Attached files

| file | filename |

|---|---|

| EX-21 - Linkwell CORP | v179445_ex21.htm |

| EX-32.1 - Linkwell CORP | v179445_ex32-1.htm |

| EX-23.1 - Linkwell CORP | v179445_ex23-1.htm |

| EX-31.2 - Linkwell CORP | v179445_ex31-2.htm |

| EX-31.1 - Linkwell CORP | v179445_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the Fiscal Year Ended December 31, 2009

OR

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

file number: 000-24977

Linkwell

Corporation

(Exact

name of registrant as specified in its charter)

|

Florida

|

65-1053546

|

|

(State

of Incorporation)

|

(I.R.S.

Employer

Identification

Number)

|

|

1104

Jiatang Road

Jiading

District

Shanghai

China

|

201807

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Securities

registered under Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which

registered

|

|

None

|

Not

Applicable

|

Securities

registered pursuant to Section 12(g) of the Act: common stock, par

value $0.0005 per share

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past

90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the

preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to

this Form 10-K. x

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of

“accelerated filer”, “large accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

|

Large

Accelerated Filer ¨

|

Accelerated

Filer ¨

|

Non-accelerated

Filer ¨

(Do

not check if a smaller

reporting

company)

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes ¨ No x

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates as of June 30, 2009, the last business day of the registrant’s

most recently completed second fiscal quarter, was approximately

$3,953,880.

The

number of shares outstanding of capital stock as of March 31, 2010 was

86,605,475.

|

TABLE

OF CONTENTS

|

||

|

Part

I

|

||

|

Item

1.

|

Business.

|

4

|

|

Item

1A.

|

Risk

Factors.

|

21

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

27

|

|

Item

2.

|

Properties.

|

27

|

|

Item

3.

|

Legal

Proceedings.

|

27

|

|

Item

4.

|

Removed

and Reserved.

|

27

|

|

Part

II

|

||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities.

|

28

|

|

Item

6.

|

Selected

Financial Data.

|

28

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

29

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

37

|

|

Item

8.

|

Financial

Statements and Supplementary Data.

|

37

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

37

|

|

Item

9A(T).

|

Controls

and Procedures.

|

37

|

|

Item

9B.

|

Other

Information.

|

38

|

|

Part

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance.

|

38

|

|

Item

11.

|

Executive

Compensation.

|

40

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

41

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

42

|

|

Item

14.

|

Principal

Accounting Fees and Services.

|

43

|

|

Part

IV

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules.

|

44

|

|

Signatures

|

47

|

2

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this annual report

contain or may contain forward-looking statements that are subject to known and

unknown risks, uncertainties and other factors which may cause actual results,

performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements. These forward-looking statements were based on various

factors and were derived utilizing numerous assumptions and other factors that

could cause our actual results to differ materially from those in the

forward-looking statements. These factors include, but are not

limited to, our ability to increase our revenues, develop our brands, implement

our strategic initiatives, economic, political and market conditions and

fluctuations, government and industry regulation, U.S. and global competition,

and other factors. Most of these factors are difficult to predict

accurately and are generally beyond our control.

You should consider the areas of risk

described in connection with any forward-looking statements that may be made in

this annual report. Readers are cautioned not to place undue reliance

on these forward-looking statements and readers should carefully review this

annual report in its entirety, including the risks described in Part I, Item 1A.

Risk Factors. Except for our ongoing obligations to disclose material

information under the Federal securities laws, we undertake no obligation to

release publicly any revisions to any forward-looking statements, to report

events or to report the occurrence of unanticipated events. These

forward-looking statements speak only as of the date of this annual report, and

you should not rely on these statements without also considering the risks and

uncertainties associated with these statements and our business.

OTHER

PERTINENT INFORMATION

As used

herein, unless the context indicates otherwise, the terms:

“Linkwell”,

the “Company”, “we” and “us” refers to Linkwell Corporation,

a Florida

corporation;

“Linkwell

Tech” refers to our 90% owned subsidiary Linkwell Tech Group, Inc.,

a Florida

corporation;

“LiKang

Disinfectant” refers to Shanghai LiKang Disinfectant High-Tech Company,

Limited,

a

wholly-owned subsidiary of Linkwell Tech;

“LiKang

Biological” refers to Shanghai LiKang Biological High-Tech Co.,

Ltd.,

a

wholly-owned subsidiary of LiKang Disinfectant;

“LiKang

International” refers to Shanghai LiKang International Trade Co.,

Ltd.,

formerly

a wholly-owned subsidiary of LiKang Disinfectant which was sold to Linkwell

International Trading Co., Limited on May 31, 2008.

We also

use the following terms when referring to certain related parties:

“Shanhai”

refers to Shanghai Shanhai Group,a Chinese company which used to be the minority

owner of LiKang Disinfectant;

“Meirui”

refers to Shanghai LiKang Meirui Pharmaceuticals High-Tech Co., Ltd., a

company of which Shanhai is a majority shareholder;

“ZhongYou”

refers to Shanghai ZhongYou Pharmaceutical High-Tech Co., Ltd., a company

owned by Shanghai Jiuqing Pharmaceuticals Company, Ltd., whose 65% owner is

Shanghai Ajiao Shiye Co. Ltd. Our Chairman and Chief Executive Officer Xuelian

Bian is a 60% shareholder of Shanghai Ajiao Shiye Co. Ltd.

The

People's Republic of China is herein referred to as China or the

PRC.

The

information which appears on our web site at www.linkwell.us is not part of this

report.

3

PART

I

ITEM

1. BUSINESS.

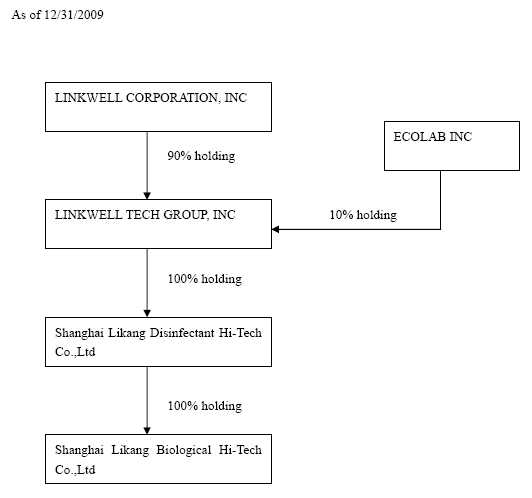

We operate under a holding company

structure and currently have one direct operating subsidiary, Linkwell Tech

Group Inc. (“Linkwell Tech”) a Florida corporation, of which we own 90%. On

February 15, 2008, Linkwell Tech sold 10% of its issued and outstanding capital

stock to Ecolab Inc., a Delaware corporation (“Ecolab”). Linkwell

Tech owns 100% of Shanghai LiKang Disinfectant High-Tech Company, Limited

(“LiKang Disinfectant”). We regard LiKang Disinfectant's business of

hospital disinfectant products as our primary business. LiKang

Disinfectant acquired 100% of LiKang Biological on March 5, 2009.

