Attached files

©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. Q3 FY2010

Investor/Analyst Call

April 29, 2010

Exhibit 99.3 |

2

Forward-looking statements and GAAP

reconciliation

This

presentation

contains

forward-looking

statements

addressing

expectations,

prospects,

estimates

and

other matters that are dependent upon future events or developments. These matters

are subject to risks and uncertainties that could cause actual results to

differ materially from those projected, anticipated or implied. These risks

and uncertainties include (but are not limited to) uncertainties and risks regarding the

effect of the CareFusion spinoff on Cardinal Health; the performance of CareFusion

and the proceeds realized from future sales of CareFusion stock;

uncertainties due to government health care reform including the recently

enacted federal healthcare reform legislation; competitive pressures in Cardinal Health’s various

lines of business; the loss of one or more key customer or supplier relationships

or changes to the terms of those relationships; disruptions in the supply of

medical isotopes for the nuclear pharmacy business; the timing of generic

and branded pharmaceutical introductions and the frequency or rate of branded

pharmaceutical price appreciation or generic pharmaceutical price deflation;

changes in the distribution patterns or reimbursement rates for health care

products and/or services; the results, consequences, effects or timing of

any inquiry or investigation by any regulatory authority or any legal or administrative

proceedings; the effects of disruptions in the financial markets, including

uncertainties related to the availability and/or cost of credit on Cardinal

Health’s customers and vendors; and conditions in the pharmaceutical

market and general economic and market conditions. In addition, Cardinal Health is subject

to additional risks and uncertainties described in Cardinal Health’s Form

10-K, Form 10-Q and Form 8-K reports

(including

all

amendments

to

those

reports)

and

exhibits

to

those

reports.

This

presentation

reflects

management’s views as of April 29, 2010. Except to the extent required by

applicable law, Cardinal Health undertakes no obligation to update or revise

any forward-looking statement. In addition, this presentation includes

non-GAAP financial measures. Cardinal Health provides definitions and reconciling information at

the

end

of

this

presentation

and

on

its

investor

relations

page

at

www.cardinalhealth.com.

An

audio

replay

of

the

conference

call

will

be

available

on

the

investor

relations

page

at

www.cardinalhealth.com.

|

©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

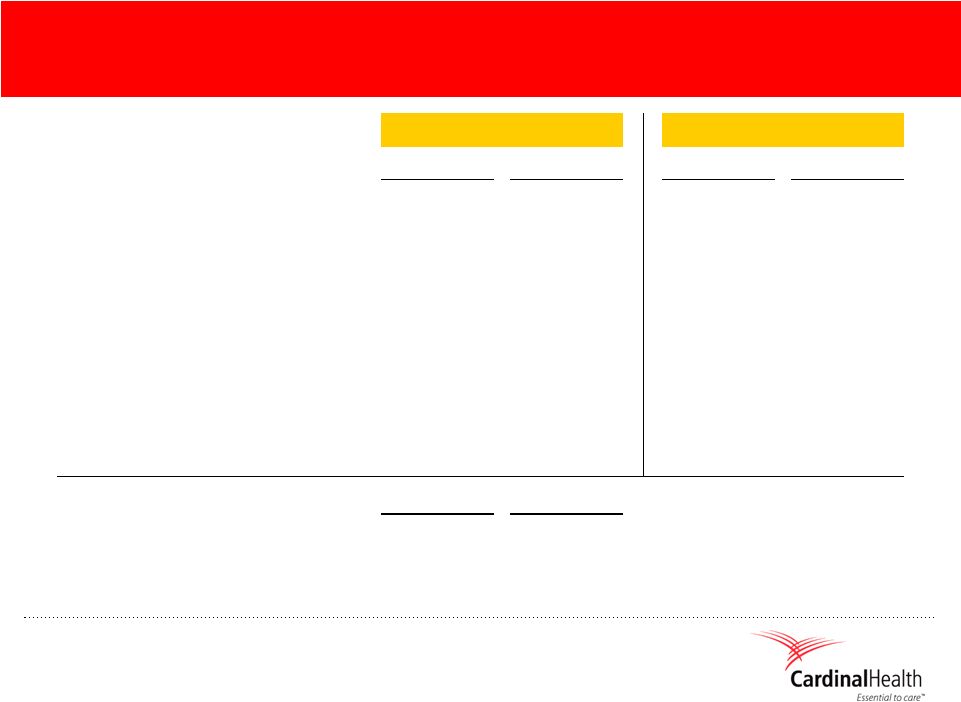

reserved. Q3 FY2010 Results

3 |

4

Q3 FY2010 Business Analysis

Q3 FY10

Q3 FY09

1

Q3 FY10

Q3 FY09

1

Revenue

$24,343

$24,089

% change

1%

10%

Operating earnings

$366

$381

$385

$415

% change

(4)%

-

(7)%

2%

Ratio to revenue

1.50%

1.58%

1.58%

1.72%

Earnings from continuing ops

$225

$215

$222

$237

% change

5%

(9)%

(6)%

(7)%

Ratio to revenue

0.92%

0.89%

0.91%

0.98%

Diluted EPS from continuing ops

$0.62

$0.60

$0.61

$0.66

% change

3%

(9)%

(8)%

(7)%

Asset Management

Q3 FY10

Q3 FY09

1

Operating Cash Flow

$879

$617

Days Receivable

18.9

19.5

Days Inventory on Hand

25

27

Non-GAAP Basis

($M)

