Attached files

| file | filename |

|---|---|

| EX-31.1 - SECTION 302 CERTIFICATION - CEO - BARK GROUP INC | exhibit31-1.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - CEO - BARK GROUP INC | exhibit32-1.htm |

| EX-32.2 - SECTION 906 CERTIFICATION - CFO - BARK GROUP INC | exhibit32-2.htm |

| EX-31.2 - SECTION 302 CERTIFICATION - CFO - BARK GROUP INC | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10–K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 000-53530

BARK GROUP INC.

(Exact name of registrant as specified in its charter)

| Nevada | Not Applicable |

| (State or other jurisdiction of incorporation or | (IRS Employer Identification No.) |

| organization) | |

| Ostergade 17-19, 3rd Floor, DK-1100 | |

| Copenhagen K, Denmark | DK-1100 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +45 7026 9926

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well–known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[

] Yes [X] No

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or 15(d) of the Exchange Act

[ ]

Yes [X] No

Indicate by check mark whether the registrant (1) filed all

reports required to be filed by Section 13 or 15(d) of the Exchange

Act

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2)

has been subject to such filing

requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers in

response to Item 405 of Regulation S–K is not contained herein,

and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated

by reference in Part III of this Form

10–K or any amendment to this Form 10–K. [X]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non–accelerated filer, or a

smaller reporting company. See the definitions of “large accelerated filer”,

“accelerated filer” and “smaller reporting company”

in Rule 12b–2 of the

Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non–accelerated filer [ ] | (do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b–2 of the Exchange Act).

[ ]

Yes [X] No

State the aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by reference

to the price at which the common equity was last sold, or the average bid and

asked price of such common equity, as of the last

business day of the registrant’s most recently completed second quarter:

$19,946,320

The registrant had 367,807,761 shares of common stock outstanding as of April 16, 2010.

TABLE OF CONTENTS

- i -

REFERENCES

As used in this annual report on Form 10-K:

-

“we”, “us”, “our”, the “Company” or “Bark Group” refers to Bark Group Inc. and its subsidiaries, unless the context otherwise requires,

-

“SEC” refers to the Securities and Exchange Commission,

-

“Securities Act” refers to the Securities Act of 1933, as amended,

-

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended,

-

all dollar amounts refer to US dollars, unless otherwise indicated,

-

DKK refers to Danish Crowns, the lawful currency of Denmark, and

-

all references to numbers of shares of our common stock are presented to reflect the 20 for one forward split of our common stock completed effective August 13, 2009.

FOREIGN EXCHANGE

Amounts presented below in Danish Crowns (DKK) for the year ended December 31, 2009 have been converted into U.S. Dollars at December 31, 2009 at the exchange rate of 5.1901 DKK per $1.00. Amounts presented below in Danish Crowns (DKK) for the year ended December 31, 2008 have been converted into U.S. Dollars as at December 31, 2008 at the exchange rate of 5.2849 DKK per $1.00. The Danish Crown (DKK) was convertible into U.S. dollars on the basis of 5.5232DKK per $1.00 as of 12 pm (noon) on March 31, 2010 according to foreign exchange information published by the Danish National Bank.

FORWARD–LOOKING STATEMENTS

The information in this annual report contains forward–looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward–looking statements involve risks and uncertainties, including statements regarding our capital needs, business plans and expectations. Such forward-looking statements involve assumptions, risks and uncertainties regarding, among others, the success of our business plan, availability of funds, government regulations, operating costs, our ability to achieve significant revenues, customer acceptance of our business model and software solutions and other factors. Forward–looking statements are made, without limitation, in relation to operating plans, business acquisitions, availability of funds, operating results and government regulation. Any statements contained herein that are not statements of historical facts may be deemed to be forward–looking statements. In some cases, you can identify forward–looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology.

Forward–looking statements in this annual report include, but are not limited to, statements with respect to the following:

-

our ability to continue to retain our existing customers and to develop new customers,

-

our ability to continue the expansion of our business,

-

our ability to maintain our current financing and to secure any additional financing that we determine to pursue,

-

our future financial or operating performances,

-

our requirements for additional capital,

-

our ability to successfully integrate businesses that we acquire,

-

our ability to negotiate and complete future business acquisitions,

- 1 -

- government regulation of our business.

These forward–looking statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions, including, the risks and uncertainties outlined under the sections titled “Risk Factors”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. If one or more of these risks or uncertainties materialize, or our underlying assumptions prove incorrect, our actual results may vary materially from those expressed or implied by our forward–looking statements anticipated, believed, estimated or expected.

We caution readers not to place undue reliance on any such forward–looking statements, which speak only to a state of affairs as of the date made. We disclaim any obligation subsequently to revise any forward–looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward–looking statements contained in this annual report by the foregoing cautionary statements.

- 2 -

PART I

ITEM 1. BUSINESS

Overview

We are a commercial communication services company that provides integrated traditional and new media advertising and marketing consulting services to our clients. We conduct our business through various subsidiaries which enables us to merge various communication expertise including traditional advertising (creativity and strategy), media consulting, digital know-how and television production. We believe this mix of skills allows us to customize advertising and marketing communication services to create the most value for our clients and their businesses.

Our clients are comprised primarily of European businesses that range in size from small local businesses to larger trans-national and multi-national corporations. These clients include a range of businesses including financial institutions and banks, consumer products companies and luxury goods companies. Examples of the clients and brands for which we have designed and implemented marketing programs include the following:

-

Coop, one of Denmark’s largest consumer retailers,

-

Simcorp, a financial software provider,

-

Grand Marnier, an alcoholic beverage,

-

Grants, an alcoholic beverage,

-

Linje Aquavit, an alcoholic beverage,

-

Jaegermeister, an alcoholic beverage,

-

Waterfront – a retail outlet,

-

RO’sTorv, a retail outlet, and

-

Tulip, a fast moving consumer goods business.

We work with our clients to create and implement full advertising and marketing campaigns from start to finish. The professional services that we provide encompass the following:

- Strategic counseling,

| o |

Creating business and brand strategies, |

|

| o |

Advising on product development, |

|

| o |

Providing workshops for management, board of directors and marketing departments , |

- Research and analysis,

| o |

Recommending of needs and methods to test different marketing challenges, |

|

| o |

Conducting focus groups, hall tests and interviews with the public, |

|

| o |

Use of our own in house internet based analysis techniques, |

|

| o |

Conducting brain science research projects focusing on human perception and giving seminars to clients and new business targets on our findings and offering our clients the opportunity to become active partners in these projects, |

- Creative development of advertising campaigns,

| o |

Definition and formulation of advertising and marketing concepts, |

|

| o |

Creative development, art direction and copy writing, |

|

| o |

Recommending creative and strategic of use of media channels, |

- 3 -

- Coordination and production of advertising campaigns,

| o |

Coordination of the chosen campaign idea being finalized in accordance with approved layout, including copy writing, proof reading, programming and final artwork, |

|

| o |

Coordination of collaboration with external partners such as photographers, sound studios, specialist programming, TV production companies, and printing houses, |

- Media strategy and counseling,

| o |

Development of media strategy in accordance with brand position, campaign objectives, chosen target group(s), and size of investment, |

|

| o |

Advising on the optimum means of using media to reach our clients’ customers and potential customers most effective and cost efficient manner as possible, |

- Price negotiations for media costs,

| o |

Negotiating cost of media for our clients. We negotiate annual agreements as well as ad hoc campaigns, |

- Coordination of campaign execution,

| o |

Dialogue with media partners within the chosen campaign media channels, such as television advertisements, radio, outdoor commercials, internet web sites, newspaper, magazine advertisements and mobile media. |

We earn revenues from the advertising and marketing services that we provide based on various different fee arrangements, including:

-

fees for advertising services,

-

fees for strategic counseling,

-

commissions on media placements,

-

performance based revenue, and

-

a combination of all of the above.

