Attached files

| file | filename |

|---|---|

| EX-3.4 - CERTIFICATE OF AMENDMENT - Hawk Systems, Inc. | hwsy_ex34.htm |

| EX-3.3 - CERTIFICATE OF CORRECTION - Hawk Systems, Inc. | hwsy_ex33.htm |

| EX-32.2 - EXHIBIT 32.2 - Hawk Systems, Inc. | hwsy_ex322.htm |

| EX-31.1 - EXHIBIT 31.1 - Hawk Systems, Inc. | hwsy_ex311.htm |

| EX-32.1 - EXHIBIT 32.1 - Hawk Systems, Inc. | hwsy_ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Hawk Systems, Inc. | hwsy_ex312.htm |

| EX-21.1 - SUBSIDIARIES OF HAWK SYSTEMS, INC. - Hawk Systems, Inc. | hwsy_ex211.htm |

| EX-10.16 - AMENDMENT NO. 1 TO THE EMPLOYMENT AGREEMENT - Hawk Systems, Inc. | hwsy_ex1016.htm |

4

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

———————

FORM

10-K

———————

|

þ

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

For

the fiscal year ended

December 31, 2009

|

|

|

or

|

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

For

the transition period from: _____________ to

_____________

|

|

| HAWK SYSTEMS, INC. | ||

| (Exact name of registrant as specified in its charter) |

|

Delaware

|

000-49864

|

65-1089222

|

||

|

(State

or Other Jurisdiction

of

Incorporation or Organization)

|

Commission

File

Number

|

(I.R.S.

Employer

Identification

No.)

|

2385

NW Executive Center Drive, Suite 100

Boca

Raton, FL 33431

(Address

of Principal Executive Office) (Zip Code)

(561)

962-2885

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

———————

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, par value $0.01

———————

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨

No

þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨

No

þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

¨ No þ

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large

accelerated filer

|

o |

Accelerated

filer

|

o |

|

Non-accelerated

filer

|

o |

Smaller

reporting company

|

þ |

|

(Do

not check if a smaller reporting company)

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes ¨ No þ

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates of the registrant, as of June 30, 2009, was

approximately $3,816,522 based upon the closing price reported for such

date on the OTC Bulletin Board. For purposes of this disclosure, shares of

common stock held by persons who hold more than 5% of the outstanding shares of

common stock and shares held by executive officers and directors of the

registrant have been excluded because such persons may be considered to be

affiliates. This determination of affiliate status is not necessarily a

conclusive determination for other purposes.

Indicate

the number of shares outstanding of each of the registrant’s classes of common

stock, as of the latest practicable date: 65,361,332 as of April 15,

2010

DOCUMENTS

INCORPORATED BY REFERENCE: NONE

HAWK

SYSTEMS, INC.

Table

of Contents

|

PART

I

|

|

||||

|

FORWARD-LOOKING

STATEMENTS

|

|

||||

|

ITEM

1.

|

BUSINESS

|

1

|

|||

|

ITEM

2.

|

PROPERTIES

|

5

|

|||

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

5

|

|||

|

PART

II

|

|

||||

|

ITEM

5.

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

6

|

|||

|

ITEM

7.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

7

|

|||

|

ITEM

8.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

10

|

|||

|

ITEM

9.

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

11

|

|||

|

ITEM

9A(T)

|

CONTROLS

AND PROCEDURES

|

11

|

|||

|

ITEM

9B.

|

OTHER

INFORMATION

|

12

|

|||

|

PART

III

|

|

||||

|

ITEM

10.

|

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

13

|

|||

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

15

|

|||

|

ITEM

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

17

|

|||

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

19

|

|||

|

ITEM

14.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

19

|

|||

|

PART

IV

|

|

|

|||

|

ITEM

15.

|

EXHIBITS

AND FINANCIAL STATEMENT SCHEDULES

|

20

|

|||

|

SIGNATURES

|

21

|

||||

PART

I

FORWARD-LOOKING

STATEMENTS

This

Annual Report on Form 10-K (“Annual Report”) contains forward-looking

statements that have been made pursuant to the provisions of Section 21E of

the Securities Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995 and concern matters that involve risks and

uncertainties that could cause actual results to differ materially from

historical results or from those projected in the forward-looking statements.

Discussions containing forward-looking statements may be found in the material

set forth under “Business,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and in other sections of this Annual

Report. Words such as “may,” “will,” “should,” “could,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” or

similar words are intended to identify forward-looking statements, although not

all forward-looking statements contain these words. Although we believe that our

opinions and expectations reflected in the forward-looking statements are

reasonable as of the date of this Annual Report, we cannot guarantee future

results, levels of activity, performance or achievements, and our actual results

may differ substantially from the views and expectations set forth in this

Annual Report. We expressly disclaim any intent or obligation to update any

forward-looking statements after the date hereof, to conform such statements to

actual results or to changes in our opinions or expectations.

ITEM

1. BUSINESS

Hawk

Systems, Inc. (the “Company” or “Hawk Systems”) is a Delaware corporation formed

in February 2001. Prior to the merger in February 2009, we were

engaged in the business of acquiring and managing parking lots and garages in

New York City and surrounding areas through our subsidiary, Parking Pro, Inc., a

New York corporation (“Parking Pro”). On February 19, 2009, pursuant

to the terms of an Agreement and Plan of Merger (the “Merger Agreement”) between

the Company (formerly known as Explorations Group, Inc.), Hawk Acquisition

Corp., a wholly-owned Florida subsidiary of the Company (“Hawk Acquisition”) and

Hawk Biometric Technologies, Inc., a Florida corporation (“Hawk Biometric”),

Hawk Acquisition merged with Hawk Biometric. Pursuant to the merger, Hawk

Biometric was the surviving entity and became a wholly-owned subsidiary of the

Company. As a result of the merger, we are now a developer of innovative

fingerprint authentication technology that we believe offers high degrees of

security, convenience, and ease of use in applications such as automobile locks

and potentially identity theft protection. We believe that this type

of technology can also be used in banking, healthcare, hotel/casino operations,

employee time clock and attendance, stadium security, sporting and gaming

applications where identity management is required.

Overview

Hawk

Biometric was incorporated on October 25, 2007. Immediately upon its

inception, Hawk Biometric acquired patented technology from Hawk Biometrics of

Canada, Inc., a Canadian corporation formed in 2002, covering the use of

fingerprint technology to permit the operation of a vehicle only by an

authorized driver. In addition, the Company acquired ideas for other

potential related technologies.

Hawk

Systems’ current product offering is based on US Patent 6,927,668 The Hawk Print

Access Security System (PASS) which is owned by Hawk Biometric and we are

working on developing a prototype using the technology under pending patent

US Patent Application SN

11/622,48, The Hawk Touch & Go POS which is

presently owned by Mr. David Coriaty our founder and member of our board of

directors. We are currently using the technology under the pending POS patent

under a verbal licensing agreement with Mr. Coriaty, however, we anticipate

formalizing this arrangment in a written agreement in the

future. It is also our intention to file

additional process patents as warranted to further expand our product

offerings.

