Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - DESERT CAPITAL REIT INC | form8k42010.htm |

FACING CHALLENGES HEAD ON

Todd Parriott

Chairman of the Board and Chief Executive Officer

In the midst of turbulent real estate market conditions impacting Desert Capital REIT, Inc. (“DCR”), we continue to work through a challenging market while attempting to execute strategic solutions for the assets in our portfolio. This balancing act has many obstacles which challenge DCR.

I speak with stockholders regularly and the prevalent question is, “Understanding the difficulties of the real estate market conditions, when and how much of my investment will be returned?” The complexity of this question warrants further discussion. As I consider the answer to this question, I ask that you consider what has likely happened with the value of your own home as a comparison. The correlation is one that I use when speaking with stockholders because it has similar implications as it relates to current value and future solutions.

DESERT CAPITAL REIT| YOUR INVESTMENT

To better understand the future of DCR, it might be helpful to start with the fundamentals. DCR was formed in December 2003 as a real estate investment trust (“REIT”). When we first began conducting business, we specialized in the financing of real estate projects by providing short-term mortgage loans to homebuilders and commercial developers in markets where we believed we possessed requisite skills and market knowledge, which were primarily in Las Vegas and the western United States. We did not invest in traditional residential mortgages. We historically invested in 12 to 18 month, first and second lien mortgage loans, consisting of acquisition and development, construction, and commercial property loans to both local and national developers and homebuilders.

We generated revenues primarily from interest payments received from mortgage investments funded mostly with stockholder capital. As you know from recent financial filings, the increased level of non-performing loans combined with our lack of capital and liquidity has forced us to discontinue our investing activities and instead focus all of our efforts on capital and asset preservation. Our portfolio has evolved from a portfolio of performing loans, into a portfolio of non-performing loans, and now, into a portfolio of interests in foreclosed properties. We did not originally intend to own real estate; however, market conditions since 2007 have created a situation where, in most cases, foreclosure has been the only option available to us. As we have foreclosed on mortgage loans, we have adjusted our portfolio strategy to address issues relating to land ownership and possible workout scenarios.

CHALLENGE ONE | PROPERTY CARRYING COSTS

Often we are asked why we don’t just “hold the properties until the values return.” The transition from holding a portfolio of loans to owning a portfolio of properties is a major shift. It requires different skills, different strategies, and most importantly, it requires money.

While on the surface a holding strategy may appear to be a good idea, there are various considerations to evaluate with such an approach. 1) In order to maintain ownership of a property there are costs including taxes, HOA fees, SID fees (where applicable), insurance, management, and marketing. With our improved properties, we incur additional maintenance and utility costs. Sometimes these combined expenses exceed the potential financial gain from holding the property. 2) The costs involved in operating DCR are substantial. As a result, because we have minimal investment income, we are required to sell some properties to cover our cash requirements. We are careful in determining which properties are appropriate to sell under current market conditions.

As we continue to execute resolution strategies for the properties we own, we have determined that placing a small amount of debt on some foreclosed properties will provide us with the needed funds to cover ownership, maintenance, and carrying costs. This leverage provides capital to manage the burden of ongoing carrying costs so as to limit the number of properties we must liquidate at depressed prices.

Since very few loans within the portfolio are currently producing monthly income, our borrowing activity has also provided us with supplemental funds to assist with ongoing operational expenses. While historically DCR has maintained a lower debt ratio than the industry average for REITs, incurring additional debt has been necessary to provide time to execute strategic resolutions for the assets in our portfolio and address the substantial carrying costs associated with such assets that continue to accrue.

During 2009, we entered into $8.2 million of new debt. The cash proceeds from this debt are being used to cover specific costs related to carrying and resolving our real estate portfolio, as well as 12 to 24 months of reserved interest payments on the debt. We continue to closely monitor and manage our liquidity position, understanding that this is of critical importance in the current economic environment. With the addition of this debt, our ratio of debt to total assets increased to 55.0% at December 31, 2009, an increase from 32.8% at December 31, 2008.

CHALLENGE TWO | DEBT OBLIGATION

Earlier I mentioned that I have used the correlation between the value of your home and market behavior when discussing the present state of the real estate industry and how our portfolio has been impacted.

During recent years, many homeowners have obtained a home equity line of credit where they borrowed against a percentage of the equity in their property to gain access to additional capital. Historically, this has provided homeowners with capital to pay off more expensive debt or to make investments that would earn more than the cost of the home equity debt. However, in today’s environment, new home equity loans have become virtually nonexistent as residential property values have plummeted, leaving numerous homeowners burdened with having to repay mortgage loans whose amounts are significantly greater than the value of their homes.

