Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LTD | exhibit32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LTD | exhibit32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LTD | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LTD | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2009

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________to ____________

Commission File Number: 000-30183

CHINA LONGYI GROUP INTERNATIONAL HOLDINGS

LIMITED

(Exact name of registrant as specified in its

charter)

| New York | 13-3874771 |

| (State or other jurisdiction of | (I.R.S. Employer Identification Number) |

| incorporation or organization) |

8/F East Area

Century Golden Resources Business

Center

69 Banjing Road

Haidian District

Beijing, People’s

Republic of China, 100089

(Address of principal executive office and

zip code)

86-10-884-52568

(Registrant’s telephone number,

including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $0.01

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [ x ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ x ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ x ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [ x ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [ x ]

As of June 30, 2009, there were 77,655,862 shares of the Registrant’s common stock outstanding and the aggregate market value of such shares held by non-affiliates of the Registrant’s common stock (based upon the average bid and asked price of such shares as reported on the Over-the-Counter Bulletin Board) was approximately $2.22 million. Shares of the Registrant’s common stock held by each executive officer and director have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of April 14, 2010, there were 77,655,862 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

| CHINA LONGYI GROUP INTERNATIONAL HOLDINGS LIMITED |

| FORM 10-K |

| For the Fiscal Year Ended December 31, 2009 |

SPECIAL NOTES REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K, including the following “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains “forward-looking statements” relating to the business of China Longyi Group International Holdings Limited and its subsidiary companies. The forward-looking statements include, among others, statements concerning our expected financial performance and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. These statements are based on assumptions and are subject to known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Risks and uncertainties include risks related to new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; any statements of belief or intention; and any of the factors mentioned in the “Risk Factors” section of this annual report on Form 10-K. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to:

-

“China Longyi,” “we,” “us,” “our,” or the “Company” are references to the combined business of China Longyi Group International Holdings Limited (formerly known as Minghua Group International Holdings Limited) and/or its consolidated subsidiaries, as the case may be;

-

“Top Time” are references to Top Time International Limited, our indirect wholly-owned subsidiary, a Hong Kong company;

-

“Beijing SOD” are references to Beijing Longyi Biology Technology Co. Ltd., our indirect, 90% owned subsidiary, a PRC company;

-

“Chongqing SOD” are references to Chongqing JiuZhou Dismutase Biology Technology Co., Ltd., our indirect, majority-owned subsidiary, a PRC company;

-

“China” and “PRC” are references to the People’s Republic of China;

-

“RMB” refers to Renminbi, the legal currency of China;

-

“U.S. dollar,” “$” and “US$” are to the legal currency of the United States (for all U.S. dollar amounts reported, the dollar amount has been calculated on the basis that $1 = RMB 6.8346 (exchange rate used in the balance sheet) and $1 = RMB 6.8311 (exchange rate used in the statements of operations) for its fiscal year 2009 financial statements, and $1 = RMB 6.9480 for fiscal year 2008 financial statements, which were determined based on the currency conversion rate in effect at the balance sheet date for each respective quarter);

-

“Securities Act” means the Securities Act of 1933, as amended; and

-

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

1

PART I

ITEM 1. BUSINESS

Overview of Our Business

We are a holding company that only operates through our indirect Chinese subsidiaries Beijing SOD and Chongqing SOD. Through our Chinese subsidiaries, we develop, manufacture and market our SOD products in China. SOD is a naturally occurring enzyme which may act as a potent antioxidant defense in cells that are exposed to oxygen. Certain research has shown that under certain biological conditions, SOD revitalizes cells and reduces the rate of cell destruction. It neutralizes the most common free radical—superoxide radical—by converting it into hydrogen peroxide and water. Because superoxide is harmful to human cells, and certain forms of SOD exist naturally in most humans, many studies show that SOD is valuable in protecting human cells from the harmful effects of superoxide. SOD is thought to be more powerful than antioxidant vitamins as it activates the body's productions of its own antioxidants. As a result, SOD is referred to as the “enzyme of life.” Commercially, SOD has a wide range of applications and is widely applied in foods, drinks, skin care productions, pharmaceuticals, to combat ailments ranging from sunburn to rheumatoid arthritis.

History and Corporate Structure

We are a New York corporation that was incorporated on February 29, 1996, as United Network Technologies, Inc. and we changed our name to Panagra International Corporation on October 2, 1998. From our inception until 2001, we were relatively inactive with limited operations. On August 2, 2001 we changed our name to Minghua Group International Holdings Limited and at that time we also increased the authorized common shares of our common stock from 40,000,000 shares to 200,000,000 shares. On October 16, 2007, we effectuated a 1-for-20 reverse stock split of all our issued and outstanding shares of common stock, or the Reverse Split, and changed our name to China Longyi Group International Holdings Limited.

Reverse Acquisition

In June 2001 we formed Minghua Acquisition Corp., a Delaware corporation, and acquired all the equity interests of Minghua Group International Holding (Hong Kong) Limited, or Minghua Hong Kong, a Hong Kong limited company formed on June 4, 1997, for a purchase price of $1,000,000 in cash and 28,000,000 (pre Reverse Split) shares of our common stock. The shares received by the Minghua Hong Kong shareholders equaled 70% of our issued and outstanding shares of common stock, resulting in a change of control to the Minghua Hong Kong shareholders.

At that time, the sole asset of Minghua Hong Kong was an 85% equity interest in the Shenzhen Minghua Environmental Protection Vehicle Co., Ltd., or Minghua EPV, a PRC corporation. The remaining 15% equity minority interest in China Minghua EPV was owned by a related party, Asia Key Group Limited, through its wholly-owned subsidiary Minghua Real Estate (Shenzhen) Ltd., formerly known as Minghua Investment Co., Ltd., or Minghua Real Estate. On January 29, 2004, the Company acquired this 15% minority interest held by Minghua Real Estate, in a related party transaction by paying $990,638 in cash and issuing 28,210,000 (pre reverse split) shares of our common stock. Through Minghua EPV, our business became the development and commercialization of mass transit, hybrid electric vehicles, primarily buses.

