Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - China Shuangji Cement Ltd. | ex312.htm |

| EX-32.1 - EXHIBIT 32.1 - China Shuangji Cement Ltd. | ex321.htm |

| EX-32.2 - EXHIBIT 32.2 - China Shuangji Cement Ltd. | ex322.htm |

| EX-31.1 - EXHIBIT 31.1 - China Shuangji Cement Ltd. | ex311.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] Annual Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2009

[ ] Transition Report Pursuant to Section 13or 15(d) of

The Securities Exchange Act of 1934

COMMISSION FILE NUMBER: 000-52440

CHINA SHUANGJI CEMENT LTD.

(Exact Name of Small Business Issuer as Specified in its Charter)

Delaware

(State of Incorporation)

95-3542340

(IRS Employer ID Number)

221 Linglong Road, Zhaoyuan City, Shandong Province

People’s Republic of China, 265400

(Address of principal executive offices)

(86) 535-8213217

(Registrant's telephone number, including area code)

None

Securities registered pursuant to Section 12(b) of the Exchange Act

Common Stock, par value $0.0001 per share

Securities registered pursuant to Section 12(g) of the Exchange Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers in pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ]

Accelerated filer [ ]

Non-accelerated filer [ ]

Smaller reporting company [X]

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act) [ ] Yes [X] No

State the aggregate market value of the voting and nonvoting common equity held by non-affiliates computed by reference to the price at which the stock was last sold, or the average bid and ask prices of such stock as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting common stock of the issuer held by non-affiliates as of June 30, 2009 was approximately $11,384,019 based upon the closing price of the common stock ($1.50) as quoted by OTC Bulletin Board on such date.

As of April 7, 2010, there are 28,157,246 shares of common stock, par value $0.0001 issued and outstanding.

1

Table of Contents

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Description of Business

|

3 |

|

Item 1A.

|

Risk Factors

|

12 |

|

Item 1B.

|

Unresolved Staff Comments

|

12 |

|

Item 2.

|

Description of Property

|

25 |

|

Item 3.

|

Legal Proceedings

|

27 |

|

Item 4.

|

(Removed and Reserved)

|

27 |

|

PART II

|

||

|

Item 5.

|

Market for Common Equity and Related Stockholder Matters

|

27 |

|

Item 6.

|

Selected Financial Data

|

29 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition or Plan of Operation

|

29 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

33 |

|

Item 8

|

Financial Statements and supplementary Data.

|

33 |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

35 |

|

Item 9A.

|

Controls and Procedures

|

35 |

|

Item 9A(T)

|

Controls and Procedures

|

36 |

|

Item 9B.

|

Other Information

|

36 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers, and Corporate Governance.

|

37 |

|

Item 11.

|

Executive Compensation

|

40 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

41 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

42 |

|

Item 14.

|

Principal Accountant Fees and Services

|

43 |

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

44 |

2

PART I

We are a supplier of high-grade portland cement to the industrial sector in the Shandong and Hainan provinces of the People’s Republic of China (PRC). Our processed cement products are primarily purchased by the cement industry for the purpose of making the cement required for the construction of buildings, roads, and other infrastructure projects. Our products have been sold nationally (in the PRC) and internationally in 10 countries.

Our principal executive office is located at 221 Linglong Road, Zhaoyuan City, Shandong Province, China, 265400. Our telephone number is +86 535-8213217 and its facsimile number is +86-535-8231341.

Our History and Background

We were organized under the laws of the State of California on September 15, 1980, as Trans-Science Corporation. On July 14, 2000, we were acquired by Composite Solutions, Inc. (“Composite”), a company which at the time was a publicly traded Florida corporation. On October 1, 2004, Composite became insolvent and both Composite and the company ceased all operations. On October 11, 2004, Composite filed a voluntary petition for bankruptcy under Chapter 7. The case was voluntarily dismissed on November 18, 2004 and on May 5, 2005 Composite filed a voluntary petition for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of California in San Diego (Case No. 05-04045). On December 4, 2006, the Bankruptcy Court approved the Plan of Reorganization proposed by Composite, the (“Plan”). Pursuant to the Plan, all creditors of Composite were paid their pro rata share of a pool of cash and their pro rata share of a pool of shares of common stock in Composite.

In addition, under the Plan we were “spun off” to the Composite’s creditors and existing shareholders. The shares were issued pursuant to Section 1145 of the Bankruptcy Code and are exempt from the registration requirements of Section 5 of the Securities Act of 1933 and any state or local law requiring registration for an offer or sale of securities.

During the period 2005 through October 3, 2007 the Company was involved in a search for a merger partner. On October 3, 2007 a British Virgin Islands company named China Shuangji Cement Holdings, Ltd. (“Holdings”) purchased 16,000,000 shares of the Company’s common stock, which represented 74% of the total shares of Company stock outstanding. Holdings is owned by a group of shareholders who also own all of the equity interests of Zhaoyuan Shuangji Co. Ltd. (“Zhaoyuan Shuangji”), a cement manufacturer incorporated in the People’s Republic of China (PRC).

Effective October 31, 2007, we re-domiciled in Delaware, changed our name to China Shuangji Cement Ltd., and effected a two for one forward stock split of our outstanding common stock. These corporate events were approved by a majority of our shareholders. Please refer to our Definitive Proxy Statement filed with the Securities and Exchange Commission on October 15, 2007. All per share information in this Form 10-K has been adjusted to reflect the forward split in accordance with SAB Topic 4C.

As part of a plan to effect control of Zhaoyuan Shuangji, on December 1, 2007, the Company acquired 100% of the outstanding capital stock of Chine Holdings, Ltd. (“Chine Holdings”), a British Virgin Islands corporation incorporated on June 28, 2007, from Wenji Song for an aggregate purchase price of $16,000. At the closing of the acquisition of Chine Holdings, the Company did not pay a cash consideration of $16,000 but accounted for the purchase price in the form of a $16,000 loan.

Chine Holdings owns 100% of Jili Zhaoyuan Investment Consulting Co. Ltd. (“JZIC”), a Wholly Foreign-Owned Entity formed under the laws of the PRC on March 9, 2007. On September 13, 2007, Chine Holdings acquired 100% of the outstanding equity of JZIC from Holdings. As such, as of December 1, 2007, Chine Holdings is a direct wholly-owned subsidiary of the Company, and JZIC is an indirect wholly-owned subsidiary of the Company.

3

On August 9, 2008, an aggregate of 20,250,000 shares of Series 2008 preferred stock of the Company were issued to Wenji Song, the Company’s president and majority shareholder. Of the 20,250,000 shares, 4,250,000 shares were issued for a purchase price of $4,250 and 16,000,000 shares of Series 2008 preferred stock were issued as consideration for the cancellation of the $16,000 loan due to Wenji Song that had been used to purchase Chine Holdings.

