Attached files

| file | filename |

|---|---|

| 8-K - Ally Financial Inc. | v182000_8k.htm |

Contact GMAC Investor Relations at (866) 710-4623 or investor.relations@gmacfs.com

Contact GMAC Investor Relations at (866) 710-4623 or investor.relations@gmacfs.com

Annual

Shareholders’

Meeting

Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,” “anticipate,”

Forward-Looking Statements

In the presentation that follows and related comments by GMAC Inc. (“GMAC”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,”

“initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,”

“intend,” “evaluate,”

“pursue,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended

to identify forward-

looking statements. All statements herein and in related management comments, other than statements of historical fact, including without

limitation, statements about future events and financial performance, are forward-looking statements

that involve certain risks and

uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are

reasonable, these statements are not guarantees of any events or financial results, and

GMAC’s actual results may differ materially due to

numerous important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for GMAC, each of which may be

revised or supplemented in subsequent reports on SEC Forms 10-Q

and 8-K. Such factors include, among others, the following: uncertainty of

GMAC's ability to enter into transactions or execute strategic alternatives to realize the value of its Residential Capital, LLC (“ResCap”)

operations; our inability

to repay our outstanding obligations to the U.S. Department of the Treasury, or to do so in a timely fashion and without

disruption to our business; our inability to successfully accommodate the additional risk exposure relating to providing wholesale and

retail

financing to Chrysler dealers and customers and the resulting impact to our financial stability; uncertainty related to Chrysler’s and GM’s recent

exits from bankruptcy; uncertainty related to the new financing arrangement between GMAC

and Chrysler; securing low cost funding for

GMAC and ResCap and maintaining the mutually beneficial relationship between GMAC and GM, and GMAC and Chrysler; our ability to

maintain an appropriate level of debt and capital; the profitability and financial

condition of GM and Chrysler; our ability to realize the

anticipated benefits associated with our recent conversion to a bank holding company, and the increased regulation and restrictions that we

are now subject to; continued challenges in the residential

mortgage and capital markets; the potential for deterioration in the residual value of

off-lease vehicles; the continuing negative impact on ResCap of the decline in the U.S. housing market; changes in U.S. government-

sponsored mortgage programs or

disruptions in the markets in which our mortgage subsidiaries operate; disruptions in the market in which we

fund GMAC’s and ResCap’s operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may

require

or that result from changes in the accounting rules or their application, which could result in an impact on earnings; changes in the

credit ratings of ResCap, GMAC, Chrysler or GM; changes in economic conditions, currency exchange rates or political stability

in the markets

in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other activities of governments, agencies

and similar organizations. Investors are cautioned not to place undue reliance

on forward-looking statements. GMAC undertakes no obligation

to update publicly or otherwise revise any forward-looking statements except where expressly required by law. A reconciliation of certain non-

GAAP financial measures included within this presentation

is provided in the supplemental charts.

Use of the term “loans” describes products associated with direct and indirect lending activities of GMAC’s global operations. The specific

products include retail installment sales

contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to

GMAC’s purchase, acquisition or direct origination of various “loan” products.

2

Transformational Year

In 2009, GMAC made significant progress transforming the Company and

Transformational Year

In 2009, GMAC made significant progress transforming the Company and

positioning itself for improved results going forward:

Auto Finance Franchise: Regained market share, added a new OEM relationship, achieved

profitability in each quarter of 2009 and began an orderly

disposition of non-core operations

Capital: Executing Bank Holding Company strategy and improved capital position through

investments made by the U.S. Treasury

Ally Bank: Introduced Ally brand and funded the majority of new originations at the bank

Liquidity: Grew deposits by $11 billion, issued $7.4 billion of TLGP parent company debt and

issued $1.8 billion of term asset backed securitizations

Legacy Mortgage: Implemented critical steps to de-risk legacy mortgage exposure and limit

further negative earnings impact

The transformation has continued into 2010: New auto franchise relationships announced,

agreement reached to sell European mortgage platform, improved corporate debt ratings and re-

entered unsecured debt markets with over $5 billion of issuances

3

Core pre-tax earnings(1) remained weak in 2009 but improved from 2008 levels

Weak economic conditions (high unemployment and declining home prices)