Biometric

Technology Background

As the

level of security breaches and transaction fraud increases, management believes

the need for highly secure identification and personal verification technologies

is becoming apparent. One solution to providing highly secure

identification and personal verification solutions is the extensive array of

existing biometric technologies. Biometrics are automated methods of

recognizing a person based on a physiological or behavioral

characteristic. Among the unique features measurable by various

biometric technologies and used for unique identification purposes are face,

fingerprints, hand geometry, handwriting, iris, retinal, vein and

voice. Traditional fingerprint scanning technology uses an image of

the surface of the finger to match and authenticate access.

1

Managment

believes that the Hawk Systems’ advantages over traditional fingerprint scanning

include the follwing:

|

·

|

Fingerprint Read vs.

Scan: The fingerprint is read vs. a scan, resulting in “live”

data.

|

|

·

|

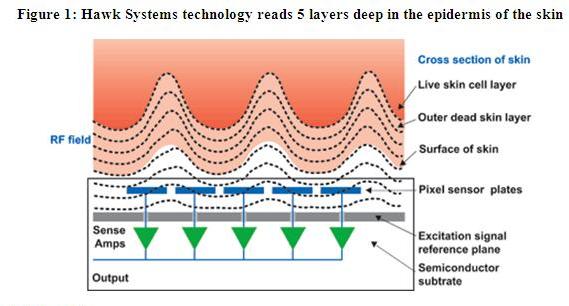

5 Layers Deep: Figure 1

illustrates how the Company’s technology penetrates 5 epidermal layers of

skin, removing the effects of surface

variations.

|

|

·

|

Eliminates fingerprint

“spoofing”: The Company’s technology completely eliminates the

ability to fraudulently mimic a fingerprint using the “gummi bear”

approach as there is no surface

scanning

|

|

·

|

Removal of data security

concerns: After the fingerprint is read, it is converted by a

unique algorithm into a numeric sequence, which cannot be used for access

without algorithmic decryption. This algorithm-based approach

is similar to the concept behind the RSA SecureID card, which utilizes a

seed and algorithm to generate a unique password number every 60

seconds.

|

|

·

|

Reduction of data

storage: The numeric sequences used by the reader take up

significantly less data storage that the corresponding fingerprint image

used by traditional scanners.

|

|

·

|

Alternate action

programming: By placing a different finger on the scanner, an

alternate programming action will be initiated. This permits

the automotive products to operate in a “valet” mode that is accessible by

any driver and the ATM products to switch to a “distressed” mode that will

trigger a silent alarm in the event someone attempts to force the user to

take money out against their will.

|

Automotive

Market Analysis

Market

Size

According

to the Bureau of Transportation Statistics, there were approximately 254.4

million registered vehicles on the road in the US in 2007.1 Over 8.7 million vehicles of the

total were fleet vehicles registered to governments, rental companies and

commercial entities.2 This total includes cars and trucks

weighing less than 19,501 lbs. The average length of time a fleet

vehicle remains in service ranges from 29 to 46 months.3

Market

Opportunity

We

believe that there is a substantial market for our Print Access Security System (PASS)

automotive security product in North America, particularly for fleet

vehicles due to both the number of vehicles in service and the level of vehicle

turnover based on average length of service.

We intend

to enter into discussions with various government, corporate and rental company

fleet management groups during the initial deployment period to explore the

possibility of entering into a business relationship. We also

plan on discussing potential licensing and subcontract partnerships with the

major automotive security product manufacturers, offering them an opportunity to

enhance the value of their products by including biometric access capability.

Currently, we have no agreements in place to sell the PASS

product.

____________________________

1

http://www.bts.gov/publications/national_transportation_statistics/html/table_01_11.html.

2 Bobit

Publishing Company, Automotive Fleet Research Department, Automotive Fleet

Factbook 2008, Redondo Beach, CA, 2009

3 Id.

2

ATM

Market Analysis

Market

Size

According

to a survey by Javelin Strategy and Research in 2007, Americans suffered $49

billion in identity theft related losses.4 Almost 8.5 million Americans were

effected by identity theft and fraud in 2007.5

Market

Opportunity

In

August, 2008, several debit-card "identities" were stolen by a skimming

device placed on a

bank's ATM in Cape Coral, Florida.6 With only a four digit security

code for protection, it has become increasingly likely that people will

experience some type of loss due to compromise of their ATM card

security. We believe that our Touch & Go POS patent

pending technology will minimize a significant amount of ATM card theft and

fraud.

We are

currently in discussions with a Florida regional bank about the potential use of

the Touch & Go POS

biometric security technology in its operations on a pilot basis. We

believe that an initial pilot project will produce valuable product enhancement

feedback as well as provide a reference customer for potential future sales

opportunities. We also intend to seek discussions with additional

financial institutions, as well as ATM network operators and ATM original

equipment manufacturers (“OEMs”) relative to both additional deployments and

technology licensing or subcontract agreements.

Technology

and Main Products

Hawk

Biometric currently holds a U.S. patent for the process of Fingerprint

Enrollment & Verification Module (“FEVM”) for use on various types of

transportation within the U.S. The FEVM can read the unique biometric profile of

an individual fingerprint and thereafter transmit this unique data to a module

with stored information and either allow or decline door locks or

ignition.

Issued

Patent:

1.

US Patent 6,927,668 The Hawk Print Access Security System (PASS)

|

a.

|

A

fingerprint enrollment and verification module is connected to the

electrical circuit of a vehicle to prevent operation of the vehicle by

unauthorized users. The module has a sensor that creates a template of a

fingerprint when a finger is placed on the module. The module has a flash

memory to store enrolled templates and a verification step. After a

fingerprint has been enrolled in the module, any operation of that vehicle

is possible only after the user's fingerprint is verified to match the

enrolled template (Print Access Security System US Patent

6927668)

|

|

b.

|

The

Print Access Security System is designed to take advantage of the

dramatically superior security features offered by biometrics together

with the convenience of never losing your “key”. The encrypted algorithm

that is created by the fingerprint reader provides a level of security

that resides literally in the hands of the car’s owner. This system does

not rely on manufactured chip sets, key blanks or even access

pins.

|

Patent

Pending:

1.

US Patent Application SN 11/622,488, The Hawk ATM Touch & Go

POS

|

a.

|

The

use of a wireless system for the creation of a personal identification

data set (“PIDS”) for communication to a secure server within a controlled

facility.

|

We

believe that the Touch & Go Biometric POS application will provide

convenience with added security against identity theft and fraud to both

financial institutions and consumers. We believe that consumers will

be able to benefit with savings by being a VIP member of the participating

retailer. The consumer will simply sign up at the POS location and enroll

multiple fingerprints into the Company’s system which will be attached to the

consumer’s account of choice, (i.e. Visa, MasterCard, Amex, and Debit). From

that point forward all the consumer will do is Touch &

Go.

Currently,

we are in discussions with a regional bank regarding the development of a

prototype for use in its branches, which we believe is the first step in

developing this product. We have not yet developed or manufactured a

product using this concept and do not currently have any agreements in

place.

This

patent application is presently registered with the United States Patent Office

in the name of its inventors, Mr. David Coriaty, a member of our board of

directors, and Craig Casey. Mr. Casey subsequently assigned his

interest in the patent to Mr. David Coriaty in April 2010. We are

currently using the technology under this patent application pursuant to a

verbal licensing agreement with Mr. Coriaty, however, we anticipate formalizing

this arrangement in a written agreement in the future.

