Attached files

| file | filename |

|---|---|

| EX-99.1 - AUDITED CONSOLIDATED FINANCIAL STATEMENTS - Mondo Acquisition III, Inc. | f8k021210a1ex99ii_mondo.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K /A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

report (Date of earliest event reported): February 12,

2010

| MONDO ACQUISITION III, INC. | ||||

| (Exact name of registrant as specified in its charter) | ||||

|

Delaware

|

000-52623

|

37-1532843

|

||

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(I.R.S.

Employer Identification No.)

|

Yangdai Village, Chendai

County

Jinjiang City, Fujian

Province

People’s Republic of

China

(Address

of principal executive offices) (Zip Code)

+86

(151) 1249-4568

(Registrant’s

telephone number, including area code)

______________________

Copies

to:

Richard

I. Anslow, Esq.

Eric

M. Stein, Esq.

Yarona

Y. Liang, Esq.

Anslow

+ Jaclin, LLP

195

Route 9 South, Suite 204

Manalapan,

New Jersey 07726

(732)

409-1212

________________________

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Explanatory

Note

On

February 12, 2010, Mondo Acquisition III, Inc. (the “Company”) filed a Form 8-K

(the “Initial Form 8-K”) describing the completion of a share exchange

transaction with Kobe Sport (International) Company Limited (“Kobe Sport”) and

its shareholders that resulted in Kobe Sport becoming a wholly-owned subsidiary

and the new operating business of the Company on February 12, 2010. The share

exchange transaction was accounted for as a reverse acquisition and

recapitalization and, as a result, the consolidated financial statements of the

Company (the legal acquirer) will, in substance, be those of Kobe Sport (the

accounting acquirer), with the assets and liabilities, and revenues and

expenses, of the Company being included effective from the date of the share

exchange transaction.

This

Current Report on Form 8-K/A (“Form 8-K/A”) is being filed to furnish the

consolidated financial statements of Kobe Sport as of December 31, 2009 and

2008. Additionally, we are amending certain disclosures under Item 2.01

(Completion of Acquisition or Disposition of Assets) to update certain

information regarding the business operations of Kobe Sport as of December 31,

2009.

This Form

8-K/A is limited in scope to the revisions described above and does not amend,

update, or change any other items or disclosures contained in the Initial Form

8-K. Accordingly, all other items that remain unaffected are omitted in

this filing. The filing of this Form 8-K/A shall not be deemed an admission

that the Initial Form 8-K, when filed, intentionally included any known untrue

statement of material fact or knowingly omitted to state a material fact

necessary to make a statement not misleading.

2

Item 2.01 Completion of Acquisition or

Disposition of Assets

CLOSING

OF EXCHANGE AGREEMENT

On

February 12, 2010, we acquired Kobe Sport, which is the parent company of a

company engages in design, manufacturing and sales of sports shoes, sportswear

and related accessories in People’s Republic of China (“China” or the “PRC”), in

accordance with the Exchange Agreement. The closing of the

transaction took place on February 12, 2010. On the Closing Date, pursuant to

the terms of the Exchange Agreement, we acquired all the Interests of Kobe Sport

from the Kobe Sport Shareholders; and the Kobe Sport Shareholders transferred

and contributed all of their Interests to us. In exchange, we issued a total of

9,000,000 shares of common stock to the Kobe Sport Shareholders, their designees

or assigns, which totals 90% of the issued and outstanding shares of common

stock of the Company on a fully-diluted basis as of and immediately after the

Closing of the Share Exchange. Following the Share Exchange, there are

10,000,000 shares of common stock issued and outstanding.

Kobe

Sport is a holding company and, through its subsidiaries, primarily engages in

design, manufacturing and sales of sports shoes, sportswear and related

accessories. It was incorporated with limited liability on September 25, 2009

under the International Business Companies Act in the British Virgin Islands and

owns a 100% issued and outstanding capital stock of Nam Kwong Trading Company

Limited (“Nam Kwong”). Fujian Jinjiang Hengfeng Shoes & Garments Co., Ltd.

(“Hengfeng”) is a sino-foreign joint stock limited liability company established

in the PRC in 1992. On December 4, 2009, Hengfeng underwent reorganization.

Before the reorganization, Hengfeng had been owned as to 94% by Nam Kwong

Trading Co., an unincorporated company registered in Hong Kong (“Nam Kwong

Unincorporated”) and 6% by Fujian Jinjiang Chenli Yangli Hengfeng Shoe-making

Factory, which is a company registered in the PRC (“Fujian Jinjiang”), according

to their respective capital contribution. Pursuant to the reorgnization, Nam

Kwong Unincorporated transferred the 94% interest in Hengfeng held by it to Nam

Kwong. As a result, through Nam Kwong, Kobe owns 94% interest in

Hengfeng.

The

Company was a “shell company” (as such term is defined in Rule 12b-2 under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”)) immediately

before the completion of the Share Exchange. Accordingly, pursuant to

the requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the

information that would be required if the Company were filing a general form for

registration of securities on Form 10 under the Exchange Act, reflecting the

Company’s common stock, which is the only class of its securities subject to the

reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon

consummation of the Share Exchange, with such information reflecting the Company

and its securities upon consummation of the Share Exchange.

3

BUSINESS

Overview

Kobe

Sport, through Hengfeng, is in the business of designing, manufacturing and

selling sports shoes, sportswear and related accessories in the PRC. Our mission

is to become the leading supplier of professional sporting goods in the China

market by building on our fully integrated value chain and delivering premium

quality products.

We

generate revenues solely from the sales of sports shoes, sportswear and related

accessories in the PRC. Our revenues for the fiscal year ended December 31, 2008

which was $63,406,121 represented a 33.27% growth from the fiscal year ended

December 31, 2007 with revenues of $47,575,629. Our fiscal year 2008

net income was $9,305,710, an increase of 40.31% compared with our fiscal year

2007 net income of $6,632,142. Our growth strategy is to open

additional facilities and product lines to increase our production

capacity.

Our

revenues for the fiscal year ended December 31, 2009 were $81,187,591,

an increase of 28.04% from revenues of $63,406,121 during the fiscal year ended

December 31, 2008. Our net income was $13,371,241 during the fiscal year

ended December 31, 2009, an increase of 43.69% from net income of

$9,305,710 during the fiscal year ended 2008.

