Attached files

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-K

| x |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

|

|

For

the fiscal year ended December 31, 2009

|

||

| o |

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

|

|

|

For

the transition period from

to

|

||

Commission

file number: 0-30361

INDUSTRIAL

MINERALS, INC.

(Exact

name of registrant as specified in its charter)

|

DELAWARE

|

11-3763974

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

|

#346

Waverley Street, Ottawa Ontario, Canada,

|

K2P

0W5

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

604-970-0901

Registrant's

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock

Title of

Class

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes

o

No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o

No x

Indicate

by check mark whether the issuer (1) filed all reports required to be filed

by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the

past 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes o No x

Indicate

by checkmark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of "large accelerated

filer," "accelerated filer" and "smaller reporting company" in Rule

12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company x |

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes o No

x

The

aggregate market value of the Common Stock held by non-affiliates as of the last

business day of the registrant's most recently completed second fiscal quarter

was (145,285,016 shares) based on the average bid and asked price as of June 30,

2009 being $.02 per share: $2,905,700.

As of

April 13, 2010 there were 163,248,416 shares of Common Stock

outstanding.

DOCUMENTS INCORPORATED BY

REFERENCE: None.

NOTE

REGARDING FORWARD LOOKING STATEMENTS

Except

for statements of historical fact, certain information contained herein

constitutes "forward-looking statements," including without limitation

statements containing the words "believes," "anticipates," "intends," "expects"

and words of similar import, as well as all projections of future results. Such

forward-looking statements involve known and unknown risks, uncertainties and

other factors which may cause the actual results or achievements of the Company

to be materially different from any future results or achievements of the

Company expressed or implied by such forward-looking statements. Such factors

include, but are not limited to the following: the Company's lack of an

operating history, the Company's minimal level of revenues and unpredictability

of future revenues; the Company's future capital requirements to develop its

mineral property within the defined claim; the risks associated with rapidly

changing technology; the risks associated with governmental regulations and

legal uncertainties; and the other risks and uncertainties described under

"Description of Business - Risk Factors" in this Form 10-K. Certain of the

Forward-looking statements contained in this annual report are identified with

cross-references to this section and/or to specific risks identified under

"Description of Business - Risk Factors".

TABLE OF

CONTENTS

PART

I

|

ITEM

1.

|

DESCRIPTION

OF BUSINESS

|

2 |

|

ITEM

1A.

|

RISK

FACTORS

|

2 |

|

ITEM

1B.

|

UNRESOLVED

STAFF COMMENTS

|

2 |

|

ITEM

2.

|

DESCRIPTION

OF PROPERTIES

|

2 |

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

6 |

|

ITEM

4.

|

(REMOVED

AND RESERVED)

|

6 |

PART

II

|

ITEM

5.

|

MARKET

FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

ITIES

|

7 |

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

7 |

|

ITEM

7.

|

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

8 |

|

ITEM

8.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

F-1 |

|

ITEM

9.

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

13 |

|

ITEM

9A.

|

CONTROLS AND PROCEDURES | 14 |

|

ITEM

9B.

|

OTHER

INFORMATION

|

14 |

PART

III

|

ITEM

10.

|

DIRECTORS,

EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION

16 OF THE EXCHANGE ACT

|

14 |

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

16 |

|

ITEM

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

18 |

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

18 |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 18 |

PART IV

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 18 |

| SIGNATURES | 19 |

ITEM

1 - DESCRIPTION OF BUSINESS

BACKGROUND

The

Company was incorporated on November 6, 1996 and since December 2001 has

operated under the name of Industrial Minerals, Inc. On January 31, 2002, the

Company acquired a 100% interest in the Bissett Creek graphite property

(“Bissett Creek”) pursuant to an assignment of the Bissett Lease from Westland

Capital Inc. Bissett Creek is the sole focus of the Company’s

activities.

In August

2004, the Company through its wholly owned subsidiary, Industrial Minerals

Canada, Inc. received notice from the Ministry of Northern Development and Mines

for the Province of Ontario that the Bissett Creek Graphite Project Certified

Closure Plan as per Subsection 141(3)(a) of the Mining Act for the Province of

Ontario was considered filed. Industrial Minerals, Inc. through its wholly owned

subsidiary Industrial Minerals Canada, Inc. was authorized to begin production

of graphite from Bissett Creek and during production must comply with the

Bissett Creek Graphite Closure Plan as filed. Bissett Creek did not

achieve commercial production and has been kept on care and maintenance basis

since 2004. The Company is currently re-evaluating its development

plans.

Item

1A RISK FACTORS

The

Company's business is subject to numerous risk factors, including the following:

While the Company intends to develop its mineral property and produce graphite

from Bissett Creek, it has no history of operations and must raise the necessary

capital. A processing building and some equipment exists on site but the Company

will need to purchase and install a substantial amount of additional equipment

in order to commence production.

The

Company has the following concerns:

1. The

Company has no record of earnings or cash flow from mining operations. It is

also subject to all the risks inherent in a developing business enterprise

including lack of cash flow, and no assurance of recovery and sale of graphite.

Furthermore, there has been minimal graphite production to date on the property

and if the Company is able to proceed to production, commercial viability will

be affected by factors that are beyond its control, including the recoverability

of graphite from the deposit, uncertainty over graphite prices, the cost of

constructing and operating a mine, the availability of economic sources for

energy, government regulations including regulations relating to prices,

royalties, as well as costs of protection of the environment. The Company has no

purchase orders for graphite to be produced by the Company.

2. The

Company's success and possible growth will depend on its ability to mine the

Bissett Creek deposit, process and recover graphite, and successfully sell it on

world markets which in turn is dependent upon the market's acceptance of the

quality and consistency of the product produced.

3. The

need for additional financing is a concern for the Company as it must raise

substantial financing to build and operate a mine at Bissett Creek. The Company

is dependent on the ability of its management team and its Board of Directors to

obtain such capital and there is no assurance that the Company will be able to

do so, or do so on terms favorable to the Company. The Company may suffer from a

lack of liquidity in the future that could impair its production efforts and

adversely affect its results from operations.

4. The

Company is wholly dependent at the present upon the personal efforts and

abilities of its Officers and Directors, who exercise control over the

day-to-day affairs of the Company.

5. There

are no dividends anticipated by the Company. At the present time, the Company

intends to focus on raising additional capital to develop Bissett

Creek.

ITEM

1B Unresolved Staff Comments

As a

smaller reporting company, the Company is not required to include this

Item.

