Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended January 30, 2010

|

|

|

OR

|

|

[ ]

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

|

For the transition period from __________to __________

Commission File No. 0-20664

BOOKS-A-MILLION, INC.

(Exact name of Registrant as specified in its charter)

|

DELAWARE

|

63-0798460

|

|

(State or other jurisdiction of

|

(IRS Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

402 Industrial Lane

|

|

|

Birmingham, Alabama

|

35211

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (205) 942-3737

Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $.01 per share

(Title of Class)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ ].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer [ ] Accelerated Filer [X]

Non-Accelerated Filer [ ] Smaller Reporting Company [ ]

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the voting stock held by non-affiliates of the Registrant (assuming for these purposes, but without conceding, that all executive officers and directors are "affiliates" of the Registrant) as of July 31, 2009 (based on the closing sale price as reported on the NASDAQ Stock Market on such date), was $64,292,832.

The number of shares outstanding of the Registrant's Common Stock as of March 26, 2010 was 15,865,567.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held on May 20, 2010 are incorporated by reference into Part III of this report.

2

BOOKS-A-MILLION, INC. AND SUBSIDIARIES

10-K INDEX

|

PART I

|

||

|

Item 1.

|

4

|

|

|

Item 1A.

|

7

|

|

|

Item 1B.

|

12

|

|

|

Item 2.

|

13

|

|

|

Item 3.

|

13

|

|

|

Item 4.

|

14

|

|

|

PART II

|

||

|

Item 5.

|

14

|

|

|

Item 6.

|

17

|

|

|

Item 7.

|

17

|

|

|

Item 7A.

|

26

|

|

|

Item 8.

|

26

|

|

|

Item 9.

|

47

|

|

|

Item 9A.

|

47

|

|

|

Item 9B.

|

48

|

|

|

PART III

|

||

|

Item 10.

|

48

|

|

|

Item 11.

|

49

|

|

|

Item 12.

|

50

|

|

|

Item 13.

|

50

|

|

|

Item 14.

|

50

|

|

|

PART IV

|

||

|

Item 15.

|

50

|

|

53

|

3

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This document contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties. A number of factors could cause the actual results, performance or, achievements of Books-A-Million, Inc. (the “Company,”) or the results of its industry to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors include, but are not limited to, the competitive environment in the book retail industry in general and in the Company’s specific market areas; inflation or deflation; economic conditions in general and in the Company’s specific market areas, including the length of time that the United States economy remains in the current economic downturn; the number of store openings and closings; the profitability of certain product lines, capital expenditures and future liquidity; liability and other claims asserted against the Company; uncertainties related to the Internet and the Company’s Internet operations; the factors described in ITEM 1A. RISK FACTORS herein; and other factors referenced herein. In addition, such forward-looking statements are necessarily dependent upon assumptions, estimates and dates that may be incorrect or imprecise and involve known and unknown risks, uncertainties and other factors. Accordingly, any forward-looking statements included herein do not purport to be predictions of future events or circumstances and may not be realized. Given these uncertainties, stockholders and prospective investors are cautioned not to place undue reliance on such forward-looking statements. The Company disclaims any obligation to update any such factors or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

PART I

ITEM 1. BUSINESS

General

Books-A-Million, Inc. is a leading book retailer in the southeastern United States. The Company was founded in 1917 and operates both superstores and traditional bookstores. Superstores, the first of which was opened in 1987, range in size from 8,000 to 36,000 square feet and operate under the names "Books-A-Million" and “Books and Co.” Traditional bookstores are smaller stores operated under the names “Bookland” and “Books-A-Million”. These stores range in size from 2,000 to 7,000 square feet and are located primarily in enclosed malls. All store formats generally offer an extensive selection of best sellers and other hardcover and paperback books, magazines, and newspapers. In addition to the retail store formats, we offer our products over the Internet at Booksamillion.com.

We were founded in 1917, originally incorporated under the laws of the State of Alabama in 1964 and reincorporated in Delaware in September 1992. Our principal executive offices are located at 402 Industrial Lane, Birmingham, Alabama 35211, and our telephone number is (205) 942-3737. Unless the context otherwise requires, references to “we,” “our,” "us" or “the Company” include our wholly owned subsidiaries, American Wholesale Book Company, Inc. ("American Wholesale"), Booksamillion.com, Inc. and BAM Card Services, LLC.

Our periodic and current reports filed with the Securities and Exchange Commission ("SEC") are made available on our website at www.booksamillioninc.com as soon as reasonably practicable. Our code of conduct and key committee charters are also available on our website. These reports are available free of charge to stockholders upon written request. Such requests should be directed to Brian W. White, our Chief Financial Officer. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street N.E., Room 1850, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us, at http: //www.sec.gov.

Business Segments

We have two reportable segments: retail trade and electronic commerce trade. In the retail trade segment we are engaged in the retail sale of primarily book merchandise at our retail stores. The retail trade segment includes our distribution center operations which predominantly supplies merchandise to our retail stores. In the electronic commerce trade segment we are engaged in the retail sale of book merchandise over the Internet. This segment is managed separately due to divergent technology and marketing requirements. For additional information on our reportable business segments, see Note 9, "Business Segments," in the notes to consolidated financial statements.

4

In both our retail trade and electronic commerce trade segments we sell books, and other merchandise, which consists of gifts, cards, collectibles, magazines, café sales, music, DVDs and other products. Sales as a percentage of net sales by merchandise category are as follows:

|

Fiscal Year Ended

|

||||||||

|

January 30, 2010

|

January 31, 2009

|

February 2, 2008

|

||||||

|

Books and magazines

|

80.9

|

%

|

82.4

|

%

|

83.8

|

%

|

||

|

General merchandise

|

8.7

|

%

|

8.1

|

%

|

7.7

|

%

|

||

|

Café

|

4.2

|

%

|

4.2

|

%

|

4.4

|

%

|

||

|

Other

|

6.2

|

%

|

5.3

|

%

|

4.1

|

%

|

||

|

Total

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

General merchandise consists of gifts, cards, collectibles and similar types of products. Café consists of coffee, tea and other edible products, as well as gift items related to our Joe Muggs cafés. Other products include music, DVD, E-Book and other products.

Retail Stores

We opened our first Books-A-Million superstore in 1987. We developed superstores to capitalize on the growing consumer demand for the convenience, selection and value associated with the superstore retailing format. Each superstore is designed to be a receptive and open environment conducive to browsing and reading and includes ample space for promotional events open to the public, including book autograph sessions and children's storytelling. We operated 201 superstores as of January 30, 2010.

Our superstores emphasize selection, value and customer service. Each of our superstores offers an extensive selection of books, magazines, general merchandise, including, gifts, cards, collectibles and similar products, including music and DVDs. Each superstore has a service center staffed with associates who are knowledgeable about the store's merchandise and who are trained to answer customers' questions, assist customers in locating books within the store and placing special orders. The majority of our superstores also include a Joe Muggs café, serving Joe Muggs coffee and assorted pastries and other edible items. Our superstores are conveniently located on major, high-traffic roads and in enclosed malls or strip shopping centers with adequate parking, and generally operate for extended hours up to 11:00 pm local time.