Historical

Sales & Income Summary

|

Fiscal Year Ended

December 31,

|

%

|

|||||||||||

|

Summary Consolidated

|

2008

|

2009

|

Growth

|

|||||||||

|

Statement of Operations:

|

(audited)

|

(audited)

|

||||||||||

|

Revenue

|

$

|

63,406,121

|

$

|

81,187,591

|

28.04

|

%

|

||||||

|

Gross

Profit

|

17,942,652

|

23,105,244

|

28.77

|

%

|

||||||||

|

Net

Income

|

9,305,710

|

13,371,241

|

43.69

|

%

|

||||||||

Organization

& Subsidiaries

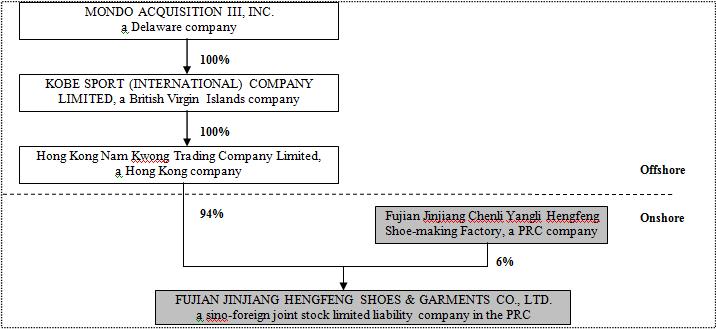

Kobe

Sport’s organizational structure was developed to permit the infusion of foreign

capital under the laws of the PRC and to maintain an efficient tax structure, as

well as to foster internal organizational efficiencies. The Company’s

organization structure post-Share Exchange is summarized in the figure

below:

4

Kobe

Sport is a holding company and, through its subsidiaries, primarily engages in

design, manufacturing and sales of sports shoes, sportswear and related

accessories. It was incorporated with limited liability on September 25, 2009

under the International Business Companies Act in the British Virgin Islands and

owns a 100% issued and outstanding capital stock of Nam Kwong. Hengfeng is a

sino-foreign joint stock limited liability company established in the PRC in

1992. On December 4, 2009, Hengfeng underwent reorganization. Before the

reorganization, Hengfeng had been owned as to 94% by Nam Kwong Unincorporated

and 6% by Fujian Jinjiang, which is a company registered in the PRC, according

to their respective capital contribution. Pursuant to the reorgnization, Nam

Kwong Unincorporated transferred the 94% interest in Hengfeng held by it to Nam

Kwong. As a result, through Nam Kwong, Kobe owns 94% interest in

Hengfeng.

Hengfeng

is established in 1992 and is engaged in the production and sales of sport

shoes, sportswear and accessories. In 2003, Hengfeng introduced its own

basketball brand of Kobe, which main products are basketball shoes and

basketball wear. Hengfeng currently owns four production lines for Kobe in

Jinjiang city, Fujiang province in the PRC. The factory has an annual production

capacity of 2.4 million pairs of sport shoes. Its products are only sold in

China. The Company is ISO9001 and ISO2000 certified for quality

management.

Market

Summary

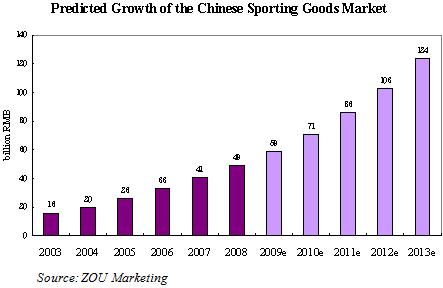

The Chinese Sporting Goods

Market

China’s

sporting goods market experienced robust growth in recent years, at a compound

annual growth rate of 20%. The market is expected to consititue 0.3% of China’s

GDP, which is far lower than the 1-3% of developed countries. The 2008 Olympic

Games in Beijing has increased the popularity of sports in China. The 2009 East

Asian Games in Hong Kong and 2010 Asian Games in Guangzhou will continue to

cultivate the Chinese interest in sports. With the rising income levels of

Chinese consumers, their expectations of quality and branding also

increase.

The

high-end sportswear market in China is currently dominated by international

brands, such as Nike, Adidas and Puma. The middle/high-class market is dominated

by local brands such as Lining, Kangwei, Great, Doublestar and Anta. The entire

middle class market is dominated by brands from Jingjiang, such as Xtep,

Hongxing Erke and Deerway. The international brands have years of experience in

the market, advanced R&D and strong financial support for marketing. On the

other hand, the domestic brands that dominant the low-end and middle-class

market is following the rapid development of the leading international

brands.

Market Trends and Brand

Implications

Increased

disposable income inspires the pursuit of fashion.

|

·

|

Increased

purchasing power drives

consumption.

|

|

·

|

Increased

income has also lead to the increase in leisure time, which has increased

the popularity of casual wear.

|

|

·

|

Casual

wear has become especially popular among those under 45 years old in

China, i.e. the target consumer group for the Kobe

brand.

|

|

·

|

The

Kobe brand can meet our target consumers’ demand by providing fashionable

casual wear.

|

Rapid

increase in demands in the second-and third-tier cities. We focus on the second

and third tier cities, because:

|

·

|

Compared

to first-tier cities, which have already been exploited by major

international brands, the second and third-tier cities provide a lot more

marketing opportunities for domestic sporting goods

brands.

|

|

·

|

At

the same time, the income levels in these cities are catching up to that

in first-tier cities, which increases demand for sporting goods in these

cities.

|

|

·

|

Hengfeng’s

franchising business model allows it to cover these target markets

quickly.

|

5

Products

Hengfeng

designs, develops, and manufactures “Kobe” branded shoes, sportswear and

accessories in Jinjiang city, Fujian province. The shoes are produced by

Hengfeng internally, while the clothes and accessories are outsourced to

subcontractors.

The

Company incorporates innovate value-adding technology into its products, such as

perspiration absorption system, 3D ventilation system and polyurethane

anti-crease system to satisfy the demands and taste of target

consumers.

The

Company holds a valuable chain of 869 stores over the whole country in 2009. The

Company targets to increase the number of stores by at least 20% each year

within the coming five years, and both the turnover and net profit would be

increased in the same line as the number of stores.

Sourcing. All of our

sportswear and accessories are produced by our subcontractors. About 44% and 50%

of our sports shoes are produced by our subcontractors for the year ended

December 31, 2007 and December 31, 2008, respectively. The approximate amount of

subcontracted and self-production of each segment are as follows:

|

Segments

|

Subcontracted

($)

|

Self-production

($)

|

Total Cost of Sales

($)

|

||||

|

For

the Year Ended

December

31, 2007

|

Sports

wears

|

8,308,220.65

|

-

|

8,308,220.65

|

|||

|

Accessories

|

1,621,650.52

|

-

|

1,621,650.52

|

||||

|

Sports

shoes

|

10,830,679.18

|

13,745,014.48

|

24,575,693.66

|

||||

|

sub-tota

|

20,760,550.36

|

13,745,014.48

|

34,505,564.84

|

||||

|

For

the Year Ended

December

31, 2008

|

Sports

wears

|

13,159,368.01

|

-

|

13,159,368.01

|

|||

|

Accessories

|

2,193,208.67

|

-

|

2,193,208.67

|

||||

|

Sports

shoes

|

15,065,668.75

|

15,010,725.18

|

30,076,393.94

|

||||

|

sub-total

|

30,418,245.43

|

15,010,725.18

|

45,428,970.61

|

||||

|

For

the Nine Months Ended

September

30, 2009

|

Sports

wears

|

15,105,609.61

|

-

|

15,105,609.61

|

|||

|

Accessories

|

2,820,805.64

|

-

|

2,820,805.64

|

||||

|

Sports

shoes

|

10,540,716.10

|

13,890,826.81

|

24,431,542.91

|

||||

|

sub-total

|

28,467,131.35

|

13,890,826.81

|

42,357,958.16

|

We

believe that the use of independent contract manufacturers afford us additional

liquidity and flexibility. We do not have any long-term contracts with any of

our manufacturers; however, we have long-standing relationships with many of our

manufacturers and believe our relationships to be good.

