UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

April 21, 2010

(Date of earliest event reported)

LABORATORY CORPORATION

OF

AMERICA HOLDINGS

| DELAWARE | 1-11353 | 13-3757370 | ||

| (State or other jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 358 SOUTH MAIN STREET, BURLINGTON, NORTH CAROLINA |

27215 | 336-229-1127 | ||

| (Address of principal executive offices) | (Zip Code) |

(Registrant's telephone number including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01. Regulation FD Disclosure

Summary information of the Company dated April 21, 2010.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Laboratory Corporation of America Holdings (Registrant) |

||||

| Date: April 21, 2010 | By: | /s/F. Samuel Eberts III | ||

| F. Samuel Eberts III, Chief Legal Officer and Secretary |

||||

1

8-K Filed April 21, 2010

2

Introduction

This slide presentation contains forward-looking statements which are

subject to change based on various important factors, including without

limitation, competitive actions in the marketplace and adverse

actions of

governmental and other third-party payors.

Actual results could differ materially from those suggested by these

forward-looking statements. Further information on potential factors that

could affect the Company’s financial results

will be included in the

Company’s Form 10-K for the year ended December 31, 2009, and

subsequent SEC filings. The Company has no obligation to provide any

updates to these forward-looking statements even if its expectations

change.

3

First Quarter Results

(In millions, except per share data)

2010

2009

+/(-)

Revenue

1,193.6

$

1,155.7

$

3.3%

Adjusted Operating Income

(1)

243.5

$

240.5

$

1.2%

Adjusted Operating Income Margin

(1)

20.4%

20.8%

(40)

bp

Adjusted EPS

(1)

1.30

$

1.22

$

6.6%

Operating Cash Flow

232.0

$

208.9

$

11.1%

Less: Capital Expenditures

(24.5)

$

(30.7)

$

(20.2%)

Free Cash Flow

207.5

$

178.2

$

16.4%

(1) See Reconciliation of non-GAAP Financial Measures (included herein)

Three Months Ended Mar 31,

4

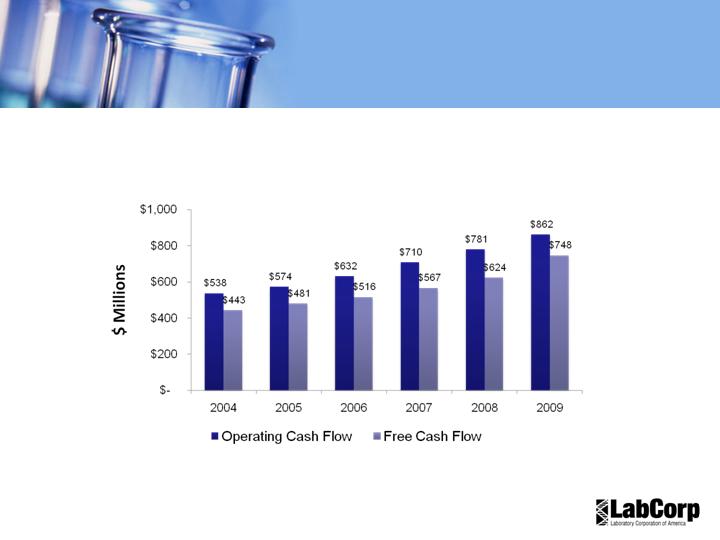

Cash Flow Trends

11% FCF CAGR

2004-2009

5

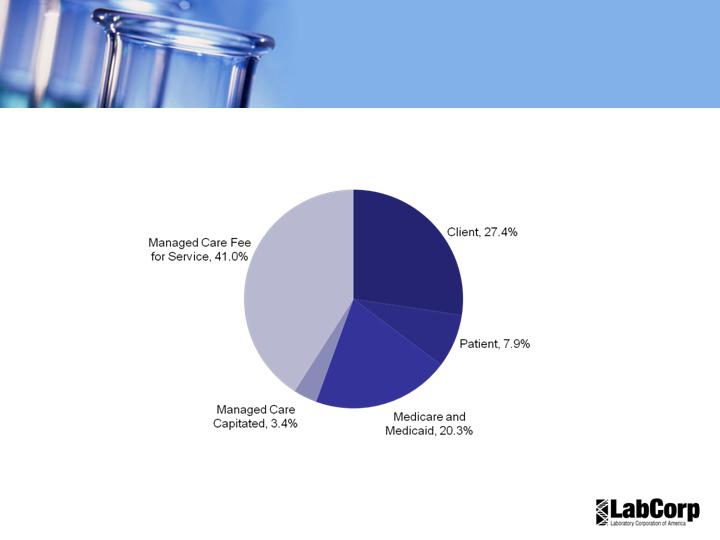

Revenue by Payer- US

2010 YTD

6

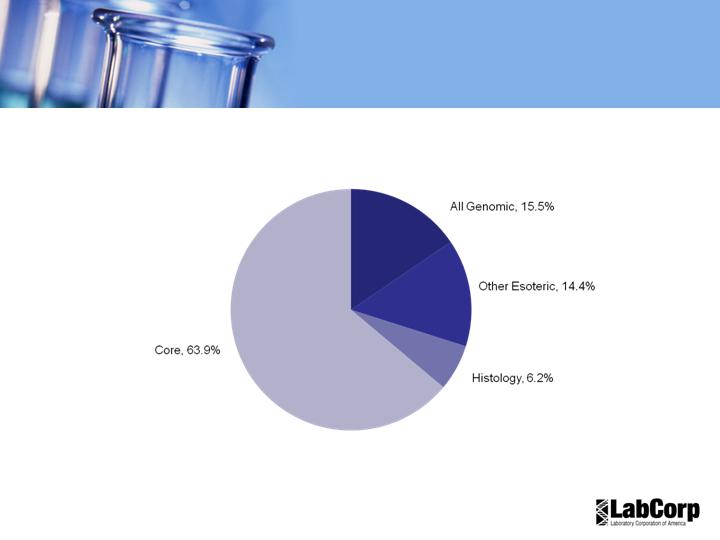

Revenue by Business Area - US

2010 YTD

7

Revenue by Payer

(in millions, except PPA)