_____________________

4 Privacy Rights

Clearinghouse, "Identity Theft Survey and Studies: How many Identity Theft

Victims are There?", 2003-2010 (citing Javelin Strategy & Research Survey,

2007 Identity Fraud Survey Report, 2007).

5Id.

6 Consumer

Reports, Jan. 2010.

3

Sales

Distribution and Partnerships

We are

dedicated to building our business based on application of our technology in a

variety of markets. We intend to work with OEMs, value added

retailers and end user customers to maximize the number of potential routes to

market for our products.

Manufacturing

We have

established a relationship with Florida MicroElectronics (“FME”) to manufacture

our PASS system. FME is an electronic manufacturing services company

located in West Palm Beach, Florida. Its 40,000 sq. ft. facility is

ISO 9001 and TS 16949 registered. We believe that FME provides a

combination of experience, core capabilities and resources in advanced

microcircuits which we can utilize to design and manufacture our

products. FME offers product design and development, prototype

services and flexible automated/semi-automated electronic component

manufacturing services.

Competition

There are

numerous companies that produce biometric, fingerprint-based security

solutions. Many of those solutions use a surface scan that produces a

digital image of the fingerprint. This approach, which involves

scanning the surface of the finger and identifying “constellation points” for a

match, has two major caveats which have impeded the wide scale deployment: data

storage size and security.

A high

resolution image requires fairly sizable amount of data storage, which can

easily be seen with today’s mega-pixel digital cameras. Scaling the

number of images to some of the potential biometric security applications

requires significant amount of data storage capacity.

A

potentially larger issue for traditional fingerprint scanning technology

involves the security of the fingerprint scan and the ability for data

compromise. One Japanese researcher, Tsutomu Matsumoto, in 1992 was

able to “spoof” a fingerprint scanner by using a gelatin found in gummy

bears.7 We believe that our technology

resolves this issue by reading five layers deep of the epidermal layer of skin,

rendering surface level fingerprint duplication impossible.

Research

and Development

Research

and development involves the development of both the design and actual

components of our fingerprint authentication technology as well as activities

that enable us to keep abreast of the dynamic and evolving industry for these

products. Research and development expenses totaled $109,491 and $15,942 for the

fiscal years ended December 31, 2009 and 2008, respectively.

Governmental

Regulation

We are

subject to the laws and regulations which apply to all businesses in general.

The cost of compliance with all such regulations is minimal. We do not believe

we are subject to any specific regulations as a result of our business and did

not spend any material amounts during the fiscal year ended December 31, 2009 on

compliance with environmental laws.

Employees

We

outsource the design and manufacturing of our product to a contract

manufacturer. This allows us to maintain a small full time staff to

handle administrative functions. As of December 31, 2009, we had one

(1) full time employee. We believe that our future success will

depend in large part on our ability to attract, integrate, retain and motivate

highly qualified sales and managerial personnel, and upon the continued service

of our senior management. The competition for qualified personnel in our

industry and graphical location is intense, and there can be no assurance that

we will be successful in attracting, integrating, retaining and motivating a

sufficient number of qualified personnel to conduct our business in the future.

From time to time, we also employ independent contractors to support our

marketing and sales organization. We have never had a work stoppage, and no

employees are represented under collective bargaining agreements. We consider

our relations with our employee to be good.

_______________________

7ITU-T Workshop on Security, Seoul; May

14, 2002.

4

ITEM

1A. RISK FACTORS

Not

required for smaller reporting companies.

ITEM 1B.UNRESOLVED STAFF

COMMENTS

Not

applicable.

ITEM

2. PROPERTIES

Our

executive offices are located at 2385 NW Executive Center Drive, Suite 100, Boca

Raton, FL 33431. The facility is a virtual office, which we rent

pursuant to a services agreement for a cost of approximately $225 per month on a

month-to-month basis. We believe that the virtual office is adequate

for our current needs and we do not anticipate the need to move to a larger

facility until we have hired several additional employees.

On June

9, 2009, Leonard Tucker, as co-Trustee of the Tucker Family Spendthrift Thrust

(“Trust”), filed a complaint against us in the 15th Judicial Circuit of Palm

Beach County. Michelle Tucker, the other co-Trustee of the Trust, was formerly

the President and Chief Executive Officer of the Company. The Trust

held a Class A, Series A Convertible Bond (“Bond”) issued by us in the principal

amount of $25,000, which was convertible into shares of our securities such

that, upon complete conversion of the Bond, the aggregate number of shares owned

by the Bondholder would be equal to 10% of all of our outstanding capital stock

and capital stock reserved in conjunction with existing corporate obligations

(i.e. options, warrants, etc.). In its complaint, the Trust alleged breach

of contract and specific performance for our failure to issue certain shares

under the Bond after the Trust provided notice of election to convert $24,000 in

principal and accrued interest of the Bond on April 29, 2009. On

January 25, 2010, we entered into a settlement agreement (“Settlement

Agreement”) with the Trust in order to settle the ongoing litigation between us

and the Trust. In accordance with the terms of the Settlement

Agreement, we agreed to issue the Trust 3,960,030 shares of our Common Stock and

64,165 shares of our Series B Preferred Stock (collectively, the “Securities”).

We subsequently issued the Securities to the Trust and therefore, we have

no further obligation under the Bond. Under the terms of the

Settlement Agreement, we and the Trust agreed to release and forever discharge

each other, our present officers, agents and employees from any and all claims

and demands which have been or may have been based upon any facts or

circumstances that arose or existed on or prior to the date of the Settlement

Agreement. We executed the release February 23, 2010 and the Trust

executed the release on March 3, 2010. The Trust filed a stipulation

and order of dismissal with prejudice with the 15th Judicial Circuit Court of

Palm Beach County and the judge entered an order of dismissal with prejudice on

February 26, 2010.

5

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market

Information

Our

Common Stock is quoted on the Over-the-Counter Bulletin Board (“OTCBB”), under

the symbol “HWSY.” Prior to that, our Common Stock was quoted under

the symbol “EXGI.” On April 7, 2010, we effected a 1-for-6 reverse

split of our Common Stock. As a result, our symbol has had the letter “D”

appended to the end of it for 20 days from the date of the reverse

split.