High levels of credit losses and continued reserve build in auto, mortgage and commercial

Core pre-tax earnings(1) remained weak in 2009 but improved from 2008 levels

Weak economic conditions (high unemployment and declining home prices)

High levels of credit losses and continued reserve build in auto, mortgage and commercial

finance portfolios

Strategic mortgage actions (revaluation of certain higher risk mortgage loans)

Increased mortgage repurchase liability reserves

Goodwill Impairment

Immaterial impact from GM bankruptcy

Full Year 2009 Financial Results

(1) Core pre-tax earnings is defined as income from continuing operations before taxes, OID amortization and bond exchange gains.

Please refer to page 15 for more details.

(2) 2008 net income includes approximately $11.5 billion of bond exchange gains

($ millions)

2009

2008

Inc / (Dec)

Core pre-tax (loss) income

(1)

(6,795)

$

(8,084)

$

1,289

$

Net (loss) income

(2)

(10,298)

$

1,868

$

(12,166)

$

Total assets

172,306

$

189,476

$

(17,170)

$

Tier 1 capital ratio

14.1%

N/A

N/A

4

2009 Full Year Results by Segment

Global Automotive Services profitability improved significantly in 2009; driven by

2009 Full Year Results by Segment

Global Automotive Services profitability improved significantly in 2009; driven by

improving results in North American Operations

Mortgage Operations results continued to be weak and were impacted by the

strategic actions taken in 4Q

Inc/(Dec) vs.

FY 2009

FY 2008

FY 2008

North American Automotive Finance

1,752

$

(207)

$

1,959

$

International Automotive Finance

(101)

141

(242)

Insurance

329

499

(170)

Global Automotive Services

1,980

433

1,547

Mortgage Operations

(7,301)

(4,008)

(3,293)

Corporate and Other

(1)

(2,617)

6,951

(9,568)

Pre-Tax (loss) income from continuing operations

(7,938)

3,376

(11,314)

Income tax benefit from continuing operations

78

(60)

138

Discontinued operations

(2,282)

(1,568)

(714)

Net income (loss)

(10,298)

$

1,868

$

(12,166)

$

(1) Corporate and Other includes Commercial Finance, equity investments, bond exchange gains, amortization of original issue discount

from GMAC bond exchanges and net impact from ALM activities

5

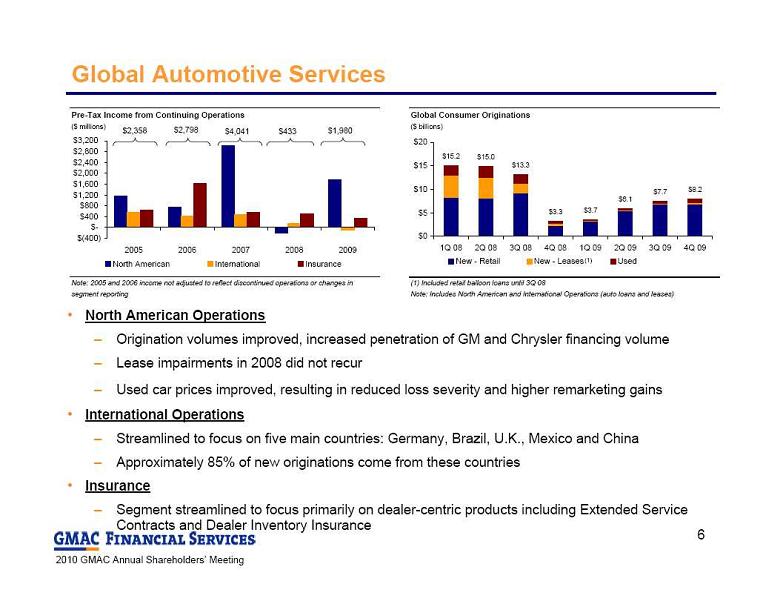

Global Automotive Services

North American Operations

Origination volumes improved, increased penetration of GM and Chrysler financing volume

