,266 | 90,476 | 4,872 | 95,348 | ||||||||||||||

| $ | 190,680 | $ | 23,295 | $ | 213,975 | $ | 188,961 | $ | 23,104 | $ | 212,065 | |||||||||

Inventories consist of products currently approved for marketing and costs related to certain products that are pending regulatory approval. From time to time, we capitalize inventory costs associated with products prior to regulatory approval based on our judgment of probable future approval, commercial success and realizable value. Such judgment incorporates our knowledge and best judgment of where the product is in the regulatory review process, our required investment in the product, market conditions, competing products and our economic expectations for the product post-approval relative to the risk of manufacturing the product prior to approval. In evaluating the market value of inventory pending regulatory approval as compared to the capitalized cost, we considered the market, pricing and demand for competing products, our anticipated selling price for the product and the position of the product in the regulatory review process. If final regulatory approval for such products is denied or delayed, we revise our estimates and judgments about the recoverability of the capitalized costs and, where required, provide reserves for or write-off such inventory in the period those estimates and judgments change.

At March 31, 2010 and December 31, 2009, inventory included $23.3 and $23.1 million, respectively, in costs related to products pending approval by the United States Food and Drug Administration (“FDA”).

We routinely review our inventory and establish reserves when the cost of the inventory is not expected to be recovered or the cost of a product exceeds estimated net realizable value. In instances where inventory is at or approaching expiration, is not expected to be saleable based on our quality and control standards, or is selling for a price below cost, we reserve for any inventory impairment based on the specific facts and circumstances. Provisions for inventory reserves are reflected in the unaudited condensed consolidated financial statements as an element of cost of sales; inventories are presented net of related reserves.

9

Table of Contents

(5) Long-Term Debt and Credit Facility

A summary of our external and intercompany debt is as follows:

| March 31, 2010 |

December 31, 2009 |

|||||||

| Senior Credit Facilities, with interest at variable rates based on LIBOR plus a margin. Term loan B2 and C2 are subject to a minimum rate. |

||||||||

| Term loan A2, due in semi-annual installments through September 10, 2013,) |

$ | 462,500 | $ | 462,500 | ||||

| Term loan B2, due in equal semi-annual installments with a final balloon payment on September 10, 2014, |

— | 458,944 | ||||||

| Term loan C2, due in equal semi-annual installments beginning June 10, 2010, with a final balloon payment on September 10, 2014, |

409,194 | — | ||||||

| Target revolving credit facility loan, due at expiration of the facility on September 10, 2013. |

80,000 | — | ||||||

| Total external debt |

951,694 | 921,444 | ||||||

| Current maturities of external debt |

(76,475 | ) | (76,475 | ) | ||||

| Long-term external debt |

$ | 875,219 | $ | 844,969 | ||||

| Internal debt |

||||||||

| Intercompany Credit Facilities |

||||||||

| Short-term unsecured intercompany loans payable to Fresenius Kabi AG, due in 30 to 60 days from date of issue, with interest at fixed rates |

$ | 290,000 | $ | 360,000 | ||||

| Secured senior intercompany loans payable to a financing subsidiary of Fresenius SE, with interest at variable rates based on LIBOR or EURIBOR plus a margin. Term loan B1 and C1 are subject to a minimum rate. |

||||||||

| Term loan A1, due in semi-annual installments through September 10, 2013, |

462,500 | 462,500 | ||||||

| Term loan B1, due in equal semi-annual installments with a final balloon payment on September 10, 2014. |

— | 657,742 | ||||||

| Term loan C1, due in equal semi-annual installments with a final balloon payment on September 10, 2014, |

586,442 | — | ||||||

| Euro currency term loan B1 (€197.5 million), due in equal semi-annual installments with a final balloon payment on September 10, 2014, |

— | 265,791 | ||||||

| Euro currency term loan C1 (€164.5 million), due in equal semi-annual installments with a final balloon payment on September 10, 2014, |

221,730 | — | ||||||

| Unsecured intercompany loans payable to a financing subsidiary of Fresenius SE, due July 15, 2015, with interest at fixed rates |

||||||||

| US dollar denominated |

500,000 | 500,000 | ||||||

| Euro currency denominated (€115.7 million) |

155,943 | 166,668 | ||||||

| Unsecured intercompany loans payable to Fresenius Kabi AG, with interest at fixed rates due September 10, 2014 |

||||||||

| Loans payable |

456,243 | 456,243 | ||||||

| Loans payable |

199,732 | 78,682 | ||||||

| Loan payable |

66,850 | 66,850 | ||||||

| Euro currency denominated loans payable (€33.0 million) due October 9, 2014 |

44,481 | 18,728 | ||||||

| Total intercompany debt |

2,983,921 | 3,033,204 | ||||||

| Current maturities of intercompany debt |

(371,325 | ) | (441,511 | ) | ||||

| Long-term intercompany debt |

$ | 2,612,596 | $ | 2,591,693 | ||||

Fresenius Merger—Credit Agreements

On August 20, 2008, in connection with the acquisition of APP, Fresenius entered into various credit arrangements to assist in funding the transaction. These credit facilities included a Senior Credit Facilities Agreement and a Bridge Facility Agreement. Proceeds from borrowings under these credit facilities, together with other available funds provided by Fresenius through equity contributions and loans to FKP Holdings and its subsidiaries, were utilized to complete the purchase of APP on September 10, 2008.

The Senior Credit Facilities Agreement provides APP Pharmaceuticals, LLC, a wholly owned subsidiary of APP, with two term loan facilities. The Senior Credit Facilities Agreement also provides APP Pharmaceuticals, LLC with a $150 million revolving credit facility.