ITEM

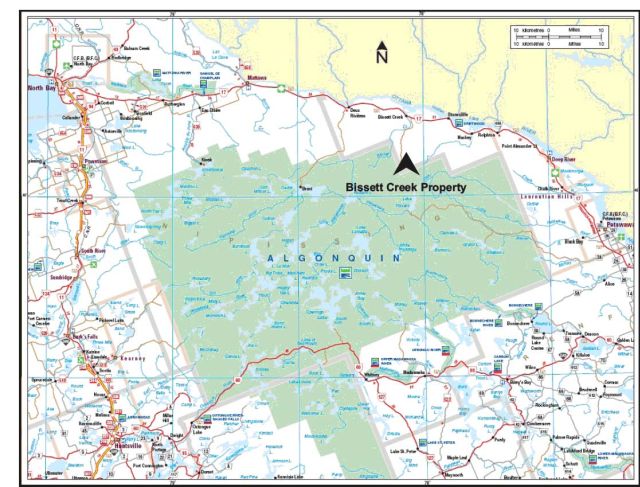

2 - DESCRIPTION OF PROPERTIES

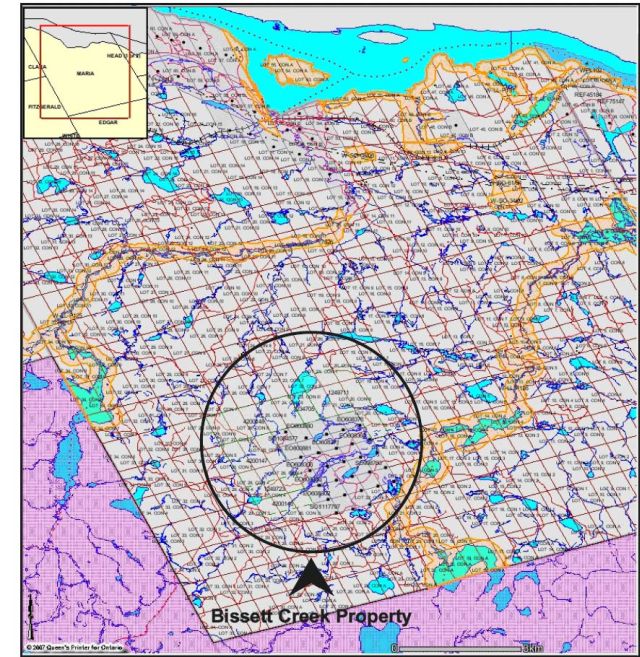

The

Company is an exploration stage company that holds exclusive rights to explore

and if feasible, develop graphite mineral claims at a site located in Maria

Township in Northern Ontario, approximately 180 miles northeast of Toronto,

Ontario. The property and the claims are referred to as "Bissett Creek" because

of their proximity to the town of Bissett Creek. The rights to the Bissett Creek

property are held through a wholly-owned subsidiary, Industrial Minerals Canada,

Inc, an Ontario corporation through which Operations are conducted.

Transportation

into and around the property is by four wheel drive vehicle. The road off of Hwy

17 is hard gravel and extends about 6 miles to the claims owned by the

Company.

2

3

4

On

January 31, 2002, the Company acquired its interest in the Bissett Property

pursuant to an assignment of the Bissett Lease from Westland Capital

Inc.

The site

is close enough to all major highways, rail and power lines to provide access to

the substantial infrastructure that will be required for a large scale open pit

mining operation, if feasible. See map below for details. The core claims are

not subject to any alienation for parks or special management zones according to

information from the Ministry of Northern Development and Mines. The area comes

under the administration of the Southern Ontario Mining District, and does not

include any rural cottage properties.

The

rights to the Bissett Creek property are based upon a Lease granted by the

Province of Ontario on September 22, 1993 to Consolidated North Coast Industries

Ltd. ("North Coast"). This is referred to as the "Bissett Creek Lease". The

Bissett Creek Lease has a twenty-one year term and an annual rental payment

payable to Ministry of Northern Development and mines in an amount prescribed by

the Mining Act. Under the terms of the Bissett Creek Lease, the tenant is

obligated to pay all taxes on the Bissett Property and remain in compliance with

the Mining Act, the Mining Tax Act, the Forest Fires Prevention Act, the Ontario

Water Resources Act and any amendments to the foregoing

legislation.

On

December 29, 1997, North Coast amalgamated with Pacific Sentinal Gold Corp, and

the surviving corporation changed its name to Great Basin Gold Ltd. ("Great

Basin"). On December 21, 2001, Great Basin assigned its rights in the Bissett

Creek Lease to Paul C. McLean, Pierre G. Lacombe and Frank P. Tagliamonte

(collectively referred to as the "McLean Group"). In connection with that

assignment, the McLean Group entered into an option agreement with Great Basin

that was subsequently terminated by a court order on May 15, 2001. The court

order granted to the McLean Group all the rights of Great Basin to the Bissett

Creek Lease.

The

McLean Group assigned the Bissett Creek Lease to Westland Capital

Inc.("Westland") in January of 2002 who in turn assigned the Bissett Creek Lease

to the Company.

As part

of the assignment to Westland Capital Inc, Westland agreed to pay to the McLean

Group, an advance royalty payment of $27,000 CDN annually in two equal

installments of $13,500 Canadian each. These payments are due March 15, and

September 15 and each carry a 30 day payment extension provision. The assignment

agreement further provides that in the event that graphite carbon concentrate is

produced from Bissett Creek, a royalty of $20.CDN per ton must be paid to the

McLean Group. Further, pursuant to the Option Agreement a 2.5% net smelter

return royalty is payable to the McLean Group in the event that any other

minerals are derived from Bissett Creek.

As a

condition of the assignment of the Bissett Creek Lease to the Company, the

Company agreed to assume all of Westland's obligations under the assignment

agreement. On August 15, 2003, the Company assigned its rights in the Bissett

Creek Lease to its wholly owned subsidiary, Industrial Minerals Canada Inc. All

payments owed to the McLean Group are current and the remaining term of the

Bissett Creek Lease is approximately 6 years.

The

Company's wholly owned subsidiary, Industrial Minerals Canada, Inc. is the

lessee of mineral interests at Bissett Creek as follows:

Lease

number 364704 consisting of the following: All those parcels or tracts of land

and land under water in the Township of Head, Clara and Maria, in the County of

Renfrew and Province of Ontario, containing by ad measurement 564.569 hectares,

be the same more or less, composed of those parts of lots 21, 22, 23, 24 and 25,

Concessions IV and V, and part of the bed of Mag Lake and the bed of the unnamed

lake, and lots 23, 24 and 25 and the north half of lots 21 and 22, Concession

III as shown on the plan of the geographic Township of Maria, designated as

parts 1, 2, 3 and 5 on a plan and a field notes deposited in the Land Registry

Office at Pembroke as Plan 49R_11203, comprising mining claims EO 608306, EO

608346, EO 608347, EO 608374, EO 608348, EO 608373, EO 608349, EO 608372, EO

608369, SO 998760, SO 1084577, EO 800884, EO 800880, EO 800881, EO 608350, EO

608371, EO 608367, EO 608370, EO 608376, EO 608368, EO 608302, SO 1117797, SO

998754, SO 1117798, SO 998755, SO 1117799, SO 998756 and SO 998757. These claims

are registered in the Land Titles Office in North Bay, Ontario.

On June

20, 2002, the Company acquired unpatented mining claims SO 1249711 (11 units),

SO 1249723 (3 units) and SO 1234705 (2 units) totaling approximately 625 acres

or 248 hectares, in Maria township, from Messrs. P. McLean, F. Tagliamonte and

the estate of P. Lacombe for CAD$50,000. In the spring of 2007, the

Company also added an additional 950 acres (380 hectares) of staked claims to

the site, bringing the total developable area to approximately 3,250 acres

(1,304 hectares).

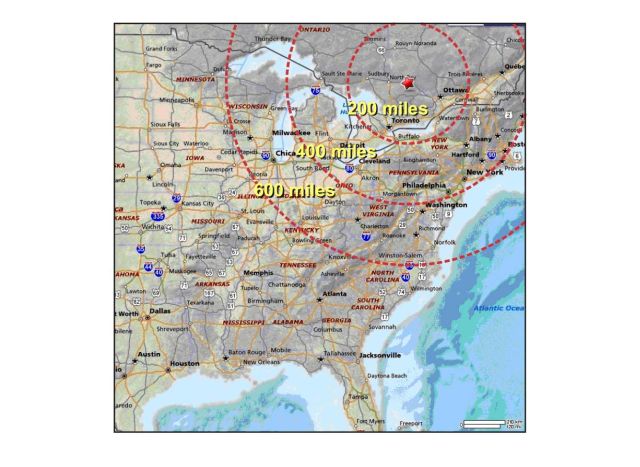

Bissett

Creek is located in Maria Township, about 300 km northeast of Toronto and 100 km

east of North Bay, Ontario. The property connects to Highway 17 (the

Trans-Canada Highway) by 16 km of good gravel road, of which 14 km is maintained

by the Province of Ontario. This represents approximately 4-5 hours

trucking time to industrial consumers in the Toronto area, which in turn is

12-16 hours from potential graphite markets in the northern and eastern regions

of the U.S.A.