Our strategic plan is to combine traditional advertising agency skills with the media agency and relevant digital know-how in order to create a communications company that is able to deliver effective integrated advertising and marketing campaigns and activities. We believe that this transformation from a traditional advertising agency to an integrated communications company has only been done on a limited scale to date. We believe this presents us with a market opportunity to expand our business and compete with much larger competitors in the marketplace.

Corporation Organization

Bark Group Inc. (“We”, “Bark Group” or the “Company”) is a Nevada corporation that was incorporated as “Exwal Inc.” on July 5, 2005. We acquired Bark Corporation on February 29, 2008 in a transaction whereby we issued 259,290,960 shares of our common stock to the shareholders of Bark Corporation for all of the outstanding share capital of Bark Corporation. We were a “shell company”, as defined by the Securities and Exchange Commission (the “SEC”), with minimal assets and operations prior to the completion of this acquisition. We completed the change of our corporate name to “Bark Group Inc.” on February 28, 2008 as a condition to the completion of closing of the acquisition, and on February 29, 2008 ceased to be a “shell company”. Our original sole executive officer and director was replaced by the management team of Bark Corporation concurrent with the closing of this acquisition.

Corporate Structure

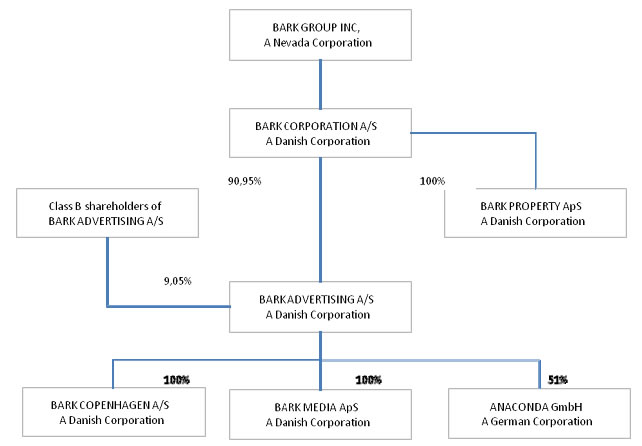

Our corporate organization as of March 31, 2010 is reflected in the following chart:

- 4 -

We provide our marketing and advertising services in Europe through our wholly owned subsidiary, Bark Corporation A/S (“Bark Corporation”). Bark Corporation is the owner of 90.95% of the share capital of Bark Advertising A/S (“Bark Advertising”), which in turn is the owner of 100% of each of Bark Copenhagen A/S (“Bark Copenhagen”) and Bark Media ApS (“Bark Media”).

Incorporation of Bark Corporation

Bark Corporation was incorporated on October 9, 2006 in Denmark under the name “K2MEDIAGROUP A/S”. Bark Corporation changed its corporate name from “K2MEDIAGROUP A/S” to “Bark Corporation A/S” on September 14, 2007. Bark Corporation is the Danish holding company for the various operating entities which comprise the Bark group of companies.

The founding shareholders of Bark Corporation were:

-

Bent Helvang, our chairman and one of our directors, through Bent Helvang Media ApS, a private company controlled by Mr. Helvang,

-

Klaus Aamann, one of our directors,

-

Jesper Svane, through Svaneco Ltd., a private company controlled by Mr. Svane,

-

Anders Hageskov, our chief executive officer, and

-

Sapiens Alliance, a private company controlled by Rene Lauritsen.

- 5 -

On October 9, 2006, Bark Corporation issued 9,090,909 shares of common stock to the founding shareholders of Bark for total proceeds of $88,700. This number of shares reflects a stock split completed by Bark Corporation prior to our acquisition of Bark Corporation.

Subsequent the organization of Bark Corporation, the founding shareholders entered into a funding agreement with Bark Corporation dated December 2007 pursuant to which the founding shareholders agreed to solicit new shareholders for Bark Corporation. The founding shareholders agreed that they would be paid a commission of 10% of the net proceeds received from new shareholders, other than Mr. Aamann who would receive a 20% commission and with the exception of sales of shares to employees, in respect of which no commission would be paid.

An additional twenty-two shareholders subscribed for and received shares in Bark Corporation. These shareholders and certain of their transferees subsequently exchanged their shares for shares of our common stock. These shares were issued as follows:

-

On September 30, 2007, Bark Corporation converted an outstanding loan from Venture Alliance Partners A/S of DKK 3,000,000 ($591,100) into 375,000 shares.

-

On September 30, 2007, Bark Corporation issued 300,000 non-vested share awards to two executives for proceeds of DKK 16,500 ($3,255).

-

On September 30, 2007, Bark Corporation issued 113,952 new shares to fifteen purchasers for proceeds of $291,000. Costs of issuing these shares were $13,000.

-

On December 28, 2007, Bark Corporation issued 120,139 shares to two purchasers for proceeds of $311,000. Costs of issuing these shares were $61,000.

As a result of the above issuances, the total number of shares issued by Bark Corporation was 10,000,000 shares. These shares were exchanged for 259,290,960 shares of our common stock upon completion of our acquisition of Bark Corporation, as described below under “Reverse Acquisition of Bark Corporation”.

Organization of Bark Advertising

Bark Corporation owns 90.95% of the outstanding share capital of Bark Advertising. Bark Advertising was incorporated on October 12, 2006 in Denmark by Bark Corporation as founder and subscriber. Bark Advertising was incorporated under the name “K2Advertising A/S”. Bark Advertising changed its name to “Bark Advertising A/S” on December 21, 2007. Bark Advertising is the holding company for the advertising branch of the Bark group of companies.

Acquisition of Bark Copenhagen

Bark Copenhagen was incorporated on January 8, 2002 under the laws of Denmark under the name “Living Brands A/S”. Bark Copenhagen has been engaged in the business of providing advertising and marketing services since its inception.

Bark Advertising acquired all the shares of Bark Copenhagen on May 14, 2007. This acquisition was completed pursuant to a share transfer agreement entered into between Bark Advertising and the shareholders of Bark Copenhagen, namely Peter Brockdorff, Daniel Soren, David Asmussen, Finn Balleby and Ole Parnam. Bark Advertising paid a purchase price of DKK 12,000,000 (equivalent to $2,191,300) which was paid by (i) the cash payment of DKK 3,594,000 (equivalent to $656,300), and (ii) the issue of 651 Class B shares of Bark Advertising to the shareholders of Bark Copenhagen with a value of DKK 8,406,000 (equivalent to $1,535,000). The Class B shares that were issued, including additional B shares that were issued on October 3, 2007, represented 12.7% of the issued share capital of Bark Advertising, with the result that Bark Corporation held 87.3% of the share capital of Bark Advertising through its Class A shares and the former shareholders of Bark Copenhagen owned 12.7% of the share capital of Bark Advertising through their Class B shares.

