Attached files

| file | filename |

|---|---|

| EX-32.2 - China Tractor Holdings, Inc. | v181203_ex32-2.htm |

| EX-31.2 - China Tractor Holdings, Inc. | v181203_ex31-2.htm |

| EX-32.1 - China Tractor Holdings, Inc. | v181203_ex32-1.htm |

| EX-31.1 - China Tractor Holdings, Inc. | v181203_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

x

|

Annual

report pursuant to section 13 or 15(d) of the Securities Exchange Act

of 1934.

For

the fiscal year ending December 31,

2009

|

Or

|

o

|

Transition

report pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934.

For

the transition period from

________ to ________.

|

Commission

file number 000-52716

China

Tractor Holdings, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

98-0445019

|

|

|

(State

or other jurisdiction

of

incorporation or organization)

|

(IRS

Employer

Identification

number)

|

|

|

Kalun

Industrial Park

JiuTai

Economic Development Zone

ChangChun

City, P.R.China

|

130507

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

86-431-82561001

(Registrant’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act: None

Title

of Each Class

Common

Stock, $.001 par value per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. o

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. o

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports) and (2) has been subject to such filing

requirements for the past 90 days.

YES x NO o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of "accelerated

filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

(Check one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

|

Smaller

reporting company ý

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes x No o

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates of the registrant was approximately $703,054 as of June 30,

2009 (based on the closing price for such stock as of June 30,

2009).

As of

April 1, 2010, there were 18,340,539 shares of common stock, par value $0.001

per share, of the registrant outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None

2

TABLE OF

CONTENTS

|

PART

I

|

4 | |

|

Item

1.

|

Business

|

4

|

|

Item

1A.

|

Risk

Factors

|

|

|

Item

1B.

|

Unresolved

Staff Comments

|

|

|

Item

2.

|

Properties

|

8

|

|

Item

3.

|

Legal

Proceedings

|

8

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

8

|

|

PART

II

|

9

|

|

|

Item

5.

|

Market

For Registrant's Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

9

|

|

Item

6.

|

Selected

Financial Data

|

10

|

|

Item

7.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

10

|

|

Item 7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

17

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

17

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

17

|

|

Item 9A.

|

Controls

and Procedures

|

17

|

|

Item 9B.

|

Other

Information

|

18

|

|

PART

III

|

19

|

|

|

Item

10.

|

Directors

and Executive Officers of the Registrant

|

19

|

|

Item

11.

|

Executive

Compensation

|

21

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

22

|

|

Item

13.

|

Certain

Relationships and Related Transactions

|

22

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

23

|

|

|

||

|

PART

IV

|

25

|

|

|

Item

15.

|

Exhibits

|

25

|

3

PART

I

ITEM

1. BUSINESS

History

References

in this Form 10-K to the “Company,” “we,” “our” and “us” refer to China

Tractor Holding, Inc. and our consolidated subsidiaries.

We were

incorporated in the state of Delaware on April 13, 2004 as Royaltech Corp., with

our principal place of business in Montreal, Quebec, Canada. At that

time, we were a developmental stage company in the business of the development,

manufacturing and marketing of biotech products. In September 2008,

we consummated a share exchange with Densen Equipment Ltd., whereby we acquired

all the assets of Densen Equipment Ltd. in exchange for approximately 91.3% of

our common stock.

As a

result of the share exchange with Densen Equipment Ltd., Densen Machinery

Investment Limited, a Hong Kong limited corporation ("Densen Machinery"), became

our wholly-owned subsidiary. In June 2005, Densen Machinery invested an

aggregate of $15,180,000 to establish Changchun Densen Agricultural Machinery

Equipment Co., Ltd. (“Changchun Densen”). Changchun Densen commenced operations

on September 27, 2005 and is engaged in the research, development and production

of low-speed vehicles, including tractors and construction machinery. Changchun

Densen acquired certain trademark rights from Changchun Tractor (Group) Co.,

Ltd. on January 9, 2007 for a 3% equity interest in Densen Machinery. Changchun

Densen changed its corporate name to Changchun Densen Changtuo Agricultural

Machinery Equipment Co., Ltd. On November 20, 2007, Changchun Densen and

State-owned Assets Supervision and Administration Commission of Changchun (the

“Commission”) started a joint venture to establish Chang Tuo Agricultural

Machinery Equipment Group Co., Ltd. (“Chang Tuo”). Up until December

1, 2009, the business operation of Chang Tuo was the sole business of the

Company.

On

December 1, 2009, the Company entered into a letter of intent to transfer all

shares owned by the Company in Chang Tuo to the Commission. As a result, on

December 1, 2009, the Company lost control over Chang Tuo as the Commission took

over Chang Tuo’s management and operations. Accordingly, Chang Tuo is reported

as a discontinued operation in accordance with ASC 205-20. The shares

of Chang Tuo will be sold to the Commission at the price of approximately

$9,799,333 (RMB67,000,000). The transfer of the shares is expected to be

completed on or about May 1, 2010.

Description

of Business

We currently do not have any

operations. Upon the closing of the transfer of the shares in Chang

Tuo, to be completed on or about May 1, 2010, we expect to receive a sum of

$9,799,333. Management has not yet decided on the future

plans.

Reports

to Security Holders

We file

reports with the Securities and Exchange Commission, or SEC, including annual

reports and quarterly reports as well as other information we are required to

file pursuant to securities laws. You may read and copy materials we file with

the SEC at the SEC’s Public Reference Room at 450 Fifth Street, N.W.,

Washington, D.C. 20549. You may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an

Internet site that contains reports, proxy and information statements and other

information regarding issuers that file electronically with the SEC which is

http://www.sec.gov.

4

SPECIAL

NOTE ON FORWARD LOOKING STATEMENTS

In

addition to historical information, this Annual Report on Form 10-K contains

forward looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. The forward-looking statements are subject

to certain risks and uncertainties that could cause actual results to differ

materially from those reflected in such forward-looking statements.

Factors that might cause such a difference include, but are not limited to,

those discussed in the sections entitled “Business”, “Risk Factors”, and

“Management’s Discussion and Analysis or Plan of Operation.” Readers are

cautioned not to place undue reliance on these forward-looking statements, which

reflect management’s opinions only as of the date thereof. We undertake no

obligation to revise or publicly release the results of any revision of these

forward-looking statements. Readers should carefully review the risk

factors described in this Annual Report and in other documents that we file from

time to time with the Securities and Exchange Commission.

In

some cases, you can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential,” “proposed,” “intended,” or “continue” or

the negative of these terms or other comparable terminology. You should read

statements that contain these words carefully, because they discuss our

expectations about our future operating results or our future financial

condition or state other “forward-looking” information. There may be events in

the future that we are not able to accurately predict or control. You should be

aware that the occurrence of any of the events described in these risk factors

and elsewhere in this Annual Report could substantially harm our business,

results of operations and financial condition, and that upon the occurrence of

any of these events, the trading price of our securities could decline. Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, growth rates, levels of

activity, performance or achievements.