The

Geology of the property consists predominantly of Middle Precambrian age

meta-sedimentary rocks. These are divided into graphite gneiss, transitional

graphitic gneiss, and barren gneiss for mapping purposes. The graphitic gneiss

is a distinctive recessive weathering unit, commonly exposed along rock cuts,

hill tops and occasional cliff faces. It is a calcareous,

biotite-amphibole-quartzofelspathic gneiss (generally with red-brown to pale

yellow-brown weathering). Graphite, pyrite and pyrrhotite occur

throughout. Graphite occurs in concentrations visually estimated to

be from 1 to 4%. Sulphides occur in concentrations from 1 to 5%. In

its unweathered state, the rock unit is pale to medium grey in

color.

5

The

graphite gneiss has a moderate 5 to 20 degree dip to the east and the high grade

layer dips 20 to 30 degrees to the south. This unit is sandwiched between the

upper barren noncalcareous gneiss, which forms the hanging wall of

the deposit and a sim ilar lower barren gneiss which forms the footwall. A total

thickness of 75 m of graphitic gneiss was intersected by drilling. The barren

gneiss is a pale to dark grey-green non-calcareous unit. Black biotite, dark

green amphiboles and red garnets distinguish the units from the graphite bearing

varieties.

On May

22, 2007, the Company signed a contract with Geostat International Inc.

("Geostat") to prepare a technical report on the Bissett Creek property in

compliance with the requirements of Canadian National Instrument 43-101. The

Geostat work program included a site visit, an independent estimation,

classification and certification of resources, certification and validation of

the database, verification and validation of the interpretation of ore zones, an

assessment of mining and processing procedures, and an estimation of the capital

and operating costs to build and operate a mine at Bissett Creek. The process

included the drilling of an additional six holes in order to assist in

verification of previously obtained data. The specific drill targets were

determined by Geostat following their review of the original target data

prepared by Kilborn Engineering. The program provided independent assay results

and material to carry out metallurgical testing and validation. Six vertical NQ

size diamond drill holes were drilled in the eastern part of the deposit for a

total of 246.43 meters (808.5 ft) around the location of Pit #1. The last drill

hole (DDH-07-06) was drilled in an area of the property previously named the

"pencil zone". Drilling was done by George Downing Estate Drilling Ltd from

August 1 to August 8, 2007 under supervision of Geostat personnel.

The

Property consists of a building and several pieces of equipment from a previous

attempt to establish a mining and processing operation at Bissett Creek. A

substantial amount of additional equipment and infrastructure will be required

for any future operation at Bissett Creek.

To

December 31, 2007, the Company had incurred general exploration costs at Bissett

Creek of $418,599. For the year ending December 31, 2008, the Company incurred

additional exploration expenses of $49,565, for a cumulative total of $468,164

to December 31, 2008. In the year ending December 31, 2009. the Company incurred

expenses of $3,933, for a cumulative total of $472,097 to December 31,

2009.

The

Company has engaged Stantec Consulting to review the current status of the site

and the permit and to provide a detailed scope of work, schedule and estimated

costs to complete a Closure Plan amendment, obtain needed environmental

approvals, and conduct a critical issues assessment to allow the Company to

proceed with the development of a mine a Bissett Creek.

The

Company's mailing address is 346 Waverley Street, Ottawa Ontario Canada, K2P

0W5.

ITEM

3 - LEGAL PROCEEDINGS

The

Company has been named in a lawsuit filed by Windale Properties in the amount of

$19,781Cdn. The claim is the result of termination of leased premises in

Oakville, Ontario prior to expiry of the lease. Discussions regarding settlement

are ongoing.

MGI

Securities Inc. obtained a default judgment on September 1, 2009 in the amount

of $10,000Cdn. The Company is currently in discussions with MGI regarding

settlement of this claim.

Westwynd

Retail Consultants Inc. obtained a judgment for $110,000Cdn plus accrued

interest in regard to a loan made to the Company. Subsequent to the year end,

the Company reached a settlement agreement with Westwynd regarding settlement of

this claim. The parties have executed an agreement and the Company has obtained

a full and final release as part of the settlement.

ITEM

4 – REMOVED AND RESERVED

6

PART

II

ITEM

5 - MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

(a) The

Registrant's common stock is traded in the over-the-counter market under the

symbol IDSM (OTC Bulletin Board Symbol). The table below sets forth he high and

low bid prices of the Registrant's common stock for the periods indicated. Such

prices are inter-dealer prices, without mark-up, mark-down or commissions and do

not necessarily represent actual sales.

|

Fiscal

Quarter Ending

|

High

|

Low

|

|

March

31, 2008

|

$0.08

|

$0.07

|

|

June

30, 2008

|

$0.08

|

$0.06

|

|

September

30, 2008

|

$0.04

|

$0.02

|

|

December

31, 2008

|

$0.01

|

$0.01

|

|

March

31, 2009

|

$0.05

|

$0.05

|

|

June

30, 2009

|

$0.02

|

$0.02

|

|

September

30, 2009

|

$0.04

|

$0.04

|

|

December

31, 2009

|

$0.02

|

$0.01

|

(b) As of

December 31, 2009, there were 336 shareholders of record of the registrant's

common stock.

(c) The

Registrant has neither declared nor paid any cash dividends on its

common

stock, and it is not anticipated that any such dividend will be

declared

or paid

in the foreseeable future.

Effective

August 11, 1993, the Securities and Exchange Commission (the "Commission")

adopted Rule 15g-9, which established the definition of a "penny stock," for

purposes relevant to the Company, as any equity security that has a market price

of less than $5.00 per share or with an exercise price of less than $5.00 per

share, subject to certain exceptions. For any transaction involving a penny

stock, unless exempt, the rules require: (i) that a broker or dealer approve a

person's account for transactions in penny stocks; and (ii) that the broker or

dealer receive from the investor a written agreement to the transaction, setting

forth the identity and quantity of the penny stock to be purchased. In order to

approve a person's account for transactions in penny stocks, the broker or

dealer must (i) obtain financial information and investment experience and

objectives of the person; and (ii) make a reasonable determination that the

transactions in penny stocks are suitable for that person and that person has

sufficient knowledge and experience in financial matters to be capable of

evaluating the risks of transactions in penny stocks. The broker or dealer must

also deliver, prior to any transaction in a penny stock, a disclosure schedule

prepared by the Commission relating to the penny stock market, which, in

highlight form,(i)sets forth the basis on which the broker or dealer made the

suitability determination; and (ii) states that the broker or dealer received a

signed, written agreement from the investor prior to the transaction. Disclosure

also has to be made about the risks of investing in penny stock in both public

offerings and in secondary trading, and about commissions payable to both the

broker-dealer and the registered representative, current quotations for the

securities and the rights and remedies available to an investor in cases of

fraud in penny stock transactions. Finally, monthly statements have to be sent

disclosing recent price information for the penny stock held in the account and

information on the limited market in penny stocks.

Equity

Compensation Plan Information

|

Plan

Category

|

(a) Number

of securities to be issued upon exercise of outstanding options, warrants

and rigihts

|

(b) Weighted

average exercise price of outstanding options, warrants and

rights

|

(c) Number

of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column

(a)

|

|

Equity

compensation plans approved by security holders

|

None

|

n/a

|

n/a

|

|

Equity

compensation plans not approved by security holders

|

7,349,999

|

$0.106

|

None

|

Using the

Black-Scholes option pricing model, the Company had stock compensation expense

for the year of $179,221. A balance of $44,665 remains to be expensed

over the vesting period of the options.

Dividends

The

Company has not paid any dividends to date, and has no plans to do so in the

immediate future.

ITEM

6 - SELECTED FINANCIAL DATA

As a

smaller reporting company, the Company is not required to include this

Item.

7

ITEM

7 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATION

MANAGEMENT

DISCUSSION AND ANALYSIS

CONSOLIDATED

RESULTS

Twelve

month periods ending December 31, 2009, 2008

Industrial

Minerals, Inc. ("the Company"), a Delaware Corporation, was incorporated on

November 6, 1996, under the name Winchester Mining Corp, and after a series of

mergers, and name changes, became known as Industrial Minerals, Inc in

2002.