In 2009,

we subcontracted our sports shoes production to eight (8) main factories in

Fujian province in the PRC. They are: Xinli Shoes Co., Ltd. (Jinjiang City),

which counted for 19.65% of the total

shoes subcontracted amount in 2009; Liweng Shoes Co., Ltd. (Jinjiang City),

14.08%;

Dongzheng Shoes Co., Ltd. (Jinjiang City), 13.69%; Yiming

(Jinjiang) Shoes Co., Ltd., 13.02%; Jielongbao Shoes

Co., Ltd. (Jinjiang City), 10.51%; Xinqile (Fujian)

Shoes Co., Ltd., 10.35%; Meilida Shoes

Co., Ltd. (Jinjiang City), 10.04%; and Dingfeng

Shoes Co., Ltd. (Jinjiang City), 8.66%. These 8

factories in total counted for 90% of the shoes subcontracted in

2009.

6

Additionally,

the following five (5) subcontractors produced approximately 90% of all our

sportswear and accessories. Their names and percentages are: Zifeng Clothing

Factory (Banfu Town, Zhongshan City), 30.79%; Qigao Clothing

Co., Ltd. (Heshan City), 22.56%; Guhe Clothing

Co., Ltd. (Xiamen City),15.10%; Ouwen Sport

Products Co., Ltd. (Guangzhou City);11.28%; and Quanhuang

Clothing & Accessories Co., Ltd. (Shishi City); 10.52%.

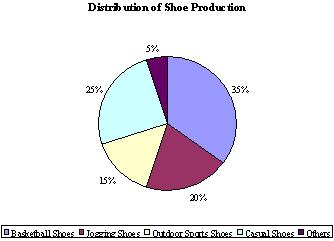

Shoe

Production

|

We focus on designing and

producing basketball shoes, which count for 35% of our total shoe

production for the year ended 2008. In addition, we produce casual shoes,

jogging shoes and outdoor sports shoes, including the skiing

shoes.

The sole of the basketball

shoes was developed and manufactured by the Company which combines latest

technology and designs. The sole helps stabilize and protect the joints.

The price of the sole is reasonable and very competitive in the industry.

It has the following features:

Cushioning Function:

The cushioning features are divided into structural and material.

Examples of the structural feature include the hive structure and arch

structure. Examples of the material feature include the air cushion and

shock absorption rubber. The index to evaluate the cushioning function, no

matter the material test or human body test, is based on the peak value of

the impact force during the vertical counterforce test or the peak value

of the negative acceleration. The lower the peak value of the impact force

or the negative acceleration, the better the cushioning function the shoe

acquires, which will greatly reduce the chance of body

injury.

|

|

Stabilization Function: The

middle and upper parts of the basketball shoes are also the focus of our

research and development. Those parts have the functions of stabilizing joints,

preventing ankle sprains, protecting the instep as well as the Achilles

tendon.

Non-Slip Function: The

non-slip function of the soles is also the friction function. The key relies on

the width and depth of the sole veins. The change of the vein shapes will

increase the friction force of the shoes and accordingly will effectively

improve the non-slip function. So far, the “人-shape” vain is

still the symbol of the most powerful ground-grasping capacity.

Rebounding Function: The

function tests during the R&D process are divided into two categories, (1)

Material Test: place the shoes on a test board or ground, and test the shoes

itself; (2) Human Body Test: a volunteer will put on the shoes and test the

shoes in different phases (walking, running, and vertical jumping). The vertical

jumping test reveals that there is no difference in the jumping height with or

without the shoes, which demonstrates that the springing capacity required for

jumping does not have substantial improvement. We speculate the reason could be

resulting from the shoes’ failure to correspond with the human bouncing

power.

We also

develop and manufacture the rubber sole of the skiing shoes. We apply the

country-leading “One-time Rubber Injection” technology which will reduce the

cost, improve the physical features and appearance of the product, and save

energy consumption by 15%. The Kobe-series products combine both the sport and

casual characteristics. Our skiing shoes are designed specifically for skiing

and combine a variety of technologies. The main characteristics include: the

cushioning function of the sole and the worn-free design of the shoelace. The

products adopt special enduring materials on most parts of the shoes to ensure

the comfortability.

In

addition, our jogging shoes also apply a variety of technologies which greatly

reduce its weight and increase its endurance. A series of new technologies are

applied in the uppers of the shoes which support the shoe body with the lightest

skeleton. The sole and the TPU-tray support the foot arches which together with

breathing cannelures prevent the fatigue of the feet after long jogging. The key

R&D concept is making the shoe sole as the continuance of the foot. The

wearer will barely feel the existence of the shoes when jogging.

7

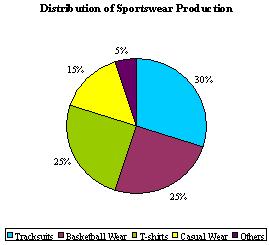

Sportswear

Production

|

We focus on tracksuits,

basketball wear and t-shirts, which counted for 30%, 25% and 25%,

respectively, of our 2009 sportswear production. In addition, we have

casual wear collection and a small portion of fashion wear

collection.

Our Kobe branded sportswear

has its unique features. We selected and purchased raw materials

ourselves; fabrics produced by weaving companies in accordance with our

requirements on color, function and vain developed by our internal

designing departments; as well as, environmentally friendly products

produced with Nano Technologies.

Warm-Keeping Feature:

Our outdoor sport suits are designed in a way that both keep warm and

light and portable. We add special ceramic powders such as chromium oxide,

magnesium oxide, zirconium oxide into compound fiber liquids such as

polyester fiber. The minor ceramic powder on the Nano-level can absorb

visible lights such as sunlight and transfer the lights into heat, and can

also reflect the infrared rays produced by human body, which enable the

material to acquire superior warm-keeping capacities. In

addition, following the bionics principles, we design the internal

structure of the polyester fiber referring to that of the poly bears,

which enable the fiber to acquire both lightness and warm-keeping

features. On the other hand, manufacturing the suits or fibers into two or

three-layer which increase the number of non-circulating layers is also

one of the traditional measures to keep warm.

|

|

Antibiotic and Antiodour Features:

We add antibiotic chemicals into the fiber and make sure they will not be

easily worn out. We also make sure the antibiotic chemicals are non-poisonous or

little poisonous. In addition, by combining certain chemicals together, we are

able to effectively shield the ultraviolet.

Sports

Accessories

We mainly

produce the following sports accessories: sports bag, wristlet, basketball,

travel bag, hat, sport socks, and scarf, etc.

Basketball: our basketballs

are manufactured in compliance with International Basketball Association

standards and borne our brand name. Advantages include: high-quality inner tube

material; special outer skin material, non-slip, enduring, and sweat absorption,

etc.

Shields: our designed shields

have good flexibility and supporting capacity and equal pressure on specially

made Coolprene materials.

Sport & Casual Bags: they

are portable, fashionable, humanity designs and structures and have streamlined

production techniques. We target customers for use of studying, traveling and

outdoor exploring.

Sport & Casual Socks:

they have sweat absorption design, streamline production techniques and

comprehensive cushion protection.

Production

Capacity

We

currently have four production lines with a total capacity of 2.4 millions pairs

of sports shoes per year. It contributes about 45% - 55% of total sports shoes

sold each year. The remaining 45% - 55% of total sports shoes are subcontracted

out each year. We plan to set up 6 more production lines in 2010 and increase in

total capacity to 6 millions pairs of sports shoes per year. We believe that

self-owned production can better control quality than

subcontracted.