Acquisition of the Bus Installation Company

On March 13, 2003, our indirect subsidiary, Ming Hua Environmental Protection Science and Technology Limited, a Hong Kong limited company, or Minghua Science, acquired an 89.8% equity interest in the Guangzhou City View Bus Installation Company, or the Bus Installation Company, through its acquisition of Good View Bus Manufacturing (Holdings) Company Limited, a Hong Kong limited company and Eagle Bus Development Limited, a Hong Kong limited company, which own 23.8% and 66% of the Bus Installation Company, respectively. The Bus Installation Company manufactured motor coaches for domestic sale in China and for export under the “Eagle” brand name. We sold 6 standard diesel buses in 2005 and 5 standard diesel buses in 2004, however, once we sold off the inventory of diesel buses and parts that we acquired along with our acquisition of the Bus Installation Company, we no longer sold or manufactured diesel buses.

Acquisition of Beijing Cardinal

On June 16, 2004, Minghua Hong Kong formed a wholly owned subsidiary in the PRC, named Beijing China Cardinal Real Estate Consulting Co., Ltd., or Beijing Cardinal. We intended to use Beijing Cardinal as a vehicle to make future real estate investments in the PRC. However, at December 31, 2006, Beijing Cardinal had not begun significant operations.

2

Sale of Environmental Vehicle Business

Through Minghua Hong Kong, we had been focused on the development and commercialization of mass transit, hybrid electric vehicles, primarily buses. However, although prototype hybrid vehicles and a limited number of other vehicles have been produced, we have not been able to successfully commercialize these vehicles. As a result, on September 28, 2006, we disposed of our entire interests in Minghua Hong Kong and Minghua Science to Messrs. Han Lian Zhong and Niu Rui Cheng for 1 HK$, in exchange for their assumption of Minghua Hong Kong and Minghua Science’s debt. However, we retained our interests in China Cardinal, which were transferred to our subsidiary, Euromax International Investments Limited, or Euromax, and in the Guangzhou City View Bus Installation Company, which was transferred to our subsidiary, Top Team Holdings Limited (BVI), or Top Team.

Qiang Long Investment

On January 29, 2004, we entered into a subscription agreement with Qiang Long Real Estate Development Co., Ltd., or Qiang Long, a PRC company, pursuant to which, as amended and supplemented from time to time, Qiang Long was obligated to purchase 140,000,000 (pre reverse split) shares of our common stock, par value $0.01 at an aggregate purchase price of US$29,400,000, or $0.21 per share. An amount equaling US$653,795 was paid to us as a performance bond and an additional US$632,911 was paid to us in 2006 in exchange for 3,013,862 (pre reverse split) shares. The balance of US$28,113,294 was to be paid in full by June 30, 2007, for the remaining 136,986,138 (pre reverse split) shares. On June 29, 2007, we consummated our obligations under the contract, pursuant to a letter agreement between the Company and Qiang Long. Pursuant to the letter agreement, we acknowledged our receipt of the final payment in cash from Qiang Long as fulfillment of Qiang Long’s investment obligation, and agreed to issue 50,000,000 (pre reverse split) shares to Qiang Long on or before July 23, 2007, and the remaining 86,986,138 (pre reverse split) shares within fifteen (15) business days following the effective date of an amendment to our Certificate of Incorporation to effect a one-for-twenty reverse split of our outstanding common stock, which will be equal to 4,349,307 shares post-reverse split. Accordingly, on August 2, 2007, 50,000,000 shares were issued to Qiang Long.

As a result of the closing of the investment transaction with Qiang Long, our Chairman, Mr. Changde Li, now beneficially owns and controls 155,000,000 (pre reverse split) shares (7,750,000 shares post-reverse split) or 54.0% of the Company’s issued and outstanding common stock, 15,000,000 (pre reverse split) of which he holds indirectly through Qiang Long, 136,986,137 (pre reverse split) of which he holds indirectly through Qiang Long’s affiliate, Jolly Concept Management Limited, a BVI company, and 3,013,863 (pre reverse split) of which he holds through Qiang Long’s affiliate, Chinese Dragon Heritage Investment Management Limited, a PRC company.

Acquisition of Top Time

From the time when we sold the 6 standard diesel buses in the first quarter of 2005 until November 12, 2007 when we completed the acquisition transaction with Daykeen Group Limited, or Daykeen, discussed herein, we had limited operations and did not engage in active business operations other than our search for, and evaluation of, potential business opportunities for acquisition or participation.

On November 12, 2007, we completed an acquisition transaction with Top Time International Limited, a Hong Kong Company, or Top Time, whereby we paid Daykeen, Top Time’s sole shareholder, a total consideration of $54.9 million (RMB 407 million, based on an exchange ratio of $1=RMB 7.414) in exchange for 100% ownership of Top Time, consisting of $30 million in cash and $24.9 million in shares of our common stock issuable within 90 days of the closing. $30 million of cash was paid to Daykeen by three transactions, Beijing Cardinal, De Qiu Hong, and Mr. Chen Zhiping paid $29 million, $0.4 million, and $0.6 million on behalf of the Company, respectively. As a result, the Company offset the same amounts of balance of the three parties’ current accounts. The equity portion of the purchase price amounts to a total of 62,250,000 (post reverse split) shares of our common stock (based upon $0.02/share, the average of the closing price of the Company’s common stock on the OTCBB for the 365 calendar days prior to May 31, 2007, which was adjusted for our stock split which occurred on October 16, 2007 and resulted an effective purchase price of $0.40 per share). Top Time thereby became our wholly owned subsidiary and Daykeen will become our controlling stockholder upon our issuance to Daykeen of the equity portion of the purchase price in accordance with the Share Purchase Agreement.

Top Time was incorporated in Hong Kong in December 2006 and currently has two subsidiaries: Beijing SOD and Chongqing SOD. Beijing SOD was incorporated in China in March 2005 and is 90% owned by Top Time and 10% owned by Ms. Ran Wang.

