Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

______________

FORM

8-K

______________

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported)

April 14, 2010

DOLAT

VENTURES, INC.

(Exact

name of Registrant as specified in its charter)

|

Nevada

|

333-151570

|

Pending

|

|

(State

or other jurisdiction

of

incorporation)

|

(Commission

File

Number)

|

(IRS

Employer of

Identification

No.)

|

545

Eighth Avenue

Suite

401

New York,

NY 10018

(Address

of principal executive offices)

(212) 502-6657

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the Registrant under any of the following

provisions (see General Instruction A.2. below):

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

1

Table of

Contents

TABLE

OF CONTENTS

|

Item

1.01

|

Entry Into a Material Definitive

Agreement

|

3

|

||

|

Item

2.01

|

Completion of Acquisition or Disposition of

Assets

|

4

|

||

|

Item

5.06

|

Change in Shell Company

Status

|

38

|

||

|

Item

8.01

|

Other Events

|

39

|

||

|

Item

9.01

|

Financial Statements and

Exhibits

|

39

|

Cautionary

Note Regarding Forward-Looking Statements

Certain

statements in this Current Report on Form 8-K contain or may contain

forward-looking statements that are subject to known and unknown risks,

uncertainties and other factors which may cause actual results, performance or

achievements to be materially different from any future results, performance or

achievements expressed or implied by such forward-looking statements. These

forward-looking statements were based on various factors and were derived

utilizing numerous assumptions and other factors that could cause our actual

results to differ materially from those in the forward-looking statements. These

factors include, but are not limited to, our ability to consummate a merger or

business combination, economic, political and market conditions and

fluctuations, government and industry regulation, interest rate risk, U.S. and

global competition, and other factors. Most of these factors are difficult to

predict accurately and are generally beyond our control. You should consider the

areas of risk described in connection with any forward-looking

statements that may be made herein. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of the

date of this report. Readers should carefully review this annual report in

its entirety, including but not limited to our financial statements and the

notes thereto. Except for our ongoing obligations to disclose material

information under the Federal securities laws, The Company undertakes no

obligation to release publicly any revisions to any forward-looking statements,

to report events or to report the occurrence of unanticipated events. For any

forward-looking statements contained in any document, The Company claims the

protection of the safe harbor for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995.

Table of

Contents

Statements

that are predictive in nature, that depend upon or refer to future events or

conditions or that include words such as "expects," "anticipates," "intends,"

"plans," "believes," "estimates" and similar expressions are forward-looking

statements. Although we believe that these statements are based upon reasonable

assumptions, including projections of orders, sales, operating margins,

earnings, cash flow, research and development costs, working capital, capital

expenditures and other projections, they are subject to several risks and

uncertainties, and therefore, we can give no assurance that these statements

will be achieved.

Investors

are cautioned that our forward-looking statements are not guarantees of future

performance and the actual results or developments may differ materially from

the expectations expressed in the forward-looking statements.

As for

the forward-looking statements that relate to future financial results and other

projections, actual results will be different due to the inherent uncertainty of

estimates, forecasts and projections may be better or worse than projected.

Given these uncertainties, you should not place any reliance on these

forward-looking statements. These forward-looking statements also represent our

estimates and assumptions only as of the date that they were made. We expressly

disclaim a duty to provide updates to these forward-looking statements, and the

estimates and assumptions associated with them, after the date of this filing to

reflect events or changes in circumstances or changes in expectations or the

occurrence of anticipated events.

2

We

undertake no obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise. You are

advised, however, to consult any additional disclosures we make in our reports

on Form 10-K, Form 10-Q, Form 8-K, or their successors. We also note that we

have provided a cautionary discussion of risks and uncertainties under the

caption "Risk Factors

" in this Current Report. These are factors that we think could cause our

actual results to differ materially from expected results. Other factors besides

those listed here could also adversely affect us.

Table of

Contents

Information

regarding market and industry statistics contained in this Current Report is

included based on information available to us which we believe is accurate. We

have not reviewed or included data from all sources, and cannot assure

stockholders of the accuracy or completeness of the data included in this

Current Report. Forecasts and other forward-looking information obtained from

these sources are subject to the same qualifications and the additional

uncertainties accompanying any estimates of future market size, revenue and

market acceptance of products and services.

Explanatory

Note

This

Current Report on Form 8-K is being filed by Dolat Ventures Inc. (either the

“Company”, “we”, or “our”) in connection with a Share Exchange Agreement in

which the Company has acquired seventy- five percent (75 %)

of issued and outstanding capital stock of Millennium Mining

LLC of Sierra Leone (“Millennium”), a Limited Liability Company organized under

the laws of Sierra Leone. On April 13, 2010, the Company entered into

a Share Exchange Agreement under which the Company agreed to exchange

Thirty-Million (30,000,000) shares of Common stock to Millennium Mining LLC in

exchange for 75%, or (22,500,000 shares) of the issued and outstanding capital

stock of Millennium Mining LLC. The acquisition of Millennium Mining

LLC is accounted for as a reverse merger.

Item

1.01 Entry into a Material Definitive Agreement

On April

13, 2010 (the “Effective Date), the Company entered into an Share Exchange

Agreement (the “SEA”), which is attached to this Current Report on Form 8-K

as Exhibit 10.1, with Millennium Mining LLC a Sierra Leone Limited

Liability Corporation (“Millennium”)

Pursuant

to the SEA, Millennium agrees to transfer to the Registrant 75%, twenty-two

million, five hundred thousand (22,500,000) shares of the capital stock of

Millennium, in exchange for thirty million (30,000,000) shares of the

registrant’s Common stock.

3

Item

2.01 Completion of Acquisition or Disposition of Assets:

As

described in Section

1.01, of this current report form 8-k on April 13, 2010, Dolat Ventures,

Inc (the “Registrant” also the “Company”) reported that it had entered into an

Agreement and Plan of Acquisition (the “Agreement”) whereby the Registrant

agreed to acquire 22,500,000 75% of the outstanding capital stock of Millennium

Mining, LLC., a Sierra Leone Limited Liability

Corporation (“Millennium”) through a share exchange transaction (the

“Acquisition”). In consideration of their shares of Millennium, the

Millennium shareholders collectively received thrity million (30,000,000) common

shares of the Registrant. All contingencies set forth in the

Agreement were satisfied, and the Acquisition became effective on April 13,

2010. The Agreement is attached to this Current Report on Form 8-K as

Exhibit 10.1.

Brief

Description of Acquired Assets

The

assets acquired through the Share Exchange Agreement include 75% of the capital

stock of Millennium Mining LLC.

Company’s

Post-acquisition Organizational Structure

Following

our acquisition of Millennium, as described under Item 2.01 and as set forth in

the following diagram, Millennium became our direct 75 % owned

subsidiary. Prior to the acquisition of Millennium, Dolat Ventures as

set forth in the diagram held the entire equity interest in Dove Diamonds and

Mining.

|

Dolat

Ventures

|

||

| Dove Diamonds and Mining (100%) |

Millennium

Mining LLC (Sierra

Leone) (75%)

|

|

Registrant

was a shell company, other than a business combination related shell company, as

those terms are defined in Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2),

immediately before the Acquisition, therefore the information that would be

required if the Registrant were filing a general form for registration of

securities on Form 10 under the Exchange Act reflecting all classes of the

Registrant’s securities subject to the reporting requirements of Section 13 (15

U.S.C. 78m) or Section 15(d) (15 U.S.C. 78o(d)) of such Act

follows:

Organizational

History of Dolat Ventures Inc

We were

incorporated on April 13, 2006 in the state of Nevada. We are an exploration

stage enterprise and have not started operations or generated or realized any

revenues from our business operations.