- 6 -

Bark Advertising entered into a shareholders agreement with the Class B shareholders concurrent with the closing of the acquisition of Bark Copenhagen. The shareholders agreement provides for the rights and restrictions of the shares held by Bark Corporation, as holder of the Class A shares, and the shares held by the Class B shares. The Class B shares of Bark Advertising have the following characteristics:

-

the shares have no dividend nor liquidation preferences,

-

the shares have the same rights to receive dividends as all other shares,

-

the shares can be called on June 1, 2010 at the purchase price or at the proportional right of ownership of Bark Advertising times average profit before tax in Bark Advertising for the last three financial years times a multiple of five. Based on budgets for Bark Advertising, the latter calculation would give a much lower price than the purchase price. all Class B shares have 1/10 of the voting rights of the Class A shares which are held by Bark Corporation,

-

in order to be redeemed, the Class B shareholders must inform Bark Advertising of the election to redeem on January 1, 2010 at the latest,

-

if the Class B shareholders choose not to be redeemed, Bark Advertising starting from June 1, 2010 and on will have the right to redeem the Class B shares at the same terms as mentioned above. However, if a Class B shareholder renounces his rights to be redeemed on June 1, 2009 at the latest, Bark Advertising will lose the right to redeem the shareholder. No Class B shareholders renounced their rights as at June 1, 2009. and

-

if the Class B shares are redeemed, Bark Advertising has the right to pay back the shares over a period of 24 months with an interest rate of the discount rate of the Danish National Bank (currently 4.25% per annum) plus 3% per annum.

In January 2009, two Class B shareholders representing 131 shares were redeemed. The redeemable amount as of December 31, 2009 was DKK 994,356 ($191,587) and as of December 31, 2008 was DKK 1,653,000 ($312,800). The redemption of shares are paid in eight quarterly installments, including interest at a variable rates (5% at December 31, 2009). At December 31, 2009, four installments are remaining and accrued interest amounted to $12,148. In November 2009, three additional Class B shareholders representing 75 shares were redeemed for DKK 900,000 (USD $180,000). The redeemable amount was converted to a total of 2,000,000 shares of common stock in Bark Group.

The shareholders’ agreement provides that each party will have pre-emptive rights to subscribe for shares on a pro rata basis in connection with any increases in share capital of Bark Advertising and further provides Bark Copenhagen with pre-emptive rights with respect to any transfer of shares by the Class B shareholders (other than transfers to another Class B shareholder). If a third party submits an offer to acquire shares of Bark Advertising causing such third party to own or control 50% or more of Bark Advertising, the other parties to the shareholders’ agreement will be obligated to transfer their shares to such third party on the same terms.

Under the terms of the shareholders’ agreement, the parties agreed that the Board of Directors of Bark Advertising be comprised of five members, of whom one shall be the chief operating officer of Bark Copenhagen and further agreed that Bark Advertising would enter into employment contracts with Peter Brockdorff and Daniel Soren. These employment agreements were entered into in May 2007.

The parties agreed that Bark Advertising would pay Bark Corporation a management fee equal to 6% of the consolidated revenue of Bark Advertising after elimination of inter-company profit. This fee is payment for the overall management of Bark Advertising, group services, ongoing business development, transaction costs, stock exchange listing and price management and acquisitions. The parties further agreed that Bark Corporation would provide a subordinate loan to Bark Advertising of DKK 9 million (equivalent to $1,607,000 as at March 31, 2009), subject to the quarterly interest rate applicable to Bark Corporation’s lending rate for overdrafts.

Following this acquisition, Bark Copenhagen changed its corporate name from “Living Brands A/S” to “Bark Copenhagen A/S” on December 17, 2007.

Acquisition of Bark Media

Bark Media was incorporated in Denmark on August 15, 2004 as “Radar 360 ApS” by BrockSo Holding ApS, Maren Holding ApS and FFF Holding ApS as founders. BrockSo Holding ApS is a private company controlled by Peter Brockdorff and Daniel Soren. Maren Holding ApS is a private company controlled by David Asmussen. FFF Holding ApS is a private company controlled by Finn Balleby. These controlling shareholders were also shareholders of Bark Copenhagen prior to its acquisition by Bark Advertising.

- 7 -

Bark Advertising acquired all the shares of Bark Media on May 14, 2007. This acquisition was completed pursuant to a share transfer agreement between Bark Advertising and the shareholders of Bark Media, namely BrockSo Holding ApS, Maren Holding ApS and FFF Holding ApS. Bark Advertising paid a purchase price of DKK 6,000,000 (equivalent to $1,095,000) for this acquisition. The purchase agreement required an initial payment of DKK 5,406,000 was paid on May 1, 2007 and DKK 594,000 was payable quarterly in arrears over the four quarters following May 1, 2007.

Following this acquisition, Bark Media changed its corporate name from “Radar 360 ApS” to “Bark Media ApS” on December 17, 2007.

Bark Property

We incorporated Bark Property ApS (“Bark Property”) on September 28, 2007 under the laws of Denmark. Bark Property is 100% owned by Bark Corporation. Bark Property was incorporated for the purpose of acquiring the premises in which our principal executive offices are located at Ostergade 17-19, 3rd Floor, DK-1100 Copenhagen K, Denmark.

Reverse Acquisition Transaction of Bark Corporation

We acquired all of the issued and outstanding share capital of Bark Corporation (the “Bark Acquisition”) on February 29, 2008 pursuant to a share exchange agreement dated February 29, 2008 between us and the principal shareholders of Bark Corporation, namely Svaneco Ltd., Sapiens Alliance Ltd., Bent Helvang Media ApS, Bristol Worldwide Ltd. BVI and Klaus Aamann. These principal shareholders represented 87.5% of the issued and outstanding shares of Bark Corporation. The remaining 12.5% interest in Bark Corporation was transferred to us by action of the board of directors of Bark Corporation in accordance with the articles of association of Bark Corporation that entitled the board to cause this transfer to be effected. We obtained the legal opinion of Danish legal counsel to Bark Corporation at the time of the acquisition that the transfer was authorized by the articles of association of Bark Corporation. These shareholders received the same consideration as the principal shareholders in the acquisition transaction, namely shares of our common stock based on a pro rata portion of their ownership of Bark Corporation. We issued an aggregate of 259,290,960 shares of our common stock to the shareholders of Bark Corporation to complete the acquisition of Bark Corporation. Upon the completion of this share exchange transaction:

-

Ms. Peceli resigned as a director and officer of the Company,

-

we changed our corporate name from “Exwal Inc.” to “Bark Group Inc.”,

-

Bent Helvang, Klaus Aamann and Jesper Svane were appointed as our directors,

-

Bent Helvang was appointed as the chairman of our board of directors,

-

Anders Hageskov was appointed as our president and chief executive officer, and

-

Ole Bjerre was appointed as our chief financial officer.

Mr. Svane subsequently resigned as director on February 4, 2010.

In addition, each principal shareholder of Bark Corporation agreed to a lock-up agreement pursuant to which the number of shares that the shareholder will be entitled to sell in any one month period for a period of one year following the date on which the shares of our common stock become eligible for trading on the OTC Bulletin Board has been restricted to the greater of:

-

10% of the shares held by the shareholder, and

-

12,500 shares of our common stock.

The minority shareholder share purchase agreements include an equivalent lock-up agreement which will be binding on the minority shareholders upon execution of their minority shareholder share purchase agreements.

- 8 -

These lock-up agreements expired in March 2010 as a result of our common stock having been eligible for trading on the OTC Bulletin Board for more than one year.

In connection with the Bark Acquisition, we entered into Repurchase and Lock-Up Agreements with each of our shareholders who purchased shares of our common stock prior to the completion of our acquisition of Bark Corporation. The Repurchase and Lock-Up Agreements originally provided that we would be entitled to purchase all shares held by each shareholder for a price of $0.001 per share in the event that we did not complete a major financing transaction by June 30, 2008. In July 2008, we delivered to the shareholders our letter confirming our agreement to extend the right of repurchase to September 30, 2008. We delivered a further letter in April 2009 confirming our agreement to extend the right of repurchase to June 30, 2009.