3

For accounting purposes, the acquisition of Top Time was treated as a reorganization of entities under common control. When we refer in this report to business and financial information for periods prior to the consummation of the acquisition, we are referring to the business and financial information of Top Time on a consolidated basis unless the context suggests otherwise.

Sale of Top Team Subsidiaries

Through acquisition of Top Time, our business became the development, manufacture and sale of SOD products. As a result, on November 28, 2007, we disposed of five subsidiaries held by Top Team Holdings Limited (BVI): Euromax International Investments Limited, Beijing China Cardinal Real Estate Consulting Co., Ltd, Eagle Bus Development Limited (HK), Good View Bus Manufacturing Company Limited (HK), and Guangzhou City View Bus Installation Company Limited (PRC), to Mr. Zhiping Cheng, for an aggregate sale price of RMB5,000,000 (approximately $715,000).

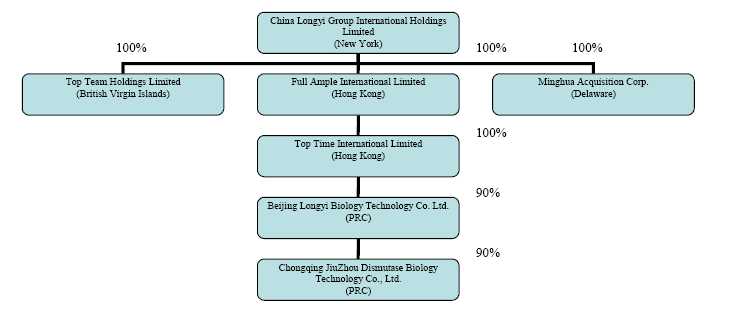

The following chart reflects our organizational structure as of the date of this report.

Our Industry

The health supplements industry in China is currently made up of many small- and medium-sized companies that manufacture and distribute products generally intended to, or marketed for the purpose of maintaining, and sometimes improving, the body’s health and general well being. China is one of the fastest growing health supplements markets in the world. With rapid economic growth and continued improvement of its peoples’ livelihoods, the demand for health supplements from China’s 1.3 billion people has expanded tremendously over the last 20 years. Today the Chinese health supplements industry is estimated to be worth approximately $6 billion in annual sales, according to the China Health Care Association, which is an association attached to China's Ministry of Health. Given China’s current annual per capita consumption of health supplements is approximately $10—which is far below that of many western countries.

Ever since American scientists Joe McCord and Irwin Fridovich discovered SOD in cattle erythrocytes in 1969 and hypothesized that it can protect life molecules from oxygenation and retrogradation, experts in the fields of biology and medicine and many entrepreneurs and industrialists have been engaged in research, study, development, application and transformation of SOD into products that we believe will provide human beings with certain health and longevity benefits.

Research into the functions and applications of SOD in China began in the late 1970’s. Since then, various centers of research in China, including universities, the military and private companies, have researched food, medicinal, and cosmetic applications for SOD. In the 1990’s, SOD foods began to be sold in China, including SOD soy milk, SOD dairy milk, and SOD beer. Due to technical problems with these first-generation SOD food products and limited public knowledge of the health benefits of SOD, many were discontinued. Technical difficulties relating to the commercialization of SOD products in China have included: (1) lack of methods for efficient harvesting of SOD from animal and human blood and plants; (2) problems with the maintenance and stabilization of harvested SOD, the longest shelf life so far being only two years in China; and (3) technical problems in the effectiveness of SOD in products, particularly food and other products to be consumed orally. More recently, however, various SOD food products have reappeared in China, including SOD milk, SOD wine, and SOD vegetables and fruits. We believe that these and other types of SOD products will become extremely popular due in part to innovations in the SOD industry; recognition of SOD technologies as proprietary intellectual property; government policies encouraging healthier food; the higher awareness of consumers in China of the health benefits of consuming products containing SOD; and the growth of the spending power of Chinese citizens.

4

In addition, the China Science and Technology Institute has recognized that SOD product technologies are proprietary intellectual property. SOD companies, including us, have instituted strict measures to protect their SOD product technologies from being misappropriated. As such, the SOD product technologies may be protected by Chinese intellectual property law even if they are not patented. As a result, companies are encouraged to develop and commercialize SOD technologies.

The growing wealth of the Chinese public and its related greater interest in better health and nutrition are also trends in SOD industry’s favor. SOD production and distribution companies have been working hard to develop innovations to best exploit the commercial potential of SOD, including our subsidiary, Chongqing SOD. Since 1993, various types of SOD products have been sold in China, such as Beijing Dabao SOD skin care series, Wuhan Jiutouniao SOD liquid nutrition drink series, Guizhou Laoliafu SOD liquid nutrition drink series, Zhejing SOD beer, SOD toothpaste, SOD soy milk. We believe that the SOD industry in China should expand as Chinese consumers grow more able and willing to purchase SOD products.

Our Products

Currently we are manufacturing one product, which is Jiuzhou SOD plant wine which we market under the name “Jiuzhou Holy Wine.” Our Jiuzhou SOD plant wine is a product developed from the zymolysis of natural wide berries with an alcohol level of 21%. We plan to produce SOD oral liquid and SOD capsules after our Jiuzhou SOD plant wine products enter into the market and generate revenues to us. We also plan to produce and sell SOD medicines and skin care products after we receive manufacturing permits from the State Food and Drug Administration, or SFDA.

Sales & Marketing Strategy

Our sales and marketing department currently consists of 16 employees. We are developing a diversified sales network which allows us to effectively market products and services to our customers. In addition to sales efforts conducted directly by our internal sales team and other employees, we also use sales agents. Currently we have 15 sales agents selling our products.

In terms of geographic area, our sales network covers 21 cities in China. Our Jiuzhou SOD wine has been listed on the governmental procurement list of Chongqing City, which will grant us a priority to sell our SOD products to various governmental agencies in Chongqing City. We also expect that our SOD products will be listed on the governmental procurement list of Beijing City. We plan to expand our sales network to cover more Chinese cities, including Shenzhen, Guangzhou, Nanjing, Shanghai, Shijiazhuang, Lhasa and Nanchang.