4

Except

for the acquisition of Dove Diamonds and Mining, Inc. as disclosed in 8-k under

the heading “Our Current Business” there have been no material

reclassifications, mergers, consolidations or purchases or sales of any

significant amount of assets not in the ordinary course of business since the

date of incorporation. We are a start-up, exploration stage company engaged in

the search for diamond, gold and related minerals. There is no assurance that a

commercially viable mineral deposit, a reserve, exists in our claim or can be

shown to exist until sufficient and appropriate exploration is done and a

comprehensive evaluation of such work concludes economic and legal feasibility.

In April of 2010, we

entered into an agreement to purchase an undivided 75% interest in Millennium

Mining LLC an operating diamond and gold mining operation located in

the towns of Gandorhun, and Njala in Tikonko Chiefdom, Bo District of Sierra

Leone. The area is known as the Baimbawai Pool of the Sewa River

located between those two towns.

Organizational

History of Millennium Mining LLC

Millennium

Mining LLC was incorporated in Sierra Leone as a Private Limited Liability

Company on March 3, 2008 and commenced commercial operations after obtaining its

license from the Ministry of Mineral Resources (Sierra Leone) shortly

after. The company’s core operations are to mine extract, refine, and

purify precious metals and stones. The Company buys, sells,

distributes and exports diamond bauxite, rutile gold, silver and all other

precious minerals in Sierra Leone and internationally. Registrant

purchased 75% of the capital stock of Millennium Mining LLC. We

presently conduct all of our mining operations through Millennium Mining

LLC.

Part

1

Item

1 - Business

.The

Company is engaged in the business of mining and wholesale distribution of

diamonds and precious gemstones. The Company is headquartered in New

York, NY. The Company acquired Dove Diamonds & Mining at the end of the

4th

quarter in 2009 prior to the current acquisition of Millennium Mining

LLC. The company has never been subject to bankruptcy, receivership

or similar proceeding; or any

material reclassification,

and, except for the Acquisition reported in this Current Report on Form 8-K, and

the acquisition of Dove Diamonds & Mining, any merger consolidation, or

purchase or sale of a significant amount of assets not in the ordinary course of

business.

Overview

Dove Diamonds & Mining

Dove Diamonds

and Mining was incorporated in the state of Nevada on May 19, 2009. Dove is

headquartered in New York NY. Dove intends to acquire

equipment, mining operations and mining locations, and to establish distribution

channels to sell its diamonds to wholesalers and retailers in the United States

and globally. Dove has no plans to sell directly to consumers

currently.

With the

acquisition of Millennium Mining, Dolat Ventures intends to mine through its

Sierra Leone Operations and send its precious gems and metals to be refined to

Dove Diamonds & Mining.

5

World

diamond prices began to decline in the fourth quarter of 2008 and continued to

decline throughout the first quarter of 2009. While prices have now

begun to stabilize, they continue to be lower on a year-over-year

basis. However, many industry professionals believe the current

market is influenced by the expectation that prices for rough Diamonds will rise

again in 2010. As a result, we intend for Dove to gain a competitive

advantage by entering the market at a low point, and establish itself as a major

diamond wholesaler as the market begins to improve. Our long term

goals include obtaining a facility to process, cut, assemble and polish rough

diamonds and gems.

Current

Business

Dolat is

currently in the early stages of acquiring diamonds, gems and precious stones

from a variety of locations throughout the African

continent. Primarily focused on the West African country of Sierra

Leone We are in an organized search for mineral locations, suppliers and sellers

of diamonds, gems and precious stones.

Millennium

Mining LLC

Description

and Location

Millennium

Mining LLC was incorporated in Sierra Leone as a Private Limited Liability

Company on March 3, 2008 and commenced commercial operations after obtaining its

license from the Ministry of Mineral Resources (Sierra Leone) shortly

after. The company’s core operations are to mine extracted, refine,

and purify precious metals and stones. The Company buys, sells,

distributes and exports diamond bauxite, rutile gold, silver and all other

precious minerals in Sierra Leone and internationally.

On August

31, 2005 the government of Sierra Leone issued a mining license for a section of

the Sewa River to a former company owned by the current

shareholders. On February 8, 2008 (pre-incorporation), the company

re-assigned the mining license in Sierra Leone for use in the new company

Millenium Mining LLC. The license received by Millennium is renewable

every three years. Both a license from the government and mining

lease are required for before any commercial mining is to take

place.

On

January 26, 2008 (pre-incorporation), the company entered into a mining

agreement to dredge mine land in the towns of Gandorhun and Njala in the Tikonko

Chiefdom, Bo district of Sierra Leone. This area is known as the

Baimbawai Pool of the Sewa River located between these two towns. The

pool is owned by individuals from two villages, Gandorhun, and Njala, located on

either side of the river, and is reachable by vehicle. The site is

free of natural rock formations, and may have precious mineral deposit from

river wash through the natural tributary of the Sewa River.

6

Dredge

Mining is considered open-pit mining, where dredge rigs work the bottom and

sides of the river pool, and retrieved material is washed through a screening

process to reveal precious minerals. The company operates one dredge

machine and plans on expansion through an additional dredge rig and seeking

additional mining claims within Sierra Leone. Machinery is petroleum

powered and readily capable of operation with routine

maintenance. Fuel is readily available as of November 30,

2009. However, disruptions to fuel supplies may occur if civil unrest

in the area were to occur. Significant efforts of the Company have

been the acquisition of equipment to support dredge operations.

Millennium Mining Inc., a

Sierra Leone Corporation is party to a mining

agreement pursuant to which owners of land in the towns of Gandorhun and Njala

in the Tikonko Chiefdom, Bo District of Sierra Leone have agreed to allow

Millennium to mine the area in and around the Baimbawai Pool of the Sewa River

located between those two towns. According to the terms of the mining agreement

dated January 26, 2008, attached hereto as Exhibit A (the “Mining Agreement”),

Millennium will fund all diamond mining operations, and shall be responsible for

all required machinery, mining equipment and/or structures. The land owners who

hold the license to mine this area shall be entitled to thirty percent (30%) of

the net profits. Prior to the acquisition Millennium was owned 75% by Shmuel

Dovid Hauck and 25% by a resident of Sierra Leone, in compliance with the Mines

and Minerals Act of Sierra Leone.

Description

and Location

Location

– Millennium

Mining Boundary Coordinates

|

Easting

- m

|

Northing

- m

|

Beacon Sequence |

|

196529.63

|

865979.53

|

1. |

|

196561.2

|

865979.53

|

2. |

|

196565.36

|

865874.15

|

3. |

|

196516.78

|

865871.15

|

4. |

The

Millennium Mining concessions lie in land near the towns of Gandorhun

and Njala in the Tikonko Chiefdom, Bo district of Sierra Leone. This

area is known as the Baimbawai Pool of the Sewa River located between these two

towns. It is centered at Latitude “8.183444” North and Longitude “-11.363297”

west. It covers an area of 20 hectares.

