Attached files

| file | filename |

|---|---|

| EX-21.1 - Secure America Acquisition CORP | v181147_ex21-1.htm |

| EX-32.1 - Secure America Acquisition CORP | v181147_ex32-1.htm |

| EX-31.1 - Secure America Acquisition CORP | v181147_ex31-1.htm |

| EX-31.2 - Secure America Acquisition CORP | v181147_ex31-2.htm |

| EX-32.2 - Secure America Acquisition CORP | v181147_ex32-2.htm |

| EX-10.31 - Secure America Acquisition CORP | v181147_ex10-31.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended December 31, 2009

OR

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from

to

COMMISSION FILE NUMBER 001-33743

ULTIMATE

ESCAPES, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

|

26-0188408

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

3501

West Vine Street, Suite 225

Kissimmee,

Florida 34741

(Address

of principal executive office)

(Zip

code)

(407)

483-1900

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to section 12(b) of the Exchange Act:

Common

Stock, $0.0001 par value per share

Common

Stock Purchase Warrants

Securities

registered pursuant to section 12(g) of the Exchange Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities

Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes ¨ No x

Indicate

by check mark whether the registrant: (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the past 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past

90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large

accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated

filer ¨

|

Smaller reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No

x

As of

June 30, 2009, the last business day of the registrants’ most recently

completed second fiscal quarter, the aggregate market value of their common

equity held by non-affiliates was $58,852,988 based on the closing sales price

of the registrant’s common stock of $7.75 per share on June 30, 2009. For

purposes of this computation, all officers, directors and 10% beneficial owners

of the registrant are deemed to be affiliates. Such determination should not be

deemed to be an admission that such officers, directors or 10% beneficial owners

are, in fact, affiliates of the registrant.

The

number of shares outstanding of the registrant’s Common Stock, par value $0.0001

per share, as of March 31, 2010: 2,517,793

Documents

Incorporated by Reference

None

ULTIMATE

ESCAPES, INC.

FORM

10-K

FOR

THE YEAR ENDED DECEMBER 31, 2009

TABLE

OF CONTENTS

|

Page

|

||

|

PART

I

|

||

|

Item 1.

|

Business

|

4

|

|

Item 1A

|

Risk

Factors

|

14

|

|

Item

2.

|

Properties

|

29

|

|

Item

3.

|

Legal

Proceedings

|

32

|

|

Item

4.

|

(Removed

and Reserved)

|

32

|

|

PART

II

|

||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

33

|

|

Item

6.

|

Selected

Financial Data

|

36

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

36

|

|

Item 7A

|

Quantitative

and Qualitative Disclosures about Market Risk

|

47

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

48

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

48

|

|

Item 9A

|

Controls

and Procedures

|

48

|

|

Item 9B

|

Other

Information

|

48

|

|

PART

III

|

||

|

Item 10

|

Directors,

Executive Officers and Corporate Governance

|

49

|

|

Item 11

|

Executive

Compensation

|

56

|

|

Item 12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

61

|

|

Item 13

|

Certain

Relationships and Related Transactions and Director

Independence

|

64

|

|

Item 14

|

Principal

Accountant Fees and Services

|

69

|

|

PART

IV

|

||

|

Item 15

|

Exhibits

and Financial Statement Schedules

|

70

|

|

Signatures

|

71

|

|

|

Exhibit

Index

|

72

|

|

2

CAUTIONARY

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements made in this Annual Report on Form 10-K constitute forward-looking

statements. Forward-looking statements include statements preceded by, followed

by or that include the words “may,” “could,” “would,” “should,” “believe,”

“expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “potential,”

“intend” or similar expressions. These statements include, among others,

statements regarding our expected business outlook, anticipated financial and

operating results, business strategy and means to implement the strategy, the

amount and timing of capital expenditures, the likelihood of our success in

building our business, financing plans, budgets, working capital needs and

sources of liquidity. We believe it is important to communicate our

expectations to our stockholders. However, there may be events in the future

that we are not able to predict accurately or over which we have no

control.

Forward-looking

statements, estimates and projections are based on management’s beliefs and

assumptions, are not guarantees of performance and may prove to be inaccurate.

Forward-looking statements also involve risks and uncertainties that could cause

actual results to differ materially from those contained in any forward-looking

statement and which may have a material adverse effect on our business,

financial condition, results of operations and liquidity. A number of important

factors could cause actual results or events to differ materially from those

indicated by forward-looking statements. These risks and uncertainties include,

but are not limited to, those factors listed in this Report under “Risk Factors.”

You are

cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this Report. Forward-looking statements involve

known and unknown risks and uncertainties that may cause our actual future

results to differ materially from those projected or contemplated in the

forward-looking statements.

All

forward-looking statements included herein attributable to us or any person

acting on our behalf are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section. Except to the extent

required by applicable laws and regulations, we undertake no obligation to

update these forward-looking statements to reflect events or circumstances after

the date of this report or to reflect the occurrence of unanticipated events.

You should be aware that the occurrence of the events described in the “Risk

Factors” section and elsewhere in this Report could have a material adverse

effect on us.

3

PART

I

ITEM 1.

BUSINESS

Ultimate

Escapes, Inc. (“we”, “us”, “our” or “the company”) operate a family of luxury

destination club offerings, including Elite ClubTM, Signature ClubTM

and Premiere Club

TM , with over 1,200 affluent club members. We provide club members and

their families with flexible access to a growing portfolio of multi-million

dollar club residences, exclusive member services and resort amenities. We

believe that we offer our club members access to more club destinations than any

other luxury destination club in the world, with over 140 luxury club residences

in 45 global destinations available in the mainland United States and Hawaii,

Mexico, Central America, the Caribbean and Europe as of December 31, 2009. Elite Club properties target

approximately $3 million in value, Signature Club properties

target approximately $2 million in value and Premiere Club properties

target approximately $1 million in value. As of December 31, 2009, we had

433 Elite Club members,

545 Signature Club

members and 236 Premiere

Club members. The majority of the properties are owned by us, and the

others are leased on either a long or short term basis. All of the properties

owned by us are subject to one or more mortgages. Of the 37 properties leased by

us as of December 31, 2009, 27 were subject to long-term leases and ten were

subject to short-term leases (including two short-term leases in which Private

Escapes Holdings, LLC (“PE Holdings”), an affiliate of ours, is the

lessor).