Lease impairments in 2008 did not recur

Used car prices improved, resulting in reduced loss severity and higher remarketing gains

International Operations

Streamlined to focus on five main countries: Germany, Brazil, U.K., Mexico and China

Approximately 85% of new originations come from these countries

Insurance

Segment streamlined to focus primarily on dealer-centric products including Extended Service

Global Automotive Services

North American Operations

Origination volumes improved, increased penetration of GM and Chrysler financing volume

Lease impairments in 2008 did not recur

Used car prices improved, resulting in reduced loss severity and higher remarketing gains

International Operations

Streamlined to focus on five main countries: Germany, Brazil, U.K., Mexico and China

Approximately 85% of new originations come from these countries

Insurance

Segment streamlined to focus primarily on dealer-centric products including Extended Service

Contracts and Dealer Inventory Insurance

$433

$1,980

$2,358

$4,041

$2,798

(1)

Pre-Tax Income from Continuing Operations

($ millions)

Note: 2005 and 2006 income not adjusted to reflect discontinued operations or changes in

segment reporting

$(400)

$-

$400

$800

$1,200

$1,600

$2,000

$2,400

$2,800

$3,200

2005

2006

2007

2008

2009

North American

International

Insurance

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

#REF!

Global Consumer Originations

($ billions)

(1) Included retail balloon loans until 3Q 08

Note: Includes North American and International Operations (auto loans and leases)

$15.2

$15.0

$13.3

$3.3

$3.7

$6.1

$7.7

$8.2

$0

$5

$10

$15

$20

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

New - Retail

New - Leases

Used

Total

6

Delinquency trends in the core auto portfolio stabilized in the second half of 2009

Legacy subprime Nuvell portfolio significantly impacting delinquent balances

Ratios impacted by declining portfolio balances

Global Auto Finance: Consumer Delinquency Trends

Global Delinquencies - Managed

Retail Contract Amount

$ Amount of Contracts Greater than 30 Days Past Due (millions)

2.62%

2.80%

2.91%

2.66%

2.96%

2.54%

2.74%

3.31%

2.82%

3.27%

3.46%

3.48%

$0

$500

$1,000

$1,500

$2,000

$2,500

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

Nuvell Delinquent Contract $

Delinquent Contract $ (excluding Nuvell)

% of Retail Contract $ Outstanding

% of Retail Contract $ Outstanding (excluding Nuvell)

7

Delinquency trends in the core auto portfolio stabilized in the second half of 2009

Legacy subprime Nuvell portfolio significantly impacting delinquent balances

Ratios impacted by declining portfolio balances

Global Auto Finance: Consumer Delinquency Trends

Global Delinquencies - Managed

Retail Contract Amount

$ Amount of Contracts Greater than 30 Days Past Due (millions)

2.62%

2.80%

2.91%

2.66%

2.96%

2.54%

2.74%

3.31%

2.82%

3.27%

3.46%

3.48%

$0

$500

$1,000

$1,500

$2,000

$2,500

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

Nuvell Delinquent Contract $

Delinquent Contract $ (excluding Nuvell)

% of Retail Contract $ Outstanding

% of Retail Contract $ Outstanding (excluding Nuvell)

7

Global Auto Finance: Consumer Loss Trends

Annualized credit losses were elevated in 2009 due to overall weak economic

Global Auto Finance: Consumer Loss Trends

Annualized credit losses were elevated in 2009 due to overall weak economic

conditions

Continued stress in subprime Nuvell portfolio

Loss severity improved in 2009 due to strong used car prices

Global Annualized Credit Losses - Managed Retail Contracts

($ millions)