The

following table sets forth, for the periods presented, the high and low bid

price ranges of our Common Stock as reported on the OTCBB prior to giving effect

to our 1-for-6 reverse stock split. The over-the-counter market quotations

reflect inter-dealer prices, without retail mark-up, mark-down or commission and

may not necessarily represent actual transactions.

|

High

|

Low

|

|||||||

|

Fiscal

year ended December 31, 2008:

|

||||||||

|

First

Quarter

|

$ | 0.020 | $ | 0.017 | ||||

|

Second

Quarter

|

$ | 0.018 | $ | 0.008 | ||||

|

Third

Quarter

|

$ | 0.010 | $ | 0.008 | ||||

|

Fourth

Quarter

|

$ | 0.090 | $ | 0.013 | ||||

|

Fiscal

year ended December 31, 2009:

|

||||||||

|

First

Quarter

|

$ | 0.03 | $ | 0.24 | ||||

|

Second

Quarter

|

$ | 0.25 | $ | 0.13 | ||||

|

Third

Quarter

|

$ | 0.21 | $ | 0.11 | ||||

|

Fourth

Quarter

|

$ | 0.15 | $ | 0.05 | ||||

Holders

As of

March 31, 2010, we had approximately 86 stockholders of record, solely based

upon the count our transfer agent provided us as of that date. This number does

not include:

|

·

|

any

beneficial owners of common stock whose shares are held in the names of

various dealers, clearing agencies, banks, brokers and other fiduciaries,

or

|

|

·

|

broker-dealers

or other participants who hold or clear shares directly or indirectly

through the Depository Trust Company, or its nominee, Cede &

Co.

|

Dividends

We have

never declared or paid dividends on our Common Stock. We intend to use retained

earnings, if any, for the operation and expansion of our business, and therefore

do not anticipate paying cash dividends in the foreseeable future. In

addition, the General Corporation Law of the State of Delaware prohibits us from

declaring and paying a dividend on our Common Stock at a time when we do not

have either (as defined under that law):

|

·

|

a

surplus, or, if we do not have a

surplus,

|

|

·

|

net

profit for the year in which the dividend is declared and for the

immediately preceding year.

|

Equity

Compensation Plan

As of

December 31, 2009, we did not have any employee compensation plans under

which our equity securities were authorized for issuance.

6

Unregistered

Sales of Equity Securities

Except as

provided herein, all unregistered sales of securities issued during the fiscal

year ended December 31, 2009 have been previously reported on the Company’s

quarterly reports on Form 10-Q or current reports on Form 8-K.

On

October 7, 2009, our board of directors approved the issuance of 4,500,000

shares of our restricted Common Stock (on a pre-reverse split basis) to an

entity controlled by our former chief executive officer, chief financial officer

and director, Mr. Eric Brown, as reimbursement for a payment made by the entity

on our behalf pursuant to a consulting agreement between us and a

consultant. The shares were not physically issued untill January 14,

2010. We believe that the issuance was exempt from registration under

Section 4(2) of the Securities Act of 1933, as amended (“Securities

Act”).

The

issuances of securities were exempt from registration under the Securities Act

in reliance upon Section 4(2) of the Securities Act and/or

Regulation D promulgated thereunder as transactions by an issuer not

involving a public offering. The securities are restricted securities for

purposes of the Securities Act. A legend was placed on the certificate

representing the securities providing that the securities have not been

registered under the Securities Act and cannot be sold or otherwise transferred

without an effective registration or an exemption therefrom.

ITEM 6.SELECTED FINANCIAL

DATA.

Not

required for smaller reporting companies under Regulation S-K.

ITEM

7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Our

predecessor, Explorations Group, Inc., operated parking garages in New York City

through its operating subsidiary Parking Pro, Inc. (“Parking Pro”). On

February 19, 2009, we acquired Hawk Biometric through a merger transaction

between our subsidiary Hawk Acquisition and Hawk Biometric whereby Hawk

Acquisition merged with and into Hawk Biometric (the “Merger”). The Merger has

been accounted for as a reverse merger in the form of a recapitalization with

Hawk Biometric as the successor. The recapitalization has been given retroactive

effect in the accompanying financial statements, and the accompanying

consolidated financial statements represent those of Hawk Biometric for all

periods prior to the consummation of the Merger.

Hawk

Biometric is a developer of innovative fingerprint authentication technology

that offers high degrees of security, convenience, and ease of use in

applications such as automobile locks and identity theft protection. We believe

technology can also be used in banking, healthcare, hotel/casino operations,

employee time clock and attendance, stadium security, sporting and gaming

applications where identity management is required.

We intend

to either sell or spin-off Parking Pro in the near future, as we anticipate

focusing on our technology business. We do not anticipate that proceeds, if any,

will be material.

CRITICAL

ACCOUNTING POLICIES AND ESTIMATES:

Our

financial statements and accompanying notes have been prepared in accordance

with accounting principles generally accepted in the United States of America.

The preparation of these financial statements requires our management to make

estimates, judgments and assumptions that affect the reported amounts of assets,

liabilities, revenues and expenses. We continually evaluate the accounting

policies and estimates we use to prepare the consolidated financial statements.

We base our estimates on historical experiences and assumptions believed to be

reasonable under current facts and circumstances. Actual amounts and results

could differ from these estimates made by management.

We do not

participate in, nor have we created, any off-balance sheet special purpose

entities or other off-balance sheet financing.

We have

identified the accounting policies below as critical to our business operations

and the understanding of our results of operations.

Principles of consolidation -

The accompanying consolidated financial statements include the accounts of the

Company and our wholly-owned subsidiaries, Parking Pro and Hawk Biometric. All

significant intercompany transactions have been eliminated.

7

Cash - We maintain cash in

bank accounts which may, at times, exceed federally insured limits. We have not

experienced any loss on these accounts.

Accounts receivables -

Accounts receivable are reported at their outstanding unpaid principal balances

reduced by an allowance for doubtful accounts. We estimate doubtful accounts

based on historical bad debts, factors related to specific customers' ability to

pay, and current economic trends. We write off accounts receivable against the

allowance when a balance is determined to be uncollectible.

Property and equipment -

Depreciation of property and equipment is provided for by the straight-line

method over the estimated useful lives of the related assets. Long-lived assets

are reviewed for impairment whenever events or changes in circumstances indicate

that the carrying amount of the asset may not be recoverable.

Intangible assets - Intangible

assets are carried at cost less accumulated amortization. Amortization is

computed on the straight-line method over the ten-year estimated useful life of

the assets. We periodically review the carrying value of our intangible assets

to determine whether impairment may exist. We consider relevant cash flow and

profitability information, including estimated future operating results, trends

and other available information, in assessing whether the carrying value of the

intangible assets can be recovered. If it is determined that the carrying value

of the intangible assets will not be recovered from the undiscounted future cash

flows, the carrying value of the assets would be considered impaired. An

impairment charge is measured as any deficiency in the amount of estimated fair

value of the intangible assets over carrying value.

Revenue Recognition - We

recognize revenue in accordance with Staff Accounting Bulletin (“SAB”)

No. 104, “Revenue Recognition in Financial Statements”. Under SAB No.104,

we recognize revenue when the following criteria have been met: persuasive

evidence of an arrangement exists, the fees are fixed and determinable, no

significant Company obligations remain and collection of the related receivable

is reasonable assured.

Share-based Compensation - We

account for stock-based compensation in accordance with SFAS No. 123(R),

“Share-Based Payment.” Under the fair value recognition provisions of this

statement, share-based compensation cost is measured at the grant date based on

the fair value of the award and is recognized as expense over the requisite

service period. Liability classified share-based awards are re-measured at fair

value each reporting period. Determining the fair value of share-based awards at

the grant date requires judgment, including estimating expected dividends. In

addition, judgment is required in estimating the amount of share-based awards

that are expected to be forfeited. If actual results differ significantly from

these estimates, stock-based compensation expense and our results of operations

could be materially affected.

