Attached files

| file | filename |

|---|---|

| 8-K - Ally Financial Inc. | v182846_8k.htm |

| EX-99.1 - Ally Financial Inc. | v182846_ex99-1.htm |

Contact GMAC Investor Relations at (866) 710-4623 or investor.relations@gmacfs.com

Preliminary

Contact GMAC Investor Relations at (866) 710-4623 or investor.relations@gmacfs.com

Preliminary

2010

First Quarter

Results

May 3, 2010

10:00 AM EDT

Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,” “anticipate,”

Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,”

“initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,”

“intend,” “evaluate,”

“pursue,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended

to identify forward-

looking statements. All statements herein and in related management comments, other than statements of historical fact, including without

limitation, statements about future events and financial performance, are forward-looking statements

that involve certain risks and

uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are

reasonable, these statements are not guarantees of any events or financial results, and

GMAC’s actual results may differ materially due to

numerous important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for GMAC, each of which may be

revised or supplemented in subsequent reports on SEC Forms 10-Q

and 8-K. Such factors include, among others, the following: uncertainty of

GMAC's ability to enter into transactions or execute strategic alternatives to realize the value of its Residential Capital, LLC (“ResCap”)

operations; our inability

to repay our outstanding obligations to the U.S. Department of the Treasury, or to do so in a timely fashion and without

disruption to our business; our inability to successfully accommodate the additional risk exposure relating to providing wholesale and

retail

financing to Chrysler dealers and customers and the resulting impact to our financial stability; uncertainty related to Chrysler’s and GM’s recent

exits from bankruptcy; uncertainty related to the new financing arrangement between GMAC

and Chrysler; securing low cost funding for

GMAC and ResCap and maintaining the mutually beneficial relationship between GMAC and GM, and GMAC and Chrysler; our ability to

maintain an appropriate level of debt and capital; the profitability and financial

condition of GM and Chrysler; our ability to realize the

anticipated benefits associated with our recent conversion to a bank holding company, and the increased regulation and restrictions that we

are now subject to; continued challenges in the residential

mortgage and capital markets; the potential for deterioration in the residual value of

off-lease vehicles; the continuing negative impact on ResCap of the decline in the U.S. housing market; changes in U.S. government-

sponsored mortgage programs or

disruptions in the markets in which our mortgage subsidiaries operate; disruptions in the market in which we

fund GMAC’s and ResCap’s operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may

require

or that result from changes in the accounting rules or their application, which could result in an impact on earnings; changes in the

credit ratings of ResCap, GMAC, Chrysler or GM; changes in economic conditions, currency exchange rates or political stability

in the markets

in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other activities of governments, agencies

and similar organizations. Investors are cautioned not to place undue reliance

on forward-looking statements. GMAC undertakes no obligation

to update publicly or otherwise revise any forward-looking statements except where expressly required by law. A reconciliation of certain non-

GAAP financial measures included within this presentation

is provided in the supplemental charts.

Use of the term “loans” describes products associated with direct and indirect lending activities of GMAC’s global operations. The specific

products include retail installment sales

contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to

GMAC’s purchase, acquisition or direct origination of various “loan” products.

2

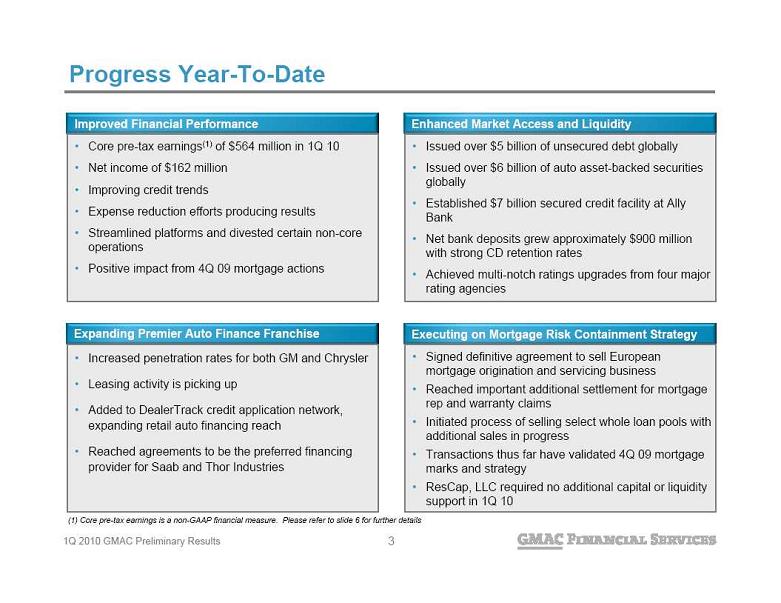

Progress Year-To-Date

Improved Financial Performance

Core pre-tax earnings(1) of $564 million in 1Q 10

Net income of $162 million

Improving credit trends

Expense reduction efforts producing results

Streamlined platforms and divested certain non-core

Progress Year-To-Date

Improved Financial Performance

Core pre-tax earnings(1) of $564 million in 1Q 10

Net income of $162 million

Improving credit trends

Expense reduction efforts producing results

Streamlined platforms and divested certain non-core

operations

Positive impact from 4Q 09 mortgage actions

Enhanced Market Access and Liquidity

Issued over $5 billion of unsecured debt globally

Issued over $6 billion of auto asset-backed securities

globally

Established $7 billion secured credit facility at Ally

Bank

Net bank deposits grew approximately $900 million

with strong CD retention rates

Achieved multi-notch ratings upgrades from four major

rating agencies

Expanding Premier Auto Finance Franchise

Increased penetration rates for both GM and Chrysler

Leasing activity is picking up

Added to DealerTrack credit application network,

expanding retail auto financing reach

Reached agreements to be the preferred financing

provider for Saab and Thor Industries

Executing on Mortgage Risk Containment Strategy

Signed definitive agreement to sell European

mortgage origination and servicing business

Reached important additional settlement for mortgage

rep and warranty claims

Initiated process of selling select whole loan pools with

additional sales in progress

Transactions thus far have validated 4Q 09 mortgage

marks and strategy

ResCap, LLC required no additional capital or liquidity

support in 1Q 10

(1) Core pre-tax earnings is a non-GAAP financial measure. Please refer to slide 6 for further details

3

Rebranding as Ally Financial

Transformation

GMAC Inc. to be rebranded as Ally Financial Inc. on

Rebranding as Ally Financial

Transformation

GMAC Inc. to be rebranded as Ally Financial Inc. on

May 10, 2010

Investing in a brand that is company-owned

Supports efforts toward becoming more customer-

focused

4

Strategic Objectives

Become the premier global auto finance provider for dealers and consumers

Improve our cost structure and efficiency

Demonstrate consistent and diversified access to capital markets

Fully transition to a bank holding company model

Improve our liquidity position by building a stable deposit base at Ally Bank

Continue to de-risk our mortgage business and define a viable long-term strategy for our

Strategic Objectives

Become the premier global auto finance provider for dealers and consumers

Improve our cost structure and efficiency

Demonstrate consistent and diversified access to capital markets

Fully transition to a bank holding company model

Improve our liquidity position by building a stable deposit base at Ally Bank

Continue to de-risk our mortgage business and define a viable long-term strategy for our

mortgage origination and servicing business

Focusing on these key objectives will assist GMAC in achieving the necessary milestones for

timely repayment of the U.S. Treasury investments

5

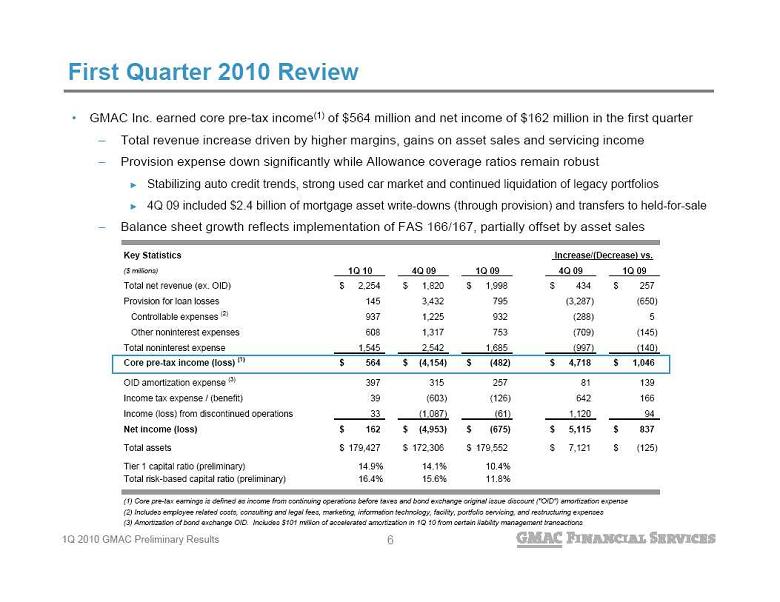

First Quarter 2010 Review

GMAC Inc. earned core pre-tax income(1) of $564 million and net income of $162 million in

the first quarter

Total revenue increase driven by higher margins, gains on asset sales and servicing income

Provision expense down significantly while Allowance coverage ratios remain robust

Stabilizing auto credit trends, strong used car market and continued liquidation of legacy portfolios

4Q 09 included $2.4 billion of mortgage asset write-downs (through provision) and transfers to held-for-sale

Balance sheet growth reflects implementation of FAS 166/167, partially offset by asset sales

6

Key Statistics

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total net revenue (ex. OID)

2,254

$

1,820

$

1,998

$

434

$

257

$

Provision for loan losses

145

3,432

795

(3,287)

(650)

Controllable expenses

(2)

937

1,225

932

(288)

5

Other noninterest expenses

608

1,317

753

(709)

(145)

Total noninterest expense

1,545

2,542

1,685

(997)

(140)

Core pre-tax income (loss)

(1)

564

$

(4,154)

$

(482)

$

4,718

$

1,046

$

OID amortization expense

(3)

397

315

257

81

139

Income tax expense / (benefit)

39

(603)

(126)

642

166

Income (loss) from discontinued operations

33

(1,087)

(61)

1,120

94

Net income (loss)

162

$

(4,953)

$

(675)

$

5,115

$

837

$

Total assets

179,427

$

172,306

$

179,552

$

7,121

$

(125)

$

Tier 1 capital ratio (preliminary)

14.9%

14.1%

10.4%

Total risk-based capital ratio (preliminary)

16.4%

15.6%

11.8%

(1) Core pre-tax earnings is defined as income from continuing operations before taxes and bond exchange original issue discount ("OID") amortization expense

(2) Includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing, and restructuring expenses

(3) Amortization of bond exchange OID. Includes $101 million of accelerated amortization in 1Q 10 from certain liability management transactions

Increase/(Decrease) vs.

