Attached files

| file | filename |

|---|---|

| 8-K - ANNUAL MEETING SLIDES - FULTON FINANCIAL CORP | f8k.htm |

1

Annual Shareholders Meeting

April 30, 2010

2

Forward-looking statement

l The Corporation has made, and may continue to make, certain forward-looking statements with respect to

its financial conditions and results of operations.

its financial conditions and results of operations.

l Many factors could affect future financial results, including without limitation: asset quality and the impact

of adverse changes in the economy and in credit or other markets and resulting effects on credit risk and

asset values; acquisition and growth strategies; market risk; changes or adverse developments in

economic, political, or regulatory conditions; a continuation or worsening of the current disruption in credit

and other markets, including the lack of or reduced access to, and the abnormal functioning of, markets for

mortgages and other asset-backed securities and for commercial paper and other short-term borrowings;

changes in the levels of Federal Deposit Insurance Corporation deposit insurance premiums and

assessments; the effect of competition and interest rates on net interest margin and net interest income;

investment strategy and income growth; investment securities gains and losses; declines in the value of

securities which may result in charges to earnings; changes in rates of deposit and loan growth or a

decline in loans originated; balances of risk-sensitive assets to risk-sensitive liabilities; salaries and

employee benefits and other expenses; amortization of intangible assets; goodwill impairment; capital and

liquidity strategies and other financial and business matters for future periods.

of adverse changes in the economy and in credit or other markets and resulting effects on credit risk and

asset values; acquisition and growth strategies; market risk; changes or adverse developments in

economic, political, or regulatory conditions; a continuation or worsening of the current disruption in credit

and other markets, including the lack of or reduced access to, and the abnormal functioning of, markets for

mortgages and other asset-backed securities and for commercial paper and other short-term borrowings;

changes in the levels of Federal Deposit Insurance Corporation deposit insurance premiums and

assessments; the effect of competition and interest rates on net interest margin and net interest income;

investment strategy and income growth; investment securities gains and losses; declines in the value of

securities which may result in charges to earnings; changes in rates of deposit and loan growth or a

decline in loans originated; balances of risk-sensitive assets to risk-sensitive liabilities; salaries and

employee benefits and other expenses; amortization of intangible assets; goodwill impairment; capital and

liquidity strategies and other financial and business matters for future periods.

l Do not unduly rely on forward-looking statements. You can identify forward-looking statements by the use

of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,” “potential,” “continue,”

“anticipates,” “believes,” “plans,” “expects,” “future” and “intends” and similar expressions which are

intended to identify forward-looking statements.

of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,” “potential,” “continue,”

“anticipates,” “believes,” “plans,” “expects,” “future” and “intends” and similar expressions which are

intended to identify forward-looking statements.

l These statements are not guarantees of future performance and are subject to risks, uncertainties and

other factors, some of which are beyond our control and difficult to predict and could cause actual results

to differ materially from those expressed or forecasted in the forward-looking statements. The Corporation

undertakes no obligation, other than as required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

other factors, some of which are beyond our control and difficult to predict and could cause actual results

to differ materially from those expressed or forecasted in the forward-looking statements. The Corporation

undertakes no obligation, other than as required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

3

Today’s meeting

• Tape recorders and cameras are not permitted

in the meeting.

in the meeting.

• The display of placards and signs is prohibited.

• Please be considerate of others -- silence or

turn off your cell phone during the meeting.

turn off your cell phone during the meeting.

• Any questions and comments should be

directed to the chairperson of the meeting

during the Question and Answer period.

Please remember to state your name prior to

asking your question.

directed to the chairperson of the meeting

during the Question and Answer period.

Please remember to state your name prior to

asking your question.

4

Annual Shareholders Meeting

April 30, 2010

5

Scott Smith

Chairman and CEO

Chairman and CEO

Welcome and Opening Remarks

6

Today’s agenda

• Business Meeting

– Proposals:

• Election of directors

• Approval of management compensation

• Ratification of appointment of independent auditor

– Introductions

– Results of Voting

– Conclusion of Business Meeting

• Management Presentation

• Questions and Answers

www.fult.com

8

Annual Shareholders Meeting

April 30, 2010

9

Board of Directors

10

Jeffrey G. Albertson, Esq.