RESULTS

OF OPERATIONS

Revenues

We

generated $0 revenue for the fiscal year ended December 31, 2009 as well as for

the comparable period in 2008. Our technology products were not yet available

for sales and licensing during the fiscal year ended December 31, 2008 and our

PASS system was in testing with a potential customer during the fiscal year

ended December 31, 2009, but it did not result in a sale.

General

and Administrative Expenses

General

and administrative expenses are comprised of costs of salaries, expenses related

to the compliance requirements of a publicly traded company, expenses incurred

in the process of identifying and qualifying suitable acquisition targets, and

other general and administrative expenses.

For the

fiscal year ended December 31, 2009, our general and administrative expenses

totaled $2,496,757, as compared to $673,818 for the fiscal year ended December

31, 2008. The increase in these expenses was primarily the result of

approximately $1.2 million in stock-based compensation expenses during the

fiscal year ended December 31, 2009, salaries, as well as expenses incurred as a

result of the reverse merger and becoming a public company in 2009.

Research

and Development Expenses

Research

and development expenses are comprised of the development of both the design and

actual components of our fingerprint authentication technology as well as

activities that enable us to keep abreast of the dynamic and evolving industry

for these products. Research and development expenses totaled $109,491 for the

fiscal year ended December 31, 2009, as compared to $15,942 for the fiscal year

ended December 31, 2008. The increase was as a result of expenses relating to

the testing and installation of prototype units of our automotive product in

vehicles, as well as expenses incurred in producing the prototype units of our

automotive product.

8

Interest

Expense

Interest

expense totaled $71,293 for the fiscal year ended December 31, 2009, as compared

to $0 for the fiscal year ended December 31, 2008. We began incurring interest

expense upon the issuance of our convertible debenture on April 30, 2009,

including interest at the rate of 10% per annum as well as the amortization of

the financing costs and the discount related to its beneficial conversion

feature and related warrant. In addition, we issued two unsecured

promissory notes on September 16, 2009 in the aggregate principal amount of

$150,000, which accrue interest at the rate of 12% per annum.

Net

Loss

Our net

profit or loss is computed as our total revenues less expenses. For the fiscal

year ended December 31, 2009, net loss decreased to $(2,659,062) compared

to $(15,689,760) during the fiscal year ended December 31, 2008. The net

loss during the fiscal year ended December 31, 2009 is primarily attributed to

the result of the commencement of product development operations, activities

pursuant to the reverse merger, and expenses related to our pursuit of suitable

acquisition targets that would complement our business activities. The net loss

during the fiscal year ended December 31, 2008 was primarily due to a

$15,000,000 impairment charge to the value of the patent acquired from Hawk

Biometrics of Canada in May 2008, when it was subsequently determined that the

patent was imparied in accordance with SFAS 144, as the expected cash flows to

be generated were $0 at the time of valuation.

LIQUIDITY

AND CAPITAL RESOURCES

Our

continuation as a going concern is dependent upon, among other things, our

ability to obtain additional financing when and as needed and to generate

sufficient cash flow to meet our obligations on a timely basis. We currently do

not have adequate capital to continue our business activities and are seeking

new sources of capital. No assurance can be given that we will be able to obtain

such financing on acceptable terms. Our independent registered public accounting

firm, in their reports on our financial statements for the year ended December

31, 2009 expressed substantial doubt about our ability to continue as a going

concern. These circumstances could complicate our ability to raise additional

capital. Our financial statements do not include any adjustments to the carrying

amounts of our assets and liabilities that might result from the outcome of this

uncertainty.

We have

funded our operations primarily through loans from our officers, directors,

related parties and certain other third parties. We issued a $100,000

convertible debenture in April 2009 and two promissory notes in

September 2009 in the aggregate principal amount of $150,000. We

have also issued promissory notes in the aggregate principal amount of $140,000

to David Coriaty, a member of our board of directors, for various loans he has

provided to us during 2009 and 2010. We used the proceeds from such loans to pay

salaries, accounting, legal, consulting, and investment banking fees. We

anticipate seeking to sell additional equity or debt securities or obtain a

credit facility in order to finance our growth. The sale of additional equity or

convertible debt securities will likely result in additional dilution to our

stockholders. The incurrence of indebtedness would result in an increase in our

fixed obligations and could result in borrowing covenants that would restrict

our operations. There can be no assurance that financing will be available in

amounts or on terms acceptable to us, if at all. If financing is not available

when required or is not available on acceptable terms, we may be unable to

develop or enhance our products or services, and, we will likely not be able to

continue any business activities. Any of these events could have a material and

adverse effect on our business, results of operations and financial condition.

9

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements required to be included in

this Annual Report appear at the end of this Annual Report beginning on page

F-1.

10

ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM

9A(T). CONTROLS AND PROCEDURES

(a) Evaluation

of Disclosure Controls and Procedures

As of the

end of the period covered by this report, management carried out an evaluation

of the effectiveness of the design and operation of the Company's disclosure

controls and procedures (as defined in Rule 13a-15(e) under the Securities

Exchange Act of 1934). In designing and evaluating its disclosure

controls and procedures, management recognized that disclosure controls and

procedures, no matter how well conceived and operated can provide only

reasonable, but not absolute, assurance that the objectives of the disclosure

controls and procedures are met. Additionally, in designing

disclosure controls and procedures, management was necessarily required to apply

its judgment in evaluating the cost-benefit relationship of possible disclosure

controls and procedures. The design of any disclosure controls and

procedures also is based in part upon certain assumptions about the likelihood

of future events, and there can be no assurance that any design will succeed in

achieving its stated goals under all potential future

conditions.

Based

upon that evaluation, our chief executive officer concluded that our disclosure

controls and procedures were not effective to ensure that the information

required to be disclosed by us in the reports that we file or submit under the

Exchange Act are recorded, processed, summarized and reported within the time

periods specified in rules and forms of the SEC due to the limited resources of

the Company, as of December 31, 2009 and the lack of centralized and continuity

of management. We believe that the appropriate steps are now being taken by the

Company to reduce this risk on a going-forward basis. We hired our chief

executive officer effective January 15, 2010 and we are seeking to hire

additional personnel to assist with the preparation of financial statements,

subject to the availability of adequate funds, and make additional changes in

our financial reporting systems and procedures wherever necessary and

appropriate to ensure their effectiveness and will make appropriate disclosures

regarding any observations and changes as required in future

periods.

(b) Management’s

Report on Internal Control Over Financial Reporting

The

Company’s management is responsible for establishing and maintaining adequate

internal control over financial reporting for the Company. In order

to evaluate the effectiveness of internal control over financial reporting, as

required by Section 404 of the Sarbanes-Oxley Act, management has conducted an

assessment, taking into consideration the criteria described in Internal

Control-Integrated Framework issued by the Committee of Sponsoring Organizations

of the Treadway Commission (“COSO”). Because of the inherent limitations,

internal control over financial reporting may not prevent or detect

misstatements. Also, projections of any evaluation of effectiveness

to future periods are subject to the risk that controls may become inadequate

because of changes in conditions, or that the degree of compliance with the

policies or procedures may deteriorate. Based on its assessment,

management has concluded that the Company’s internal control over financial

reporting was ineffective as of December 31, 2009.