Linkwell Corporation, through LiKang

Disinfectant, is engaged in the development, manufacture, sale and distribution

of disinfectant health care products primarily to the medical industry in China.

We have a national marketing and sales presence throughout all twenty-two

provinces as well as four autonomous regions and four municipalities in China.

We currently employ forty full-time sales and marketing people based in

Shanghai. Shanghai ZhongYou Pharmaceutical High-Tech Co., Ltd,

(“ZhongYou Pharmaceutical”) a company 65% owned by our Chairman and Chief

Executive Officer, Xuelian Bian, also sells our products using seventy

independent sales representatives in China.

We market

our products to the medical industry in China, however we are making efforts to

diversify and expand our reach to the retail market. We have made

efforts to grow our customer base by expanding into the civil, industrial,

livestock and agricultural disinfection markets of China. Currently

we offer a variety of disinfectant products for the following

applications:

|

·

|

Skin

and mucous membrane disinfectants;

|

|

·

|

Hand

disinfectants (external);

|

|

·

|

Environment

and surface disinfectants;

|

|

·

|

Medical

devices and equipment

disinfectants;

|

|

·

|

Machine

disinfectants; and

|

|

·

|

Animal

disinfectants.

|

LiKang Disinfectant has fifty-six

marketed products, fifty of which are certified by one or more government

authorities; the Chinese Ministry of Health, State Food and Drug Administration,

or Ministry of Agriculture. China’s Ministry of Health approves those

products that require the highest level of licensing and have granted thirty

hygiene licenses to Linkwell. We also sell products which have been

developed and manufactured by third parties. These parties

manufacture disinfectant products that generated approximately 1.0% of our

revenue for the fiscal year ended December 31, 2009. Products that we

manufacture account for approximately 99.0% of our total net revenues for the

fiscal year ended December 31, 2009.

Prior to May 31, 2008, we owned 100% of

Shanghai LiKang International Trade Co. Ltd., through our subsidiary LiKang

Disinfectant. The primary business of LiKang International was the import and

export of a variety of products and services ranging from small medical

equipment and chemical products to computers. On May 31, 2008, LiKang

Disinfectant sold 100% of the capital stock of LiKang International to Linkwell

International Trading Co., Ltd. a company registered in Hong Kong which is 100%

owned by Mr. Wei Guan our Vice President and Director.

Corporate Structure

Chart

Industry

Background

In 2007, Frost & Sullivan stated,

“The Chinese healthcare industry has been one of the fastest growing healthcare

industries in the world. It is expected to become the fifth largest by 2010. Its

growth is mainly driven by the government’s initiatives to simplify regulatory

procedures, enhance trade relations, and attract foreign investment through

friendly policies.”

4

According to the China Federation of

Industrial Economics, China’s disinfectant industry is estimated at well over

$6.5 billion. Other experts believe the Chinese market demand for

biocides will increase by approximately 7.9% annually to 574,000 metric tons by

the year 2010.

The disinfectant industry in China may

be characterized as an emerging industry, populated by approximately 1,000 small

domestic manufacturers and distributors, and half a dozen large international

companies with limited presence and products.

Major contributing factors responsible

for the vigor of China’s disinfectant industry growth include the transition to

a market economy, increasing health consciousness in the general population and

increasing government health standards and education.

Increasing Domestic

Demand

Since the shift to a market economy, the

Chinese government has initiated several policies to improve public health and

living standards and improve the Chinese healthcare

industry. Consequently, these initiatives and traditional market

forces have driven increasing demand for disinfectant

products. According to Frost & Sullivan, China’s healthcare

expenditures grew from 5.0% of GDP in 1999 to 6.7% in 2005, representing a

growth rate of approximately 5%. During the same period, USA healthcare

expenditures grew from 13.2% to 15.9%, representing a growth rate of

approximately 3%.

After nearly 30 years of sustaining

economic growth in China, both the Chinese government and the public have become

more concerned about the quality and cost of healthcare in China. A greater

public awareness of the health benefits of our products, as well as these new

public concerns have led to a surge in interest for disinfectant products in

China with consumers maintaining stockpiles of disinfectant products. Other

factors that support the growth in demand for disinfectant products

include:

· China’s

population of 1.3 billion; a large and rapidly aging population base that

require better sanitization standards to protect their

health. According to a United Nations study released in 2005, the

number of people aged 60 or over in China is expected to rise to more than 430

million people;

· Healthcare

professionals and citizens want a healthcare system and hygienic standards as

advanced as western countries;

· Ongoing

government reforms in hospital sanitation, medical standards and disinfectant

regulations;

· Government

educational program to increase public awareness of public health and hygienic

standards; and

· An

increase in government investment in healthcare and medical services to achieve

sustainable development of the disinfectant industry.

Recent Health Concerns in

China

The most critical factors that triggered

health concerns in China are the recent and recurring health crises that have

led to several epidemics (see Table below) and potential pandemics. In response,

the Chinese government has taken initiatives to improve public health and living

standards, including the establishment of The Ministry of Public Health in China

for the disinfectant industry in China.

5

|

Outbreak time

|

Location

|

Disease

|

Situation

|

|||

|

January,

1988

|

Shanghai

|

Hepatitis

A

|

310,000

reported cases of Hepatitis A, 47 deaths

|

|||

|

April

- May, 1998

|

Shenzhen

|

Sub-Tuberculosis

bacillus disease

M.