Our traditional stores are tailored to the size, demographics and competitive conditions of the particular market area. Traditional stores are located primarily in enclosed malls and generally feature a wide selection of books, magazines and gift items. We had 22 traditional stores as of January 30, 2010.

Merchandising

We employ several value-oriented merchandising strategies. Books on our best-seller list, which is developed by us based on the sales and customer demand in our stores, are generally sold in the Company's superstores at or below publishers' suggested retail prices. In addition, customers can join the Millionaire's Club and save 10% on all purchases in any of our stores, including already discounted best-sellers. Our point-of-sale computer system provides data designed to enable us to anticipate consumer demand and customize store inventory selection to reflect local customer interest.

Marketing

We promote our bookstores principally through the use of traditional direct mail, email and online advertising, as well as point-of-sale materials posted and distributed in the stores. In certain markets, radio and newspaper advertising is also used on a selective basis. We also arrange for special appearances and book autograph sessions with recognized authors to attract customers and to build and reinforce customer awareness of our stores. A substantial portion of our advertising expenses are reimbursed from publishers through their cooperative advertising programs.

Store Operations and Site Selection

In choosing specific store sites within a market area, we apply standardized site selection criteria that take into account numerous factors, including the local demographics, desirability of available leasing arrangements, proximity to our existing stores and stores of our competitors and overall level of retail activity. In general, stores are located on major high-traffic roads convenient to customers and have adequate parking. We generally negotiate short-term leases with renewal options. We also periodically review the profitability trends and prospects of each of our stores and evaluate whether or not any underperforming stores should be closed, converted to a different format or relocated to more desirable locations.

5

Internet Operations

On Booksamillion.com we sell a wide selection of books, magazines and general merchandise similar to those sold in our Books-A-Million superstores.

Purchasing

Our purchasing decisions are made by our merchandising department on a centralized basis. Our buyers negotiate terms, discounts and cooperative advertising allowances for all of our bookstores and decide which books to purchase, in what quantity and for which stores. The buyers use current inventory and sales information provided by our in-store point-of-sale computer system to make reorder decisions.

We purchase merchandise from over 1,500 vendors. We purchase the majority of our collectors' supplies from Anderson Press, Inc. and substantially all of our magazines from Anderson Media, each of which is a related party, see Note 7, "Related Party Transactions," in the notes to consolidated financial statements. No one vendor accounted for over 10.0% of our overall merchandise purchases in the fiscal year ended January 30, 2010. In general, more than 80% of our inventory may be returned to the publishers for credit, which substantially reduces our risk of inventory obsolescence.

Distribution Capabilities

Our subsidiary, American Wholesale, receives a substantial portion of our inventory shipments, including substantially all of our books, at its two facilities located in Florence and Tuscumbia, Alabama. Orders from our bookstores are processed by computer and assembled for delivery to the stores on pre-determined weekly schedules. Substantially all deliveries of inventory from American Wholesale’s facilities are made by a dedicated transportation fleet. At the time deliveries are made to each of our stores, returns of slow moving or obsolete books are picked up and returned to the American Wholesale returns processing center. American Wholesale then returns these books to publishers for credit.

Competition

The retail book business is highly competitive, and competition within the industry is fragmented. We face direct competition from other superstores, such as Barnes & Noble and Borders, and we also face competition from mass merchandisers, such as Wal-Mart and Costco, and online retailers such as Amazon, Barnes & Noble, Borders and Wal-Mart. Our bookstores also compete with specialty retail stores that offer books in particular subject areas, independent single store operators, variety discounters, drug stores, warehouse clubs, mail order clubs and other retailers offering books. In addition, our bookstores may face additional competition from the expanding market for electronic books and from other categories of retailers entering the retail book market. We believe that the key competitive factors in the retail book industry are convenience of location, selection, customer service and price.

Seasonality

Similar to many retailers, our business is seasonal, with the highest retail sales, gross profit and net income historically occurring in our fourth fiscal quarter. This seasonal pattern reflects the increased demand for books and gifts during the year-end holiday selling season. Working capital requirements are generally at their highest during the third fiscal quarter and the early part of the fourth fiscal quarter due to the seasonality of our business. As a result, our results of operations depend significantly upon net sales generated during the fourth fiscal quarter, and any significant adverse trend in the net sales of such period would likely have a material adverse effect on our results of operations for the full year. In addition to seasonality, our results of operations may fluctuate from quarter to quarter as a result of the amount and timing of sales and profits contributed by new stores as well as other factors. Accordingly, the addition of a large number of new stores in a particular fiscal quarter could adversely affect our results of operations for that quarter.

Trademarks

“Books-A-Million,” “BAM! Books-A-Million,” “Bookland,” “Books & Co.,” “Millionaire’s Club,” “Sweet Water Press,” “Thanks-A-Million,” “Big Fat Coloring Book,” “Up All Night Reader,” “Read & Save Rebate,” “Readables Accessories for Readers,” “Kids-A-Million,” “Teachers First,” “The Write-Price,” “Bambeanos,” “Hold That Thought,” “Book$mart,” “BAMM,” “BAMM.com,” “BOOKSAMILLION.com,” “Chillatte,” “Joe Muggs Newsstand,” “Page Pets,” “JOEMUGGS.com,” “FAITHPOINT.com,” “Faithmark,” “Joe Muggs,” “Anderson’s Bookland,” “Snow Joe,” “American Wholesale Book Company,” “AWBC” and “NetCentral” are the primary registered trademarks of the Company.

Employees

As of January 30, 2010, we employed approximately 2,800 full-time associates and 2,700 part-time associates. The number of part-time associates employed fluctuates based upon seasonal needs. None of our associates are covered by a collective bargaining agreement. We believe that relations with our associates are good.

6

ITEM 1A. RISK FACTORS

The following risk factors and other information included in this Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows could be materially adversely affected.

Business Strategy

Our future results will depend, among other things, on our success in implementing our business strategy. There can be no assurance that we will be successful in implementing our business strategy or that the strategy will be successful in sustaining acceptable levels of sales growth and profitability.

Intense competition from traditional retail sources and the Internet may adversely affect our business.

The retail book business is highly competitive, and competition within the industry is fragmented. We face direct competition from other superstores, such as Barnes & Noble and Borders, and we also face competition from mass merchandisers, such as Wal-Mart and Costco, and online retailers such as Amazon, Barnes & Noble, Borders and Wal-Mart. Our bookstores also compete with specialty retail stores that offer books in particular subject areas, independent single store operators, variety discounters, drug stores, warehouse clubs, mail order clubs and other retailers offering books. In addition, our bookstores may face additional competition from the expanding market for electronic books and from other categories of retailers entering the retail book market.