Raw

Materials and Suppliers

Leather,

plastic, rubber, thread and other basic components are our main raw materials

for the production of shoes. The Company's principal required raw material is

quality leather, which it purchases from a selected group of Chinese suppliers.

The global availability of common upper materials and specialty leathers

eliminates any reliance by the Company upon a sole supplier. The Company

purchases all of its other raw materials and component parts from a variety of

sources, none of which is believed by the Company to be a dominant supplier.

Alternative sources of supply are believed to be available to the

Company. Our top five (5) raw material suppliers are as

below:

8

|

Suppliers

|

Supplied Raw

Materials

|

Percentage of Total Supplied

Amount in 2009

|

||

|

Jinjiang

Daxin Shoes Co., Ltd.

|

Leather,

plastic, rubber, thread and other basic components

|

10.34%

|

||

|

Jinjiang

Zhongyu Leather & Clothes Co., Ltd.

|

Leather

|

9.00%

|

||

|

Jinjiang

Libao Industrial Chemicals Co., Ltd.

|

Chemicals

|

7.92%

|

||

|

Jinjiang

Lianfa Shoes Materials Co., Ltd.

|

Leather,

plastic, rubber, thread and other basic components

|

7.68%

|

||

|

Quanzhou

Baoshu Packing Co., Ltd.

|

Shoes

boxes

|

7.68%

|

||

|

Total

|

42.62%

|

Product

Design and Development

Our

principal goal in product design is to generate new and exciting sport shoes and

sportswear or accessories in all of our product lines with contemporary and

progressive styles and comfort-enhancing performance features. Targeted to the

active, youthful and style-savvy, we design most new styles to be fashionable

and marketable to the 15 to 24 year-old consumer, while substantially all

of our lines appeal to the broader range of 15 to 45 year-old

consumers.

We

believe that our products’ success is related to our ability to recognize trends

in the footwear markets and to design products that anticipate and accommodate

consumers’ ever-evolving preferences. We are able to quickly translate the

latest fashion trends into stylish, quality footwear at a reasonable price by

analyzing and interpreting current and emerging lifestyle trends. Lifestyle

trend information is compiled and analyzed by our designers from various

sources, including the review and analysis of modern music, television, cinema,

clothing, alternative sports and other trend-setting media; traveling to

domestic and international fashion markets to identify and confirm current

trends; consulting with our retail and e-commerce customers for information on

current retail selling trends; participating in major footwear trade shows to

stay abreast of popular brands, fashions and styles; and subscribing to various

fashion and color information services. In addition, a key component of our

design philosophy is to continually reinterpret and develop our successful

styles in our brands’ image.

Our

products are designed and developed primarily by our in-house design staff. To

promote innovation and brand relevance, we utilize dedicated design teams, who

report to our senior design executives and focus on each of the men’s and

women’s categories. In addition, we utilize outside design firms on an

item-specific basis to supplement our internal design efforts. The design

process is extremely collaborative, as members of the design staff frequently

meet with the heads of retail, merchandising, sales, production and sourcing to

further refine our products to meet the particular needs of the target

market.

After a

design team arrives at a consensus regarding the fashion themes for the coming

season, the designers then translate these themes into our products. These

interpretations include variations in product color, material structure and

embellishments, which are arrived at after close consultation with our

production department. Prototype blueprints and specifications are created and

forwarded to our manufacturers for a design prototype. The design prototypes are

then sent back to our design teams. Our major retail customers may also review

these new design concepts. Customer input not only allows us to measure consumer

reaction to the latest designs, but also affords us an opportunity to foster

deeper and more collaborative relationships with our customers. We also

occasionally order limited production runs that may initially be tested in our

concept stores. By working closely with store personnel, we obtain customer

feedback that often influences product design and development. Our design teams

can easily and quickly modify and refine a design based on customer

input.

Quality

Control

We

believe that quality control is an important and effective means of maintaining

the quality and reputation of our products. Our quality control program is

designed to ensure that not only finished goods meet our established design

specifications, but also that all goods bearing our trademarks meet our

standards for quality. Our quality control personnel perform an array of

inspection procedures at various stages of the production process, including

examination and testing of prototypes of key raw materials prior to manufacture,

samples and materials at various stages of production and final products prior

to shipment. Our employees are on-site at each of our major manufacturers to

oversee production. For some of our lower volume manufacturers, our staff is

on-site during significant production runs or we will perform unannounced visits

to their manufacturing sites to further monitor compliance with our

manufacturing specifications.

Sales

and Marketing

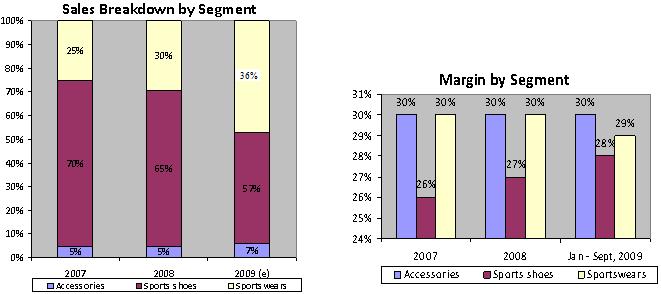

Sales

breakdown: our sports shoes sales counted for 70% and 65% of the total sales in

our fiscal year ended December 31, 2007 and 2008. We also estimated that our

shoes sales in 2009 will be decreased to 57% of the total sales. In the

contrary, our sports wears sales are estimated to be increasing from 25% for the

year ended December 31, 2007 to 36% of the total sales in 2009. The

revenue margin in sports shoes is lower than sports wears and sports

accessories. The charts of sales breakdown by segment and margin by segment are

as below:

9

Sales and Marketing

Strategies

Product Orientation:

Middle-ranged priced professional and functional sporting goods with high

technical content. The products represent comfort, quality and high sports

performance.

Target Consumers: 15-45 year

olds: secondary school and university students that have a taste for fashion;

middle-aged individuals that have a high purchase power and preference for

quality.

Target Market: we mainly

focus on second and third-tier cities with trendy consumers and professional

athletes.

Expansion of Sales Network:

Although international brands such as Nike and Adidas have a high market share,

domestic brands are more capable of penetrating into smaller cities and

provinces. We plan to expand our sales channel to second and third-tier cities

of primary markets, and first and second-tier cities. Therefore, our strategy is

to focus on brand promotion in first-tier cities, establish many retail outlets

in second-tier cities and open flagship stores in third-tier cities. Below are

our different levels of targeted markets:

|

Area

|

Primary

Market

|

Secondary

Market

|

Tertiary

Market

|

|||

|

Northern

China

|

Beijing

Tianjin

|

Hebei

Inner

Mongolia

|

Shanxi

|

|||

|

Northeast

China

|

Liaoning

|

Heilongjiang

|

Jilin

|

|||

|

Eastern

China

|

Shanghai

Zhejiang

|

Jiangsu

Fujian

|

Anhui,

Shandong

Jiangxi

|

|||

|

Southern

China

|

Guangdong

Hunan

|

Henan

Hubei

|

Guangxi

Zhuang A.R.