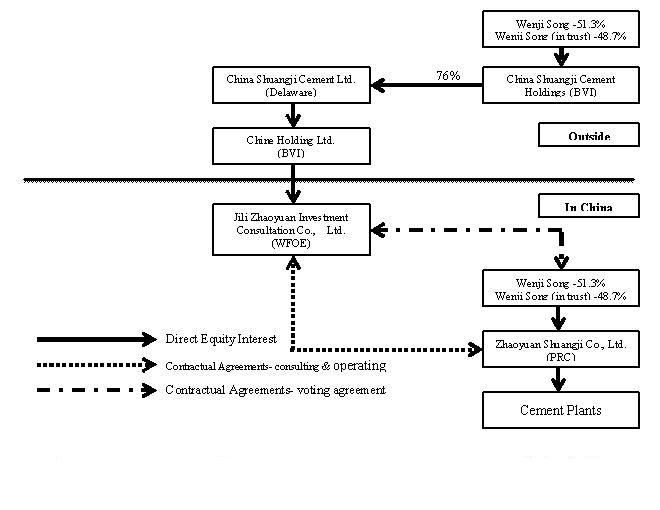

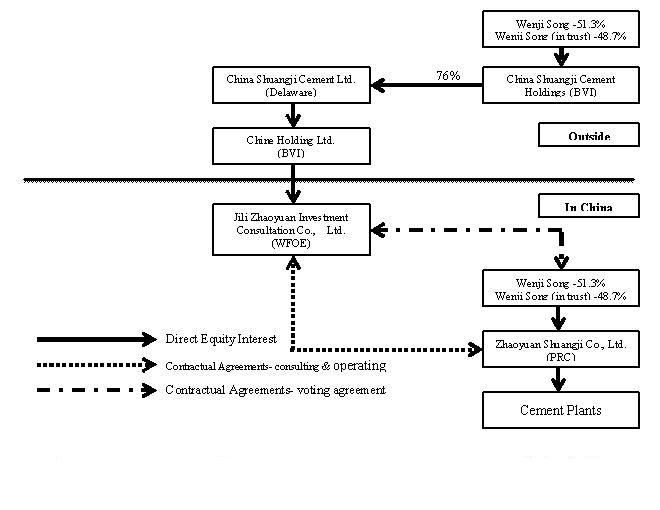

We are currently organized using an offshore holding structure commonly used by foreign investors with operations in China. As a Delaware corporation, we wholly-own Chine Holdings Ltd. (“Chine Holdings”), a company incorporated in the British Virgin Islands; which owns Jili Zhaoyuan Investment Consulting Co., Ltd. (“JZIC”), a Wholly Foreign-Owned Enterprise (WFOE) established under the laws of the PRC. Through contractual agreements in place between our affiliates and other commonly controlled entities, since August 2008 we have controlled our operating cement company Zhaoyuan Shuangji Co. Ltd, a PRC company (“Zhaoyuan Shuangji”). However, our control is subject to certain risks and uncertainties. See “Item 1A Risk Factors” below. Zhaoyuan Shuangji, the operating PRC entity, produces high-grade cement to the industrial sectors in the PRC and internationally.

The abovementioned contractual arrangements are comprised of a series of agreements, including a Strategic Consulting Service Agreement and Operating Agreement, through which JZIC has the right to advise, consult, manage and operate Zhaoyuan Shuangji for a fee. In order to further reinforce JZIC’s rights to control and operate Zhaoyuan Shuangji and to collect consulting and services fees provided by JZIC to Zhaoyuan Shuangji, Zhaoyuan Shuangji’s shareholders have granted JZIC the exclusive right and option to acquire all of their equity interests and voting rights in Zhaoyuan Shuangji through an Exclusive Option Agreement and Authorization Agreements. Pursuant to these agreements, JZIC operates and controls the business of Zhaoyuan Shuangji Under the present structure, there is no change in personnel of Zhaoyuan Shuangji and our agreements with the Zhaoyuan Shuangji have a term of ten years with an option to renew.

The Company’s current structure is set forth in the diagram below:

On April 16, 2009, the Company affected a reverse split of its common stock under whereby its shareholders received one share of common stock for every four shares then-owned.

4

History and Background of Zhaoyuan Shuangji Co., Ltd.

Zhaoyuan Shuangji was founded in 1971 as a state-owned enterprise. On March 29, 2002, Zhaoyuan Shuangji was purchased by 198 shareholders and reorganized as a privately held corporation. As of December 31, 2009 has total assets of approximately $38 million, total staff of more than 620, and is one of the strongest 500 building materials enterprises in China. Zhaoyuan Shuangji has received “AA credit taxpayer” status, a AAA bank credit rating in the PRC and an ISO 9001 Quality Certificate. In the last few years, we have received the National Environmental Protection Advanced Enterprise Award and Quality Management Prize from the National Building Materials Bureau.

Our Zhaoyuan cement plant commenced operations in 1971 with an initial annual capacity of 80,000 metric tons (MT) of cement. In 1992, the annual capacity increased to 400,000 MT, and a new cement plant was built in Hainan Province called Dongfang Shuangji cement plant with an annual production of 500,000 MT of cement. Shandong Zhaoyuan Shuangji Group Co., Ltd., a state-owned company, was formed in 1992 to incorporate the operations of both cement plants. In 2002, the state-owned company was restructured as part of a privatization buyout by Wenji Song, our Chairman, and 197 other employees, in which Zhaoyuan Shuangji was formed. Zhaoyuan Shuangji purchased our Hainan Danzhou cement plant in 2002 to add another 500,000 MT of production. During the fourth quarter of 2008, at the request of the city of Zhaoyuan, we ceased operations of our Zhaoyuan plant and began the relocation of the old facility and construction of new facility within the city of Zhaoyuan. For more information on the cement plants see “Item 2. Description of Properties” below.

Cement Industry in China and Competition

The demand for cement in China has been and continues to be substantial. Cement in China, the 2009 study by US-based research company, The Freedonia Group, forecasts that China’s cement consumption is expected to grow 6.0% annually through 2012 to 1.8 billion MT. In 2009, the Chinese National Bureau of Statistics announced that China’s GDP had grown by 8.7% in 2009. This is on top of 9% growth in 2008 and 13% growth in 2007 as published by the World Bank. In March 2010, the World Bank increased its GDP growth forecast for China from 9.0% to 9.5% for 2010. The World Bank stated that consumption by both businesses and households would grow strongly in 2010, even though government stimulus measures were being pared back. A key component of such growth has been infrastructure development consisting of local roads, super highways, railways, and new commercial building construction, all of which drive demand for our concrete products.

In 2008, China produced roughly one half of the total world cement output, and exports a small percentage of its production. As of 2008, China has ranked first place in the world for 23 successive years in production.

According to China Research and Intelligence, in 2009, Chinese cement production was 1.63 billion MT, a 17.91% increase from 2008. Revenues from sales of cement in 2009 were RMB 500.7 billion (US $73 billion). According to the Ministry of Industry and Information Technology, the average ex-factory price of cement increased by RMB 2 from October 2009 to RMB 278 per MT in November 2009. The cement price in the eastern region was RMB 250 per MT in November 2009, up RMB 3 per MT from October 2009. The cement prices closed the year at RMB 316 in Shandong Province on December 25, 2009 and RMB 485 in Hainan Province.