We

combine the privacy and intimacy of multi-million dollar residences in a wide

variety of global resort destinations with “white glove” member concierge

services and club amenities. Our management believes that we offer a unique and

compelling value proposition that is a cost effective vacation alternative for a

large, affluent target market that Spectrem Group estimates at year end 2008

included approximately 6.7 million “millionaires” in the United States with

assets of at least $1 million and approximately 840,000 “pentamillionaires” in

the United States with assets of at least $5 million. For the consumer market, a

club membership offers a more flexible, efficient and cost effective vacation

alternative as compared with the high costs, inefficiencies and hassles of

second home ownership in this cost range, the expense, uncertainties and

time-consuming effort to rent luxury villas in the United States and

international markets or the high costs and typical small rooms of luxury

hotels. For the corporate market, our corporate membership option targets the

growing multi-billion dollar corporate reward and incentive market, and offers

corporations an affordable, flexible corporate reward and incentive program for

top performing employees, senior executives, board members, key advisors,

existing customers and new prospects.

In

addition to providing club members with flexible access to a portfolio of over

140 luxury club residences in 45 global destinations as of December 31, 2009, we

provide our club members with preferred access to over 140 four and five-star

hotel properties and resorts affiliated with The Ultimate Collection

TM , offering club members access to hundreds of beach, mountain, golf,

metropolitan and leisure club properties in world-class resorts and destinations

throughout the world. With multiple club offerings and various club membership

levels in each club, we believe that we have the widest market appeal in the

destination club industry.

Club

members join us by paying a one-time, membership fee (similar to a golf club

membership) currently ranging from $70,000 to $450,000, depending on the club

level and membership usage plan. Club members also pay annual dues currently

ranging from $8,000 to $49,000 per year, again based on the corresponding club

level and membership usage plan. In addition to annual dues, additional revenues

are derived from upgrades, additional use fees and reciprocity fees from third

party operations. As currently structured, if a club member resigns from the

club, his or her club membership is redeemed on a three-in, one-out basis, which

means that three new club members must join the club before a current club

member who desires to resign from the club will have his or her club membership

redeemed. Such redeemed club member typically receives 80% of the club

membership resale proceeds with us retaining a 20% transfer fee. This redemption

mechanism is common in private country clubs and has also been adopted by most

destination clubs.

4

We also

offer an Ultimate

DiscoveryTM

“trial membership” whereby qualified club prospects or club member referrals can

purchase a seven-day “mini-vacation package” for an average of $3,500 and

experience the club as an authorized guest at one of our club properties within

six months of purchasing an Ultimate

Discovery trial membership. If the trial member purchases an

Ultimate Escapes lifetime membership within 30 days of completing the Ultimate Discovery vacation

experience, then 100% of the fee paid for the Ultimate Discovery trial

membership is applied toward the purchase of the lifetime

membership.

In 2008,

we launched the Ultimate

Reciprocity ProgramTM,

an affiliate club membership reciprocity program targeting a growing market

estimated by Ragatz Associates to consist of approximately 50,000 fractional and

private residence club owners at hundreds of private residence clubs and luxury

fractional ownership resorts in the United States, Mexico, Central America, the

Caribbean and Europe. The

Ultimate Reciprocity Program offers participating luxury resorts the

opportunity to offer their shared-use owners an affiliate club membership that

provides annual reciprocity access to our global club properties, affiliate

member services and club amenities; this program provides owners at

participating luxury resorts with reciprocal access to over 140 club properties

offered by us in the continental United States, Hawaii, Mexico, Central America,

the Caribbean and Europe. Participating resort developers sign multi-year

reciprocity agreements with us and pay an upfront affiliate resort developer fee

depending on resort size. In addition, participating resorts pay a one-time

affiliate member fee of $3,000 for each shared-use owner that participates at

each affiliated resort, which fee includes the affiliate club member’s first

year annual dues. Affiliate club members also pay us a $250 transaction fee for

each reciprocity transaction executed within our reservation system, and each

affiliate club member continues to pay its affiliate member annual dues

beginning in the second year of its affiliate club member reciprocity agreement

with us.

Participating

developers and shared-use owners contribute up to two weeks per year of

participating shared-use ownership inventory into our proprietary web-based

reservation system, providing over 1,200 club members with additional benefits,

including expanded access to new destinations and affiliated resorts generally

at no additional cost. The

Ultimate Reciprocity Program also provides participating luxury resort

developers with custom-designed websites developed and hosted by us that offer

affiliate resort developers and their club members online information about our

destinations, club properties, affiliate member services and on-line

availability, leveraging our advanced web-based technology

platform.

Participating

resorts have access to a variety of our reciprocity services designed to help

improve developer real estate sales performance, owner retention and owner

referrals. Additionally, we offer participating resorts an opportunity to

differentiate their shared ownership offerings from other non-affiliated

resorts, helping to increase participating resort developer’s sales and maintain

higher price points. To participating resort developers, bundling the Ultimate Reciprocity

Program with luxury shared ownership real estate creates a

unique “hybrid” offering that greatly expands the number of luxury resort

destinations and club properties that affiliate club members can book

reservations and travel to.

Resorts

that participate in the

Ultimate Reciprocity Program receive increased market exposure from a

base of over 1,200 affluent club members and their family and friends, some of

whom also explore purchasing additional vacation real estate while traveling to

club destinations. In addition, participating resorts benefit from reciprocal

reservations booked by our club members and their guests, who on average spend

between $5,000 and $10,000 per vacation on food, drinks, golf, spa,

entertainment and shopping when traveling to various club properties and

affiliated properties.

The

destination club industry has gone through dramatic changes and a period of

rapid consolidation over the last few years, which has led to fewer, larger

destination clubs that have achieved operating efficiencies as a result of

scalable, sustainable business models, experienced management teams, strong

capital bases, financial transparency and affordable access to high quality club

member services in the wide variety of global destinations.

5

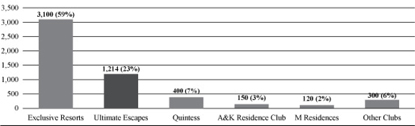

We

believe that the two largest clubs in the industry, as measured by numbers of

members, are Exclusive Resorts and our company, with a combined 82% global

market share in the destination club industry, as noted in the chart below,

which shows the number of club members in various destination clubs and market

share, based on industry data available to us as of December 2009.

We were

structured to be more affordable than other luxury consumer vacation travel

options and business incentive travel options, including second home ownership,

while simultaneously offering equal or superior benefits (especially for anyone

requiring flexible access to private homes with multiple bedrooms for friends

and family). For individual club members, we eliminate the burdens of owning one

or multiple second homes and the uncertainties and expense of renting different

homes or villas in multiple United States and international markets. For

corporations, we offer a more affordable, flexible corporate reward and

incentive program for top performers, key advisors, key employees and important

customers and prospects.