Many of our current and potential competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we have. They may be able to secure merchandise from vendors on more favorable terms and may be able to adopt more aggressive pricing policies. Competitors in both the retail and electronic commerce trade also may be able to devote more resources to technology development, fulfillment and marketing than we are.

Competition in electronic commerce trade may intensify. The online market is rapidly evolving and intensely competitive, with few barriers to entry. Companies in the retail and electronic commerce trade may enter into business combinations or alliances that strengthen their competitive positions. This increased competition may reduce our sales or operating profits, or both.

Our business is highly seasonal.

Our business is highly seasonal, with sales and earnings generally highest in the fourth fiscal quarter and lowest in the first fiscal quarter. Our results of operations depend significantly upon the holiday selling season in the fourth fiscal quarter. During the fiscal year ended January 30, 2010, approximately 30.9% of our sales and approximately 83.4% of our operating income were generated in the fourth fiscal quarter. If we do not stock popular products in sufficient amounts or if we fail to have sources to timely restock popular products during the busy holiday period such that we fail to meet customer demand, it could significantly affect our revenue and earnings and our future growth. In addition, if we experience less than satisfactory net sales during a fourth fiscal quarter, we may not be able to sufficiently compensate for any losses which may have been incurred during the first three quarters of such fiscal year.

The current economic downturn, along with difficult and volatile conditions in the capital and credit markets, could materially adversely affect our financial position, results of operations and cash flows, and we do not know if these conditions will improve in the near future.

The Company believes that the United States and global economies are presently experiencing extremely challenging times and that general economic conditions could persist or deteriorate further. The Company believes that these conditions have had and may continue to have an adverse impact on spending by the Company’s current retail customer base and potential new customers. Because of these significant challenges, we are continuously reviewing and adjusting our business activities to address the changing economic environment. We are carefully managing our inventory and liquidity and enforcing expense controls while working diligently and prudently to grow our business. Because of the uncertainty in the overall economic environment, the unpredictability of consumer behavior and the concern as to whether economic conditions will improve, it is very difficult for us to predict how our business may be affected in the future. Our business and financial performance may be adversely affected by current and future economic conditions that cause a further decline in business and consumer spending, including limited or further reduced availability of credit, continued high or increased unemployment levels, higher energy and fuel costs, rising interest rates, financial market volatility and long-term downturn. These conditions could have a negative impact on the earnings, liquidity and capital resources of the Company.

7

Current economic conditions have accentuated these risks and magnified their potential effect on us and our business. The current economic downturn and difficult conditions in the capital and credit markets may affect our business in a number of ways. For example:

• The economic downturn could have a significant adverse impact on consumer confidence and discretionary consumer spending, which may result in decreased sales

and earnings for us.

• Although we believe that we have sufficient liquidity under our credit agreement to run our business and to provide for our plans for growth, under depressed economic

or extreme market conditions, there can be no ssurance that such funds would be available or sufficient and, in such a case, we may not be able to successfully obtain

additional debt financing on favorable terms, or at all.

• Recent market volatility has exerted downward pressure on our stock price, which may make it more difficult for us to raise additional capital in the future.

We do not know if the state of the economy or market conditions will improve in the near future or when any such improvement will occur.

If the Company is unable to continue to open new stores, our growth may decline.

The Company’s growth depends in part on our ability to open new stores and operate them profitably. In general, the rate of expansion depends, among other things, on general economic and business conditions affecting consumer confidence and spending, the availability of desired locations and qualified management personnel, the negotiation of acceptable lease terms and the ability to manage the operational aspects of growth. It also depends upon the availability of adequate capital, which in turn depends in large part upon cash flow generated by the Company.

If stores are opened more slowly than expected, sales at new stores reach targeted levels more slowly than expected (or fail to reach targeted levels) or related overhead costs increase in excess of expected levels, the Company’s ability to successfully implement its expansion strategy would be adversely affected. In addition, the Company may open new stores in certain markets in which the Company is already operating stores, which could adversely affect sales at those existing stores.

Furthermore, increases in the complexity of the Company’s business could place a significant strain on our management, operations, technical performance, financial resources and internal financial control and reporting functions, and there can be no assurance that the Company will be able to manage this effectively. The Company’s current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations, especially as the Company employs personnel in multiple geographic locations. The Company may not be able to hire, train, retain, motivate and manage required personnel, which may limit our growth. If any of this were to occur, it could damage the Company’s reputation, limit growth, negatively affect operating results and harm the Company’s business.

Our business is dependent upon consumer spending patterns.

Sales of books may depend upon discretionary consumer spending, which may be affected by general economic conditions, consumer confidence and other factors beyond our control. Weather, among other things, can affect comparable store sales, because inclement weather can require us to close certain stores temporarily and thus reduce store traffic. Even if stores are not closed, customers may decide to avoid going to stores in bad weather. In addition, sales are dependent in part on the strength of new release titles offered by vendors. A decline in consumer spending on books could have a material adverse effect on our financial condition and results of operations.

The Company faces the risk of a shift in consumer spending patterns to e-content.

As technology evolves and consumers shift spending patterns to e-content, the Company may enter new markets in which we have limited experience. The offering of e-content may present new and difficult challenges. The Company’s gross margin of e-content products may be lower than our traditional product lines, and the Company may not recover our investments in this area. These challenges may negatively affect the Company’s operating results.

The Company’s costs of doing business could increase as a result of changes in federal, state or local laws or regulations.

Changes in federal, state or local laws or regulations, including, but not limited to, laws related to employment, wages, data privacy and information security, taxes and consumer products, could increase the Company’s costs of doing business.

8

Our business may be affected by our relationships with suppliers and delays in product shipments.

We rely heavily upon our suppliers to provide us with new products as quickly as possible. The loss of any of our suppliers could reduce our product offerings, which could cause us to be at a competitive disadvantage. In addition, we depend upon the business terms we can obtain from suppliers, including competitive prices, unsold product return policies, new release title quantity allocations, advertising and market development allowances, freight charges and payment terms. Our failure to maintain favorable business terms with our suppliers could adversely affect our ability to offer products to consumers at competitive prices. To the extent that our suppliers rely on overseas sources for a large portion of their products, any event causing a disruption of imports, including the imposition of import restrictions in the form of tariffs or quotas and currency fluctuations, could hurt our business.

Our vendor relationships subject us to a number of risks, and we rely on certain vendors that are related parties.

Although we purchase merchandise from over 1,500 vendors and no one vendor accounted for more than 10.0% of our inventory purchases in the fiscal year ended January 30, 2010, we have significant vendors that are important to us. If our current vendors were to stop selling merchandise to us on acceptable terms, we may not be able to acquire merchandise from other suppliers in a timely and efficient manner and on acceptable terms. We have entered into and may, in the future, enter into various transactions and agreements with entities wholly or partially owned by certain stockholders or directors (including certain officers) of the Company, including one such entity that serves as our primary magazine vendor and another that serves as our primary provider of collectors' supplies. We believe that the transactions and agreements that we have entered into with related parties are on terms that are at least as favorable to us as could reasonably have been obtained at such time from unrelated third parties.