The concrete and cement industry is generally fragmented and characterized by large numbers of smaller providers and only a few larger and more developed companies with the average annual production of approximately 250,000 MT. The ten largest Chinese cement producers accounted for 21.1% of total production in China in 2008.

An important trend in the Chinese cement marketplace is the government program to consolidate the industry into fewer, modern, cleaner producers. To clean up the industry, the Chinese government is closing many smaller, less environmentally-friendly plants. We believe that approximately 300 smaller plants, mostly under 200,000 MT of annual capacity, will be closed in Shandong province in 2010. According to the Chinese Government’s Plan of Cement Industry during the 11th Five-Year Plan Period, the government forecasts that this program will reduce the number of cement plants from 5,500 to around 3,000 by the end of 2010, causing a reduction of approximately 250 million MT of annual production. We believe that such government actions will create additional demand for our high-quality cement.

5

The average production of China’s cement producers was approximately 250,000 MT in 2008. The largest cement company in China is Anhui Conch Cement Company Limited (HKEX, 0914). Anhui Conch Cement had revenues of RMB 54.5 billion in 2009 with total pre-tax profit of RMB 5.8 billion. In 2008, Anhui Conch Cement produced 81 million MT, followed by China National Building Materials (CNBM) with 66 million MT and Shanshui Cement as the third largest producer at 27 million MT. We consider China Runji Cement (CRJI – OTCBB) with 1 million MT annual capacity in Anhui province, west of Shanghai, and China Advanced Construction Materials Group, Inc. (CADC – NasdaqGM), in Beijing, to be competitors similar in size to our company.

Under the Chinese Government's 4-trillion-RMB (approximately $586 billion) economic stimulus plan announced in November 2008, 300 billion RMB will go to transportation and logistics sectors, which the government believes will attract nearly 700 billion RMB in investment from other sources. We believe that such huge investment should continue to drive substantial demand for cement.

Products

Similar to Eagle Materials Inc. (NYSE:EXP) or Texas Industries Inc. (NYSE:TXI) in the United States, we produce portland cement, a basic ingredient of concrete, mortar, stucco and most grout. It is a fine powder produced by grinding portland cement clinker and calcium, which controls the set time, and minor portions of silicon, iron, aluminum and sulfur. We make portland cement clinker by heating, in a kiln, a mixture of raw materials mostly comprised of limestone mixed with clay.

We believe that we are considered a large and environmentally-friendly producer of cement and will benefit from the government’s plan to shut down smaller producers and move to “dry” processes that create far less environmentally damaging waste products.

We currently sell all of the cement we produce. For the twelve months ended December 31, 2008, we produced 1,595,328 MT of cement and sold 1,607,954 MT. For the twelve months ended December 31, 2009, we produced 1,598,836 MT of cement and sold 1,591,216 MT.

Raw Materials

We purchase various raw materials for use in our manufacturing processes. The principal components and raw materials include limestone, coal, coal ash, gangue, slag, and plaster. The most important raw material in portland cement is limestone rock. Typically, we enter into purchase agreements with local suppliers. The annual purchase plans are determined at the beginning of the calendar year but are subject to revision every three months based on our order history. A purchase order is made according to monthly production plans which we receive from customers. This arrangement protects us from building up inventory when the orders from customers change.

All components and raw materials are available from numerous sources. In recent years, we have not experienced any significant shortages of manufactured components or raw materials, and we normally do not carry inventories of these items in excess of what is reasonably required to meet our production and shipping schedules.

Our ten largest suppliers provided 74.73% of all components and raw materials that we purchased for the year ended December 31, 2009. The table sets forth information regarding our ten largest suppliers.

List of Major Suppliers

|

Name of Suppliers

|

Material

|

Percentage of Total

Purchases in 2009

|

|

Dongfang Dongan Limestone Supplement Company

|

Limestone

|

7.3%

|

|

Dongfang Hongfa Coal Sale Co., Ltd

|

Coal

|

18.9%

|

|

Zhaoyuan Fuel Company

|

Coal

|

14.3%

|

|

Danzhao Yalahe Commodity Company

|

Coal

|

15.7%

|

|

Hebei Jiqing Coal Company

|

Coal

|

10.7%

|

|

Ou Jiyong

|

Limestone

|

0.63%

|

|

Cangshan Dahan Plaster Supplement Company

|

Plaster

|

4.0%

|

|

Zhanyuan Cogeneration Plant

|

Coal Ash

|

1.9%

|

|

Danzhou Nanfeng Welfare Packing Plant

|

Packing Bags

|

0.9%

|

|

Wangshunde Clay Plant

|

Yellow Clay

|

0.4%

|

|

74.73%

|

6

Apart from raw materials, electricity and coal are the major costs associated with the production of cement. In 2008 and 2009, they accounted for 63.57 % and 62.42% of our Cost of Revenue, around RMB 148 and RMB 141 per MT respectively. However, in 2009, we saw an increase in the cost of coal. We purchase coal from Vietnam and Hebei. Hebei is approximately 636 km west of our plant in Zhaoyuan. The cost of coal per MT of cement produced was almost has only increased by 1% from 2008 to 2009. We estimate that for every RMB 100/MT rise in the cost of coal, the cost of cement will increase by RMB 16.8 per MT.

We purchase electricity from the Shandong and Hainan electricity grid. The cost of electricity (kWh) per MT of cement produced has increased by only 0.4% from 2008 to 2009. We estimate that every RMB 0.02/kWh increase in the electricity price will increase the cost of cement by RMB 1.65/MT.

In 2009, even with very slight increases in the cost of electricity and coal, we were able to reduce our Cost of Revenue year-over-year by 4.7% from RMB 148 to RMB 141 per MT. This was accomplished by increasing the amount of recycled industrial by-products in our cement from 35% in 2008 to 40% in 2009. Making portland cement from limestone rock is an energy intensive process. Fly ash and slag cement are industrial by-products that can substitute for portland cement in certain blended amounts. Fly ash is a by-product of coal burning electric power plants. Slag cement is made from the slag left from blast-furnaces that make iron and steel. If not used in concrete, these materials would use valuable landfill space. By blending more fly ash and slag cement into our finished product, we reduce the amount of new portland cement we need to make and therefore the amount of energy needed to make our product.

Operations

Zhaoyuan Shuangji controls four cement plant facilities, Zhaoyuan Cement Plant and Longkou Cement Plant in Shandong Province and Dongfang Cement Plant and Danzhou Cement Plant in Hainan Province. All of our plants produce portland cement, the most common type of cement worldwide. Zhaoyuan Cement Plant, the first “smokeless” cement plant in Hainan province, has an annual capacity of approximately 500,000 MT. Zhaoyuan Cement Plant is currently being upgraded and expanded and is not producing. We acquired 51% of the equity in Longkou Cement Plant in April 2009. In July 2009, we made new modifications to increase capacity at Longkou to 500,000 MT. Dongfang Cement Plant was established in 1994 and has a total annual capacity of approximately 500,000 MT. Danzhou Cement Plant was established in 1992 and has an annual capacity of approximately 500,000 MT. As of December 31, 2009, the combined maximum cement output by these facilities is approximately 1,500,000 MT per year. Refer to “Item 2. Description of Properties” below for a detailed description of these plants.