Under these Repurchase and Lock-Up Agreements, as amended, each shareholder agreed to the following:

| • |

in the event that we did not complete a major financing transaction by the agreed upon date, we would be entitled to purchase all shares held by each shareholder for a price of $0.001 per share. A major financing transaction was defined as a financing transaction whereby we will raise not less than $10 million by the issuance of not more than 57,142,860 shares of our common stock of not less than $0.175 per share. Exercise of this option would have resulted in the former shareholders of Bark Corporation owning all of the shares of our common stock pro rata in accordance with their former shareholdings of Bark Corporation, with the exception of shares sold within the limitations of the lock- up agreement prior to the repurchase, | |

| • |

each shareholder agreed to the change of our corporate name and to the two and one half to one consolidation of our outstanding shares of common stock, and | |

| • |

each shareholder agreed to a lock-up agreement pursuant to which the number of shares that the shareholder will be entitled to sell in any one month period for a period of one year following the date on which the shares of our common stock become eligible for trading on the OTC Bulletin Board has been restricted to the greater of: | |

|

o |

10% of the shares held by the shareholder, and | |

|

o |

12,500 shares of our common stock. | |

We determined in August 2009 to terminate the Repurchase and Lock-Up Agreements and to release the shareholders from their respective obligations that were included in the Repurchase and Lock-Up Agreements. As a result of this termination and release and effective July 30, 2009, we no longer have the right to purchase any shares held by original shareholders of Bark Group Inc. and the original shareholders of Bark Group Inc. are able to resell their shares without restriction, subject to compliance with applicable securities laws. For clarity, each of the original shareholders of Bark Group Inc., who hold in aggregate 64,674,880 shares of our common stock, retained their original shares and are no longer subject to any contractual restriction on resale between us and the shareholder.

Regulation S Share Transfers

The number of our shareholders increased in August 2008 as a result of share transfers completed by Bark Holding Ltd. and Venture Capital Alliance Ltd. These share transfers were completed as “offshore transactions” within the meaning of Regulation S in accordance with the requirements of Regulation S. Each purchasing shareholder was either a close friend or a business associate of a principal of Bark Holding resident in Denmark. Each shareholder executed a Regulation S Transfer Agreement wherein they represented to Venture Alliance Partners Ltd. and to us that (i) the shareholder is not a U.S. Person, as defined in Regulation S, (ii) the shareholder was not in the United States at the time the offer to purchase the shares was received or at the time the offer was accepted, (iii) the shareholder acknowledged that the shares are restricted securities within the meaning of the Securities Act and cannot be transferred other than pursuant to registration under the Securities Act, pursuant to Regulation S of the Securities Act or pursuant to an exemption from the registration requirements of the Securities Act, (iv) the shares would be endorsed with a legend confirming the restrictions on transfer under the Securities Act, (v) hedging transactions in the shares are prohibited, and (vi) the shareholder consented to a notation on the registrar of the shareholders of the Company confirming that the shares are restricted securities.

- 9 -

As a consequence of these share transfers, the number of our shareholders at the time of the transfer increased from 67 shareholders to 79 shareholders. These share transfers were completed by Bark Holding Ltd. and Venture Capital Alliance Ltd. based on the individual decisions by these investors to sell a portion of their shares for cash consideration.

Share Consolidation and Subsequent Forward Split

We completed a one for two and one-half consolidation of our issued and outstanding shares of common stock on February 26, 2008 prior to the completion of the Bark Acquisition. All information presented in this Form 10-K annual report takes into consideration the consolidation of our shares of common stock, including all share amounts and per share prices.

We subsequently has filed a Certificate of Change with the Secretary of State of Nevada, with an effective date of August 13, 2009, to effectuate a forward stock split of the Company’s authorized share capital and its issued and outstanding shares of common stock, in each case on the basis of twenty new common shares for each one old common share. The forward stock split is payable on August 17, 2009 to all shareholders of record as of the record date, August 13, 2009. As a result, as of August 13, 2009, the Company’s authorized share capital increased from 100,000,000 shares of common stock to 2,000,000,000 shares of common stock and its issued and outstanding share capital increased from 16,355,686 shares of common stock to 327,113,270 shares of common stock.

All references to numbers of shares of our common stock in this Annual Report are presented to reflect the 20 for one forward split of our common stock completed effective August 13, 2009.

Agreement with DeBondo Capital

Pursuant to an engagement letter from Debondo Capital Inc. (“Debondo”) to Bark Corporation dated October 2, 2007, Debondo proposed to provide the advisory services necessary to list our shares on the NYSE Alternext US (formally American Stock Exchange) (“AMEX”) through a two stage process consisting of an initial quotation of the Company’s shares on the OTC Bulletin Board (the “OTCBB”) and a subsequent listing of our shares on AMEX. The advisory services proposed by Debondo included:

-

consulting with us and all relevant professionals and regulatory bodies to structure and package our corporate organization for the most efficient listing on AMEX and market valuation post-listing on both the OTCBB and AMEX,

-

provide and make available a U.S. incorporate holding company, which was Exwal Inc., to enable us to list on the OTCBB,

-

introducing us to PacificWave Partners Limited and its institutional investors and securing additional funding of $10 million to be released to us in accordance with our agreement with PacificWave, as described below, and

-

arranging road shows for the Company post-listing.

Under the terms of the engagement agreement, Bark Corporation agreed to pay Debondo a fee consisting of the following:

-

an initial payment of $25,000 due and payable on submission of our initial Form S-1 registration statement with the SEC,

-

payment of $200,000 on final receipt and acceptance of the Company’s Form 211 with the Financial Industry Regulatory Authority Inc. and the issuance of a ticker symbol for Bark Group Inc., and

-

payment of $25,000 upon our shares being registered on the American Stock Exchange.

Further to its engagement agreement, DeBondo introduced Bark Corporation to us. In order to facilitate our acquisition of Bark Corporation, DeBondo Capital Limited (Hong Kong) executed an indemnification agreement dated February 29, 2008 wherein DeBondo agreed to indemnify and save Bark Corporation and the shareholders of Bark Corporation harmless from any and all losses, liabilities, actions, costs, damages and expenses arising from the material breach by us or the material inaccuracy or untruth of our representations and warranties in the share purchase agreements. In addition, DeBondo Capital Limited (Hong Kong) agreed to pay to us compensation of $25,000 if we exercised the right to redeem the shares held by the Exwal shareholders pursuant to the Repurchase and Lock-Up Agreement by June 30, 2008.

Bark Corporation received the required audited financial statements in April 2008 and reached a determination that these financial statements do not conflict with our representations and warranties set forth in the Share Purchase Agreements. Accordingly, we agreed that DeBondo had no further obligation under the indemnification agreement with respect to representations and warranties set forth in the Share Purchase Agreements.

- 10 -

We entered into an amendment to the indemnification agreement with DeBondo in April 2009 to reflect the extension of the financing deadline under the Repurchase and Lock-Up Agreements to June 30, 2009. Under the amendment to the indemnification agreement, Debondo agreed that the obligation to pay to us compensation of $25,000 if we exercise the right to redeem the shares held by the Exwal shareholders pursuant to the Repurchase and Lock-Up Agreement would extend until July 31, 2009. Under the amended agreements, this compensation amount would only become payable if we were to exercise the repurchase right subsequent to June 30, 2009. Under the amended agreement, DeBondo further agreed that the $225,000 balance of their fee would only be due and payable upon completion by us of a $2.5 million equity financing pursuant to either (i) the agreement between us and PacificWave, as discussed below under “PacificWave Engagement Agreement”, or (ii) by any other party, provided that in this case the financing completes by June 30, 2009.