chelonae

|

Shenzhen

Woman and Children Hospital reports an airborne infection. 168 patients

infected, 46 severe cases

|

|||

|

November

2002

|

Throughout

China

|

SARS

|

8,000

reported cases, 800 deaths

|

|||

|

June

24 - August 20 2005

|

Sichuan

Province

|

Streptococcus suis in

swine and humans

|

204

reported cases of humans infected with the Swine streptococci in Sichuan,

38 deaths

|

|||

|

April

2005

|

Throughout

China

|

Pulmonary

tuberculosis, Hepatitis B

|

Pulmonary

tuberculosis, Hepatitis B remain top two priorities on the infectious

disease list in China

|

|||

|

June,

2005

|

Tibet

|

Bubonic

plague

|

Five

infected cases reported, two deaths

|

|||

|

July-September

2005

|

Hunan,

Fujian, Zhejiang provinces

|

Cholera

|

638

cases reported, two deaths

|

|||

|

August,

2005

|

Guizhou,

Ningxia, Liaoning, Jilin

|

Anthrax

|

140

cases reported, one death

|

|||

|

October,

2005

|

Inner

Mongolia , Hunan , Anhui , Liaoning , and Hubei provinces

|

Avian

Flu

|

Three

confirmed cases reported, two deaths

|

|||

|

October,

2005

|

Zhejiang,

Anhui provinces

|

highly

pathogenic bird flu

|

One

confirmed case in each province reported

|

|||

|

March

24, 2006

|

Shanghai

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

June

16,2006

|

Guangdong

Province

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

August

14, 2006

|

XinJiang

Province

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

January

9, 2007

|

Anhui

provinces

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

February

27, 2007

|

Fujian

provinces

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

March

28, 2007

|

Anhui

provinces

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

May

24, 2007

|

People’s

Liberation Army X department

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

December

2, 2007

|

Jiangsu

provinces

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

December

6, 2007

|

Jiangsu

provinces

|

highly

pathogenic bird flu

|

One

confirmed case reported

|

|||

|

January-February

, 2008

|

Xinjiang

municipality

|

Measles

Virus

|

11,000

cases reported, 21 deaths

|

|||

|

February,

2008

|

Guangdong,

Guangxi and Hunan provinces

|

Avian

Flu

|

Three

cases reported, three deaths

|

|||

|

April-May,

2008

|

Nationwide

|

Hand,

Foot and Mouth Disease

|

176,321

cases reported, 40 deaths

|

|||

|

January-September,

2008

|

Nationwide

|

HIV

|

44,839

cases reported, 6,897 deaths

|

|||

|

October-November,

2008

|

Hainan

province

|

Cholera

|

42

cases reported,

|

|||

|

October-November,

2008

|

Hainan

province

|

Diarrhea

|

351

cases reported

|

|||

|

January,

2009

|

Nationwide

|

Avian

Flu

|

Eight

cases reported, five deaths

|

|||

|

April,

2009

|

Worldwide

|

H1N1

|

12,220

deaths deaths

|

|||

|

November,

2009

|

|

Ukraine

|

|

Flu

|

|

1.4

million infected and 328

deaths.

|

SARS - Severe Acute

Respiratory Syndrome

In recent years, the Severe Acute

Respiratory Syndrome (SARS) has threatened the public community. SARS, which is

a viral respiratory illness caused by a corona virus, called SARS-associated

corona virus (SARS-CoV), was first reported in Asia in November 2002. Over the

next few months, the illness spread to more than two dozen countries in North

America, South America, Europe, and Asia before the SARS global outbreak of 2003

was contained. In April 2004, the Chinese Ministry of Health reported several

new cases of possible SARS outbreaks in Beijing and the Anhui Province, which is

located in east-central China.

6

According to the Center for Disease

Control of the central government of China, the common manner in which SARS

seems to spread is by close person-to-person contact. The virus that causes SARS

is thought to be transmitted most readily by respiratory droplets (“droplet

spread”) when an infected person coughs or sneezes. Droplet spread

occurs as germs from the cough or sneeze of an infected person are propelled a

short distance (generally up to three feet) through the air and deposited on the

mucous membranes of the mouth, nose, or eyes of nearby persons. The virus also

can spread when a person touches a surface or object contaminated with

infectious droplets and then touches his or her mouth, nose, or eye(s).

Ultimately, there is much the global community does not know about SARS, and it

is possible that the SARS virus might spread more broadly through the air

(airborne spread) or by other ways that are not yet known.

Avian

Influenza

In 2005, the threat of a global pandemic

as a result of the avian flu began to capture the attention of the global

community. The avian flu is a type of the A strain virus that infects birds.

Typically, it is not common for humans to be infected with the virus via contact

with birds, however a few bird-to-human outbreaks have been reported and most

have been in Asia. Humans were infected when they came into contact with sick

birds or contaminated surfaces. In most cases, infected persons reported

flu-like symptoms, but some had more serious complications, including pneumonia

and acute respiratory distress. The avian flu has led to increased concerns for

improved health conditions.

Up to February 5, 2009, there were 405

confirmed cases of highly pathogenic bird flu reported throughout the world,

that resulted in 254 deaths. Within China there were 11 confirmed cases

resulting in eight deaths during 2008.

H1N1

HINI is an influenza virus that had

never been identified as a cause of infections in people before the current H1N1

pandemic. Genetic analyses of this virus have shown that it originated from

animal influenza viruses and is unrelated to the human seasonal H1N1 viruses

that have been in general circulation among people since 1977.

Antigenic

analysis has shown that antibodies to the seasonal H1N1 virus do not protect

against the pandemic H1N1 virus. However, other studies have shown that a

significant percentage of people age 65 and older do have some immunity against

the pandemic virus. This suggests that some people in older age groups may have

some cross protection from exposure to viruses that have circulated in the more

distant past.

Unlike

typical seasonal flu patterns, the new virus caused high levels of summer

infections in the northern hemisphere, and then even higher levels of activity

during cooler months in this part of the world. After early outbreaks in North

America in April 2009 the new influenza virus spread rapidly around the world.

To date, most countries in the world have confirmed infections from the new

virus. As of December 27 2009, worldwide more than 208 countries and overseas

territories or communities have reported laboratory confirmed cases of pandemic

influenza H1N1 2009, including at least 12,220 deaths.

The new

virus has also led to patterns of death and illness not normally seen in

influenza infections. Most of the deaths caused by the pandemic influenza have

occurred among younger people, including those who were otherwise healthy.

Pregnant women, younger children and people of any age with certain chronic lung

or other medical conditions appear to be at higher risk of more complicated or

severe illness. Many of the severe cases have been due to viral pneumonia, which

is harder to treat than bacterial pneumonias usually associated with seasonal

influenza. Many of these patients have required intensive care.

H1N1 Flu viruses are spread mainly from

person to person through coughing or sneezing by people with influenza.

Sometimes people may become infected by touching something with flu viruses on

it and then touching their eyes, mouth, or nose. Providing sufficient facilities

for hand washing and alcohol-based hand sanitizers in common workplace areas

such as lobbies, corridors, and rest rooms can reduce the chance of spread of

the H1N1 virus. Studies have shown that influenza virus can survive on

environmental surfaces and can infect a person for up to 2-8 hours after being

deposited on the surface. Disinfecting commonly touched hard surfaces in the

workplace, such as work stations, counter tops, door knobs, and bathroom

surfaces by wiping them down with disinfectant can reduce the chance of spread

of the H1N1 virus.

7

China Health

Standards

In July 2002, the Chinese Ministry of

Public Health issued the 27th order of Ministry of Health of the People's

Republic of China establishing national standards for the disinfection

industry. The first criterion of the new order stipulated that

disinfectant manufacturers in China must obtain a license to manufacture hygiene

disinfectants. Secondly, prior to release, all disinfectant

instruments must obtain the official hygiene permit document of both the local

provincial hygiene administrative department and the Ministry of Public

Health.

In June 2009, the Chinese Ministry of

Public Health issued the Hygiene Standard of Manufacturers of Disinfection

Products (2009) (“Hygiene Standard”) which updated the previously issued 2004

version. It specifies plant layout, hygiene requirements for workplaces,

requirements for production equipment, materials, warehouse and workers. The

Hygiene Standard will go into effect on January 1, 2010 and will restrict market

access of some small disinfectant companies due to the high Good Manufacturing

Practice (“GMP”) standard which should prove to be beneficial for normalization

of the disinfectant market.