Zhaoyuan Shuangji markets the cement principally to companies in the building material industry in its geographic market of Shandong Province and Hainan Province. However, in 2008, we sold 10,000 MT to Russia and in 2009, we also sold 20,000 MT to New Zealand. Currently we have agreements in place to deliver cement to other international markets including England and Russia.

During fiscal 2009 and 2008, we incurred no expenditures on research and development. In addition, during fiscal 2009 and 2008, we incurred no expenditures in complying with regulations involving the discharge of materials into the environment.

Geography

Shandong province where Zhaoyuan and Longkou factories are located is on the coast of the East China Sea between Beijing to the north and Shanghai to the south. Shandong province with an area of 157,000 square kilometers is nearly the size of Bangladesh or Uruguay. With a population of roughly 90 million, it is the second largest province in China. Shandong is one of the richest provinces in China and at RMB 3.11 trillion; its GDP was 2nd of all provinces in China for 2008. Shandong is rich in natural resources including coal and oil and home to major corporations such as appliance maker Haier and brewer Tsingtao. The Shandong economy also benefits from investment from nearby Korea and Japan.

7

Hainan province where Dongfang and Danzhou factories are located is an island located in the South China Sea in southern China west of Hong Kong and east of Hanoi, Vietnam. At 34,000 square kilometers, Hainan is approximately the size of Taiwan or Belgium. We are optimistic that cement demand will be strong in Hainan. It is the southernmost province and is known as the “Hawaii” of China with palm trees, beautiful beaches, golf courses and internationally known five-star hotel chains like the Ritz Carlton, Shangri-La and Mandarin Oriental. Hainan is rapidly growing and has plans to become duty and visa-free to more easily attract international tourists and shoppers. Currently, a 22 km bridge is under construction to the mainland to reduce travel time to minutes instead of the longer ferry ride.

Strategic Growth Plan

Because we have been able to sell as much cement as we produce, increasing capacity is our primary objective. As such, for 2010, we are focused on two major near-term objectives, to bring Zhoayuan Cement Plant back into production, doubling its former production and to double production at the Longkou Cement Plant.

Our mid-term strategic plan is to focus on domestic and international market expansion and increase profitability. To achieve these goals we intend to focus on developing brand recognition, improving quality control, streamlining production through improved operating efficiencies, and effecting strategic acquisitions.

Specifically, we plan to grow through organic upgrades to our existing lines of business and through strategic operating licenses and acquisitions. We are in the midst of such organic growth with high-return projects that include upgrades at Zhaoyuan and Longkou. We are looking to acquire companies that can be easily integrated into our operations, such as the newly acquired Longkou cement plant. We are also seeking operating licenses or joint ventures with companies that need expert management.

We anticipate that additional funding will be required in the form of equity financing from the sale of our common stock to achieve all or part of these goals. We cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to accomplish our goals. We do not have any arrangements in place for any future equity financing. In addition to the foregoing, in the future, we may broker cement transactions pursuant to which we will receive a broker’s fee for acting as an intermediary.

Plant Expansion

As of March 26, 2009, we are seeking financing to expand capacity in 2010 from 1.5 million MT to 2.5 million MT in 2010 by completing a new modern cement plant in Zhaoyuan City. Zhaoyuan City is in Shandong province on the coast, south of Beijing and north of Shanghai. The Zhaoyuan Cement Plant was established in 1971 in Shandong province and was upgraded in 1994 to a yearly capacity of 500,000 MT. It was shut down by the Zhaoyuan City government in winter 2008 to make way for a residential real estate development. Pending financing, the new site will start producing in 2010 with an annual capacity of 1,000,000 MT.

Further enhancements at our Longkou Plant could increase capacity from 500,000 MT to 1,000,000 MT.

Customers

Our ten largest customers represent 48.4% of our total sales for the year ended December 31, 2009. The following table sets forth information regarding our ten largest customers.

8

List of Major Customers

| Percentage of Total | ||||

| Name of Customer | Revenue in 2009 | |||

|

Danzhou Mingcheng Cement Management Company

|

13.3%

|

|||

|

Hainan Haiji Building Company

|

8.6% | |||

|

Hainan Dongfan Shunda Machinery Company

|

6.0%

|

|||

|

Danzhou Yongcheng Company

|

|

4.8% | ||

|

Hainan Guangba Engineering Co., Ltd

|

2.0% |

|

||

|

Danzhou Nada Hongfa Bridge Building Company

|

1.6%

|

|||

|

Zhaoyuan Jindu Concrete Company

|

7.3% |

|

||

|

Qingdao Building Material Supplement and Sale Company

|

|

1.6% | ||

|

Zhaoyuan Building Company

|

1.9% | |||

|

Zhaoyuan Municipal Engineering Company

|

1.3% |

|

||

|

|

||||

|

Total

|

48.4% |

Employees

We currently have approximately 620 full-time employees. Approximately 565 of these employees are in production, quality control and transportation. The remaining 35 employees are in corporate finance, purchasing, marketing and sales. Each full-time employees of our operating entity, Zhaoyuan Shuangji, has a labor agreement with us that states that Zhaoyuan Shuangji will pay employees for salary, pension, and other benefits according to PRC law and regulations.

Sales and Marketing

We sell our cement products through a direct sales force of approximately 24 full-time employees who market directly to our customers. Our customers are either engaged in the building construction industry or in foreign trade. We do not have any agreements with any third-party distributors or wholesalers. Most of our sales are made pursuant to longer term supply agreements with our customers, the duration of which is about 1 year, but the prices do fluctuate with the spot market price of cement and that of our raw materials. However, from time to time, we make individual sales outside of a supply agreement, if adequate capacity exists at the time.

Our senior management maintains direct personal relationships with our top customers such as Danzhou Mingcheng Cement Management Company. Our outside sales people identify new customers through telephone and in-person visits and negotiate contracts with new customers. Our inside sales staff provide pricing and receive individual orders via telephone, mail and facsimile.

We differentiate ourselves from our competitors through customer service and quality. Our sales staff is well educated in our product and we are easy for our customers to do business with. We maintain customers by providing high-quality products that are delivered in a timely manner.

Specifically, we target customers involved in highway construction, water supply construction, subway system construction, nuclear power plant construction, tunnel construction, commercial building construction, theme parks and port facilities.

Distribution

The majority of our customers are located in Longkou, Penglai, and Qixia in Shandong Province; all easily accessible by rail lines and truck. Our customers on Hainan Island are accessible by truck. Our international customers have their cement transported by ship at the port facility located at Longkou, 30 km from Zhaoyuan City. Normally, our customers pay for freight charges.