We

operate a proprietary occupancy model that provides club members with flexible

access and reasonable availability, principally by maintaining a low 6-to-1

equivalent member-to-property ratio and purposely under-utilizing each club

property, targeting annual club occupancy of 75% or less. An

equivalent member is a member who has a 60 day annual plan. For all club

properties, occupancy was 57% during 2008 and 61% during 2009. We charge a

one-time membership fee to join the club that we believe is generally lower than

the typical down payment for a single second home property, and charge annual

dues that are generally a fraction of the cost of owning and operating a single

$1 – $3 plus million second home.

We have

focused on the creation of a unique brand supported by a valuable portfolio of

luxury properties in some of the world’s premier resort and urban destinations.

These luxury properties target the affluent family vacationer. We believe that

this affluent segment is particularly well-positioned for future

growth.

We

differentiate ourselves from our competitors with the widest offerings in the

destination club industry, with multiple clubs each offering five tiers of club

membership plans. The breadth of this offering provides our club members with

multiple upgrade paths, both in terms of use rights and club levels. Our club

membership provides club members with internal reciprocity use within all club

properties, which in some cases requires a nightly reciprocity fee for members

in Premiere Club

or Signature Club to

reserve residences in more expensive clubs (for example, Premiere Club members

reserving Elite Club

residences through internal reciprocity). The flexibility allows club members to

grow and change with the club, while providing incremental revenues streams to

us.

James M.

Tousignant, the founder of Ultimate Resort, LLC (“Ultimate Resort”) and our

President and Chief Executive Officer, and Richard Keith, the founder of Private

Escapes Destination Clubs (“Private Escapes”) and our Chairman, along with many

other members of our management team, have worked together for many years and

have over 100 years of collective experience building and managing public and

private companies.

6

History

We were

formed on May 14, 2007, as a blank check company for the purpose of acquiring,

or acquiring control of, through a merger, capital stock exchange, asset

acquisition, stock purchase or other similar business combination, one or more

domestic or international operating businesses. We changed our name from

“Fortress America Acquisition Corporation II” to “Secure America Acquisition

Corporation” on August 6, 2007 and on October 29, 2009 changed our name to

“Ultimate Escapes, Inc”.

On

October 29, 2009, we consummated a business combination with Ultimate Escapes

Holdings, LLC (“Ultimate Escapes Holdings”), pursuant to a Contribution

Agreement dated September 2, 2009, by and among us, Ultimate Escapes Holdings,

Ultimate Resort Holdings, LLC (“Ultimate Resort Holdings”) and James M.

Tousignant, in his capacity as the representative of the holders of the issued

and outstanding ownership units of Ultimate Escapes Holdings and Ultimate Resort

Holdings (the “Owner Representative”), as amended by Amendment No. 1 dated as of

October 28, 2009 (the “Contribution Agreement”). Although we legally acquired

Ultimate Escapes Holdings and it became our subsidiary, for accounting purposes,

the business combination with Ultimate Escapes Holdings was accounted for as a

reverse merger (the “reverse merger”), whereby Ultimate Escapes Holdings is the

continuing entity for financial reporting purposes and is deemed, for accounting

purposes, to have acquired us.

In

accordance with the Contribution Agreement, we received 1,232,601 ownership

units of Ultimate Escapes Holdings. The owners of Ultimate Escapes Holdings

prior to the reverse merger, consisting of Ultimate Resort Holdings, PE Holdings

and JDI Ultimate, L.L.C. (“JDI”) (collectively, the “UE Owners”) retained the

remaining 7,556,675 ownership units of Ultimate Escapes Holdings, which, under

the terms of the amended and restated operating agreement of Ultimate Escapes

Holdings (the “Operating Agreement”) may be converted on a one-to-one basis into

shares of our common stock. These 7,556,675 ownership units are held

as follows: 3,858,571 units by Ultimate Resort Holdings, 3,123,797 units by JDI

and 574,307 units by PE Holdings. Of such retained units, 717,884 units were

deposited into escrow at the closing of the reverse merger to secure the

indemnification obligations of the UE Owners to us. Additionally, the UE Owners

are eligible to receive up to an aggregate of 7,000,000 additional ownership

units of Ultimate Escapes Holdings, convertible on a one-to-one basis into

shares of our common stock upon the achievement of certain Adjusted EBITDA

milestones, as set forth in the Operating Agreement. For each ownership unit of

Ultimate Escapes Holdings issued to the UE Owners, the Owner Representative also

received one share of our Series A Voting Preferred Stock. At any time that any

UE Owner exchanges ownership units of Ultimate Escapes Holdings for shares of

our common stock, a like number of shares of Series A Voting Preferred Stock

will be canceled. Upon consummation of the reverse merger, Ultimate Escapes

Holdings became our subsidiary, and the business and assets of Ultimate Escapes

Holdings and its subsidiaries are our only operations.

Ultimate

Escapes Holdings was founded in 2004, as Ultimate Resort, by Mr. Tousignant to

address what he perceived was an emerging and underserved segment of the luxury

shared-use market — the high-end “luxury destination club.” Mr.

Tousignant has over 20 years of management experience, including with

entrepreneurial ventures and public companies.

Since its

inception in 2004, Ultimate Resort grew rapidly to become one of the largest

players in the destination club industry. Recognizing that achieving “critical

mass”, which it viewed as having at least 800 to 1,000 club members, is a key

component to operating a successful destination club business model, Ultimate

Resort aggressively pursued a two-tiered growth strategy of organic growth

combined with strategic transactions to reach critical mass

quickly.

In May

2007, Ultimate Resort Holdings acquired all of the assets and business of its

parent company, Ultimate Resort, and purchased certain real estate assets for

approximately $105 million in federal bankruptcy court as a result of the 2006

bankruptcy of Tanner & Haley. To finance the acquisition of the real estate

assets, secured debt financing was obtained from CapitalSource Finance, a

NYSE-listed specialty lender. In addition, new club membership agreements were

signed with 645 previous Tanner & Haley club members. In February 2008,

additional real estate assets were purchased for $12 million from Ventures

Equity Vacation Club and new club membership agreements were signed with 19

previous club members of Ventures Equity Vacation Club.

7

In May

2008, Ultimate Resort Holdings signed a cooperative marketing agreement and a

definitive contribution agreement to acquire certain assets and assume certain

liabilities from Private Escapes, including club properties of approximately $50

million, located in 28 beach, mountain, golf and metropolitan destinations

throughout the continental United States, Hawaii, Mexico, Central America, the

Caribbean and Europe. Private Escapes was founded by our Chairman, Richard

Keith, in 2003 and became a market leader at the one million dollar home entry

level category and, over several years of operations, became the industry’s

third largest destination club as measured by number of club members, according

to HalogenGuides. Also in May 2008, Ultimate Resort Holdings began operating its

business under the “Ultimate Escapes” brand name.