6

First Quarter 2010 Review

GMAC Inc. earned core pre-tax income(1) of $564 million and net income of $162 million in

the first quarter

Total revenue increase driven by higher margins, gains on asset sales and servicing income

Provision expense down significantly while Allowance coverage ratios remain robust

Stabilizing auto credit trends, strong used car market and continued liquidation of legacy portfolios

4Q 09 included $2.4 billion of mortgage asset write-downs (through provision) and transfers to held-for-sale

Balance sheet growth reflects implementation of FAS 166/167, partially offset by asset sales

6

Key Statistics

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total net revenue (ex. OID)

2,254

$

1,820

$

1,998

$

434

$

257

$

Provision for loan losses

145

3,432

795

(3,287)

(650)

Controllable expenses

(2)

937

1,225

932

(288)

5

Other noninterest expenses

608

1,317

753

(709)

(145)

Total noninterest expense

1,545

2,542

1,685

(997)

(140)

Core pre-tax income (loss)

(1)

564

$

(4,154)

$

(482)

$

4,718

$

1,046

$

OID amortization expense

(3)

397

315

257

81

139

Income tax expense / (benefit)

39

(603)

(126)

642

166

Income (loss) from discontinued operations

33

(1,087)

(61)

1,120

94

Net income (loss)

162

$

(4,953)

$

(675)

$

5,115

$

837

$

Total assets

179,427

$

172,306

$

179,552

$

7,121

$

(125)

$

Tier 1 capital ratio (preliminary)

14.9%

14.1%

10.4%

Total risk-based capital ratio (preliminary)

16.4%

15.6%

11.8%

(1) Core pre-tax earnings is defined as income from continuing operations before taxes and bond exchange original issue discount ("OID") amortization expense

(2) Includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing, and restructuring expenses

(3) Amortization of bond exchange OID. Includes $101 million of accelerated amortization in 1Q 10 from certain liability management transactions

Increase/(Decrease) vs.

6

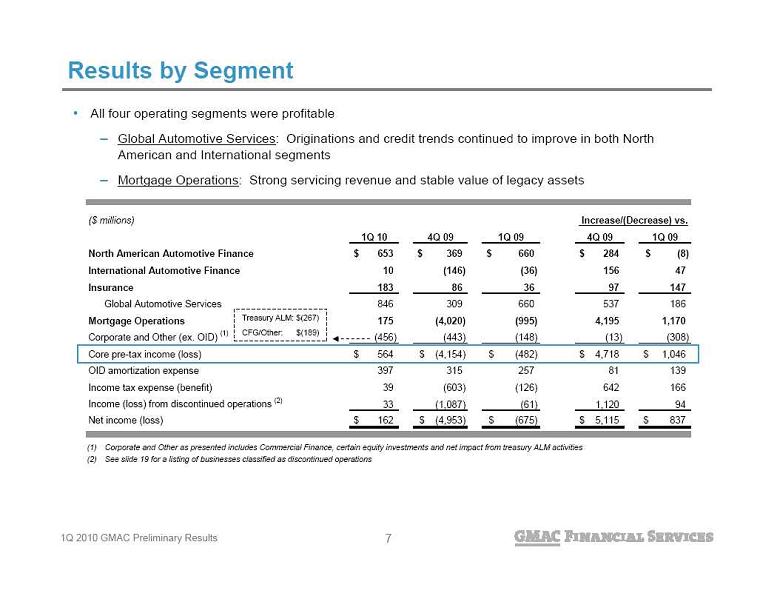

Results by Segment

(1) Corporate and Other as presented includes Commercial Finance, certain equity investments and net impact from treasury ALM activities

(2) See slide 19 for a listing of businesses classified as discontinued operations

All four operating segments were profitable

Global Automotive Services: Originations and credit trends continued to improve in both North

Results by Segment

(1) Corporate and Other as presented includes Commercial Finance, certain equity investments and net impact from treasury ALM activities

(2) See slide 19 for a listing of businesses classified as discontinued operations

All four operating segments were profitable

Global Automotive Services: Originations and credit trends continued to improve in both North

American and International segments

Mortgage Operations: Strong servicing revenue and stable value of legacy assets

Treasury ALM: $(267)

CFG/Other: $(189)

7

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

North American Automotive Finance

653

$

369

$

660

$

284

$

(8)

$

International Automotive Finance

10

(146)

(36)

156

47

Insurance

183

86

36

97

147

Global Automotive Services

846

309

660

537

186

Mortgage Operations

175

(4,020)

(995)

4,195

1,170

Corporate and Other (ex. OID)

(1)

(456)

(443)

(148)

(13)

(308)

Core pre-tax income (loss)

564

$

(4,154)

$

(482)

$

4,718

$

1,046

$

OID amortization expense

397

315

257

81

139

Income tax expense (benefit)

39

(603)

(126)

642

166

Income (loss) from discontinued operations

(2)

33

(1,087)

(61)

1,120

94

Net income (loss)

162

$

(4,953)

$

(675)

$

5,115

$

837

$

Increase/(Decrease) vs.

7

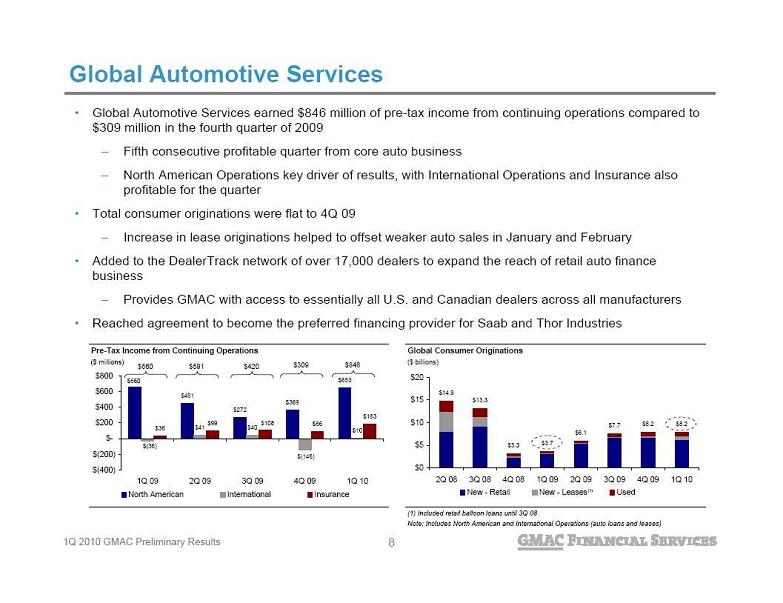

Global Automotive Services

Global Automotive Services earned $846 million of pre-tax income from continuing operations compared to

Global Automotive Services

Global Automotive Services earned $846 million of pre-tax income from continuing operations compared to

$309 million in the fourth quarter of 2009

Fifth consecutive profitable quarter from core auto business

North American Operations key driver of results, with International Operations and Insurance also

profitable for the quarter

Total consumer originations were flat to 4Q 09

Increase in lease originations helped to offset weaker auto sales in January and February

Added to the DealerTrack network of over 17,000 dealers to expand the reach of retail auto finance

business

Provides GMAC with access to essentially all U.S. and Canadian dealers across all manufacturers

Reached agreement to become the preferred financing provider for Saab and Thor Industries

$309

$846

$660

(1)

$420

$591

Pre-Tax Income from Continuing Operations

Global Consumer Originations

($ millions)

($ billions)

(1) Included retail balloon loans until 3Q 08

Note: Includes North American and International Operations (auto loans and leases)

$451

$272

$369

$653

$40

$(146)

$10

$36

$99

$86

$183

$660

$41

$(36)

$108

$(400)

$(200)

$-

$200

$400

$600

$800

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

North American

International

Insurance

$14.9

$13.3

$3.3

$3.7

$6.1

$7.7

$8.2

$8.2

$0

$5

$10

$15

$20

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

New - Retail

New - Leases

Used

Total

8

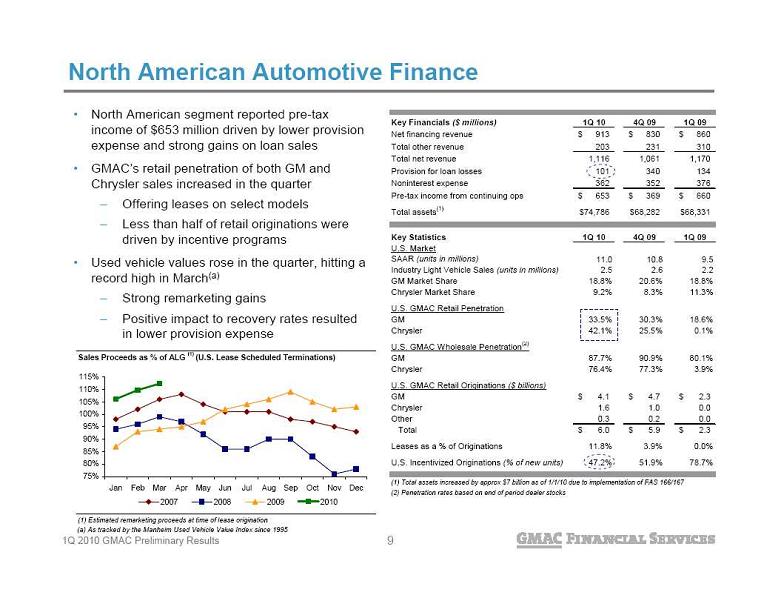

North American Automotive Finance

North American segment reported pre-tax

North American Automotive Finance

North American segment reported pre-tax

income of $653 million driven by lower provision

expense and strong gains on loan sales

GMAC’s retail penetration of both GM and

Chrysler sales increased in the quarter

Offering leases on select models

Less than half of retail originations were

driven by incentive programs

Used vehicle values rose in the quarter, hitting a

record high in March(a)

Strong remarketing gains

Positive impact to recovery rates resulted

in lower provision expense

(a) As tracked by the Manheim Used Vehicle Value Index since 1995

Sales Proceeds as % of ALG

(1)

(U.S. Lease Scheduled Terminations)

(1) Estimated remarketing proceeds at time of lease origination

75%

80%

85%

90%

95%

100%

105%

110%

115%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2007

2008

2009

2010

Key Financials

($ millions)

1Q 10

4Q 09

1Q 09

Net financing revenue

913

$

830

$

860

$

Total other revenue

203

231

310

Total net revenue

1,116

1,061

1,170

Provision for loan losses

101

340

134

Noninterest expense

362

352

376

Pre-tax income from continuing ops

653

$

369

$

660

$

Total assets

(1)

74,786

$

68,282

$

68,331

$

Key Statistics

1Q 10

4Q 09

1Q 09

U.S. Market

SAAR

(units in millions)

11.0

10.8

9.5

Industry Light Vehicle Sales

(units in millions)

2.5

2.6

2.2

GM Market Share

18.8%

20.6%

18.8%

Chrysler Market Share

9.2%

8.3%

11.3%

U.S. GMAC Retail Penetration

GM

33.5%

30.3%

18.6%

Chrysler

42.1%

25.5%

0.1%

U.S. GMAC Wholesale Penetration

(2)

GM

87.7%

90.9%

80.1%

Chrysler

76.4%

77.3%

3.9%

U.S. GMAC Retail Originations

($ billions)

GM

4.1

$

4.7

$

2.3

$

Chrysler

1.6

1.0

0.0

Other

0.3

0.2

0.0

Total

6.0

$

5.9

$

2.3

$

Leases as a % of Originations

11.8%

3.9%

0.0%

U.S. Incentivized Originations

(% of new units)

47.2%

51.9%

78.7%

(1) Total assets increased by approx $7 billion as of 1/1/10 due to implementation of FAS 166/167