For the

fiscal year commencing January 1, 2008, the Board of Directors was comprised of

William Thomson, William Booth and Robert Dinning. Mr. Thomson, who was also

Chairman of the Company, resigned on June 20, 2008 and Mr. Booth, an independent

director resigned on July 9, 2008. The President of the Company, David Wodar,

who was appointed July 9, 2007, resigned on June 12, 2008. Following these

resignations, Mr. Chris Crupi C.A. and Mr. Gregory Bowes, MBA, were appointed

directors of the Company and Mr. Robert Dinning C.A.was appointed President and

CEO on June 23, 2008. Mr. Robert Dinning C.A. continued as a director and was

also reappointed CFO effective June 23, 2008. Mr. Dinning was originally

appointed CFO and Director September 15, 2006. Mr. Crupi was appointed Chairman

of the Audit Committee and both Mr. Crupi and Mr. Bowes are independent

directors of the Company

The

Company also moved its corporate offices to 346 Waverley Street, Ottawa Ontario,

K2P 0W5, effective June 23, 2008.

Under the

mandate of the restructured Board of Directors, the Company significantly

reduced its monthly operating expenses and focused its efforts on settling

payables, reducing debt, raising financing and developing a plan to move the

Bissett Creek project forward. .

On

October 27, 2008, the Company engaged RBC Capital Markets, a division of the

Royal Bank of Canada, as financial advisor with respect to strategic options

facing the company. The engagement was for a term of 12 months with a success

fee based compensation for completion of a transaction. Under terms of the

agreement, the Company agreed to engage RBC Dominion Securities (RBC), a member

company of RBC Capital Markets, as its exclusive financial advisor in connection

with a potential transaction involving the Company. This includes potential sale

of the Company, investment by a third party, amalgamation, arrangement, or other

business transaction involving the Company. By mutual consent, this agreement

was terminated in June 2009.

In

addition to engaging outside technical professional consultants when needed, the

Company on November 7, 2008 announced appointment of George Hawley as Technical

Advisor to the Board of Directors. Mr. Hawley has 40 years experience in the

processing of industrial minerals including mica, graphite, and silica, all of

which are specific to the Bissett Creek property. Mr. Hawley worked for various

companies in the USA, Europe, Japan, Australia, Africa and Canada and has

published over 50 technical papers on industrial mineral products pertaining to

technical and marketing topics.

On

October 28, 2009, the Company announced that it had entered into a non brokered

agreement with various lenders, including a director of the Company, to issue

approximately CDN$300,000 (US$286,560) in senior secured convertible

non-interest bearing notes (the “Notes”) to provide working capital for its

subsidiary, Industrial Minerals Canada Inc, (“IMC”) and pay the costs of

attempting to raise financing and take IMC public in Canada. The Notes were

secured by a security interest over all of the assets of IMC, including the

mineral claims and leases comprising the Project. Subsequent to year

end the amount of the Notes was increased to CDN$600,000 and they were converted

into units of IMC as described below.

In

addition to the short-term financing stated above, the Company announced on

October 28, 2009, that IMC had entered into a letter of intent to effect a

business combination with Rattlesnake Ventures Inc.(“RVI”) to form a new company

to be called Northern Graphite Corporation (“Northern Graphite”) (the

“Transaction”). The proposed Transaction would constitute the Qualifying

Transaction of RVI, a Capital Pool Company, and if completed would result in IMC

becoming publicly listed on the TSX Venture Exchange as Northern

Graphite.

In

conjunction with the Transaction, the Company also signed an engagement letter

with Research Capital to complete, on a best efforts basis, a financing for

Northern Graphite consisting of CDN$3,000,000 (US$2,865,600) in

subscription receipts at a price of $CDN0.50 (US$0.47) per subscription

receipt and CDN$3,000,000 (US$2,865,600) in flow-through common shares at a

price of CDN$0.50 (US$0.47) per share (the “Offering”). Each subscription

receipt was, subject to the satisfaction of certain conditions, convertible into

one unit consisting of one common share and one half of one common share

purchase warrant of Northern Graphite. This transaction was not

completed and was terminated in December 2009. Subsequent to the year

end, the agreement with Rattlesnake Ventures Inc was also

terminated. The Company did complete the name change of IMC to

Northern Graphite Corporation.

8

Subsequent

to the year end, on March 8, 2010, the Company announced that its wholly-owned

subsidiary Northern Graphite had completed a non-brokered private

placement financing consisting of the issuance of 5,900,000 units at a price of

C$0.25 per unit, each unit being comprised of one common share and one common

share purchase warrant exercisable at a price of C$0.35 per share for a period

of 18 months from the date upon which the Company or its successor becomes a

reporting issuer in a jurisdiction of Canada. Gross proceeds were C$1.475

million. In addition, Northern Graphite had increased the capital raised through

the issuance of the Notes to C$600,000 and the Notes, pursuant to their terms,

automatically converted into units upon the closing of the financing at a

conversion price of $0.175 per unit, each unit consisting of one common share

and one common share purchase warrant exercisable at a price of C$0.245 per

share for a period of 18 months from the date upon which Northern Graphite or

its successor becomes a reporting issuer in a jurisdiction of

Canada.

As a

result of the private placement and the conversion of the Notes Northern

Graphite issued a total of 9,328,571 common shares. The Company owns 11,750,000

common shares of Northern Graphite which represents a 55.7% interest. Subject to

the receipt of all required corporate, regulatory and stock exchange approvals,

Northern Graphite plans to complete a going public transaction in Canada as soon

as possible and the Company plans to distribute its Northern Graphite shares to

its shareholders.

While the

Company was unsuccessful in raising financing through Research Capital and

taking Northern Graphite public in Canada through the RVI transaction, the

private placement and Note financings enabled it to deal with critical issues

relating to payables and corporate debts and have put Northern Graphite on a

sound footing to move Bissett Creek forward. It is still the

Company’s objective to take Northern Graphite public. However, the

Company recognizes it will require substantial additional capital in the future

to continue the development of Bissett Creek. While the Company is

optimistic such capital can be obtained, there is no assurance that it will be

available or available on terms that are attractive to the Company.

RESULTS

OF OPERATIONS

During

the fiscal years' ending December 31, 2009 and 2008, the Company had no

revenues. The Company originally planned to complete the installation of a pilot

plant that would have generated about 10 tons of graphite per day that could be

distributed to prospective customers for testing. The expected cost of the pilot

plant was higher than originally contemplated and the Company deferred setting

up the pilot plant as it did not have the capital to do so. The Company is

studying alternatives to building its own pilot plant.

Total

expenses and the resulting loss for the year ended December 31, 2009 amounted to

$1,629,281 vs. $1,579,801 in 2008. Due to a lack of capital and a significant

downturn in business activity the Company decided to reduce general overhead,

including consultants hired to assist in the development of Bissett Creek. The

most significant decrease was management fees which amounted to $448,719 in 2009

vs. $827,398 in 2008. These figures include stock compensation expense of

$179,221 in 2009 vs. $176,427 in 2008.

The

Company adopted SFAS 123 "Accounting for Stock-Based Compensation", effective

April 1, 2007. Compensation costs for the Company's stock options had been

determined in accordance with the fair value based method prescribed as SFAS

123. The fair value of each option is estimated on the date of the grant using

the Black-Scholes option-pricing model with the following weighted average

assumptions used for options granted during the year ending December 31, 2007.

Expected volatility of 98.47% at December 31, 2009, risk-free interest rate 4%;

and an expected life of up to 4 years. The Company confirms that all stock

compensation disclosures adhere to SFAS 123(R).

General

exploration expenses in 2009 were $3,933 vs. $49,565 in 2008. Because of

financial constraints, the Company reduced its exploration activities at Bissett

Creek in 2009 pending completion of additional financing. With the completion of

additional financing subsequent to the year end, the Company expects to

undertake pre feasibility studies and additional drilling at its Bissett Creek

property in 2010.