9

Intellectual Property

We indirectly own through Zhaoyuan Shuangji the trademark brand “Shuangji” which translated into English means “double lucky”. We rely on a combination of trademark and copyright laws in China to protect our brand name. We have no patents, other trademarks, licenses, franchises, concessions or royalty agreements.

Our web site www.shuangjicement.com is copyrighted under PRC law and is a registered domain name owned indirectly by us.

Governmental Regulations on our Operations in China

All of our PRC subsidiary companies operate in facilities that are located in China. Accordingly, our PRC subsidiaries’ operations have to conform to the governmental regulations and rules of China.

We are subject to the PRC’s National Environmental Protection Law, which was enacted on December 26, 1989, as well as a number of other national and local laws and regulations regulating air, water, and noise pollution and setting pollutant discharge standards. Violation of such laws and regulations could result in warnings, fines, orders to cease operations, and even criminal penalties, depending on the circumstances of such violation. We believe that all manufacturing operations comply with applicable environmental laws, including those laws relating to air, water, and noise pollution.

We are also subject to various laws and regulations administered by various local governments relating to the operation of our production facilities. We believe that we are in compliance with all governmental laws and regulations related to our products and facilities.

Doing Business in China

Chinese Legal System

The practical effect of the Chinese legal system on our business operations in China can be viewed from two separate but intertwined considerations. First, as a matter of substantive law, the Foreign Invested Enterprise Laws provide significant protection from government interference. In addition, these laws guarantee the full enjoyment of the benefits of corporate organization and contracts to Foreign Invested Enterprise participants, such as Wholly Foreign Owned Enterprises and Sino-Foreign Joint Ventures. These laws, however, do impose standards concerning corporate formation and governance, which are not qualitatively different from the general corporation laws of the several provinces. Similarly, the Chinese accounting laws mandate accounting practices, which are not consistent with US Generally Accepted Accounting Principles (GAAP). The Chinese accounting laws require that an annual “statutory audit” be performed in accordance with Chinese accounting standards and that the books of account of Foreign Invested Enterprises be maintained in accordance with Chinese accounting laws. Article 14 of the People’s Republic of China Wholly Foreign-Owned Enterprise Law requires a Wholly Foreign-Owned Enterprise to submit certain periodic fiscal reports and statements to designated financial and tax authorities, otherwise there is risk that its business license will be revoked. Notwithstanding these legal requirements, the financial statements included elsewhere in this filing have been prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and audited in accordance with the standards of the United States Public Company Accounting Oversight Board (PCAOB).

Second, while the enforcement of substantive rights may appear less clear than those in the United States, the Foreign Invested Enterprises and Wholly Foreign-Owned Enterprises are Chinese registered companies which enjoy the same status as other Chinese registered companies in business dispute resolution. Because the terms of the Company’s various Articles of Association provide that all business disputes pertaining to Foreign Invested Enterprises will be resolved by the Arbitration Institute of the Stockholm Chamber of Commerce in Stockholm, Sweden applying Chinese substantive law, the Chinese minority partner in the Company’s joint venture companies will not assume any advantageous position regarding such disputes. Any award rendered by this arbitration tribunal is, by the express terms of the various Articles of Association, enforceable in accordance with the “United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958).” Therefore, as a practical matter, although no assurances can be given, the Chinese legal infrastructure, while different from its United States counterpart, should not present any significant impediment to the operation of Foreign Invested Enterprises.

10

Economic Reform Issues

Although the Chinese Government owns the majority of productive assets in China, in the past several years the Government has implemented economic reform measures that emphasize decentralization and encourage private economic activity. Because these economic reform measures may be inconsistent or ineffectual, there is no assurance that:

|

·

|

We will be able to capitalize on economic reforms;

|

|

·

|

The Chinese Government will continue its pursuit of economic reform policies;

|

|

·

|

The economic policies, even if pursued, will be successful;

|

|

·

|

Economic policies will not be significantly altered from time to time; and

|

|

·

|

Business operations in China will not become subject to the risk of nationalization.

|

Negative impact on economic reform policies or nationalization could result in a total investment loss of our common stock.

Since 1979, the Chinese Government has reformed its economic systems. Because many reforms are unprecedented or experimental, they are expected to be refined and readjusted. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or in the disparities in per capita wealth between regions within China, could lead to further readjustment of the reform measures. This refining and readjustment process may negatively affect our operations.

Over the last few years, China’s economy has registered a high growth rate. Recently, there have been indications that the rate of inflation has increased. In response, the Chinese Government recently has taken measures to curb the excessively expansive economy. These measures included implementation of a unitary and well-managed floating exchange rate system based on market supply and demand for the exchange rates of RMB, restrictions on the availability of domestic credit, reduction of the purchasing capability of certain of its citizens, and centralization of the approval process for purchases of certain limited foreign products. These austerity measures alone may not succeed in slowing down the economy’s excessive expansion or control inflation, and may result in severe dislocations in the Chinese economy. The Chinese Government may adopt additional measures to further combat inflation, including the establishment of freezes or restraints on certain projects or markets.

Presently, reforms to China’s economic system have not adversely affected our operations and are not expected to adversely affect our operations in the foreseeable future; however, there can be no assurance that reforms to China’s economic system will continue or that we will not be adversely affected by changes in China’s political, economic, and social conditions and by changes in policies of the Chinese Government, such as changes in laws and regulations, measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and remittance abroad, reduction in tariff protection and other import restrictions.

Earnings and Distributions of the FIE’s

Wholly Foreign-Owned Enterprise laws provide for and guarantee the distribution of profits to foreign investors in Chinese Foreign Invested Enterprises. Article 19 of the People’s Republic of China Wholly Foreign Owned Enterprise Law provides that a foreign investor may remit abroad profits that are earned by a Foreign Invested Enterprise, as well as other funds remaining after the enterprise is liquidated.

Because our Chinese businesses are controlled foreign corporations, for U.S. federal income tax purposes, we may be required to include in our gross income for U.S. tax purposes:

|

·

|

Those companies’ “Subpart F” income, which includes certain passive income and income from certain transactions with related persons, whether or not this income is distributed to it; and

|

|

·

|

Increases in those companies’ earnings invested in certain U.S. property.

|

Based on the current and expected income, assets, and operations of Chinese businesses, we believe that it will not have significant U.S. federal income tax consequences under the controlled foreign corporation rules.

11

ITEM 1A. - RISK FACTORS

In addition to the other information included in this Form 10-K, the following risk factors should be considered in evaluating the Company’s business and future prospects. The risk factors described below are not necessarily exhaustive and you are encouraged to perform your own investigation with respect to the Company and its business. You should also read the other information included in this Form 10-K, including the financial statements and related notes.

Our business operations are conducted entirely in the PRC. Because China’s economy and its laws, regulations and policies are different from those typically found in the west and are continually changing, we face certain risks, including but not limited to those summarized below.

Risks Relating to Our Structure

Our corporate structure makes it difficult for us to evaluate our long term business prospects.