YTD Q1-2008

YTD Q1-2009

YTD Q1-2010

Revenue

Revenue

Revenue

$'s

%

Accns

PPA

$'s

%

Accns

PPA

$'s

%

Accns

PPA

Client

285.4

$

27%

8.638

33.04

$

303.3

$

28%

8.918

34.01

$

307.9

$

27%

8.598

35.80

$

Patient

97.9

9%

0.590

165.98

$

83.7

8%

0.531

157.57

$

88.3

8%

0.536

164.81

$

Third Party

(Medicare/Medicaid)

198.8

19%

4.728

42.05

$

220.3

20%

4.983

44.21

$

228.5

20%

4.927

46.37

$

Managed Care:

- Capitated

42.4

4%

3.691

11.49

$

44.6

4%

3.665

12.16

$

39.0

3%

3.225

12.11

$

- Fee for service

414.6

40%

9.339

44.39

$

448.3

41%

9.584

46.78

$

461.0

41%

9.491

48.57

$

Total Managed Care

457.0

44%

13.030

35.07

$

492.9

45%

13.249

37.20

$

500.0

44%

12.716

39.32

$

LabCorp Total - US

1,039.1

$

100%

26.986

38.51

$

1,100.1

$

100%

27.681

39.74

$

1,124.7

$

100%

26.777

42.00

$

LabCorp Total - Canada

64.1

$

-

1.835

34.90

$

55.6

$

-

2.269

24.50

$

68.9

$

-

2.287

30.14

$

LabCorp Total

1,103.2

$

28.821

38.28

$

1,155.7

$

29.950

38.59

$

1,193.6

$

29.064

41.07

$

8

Revenue by Business Area

(in millions, except PPA)

YTD Q1-2008

YTD Q1-2009

YTD Q1-2010

Revenue

Revenue

Revenue

$'s

%

Accns

PPA

$'s

%

Accns

PPA

$'s

%

Accns

PPA

All Genomic

156.4

$

15%

2.144

72.94

$

172.4

$

16%

2.250

76.64

$

174.5

$

16%

2.189

79.68

$

Other Esoteric

118.1

11%

2.881

40.98

140.2

13%

3.303

42.44

161.8

14%

3.734

43.33

Histology

79.2

8%

0.629

125.99

73.5

7%

0.609

120.69

70.1

6%

0.564

124.28

All Genomic / Esoteric

353.7

34%

5.654

62.55

386.1

35%

6.162

62.67

406.4

36%

6.487

62.65

Core

685.5

66%

21.332

32.13

714.0

65%

21.520

33.18

718.3

64%

20.290

35.40

LabCorp Total - US

1,039.1

$

100%

26.986

38.51

$

1,100.1

$

100%

27.681

39.74

1,124.7

$

100%

26.777

42.00

LabCorp Total - Canada

64.1

$

-

1.835

34.90

$

55.6

$

-

2.269

24.50

$

68.9

$

-

2.287

30.14

$

LabCorp Total

1,103.2

$

28.821

38.28

$

1,155.7

$

29.950

38.59

$

1,193.6

$

29.064

41.07

$

9

Financial Guidance - 2010

Excluding the impact of restructuring and other special charges

and share repurchase activity after March 31, 2010,

guidance for 2010 is:

Revenue growth:

Approximately 2.5% – 4.5%

Adjusted EPS:

$5.35 to $5.55

Operating cash flow of approximately(1):

$870 Million

Capital expenditures of approximately:

$135 Million

(1) Operating cash flow guidance excludes any transition payments to UnitedHealthcare.

10

Supplemental Financial

Information

Q1 10

Depreciation

$32.2

Amortization

$17.4

Capital expenditures

$24.5

Cash flows from operations

$232.0

Bad debt as a percentage of sales

5.05%

Effective interest rates on debt:

Zero-coupon subordinated notes

2.00%

5 1/2% Senior Notes

5.38%

5 5/8% Senior Notes

5.75%

Term loan

3.67%

Revolving credit facility (weighted average)

0.58%

Days sales outstanding

46

UnitedHeathcare transition payments - Billed

$10.1

UnitedHeathcare transition payments - Paid

$14.5

Laboratory Corporation of America

Other Financial Information

March 31, 2010

($ in millions)

11

Reconciliation of non-GAAP

Financial Measures

Adjusted Operating Income

2010

2009

Operating income

$234.2

$240.5

Restructuring and other special charges

9.3

-

Adjusted operating income

$243.5

$240.5

Adjusted EPS

Diluted earnings per common share

$1.25

$1.22

Impact of restructuring and other special charges (1)

0.05

-

Adjusted EPS

$1.30

$1.22

Three Months Ended Mar 31,

(1) After tax impact of restructuring and other special charges, $5.7 million divided by 106.5 million shares

Reconciliation of non-GAAP Financial Measures

(In millions, except per share data)

12