Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Computer Software Innovations, Inc. | d8k.htm |

Computer Software Innovations, Inc.

OTC BB: CSWI

Investor Presentation

April 2010

1

Exhibit 99.1 |

Safe

Harbor 2

This presentation contains “forward-looking statements” – that is, statements

related to future, not past, events. In this context, forward looking statements often address

our expected future business and financial performance, and often contain words such as

“may,” “could,” “should,” “expect,”

“believe,” “seek,” “estimate,” “predict,” or

“project.” Forward-looking statements by their nature address matters that are,

to different degrees, uncertain. For us, particular uncertainties arise from economic health of

the software and technology industry, demand for CSI’s products and engineering services,

competitive pricing pressures and the availability of necessary financing. In addition, other

risks are more fully described in CSI’s Form 10-K and other filings with the Securities and

Exchange Commission. These uncertainties may cause our actual results to be materially

different from those expressed in our forward-looking statements. We do not undertake to

update our forward-looking statements.

|

CSI,

Inc. Overview OTCBB:CSWI

Headquarters:

Easley, SC

215 Employees

4 offices

Provider of software and technology solutions to education

and local government markets

Customer base: 800+ K-12 school districts,

colleges/universities, city/county governments, non-profit

organizations

Software Applications Segment

•

Financial Management Software

•

Version3 Identity Life Cycle Management

•

CSI@K12 Communications and Collaboration Solutions

Technology Solutions Segment

•

21

st

Century

Connected

Classroom

•

Convergence Applications –

IP telephony, surveillance, video

•

Network Infrastructure & end-devices

•

Infrastructure Management –

monitoring, performance,

maintenance

3 |

Increase Customer Base In Existing Markets

Leverage Current Solution Portfolio:

–

Sell CSI Solutions To Customers Gained In Acquisitions

–

Cross-Sell Existing Customers

Continue Expanding Geographic Footprint Organically and by

Acquisitions

Expand Intellectual Property Portfolio through

–

Organic Product Development, including cloud-based solutions

–

Acquisitions

Potential to more than double EBITDA in next 5 years

Growth Drivers

4 |

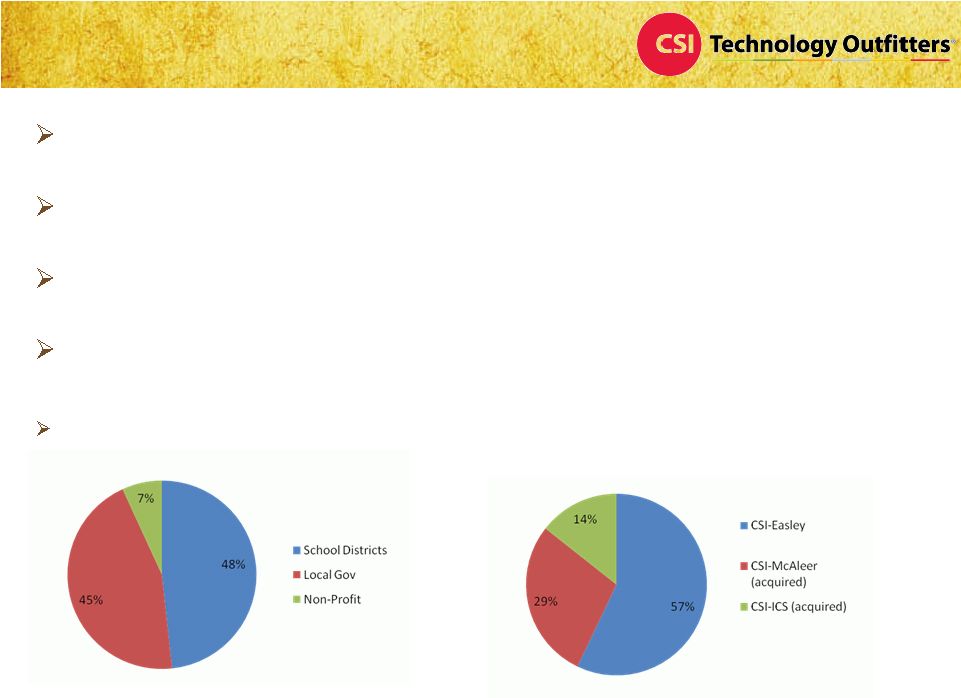

600

customers in 8 southeastern states Strong Gross Margins

>50% Recurring Revenue

Solutions

Include:

Financial

Management,

Billing

and

Revenue

Management,

Payroll/Human Resources, School Activity Accounting, eGov, Document Services

Type of

Customers

Growth by Acquisitions Financial Management

Software 5 |

Customers throughout US as well as Canada and UK

Customers

include

some

of

the

US’s

largest

school

districts

Solutions Include:

Version3 Identify Life Cycle

Management

6 |

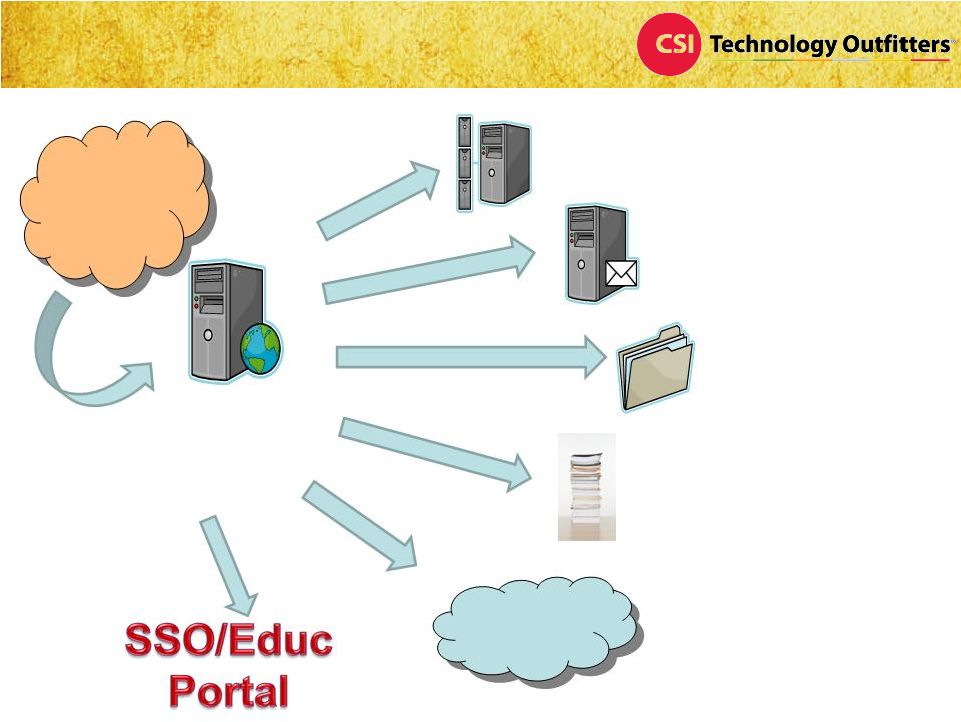

Version3 Identify Life Cycle

Management

Provisioning

Active Directory

(or other directories)

Exchange

(Other email systems)

CSI@K12

Home Folders

E-Portfolio / Archive

Applications –

Local /

Hosted

Orchard, PlatoWeb, Destiny,

etc

(API Support) (Supports SIF)