We presently operate the business of Zhaoyuan Shuangji pursuant to contractual agreements discussed elsewhere herein, which provide that we have operating control and receive the profit and loss from its operations. Our agreements with Zhaoyuan Shuangji have a term of ten years with an option to renew. In the event that the agreements are not extended upon their expiration for any reason, or if there is a change in government policy that prohibits or restricts such agreements, our ability to continue our business would be impaired in a material adverse manner.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may materially adversely affect us.

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (i) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (ii) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; (iii) covering the use of existing offshore entities for offshore financings; (iv) purporting to cover situations in which an offshore special purpose vehicle establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (v) making the domestic affiliate of the special purpose vehicle responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore special purpose vehicle jointly responsible for these filings. In the case of an special purpose vehicle which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006; this date was subsequently extended indefinitely by Notice 106, which also required that the registrant establish that all foreign exchange transactions undertaken by the special purpose vehicle and its affiliates were in compliance with applicable laws and regulations. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the special purpose vehicle’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the special purpose vehicle, or from engaging in other transfers of funds into or out of China.

12

The owners of the Zhaoyuan Shuangji submitted their application to SAFE and their application has been approved permitting these Chinese citizens to establish an offshore company, China Shuangji Cement Holding Ltd. (“Holdings”), as a special purpose vehicle for any foreign ownership and capital raising activities by Zhaoyuan Shuangji. However, we cannot be sure that the structure of our organization has fully complied with all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply to us, we cannot predict how it will affect our business operations or future strategies. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

The agreements, through which we indirectly participate in the operations of Zhaoyuan Shuangji may not be enforceable or in compliance with Chinese laws. Since our contractual rights under these agreements is our sole source of revenue, our results of operation would be materially adversely effected if the agreements were found to be illegal, could not be enforced, or were cancelled.

Through the agreements and an offshore holding structure, we are contractually entitled to manage and control the operations of Zhaoyuan Shuangji and receive the economic benefits of and incur the risks from Zhaoyuan Shuangji’s operations. Neither the Company, Chine Holdings, nor JZIC have any equity ownership in Zhaoyuan Shuangji. If the Chinese government determines that the agreements with Zhaoyuan Shuangji are not in compliance with applicable regulations, our business interests in China could be adversely affected. Our contractual rights under the Agreements are our sole source of revenue. Pursuant to the agreements, JZIC has agreed to advise, consult, manage and operate Zhaoyuan Shuangji’s business and to may provide certain financial accommodations to Zhaoyuan Shuangji in exchange for Zhaoyuan Shuangji’s payment of certain fees to JZIC. Further, each of the individual equity owners of Zhaoyuan Shuangji has contractually authorized JZIC to vote at any meeting or action of the owners of Zhaoyuan Shuangji and to act as the representative for such owners in all matters respecting Zhaoyuan Shuangji. The Chinese government may determine that the Agreements are not in compliance with Chinese licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future. If the agreements are determined not to be in compliance, the Chinese government could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business.

We may also encounter difficulties in obtaining performance under, or enforcement of, the Agreements. We must rely on the Agreements to indirectly control Zhaoyuan Shuangji’s business and participate in its operations. These contractual arrangements may not be effective in providing control over Zhaoyuan Shuangji. For example, Zhaoyuan Shuangji could breach the agreements or fail to take actions required for our business or fail to maintain and operate its business in compliance with its contractual obligations to do so or the agreements could be declared illegal or unenforceable under applicable law. If Zhaoyuan Shuangji fails to perform under the agreements with us, we may have to rely on legal remedies under Chinese law, which may not be effective, or we may lack the legal resources to pursue such rights. Furthermore, Wenji Song and the other individual equity owners of Zhaoyuan Shuangji effectively own and control the Company and its subsidiaries. Mr. Song and these other equity holders of Zhaoyuan Shuangji may have conflicts of interest and may not act in the best interest of the other equity holders of the Company, who do not have a direct equity interest in Zhaoyuan Shuangji.

If the agreements were terminated, our business in China could be adversely affected. The Agreements are comprised of the Strategic Consulting Service Agreement, the Operating Agreement, and Authorization Agreements, and Exclusive Option Agreement. All of the Agreements have a term of 10 years from the date they were entered into on August 11, 2008. Although we are the beneficial owners in the entire registered capital of JZIC, Wenji Song and two other Zhaoyuan Shuangji shareholders manage JZIC. In the event that Wenji Song and two other Zhaoyuan Shuangji shareholders acted in their capacity as management of JZIC to terminate the Agreements, we may have to rely on legal remedies which would arise under their fiduciary obligations to us and to JZIC. For example, JZIC is subject to the Company Law of the PRC, including Article 59 thereof which requires that directors, supervisors and managers shall faithfully execute their official duties and protect their company’s interests. However, laws in the PRC related to such concepts as management’s fiduciary duty are not well developed and may not protect us in the event we are required to rely upon them.

13

Risks Relating to Our Business

We may experience risks resulting from our plans for expansion.

We may expand our operations by acquiring other companies or entering into joint ventures in the future. Entering into an acquisition or joint venture entails many risks, any of which could harm our business, including: (a) diversion of management’s attention from other business concerns; (b) failure to integrate the acquired company with our existing businesses; (c) additional operating expenses not offset by additional revenue; and (d) dilution of our stock as a result of issuing equity securities.

If we are unable to implement our expansion strategy, we may be less successful in the future. A key component of our growth strategy is to acquire additional cement factories and, if our acquisition of cement factories proves successful, our acquisition strategy may expand to include future acquisitions of cement businesses. While there are many such companies, we may not always be able to identify and acquire companies meeting our acquisition criteria on terms acceptable to us. Additionally, financing to complete significant acquisitions may not always be available on satisfactory terms. Further, our acquisition strategy presents a number of special risks to us that we would not otherwise contend with absent such strategy, including possible adverse effects on our earnings after each acquisition, diversion of management’s attention from our core business due to the special attention that a particular acquisition may require, failure to retain key acquired personnel and risks associated with unanticipated events or liabilities arising after each acquisition, some or all of which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to environmental and safety regulations, which may increase our compliance costs and may adversely affect our results of operation.

We, indirectly through our agreements participate in the operation of Zhaoyuan Shuangji, which is subject to the requirements of environmental and occupational safety and health laws and regulations in China. The Company cannot provide assurance that Zhaoyuan Shuangji has been or will be at all times in full compliance with all of these requirements, or that it will not incur material costs or liabilities in connection with these requirement. Additionally, these regulations may change in a manner that could have a material adverse effect on Zhaoyuan Shuangji’s business, results of operations and financial condition, all of which would have a material adverse effect on the Company. The capital requirements and other expenditures that may be necessary to comply with environmental requirements could increase and become a material expense of doing business.

We rely on a major customers and the loss of these customers could adversely affect our revenues.

The Company’s top ten customers represent 48.4 percent of the Company’s total revenues for the year ended December 31, 2009. It is difficult to keep these contracts as a result of severity price competition and customer’s diversification of its supply base to keep these contracts. The Company’s business would be materially and adversely affected if it loses these major customers.

Our future operating results may be affected by fluctuations in raw material prices. We may not be able to pass on increases to customers.