11

John M. Bond, Jr.

12

Donald M. Bowman, Jr.

13

Dana A. Chryst

14

Hon. Craig A. Dally

15

Patrick J. Freer

16

Rufus A. Fulton, Jr.

17

George W. Hodges

18

Willem Kooyker

19

Donald W. Lesher, Jr.

20

John O. Shirk, Esq.

21

Gary A. Stewart

22

Phil Wenger

23

Senior Management

24

Charlie Nugent

25

Jim Shreiner

26

Craig Hill

27

Craig Roda

28

Scott Kintzing

29

CEOs and Presidents

30

Jill Carson

31

Dick Grafmyre

32

Dave Hanson

33

Steve Miller

34

Curt Myers

35

Gerry Nau

36

John Scaldara

37

Angela Snyder

38

Randy Taylor

39

Mike Wimer

40

Report of Judge of Election

41

Annual Shareholders Meeting

April 30, 2010

42

Management Presentation

43

Forbes Magazine

• Fulton Financial named one of the nation’s

“100 Most Trustworthy Companies”

“100 Most Trustworthy Companies”

• Selected from over 8,000 publicly held

companies

companies

• The only bank included in

Large-Cap or Mid-Cap

company lists

Large-Cap or Mid-Cap

company lists

• One of only four banks

on entire list

on entire list

The Fulton Financial Team

45

Management Presentation

46

Milestones of 2009

47

Protecting the company

• Preserving capital

through uncertain

and unstable times

through uncertain

and unstable times

48

Quarterly cash dividend

• Very important to

shareholders

shareholders

• Needed to retain more

earnings

earnings

• Reduced, but

preserved, the dividend

preserved, the dividend

• Look to increase this in

the future

the future

49

Reducing expenses

• 2007/2008 consolidations =

2009 benefits

2009 benefits

50

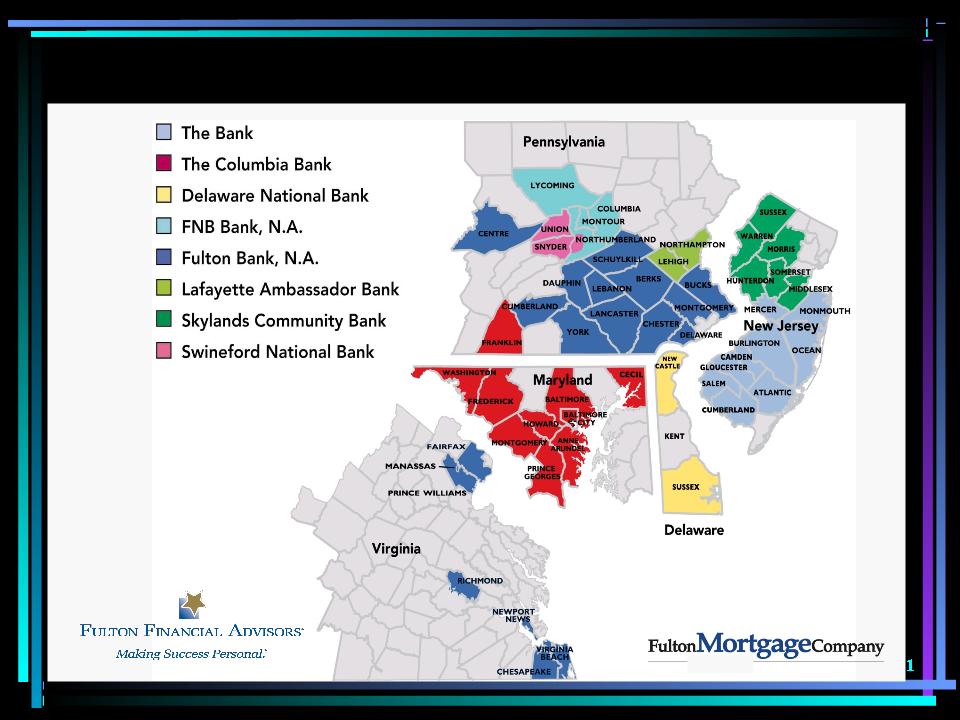

Maryland mergers

Fulton Financial Corporation - 2010

52

Weathering the storm

• Increased FDIC

assessment

assessment

• Significant stock

price decrease

price decrease