(2) Penetration rates based on end of period dealer stocks

9

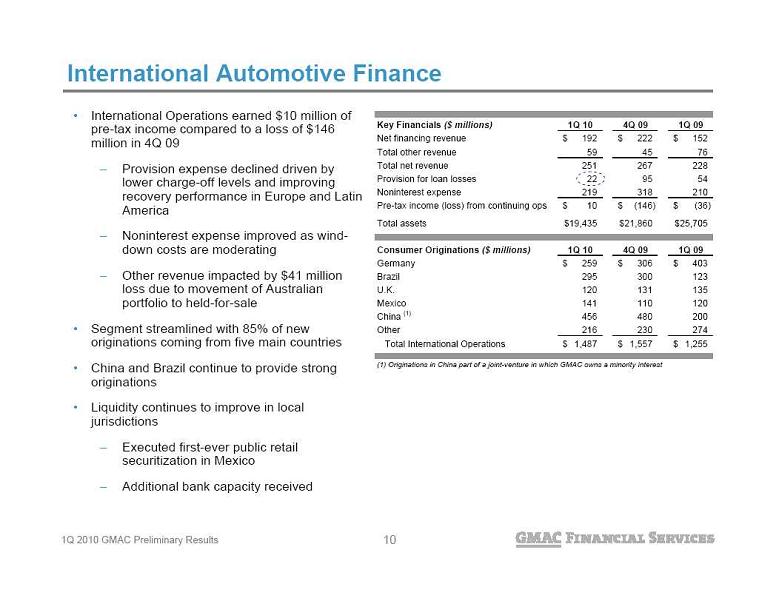

International Automotive Finance

International Operations earned $10 million of

International Automotive Finance

International Operations earned $10 million of

pre-tax income compared to a loss of $146

million in 4Q 09

Provision expense declined driven by

lower charge-off levels and improving

recovery performance in Europe and Latin

America

Noninterest expense improved as wind-

down costs are moderating

Other revenue impacted by $41 million

loss due to movement of Australian

portfolio to held-for-sale

Segment streamlined with 85% of new

originations coming from five main countries

China and Brazil continue to provide strong

originations

Liquidity continues to improve in local

jurisdictions

Executed first-ever public retail

securitization in Mexico

Additional bank capacity received

Key Financials

($ millions)

1Q 10

4Q 09

1Q 09

Net financing revenue

192

$

222

$

152

$

Total other revenue

59

45

76

Total net revenue

251

267

228

Provision for loan losses

22

95

54

Noninterest expense

219

318

210

Pre-tax income (loss) from continuing ops

10

$

(146)

$

(36)

$

Total assets

19,435

$

21,860

$

25,705

$

Consumer Originations

($ millions)

1Q 10

4Q 09

1Q 09

Germany

259

$

306

$

403

$

Brazil

295

300

123

U.K.

120

131

135

Mexico

141

110

120

China

(1)

456

480

200

Other

216

230

274

Total International Operations

1,487

$

1,557

$

1,255

$

(1) Originations in China part of a joint-venture in which GMAC owns a minority interest

10

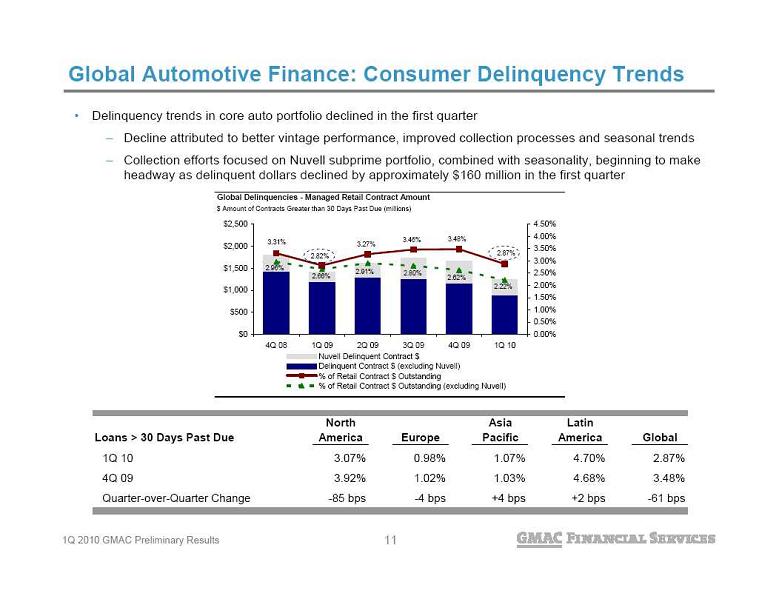

Delinquency trends in core auto portfolio declined in the first quarter

Decline attributed to better vintage performance, improved collection processes and seasonal trends

Collection efforts focused on Nuvell subprime portfolio, combined with seasonality, beginning to make

Delinquency trends in core auto portfolio declined in the first quarter

Decline attributed to better vintage performance, improved collection processes and seasonal trends

Collection efforts focused on Nuvell subprime portfolio, combined with seasonality, beginning to make

headway as delinquent dollars declined by approximately $160 million in the first quarter

Global Automotive Finance: Consumer Delinquency Trends

Global Delinquencies - Managed

Retail Contract Amount

$ Amount of Contracts Greater than 30 Days Past Due (millions)

2.22%

2.62%

2.80%

2.91%

2.66%

2.96%

3.31%

2.82%

3.27%

3.46%

3.48%

2.87%

$0

$500

$1,000

$1,500

$2,000

$2,500

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

Nuvell Delinquent Contract $

Delinquent Contract $ (excluding Nuvell)

% of Retail Contract $ Outstanding

% of Retail Contract $ Outstanding (excluding Nuvell)

Loans > 30 Days Past Due

North

America

Europe

Asia

Pacific

Latin

America

Global

1Q 10

3.07%

0.98%

1.07%

4.70%

2.87%

4Q 09

3.92%

1.02%

1.03%

4.68%

3.48%

Quarter-over-Quarter Change

-85 bps

-4 bps

+4 bps

+2 bps

-61 bps

11

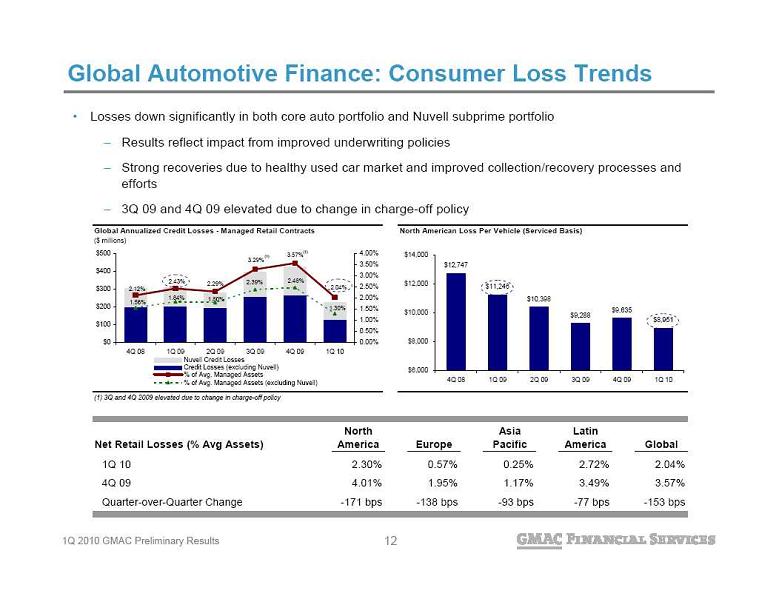

Global Automotive Finance: Consumer Loss Trends

Losses down significantly in both core auto portfolio and Nuvell subprime portfolio

Results reflect impact from improved underwriting policies

Strong recoveries due to healthy used car market and improved collection/recovery processes and

Global Automotive Finance: Consumer Loss Trends

Losses down significantly in both core auto portfolio and Nuvell subprime portfolio

Results reflect impact from improved underwriting policies

Strong recoveries due to healthy used car market and improved collection/recovery processes and

efforts

3Q 09 and 4Q 09 elevated due to change in charge-off policy

Global Annualized Credit Losses - Managed Retail Contracts

North American Loss Per Vehicle (Serviced Basis)

($ millions)

(1) 3Q and 4Q 2009 elevated due to change in charge-off policy

1.56%

1.84%

1.80%

2.39%

2.48%

1.30%

2.04%

3.57%

3.29%

2.29%

2.43%

2.12%

$0

$100

$200

$300

$400

$500

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Nuvell Credit Losses

Credit Losses (excluding Nuvell)

% of Avg. Managed Assets

% of Avg. Managed Assets (excluding Nuvell)

Delinquent

Contracts

Delinquencies

as a % of

Managed

Contracts

$12,747

$11,246

$10,398

$9,288

$9,635

$8,951

$6,000

$8,000

$10,000

$12,000

$14,000

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

(1)

(1)

Net Retail Losses (% Avg Assets)

North

America

Europe

Asia

Pacific

Latin

America

Global

1Q 10

2.30%

0.57%

0.25%

2.72%

2.04%

4Q 09

4.01%

1.95%

1.17%

3.49%

3.57%

Quarter-over-Quarter Change

-171 bps

-138 bps

-93 bps

-77 bps

-153 bps

12

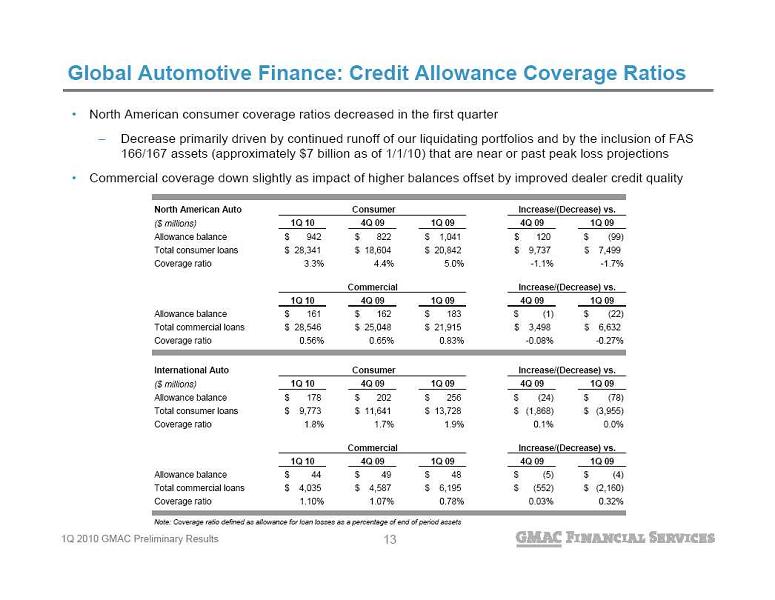

Global Automotive Finance: Credit Allowance Coverage Ratios

North American consumer coverage ratios decreased in the first quarter

Decrease primarily driven by continued runoff of our liquidating portfolios and by the inclusion of FAS

Global Automotive Finance: Credit Allowance Coverage Ratios

North American consumer coverage ratios decreased in the first quarter

Decrease primarily driven by continued runoff of our liquidating portfolios and by the inclusion of FAS

166/167 assets (approximately $7 billion as of 1/1/10) that are near or past peak loss projections

Commercial coverage down slightly as impact of higher balances offset by improved dealer credit quality

North American Auto

Consumer

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Allowance balance

942

$

822

$

1,041

$

120

$

(99)

$

Total consumer loans

28,341

$

18,604

$

20,842

$

9,737

$

7,499

$

Coverage ratio

3.3%

4.4%

5.0%

-1.1%

-1.7%

Commercial

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Allowance balance

161

$

162

$

183

$

(1)

$

(22)

$

Total commercial loans

28,546

$

25,048

$

21,915

$

3,498

$

6,632

$

Coverage ratio

0.56%

0.65%

0.83%

-0.08%

-0.27%

International Auto

Consumer

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Allowance balance

178

$

202

$

256

$

(24)

$

(78)

$

Total consumer loans

9,773

$

11,641

$

13,728

$

(1,868)

$

(3,955)

$

Coverage ratio

1.8%

1.7%

1.9%

0.1%

0.0%

Commercial

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Allowance balance

44

$

49

$

48

$

(5)

$

(4)

$

Total commercial loans

4,035

$

4,587

$

6,195

$

(552)

$

(2,160)

$

Coverage ratio

1.10%

1.07%

0.78%

0.03%

0.32%

Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets

Increase/(Decrease) vs.