Our profits may be negatively affected by fluctuations in the price of raw materials. We could be subject to short-term price volatility and may be forced to purchase raw materials at higher prices and may be unable to pass the cost increase to our customers. This may adversely affect gross margins and profitability. Our sales agreements with customers generally contain provisions that permit the parties to adjust the contract price of the cement upward or downward at specified times. For example, we may adjust these contract prices because of increases or decreases in the price of raw material from our mining suppliers, general inflation or deflation, or changes in the cost of producing cement caused by such things as changes in taxes, fees, royalties or the laws regulating the mining, production, sale or use of cement. However, if we fail to agree on a price with our customer under these provisions, many agreements permit the customer to terminate the contract or refuse to buy all of the quantities previously contracted. Market prices for raw materials generally increased in most regions in China in 2008 and 2009 and are expected to continue due to increased demand. Top quality source rock is critical to maintaining the operating efficiencies of Zhaoyuan Shuangji and delivering cement to customers which meets their specifications. Since top quality raw source rock is more limited in supply, its price tends to be more volatile. A general rise in cement prices also may adversely affect the price of, and demand for, cement and products made with cement such as concrete. This may in turn lead to a fall in demand for Zhaoyuan Shuangji’s products, which would have a material adverse effect on the Company.

14

The demand for our product is cyclical and is affected by industrial economic conditions. Downturns in the economy may reduce demand for our product and our revenues could decline.

The domestic and international cement markets are cyclical and exhibit fluctuation in supply and demand from year to year and are subject to numerous factors beyond our control, including, but not limited to, the economic conditions in China, the global economic conditions and fluctuations in industries with high demand for cement, such as the road building and construction industries. A significant decline in demand or excess supply for cement may have a material adverse effect on the business and operations of Zhaoyuan Shuangji which would have a material adverse effect on the Company.

If any of Zhaoyuan Shuangji Cement’s sales agreements terminate or expire, our revenues and operating profits could suffer.

A substantial portion of our revenue relates to sales made under cement sales agreements, which are important to the stability and profitability of our operations. It is common business practice in China that cement purchase and sale agreements are signed for one year terms, with annual renewals. This practice makes it difficult for us to forecast long-term purchase and sale quantities and can negatively affect our ability to manage inventory. These agreements may expire or be terminated. Cement sales agreements also typically contain force majeure provisions allowing temporary suspension of performance by us or the customer during the duration of specified events beyond the control of the affected party. Moreover, even if sales agreements are in force, buyers are generally not obligated to take the quantities specified in the contracts.

Increases in transportation costs could have a material adverse effect on our revenue.

Cement producers and processors depend upon rail, barge, trucking, overland conveyor and other systems to deliver cement to markets. While Zhaoyuan Shuangji’s customers typically arrange and pay for transportation of cement from our facilities to the point of use, any disruption of these transportation services because of weather-related problems, strikes, lock-outs or other events could temporarily impair Zhaoyuan Shuangji’s ability to supply cement to its customers and thus could adversely affect its results of operations, which would have a material adverse effect on the Company. If transportation for Zhaoyuan Shuangji’s cement becomes unavailable or uneconomic for its customers, Zhaoyuan Shuangji’s ability to sell cement could suffer, which would have a material adverse effect on the Company. Transportation costs can represent a significant portion of the total cost of cement. Since Zhaoyuan Shuangji’s customers typically pay that cost, it is a critical factor in a distant customer’s purchasing decision. If transportation costs from Zhaoyuan Shuangji’s facilities to the customer’s are not competitive, the customer may elect to purchase from another company.

We may not be able to meet quality specifications required by our customers and as a result could incur economic penalties or cancelled agreements which would reduce our sales and profitability.

Most of Zhaoyuan Shuangji’s cement sales agreements contain provisions requiring it to deliver cement meeting quality thresholds for certain geotechnical and geochemical technical characteristics. If Zhaoyuan Shuangji is not able to meet these specifications, because, for example, it is not able to source cement of the proper quality, it may incur economic penalties, including price adjustments, the rejection of deliveries or termination of the contracts, all of which could have a material adverse effect on the Company.

Our business is highly competitive and increased competition could reduce our sales, earnings and profitability.

The cement production business is highly competitive in China and Zhaoyuan Shuangji faces substantial competition in connection with the marketing and sale of its products. Some of its competitors are well established, have greater financial, marketing, personnel and other resources, have been in business for longer periods of time than Zhaoyuan Shuangji, and have products that have gained wide customer acceptance in the marketplace. The greater financial resources of these competitors will permit them to implement extensive marketing and promotional programs. We could fail to expand Zhaoyuan Shuangji’s market share, and could fail to maintain Zhaoyuan Shuangji’s current share.

15

We depend on our senior management team and the loss of any member could adversely affect our operations.

We are highly dependent on the services of Wenji Song and the loss of his services would have a material adverse effect on the operations of Zhaoyuan Shuangji and a material adverse effect on us. Mr. Song has been primarily responsible for the development of Zhaoyuan Shuangji and the development and marketing of its products. None of our executive officers or those of our subsidiaries, including Wenji Song, currently have any formal employment agreements. None of our companies have applied for key-man life insurance on the lives of these executives.

We do not have any registered patents or other intellectual property and we may not be able to maintain the confidentiality of our processes.

We do not have any patents covering Zhaoyuan Shuangji’s cement manufacturing processes nor Zhaoyuan Shuangji relies on the confidentiality of it manufacturing processes in producing a competitive product. There can be no guarantee that such confidentiality will be maintained or that such processes remain competitive in the marketplace.

We do not carry insurance coverage, any material loss to our properties or assets will have a material adverse effect on our financial condition and operations.

We (including our subsidiaries and operating companies) are not insured in amounts that adequately cover the risks of our business operations. As a result, any material loss or damage to our direct or indirect, properties or other assets, or personal injuries arising from our direct or indirect business operations would have a material adverse affect on our financial condition and operations. Neither we, our subsidiaries nor our operating company, carries officer and director liability insurance. This may cause us to experience difficulties in convincing qualified persons to fill such positions.

Terrorist attacks or military conflict could result in disruption of our business.

Terrorist attacks and threats, escalation of military activity in response to such attacks or acts of war may negatively affect our business, financial condition and results of operations. Our business is affected by general economic conditions, fluctuations in consumer confidence and spending, and market liquidity, which can decline as a result of numerous factors outside of our control, such as terrorist attacks and acts of war. Future terrorist attacks, rumors or threats of war, actual conflicts involving China or its allies, or military or trade disruptions affecting Zhaoyuan Shuangji’s customers may materially adversely affect our operations. As a result, there could be delays or losses in transportation and deliveries of processed cement to Zhaoyuan Shuangji’s customers, decreased sales of cement and extensions of time for payment of accounts receivable from customers. Strategic targets such as energy-related assets may be at greater risk of terrorist attacks than other targets. In addition, disruption or significant increases in energy prices could result in government-imposed price controls. Any, or a combination, of these occurrences could have

a material adverse effect on Zhaoyuan Shuangji’s business, financial condition and results of operations, which would have a material adverse effect on the Company.