The

project is situated about 40 kilometers Northwest of the town of Bo and

approximately 110 km West of the major capital Freetown based on the Atlantic

Ocean. The project lies in the middle of Sierra Leone, based on the

Sewa River. The river Formed by the junction of the Bagbe and Bafi

rivers, it flows 150 mi (240 km) to join the Waanje River and form the Kittam,

which empties into the Atlantic Ocean. The country's most important commercial

river, it is extensively panned and mined for diamonds.

7

Country

Dynamics

Mining

in Sierra Leone

Political

History

Sierra

Leone has been a major diamond producer for 70 years, but it has one of the

lowest Gross National Products in the world. Civil war ravaged the country from

1991 to 2002, primarily over the distribution of wealth from the country's

diamond mines.

In

October 1999, the U.N. Security Counsel established the United Nations Mission

in Sierra Leone (UNAMSIL) to help implement disarmament.

At the

beginning of July 2000 the United Nations Security Council decided to impose an

18 month ban on diamond exports from Sierra Leone, recognizing that diamonds had

been fueling the conflict and that the rebels had been mining diamonds and

selling them to fund their weapons purchase and other activities, including

human rights abuses.

Additionally,

in July 2001, a diamond mining ban was announced in Sierra Leone in an attempt

to address the violence and curb human rights abuses.

UNAMSIL

successfully completed its mission in December 2005. It was succeeded by a new

mission, the United Nations Integrated Office for Sierra Leone (UNIOSL)

established by the Security Counsel to help consolidate peace in Sierra

Leone.

Mining

History

Diamond

output in Sierra Leone was 600,000 carats in 1999, 2000, and 2001, 250,000 in

1998, and 400,000 in 1997; most production was by artisanal

miners. The process of alluvial diamond mining involves digging and

sifting through mud, sand and gravel using shovels, sieves, or even bare hands.

Typically, diamonds come from geologic rock formations called Kimberlites.

Kimberlite rock formations that contain diamonds are eroded over time by rivers

and streams and can deposit diamonds in the sediments carried by those streams

farther downstream from the original source rocks. These deposits are called

alluvial diamond deposits. The locations of these alluvial diamond deposits are

controlled by the surrounding topography, drainage patterns, and the location of

the Kimberlites themselves. Alluvial deposits are often mined and exploited by

small-scale miners using artisanal mining techniques. It was believed that a

substantial portion of the diamonds close to the earth's surface was smuggled

out of the country. Alluvial diamonds, first discovered in Kono District in

1930, were widely scattered over a large area, but particularly along the upper

Sewa River. The main diamond deposits were the Koidu and Tongo fields. Diamond

Works Ltd., of Canada, which owned 60% of the Koidu mine (reserves of 2.67

million carats), announced in 2001 that it was returning to Sierra Leone.

Diamond Works also held diamond exploration licenses on the Sewa River with

reserves containing 1.7 million carats. Production of alluvial gold in 2001 was

30 kg, down from 123 kg in 1994.

8

For 25

years, the Sierra Leone Selection Trust (SLST), a subsidiary of the Consolidated

African Selection Trust, had exclusive diamond prospecting rights and gave the

government 27.5% of its annual net profit. However, this monopoly, plus numerous

finds of gem diamonds at or close to the surface, encouraged so much illicit

mining and exportation that, in 1955, the government renegotiated SLST's

concession, limiting it to two areas, Yengema, in Kono District, and Tongo, in

Kenema District, and compensated the company for surrendering its rights in

other areas. In 1956, the government introduced the Alluvial Diamond Mining

Scheme, in which Sierra Leoneans were issued licenses to dig in declared areas

totaling more than 23,300 sq km (9,000 sq mi). In addition to a licensing fee,

each licensee had to pay land rental to the local chiefdom authorities and could

employ up to 20 diggers. A buying organization, the Government Diamond Office

(the Government Gold and Diamond Office since 1985), was set up in agreement

with the Diamond Inc., in London. Foreigners, who had figured significantly in

illicit diamond dealing, were removed from the diamond-mining areas. In 1962,

the government ordered the SLST to sell all its diamond through the government

office. In 1970, the government acquired a 51% interest in SLST and formed the

National Diamond Mining Co. (NDM). In 1991, the government started returning

control of diamond and gold export activities back to the private sector, to

curtail illicit trading and maximize revenues. New mining policy in 1994 made

requirements for licensing miners and exporters more rigid, to address the heavy

revenue losses from illegal trading in diamonds and gold. NDM ceased operations

in 1992, partly because of rebel activities in the Yengema mining

district.

Sierra

Rutile Ltd. announced that rutile mining would resume in 2003, having closed in

1995 because of fighting. The Sierra Rutile mine was the largest and

highest-grade rutile resource in the world.

Rutile is

a major mineral source of the element titanium. Rutile is typically about 60%

titanium and 40% oxygen. It can have some iron present, sometimes up to 10%. The

rutile specimen in the photo does have about 5% iron in it. Rutile is one of the

most common titanium minerals, occurring in gneiss, mica, schist, granite,

limestone and dolomite. It is also associated with quartz, hematite and

feldspar. As a secondary mineral, it is common in beach sand deposits, along

with the other titanium mineral, ilmenite.

The

Mining of rutile, a titanium oxide, began in the Southern Province, near Bonthe,

in 1967; because of technical difficulties, mining operations were stopped in

1971. Sierra Rutile began operating a pilot plant in 1973, and production

resumed in December 1979. Output rose from 46,000 tons in 1980–81 to a record

154,000 in 1991, before falling to 137,000 in 1994.

The main

iron ore deposits were near Marampa, in the Port Loko District, and between the

Sokoya and Waka hills, in the Tonkolili District. Mining began in 1933, and a

program of expansion of the Marampa mine was launched in 1961. Exports increased

from 952,000 tons in 1960 to 2.4 million tons in 1973, but the mine was closed

in 1975. It reopened in 1982, under government ownership and Austrian

management, shipment of iron ore resumed in 1983, and the mine was closed again

in 1985.

Bauxite

mining in the Mokanji Hills area of the Southern Province was begun by the

Sierra Leone Ore and Metal Co. in 1963. Production of 735,000 tons was reported

in 1994, before operations were disrupted by civil unrest. In 1996, the company

announced that it would not reopen the site. A second bauxite operation and

alumina plant were to be developed at Port Loko. A zircon recovery plant opened

in 1991, using old tailings and new mine output from the rutile mines. Known

reserves of other minerals included antimony, cassiterite, columbite, corundum,

fluorspar, ilmenite, lead, lignite, magnetite, molybdenum, monazite, platinum,

silver, tantalite, tin, titanium, tungsten, and zinc.

A 1999

amendment to the 1994 Mines and Minerals Act introduced procedures for sale and

export of precious minerals by license holders, and penalties for unlawful

possession or smuggling of precious minerals. In 2001, Sierra Leone and Angola

introduced a diamond certification scheme in response to UN sanctions aimed at

prohibiting importation of diamonds from rebel-controlled areas in the

countries.

Current

Status

Currently,

the mining business in Sierra Leone includes about 2,500 small operations.

Unlike oil, iron ore and even gold, diamonds are so easy to transport that if

regulations are too onerous and taxes too high, miners and exporters will simply

turn to smuggling.