10

Table of Contents

Pursuant to the Senior Credit Facilities Agreement, FKP Holdings and its subsidiaries have entered into various secured senior intercompany loans with finance subsidiaries of Fresenius SE (collectively, the “Senior Intercompany Loans”), the amount, maturity and other financial terms of which correspond to those applicable to the loans provided to such borrowers under the Senior Credit Facilities Agreement described above. The Senior Intercompany Loans are guaranteed by FKP Holdings and certain of its affiliates and subsidiaries and secured by the assets of FKP Holdings and certain of its affiliates and subsidiaries. The Senior Intercompany Loans provide for an event of default and acceleration if there is an event of default and acceleration under the Senior Credit Facilities Agreement, but acceleration of the Senior Intercompany Loans may not occur prior to acceleration of the loans under the Senior Credit Facilities Agreement. By entering into the Senior Intercompany Loans, Fresenius effectively pushed-down its Merger-related term loan borrowings under the Senior Credit Facilities Agreement to the FKP Holdings group.

The Senior Credit Facilities Agreement contains a number of affirmative and negative covenants that are assessed at the Fresenius level and are not separately assessed at FKP Holdings or its subsidiaries. The Company’s obligations under the Senior Credit Facilities Agreement are unconditionally guaranteed by Fresenius SE and certain of its subsidiaries, and are secured by a first-priority security interest in substantially all tangible and intangible assets of APP Pharmaceuticals, Inc. and APP Pharmaceuticals, LLC.

Post-Merger Activity

In October 2008, the amount available under the Senior Credit Facilities Agreement was increased and the full amount of the increase to the facility was drawn down. These funds, along with an additional $166.9 million of proceeds from other intercompany borrowings were used to repay a portion of the $1.3 billion outstanding under the Bridge Facility Agreement. On January 21, 2009, the borrower under the Bridge Facility Agreement, which is an affiliate of Fresenius, issued two tranches of notes in a private placement. Proceeds of the notes issuance were used, among other things, to repay in full the balance outstanding under the Bridge Facility Agreement. Upon the repayment of the bridge loan, the Bridge Intercompany Loan was refinanced and replaced with an Intercompany Dollar Loan of $500 million and an Intercompany Euro Loan of €115.7 million. These new intercompany loans are not guaranteed or secured. As a result of the refinancing, in the first quarter of 2009, the Company wrote-off $14.6 million of Bridge Intercompany Loan unamortized debt issuance costs and incurred debt issuance costs of $67.5 million for the new Intercompany Dollar and Euro loans.

On December 10, 2009 and February 10, 2010, the Company entered into three unsecured intercompany loans with Fresenius Kabi AG in the amount of €13 million, $46.3 million and $32.3 million and €20 million, $71.3 million and $49.8 million, respectively. These loans replaced Senior Intercompany Loans of like amounts. These Fresenius Kabi AG notes bear fixed interest rates. There was no change to principal maturity dates related to this exchange of notes.

On March 18, 2010, the 2008 Senior Credit Facilities Agreement was amended, and Term Loan B, consisting of APP’s Term Loan B2 of $409.2 million and Term Loan B1 (comprised of loans payable of €164.5 million and $586.4 million) were replaced with a lower interest bearing Term Loan C, consisting of APP’s Term Loan C2 of $409.2 million and Term Loan C1 (comprised of loans payable of €164.5 million and $586.4 million). Other amendments to the 2008 Senior Credit Agreement relate to the financial covenants, which are measured at the consolidated Fresenius SE level, as defined in the agreement. As a result of the debt replacement in the first quarter of 2010, the Company incurred debt issuance costs of $13.7 million for the Term Loan C, of which $12.2 million was paid directly by the Company and $1.5 million was pushed down from the Parent.

The following is the repayment schedule for Term Loans A2 and C2, Target Revolver and the intercompany loans outstanding as of March 31, 2010 (in thousands):

| Term Loan A2 | Term Loan C2 | Target Revolver |

Intercompany Fresenius |

Total | |||||||||||

| 2010 |

$ | 71,500 | $ | 4,975 | $ | — | $ | 371,325 | $ | 447,800 | |||||

| 2011 |

122,500 | 4,975 | — | 132,326 | 259,801 | ||||||||||

| 2012 |

150,000 | 4,975 | — | 159,826 | 314,801 | ||||||||||

| 2013 |

118,500 | 4,975 | 80,000 | 128,326 | 331,801 | ||||||||||

| 2014 |

— | 389,294 | — | 1,536,175 | 1,925,469 | ||||||||||

| 2015 and thereafter |

— | — | — | 655,943 | 655,943 | ||||||||||

| $ | 462,500 | $ | 409,194 | $ | 80,000 | $ | 2,983,921 | $ | 3,935,615 | ||||||

11

Table of Contents

(6) Derivatives

The Company does not engage in the trading of derivative financial instruments except where the Company’s objective is to manage the variability of forecasted principal and interest payments attributable to changes in interest rates or foreign currency exchange rate fluctuations. In general, the Company enters into derivative transactions in limited situations based on management’s assessment of current market conditions and perceived risks.

As a result of the use of derivative instruments, the Company is exposed to counterparty credit risk when these instruments are in an asset position. The Company manages the counterparty credit risk by entering into derivative contracts only with its Parent company and its affiliates. As a result, as of March 31, 2010, the Company does not expect to experience any losses as a result of default of its counterparty.

Foreign Currency Contracts: Included in our intercompany borrowings are several Euro-denominated notes, €197.5 million notes with a maturity in 2014 and a €115.7 million note with a maturity in 2015. In connection with these borrowings, we entered into intercompany foreign currency swap contracts in order to limit our exposure to changes in current exchange rates on the Euro-denominated notes principal balance. We have entered into foreign currency swaps with affiliates of Fresenius for the total of the Euro-denominated notes principal balance. These agreements mature at various dates through January 2012, and are not designated as hedging instruments for accounting purposes. For the three months ended March 31, 2010 and March 31, 2009 we recognized a foreign currency loss of approximately $25.8 million and $2.2 million, respectively, in our other income (expense) related to the change in fair value of these swap agreements. These foreign currency losses were offset by $29.0 million and $8.2 million in currency gains we recorded in the three months ended March 31, 2010 and March 31, 2009, respectively, in order to adjust the carrying value of the Euro-denominated notes to reflect the period-end exchange rate.