Except

as required by applicable law, including the securities laws of the United

States, we do not intend to update any of the forward-looking statements to

conform these statements to actual results. The following discussion should be

read in conjunction with our financial statements and the related notes that

appear elsewhere in this report.

We

cannot give any guarantee that these plans, intentions or expectations will be

achieved. All forward-looking statements involve risks and uncertainties, and

actual results may differ materially from those discussed in the forward-looking

statements as a result of various factors, including those factors described in

the “Risk Factors” section of this Annual Report.

RISKS

ASSOCIATED WITH INVESTING IN OUR COMMON STOCK

There

can be no assurance that an established trading market will

develop.

Although

quotations for our common stock appear on the OTC Bulletin Board, the absence of

a large trading volume in the common stock indicates there is no established

trading market for the common stock. We can provide no assurance an established

trading market will develop in the future or that you will be able to sell all

or any portion of the holdings when you choose.

If

a trading market for our common stock does develop, trading prices may be

volatile and sporadic, which could depress the market price of our common stock

and make it difficult for our stockholders to resell their shares.

In the

event a trading market develops, the market price of our common stock may be

based on factors that may not be indicative of future market performance.

Consequently, the market price of our common stock may vary greatly. If a market

for our common stock develops, there is a significant risk our stock price may

fluctuate dramatically in the future in response to any of the following

factors, some of which are beyond our control:

5

|

·

|

variations

in our quarterly operating results;

|

|

·

|

announcements

that our revenue or income/loss levels are below analysts'

expectations;

|

|

·

|

general

economic slowdowns;

|

|

·

|

changes

in market valuations of similar

companies;

|

|

·

|

announcements

by us or our competitors of significant contracts;

or

|

|

·

|

acquisitions,

strategic partnerships, joint ventures or capital

commitments.

|

This

volatility could depress the market price of our common stock for reasons

unrelated to operating performance. Moreover, the OTC Bulletin Board is not a

stock exchange, and trading of securities on the OTC Bulletin Board is often

more sporadic than trading of securities listed on a quotation system like

Nasdaq or a stock exchange like the American Stock Exchange. Accordingly, our

stockholders may have difficulty reselling any of their shares.

There is no

assurance our common stock will remain on the OTC Bulletin

Board.

In order

to maintain the quotation of our common stock on the OTC Bulletin Board, we must

remain a reporting company under the Securities Exchange Act of 1934. It is

possible our common stock could be removed from the OTC Bulletin Board and be

traded on the Pink Sheets. In either venue, an investor may find it difficult to

obtain accurate quotations as to the market value of the common stock. In

addition, if we fail to meet the criteria set forth in SEC regulations, various

requirements would be imposed by law on broker-dealers who sell our securities

to persons other than established customers and accredited investors.

Consequently, such regulations may deter broker-dealers from recommending or

selling our common stock, which may further affect its liquidity. This would

also make it more difficult for us to raise additional capital.

We

are subject to the reporting requirements of the federal securities

laws.

We are a

public reporting company in the United States and, accordingly, subject to the

information and reporting requirements of the Securities Exchange Act of 1934

and other federal securities laws, and the compliance obligations of the

Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly

reports and other information with the SEC will cause our expenses to be higher

than they would be if we were a privately-held company. We are also required to

prepare our financial statements in accordance with US GAAP, which further

increases our operating expenses.

We

have no dividend history and have no intention to pay dividends in the

foreseeable future.

We have

never paid dividends on or in connection with any class of our common stock and

do not intend to pay any dividends to common stockholders for the foreseeable

future.

Our

officers, directors and principal stockholders own approximately 85% of our

outstanding shares of common stock, allowing these stockholders to control

matters requiring approval of our stockholders.

All of

our officers and directors as a group own, in the aggregate, approximately 61.4%

of our outstanding shares of common stock, giving them such concentrated control

reduces your ability to influence the direction of the company and may adversely

affect the price of our common stock. Control over matters requiring approval by

our security holders, including the election of directors.

Trading

of our stock may be restricted by the SEC’s penny stock regulations and FINRA’s

sales practice requirements, which may limit a stockholder’s ability to buy and

sell our stock.

6

Our stock

is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9

which generally defines “penny stock” to be any equity security that has a

market price (as defined) less than $5.00 per share or an exercise price of less

than $5.00 per share, subject to certain exceptions. Our securities are covered

by the penny stock rules, which impose additional sales practice requirements on

broker-dealers who sell to persons other than established customers and

“accredited investors”. The term “accredited investor” refers generally to

institutions with assets in excess of $5,000,000 or individuals with a net worth

in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly

with their spouse. The penny stock rules require a broker-dealer, prior to a

transaction in a penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document in a form prepared by the SEC which

provides information about penny stocks and the nature and level of risks in the

penny stock market. The broker-dealer also must provide the customer with

current bid and offer quotations for the penny stock, the compensation of the

broker-dealer and its salesperson in the transaction and monthly account

statements showing the market value of each penny stock held in the customer’s

account. The bid and offer quotations, and the broker-dealer and salesperson

compensation information, must be given to the customer orally or in writing

prior to effecting the transaction and must be given to the customer in writing

before or with the customer’s confirmation. In addition, the penny stock rules

require that prior to a transaction in a penny stock not otherwise exempt from

these rules, the broker-dealer must make a special written determination that

the penny stock is a suitable investment for the purchaser and receive the

purchaser’s written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity in the secondary

market for the stock that is subject to these penny stock rules. Consequently,

these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe the penny stock rules discourage investor interest in,

and limit the marketability of, our common stock.

Financial

Industry Regulatory Authority (FINRA) sales practice requirements may also limit

a stockholder’s ability to buy and sell our stock.

In

addition to the “penny stock” rules promulgated by the Securities and Exchange

Commission (see above for a discussion of penny stock rules), FINRA rules

require that in recommending an investment to a customer, a broker-dealer must

have reasonable grounds for believing the investment is suitable for that

customer. Prior to recommending speculative low priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to

obtain information about the customer’s financial status, tax status, investment

objectives and other information. Under interpretations of these rules, FINRA

believes there is a high probability that speculative low priced securities will

not be suitable for at least some customers. FINRA requirements make it more

difficult for broker-dealers to recommend their customers buy our common stock,

which may limit your ability to buy and sell our stock, which could have an

adverse effect on the market price for our shares and on your ability to dispose

of your securities.

7

ITEM 2. DESCRIPTION OF

PROPERTY

None.