Professional

fees in the year amounted to $96,626 vs. $100,762 in 2008. This was the result

of legal expenses in excess of $50,000 in 2008 related to preparation of filings

for matters that did not proceed.

Total

depreciation expenses for 2009 were $111,579 compared to $201,843 in 2008 as the

Company also incurred an impairment charge of $683,327 in 2009 on assets deemed

obsolete. No such charge occurred in 2008.

Total

royalty expenses were $23,644 in 2009 compared to $22,059 in 2008. The expenses

in Canadian Dollars were the same each year with currency exchange rates

accounting for the difference between 2009 and 2008. The Company is required to

pay a yearly royalty of $27,000 Canadian whether graphite is produced or not.

These payments are due semi-annually in March and September of each

year.

General

and administrative expenses totaled $242,596 in 2009 vs. $395,677 in 2008. This

includes a charge for property taxes at Bissett Creek of $98,916.

The

foreign exchange loss in 2009 of $139,298 vs.$17,504 in 2008 reflects the large

swing in exchange rates in 2009 and 2008. In 2008 the Canadian Dollar was valued

at $0.8170US whereas in 2009, the Canadian Dollar increased to $0.9552US.

Financial statement reporting is conducted in $U.S. currency while most expenses

occur in Canadian Dollars.

The

Company had a net loss from operations of $1,629,281 in 2009 vs. $1,579,801 in

2008. The Company recognizes that it must continue to acquire

additional financing in order to properly develop the Bissett Creek property and

to sell the resulting graphite on the world market. There is no assurance that

the Company or its management will be successful in its attempts to acquire such

financing.

9

Liquidity

and Capital Resources

The

Company had cash on hand at December 31, 2009 of $271,168 vs. $307 vs. at

December 31, 2008. The receivable on the Balance Sheet represents a refund of

GST tax due from the Government of Canada.

The

Company has no deposits at December 31, 2009 vs. $12,510 at December 31, 2008.

This includes a deposit on equipment in the amount of $10,000 in 2008 which was

returned in 2009.

The

Company has a long-term deposit with the Ministry of Finance for the Province of

Ontario. During the year ending December 31, 2004 a Mine Development and Closure

Plan was filed with, and accepted by, the Ministry of Northern Development and

Mines, in accordance with the MINING ACT, R.S.O. 1990 Ontario Regulation 240/00,

including the standards, procedures and requirements of the Mining Code of

Ontario. The Company's deposit in 2004 amounted to $288,363Cdn. Since that time

the deposit has accrued interest of $23,833 bringing the total Reclamation

Deposit at December 31, 2009 to $299,277. This is a financial guarantee to the

Province of Ontario ensuring that there are enough funds on hand to affect a

proper closure of the Bissett Creek property.

During

the year ending December 31, 2009, the Company had no fixed asset additions but

did sell some equipment and incur an impairment charge on obsolete equipment of

$683,327.

Various

equipment items originally costing $757,994, which had a current net book value

of $437,401, were written off based on management’s assessment that the

equipment was of no further use. Additional office equipment with a net book

value of $15,927 was also disposed of increasing the impairment write-off for

the year to $453,327. In addition the Company wrote off the asset retirement

obligation of $230,000, thus increasing the impairment charge for the year to

$683,327. In 2008, the Company agreed to sell some equipment to Montana Mining

LLC of Nassau Bahamas for a total consideration of $105,000Cdn ($99,3405US),

subject to receipt of all funds prior to completion of the sale. This

transaction completed in December 2009.

The

Company has total current liabilities in the amount of $2,024,604 at December

31, 2009 vs. $833,319 at December 31, 2008. This is comprised of:

|

Liability

|

2009

|

2008

|

||||||

|

Accounts

payable

|

$ | 405,049 | $ | 270,150 | ||||

|

Accrued

interest

|

102,183 | 65,317 | ||||||

|

Loans

payable – current

|

820,457 | 416,274 | ||||||

|

Due

to related parties

|

252,746 | 28,472 | ||||||

|

Notes

payable

|

300,888 | 0 | ||||||

|

Funds

received in advance

|

143,280 | 0 | ||||||

|

Customer

Deposit

|

0 | 53,105 | ||||||

| $ | 2,024,604 | $ | 833,318 | |||||

Included

in current loans payable is a debt of $90,796 plus accrued interest payable to

First Plain Inc. The debt was repayable on July 15, 2009. On February 15, 2010

First Plain Inc. agreed to a settlement consisting of CAD $95,000 to be paid in

cash, and 160,000 units of Northern Graphite as per the private placement as

settlement for accrued interest.

Also

included in loans payable is an amount owing to C.Birge in the amount of

$161,000 repayable on December 31, 2009 with interest accruing at 10 per cent

per annum. On February 15, 2010, Mr. Birge agreed to settle this loan in one

year on receipt of $150,000 with no interest payable on this extension. In

addition, Mr. Birge will receive a payment of CAD $35,000 on other loans due to

him plus 140,000 units of Northern Graphite as per the private placement

terms.

Current

loans payable also includes a loan payable to Westwynd Retail Consultants Inc.

of $105,072,US ($110,000Cdn) plus accrued interest at 10%. This note is

currently due and Westwynd had obtained both a judgment against the Company and

a Sheriff’s writ. A full settlement was reached in February 2010

consisting of the payment of CDN$125,000 ($119,400US) plus the issuance of

100,000 units in Northern Graphite as per the private placement

terms.

The

remaining current loans are due to two shareholders and former officers and/or

directors of the Company and amount to $77,925 US. Agreement has been reached

subsequent to the year end regarding the settlement of one loan for $22,925US,

but there is no agreement to date on the remaining balance.

The

Company also has loans of $385,665 outstanding at December 31, 2009 vs. $334,714

at December 31, 2008. This is the same loan in both years and is in Canadian

funds, thus resulting in the foreign exchange fluctuation. This loan has been

settled subsequent to the year end and has been settled for stock.

There are

no terms of repayment at the present time regarding amounts due to related

parties.

The

Company intends to continue to seek debt or equity financing from

non-affiliates, officers, directors and shareholders.

On March

8, 2010, Northern Graphite completed a non brokered private placement of

5,900,000 units at $0.25 per unit for total proceeds of $1,475,000Cdn

($1,408,920US). This along with the sale of Convertible Secured Notes for

$600,000Cdn ($573,120US) brought the total of funds raised to $2,075,000Cdn

($1,982,040US).

All risks

and uncertainties inherent in any start-up company exist with respect to the

Company.

The

Company had long term loans payable amounting to $385,665 at December 31, 2009.

These loans were settled subsequent to the year end through the issuance of

1,091,600 restricted common shares

10

In 2009

the Company’s wholly owned subsidiary Industrial Minerals Canada, Inc., now

Northern Graphite, completing a non-brokered financing with various lenders,

including a director of the Company, for CDN$300,000 through the issuance of

senior secured convertible non-interest bearing notes (the “Notes”) A first mortgage and

security interest over all assets of Northern, including and specifically the

mineral claims and leases known as the Bissett Creek property was granted to

2221862 Ontario Inc., a newly-incorporated company incorporated and controlled

by Gregory Bowes, a Director of the Company and CEO of Northern, to hold the

security on behalf of the Note holders as well as to hold the proceeds from sale

of the Notes in trust, and to distribute such proceeds to the Company as

required to cover the costs that were to be incurred in connection with a

proposed transaction with RVI and the Research Capital financing and to pay

existing and future expenses which were critical and necessary to keep Northern

Graphite functional and solvent and protect its assets. Northern

Graphite was specifically prohibited from using any of the proceeds to make any

payments to Directors or Officers or to repay existing loans. In the

event that Northern Graphite raised not less than $1,000,000 in financing the

Notes automatically convert into units of Northern Graphite consisting of one

common share and one common share purchase warrant having terms substantially

similar to units issued in the financing except that the price of the units

would be at a 30% discount to the financing and the exercise price of the

warrants would also be at a 30% discount to the exercise price of the warrants

issued under the financing and holders of the Notes would be entitled to one

full warrant.