We have also entered into foreign currency hedges for the €18.9 million of future cash flows related to the interest payments due on the €197.5 million notes through December 12, 2011, and for the €25.4 million of future cash flows related to the interest payments on the €115.7 million note through January 17, 2012. These foreign currency agreements have been designated as hedges of our exposure to fluctuations in interest payments on outstanding Euro-denominated borrowings due to changes in Euro/U.S. dollar exchange rates (a cash flow hedge). The fair value of these foreign currency hedges at March 31, 2010 and December 31, 2009 is an asset of $0.7 million and $5.0 million, respectively, and is included in prepaid expenses and other current assets and other non-current assets, net in our condensed consolidated balance sheet. During the three months ended March 31, 2010 and 2009, we recognized a foreign currency loss of $4.3 million and a foreign currency gain of $2.1 million, respectively, in other comprehensive income (loss) related to these instruments.

Interest Rate Swaps: On November 3, 2008, we entered into four interest rate swap agreements with Fresenius for an aggregate notional principal amount of $900 million. These agreements require us to pay interest at an average fixed rate of 3.97% and entitle us to receive interest at a variable rate equal to three-month LIBOR, which is equal to the benchmark for the term A Loans being hedged, on the notional amount. The interest rate swaps expire in October 2011 and December 2013. These swaps have been designated as hedges of our exposure to fluctuations in interest payments on outstanding variable rate borrowings due to changes in interest rates (a cash flow hedge). The fair value of these interest rate swap agreements at March 31, 2010 and December 31, 2009 was a liability of $59.9 million and $53.2 million, respectively, and is included in long-term liabilities in our condensed consolidated balance sheets. As noted above, the Company entered into derivative contracts with its Parent, who pushed down the interest rate swap agreements to the Company. From inception of the agreements to the time the interest rate swaps were transferred to the Company, the Parent recognized $15.9 million in losses in other comprehensive income (loss). From the time the interest rate swap agreements were transferred to the Company through March 31, 2010, we recorded a deferred loss of $26.0 million, net of tax benefit of $16.4 million, in other comprehensive income (loss) and recognized $1.5 million, in intercompany interest expense, which represented the amount of hedge ineffectiveness.

12

Table of Contents

The fair value amounts in our condensed consolidated balance sheet at March 31, 2010 and December 31, 2009, related to foreign currency forward and interest rate swap contracts were as follows:

| Asset Derivatives |

Liability Derivatives | |||||||||

| March 31, 2010 (In millions) |

Balance Sheet Location |

Fair Value |

Balance Sheet Location |

Fair Value | ||||||

| Derivatives designated as hedging instruments |

||||||||||

| Foreign currency forward contracts-interest (current) |

Prepaid expense and other current assets | $ | 0.6 | Other accrued expenses | $ | — | ||||

| Foreign currency forward contracts-interest (non-current) |

Other non-current assets, net | 0.1 | Other non-current liabilities | — | ||||||

| Interest rate swap contracts (non-current) |

Other non-current assets, net | — | Fair value of interest rate swaps with Parent and affiliates | 59.9 | ||||||

| Total |

$ | 0.7 | $ | 59.9 | ||||||

| Asset Derivatives |

Liability Derivatives | |||||||||

| (In millions) |

Balance Sheet Location |

Fair Value |

Balance Sheet Location |

Fair Value | ||||||

| Derivatives not designated as hedging instruments |

||||||||||

| Foreign currency forward contracts (current) |

Prepaid expense and other current assets | $ | 1.2 | Other accrued expenses | $ | 0.7 | ||||

| Foreign currency forward contracts (non-current) |

Other non-current assets, net | 8.0 | Other non-current liabilities | — | ||||||

| Total |

$ | 9.2 | $ | 0.7 | ||||||

| Asset Derivatives |

Liability Derivatives | |||||||||

| December 31, 2009 (In millions) |

Balance Sheet Location |

Fair Value |

Balance Sheet Location |

Fair Value | ||||||

| Derivatives designated as hedging instruments |

||||||||||

| Foreign currency forward contracts-interest (current) |

Prepaid expense and other current assets | $ | 2.7 | Other accrued expenses | $ | — | ||||

| Foreign currency forward contracts-interest (non-current) |

Other non-current assets, net | 2.3 | Other non-current liabilities | — | ||||||

| Interest rate swap contracts (non-current) |

Other non-current assets, net | — | Fair value of interest rate swaps with Parent and affiliates | 53.2 | ||||||

| Total |

$ | 5.0 | $ | 53.2 | ||||||

| Asset Derivatives |

Liability Derivatives | |||||||||

| (In millions) |

Balance Sheet Location |

Fair Value |

Balance Sheet Location |

Fair Value | ||||||

| Derivatives not designated as hedging instruments |

||||||||||

| Foreign currency forward contracts (current) |

Prepaid expense and other current assets | $ | 8.6 | Other accrued expenses | $ | — | ||||

| Foreign currency forward contracts (non-current) |

Other non-current assets, net | 25.6 | Other non-current liabilities | — | ||||||

| Total |

$ | 34.2 | $ | — | ||||||

13

Table of Contents

The pretax derivative gains and losses in our condensed consolidated statements of operations for the three months ended March 31, 2010 and 2009, related to our foreign currency forward and interest rate swap contracts were as follows:

March 31, 2010

| Derivatives in Cash Flow Hedging Relationships |

Gain (Loss) Recognized in Other Comprehensive Income on Effective Portion of Derivative |