ITEM 3. LEGAL PROCEEDINGS

From time

to time, we may become involved in various lawsuits and legal proceedings that

arise in the ordinary course of business. However, litigation is subject to

inherent uncertainties, and an adverse result in these or other matters may

arise from time to time that may harm our business. We are currently not aware

of any such legal proceedings or claims that we believe will have a material

adverse affect on our business, financial condition or operating

results.

ITEM 4. Reserved

8

PART

II

|

ITEM

5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

|

|

(a) Market

Information. The following

chart sets forth the closing high and low sales prices of our common stock for

each quarter from January 1, 2007 through December 31,

2009.

|

|

High

|

Low

|

||||||

|

2010

First Quarter

|

$ | 0.10 | $ | 0.10 | ||||

|

2009 by

Quarter

|

||||||||

|

January

1 - March 31

|

$ | 1.80 | 1.20 | |||||

|

April

1 - June 30

|

$ | 1.20 | 1.20 | |||||

|

July

1 - September 30*

|

$ | 1.20 | .75 | |||||

|

October

1 - December 31*

|

$ | 1.31 | 0.45 | |||||

|

|

||||||||

|

2008 by

Quarter

|

||||||||

|

January

1 - March 31

|

$ | 1.80 | 1.20 | |||||

|

April

1 - June 30

|

$ | 1.20 | 1.20 | |||||

|

July

1 - September 30*

|

$ | 1.20 | .75 | |||||

|

October

1 - December 31*

|

$ | 1.31 | 0.45 | |||||

* A

reverse split of one for fifteen was effected on August 12, 2008.

|

1

|

Our

common stock received approval to be quoted on the OTC Bulletin Board on

June 21, 2007.

|

On April

15, 2010, the closing price for shares of our common stock, as reported by the

Over-the-Counter Bulletin Board, was $0.10.

No

prediction can be made as to the effect, if any, that future sales of shares of

our common stock or the availability of our common stock for future sale will

have on the market price of our common stock prevailing from time-to-time. The

registration of additional shares of our common stock and the sale of

substantial amounts of our common stock in the public market could adversely

affect the prevailing market price of our common stock.

(b) Record

Holders. As of April 9, 2010, there were 123 registered holders of our

common stock. As of April 9, 2010, there were 18,340,539 shares of common stock

issued and outstanding.

(c) Dividends.

We have not paid dividends on our common stock in the past and do not anticipate

doing so in the foreseeable future. We currently intend to retain future

earnings, if any, to fund the development and growth of our business. In

addition, the Loan and Security Agreement with Access Capital requires that we

obtain their consent prior to paying any dividends.

(d) Sales of

Unregistered Securities

During

the period covered by this report we did not issue any other securities that

were not registered under the Securities Act of 1933, as amended, except as

previously disclosed in a quarterly report on Form 10-Q or a current report on

Form 8-K.

9

ITEM

6. SELECTED FINANCIAL DATA

We are a

“smaller reporting company” as defined by Regulation S-K and as such, are not

providing the information contained in this item pursuant to Regulation

S-K.

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The

following discussion and analysis of our financial condition and results of

operations should be read in conjunction with our financial statements and notes

thereto and the other financial information included elsewhere in this

report.

Note on Forward Looking

Statements

This yearly report on Form 10-K includes and incorporates by reference

“forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934

with respect to our financial condition, results of operations, plans,

objectives, future performance and business, which are usually identified by the

use of words such as “will,” “may,” “anticipates,” “believes,” “estimates,”

“expects,” “projects,” “plans,” “predicts,” “continues,” “intends,” “should,”

“would,” or similar expressions. We intend for these forward-looking statements

to be covered by the safe harbor provisions for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995, and are

including this statement for purposes of complying with these safe harbor

provisions.

These forward-looking statements reflect our current views and expectations

about our plans, strategies and prospects, which are based on the information

currently available and on current assumptions.

We cannot give any guarantee that these plans, intentions or expectations will

be achieved. Investors are cautioned that all forward-looking statements involve

risks and uncertainties, and actual results may differ materially from those

discussed in the forward-looking statements as a result of various factors,

including those Risk Factors set forth in our Form 8-K filed with the SEC on

September 15, 2008. Listed below and discussed elsewhere in this yearly report

are some important risks, uncertainties and contingencies that could cause our

actual results, performances or achievements to be materially different from the

forward-looking statements included in this yearly report. These risks,

uncertainties and contingencies include, but are not limited to, the

following:

You

should read this document with the understanding that our actual future results

may be materially different from what we expect. We may not update these

forward-looking statements, even though our situation may change in the future.

We qualify all of our forward-looking statements by these cautionary

statements.

We are a

Delaware Corporation incorporated on April 13, 2004 under the name Royaltech

Corp. From inception to September 2008, we were a developmental stage company

focused on developing and manufacturing clinical diagnostic kits in the People’s

Republic of China (“PRC”). From inception to September 2008, we had not

manufactured or sold any products, and had limited operating

history.

On

September 9, 2008, we entered into a share exchange agreement with by Densen

Equipment Ltd. (“DEL”), which resulted in a change of control. For acquiring all

the assets of DEL, the former shareholders of DEL acquired over 90% of the

issued and outstanding shares of our common stock. The former officers and

directors of DEL were also appointed to serve as our officers and directors.

Following the acquisition of these assets, we changed our corporate name to

China Tractor Holdings, Inc. and our business is focused on the research,

production, and sales of low-speed vehicles, tractors and construction machinery

in the PRC, through our wholly owned subsidiary, Densen Machinery Investment

Limited, incorporated in Hong Kong in April 2005 ("Densen Machinery"). For

further details regarding the share exchange transaction with DEL, please see

our Current Report on Form 8-K, filed with the SEC on September 15,

2008.

10

Up until

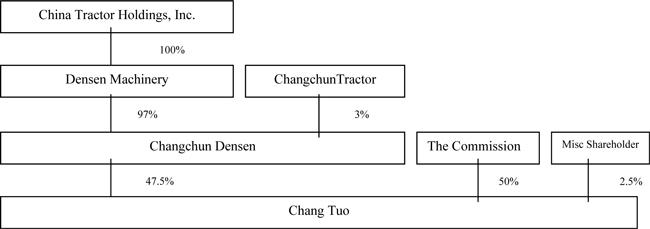

December 1, 2009 Our corporate structure is summarized in the chart below and

the accompanying summary:

On

December 1, 2009, the Company entered into a letter of intent to transfer all

shares owned by the Company in Chang Tuo to the Commission. As a result, on

December 1, 2009, the Company lost control over Chang Tuo as the Commission has

taken over its management and operations. Accordingly, Chang Tuo is reported as

a discontinued operation in accordance with ASC 205-20. The shares of

Chang Tuo will be sold to the Commission at the price of approximately

$9,799,333 (RMB67,000,000). The transfer of the shares is expected to be

completed on or about May 1, 2010.