Increase/(Decrease) vs.

Increase/(Decrease) vs.

Increase/(Decrease) vs.

13

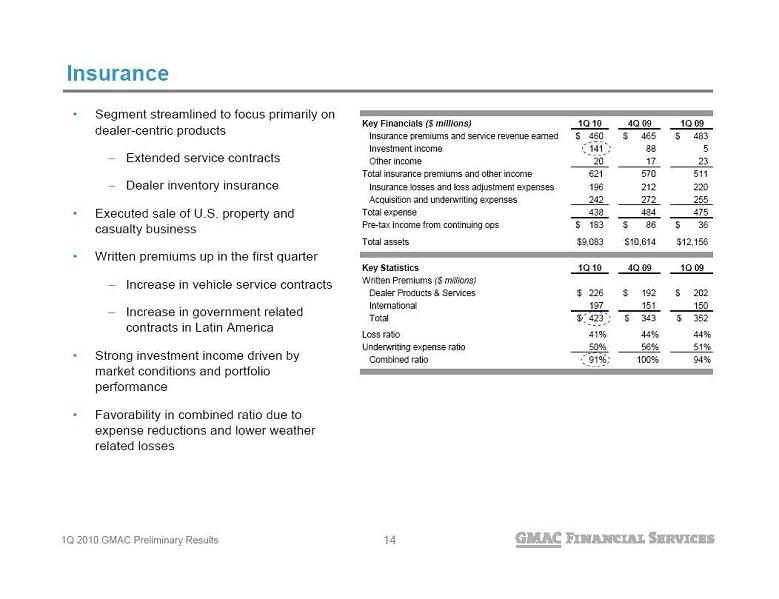

Insurance

Segment streamlined to focus primarily on

Insurance

Segment streamlined to focus primarily on

dealer-centric products

Extended service contracts

Dealer inventory insurance

Executed sale of U.S. property and

casualty business

Written premiums up in the first quarter

Increase in vehicle service contracts

Increase in government related

contracts in Latin America

Strong investment income driven by

market conditions and portfolio

performance

Favorability in combined ratio due to

expense reductions and lower weather

related losses

Key Financials

($ millions)

1Q 10

4Q 09

1Q 09

Insurance premiums and service revenue earned

460

$

465

$

483

$

Investment income

141

88

5

Other income

20

17

23

Total insurance premiums and other income

621

570

511

Insurance losses and loss adjustment expenses

196

212

220

Acquisition and underwriting expenses

242

272

255

Total expense

438

484

475

Pre-tax income from continuing ops

183

$

86

$

36

$

Total assets

9,083

$

10,614

$

12,156

$

Key Statistics

1Q 10

4Q 09

1Q 09

Written Premiums

($ millions)

Dealer Products & Services

226

$

192

$

202

$

International

197

151

150

Total

423

$

343

$

352

$

Loss ratio

41%

44%

44%

Underwriting expense ratio

50%

56%

51%

Combined ratio

91%

100%

94%

14

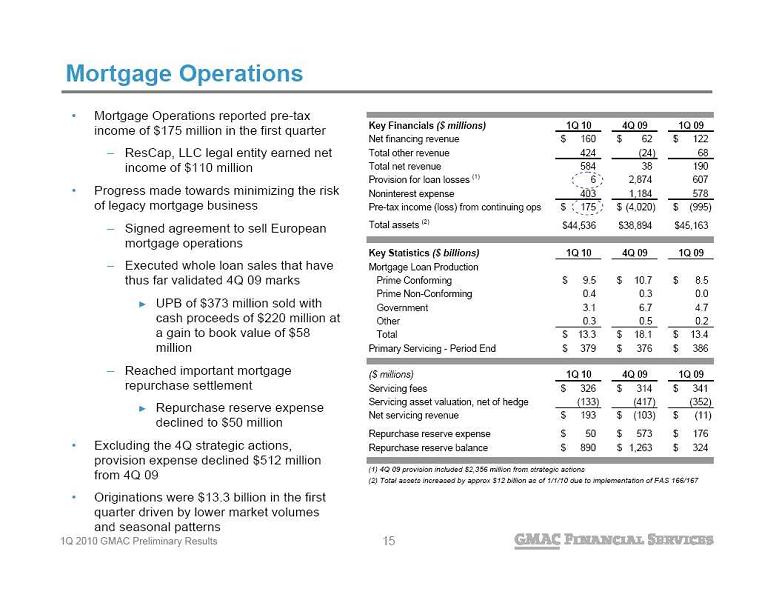

Mortgage Operations

Mortgage Operations reported pre-tax

Mortgage Operations

Mortgage Operations reported pre-tax

income of $175 million in the first quarter

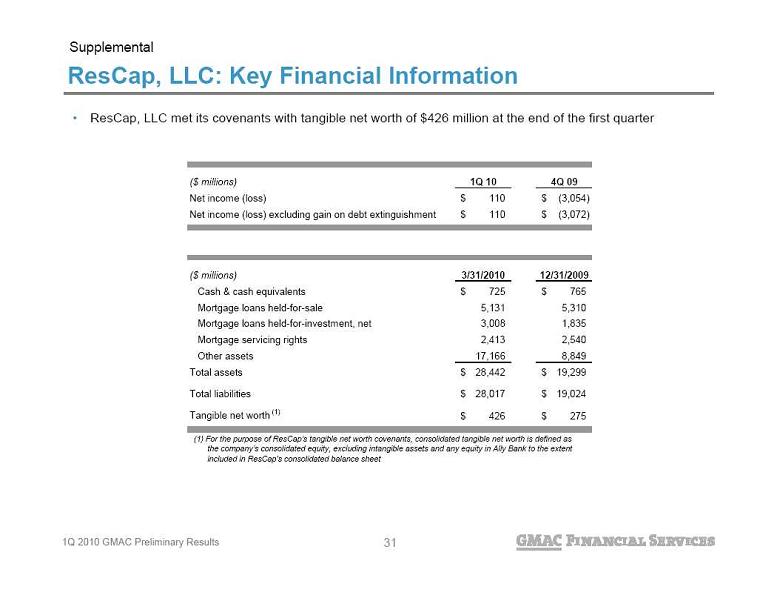

ResCap, LLC legal entity earned net

income of $110 million

Progress made towards minimizing the risk

of legacy mortgage business

Signed agreement to sell European

mortgage operations

Executed whole loan sales that have

thus far validated 4Q 09 marks

UPB of $373 million sold with

cash proceeds of $220 million at

a gain to book value of $58

million

Reached important mortgage

repurchase settlement

Repurchase reserve expense

declined to $50 million

Excluding the 4Q strategic actions,

provision expense declined $512 million

from 4Q 09

Originations were $13.3 billion in the first

quarter driven by lower market volumes

and seasonal patterns

Key Financials

($ millions)

1Q 10

4Q 09

1Q 09

Net financing revenue

160

$

62

$

122

$

Total other revenue

424

(24)

68

Total net revenue

584

38

190

Provision for loan losses

(1)

6

2,874

607

Noninterest expense

403

1,184

578

Pre-tax income (loss) from continuing ops

175

$

(4,020)

$

(995)

$

Total assets

(2)

44,536

$

38,894

$

45,163

$

Key Statistics

($ billions)

1Q 10

4Q 09

1Q 09

Mortgage Loan Production

Prime Conforming

9.5

$

10.7

$

8.5

$

Prime Non-Conforming

0.4

0.3

0.0

Government

3.1

6.7

4.7

Other

0.3

0.5

0.2

Total

13.3

$

18.1

$

13.4

$

Primary Servicing - Period End

379

$

376

$

386

$

($ millions)

1Q 10

4Q 09

1Q 09

Servicing fees

326

$

314

$

341

$

Servicing asset valuation, net of hedge

(133)

(417)

(352)

Net servicing revenue

193

$

(103)

$

(11)

$

Repurchase reserve expense

50

$

573

$

176

$

Repurchase reserve balance

890

$

1,263

$

324

$

(1) 4Q 09 provision included $2,356 million from strategic actions

(2) Total assets increased by approx $12 billion as of 1/1/10 due to implementation of FAS 166/167

15

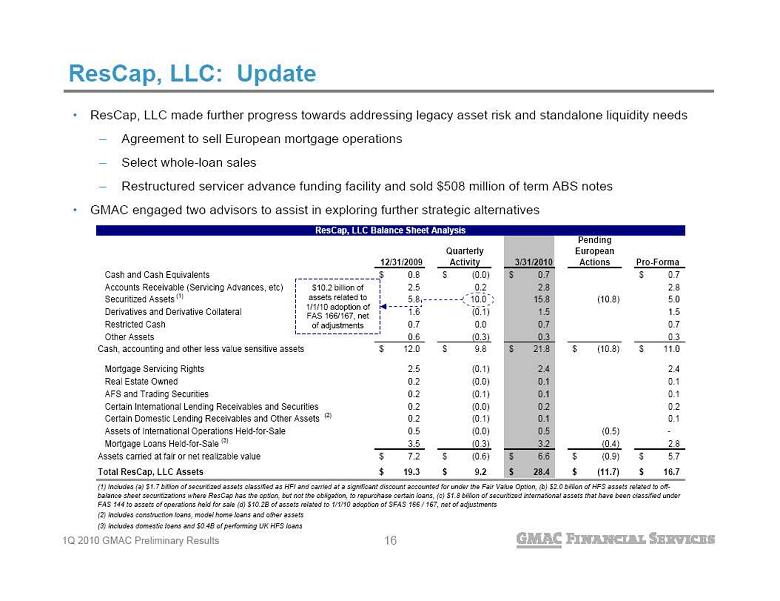

ResCap, LLC: Update

ResCap, LLC made further progress towards addressing legacy asset risk and standalone liquidity needs

Agreement to sell European mortgage operations

Select whole-loan sales

Restructured servicer advance funding facility and sold $508 million of term ABS notes

GMAC engaged two advisors to assist in exploring further strategic alternatives

$10.2 billion of

ResCap, LLC: Update

ResCap, LLC made further progress towards addressing legacy asset risk and standalone liquidity needs

Agreement to sell European mortgage operations

Select whole-loan sales

Restructured servicer advance funding facility and sold $508 million of term ABS notes

GMAC engaged two advisors to assist in exploring further strategic alternatives

$10.2 billion of

assets related to

1/1/10 adoption of

FAS 166/167, net

of adjustments

12/31/2009

Quarterly

Activity

3/31/2010

Pending

European

Actions

Pro-Forma

Cash and Cash Equivalents

0.8

$

(0.0)

$

0.7

$

0.7

$

Accounts Receivable (Servicing Advances, etc)

2.5

0.2

2.8

2.8

Securitized Assets

(1)

5.8

10.0

15.8

(10.8)

5.0

Derivatives and Derivative Collateral

1.6

(0.1)

1.5

1.5

Restricted Cash

0.7

0.0

0.7

0.7

Other Assets

0.6

(0.3)

0.3

0.3

Cash, accounting and other less value sensitive assets

12.0

$

9.8

$

21.8

$

(10.8)

$

11.0

$

Mortgage Servicing Rights

2.5

(0.1)

2.4

2.4

Real Estate Owned

0.2

(0.0)

0.1

0.1

AFS and Trading Securities

0.2

(0.1)

0.1

0.1

Certain International Lending Receivables and Securities

0.2

(0.0)

0.2

0.2

Certain Domestic Lending Receivables and Other Assets

(2)

0.2

(0.1)

0.1

0.1

Assets of International Operations Held-for-Sale

0.5

(0.0)

0.5

(0.5)