Gain (Loss) on Effective |

Ineffective Portion of Gain (Loss) on |

||||||||||||

| (In millions) |

Amount | Location |

Amount | Location |

Amount | ||||||||||

| Foreign currency forward contracts-interest |

$ | (4.3 | ) | Interest income and other, net | $ | — | Interest income and other, net | $ | 0.1 | ||||||

| Interest rate swap contracts |

(6.1 | ) | Interest income and other, net | — | Intercompany interest expense | (0.5 | ) | ||||||||

| Total |

$ | (10.4 | ) | $ | — | $ | (0.4 | ) | |||||||

| Derivatives Not Designated as Hedging Instruments |

Location of Gain (Loss) Recognized in Income on Derivative |

Gain (Loss) Recognized in Income on Derivative |

||||

| Foreign currency forward contracts |

Interest income and other, net |

$ | (25.8 | ) | ||

March 31, 2009

| Derivatives in Cash Flow Hedging Relationships |

Gain (Loss) Recognized in Other Comprehensive Income on Effective Portion of Derivative |

Gain (Loss) on Effective |

Ineffective Portion of Gain (Loss) on |

||||||||||||

| (In millions) |

Amount | Location |

Amount | Location |

Amount | ||||||||||

| Foreign currency forward contracts-interest |

$ | 2.1 | Interest income and other, net | $ | — | Interest income and other, net | $ | — | |||||||

| Interest rate swap contracts |

(3.9 | ) | Interest income and other, net | — | Intercompany interest expense | (0.9 | ) | ||||||||

| Total |

$ | (1.8 | ) | $ | — | $ | (0.9 | ) | |||||||

| Derivatives Not Designated as Hedging Instruments |

Location of Gain (Loss) Recognized in Income on Derivative |

Gain (Loss) Recognized in Income on Derivative |

||||

| Foreign currency forward contracts |

Interest income and other, net |

$ | (2.2 | ) | ||

(7) Fair Value Measurements

Accounting guidance on fair value measurements sets a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value for certain financial assets and liabilities. The basis of the fair value measurement is categorized in three levels, in order of priority, as described below:

| Level 1: | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. |

14

Table of Contents

| Level 2: | Quoted prices in markets that are not active, or financial instruments for which all significant inputs are observable either directly or indirectly. | |

| Level 3: | Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable, thus reflecting assumptions about the market participants. | |

In valuing assets and liabilities, we are required to maximize the use of quoted market prices and minimize the use of unobservable inputs. We calculated the fair value of our Level 1 and Level 2 instruments based on the exchange traded price of similar or identical instruments where available or based on other observable instruments. The Company has not changed its valuation techniques in measuring the fair value of any financial assets and liabilities during the period.

The following table sets forth the Company’s financial assets and liabilities as of March 31, 2010 that are measured at fair value on a recurring basis, segregated by level within the fair value hierarchy:

| Balance at March 31, 2010 |

Basis of Fair Value Measurement (in thousands) | |||||||||||

| Quoted Prices in Active Markets for Identical Items (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) | ||||||||||

| Assets – fair value of foreign currency swaps |

$ | 9,919 | $ | — | $ | 9,919 | $ | — | ||||

| Liabilities: |

||||||||||||

| Contingent value rights |

$ | 24,488 | $ | 24,488 | — | — | ||||||

| Fair value of interest rate swaps |

59,858 | — | 59,858 | — | ||||||||

| Fair value of foreign currency swaps |

671 | — | 671 | — | ||||||||

| Total liabilities |

$ | 85,017 | $ | 24,488 | $ | 60,529 | $ | — | ||||

(8) Related Party Transactions

Related parties balances and transactions for periods ended March 31, 2010 and 2009 pertain to balances and transactions with Fresenius and its direct and indirectly owned subsidiaries. Below is a discussion of these transactions.

Transactions with Fresenius

In connection with the Merger and associated financing transactions, FKP Holdings and its subsidiaries entered into a number of intercompany loan agreements with subsidiaries of Fresenius, the Company’s parent, as described in Note 5 to the condensed consolidated financial statements—Long-Term Debt and Credit Facility. At March 31, 2010 and December 31, 2009, the principal amount outstanding under these loans was $2,983.9 million and $3,033.2 million, respectively. Interest expense recognized on these intercompany loans for the three months ended March 31, 2010 and 2009 was $57.5 million and $52.6 million, respectively. Accrued interest of $48.3 million and $47.1 million was due on these intercompany loans at March 31, 2010 and December 31, 2009, respectively. As described in Note 5 to the condensed consolidated financial statements—Long-Term Debt and Credit Facility, in the period ended March 31, 2010 the Company paid $12.2 million in issuance costs related to the refinancing of the Term Loan C and $1.5 million was pushed down and included in current payables to related parties. Also, included in current payables to related parties is $11.8 million of inventory purchased from Fresenius subsidiaries during the three months ended March 31, 2010.

15

Table of Contents

| (9) | Goodwill and Other Intangibles |

As of March 31, 2010 and December 31, 2009, goodwill had a carrying value of $3,664.4 million, respectively. All of our intangible assets, other than goodwill, are subject to amortization. The following table reflects the components of identifiable intangible assets, all of which have finite lives, as of March 31, 2010 and December 31, 2009:

| March 31, 2010 | December 31, 2009 | Category Amortization Period | ||||||||||||