After the

completion of the transaction, the Company will have no substantial business

operations until it enters a new industry through merger or acquires other

operational entities. As a direct result of the incident, the

Company has experienced significant operating losses for the year ended December

31, 2009. The discontinued operation and the ensuing operating losses

raises substantial doubt as to the Company's ability to continue as a going

concern. Management is attempting to evaluate other potential

industries to enter.

Overview

At the

present time, our business is solely comprised of the business of our

wholly-owned subsidiary, Densen Machinery. Densen Machinery invested $15,180,000

to establish Changchun Densen Agricultural Machinery Equipment Co., Ltd.

(“Changchun Densen”) on September 2005. Changchun Densen is engaged in the

research and development and production of low-speed vehicles, tractors and

construction machinery. In November 2007, Changchun Densen and SOASACC entered

into a joint venture to establish Chang Tuo Chang Tuo to put itself in a better

position in the marketplace. As of September 30, 2008, the total registered

capital of Chang Tuo was RMB200,000,000 ($29.3 million) and was engaged in the

research, development, production, and sale of low-speed vehicles, tractors and

construction machineries, and sales of agricultural machineries and

accessories.

Densen

Machinery is a recipient of subsidies and tax incentives from the Chinese

government as part of its plan to promote the development of agriculture in the

northeast regions of China. The major markets for our products are located

mainly in the provinces of Jilin, Liaoning, Heilongjiang and Shandong. For the

changing of our business operation strategy, ownership in Chang Tuo will be

wholly transferred in a nearly future, we’ve reported Chang Tuo as discontinued

operation in our financial statement at the year ended December 31,

2009.

11

Critical

Accounting Policies and Estimates

The

preparation of consolidated financial statements in conformity with generally

accepted accounting principles in the United States (“US GAAP”) requires us to

make estimates and judgments that affect our reported assets, liabilities,

revenues, and expenses, and the disclosure of contingent assets and liabilities.

We base our estimates and judgments on historical experience and on various

other assumptions we believe to be reasonable under the circumstances. Future

events, however, may differ markedly from our current expectations and

assumptions. While there are a number of significant accounting policies

affecting our consolidated financial statements, we believe the following

critical accounting policies involve the most complex, difficult and subjective

estimates and judgments: allowance for doubtful accounts; income taxes; and

asset impairment.

Revenue

Recognition

In

accordance with US GAAP, revenue is recognized only when the price is fixed or

determinable, persuasive evidence of an arrangement exists, the service is

performed, and collection of the resulting receivable is reasonably

assured.

Revenue

is recognized at the date of shipment to customers when a formal arrangement

exists, the price is fixed or determinable, the delivery is completed, no other

significant obligations of the Company exist and collect ability is reasonably

assured. Payments received before all of the relevant criteria for revenue

recognition are satisfied are recorded as advances from customers. Please see

Note 1 of our financial statements.

Allowance

for doubtful accounts

We

maintain an allowance for doubtful accounts to reduce trade receivable amounts

to their estimated realizable value. A judgment is required when we assess the

realization of accounts receivables, including assessing the probability of

collection and the current credit-worthiness of each customer. If the financial

condition of our customers were to deteriorate, resulting in an impairment of

their ability to make payments, an additional provision for doubtful accounts

could be required.. In estimating the provision for doubtful accounts, we

consider:

|

(i)

|

the

aging of the accounts receivable;

|

|

(ii)

|

trends

within and ratios involving the age of the accounts

receivable;

|

|

(iii)

|

the

customer mix in each of the aging categories and the nature of the

receivable;

|

|

(iv)

|

our

historical provision for doubtful

accounts;

|

|

(v)

|

the

credit worthiness of the customer;

|

|

(vi)

|

the

economic conditions of the customer’s industry as well as general economic

conditions, among other factors.

|

Income

taxes

We

account for income taxes in accordance with ASC 740 “Income Taxes”, previously

SFAS No. 109, which prescribes the use of the liability method. Under this

method, deferred tax assets and liabilities are recognized for the future tax

consequences attributable to temporary differences between the financial

statement carrying amounts and the tax basis of assets and liabilities. Deferred

tax assets and liabilities are measured using the enacted tax rates expected to

apply to taxable income in the years in which those temporary differences are

expected to be recovered or settled. We then assess the likelihood that our

deferred tax assets will be recovered from future taxable income and to the

extent we believe that recovery is not likely, we establish a valuation

allowance. To the extent we establish a valuation allowance, or increase or

decrease this allowance in a period, we increase or decrease our income tax

provision in our statement of operations. If any of our estimates of our prior

period taxable income or loss prove to be incorrect, material differences could

impact the amount and timing of income tax benefits or payments for any period.

In addition, as a result of the significant change in the Company’s ownership,

the Company's future use of its existing net operating losses may be

limited.

12

We are

subject to numerous domestic and foreign tax jurisdictions and tax agreements

and treaties among the various taxing authorities. Our operations in these

jurisdictions are taxed on various bases: income before taxes, deemed profits

and withholding taxes based on revenue. The calculation of our tax liabilities

involves consideration of uncertainties in the application and interpretation of

complex tax regulations in a multitude of jurisdictions across our global

operations.

We

recognize potential liabilities and record tax liabilities for anticipated tax

audit issues in the U.S. and other tax jurisdictions based on our estimate of

whether, and the extent to which, additional taxes will be due. The tax

liabilities are reflected net of realized tax loss carry forwards. We adjust

these reserves upon specific events; however, due to the complexity of some of

these uncertainties, the ultimate resolution may result in a payment that is

different from our current estimate of the tax liabilities. If our estimate of

tax liabilities proves to be less than the ultimate assessment, an additional

charge to expense would result. If payment of these amounts ultimately proves to

be less than the recorded amounts, the reversal of the liabilities would result

in tax benefits being recognized in the period when the contingency has been

resolved and the liabilities are no longer necessary.

Changes

in tax laws, regulations, agreements and treaties, foreign currency exchange

restrictions or our level of operations or profitability in each taxing

jurisdiction could have an impact upon the amount of income taxes that we

provide during any given year.

Asset

Impairment

We

periodically evaluate the carrying value of other long-lived assets, including,

but not limited to, property and equipment and intangible assets, when events

and circumstances warrant such a review. The carrying value of a long-lived

asset is considered impaired when the anticipated undiscounted cash flows from

such asset is less than its carrying value. In that event, a loss is recognized

based on the amount by which the carrying value exceeds the fair value of the

long-lived asset. Fair value is determined primarily using the anticipated cash

flows discounted at a rate commensurate with the risk involved. Significant

estimates are utilized to calculate expected future cash flows utilized in

impairment analyses. We also utilize judgment to determine other factors within

fair value analyses, including the applicable discount rate.