(1) 3Q 09 elevated due to change in previously disclosed charge-off policy

1.80%

1.84%

1.56%

1.13%

1.04%

0.87%

2.39%

2.48%

1.35%

1.41%

1.57%

2.12%

2.43%

2.29%

3.29%

3.57%

$0

$100

$200

$300

$400

$500

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Nuvell Credit Losses

Credit Losses (excluding Nuvell)

% of Avg. Managed Assets

% of Avg. Managed Assets (excluding Nuvell)

(1)

8

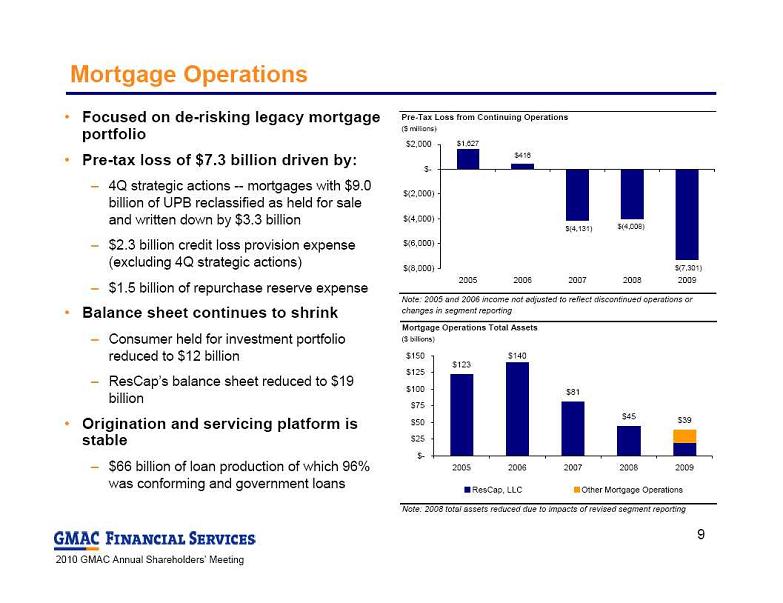

Mortgage Operations

Focused on de-risking legacy mortgage

Mortgage Operations

Focused on de-risking legacy mortgage

portfolio

Pre-tax loss of $7.3 billion driven by:

4Q strategic actions -- mortgages with $9.0

billion of UPB reclassified as held for sale

and written down by $3.3 billion

$2.3 billion credit loss provision expense

(excluding 4Q strategic actions)

$1.5 billion of repurchase reserve expense

Balance sheet continues to shrink

Consumer held for investment portfolio

reduced to $12 billion

ResCap’s balance sheet reduced to $19

billion

Origination and servicing platform is

stable

$66 billion of loan production of which 96%

was conforming and government loans

Pre-Tax Loss from Continuing Operations

($ millions)

Note: 2005 and 2006 income not adjusted to reflect discontinued operations or

changes in segment reporting

$1,627

$416

$(4,131)

$(7,301)

$(4,008)

$(8,000)

$(6,000)

$(4,000)

$(2,000)

$-

$2,000

2005

2006

2007

2008

2009

Mortgage Operations Total Assets

($ billions)

Note: 2008 total assets reduced due to impacts of revised segment reporting

$123

$140

$81

$45

$39

$-

$25

$50

$75

$100

$125

$150

2005

2006

2007

2008

2009

ResCap, LLC

Other Mortgage Operations

9

In the 4th Quarter, GMAC took several strategic actions to address challenges in

In the 4th Quarter, GMAC took several strategic actions to address challenges in

the legacy mortgage business, which were designed to:

Minimize impact of future ResCap issues and position GMAC for improved financial performance

Accelerate access to the capital markets

Position GMAC to explore strategic alternatives for ResCap and the mortgage business

$ 9.0 billion of ResCap and Ally Bank assets transferred from held for investment

to held for sale and marked down to approximately 42% of UPB

Ally Bank loans were purchased by GMAC and subsequently contributed to

ResCap as a capital contribution

Mortgage Restructuring Actions

($ in billions)

Unpaid

Principal

Balance

Carry Value

as of

12/31/2009

4Q 09 Marks

% of Unpaid

Principal

Balance

Ally Bank Loans

(1)