We also plan to employ an online order system, which will cover four major metropolitan areas, such as Beijing, Chengdu, Kuming and Chongqing, within the next 12 months. Through our website http://www.jiuzhoushengjiu.com/index.asp, we will be able to offer a complete line of our products to our customers 24 hours a day, seven days a week. This additional sales channel will enable us to market and sell our products in regions where we do not have retail operations or have limited operations.

Competition

The health supplementary business both within China and globally is highly fragmented and intensely competitive. Many of our competitors, both domestic and international, have significant research and development capabilities and financial, scientific, manufacturing, marketing and sales resources. Although our marketing and sales efforts of SOD products are very limited, we believe that we will compete with our competitors based upon the price and quality of our products, ability to produce a diverse range of products and customer services.

In China, we compete principally with Chengdu New Asia Bioengineering Co., Ltd., Zhuhai Zixing Biological Engineering Co., Ltd. and Liaoyuan Jinchang Bioengineering Co., Ltd.

We believe that our Jiuzhou SOD wine, made from more than 10 kinds of wild plants, is more efficient to remove superoxide free radicals than SOD liquid products made by our competitors. In addition, we believe that our SOD plant compound enzyme can be stored under the normal atmospheric temperature for more than 10 years, much longer than the life span of many other SOD products made from animal blood or a single plant.

5

Intellectual Property

Although none of our products are currently covered by patents, we already prepared all necessary documents and related materials and will register patent for SOD mother solution application skill. Furthermore, we have registered a trademark for our SOD product which we will sell under the name “Jiuzhou Holy Wine.”

In addition, we protect our know how technologies through confidentiality agreements we entered into with our employees in our production department.

Research and Development

We currently operate our research and development department through Beijing SOD. As of December 31, 2009, we have 12 research and development staff and five of them hold Master/PhD degrees. Our research and development department is responsible for developing advanced technologies, developing new SOD products and training. We also plan to establish a “life technology” research academy where our staff may research and develop SOD’s application as an antioxidant and energy booster.

Expenditures for research and development for the years ended December 31, 2009 and 2008 were $29,278 and $0 respectively.

Regulation

Based on different potential uses, SOD products in China are classified into three types under the Chinese law and accordingly are subject to different Chinese laws and regulations.

If the SOD products are sold for manufacturing food, they are considered as food additives. Under current Chinese law, a company may not produce SOD products for food additives use without two licenses, the Food Hygiene License issued by the provincial Administration of Health, or AOH, and the Food Production License issued by the provincial Administration of Quality Supervision, Inspection and Quarantine, or AQSIQ. If the SOD products are sold as raw materials for drugs, the Company should first obtain the Pharmaceutical Producer License from the provincial AOH and the approval from the provincial Food and Drug Administration, or FDA.

We have already obtained both the Food Hygiene License issued by the Chongqing AOH and the Food Production License issued by the local AQSIQ. Since we also plan to produce and sell SOD medicines and skin care products, we plan to apply for the Pharmaceutical Producer License from the provincial AOH and the approval from the provincial FDA.

In addition, we are also subject to PRC’s foreign currency regulations. The PRC government has control over RMB reserves through, among other things, direct regulation of the conversion or RMB into other foreign currencies. Although foreign currencies which are required for “current account” transactions can be bought freely at authorized Chinese banks, the proper procedural requirements prescribed by Chinese law must be met. At the same time, Chinese companies are also required to sell their foreign exchange earnings to authorized Chinese banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the Chinese government.

Employees

As of December 31, 2009, we had a total of 72 full-time employees. The following table illustrates the allocation of these employees among the various job functions conducted at our Company.

| Department | Number of Employees | |

| Sales | 16 | |

| Administration | 8 | |

| Finance | 5 |

| SOD Production Center | 35 | |

| Research and Development | 12 | |

| Total | 76 |

6

We believe that our relationship with our employees is good. The remuneration payable to employees includes basic salaries and allowances. We have not experienced any significant problems or disruption to our operations due to labor disputes, nor have we experienced any difficulties in recruitment and retention of experienced staff.

As required by applicable Chinese laws, we have entered into employment contracts with all of our officers, managers and employees.

Our employees in China participate in a state pension scheme organized by Chinese municipal and provincial governments. We are required to contribute to the scheme at a rate of 28% of the average monthly salary. In addition, we are required by Chinese laws to cover employees in China with various types of social insurance. We have purchased social insurances for all of our employees.

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below, which constitute all of the material risks facing us. If any of the following risks actually occur, our business could be harmed. You should also refer to the other information about us contained in this report, including our financial statements and related notes.

RISKS RELATED TO OUR BUSINESS

The recent financial crisis could negatively affect our business, results of operations, and financial condition.

The recent credit crisis and turmoil in the global financial system may have an impact on our business and our financial condition, and we may face challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise capital, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, these economic conditions also impact levels of consumer spending, which have recently deteriorated significantly and may remain depressed for the foreseeable future. Consumer purchases of discretionary items, including our Jiuzhou SOD plant wine, generally decline during recessionary periods and other periods where disposable income is adversely affected. If demand for our products fluctuates as a result of economic conditions or otherwise, our revenue and gross margin could be harmed.

We are an early stage development company and we have a limited operating history of our current business. We have earned only insignificant revenues and it is uncertain whether we will earn any revenues in the future or whether we will ultimately be profitable.

We are in the development stage and our future operations are subject to all of the risks inherent in the establishment of a new business enterprise. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the development of SOD products, the utilization of unproven technology and the competitive environment in which we operate. There can be no assurance that we will be able to develop, manufacture or market any products in the future, that future revenues will be significant, that any sales will be profitable or that we will have sufficient funds available to complete our marketing and development programs or to market any products which we may develop. In addition, as a result of our limited operating history even though we do currently have a marketable product, we expect to incur substantial operating losses until we can generate sufficient revenues from the sales of our SOD products to cover our operating costs. We currently have limited sources of potential operating revenue and there can be no assurance that we will be able to develop revenue sources or that our operations will ever become profitable.