The table

below details the 30 licenses issued to LiKang Disinfectant by the Chinese

Ministry of Public Health.

|

#

|

Products

|

Date

|

||

|

1

|

An’erdian

Skin Disinfectant

|

2003.2.13

|

||

|

2

|

An’erdian-type

2nd skin disinfectant

|

2002.11.22

|

||

|

3

|

An’erdian-type

3rd skin and mucous membrane disinfectant

|

2005.1.19

|

||

|

4

|

Dian’erkang

Aerosol Disinfectant

|

2004.3.22

|

||

|

5

|

Dian’erkang

2% glutaraldehyde disinfectant

|

2002.11.22

|

||

|

6

|

Aiershi

disinfectant tablets

|

2004.2.9

|

||

|

7

|

Aiershi

disinfectant

|

2004.2.9

|

||

|

8

|

Dian’erkang

PVP-I disinfectant

|

2005.3.30

|

||

|

9

|

Dian’erkang

Iodophor disinfectant

|

2004.2.19

|

||

|

10

|

Jifro

disinfectant gel

|

2005.1.19

|

||

|

11

|

Dian’erkang

alcohol disinfectant

|

2003.12.23

|

||

|

12

|

Dian’erkang

compound iodine disinfectant

|

2004.4.28

|

||

|

13

|

Lvshaxing

disinfectant granule

|

2004.2.19

|

||

|

14

|

Lvshaxing

disinfectant tablets

|

2004.3.29

|

||

|

15

|

LiKang

test paper of chlorine

|

2004.1.16

|

||

|

16

|

Jifro

4% Chlorhexidine gluconate surgical hand scrub

|

2004.9.7

|

||

|

17

|

JifroSongning

disinfectant

|

2004.9.7

|

||

|

18

|

Lineng

glutaraldehyde disinfectant

|

2005.2.17

|

||

|

19

|

LiKang

121 steam pressure sterilization chemical indicator

|

2005.3.30

|

||

|

20

|

LiKang

132 steam pressure sterilization chemical indicator

|

2005.3.30

|

||

|

21

|

LiKang

steam pressure sterilization chemical indicator

|

2005.4.1

|

||

|

22

|

LiKang

84 disinfectant

|

2005.6.27

|

||

|

23

|

LiKang

Glutaraldehyde Monitors (Strip)

|

2005.12.14

|

||

|

24

|

PuTai

Skin Disinfectant

|

2007.1.11

|

||

|

25

|

PuTai

washless surgical hand scrub

|

2007.1.11

|

||

|

26

|

PuTai

washless surgical hand foam disinfectant

|

2007.1.11

|

||

|

27

|

LiKang

disinfectant detergent

|

2007.4.19

|

||

|

28

|

JifroTaixin

disinfectant

|

2007.6.4

|

||

|

29

|

Jifro

surgical hand scrub

|

2009.12.22

|

||

|

30

|

|

Putai

2% Chlorhexidine gluconate disinfectant

|

|

2009.12.22

|

Product

Lines

We market

fifty-six products, which range from air disinfection machines to hot press

bags, disinfection swabs, and disinfection indicators. Our products

fall into five categories and six product types.

8

Five

Product Categories:

|

·

|

Skin

and Mucous Membrane Disinfectants – Eight

Products

|

|

·

|

Hand

Disinfectants – Eight Products

|

|

·

|

Environment

and Surface Disinfectants – Ten

Products

|

|

·

|

Medical

Devices and Equipment Disinfectants – Five

Products

|

|

·

|

Air

disinfection equipment – Seven

Products

|

|

·

|

Other

products – Eighteen Products

|

Six

Product Types:

|

·

|

Liquids

- gel

|

|

·

|

Tablets

- powder

|

|

·

|

Aerosol

|

|

·

|

Chemical

indicator

|

|

·

|

Disinfectant

appliance

|

|

·

|

Liquids

- foam

|

We believe our varied product line gives

us a marketing advantage to build a national customer base for our products and

services. Approximately 99.0% of our sales are derived from products

we have internally developed and produced and 1.0% of sales are produced by

outside companies. The tables below offer a summary of our current product

offerings:

Skin and Mucous Membrane

Disinfectants

Skin and mucous membrane disinfectants

target both external and internal applications. Prior to operations,

incisions, or injections the products are used to clean the skin

surface. Mucous membrane disinfectants target internal germs located

in the mouth, eye, perineum, and other internal sources. This product

group accounted for approximately 45.8% of our fiscal year 2009 sales, and

approximately 51.7% of our fiscal year 2008 sales. The table below

lists our skin and/or mucous membrane disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

An’erdian

Skin Disinfectant

|

iodine,

alcohol

|

Skin

disinfectant

|

Q/SUVE

20-2003

|

|||

|

An’erdian-type

3rd skin and mucous membrane disinfectant

|

iodine,

chlorhexidine

|

Skin

& mucous membrane disinfectant

|

Q/SUVE

22-2003

|

|||

|

Dian’erkang

PVP-I disinfectant

|

Povidone-iodine

|

Skin

& mucous membrane disinfectant

|

Q/SUVE

28-2004

|

|||

|

Dian’erkang

alcohol disinfectant

|

alcohol

|

Skin

disinfectant

|

Q/SUVE

08-2004

|

|||

|

PuTai

Skin disinfectant

|

|

Chlorhexidine

gluconate, alcohol

|

|

Skin

disinfectant

|

|

Q/SUVE

37-2006

|

9

Hand

Disinfectants

These disinfectants target the skin

surface. Products are applied to the skin prior to medial

procedures. This product group accounted for approximately 26.3% of

our fiscal year 2009 sales and approximately 18.7% of our fiscal year 2008

sales. The table below lists our hand disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Jifro

antimicrobial hand washing

|

Chlorhexidine

|

Hand

washing

|

Q/SUVE

04-2003

|

|||

|

Jifro

disinfectant gel

|

DP300

(Triclosan)

|

Hand

disinfectant

|

Q/SUVE

02-2003

|

|||

|

Jifro

4% Chlorhexidine gluconate surgical hand scrub

|

Chlorhexidine

gluconate

|

Surgical

hand disinfectant

|

Q/SUVE

09-2004

|

|||

|

PuTai

washless surgical hand scrub

|

Chlorhexidine

gluconate, alcohol

|

Hand

disinfectant

|

Q/SUVE

39-2006

|

|||

|

PuTai

washless surgical hand foam disinfectant

|

|

Chlorhexidine

gluconate, alcohol

|

|

Hand

disinfectant

|

|

Q/SUVE

38-2006

|

Environment and Surface

Disinfectants

These disinfectants target a variety of

surfaces, such as floors, walls, tables, and medical

devices. Additionally, the products can be applied to cloth materials

including furniture and bedding. This product group accounted for

approximately 12.5% of our fiscal year 2009 sales and approximately 17.7% of our

fiscal year 2008 sales. The table below lists our environment and

surface disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Aiershi

disinfectant tablets

|

Trichloroisocyanuric

acid

|

Environment

and surface disinfection

|

Q/SUVE

34-2004

|

|||

|

Lvshaxing

disinfectant tablets

|

Dichloro

dimethylhydantoin

|

Environment

and surface disinfection

|

Q/SUVE

33-2003

|

|||

|

Dian’erkang

aerosol disinfectant

|

Benzethonium

Chloride

|

Environment

and surface disinfection, preventing the spread of airborne viruses such

as human influenza virus, SARS, and the Bird flu virus.