Hainan

|

|||

|

Southwest

China

|

Chongqing

Sichuan

|

Guizhou

Yunnan

|

Tibet

|

|||

|

Northwest

China

|

Shaanxi

Qinghai

|

Gansu

Ningxia

Hui A.R.

|

Xinjiang

Uygur A.R.

|

The map

below shows our sales network and the locations of our franchise

stores:

10

In

addition, we also sponsor sports events to gain a higher brand exposure or

sponsor gyms, which are a main exercising venue for the target consumer group.

The Kobe brand is able to infiltrate the target consumers’ daily lives and hence

cultivate brand loyalty. Further, we plan to design a website with a large

online media company that represents the unique characteristics of the Kobe

brand.

Business

Model

Franchising

Franchising

is popular among enterprises in the sporting goods industry due to the following

advantages: sales staff of franchisees are placed closed to, and hence can

influence target consumers; market reaction can be quickly observed; enables

refunds and exchange, which improves the brand’s credibility; shortens the

period of time for products to be introduced to the market; and Easy to manage,

where the sales functions are subcontracted to outsiders.

Hengfeng,

as the franchisor,

grants the franchisees the right to distribute its products, techniques,

and trademarks for a percentage of gross monthly sales. We also provide the

franchisees with advertising, staff training and other support services.

Franchising standardizes the shop design, product display, products, service,

brand image and management.

Self-owned

Self-owned

stores have the following advantage: increase in profit margin per item sold for

the Company although self owned shops need to take up their owned running costs

and increase in time required for the management to run the shops, sales staff

of the Company would be closed to customers and react quickly for any

change in consumers’ taste.

We do not

have any self owned shops up to date. However, we plan to set up 50 self owned

shops in year 2010 which will increase our revenue 20% per year for coming five

years.

Our

development plan for the franchising and self-owned stores is as

below:

|

2009

|

2010

(e)

|

2011

(e)

|

2012

(e)

|

|||||||||

|

No.

of Franchisees

|

869 | 1,243 | 1,492 | 1,790 | ||||||||

|

No.

of Self-Owned

|

0 | 50 | 60 | 72 | ||||||||

|

Total

|

869 | 1,293 | 1,552 | 1,862 |

11

Competition

Competition

in the sport shoes and sportswear industry is intense. Although we believe that

we do not compete directly with any single company with respect to its entire

range of products, our products compete with other branded products within their

product category as well as with private label products sold by retailers,

including some of our customers. Our sport shoes compete with sports shoes

offered by international companies such as Nike, Inc., adidas AG, Puma AG, and

New Balance Athletic Shoe, Inc. and PRC companies such as Anta Sports Products

Limited, Li Ning Company Limited and Qiaodan (China) Co., Ltd. In varying

degrees, depending on the product category involved, we compete on the basis of

style, price, quality, comfort and brand name prestige and recognition, among

other considerations. These and other competitors pose challenges to our market

share in our major domestic markets and may make it more difficult to establish

our products in the PRC. We also compete with numerous manufacturers, importers

and distributors of footwear for the limited shelf space available for the

display of such products to the consumer. Moreover, the general availability of

contract manufacturing capacity allows ease of access by new market entrants.

Many of our competitors are larger, have been in existence for a longer period

of time, have achieved greater recognition for their brand names, have captured

greater market share and/or have substantially greater financial, distribution,

marketing and other resources than we do. We cannot be certain that we will be

able to compete successfully against present or future competitors, or that

competitive pressures will not have a material adverse effect on our business,

financial condition and results of operations.

Growth

Strategy

We intend

to improve our sales network, production capacity, increase our research

expenditure and brand promotion of the Kobe brand, a brand that belongs to

Fujian Jingjiang Hengfeng Shoes & Garment Co., Ltd., by using the following

means:

Expand Sales Network: To

provide training, advertising and marketing assistance, and renovation subsidies

to franchisees and increase the number of franchisees from 869 in 2009 to 1862

by 2012, representing approximately the rate of 114% within 3

years.

Expand Production Facility:

To construct a new factory of 20,000m2 and increase the 4 production lines to

10, which would raise annual production capacity from 2.4 million to 6 million

pairs by 2010.

Diversify Products: To

diversify products from basketball shoes to other types of shoes and clothes for

outdoor activities, and to keep the product mix of 43%: 57% of sports wears and

accessories to sports shoes.

IT System Upgrades: Introduce

Management Information System (MIS) to efficiently monitor sales and inventory

status of various stores and franchisees to conduct sales analysis and

forecasts

Research and Development: To

improve on existing technology, such as the perspiration absorption system, to

increase the competitiveness of Kobe products.

Human Capital: To hire an

experienced design team to introduce innovative and Trendy products targeted for

consumers’ taste and preference in order to further boost sales.

Intellectual

Properties

We own

and utilize a variety of trademarks, including the Kobe trademark. We

continuously look to increase the number of our trademarks and potential design

patents where necessary to protect valuable intellectual property. We regard our

trademarks and other intellectual property as valuable assets and believe that

they have significant value in the marketing of our products. We vigorously

protect our trademarks against infringement, including through the use of cease

and desist letters, administrative proceedings and lawsuits.

We rely

on trademark, patent, copyright and trade secret protection, non-disclosure

agreements and licensing arrangements to establish, protect and enforce

intellectual property rights in our logos, trade names and in the design of our

products. In particular, we believe that our future success will largely depend

on our ability to maintain and protect the Kobe trademark and other key

trademarks. Despite our efforts to safeguard and maintain our intellectual

property rights, we cannot be certain that we will be successful in this regard.

Furthermore, we cannot be certain that our trademarks, products and promotional

materials or other intellectual property rights do not or will not violate the

intellectual property rights of others, that our intellectual property would be

upheld if challenged, or that we would, in such an event, not be prevented from

using our trademarks or other intellectual property rights. Such claims, if

proven, could materially and adversely affect our business, financial condition

and results of operations. In addition, although any such claims may ultimately

prove to be without merit, the necessary management attention to and legal costs

associated with litigation or other resolution of future claims concerning

trademarks and other intellectual property rights could materially and adversely

affect our business, financial condition and results of operations.

12

The laws

of certain foreign countries do not protect intellectual property rights to the

same extent or in the same manner as do the laws of the PRC. Although we

continue to implement protective measures and intend to defend our intellectual

property rights vigorously, these efforts may not be successful or the costs

associated with protecting our rights in certain jurisdictions may be

prohibitive. From time to time we discover products in the marketplace that are

counterfeit reproductions of our products or that otherwise infringe upon

intellectual property rights held by us. Actions taken by us to establish and

protect our trademarks and other intellectual property rights may not be

adequate to prevent imitation of our products by others or to prevent others

from seeking to block sales of our products as violating trademarks and

intellectual property rights. If we are unsuccessful in challenging a third

party’s products on the basis of infringement of our intellectual property

rights, continued sales of such products by that or any other third party could

adversely impact the Kobe brand, result in the shift of consumer preferences

away from our products and generally have a material adverse effect on our

business, financial condition and results of operations.