| Gross Carrying Amount |

Accumulated Amortization |

Gross Carrying Amount |

Accumulated Amortization |

|||||||||||

| (in thousands) | (in thousands) | |||||||||||||

| Developed product technology |

$ | 489,000 | $ | 38,041 | $ | 489,000 | $ | 31,928 | 20 years | |||||

| Product rights |

2,300 | 100 | 2,300 | 87 | 10 years | |||||||||

| Patents |

6,847 | 883 | 6,847 | 533 | 5 years | |||||||||

| Contracts and other |

45,500 | 13,914 | 45,500 | 11,641 | 5 years | |||||||||

| Customer relationships |

12,000 | 6,223 | 12,000 | 5,223 | 3 years | |||||||||

| Total |

$ | 555,647 | $ | 59,161 | $ | 555,647 | $ | 49,432 | ||||||

We amortize all of our identifiable intangible assets with finite lives over their expected period of benefit using the straight-line method. In determining the appropriate amortization period and method for developed product technology, we considered, among other things, the nature of the products, the anticipated timing of cash flows and the relatively high barriers to entry for competition due to the complex development and manufacturing processes. In addition, the products all share similar attributes in that they have a favorable risk profile (e.g., minimal side effects, adverse experiences, etc.) and are easy to administer to patients. Based on the risk profile and ease of use of the related products, we do not expect that new competing products will enter the market in the foreseeable future, and that the barriers to entry will help to protect the market positions of the products and preserve their useful lives. We have manufactured and sold many of our products for more than 20 years. Accordingly, as future cash flows with respect to these and our other products are expected to exceed 20 years, we have utilized the straight-line amortization method and a 20-year expected period of benefit. However, we cannot predict with certainty whether new competing products will enter the market, the timing of such competition or the Company’s ability to protect the market positions of its products and preserve their useful lives. In the event that we experience stronger or more rapid competition or other conditions that change the market positions of our products, we may need to accelerate the amortization of our developed product technology intangibles or recognize an impairment charge.

The Company follows the policy of capitalizing patent defense costs when it determines that such costs are recoverable from future product sales and a successful defense is probable. These costs are amortized over the remaining useful life of the patent. Patent defense costs are expensed as incurred until the criteria for capitalization are met; previously capitalized costs are written-off when it is determined that the likelihood of success is no longer considered probable. During the year ended December 31, 2009 the Company capitalized $6.8 million in legal costs related to the defense of its patents.

Amortization expense on intangible assets attributable to operations for the three months ended March 31, 2010 and 2009 was $9.7 million and $9.2 million, respectively. At March 31, 2010, the weighted average expected lives of intangibles was approximately 18.6 years. Total estimated amortization expense for our finite-lived intangible assets for the next five years is as follows:

| Estimated Amortization | |||

| (in thousands) | |||

| 2010 (9 months from 3/31/10 to 12/31/10) |

$ | 29,188 | |

| 2011 |

37,694 | ||

| 2012 |

34,917 | ||

| 2013 |

32,409 | ||

| 2014 |

25,494 | ||

| 2015 |

24,500 | ||

| 2016 (3 months ending 3/31/16) |

6,125 | ||

(10) Accrued Liabilities

Accrued liabilities consisted of the following at March 31, 2010 and December 31, 2009:

| March 31, 2010 |

December 31, 2009 | |||||

| (in thousands) | ||||||

| Sales and marketing |

$ | 33,284 | $ | 28,099 | ||

| Payroll and employee benefits |

17,298 | 17,935 | ||||

| Legal and insurance |

5,449 | 2,252 | ||||

| Accrued interest |

7,186 | 7,600 | ||||

| Other |

544 | 1,434 | ||||

| $ | 63,761 | $ | 57,320 | |||

16

Table of Contents

(11) Income Taxes

As of March 31, 2010, the total amount of gross unrecognized tax benefits, which are reported in other non-current liabilities in our unaudited condensed consolidated balance sheet, was $17.4 million. This entire amount would impact net income if recognized. In addition, we accrue interest and any necessary penalties related to unrecognized tax positions in our provision for income taxes. For the three month period ended March 31, 2010, $0.5 million of such interest was accrued.

A reconciliation of the beginning and ending gross unrecognized tax benefits is as follows:

| Amount | ||||

| (thousands) | ||||

| Balance at December 31, 2009 |

$ | 17,156 | ||

| Increase related to prior year tax positions |

350 | |||

| Settlements |

(91 | ) | ||

| Balance at March 31, 2010 |

$ | 17,415 | ||

For 2009, the Company reported a taxable loss due primarily to tax deductions related to interest expense and the closure of the Puerto Rico manufacturing facility. At year end 2009, the Company initially concluded that it would be able to file a carry back claim and recover approximately $36.7 million in taxes paid by APP in 2007. After further review, the Company concluded that the loss was not entirely eligible for carry back under the tax regulations, but instead may be carried forward and used to reduce taxes payable in future periods through 2029. Accordingly, in the accompanying condensed consolidated balance sheet as of March 31, 2010, the Company has reclassified the $34.2 million income tax receivable amount reported at December 31, 2009 to deferred income taxes. Deferred tax assets are recognized if, in management’s judgment, it is more likely than not such assets will be realized.

Through the date of the Merger, APP and its subsidiaries filed income tax returns in the U.S. Federal jurisdiction, Canada, Puerto Rico, and various state jurisdictions. On April 21, 2010, the Company received the Revenue Agent’s Report relating to the U.S. Federal income tax examination of tax years 2006 and 2007. We included $0.6 million of tax expense and $0.5 million of related interest in income tax expense in the quarter ended March 31, 2010 related to this examination. Tax years 2008 and 2009 are open for possible examination. APP is also currently under state income tax examinations in California, Illinois and North Carolina for various tax years. Although not currently under examination or audit, APP’s Canadian income tax returns for the 2005 through 2008 tax years, its Puerto Rico income tax returns for the 2006 through 2008 tax years, and its state income tax returns for the 2004 through 2008 tax years remain open for possible examination by the appropriate governmental agencies. There are no other open federal, state, or foreign government income tax audits at this time.

On September 10, 2008, the date of the Merger, a wholly-owned subsidiary of FKP Holdings merged with and into APP pursuant to and by the Agreement and Plan of Merger dated July 6, 2008. Accordingly, FKP Holdings became the parent company of APP and its subsidiaries. For periods beginning January 1, 2009, APP and its subsidiaries are included in the consolidated US Federal income tax return of FKP Holdings.