If we do not successfully optimize inventory and manage our distribution, our business could be harmed.

If we do not successfully optimize our inventory and operate our distribution centers, it could significantly limit our ability to meet customer demand. Because it is difficult to predict demand, we may not manage our facilities in an optimal way, which may result in excess or insufficient inventory or warehousing, fulfillment or distribution capacity. Additionally, if we open new stores in new geographic areas where we do not currently have a presence, we may not be able to provide those stores with efficient distribution and fulfillment services, which may impact our stores in those markets. We may be unable to adequately staff our fulfillment and customer service centers to meet customer demand. There can be no assurance that we will be able to operate our network effectively.

We rely heavily on the American Wholesale warehouse distribution facilities for merchandise distribution functions and to maintain inventory stock for our retail stores. Our ability to distribute merchandise to our stores and maintain adequate inventory levels may be materially impacted by any material damage incurred at our warehouse facilities caused by inclement weather, fire, flood, power loss, earthquakes, acts of war or terrorism, acts of God and similar factors.

We also rely heavily on our dedicated transportation fleet for deliveries of inventory. As a result, our ability to receive or ship inventory efficiently may be negatively affected by inclement weather, fire, flood, power loss, earthquakes, labor disputes, acts of war or terrorism, acts of God and similar factors.

Any of the inventory risk factors set forth above may adversely affect our financial condition, results of operations and cash flows.

Failure to retain key personnel could adversely affect our business.

Our continued success depends to a significant extent upon the efforts and abilities of our senior management. The failure to retain our senior managers could have a material adverse effect on our business and our results of operations. We do not maintain “key man” life insurance on any of our senior managers.

Failure to attract and retain qualified associates and other labor issues could adversely affect our financial performance.

Our ability to continue to expand our operations depends on our ability to attract and retain a large and growing number of qualified associates. Our ability to meet our labor needs generally while controlling our associate wage and related labor costs is subject to numerous external factors, including the availability of a sufficient number of qualified persons in the work force, unemployment levels, prevailing wage rates, changing demographics, health and other insurance costs and changes in employment legislation. If we are unable to locate, attract and retain qualified personnel or if our costs of labor or related costs increase significantly, our financial performance could be affected adversely.

9

We rely extensively on communication and computer systems to process transactions, summarize results and manage our business. Disruptions in these systems could harm our ability to run our business.

Given the number of individual transactions that we have each year, it is critical that we maintain uninterrupted operation of our computer and communications hardware and software systems. Our systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, catastrophic events, such as acts of God, fires, tornadoes, hurricanes, floods, earthquakes, power losses, telecommunications failures, acts of war or terrorism, physical or electronic break-ins and similar events or disruptions, and usage errors by our employees. If our systems are damaged or cease to function properly, we may have to make a significant investment to fix or replace them, and we may suffer interruptions in our operations in the interim. Any material interruption in our computer operations may have a material adverse effect on our business or results of operations.

Our electronic commerce trade faces business risks, which include:

• competition from other Internet-based companies and traditional retailers;

• risks associated with a failure to manage growth effectively;

• risks of the Internet as a medium for commerce, including Internet security risks;

• risks associated with the need to keep pace with rapid technological change;

• risks of system failure or inadequacy; and

• risks associated with the maintenance of domain names.

If any of these risks materialize, it could have an adverse effect on our electronic commerce trade.

Government regulation of the Internet and e-commerce is evolving, and unfavorable changes could harm our business.

We are subject to general business regulations and laws, as well as regulations and laws specifically governing the Internet and e-commerce. Such existing and future laws and regulations may impede the growth of the Internet or other online services. These regulations and laws may cover taxation, privacy, data protection, pricing, content, copyrights, distribution, electronic contracts and other communications, consumer protection, the provision of online payment services, unencumbered Internet access to our services and the characteristics and quality of products and services. It is not clear how existing laws governing issues such as property ownership, sales and other taxes, libel and personal privacy apply to the Internet and e-commerce. Unfavorable resolution of these issues may harm our business.

We could be liable for breaches of security on our website.

A fundamental requirement for e-commerce is the secure storage and transmission of confidential information. Although we have developed systems and processes that are designed to protect consumer information and prevent fraudulent credit card transactions and other security breaches, failure to prevent or mitigate such fraud or breaches may adversely affect our business or results of operations.

We are subject to a number of risks related to payments that we accept.

We accept payments by a variety of methods, including credit card, debit card, gift cards, direct debit from a customer’s bank account, physical bank check and cash. For certain payment transactions, including credit and debit cards, we pay interchange and other fees, which may increase over time and raise our operating costs and lower our profit margins. We are also subject to payment card association operating rules, certification requirements and rules governing electronic funds transfers, which could change or be reinterpreted to make it difficult or impossible for us to comply. If we fail to comply with these rules or requirements, we may be subject to fines and higher transaction fees and lose our ability to accept credit and debit card payments from our customers, process electronic funds transfers or facilitate other types of online payments, and our business and operating results could be adversely affected. If one or more of these agreements are terminated and we are unable to replace them on similar terms, or at all, it could adversely affect our operating results. In addition, as we offer new payment options to our customers, we may be subject to additional regulations and compliance requirements and a greater risk of fraud.

We may be unable to protect our intellectual property, which could harm our brand and reputation.

To protect our proprietary rights in our intellectual property, we rely generally on copyright, trademark and trade secret laws. Although we do not believe that our trademarks and other intellectual property are materially important to the continuation of our operations, our failure or inability to maintain or protect our proprietary rights could materially decrease their value, and our brand and reputation could be harmed as a result.

10

We are subject to certain legal proceedings that may affect our financial condition and results of operations.

We are involved in a number of legal proceedings. In the opinion of management, after consultation with legal counsel, the ultimate liability, if any, with respect to those proceedings is not presently expected to materially affect our financial condition or results of operations. However, we can give no assurances that certain lawsuits either now or in the future will not materially affect our financial condition or results of operations.

Changes in our effective income tax rate could affect our results of operations.

Our effective income tax rate is influenced by a number of factors. Changes in the tax laws, the interpretation of existing laws or our failure to sustain our reporting positions on examination could adversely affect our effective income tax rate and, as a result, our results of operations.

Changes in accounting standards could affect our results of operations.

A change in accounting standards or practices can have a significant effect on our reported results of operations. New accounting pronouncements and interpretations of existing accounting rules and practices have occurred and may occur in the future. Changes to existing rules may adversely affect our reported financial results.

If the Company is unable to renew or enter into new leases on favorable terms, our revenue growth may decline.