|

Q/SUVE

07-2004

|

|||

|

Lvshaxing

disinfectant granule

|

Dichloro

dimethylhydantoin

|

Environment

and surface disinfection

|

Q/SUVE

32-2003

|

|||

|

LiKang

disinfectant detergent

|

|

Sodium

hypochlorite

|

|

Surface

disinfectant

|

|

Q/SUVE

37-2006

|

Medical Devices and

Equipment Disinfectants

This line of disinfectants targets

medical equipment, including the sterilization of thermo sensitive instruments

and endoscope equipment. This product group accounted for

approximately 9.9% of our fiscal year 2009 sales and approximately 10.6% of our

fiscal year 2008 sales. The table below lists our medical device and

equipment disinfectants.

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Dian’erkang

2% glutaraldehyde disinfectant

|

Glutaraldehyde

|

Disinfection

and sterilization of device

|

Q/SUVE

10-2003

|

|||

|

Dian’erkang

2% glutaraldehyde disinfectant (sales to Olympus

Corporation)

|

Glutaraldehyde

|

Disinfection

and sterilization of endoscopes

|

Q/SUVE

10-2003

|

|||

|

Dian’erkang

multi-enzyme rapid detergents

|

|

Multi-Enzyme

|

|

Rinsing

and decontamination of device

|

|

Q/SUVE

14-2004

|

Machine

Series

The machine series is a line of

disinfectants that target air quality. This product group accounted

for approximately 1.3% of our fiscal year 2009 sales and approximately 1.1% of

our fiscal year 2008 sales. The table below lists our machine series

disinfectants.

10

|

Product Names

|

Ingredients

|

Application

|

Industry Standard

|

|||

|

Lvshaxing

LKQG-1000 air disinfection machine

|

Ozone,

ultraviolet radiation, electrostatic

|

Air

disinfection

|

Q/SUPE

09-2003

|

|||

|

An’erdian

disinfection swab

|

An’erdian

|

Skin

and disinfection

|

Q/NYMN07-2003

|

|||

|

LiKang

test paper of chlorine

|

reagent

|

Indicates

disinfectant concentration

|

Q/SUVE

40-2003

|

|||

|

LiKang

121 steam pressure sterilization chemical indicator (card and adhesive

tape)

|

Indication

oil

|

Indicates

sterilization effect

|

Q/SUVE

16-2005

|

|||

|

LiKang

132 steam pressure sterilization chemical indicator

(label)

|

Indication

oil

|

Indicates

sterilization effect

|

Q/SUVE

17-2005

|

|||

|

LiKang

steam pressure sterilization chemical indicator

|

|

Indication

oil

|

|

Indicates

sterilization effect

|

|

Q/SUVE

18-2005

|

Retail

products

In 2005, we began to expand our

distribution reach to the retail market. As a result, our products have gained

access to hotels, schools, supermarkets, and drugstores. We have

repackaged commercial disinfectant products for sale to the consumer

market. Since October 1999, we redeveloped four separate products for

distribution to the retail market. LiKang Disinfectant redeveloped

the following products in the months and years listed:

|

·

|

Jin

Zhongda collutory (mouthwash)

|

October

1999

|

|

·

|

Antibacterial

lubricant

|

October

1999

|

|

·

|

LiKang

Disinfectant 84

|

August

2005

|

|

·

|

Dian’erkang

aerosol disinfectant

|

October

2005

|

Customers

We sell our products on a wholesale and

retail basis to the medical community in China. We have approximately

6,000 active and recurring customers including hospitals, medical suppliers, and

distribution companies throughout China. We maintain over 20

distribution contracts with wholesale dealers and agents. We

generally offer payment terms of four to six months before payment for the

products is due. For the fiscal year ended December 31, 2009 two

affiliated entities that are our customers, ZhongYou Pharmaceutical and Shanghai

Jiuqing Pharmaceuticals Co. Ltd., represented approximately 36.6% of our total

net revenues.

Manufacturing

We operate two production facilities in

Shanghai, one located in the Shanghai Jiading district and one located in the

Shanghai Jinshan district. Products are manufactured primarily in

liquid, tablet, and powder form. Approximately 99% of LiKang

Disinfectant’s revenues for fiscal 2009 were derived from products manufactured

in these two factories.

The Shanghai Jiading district factory is

approximately 21,500 square feet, all of which is used for

production. The main products produced at the Shanghai Jiading

district factory are liquid and index disinfectant devices. The

manufacturing facility has the capacity to produce approximately 9 million

liters of liquid disinfectant annually. The manufacturing cycle for

the liquids, from formulation to finished product, is one day.

The Shanghai Jinshan district factory is

approximately 4,300 square feet and is used in the manufacture of the tablet and

powder forms of disinfectants. The manufacturing capacity is 300

metric tons of tablet and 180 metric tons of powder disinfectant

annually. The average manufacturing cycle for the tablets and powder,

from formulation to finished product, is one day.

11

During fiscal 2007, following GMP

certification for both the factory and the equipment; we began utilizing the

services of LiKang Biological, a related party, to manufacture some of our

products including our An'erdian and Dian'erkang lines of

disinfectants. On March 25, 2008, Linkwell Tech purchased 100% of the

issued and outstanding stock of LiKang Biological.

We have

found in our experience that products manufactured at GMP certified facilities

utilizing GMP certified equipment can be sold at higher prices than similar

products manufactured at non- GMP certified facilities. While GMP

certified products cost more to produce, we are able to increase our selling

prices proportionally. Our product packaging varies to meet different

needs of the market. We package our liquid and gel disinfectants in popular

sizes ranging from 40 ml to 5 liters. We package these tablets in 50 tablet, 100

tablet and 200 tablet bottles. Finally, we package our powder disinfectants in

250 gram and 500 gram containers.

We maintain an inventory of finished

products equal to approximately 1 month of average sales. Currently,

we are manufacturing at about 50% of full capacity based upon our current

product demand, and we have the ability to increase to full capacity if demand

continues to increase.

We have an in-house fulfillment and

distribution operation, which is used to manage our supply chain, beginning with

the placement of the order, continuing through order processing, packaging and

shipping the products to each customer. We maintain inventory and

fill customer orders from both the Jiading factory and the Jinshan

factory.