3.5

1.4

(1.3)

41%

ResCap Domestic Loans

3.0

1.5

(0.7)

48%

ResCap International Assets

2.4

0.9

(1.3)

36%

Total Asset Valuation

9.0

$

3.8

$

(3.3)

$

42%

(1)

Includes certain mortgage loans with low FICO, high LTV, low/no documentation or unfavorable geographic concentration

Summary of Mortgage Related Marks

10

Liquidity

GMAC’s liquidity profile has significantly improved over the past year

Building lower cost deposit base

Grew deposits by $11 billion in 2009

Parent company liquidity grew to

Liquidity

GMAC’s liquidity profile has significantly improved over the past year

Building lower cost deposit base

Grew deposits by $11 billion in 2009

Parent company liquidity grew to

$31.4 billion at 12/31/09

$8.9 billion in cash

$12.5 billion available based on

existing collateral

Improved access to capital

markets

Issued $7.4 billion of TLGP debt

Re-entered term ABS market under

programs sponsored by Ally bank

Issued over $5 billion of unsecured

debt in 2010 year to date

Received multi-notch upgrades

Deposits

($ billions)

$20.0

$31.1

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

4Q 08

4Q 09

Ally Bank Retail

Ally Bank Brokered

Ally Bank Other

ResMor

Agency

Previous

Current

Outlook

Moody's

Ca

B3

Stable

S&P

CCC

B

Stable

Fitch

CC

B

Positive

DBRS

CCC

BB (low)

Stable

GMAC Inc. Unsecured Ratings

11

Capital

Total capital base has improved despite absorbing losses while working through

Capital

Total capital base has improved despite absorbing losses while working through

legacy assets

Total Risk Based Capital Ratio of 15.5%

Balance sheet has been reduced by $120 billion since 2006

Sale and wind down of legacy mortgage assets

Divestiture of non-core assets/divisions

Continued focus on optimizing capital base and supporting core originations

(1) First time GMAC reported capital ratios

(2) Tier 1 Common Capital Ratio would have been 11.7% assuming full

conversion of Series F-2 MCP

($ billions)

12/31/2009

3/31/2009

Tier 1 Capital

22.4

$

20.5

$

Tier 1 Common Capital

7.7

$

14.3

$

Total Risk-Based Capital

24.6

$

23.4

$

Tangible Assets

171.8

$

179.6

$

Risk-Weighted Assets

158.4

$

194.4

$

Tier 1 Capital Ratio

14.1%

10.6%

Tier 1 Common Capital Ratio

4.8%

7.3%

Total Risk-Based Capital Ratio

15.5%

12.0%

(2)

(1)

GMAC Total Assets

$ Billions

$292

$249

$189

$172

$0

$50

$100

$150

$200

$250

$300

$350

2006

2007

2008

2009

12

Conclusion

Objectives

Capitalize on opportunities in the auto finance business

Drive critical focus on profitability

Demonstrate improved access to the capital markets

Transition fully to bank holding company model

Expand use of deposits and other cost efficient funding at Ally Bank

Explore strategic alternatives to maximize value of mortgage operations and

Conclusion

Objectives

Capitalize on opportunities in the auto finance business

Drive critical focus on profitability

Demonstrate improved access to the capital markets

Transition fully to bank holding company model

Expand use of deposits and other cost efficient funding at Ally Bank

Explore strategic alternatives to maximize value of mortgage operations and

further limit risk

The progress made in 2009 positions GMAC to accelerate its return to profitability

and access to the capital markets, which will assist in timely repayment of U.S.