In 2007,

Sierra Leone officially exported over $175 million worth of diamonds, government

records show. That is a vast improvement over the $24 million officially

exported in 2001, before stringent new rules known as the Kimberly Process

required diamond deals to be certified by the authorities. Before that, most

diamonds were smuggled out of the country through Liberia and Guinea and sold

for weapons.

Sierra

Leone’s primary mineral resources are diamonds, rutile, bauxite, gold and small

amounts of iron ore and limonite.

Diamonds

The

Sierra Leone diamond fields cover an area of about 7,700 square miles (about one

quarter of the country) in the south-eastern and eastern parts of Sierra Leone.

The diamond producing areas are concentrated in Kono, Kenema and Bo Districts

and are mainly situated in the drainage areas of the Sewa, Bafi, Woa, Mano and

Moa Rivers. Alluvial diamond concentrations occur in river channel gravels,

flood-plain gravels, terrace gravels, gravel residues in soils and swamps.

Sierra Leone is known for producing mostly gem quality diamonds including some

spectacularly large stones of very high value.

The

largest ever discovered (February 1972) was a 969.8 carat diamond code-named the

“Star of Sierra Leone” (the third largest diamond ever found worldwide).

Kimberlites, the primary host rocks for diamonds, have been discovered in the

Koidu and Tongo areas. Reserves are estimated at 6.3 million carats down to a

depth of 600m at Koidu and 3.2 million carats to a depth of 600m at Tongo.

Artisanal and small-scale diamond mining activities are widespread in the Kono

District as well as Kenema, Bo and Pujehun Districts. About 1,700 artisanal

mining licenses are currently operating in these areas.

Gold

Gold was

discovered in several localities in the years from 1926, in the Sula Mountains

and Kangari Hills, and in the Koinadugu, Tonkolili and Bo Districts.All

greenstone belts in Sierra Leone (with the possible exception of the Marampa

Group and perhaps the Kambui Hills) are known to contain gold. Rivers and

streams draining these areas also carry gold. The most important known lode gold

deposits occur around the Lake Sonfon area, Kalmaro, Makong, Baomahun and

Komahun. At present, the only gold production in Sierra Leone comes from

alluvial deposits. Notwithstanding the limited gold exports in recent years,

Sierra Leone is thought to be well-endowed with gold

deposits.

9

|

SIERRA

LEONE - GEOGRAPHY AND GEOLOGY OVERVIEW

The

Republic of Sierra Leone is located on the West Coast of Africa, between

latitudes 7 and 10 north and longitudes 10.5 and 13 west. The Republic of

Guinea is to the north and northeast; Liberia is to the east and

southeast, and the Atlantic Ocean on the west and south. It has 300 miles

of coastline.

From

an approximate 70-mile coastal belt of low-lying land, the country rises

to a mountain plateau near the eastern frontier rising 4000 to 6000 feet

with a rich timber forest region. The Western Area encompasses the Sierra

Leone Peninsula, on which the capital and main commercial centre of

Freetown stands; is 24 miles long and 10 miles wide.

A

mountainous promontory, it rises in places to 300 feet above sea level -

one of the few parts of the West African Coast where there is high land so

near the sea. Where the lush green forest spills down hillsides to meet

the most beautiful white sandy beaches along the Atlantic

Ocean.

This

27,925 square mile (73,326 sq km) country has a population of

approximately 4.5 million people. Sierra Leone is divided into four main

Provinces, West, North, East and South. There are twelve Districts in the

entire country.

Most

of the country is underlain by rocks of Precambrian age (Archaean and

Proterozoic) with a coastal strip about 50 km in width comprising marine

and estuarine sediments of Tertiary and Quaternary to recent age. The

Precambrian (mainly Archaean) outcrops over about 75% of the country and

typically comprises granite-greenstone terrain. It represents parts of

ancient continental nuclei located on the edge of the West African Craton.

Regional reconnaissance mapping indicates that the Archaean basement can

be subdivided into infracrustal rocks (gneisses and granitoids);

supracrustal rocks (containing greenstone belts); and basic and ultrabasic

igneous intrusions. The infracrustal gneisses and granitoids were formed

and reworked during two major orogenic cycles, an older Leonean episode

(~2,950-3,200 Ma) and a younger Liberian episode (~2700 Ma).

The

Leonean orogenic episode commenced with the intrusion of a basic igneous

suite (the Pre-Leonean amphibolites) and by the formation of a greenstone

belt represented by the Loko Group which is now deeply eroded. The Loko

Group comprises amphibolites, silimanite quartzites and ironstones. It

appears to have formed on a gneiss/granitoid basement in which several

granitoid bodies related to an earlier plutonicorogenic episode have been

distinguished mainly in the northern part of the country. Only the main

deformational phase of the Leonean orogenic episode which resulted in

folds and fabrics trending east-west has been distinguished. Minor gold

and cassiterite mineralization associated with portions of the Loko Group

is probably related to a late Leonean granitisation event which

accompanied the formation of major shear zones in the

craton.

Other

volcano-sedimentary sequences are preserved within the granites, gneisses

and migmatites. Highly folded greenstone belts predominate in the north

and central Sierra Leone. In the southeast, the metamorphic facies

increases, first with the Kambui Schists and finally with the Mano-Moa

Granulites. Greenstone belts of the Kambui Supergroup are believed to have

been deposited upon a post-Leonean basement and accompanies by basic to

ultrabasic intrusives. The Kambui Supergroup includes most of the schist

belts exposed in the Sula Mountains and the Kangari, Kambui, Nimini and

Gori Hills; the Marampa Group; and the two small greenstone belts of

Serekolia and Sankarama in the northeast. These greenstone belts comprise

a lower volcanic unit composed of ultrabasic lavas and basic lavas with

pillow layers, overlain by a sedimentary unit comprising tuffs, pelitic

and psammitic sediments, with conglomerate layers and ironstone bands. The

greenstone belts are the principal hosts of the gold mineralisation of the

country.

Other

associated mineral deposits include molybdenite, columbite-tantalite and

chromite. The Marampa Group, bounded on its eastern margin by a tectonic

contact, is important for its iron-ore deposits and forms the upper part

of the Kambui Group. Late Liberian granitoids, marginal to, and within,

the Kambui Supergroup, are associated with important zones of shearing and

deformation where gold, sulphide and molybdenite mineralisation has been

concentrated.

The

Rokel-Kasila Zone bounds the main part of the West African Craton on its

west and southwestern margin in Sierra Leone, and appears to form part of

a north-south orogenic belt. Within this belt, the Marampa Group appears

to represent some of the oldest rocks. The Kasila Group, also considered

to be part of the Kambui Supergroup, comprises a high-grade series of

granulites, consisting of garnet, hypersthene and hornblende gneisses,

quartzites and associated migmatites. Where eroded, signi_ cant secondary

deposition of titanium minerals have formed from this unit. The Kasila

Group also contains bauxite.

A

late Precambrian to Cambrian sedimentary and volcanic assemblage, the

Rokel River Group, was deposited unconformably on a basement complex.

Deposition was probably in a fault-bounded basin of the intracratonic type

along the line of the Rokel-Kasila Group following the formation of the

tectonic zone at the end of the Liberian or during the Eburnean Orogeny.

The Rokel River Group and the Kasila Group to the west were deformed

during the Rokelide orogenic episode (~550 Ma). Deformation increased in

intensity westwards.