Raw

Materials

We purchase raw materials from six

primary suppliers, and we have signed purchase contracts with these suppliers in

an effort to ensure a steady supply of raw materials. We have

maintained stable business relations with these suppliers for over 10 years, and

believe that our relationships with these primary suppliers will remain

stable. In the event the relationships falter, there are many

suppliers with the capability to supply our company. We purchase raw

materials on payment terms of 30 days to three months. Some of the

suppliers import from foreign countries, as listed below, and we purchase

directly from these suppliers.

The table below details the supply

relationships for raw materials

|

Raw materials

|

Suppliers

|

Origin

|

||

|

Iodine

|

Shanghai

Wenshui Chemical Co., Ltd

|

USA

|

||

|

Potassium

iodide

|

Shanghai

Wenshui Chemical Co., Ltd

|

Holland

|

||

|

Glutaraldehyde

|

Shanghai

Jin an tang Hygienical Product Factory

|

Germany

|

||

|

Triclosan

|

Ciba

Specialty Chemicals (China) LTD

|

Domestic

|

||

|

Alcohol

|

Shanghai

Jangbo Chemical Co., L td

|

Domestic

|

||

|

Trichloroisocyanuric

acid

|

Xuzhou

Keweisi Disinfectant Co., Ltd

|

Domestic

|

Customer Service and

Support

We believe that a high level of customer

service and support is critical in retaining and expanding our customer

base. Customer care representatives participate in ongoing training

programs under the supervision of our training managers. These

training sessions include a variety of topics such as product knowledge and

customer service tips. Our customer care representatives respond to

customers’ e-mails and calls that are related to order status, prices and

shipping. If our customer care representatives are unable to respond

to a customer’s inquiry at the time of the call, we strive to provide an answer

within 24 hours. We believe our customer care representatives are a

valuable source of feedback regarding customer satisfaction. Our

customer returns and credits average approximately 1% of total

sales.

New Product

Development

We are committed to research and

development. LiKang Disinfectant was created as a research and

development organization by the Second Military Medical University (SMMU) of the

Chinese Army in 1988. We develop our products internally and own all

rights associated with these products.

12

We commercialized four new disinfectant

products in 2007, including PuTai Skin Disinfectant, PuTai washless surgical

hand scrub, PuTai washless surgical hand foam disinfectant and LiKang

disinfectant detergent, which is an environmental and surface

disinfectant. In 2008, 8 products were in development and licensing

applications were filed for 4 of these products. In 2009, we commercialized two

new disinfectant products, Jifro surgical hand scrub and Putai 2% Chlorhexidine

gluconate disinfectant.

For the fiscal years ended December 31,

2009 and 2008, we spent approximately $108,026 and approximately $63,552,

respectively, on research and development.

Marketing and

Sales

We were formed in 1988 as a research and

development organization by the Second Military Medical University (SMMU) of the

Chinese Army. Our CEO, Mr. Xuelian Bian, was a member of the staff of

SMMU. We believe that his relationships with alumni and business

persons associated with SMMU provide us with certain marketing

advantages. The university is a well recognized, prestigious

institution in China and many of its graduates work at hospitals, medical

suppliers, and distribution companies throughout China in senior positions,

which places them in the decision making process for purchasing the kind of

products we sell. In addition, the students and faculty at the

university provide a pool of talent from which we draw, both as potential

employees or summer interns who go on to work at other companies, many of whom

are customers or potential customers for our products. In marketing

our products, we seek to leverage these relationships.

During the 2007 fiscal year, we expanded

our distribution capability in the PRC. We have a national marketing

and sales presence throughout all 22 provinces, as well as four autonomous

regions, and four municipalities of China. We currently employ 40

full-time sales and marketing people based in Shanghai. ZhongYou

Pharmaceutical, an affiliate, also sells our products using 70 independent sales

representatives in other provinces of China.

Approximately 26.3% of our sales are

achieved by our proprietary sales force, while the remaining 73.7% are

outsourced to independent dealers and agents. We compensate our proprietary

salesman with a base salary plus commission. The sales representatives are

located in each of China’s provinces. The external sales network

currently covers hospitals in the following 22 provinces including: Beijing,

Guangdong, Tianjin, Fujian, Yunnan, Hainan, Jiangsu, Zhejiang, Anhui, Shandong,

Henan, Hebei, Liaoning, Heilongjiang, Shanxi, Gansu, Ningxia, Guizhou, Hunan,

Sichuan, Xinjiang, Neimenggu. The independent sales representatives

sell directly to the end-users.

Disinfectant Educational

Center

On May 25, 2006, we entered into an

agreement with China Pest Infestation Control and Sanitation Association, an

association governed by the Chinese central government, to establish and operate

a disinfectant educational center in Beijing, China. We will be

responsible for the establishment and development of the disinfectant

educational center, as well as its management and funding. The China

Pest Infestation Control and Sanitation Association will be responsible for

establishing a job training base in Beijing. We believe we were

selected to participate in this program based upon our reputation and experience

in the disinfectant industry.

We anticipate that the disinfectant

educational center will offer a job training program to educate and train

professionals to work in the disinfectant field. The disinfectant

educational center will be a tuition based education program for which graduates

will receive a license from the China Pest Infestation Control and Sanitation

Association. After completion of the program, it is envisioned that a

personnel exchange service center of the Chinese central government's Health

Department will function much like a placement office and assist the center's

graduates in securing positions with companies seeking to fill positions in the

PRC. From time to time we may also recruit graduates from the

disinfectant educational center to join our company.

In 2006, LiKang Disinfectant entered

into an agreement with the China Pest Infestation Control Association, the

Ministry of Health and the Beijing Olympic Game Committee to establish and

operate a disinfectant educational center in Beijing, China. In

accordance with the agreement, LiKang Disinfectant is responsible for the

establishment of the disinfectant educational center, as well as its management

and funding. As of December 31, 2007, we had provided the text books

and technical standards for training. In 2008, prior to the Bejing Olympic Games

starting, we held the first class for training the 2008

Beijing Olympic Staff. There were 46 staff were qualified among total 51

participants

13

After the Wenchuan Earthquake occurred,

LiKang Disinfectant entered into an agreement with the Ministry of Health, the

National Patriot and Sanitation Committee, and the Dujiangyan National Disaster

Headquarters to provide service to stricken areas. On June 6, 2008, Likang

Disinfectant sent its own teams to Sichuan to provide sanitation technical

training for over 270 staff as well as providing a qualification course and

examinations to over 100 national disinfectors. On June 27, 2008, 76

national disinfectors had taken professional qualification exams and 67 national

disinfectors were qualified. The passage rate was 88%.

In 2008, there were 325 participants

that attended the Likang Disinfectant training course, of which 117 became

qualified. In 2009, there were 2,320 participants that attended the

Likang Disinfectant training course, of which 2,156 became

qualified.