If

Northern Graphite raised less than $1,000,000 the Notes were convertible into

units of the Company at the option of the holder at any time after the date

which is six months from the date of closing of the issuance of the Notes, at a

conversion price of $0.02 per share and each such share would have attached one

common share purchase warrant entitling the holder to purchase one common share

of the Company at a price of $0.03 per share for a period of 24

months.

The Notes

would, unless previously converted, become fully due and payable on the date

which is 24 months from issuance and unless previously converted, became fully

due and payable in the event that there was any material adverse change in the

business or affairs of the Company or Northern Graphite including the initiation

of bankruptcy or insolvency proceedings, as determined by 2221862 Ontario Inc.

in its sole discretion.

Subsequent

to the end of 2009 the principal amount of the Notes was increased to

CAD$600,000 to provide additional working capital and the Notes were converted

to shares of Northern Graphite pursuant to their terms and the completion of a

private placement described elsewhere herein.

During

2008, the Company completed private placements as described below:

On

February 26, 2008, the Company completed a private placement to one accredited

investor for 227,273 restricted common shares at $0.11 per share for a total of

$25,000. There were no warrants attached to this investment.

On March

10, 2008, the Company completed a private placement with five accredited

investors for 1,780,000 units at $0.09 per unit for $160,200. Each unit

consisted of one share of common stock and one common stock purchase warrant

entitling the investor to acquire an additional share of common stock at $0.15

per share on or before March 10, 2010. The warrants were not exercised and have

expired.

On May

15, 2008, the Company completed a private placement to one accredited investor

for 416,667 restricted common shares at $0.06 per share for

$25,000. There were no warrants attached to this

financing.

On June

30, 2008, the Company completed a private placement with six accredited

investors for 6,575,000 units at $0.04 per unit for $265,000. Each unit

consisted of one share of common stock and one-half of one common stock purchase

warrant entitling the investor to acquire an additional share of common stock

for each two common share purchase warrants held at $0.08 per share. These

warrants expired without being exercised.

On

November 7, 2008, the Company completed a private placement with one accredited

investor for 250,000 units at $0.04 per unit for $10,000. Each unit consisted of

one share of common stock and one-half of one common stock purchase warrant

entitling the investor to acquire an additional share of common stock for each

two common share purchase warrants held at $0.08 per share. These warrants

expired without being exercised.

11

CRITICAL

ACCOUNTING ESTIMATES

The

consolidated financial statements of Industrial Minerals, Inc. are prepared in

conformity with GAAP, which requires the use of estimates, judgments, and

assumptions that affect the reported amounts of assets and liabilities at the

date of the financial statements and the reported amounts of revenues and

expenses during the periods presented. Industrial Minerals, Inc.'s accounting

policies are described in Note 1 to the Consolidated Financial Statements.

Critical accounting estimates are described in this section. An accounting

estimate is considered critical if the estimate requires management to make

assumptions about matters that were highly uncertain at the time the estimate

was made, different estimates reasonably could have been used, or if changes in

the estimate that would have a material impact on the Corporation's financial

condition or results of operations are reasonably likely to occur from period to

period. Management believes that the accounting estimates employed are

appropriate and resulting balances are reasonable. However, actual

results could differ from the original estimates, requiring adjustments to these

balances in future periods. The Company has discussed the development, selection

and disclosures of these critical accounting estimates with the Audit Committee

of Industrial Minerals, Inc.'s Board of Directors, and the Audit Committee has

reviewed the Company's disclosures relating to these estimates.

GOING

CONCERN

The

critical assumption made by management of the Company is that the Company will

continue to operate as a going concern. The following is contained in the notes

to the financial statements and the Company's auditors have expressed a concern

that the Company may not be able to continue as a going concern.

The

Company's financial statements have been presented on the basis that it is a

going concern. The Company is in the exploration stage and has not earned

significant revenues from operations. The Company's current liabilities exceed

current assets by $1,745,433 and the Company recorded a net loss amounting to

$1,629,281 during the year ended December 31, 2009. The Company's ability to

continue as a going concern is dependent upon its ability to continue to

identify additional sources of capital to pay its payables and debts, meet

administrative expenses and advance its Bissett Creek Property and ultimately,

achieve profitable operations. Management has obtained additional financing

subsequent to the year end which will allow it to settle with existing creditors

and lenders and advance the Bissett Creek project.

If the

Company cannot continue as a going concern the value of the Company's assets may

approach a level close to zero. Investors should be cautioned that should the

Company cease to operate the Company may recover a small fraction of the

original costs of its assets should a liquidation of the Company's assets occur.

The accompanying financial statements do not include any adjustments that might

result if the going concern assumption is not valid.

Impairment

of Long-Lived Assets

Industrial

Minerals, Inc. periodically reviews the carrying value of its long-lived assets

held and used, other than goodwill and intangible assets with indefinite lives,

and assets to be disposed of when events and circumstances warrant such a

review. This review is performed using estimates of future cash flows as well as

industry and market conditions and the Company’s future development plans. If

the carrying value of a long-lived asset is considered impaired, an impairment

charge is recorded for the amount by which the carrying value of the long-lived

asset exceeds its fair value.

During

the year, the Company evaluated its fixed assets at the mine site and determined

that it would take an impairment charge of $683,327 regarding assets deemed

obsolete or non-functional.

12

ITEM

8- FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

To the Board of Directors and

Stockholders of Industrial

Minerals, Inc. (An Exploration Stage Corporation):

We have

audited the accompanying consolidated balance sheet of Industrial Minerals,

Inc.("the Company") as at December 31, 2009 and the related consolidated

statement of operations, stockholders' equity and cash flows for the year then

ended. The consolidated financial statements for the period from November 6,

1996 (inception) through December 31, 2008 were audited by other auditors. Our

opinion, insofar as it relates to amounts included from inception through

December 31, 2008 is based solely on the reports of other auditors. These

financial statements are the responsibility of the Company's management. Our

responsibility is to express an opinion on these financial statements based on

our audits. The financial statements of Industrial Minerals, Inc as of December

31, 2008, were audited by other auditors whose report dated March 31, 2009,

expressed an unqualified opinion on those statements.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan

and perform an audit to obtain reasonable assurance whether the financial

statements are free of material misstatement. We were not engaged to perform an

audit of the Company's internal control over financial reporting. Our audits

included consideration of internal control over financial reporting as a basis

for designing audit procedures that are appropriate in the circumstances, but

not for the purpose of expressing an opinion on the effectiveness of the

Company's internal control over financial reporting. Accordingly, we express no

such opinion. An audit also includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements. An audit

also includes assessing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis for our

opinion.

In our

opinion, these consolidated financial statements present fairly, in all material

respects, the financial position of the company as at December 31, 2009 and the

results of its operations and its cash flows for the year then ended in

conformity with generally accepted accounting principles in the United States of

America.

The

accompanying financial statements have been prepared assuming that the Company

will continue as a going concern. As discussed in Note 1, the Company has not

generated revenues since its inception, has incurred annual losses, and further

losses are anticipated. The Company requires additional funds to meet its

obligations and ongoing operations. Management's plans in this regard are

described in Note 1. These factors raise substantial doubt about the Company's

ability to continue as a going concern. The financial statements do not include

any adjustments that might result from the outcome of this

uncertainty.

|

|

|

Meyers Norris Penny LLP, Chartered

Accountants

|

Vancouver,

BC, Canada

April 14,

2010

F-1

|

CHARTERED

ACCOUNTANTS & BUSINESS ADVISORS

2300 – 1055 DUNSMUIR STREET VANCOUVER, BC V7X

1J1

PH.