All of the Company’s stores are located in leased premises. If the cost of leasing existing stores increases, the Company cannot assure that we will be able to maintain our existing store locations as leases expire. In addition, the Company may not be able to enter into new leases on favorable terms or at all, or we may not be able to locate suitable alternative sites or additional sites for new store expansion in a timely manner. The Company’s revenues and earnings may decline if the Company fails to maintain existing store locations, enter into new leases, locate alternative sites or find additional sites for new store expansion.

The Company may engage in acquisitions which, among other things, could negatively impact our business if we fail to successfully complete and integrate them.

To enhance our efforts to grow and compete, the Company may engage in acquisitions. Any future acquisitions are subject to the Company’s ability to negotiate favorable terms for them. Accordingly, the Company cannot assure that future acquisitions will be completed. In addition, to facilitate future acquisitions, the Company may take actions that could dilute the equity interests of our stockholders, increase our debt or cause us to assume contingent liabilities, all of which may have a detrimental effect on the price of our common stock. Finally, if any acquisitions are not successfully integrated with the Company’s business, the Company’s ongoing operations could be adversely affected.

The occurrence of severe weather events, catastrophic health events or natural disasters could significantly damage or destroy our retail locations, could prohibit consumers from traveling to our retail locations or could prevent us from resupplying our stores or distribution centers, especially during peak shopping seasons.

Unforeseen events, including public health issues, and natural disasters such as earthquakes, hurricanes, snow storms, floods and heavy rains, could disrupt our operations or the operations of our suppliers, as well as the behavior of our consumer. We believe that we take reasonable precautions to prepare particularly for weather-related events, however, our precautions may not be adequate to deal with such events in the future. As these events occur in the future, if they should impact areas in which we have our distribution centers or a concentration of retail stores, such events could have a material adverse effect on our business, financial condition and results of operations, particularly if they occur during peak shopping seasons.

Increases in transportation costs due to rising fuel costs, climate change regulation and other factors may negatively impact our operating results.

We rely upon various means of transportation, including sea and truck, to deliver products from vendors to our distribution centers and from our distribution centers to our stores. Consequently, our results can vary depending upon the price of fuel. The price of oil has fluctuated drastically over the last few years, and may rapidly increase again, which would sharply increase our fuel costs. In addition, efforts to combat climate change through reduction of greenhouse gases may result in higher fuel costs through taxation or other means. Any such future increases in fuel costs would increase our transportation costs for delivery of product to our distribution centers and distribution to our stores, as well as our vendors’ transportation costs, which could decrease our operating results.

In addition, labor shortages in the transportation industry could negatively affect transportation costs and our ability to supply our stores in a timely manner. In particular, our business is highly dependent on the trucking industry to deliver products to our distribution centers and our stores. Our operating results may be adversely affected if we or our vendors are unable to secure adequate trucking resources at competitive prices to fulfill our delivery schedules to our distribution centers or our stores.

11

Our stock price may be subject to volatility.

The trading price of our common stock may fluctuate in response to a number of events and factors, many of which are beyond our control, such as:

• general economic conditions;

• changes in interest rates;

• conditions or trends in the retail book and electronic commerce trade industries;

• fluctuations in the stock market in general;

• quarterly variations in operating results;

• new products, services, innovations and strategic developments by our competitors or us, or business combinations and investments by our competitors or us;

• changes in financial estimates by us or securities analysts and recommendations by securities analysts;

• changes in regulation;

• changes in our capital structure, including issuance of additional debt or equity to the public;

• corporate restructurings, including layoffs or closures of facilities;

• changes in the valuation methodology of, or performance by, others in the retail book and electronic trade industries; and

• transactions in our common stock by major investors, and analyst reports, news and speculation.

Any of these events may cause our stock price to rise or fall and may adversely affect our financial condition or results of operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

12

ITEM 2. PROPERTIES

Our bookstores are generally located either in enclosed malls or strip shopping centers. All of our stores are leased. Generally, these leases have terms ranging from three to ten years and require that we pay a fixed minimum rental fee and/or a rental fee based on a percentage of net sales together with certain customary costs (such as property taxes, common area maintenance and insurance).

The number of stores located in each state and the District of Columbia as of January 30, 2010 are listed below:

|

State

|

Number of Super Stores

|

Number of Traditional Book Stores

|

|

Florida

|

39

|

1

|

|

Alabama

|

25

|

2

|

|

Virginia

|

17

|

2

|

|

Tennessee

|

16

|

1

|

|

N. Carolina

|

15

|

2

|

|

Georgia

|

15

|

2

|

|

S. Carolina

|

14

|

--

|

|

Texas

|

11

|

--

|

|

Louisiana

|

10

|

--

|

|

Mississippi

|

7

|

4

|

|

Ohio

|

5

|

1

|

|

Indiana

|

4

|

--

|

|

Kentucky

|

4

|

3

|

|

Arkansas

|

4

|

--

|

|

W. Virginia

|

4

|

--

|

|

Missouri

|

3

|

--

|

|

Oklahoma

|

2

|

--

|

|

Maryland

|

2

|

2

|

|

Illinois

|

1

|

1

|

|

District of Columbia

|

1

|

--

|

|

Nebraska

|

1

|

--

|

|

Kansas

|

1

|

--

|

|

New Jersey

|

--

|

1

|

|

Total

|

201

|

22

|

The Company operates two distribution facilities near Florence, Alabama. The combined square footage of these distribution facilities is 538,000 square feet.

Our principal executive offices are located in a 20,550 square-foot leased building located in Birmingham, Alabama. Until October 2009, we also leased a 37,000 square-foot building located in Irondale, Alabama. Each of the leases involves related parties, see Note 7, "Related Party Transactions," in the notes to consolidated financial statements. The Birmingham, Alabama office space is leased month-to-month. The Irondale, Alabama office space was leased month-to-month. In addition, we lease approximately 4,025 square feet of office space in Nashville, Tennessee and an additional 28,300 square-foot building located in Birmingham, Alabama for additional corporate office space. The Nashville, Tennessee space is leased month-to-month. The additional Birmingham space is leased until February 28, 2013. We believe that the loss of any office space currently leased on a month-to-month basis would not have a material adverse effect on our business, financial condition or results of operations.

American Wholesale owns a wholesale distribution center located in an approximately 290,000 square foot facility in Florence, Alabama. During fiscal 1995 and 1996, we financed the acquisition and construction of the wholesale distribution facility through loans obtained from the proceeds of an industrial development revenue bond (the “Bond”). American Wholesale also leases on a month-to-month basis, from a related party, a second 210,000 square foot warehouse facility located in Tuscumbia, Alabama. We believe that the failure to extend the lease for this warehouse facility currently leased on a month-to-month basis would not have a material adverse effect on our business, financial condition or results of operations. In addition we lease a portion of the tractors that pull the Company-owned trailers, which comprise our transportation fleet.