The

Saionya Scarp Group forms a small ingression into Sierra Leone in the

northwest of the country, and is composed of horizontally-bedded arkoses,

grits and shales with intruded dolerite sills. The group appears to belong

to that part of the Gres Horizontaux of Guinea which has been classi_ ed

as Ordovician, based on the discovery of the graptolites Monograptus

riccartonensis and Monograptus priodon in shales near

Telimele.

In

Sierra Leone, the Saionya Scarp Group rests on The Rokel River

Group.

Dolerite

intrusions are common as dykes trending mainly east-west within the

basement complex, and as extensive sills above the Rokel River Group.

Kimberlite dykes and pipes follow a similar pattern in the east of the

country and could also be present in the north and

west.

The

Freetown igneous complex forms an intrusive body on the coast, with

arcuate outcrop concave towards the west. It is composed of a layered

complex of gabbro, norite, troctolite and anorthosite. Platinum occurs in

the gravels of many of the streams that cut the outcrops of anorthosite

and anorthositic gabbro in the noritic gabbro complex of the Freetown

Peninsula. The relation of this complex with the other units is obscured

by the coastal veneer of Tertiary sediments of the Bullom Group which lies

unconformably on the basement. Tertiary and more recent weathering has led

to lateritisation across a large part of Sierra Leone, affecting mainly

the greenstone belts and the extensive dolerite intrusions. The bauxite

deposits formed within the Kasila Group are a result of this weathering

process.

|

10

Sierra

Leone TRANSPARENCY

Stemming

the flow of Conflict Diamonds - The Kimberley Process

The

Kimberley Process (KP) is a joint governments, industry and civil society

initiative to stem the flow of conflict diamonds – rough diamonds used by rebel

movements to finance wars against legitimate governments. The trade in these

illicit stones has fuelled decades of devastating conflicts in countries such as

Angola, Cote d'Ivoire, the Democratic Republic of the Congo and Sierra

Leone.

The

Kimberley Process Certification Scheme (KPCS) imposes extensive requirements on

its members to enable them to certify shipments of rough diamonds as

‘conflict-free’. As of December 2009, the KP has 49 members, representing 75

countries, with the European Community and its Member States counting as an

individual participant.

History

The

Kimberley process started when Southern African diamond-producing states met in

Kimberley, South Africa, in May 2000, to discuss ways to stop the trade in

‘conflict diamonds’ and ensure that diamond purchases were not funding violence.

In December 2000, the United Nations General Assembly adopted a landmark

resolution supporting the creation of an international certification scheme for

rough diamonds. By November 2002, negotiations between governments, the

international diamond industry and civil society organizations resulted in the

creation of the Kimberley Process Certification Scheme (KPCS) . The KPCS

document sets out the requirements for controlling rough diamond production and

trade. The KPCS entered into force in 2003, when participating countries started

to implement its rules.

Who

is involved?

The

Kimberley Process (KP) is open to all countries that are willing and able to

implement its requirements. As of December 2009, the KP has 49 members,

representing 75 countries, with the European Community and its Member States

counting as an individual participant. KP members account for approximately

99.8% of the global production of rough diamonds. In addition, the World Diamond

Council, representing the international diamond industry, and civil society

organizations – Global Witness, Partnership-Africa Canada – are participating in

the KP and have played a major role since its outset.

11

How

does the Kimberley Process work?

The

Kimberley Process Certification Scheme (KPCS) imposes extensive requirements on

its members to enable them to certify shipments of rough diamonds as

‘conflict-free’ and prevent conflict diamonds from entering the legitimate

trade. Under the terms of the KPCS, participating states must meet ‘minimum

requirements’ and must put in place national legislation and institutions;

export, import and internal controls; and also commit to transparency and the

exchange of statistical data. Participants can only legally trade with other

participants who have also met the minimum requirements of the scheme, and

international shipments of rough diamonds must be accompanied by a KP

certificate guaranteeing that they are conflict-free.

KP

participating countries and industry and civil society observers gather twice a

year at intercessional and plenary meetings, as well as in working groups and

committees that meet on a regular basis. Implementation is monitored through

‘review visits’ and annual reports as well as by regular exchange and analysis

of statistical data.

The

Kimberley Process: unique and effective

The joint

efforts of governments, industry leaders and civil society representatives have

enabled the Kimberley Process (KP) to curb successfully the flow of conflict

diamonds in a very short period of time. Diamond experts estimate that conflict

diamonds now represent a fraction of one percent of the international trade in

diamonds, compared to estimates of up to 15% in the 1990s. The KP has also

brought large volumes of diamonds onto the legal market that would not otherwise

have made it there. This has increased the revenues of poor governments, and

helped them to address their countries’ development

challenges.

The

Kimberley Process and Sierra Leone

The UN

Resolution on Sierra Leone diamonds was lifted in 2003 when the KP came into

effect and since then all legally won diamonds have been exported in compliance

with the minimum requirements of the KP. Since the Certification of Sierra Leone

diamonds, in 2000, the diamond export statistics are as follows:

12

| Year | Value (USD) |

| 2000 | 10 million |

| 2001 | 26 million |

| 2002 | 41 million |

| 2003 | 76 million |

| 2004 | 126 million |

| 2005 | 141 million |

| 2006 | 126 million |

| 2007 | 142 million |

| 2008 | 99 million |

| 2009 | 80 million |

*From

Sierra Leone Mining Ministry Website

http://www.slminerals.org/content/index.php?option=com_content&view=article&id=11&Itemid=15

Principal

Products

Diamonds

and Gems

We will

generally sell our diamonds at the prevailing market price during the month in

which the diamonds are delivered to the customer. We will recognize revenue from

a sale when the price is determinable, the diamonds has been delivered, the

title has been transferred to the customer and collection of the sales price is

reasonably assured.

The

company will refine, cut and sell its Diamonds on the international market with

importation into the United States, and Europe for cutting

purposes. All diamonds currently will be sold to jewelers for

cutting, however in the future company intends to cut diamonds for

itself through its interests in Dove Diamonds & Mining.

Currently

the company does not own any cutting operations but intends to in the

future.

Diamond

Pricing

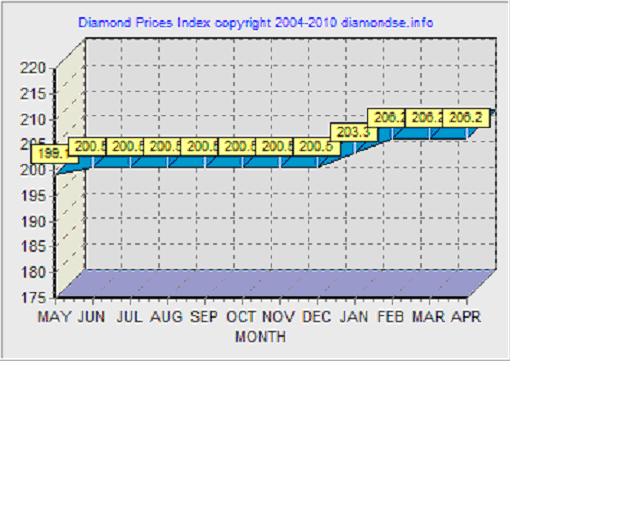

For the

month of April 2010, diamond

prices are unchanged as of the last two months.