All

products and logos below are protected by patents issued by the Trademark Office

State Administration for Industry and Commerce of People’s Republic of

China.

|

Date

|

Number

|

Registered

Trademark

|

|

12/21/1999

|

1345896

|

FREE

AIR FEET/天足概念

|

|

06/14/2000

|

1408187

|

KB8Kobe/科比

|

|

11/21/2001

|

1669434

|

AirŸcarter

新飞人‧卡特

|

|

01/16/2004

|

3740958

|

(Exhibit

‘a’)

|

|

05/08/2004

|

ZC4052099SL

|

(Exhibit

‘b’)

|

|

06/28/2006

|

3740959

|

KB8

|

|

06/28/2006

|

3740970

|

科比

|

|

07/28/2006

|

3750412

|

天足概念

|

|

08/07/2006

|

3750413

|

FREE

AIR FEET

|

|

01/07/2007

|

3829504

|

KOBE8

|

|

12/21/2007

|

ZC3976339SL

|

KING

JAMES

|

|

05/16/2008

|

4185429

|

科比飞人

|

Environmental

Protection

Compliance

with national, provincial or local provisions which have been enacted or adopted

regulating the discharge of materials into the environment, or otherwise

relating to the protection of the environment have not had, nor are they

expected to have, any material effect on the capital expenditures, earnings or

competitive position of the Company. The Company uses and generates certain

substances and wastes that are or can be regulated or may be deemed hazardous

under certain national, provincial or local regulations with respect to the

environment. The Company from time to time works with government agencies to

resolve cleanup issues at waste sites and other regulatory issues.

Properties

Our

corporate headquarter and factory is located at Yangdai Village, Chendai County,

Jinjiang City, Fujian Province in the PRC, which consist of an aggregate of

approximately 50,000 square meters. Such facility, which is situated

on approximately 7,500 square meters of developed land, is leased from the

Chinese government for a period of 50 years and is scheduled to expire in

2057.

Insurance

We have

obtained insurance for our properties, including our office building, factory

and equipment, etc. for a total of $2,000,000 insured amount, from September 1,

2009 until September 1, 2010, which we renew annually.

13

Employees

As of the

date hereof, we have approximately 1000 full-time employees. The breakdown of

our employees by department is:

|

General

and Administration Department

|

60 | |||

|

Production

Department

|

600 | |||

|

Shoe

Sole Department

|

250 | |||

|

Sales

Department

|

40 | |||

|

Research

and Development

|

50 |

We have

employment agreements with our employees for one-year term which are subject to

renew every year. We believe we have good relations with our

employees.

RISK

FACTORS

You

should carefully consider the risks described below together with all of the

other information included in this report before making an investment decision

with regard to our securities. The statements contained in or

incorporated herein that are not historic facts are forward-looking statements

that are subject to risks and uncertainties that could cause actual results to

differ materially from those set forth in or implied by forward-looking

statements. If any of the following risks actually occurs, our business,

financial condition or results of operations could be harmed. In that case, you

may lose all or part of your investment.

Risks Relating to Our

Business

The effects of the recent global

economic slowdown may continue to have a negative impact on our business,

results of operations or financial condition.

The

recent global economic slowdown has caused disruptions and extreme volatility in

global financial markets, increased rates of default and bankruptcy, and

declining consumer and business confidence, which has led to decreased levels of

consumer spending, particularly on discretionary items such as footwear and

sports wear. These macroeconomic developments have and could continue to

negatively impact our business, which depends on the general economic

environment and levels of consumer spending in the PRC and other parts of the

world that affect not only the ultimate consumer, but also retailers, who are

our primary direct customers. As a result, we may not be able to maintain or

increase our sales to existing customers, make sales to new customers, open and

operate new retail stores, maintain sales levels at our existing stores,

maintain or increase our international operations on a profitable basis, or

maintain or improve our earnings from operations as a percentage of net sales.

If the global economic slowdown continues for a significant period or continues

to worsen, our results of operations, financial condition, and cash flows could

be materially adversely affected.

Our

results of operations are cyclical and could be adversely affected by

fluctuations in the raw materials such as artificial leather, shoes sole and

fabric.

We are

largely dependent on the cost and supply of raw materials such as artificial

leather, shoes sole and fabric and the selling price of our products, which are

determined by constantly changing and volatile market forces of supply and

demand as well as other factors over which we have little or no control. These

other factors include:

|

•

|

competing

demand for the raw materials,

|

|

•

|

environmental

and conservation regulations, and

|

|

•

|

economic

conditions,

|

We cannot

assure you that all or part of any increased costs experienced by us from time

to time can be passed along to consumers of our products, in a timely manner or

at all.

Substantially

all of our business, assets and operations are located in the PRC.

Substantially

all of our business, assets and operations are located in PRC. The economy of

PRC differs from the economies of most developed countries in many respects. The

economy of PRC has been transitioning from a planned economy to a

market-oriented economy. Although in recent years the PRC government has

implemented measures emphasizing the utilization of market forces for economic

reform, the reduction of state ownership of productive assets and the

establishment of sound corporate governance in business enterprises, a

substantial portion of productive assets in PRC is still owned by the PRC

government. In addition, the PRC government continues to play a significant role

in regulating industry by imposing industrial policies. It also exercises

significant control over PRC’s economic growth through the allocation of

resources, controlling payment of foreign currency-denominated obligations,

setting monetary policy and providing preferential treatment to particular

industries or companies. Some of these measures benefit the overall economy of

PRC, but may have a negative effect on us.

14

Our

management has no experience in managing and operating a public company. Any

failure to comply or adequately comply with federal securities laws, rules or

regulations could subject us to fines or regulatory actions, which may

materially adversely affect our business, results of operations and financial

condition.

Our

current management has no experience managing and operating a public company and

relies in many instances on the professional experience and advice of third

parties including its attorneys and accountants. Failure to comply or adequately

comply with any laws, rules, or regulations applicable to our business may

result in fines or regulatory actions, which may materially adversely affect our

business, results of operation, or financial condition and could result in

delays in achieving the development of an active and liquid trading market for

our stock.

Our business and the success of our

products could be harmed if we are unable to maintain our brand

image.

Our

success to date has been due in large part to the strength of the Kobe brand,

and to a lesser degree, the reputation of our fashion brands. If we are unable

to timely and appropriately respond to changing consumer demand, our brand name

and brand image may be impaired. Even if we react appropriately to changes in

consumer preferences, consumers may consider our brand image to be outdated or

associate our brand with styles of footwear that are no longer popular. In the

past, several footwear companies including ours have experienced periods of

rapid growth in revenues and earnings followed by periods of declining sales and

losses. Our business may be similarly affected in the future.

Our

plans to expand our production, to increase research and development and to

improve and upgrade our internal control and management system will require

capital expenditures in 2010.

Our plans

to expand our production, to increase our research and development and to

improve and upgrade our internal control and management system will require

capital expenditures in 2010. We may also need further funding for working

capital, investments, potential acquisitions and research and development and

other corporate requirements. We cannot assure you that cash generated from our

operations will be sufficient to fund these development plans, or that our

actual capital expenditures and investments will not significantly exceed our

current planned amounts. If either of these conditions arises, we may have to

seek external financing to satisfy our capital needs. Our ability to obtain

external financing at reasonable costs is subject to a variety of uncertainties.

Failure to obtain sufficient external funds for our development plans could

adversely affect our business, financial condition and operating

performance.