In August 2009, we terminated our engagement letter with Debondo Capital Inc. (“Debondo”) originally dated October 2, 2007, as amended, as the financing contemplated under the engagement letter was not completed by June 30, 2009. In addition, and as a result of the termination of the Repurchase and Lock-Up Agreements discussed above, we also terminated the indemnification agreement dated February 29, 2008 with DeBondo Capital Limited (Hong Kong), as amended, wherein DeBondo Capital Limited (Hong Kong) agreed to pay to us compensation of $25,000 if we exercised the right to redeem the shares held by the Exwal shareholders pursuant to the Repurchase and Lock-Up Agreement by June 30, 2009. Neither the $225,000 performance incentive fee, nor the $25,000 indemnification fee was paid to Debondo.

DeBondo was considered one of our promoters by virtue of its role and involvement in our corporate organization.

PacificWave Engagement Agreement

Bark Corporation entered into an engagement agreement with PacificWave Partners Limited on August 17, 2007 wherein Bark Corporation engaged PacificWave to act as financial advisor to Bark Corporation in connection with the potential financing of Bark Corporation. The term of this engagement agreement was originally for a period of three years, subject to the termination rights provided for in the engagement agreement, during which time PacificWave was to be the exclusive financial advisor to Bark Corporation. The agreement could be terminated by Bark Corporation with six months notice during this term. We entered into an amendment to the engagement agreement with PacificWave Partners Limited on July 14, 2008. Under the amended engagement agreement, if the financial target of raising $10 million for Bark Corporation was not met by September 30, 2008, the agreement was to be considered to be null and void. As the contemplated financing was not raised by September 30, 2008, the engagement agreement terminated as at September 30, 2008. We entered into a further agreement with PacificWave Partners in March 2009 whereby the agreement was confirmed on the understanding that the agreement would terminate if the financial target of raising $10 million for Bark Corporation was not met by June 30, 2009. As the $10 million financing was not raised by June 30, 2009, this agreement terminated in accordance with its terms as at June 30, 2009.

Our Offices

Our principal executive and head office is located in Copenhagen, Denmark where all of management and professional staff are employed. The address of our principal executive office is Ostergade 17-19, 3rd Floor, DK-1100 Copenhagen K, Denmark. Our telephone number is +45 7026 9926 and our fax number is +45 3332 0078.

Our History and Business Development

We commenced our business operations in October 2006 when Bark Corporation was incorporated. We expanded our business in May 2007 with the acquisitions Bark Copenhagen and Bark Media.

- 11 -

Bark Copenhagen was founded in 2002 and has evolved into a business with strong management and a client portfolio that included several blue chip accounts and cross border projects. Bark Copenhagen expanded from two employees to twenty-three employees from 2002 to 2007 when it was acquired by us. During this period, Bark Copenhagen expanded its communication expertise beyond the traditional advertising agency model to incorporate new media and advertising skills and consulting services. This included adding a digital department, developing and implementing Internet design and programming, and adding creative as well as traditional media counseling. As a result of this development, Bark Copenhagen has been able to achieve industry recognition within the Danish advertising market. Bark Copenhagen has been recognized in Denmark as being within the top advertising and media firms for strategy, advertising and creative media counseling and has won national as well as international industry awards for its advertising and marketing programs, including:

-

the Arnold Award in 2004 granted by Danish Cinema Commercial,

-

the Gold Diploma awarded by Creative Circle in 2005,

-

the Epica Bronze Award in 2006, and

-

three Creative Circle nominations in Cannes 2010.

Bark Copenhagen’s revenues prior to our acquisition of Bark Copenhagen were comprised primarily from fees generated from advertising and marketing services provided to its clients. As discussed below, these revenues did not include certain revenues from media placement commissions which were recognized by Bark Media.

Bark Media was organized in 2004 as a media consulting company. The revenues earned by Bark Media prior to our acquisition of Bark Media were attributable solely to revenues from media placement commissions. Under an arrangement between the previous partners of Bark Copenhagen, media placement commissions on new business created by Bark Copenhagen were owned by Bark Media. This provided a means whereby profit of new business generated by Bark Copenhagen would be shared amongst the then current active partners of Bark Copenhagen. The active partners of Bark Copenhagen comprised the shareholders of Bark Media. This arrangement resulted in revenues and corresponding profits attributable to media placement commissions being stripped out of Bark Copenhagen and recognized in Bark Media. This resulted in a reduction to the revenues and corresponding profits realized by Bark Copenhagen during 2006 and the period ended May 14, 2007.

Since completing these acquisitions, we have focused on merging the synergies of their respective skills, expanding work opportunities from their existing clients and identifying new business for these integrated solutions. We have also implemented a digital department into the agency by hiring senior skilled personnel and focused on upgrading our creative department by hiring additional senior creative directors. We believe that this expansion in our capabilities will help us to attract more large national and international client accounts.

Our Industry and Competition

We believe that the industry of commercial communication and advertising is going through a structural change. This structural change follows years with decentralization of the core skills of advertising, namely strategy, creativity, research and media counseling. It also reflects the re-establishment of the digital and internet segment. Based on these perceived structural changes in the industry, we have identified characteristics that we believe the future optimal advertising agency must have merged, namely the skills of:

-

advertising, including strategic, creative and production expertise,

-

media counseling, including both on-line and off-line expertise, and

-

digital know-how, including consulting and production expertise.

Our competitive experience is that local advertising agencies are incorporating digital skills and know-how into their businesses. We also see international advertising agencies and networks beginning to expand and build their own brands by focusing on online skills. A very few have started to focus on media counseling, primarily on-line media counseling. The traditional and new media agencies are typically using external media partners.

- 12 -

Our objective is to focus on providing integrated media counseling services within both the traditional and new media advertising services. We believe the changes in technology and the growth in digital media present us with opportunities to compete against traditional media agencies. These opportunities include the opportunity to pursue new media possibilities that incorporate traditional advertising skills with relevant digital know-how. We believe that these changes represent a fundamental change in the media and advertising industry and that these changes represent a growth opportunity for companies that are able to acquire and combine these new media skills with the traditional advertising model.

Our competitors include:

-

advertising agencies,

-

media agencies, and

-

digital agencies.

We believe the following companies to be relevant examples of our key competitors in the different competitor segments. Many of these companies are significantly larger international companies and have substantially greater financial and professional resources than we have. Further, many of these competitors will have global and regional offices from which they can provide services across a wide range of markets for prospective clients. Our location in Denmark, while providing access to the European Union, may be an impediment for international markets, including the United States. Further, our size may be an impediment with potential clients who believe that they need to engage a communications agency that has greater internal resources in order to address their business and marketing needs across a wide range of products and markets. We plan to compete against these larger clients using our business strategy outlined below, which generally involves delivering effective and strategic advertising and marketing campaigns by integrating traditional advertising agency skills with media agency and digital expertise. We believe, as is the experience with a number of our clients to date, that our approach to delivering professional communications services will enable us to compete against these larger competitors, notwithstanding their access to larger resources.