Please

refer to annual Diamond Pricing context from May of 2009 to Current April

2010.

13

Price

Per Carat.

Wholesale

Diamond Pricing on the Retail Level

All

prices are estimates according to the diamond market. Diamond prices are subject

to change based on current market conditions and are updated at least every 30

days. X Axis defines Clarity, Y axis defines Cut.

|

Rounds

(.50 - .69 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

7,752

|

6,161

|

11,110

|

4,786

|

4,116

|

3,709

|

2,988

|

||||||||

|

E

|

6,181

|

5,498

|

5,049

|

4,214

|

0.00

|

3,266

|

2,727

|

||||||||

|

F

|

11,220

|

10,200

|

4,751

|

3,920

|

0.00

|

0.00

|

2,475

|

||||||||

|

G

|

5,151

|

4,553

|

0.00

|

0.00

|

6,666

|

2,744

|

2,393

|

||||||||

|

H

|

4,498

|

3,960

|

3,672

|

3,332

|

2,899

|

2,500

|

2,121

|

||||||||

|

I

|

3,626

|

0.00

|

3,029

|

2,726

|

0.00

|

4,400

|

1,960

|

||||||||

|

J

|

0.00

|

2,673

|

0.00

|

0.00

|

2,199

|

1,999

|

1,836

|

||||||||

|

Rounds

(.70 - .89 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

9,180

|

7,314

|

6,630

|

6,034

|

10,706

|

4,752

|

4,257

|

||||||||

|

E

|

14,140

|

0.00

|

5,958

|

5,454

|

5,151

|

4,598

|

4,058

|

||||||||

|

F

|

0.00

|

6,222

|

5,445

|

5,203

|

4,747

|

4,430

|

3,876

|

||||||||

|

G

|

5,939

|

5,666

|

0.00

|

4,794

|

4,355

|

4,000

|

3,635

|

||||||||

|

H

|

5,345

|

5,048

|

0.00

|

4,370

|

0.00

|

3,812

|

3,503

|

||||||||

|

I

|

4,590

|

4,198

|

4,000

|

3,876

|

3,528

|

3,468

|

3,091

|

||||||||

|

J

|

3,641

|

3,332

|

3,400

|

0.00

|

6,000

|

3,017

|

2,699

|

||||||||

14

|

Rounds

(.90 - .99 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

21,420

|

8,583

|

0.00

|

14,200

|

6,434

|

6,161

|

5,246

|

||||||||

|

E

|

8,330

|

8,323

|

7,326

|

6,696

|

0.00

|

5,858

|

10,200

|

||||||||

|

F

|

8,097

|

7,524

|

7,070

|

6,325

|

0.00

|

5,390

|

5,048

|

||||||||

|

G

|

7,350

|

6,899

|

13,130

|

5,899

|

5,642

|

5,357

|

0.00

|

||||||||

|

H

|

0.00

|

6,362

|

12,000

|

5,713

|

5,618

|

4,752

|

4,400

|

||||||||

|

I

|

0.00

|

10,600

|

4,950

|

0.00

|

0.00

|

4,474

|

3,861

|

||||||||

|

J

|

9,696

|

4,508

|

8,800

|

4,200

|

3,998

|

0.00

|

3,500

|

||||||||

|

Rounds

(1.00 - 1.49 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

36,200

|

12,925

|

23,000

|

9,487

|

8,654

|

7,070

|

0.00

|

||||||||

|

E

|

12,499

|

23,200

|

20,604

|

8,976

|

8,161

|

6,799

|

5,599

|

||||||||

|

F

|

23,230

|

10,714

|

0.00

|

16,968

|

7,699

|

0.00

|

5,406

|

||||||||

|

G

|

9,601

|

8,918

|

17,600

|

7,722

|

7,417

|

6,019

|

0.00

|

||||||||

|

H

|

15,200

|

7,447

|

7,140

|

6,565

|

6,387

|

5,872

|

10,000

|

||||||||

|

I

|

6,696

|

12,600

|

12,120

|

5,769

|

5,353

|

0.00

|

4,410

|

||||||||

|

J

|

5,554

|

5,399

|

5,299

|

5,050

|

0.00

|

4,682

|

4,370

|

||||||||

|

Rounds

(1.50 - 1.99 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

0.00

|

16,126

|

14,790

|

12,295

|

22,600

|

19,380

|

7,956

|

||||||||

|

E

|

15,345

|

29,200

|

26,260

|

0.00

|

21,600

|

9,016

|

7,574

|

||||||||

|

F

|

29,088

|

0.00

|

12,599

|

22,400

|

21,008

|

17,400

|

7,283

|

||||||||

|

G

|

12,465

|

0.00

|

11,444

|

10,507

|

9,793

|

0.00

|

13,130

|

||||||||

|

H

|

9,596

|

9,292

|

8,989

|

8,568

|

8,263

|

15,096

|

6,324

|

||||||||

|

I

|

8,036

|

16,160

|

0.00

|

15,150

|

7,070

|

6,434

|

5,656

|

||||||||

|

J

|

6,997

|

0.00

|

13,464

|

6,362

|

5,858

|

5,666

|

5,048

|

||||||||

|

Rounds

(2.00 - 2.99 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

32,597

|

53,244

|

23,937

|

0.00

|

15,998

|

12,471

|

10,507

|

||||||||

|

E

|

0.00

|

24,033

|

20,708

|

17,877

|

16,022

|

12,175

|

10,098

|

||||||||

|

F

|

22,736

|

20,295

|

37,740

|

33,660

|

15,453

|

11,899

|

19,400

|

||||||||

|

G

|

0.00

|

17,223

|

15,484

|

15,814

|

13,622

|

11,424

|

0.00

|

||||||||

|

H

|

0.00

|

13,805

|

13,187

|

12,671

|

11,730

|

20,000

|

8,611

|

||||||||

|

I

|

11,716

|

22,826

|

0.00

|

9,996

|

0.00

|

8,787

|

7,957

|

||||||||

|

J

|

19,380

|

9,096

|

8,809

|

8,466

|

7,546

|

7,417

|

6,632

|

||||||||

|

Rounds

(3.00 - 3.99 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

49,781

|

37,464

|

32,670

|

0.00

|

22,646

|

16,464

|

12,274

|

||||||||

|

E

|

0.00

|

32,242

|

26,950

|

23,291

|

40,800

|

16,646

|

11,899

|

||||||||

|

F

|

31,654

|

27,121

|

23,661

|

43,430

|

19,301

|

0.00

|

11,383

|

||||||||

|

G

|

25,542

|

23,513

|

20,786

|

40,800

|

17,999

|

14,137

|

11,199

|

||||||||

|

H

|

40,188

|

0.00

|

17,444

|

16,438

|

14,383

|

11,781

|

10,817

|

||||||||

|

I

|

15,150

|

14,629

|

13,733

|

25,908

|

10,888

|

10,714

|

8,918

|

||||||||

|

J

|

0.00

|

11,466

|

11,526

|

10,817

|

9,988

|

0.00

|

7,918

|

||||||||

15

|

Rounds

(4.00 - 4.99 CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

54,695

|

42,596

|

38,085

|

61,812

|

26,167

|

20,398

|

0.00

|

||||||||

|

E

|

43,268

|

77,724

|

64,640

|

26,730

|

47,532

|

18,608

|

28,684

|

||||||||

|

F

|

38,250

|

33,189

|

28,110

|

0.00

|

22,077

|

17,974

|

13,799

|

||||||||

|

G

|

29,793

|

26,068

|

49,980

|

23,528

|

19,499

|

16,298

|

13,495

|

||||||||

|

H

|

22,374

|

20,885

|

19,404

|

18,770

|

15,994

|

14,137

|

25,296

|

||||||||

|

I

|

18,056

|

17,204

|

0.00

|

15,349

|

13,974

|

12,623

|

11,086

|

||||||||

|

J

|

14,642

|

28,078

|

13,668

|

12,852

|

11,482

|

10,591

|

9,702

|

||||||||

|

Rounds

(5.00 - 5.99+ CT.)