We

derive all of our revenues from sales in the PRC and any downturn in the Chinese

economy could have a material adverse effect on our business and financial

condition.

All of

our revenues are generated from sales in the PRC. We anticipate that revenues

from sales of our products in the PRC will continue to represent the substantial

portion of our total revenues in the near future. Our sales and earnings can

also be affected by changes in the general economy since purchases of pork

products are generally discretionary for consumers. Our success is influenced by

a number of economic factors which affect disposable consumer income, such as

employment levels, business conditions, interest rates, oil and gas prices and

taxation rates. Adverse changes in these economic factors, among others, may

restrict consumer spending, thereby negatively affecting our sales and

profitability.

Our

planned expansion could be delayed or adversely affected by, among other things,

difficulties in obtaining sufficient financing, technical difficulties, or human

or other resource constraints.

Our

planned expansion could be delayed or adversely affected by, among other things,

difficulties in obtaining sufficient financing, technical difficulties, or human

or other resource constraints. Moreover, the costs involved in these projects

may exceed those originally contemplated. Costs savings and other economic

benefits expected from these projects may not materialize as a result of any

such project delays, cost overruns or changes in market circumstances. Failure

to obtain intended economic benefits from these projects could adversely affect

our business, financial condition and operating performances.

We

encounter substantial competition in our business and any failure to compete

effectively could adversely affect our results of operations.

Competition

in the sport shoes and sportswear industry is intense. Although we believe that

we do not compete directly with any single company with respect to its entire

range of products, our products compete with other branded products within their

product category as well as with private label products sold by retailers,

including some of our customers. Our sport shoes compete with sports shoes

offered by international companies such as Nike, Inc., adidas AG, Puma AG, and

New Balance Athletic Shoe, Inc. and PRC companies such as Anta Sports Products

Limited, Li Ning Company Limited and Qiaodan (China) Co., Ltd. We anticipate

that our competitors will continue to expand and seek to obtain additional

market share with competitive price and performance characteristics. Aggressive

expansion of our competitors or the entrance of new competitors into our markets

could have a material adverse effect on our business, results of operations and

financial condition.

15

Our

limited operating history may not serve as an adequate basis to judge our future

prospects and results of operations.

Our

limited operating history in the sports goods industry may not provide a

meaningful basis for evaluating our business. Hengfeng entered into its current

line of business “Kobe” branded shoes, sportswear and accessories in 2003,

although it is established in 1992. Although its revenues have grown rapidly

since its inception, we cannot guaranty that we will maintain profitability or

that we will not incur net losses in the future. We will continue to encounter

risks and difficulties that companies at a similar stage of development

frequently experience, including the potential failure to:

|

·

|

obtain

sufficient working capital to support our

expansion;

|

|

·

|

expand

our product offerings and maintain the high quality of our

products;

|

|

·

|

manage

our expanding operations and continue to fill customers’ orders on

time;

|

|

·

|

maintain

adequate control of our expenses allowing us to realize anticipated income

growth;

|

|

·

|

implement

our product development, sales, and acquisition strategies and adapt and

modify them as needed;

|

|

·

|

successfully

integrate any future acquisitions;

and

|

|

·

|

anticipate

and adapt to changing conditions in the sportswear industry resulting from

changes in government regulations, mergers and acquisitions involving our

competitors, technological developments and other significant competitive

and market dynamics.

|

If we are

not successful in addressing any or all of the foregoing risks, our business may

be materially and adversely affected.

We

need to manage growth in operations to maximize our potential growth and achieve

our expected revenues and our failure to manage growth will cause a disruption

of our operations resulting in the failure to generate revenue at levels we

expect.

In order

to maximize potential growth in our current and potential markets, we believe

that we must expand our producing operations. This expansion will place a

significant strain on our management and our operational, accounting, and

information systems. We expect that we will need to continue to improve our

financial controls, operating procedures, and management information systems. We

will also need to effectively train, motivate, and manage our employees. Our

failure to manage our growth could disrupt our operations and ultimately prevent

us from generating the revenues we expect.

We

cannot assure you that our growth strategy will be successful which may result

in a negative impact on our growth, financial condition, results of operations

and cash flow.

One of

our strategies is to develop self-owned stores. However, many obstacles to

entering such new markets exist including, but not limited to, established

companies in such existing markets in the PRC. We cannot, therefore, assure you

that we will be able to successfully overcome such obstacles and establish our

products in any additional markets. Our inability to implement this organic

growth strategy successfully may have a negative impact on our growth, future

financial condition, results of operations or cash flows.

If

we need additional capital to fund our growing operations, we may not be able to

obtain sufficient capital and may be forced to limit the scope of our

operations.

If

adequate additional financing is not available on reasonable terms, we may not

be able to expand our production lines and to develop self-owned stores, and we

would have to modify our business plans accordingly. There is no assurance that

additional financing will be available to us.

In

connection with our growth strategies, we may experience increased capital needs

and accordingly, we may not have sufficient capital to fund our future

operations without additional capital investments. Our capital needs will depend

on numerous factors, including (i) our profitability; (ii) the release of

competitive products by our competition; (iii) the level of our investment in

research and development; and (iv) the amount of our capital expenditures,

including acquisitions. We cannot assure you that we will be able to obtain

capital in the future to meet our needs.

16

In recent

years, the securities markets in the United States have experienced a high level

of price and volume volatility, and the market price of securities of many

companies have experienced wide fluctuations that have not necessarily been

related to the operations, performances, underlying asset values or prospects of

such companies. For these reasons, our securities can also be expected to be

subject to volatility resulting from purely market forces over which we will

have no control. If we need additional funding we will, most likely, seek such

funding in the United States (although we may be able to obtain funding in the

PRC) and the market fluctuations affect on our stock price could limit our

ability to obtain equity financing.

If we

cannot obtain additional funding, we may be required to: (i) limit our

expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate

capital expenditures. Such reductions could materially adversely affect our

business and our ability to compete.

Even if

we do find a source of additional capital, we may not be able to negotiate terms

and conditions for receiving the additional capital that are favorable to us.

Any future capital investments could dilute or otherwise materially and

adversely affect the holdings or rights of our existing shareholders. In

addition, new equity or convertible debt securities issued by us to obtain

financing could have rights, preferences and privileges senior to the Units. We

cannot give you any assurance that any additional financing will be available to

us, or if available, will be on terms favorable to us.

Need

for additional employees.

The

Company’s future success also depends upon its continuing ability to attract and

retain highly qualified personnel. Expansion of the Company’s business and the

management and operation of the Company will require additional managers and

employees with industry experience, and the success of the Company will be

highly dependent on the Company’s ability to attract and retain skilled

management personnel and other employees. There can be no assurance that the

Company will be able to attract or retain highly qualified personnel.

Competition for skilled personnel in the construction industry is significant.

This competition may make it more difficult and expensive to attract, hire and

retain qualified managers and employees.

The

loss of the services of our key employees, particularly the services rendered by

Qionglin Lin, our General Manager and Director, Mendoza Anding Lin, our

President, CEO and Chairman, Tommy Lo, our Chief Executive Officer, and Aling

Lin, our Director, could harm our business.