Similarly, in June of 2006, in order to enhance returns for our stockholders and strengthen our portfolio, we borrowed $30 million (approximately 15% of the portfolio value at the time) from a third party lender. We were able to generate a spread between these leveraged funds and the interest income generated from our portfolio of investments. Yet as the market conditions dramatically changed and numerous loans became nonperforming, interest income from these original investments became virtually nonexistent. However, our $30 million loan is still outstanding. Currently, this debt bears interest at a floating rate based on the three-month LIBOR plus 400 basis points, which resets each calendar quarter. This rate was 4.25% on December 31, 2009.

While we have timely paid our interest payments, our debt agreement contains specific provisions which require us to maintain certain financial ratios at quarterly determination dates, including a minimum tangible net worth requirement of $100 million. Due to significant market depreciation impacting our portfolio’s property values, we are currently in default of the net worth requirement.

We have been in negotiations with our lender to work out a restructuring of our debt obligations to them, and have entered into a Standstill Agreement. Per the Standstill Agreement, as long as we continue to make timely payments of interest, our lender has agreed to refrain from exercising certain rights and taking action against us despite our current state of default. In the event we are not able to fulfill our interest payment obligations, our lender could take action against us to collect the debt, which would have a material impact on our financial condition.

BOARD MEETING| ADDRESSING STOCKHOLDER QUESTIONS

We strongly encourage our stockholders to review quarterly financials, which are available on our website at www.desertcapitalreit.com, through the Securities and Exchange Commission (SEC) website, or they can be requested directly from our stockholder relations department at 800-419-2855.

Q1 | What is the current value of my Desert Capital REIT shares?

Answer: In conjunction with preparing our financial statements for each of our quarterly SEC filings, we review each of our investment assets for indications of impairment. This detailed review includes thorough discussions with our asset manager regarding the best potential strategic resolution for each property at that point in time. We then use this information to estimate the value of the property as of each quarter-end, which directly impacts the equity available to stockholders as presented on our balance sheet (as calculated in accordance with generally accepted accounting principles aka GAAP). At December 31, 2009, our estimated equity available (total assets less total liabilities) per common share was $1.47. This estimate of value is based solely on our audited financial statements and is not a representation, warranty or guarantee that we or our stockholders, upon liquidation, will actually realize the estimated value per share. We have not requested, nor have we received, an estimate of the value of our common stock from an independent appraisal firm.

Until we see the trends in the real estate market shift, and property values begin to appreciate instead of depreciate, we may continue to write-down assets in our portfolio, which could further negatively impact the value of our equity.

Q2 | Is my investment lost? If not, when will liquidation of assets begin and how will the funds be distributed?

Answer: As a stockholder, you have an ownership interest in DCR which in turn owns mortgage loans and interests in real estate it has acquired through foreclosure. These assets have value.

As a result of today’s market volatility, we cannot state exactly what the value of our portfolio is, or what it could be in the future. Values are based, among other things, on market supply and demand. As stated in the previous question, at December 31, 2009, our equity (based on our balance sheet) was $1.47 per common share. If we were to liquidate DCR today, it would result in selling assets at what we believe would be at or near bottom-of-the-market prices. Because the market is so depressed, we do not believe that liquidation at these values would be in the best interest of our stockholders, which is why we have exercised patience and have not sold many of our foreclosed properties to date.

As you are aware, DCR is scheduled to “list or liquidate” by December 31, 2011. As part of our primary focus to preserve the value of our portfolio and maximize stockholder value, we continue to evaluate the timing and form of available liquidity options. At this time a determination has not been made, but the topic will continue to be reviewed by our Board of Directors.

Q3 | How is Desert Capital surviving?

Answer: We are operating in an extremely challenging market, and unfortunately, government bailouts do not exist for companies like ours. Many companies within our industry have made the decision to close their doors or have filed for bankruptcy. We feel that bankruptcy is an option of last resort, and we have chosen to battle through this market on behalf of our stockholders. The following outlines some of the factors that enable us to continue to generate cash flow and survive in today’s environment:

|

•

|

A small number of our loans are still performing.

|

|

•

|

We receive interest payments on our note receivable from CM Capital Services.

|

|

•

|

Tenants lease space within our headquarters.

|

|

•

|

Some of our loans are in workout stages (joint ventures/leases) that produce some cash flow.

|

|

•

|

The final disposition and sale of properties upon successful resolution strategies generate cash proceeds.

|

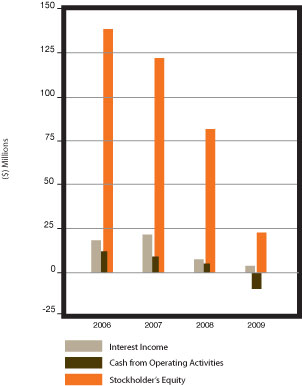

The chart below illustrates how interest income and cash levels generated from operating activities have been severely impacted by the collapse of the real estate market, which has had a direct impact on the value of DCR stockholder’s equity over the years.