ITEM 3. LEGAL PROCEEDINGS

We are a party to various legal proceedings in the normal course of our business. In the opinion of management, after consultation with legal counsel, the ultimate liability, if any, with respect to those proceedings is not presently expected to materially affect our financial condition or results of operations.

13

ITEM 4. RESERVED

Not Applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of Books-A-Million, Inc. is traded on the NASDAQ Global Select Market under the symbol "BAMM." The chart below sets forth the high and low sales prices for the Company's common stock for each quarter of the fiscal years ended January 30, 2010 and January 31, 2009, and the cash dividends declared per share in each such quarter.

|

Fiscal Quarter Ended

|

High

|

Low

|

Dividends Declared

|

|||

|

January 2010

|

$9.00

|

$5.90

|

$0.15

|

|||

|

October 2009

|

15.00

|

8.25

|

0.05

|

|||

|

July 2009

|

12.00

|

5.77

|

0.05

|

|||

|

April 2009

|

5.93

|

2.30

|

0.05

|

|||

|

January 2009

|

3.16

|

1.70

|

0.05

|

|||

|

October 2008

|

7.37

|

2.64

|

0.05

|

|||

|

July 2008

|

8.80

|

5.05

|

0.09

|

|||

|

April 2008

|

$10.76

|

$7.55

|

$0.09

|

The closing price for the Company's common stock on March 26, 2010 was $7.11. As of that date Books-A-Million, Inc. had approximately 6,779 stockholders of record.

14

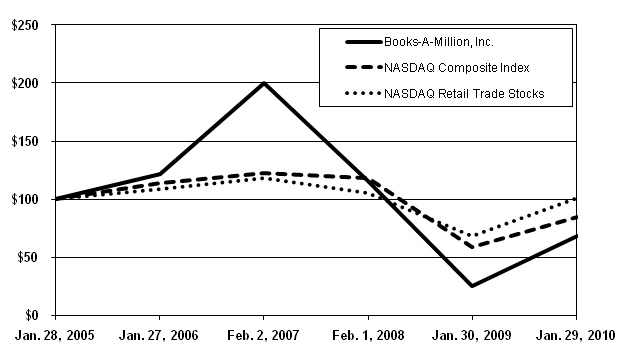

Comparison of 5-Year Cumulative Total Return

Among Books-A-Million, Inc., the NASDAQ Composite Index and the NASDAQ Retail Trade Stock Index

The following indexed line graph indicates the Company’s total return to stockholders from January 28, 2005 to January 29, 2010, the last trading day prior to the Company’s 2010 fiscal year end, as compared to the total return for the NASDAQ Composite Index and the NASDAQ Retail Trade Stock Index for the same period. Total stockholder return for prior periods is not necessarily an indication of future performance.

|

Jan 28,

|

Jan 27,

|

Feb 2,

|

Feb 1,

|

Jan 30,

|

Jan 29,

|

|||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||

|

Books-A-Million, Inc.

|

$100

|

$122

|

$200

|

$115

|

$25

|

$68

|

||||||

|

NASDAQ Composite Index

|

$100

|

$114

|

$122

|

$119

|

$58

|

$84

|

||||||

|

NASDAQ Retail Trade Stocks

|

$100

|

$108

|

$118

|

$105

|

$68

|

$101

|

15

Issuer Purchases of Equity Securities

The following table shows common stock repurchases during the thirteen weeks ended January 30, 2010 under the stock repurchase program approved by our board of directors on March 26, 2009 (the "2009 Repurchase Program"), under which we were authorized to purchase up to $5 million of our common stock.

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Program

|

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program at End of Period

|

||||

|

November 1, 2009 through November 28, 2009

|

--

|

--

|

--

|

$4,480,000

|

||||

|

November 29, 2009 through December 2, 2009

|

54,000

|

$7.27

|

54,000

|

$4,090,000

|

||||

|

December 3, 2009 through January 30, 2010

|

24,000

|

$6.45

|

24,000

|

$3,924,000

|

||||

|

Total

|

78,000

|

$7.14

|

78,000

|

$3,924,000

|

In March 2010, our board of directors approved a new stock repurchase program (the “March 2010 Program”) to replace the 2009 Repurchase Program. Pursuant to the March 2010 Program, we are authorized to purchase up to $5 million of our common stock.

Under the 2009 Repurchase Program, the Company repurchased a total of 165,000 shares at a cost of $1.1 million during the fiscal year ended January 30, 2010. As of January 30, 2010, the Company had repurchased a total of 5,621,081 shares of our common stock at a cost of $47.3 million in total under the repurchase programs.

16

ITEM 6. SELECTED FINANCIAL DATA

The following selected consolidated financial data has been derived from the consolidated financial statements of the Company. The data set forth below should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and notes to financial statements thereto.

|

For the Fiscal Year Ended:

|

||||||||||||||||||||

|

(In thousands, except per share amounts, ratios and

|

January 30,

|

January 31,

|

February 2,

|

February 3,

|

January 28,

|

|||||||||||||||

|

operational data)

|

2010

|

2009(2)

|

2008(2)

|

2007(1) (2)

|

2006(2)