GAAP Basis

($M)

1

All FY09 financial information reflects the reclassification of CareFusion

to discontinued operations and change in reportable segments. See the

Company’s Form 8-K filed on November 16, 2009. |

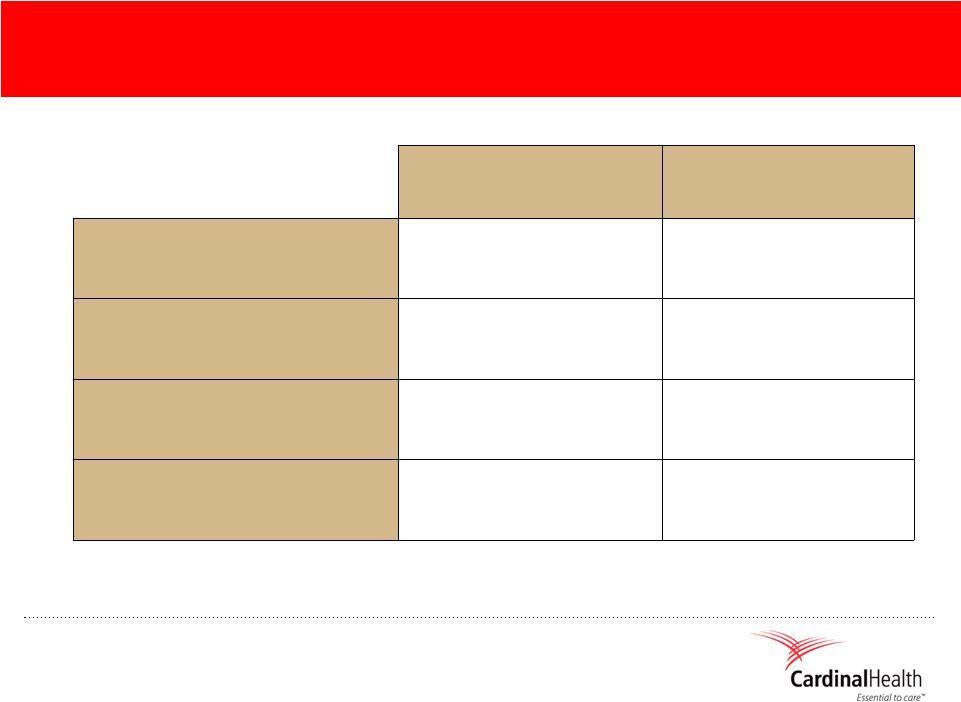

5

Q3FY10 Pharmaceutical Segment

Business Analysis

Highlights:

•

Revenue performance was driven by increased sales to existing pharmaceutical

distribution customers and solid growth in generics

–

Revenue from non-bulk customers increased 0.5% to $11.3 billion driven by

growth in retail chain, hospital and retail independents

–

Revenue from bulk customers increased 0.5% to $10.9 billion

•

Segment profit increased 7% to $307 million primarily from continued strong

performance under branded manufacturer agreements, positive margin

contribution from the company’s generic programs and disciplined

expense management •

Continued progress made in sourcing, contract compliance and customer-facing

IT initiatives •

Excellent execution in nuclear pharmacy services

•

Continued solid working capital management

Revenue

Segment Profit

Segment Profit Margin

$22,226

$307

1.38%

Q3 FY10

($M)

$22,118

$286

1.29%

Q3 FY09

($M)