Results

of Operations for the years ended December 31, 2009 and 2008

CHINA

TRACTOR HOLDINGS, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE GAINS/LOSS

YEARS

ENDED DECEMBER 31, 2009 AND 2008

|

|

|

|

|

2009

|

|

2008

|

|

Change

|

||||||||||||||

|

|

|

|

|

|

|

|

|

Amount

|

|

%

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net

revenue

|

|

$ | 18,991 | $ | 191,191 | $ | (172,200 | ) |

|

(90 | %) | |||||||||||

|

Cost

of sales

|

|

|

(159,058 | ) |

|

(70,313 | ) |

|

(88,745 | ) |

|

126 | % | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Gross

profit/(loss)

|

|

|

(140,067 | ) |

|

120,878 |

|

(260,945 | ) |

|

(216 | %) | ||||||||||

|

Operating

expenses:

|

|

|

|

|

|

|||||||||||||||||

|

|

Selling

and general and administrative expenses

|

|

(349,539 | ) |

|

(211,149 | ) |

|

(138,390 | ) |

|

66 | % | |||||||||

|

|

Impairment

loss of assets

|

|

|

|

(2,543 | ) |

|

2,543 |

|

(100 | %) | |||||||||||

|

(Loss)

from operations

|

|

|

(489,606 | ) |

|

(92,814 | ) |

|

(396,792 | ) |

|

428 | % | |||||||||

|

Other

income

|

|

|

966 |

|

117,697 |

|

(116,731 | ) |

|

(99 | %) | |||||||||||

|

Income/(loss)

before income taxes

|

(488,640 | ) | 24,883 | (513,523 | ) | (2,064 | %) | |||||||||||||||

|

Discontinued

operations, net of tax

|

(3,328,549 | ) | 1,481,203 | (4,809,752 | ) | (325 | %) | |||||||||||||||

|

Net

income/(loss)

|

(3,817,189 | ) | 1,506,086 | (5,323,275 | ) | (353 | %) | |||||||||||||||

|

Net

income/(loss) attributable to noncontrolling interest

|

114,516 | (800,299 | ) | 914,815 | (114 | %) | ||||||||||||||||

|

Net

Income/(loss) attributable to China Tractor Holdings, Inc.

|

(3,702,673 | ) | 705,787 | (4,408,460 | ) | (625 | %) | |||||||||||||||

|

Other

comprehensive income/(loss)

|

39,701 | 943,830 | (904,129 | ) | (96 | %) | ||||||||||||||||

|

Comprehensive

income/(loss)

|

(3,662,972 | ) | 1,649,617 | (5,312,589 | ) | (322 | %) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Comprehensive

(loss) attributable to noncontrolling interest

|

|

(1,203 | ) |

|

(77,369 | ) |

|

(76,166 | ) |

|

(98 | %) | ||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

|

Net

profit/(loss) attributable to stockholders

|

$ | (3,664,175 | ) | $ | 1,572,248 |

|

(5,236,423 | ) |

|

(342 | %) | |||||||||||

13

Revenue

Revenue

for the year ended December 31, 2009 was $18,991, compared to $191,191 for 2008,

a decrease of $172,200 or 90%. The decrease mainly resulted from Densen

transfering its operation to Chang Tuo in 2008, and the decline in its business

operations in 2009. In 2007, we established Chang Tuo with SOASACC and

transferred all business operations to Chang Tuo in 2008, resulting in almost

all finished tractors and raw materials being sold by Chang Tuo in 2009. In

2009, Densen primarily played a management role.

Cost

of sales

Cost of

sales for the year ended December 31, 2009 increased to $159,058 from $70,313

for 2008, an increase of $88,745 or 126%. The increase is resulted

from the impairment loss of raw materials. The cost of sales for the year 2009

included $16,939 from sales of raw materials and $142,119 from impairment loss

of inventory.

Gross

profit (loss)

The gross

loss for 2009 was $140,067, a decrease of $260,945 or 216% compared to gross

profit of $120,878 for 2008. The decrease is due to no business

operation and all revenue was resulted from the sales of out-of-date raw

materials in 2009. The cost of sales for year 2009 included $16,939

from sales of raw materials and $142,119 from impairment loss of

inventory.

Selling,

general and administrative expenses

Selling,

general and administrative expenses increased to $349,538 in 2009 from $211,149

in 2008, an increase of $138,389 or 66%. The increase

generally resulted from the increase of agency fee, which is $207,139 and

$52,562 respectively for the years ended December 31, 2009 and 2008. Agency fee

mainly includes audit fees.

Provision

for impairment of assets

The

provision for impairment of assets in 2008 represents the provision for accounts

receivable of $2,543.

14

Other

income/(expenses)-net

Other

income-net for 2009 was $966, compared to $117,697 for 2008. Other income for

2009 mainly consisted of subsidies from governments for international business

development of $2,924 while other expenses mainly consisted of interest. Other

income for the year ended December 31, 2009 mainly consisted of subsidies from

governments for agricultural machinery manufacturers of $71,816.

Non-controlling

interest

Non-controlling

interest resulted in loss of $113,313 and gain of $877,668 for 2009 and 2008

respectively, representing the 3% minority interest of Changchun Tractor in

Densen.

Other

comprehensive income

Other

comprehensive loss in 2009 was $39,701 compared to comprehensive income of

$943,830 in 2008. It represents the foreign currency translation income resulted

from appreciation of RMB against the US dollar.

Net

income/(loss)

Net loss

in the year ended December 31, 2009 was $3,664,175, compared to net income of

$1,572,248 in 2008. This mainly resulted from discontinued operations of Chang

Tuo. Subsidy income in Chang Tuo for the years ended December 31, 2009 and 2008

was $5,847 and $871,845 respectively. Interest expense in Chang Tuo for the

years ended December 31, 2009 and 2008 was $741,136 and $11,274 respectively. In

addition, loss on disposal of operations of Chang Tuo was $3,264,057 in

2009.

Liquidity

and Capital Resources

China

Tractor generally finances its operations from short-term loans from

domestic banks. As of December 31, 2009, we had cash and cash

equivalents of $15,967 which represented an increase of $15,549 from

$418 as of December 31, 2008.

Operating

Activities

The net

cash provided in operating activities in 2009 was $1,154,073 compared to

net cash used in operating activities was $1,641,809 in 2008. The net cash

inflow from operating activities in 2009 was mainly due to the decrease in

receivable from sale of discontinued operation of $1,030,412.

Investing

Activities

Net cash

used for investing activities amounted to $5,776,160 in 2009, primarily due

to increase in payments for construction in progress.

Financing

Activities

Net cash

provided by financing activities was $2,658,891 in the year ended

December 31, 2009 which included an inflow by short-term loans; a net

inflow from related party borrowings of $612,383 and a net inflow from third

party borrowings of $1,315,613.

Going

forward, over the next 12 months, China Tractor intends to continue to rely

on short-term loans to fund its operational cash needs.