Our industry is highly fragmented and competitive, and increased competition could reduce our operating income.

The health supplement business both within China and globally is highly fragmented and intensely competitive. We compete with a number of domestic and international manufacturers and distributors that are producing and marketing products in China that are similar to our products. We may not be able to effectively compete against them because our existing or potential competitors may have superior financial, technical, distribution, marketing, sales and other resources, as well as more significant name recognition and established positions in the market we serve. Increased competition could force us to lower our prices or offer services at a higher cost to us, which could reduce our operating income.

7

Our products could be subject to product liability claims by consumers, which would adversely affect our profit margins, results from operations and stockholder value.

We are exposed to risks inherent in the packaging and distribution of health supplement products, such as with respect to adequacy of warnings, mislabeling and contamination. As a result, there is a risk that someone using our products may experience significant negative side effects which may permanently harm them and we could be subject to claims for damages based on theories of product liability and other legal theories. The costs and resources to defend such claims could be substantial and, if such claims are successful, we could be responsible for paying some or all of the damages. Also, our reputation could be adversely affected, regardless of whether such claims are successful. We currently intend to obtain product liability insurance at the appropriate time; however, there can be no assurance that we will be able to obtain or maintain insurance on acceptable terms for our products or that such insurance would be sufficient to cover any potential product liability claim or recall. Any of these results would adversely affect our profit margins, results from operations and stockholder value.

We may not be able to adequately protect our proprietary intellectual property and technology, which may harm our competitive position and result in increased expenses incurred to enforce our rights.

We rely on a combination of copyright, trademark and trade secret laws, non-disclosure agreements and other confidentiality procedures and contractual provisions to establish, protect and maintain our proprietary intellectual property and technology and other confidential information. Some of these technologies, especially the technology to extract SOD and SOD related enzyme from wild plants, are important to our business and are not protected by patents. Despite our efforts, the steps we have taken to protect our proprietary intellectual property and technology and other confidential information may not be adequate to preclude misappropriation of our proprietary information or infringement of our intellectual property rights. Protecting against the unauthorized use of our products, trademarks and other proprietary rights is also expensive, difficult and, in some cases, impossible. Litigation may be necessary in the future to enforce or defend our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. Such litigation could result in substantial costs and diversion of management resources, either of which could harm our business, operating results and financial condition.

Compliance with environmental regulations can be expensive, and our failure to comply with these regulations may result in adverse publicity and may have a material adverse effect on our business.

As a manufacturer, we are subject to various Chinese environmental laws and regulations on air emission, waste water discharge, solid wastes and noise. Although we believe that our operations are in substantial compliance with current environmental laws and regulations, we may not be able to comply with these regulations at all times as the Chinese environmental legal regime is evolving and becoming more stringent. Therefore, if the Chinese government imposes more stringent regulations in the future, we will have to incur additional and potentially substantial costs and expenses in order to comply with new regulations, which may negatively affect our results of operations. If we fail to comply with any of the present or future environmental regulations in any material aspects, we may suffer from negative publicity and may be required to pay substantial fines, suspend or even cease operations. Failure to comply with Chinese environmental laws and regulations may materially and adversely affect our business, financial condition and results of operations.

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Jie Chen, our Chief Executive Officer and Xinmin Pan, our Chief Financial Officer. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, marketing and sales and support personnel for our operations. If we lose a key employee or if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete our institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the manufacturing, technical, marketing and sales aspects of our business, any part of which could be harmed by further turnover.

8

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have the operating effectiveness of our internal controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the Company’s internal controls over financial reporting in their annual reports on Form 10-K. We are subject to this requirement commencing with our fiscal year ended December 31, 2008 and a report of our management is included under Item 9A(T) of this Annual Report on Form 10-K. In addition, SOX 404 requires the independent registered public accounting firm auditing a company’s financial statements to also attest to and report on the operating effectiveness of such company’s internal controls. However, this annual report does not include an attestation report because under current law, we will not be subject to these requirements until our annual report for the fiscal year ending December 31, 2010. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no assurance that we will receive a positive attestation from our independent registered public accountants. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent registered public accountants with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

Our holding company structure may limit the payment of dividends to our stockholders.

We have no direct business operations, other than our ownership of our subsidiaries. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

Chinese regulations currently permit the payment of dividends only out of accumulated profits as determined in accordance with Chinese accounting standards and regulations. Our subsidiaries in China are also required to set aside a portion of their after tax profits according to Chinese accounting standards and regulations to fund certain reserve funds. Currently, our subsidiaries in China are the only sources of revenues or investment holdings for the payment of dividends. If they do not accumulate sufficient profits under Chinese accounting standards and regulations to first fund certain reserve funds as required by Chinese accounting standards, we will be unable to pay any dividends.

RISKS RELATED TO DOING BUSINESS IN CHINA

Changes in China’s political or economic situation could harm us and our operational results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

-

Level of government involvement in the economy;

-

Control of foreign exchange;

-

Methods of allocating resources;

-

Balance of payments position;

-

International trade restrictions; and

-

International conflict.

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

Our business is largely subject to the uncertain legal environment in China and your legal protection could be limited.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign invested enterprises in China. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses. In addition, all of our executive officers are residents of China and not of the U.S., and substantially all the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against us or any of these persons.

9

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

China only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business profitably in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2% . These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

Any recurrence of severe acute respiratory syndrome, or SARS, or another widespread public health problem, could harm our operations.

A renewed outbreak of SARS or another widespread public health problem in China, where our operations are conducted, could have a negative effect on our operations.

Our operations may be impacted by a number of health-related factors, including the following:

-

quarantines or closures of some of our offices which would severely disrupt our operations,

-

the sickness or death of our key officers and employees, and

-

a general slowdown in the Chinese economy.