-

Mortgage Loans Held-for-Sale

(3)

3.5

(0.3)

3.2

(0.4)

2.8

Assets carried at fair or net realizable value

7.2

$

(0.6)

$

6.6

$

(0.9)

$

5.7

$

Total ResCap, LLC Assets

19.3

$

9.2

$

28.4

$

(11.7)

$

16.7

$

ResCap, LLC Balance Sheet Analysis

(1) Includes (a) $1.7 billion of securitized assets classified as HFI and carried at a significant discount accounted for under the Fair Value Option, (b) $2.0 billion of HFS assets related to off-

balance sheet securitizations where ResCap has the option, but not the obligation, to repurchase certain loans, (c) $1.8 billion of securitized international assets that have been classified under

FAS 144 to assets of operations held for sale (d) $10.2B of assets related to 1/1/10 adoption of SFAS 166 / 167, net of adjustments

(3) Includes domestic loans and $0.4B of performing UK HFS loans

(2) Includes construction loans, model home loans and other assets

16

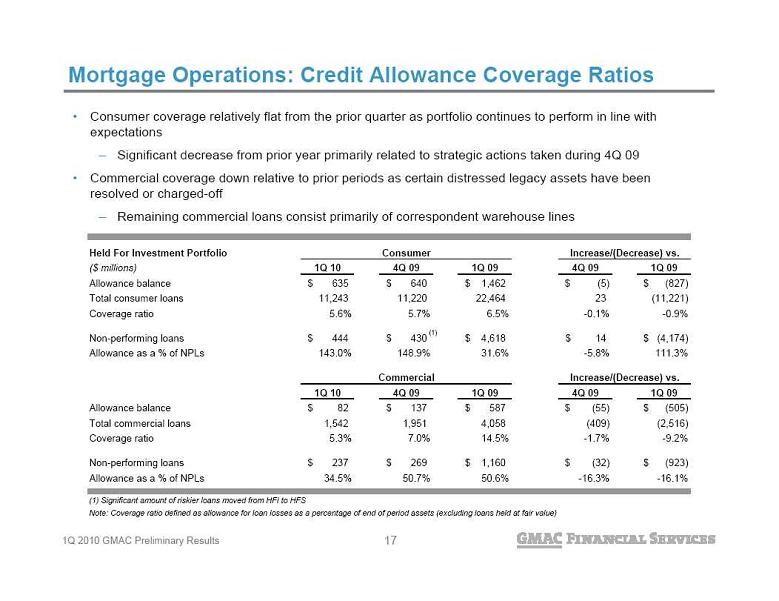

Mortgage Operations: Credit Allowance Coverage Ratios

Consumer coverage relatively flat from the prior quarter as portfolio continues to perform in line with

Mortgage Operations: Credit Allowance Coverage Ratios

Consumer coverage relatively flat from the prior quarter as portfolio continues to perform in line with

expectations

Significant decrease from prior year primarily related to strategic actions taken during 4Q 09

Commercial coverage down relative to prior periods as certain distressed legacy assets have been

resolved or charged-off

Remaining commercial loans consist primarily of correspondent warehouse lines

Held For Investment Portfolio

Consumer

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Allowance balance

635

$

640

$

1,462

$

(5)

$

(827)

$

Total consumer loans

11,243

11,220

22,464

23

(11,221)

Coverage ratio

5.6%

5.7%

6.5%

-0.1%

-0.9%

Non-performing loans

444

$

430

$

4,618

$

14

$

(4,174)

$

Allowance as a % of NPLs

143.0%

148.9%

31.6%

-5.8%

111.3%

Commercial

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Allowance balance

82

$

137

$

587

$

(55)

$

(505)

$

Total commercial loans

1,542

1,951

4,058

(409)

(2,516)

Coverage ratio

5.3%

7.0%

14.5%

-1.7%

-9.2%

Non-performing loans

237

$

269

$

1,160

$

(32)

$

(923)

$

Allowance as a % of NPLs

34.5%

50.7%

50.6%

-16.3%

-16.1%

(1) Significant amount of riskier loans moved from HFI to HFS

Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets (excluding loans held at fair value)

Increase/(Decrease) vs.

Increase/(Decrease) vs.

(1)

17

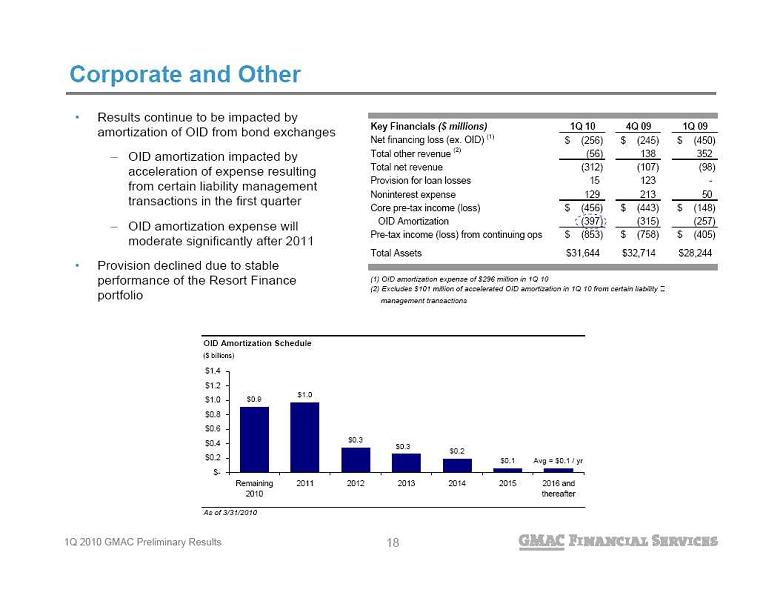

Corporate and Other

Results continue to be impacted by

Corporate and Other

Results continue to be impacted by

amortization of OID from bond exchanges

OID amortization impacted by

acceleration of expense resulting

from certain liability management

transactions in the first quarter

OID amortization expense will

moderate significantly after 2011

Provision declined due to stable

performance of the Resort Finance

portfolio

Key Financials

($ millions)

1Q 10

4Q 09

1Q 09

Net financing loss (ex. OID)

(1)

(256)

$

(245)

$

(450)

$

Total other revenue

(2)

(56)

138

352

Total net revenue

(312)

(107)

(98)

Provision for loan losses

15

123

-

Noninterest expense

129

213

50

Core pre-tax income (loss)

(456)

$

(443)

$

(148)

$

OID Amortization

(397)

(315)

(257)

Pre-tax income (loss) from continuing ops

(853)

$

(758)

$

(405)

$

Total Assets

31,644

$

32,714

$

28,244

$

(1) OID amortization expense of $296 million in 1Q 10

(2) Excludes $101 million of accelerated OID amortization in 1Q 10 from certain liability

management transactions

OID Amortization Schedule

($ billions)

As of 3/31/2010

$0.9

$1.0

$0.3

$0.2

$0.1

Avg = $0.1 / yr

$0.3

$-

$0.2

$0.4

$0.6

$0.8

$1.0

$1.2

$1.4

Remaining

2010

2011

2012

2013

2014

2015

2016 and

thereafter

18

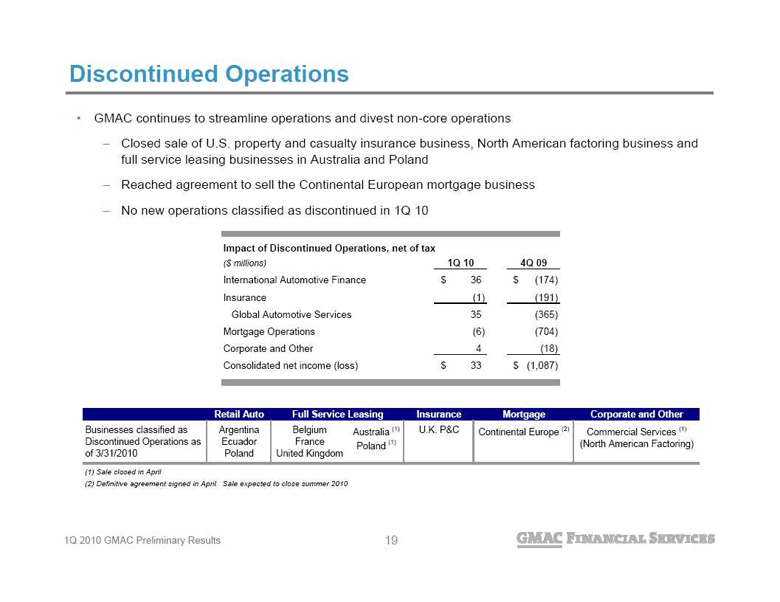

Discontinued Operations

GMAC continues to streamline operations and divest non-core operations

Closed sale of U.S. property and casualty insurance business, North American factoring business and

Discontinued Operations

GMAC continues to streamline operations and divest non-core operations

Closed sale of U.S. property and casualty insurance business, North American factoring business and

full service leasing businesses in Australia and Poland

Reached agreement to sell the Continental European mortgage business

No new operations classified as discontinued in 1Q 10

19

Impact of Discontinued Operations, net of tax

($ millions)

1Q 10

4Q 09

International Automotive Finance

36

$

(174)

$

Insurance

(1)

(191)

Global Automotive Services

35

(365)

Mortgage Operations

(6)

(704)

Corporate and Other

4

(18)

Consolidated net income (loss)

33

$

(1,087)

$

Retail Auto

Insurance

Mortgage

Corporate and Other

Businesses classified as

Discontinued Operations as

of 3/31/2010

Argentina

Ecuador

Poland

Belgium

France

United Kingdom

Australia

(1)

Poland

(1)

U.K. P&C

Continental Europe

(2)

Commercial Services

(1)

(North American Factoring)

(1) Sale closed in April

(2) Definitive agreement signed in April. Sale expected to close summer 2010

Full Service Leasing

19

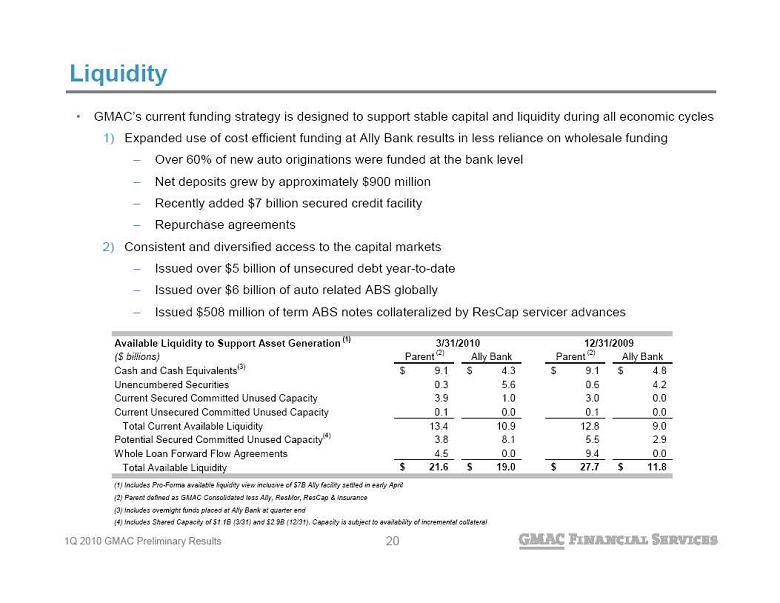

Liquidity

GMAC’s current funding strategy is designed to support stable capital and liquidity during all economic cycles

1)Expanded use of cost efficient funding at Ally Bank results in less reliance on wholesale funding