Traditional Advertising Agencies

Our definition of traditional advertising agencies and networks is companies who historically and presently have primarily branded themselves on providing strategic consulting, creative development and production. These competitors include

-

BBDO

-

Young & Rubicam

-

Bates

-

EuroRSCG

-

J. Walter Thompson

-

McCann

The market also includes agencies that combine traditional and new media advertising, such as the following competitors:

-

Fallon

-

180 Amsterdam,

-

Saatchi & Saatchi,

-

Forsmann & Bodenfors

In addition to the companies above who are all well established companies with a worldwide network and customer base, we also experience competition from local boutique advertising and media service companies that provide traditional advertising services.

- 13 -

Media Agencies

Competitors that are media agencies include:

-

OMD

-

MediaedgeCIA

In addition to these competitors who have a worldwide representation, we also experience some minor competition from local media agencies.

Our Strategic Plans

Our strategic plan is to integrate traditional advertising agency skills with the media agency and relevant digital know-how in order to create a communications company that is able to deliver effective advertising and marketing campaigns. We believe that this transformation from a traditional advertising agency to an integrated communications company has only been done on a limited scale to date. We believe this presents us with a market opportunity to expand our business and compete with much larger competitors in the marketplace.

Our strategy is to be able to develop and implement integrated marketing activities for our clients that are effective on a structural and strategic level as well as on an emotive and creative level. We believe this is the key to the creation of effective brand recognition in what has become an over-communicated world. Today’s consumers are continually targeted by ever increasing advertising and marketing. Accordingly, there is a need for intelligent and effective ways to reach the hearts and minds of consumers in a manner which differentiates a client’s products and services. Given the financial constraints of any marketing campaign, it is necessary to create marketing campaigns that break through the background of commercial noise in order to connect with prospective customers in an effective and efficient manner.

Traditional advertising campaigns are experiencing decreasing levels of efficiency when measured against industry standard metrics, such as “targeted rating points” and “gross rating points”. As a result of these decreased efficiencies, traditional advertising can only retain its effectiveness by increasing the volume of advertising, resulting in increased cost to the client. We believe that it is necessary to seek and to understand the consumer’s inner dialogue in order to design a program of effective communication with the consumer. If we can design marketing campaigns that dominate the customer’s inner dialogue, we can create a strong anchor in the consumer’s mind for our clients’ products and services. This strong anchoring creates an authoritative brand positioning. We believe that this anchoring is typically not dependent upon the size of investments in the advertising or marketing, but on the understanding of how to anchor the inner dialogue. Our strategy is to incorporate this objective into our marketing and advertising campaigns in order to create campaigns that are efficient in terms of creating brand awareness and connection with consumers while at the same time minimizing the cost of the campaign for the client.

Our strategy includes the incorporation of various distinct elements with the traditional advertising in order to create a cutting-edge creative platform and an insightful media set-up. This requires that we incorporate our core competencies into each Bark marketing and advertising campaign. The components of our Bark business concept are summarized as follows:

-

Bark Advertising – cutting edge business strategy and creativity,

-

Bark Media – traditional and new media consulting,

-

Bark Digital – development and production of digital platforms and digital content for the Internet; implementing television and mobile solutions based on our marketing experiences; seed and tracking and analyzing the effectiveness and penetration of marketing campaigns, and

-

Bark Production – production of television commercials, dissemination of viral films, product placement and development of commercial television formats.

- 14 -

Our objective is to expand our operations beyond our current base in Copenhagen. We believe that we have the opportunity to be a “first-mover” within the market by implementing our strategy on an international scale. This will involve expanding the expertise that we have developed and the experience that we have gained to new markets. We believe that this strategy will require that we complete acquisitions in order to build a critical mass and a brand image as a recognized player firstly in the European communications market. We believe that we have opportunities both within Western Europe, where markets are more established, and new European market countries, where expanding economies are triggering increased spending on media and advertising budgets.

We have begun the process of identifying potential acquisition targets. We will apply the following criteria in evaluating existing media and advertising firms that we think may qualify as strategic acquisitions that will enable us to expand our business in line with our overall strategy:

-

proven profitability,

-

well-established in the local market,

-

strong professional skills,

-

dynamic and effective management,

-

strong ranking amongst local industry peers, and

-

proven track record in the industry.

While we have begun to implement our search for prospective acquisition targets, we believe that there will be a limited number of media and advertising firms that will meet our qualifications for acquisition. Further, even if we identify firms for acquisition, there is no assurance that we will be able to negotiate and conclude acquisitions with the principals of these firms. Accordingly, there is no assurance that we will be able to successfully implement our acquisition strategy.

Anaconda

We completed the acquisition of a 51% interest in Anaconda.tv GmbH, a television production company incorporated in Munich, Germany (“Anaconda”) effective March 31, 2010. The acquisition was completed pursuant to a share purchase agreement dated January 18, 2010 between Bark Corporation and Bark Holding Ltd. (“Bark Holding”) (the “Share Purchase Agreement”). Bark Holding is a private corporation presently owned by Mr. Lauritsen, who is the owner of more than 10% of our outstanding common stock. Under the terms of the Share Purchase Agreement, we agreed to purchase a 25.5% interest in the issued and outstanding share capital of Anaconda. The Share Purchase Agreement also included the grant by Bark Holding to Bark Corporation A/S the option to purchase an additional 25.5% interest in Anaconda. We were entitled to exercise this option on or before March 31, 2010. We exercised this option and completed the acquisition of the 51% interest in Anaconda effective March 31, 2010. As consideration for this acquisition, we have issued 14,000,000 shares of our common stock. At the direction of Bark Holding, 7,000,000 shares were issued to Mr. Jesper Svane, one of our principal shareholders, and 7,000,000 shares were issued to Mr. René Lauritsen.

Anaconda was founded by Mr. Matthias Lange, the minority shareholder of Anaconda, and two of the present major shareholders of Bark Group, Mr. Svane and Mr. Lauritsen. Mr. Svane and Mr. Lauritsen previously held 51% of Anaconda through Bark Holding. This interest has been transferred to us, with Mr. Lange holding the remaining 49% interest in Anaconda.

Anaconda is an international format and production company located in Germany that was pre-nominated as one of the runner ups for an OSCAR for one of its productions some years ago. The company produces TV formats for a number of TV stations in Germany and Europe, such as RTL, ZDF, as well as TV channels in the US, and specializes also in clipsshow as well as fiction and factual programs as well as the content for internet commercials. Anaconda’s staff consists of seven people and a number of freelancers depending on the scale of production. Anaconda’s headquarters are in Taufkirchen, a suburb to Munich, Germany. Due to the fact that approximately 70% of Europe has broadband Internet coverage, Bark Group plans to use Anaconda’s capabilities for live production for their digital platform on the Internet as well as the production of commercials and product placement for television.

- 15 -

Tre Kronor

We entered into a share purchase agreement to acquire all of the issued and outstanding shares of Tre Kronor Media AB, a Swedish media company (“Tre Kronor”). The share purchase agreement is dated April 9, 2010 and has been entered into between Bark Group and each of the shareholders of Tre Kronor. The acquisition is anticipated to complete in the second quarter of 2010.