On

September 15, 2009, Ultimate Resort Holdings contributed all of its assets and

liabilities to Ultimate Escapes Holdings and, on the same date, Ultimate Escapes

Holdings completed the acquisition of a majority of the assets of Private

Escapes. On October 29, 2009, we completed the reverse merger business

combination with Ultimate Escapes Holdings.

Industry

Luxury

destination clubs first started to appear in the market in 1999 and since then

have become the second largest segment of the $1.5 billion luxury shared-use

vacation market in 2008, according to Ragatz Associates. The luxury shared-use

vacation market includes destination clubs, traditional fractional interests and

private residence clubs. Destination clubs differ from traditional fractional

interests and private residence clubs in a number of ways. The destination club

and fractional industry business models are fundamentally based on the purchase

of either a deeded real estate interest (timeshare/fractional) or some form of

member use right to access a collection of various club properties and

destinations (destination club). Within the fractional and destination club

umbrella, there are a variety of approaches, classified into the following three

categories:

|

•

|

Traditional Timeshare Interval

Week Ownership — The consumer purchases a deeded real

estate interest to a specific week at a specific resort. This specific

week purchased may then be exchanged through internal and/or external

exchange systems (such as RCI LLC or Interval, Leisure Group, Inc.),

either for a different interval week from another owner or, in some cases,

for an exchange credit. The traditional timeshare product structure has

been successful with low-to-medium income consumers, but has not been a

preferred choice by high-income, affluent consumers looking for a luxury

vacation experience, and, in our view, is not a competitive offering for

affluent consumers, as compared to new luxury vacation lifestyle products

like destination clubs being introduced to the market. Timeshare units are

generally smaller (1 – 2 bedroom, 1,200 square feet), with

modest furnishings and finishes and are generally thought to be

over-priced, hard to resell by owners and less flexible from the

consumer’s point of view.

|

|

•

|

Fractional Ownership/Private

Residence Clubs — Similar to the traditional timeshare

interval week system, the fractional or private residence club owner

typically purchases a higher quality fractional unit that generally

provides a larger deeded fractional interest, typically a one-sixth,

one-tenth or one-twelfth deeded ownership interest in a particular

fractional unit. Originally started in and around seasonal ski areas, this

product’s pricing and use structure is generally based on seasonal usage

patterns and owner use is typically planned nine to twelve months in

advance.

|

8

|

•

|

Destination Club

Membership — Destination clubs generally offer

non-equity, right-to-use club memberships that are structured more like

membership in a private country club. Destination clubs sell club

memberships that enable a club member to use the club’s homes, amenities

and club member services for a specified amount of time, typically two to

six weeks per year. They also provide their club members with access to

fully furnished, luxury one to six bedroom residences in any of the club’s

portfolio of residences. In addition, destination clubs typically provide

many of the amenities of a luxury five-star hotel, including personal

concierge services and access to private beaches, spas, golf courses, ski

resorts and yacht clubs. Destination clubs have grown to $349 million in

annual revenue in 2008, according to Ragatz Associates, appealing to

affluent club members who have exclusive use of a growing portfolio of

beautiful club homes, easy and flexible access, reasonable long-term value

and a superior level of member services and resort

amenities.

|

Growth

Strategy

Our

objective is to achieve significant EBITDA and revenue growth over the next

several years. Key elements of our future growth strategy include:

|

•

|

Expand Organic Sales

by:

|

|

•

|

Increasing

brand awareness and marketing spend to generate new club membership

sales

|

|

•

|

Increasing

club member referrals through member events held in major metropolitan

markets

|

|

•

|

Increasing

sales staff in major cities throughout North America and

internationally

|

|

•

|

Expanding

corporate membership sales programs

|

|

•

|

Encouraging

club member upgrades with regular incentive

programs

|

|

•

|

Pursue Additional

Acquisitions: Less expensive to buy existing clubs and

properties than build, due to historically lower club member acquisition

costs and real estate costs.

|

|

•

|

Global Expansion

in:

|

|

•

|

Europe

|

|

•

|

Asia

|

|

•

|

Marketing Partnerships/Joint

Ventures with Hospitality

REITS

|

|

•

|

“Private Label” Offerings with

Resort and Hospitality

Brands

|

Club

Membership Plans and Benefits

We offer

multiple club membership plans divided into three club tiers designated

Premiere, Signature and Elite, that provide club members between 14 and 60 days

of use annually at a unique collection of club and affiliate destinations

located around the world. Our destination properties are located in or near

markets with global tourist and business appeal that offer club members a world

class vacation experience. By combining the best elements of multi-million

dollar single family residences with world class amenities and concierge

service, management believes it has created the best and most cost-effective

option for access to luxury second-home ownership available in the market

today.

9

Premiere

Club TM

Premiere Club membership

plans range from the

Bronze plan, with an initial membership fee of $70,000 and $8,000 in

annual dues for 14 days of annual vacation use, up to the Platinum

Plus plan, with an initial membership fee of $150,000 and

$17,000 in annual dues for 60 days of annual vacation use. All of our club

membership plans include extended family use for maximum value and flexibility,

as club members may grant access to their unaccompanied family members (age 21

and over) for any amount of their given annual use. Each home in the Premiere Club portfolio is

designed to accommodate families with children of all ages. Premiere Club

properties have a target home value of approximately $1 million. The club allows

its members to upgrade their club membership plans as their vacation needs

evolve every year.

Signature

Club TM

Signature Club membership

plans range from the

Bronze plan, with an initial membership fee of $145,000 and $11,500 in

annual dues for 14 days of annual vacation use, up to the Platinum

Plus membership plan, with an initial membership fee of

$300,000 and $35,500 in annual dues for 60 days of annual vacation use. All of

our club membership plans included extended family use for maximum value and

flexibility, as club members may grant access to their unaccompanied family

members (age 21 and over) for any amount of their given annual use. Each home in

the Signature Club

portfolio is designed to accommodate families with children of all ages. Signature Club

properties are generally larger than homes in the Premiere Club and have a

target home value of approximately $2 million. The club allows its members to

upgrade their club membership plans as their vacation needs evolve every

year.