Over 60% of new auto originations were funded at the bank level

Net deposits grew by approximately $900 million

Recently added $7 billion secured credit facility

Repurchase agreements

2) Consistent and diversified access to the capital markets

Issued over $5 billion of unsecured debt year-to-date

Issued over $6 billion of auto related ABS globally

Issued $508 million of term ABS notes collateralized by ResCap servicer advances

Available Liquidity to Support Asset Generation

(1)

($ billions)

Parent

(2)

Ally Bank

Parent

(2)

Ally Bank

Cash and Cash Equivalents

(3)

9.1

$

4.3

$

9.1

$

4.8

$

Unencumbered Securities

0.3

5.6

0.6

4.2

Current Secured Committed Unused Capacity

3.9

1.0

3.0

0.0

Current Unsecured Committed Unused Capacity

0.1

0.0

0.1

0.0

Total Current Available Liquidity

13.4

10.9

12.8

9.0

Potential Secured Committed Unused Capacity

(4)

3.8

8.1

5.5

2.9

Whole Loan Forward Flow Agreements

4.5

0.0

9.4

0.0

Total Available Liquidity

21.6

$

19.0

$

27.7

$

11.8

$

(1) Includes Pro-Forma available liquidity view inclusive of $7B Ally facility settled in early April

(2) Parent defined as GMAC Consolidated less Ally, ResMor, ResCap & Insurance

(3) Includes overnight funds placed at Ally Bank at quarter end

(4) Includes Shared Capacity of $1.1B (3/31) and $2.9B (12/31). Capacity is subject to availability of incremental collateral

3/31/2010

12/31/2009

20

Liquidity

GMAC’s current funding strategy is designed to support stable capital and liquidity during all economic cycles

1)Expanded use of cost efficient funding at Ally Bank results in less reliance on wholesale funding

Over 60% of new auto originations were funded at the bank level

Net deposits grew by approximately $900 million

Recently added $7 billion secured credit facility

Repurchase agreements

2) Consistent and diversified access to the capital markets

Issued over $5 billion of unsecured debt year-to-date

Issued over $6 billion of auto related ABS globally

Issued $508 million of term ABS notes collateralized by ResCap servicer advances

Available Liquidity to Support Asset Generation

(1)

($ billions)

Parent

(2)

Ally Bank

Parent

(2)

Ally Bank

Cash and Cash Equivalents

(3)

9.1

$

4.3

$

9.1

$

4.8

$

Unencumbered Securities

0.3

5.6

0.6

4.2

Current Secured Committed Unused Capacity

3.9

1.0

3.0

0.0

Current Unsecured Committed Unused Capacity

0.1

0.0

0.1

0.0

Total Current Available Liquidity

13.4

10.9

12.8

9.0

Potential Secured Committed Unused Capacity

(4)

3.8

8.1

5.5

2.9

Whole Loan Forward Flow Agreements

4.5

0.0

9.4

0.0

Total Available Liquidity

21.6

$

19.0

$

27.7

$

11.8

$

(1) Includes Pro-Forma available liquidity view inclusive of $7B Ally facility settled in early April

(2) Parent defined as GMAC Consolidated less Ally, ResMor, ResCap & Insurance

(3) Includes overnight funds placed at Ally Bank at quarter end

(4) Includes Shared Capacity of $1.1B (3/31) and $2.9B (12/31). Capacity is subject to availability of incremental collateral

3/31/2010

12/31/2009

20

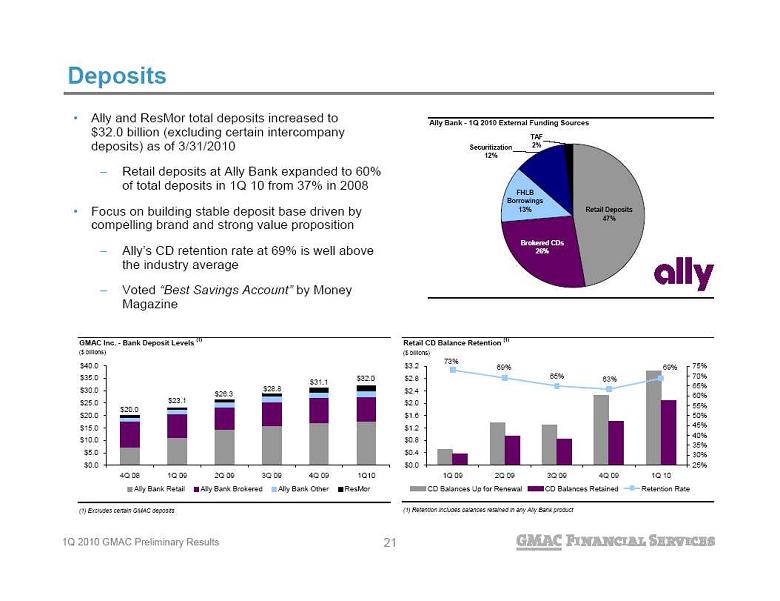

Ally and ResMor total deposits increased to

Ally and ResMor total deposits increased to

$32.0 billion (excluding certain intercompany

deposits) as of 3/31/2010

Retail deposits at Ally Bank expanded to 60%

of total deposits in 1Q 10 from 37% in 2008

Focus on building stable deposit base driven by

compelling brand and strong value proposition

Ally’s CD retention rate at 69% is well above

the industry average

Voted “Best Savings Account”

by Money

Magazine

Deposits

Ally Bank - 1Q 2010 External Funding Sources

TAF

2%

Securitization

12%

Brokered CDs

26%

Retail Deposits

47%

FHLB

Borrowings

13%

GMAC Inc. - Bank Deposit Levels

(1)

($ billions)

(1) Excludes certain GMAC deposits

$20.0

$23.1

$26.3

$28.8

$31.1

$32.0

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q10

Ally Bank Retail

Ally Bank Brokered

Ally Bank Other

ResMor

Retail CD Balance Retention

(1)

($ billions)

(1) Retention includes balances retained in any Ally Bank product

69%

63%

65%

69%

73%

$0.0

$0.4

$0.8

$1.2

$1.6

$2.0

$2.4

$2.8

$3.2

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

25%

30%

35%

40%

45%

50%

55%

60%

65%

70%

75%

CD Balances Up for Renewal

CD Balances Retained

Retention Rate

21

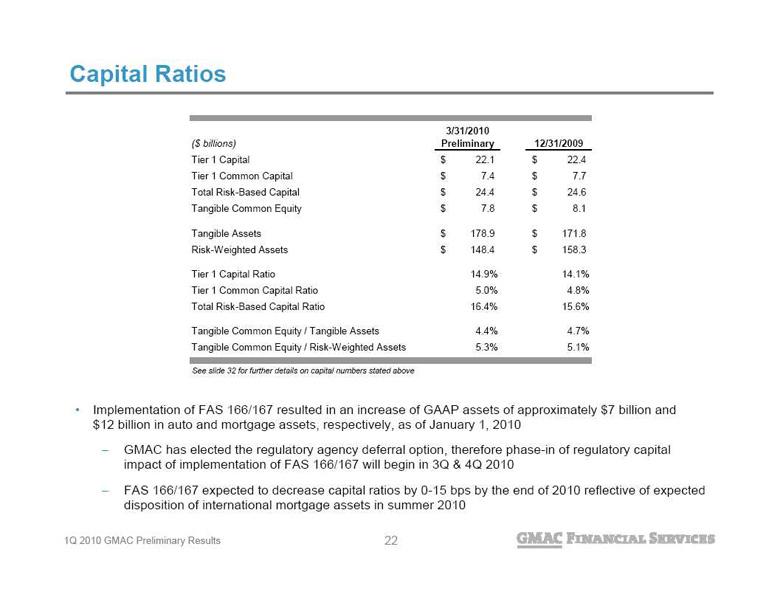

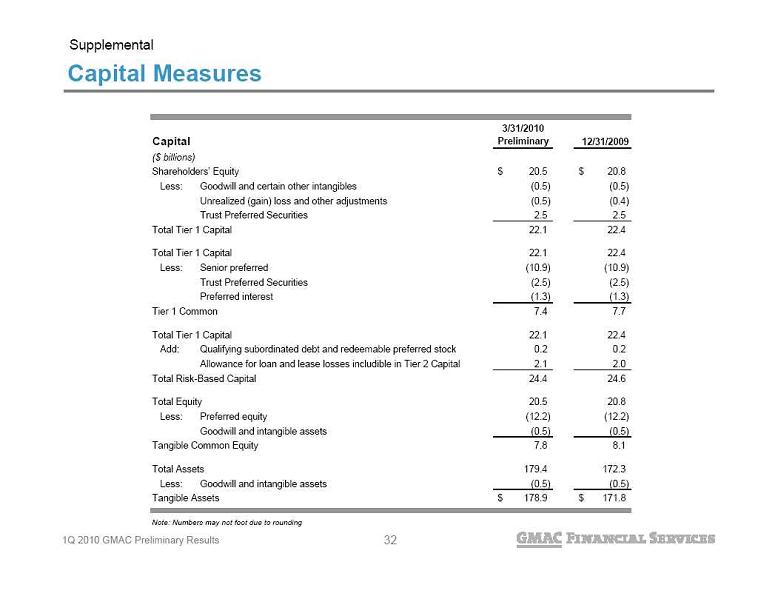

Capital Ratios

See slide 32 for further details on capital numbers stated above

Implementation of FAS 166/167 resulted in an increase of GAAP assets of approximately $7 billion and

Capital Ratios

See slide 32 for further details on capital numbers stated above

Implementation of FAS 166/167 resulted in an increase of GAAP assets of approximately $7 billion and

$12 billion in auto and mortgage assets, respectively, as of January 1, 2010

GMAC has elected the regulatory agency deferral option, therefore phase-in of regulatory capital

impact of implementation of FAS 166/167 will begin in

3Q & 4Q 2010

FAS 166/167 expected to decrease capital ratios by 0-15 bps by the end of 2010 reflective of expected

disposition of international mortgage assets in summer 2010

22

($ billions)

3/31/2010

Preliminary

12/31/2009

Tier 1 Capital

22.1

$

22.4

$

Tier 1 Common Capital

7.4

$

7.7

$

Total Risk-Based Capital

24.4

$

24.6

$

Tangible Common Equity

7.8

$

8.1

$

Tangible Assets

178.9

$

171.8

$

Risk-Weighted Assets

148.4

$

158.3

$

Tier 1 Capital Ratio

14.9%

14.1%

Tier 1 Common Capital Ratio

5.0%

4.8%

Total Risk-Based Capital Ratio

16.4%

15.6%

Tangible Common Equity / Tangible Assets

4.4%

4.7%

Tangible Common Equity / Risk-Weighted Assets

5.3%

5.1%

22

Summary

All four operating segments were profitable

Improving credit trends

Expanded auto finance franchise

Re-entered unsecured market

Reached several important agreements to further contain legacy mortgage risk

Significant Progress in First Quarter

Continued Focus on Strategic Objectives

Become the premier global auto finance provider for dealers and consumers

Improve our cost structure and efficiency

Demonstrate consistent and diversified access to capital markets

Fully transition to a bank holding company model

Improve our liquidity position by building stable deposit base at Ally Bank

Continue to de-risk our mortgage business and define a viable long-term strategy for our mortgage