The principal terms of the Tre Kronor are summarized as follows:

| • |

we will issue an aggregate of 35,000,000 share of our common stock to the shareholders of Tre Kronor, pro rata with their respective ownership interests in Tre Kronor, | |

| • |

all shares issued to the Tre Kronor shareholders will be subject to a three year lock-up period calculated from the date of closing, however such lock-up period will in no event extend beyond June 30, 2013, during which period each shareholder will be restricted from selling or transferring the Bark shares except as expressly provided in the Share Purchase Agreement. Further, after three years, any sales must not exceed 10% of the daily registered turnover of Bark’s common stock on the OTCBB, | |

| • |

notwithstanding the above lock-up agreement, three of the shareholders, including Niclas Froberg and Carl Johan Grandinson, will be permitted to sell in each year a portion of their shares provided that (i) the sales price does not exceed SEK 3,000,000, and (ii) the transfers do not exceed 10% of the daily registered turnover of Bark’s common stock on the OTCBB, however in 2010 the shareholders may only make sales following six months from the date of completion of the acquisition, | |

| • |

in 2010 only, Niclas Froberg, one of the principal shareholders, will replace a portion of his shares against a cash payment from the Company in the aggregate amount of SEK 3,000,000 to be paid as follows (i) SEK 750,000 in May 2010, and (ii) SEK 750,000 in June 2010, and (iii) SEK 1,500,000 in July 2010. The replacement of the shares will be based on the valuation on the date of payment, | |

| • |

in the event that we do raise share capital injections or external financing via convertible notes before 31 December 2010 in the minimum amount of $3,000,000, the Tre Kronor shareholders will have the right to re-acquire all of the issued and outstanding shares of Tre Kronor from us by (i) delivering written notice by 15 January 2011 and returning to us all consideration issued to such shareholders within 30 days of such notice, including the cash value of any shares that may have been sold by the Tre Kronor shareholders, | |

| • |

we have also agreed to issue up to an additional 6,000,000 shares of our common stock based on Tre Kronor achieving certain “Earnings Before Tax” (“EBT”), as determined in accordance with the agreement, thresholds for the accounting years 2010 to 2012: | |

| o |

EBT being more than SEK 2 million for 2010; issuance of additional 2,000,000 Bark shares | |

| o |

EBT being more than SEK 2 million for 2011; issuance of additional 2,000,000 Bark shares | |

| o |

EBT being more than SEK 2 million for 2012; issuance of additional 2,000,000 Bark shares, | |

| • |

as an alternative to the above, the Tre Kronor shareholders will receive 4,000,000 shares if the accumulated EBT for 2010 and 2011 is more than SEK 5 million, or 6,000,000 shares if the accumulated EBT foe 2010, 2011 and 2012 is more than SEK 9 million, | |

| • |

Niclas Froberg will remain chief executive officer of Tre Kronor and Carl Johan Grandinson will remain as chief operative officer of Tre Kronor. Mr. Froberg will be appointed as a member of the board of directors of Bark Corporation. Mr. Froberg and Mr. Grandinson will be members of the executive management of Bark Corporation. Further Mr. Froberg and Mr. Grandinson shall be chief executive officer and chief operative officer, respectively, for the management of our international media division. Mr. Froberg’s and Mr. Grandinson’s main focus will be to establish a Stockholm office for Bark and the integration of Tre Kronor with the our current existing business. Mr. Froberg and Mr. Grandinson will be responsible for the roll-out, consolidation and thee result of our media companies in Europe and Scandinavia. Each will entered into employment agreements setting forth their duties and responsibilities. | |

- 16 -

Closing of the acquisition of Tre Kronor is anticipated to occur during the week of April 19, 2010. There is no assurance that the transaction will complete.

Our Operations

Marketing Campaigns

We work with our clients to implement the full advertising and marketing campaigns from start to finish. We meet with our clients to discuss their brand and objectives and then work with them to devise an advertising and marketing strategy to achieve their objectives. This work will typically involve:

| • |

Definition of business and/or communication strategies: | |

|

o |

Definition of market situation and trends, | |

|

o |

Analysis and research work, | |

|

o |

Definition of the future strategic brand platform, | |

|

o |

Formulation of advertising and marketing concepts, | |

| • |

Creative development: | |

|

o |

Development of the creative platform in accordance with the brand personality, | |

|

o |

Development of creative campaign, | |

| • |

Media strategy and consulting: | |

|

o |

Advising on the optimum means of using media to reach our clients’ customers and potential customers, | |

|

o |

Coordination and production of the campaigns, for media implementation, such as television advertisements, radio commercials, Internet web sites and newspaper and magazine advertisements. | |

As part of our engagement, we will work with our partners in the media business in order to create and implement our clients’ marketing programs. Once we have agreed with our client on the ideas and concepts that will form the basis of a marketing campaign, we will then work to implement the campaign. We work with film producers and photographic studies in order to create the campaigns that will be distributed via media outlets to our clients’ desired customer base. This work will include, for example, arranging for the creation for the following media:

-

the filming and production of television advertisements,

-

the recording and production of radio commercials,

-

photography and illustrations

-

printing via printing houses

We work closely with these other media professionals in order to guide the creative development and implementation of the advertising and marketing campaign. We supervise the work of these professionals in order to ensure that our concept is achieved.

The marketing campaigns that we develop and implement for our clients typically range from about three months to twelve months in duration. This contrasts with the strategic part of our services which typically has a range of several years.

- 17 -

We are paid by our clients on a fee for services basis for this work. In addition, we may also be paid commissions for media placement and production commissions when working with external partners. Our clients will pay for the expense of the placement of the media in media outlets, such as television stations, radio stations, the Internet, newspapers and magazines.

Fee for Advertising Services

We earn the majority of our revenues in fees for services arrangements where we enter into contracts with our clients for our advertising and marketing services. The professional services that we provide encompass the following:

| • |

Strategic counseling: | |

|

o |

Creating business and brand strategies, | |

|

o |

Advising on product development, | |

|

o |

Providing workshops for management, board of directors and marketing departments, | |

| • |

Research and analysis: | |

|

o |

Recommending of need and methods to test different marketing challenges, | |

|

o |

Conducting focus groups, hall tests and interviews with the public | |

|

o |

Use of our own in house internet based analysis tool, | |

|

o |

Conducting brain science research projects focusing on human perception and giving seminars to clients and new business targets on our findings and offering our clients the opportunity to become active partners in these projects, | |

| • |

Creative development of advertising campaigns: | |

|

o |

Definition and formulation of advertising and marketing concepts, | |

|

o |

Creative development, art direction and copy writing, | |

|

o |

Recommending creative and strategic of use of media channels, | |

| • |

Coordination and production of advertising campaigns: | |

|

o |

Coordination of the chosen campaign idea is being finalised in accordance with approved layout, including copy writing, proof reading, programming and final artwork, | |

|

o |

Coordination of collaboration with external partners such as photographers, sound studios, specialist programming, TV production companies, and printing houses, | |

| • |

Media strategy and counseling: | |

|

o |

Development of media strategy in accordance to brand position, campaign objectives, chosen target group(s), and size of investment, | |

|

o |

Advising on the optimum means of using media to reach our clients’ customers and potential customers most effective and cost efficient manner as possible, | |

| • |

Price negotiations for media costs: | |

|

o |

Negotiating cost of media for our clients. We negotiate annual agreements as well as ad hoc campaigns, | |

| • |

Coordination of campaign execution: | |

- 18 -

| o |

Dialogue with media partners within the chosen campaign media channels, such as television advertisements, radio, outdoor commercials, internet web sites, newspaper, magazine advertisements and mobile media. |

Commissions on Media Placement

We earn commissions based on the placement of advertising on media for our clients. Under these arrangements, we are engaged by our clients to develop the ideas and the concept being behind an advertising and marketing program for our clients. We engage professionals for the creation of the advertising media which is created using outside partners, such as film and photographic studies. We then arrange with other media agencies to set up the advertising and marketing programs across a spectrum of media outlets, including television, radio, newspapers and magazines. The media agencies will arrange for the placement of the advertisements and deal directly with the media companies. We are compensated in these arrangements based on the total amount that the client ultimately spends on the marketing and advertising programs. We earn a commission in the range of 3% to 5% of the total advertising and marketing budget. These commissions are paid to us on a monthly basis. In certain circumstances, we may be paid a fee for our initial creative services, with an additional commission based on media placements.