15

Inflation

In the

opinion of management, inflation has not had a material effect on the Company's

financial condition or results of its operations.

Trends

and uncertainties

The

consolidated financial statements of the Company have been prepared in

accordance with US GAAP assuming the Company will continue as a going concern.

Under that assumption, it is expected that assets will be realized and

liabilities will be satisfied in the normal course of business. On December 1,

2009, the Company signed a letter of intent to transfer all shares owned by the

Company in Chang Tuo to SOASACC. After the completion of the

transaction, the Company will have no substantial business operations until it

enters a new industry through merger or acquisition of other operating

entities. As a direct result of this transfer of ownership, the

Company has experienced significant operating losses for the year ended December

31, 2009. The discontinued operation and the ensuing operating losses

raise substantial doubt as to the Company's ability to continue as a going

concern. Management is attempting to evaluate other potential

industries to enter.

Off-Balance

Sheet Arrangements

We had no

off-balance sheet arrangements that have or are reasonably likely to have a

current or future effect on the Company’s financial condition, changes in

financial condition, revenues or expenses, results of operations, liquidity,

capital expenditures or capital resources, that are material to investors at

December 31, 2009 or 2008.

16

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a

“smaller reporting company” as defined by Regulation S-K and as such, are not

providing the information contained in this item pursuant to Regulation

S-K.

ITEM

8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Our

Consolidated Financial Statements and Notes thereto and the report of Goldman

Parks Kurland Mohidin LLP, our independent registered public accounting firm,

are set forth on pages F-1 through F-22 of this Report.

ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE.

None

.

ITEM

9A. CONTROLS AND PROCEDURES

Evaluation

of controls and procedures.

As of the

end of the period covered by this Annual Report, the Company’s management, with

the participation of the Company’s Chief Executive Officer and Chief Financial

Officer (“the Certifying Officers”), conducted evaluations of the Company’s

disclosure controls and procedures. As defined under Sections 13a-15(e) and

15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), the term “disclosure controls and procedures” means controls and other

procedures of an issuer that are designed to ensure that information required to

be disclosed by the issuer in the reports that it files or submits under the

Exchange Act is recorded, processed, summarized and reported, within the time

periods specified in the Commission’s rules and forms. Disclosure controls and

procedures include without limitation, controls and procedures designed to

ensure that information required to be disclosed by an issuer in the reports

that it files or submits under the Exchange Act is accumulated and communicated

to the issuer’s management, including the Certifying Officers, to allow timely

decisions regarding required disclosures. Based on this evaluation, the

Certifying Officers have concluded that the Company’s disclosure controls and

procedures were not effective to ensure that material information is recorded,

processed, summarized and reported by management of the Company on a timely

basis in order to comply with the Company’s disclosure obligations under the

Exchange Act and the rules and regulations promulgated thereunder due to

material weaknesses in its internal control over financial reported as described

below. In addition, disclosure controls and procedures were not

effective because management requires a better understanding of its disclosure

obligations under the Exchange Act.

Management’s

Report on Internal Controls Over Financial Reporting.

Our Chief

Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), are responsible

for establishing and maintaining adequate internal control over financial

reporting, as such term is defined in Rule 13a-15(f) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”)

Internal

control over financial reporting is promulgated under the Exchange Act as a

process designed by, or under the supervision of, our CEO and CFO and effected

by our board of directors, management and other personnel, to provide reasonable

assurance regarding the reliability of financial reporting and the preparation

of financial statements for external purposes in accordance with generally

accepted accounting principles and includes those policies and procedures

that:

|

·

|

Pertain

to the maintenance of records that in reasonable detail accurately and

fairly reflect the transactions and dispositions of our

assets;

|

17

|

·

|

Provide

reasonable assurance that transactions are recorded as necessary to permit

preparation of financial statements in accordance with generally accepted

accounting principles, and that our receipts and expenditures are being

made only in accordance with authorizations of our management and

directors; and

|

|

·

|

Provide

reasonable assurance regarding prevention or timely detection of

unauthorized acquisition or disposition of our assets that could have a

material effect on the financial

statements.

|

Readers

are cautioned that internal control over financial reporting, no matter how well

designed, has inherent limitations and may not prevent or detect misstatements.

Therefore, even effective internal control over financial reporting can only

provide reasonable assurance with respect to the financial statement preparation

and presentation.

Our

management, under the supervision and with the participation of our CEO and CFO,

has evaluated the effectiveness of our disclosure controls and procedures and

internal controls over financial reporting as defined in Exchange Act Rules

13a-15(e) and (f) and 15d-15(e) and (f) as of the end of the period covered by

this Report based upon the framework in Internal Control—Integrated Framework

issued by the Committee of Sponsoring Organizations of the Treadway Commission

(COSO). Based on such evaluation, our management has made an assessment that our

internal control over financial reporting is not effective as of December 31,

2009 for the following reasons:

|

a.

|

Our

internal accounting staff do not have sufficient U.S. GAAP knowledge and

experiences

|

|

b.

|

Our

senior financial staff lacks knowledge of internal control obligations,

including Section 404

|

|

c.

|

The

audit committee oversight was not effective in

2009.

|

We plan

to take the following steps to remediate the significant deficiencies in

internal control over financial reporting that are identified

above.

a. Hire

a senior accounting staff who has experiences in U.S. GAAP and SOX 404 to

oversee the financial reporting process in order to ensure the Company’s

compliance with U.S. GAAP and security laws.

b. Provide

training to accounting staff on U.S. GAAP

This

annual report does not include an attestation report of the company’s registered

public accounting firm regarding internal control over financial reporting.

Management’s report was not subject to attestation by the company’s registered

public accounting firm pursuant to temporary rules of the Securities and

Exchange Commission that permit the company to provide only management’s report

in this annual report.

Changes

in internal control over financial reporting.

No

significant changes were made in our internal control over financial reporting

during the Company’s fourth quarter of 2009 that have materially affected, or

are reasonably likely to materially affect, the Company’s internal control over

financial reporting.

ITEM 9B. OTHER INFORMATION

Not

applicable.

18

PART

III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS,

PROMOTERS AND CONTROL PERSONS;

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT.

The

following table sets forth the names and ages of our current directors and

executive officers, the principal offices and positions with us held by each

person and the date such person became a director or executive officer. Each

year the stockholders elect the members of our Board of Directors

The

following sets forth the name and position of each of our current executive

officers and directors.

|

Name

|

Age

|

Title

|

||

|

Lau

San

|

58

|

CEO,

Chairman

|

||

|

Liu

Jingdong

|

33

|

President,

Director

|

||

|

Chen

Guocheng

|

46

|

CFO,

Director

|

||

|

Changfu

Wang

|

68

|

Independent

Director

|

||

|

Dr.