0.5%

7%

% Change |

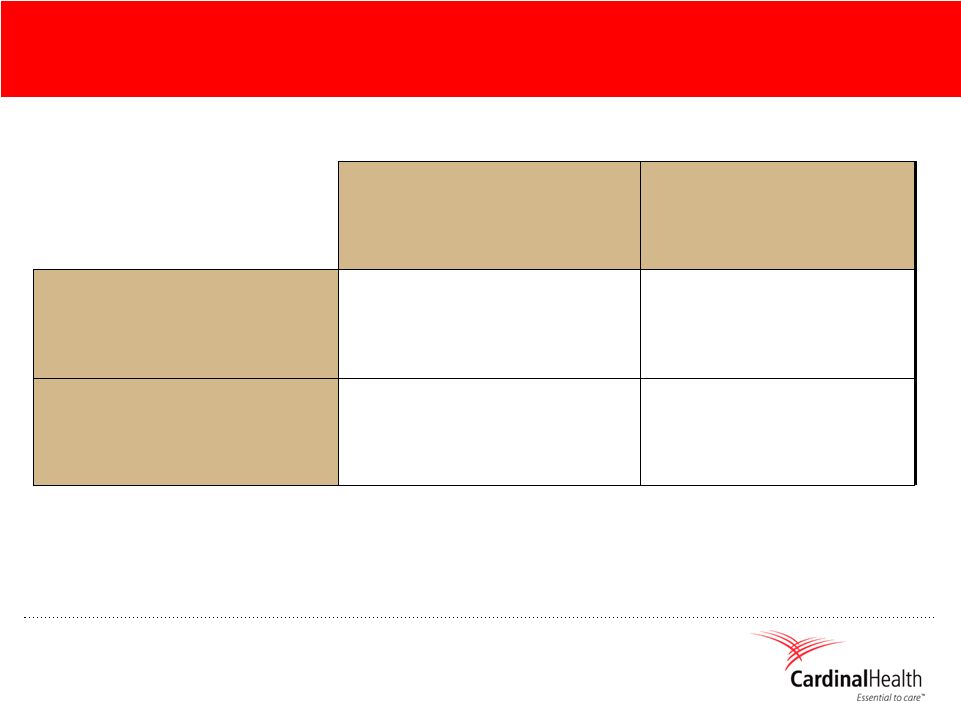

6

Q3FY10 Medical Segment

Business Analysis

Revenue

Segment Profit

Segment Profit Margin

$2,123

$108

5.08%

Q3 FY10

($M)

$1,976

$128

6.49%

Q3 FY09

($M)

7%

(16)%

% Change

Highlights:

•

Revenue increase was driven by growth in existing domestic customer base, and

strong growth in Canada

•

Segment profit decline was due to an unusual year-over-year comparison in

cost of goods sold, the impact of performance-based employee

compensation and increased Medical Business Transformation investment

spend –

Decline was partially offset from the positive profit impact of revenue growth

within the lab and ambulatory businesses as well as preferred

products •

Segment profit increased sequentially from Q2 by more than $5M

•

Continued momentum in Medical Transformation and customer-facing IT

initiatives |

7

Q3FY10 GAAP to Non-GAAP Reconciliation

Note:

Costs

associated

with

the

CareFusion

spinoff

are

as

follows:

Operating

Earnings ($M)

Earnings from

Continuing

Operations ($M)

Diluted EPS from

Continuing

Operations

Operating

Earnings ($M)

Earnings from

Continuing

Operations ($M)

Diluted EPS from

Continuing

Operations

GAAP

$366

$225

$0.62

$381

$215

$0.60

Restructuring and Employee

Severance

(Note)

$14

$4

$0.01

$32

$27

$0.08

Impairments and Loss on Sale of

Assets

$4

$16

$0.04

$1

($6)

($0.02)

Litigation (Credits)/Charges, Net

($3)

($2)

($0.01)

$1

-

-

Other Spinoff Costs

(Note)

$4

$3

$0.01

$1

-

-

Gain on Sale of CareFusion

Stock

-

($23)

($0.06)

-

-

-

Non-GAAP

$385

$222

$0.61

$415

$237

$0.66

Spinoff Costs Included in

Restructuring and Employee

Severance

$3

($3)

Other Spinoff Costs

$4

$3

Total Spinoff Costs

$7

$0

Q3 FY 2009

Q3 FY 2010 |

8

Significant Q3 FY10 Items

•

CareFusion Investment

–

Sold 5.4 million shares for total proceeds of $136 million and realized gain of

$23 million

–

No income tax impact

–

Realized gain excluded from non-GAAP earnings

–

Remaining 30.5 million shares at 3/31/10 have market value of $805.2 million

–

Pre-tax

unrealized

gain

of

$43.3

million

recognized

in

equity

in

Q3;

no

earnings impact until shares are sold

•

Other Items

–

Completed

sale

of

Specialty

Scripts;

signed

definitive

agreement

to

sell

Martindale with close anticipated by end of June |

©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. FY2010 Outlook

9 |

10

FY10 outlook

FY09

Non-GAAP effective tax

rate

37%+

37%

Diluted weighted average

shares outstanding

~361M

361.5M

Interest and other, net

~$110M

$128M

Capital expenditures

$200M -

$250M

$421M

1

May change due to unique items affecting quarters

2

Includes $150M repurchase of assets under synthetic lease

CAH FY10 Overall Expectations

April 29, 2010

1

2 |

11

FY10 outlook

FY09

Revenue:

Low single digit

growth

$96B

Non-GAAP EPS

1

:

$2.15 -

$2.20

$2.26

1

Non-GAAP diluted earnings per share from continuing operations

CAH FY10 Financial Expectations

April 29, 2010 |

©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. 12

FY2011 Preliminary Outlook

1

Non-GAAP diluted earnings per share from continuing operations

Non-GAAP EPS

: $2.35 -

$2.45

1 |

13

Pharmaceutical Segment

FY11 Preliminary Assumptions

April 29, 2010

•

Renewal of major contracts

•

Brand inflation comparable to FY10

•

Generic launches and deflation comparable to FY10

•

Continued improvement in generic programs

•

Nuclear pharmacy assumes raw material from Canadian reactor to be at

more normal levels in Q2 FY11

•

Continued significant investment in IT systems for longer-term benefits

•

Continued working capital improvement

•

Assumes no LIFO impact |

14

Medical Segment

FY11 Preliminary Assumptions

April 29, 2010

•

Benefit from investments in Ambulatory Care

•

Growth in higher margin preferred products category

•

Improvement in performance from kitting business, following a year of

stabilization and investment

•

Medical Transformation investment expense comparable to FY10

•

Raw materials costs/COGS increasing driven by oil and latex price

movements

•

Lean/operational excellence initiatives improving working capital

|

©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. 15

Q & A |

16 |

©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. 17

Q3 FY10 Trailing Five Quarters |

18

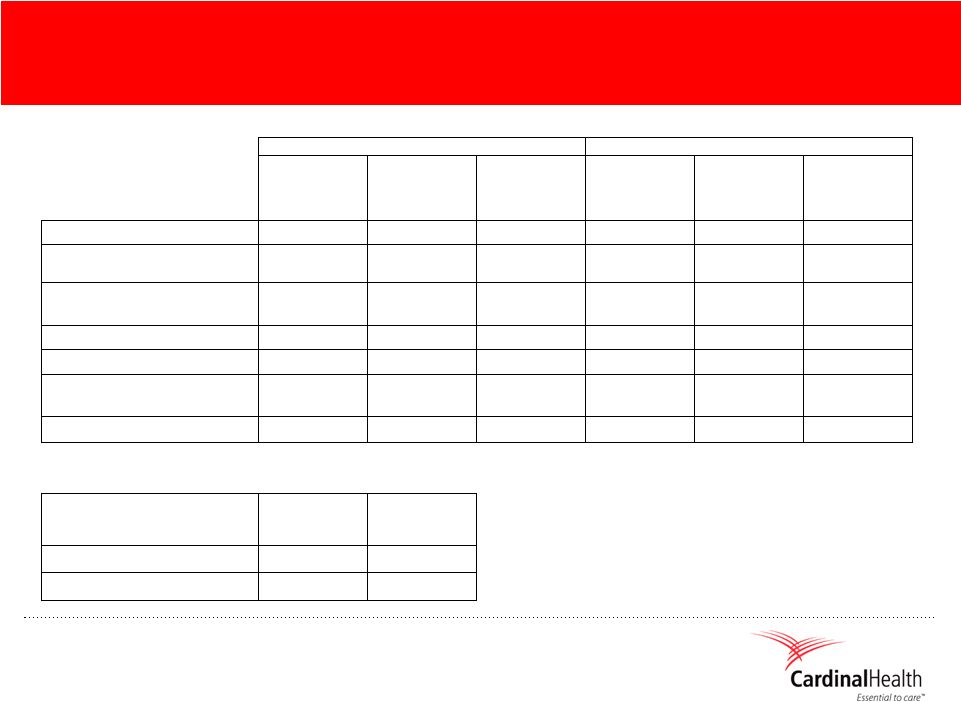

Q3 FY10 Segment Analysis

Q3FY09

Q4FY09

Q1FY10

Q2FY10

Q3FY10

Revenue ($M)

22,118

22,263

22,562

22,695

22,226

Segment

Profit ($M)

286

273

208

260

307

Q3FY09

Q4FY09

Q1FY10

Q2FY10

Q3FY10

Revenue

($M)

1,976

2,090

2,237

2,232

2,123

Segment

Profit ($M)

128

83

115

103

108

Pharmaceutical Segment

Medical Segment |

©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. ©

Copyright 2010, Cardinal Health, Inc. or one of its subsidiaries. All rights

reserved. 19

GAAP to Non-GAAP

Reconciliation Statements |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| Third Quarter 2010 | Year-To-Date 2010 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, |

GAAP | Restructuring and Employee Severance |

Impairments and Loss on Sale of Assets |

Litigation (Credits)/ Charges, Net |

Other Spin-Off Costs |

Gain on Sale of CareFusion Stock |

Non-GAAP | GAAP | Restructuring and Employee Severance |

Impairments and Loss on Sale of Assets |

Litigation (Credits)/ Charges, Net |

Other Spin-Off Costs |

Gain on Sale of CareFusion Stock |

Non-GAAP | ||||||||||||||||||||||||||||||||||||

| Operating Earnings |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount |

$ | 366 | $ | 14 | $ | 4 | ($3 | ) | $ | 4 | — | $ | 385 | $ | 973 | $ | 84 | $ | 28 | ($29 | ) | $ | 9 | — | $ | 1,066 | ||||||||||||||||||||||||

| Growth Rate |

(4 | )% | (7 | )% | (1 | )% | — | |||||||||||||||||||||||||||||||||||||||||||

| Earnings Before Income Taxes and Discontinued Operations |

$ | 363 | $ | 14 | $ | 4 | ($3 | ) | $ | 4 | ($23 | ) | $ | 359 | $ | 903 | $ | 84 | $ | 28 | ($29 | ) | $ | 52 | ($43 | ) | $ | 995 | ||||||||||||||||||||||

| Provision for Income Taxes1 |

$ | 138 | $ | 10 | ($12 | ) | ($1 | ) | $ | 1 | — | $ | 137 | $ | 510 | $ | 30 | ($3 | ) | ($11 | ) | ($153 | ) | — | $ | 373 | ||||||||||||||||||||||||

| Earnings from Continuing Operations |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount |

$ | 225 | $ | 4 | $ | 16 | ($2 | ) | $ | 3 | ($23 | ) | $ | 222 | $ | 393 | $ | 54 | $ | 32 | ($18 | ) | $ | 205 | ($43 | ) | $ | 622 | ||||||||||||||||||||||

| Growth Rate |

5 | % | (6 | )% | (29 | )% | 6 | % | ||||||||||||||||||||||||||||||||||||||||||

| Diluted EPS from Continuing Operations |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount |

$ | 0.62 | $ | 0.01 | $ | 0.04 | ($0.01 | ) | $ | 0.01 | ($0.06 | ) | $ | 0.61 | $ | 1.09 | $ | 0.15 | $ | 0.09 | ($0.05 | ) | $ | 0.56 | ($0.12 | ) | $ | 1.72 | ||||||||||||||||||||||

| Growth Rate |

3 | % | (8 | )% | (29 | )% | 6 | % | ||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2009 | Year-To-Date 2009 | |||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP | Restructuring and Employee Severance |

Impairments and Loss on Sale of Assets |

Litigation (Credits)/ Charges, Net |

Other Spin-Off Costs |

Gain on Sale of CareFusion Stock |

Non-GAAP | GAAP | Restructuring and Employee Severance |

Impairments and Loss on Sale of Assets |

Litigation (Credits)/ Charges, Net |

Other Spin-Off Costs |

Gain on Sale of CareFusion Stock |

Non-GAAP | |||||||||||||||||||||||||||||||||||||

| Operating Earnings |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount |

$ | 381 | $ | 32 | $ | 1 | $ | 1 | $ | 1 | — | $ | 415 | $ | 981 | $ | 69 | $ | 11 | — | $ | 1 | — | $ | 1,062 | |||||||||||||||||||||||||

| Growth Rate |

— | 2 | % | (7 | )% | (3 | )% | |||||||||||||||||||||||||||||||||||||||||||

| Earnings Before Income Taxes and Discontinued Operations |

$ | 344 | $ | 32 | $ | 1 | $ | 1 | $ | 1 | — | $ | 378 | $ | 870 | $ | 69 | $ | 11 | — | $ | 1 | — | $ | 951 | |||||||||||||||||||||||||

| Provision for Income Taxes 1 |

$ | 129 | $ | 5 | $ | 7 | — | — | — | $ | 141 | $ | 314 | $ | 19 | $ | 31 | — | — | — | $ | 364 | ||||||||||||||||||||||||||||

| Earnings from Continuing Operations |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount |

$ | 215 | $ | 27 | ($6 | ) | — | — | — | $ | 237 | $ | 556 | $ | 50 | ($20 | ) | — | $ | 1 | — | $ | 587 | |||||||||||||||||||||||||||

| Growth Rate |

(9 | )% | (7 | )% | (16 | )% | (15 | )% | ||||||||||||||||||||||||||||||||||||||||||

| Diluted EPS from Continuing Operations |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount |

$ | 0.60 | $ | 0.08 | ($0.02 | ) | — | — | — | $ | 0.66 | $ | 1.54 | $ | 0.14 | ($0.05 | ) | — | — | — | $ | 1.63 | ||||||||||||||||||||||||||||

| Growth Rate |

(9 | )% | (7 | )% | (15 | )% | (14 | )% | ||||||||||||||||||||||||||||||||||||||||||

The sum of the components may not equal the total due to rounding.

| 1 | The Company applies varying tax rates depending upon the tax jurisdiction where the items are incurred. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| Third Quarter | Third Quarter | ||||||||||||||

| (in millions) |

2010 | 2009 | |||||||||||||

| GAAP Return on Equity |

16.8 | % | 15.1 | % | |||||||||||

| Non-GAAP Return on Equity |

|||||||||||||||

| Net earnings |

$ | 222.4 | $ | 312.9 | |||||||||||

| Restructuring and employee severance, net of tax, in continuing operations1 |

3.9 | 26.8 | |||||||||||||

| Impairments and loss on sale of assets, net of tax, in continuing operations1 |