• Loan losses beyond

our historical

performance

our historical

performance

53

Loan quality

• Credit issues - major challenge in 2009

• Worked to

address issues early

address issues early

• Managing commercial

real estate portfolio

carefully

real estate portfolio

carefully

54

Loan activity

• We are lending!

• Some credit-worthy

customers did not

want to borrow

customers did not

want to borrow

• Despite this,

loans increased slightly

loans increased slightly

55

Customer experience

WE WILL:

• Care

• Listen

• Understand

• Deliver

56

Measurement

• A variety of measurement systems in

place

place

• Measure key drivers of customer

satisfaction

satisfaction

• Strong results, and working to make

them even stronger

them even stronger

57

Market share growth

• Market share increased in

36 out of 53 counties served

in our five-state market

36 out of 53 counties served

in our five-state market

• Market share increased

in 27 out of 31 counties served

in PA, MD, and DE

in 27 out of 31 counties served

in PA, MD, and DE

58

Market share growth

Due to:

• Superior customer experience

• Business development efforts

• Customer segmentation

• Marketing/promotions

59

Our Brand: Listening is just the beginning.

COMMUNITY BANKING

SMALL BUSINESS

HIGH NET WORTH

RETAIL BANKING

60

Investments in our future

• Completion of major

technology initiatives

technology initiatives

• Creation of the

“School of Promise”

“School of Promise”

• New branches opened

• Added focus on small business

• Relationship rewards

61

Milestones of 2009

62

Special Video Presentation

“My Journey”

Words from our employees

63

Milestones of 2009

64

Management Presentation

65

Headed in the right direction

December 31, 2009:

¨ Gain of $53.8 million (31 cents per share)