(12) Other Comprehensive Income

Elements of other comprehensive income, net of income taxes, were as follows:

| Three Months Ended March 31, | ||||||||

| 2010 | 2009 | |||||||

| (in thousands) | ||||||||

| Foreign currency translation adjustments |

$ | 1,462 | $ | (789 | ) | |||

| Change in fair value of interest rate swaps, net of tax |

(3,776 | ) | (2,412 | ) | ||||

| Change in the fair value of foreign currency swap, net of tax |

(3,063 | ) | 1,317 | |||||

| Other comprehensive loss |

(5,377 | ) | (1,884 | ) | ||||

| Net income (loss) |

11,866 | (11,105 | ) | |||||

| Comprehensive income (loss) |

$ | 6,489 | $ | (12,989 | ) | |||

At March 31, 2010 and 2009, we had a cumulative loss from the change in the fair value of our interest rate swaps, net of tax, of $26.0 million and $34.8 million, respectively. The cumulative change in foreign currency swaps, net of tax, was a gain of $0.0 million and $1.3 million and as of March 31, 2010 and 2009, respectively. The cumulative foreign currency translation adjustment was a gain of $2.2 million as of March 31, 2010 and a loss of $5.3 million as of March 31, 2009.

17

Table of Contents

(13) Contingencies

We are from time to time subject to claims and litigation arising in the ordinary course of business. These claims have included assertions that our products infringe existing patents, allegations of product liability and also claims that the uses of our products have caused personal injuries. We believe we have substantial defenses in these matters, however litigation is inherently unpredictable. Consequently any adverse judgment or settlement could have a material adverse effect on our results of operations, cash flows or financial condition for a particular period. We record accruals for such contingencies to the extent that we conclude a loss is probable and the amount can be reasonably estimated. We also record receivables for probable and estimable insurance recoveries from third party insurers.

Summarized below are the more significant legal matters pending to which we are a party:

Patent Litigation

Pemetrexed Disodium

We have filed an abbreviated new drug application, or “ANDA”, seeking approval from the FDA to market pemetrexed disodium for injection, 500 mg/vial. The Reference Listed Drug for APP’s ANDA is Alimta®, a chemotherapy agent for the treatment of various types of cancer marketed by Eli Lilly. Eli Lilly is believed to be the exclusive licensee of certain patent rights from Princeton University. We notified Eli Lilly and Princeton University of our ANDA filing pursuant to the provisions of the Hatch-Waxman Act and, in June 2008, Eli Lilly and Princeton University filed a patent infringement action in the U.S. District Court for the District of Delaware seeking to prevent us from marketing this product until after the expiration of U.S. Patent 5,344,932, which is alleged to expire in 2016. We filed our Answer and Counterclaims in August 2008 and trial is scheduled for November 2010.

Naropin®

In March 2007 we filed a complaint for patent infringement against Navinta LLC in the U.S District Court for the District of New Jersey. Navinta filed an ANDA seeking approval from the FDA to market ropivacaine hydrochloride injection, in the 2 mg/ml, 5 mg/ml and 10 mg/ml dosage forms. The Reference Listed Drug for Navinta’s ANDA is APP’s proprietary product Naropin®. This matter proceeded to trial on July 20, 2009. The U.S. District Court, District of New Jersey reached a judgment in favor of the Company on August 3, 2009, determining that Navinta’s ANDA product infringed on the Company’s proprietary product Naropin. The judgment has been appealed by Navinta.

Oxaliplatin

The Company filed ANDAs to market oxaliplatin for injection, 10 mg and 50mg vials, and oxaliplatin injection, in 5mg/ml, 10ml, 20ml and 40 ml dosage forms. The Reference Listed Drug is the chemotherapeutic agent Eloxatin® marketed by Sanofi-Aventis that is approved for the treatment of colorectal cancer. Sanofi-Aventis is believed to be the exclusive licensee of certain patent rights from Debiopharm. We notified Sanofi-Aventis and Debiopharm of the ANDA filings pursuant to the provisions of the Hatch-Waxman Act, and Sanofi-Aventis and Debiopharm filed a patent infringement action in the U.S. District Court for the District of New Jersey seeking to prevent us from marketing these products until after the expiration of various U.S. patents. Multiple cases proceeding against other generic drug manufacturers including a subsidiary of Fresenius Kabi were consolidated pursuant to a pre-trial scheduling order in April 2008. The defendants motion for summary judgment on one of the patents at issue was granted and an order entered by the U.S. District Court. The order was successfully challenged by Sanofi-Aventis and on November 17, 2009, Sanofi-Aventis’s motion seeking a preliminary injunction to prevent sales of oxaliplatin by generic drug manufacturers was heard.

On April 1, 2010, prior to a ruling by the Court, Fresenius Kabi announced that APP and other Fresenius Kabi companies had entered into a license and settlement agreement with Sanofi-Aventis and Debiopharm. Under the terms of the Agreement, all generic manufacturers will stop selling oxaliplatin injection on June 30, 2010 in consideration for the grant of a license to market their generic versions of oxaliplatin, 50 mg/vial, 100 mg/vial and 5 mg/mL, 10 mL and 20mL vials, beginning no later than August 9, 2012.

18

Table of Contents

Bivalirudin

We have filed an ANDA seeking approval from the FDA to market generic bivalirudin, 250 mg/vial for intravenous injection. The reference listed drug for APP’s ANDA is Angiomax, for use as an anticoagulant in patients with unstable angina and currently marketed by The Medicines Co. The Medicines Co. is believed to be the exclusive assignee of certain patent rights from Gopal Krishna and Gary Musso. The patent, alleged to be generally directed to bivalirudin compositions, was issued on September 1, 2009. APP notified The Medicines Co. of our ANDA filing pursuant to the provisions of the Hatch-Waxman Act, and on October 8, 2009, The Medicines Co. filed a patent infringement action in the United States District Court for the District of Delaware seeking to prevent APP from marketing this product until after the patent’s expiration. We filed our Answer and Counterclaims on December 9, 2009. The Medicines Co. filed its response on December 28, 2009.