(604)

685-8408 FAX (604)

685-8594 www.mnp.ca

|

|

INDUSTRIAL

MINERALS, INC.

|

||||||||

|

And

Subsidiary

|

||||||||

|

(An

Exploration Stage Company)

|

||||||||

|

CONSOLIDATED

BALANCE SHEETS

|

||||||||

|

December

31, 2009 and December 31, 2008

|

||||||||

|

December

31

|

December

31

|

|||||||

|

ASSETS

|

2009

|

2008

|

||||||

|

CURRENT

ASSETS

|

||||||||

|

Cash

|

$ | 271,168 | $ | 307 | ||||

|

Receivables

|

8,003 | 15,420 | ||||||

|

Deposits

|

- | 12,026 | ||||||

|

Total

Current Assets

|

279,171 | 27,753 | ||||||

|

RECLAMATION

DEPOSIT

|

299,277 | 230,000 | ||||||

|

FIXED

ASSETS

|

||||||||

|

Building

and Equipment

|

1,243,511 | 2,388,876 | ||||||

|

Asset

retirement obligations

|

- | 230,000 | ||||||

|

Less

accumulated depreciation

|

(746,750 | ) | (1,097,209 | ) | ||||

| 496,761 | 1,291,667 | |||||||

|

TOTAL

ASSETS

|

$ | 1,075,209 | $ | 1,549,420 | ||||

|

LIABILITIES

& STOCKHOLDERS' EQUITY

|

||||||||

|

CURRENT

LIABILITIES

|

||||||||

|

Accounts

payable

|

$ | 405,049 | $ | 270,150 | ||||

|

Accrued

interest payable

|

102,183 | 65,317 | ||||||

|

Loans

payable - current

|

820,457 | 416,274 | ||||||

|

Due

to related party

|

252,746 | 28,472 | ||||||

|

Notes

payable

|

300,888 | - | ||||||

|

Funds

received in advance

|

143,280 | - | ||||||

|

Other

current liabilities

|

- | 53,105 | ||||||

|

Total

Current Liabilities

|

2,024,604 | 833,319 | ||||||

|

OTHER

LIABILITIES

|

||||||||

|

Asset

retirement obligations

|

299,277 | 230,000 | ||||||

|

Loans

payable - Due beyond one year

|

- | 334,714 | ||||||

| 299,277 | 564,714 | |||||||

|

STOCKHOLDERS'

EQUITY

|

||||||||

|

Common

stock, 200,000,000 shares authorized, $0.0001

|

||||||||

|

par

value; 163,248,416 and 137,644,476 shares

|

||||||||

|

issued

and outstanding, respectively

|

16,322 | 16,072 | ||||||

|

Additional

paid-in capital

|

10,201,185 | 9,972,214 | ||||||

|

Accumulated

other comprehensive income

|

(105,985 | ) | (105,985 | ) | ||||

|

Deficit

accumulated during exploration stage

|

(11,360,194 | ) | (9,730,913 | ) | ||||

|

TOTAL

STOCKHOLDERS' EQUITY

|

(1,248,672 | ) | 151,388 | |||||

|

TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY

|

$ | 1,075,209 | $ | 1,549,420 | ||||

See

accompanying notes to consolidated financial statements

F-2

INDUSTRIAL

MINERALS, INC.

AND

SUBSIDIARY

(An

Exploration Stage Company)

CONSOLIDATED

STATEMENTS OF OPERATIONS

|

Year

Ended

|

Year

Ended

|

|||||||

|

December

31,

|

December

31,

|

|||||||

|

2009

|

2008

|

|||||||

|

REVENUE

|

||||||||

|

Income

earned during exploration stage

|

$ | - | - | |||||

|

EXPENSES

|

||||||||

|

Cost

of revenues

|

- | - | ||||||

|

Professional

fees

|

96,626 | 100,762 | ||||||

|

Royalty

fees

|

23,644 | 22,059 | ||||||

|

Depreciation

and amortization

|

111,579 | 201,843 | ||||||

|

Impairment

of long-lived assets

|

683,327 | - | ||||||

|

Loss

on disposal of assets

|

- | - | ||||||

|

Management

fees and salaries

|

448,719 | 827,398 | ||||||

|

General

exploration expense

|

3,933 | 49,565 | ||||||

|

Other

general and administrative

|

242,597 | 395,677 | ||||||

|

TOTAL

EXPENSES

|

1,610,425 | 1,597,305 | ||||||

|

LOSS

FROM OPERATIONS

|

(1,610,425 | ) | (1,597,305 | ) | ||||

|

OTHER

INCOME (EXPENSE)

|

||||||||

|

Interest

income

|

- | - | ||||||

|

Gain

from extinguishment of debt

|

- | - | ||||||

|

Foreign

currency loss

|

(139,298 | ) | (17,504 | ) | ||||

|

Gain

on sale of asset

|

99,340 | - | ||||||

|

Gain

on debt settlement

|

21,102 | - | ||||||

|

TOTAL

OTHER INCOME

|

(18,856 | ) | (17,504 | ) | ||||

|

LOSS

FROM OPERATIONS

|

(1,629,281 | ) | (1,579,801 | ) | ||||

|

INCOME

TAXES

|

||||||||

|

NET

LOSS

|

$ | (1,629,281 | ) | (1,579,801 | ) | |||

|

NET

LOSS PER SHARE, BASIC AND DILUTED

|

$ | (0.01 | ) | (0.01 | ) | |||

|

WEIGHTED

AVERAGE NUMBER OF

|

||||||||

|

COMMON

STOCK SHARES OUTSTANDING, BASIC AND DILUTED:

|

162,742,617 | 139,275,920 | ||||||

See

accompanying notes to consolidated financial statements

F-3

INDUSTRIAL

MINERALS, INC. AND SUBSIDIARY

(An

Exploration Stage Company)

CONSOLIDATED

STATEMENTS OF CASH FLOWS

|

Year

|

Year

|

|||||||

|

Ended

|

Ended

|

|||||||

|

December

31, 2009

|

December

31, 2008

|

|||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net loss

|

$ | (1,629,281 | ) | $ | (1,579,801 | ) | ||

|

Adjustments to reconcile net loss

|

||||||||

|

to net cash used by operating activities:

|

||||||||

|

Depreciation

|

111,579 | 201,843 | ||||||

|

Provision for bad debts

|

- | - | ||||||

|

Stock issued for services

|

50,000 | 446,700 | ||||||

|

Impairment of long-lived assets

|

683,327 | - | ||||||

|

Stock based compensation

|

179,221 | 176,427 | ||||||

|

Loss on disposal of assets

|

- | - | ||||||

|

Gain on settlement of debt

|

(21,102 | ) | - | |||||

|

Gain on sale of assets

|

(99,340 | ) | - | |||||

|

Changes in:

|

||||||||

|

Receivables

|

7,417 | 3,100 | ||||||

|

Inventory

|

- | - | ||||||

| Prepaid expenses | - | - | ||||||

|

Deposits

|

12,026 | 484 | ||||||

|

Accounts payable and accrued expenses

|

156,001 | 127,565 | ||||||

|

Accrued interest payable

|

36,867 | 13,228 | ||||||

|

Due to related parties

|

- | 4,520 | ||||||

|

Net cash used in operating activities

|

(513,285 | ) | (605,934 | ) | ||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of building and equipment

|

- | |||||||

|

Advance received for sale of Equipment

|

46,235 | 53,105 | ||||||

|

Investment inMultiplex

|

- | - | ||||||

|

Acquisition of goodwill

|

- | - | ||||||

|

Loan to related party

|

- | - | ||||||

|

Long-term deposits

|

- | - | ||||||

|

Net cash used in investing activites

|

46,235 | 53,105 | ||||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Proceeds from issuance of notes

|

444,168 | - | ||||||

|

Due to related party

|

224,274 | - | ||||||

|

Current loans

|

69,469 | - | ||||||

|

Net proceeds from sale of common stock

|

- | 485,200 | ||||||

|

Net proceeds from loans payable

|

- | |||||||

|

Loan repayments

|

(18,796 | ) | ||||||

|

Proceeds from mortgage

|

- | - | ||||||

|

Principal payments on mortgage

|

- | - | ||||||

|

Stock issued in settlement of debt

|

- | |||||||

|

Cash acquired in acquisition of Peanut Butter & Jelly,

Inc.