Intellectual

Property

We have received eleven patents and have

twenty-one pending patent application with National Property Right

Administration of the PRC. The patent approval process can take up to

thirty-six months. The following is a list of LiKang Disinfectant’s

patents and pending patent applications:

|

Patent

Category

|

Patent name

|

Patent No

|

Notes

|

|||

|

New

invention

|

Low

smell and stimulus contain chlorine disinfectant tablet, powder

etc

|

ZL

200410068135.8

|

Approved,

expires August 2026

|

|||

|

New

invention

|

A

new skin & mucous membrane disinfectant including preparation

methods

|

Application

# 200410025305.4

|

Pending.

Applied on 2004-11-12

|

|||

|

Appearance

design

|

Bottle

(with the wing stretch)

|

ZL

00 3 14391.0

|

Approved,

expires April 2010

|

|||

|

Appearance

design

|

Packaging

bottle

|

ZL

2003 3 0108274.5

|

Approved,

expires November 2013

|

|||

|

Appearance

design

|

Bottle

|

ZL

200530034239.2

|

Approved,

expires December 2015

|

|||

|

Appearance

design

|

Test

paper box of chlorine

|

ZL

2004 3 0022740.2

|

Approved,

expires May 2014

|

|||

|

Product

Improvement

|

Improved

heavy duty bottle

|

ZL

03 2 29616.9

|

Approved,

expires March 2013

|

|||

|

Product

Improvement

|

High

strength water sterilizer with Model H ultraviolet

lamp

|

ZL

03 2 10513.4

|

Approved,

expires September 2013

|

|||

|

Product

Improvement

|

Sewage

application

|

ZL

2004 2 0037013.8

|

Approved,

expires June 2014

|

|||

|

Product

Improvement

|

Container

with the vacuum pump

|

ZL

200420090682.1

|

Approved,

expires June 2016

|

|||

|

Product

Improvement

|

Multifunctional

air disinfectant

|

ZL

200420037010.4

|

Approved,

expires August 2015

|

|||

|

Product

Improvement

|

|

Bracket

for heavy duty bottle

|

|

ZL

200520039668.3

|

|

Approved,

expires

October 2016

|

We have nine product trademarks, of

which four are registered trademarks with the China State Administration for

industry and commerce trademark office. These trademarks cover our

four major product lines, An’erdian, Jifro, Dian’erkang and

Lvshaxing.

We are not a party to any

confidentiality or similar agreement with any of our employees or any third

parties regarding our intellectual property. It is possible that a

third party could, without authorization, utilize our propriety technologies

without our consent. We can give no assurance that our proprietary

technologies will not otherwise become known or independently developed by

competitors.

14

Competition

We operate in a fragmented, competitive

national market for healthcare disinfectant products. According to a

survey conducted in 2004 by the China Federation of Industrial Economics (CFIC),

the disinfectant market in the PRC was approximately $6.25 billion

(USD). While the disinfectant industry in China is an emerging

industry, and the industry is populated with small regional players, we estimate

that there are over 1,000 manufacturers and distributors of disinfectant

products in China and certain of our major competitors distribute products

similar to ours, including those which also prevent the spread of airborne

viruses such as avian flu and SARS.

We compete with foreign companies,

including 3M, who are marketing a limited line of disinfectant products in

China, as well as smaller, domestic manufacturers. Most domestic

competitors offer a limited line of products and there are few domestic

companies with a nationwide presence. We believe that our national

marketing and sales presence throughout all 22 provinces, as well as four

autonomous regions, and four municipalities of China gives us a competitive

advantage over many other disinfectant companies in China.

In addition, prior to the adoption of

industry standards in July 2002 by the central government of China, disinfectant

products were generally marketed and sold based on pricing

factors. We believe the recent standards implemented by the

government and a growing middle income class will shift the customer demand from

price to quality.

As a result of this heightened license

and permit system, all disinfectant manufacturers must comply with "qualified

disinfection product manufacturing enterprise requirements” established by the

Ministry of Public Health. The requirements include standards for

both hardware and software. Hardware includes facilities and

machinery and software includes the technology to monitor the

facilities. Furthermore the requirements will encompass the knowledge

and capability of both the production staff and quality control

procedures.

Furthermore we estimate the new

government standards adopted in July 2002 are increasing the barriers to entry

in the disinfectant industry. We believe that the new standards may

lead to fewer competitors as companies falter in their efforts to adhere to the

new standards. The implementation of these improved production

standards and licenses have effectively decreased the competitiveness of small

and mid-size manufacturers. Compliance with the new standards is

especially difficult for companies with limited product offerings and inferior

technical content.

Competitive

Advantages

We believe that the following are the

principal competitive strengths that differentiate our company from the majority

of our competition:

· Strong sales

and distribution network in China – enables us to compete effectively with

domestic competitors, as well as larger foreign-owned competitors;

· Product

selection and availability – A number of our

competitors are smaller, regional companies with a limited number of product

offerings. We offer our customers a wide variety of disinfectant

products and the ability to ship products to our customers on a timely basis

throughout the PRC;

· Research

and development – Our efforts to respond

to market demand for new products have resulted in the issuance to us of 28

hygiene licenses by the Ministry of Public Health of the central government of

China. Based upon our knowledge of our competitors, we do not believe

any of our competitors have received as many licenses since the enactment of the

licensing standards in July 2002;

· Strong

product pipeline – We have a history of

introducing 3 or 4 new products to the market each year. We have filed

applications for 4 new products and have 8 additional products in

development;

· Manufacturing

capacity – We are

operating at 91% capacity to produce GMP certified products and we have the

ability to increase capacity significantly at moderate costs;

· Customer

services – Our sales personnel are thoroughly educated about our products, which

enable them to better understand the needs of our customers. Our

customer service representatives strive to answer questions immediately and, at

a minimum, no later than 24 hours after a customer’s inquiry;

15

· Reliability

and speed of delivery. We believe our products have developed a

reputation of good quality and effectiveness and our manufacturing capabilities

enable us to produce and ship products to our customers promptly;

· Customer

service – Our

customer service representatives participate in ongoing product training

programs and we strive to respond to all customer inquiries within 24 hours;

and

· Price

– We have developed

relationships with a number of raw material suppliers which enables us to keep

our costs low and thereby offer prices to our customers which are very

competitive.

Our primary competitors in the sale of

chemical disinfectants are 3M and Ace Disinfection Factory Co.,

Ltd. The primary competitors for instrument disinfectants are Chengdu

Kangaking Instrument Co., Ltd. and Hangzhou Yangchi Medicine Article Co., Ltd.

and the primary competitors for chemical indicators are 3M and Shandong Xinhua

Medical Instrument Co., Ltd. Domestic competition comes from regional

companies which tend to offer products in small geographic areas and do not

distribute their product lines throughout China.