Elite

Club TM

Elite Club membership plans

range from the Bronze

plan, with an initial membership fee of $200,000 and annual dues of $16,000 for

14 days of annual vacation use, up to the Platinum Plus plan, with an

initial membership fee of $450,000 and $49,000 in annual dues for 60 days of

annual vacation use. All of our club membership plans included extended family

use for maximum value and flexibility, as club members may grant access to their

unaccompanied family members (age 21 and over) for any amount of their given

annual use. Each home in the

Elite Club portfolio is designed to accommodate families with children of

all ages. Elite

Club properties are generally larger than homes in the Premiere Club and Signature Club and are of

the highest standards, with target home values of approximately $3 million and

the club allows club members to upgrade their club membership plans as their

vacation needs evolve every year.

Members

of any club membership plan can add a “corporate option” to their

club membership for an additional 10% of their club membership and annual dues.

This allows the club member to designate any key executives, employees,

customers and business prospects (21 and over) to use the club unattended by the

primary club member. The corporate use option has proven to be a valuable tool

for employee rewards and retention programs.

The

Ultimate Collection TM

The Ultimate Collection provides

club members with access to over 140 luxury four and five-star hotels in many of

the world’s most desirable cities and resorts throughout the United States,

Europe, Asia, the Middle East, Central America and South America, Africa and

Australia. Club members can make reservations at any of the beautiful luxury

hotels in exciting cities and resorts, using up to seven of the club membership

“included days” each year, as if a club member was using club

properties.

Ultimate

Rewards Program TM

The

Ultimate Rewards Program is the destination club industry’s first club

membership rewards points program which rewards club members who recommend a

friend, family member or business colleague for club membership if they

subsequently join us. Club members can redeem reward points for extra club days,

annual dues, private yacht and jet charters, private chef services, trips to

special events and much more.

10

Smart

Home Technology

We have

invested in developing a proprietary web-based technology platform and we are

planning to begin using “smart home” technology to improve our ability to manage

club properties, reduce energy and water consumption and provide club members

with a safer and more comfortable experience and home environment.

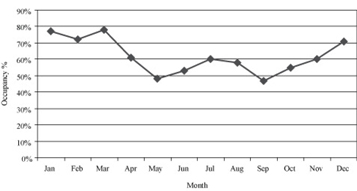

Seasonality

Our

business, like most organizations in the travel industry, is subject to seasonal

activity. The chart below shows overall club occupancy by month for 2009 and

this seasonality pattern is typical for historical years as well. High travel

seasons are typically January through March for winter vacations and June

through August for summer vacations. A key factor is the school calendar, for

those club members with children still living at home, which creates greater

occupancy pressure during holiday periods. Seasonality also varies by type of

destination. For example, club mountain properties are typically heavily

occupied during the ski season, yet tend to remain vacant during the “shoulder

seasons” (April through early June and September through December) resulting in

an annualized occupancy of 40 – 45%. Conversely, club city

destinations are typically not seasonal due to both business and pleasure trips,

consistently generating month-over-month club occupancies in the

80 – 90% range.

2009

Seasonality

Regulation

Our

business is subject to and affected by international, federal, state and local

laws, regulations and policies, which are subject to change. The descriptions of

the laws, regulations and policies that follow are summaries of those which we

believe to be most relevant to our business and do not purport to cover all of

the laws, regulations and policies that affect our businesses. We believe that

we are in material compliance with these laws, regulations and

policies.

|

•

|

Marketing Operations.

Our club products are marketed through a number of distribution channels,

each of which is regulated at the federal and state level. Such

regulations may limit our ability to solicit new customers or to market

additional products or services to existing customers. For example, to

comply with state and federal “do not call” regulations, we have adopted

processes to routinely identify and remove phone numbers listed on the

various “do not call” registries from our calling lists and have

instituted procedures for preventing unsolicited or otherwise unauthorized

telemarketing calls. We have similarly adopted email messaging practices,

and utilize various software systems responsive to the requirements of

various state and federal regulations which may place limitations on our

ability to engage our consumers in electronic mail marketing campaigns,

most notably, the CAN-SPAM Act, which imposes various requirements on the

transmission of e-mail messages whose primary purpose is to advertise or

promote a commercial product or service. Further we have placed an

emphasis on permission-based marketing and

referrals.

|

11

|

|

•

|

Privacy and Data

Collection. The collection and use of personal data of

our customers, as well as the sharing of our customer data with affiliates

and third parties, are governed by privacy laws and regulations enacted in

the United States and in other jurisdictions around the world. For

instance, several states have introduced legislation or enacted laws and

regulations that require compliance with standards with standards for data

collection and protection of privacy and, in some instances, provide for

penalties for failure to notify customers when the security of a company’s

electronic/computer systems designed to protect such standards are

breached, even by third parties. Other states, such as California, have

enacted legislation that requires enhanced disclosure on Internet web

sites regarding consumer privacy and information sharing among affiliated

entities or have such legislation pending. In addition, the European Union

Directive on Data Protection requires that, unless the use of data is

“necessary” for certain specified purposes, including, for example, the

performance of a contract with the individual concerned, consent must be

obtained to use the data (other than in accordance with our stipulated

privacy policies) or to transfer it outside of the European Union. We

believe that we are in material compliance with the laws and regulations

applicable to privacy and data collection as such are relevant to our

business.

|

|

|

•

|

Internet. A

number of laws and regulations have been adopted to regulate the Internet,

particularly in the areas of privacy and data collection. In addition, it

is possible that existing laws may be interpreted to apply to the Internet

in ways that the existing laws are not currently applied, particularly

with respect to the imposition of state and local taxes on transactions

through the Internet. Regulatory and legal requirements are particularly

subject to change with respect to the Internet. We cannot predict with

certainty whether such new requirements will affect our practices or

impact our ability to market our products and services

online.

|

|

|

•

|

Seller of Travel

Regulation. Our activities in the State of Florida are

governed by the Florida Sellers of Travel Act, Chapter 559, Florida

Statutes. We currently hold all necessary registrations under this

statute, and believe that we are in material compliance with its

provisions.

|

|

|

•

|

Regulations of Timeshare Plan

and Similar Products. We are confident based upon

various regulatory opinions and court decisions that our business is not

currently subject to any various State regulations governing timeshare

plans and similar products, provided however that we have not received nor

requested either a declaratory ruling or no-action letter from any State

agency with respect to same. Because of the lack of any enacted regulation

as specifically respects the destination club industry, we cannot predict

with certainty the likelihood of the imposition of new laws and regulation

of the industry, or the likelihood that existing regulations of timeshare

plans will be extended, interpreted and applied to include the destination

club industry and/or the club products currently being marketed and sold

in our business.

|

Competition

We

operate principally in the luxury vacation industry and compete against numerous

global, regional and boutique destination clubs; as well as other shared usage

or interval ownership resort and vacation property companies, real estate

developers and sponsors; vacation home owners, brokers and managers; resort

sponsors and managers; and, more broadly, luxury resorts and other

transient/leisure accommodations; as well as alternative leisure and recreation

categories, such as golf clubs or other club membership organizations. We have

encountered and expect to encounter in the future intense competition from our

rivals in the destination club industry and from other companies offering

competitive products and services. Many of our competitors have greater consumer

recognition or resources and/or more established and familiar products than us.