The

matter involving internal controls and procedures that our management considered

to be a material weakness under the standards of the Public Company Accounting

Oversight Board is that due to financial constraints, we do not currently have a

chief financial officer or a full-time person performing such

function. During the fiscal year ended December 31, 2009, we have

used outside consultants to assist us in meeting our financial reporting

obligations. This increases the possibility for misstatement in the

financial statements to occur and not be detected in a timely manner. This

deficiency could cause the financial statements and the underlying financial

records to be misstated. In addition, it creates the opportunity for possible

irregularities to exist and continue without detection on a timely

basis. Accordingly, management has determined that these control

deficiencies constitute a material weakness. The material weakness is

anticipated to be remediated during the fiscal year ended December 31, 2010

through the hiring of an appropriate full or part-time chief financial

officer.

The

Annual Report does not include an attestation report of the Company’s registered

public accounting firm regarding internal control over financial

reporting. Management’s report was not subject to attestation by the

Company’s independent registered public accounting firm pursuant to temporary

rules of the Securities and Exchange Commission that permit the Company to

provide only management’s report in this Annual Report.

(c) Changes in Internal Control Over

Financial Reporting.

There

were no changes in our internal control over financial reporting identified in

connection with the evaluation required by paragraph (d) of Exchange Act Rules

13a-15 or 15d-15 that occurred during our last fiscal quarter that have

materially affected, or are reasonably likely to materially affect, our internal

control over financial reporting.

11

ITEM 9B. OTHER

INFORMATION.

None.

12

PART

III

ITEM

10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The

following table sets forth the names and positions of our directors and

executive officers as of March 31,

2010:

|

Name

|

Age

|

Position

|

||

|

Michael

Diamant

|

53 |

Chief

Executive Officer and Director

|

||

|

David

Coriaty

|

40 |

Director

|

||

|

Antonio

DeRisi

|

42 |

Director

|

||

|

Mark

Spanakos

|

50 |

Director

|

||

|

Edward

Sebastiano

|

52 |

Director

|

The

following sets forth biographical information concerning our directors and

executive officers for at least the past five years:

Michael Diamant. Mr. Diamant

has been our chief executive officer and a member of our board of directors

since January 2010. Mr. Diamant has over 29 years professional experience

planning, managing and implementing strategic systems, specializing in critical

business systems deployment and operations turnaround. He was the Vice President

and Chief Technology Officer of MoreDirect, Inc. from May 2000 December 2009,

where he directed the strategic planning, implementation and support of

technology for an information technology eProcurement company. He spearheaded

integrating MoreDirect’s Traxx system with leading business-to-business and

enterprise resource planning systems such as Ariba, SAP, PeopleSoft and Oracle

using cXML, EDI, OCI and custom interfaces. Mr. Diamant initiated upgrades of

MoreDirect’s website availability, business continuity plan, innovative supply

chain features and internal business processes, in addition to adding new

website functionality such as Purchase Approval, Software Licensing and numerous

customer-specific web sites. Prior to that, from November 1999 to May 2000, Mr.

Diamant was the Chief Technology Officer for ilife.com, Inc., now known as

Bankrate.com, a personal finance portal. While at ilife.com, he initiated

infrastructure projects involving availability, fault tolerance, wireless access

and capacity planning. Prior to ilife, Mr. Diamant held technical management

positions at PowerCerv, Signature Flight Support, The Continuum Company, Martin

Marietta, The Johns Hopkins University Applied Physics Laboratory and

Westinghouse. Mr. Diamant earned Bachelor of Arts and Master of Science degrees

from the University of Pennsylvania and a Master of Science degree from The

Johns Hopkins University. Mr. Diamant has published several articles and papers

on eProcurement deployment and return on investment, distributed computing and

network design/implementation. The particular experience,

qualifications, attributes or skills that led the board to conclude that Mr.

Diamant should serve as a member of the board of directors included his

knowledge of the technology industry and his previous executive management

experience.

David Coriaty. Mr.

Coriaty has been a member of the board of directors of the Company since

February 2009. Mr. Coriaty is one of the founders of Hawk Biometrics

and one of the inventors of Hawk Biometrics’ patented technology. Mr.

Coriaty has launched multiple business ventures including internet start-ups and

a sports representation agency that works with well-known NFL and MLB

athletes. The particular experience, qualifications, attributes or

skills that led the board to conclude that Mr. Coriaty should serve as a member

of the board of directors included his knowledge as founder of the Company and

co-inventor of the Company’s technology.

Antonio

DeRisi. Mr. DeRisi has been a member of the board of directors

of the Company since February 2009. Mr. DeRisi has more than twenty

years retail experience managing multiple retail locations in and around

Montreal, Canada. Mr. DeRisi is currently the president of the Chamber of

Commerce for the City of St. Leonard in Montreal, Canada. He owns a

distribution center that distributes all types of products, including food and

non-food items, to retail stores and distributors throughout

Canada. Mr. DeRisi holds the Canadian equivalent of a bachelor of

science in business administration from Dawson College located in Montreal,

Canada. The particular experience, qualifications, attributes or

skills that led the board to conclude that Mr. DeRisi should serve as a member

of the board of directors included his knowledge of the Company and his previous

business management and distribution experience.

13

Mark Spanakos. Mr.

Spanakos has been a member of the board of directors of the Company since

February 2009. Mr. Spanakos has experience in the financial markets

and owns a seat on the New York Mercantile Exchange (NYMEX). The

particular experience, qualifications, attributes or skills that led the board

to conclude that Mr. Spanakos should serve as a member of the board of directors

included his financial industry experience.

Edward

Sebastiano. Mr. Sebastiano has been a member of the board of

directors of the Company since February 2009. Mr. Sebastiano has more

than twenty five years of experience in the financial markets. Since

November 2007, he has been the president of, and a partner in, EPTrading Inc., a

commodities trading company in New York City. Prior to that from January 2005,

Mr. Sebastiano was the president and owner of Esco Commodities, also a

commodities trading company in New York City. He is also the founder of GFA, a

public relations and management company. The particular experience,

qualifications, attributes or skills that led the board to conclude that Mr.

Sebastiano should serve as a member of the board of directors included his

knowledge of the company and his financial industry experience.

COMPLIANCE

WITH SECTION 16(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Section

16(a) of the Exchange Act requires our officers, directors, and persons who own

more than ten percent of a registered class of our equity securities to file

reports of securities ownership and changes in such ownership with the SEC.

Officers, directors, and greater-than-ten-percent stockholders are required by

SEC regulations to furnish us with copies of all Section 16(a) forms that they

file.

Based

solely upon a review of Forms 3, Forms 4, and Forms 5 furnished to us pursuant

to Rule 16a-3 under the Exchange Act, we believe that all such forms required to

be filed pursuant to Section 16(a) of the Exchange Act during the year ended

December 31, 2009 were timely filed, as necessary, by the officers, directors,

and security holders required to file such forms, except for the

following:

Mr.

Michael Diamant filed an untimely Form 3;

Mr. David

Coriaty filed a Form 5 as a result of his failure to file his initial Form 3 and

a Form 4 with respect to one transaction;

Mr.

Antonio DeRisi filed a Form 5 as a result of his failure to file his initial

Form 3;

Mr.