|

|||||||||||||||

|

Statement of Income Data

|

52 weeks

|

52 weeks

|

52 weeks

|

53 weeks

|

52 weeks

|

|||||||||||||||

|

Net revenue

|

$ | 508,667 | $ | 515,357 | $ | 536,054 | $ | 520,724 | $ | 503,751 | ||||||||||

|

Net income

|

13,836 | 10,574 | 16,522 | 18,887 | 13,067 | |||||||||||||||

|

Earnings per share - diluted

|

0.88 | 0.68 | 1.00 | 1.12 | 0.78 | |||||||||||||||

|

Weighted average shares - diluted

|

15,744 | 15,676 | 16,476 | 16,818 | 16,750 | |||||||||||||||

|

Dividends per share - declared

|

0.30 | 0.28 | 3.36 | 0.33 | 0.23 | |||||||||||||||

|

|

||||||||||||||||||||

|

Balance Sheet Data

|

||||||||||||||||||||

|

Property and equipment, net

|

$ | 53,141 | $ | 58,038 | $ | 53,514 | $ | 51,471 | $ | 51,001 | ||||||||||

|

Total assets

|

273,498 | 279,292 | 284,833 | 304,037 | 311,659 | |||||||||||||||

|

Long-term debt

|

6,360 | 6,720 | 6,975 | 7,100 | 7,200 | |||||||||||||||

|

Deferred Rent

|

8,319 | 8,554 | 8,079 | 8,706 | 8,637 | |||||||||||||||

|

Liability for uncertain tax positions

|

1,901 | 2,032 | 2,174 | -- | -- | |||||||||||||||

|

Stockholders’ equity

|

114,708 | 104,494 | 99,051 | 157,034 | 145,009 | |||||||||||||||

|

Statement of Cash Flow Data

|

||||||||||||||||||||

|

Cash flows from operating activities

|

$ | 31,985 | $ | 39,223 | $ | 34,494 | $ | 21,306 | $ | 36,713 | ||||||||||

|

Cash flows from investing activities

|

(10,622 | ) | (19,806 | ) | (16,878 | ) | (16,176 | ) | (11,286 | ) | ||||||||||

|

Cash flows from financing activities

|

(20,290 | ) | (19,483 | ) | (46,142 | ) | (8,528 | ) | (4,467 | ) | ||||||||||

|

Other Data

|

||||||||||||||||||||

|

Working capital

|

$ | 74,904 | $ | 62,145 | $ | 58,785 | $ | 117,737 | $ | 106,637 | ||||||||||

|

Debt to total capital ratio

|

0.06 | 0.22 | 0.35 | 0.05 | 0.05 | |||||||||||||||

|

Operational Data

|

||||||||||||||||||||

|

Total number of stores

|

223 | 220 | 208 | 206 | 205 | |||||||||||||||

|

Number of superstores

|

201 | 200 | 184 | 179 | 173 | |||||||||||||||

|

Number of traditional stores

|

22 | 20 | 24 | 27 | 32 | |||||||||||||||

|

(1)

|

The year ended February 3, 2007 included an extra week and $2.3 million of gift card breakage from prior periods.

|

|

(2)

|

On February 1, 2009, the Company adopted Financial Accounting Standards Board (the "FASB") Accounting Standards Codification ("ASC") 260-10-45, Earnings per Share, for calculating earnings per share when participating securities are present. The Company's unvested restricted stock awards pay dividends and therefore qualify as participating securities. The above information reflects the effect of this change as if the Company had adopted ASC 260-10-45 at the beginning of the earliest period presented.

|

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

The Company was founded in 1917 and currently operates 223 retail bookstores concentrated primarily in the southeastern United States. Of the 223 stores, 201 are superstores that operate under the names Books-A-Million and Books & Co., and 22 are traditional stores that operate under the Bookland and Books-A-Million names. In addition to the retail store formats, the Company offers its products over the Internet at www.booksamillion.com. As of January 30, 2010, the Company employed approximately 5,500 full and part-time employees.

The Company’s growth strategy is focused on opening stores in new and existing market areas. In addition to opening new stores, management intends to continue its practice of reviewing the profitability trends and prospects of existing stores and closing or relocating under-performing stores. During fiscal 2010, the Company opened five stores, closed two stores and relocated four stores.

17

The Company’s performance is partially measured based on comparable store sales, which is similar to most retailers. Comparable store sales are determined each fiscal quarter during the year based on all stores that have been open at least 12 full months as of the first day of the fiscal period. Any stores closed during a fiscal period are excluded from comparable store sales as of the first day of the fiscal period in which they close. Remodeled and relocated stores are also included as comparable stores. The factors affecting the future trend of comparable store sales include, among others, overall demand for products the Company sells, the Company’s marketing programs, pricing strategies, store operations and competition.

Current Economic Environment

The United States and global economies are presently experiencing extremely challenging times and it is possible that general economic conditions could persist or deteriorate further. The Company believes that these conditions have had and may continue to have an adverse impact on spending by the Company’s current retail customer base and potential new customers. Because of these significant challenges, we are continuously reviewing and adjusting our business activities to address the changing economic environment. We are carefully managing our inventory and liquidity and enforcing expense controls while working diligently and prudently to grow our business. Despite overall store number growth in fiscal 2010, the Company reduced its year-end inventory balance by $2.8 million as of January 30, 2010 to $201.5 million, as compared to the fiscal year-end 2009 balance of $204.3 million. In addition, we reduced our outstanding loan balance at fiscal year-end 2010 under the Company’s revolving credit facility to $0. This credit facility had a balance of $15.8 million at January 31, 2009. The Company was also able to reduce its operating, selling and administrative expenses during fiscal 2010 by $3.6 million as compared to fiscal 2009. The Company opened five new stores, closed two stores and relocated four stores in fiscal 2010. Because of the uncertainty in the overall economic environment, the unpredictability of consumer behavior and the concern as to whether economic conditions will improve, it is very difficult for us to predict how our business may be affected in the future. Our business and financial performance may be adversely affected by current and future economic conditions that cause a further decline in business and consumer spending, including limited or further reduced availability of credit, continued high or increased unemployment levels, higher energy and fuel costs, rising interest rates, financial market volatility and long-term downturn. These conditions could have a negative impact on the earnings, liquidity and capital resources of the Company.

Executive Summary

The purpose of this section is to provide a brief summary overview of the 52-week period ended January 30, 2010. Additional detail about the income statement and balance sheet is provided in the pages following this summary.

Income Statement

For the 52-week period ended January 30, 2010, Books-A-Million reported net income of $13.8 million. This represents a 30.9% increase from the 52-week period ended January 31, 2009. The increase is primarily attributable to overall cost cutting measures and reduced store opening, closing, and remodeling expenses.

Consolidated net revenue decreased $6.7 million, or 1.3%, in the 52-week period ended January 30, 2010, compared to the 52-week period ended January 31, 2009. The decrease is due to a comparable store sales decline of 3.8% in fiscal 2010 compared to fiscal 2009, and reduced Internet and wholesale book sales, offset in part by a $16.8 million increase in sales from our stores open less than one year. The comparable store sales decline is the result of weak economic conditions and the anniversary of very strong sales of the Twilight series by Stephanie Meyer in the prior year.

Gross profit, which includes cost of sales, distribution costs and occupancy costs, decreased $1.2 million, or 0.8%, in the 52-week period ended January 30, 2010, compared to the 52-week period ended January 31, 2009. The decrease is attributable to lower sales. Gross profit as a percentage of sales increased from 29.8% to 29.9% over the same period. This increase is attributable to improved sales of higher margin items, lower occupancy and distribution costs, offset by higher inventory shrinkage and markdowns.

Operating, selling and administrative expenses decreased $3.6 million, or 3.1%, in the 52-week period ended January 30, 2010, compared to the 52-week period ended January 31, 2009. The decrease was attributable to reduced corporate salaries and restricted stock expense, reduced travel expenses, reduced professional fees, reduced repair and maintenance expenses and reduced store opening, closing and remodeling expenses, offset by higher health insurance and store associate salaries.

Impairment charges decreased $0.3 million in the 52-week period ended January 30, 2010, compared to the 52-week period ended January 31, 2009. The decrease was attributable to a $0.7 million goodwill impairment charge in the prior year that was not repeated, offset by impairment charges taken on leasehold improvements at various stores in the prior year.

Consolidated operating profit was $21.7 million for the 52-week period ended January 30, 2010, compared to $18.9 million for the 52-week period ended January 31, 2009, an increase of $2.8 million. This increase was attributable to decreased operating, selling and administrative expenses.