Baoyun Qiao

|

44

|

Independent

Director

|

LAU San Chairman of the Board

of Directors and Chief Executive Officer. Mr. Lau became our Chairman and Chief

Executive Officer on September 9, 2008, upon consummation of our share exchange

with Densen. Mr. Lau is the founder of Densen and Changchun Densen, and served

as Chairman of these two companies since their inception in 2005. From 1992 to

2005, Mr. Lau was mainly engaged in real estate development through Densen

Investment Co., Ltd., which was established in December 1991. In 2003, Mr. Lau

was elected as member of the Chinese People's Political Consultative Conference

of Heilongjiang Province Vice President of the Overseas Friendship Association

of Heilongjiang Province and Vice President of the Federation of Chinese

Businessmen. Mr. Lau graduated from University of Heilongjiang, with a Masters

degree in Law.

Jingdong LIU President

and Director. Mr. Liu became President and Director on September 9, 2008, upon

consummation of our share exchange with Densen. Mr. Liu has been the President

of Changchun Densen since its inception in 2005, and is in charge of purchasing

and sales management. Mr. Liu graduated with a Bachelor of Economic Management

from the North York University of Canada in 2004. Mr. Jingdong Liu is the son of

Mr. Lau San.

Guocheng CHEN Chief

Financial Officer and Director. Mr. Chen became a Director and our

Chief Financial Officer on September 9, 2008, upon consummation of our share

exchange with Densen. Mr. Chen has been the Chief Financial Officer of Changchun

Densen since October 2005. He has 25 years experience in corporate accounting

and finance. From 2001 to October 2005, he served as the Chief Financial Officer

of Changchun Dahe Company, a Hong Kong listed company. From 1984 to 2001, Mr.

Chen worked for Shulan Mining Bureau, and held the positions of Financial

Controller, Chief Financial Officer, and Director of Operations. Mr. Chen

graduated with a Bachelor of Industrial Accounting from Jilin Economic Trade

College.

Changfu WANG Independent

Director. Mr. Wang became our Independent Director on September 9, 2008, upon

consummation of our share exchange with Densen. Before joining us, Mr. Wang was

a top provincial official. He served as Vice Secretary General of Heilongjiang

provincial government from March 2003 to March 2008. During the period of 1965

to 2003, Mr. Wang was engaged in forestry resource management for Heilongjiang

provincial government and served as Director of Bureau for Main Office of

Heilongjiang Forestry Industry. Mr. Wang graduated with a Bachelor of Forestry

Industry from Northeast Forestry Industry College.

Dr. Baoyun

QIAO Independent Director. Dr. Qiao became our Independent Director

on September 9, 2008 upon consummation of our share exchange with Densen. He is

a Professor of Economics and Dean at the China Academy of Public Finance and

Policy, at the Central University of Finance and Economics since July, 2008. Dr.

Qiao graduated from Georgia State University, where he earned his Ph.D. in

economics. He has been a senior research associate of Georgia State University

since January, 2003. He has published numerous papers and his research interest

is in the area of finance, public economics, development economics and

macroeconomics as well as China’s economy. Professor Qiao has served as the Vice

President of Chinese Economist Society since 2007.

19

Code

of Conduct and Ethics

|

·

|

honest

and ethical conduct, including the ethical handling of actual or apparent

conflicts of interest between personal and professional

relationships;

|

|

·

|

full,

fair, accurate, timely and understandable disclosure in reports and

documents we file with, or submit to, the SEC and in other public

communications made by us;

|

|

·

|

compliance

with applicable governmental laws, rules and

regulations;

|

|

·

|

the

prompt internal reporting of violations of the code to an appropriate

person or persons identified in the Code;

and

|

|

·

|

accountability

for adherence to the Code.

|

A copy of

our Code of Business Conduct and Ethics has been filed with the SEC as an

exhibit to this report. The Code of Business Conduct and Ethics is available at

our website at www.densen.com.cn. We will provide a copy, without charge, to any

person desiring a copy of the Code of Business Conduct and Ethics, by written

request to Kalun Industrial Zone, Jiutai Economic Development Zone, Changchun

City, Jilin Province, People’s Republic of China, Attention: CTHL Corporate

Secretary.

Director

Independence

The Board

has reviewed each of the directors’ relationships with the Company in

conjunction with the definitions set out in NASDAQ Rule 4200(a)(15) and has

affirmatively determined that two of our directors, Changfu Wang and Baoyun

Qiao, are independent of management and free of any relationship that would

interfere with the independent judgment as members of the Board of Directors or

any committee thereof.

Committees

of the Board of Directors

Our Board

of Directors in its entirety acts as the audit committee, nominating committee

and compensation committee. Our Board of Directors may create an audit

committee, nominating committee and compensation committee in the future. Our

Board of Directors intends to adopt charters for these committees at such time

as the committee is created.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act of 1934, as amended, requires our officers,

directors and persons who beneficially own more than 10% of a registered class

of our equity securities (“ten percent stockholders”) to file reports of

ownership and changes in ownership with the Securities and Exchange

Commission. Officers, directors and ten percent stockholders are charged

by the SEC regulations to furnish us with copies of all Section 16(a) forms they

file.

20

Based

solely upon a review of copies of Section 16(a) reports and representations

received by us from reporting persons, and without conducting any independent

investigation of our own, in fiscal year 2009, our officers, directors and ten

percent stockholders are in compliance with Section 16(a), except that the Form

3s filed by each of our officers and directors, Lau San, Liu Jingdong, Chen

Guochen, Wang Changfu, and Qiao Baoyun were late.

ITEM 11. EXECUTIVE

COMPENSATION.

The

following table sets forth the compensation paid by the Company for services

rendered for the past two completed fiscal years to the principal executive

officer at the end of the year ended December 31, 2008. We did not have any

officer whose cash compensation exceeded $100,000. No equity awards

were given to our officers and directors.

|

SUMMARY COMPENSATION

TABLE

|

||||||||||||||||||||||||||||

|

Name and

Principal

Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive

Plan

Compensation

($)

|

Change

in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

|

All Other

Compensation

($)

|

Total

($)

|

|||||||||||||||||||

|

Lau

San

|

2009

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|||||||||||||||||||

|

CEO

&

Chairman(1)

|

2008

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

|||||||||||||||||||

(1) Lau

San became our CEO on September 9, 2008.

Following

the share exchange and reorganization effected on September 9, 2008, we have

decided, and our Chief Executive Officer has agreed that no compensation will be

paid in 2008 and 2009.

Director

Compensation

Directors

of our company may be paid for their expenses incurred in attending each meeting

of the directors. In addition to expenses, directors may be paid a sum for

attending each meeting of the directors or may receive a stated salary as

director. No payment precludes any director from serving our company in any

other capacity and being compensated for such service. During the fiscal year

ended December 31, 2009, our compensation to our directors is set forth in the

following table.