On March 23, 2010, the Judge ordered that this case be consolidated with four other infringement actions against Teva/Pliva Hrvatska for pre-trial purposes. On March 24, 2010, an interim protective order and scheduling order was approved by the Judge. Fact discovery is currently underway.

Gemcitabine

We have filed an ANDA seeking approval from the FDA to market gemcitabine for injection, 200 mg base/vial, 1 g base/vial and 2 g base/vial. The reference listed drug for APP’s ANDA is Gemzar, for use as a treatment for non-small lung cancer, pancreatic cancer, breast cancer and ovarian cancer. Eli Lilly is the holder of the New Drug Application for Gemzar and is believed to be the owner of the patent rights, which are set to expire on November 7, 2012, followed by a six month period of pediatric market exclusivity ending on May 7, 2013. APP notified Eli Lilly of our ANDA filing pursuant to the provisions of the Hatch-Waxman Act on November 4, 2009. On December 16, 2009, Eli Lilly filed a patent infringement action in the United States District Court in the Southern District of Indiana seeking to prevent APP from marketing this product until after the patent’s expiration. APP was served on January 7, 2010 and filed a Motion to Dismiss on March 19, 2010, basing its motion on the adjudicated invalidity of the patent in another action.

Product Liability Matters

Sensorcaine

We have been named as a defendant in numerous personal injury/product liability actions brought against us and other pharmaceutical companies and medical device manufacturers by plaintiffs claiming that they suffered injuries resulting from the post-surgical release of certain local anesthetics into the shoulder joint via a pain pump. We acquired several generic anesthetic products from AstraZeneca in June 2006. Pursuant to the Asset Purchase Agreement with AstraZeneca, we are responsible for indemnifying Astra Zeneca for defense of suits alleging injuries occurring after the acquisition date (unless the drugs are determined to be defective in manufacturing, in which case AstraZeneca will indemnify us pursuant to that certain Manufacturing and Supply Agreement entered into by us and AstraZeneca). Likewise Astra Zeneca agreed to indemnify us for suits alleging injuries occurring prior to the acquisition date. Forty actions involve an alleged event after the acquisition date. All of our local anesthetic products are approved by the FDA and continue to be marketed and sold to customers. Since December 2009, more than 100 cases naming APP or New Abraxis have been dismissed due to lack of product identification or failure to plead with sufficient specificity to withstand a Motion to Dismiss.

The cases have been filed in various jurisdictions around the country, including Indiana, Kentucky, New York, Colorado, Ohio, Minnesota, and California. Some cases were brought in state court, but most were filed in federal court. Discovery has just begun in most cases. We anticipate additional cases will be filed throughout the U.S. and we maintain product liability insurance for these matters. In December 2009, a group of plaintiffs filed a renewed motion to create a multi-district litigation (“MDL”) case in the United States District of Minnesota. A hearing on the motion was held on March 25, 2010 and is currently pending.

19

Table of Contents

Aredia and Zometa

We have been named as a defendant in approximately 30 personal injury/product liability cases brought against us and other manufacturers by plaintiffs claiming that they suffered injuries resulting from the use of pamidronate (the generic equivalent of Aredia®) prescribed for the management of metastic bone disease. Plaintiffs’ allege Aredia causes osteonecrosis to the jaw. Four cases have been consolidated into multi-district litigation (“MDL”) before the Court in the U.S. District Court, Middle District Tennessee. We filed answers in three of the cases and filed a joinder in October 2008 with another defendant’s Motion to Dismiss for failure to serve the plaintiff’s complaint within 120 days of filing. The case was dismissed in November 2008. Defendants in these cases are opposed to the MDL Court issuing a remand order, and a ruling on this issue is pending before a United States Judicial Panel. Until a decision is reached, discovery in these cases remains stayed. Recently, four additional cases have been filed against us in a coordinated proceeding in the Superior Court of New Jersey, Middlesex County. One of those four complaints has yet to be served. Discovery has not yet started in these cases.

On December 2, 2009, nine cases naming APP were transferred to an MDL in the Eastern District of New York. Seven of the nine cases have been served on APP. At a January 26, 2010 status conference, the MDL Judge ordered the parties to begin product identification discovery and a progress report was submitted on April 26, 2010. Recently, seven cases filed against APP in the coordinated proceeding in New Jersey were dismissed. Product identification reports on the remaining four cases are to be filed with the Judge in June 2010.

Heparin

We have been named as a defendant in eight personal injury/product liability cases brought against us and other manufacturers claiming that the plaintiffs suffered side effects from heparin-induced thrombocytopenia (“HIT”). The cases were filed in state and federal courts in New Jersey, Pennsylvania, West Virginia and Illinois. Product identification discovery is underway in all eight cases.

Regulatory Matters

We are subject to regulatory oversight by the FDA and other regulatory authorities with respect to the development and manufacture of our products. Failure to comply with regulatory requirements can have a significant effect on our business and operations. Management has designed and operates a system of controls to attempt to ensure compliance with applicable regulatory requirements.

(13) Revenue by Product Line

Total revenues by product line were as follows (in thousands):

| For the Three Month Period Ended March 31, | ||||||||

| 2010 | 2009* | |||||||

| Critical care |

$ | 148,197 | $ | 122,060 | ||||

| Anti-infective |

45,987 | 49,988 | ||||||

| Oncology |

19,071 | 17,321 | ||||||

| Contract manufacturing and other |

2,944 | 2,828 | ||||||

| Total revenue |

$ | 216,199 | $ | 192,197 | ||||

| * | Reclassified to conform with presentation adopted in 2010. |

20

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q and other documents we file with the Securities and Exchange Commission contain forward-looking statements, as the term is defined in the Private Securities Litigation Reform Act of 1995. In addition, we may make forward-looking statements in press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of business through meetings, webcasts, phone calls and conference calls. Such forward-looking statements, whether expressed or implied, are subject to risks and uncertainties which could cause our actual results and those of our consolidated subsidiaries to differ materially from those implied by such forward-looking statements, due to a number of factors, many of which are beyond our control, which include, but are not limited to:

| • | the market adoption of and demand for our existing and new pharmaceutical products; |

| • | our ability to maintain and/or improve sales and earnings performance; |

| • | the ability to successfully manufacture products in an efficient, time-sensitive and cost effective manner; |

| • | our ability to service our debt; |

| • | the impact on our products and revenues of patents and other proprietary rights licensed or owned by us, our competitors and other third parties; |

| • | our ability, and that of our suppliers, to comply with laws, regulations and standards, and the application and interpretation of those laws, regulations and standards, that govern or affect the pharmaceutical industry, the non-compliance with which may delay or prevent the sale of our products; |

| • | the difficulty in predicting the timing or outcome of product development efforts and regulatory approvals; |

| • | the availability and price of acceptable raw materials and components from third-party suppliers; |

| • | evolution of the fee-for-service arrangements being adopted by our major wholesale customers; |

| • | risks inherent in divestitures and spin-offs, including business risks, legal risks and risks associated with the tax and accounting treatment of such transactions; |

| • | inventory reductions or fluctuations in buying patterns by wholesalers or distributors; |

| • | the effect of the Merger on APP’s customer and supplier relationships, operating results and business generally; |

| • | risks that the Merger will disrupt APP’s current plans and operations, and the potential difficulties in retaining APP’s employees as a result of the Merger; |

| • | the outcome of any pending or future litigation and administrative claims; |

| • | the impact of recent legislative changes to the governmental reimbursement system; |

| • | potential restructurings of FKP Holdings and its subsidiaries (which include APP and its subsidiaries) which could affect its ability to generate Adjusted EBITDA; |

| • | the ability of FKP Holdings to generate Adjusted EBITDA sufficient to trigger a payment under the CVRs; |

| • | challenges of integration and restructuring associated with the Merger or other planned acquisitions and the challenges of achieving anticipated synergies; |

| • | the impact of any product liability, or other litigation to which the company is, or may become a party; and |

| • | the impact of healthcare reform in the U.S. and elsewhere. |

Forward-looking statements also include the assumptions underlying or relating to any of the foregoing or other such statements. When used in this report, the words “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict” and similar expressions are generally intended to identify forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, whether as a result of new information, changes in assumptions, future events or otherwise. Readers should carefully review the factors described in “Risk Factors” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009, and in “Item 1A: Risk Factors” of Part II of this Form 10-Q and other documents we file from time to time with the Securities and Exchange Commission. Readers should understand that it is not possible to predict or identify all such factors. Consequently, readers should not consider any such list to be a complete set of all potential risks or uncertainties.

21

Table of Contents

OVERVIEW

The following management’s discussion and analysis of financial condition and results of operations, or MD&A, is intended to assist the reader in understanding our company. The MD&A is provided as a supplement to, and should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2009, including the information in “Item 1: Business”; “Item 1A: Risk Factors”, “Item 6: Selected Financial Data”; and “Item 8: Financial Statements and Supplementary Data.”

In March 2010, healthcare reform legislation was enacted in the U.S. This legislation contains several provisions that impact our business, although it is not expected to be material. Although many provisions of the new legislation do not take effect immediately, several provisions became effective in the first quarter of 2010. These include (1) an increase in the minimum Medicaid rebate to states participating in the Medicaid program from 15.1% to 23.1% on our branded prescription drugs, and from 11% to 13% on our generic prescription drugs; (2) the extension of the Medicaid rebate to Managed Care Organizations that dispense drugs to Medicaid beneficiaries; and (3) the expansion of the 340(B) Public Health Services drug pricing program, which provides outpatient drugs at reduced rates, to include additional hospitals, clinics, and healthcare centers.

Background

FKP Holdings including its operating subsidiary APP is an integrated pharmaceutical company that develops, manufactures and markets injectable pharmaceutical products. We believe that we are the only company with a primary focus on the injectable oncology, anti-infective and critical care markets, and we further believe that we offer one of the most comprehensive injectable product portfolios in the pharmaceutical industry. We manufacture products in each of the three basic forms in which injectable products are sold: liquid, powder and lyophilized, or freeze-dried.

Our products are generally used in hospitals, long-term care facilities, alternate care sites and clinics within North America. Unlike the retail pharmacy market for oral products, the injectable pharmaceuticals marketplace is largely made up of end users who have relationships with group purchasing organizations, or GPOs, and/or specialty distributors who distribute products within a particular end-user market, such as oncology clinics. GPOs and specialty distributors generally enter into collective product purchasing agreements with pharmaceutical suppliers in an effort to secure more favorable drug pricing on behalf of their members.

American Pharmaceutical Partners, Inc. (“Old APP”) began in 1996 with an initial focus on U.S. marketing and distribution of generic pharmaceutical products manufactured by others. In June 1998, Old APP acquired Fujisawa USA, Inc.’s generic injectable pharmaceutical business, including manufacturing facilities in Melrose Park, Illinois and Grand Island, New York and our research and development facility in Melrose Park, Illinois. Old APP also acquired additional assets in that transaction, including inventories, plant and equipment and abbreviated new drug applications that were approved by or pending with the FDA.

FKP Holdings is a Delaware company formed in connection with the Fresenius merger discussed below. APP is a Delaware corporation that was formed in 2007. Old APP was a Delaware corporation formed in 2001 and a California corporation formed in 1996. On April 18, 2006, Old APP completed a merger with American BioScience, Inc., or ABI, APP’s former parent. In connection with the closing of that merger, Old APP’s certificate of incorporation was amended to change its original name of American Pharmaceutical Partners, Inc. to Abraxis BioScience, Inc. which we refer to as “Old Abraxis.” Old Abraxis operated in two distinct business segments: Abraxis BioScience, representing the combined operations of Abraxis Oncology and Abraxis Research; and Abraxis Pharmaceutical Products, representing the hospital-based operations.