Scheduled

Event

Authoritative

Source

SIS or

HR

Systems

Cloud

Computing |

Developed in partnership with Microsoft and based on Live@edu, a

hosted email solution for education market

Provides a cloud-based instructional communications management

solution

–

Manages regulatory compliance and security standards for K-12 email

–

Integrates a portal experience for educators, students and parents

–

Provides access to email, homework and class tasks, network files

Funded through federal E-rate program

Expect significant revenue growth from this solution in late 2011-

2012

CSI@K12 Communication and

Collaboration Solution

8 |

School rooms with

Internet

access

1

1994: 3%

2005: 93%

Public schools providing

handheld computers

to

students

or

teachers

1

2003: 10%

2005: 19%

K12

enrollment

in

South

region projected to

grow 17% through

2016–

highest growth in the

country

1

U.S. has highest

growth rate

for interactive

white

boards

2

55% in 2007

9

1

Source: Dept. of Education-

Nat’l Center for Education Statistics

2

Source: Decision Tree Consulting 2008 Study

21

st

Century

Connected

Classroom |

Cross-Sell Existing

Customers

10

Technology Solutions

Network

Infrastructure &

End-Devices

Connected

Classroom

Infrastructure

Management

Convergence

Applications |

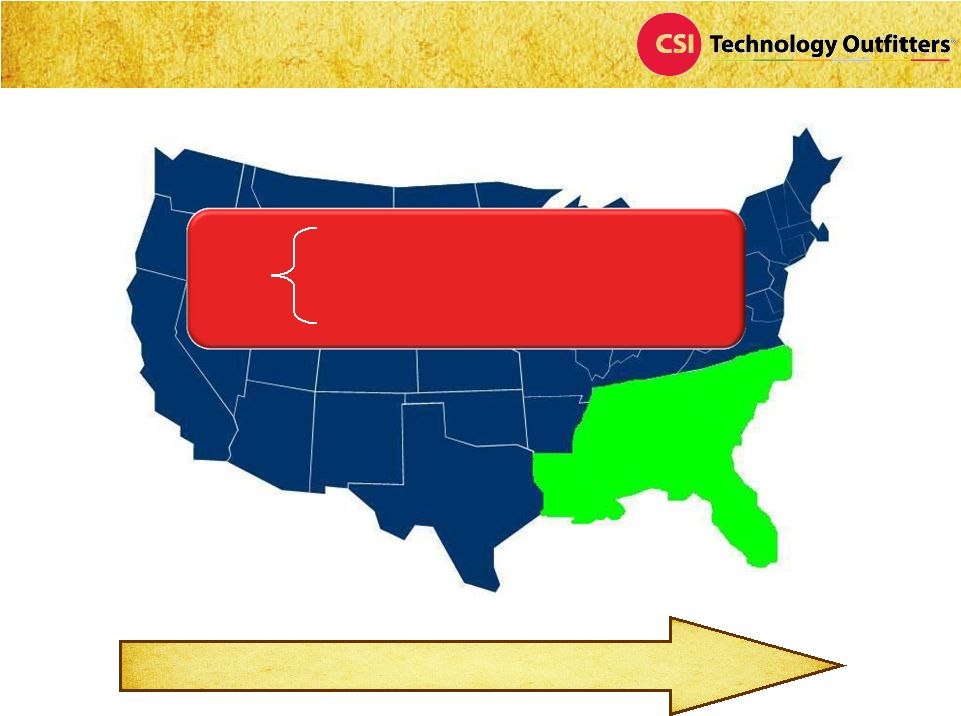

Grow via continued expansion into new geographies

Total

U.S.

11

Nationwide Prospects

CSI

Core Markets

3,100 County Governments

36,000 City Governments

14,000 School Districts

Total

U.S.

1

Source: Dept of Census

2

Source: National League of Cities

3

Source: Dept. of Education

-

National Center for Education Statistics

3

2

1 |

Summary of Capitalization as of 4.15.10

Common Shares Outstanding

7.0 M

F/D Shares Outstanding

13.7 M

Full Potential Diluted

14.2 M

52 Wk Trading Range

$ 0.40 -

$1.15

Current Share Price

$ 0.68

Current Market Cap

$ 4.8 M

Management/Board/Insider

Ownership

4.0 Million Shares

= 57% of Common

outstanding

; 28% outstanding shares

(common & preferred)

Select Financials

12

Key Statistics -

Dec 31, 2009

Fiscal Year Ends

Dec 31

EPS (Fully Diluted) 2009

$ 0.02

Revenue FY 2009

$ 51.8 M

EPS (Fully Diluted) 2008

$ 0.11

Revenue TTM

$ 51.8 M

Total Assets

$ 18.8 M

EBITDA

FY 2009

$ 3.5 M

Total Debt With Sub-Debt

$ 2.4 M

EBITDA

FY 2008

$ 5.1 M

Without Sub-Debt

$ 0.6 M

3

EBITDA is a non-GAAP financial measure. See reconciliation to GAAP measure

provided in our Earnings Release for our

year

ended

12/31/2009

at

www.csioutfitters.com.

2

TTM: Trailing Twelve Months is a sum of the past 12 month timeframe.

1

Common shares outstanding includes 0.5 M shares held in trust related to Version3

acquisition. 2

3

3

1

1 |

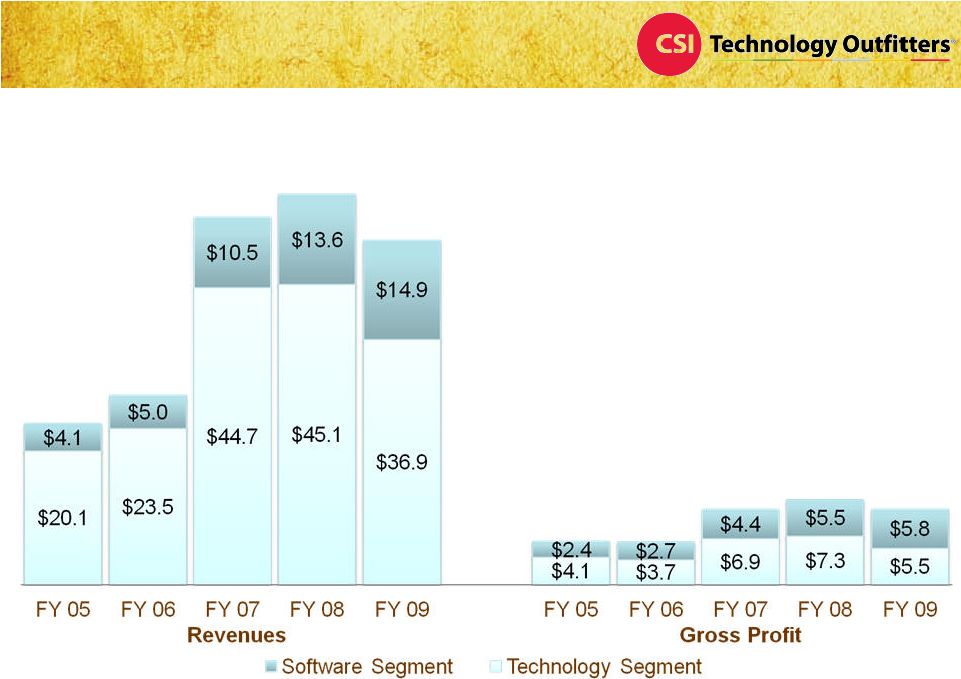

Select Financials

($ in millions)