Our

success depends to a significant degree on the services rendered to us by our

key employees. If we fail to attract, train and retain sufficient

numbers of these qualified people, our prospects, business, financial condition

and results of operations will be materially and adversely affected. In

particular, we are heavily dependent on the continued services of Qionglin Lin,

our General Manager and Director, Mendoza Anding Lin, our President, CEO and

Chairman, Tommy Lo, our Chief Executive Officer, and Aling Lin, our Director.

The loss of any key employees, including members of our senior management team,

and our inability to attract highly skilled personnel with sufficient experience

in our industry could harm our business.

Our ability to compete could be

jeopardized ff we are unable to protect our intellectual property rights or if

we are sued for intellectual property infringement.

We

believe that our trademarks and other proprietary rights are important to our

success and our competitive position. We use trademarks on nearly all of our

products and believe that having distinctive marks that are readily identifiable

is an important factor in creating a market for our goods, in identifying us and

in distinguishing our goods from the goods of others. We consider our trademarks

to be among our most valuable assets, and we have registered these trademarks in

many countries. In addition, we own many other trademarks that we utilize in

marketing our products. We believe that our trademarks are generally sufficient

to permit us to carry on our business as presently conducted. While we

vigorously protect our trademarks against infringement, we cannot assure you

that we will be able to secure patents or trademark protection for our

intellectual property in the future or that protection will be adequate for

future products. Further, we have been sued for patent and trademark

infringement and cannot be sure that our activities do not and will not infringe

on the intellectual property rights of others. If we are compelled to prosecute

infringing parties, defend our intellectual property or defend ourselves from

intellectual property claims made by others, we may face significant expenses

and liability as well as the diversion of management’s attention from our

business, each of which could negatively impact our business or financial

condition.

In

addition, the laws of foreign countries where we source and distribute our

products may not protect intellectual property rights to the same extent as do

the laws of the PRC. We cannot assure you that the actions we have taken to

establish and protect our trademarks and other intellectual property rights

outside the PRC will be adequate to prevent imitation of our products by others

or, if necessary, successfully challenge another party’s counterfeit products or

products that otherwise infringe on our intellectual property rights on the

basis of trademark infringement. Continued sales of these products could

adversely affect our sales and our brand and result in the shift of consumer

preference away from our products. We may face significant expenses and

liability in connection with the protection of our intellectual property rights

outside the PRC, and if we are unable to successfully protect our rights or

resolve intellectual property conflicts with others, our business or financial

condition could be adversely affected.

17

Our principal stockholder is able to

control substantially all matters requiring a vote of our stockholders and his

interests may differ from the interests of our other

stockholders.

As of the

date hereof, Anding Lin, our President, beneficially owned 63% of our

outstanding common stock. Mr. Lin may have different interests than our

other stockholders, and because he is able to control substantially all matters

requiring approval by our stockholders, he may direct the operations of our

business in a manner contrary to the interests of our other stockholders.

Matters that require the approval of our stockholders include the election of

directors and the approval of mergers or other business combination

transactions. Mr. Lin also has control over our management and affairs. As

a result of such control, certain transactions are not possible without the

approval of Mr. Lin, including proxy contests, tender offers, open market

purchase programs or other transactions that can give our stockholders the

opportunity to realize a premium over the then-prevailing market prices for

their shares of our common stock.

Our

failure to comply with increasingly stringent environmental regulations and

related litigation could result in significant penalties, damages and adverse

publicity for our business.

In recent

years, the government of China has become increasingly concerned with the

degradation of China’s environment that has accompanied the country’s rapid

economic growth. In the future, we expect that our operations and

properties will be subject to extensive and increasingly stringent laws and

regulations pertaining to, among other things, the discharge of materials into

the environment and the handling and disposition of wastes (including solid and

hazardous wastes) or otherwise relating to protection of the environment.

Failure to comply with any laws and regulations and future changes to them may

result in significant consequences to us, including civil and criminal

penalties, liability for damages and negative publicity. We cannot

assure you that additional environmental issues will not require currently

unanticipated investigations, assessments or expenditures, or that requirements

applicable to us will not be altered in ways that will require us to incur

significant additional costs.

We

will incur significant costs to ensure compliance with United States corporate

governance and accounting requirements.

We will

incur significant costs associated with our public company reporting

requirements, costs associated with newly applicable corporate governance

requirements, including requirements under the Sarbanes-Oxley Act of 2002 and

other rules implemented by the Securities and Exchange Commission. We expect all

of these applicable rules and regulations to significantly increase our legal

and financial compliance costs and to make some activities more time consuming

and costly. We also expect that these applicable rules and regulations may make

it more difficult and more expensive for us to obtain director and officer

liability insurance and we may be required to accept reduced policy limits and

coverage or incur substantially higher costs to obtain the same or similar

coverage. As a result, it may be more difficult for us to attract and retain

qualified individuals to serve on our board of directors or as executive

officers. We are currently evaluating and monitoring developments with respect

to these newly applicable rules, and we cannot predict or estimate the amount of

additional costs we may incur or the timing of such costs.

We

may not be able to meet the accelerated filing and internal control reporting

requirements imposed by the Securities and Exchange Commission resulting in a

possible decline in the price of our common stock and our inability to obtain

future financing.

As

directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No.

33-8934 on June 26, 2008, the Securities and Exchange Commission adopted rules

requiring each public company to include a report of management on the company’s

internal controls over financial reporting in its annual reports. In

addition, the independent registered public accounting firm auditing a company’s

financial statements must also attest to and report on management’s assessment

of the effectiveness of the company’s internal controls over financial reporting

as well as the operating effectiveness of the company’s internal controls.

Commencing with its annual report for the year ending December 31, 2010, we will

be required to include a report of management on its internal control over

financial reporting. The internal control report must include a

statement

|

·

|

Of

management’s responsibility for establishing and maintaining adequate

internal control over its financial

reporting;

|

|

·

|

Of

management’s assessment of the effectiveness of its internal control over

financial reporting as of year end;

and

|

|

·

|

Of

the framework used by management to evaluate the effectiveness of our

internal control over financial

reporting.

|

Furthermore,

in the following year, our independent registered public accounting

firm is required to file its attestation report separately on our

internal control over financial reporting on whether it believes that we have

maintained, in all material respects, effective internal control over financial

reporting.

18

While we

expect to expend significant resources in developing the necessary documentation

and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there

is a risk that we may not be able to comply timely with all of the requirements

imposed by this rule. In the event that we are unable to receive a

positive attestation from our independent registered public accounting firm with

respect to our internal controls, investors and others may lose confidence in

the reliability of our financial statements and our stock price and ability to

obtain equity or debt financing as needed could suffer.

In

addition, in the event that our independent registered public accounting firm is

unable to rely on our internal controls in connection with its audit of our

financial statements, and in the further event that it is unable to devise

alternative procedures in order to satisfy itself as to the material accuracy of

our financial statements and related disclosures, it is possible that we would

be unable to file our Annual Report on Form 10-K with the Securities and

Exchange Commission, which could also adversely affect the market price of our

securities and our ability to secure additional financing as

needed.

The

transaction involves a reverse merger of a foreign company into a domestic shell

company, so that there is no history of compliance with United States securities

laws and accounting rules.

In order

to be able to comply with United States securities laws, Kobe

Sport prepared its financial statements for the first time under U.S.

generally accepted accounting principles and recently had its initial audit of

its financial statements in accordance with Public Company Accounting