15.7 | (6.0 | ) | ||||||||||||

| Litigation (credits)/charges, net, net of tax, in continuing operations1 |

(1.8 | ) | 0.4 | ||||||||||||

| Other spin-off costs, net of tax1 |

2.5 | 0.4 | |||||||||||||

| Gain on sale of CareFusion stock, net of tax1 |

(23.2 | ) | — | ||||||||||||

| CareFusion net earnings in discontinued operations, net of tax1, 2 |

4.7 | (98.0 | ) | ||||||||||||

| Adjusted net earnings |

$ | 224.2 | $ | 236.5 | |||||||||||

| Annualized |

$ | 896.8 | $ | 946.0 | |||||||||||

| Third Quarter | Second Quarter | Third Quarter | Second Quarter | ||||||||||||

| 2010 | 2010 | 2009 | 2009 | ||||||||||||

| Non-GAAP Shareholders’ Equity |

|||||||||||||||

| Total shareholders’ equity |

$ | 5,360.9 | $ | 5,226.1 | $ | 8,434.5 | $ | 8,127.9 | |||||||

| Non-cash dividend related to CareFusion spin-off |

— | — | (3,758.0 | ) | (3,758.0 | ) | |||||||||

| Non-GAAP shareholders’ equity |

$ | 5,360.9 | $ | 5,226.1 | $ | 4,676.5 | $ | 4,369.9 | |||||||

| Divided by average shareholders’ equity |

5,293.5 | 4,523.2 | |||||||||||||

| Non-GAAP return on equity |

16.9 | % | 20.9 | % | |||||||||||

| 1 | The Company applies varying tax rates depending upon the tax jurisdiction where the items are incurred. |

| 2 | To properly reflect the impact of the spin-off, on a non-GAAP basis, CareFusion net earnings included in discontinued operations are excluded from adjusted net earnings for all periods presented. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| Year-To-Date | Year-To-Date | |||||||||||||||||||||||||||||

| (in millions) |

2010 | 2009 | ||||||||||||||||||||||||||||

| GAAP Return on Equity |

9.2 | % | 14.5 | % | ||||||||||||||||||||||||||

| Non-GAAP Return on Equity |

||||||||||||||||||||||||||||||

| Net earnings |

$ | 418.7 | $ | 878.4 | ||||||||||||||||||||||||||

| Restructuring and employee severance, net of tax, in continuing operations1 |

54.3 | 50.3 | ||||||||||||||||||||||||||||

| Impairments and loss on sale of assets, net of tax, in continuing operations1 |

31.5 | (19.7 | ) | |||||||||||||||||||||||||||

| Litigation (credits)/charges, net, net of tax, in continuing operations1 |

(17.9 | ) | 0.2 | |||||||||||||||||||||||||||

| Other spin-off costs, net of tax1 |

204.7 | 0.4 | ||||||||||||||||||||||||||||

| Gain on sale of CareFusion stock, net of tax1 |

(43.3 | ) | — | |||||||||||||||||||||||||||

| CareFusion net earnings in discontinued operations, net of tax1, 2 |

(15.4 | ) | (319.1 | ) | ||||||||||||||||||||||||||

| Adjusted net earnings |

$ | 632.6 | $ | 590.5 | ||||||||||||||||||||||||||

| Annualized |

$ | 843.5 | $ | 787.3 | ||||||||||||||||||||||||||

| Third Quarter | Second Quarter | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | Fourth Quarter | |||||||||||||||||||||||

| 2010 | 2010 | 2010 | 2009 | 2009 | 2009 | 2009 | 2008 | |||||||||||||||||||||||

| Non-GAAP Shareholders’ Equity |

||||||||||||||||||||||||||||||

| Total shareholders’ equity |

$ | 5,360.9 | $ | 5,226.1 | $ | 4,941.2 | $ | 8,724.7 | $ | 8,434.5 | $ | 8,127.9 | $ | 7,918.1 | $ | 7,747.5 | ||||||||||||||

| Non-cash dividend related to CareFusion spin-off |

— | — | — | (3,758.0 | ) | (3,758.0 | ) | (3,758.0 | ) | (3,758.0 | ) | (3,758.0 | ) | |||||||||||||||||

| Non-GAAP shareholders’ equity |

$ | 5,360.9 | $ | 5,226.1 | $ | 4,941.2 | $ | 4,966.7 | $ | 4,676.5 | $ | 4,369.9 | $ | 4,160.1 | $ | 3,989.5 | ||||||||||||||

| Divided by average shareholders’ equity |

5,123.7 | 4,299.0 | ||||||||||||||||||||||||||||

| Non-GAAP return on equity |

16.5 | % | 18.3 | % | ||||||||||||||||||||||||||

| 1 | The Company applies varying tax rates depending upon the tax jurisdiction where the items are incurred. |

| 2 | To properly reflect the impact of the spin-off, on a non-GAAP basis, CareFusion net earnings included in discontinued operations are excluded from adjusted net earnings for all periods presented. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| Third Quarter | Year-to-Date | |||||||||||||||