Treasury investments

13

Supplemental Charts

Supplemental Charts

14

Core Earnings Walk

Supplemental

($ millions)

2009

2008

Inc / (Dec)

Total net revenue (less OID and bond exchange gains)

7,404

$

3,975

$

3,429

$

Provision for loan losses

6,043

3,410

2,633

Noninterest expense

8,156

8,649

(493)

Core pre-tax (loss) income

(6,795)

$

(8,084)

$

1,289

$

OID amortization

(1,143)

-

(1,143)

Bond exchange gains

-

11,460

(11,460)

Income tax expense / (benefit)

78

(60)

138

Loss from discontinued operations

(2,282)

(1,568)

(714)

Net (loss) income

(10,298)

$

1,868

$

(12,166)

$

Total assets

172,306

$

189,476

$

(17,170)

$

Tier 1 capital ratio

14.1%

N/A

N/A

15

Core Earnings Walk

Supplemental

($ millions)

2009

2008

Inc / (Dec)

Total net revenue (less OID and bond exchange gains)

7,404

$

3,975

$

3,429

$

Provision for loan losses

6,043

3,410

2,633

Noninterest expense

8,156

8,649

(493)

Core pre-tax (loss) income

(6,795)

$

(8,084)

$

1,289

$

OID amortization

(1,143)

-

(1,143)

Bond exchange gains

-

11,460

(11,460)

Income tax expense / (benefit)

78

(60)

138

Loss from discontinued operations

(2,282)

(1,568)

(714)

Net (loss) income

(10,298)

$

1,868

$

(12,166)

$

Total assets

172,306

$

189,476

$

(17,170)

$

Tier 1 capital ratio

14.1%

N/A

N/A

15

Capital Measures as of 12/31/09

Supplemental

Capital

12/31/2009

3/31/2009

Shareholders’ Equity

20.8

$

22.0

$

Less:

Goodwill and certain other intangibles

(0.5)

(1.4)

Unrealized (gain) loss and other adjustments

(0.4)

(0.1)

Trust Preferred Securities

2.5

-

Total Tier 1 Capital

22.4

20.5

Total Tier 1 Capital

22.4

20.5

Less:

Senior preferred

(10.9)

(5.0)

Trust Preferred Securities

(2.5)

-

Preferred interest

(1.3)

(1.3)

Tier 1 Common

7.7

14.3

Total Tier 1 Capital

22.4

20.5

Add:

Qualifying subordinated debt and redeemable preferred stock

0.2

0.2

Allowance for loan and lease losses includible in Tier 2 Capital

2.0

2.6

Total Risk-Based Capital

24.6

23.4

Total Equity

20.8

22.0

Less:

Preferred equity

(12.2)

(6.3)

Goodwill and intangible assets

(0.5)

(1.4)

Tangible Common Equity

8.1

14.3

Total Assets

172.3

179.6

Less:

Goodwill and intangible assets

(0.5)

(1.4)

Tangible Assets

171.8

$

178.1

$

Note: Numbers may not foot due to rounding

($ billions)

16

Capital Measures as of 12/31/09

Supplemental

Capital

12/31/2009

3/31/2009

Shareholders’ Equity

20.8

$

22.0

$

Less:

Goodwill and certain other intangibles

(0.5)

(1.4)

Unrealized (gain) loss and other adjustments

(0.4)

(0.1)

Trust Preferred Securities

2.5

-

Total Tier 1 Capital

22.4

20.5

Total Tier 1 Capital

22.4

20.5

Less:

Senior preferred

(10.9)

(5.0)

Trust Preferred Securities

(2.5)

-

Preferred interest

(1.3)

(1.3)

Tier 1 Common

7.7

14.3

Total Tier 1 Capital

22.4

20.5

Add:

Qualifying subordinated debt and redeemable preferred stock

0.2

0.2

Allowance for loan and lease losses includible in Tier 2 Capital

2.0

2.6

Total Risk-Based Capital

24.6

23.4

Total Equity

20.8

22.0

Less:

Preferred equity

(12.2)

(6.3)

Goodwill and intangible assets

(0.5)

(1.4)

Tangible Common Equity

8.1

14.3

Total Assets

172.3

179.6

Less:

Goodwill and intangible assets

(0.5)

(1.4)

Tangible Assets

171.8

$

178.1

$

Note: Numbers may not foot due to rounding

($ billions)

16