Our

primary competitors include:

|

Competitor

|

Products

|

|

|

3M

Company

|

Hand

disinfectant, skin and mucous disinfectant

|

|

|

Ace

|

Skin

and mucous disinfectant

|

|

|

Chengdu

Kangaking

|

Medical

equipment and devices

|

|

|

Hangzhou

Yangchi

|

Sterilized

Q-tip

|

|

|

Shandong

Xinhua

|

|

Chemical

indicators

|

Our primary foreign competitor is 3M

Company which has had a presence in China for more than 20 years. 3M

Company entered the hand disinfection market at the end of 2004 and primarily

offers products in the areas of index and control devices and disinfectant

machines. At present, 3M Company has five products for use in

operating rooms and its products are found in provincial capital cities of China

such as Shanghai, Beijing, Guangzhou, Hangzhou, Nanjin, Chengdu and

Xi’an. 3M Company’s product line in China is relatively narrow, with

few overlapping products between 3M Company and our company.

Another foreign competitor is Johnson

& Johnson, established operations in China in 1994. In China,

Johnson & Johnson offers a variety of skin, hand, and medical equipment

disinfectants. Prior to the recent initiatives by the government,

disinfectant products were marketed based on pricing and despite the brand

awareness of Johnson & Johnson; its products did not have widespread

reception among the community. Furthermore, Johnson & Johnson

does not offer a wide variety of disinfectant products in China.

Government

Regulations

Our business and operations are located

in the PRC. We are subject to local food, drug, environmental laws

related to certification of manufacturing and distributing of

disinfectants. We are also licensed by the Shanghai City Government

to manufacture and distribute disinfectants. We are in substantial

compliance with all provisions of those licenses and have no reason to believe

that they will not be renewed as required by the applicable rules of

Shanghai. In addition, our operations must conform to general

governmental regulations and rules for private companies conducting business in

China.

Pursuant to the July 2002 Ministry of

Public Health 27th Order of Ministry of Health of the People's Republic of

China, all disinfectant manufacturers in China must obtain a license to

manufacture hygiene disinfectants. Prior to release, all disinfectant

instruments must obtain the official hygiene permit document of Ministry of

Public Health and the approval of the provincial hygiene administrative

department. The implementation of these improved production standards

and licenses has effectively decreased the competitiveness of small to mid size

manufacturers with single product and inferior technical

content. Presently we meet all standards initiated by this ordinance

and we have been granted 28 hygiene licenses by the Ministry of Public

Health.

16

We are also subject to various other

rules and regulations, including the People’s Republic of China Infectious

Disease Prevention and Cure Law, Disinfection Management Regulation,

Disinfection Technique Regulation, Disinfection Product Manufacturer Sanitation

Regulation, and Endoscope Rinse and Disinfection Technique Manipulation

Regulation. We believe we are in material compliance with all of the

applicable regulations.

Sanitary Standard for

Producing Disinfectant products Enterprises 2009

To strengthen supervision and management

of disinfection products, standardize the behavior of disinfection products

based on "Infectious Diseases Prevention Law" and "sterilization management

approach," The People's Republic of China Ministry of Health have revised the

old disinfectant manufacturing criteria and enacted the “Sanitary Standard for

Producing Disinfectant products Enterprises 2009 ” and effective from January 1,

2010.

According to the new guideline, the

compounding, mixing and subpackaging of Skin and mucous membrane disinfectants,

and antibacterial preparation (except for hand-washing products), should be

processed in a workshop with a 300,000 level of air purification.

PRC Legal

System

Since 1979, many laws and regulations

addressing economic matters in general have been promulgated in the PRC. Despite

development of its legal system, the PRC does not have a comprehensive system of

laws. In addition, enforcement of existing laws may be uncertain and

sporadic, and implementation and interpretation thereof

inconsistent. The PRC judiciary is relatively inexperienced in

enforcing the laws that exist, leading to a higher than usual degree of

uncertainty as to the outcome of any litigation. Even where adequate

laws exist in the PRC, it may be difficult to obtain swift and equitable

enforcement of such laws, or to obtain enforcement of a judgment by a court of

another jurisdiction. The PRC's legal system is based on written

statutes and, therefore, decided legal cases are without binding legal effect,

although they are often followed by judges as guidance. The

interpretation of PRC laws may be subject to policy changes reflecting domestic

political changes. As the PRC legal system develops, the promulgation

of new laws, changes to existing laws and the preemption of local regulations by

national laws may adversely affect foreign investors. The trend of

legislation over the past 20 years has, however, significantly enhanced the

protection afforded foreign investors in enterprises in the

PRC. However, there can be no assurance that changes in such

legislation or interpretation thereof will not have an adverse effect upon our

business operations or prospects.

Economic Reform

Issues

Since 1979, the Chinese government has

reformed its economic systems. Many reforms are unprecedented or

experimental; therefore they are expected to be refined and

improved. Other political, economic and social factors, such as

political changes, changes in the rates of economic growth, unemployment or

inflation, or in the disparities in per capita wealth between regions within

China, could lead to further readjustment of the reform measures. We

cannot predict if this refining and readjustment process may negatively affect

our operations in future periods.

Over the last several years, China's

economy has registered a high growth rate. Recently, there have been

indications that rates of inflation have increased. In response, the Chinese

government recently has taken measures to curb this excessively expansive

economy. These measures have included devaluations of the Chinese

currency as the result of inflation. This relative Renminbi (“RMB”)

devaluation places some restrictions on the availability of domestic credit,

reducing the purchasing capability of customers, and limiting re-centralization

of the approval process for some foreign product purchases. These

austerity measures alone may not succeed in slowing down the economy's excessive

expansion or control inflation, and may result in severe dislocations in the

Chinese economy. The Chinese government may adopt additional measures

to further combat inflation, including the establishment of freezes or

restraints on certain projects or markets.

To date reforms to China's economic

system have not adversely impacted our operations and are not expected to

adversely impact operations in the foreseeable future; however, there can be no

assurance that the reforms toChina's economic system will continue or that we

will not be adversely affected by changes in China's political, economic, and

social conditions and by changes in policies of the Chinese government, such as

changes in laws and regulations, measures which may be introduced to control

inflation, changes in the rate or method of taxation, imposition of additional

restrictions on currency conversion and remittance abroad, and reduction in

tariff protection and other import restrictions.

17

Employees

The

Company employs approximately 162 full time employees, including our executive

officers, as follows:

|

Department

|

Number of Employees

|

|

|

Administrative

center

|

15

|

|

|

Accounting

|

12

|

|

|

Production

|

54

|

|

|

Logistics

|

17

|

|

|

Sales

and Marketing Staff in Shanghai

|

40

|

|

|

Training

|

9

|

|

|

Research

and Development

|

15

|

|

|

Total

|

|

162

|

U.S.

Advisors

In

September 2006, we entered into a three-year agreement with a consultant to

provide business development and management services. In connection with this

agreement, we issued 500,000 shares of our common stock. We valued these

services using the fair value of common shares on the grant date at $0.185 per

share and recorded a deferred consulting expense of $92,500 to be amortized over

the service period. For the year ended December 31, 2009, amortization of

consulting compensation amounted to $20,556.

On

November 20, 2007, we entered into a one year agreement with Segue Ventures LLC

to provide various informal advisory and consulting services, including U.S.

business methods and compliance with SEC disclosure requirements. In connection