Any of the foregoing events or other unforeseen consequences of public health problems could damage our operations.

If consumer spending power in China declines, our ability to market SOD products may weaken.

The success of our SOD products relies in part on the perception of consumers of the relative necessity of SOD, which is largely dependent on Chinese consumers’ financial ability to afford SOD-enriched products. If Chinese consumers’ spending power declines, whether because of the reversal of China’s economic growth or other causes, then our SOD products may become less profitable if companies that use its product to enrich their products stop ordering it.

If health problems relating to SOD products made in China emerge, then SOD sales may fall or be banned entirely.

In light of recent news pieces about the health problems and risks of products made in China, the global market and foreign and Chinese health authorities may be especially sensitive about health problems caused by or relating to SOD products made in China. If health problems relating to SOD products made in China become evident, then the market demand for Chinese SOD producers may be particularly susceptible to a fall. Likewise, such problems become evident, foreign or Chinese health authorities may ban or impose other controls or regulations on such SOD products that could harm or eliminate SOD product sales. As a producer of a SOD product in China, we would be subject to these risks.

10

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

The majority of our revenue will be settled in RMB and U.S. Dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations which became effective on September 8, 2006.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, among other things, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the PRC parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions has become significantly more complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

The new regulation allows PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to the Ministry of Commerce and other relevant government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the PRC business or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulation also limits our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulation may impede our ability to negotiate and complete a business combination transaction on financial terms that satisfy our investors and protect our stockholders’ economic interests.

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and RMB.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and RMB, and between those currencies and other currencies in which our sales may be denominated. Currently, RMB is stronger than U.S. Dollars. For example, to the extent that we need to convert U.S. dollars into RMB for our operational needs and should RMB appreciate against the U.S. dollar at that time, our financial position, the business of the Company, and the price of our common stock may be harmed. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against RMB, the U.S. dollar equivalent of our earnings from our subsidiaries in China would be reduced.

RISKS RELATED TO THE MARKET FOR OUR STOCK

Our common stock is quoted on the OTC Bulletin Board which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTC Bulletin Board. The OTC Bulletin Board is a significantly more limited market than the New York Stock Exchange or Nasdaq system. The quotation of our shares on the OTC Bulletin Board may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

11

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. If our common stock becomes a “penny stock”, we may become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Our controlling stockholder, Wei Wang, holds a significant percentage of our outstanding voting securities and accordingly may make decisions regarding our daily operations, significant corporate transactions and other matters that other stockholders may believe are not in their best interests.

Ms. Wei Wang, our Director, is the beneficial owner of approximately 80.81% of our outstanding voting securities. As a result, she possesses significant influence over the election of our Board of Directors and significant corporate transactions. Her ownership may also have the effect of delaying or preventing a future change in control, impeding a merger, consolidation, takeover or other business combination or discourage a potential acquirer from making a tender offer. Other stockholders may believe that these future decisions made by Ms. Wang are not in their best interests.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

All land in China is owned by the State or collectives. Individuals and companies are permitted to acquire rights to use land or land use rights for specific purposes. In the case of land used for industrial purposes, the land use rights are granted for a period of 50 years. This period may be renewed at the expiration of the initial and any subsequent terms according to the relevant Chinese laws. Granted land use rights are transferable and may be used as security for borrowings and other obligations.

Our executive offices are located at 8/F East Area, Century Golden Resources Business Center, 69 Bangjing Road, Haidian District, Beijing, People’s Republic of China 100089. Our executive offices consist of approximately 130 square meters consisting entirely of administrative office space. This lease expired on December 31, 2005 and we continue to rent this property on a month-to-month basis.

Our main production facilities are located at Sanjie Village, Shuanfu Town, Jiangjin City, Chongqing. The total site area is approximately 20,000 square meters. We lease this facility under a lease agreement with ShuanFu Town Government. The term of the lease is 20 years. We plan to buy the facility when the lease expires.

12

We believe that all our properties have been adequately maintained, are generally in good condition, and are suitable and adequate for our business.

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse affect on our business, financial condition or operating results.

ITEM 4. (REMOVED AND RESERVED)

13

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted and traded from time to time on the Over-the-Counter Electronic Bulletin Board (OTCBB) under the symbol “CGYG”. The CUSIP number is 16942Q109. The transfer agent of our common stock is Securities Transfer Corporation whose address is at 2591 Dallas Parkway, Suite 102 Frisco, TX 75034, (469) 633-0101.

The following table sets forth, for the periods indicated, the high and low bid prices for the common stock as reported on Yahoo.com. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Closing Prices (1) | ||||||

| High | Low | |||||

| Year Ended December 31, 2009 | ||||||

| 1st Quarter | $ | 0.25 | $ | 0.25 | ||

| 2nd Quarter | $ | 0.25 | $ | 0.25 | ||

| 3rd Quarter | $ | 0.25 | $ | 0.25 | ||

| 4th Quarter | $ | 0.25 | $ | 0.25 | ||

| Year Ended December 31, 2008 | ||||||

| 1st Quarter | $ | 2.50 | $ | 0.51 | ||

| 2nd Quarter | $ | 1.25 | $ | 0.25 | ||

| 3rd Quarter | $ | 0.25 | $ | 0.25 | ||

| 4th Quarter | $ | 0.25 | $ | 0.25 | ||

_____________________________

(1)The above tables set forth

the range of high and low closing bid prices per share of our common stock as

reported by www.quotemedia.com for the periods indicated.

Holders

On April 14, 2010, there were approximately 306 stockholders of record of our common stock.

Dividends

We have not paid any cash dividends with respect to our common stock in the last two fiscal years. We presently intend to retain future earnings to finance our development and expansion and therefore do not anticipate the payment of any cash dividends in the foreseeable future. Payment of future dividends, if any, will depend upon our future earnings and capital requirements and other factors that our board of directors considers appropriate.