Our Customer Base

We have a customer base comprising of a wide range of clients, including both large multi-national companies and smaller start-up business. We work with clients across a broad range of industries and brands. Our clients are presently primarily based in or connected to Denmark, however we have a number of international clients. We presently have a customer base of approximately 53 customers. Within this customer base, we have approximately five customers that account for approximately 73% of our overall revenues.

Our key customers and brands include the following:

-

Simcorp, a financial software provider,

-

COOP, a leading Danish retail company,

-

Grand Marnier, an alcoholic beverage,

-

Jaegermeister, an alcoholic beverage,

-

Grants, an alcoholic beverage,

-

Linje Aquavit, an alcoholic beverage,

-

Waterfront, a retail outlet,

-

RO’sTorv, a retail outlet,

-

Tulip, a fast moving consumer goods business, and

-

Børsen, Denmark’s leading daily business newspaper

We feel that, initially, our strongest market opportunities for expansion are in Western and Eastern Europe. We feel that emerging Eastern European economies will provide significant opportunity for the commercial communication services that we provide. We are currently focused on expanding our business in the following markets: Copenhagen, Stockholm, Munich, Hamburg, Milan, Paris, Barcelona, Warsaw, Malmo, Prague, London, Budapest and Geneva. We are experiencing an interest for our concept outside Europe and plan to explore these opportunities.

We plan to expand our business through a combination of organic growth and through acquisition of strategic businesses, subject to our achieving the necessary financing.

- 19 -

Our Employees

We have a total of twenty-two (22) employees as of March 31, 2010. All of our employees other than our receptionist are professional services personnel.

Our professional management team is comprised of:

| Name | Professional Management Positions |

| Bent Helvang |

Chairman of Bark Group Inc., Chairman of Bark Corporation, Bark Advertising, Bark Copenhagen, Bark Media; Chief Executive Officer of Bark Property |

| Anders Hageskov |

President and Chief Executive Officer of Bark Group Inc., Bark Corporation and Bark Advertising |

| Peter Brockdorff |

Chief Executive Officer of Bark Copenhagen and Bark Media |

| Henrik Sorensen |

Vice-President of Bark Copenhagen |

| Daniel Soren |

Chief Operating Officer of Bark Copenhagen and Bark Media |

| Ulrik Gerdes |

Chief Financial Officer |

The biographical experience of each of the above persons is presented in Item 10 under the heading “Directors, Executive Officers and Corporate Governance”.

Our skilled senior staff include experts within their field of work who enable us to provide consulting services and advice to our clients in the following areas:

| • |

Business strategy | |

|

o |

We have developed a number of strategic products that we provide exclusively to our clients, | |

| • |

Research and analysis methods and programmes. | |

|

o |

We are qualified and experienced in working with all common analysis methods | |

|

o |

We will conduct some research and analysis ourselves for the benefit of our clients | |

| • |

Human perception of commercial messages. | |

|

o |

We are among the leading companies within our industry taking part in brain science projects. | |

| • |

Creative and traditional media counseling | |

| • |

Internal learning for our clients | |

|

o |

We have personnel consulting our clients in how optimize learning within companies | |

|

o |

We teach and train our clients’ employees in new products, services and marketing activities | |

Intellectual Property

Our intellectual property relates to the business techniques and processes and other trade secrets that we use in order to provide our professional services. As outlined above under “Employees”, this includes intellectual property relating to our expertise in the following areas:

-

Business strategy,

-

Research and analysis of methods and programmes,

- 20 -

-

Creative and traditional media counseling techniques, and

-

Research into human perception of commercial messages.

While this intellectual property is important to our business success, this intellectual property is not subject to any patents, nor do we anticipate that any patents would be granted for this intellectual property. However, we may consult with patent legal counsel in the future to assess whether any of the intellectual property that we create would be eligible for patent protection. We rely on confidentiality agreements with our professional staff and non-competition agreements with our key employees in order to maintain the confidentiality of this information and to ensure that our competitors do not learn our business techniques and processes and trade secrets. However, there is no assurance that employees whose employment with us is terminated will not attempt to use this information in there new employment of businesses.

We do not own the copyright in the work that we create for our clients. Under our standard contractual arrangements, our clients will own the intellectual property that relates to the media that we generate in the course of providing our professional services.

We are in the process of preparing and submitting a trademark application for the “Bark” trade name that we use in connection with our business and professional services. This trademark application has not yet been submitted and there is no assurance that any trademark will be granted.

Government Regulation

Our industry is regulated by the local (i.e. Danish) laws for marketers as well as European Union regulations. It is our duty and responsibility towards our clients that our counseling at all times respect the law. Our account responsible employees are frequently trained in the word of the local law as well as changes that appears from time to time in order to ensure compliance with these laws.

We are required to qualify to do business in each jurisdiction in which we do business. We are further subject to laws of general application that apply to conducting business in each jurisdiction where we carry on business. There are no specific government laws or regulation, other than those of general application, that are conditions to us carrying on business and providing professional services in those jurisdictions in which we currently carry on business. As we expand our business into new jurisdictions, we will have to assess the local laws of each jurisdiction in order to ensure that we are able to carry on our business as planned.

ITEM 1A. RISK FACTORS

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward looking statements”. Such forward looking statements include any projections or estimates made by us and our management in connection with our business operations. While these forward looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggested herein. We undertake no obligation to update forward looking statements to reflect events or circumstances occurring after the date of such statements.

Such estimates, projections or other “forward looking statements” involve various risks and uncertainties as outlined below. We caution readers of this annual report that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward looking statements”. In evaluating us, our business and any investment in our business, readers should carefully consider the following factors.

- 21 -

Risks Relating To Our Business And Financial Condition

As there is a substantial doubt as to our ability to continue as a going concern, there is a significant risk that our business could fail.

Our audited financial statements for the years ended December 31, 2009 and 2008 include a note expressing doubt about our ability to continue as a going concern. The inclusion of this note was due to the fact that we have negative working capital of $5,809,000 and we reported a shareholder’s deficiency of $2,971,000 as at December 31, 2009. This note also reflects the fact that we have incurred losses to date without achieving profitable operations, including a net loss of $3,197,000 for the year ended December 31, 2008 and a net loss of $2,569,000 for the year ended December 31, 2009. We intend to fund our operations and expansion through future sales and equity financing arrangements, which may be insufficient to fund our capital expenditures, working capital and other cash requirements for the current fiscal year. Thereafter, we will be required to seek additional funds, either through sales and/ or equity financing, to finance our long-term operations. The successful outcome of future activities cannot be determined at this time and there is no assurance that, if achieved, we will have sufficient funds to execute our intended business plan or generate positive operating results. These factors raise substantial doubt about our ability to continue as a going concern. As a result, we caution investors that there is a risk that our business could fail. Our current working capital deficit as at December 31, 2009 and our negative cash flow from operations for the year ended December 31, 2009 raise substantial doubt about our ability to continue as a going concern. Accordingly, there remained a substantial doubt about our ability to continue as a going concern as at December 31, 2009, as reflected in the notes to our consolidated financial statements for the year ended December 31, 2009.