|

|||||||||||||||

|

IF

|

VVS1

|

VVS2

|

VS1

|

VS2

|

SI1

|

SI2

|

|||||||||

|

D

|

0.00

|

50,795

|

46,565

|

0.00

|

31,730

|

24,354

|

18,258

|

||||||||

|

E

|

51,819

|

46,109

|

78,000

|

34,476

|

28,407

|

0.00

|

17,398

|

||||||||

|

F

|

46,610

|

39,784

|

35,396

|

63,024

|

26,991

|

21,014

|

17,066

|

||||||||

|

G

|

36,554

|

34,821

|

31,627

|

28,257

|

24,416

|

19,482

|

15,998

|

||||||||

|

H

|

30,294

|

26,824

|

25,343

|

21,952

|

0.00

|

16,998

|

28,684

|

||||||||

|

I

|

22,791

|

22,340

|

21,325

|

18,887

|

16,864

|

13,799

|

12,499

|

||||||||

|

J

|

17,034

|

16,460

|

16,438

|

14,949

|

14,011

|

12,343

|

11,322

|

||||||||

Gold

We will

generally sell our gold at the prevailing market price during the month in which

the gold is delivered to the customer. We will recognize revenue from a sale

when the price is determinable, the gold has been delivered, the title has been

transferred to the customer and collection of the sales price is reasonably

assured. There is a local market for the minor amounts of Gold that we

find.

Gold

Uses

Gold

has two main categories of use: fabrication and investment. Fabricated gold has

a variety of end uses, including jewelry, electronics, dentistry, industrial and

decorative uses, medals, medallions and official coins. Gold investors buy gold

bullion, official coins and jewelry.

16

Gold Supply

The

supply of gold consists of a combination of current production from mining and

the draw-down of existing stocks of gold held by governments, financial

institutions, industrial organizations and private individuals.

Gold

Price.

The

following table presents the annual high, low and average afternoon fixing

prices for gold over the past ten years, expressed in US dollars per ounce, on

the London Bullion Market.

|

Gold

Price (USD) on the

London

Bullion Market

|

||||||||||||

|

Year

|

High

|

Low

|

Average

|

|||||||||

|

1999

|

$ | 326 | $ | 253 | $ | 279 | ||||||

|

2000

|

313 | 264 | 279 | |||||||||

|

2001

|

293 | 256 | 271 | |||||||||

|

2002

|

349 | 278 | 310 | |||||||||

|

2003

|

416 | 320 | 363 | |||||||||

|

2004

|

454 | 375 | 410 | |||||||||

|

2005

|

536 | 411 | 444 | |||||||||

|

2006

|

725 | 525 | 604 | |||||||||

|

2007

|

841 | 608 | 695 | |||||||||

|

2008

|

1,011 | 713 | 872 | |||||||||

|

2009

|

1214 | 810 | 1015 | |||||||||

Source: London Metal Exchange

On

April 9, 2010, the afternoon fixing price for gold on the London Bullion

Market was $1161.41 per ounce.

Revenues

Prior to

the acquisition of Millennium Mining we had no operations or

revenues. We have achieved losses since inception, have been issued a

going concern opinion by our auditors and rely upon the sale of our securities

to fund operations.

Mining

operations at the Millennium Project currently produces approximately10-15

Carats of diamonds per month with minor amounts of Gold ( Under 1 oz per month).

The company has begun dredging operations with its main dredge and is currently

about to acquire a full scale large dredging machine to increase capacity

substantially.

Currently,

diamonds mined from the Millennium Project are Kimberly licensed by the

Government of Sierra Leone, where all taxes and related expenses are paid and

are then brought back to the United States for sale to Diamond wholesalers for

cutting purposes. Millennium Mining has received an export license,

and we anticipate that most of our revenue will come from the sale of diamonds

in the international market. Pursuant to recently enacted Sierra

Leone mining law, the mining act passed last November 2009 raised taxes on

diamonds to 6.5% from a previous 5%, and on gold and other precious metals to 5%

from 4%. The new law has imposed a new 15% tax on exports of high

value diamonds,

effective, 2010.

17

Employees

The Registrant current employs 2

Full-Time Equivalents (FTEs) in the United States, and approximately 95 in

Sierra Leone.

Environmental

Regulation

Our

diamond and gold projects are subject to various federal, state and local laws

and regulations governing protection of the environment. These laws are

continually changing and, in general, are becoming more restrictive. Our policy

is

to conduct business in a

way that safeguards public health and the environment. We believe that our

operations are in material compliance with applicable laws and

regulations.

Changes

to current local, state or federal laws and regulations in the jurisdictions

where we operate could require additional capital expenditures and increased

operating and/or reclamation costs. Although we are unable to predict what

additional legislation, if any, might be proposed or enacted, additional

regulatory requirements could impact the economics of our planned projects.

We estimate that we will not incur material capital expenditures for

environmental control facilities during the current fiscal year.

Competition

We

compete with other mining companies in connection with the acquisition,

exploration, financing and development of diamond and gold properties. There is

competition for the limited number of gold acquisition and exploration

opportunities, some of which is with other companies having substantially

greater financial resources than we have. We also compete with other mining

companies for mining engineers, geologists and other skilled personnel in the

mining industry and for exploration and development equipment.

18

We

believe no single company has sufficient market power to affect the price or

supply of diamonds or gold in the world market.

The two

biggest direct investors in Sierra Leone are mining companies -- UK-listed

Titanium Resources Group , which mines rutile and bauxite, and Koidu Holdings

SA, which is a kimberlite diamond operation.

Koidu

Holdings is 65 percent owned by global private resource group BSG Resources Ltd

and 35 percent by Magma Diamond Resources, a subsidiary of Geneva-based Beny

Steinmetz Group.

We

believe that our two main competitors are African Minerals Ltd. (“AML”),

formerly known as Sierra Leone Diamond Company, and Cream Minerals, Ltd. (“Cream

Minerals”). AML is one of the largest mining companies in Sierra Leone. It

focuses on mineral and diamond exploration in Sierra Leone and is currently the

largest owner of mineral rights in Sierra

Leone. AML’s shares are publicly traded on the London

Stock Exchange. Cream Minerals is a mineral exploration company with properties

in Canada, Mexico and Sierra Leone. Both companies are larger, and are better

capitalized than the company. While we believe that the experience of our

management team and staff, as well as the land we have licensed and the contacts

we have made will allow us to run a successful operation, we cannot guarantee

that we will be successful or that we will be able to compete with these better

established corporations.