The factors that we believe are important to customers include:

12

|

|

•

|

number

and variety of club destinations available to club

members;

|

|

|

•

|

quality

of member services and concierge

services;

|

|

|

•

|

quality

of destination club properties;

|

|

|

•

|

pricing

of club membership plans;

|

|

|

•

|

type

and quality of resort amenities

offered;

|

|

|

•

|

reputation

of club;

|

|

|

•

|

destination

club properties in proximity to major population

centers;

|

|

|

•

|

availability

and cost of air and ground transportation to destination club properties;

and

|

|

|

•

|

ease

of travel to resorts (including direct flights by major

airlines).

|

We have

many competitors for our club members, including other major resort destinations

worldwide. We also directly compete with other destination clubs, such as

Exclusive Resorts, which is the largest company in the destination club

marketplace, as measured by number of club members. Our destination club members

can choose from any of these alternatives.

Club

Members Located Abroad

As of

December 31, 2009, we had 54 club members that reside outside the United States

in the following countries:

|

Mexico

|

2 | |||

|

Canada

|

41 | |||

|

Estonia

|

1 | |||

|

Germany

|

1 | |||

|

United

Kingdom

|

8 | |||

|

Brazil

|

1 | |||

|

Total:

|

54 |

Intellectual

Property

We own

the trademarks “Ultimate Escapes,” “Ultimate Resort,” “Private Escapes” and

related trademarks. Such trademarks are material to our business. All of the

material trademarks are registered (or have applications pending) with the

United States Patent and Trademark Office as well as, in some cases, with the

relevant authorities in certain foreign countries.

We also

own the following Internet domain names: ultimateescapes.com,

whatisadestinationclub.com, whatsadestinationclub.com, private-escapes.com,

ultimateescapes.info, ultimateescapes.net, ultimateescapes.org,

ultimateescapes.tv, privateescapes.com and

privateescapes.co.uk.

13

Employees

As of

December 31, 2009, we had 88 full time employees. Our employees are not covered

under any collective bargaining agreement and we have never experienced a work

stoppage. We believe we have good relations with our employees.

|

ITEM

1A.

|

RISK

FACTORS

|

We

operate in a rapidly changing environment that involves a number of risks, some

of which are beyond our control. This discussion highlights some of the risks

which may affect future operating results. These are the risks and uncertainties

we believe are most important for you to consider. Additional risks and

uncertainties not presently known to us, which we currently deem immaterial or

which are similar to those faced by other companies in our industry or business

in general, may also impair our business operations. If any of the following

risks or uncertainties actually occurs, our business, financial condition and

operating results would likely suffer.

Risks

Related to Our Company

We

have a history of losses, and may never achieve or sustain

profitability.

We

incurred substantial losses, and we may continue to incur substantial losses in

the future. We incurred net losses of $13.0 million and $23.2 million during the

year ended December 31, 2009 and the year ended December 31, 2008, respectively.

We have also experienced a decrease in new club membership sales and existing

club member upgrades during the last six months of 2008 and all of 2009. These

circumstances raise substantial doubt about our ability to continue to fund

operating losses and provide necessary operating liquidity. Even if we do

achieve profitability, we may be unable to sustain or increase our profitability

in the future.

We

have received a report from our independent registered public accounting firm

expressing doubt regarding our ability to continue as a going

concern.

Our independent registered public

accounting firm noted in their report accompanying our consolidated balance

sheets of December 31, 2009 and 2008 and the related consolidated statements of

operations, changes in owners’ equity (deficit) and cash flows for the years

ended December 31, 2009 and 2008 that our recurring losses from operations and

ongoing requirements for additional capital investment raise substantial doubt

about our ability to continue as a going concern. Management plans to maintain

our viability as a going concern by:

if necessary, selling selected club

properties;

closely maintaining and reducing

operating expenses; and

seeking to raise additional working

capital.

We cannot

assure you that our plans will be successful. This doubt about our ability to

continue as a going concern could adversely affect our ability to obtain

additional financing at favorable terms, if at all, as such an opinion may cause

investors to have reservations about our long-term prospects, and may adversely

affect our relationship with customers and others. If we cannot successfully

continue as a going concern, our stockholders may lose their entire investment

in us.

14

Our

business is capital intensive and the lack of available financing to fund the

acquisition of additional destination club properties and our operations could

adversely affect our ability to maintain and grow our club membership base which

could adversely affect our business, financial condition and results of

operations.

In order

for our destination clubs to remain attractive and competitive, we have to spend

a significant amount of money to keep the properties well maintained, modernized

and refurbished and to add new luxury properties periodically to our portfolio

of destination club properties as we add new club members. This creates an

ongoing need for cash and, to the extent we cannot fund expenditures from cash

generated by operations, funds must be borrowed or otherwise obtained. We could

finance future expenditures from any of the following sources:

|

|

•

|

cash

flow from operations;

|

|

|

•

|

non-recourse,

sale-leaseback or other financing;

|

|

|

•

|

bank

borrowings;

|

|

|

•

|

annual

dues increases or club member

assessments;

|

|

|

•

|

public

and private offerings of debt or

equity;

|

|

|

•

|

sale

of existing real estate; or

|

|

|

•

|

some

combination of the above.

|

We might

not be able to obtain financing for future expenditures on favorable terms or at

all, which could inhibit our ability to continue to grow. Events during 2008 and

2009, including the failures and near failures of numerous financial services

companies and the decrease in liquidity and available equity and debt capital

have negatively impacted the capital markets for real estate investments.

Accordingly, our financial results have been and may continue to be impacted by

the cost and availability of funds needed to grow our business.

We

have a substantial amount of indebtedness, which could adversely affect our

financial position.