In 2006, the real estate market was experiencing tremendous growth, contributing to significant increases in residential and commercial property values. DCR had $146 million in performing loans, was paying an annual dividend of $.10 per share, and generated net income of $14.2 million. Only 3% of our loans were in default. Based on the portfolio performance at the time, the debt ratio was 24%, and DCR was able to meet its financial obligations.

By 2009, times had changed dramatically with regard to market conditions, with nearly every loan in some stage of default or foreclosure. With very few loans performing ($6.1 million at December 31, 2009), additional expenses related to foreclosure activity, property taxes, and asset management fees have escalated, which when added to the original fixed operating costs, create a substantial financial burden. In 2009, our interest expense was greater than our interest income by more than $1.3 million. Our debt ratio has increased to 55%, as we have incurred additional debt on our assets and have sold certain properties within our portfolio to provide cash to cover our operating and property costs.

2009 ACTIVITY

While 2008 was widely characterized by market duress and the unknown with regard to how market dynamics would play out, we were able to better grasp what we were dealing with as we worked through 2009. By year end we had foreclosed on most properties and initiated a plan for each asset within the portfolio. While there are still a number of uncertainties in the marketplace, we are actively dealing with the issues at hand.

Our advisor and asset manager aggressively and diligently accomplished the following during 2009 in order to sustain our operations:

|

|

•

|

Foreclosed on real estate with original loan balances totaling $70.2 million.

|

|

|

•

|

Took possession of an operating commercial business through foreclosure and currently have it leased to a third-party with an option to purchase. This represents the largest real estate asset within our portfolio.

|

|

|

•

|

Sold real estate assets for cash proceeds of $2.9 million, thereby allowing DCR to continue to meet its financial obligations and satisfy those that were past-due, including legal and advisory fees, and the outstanding balance on our line of credit.

|

Q4 | What is the current and future outlook for residential and commercial real estate?

SUPPLY & DEMAND| RAW LAND

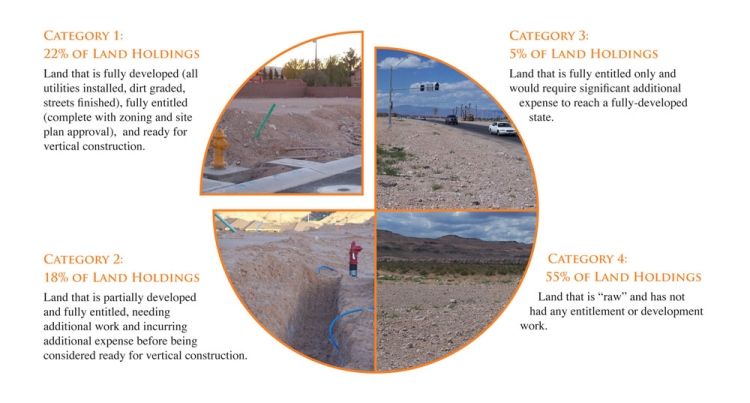

The different stages of the residential and commercial land lifecycle can be characterized in a number of ways. In our markets we have observed that land falls into four categories when determining builder and developer demand patterns. (Approximately 60% of the assets we currently hold interests in are land parcels.) Illustrated below is the breakdown of this portion of our portfolio.

In today’s market, commercial developers are faced with uncommon opportunities to acquire fully-developed land below replacement costs (property that would fall under Category 1). In other words, they are able to buy the “dirt for free,” since the cost of incorporating all of the needed development work would exceed what they are able to buy the land for today. Right now there is still an ample supply of this type of property available, but in recent months, national home builders have started to make offers on this property type. While offer prices are low, it is encouraging to see activity. Estimates are that once this land (from Category 1) is absorbed, developers will then pursue land in the second category, and so on, with Category 4 seeing an active market last.

Because we hold 11% of our portfolio in Category 2 land, and 33% of our portfolio in Category 4 land, we expect to be in a holding pattern with these assets for the foreseeable future.