Summary

All four operating segments were profitable

Improving credit trends

Expanded auto finance franchise

Re-entered unsecured market

Reached several important agreements to further contain legacy mortgage risk

Significant Progress in First Quarter

Continued Focus on Strategic Objectives

Become the premier global auto finance provider for dealers and consumers

Improve our cost structure and efficiency

Demonstrate consistent and diversified access to capital markets

Fully transition to a bank holding company model

Improve our liquidity position by building stable deposit base at Ally Bank

Continue to de-risk our mortgage business and define a viable long-term strategy for our mortgage

origination and servicing business

23

Supplemental Charts

Supplemental Charts

24

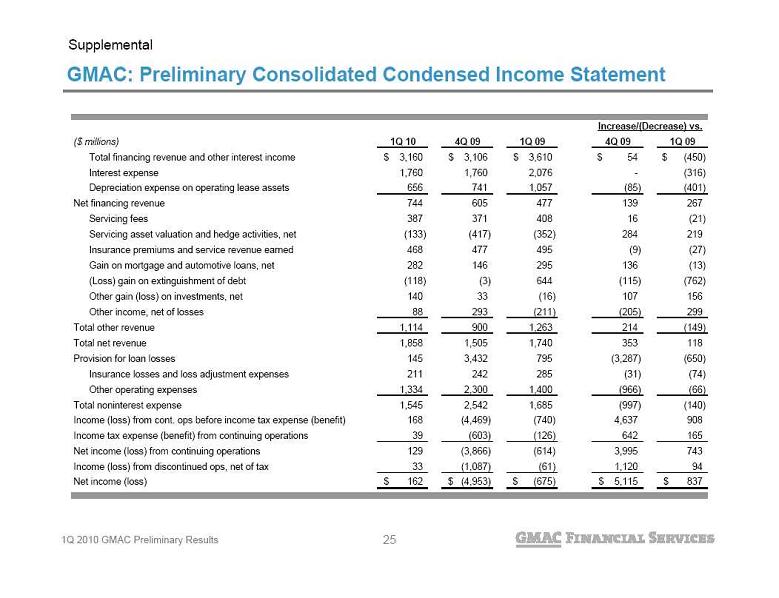

GMAC: Preliminary Consolidated Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

3,160

$

3,106

$

3,610

$

54

$

(450)

$

Interest expense

1,760

1,760

2,076

-

(316)

Depreciation expense on operating lease assets

656

741

1,057

(85)

(401)

Net financing revenue

744

605

477

139

267

Servicing fees

387

371

408

16

(21)

Servicing asset valuation and hedge activities, net

(133)

(417)

(352)

284

219

Insurance premiums and service revenue earned

468

477

495

(9)

(27)

Gain on mortgage and automotive loans, net

282

146

295

136

(13)

(Loss) gain on extinguishment of debt

(118)

(3)

644

(115)

(762)

Other gain (loss) on investments, net

140

33

(16)

107

156

Other income, net of losses

88

293

(211)

(205)

299

Total other revenue

1,114

900

1,263

214

(149)

Total net revenue

1,858

1,505

1,740

353

118

Provision for loan losses

145

3,432

795

(3,287)

(650)

Insurance losses and loss adjustment expenses

211

242

285

(31)

(74)

Other operating expenses

1,334

2,300

1,400

(966)

(66)

Total noninterest expense

1,545

2,542

1,685

(997)

(140)

Income (loss) from cont. ops before income tax expense (benefit)

168

(4,469)

(740)

4,637

908

Income tax expense (benefit) from continuing operations

39

(603)

(126)

642

165

Net income (loss) from continuing operations

129

(3,866)

(614)

3,995

743

Income (loss) from discontinued ops, net of tax

33

(1,087)

(61)

1,120

94

Net income (loss)

162

$

(4,953)

$

(675)

$

5,115

$

837

$

Increase/(Decrease) vs.

25

GMAC: Preliminary Consolidated Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

3,160

$

3,106

$

3,610

$

54

$

(450)

$

Interest expense

1,760

1,760

2,076

-

(316)

Depreciation expense on operating lease assets

656

741

1,057

(85)

(401)

Net financing revenue

744

605

477

139

267

Servicing fees

387

371

408

16

(21)

Servicing asset valuation and hedge activities, net

(133)

(417)

(352)

284

219

Insurance premiums and service revenue earned

468

477

495

(9)

(27)

Gain on mortgage and automotive loans, net

282

146

295

136

(13)

(Loss) gain on extinguishment of debt

(118)

(3)

644

(115)

(762)

Other gain (loss) on investments, net

140

33

(16)

107

156

Other income, net of losses

88

293

(211)

(205)

299

Total other revenue

1,114

900

1,263

214

(149)

Total net revenue

1,858

1,505

1,740

353

118

Provision for loan losses

145

3,432

795

(3,287)

(650)

Insurance losses and loss adjustment expenses

211

242

285

(31)

(74)

Other operating expenses

1,334

2,300

1,400

(966)

(66)

Total noninterest expense

1,545

2,542

1,685

(997)

(140)

Income (loss) from cont. ops before income tax expense (benefit)

168

(4,469)

(740)

4,637

908

Income tax expense (benefit) from continuing operations

39

(603)

(126)

642

165

Net income (loss) from continuing operations

129

(3,866)

(614)

3,995

743

Income (loss) from discontinued ops, net of tax

33

(1,087)

(61)

1,120

94

Net income (loss)

162

$

(4,953)

$

(675)

$

5,115

$

837

$

Increase/(Decrease) vs.

25

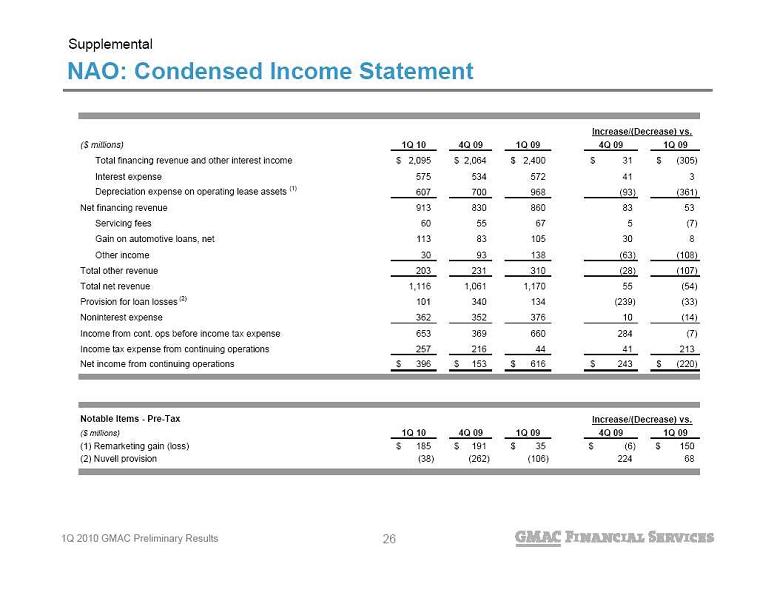

NAO: Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

2,095

$

2,064

$

2,400

$

31

$

(305)

$

Interest expense

575

534

572

41

3

Depreciation expense on operating lease assets

(1)

607

700

968

(93)

(361)

Net financing revenue

913

830

860

83

53

Servicing fees

60

55

67

5

(7)

Gain on automotive loans, net

113

83

105

30

8

Other income

30

93

138

(63)

(108)

Total other revenue

203

231

310

(28)

(107)

Total net revenue

1,116

1,061

1,170

55

(54)

Provision for loan losses

(2)

101

340

134

(239)

(33)

Noninterest expense

362

352

376

10

(14)

Income from cont. ops before income tax expense

653

369

660

284

(7)

Income tax expense from continuing operations

257

216

44

41

213

Net income from continuing operations

396

$

153

$

616

$

243

$

(220)

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Remarketing gain (loss)

185

$

191

$

35

$

(6)

$

150

$

(2) Nuvell provision

(38)

(262)

(106)

224

68

Increase/(Decrease) vs.

Increase/(Decrease) vs.

26

NAO: Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

2,095

$

2,064

$

2,400

$

31

$

(305)

$

Interest expense

575

534

572

41

3

Depreciation expense on operating lease assets

(1)

607

700

968

(93)

(361)

Net financing revenue

913

830

860

83

53

Servicing fees

60

55

67

5

(7)

Gain on automotive loans, net

113

83

105

30

8

Other income

30

93

138

(63)

(108)

Total other revenue

203

231

310

(28)

(107)

Total net revenue

1,116

1,061

1,170

55

(54)

Provision for loan losses

(2)

101

340

134

(239)

(33)

Noninterest expense

362

352

376

10

(14)

Income from cont. ops before income tax expense

653

369

660

284

(7)

Income tax expense from continuing operations

257

216

44

41

213

Net income from continuing operations

396

$

153

$

616

$

243

$

(220)

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Remarketing gain (loss)

185

$

191

$

35

$

(6)

$

150

$

(2) Nuvell provision

(38)

(262)

(106)

224

68

Increase/(Decrease) vs.

Increase/(Decrease) vs.

26

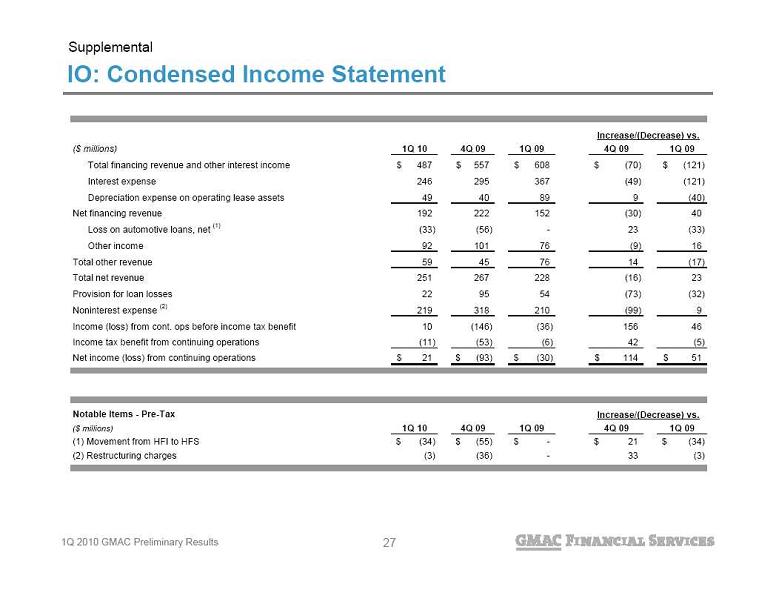

IO: Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

487

$

557

$

608

$

(70)

$

(121)

$

Interest expense

246

295

367

(49)

(121)

Depreciation expense on operating lease assets

49

40

89

9

(40)

Net financing revenue

192

222

152

(30)

40

Loss on automotive loans, net

(1)

(33)

(56)

-

23

(33)

Other income

92

101

76

(9)

16

Total other revenue

59

45

76

14

(17)

Total net revenue

251

267

228

(16)

23

Provision for loan losses

22

95

54

(73)

(32)

Noninterest expense

(2)

219

318

210

(99)

9

Income (loss) from cont. ops before income tax benefit

10

(146)

(36)

156

46

Income tax benefit from continuing operations

(11)

(53)

(6)

42

(5)

Net income (loss) from continuing operations

21

$

(93)

$

(30)

$

114

$

51

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Movement from HFI to HFS

(34)

$

(55)

$

-

$

21

$

(34)

$

(2) Restructuring charges

(3)

(36)

-

33

(3)

Increase/(Decrease) vs.

Increase/(Decrease) vs.