We have a

substantial amount of indebtedness. As of December 31, 2009, we had total debt

of approximately $123 million, consisting of $99 million of borrowings under our

senior secured credit facility and $24 million of additional debt obligations

secured by destination club properties. Our senior secured credit facility is an

amended and restated $110 million revolving credit facility with CapitalSource,

secured by our real estate assets, which will mature on April 30, 2011, subject

to extension by us for up to two one-year periods. The revolving credit facility

includes financial and operational covenants that limit our ability to incur

additional indebtedness and pay dividends as well as purchase or dispose of

significant assets. Covenants in the revolving credit facility include

obligations to maintain either a restricted cash balance of not less than six

months of debt service or a debt service coverage ratio of 1.25 to 1, to

maintain a leverage ratio between debt and consolidated net worth of no more

than 3.5 to 1, to comply with specified ratios of number of club properties to

club members, to have a net loss of no more than $10 million in fiscal

2009 and $5 million in fiscal 2010, and to have net income in each

year thereafter (as adjusted in each year for the non-refundable portion of new

member initiation fees not yet recognized in income and, in 2009, for non-cash

stock-based compensation), and to maintain a consolidated debt ratio of no more

than 80%. Although we believe that we are in compliance with all of the

covenants in the revolving credit facility, we have previously violated certain

covenants contained in our prior revolving credit facility with CapitalSource,

which covenant violations were waived by the lender, we cannot provide any

assurance that in the future, if we were to need a waiver of a breach of a

covenant, that such a waiver would be granted. In addition, we have

approximately $23 million in additional indebtedness secured by real estate

assets with various first and second mortgage lenders. In the event we default

on our secured debt obligations, the lenders could enforce their rights under

the loan agreements, which would impair our ability to conduct our business and

have a material adverse effect on our business, financial condition and results

of operations. If we are unable to make payments on one or more mortgages on the

properties or otherwise default on our debt obligations, the lenders could

foreclose on such properties, which would have a material adverse effect on our

business, financial condition and results of operations. We may also incur

significant additional indebtedness in the future. Our substantial indebtedness

may:

15

|

|

•

|

make

it difficult for us to satisfy our financial obligations, including making

scheduled principal and interest payments on our

indebtedness;

|

|

|

•

|

limit

our ability to borrow additional funds for working capital, capital

expenditures, acquisitions or other general business

purposes;

|

|

|

•

|

limit

our ability to use our cash flow or obtain additional financing for future

working capital, capital expenditures, acquisitions or other general

business purposes;

|

|

|

•

|

require

us to use a substantial portion of our cash flow from operations to make

debt service payments;

|

|

|

•

|

limit

our flexibility to plan for, or react to, changes in our business and

industry;

|

|

|

•

|

place

us at a competitive disadvantage compared to less leveraged competitors;

and

|

|

|

•

|

increase

our vulnerability to the impact of adverse economic and industry

conditions.

|

We

may not be able to generate sufficient cash to service our debt

obligations.

Our

ability to make payments on and to refinance our indebtedness will depend on our

financial and operating performance, which is subject to prevailing economic and

competitive conditions and to certain financial, business and other factors

beyond our control. We may be unable to maintain a level of cash flows from

operating activities sufficient to permit us to pay the principal, premium, if

any, and interest on our indebtedness.

If our

cash flows and capital resources are insufficient to fund our debt service

obligations, we may be forced to reduce or delay investments and capital

expenditures, or to sell assets, seek additional capital or restructure or

refinance our indebtedness. These alternative measures may not be successful and

may not permit us to meet our scheduled debt service obligations. In the absence

of such operating results and resources, we could face substantial liquidity

problems and might be required to dispose of material assets or operations to

meet our debt service and other obligations. Our senior secured credit agreement

restricts our ability to dispose of assets, and requires the use of proceeds

from any disposition of assets to repay our indebtedness. We may not be able to

consummate those dispositions or to obtain the proceeds that we could realize

from them and these proceeds may not be adequate to meet any debt service

obligations then due.

The

luxury vacation industry is highly competitive and we are subject to risks

relating to competition that may adversely affect our performance.

We

operate principally in the luxury vacation industry and compete against numerous

global, regional and boutique destination clubs; as well as other shared usage

or interval ownership resort and vacation property companies, real estate

developers and sponsors; vacation home owners, brokers and managers; resort

sponsors and managers; and, more broadly, luxury resorts and other

transient/leisure accommodations; as well as alternative leisure and recreation

categories, such as golf clubs or other club membership organizations. We have

encountered and expect to encounter in the future intense competition from our

rivals in the destination club industry and from other companies offering

competitive products and services. Many of our competitors have greater consumer

recognition or resources and/or more established and familiar products than us.

The factors that we believe are important to customers include:

|

|

•

|

number

and variety of club destinations available to club

members;

|

|

|

•

|

quality

of member services and concierge

services;

|

|

|

•

|

quality

of destination club properties;

|

|

|

•

|

pricing

of club membership plans;

|

16

|

|

•

|

type

and quality of resort amenities

offered;

|

|

|

•

|

reputation

of club;

|

|

|

•

|

destination

club properties in proximity to major population

centers;

|

|

|

•

|

availability

and cost of air and ground transportation to destination club properties;

and

|

|

|

•

|

ease

of travel to resorts (including direct flights by major

airlines).

|

We have

many competitors for our club members, including other major resort destinations

worldwide. We also directly compete with other destination clubs, such as

Exclusive Resorts, which is the largest company in the destination club

marketplace, as measured by number of club members. Our destination club members

can choose from any of these alternatives.

We

compete with numerous other resorts that may have greater financial resources

than we do and that may be able to adapt more quickly to changes in customer

requirements or devote greater resources to promotion of their offerings than we

can. We believe that developing and maintaining a competitive advantage will

require continued investment in our technology platform, brand, existing

destination club properties and the acquisition of additional luxury properties

to our portfolio of destination club properties. There can be no assurance that

we will have sufficient resources to make the necessary investments to do so, or

that we will be able to compete successfully in this market or against such

competitors.

We

are subject to the operating risks common to the luxury vacation industry which

could adversely affect our business, financial condition and results of

operations.

Our

business is subject to numerous operating risks common to the luxury vacation

industry. Some of these risks include:

|

|

•

|

impact

of war and terrorist activity (including threatened terrorist activity)

and heightened travel security measures instituted in response

thereto;

|

|

|

•

|

travelers’

fears of exposure to contagious

diseases;

|

|

|

•

|

decreases

in the demand for transient rooms and related lodging services, including

a reduction in personal and business travel as a result of general

economic conditions;

|

|

|

•

|

cyclical

over-building in the vacation ownership

industry;

|

|

|

•

|

restrictive

changes in zoning and similar land use laws and regulations or in health,

safety and environmental laws, rules and regulations and other

governmental and regulatory action;

|

|

|

•

|

changes

in travel patterns;

|

|

|

•

|

the

costs and administrative burdens associated with compliance with

applicable laws and regulations, including, among others, franchising,

timeshare, privacy, licensing, labor and employment, and regulations under

the Office of Foreign Assets Control and the Foreign Corrupt Practices

Act;

|

|

|

•

|

the

availability and cost of capital to allow us to fund acquisitions of

additional destination club properties, renovations and

investments;

|

|

|

•

|

disruptions

in relationships with third parties, including marketing alliances and

affiliations with luxury resort property

owners;

|

|

|

•

|

foreign

exchange fluctuations; and

|

|

|

•

|

the

financial condition of the airline industry and the impact on air

travel.

|

The

matters described above could result in a decrease in the number, or lack of

growth, in our destination club members and could have a material adverse effect

on the luxury vacation industry, which in turn could have a material adverse

effect on our business, financial condition and results of

operations.