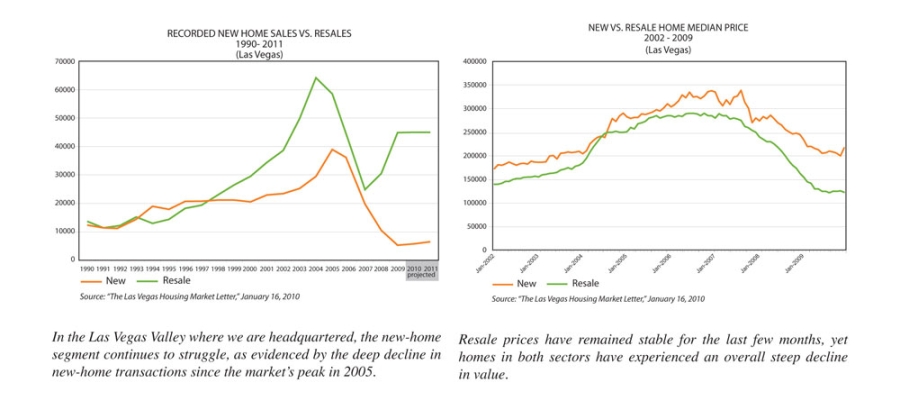

RESIDENTIAL MARKET| PRICING & SALES VOLUME

Before the new home segment can begin a substantial recovery, a national movement needs to occur with the absorption of existing residential inventory. Once this stabilizes and buyers have less available inventory to choose from, they will then begin seeking options for new home construction. Therefore, it is anticipated that Category 1 – type property as illustrated earlier, will experience an increased interest from builders and developers as they look to fulfill buyer demand for new homes.

The resale segment does appear to be trending in a positive direction, with available housing inventory levels declining. Current estimated inventory figures in the Las Vegas Valley reflect similar levels to resale housing availability in 2005. Bank-owned homes and homes pending short-sale approvals from lenders comprise the majority of properties currently under contract. This past year recorded the fourth-highest number of resale (single-family residential) transactions ever documented, at approximately 45,000. That being said, prices remain at historic lows, and it is apparent that investors have re-entered the marketplace, along with an increased number of new and repeat buyers attempting to take advantage of the federal home tax credit program, as well as newfound affordability associated with deep pricing drops.

We cannot predict when and if this will lead to increased values in home prices in the Las Vegas market, or other markets throughout the Southwest where we currently hold assets. However, lower supply levels coupled with an increase in buyer demand suggest that the housing market may finally be at or near the proverbial pricing “bottom.”

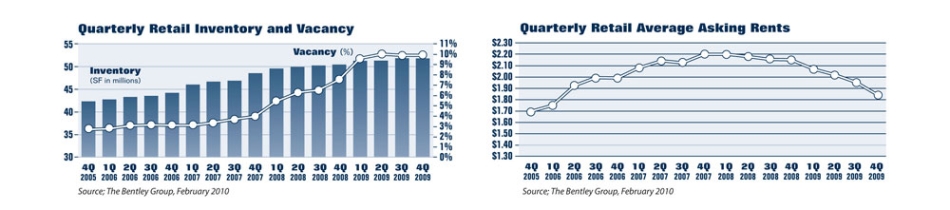

COMMERICAL MARKET | VACANCY & RENTAL PRICING

Whereas the pricing bottom may be within sight for the residential sector, negative downward trends are significantly affecting commercial real estate, leaving many market analysts wondering how far values will decline before settling and stabilizing. Many businesses have postponed or canceled expansions, downsized, or have closed their doors. This has contributed to a growing uptick in commercial vacancy rates, as illustrated above, with asking rent prices dropping in order to attract tenants to fill empty office space. Many markets across the country, including Las Vegas, contain an overabundance of supply with owners seeking tenants, thereby placing downward pressure on present commercial property values. Once the supply of vacant office buildings is absorbed, demand for commercial land is expected to increase. It is unknown how the real estate market will react in terms of movement in other areas (such as raw land), as buyer demand correlates to economic conditions and consumer confidence.

In closing, while no one can predict the future, we will continue to seek opportunities that we believe will be in the best collective interest of our stockholders. On behalf of the Board of Directors, I thank you for your continued support.

/s/ Todd Parriott

Todd Parriott

Chairman of the Board and Chief Executive Officer

FORWARD-LOOKING STATEMENTS Certain matters discussed in this stockholder letter are “forward-looking statements” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical in nature. They can often be identified by their inclusion of words such as “will,” “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend” and similar expressions. Any projection of revenues, earnings or losses, capital expenditures, distributions, capital structure or other financial terms is a forward-looking statement. Similarly, statements that describe DCR’s future plans, objectives or goals are also forward-looking statements.

Our forward-looking statements are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to us. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us and are beyond our control, that might cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. Some of the important factors that could cause our actual results, performance or financial condition to differ materially from expectations are: economic conditions impacting the real estate market and credit markets; changes in interest rates; our ability to sell assets; our continued inability to obtain liquidity; additional impairments on our assets; our inability to restructure our obligations under our junior subordinated notes; and, although we believe our proposed method of operations will be in conformity with the requirements for qualification as a REIT, we cannot assure you that we will qualify as a REIT or, if so qualified, will continue to qualify as a REIT. Our failure to qualify or remain qualified as a REIT could have material adverse effect on our performance and your investment.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the events described by our forward-looking statements might not occur. We qualify any and all of our forward-looking statements by these cautionary factors.

For a more detailed description of the risks affecting our financial condition and results of operations, see “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2009, as filed with the Securities and Exchange Commission, which is available on DCR’s website at www.desertcapital.com.