|

- | - | ||||||

|

Net

cash provided by financing activities

|

737,911 | 466,404 | ||||||

|

Effect

of exchange rate on Changes in Cash

|

(17,504 | ) | ||||||

|

NET

INCREASE (DECREASE) IN CASH

|

270,861 | (103,929 | ) | |||||

|

Cash,

beginning of period

|

307 | 104,236 | ||||||

|

Cash,

end of period

|

$ | 271,168 | $ | 307 | ||||

|

SUPPLEMENTAL

CASH FLOW DISCLOSURES:

|

||||||||

|

Interest paid

|

$ | - | $ | - | ||||

|

Income taxes paid

|

$ | - | $ | - | ||||

|

Non-cash investing and financing activities:

|

||||||||

|

Shares issued for related party debt

|

61,200 | |||||||

|

Shares issued for debt

|

50,000 | 65,000 | ||||||

|

Shares issued for services

|

- | - | ||||||

|

Shares issued for investment

|

- | - | ||||||

|

Shares issued for accrued interest

|

- | - | ||||||

|

Long term deposits financed by accounts payable

|

- | - | ||||||

| Property costs financed by issuance of common stock | - | - | ||||||

|

Equipment financed by:

|

||||||||

|

Accounts payable

|

- | |||||||

|

Issuance of common stock

|

- | |||||||

| - | ||||||||

See

accompanying notes to consolidated financial statements

F-4

INDUSTRIAL

MINERALS, INC. AND SUBSIDIARY

(An

Exploration Company)

CONSOLIDATED

STATEMENT OF STOCKHOLDERS' EQUITY

December 31,

2009

|

|

|

|

|||||||||||||||||||||||||||

|

Common

Stock

|

Additional

|

Accumulated Deficit

During |

Accumulated Other |

Common

Stock

|

Total Stockholders' |

||||||||||||||||||||||||

|

Number

|

Number

|

Paid-in

|

Exploration

|

Comprehensive

|

Subscriptions

|

Equity

|

|||||||||||||||||||||||

|

of

Shares

|

of

Shares

|

Amount

|

Capital

|

Stage

|

Income

|

Received

|

(Deficit)

|

||||||||||||||||||||||

|

Inception

- November 6, 1996 - See Note A below

|

- | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||||||

|

Balance

at December 31, 1998

|

252,500 | 757,500 | 76 | 505,092 | (750,830 | ) | - | (245,662 | ) | ||||||||||||||||||||

|

Issuance

of common stock for cash

|

30,000 | 90,000 | 9 | 146,612 | - | - | 146,621 | ||||||||||||||||||||||

|

Issuance

of common stock for services

|

55,000 | 165,000 | 17 | 274,983 | - | - | 275,000 | ||||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (259,404 | ) | - | (259,404 | ) | ||||||||||||||||||||

|

Balance

at December 31, 1999

|

337,500 | 1,012,500 | 102 | 926,687 | (1,010,234 | ) | - | (83,445 | ) | ||||||||||||||||||||

|

Issuance

of common stock for cash

|

84,900 | 254,700 | 25 | 413,045 | - | - | 413,070 | ||||||||||||||||||||||

|

Issuance

of common stock for services

|

70,000 | 210,000 | 21 | 349,979 | - | - | 350,000 | ||||||||||||||||||||||

|

Issuance

of common stock for Multiplex stock

|

3,000 | 9,000 | 1 | 29 | - | - | 30 | ||||||||||||||||||||||

|

Issuance

of common stock for acquisition

|

475,463 | 1,426,389 | 143 | 4,603 | - | - | 4,746 | ||||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (694,758 | ) | - | (694,758 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2000

|

970,863 | 2,912,589 | 292 | 1,694,343 | (1,704,992 | ) | - | (10,357 | ) | ||||||||||||||||||||

|

Issuance

of common stock for compensation

|

30,000 | 90,000 | 9 | 59,991 | - | - | 60,000 | ||||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (67,251 | ) | - | (67,251 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2001

|

1,000,863 | 3,002,589 | 301 | 1,754,334 | (1,772,243 | ) | - | (17,608 | ) | ||||||||||||||||||||

|

Issuance

of common stock re acquisition of

|

35,000,000 | 105,000,000 | 10,500 | (1,747,393 | ) | 1,696,982 | - | (39,911 | ) | ||||||||||||||||||||

|

Industrial

Minerals Incorporated

|

|||||||||||||||||||||||||||||

|

Minimum

50 shares post-split allocation

|

30,758 | 92,274 | 6 | (6 | ) | - | - | - | |||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (520,242 | ) | - | (520,242 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2002

|

36,031,621 | 108,094,863 | 10,807 | 6,935 | (595,503 | ) | - | (577,761 | ) | ||||||||||||||||||||

|

Minimum

50 shares post-split allocation

|

327 | 981 | - | - | - | - | - | ||||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (1,133,197 | ) | - | (1,133,197 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2003

|

72,063,896 | 108,095,844 | 10,807 | 6,935 | (1,728,700 | ) | - | (1,710,958 | ) | ||||||||||||||||||||

|

Allocation

on round-up of shares

|

7 | 7 | - | - | - | - | - | ||||||||||||||||||||||

|

Issuance

of common stock in settlement of debt

|

3,492,115 | 3,492,115 | 349 | 4,190,189 | - | - | 4,190,538 | ||||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (561,153 | ) | - | (561,153 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2004

|

111,587,966 | 111,587,966 | 11,156 | 4,197,124 | (2,289,853 | ) | - | 1,918,427 | |||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (1,844,219 | ) | - | (1,844,219 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2005

|

111,587,966 | 111,587,966 | 11,156 | 4,197,124 | (4,134,072 | ) | - | 74,208 | |||||||||||||||||||||

|

Issuance

of common stock for cash

|

200,000 | 200,000 | 20 | 69,640 | - | - | 69,660 | ||||||||||||||||||||||

|

Issuance

of common stock in settlement of debt

|

6,255,810 | 6,255,810 | 625 | 1,876,118 | - | - | 1,876,743 | ||||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (1,255,584 | ) | - | (1,255,584 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2006

|

118,043,776 | 118,043,776 | 11,801 | 6,142,882 | (5,389,656 | ) | - | 765,027 | |||||||||||||||||||||

|

Issuance

of common stock for cash

|

13,193,699 | 13,193,699 | 1,319 | 1,569,486 | - | - | 1,570,805 | ||||||||||||||||||||||

|

Issuance

of common stock for services

|

6,407,001 | 6,407,001 | 641 | 641,976 | - | - | 642,617 | ||||||||||||||||||||||

|

Stock

compensation expense

|

- | - | - | 446,853 | - | 446,853 | |||||||||||||||||||||||

|

Foreign

Currency Translation

|

- | - | - | - | - | (105,985 | ) | (105,985 | ) | ||||||||||||||||||||

|

Net

Loss

|

- | - | - | - | (2,761,455 | ) | - | (2,761,455 | ) | ||||||||||||||||||||

|

Balance

at December 31, 2007

|

137,644,476 | 137,644,476 | 13,761 | 8,801,197 | (8,151,111 | ) | (105,985 | ) | 557,862 | ||||||||||||||||||||

|

Issuance

of common stock for cash

|

- | 9,248,940 | 925 | 484,275 | - | - |

(265,000)

|

220,200 | |||||||||||||||||||||

|

Issuance

of common stock for services

|

- | 12,605,000 | 1,261 | 445,439 | 446,700 | ||||||||||||||||||||||||

|

Stock

compensation expense

|

- | - | - | 176,427 | - | - | 176,427 | ||||||||||||||||||||||