| (in millions) |

2010 | 2009 | 2010 | 2009 | ||||||||||||

| GAAP Effective Tax Rate from Continuing Operations |

38.1 | % | 37.5 | % | 56.5 | % | 36.1 | % | ||||||||

| Non-GAAP Effective Tax Rate from Continuing Operations |

||||||||||||||||

| Earnings before income taxes and discontinued operations |

$ | 363.2 | $ | 344.1 | $ | 903.2 | $ | 870.1 | ||||||||

| Restructuring and employee severance |

13.9 | 31.7 | 84.4 | 69.3 | ||||||||||||

| Impairments and loss on sale of assets |

4.2 | 0.7 | 28.2 | 11.2 | ||||||||||||

| Litigation (credits)/charges, net |

(2.9 | ) | 0.6 | (28.8 | ) | 0.3 | ||||||||||

| Other spin-off costs |

3.7 | 0.7 | 51.5 | 0.7 | ||||||||||||

| Gain on sale of CareFusion stock |

(23.2 | ) | — | (43.3 | ) | — | ||||||||||

| Adjusted earnings before income taxes and discontinued operations |

$ | 358.9 | $ | 377.8 | $ | 995.2 | $ | 951.6 | ||||||||

| Provision for income taxes1 |

$ | 138.4 | $ | 129.0 | $ | 510.0 | $ | 313.9 | ||||||||

| Restructuring and employee severance tax benefit1 |

10.0 | 4.9 | 30.1 | 19.0 | ||||||||||||

| Impairments and loss on sale of assets, tax benefit/(expense)1 |

(11.5 | ) | 6.7 | (3.3 | ) | 30.9 | ||||||||||

| Litigation (credits)/charges, net tax benefit/(expense)1 |

(1.1 | ) | 0.2 | (10.9 | ) | 0.1 | ||||||||||

| Other spin-off costs tax benefit/(expense)1 |

1.2 | 0.3 | (153.2 | ) | 0.3 | |||||||||||

| Gain on sale of CareFusion stock tax expense1 |

— | — | — | — | ||||||||||||

| Adjusted provision for income taxes |

$ | 137.0 | $ | 141.1 | $ | 372.7 | $ | 364.2 | ||||||||

| Non-GAAP effective tax rate from continuing operations |

38.2 | % | 37.3 | % | 37.5 | % | 38.3 | % | ||||||||

| Third Quarter | ||||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Debt to Total Capital |

28 | % | 30 | % | ||||||||||||

| Net Debt to Capital |

||||||||||||||||

| Current portion of long-term obligations and other short-term borrowings |

$ | 232.6 | $ | 359.8 | ||||||||||||

| Long-term obligations, less current portion and other short-term borrowings |

1,875.6 | 3,300.6 | ||||||||||||||

| Debt |

$ | 2,108.2 | $ | 3,660.4 | ||||||||||||

| Cash and equivalents |

(2,638.8 | ) | (971.8 | ) | ||||||||||||

| Net debt |

$ | (530.6 | ) | $ | 2,688.6 | |||||||||||

| Total shareholders’ equity |

$ | 5,360.9 | $ | 8,434.5 | ||||||||||||

| Capital |

$ | 4,830.3 | $ | 11,123.1 | ||||||||||||

| Net Debt to Capital |

(11 | )% | 24 | % | ||||||||||||

| 1 | The Company applies varying tax rates depending upon the tax jurisdiction where the items are incurred. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| Third Quarter | ||||||||

| (in millions) |

2010 | 2009 | ||||||

| Distribution, selling, general and administrative expenses |

$ | 628.6 | $ | 573.0 | ||||

| Restructuring and employee severance |

13.9 | 31.7 | ||||||

| Impairments and loss on sale of assets |

4.2 | 0.7 | ||||||

| Litigation (credits)/charges, net |

(2.9 | ) | 0.6 | |||||

| Total GAAP operating expenses |

$ | 643.8 | $ | 606.0 | ||||

| Restructuring and employee severance |

(13.9 | ) | (31.7 | ) | ||||

| Impairments and loss on sale of assets |

(4.2 | ) | (0.7 | ) | ||||

| Litigation credits/(charges), net |

2.9 | (0.6 | ) | |||||

| Other spin-off costs |

(3.7 | ) | (0.7 | ) | ||||

| Total non-GAAP operating expenses |

$ | 624.9 | $ | 572.3 | ||||

| Growth Rate |

9.2 | % | ||||||

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| Fiscal 2009 | |||||||||||||||||||||

| GAAP | Restructuring and Employee Severance |

Impairments and Loss on Sale of Assets |

Litigation (Credits)/ Charges, Net |

Other Spin-Off Costs |

Gain on Sale of CareFusion Stock |

Non-GAAP | |||||||||||||||

| Diluted EPS from Continuing Operations |

|||||||||||||||||||||

| Amount |

$ | 2.10 | $ | 0.21 | $ | (0.07 | ) | $ | 0.01 | $ | 0.01 | — | $ | 2.26 | |||||||

Forward-Looking Non-GAAP Financial Measures

The Company presents non-GAAP earnings from continuing operations and non-GAAP effective tax rate from continuing operations (and presentations derived from these financial measures, including per share calculations) on a forward-looking basis. The most directly comparable forward-looking GAAP measures are earnings from continuing operations and effective tax rate from continuing operations. The Company is unable to provide a quantitative reconciliation of these forward-looking non-GAAP measures to the most directly comparable forward-looking GAAP measures because the Company cannot reliably forecast restructuring and employee severance, impairments and loss on sale of assets, litigation (credits)/charges, net, other spin-off costs and gains or losses on sale of CareFusion stock, which are difficult to predict and estimate and are primarily dependent on future events. Please note that the unavailable reconciling items could significantly impact the Company’s future financial results.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

| Third Quarter | ||||||

| (in millions) |

2010 | 2009 | ||||

| Days Inventory on Hand |

||||||

| Inventories |

$ | 7,214.9 | $ | 7,748.0 | ||

| Cost of products sold |

$ | 23,332.7 | $ | 23,102.4 | ||

| Chargeback billings |

3,053.2 | 2,981.5 | ||||

| Adjusted cost of products sold |

$ | 26,385.9 | $ | 26,083.9 | ||

| Adjusted cost of products sold divided by 90 days |

$ | 293.2 | $ | 289.8 | ||

| Days inventory on hand |

25 | 27 | ||||

Days Inventory on Hand: inventory divided by ((quarterly costs of products sold plus chargeback billings) divided by 90 days). Chargeback billings are the difference between a product’s wholesale acquisition cost and the contract price established between pharmaceutical manufacturers and the end customer.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