13

Revenues and Gross Profit

5-Year Trend |

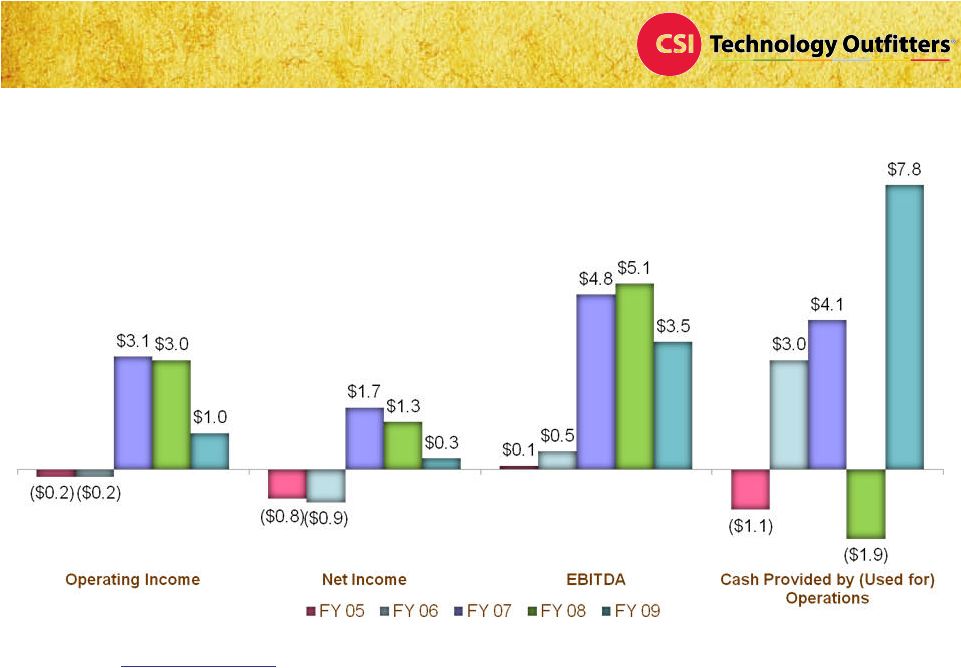

14

Select Financials

Operating Income , Net Income , EBITDA & Cash Provided by (Used

for)

Operations 5-Year Trend

($ in Millions)

1

EBITDA is a non-GAAP financial measure. See reconciliation to GAAP measure in

our earnings release for our year ended

12/31/2009 at www.csioutfitters.com.

Operating Income and Net Income have declined more than EBITDA due to

increased Amortization from Intangible Acquisitions. New product developing

and acquired from Acquisitions provides the potential to double EBITDA over

the next 5 years, over 2008 levels. 1

1

1 |

Select Financials

15

Balance Sheet 3-Year Trend

1

Includes deferred revenue, such as revenue from recurring support agreements.

($ in Millions) |

Nancy

K. Hedrick •

CEO & President

•

30 yrs in IT

•

President of CSI since 1989

Thomas P. Clinton

•

Sr. VP of Strategic Partnerships

•

25 yrs in IT

•

VP at CSI since 1999

David Dechant, CPA

•

Chief Financial Officer

•

25 yrs in Finance

(including Conso Int’l Corp & Warner-Lambert)

•

CFO at CSI since 2005

Beverly N. Hawkins

•

Sr. VP of Product Development

•

24 yrs in IT

•

VP of CSI since 1989

William J. Buchanan

•

Sr. VP of Delivery & Support

•

25 yrs in IT

•

VP at CSI since 1999

Senior Management Team

16 |

Advantages of business model

–

Strong gross margins

–

Recurring revenue stream

–

Proprietary software solutions and diversity of our offerings

–

Focused on public sector markets with continuous budgets

Positioned for continued growth

–

Strategic investments in new products and enhanced offerings

–

Customer base growth in existing markets

–

Leverage solution portfolio with newly acquired and existing customers

–

Continue expanding into new geographies

Investment Summary

17 |

Company Contact

David Dechant, CFO

ddechant@csioutfitters.com

Telephone: 864.855.3900

Company

Website:

www.csioutfitters.com

Investor Contact

DC Consulting, LLC

Daniel Conway

daniel@dcconsultingllc.com

Telephone: 407.792.3332

18

Contact Us

OTC BB: CSWI |