Edward Sebasiano filed a Form 5 as a result of his failure to file his initial

Form 3;

Mr. Mark

Spanakos filed a Form 5 as a result of his failure to file his initial Form

3;

C.L.R.,

Associates, Inc. filed a Form 5 as a result of its failure to file its initial

Form 3 and a Form 4 with respect to nine transactions;

Grand

Columbus Holding Inc. did not file a Form 4 with respect to three

transactions;

Greystone

Business Credit II, LLC filed an untimely Form 3;

Greystone

Real Estate Holdings Corp. filed an untimely Form 3;

Greystone

& Co. Holdings L.L.C. filed an untimely Form 3; and

Stephen

Rosenberg 2004 Descendants' Trust filed an untimely Form 3.

Family

Relationships

There are

no family relationships between or among the directors and executive officers of

the Company.

14

Involvement

in Legal Proceedings

To the

best of the Company's knowledge, during the past ten years, none of the

proceedings described in Item 401(f) of Regulation S-K occurred with respect to

a present director or executive officer of the Company except that Mr. David

Coriaty filed for personal bankruptcy which was discharged in May

2004.

On

December 1, 2004, we adopted a Code of Conduct that applies to all employees of

the Company, which includes our principal executive officer and

principal financial officer who are currently employees of the Company. We

are currently in the process of adopting a Code of Ethics in addition to the

Code of Conduct that only applies to our principal executive officer, principal

financial officer, principal accounting officer or controller, or persons

performing similar functions. A copy of the Code of Conduct can be found as

Exhibit 99 to our Form 10-KSB filed for the year ended December 31, 2004. We

undertake to provide to any person without charge, upon request a copy of such

Code of Ethics once adopted, by writing to the Company's chief executive officer

at c/o Hawk Systems, Inc. 2385 Executive Center Drive, Suite 100, Boca Raton, FL

33431.

Committees

of the Board

Our board

of directors has not yet established an audit, nominating or compensation

committee. Our full board of directors will perform those functions

until such time as those committees are established. We have not yet

identified an audit committee financial expert meeting the required criteria and

qualifications to serve on our audit committee once it is established, however,

we anticipate identifying one in the future.

Director

Nominations

The board

of directors identifies director candidates through numerous sources, including

recommendations from directors, executive officers and our stockholders. The

board of directors seeks to identify those individuals most qualified to serve

as board members and will consider many factors with regard to each candidate,

including judgment, reputation, integrity, diversity, prior experience, the

interplay of the candidate’s experience with the experience of other directors

and the candidate’s willingness to devote the time and effort required for board

responsibilities. Our board of directors has not yet adopted any formal

procedures by which stockholders may recommend nominees to the Company’s board

of directors.

ITEM

11: EXECUTIVE COMPENSATION

The

following table sets forth certain information relating to the compensation paid

to (i) Michael Diamant, our Chief Executive Officer and Director, (ii) David

Coriaty, a member of our board of directors and former president, chief

executive officer, and chairman, and (iii) Robert McCann III, our former chief

executive officer (collectively, the “named executive officers”), during our

fiscal years ended December 31, 2009 and 2008.

2009

Summary Compensation Table

|

Name

and Principal Position

|

Year

|

Salary

($)

|

Option

Award(s)

($)

|

Total

($)

|

||||||||||

|

Michael

Diamant, Chief Executive Officer and Director (1)

|

2009 | — | — | — | ||||||||||

|

2008

|

— | — | — | |||||||||||

|

David

Coriaty, Director and Former President, Chief

Executive Officer and Chairman (2)

|

2009

|

500,000 | (3) | — | 500,000 | |||||||||

|

2008

|

252,363 | — | 252,363 | |||||||||||

|

Eric

Brown, Former

Chief Executive Officer, Chief Financial Officer and

Director

|

2009

|

— | — | — | ||||||||||

|

2008

|

50,000 | (4) | — | 50,000 | ||||||||||

|

Robert

E. McCann, Former

Chief Executive Officer (5)

|

2009

|

90,211 | 0 | (6) | 90,211 | |||||||||

|

2008

|

— | — | — | |||||||||||

15

———————

(1) Mr.

Diamant was appointed chief executive officer in December 2009, effective

January 15, 2010, and did not receive any compensation as our executive officer

during the fiscal year ended December 31, 2009.

(2) Mr.

David Coriaty was appointed president and chief executive officer in February

2009 and resigned from both positions in May 2009. Mr. Coriaty was

also appointed executive chairman in May 2009 and resigned from the position in

September 2009.

(3) Includes

deferred compensation in the aggregate amount of $231,566, which as of April 1,

2010 has not been paid.

(4) This

amount is accrued but not paid.

(5) Mr.

Robert McCann was appointed chief executive officer in May 2009 and terminated

in October 2009.

(6) In

connection with Mr. McCann’s termination on October 28, 2009, we cancelled his

stock option to purchase 7,800,000 shares of Common Stock at an exercise price

of $0.16 per share which had previously been granted in May 2009.

Narrative

Disclosure to 2009 Summary Compensation Table

Michael Diamant Employment

Agreement

On

December 15, 2009, we entered into an Employment Agreement with Mr. Michael

Diamant (the “Diamant Employment Agreement”), which was amended on

January 19, 2010 (the “Diamant Amendment”, together with the Diamant

Employment Agreement, the “Diamant Agreement”), pursuant to which Mr. Diamant

was hired to serve as our Chief Executive Officer. The term of the

Diamant Agreement commenced on January 15, 2010 for a one (1) year term

which will automatically extend for subsequent one (1) year periods unless

either party notifies the other not later than sixty (60) days prior to the then

current expiration date that such party does not intend for the Diamant

Agreement to automatically extend. Pursuant to the terms of the Diamant

Agreement, Mr. Diamant is entitled to receive a signing bonus equal to

$160,000 and an annual salary equal to $500,000, payable in equal monthly

installments. In addition, the Diamant Agreement provides that on

May 12, 2010 Mr. Diamant is entitled to receive an option to purchase

8,000,000 shares of our Common Stock(calculated on a post-reverse split basis)

at an exercise price equal to $0.36 (on a post-reverse split basis). The option

may be exercised for a term of five (5) years and will be fully vested and

non-cancellable at the time of the grant. The Diamant Agreement further provides

for an annual bonus opportunity of up to $200,000 during each year of the term

of the Diamant Agreement based upon performance criteria to be established

jointly by the Compensation Committee and Mr. Diamant within sixty (60) days of

the commencement of the Diamant Agreement and approved by our board of directors

each year.

If the

Diamant Agreement is terminated for any reason, we would be required to pay Mr.

Diamant his earned and accrued salary and bonus, if any, plus all reimbursable

expenses. If the Diamant Agreement is terminated for any reason other

than our terminating Mr. Diamant for cause, Mr. Diamant would additionally be

entitled to receive payments equal to twelve (12) months of his base

salary.

The

foregoing description of the Diamant Employment Agreement is qualified in its

entirety by the full text of the Diamant Employment Agreement, which was filed

as Exhibit 10.1 to the Current Report on Form 8-K filed with the SEC

on December 29, 2009 and the full text of the Diamant Amendment which was

filed as Exhibit 10.1 to the Current Report on Form 8-K filed with the

SEC on January 20, 2010, each of which are incorporated herein by

reference.