17

The

current slowdown in the travel industry and the global economy generally will

continue to impact our financial results and growth.

The

present economic slowdown and the uncertainty over its breadth, depth and

duration has had a negative impact on the luxury vacation industry. There is now

general consensus among economists that the economies of the United States,

Europe and much of the rest of the world have been in a recession since December

2007. The current downturn in the economy has reduced, and may in the future

reduce the demand for our destination club memberships and may increase club

member resignations and redemptions. Accordingly, our financial results have

been impacted by the economic slowdown and both our future financial results and

growth could be further harmed if the recession continues for a significant

period or becomes worse.

We

are subject to the risks that generally relate to real estate investments, which

may have a material adverse effect on our business, financial condition and

results of operations.

We are

subject to the risks that generally relate to investments in real property

because we own most of our destination club properties. The investment returns

available from equity investments in real estate depend in large part on the

amount of income earned and capital appreciation generated by the related

properties, and the expenses incurred. In addition, a variety of other factors

affect income from properties and real estate values, including governmental

regulations, insurance, zoning, tax and eminent domain laws, interest rate

levels and the availability of financing. When interest rates increase, the cost

of acquiring, developing, expanding or renovating real property increases and

real property values may decrease as the number of potential buyers decreases.

Similarly, as financing becomes less available, it becomes more difficult both

to acquire and to sell real property. In addition, our loan facility restricts

our ability to sell our assets, including our real estate holdings. Finally,

under eminent domain laws, governments can take real property. Sometimes this

taking is for less compensation than the owner believes the property is worth.

Any of these factors could have a material adverse impact on our results of

operations or financial condition. In addition, equity real estate investments

are difficult to sell quickly and we may not be able to adjust our portfolio of

owned properties quickly in response to economic or other conditions. If our

properties do not generate revenue sufficient to meet operating expenses,

including debt service and capital expenditures, our income and financial

condition will be adversely affected. The real estate investment industry is

susceptible to trends in the national and/or regional economies and there can be

no assurance that we can operate our destination club properties and then later

sell any or all of them at a profit.

The

need for ongoing property renovations could adversely affect our business,

financial condition and results of operations.

Our

properties require routine maintenance as well as periodic renovations and

capital improvements. Ongoing renovations at a particular property may

negatively impact the desirability of the property as a vacation destination. A

significant decrease in the supply of available vacation rental accommodations

and the need for vacation rental services during renovation periods, coupled

with the inability to attract vacationers to properties undergoing renovations,

could have a material adverse effect on our business, financial condition and

results of operations.

18

Environmental

liabilities, including claims with respect to mold or hazardous or toxic

substances, could have a negative impact on our reputation and cause us to incur

additional expense to remedy any such liability or claim.

Under

various federal, state, local and foreign environmental laws, ordinances and

regulations, a current or previous property owner of real property may be liable

for the costs of removal or remediation of hazardous or toxic substances,

including mold, on, under or in such property. These laws could impose liability

without regard to whether we knew of, or were responsible for, the presence of

hazardous or toxic substances. The presence of hazardous or toxic substances, or

the failure to properly clean up such substances when present, could jeopardize

our ability to develop, use, sell or rent the real property or to borrow using

the real property as collateral. If we arrange for the disposal or treatment of

hazardous or toxic wastes, we could be liable for the costs of removing or

cleaning up wastes at the disposal or treatment facility, even if we never owned

or operated that facility. Other laws, ordinances and regulations could require

us to manage, abate or remove lead or asbestos containing materials. Similarly,

the operation and closure of storage tanks are often regulated by federal,

state, local and foreign laws. Certain laws, ordinances and regulations,

particularly those governing the management or preservation of wetlands, coastal

zones and threatened or endangered species, could limit our ability to develop,

use, sell or rent our real property.

We cannot

provide any assurances that environmental issues will not exist with respect to

any destination club property we own or acquire. Even if environmental

inspections are made, environmental issues may later be determined to exist

because the inspections were not complete or accurate or environmental releases

migrate to the properties from adjacent property. In addition to liability for

environmental issues which can substantially adversely impact our business and

financial condition, the marketability of the destination club properties for

sale or refinancing can be adversely affected because of the concerns of a third

party who may buy or lend money on the properties over the possible

environmental liability and/or environmental clean-up costs. In addition, our

reputation may be damaged by any alleged claim or incurrence of environmental

liabilities, which could reduce demand for our destination club memberships and

have a material adverse effect on our business.

We

own properties that are located internationally and thus are subject to special

political and monetary risks not generally applicable to our domestic

properties.

We

operate properties located abroad which, as of December 31, 2009, included 44

properties in 12 international locations. We intend to expand our portfolio of

international destination club properties. Properties abroad generally are

subject to various political, geopolitical, and other risks that are not present

or are different in the United States. These risks include the risk of war,

terrorism, civil unrest, expropriation and nationalization and regulation, as

well as the impact in cases in which there are inconsistencies between U.S. law

and the laws of an international jurisdiction. In addition, sales in

international jurisdictions typically are made in local currencies, which

subject us to risks associated with currency fluctuations. Currency devaluations

and unfavorable changes in international monetary and tax policies could have a

material adverse effect on our profitability and financing plans, as could other

changes in the international regulatory climate and international economic

conditions, in the event that we increase our operation of properties

abroad.

We

have a limited operating history, which may make it difficult to predict our

future performance.

We have

been operating only since 2004 and therefore do not have an established

operating history. In addition, the acquisition of certain assets and

liabilities of Private Escapes was consummated on September 15, 2009, and as a

result we now have a much larger base of club members, club properties and

employees to manage and operate. Consequently, any predictions you make about

our future success or viability may not be as accurate as they could be if we

had a longer operating history.

We

may experience financial and operational risks in connection with acquisitions.

In addition, businesses acquired by us may incur significant losses from

operations or experience impairment of carrying value.

We

completed our acquisition of certain assets and liabilities of Private Escapes

on September 15, 2009, and intend to selectively pursue other acquisitions.

However, we may be unable to identify attractive acquisition candidates or

complete transactions on favorable terms. In addition, in the case of acquired