Securities Authorized for Issuance under Equity Compensation Plans

| Plan category | Number of securities to be | Weighted-average exercise | Number of securities |

| issued upon exercise of | price of outstanding | remaining available for | |

| outstanding options, | options, warrants and | future issuance | |

| warrants and rights | rights | ||

| Equity compensation plans approved by security holders |

- |

- |

0 |

| Equity compensation plans not approved by security holders |

2,000,000 |

$1.75 |

20,000,000 |

Total |

2,000,000 |

- |

20,000,000 |

14

ITEM 6. SELECTED FINANCIAL DATA

Not Applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

This subsection of MD&A is an overview of the important factors that management focuses on in evaluating our businesses, financial condition and operating performance, our overall business strategy and our earnings for the periods covered.

General

We are a holding company that only operates through our indirect Chinese subsidiaries. Through our Chinese subsidiaries, we develop and manufacture SOD in China, with a wide range of applications, especially in foods, medicines and cosmetic products. We plan to market, sell and service our products nationally through a combination of company-owned offices and independent sales agents. Currently we have two sales offices, one located in Chengdu, and the other located in Chongqing, and we plan to establish agents in additional offices across China. We have targeted our approach to meet local market conditions which we believe provides the best possible products for our customers throughout China. In recent years, more and more people are choosing to eat or drink healthier foods and beverages. During fiscal year 2010, we plan to not only produce and sell our SOD wine and beverage products, but we plan to negotiate with local food manufacturing companies to become a supplier of SOD for use as a food additive.

Industry Wide Factors that are Relevant to Our Business

We expect several key demographic, healthcare, and lifestyle trends to drive the growth of our business in the coming future:

-

Increased Focus on Healthy Living: Our management believes that as China becomes more affluent, its citizens are becoming more health conscious. They are leading more active lifestyles and becoming increasingly focused on healthy living, nutrition, and supplementation. According to the Nutrition Business Journal, a higher percentage of today’s global population is involved to some degree in health and wellness than a few years ago. We believe that growth in the health supplements industry will continue to be driven by consumers who increasingly embrace health and wellness as a critical part of their lifestyles.

-

Aging Population: According to the U.S. Census Bureau, China's population age 60 and above was more than 142 million in 2005. The bureau estimates that by 2025 this demographic will more than double in size to approximately 290 million. We believe that these consumers are significantly more likely to use health supplements than younger persons and have higher levels of disposable income to pursue healthy lifestyles.

-

Rising Healthcare Costs and Use of Preventive Measures: Healthcare related costs have increased substantially in China. A survey released by China’s Ministry of Health found that the percentage of out-of-pocket health expenditures in China has increased from 35.7% in 1990 to 55.5% in 2003. To reduce medical costs and avoid the complexities of dealing with the healthcare system, and given increasing incidence of medical problems and concern over the use and effects of prescription drugs, many consumers take preventive measures, including alternative medicines and nutritional supplements.

-

Food and Beverage Security: Since 2007, food and beverage security has become more important to PRC regulators. The PRC government regulates and enforces strict food and beverage testing procedures and we are required to obtain licenses for the sale of any new food and beverage products from the relevant authorities. We currently sell SOD products (SOD WINE ) for manufacturing food, and we have already obtained both the Food Hygiene License issued by the Chongqing AOH and the Food Production License issued by the local AQSIQ. We also plan to produce and sell SOD medicines and skin care products, and we have applied for the Pharmaceutical Producer License from the provincial AOH and the approval from the provincial State Food and Drug Administration, or SFDA. It will take more than half year to get the license from AOH and the approval from SFDA for us to sell SOD medicines and skin care products.

15

Weaknesses and Uncertainties that Affect our Financial Condition

We face certain challenges and risks that may affect our financial condition. In recent years, low quality products and false advertisements have given the Chinese cosmetic and health products market a bad reputation. Consumers are often suspicious of the effects of cosmetics and health products. Some consumers think that these products cannot induce substantial beautification or health improvements, while others think these products may actually be harmful. In a market where efficient and inefficient markets are mixed up, and consumers have a distrust of the market, we will keep up our research and development of products, while strengthening our quality control at the same time. Based on our past high quality control, we believe that the reputation of our products will be strong.

Results of Operations

We are a development stage company. We have only generated limited revenues from our operations since our inception. Before November 12, 2007, we had limited operations and our purpose was to acquire an operating business or the valuable assets of an unidentified company. As a result of the acquisition of Top Time, we changed our business to the development, manufacture and sale of SOD products.

Fiscal Year Ended December 31, 2009 Compared to December 31, 2008

The following table summarizes the results of our operations during the fiscal years ended December 31, 2009 and 2008 and provides information regarding the dollar and percentage increase or (decrease) from the 2008 fiscal year to the 2009 fiscal year.

| Line Item | December 31, 2009 | December 31, 2008 | Increase (Decrease) | Percentage Increase (Decrease) | ||||||||

| Revenues | $ | 57,878 | $ | 144,402 | $ | (86,524 | ) | (60 | )% | |||

| Cost of Sales | $ | 52,465 | $ | 97,849 | $ | (45,384 | ) | (46 | )% | |||

| Operating Expenses | $ | 649,201 | $ | 2,486,510 | $ | (1,837,309 | ) | (74 | )% | |||

| Income Taxes | $ | - | $ | - | $ | - | - | |||||

| Net (Loss) | $ | (493,512 | ) | $ | (2,188,359 | ) | $ | 1,694,847 | (77 | )% |

Revenue

Our revenues in fiscal year 2009 amounted to $57,878, which is $86,524 or approximately 60% less than that of fiscal year 2008, when we had revenues of $144,402. Our sales of SOD products decreased during the fiscal year of 2009 because the management decided to change our products’ package in order to reduce future costs. As a result, we only sold products with current package to reduce the level of inventory without producing new products in the fiscal year of 2009. In addition, in order to increase of the market awareness of our products, we sold our products at prices lower than their costs which also contributed to the decline of our revenues.