16

Risks Relating to Doing Business in China

If the PRC enacts regulations which forbid or restrict foreign investment, our ability to grow may be severely impaired.

We intend to expand our business through acquisitions or joint ventures. We also may expand by seeking to develop equipment for other industries or by making acquisitions of companies in related industries. Many of the rules and regulations that we would face are not explicitly communicated, and we may be subject to rules that would affect our ability to grow, either internally or through acquisition of other Chinese or foreign companies. There are also substantial uncertainties regarding the proper interpretation of current laws and regulations of the PRC. New laws or regulations that forbid foreign investment could severely impair our businesses and prospects. Additionally, if the relevant authorities find us in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

· levying fines;

· revoking our business and other licenses and;

· requiring that we restructure our ownership or operations

Any deterioration of political relations between the United States and the PRC could impair our operations.

The relationship between the United States and the PRC is subject to sudden fluctuation and periodic tension. Changes in political conditions in the PRC and changes in the state of Sino-U.S. relations are difficult to predict and could adversely affect our operations or cause potential acquisition candidates or their goods and services to become less attractive. Such a change could lead to a decline in our profitability. Any weakening of relations between the United States and the PRC could have a material adverse effect on our operations, particularly in our efforts to raise capital to expand our other business activities.

Our operations and assets in the PRC are subject to significant political and economic uncertainties.

Government policies are subject to rapid change and the government of the PRC may adopt policies which have the effect of hindering private economic activity and greater economic decentralization. There is no assurance that the government of the PRC will not significantly alter its policies from time to time without notice in a manner with reduces or eliminates any benefits from its present policies of economic reform. The government of the PRC also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency and providing preferential treatment to particular industries or companies. Uncertainties may arise with changing of governmental policies and measures. In addition, changes in laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency, the nationalization or other expropriation of private enterprises, as well as adverse changes in the political, economic or social conditions in the PRC, could have a material adverse effect on our business, results of operations and financial condition.

Price controls may affect both our revenues and net income.

The laws of the PRC provide for the government to fix and adjust prices. Although we are not presently subject to price controls in connection with the sale of our products, it is possible that price controls may be imposed in the future. To the extent that we are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our sales will be limited and, unless there is also price control on the products that we purchase from our suppliers, we may face no limitation on our costs. Further, if price controls affect both our revenue and our costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable regulatory authorities in the PRC.

Our operations may not develop in the same way or at the same rate as might be expected if the PRC economy were similar to the market-oriented economies of OECD member countries.

The economy of the PRC has historically been a nationalistic, “planned economy,” meaning it functions and produces according to governmental plans and pre-set targets or quotas. In certain aspects, the PRC’s economy has been making a transition to a more market-oriented economy, although the government imposes price controls on certain products and in certain industries. However, we cannot predict the future direction of these economic reforms or the effects these measures may have. The economy of the PRC also differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development (the “OECD”), an international group of member countries sharing a commitment to democratic government and market economy. For instance:

17

|

·

|

the level of state-owned enterprises in the PRC, as well as the level of governmental control over the allocation of resources is greater than in most of the countries belonging to the OECD;

|

|

·

|

the level of capital reinvestment is lower in the PRC than in other countries that are members of the OECD;

|

|

·

|

the government of the PRC has a greater involvement in general in the economy and the economic structure of industries within the PRC than other countries belonging to the OECD;

|

|

·

|

the government of the PRC imposes price controls on certain products and our products may become subject to additional price controls; and

|

|

·

|

the PRC has various impediments in place that make it difficult for foreign firms to obtain local currency, as opposed to other countries belonging to the OECD where exchange of currencies is generally free from restriction.

|

As a result of these differences, our business may not develop in the same way or at the same rate as might be expected if the economy of the PRC were similar to those of the OECD member countries.

All our officers and directors reside outside of the United States, it may be difficult for you to enforce your rights against them or enforce United States court judgments against them in the PRC.

All our directors and executive officers reside in the PRC and substantially all of our assets are located in the PRC. It may therefore be difficult for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under federal securities laws. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement of criminal penalties of the federal securities laws.

We may have limited legal recourse under Chinese law if disputes arise under contracts with third parties.

Almost all of our agreements or arrangements with our employees and third parties, including our supplier and customers, are governed by the laws of the PRC. The legal system in the PRC is a civil law system based on written statutes. Unlike common law systems, such as we have in the United States, decided legal cases have little precedential value in this system. The government of the PRC has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the PRC, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance or to seek an injunction under Chinese law are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Because we may not be able to obtain business insurance in the PRC, we may not be protected from risks that are customarily covered by insurance in the United States.

As mentioned above, we do not carry business insurance. Business insurance is not readily available in the PRC. To the extent that we suffer a loss of a type which would normally be covered by insurance in the United States, such as product liability and general liability insurance, we would incur significant expenses in both defending any action and in paying any claims that result from a settlement or judgment.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences in the United States that may have a material adverse effect on our business, financial condition and results of operations.

18

If the United States imposes trade sanctions on the PRC due to its currency, export or other policies, our ability to succeed in the international markets may be diminished.

The PRC currently “pegs” its currency to a basket of currencies, including United States dollar. This means that each unit of Chinese currency has a set ratio for which it may be exchanged for United States currency, as opposed to having a floating value like other countries’ currencies. This policy is currently under review by policy makers in the United States. Trade groups in the United States have blamed the cheap value of the Chinese currency for causing job losses in American factories, giving exporters an unfair advantage and making its imports expensive. There is increasing pressure for the PRC to change its currency policies to provide for its currency to float freely on international markets. As a result, Congress may consider enacting legislation which could result in the imposition of quotas and tariffs. If the PRC changes its existing currency policies or if the United States or other countries enact laws to penalize the PRC for its existing currency policies, our business may be adversely affected, even though we do not sell outside of the PRC. Further, we cannot predict what action the PRC may take in the event that the United States imposes tariffs, quotas or other sanctions on Chinese products. Even though we do not sell products into the United States market, it is possible that such action by the PRC may nonetheless affect both our business, since we are a United States corporation and the market for our stock, although we cannot predict the nature or extent thereof. Any government action which has the effect of inhibiting foreign investment could hurt our ability to raise funds that we need for our operations. The devaluation of the currency of the PRC against the United States dollar would have adverse effects on our financial performance and asset values when measured in terms of the United Stated dollar.

Exchange controls that exist in the PRC may limit our ability to utilize our cash flow effectively.

We are subject to the PRC’s rules and regulations affecting currency conversion. Any restrictions on currency exchanges may limit our ability to use our cash flow for the distribution of dividends to our stockholders or to fund operations we may have outside of the PRC. Conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in the PRC, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the regulatory authorities of the PRC will not impose more stringent restrictions on the convertibility of the RMB, known as RMB, especially with respect to foreign exchange transactions.

Fluctuations in the exchange rate could have a material adverse effect upon our business.