DEFINITIONS

GAAP

Debt: long-term obligations plus short-term borrowings

Debt to Total Capital: debt divided by (debt plus total shareholders’ equity)

Diluted EPS from Continuing Operations: earnings from continuing operations divided by diluted weighted average shares outstanding

Effective Tax Rate from Continuing Operations: provision for income taxes divided by earnings before income taxes and discontinued operations

Gain on Sale of CareFusion Stock: realized gains and losses from the sale of the Company’s ownership of CareFusion common stock retained in connection with the spin-off

Operating Expenses: distribution, selling, general and administrative expenses, restructuring and employee severance, impairments and loss on sale of assets, and litigation (credits)/charges, net

Other Spin-Off Costs: costs and tax charges incurred in connection with the Company’s spin-off of CareFusion that are not included in restructuring and employee severance, impairments and loss on sale of assets and litigation (credits)/charges, net. Other spin-off costs include, among other things, the loss on extinguishment of debt and the income tax charge related to the anticipated repatriation of a portion of cash loaned to the Company’s entities within the United States

Receivable Days: trade receivables, net divided by (monthly revenue divided by 30 days)

Segment Profit: segment revenue minus (segment cost of products sold and segment distribution, selling, general and administrative expenses)

Segment Profit Margin: segment profit divided by segment revenue

Segment Profit Mix: segment profit divided by total segment profit for all segments

Return on Equity: annualized net earnings divided by average shareholders’ equity

Revenue Mix: segment revenue divided by total segment revenue for all segments

NON-GAAP

Net Debt to Capital: net debt divided by (net debt plus total shareholders’ equity)

Net Debt: debt minus (cash and equivalents)

Non-GAAP Diluted EPS from Continuing Operations: non-GAAP earnings from continuing operations divided by diluted weighted average shares outstanding

Non-GAAP Diluted EPS from Continuing Operations Growth Rate: (current period non-GAAP diluted EPS from continuing operations minus prior period non-GAAP diluted EPS from continuing operations) divided by prior period non-GAAP diluted EPS from continuing operations

Non-GAAP Earnings from Continuing Operations: earnings from continuing operations excluding (1) restructuring and employee severance, (2) impairments and loss on sale of assets, (3) litigation (credits)/charges, net, (4) Other Spin-Off Costs and (5) gain on sale of CareFusion stock, each net of tax

Non-GAAP Earnings from Continuing Operations Growth Rate: (current period non-GAAP earnings from continuing operations minus prior period non-GAAP earnings from continuing operations) divided by prior period non-GAAP earnings from continuing operations

Non-GAAP Effective Tax Rate from Continuing Operations: (provision for income taxes adjusted for (1) restructuring and employee severance, (2) impairments and loss on sale of assets, (3) litigation (credits)/charges, net, (4) Other Spin-Off Costs and (5) gain on sale of CareFusion stock) divided by (earnings before income taxes and discontinued operations adjusted for (1) restructuring and employee severance, (2) impairments and loss on sale of assets, (3) litigation (credits)/charges, net, (4) Other Spin-Off Costs and (5) gain on sale of CareFusion stock)

Non-GAAP Operating Earnings: operating earnings excluding (1) restructuring and employee severance, (2) impairments and loss on sale of assets, (3) litigation credits/(charges), net and (4) Other Spin-Off Costs included within distribution, selling, general and administrative expenses

Non-GAAP Operating Earnings Growth Rate: (current period non-GAAP operating earnings minus prior period non-GAAP operating earnings) divided by prior period non-GAAP operating earnings

Non-GAAP Operating Expenses: operating expenses excluding (1) restructuring and employee severance, (2) impairments and loss on sale of assets, (3) litigation (credits)/charges, net and (4) Other Spin-Off Costs

Non-GAAP Operating Expenses Growth Rate: (current period non-GAAP operating expenses minus prior period non-GAAP operating expenses) divided by prior period non-GAAP operating expenses

Non-GAAP Return on Equity: (annualized current period net earnings excluding (1) restructuring and employee severance, (2) impairments and loss on sale of assets, (3) litigation (credits)/charges, net, (4) Other Spin-Off Costs, (5) CareFusion net earnings in discontinued operations and (6) gain on sale of CareFusion stock, each net of tax) divided by average shareholders’ equity adjusted for the $3.8 billion non-cash dividend issued in connection with the spin-off