27

IO: Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

487

$

557

$

608

$

(70)

$

(121)

$

Interest expense

246

295

367

(49)

(121)

Depreciation expense on operating lease assets

49

40

89

9

(40)

Net financing revenue

192

222

152

(30)

40

Loss on automotive loans, net

(1)

(33)

(56)

-

23

(33)

Other income

92

101

76

(9)

16

Total other revenue

59

45

76

14

(17)

Total net revenue

251

267

228

(16)

23

Provision for loan losses

22

95

54

(73)

(32)

Noninterest expense

(2)

219

318

210

(99)

9

Income (loss) from cont. ops before income tax benefit

10

(146)

(36)

156

46

Income tax benefit from continuing operations

(11)

(53)

(6)

42

(5)

Net income (loss) from continuing operations

21

$

(93)

$

(30)

$

114

$

51

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Movement from HFI to HFS

(34)

$

(55)

$

-

$

21

$

(34)

$

(2) Restructuring charges

(3)

(36)

-

33

(3)

Increase/(Decrease) vs.

Increase/(Decrease) vs.

27

Mortgage Operations: Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

503

$

464

$

551

$

39

$

(48)

$

Interest expense

343

402

429

(59)

(86)

Net financing revenue

160

62

122

98

38

Servicing fees

(1)

326

314

341

12

(15)

Servicing asset valuation & hedge activities, net

(1)

(133)

(417)

(352)

284

219

Gain on mortgage loans, net

(2)

202

111

193

91

9

Gain on extinguishment of debt

-

0

5

-

(5)

Other income, net of losses

(2)

29

(32)

(119)

61

148

Total other revenue (expense)

424

(24)

68

448

356

Total net revenue

584

38

190

546

394

Provision for loan losses

(2)

6

2,874

607

(2,868)

(601)

Noninterest expense

(2)(3)

403

1,184

578

(781)

(175)

Income (loss) from cont. ops before income tax expense (benefit)

175

(4,020)

(995)

4,195

1,170

Income tax expense (benefit) from continuing operations

9

197

(90)

(188)

99

Net income (loss) from continuing operations

166

$

(4,217)

$

(905)

$

4,383

$

1,071

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Net servicing

193

$

(103)

$

(11)

$

296

$

204

$

(2) Gain (loss) related to strategic mortgage actions

(a)

58

(2,582)

-

2,640

58

(3) Mortgage repurchase reserve expense

(50)

(573)

(176)

523

126

(a) Excludes $700 million of marks on assets classified as discontinued operations in 4Q 09

Increase/(Decrease) vs.

Increase/(Decrease) vs.

28

Mortgage Operations: Condensed Income Statement

Supplemental

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Total financing revenue and other interest income

503

$

464

$

551

$

39

$

(48)

$

Interest expense

343

402

429

(59)

(86)

Net financing revenue

160

62

122

98

38

Servicing fees

(1)

326

314

341

12

(15)

Servicing asset valuation & hedge activities, net

(1)

(133)

(417)

(352)

284

219

Gain on mortgage loans, net

(2)

202

111

193

91

9

Gain on extinguishment of debt

-

0

5

-

(5)

Other income, net of losses

(2)

29

(32)

(119)

61

148

Total other revenue (expense)

424

(24)

68

448

356

Total net revenue

584

38

190

546

394

Provision for loan losses

(2)

6

2,874

607

(2,868)

(601)

Noninterest expense

(2)(3)

403

1,184

578

(781)

(175)

Income (loss) from cont. ops before income tax expense (benefit)

175

(4,020)

(995)

4,195

1,170

Income tax expense (benefit) from continuing operations

9

197

(90)

(188)

99

Net income (loss) from continuing operations

166

$

(4,217)

$

(905)

$

4,383

$

1,071

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Net servicing

193

$

(103)

$

(11)

$

296

$

204

$

(2) Gain (loss) related to strategic mortgage actions

(a)

58

(2,582)

-

2,640

58

(3) Mortgage repurchase reserve expense

(50)

(573)

(176)

523

126

(a) Excludes $700 million of marks on assets classified as discontinued operations in 4Q 09

Increase/(Decrease) vs.

Increase/(Decrease) vs.

28

Corporate and Other: Condensed Income Statement

Supplemental

29

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Net financing loss

(1)(4)

(552)

$

(560)

$

(707)

$

8

$

155

$

Gain (loss) on mortgage and automotive loans, net

-

8

(3)

(8)

3

(Loss) gain on extinguishment of debt

(2) (5)

(118)

(3)

639

(115)

(757)

Other income, net of losses

(6)

(39)

133

(284)

(172)

245

Total other revenue

(157)

138

352

(295)

(509)

Total net loss

(709)

(422)

(355)

(287)

(354)

Provision for loan losses

(3)

15

123

0

(108)

15

Noninterest expense

129

213

50

(84)

79

Loss from cont. ops before income tax benefit

(853)

(758)

(405)

(95)

(448)

Income tax benefit from cont. ops

(277)

(927)

(80)

650

(197)

Net (loss) income from continuing operations

(576)

$

169

$

(325)

$

(745)

$

(251)

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Amortization of bond exchange discount

(296)

$

(315)

$

(257)

$

19

$

(39)

$

(2) Accelerated OID from 1Q 10 debt exchange

(101)

-

-

(101)

(101)

(3) Commercial Finance provision

(15)

(123)

-

108

(15)

(4) Net impact of treasury ALM activities

(267)

(243)

(505)

(24)

238

(5) 1Q 09 debt exchange

-

-

634

-

(634)

(6) Resort Finance MTM

-

-

(87)

-

87

Increase/(Decrease) vs.

Increase/(Decrease) vs.

29

Corporate and Other: Condensed Income Statement

Supplemental

29

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

Net financing loss

(1)(4)

(552)

$

(560)

$

(707)

$

8

$

155

$

Gain (loss) on mortgage and automotive loans, net

-

8

(3)

(8)

3

(Loss) gain on extinguishment of debt

(2) (5)

(118)

(3)

639

(115)

(757)

Other income, net of losses

(6)

(39)

133

(284)

(172)

245

Total other revenue

(157)

138

352

(295)

(509)

Total net loss

(709)

(422)

(355)

(287)

(354)

Provision for loan losses

(3)

15

123

0

(108)

15

Noninterest expense

129

213

50

(84)

79

Loss from cont. ops before income tax benefit

(853)

(758)

(405)

(95)

(448)

Income tax benefit from cont. ops

(277)

(927)

(80)

650

(197)

Net (loss) income from continuing operations

(576)

$

169

$

(325)

$

(745)

$

(251)

$

Notable Items - Pre-Tax

($ millions)

1Q 10

4Q 09

1Q 09

4Q 09

1Q 09

(1) Amortization of bond exchange discount

(296)

$

(315)

$

(257)

$

19

$

(39)

$

(2) Accelerated OID from 1Q 10 debt exchange

(101)

-

-

(101)

(101)

(3) Commercial Finance provision

(15)

(123)

-

108

(15)

(4) Net impact of treasury ALM activities

(267)

(243)

(505)

(24)

238

(5) 1Q 09 debt exchange

-

-

634

-

(634)

(6) Resort Finance MTM

-

-

(87)

-

87

Increase/(Decrease) vs.

Increase/(Decrease) vs.

29

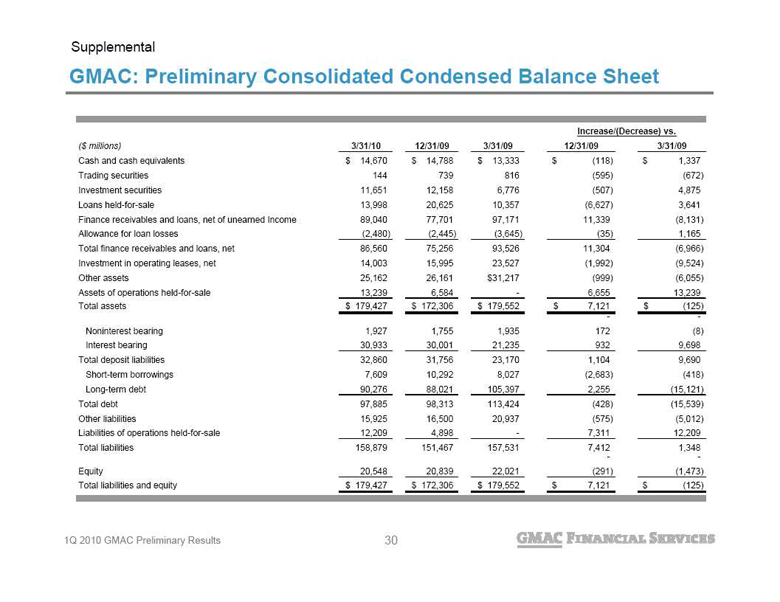

GMAC: Preliminary Consolidated Condensed Balance Sheet

Supplemental

30

($ millions)

3/31/10

12/31/09

3/31/09

12/31/09

3/31/09

Cash and cash equivalents

14,670

$

14,788

$

13,333

$

(118)

$

1,337

$

Trading securities

144

739

816

(595)

(672)

Investment securities

11,651

12,158

6,776

(507)

4,875

Loans held-for-sale

13,998

20,625

10,357

(6,627)

3,641

Finance receivables and loans, net of unearned Income

89,040

77,701

97,171

11,339

(8,131)

Allowance for loan losses

(2,480)

(2,445)

(3,645)

(35)

1,165

Total finance receivables and loans, net

86,560

75,256

93,526

11,304

(6,966)

Investment in operating leases, net

14,003

15,995

23,527

(1,992)

(9,524)

Other assets

25,162

26,161

$31,217

(999)

(6,055)

Assets of operations held-for-sale

13,239

6,584

-

6,655

13,239

Total assets

179,427

$

172,306

$

179,552

$

7,121

$

(125)

$

-

-

Noninterest bearing

1,927

1,755

1,935

172

(8)

Interest bearing

30,933

30,001

21,235

932

9,698

Total deposit liabilities

32,860

31,756

23,170

1,104

9,690

Short-term borrowings

7,609

10,292

8,027

(2,683)

(418)

Long-term debt

90,276

88,021

105,397

2,255

(15,121)

Total debt

97,885

98,313

113,424

(428)

(15,539)

Other liabilities

15,925

16,500

20,937

(575)

(5,012)

Liabilities of operations held-for-sale

12,209

4,898

-

7,311

12,209

Total liabilities

158,879

151,467

157,531

7,412

1,348

-

-

Equity

20,548

20,839

22,021

(291)

(1,473)

Total liabilities and equity

179,427

$

172,306

$

179,552

$

7,121

$

(125)

$

Increase/(Decrease) vs.

30

GMAC: Preliminary Consolidated Condensed Balance Sheet

Supplemental

30

($ millions)

3/31/10

12/31/09

3/31/09

12/31/09

3/31/09

Cash and cash equivalents

14,670

$

14,788

$

13,333

$

(118)

$

1,337

$

Trading securities

144

739

816

(595)

(672)

Investment securities

11,651

12,158

6,776

(507)

4,875

Loans held-for-sale

13,998

20,625

10,357

(6,627)

3,641

Finance receivables and loans, net of unearned Income

89,040

77,701

97,171

11,339

(8,131)

Allowance for loan losses

(2,480)

(2,445)

(3,645)

(35)

1,165

Total finance receivables and loans, net

86,560

75,256

93,526

11,304

(6,966)

Investment in operating leases, net

14,003

15,995

23,527

(1,992)

(9,524)

Other assets

25,162

26,161

$31,217

(999)

(6,055)

Assets of operations held-for-sale

13,239

6,584

-

6,655

13,239

Total assets

179,427

$

172,306

$

179,552

$

7,121

$

(125)

$

-

-

Noninterest bearing

1,927

1,755

1,935

172

(8)

Interest bearing

30,933

30,001

21,235

932

9,698

Total deposit liabilities

32,860

31,756

23,170

1,104

9,690

Short-term borrowings

7,609

10,292

8,027

(2,683)

(418)