Cost of Sales

Our cost of sales in fiscal years 2009 and 2008 was $52,465 and $97,849, respectively, which accounts for approximately 91% and 68%, respectively, as a percentage of total revenues. The dollar amount of the cost of sales decreased with the reduction of annual sales. Cost of sales as a percentage of annual revenues increased by about 23% in 2009 as compared with 2008, which is mainly attributable to the fact that some of SOD products were sold at a lower price than the cost for our market promotion purposes.

16

Operating Expenses

Our operating expenses for the fiscal year ended December 31, 2009 were $649,201, as compared to $2,486,510 for 2008. This decrease of $1,837,309 or 74% is primarily the result of the decrease of our sales of SOD products. In addition, at the beginning of 2009, our management decided to terminate some financial services provided by our accounting advisors in order to reduce the General and Administration expenses.

Income taxes

-

United States: China Longyi Group International Holding Limited is subject to United States tax at a tax rate of 34%. No provision for income taxes in the United States has been made as China Longyi Group International Holding Limited had no income subject to United States taxation for the year ended 2009.

-

British Virgin Islands: Our wholly owned subsidiary Top Team Holdings Limited was incorporated in the BVI. Under the current laws of the BVI, it is not subject to income taxes.

-

China: Before the implementation of the enterprise income tax, or EIT, Foreign Invested Enterprises or FIEs, established in the PRC were generally subject to an EIT rate of 33.0%, which includes a 30.0% state income tax and a 3.0% local income tax. On March 16, 2007, the National People’s Congress of China passed the new Corporate Income Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed the Implementing Rules for the EIT Law, or Implementing Rules, which took effect on January 1, 2008. The EIT Law and Implementing Rules impose a unified EIT of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions. Therefore, nearly all FIEs are subject to the new tax rate alongside other domestic businesses rather than benefiting from the old tax laws applicable to FIEs, and its associated preferential tax treatments, beginning January 1, 2008.

The Old FIEs that are eligible for the “two-year exemption and three-year half reduction” or “five-year exemption and five-year half-reduction” under the original EIT Law, are allowed to remain to enjoy their preference until these holidays expire. The discontinuation of any such special or preferential tax treatment or other incentives would have an adverse effect on any organization’s business, fiscal condition and current operations in China.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to a EIT of 25.0% on its global income. The Implementing Rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that the Company should be classified as a resident enterprise, then the organization’s global income will be subject to PRC income tax of 25.0%.

We incurred no income taxes in either 2009 or 2008.

Net Loss.

Net loss decreased $1,694,847, or 77%, to $493,512 for the year ended December 31, 2009, from $2,188,359 for 2008. This decrease in net loss was primarily due to the decrease of our sales of SOD products. In addition, at the beginning of 2009, our management decided to terminate some financial services provided by our accounting advisors in order to reduce the General and Administration expenses.

Liquidity and Capital Resources

General

As of December 31, 2009, we had cash and cash equivalents of approximately $26,132. The following table provides detailed information about our net cash flow for all financial statement periods presented in this report.

17

Cash Flow

| For the Fiscal Year Ended December 31, | ||

| 2009 | 2008 | |

| Net cash used in operating activities | $(469,228) | $(704,158) |

| Net cash provided by investing activities | 357, 924 | 462,566 |

| Net cash provided by financing activities | 75,480 | 377,494 |

| Net cash flow | (25,175) | (13,240) |

Operating Activities

Net cash used in operating activities was $469,228 for the fiscal year ended December 31, 2009, which is a decrease of $234,930 from $704,158 net cash used in operating activities for 2008. The decrease of the cash used in operating activities was mainly attributable to the change of the account of other payable. The net cash provided by other payable was $6,750 in 2009 compared with net cash used in other payable of $406,789 in 2008, which is a decrease of $413,359.

Investing Activities

Our primary uses of cash for investing activities are payments for the acquisition of property, plant and equipment.

Net cash provided by investing activities for the fiscal year ended December 31, 2009 was $357,924, which is a decrease of $104,642 from net cash provided by investing activities of $462,566 for 2008. This decrease was attributable to the reduction of the short term investment principle during the fiscal year 2009.

Financing Activities

Net cash provided by financing activities for the fiscal year ended December 31, 2009 was $75,480, while in 2008 we had $377,494 net cash provided by financing activities. Such change was attributable to the fact that one of our shareholders paid off the loan borrowed from us entirely and the balance of the loan was $0 as of December 31, 2009. There were no other financing activities during the fiscal year 2009.

Although we believe that we will have enough capital to sustain our operations at our current levels through at least the next twelve months, depending on our future needs and changes and trends in the capital markets affecting our shares and the Company, we may determine to seek additional equity or debt financing in the private or public markets.

Critical Accounting Policies

Economic and Political Risks

The Company faces a number of risks and challenges as a result of having primary operations and marketing in the PRC. Changing political climates in the PRC could have a significant effect on the Company’s business.

Foreign Currencies

The company has determined that RMB to be its functional currency. The accompanying consolidated financial statements are presented in U.S. dollars. The consolidation financial statements are translated into US dollars from RMB at year-end exchange rates for assets and liabilities, and weighted average exchange rates for revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

18

Significant Estimates

Several areas require significant management estimates relating to uncertainties for which it is reasonably possible that there will be a material change in the near term. The more significant areas requiring the use of management estimates related to property and equipment, accrued liabilities and, the useful lives for depreciation.

Restrictions on Transfer of Assets Out of the PRC

Dividend payments by Beijing SOD are limited by certain statutory regulations in the PRC. No dividends may be paid by Beijing SOD without first receiving prior approval from the Foreign Currency Exchange Management Bureau. Dividend payments are restricted to 85% of profits, after tax.

Revenue Recognition

The Company recognizes revenue in accordance with Staff Accounting Bulletin No.104 “Revenue recognition” (“ASC Topic 605”). Revenues are recognized as earned when the following four criteria are met: (1) a customer issues purchase orders or otherwise agrees to purchase products; (2) products are delivered to the customer; (3) pricing is fixed or determined in accordance with the purchase order or agreement; and (4) collectability is reasonably assured.

New Accounting Pronouncements