66

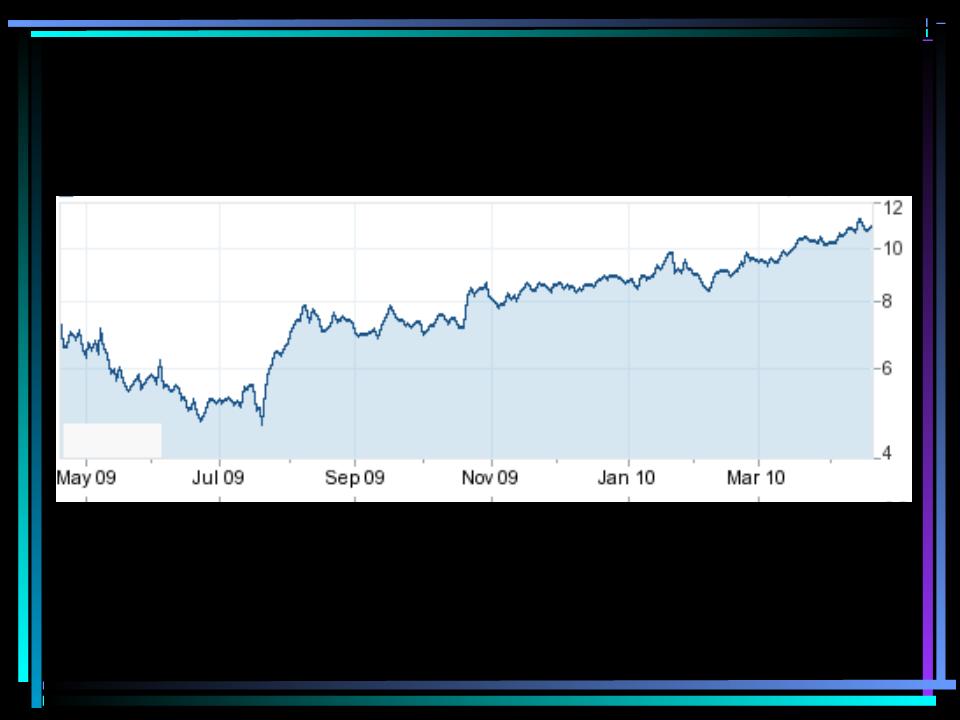

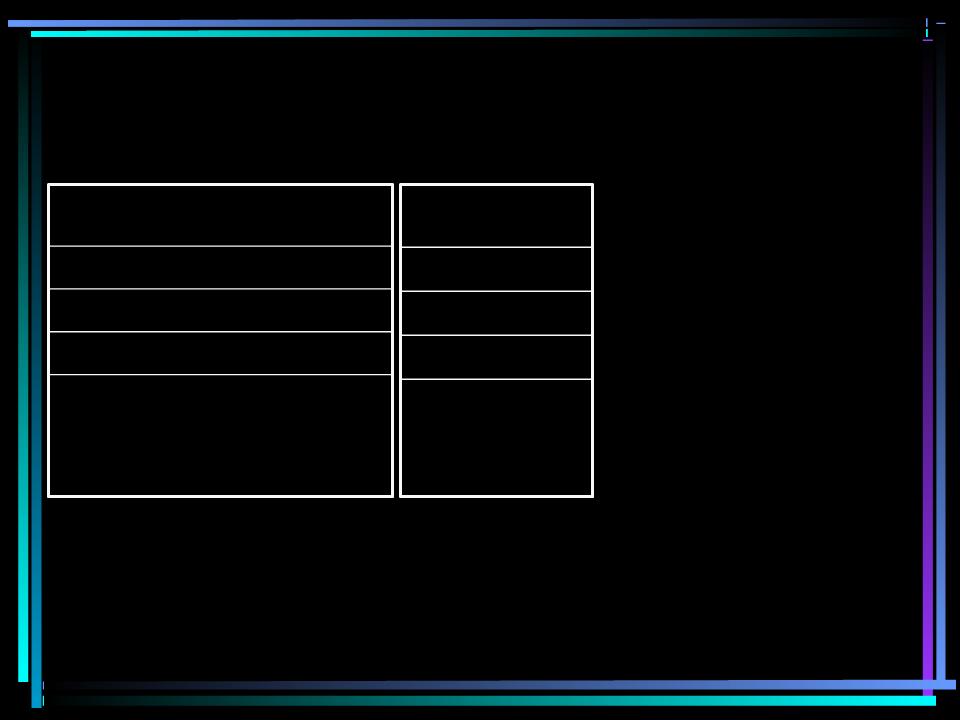

Stock price

4/30/09

$6.50

4/28/10

$10.95

Source: Yahoo! Inc.

First quarter 2010 earnings

Net income:

• Up 18 percent

over previous

quarter

over previous

quarter

• Up 178 percent

over first

quarter of

2009

over first

quarter of

2009

68

Capital

|

FFC with

Cap. Purch.

|

|

14.70%

|

|

11.90%

|

|

9.70%

|

|

6.30%

|

Tangible Common Equity

Leverage Capital

Tier 1 Risk-Based Capital

Total Risk-Based Capital

Ratio:

5.00%

6.00%

10.00%

Regulatory Well

Capitalized

Capitalized

|

FFC without

Cap. Purch.

|

|

11.80%

|

|

9.00%

|

|

7.30%

|

|

6.30%

|

69

Management Presentation

70

Questions and answers

Please remember to:

• Use the microphones in front of room

• Ask only one question to give other

shareholders a chance

shareholders a chance

• State your name before you ask your

question

question

71

Annual Shareholders Meeting

April 30, 2010