DIRECTOR

COMPENSATION

|

Name

(a)

|

|

Fees

Earned

or Paid

in Cash

($)

|

|

Stock

Awards

($)

|

|

Option

Awards

($)

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

Non-Qualified

Deferred

Compensation

Earnings

($)

|

|

All

Other

Compensation

($)

|

|

Total

($)

|

|||

|

Lau

San

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||

|

Liu

Jingdong

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||

|

Chen

Guochen

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||

|

Wang

Changfu

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||

|

Qiao

Baoyun

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||

21

Following

the share exchange and reorganization effected on September 9, 2008, we have

decided, and our Board of Directors have agreed that no compensation will be

paid to them in 2008 and 2009.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER

MATTERS

The table

sets forth below certain information regarding the beneficial ownership of our

common stock, our only class of outstanding voting securities, as of April 6,

2009, based on 18,340,539 aggregate shares of common stock outstanding as of

such date, by: (i) each person who is known by us to own beneficially more than

5% of our outstanding common stock with the address of each such person, (ii)

each of our present directors and officers, and (iii) all officers and directors

as a group.

Unless

otherwise indicated, we believe all persons named in the table have sole voting

and investment power with respect to all common shares beneficially owned by

them.

|

Name and Address of

Beneficial

Owner

|

Title, if any

|

Amount and Nature of Beneficial

Ownership

|

Percentage of

Common Stock

|

|||||||

|

Lau

Lau San

|

CEO

& Chairman

|

10,000,000

|

54.6

|

%

|

||||||

|

Liu

Jingdong

|

President,

Director

|

1,000,000

|

5.5

|

%

|

||||||

|

Chen

Guocheng

|

CFO,

Director

|

200,000

|

1.1

|

|||||||

|

Changfu

Wang

|

Independent

Director

|

50,000

|

*

|

|||||||

|

Dr.

Baoyun Qiao

|

Independent

Director

|

30,000

|

*

|

|||||||

|

All

of our officers and directors as a group (5 individuals)

|

11,280,000

|

61.4

|

%

|

|||||||

*less

than 1%

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED

PARTY TRANSACTIONS

As of

December 31, 2009 and 2008, due from related parties was summarized as

follows:

|

2009

|

2008

|

|||||||

|

Lau

San

|

$ | 284,553 | $ | - | ||||

|

Mudanjiang

Binjiang Garden City

|

- | 1,900,128 | ||||||

|

Total

due from related parties

|

$ | 284,553 | $ | 1,900,128 | ||||

A

director of the Company, Mr. Lau San, borrowed money from the Company. These

amounts are interest-free, unsecured and repayable on demand.

22

Due to related

parties

As of

December 31, 2009 and 2008, due to related parties was summarized as

follows:

|

2009

|

2008

|

|||||||

|

Lau

San

|

$ | - | $ | 1,005,084 | ||||

|

Changchun

Junming Machinery Co., Ltd. (“CJMCL”)

|

149,105 | 148,734 | ||||||

|

Shenzhen

Junsheng Property Management Co., Ltd. (“SJPMCL”)

|

14,626 | 14,590 | ||||||

|

Zhongji

North Machinery Co., Ltd. (“Zhongji North”)

|

409,524 | 413,666 | ||||||

|

Total

due to related parties

|

$ | 573,255 | $ | 1,582,074 | ||||

The

Company borrowed from CJMCL, which is controlled by Mr. Lau San, a director of

the Company for use in operations. The loan bore no interest and the principal

is due upon demand.

The

Company borrowed from SJPMCL, which is controlled by Ms. Yang, Fengyan, Mr. Lau

San’s wife, for use in operations. The loan bore no interest and the principal

is due upon demand.

The

Company, as noncontrolling shareholder of Zhongji North, borrowed from Zhongji

North, to fund the Company’s operations. These amounts are

interest-free, unsecured and the principal is due upon demand.

ITEM

14. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

The

following table sets forth fees billed to us by our independent registered

public accounting firms during the fiscal years ended December 31, 2009 and

December 31, 2008 for: (i) services rendered for the audit of our annual

financial statements and the review of our quarterly financial statements; (ii)

services by our independent registered public accounting firms that are

reasonably related to the performance of the audit or review of our financial

statements and that are not reported as audit fees; (iii) services rendered in

connection with tax compliance, tax advice and tax planning; and (iv) all other

fees for services rendered.

|

December

31,

2009

|

December

31,

2008

|

|||||||

|

Audit

Fees

|

$ | 90,000 | $ | 90,000 | ||||

|

Audit

Related Fees

|

$ | - | $ | - | ||||

|

Tax

Fees

|

$ | - | $ | - | ||||

|

All

Other Fees

|

$ | - | $ | - | ||||

|

TOTAL

|

$ | 90,000 | $ | 90,000 | ||||

23

Audit Committee

Policies

The Board

of Directors is solely responsible for the approval in advance of all audit and

permitted non-audit services to be provided by the independent auditors

(including the fees and other terms thereof), subject to the de minimus

exceptions for non-audit services provided by Section 10A(i)(1)(B) of the

Exchange Act, which services are subsequently approved by the Board of Directors

prior to the completion of the audit. None of the fees listed above are for

services rendered pursuant to such de minimus exceptions.

24

Part

IV

ITEM 15. EXHIBITS

|

Item Number

|

Description

|

|

|

(3)

|

Articles of Incorporation and

By-laws

|

|

|

3.1

|

Certificate

of Incorporation (incorporated by reference from our Registration

Statement on Form SB-2, filed on February 13, 2006)

|

|

|

3.2

|

Certificate

of Amendment filed with the Delaware Secretary of State on July 31, 2008

effective August 12, 2008 (incorporated by reference from our Current

Report on Form 8-K, filed on August 12, 2008)

|

|

|

3.3

|

Bylaws

(incorporated by reference from our Registration Statement on Form SB-2

filed on February 13, 2006)

|

|

|

(10)

|

Material

Contracts

|

|

|

10.1

|

Licensing

Agreement dated October 2004 between Royaltech Corp. and Mr. Kang Zhang

(incorporated by reference from our Registration Statement on Form SB-2

filed on February 13, 2006)

|

|

|

10.2

|

Investment

Agreement dated January 10, 2006 between Royaltech Corp. and Aventech

Capital Inc. for 350,000 shares (incorporated by reference from our

Registration Statement on Form SB-2 filed on February 13,

2006)

|

|

|

10.3

|

Investment

Agreement dated January 10, 2006 between Royaltech Corp. and Alliance PKU

Management Consultants Ltd for 350,000 shares (incorporated by reference

from our Registration Statement on Form SB-2 filed on February 13,

2006)

|

|

|

10.4

|

Investment

Agreement dated January 10, 2006 between Royaltech Corp. and Hong Sheng

for 30,000 shares (incorporated by reference from our Registration