An

investment in our common stock is speculative and involves a high degree of risk

and uncertainty. You should carefully consider the risks described below,

together with the other information contained in this form 8-K, including the

consolidated financial statements and notes thereto of our Company, before

deciding to invest in our common stock. The risks described below are not the

only ones facing our Company. Additional risks not presently known to us or that

we presently consider immaterial may also adversely affect our Company. If any

of the following risks occur, our business, financial condition and results of

operations and the value of our common stock could be materially and adversely

affected.

Decrease

in value of diamonds could result in decreased revenues.

While we

intend to mine for other precious stones and metals, our business is focused on

mining for diamonds. Thus, in the event the price of diamonds decreases, our

revenues and/or profit margins could likewise decrease.

We

will be competing with better established companies.

We will

not be the first company to attempt to mine for diamonds and other precious

stones and metals in Sierra Leone. There are other companies whose equipment may

be more advanced than ours, and whose methods may be more cost-effective.

Further, we will be facing competition from better established companies such as

Cream Minerals, SLDC, which may have better local, regional and national

connections in Sierra Leone, and whose efforts produce a higher quality

diamond.

Our

mining efforts may not meet our expectations.

Our

mining efforts will focus exclusively on the Baimbawai Pool in the Sewa River in

Sierra Leone. While based on previous geological events and other companies'

mining efforts, we believe that we will be able to successfully mine this area,

there is no such guarantee. It is possible that after purchasing mining

equipment and paying salaries, we will have little of value to show for

it.

19

We

are dependent on key management personnel and employees.

The

Company’s success is dependent upon its management team, most particularly,

Dovid Hauck, our President and Chief Executive Officer, and Mr. Sholomo Bleier,

our site manager and Chief Operating Officer, due to their prior experience in

mining Sierra Leone. The Company believes that its success will depend to a

certain extent upon the efforts and abilities of Mr. Hauck and Mr.Bleier. The

loss of Mr. Hauck or Mr. Bleier could have a material adverse impact on the

Company’s business, financial condition or results of operations.

There

has been political instability in Sierra Leone which, if reignited, could

adversely effect our business.

Between

1991 and 2002, Sierra Leone was engaged in a civil war, in which tens of

thousands of people were killed and more than two million people were displaced.

Control of Sierra Leone's diamond industry was the primary cause of this war.

Since 2002, the government has been stable. However, given the history of that

country, and the previous focus on the disparity between Sierra Leone's diamonds

and the poverty of many of its citizens, there is the risk that other conflicts

will arise. Such political strife could adversely effect our ability to mine

diamonds and other precious stones and metals in Sierra Leone.

Diamond

prices are volatile and there can be no assurance that a profitable market for

Diamonds and gems will exist.

The

diamonds and metals mining industry is intensely competitive, and there is no

assurance that, even if the Company discovers commercial quantities of diamonds

and mineral resources, a profitable market will exist for the sale of those

resources. There can be no assurance that diamond and gold prices

will remain at such levels or be such that the Company can mine at a

profit. Factors beyond the Company's control may affect the

marketability of any minerals discovered. Diamonds and Gold prices

are subject to volatile changes resulting from a variety of factors including

international, economic and political trends, expectations of inflation, global

and regional supply and demand and consumption patterns, metal stock levels

maintained by producers and others, the availability and cost of metal

substitutes, currency exchange fluctuations, inflation rates, interest rates,

speculative activities and increased production due to improved mining and

production methods.

Uncertainty

involved in mining.

Mining

involves various types of risks and hazards, including environmental hazards,

unusual or unexpected geological operating conditions such as rock bursts,

structural cave-ins or slides, flooding, earthquakes and fires, labor

disruptions, industrial accidents, metallurgical and other processing problems,

metal losses, and periodic interruptions due to inclement or hazardous weather

conditions. These risks could result in damage to, or destruction of,

mineral properties, production facilities or other properties, personal injury,

environmental damage, delays in mining, increased production costs, monetary

losses, and possible legal liability.

The

Company may not be able to obtain insurance to cover these risks at economically

feasible premiums. Insurance against certain environmental risks,

including potential liability for pollution or other hazards as a result of the

disposal of waste products occurring from production, is not generally available

to the Company or to other companies within the mining industry. The

Company may suffer a material adverse effect on its business if it incurs losses

related to any significant events that are not covered by its insurance

policies.

20

Calculation

of mineral resources and metal recovery is only an estimate, and there can be no

assurance about the quantity and grade of minerals until resources are actually

mined.

The

calculation of reserves, resources and corresponding grades being mined or

dedicated to future production are imprecise and depend on geological

interpretation and statistical inferences or assumptions drawn from drilling and

sampling analysis, which might prove to be unpredictable. Mineral

resources that are not mineral reserves do not have demonstrated economic

viability. Until reserves or resources are actually mined and

processed, the quantity of reserves or resources and grades must be considered

as estimates only. Any material change in the quantity of reserves,

resources, grade or stripping ratio may affect the economic viability of the

Company's properties. In addition, there can be no assurance that

metal recoveries in small-scale laboratory tests will be duplicated in larger

scale tests under on-site conditions or during production.

The

Company's operations involve exploration and development and there is no

guarantee that any such activity will result in commercial production of mineral

deposits.

There has

been no drilling to test the depth potential of commercial ore on these

properties, and proposed programs on such properties are exploratory in

nature. Development of these mineral properties is contingent upon

obtaining satisfactory exploration results. Mineral exploration and

development involve substantial expenses and a high degree of risk, which even a

combination of experience, knowledge and careful evaluation may not be able to

adequately mitigate. There is no assurance that additional commercial

quantities of ore will be discovered on the Company's exploration

properties. There is also no assurance that, even if commercial

quantities of ore are discovered, a mineral property will be brought into

commercial production, or if brought into production, that it will be

profitable. The discovery of mineral deposits is dependent upon a

number of factors including the technical skill of the exploration personnel

involved. The commercial viability of a mineral deposit is also dependent upon,

among a number of other factors, its size, grade and proximity to

infrastructure, current metal prices, and government regulations, including

regulations relating to royalties, allowable production, importing and exporting

of minerals, and environmental protection. Most of the above factors

are beyond the Company's control.

Competition

for new mining properties may prevent the Company from acquiring interests in

additional properties or mining operations.

21

Significant

and increasing competition exists for mineral acquisition opportunities

throughout the world. Some of the competitors are large, more

established mining companies with substantial capabilities and greater financial

resources, operational experience and technical capabilities than the

Company. As a result of the competition, the Company may be unable to

acquire rights to exploit additional attractive mining properties on terms it

considers acceptable. Increased competition could adversely affect

the Company's ability to attract necessary capital funding or acquire any

interest in additional operations that would yield reserves or result in

commercial mining operations.

Recent

high Diamond and metal prices have encouraged increased mining exploration,

development and construction activity, which has increased demand for, and cost

of, exploration, development and construction services and

equipment.

Recent

increases in Diamond and gold prices have led to increases in mining

exploration, development and construction activities, which have resulted in

higher demand for, and costs of, exploration, development and construction

services and equipment. Increased demand for services and equipment

could cause project costs to increase materially, resulting in delays if

services or equipment cannot be obtained in a timely manner due to inadequate

availability, and increase potential scheduling difficulties and cost increases

due to the need to coordinate the availability of services or equipment, any of