16

David Coriaty Employment

Agreement

On May 1,

2009, we entered into an Employment Agreement with Mr. David Coriaty (the

“Coriaty Employment Agreement”), which was amended on April 9, 2010 (the

“Coriaty Amendment”, together with the Coriaty Employment Agreement, the

“Coriaty Agreement”), pursuant to which Mr. Coriaty was hired to serve as our

Chairman. The term of the Coriaty Agreement commenced on May 1, 2009

for a one (1) year term which will automatically extend for subsequent one (1)

year periods unless either party notifies the other not later than ninety (90)

days prior to the then current expiration date that such party does not intend

for the Coriaty Agreement to automatically extend. Pursuant to the terms of the

Coriaty Agreement, Mr. Coriaty is entitled to receive an annual salary

equal to $500,000, payable in equal monthly installments. In

addition, the Coriaty Agreement provides that Mr. Coriaty is entitled to convert

any accrued but unpaid salary into shares of Common Stock at a conversion

price equal to the average closing bid price of the Common Stock on the twenty

(20) trading days immediately prior to such conversion date or such price as our

board of directors shall determine and Mr. Coriaty shall approve. If

the Coriaty Agreement is terminated for any reason, we would be required to pay

Mr. Coriaty his earned and accrued salary plus all reimbursable

expenses.

The

description of the Coriaty Employment Agreement is qualified in its entirety by

the full text of the Coriaty Employment Agreement, which was filed as

Exhibit 10.1 to the Quarterly Report on Form 10-Q filed with the SEC

on August 19, 2009 and the full text of the Coriaty Amendment which is filed as

Exhibit 10.16 to this Annual Report, each of which are incorporated herein

by reference.

Outstanding

Equity Awards at December 31, 2009

There

were no outstanding equity incentive awards held by our named executive officers

as of December 31, 2009.

DIRECTOR

COMPENSATION

None of

the members of our board of directors received compensation for their services

on the board of directors during the fiscal year ended December 31,

2009.

DIRECTOR

INDEPENDENCE

Our board

of directors has determined that there are presently no independent directors

based on the independence standards contained in the Marketplace Rules of the

NASDAQ Stock Market, although these independent director standards do not

directly apply to us because we do not have any securities that are listed on

NASDAQ.

ITEM

12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information regarding beneficial ownership of

our Common Stock as of April 6, 2010 by (i) each person (or group of

affiliated persons) who is known by the Company to own more than

five percent of the outstanding shares of Common Stock, (ii) each director

and executive officer, and (iii) all of the Company’s directors and executive

officers as a group. Beneficial ownership is determined in accordance with the

rules of the Securities and Exchange Commission (“SEC”) and generally includes

voting or investment power with respect to securities. Shares of our Common

Stock which may be acquired upon conversion of preferred stock or exercise of

stock options or warrants which are currently exercisable or convertible or

which become exercisable or convertible within 60 days after the date indicated

in the table are deemed beneficially owned by the holders thereof. Subject to

any applicable community property laws, the persons or entities named in the

table below have sole voting and investment power with respect to all shares

indicated as beneficially owned by them. All share amounts shown below are prior

to the 1-for-6 reverse stock split.

|

Title

of Class

|

Name

and Address of Beneficial Owner (1)

|

Amount

and

Nature

of

Beneficial

Ownership

|

Percent

of

Class Prior

to

Reverse

Split

(2)

|

Percent

of

Class After

Reverse

Split

(3)

|

|

Security Ownership of

Management:

|

||||

|

Common

Stock

|

Michael

Diamant (4)

|

8,000,000

|

16.8%

|

12.2%

|

|

Common

Stock

|

David

Coriaty (5)

|

6,465,000

|

14.0%

|

9.9%

|

|

Common

Stock

|

Antonio

De Risi (6)

|

8,000,000

|

16.8%

|

12.2%

|

|

Common

Stock

|

Edward

Sebastiano (7)

|

8,000,000

|

16.8%

|

12.2%

|

|

Common

Stock

|

Mark

Spanakos (8)

|

8,000,000

|

16.8%

|

12.2%

|

|

Officer

& Directors as a Group (5 persons)

|

38,465,000

|

54.8%

|

58.8%

|

|

|

Security Ownership of Certain Beneficial

Owners:

|

||||

|

Common

Stock

|

Grand

Columbus Holding Inc. (9)

|

4,787,500

|

12.0%

|

1.2%

|

|

Common

Stock

|

Greystone

Business Credit II, LLC (10)

|

4,000,000

|

10.1%

|

1.0%

|

|

Common

Stock

|

The

Tucker Family Spendthrift Trust (11)

|

10,376,530

|

22.5%

|

9.9%

|

|

Common

Stock

|

C.L.R.,

Associates, Inc. (12)

|

5,374,000

|

11.9%

|

8.2%

|

———————

* Less

than 1%

|

(1)

|

Unless

otherwise noted, the principal address of each of the directors and

officers listed above is c/o Hawk Systems, Inc., 2385 NW Executive Center

Drive, Suite 100, Boca Raton, FL

33431.

|

17

|

(2)

|

Assuming

39,759,345 shares of Common Stock issued and outstanding as of

April 2, 2010. With respect to any securities not outstanding which

are subject to such options, warrants, rights or conversion privileges,

such shares are deemed to be outstanding for the purpose of computing

the percentage of outstanding securities of the class owned by such

person but are not deemed to be outstanding for the purpose of computing

the percentage of the class by any other

person.

|

|

(3)

|

Assuming

approximately 65,564,258 shares of Common Stock issued and outstanding

after the Reverse Split and after giving effect to the conversion of all

of the outstanding shares of Series B Preferred Stock issued in

connection with the Merger. Of the shares of Series B Preferred Stock

outstanding immediately prior to the Reverse Split, 64,165 shares of

Series B Preferred Stock, which are convertible into 6,416,500 shares

of Common Stock, were issued subsequent to the merger and are not

automatically convertible into Common Stock in connection with the Reverse

Split. Accordingly, these shares have not been included for purposes of

the calculation above.

|

|

(4)

|

Includes

an option the Company has agreed to issue to Mr. Diamant on

May 12, 2010, whereby Mr. Diamant will have the right to

purchase 8,000,000 shares of the Company’s Common Stock on a post-Reverse

Split basis at an exercise price of $0.36 per share, exercisable for a

period of five (5) years from the date of

issuance.

|

|

(5)

|

This

amount consists of 105,890 shares of Series B Preferred Stock, which

are convertible into the number of shares of Common Stock listed

above.

|

|

(6)

|

This

amount consists of 80,000 shares of Series B Preferred Stock, which

are convertible into the number of shares of Common Stock listed

above.

|

|

(7)

|

This

amount consists of 80,000 shares of Series B Preferred Stock, which

are convertible into the number of shares of Common Stock listed

above.

|

|

(8)

|

This

amount consists of 80,000 shares of Series B Preferred Stock, which

are convertible into the number of shares of Common Stock listed

above.

|

|

(9)

|

The

stockholder’s address is 34 15th

Street, Brooklyn, New York 11215.

|

|

(10)

|

The