18

Balance Sheet

Current assets decreased $2.5 million, or 1.2%, in fiscal year 2010 compared to fiscal year 2009. The decrease is attributable to a $2.8 million decrease in inventory, a $0.3 million decrease in prepaid expenses and a $0.5 million decrease in accounts and related party receivables, partially offset by a $1.1 million increase in cash and cash equivalents. The reduction in inventory is attributable to a tight focus on inventory reduction and control in our warehouse in response to difficult macro-economic conditions. The decrease in accounts and related party receivables is the result of reduced sales. The increase in cash and cash equivalents is the result of having excess cash after paying off all short-term debt.

Current liabilities decreased $15.3 million, or 9.7%, in fiscal year 2010 compared to fiscal year 2009. The decrease is attributable to a $15.8 million decrease in short-term borrowings and a $6.1 million decrease in accounts payable, partially offset by a $5.6 million increase in accrued income taxes and deferred taxes and a $1.0 million increase in accrued expenses. The decrease in short-term borrowings is the result of cost control measures, a reduction in inventory and an increase in accounts payable leverage. Accounts payable decreased due to reduced inventory levels and more effective management of payment terms. The increase in accrued expenses is the result of higher bonus accruals, payroll taxes and real estate taxes.

Results of Operations

The following table sets forth statement of income data expressed as a percentage of net sales for the periods presented.

|

Fiscal Year Ended

|

||||||||||||

|

January 30, 2010

|

January 31, 2009

|

February 2, 2008

|

||||||||||

|

52 weeks

|

52 weeks

|

52 weeks

|

||||||||||

|

Net revenue

|

100.0 | % | 100.0 | % | 100.0 | % | ||||||

|

Gross profit

|

29.9 | % | 29.8 | % | 29.7 | % | ||||||

|

Operating, selling, and administrative expenses

|

22.6 | % | 23.0 | % | 22.0 | % | ||||||

|

Impairment charges

|

0.2 | % | 0.3 | % | 0.0 | % | ||||||

|

Depreciation and amortization

|

2.8 | % | 2.8 | % | 2.6 | % | ||||||

|

Operating profit

|

4.3 | % | 3.7 | % | 5.1 | % | ||||||

|

Interest expense, net

|

0.1 | % | 0.4 | % | 0.3 | % | ||||||

|

Income before income taxes

|

4.1 | % | 3.3 | % | 4.9 | % | ||||||

|

Provision for income taxes

|

1.4 | % | 1.2 | % | 1.8 | % | ||||||

|

Net income

|

2.7 | % | 2.1 | % | 3.1 | % | ||||||

Fiscal 2010 Compared to Fiscal 2009

Consolidated net revenue decreased $6.7 million, or 1.3%, to $508.7 million for the 52-week period ended January 30, 2010 as compared to $515.4 million for the 52-week period ended January 31, 2009.

Comparable store sales for the 52-week period ended January 30, 2010 decreased 3.8% when compared to the same 52-week period in the prior fiscal year. The decrease in comparable store sales was attributable to weak economic conditions and the anniversary of very strong sales of the Twilight series by Stephanie Meyer in the prior year.

Our core book department business was down for the year. However, several categories performed well. Fiction based titles and political science related titles demonstrated strength. The teen category continued to see an impact from the success of Stephanie Meyer’s Twilight series. Titles such as Sarah Palin’s, Going Rogue, and Glenn Beck’s, Arguing with Idiots, also had a positive impact. Bargain books and gifts continued to increase year over year driven by the broader economic climate and better product assortments.

The Company opened five new stores during fiscal 2010, resulting in partial year sales of $5.6 million, and closed two stores during fiscal 2010 with partial year sales of $1.0 million.

Net sales for the retail trade segment decreased $7.0 million, or 1.4%, to $503.3 million in the 52-week period ended January 30, 2010, from $510.3 million in the 52-week period ended January 31, 2009. The decrease is due to the 3.8% decrease in comparable store sales as described above, partially offset by the impact of sales from new stores opened in fiscal 2009 and fiscal 2010.

Net sales for the electronic commerce segment decreased $1.4 million, or 5.3%, to $23.8 million in the 52-week period ended January 30, 2010, from $25.2 million in the 52-week period ended January 31, 2009. The decrease in net sales for the electronic commerce segment was due to macro-economic conditions and decreased business-to-business sales.

19

Gross profit, which includes cost of sales, distribution costs and occupancy costs (including rent, common area maintenance, property taxes, utilities and merchant association dues), decreased $1.2 million, or 0.8%, to $152.2 million in the 52-week period ended January 30, 2010, from $153.4 million in the 52-week period ended January 31, 2009. Gross profit as a percentage of net sales increased to 29.9% in the 52-week period ended January 30, 2010, from 29.8% in the 52-week period ended January 31, 2009. The increase is attributable to improved sales of higher margin items, lower occupancy and distribution costs, offset by higher inventory shrinkage and markdowns.

Operating, selling and administrative expenses decreased $3.6 million, or 3.1%, to $115.1 million in the 52-week period ended January 30, 2010, from $118.7 million in the 52-week period ended January 31, 2009. Operating, selling and administrative expenses as a percentage of net sales decreased to 22.6% in the 52-week period ended January 30, 2010 from 23.0% in the 52-week period ended January 31, 2009. The decrease was attributable to reduced corporate salaries and restricted stock expenses, reduced travel expenses, reduced professional fees, reduced repair and maintenance expenses and reduced store opening, closing and remodeling expenses, offset by higher health insurance costs and store associate salaries.

Impairment charges decreased $0.3 million in the 52-week period ended January 30, 2010, compared to the 52-week period ended January 31, 2009. The decrease was attributable to a $0.7 million goodwill impairment charge in the prior year that was not repeated, offset by impairment charges taken on leasehold improvements at various stores.

Depreciation and amortization expenses decreased $0.1 million, or 0.4%, to $14.4 million in fiscal 2010, from $14.5 million in fiscal 2009. Depreciation and amortization expenses as a percentage of net sales remained flat at 2.8% in fiscal 2010 and fiscal 2009.

Consolidated operating profit was $21.7 million for the 52-week period ended January 30, 2010, compared to $18.9 million for the 52-week period ended January 31, 2009. This 14.8% increase was attributable to decreased operating, selling and administrative expenses and impairment charges, partially offset by the decline in gross profit. Operating profit as a percentage of sales was 4.3% for fiscal 2010. Operating profit was 3.7% of sales for fiscal 2009. The increase as a percentage of sales from fiscal 2009 is attributable to the increase in gross margin as a percentage of sales plus the decrease in operating, selling and administrative expenses and impairment charges as outlined above. Operating profit for the electronic commerce segment decreased $0.4 million to $1.1 million in fiscal 2010, from $1.5 million in fiscal 2009. This decrease was caused by decreased sales and higher payroll expense.

Net interest expense decreased $1.3 million, or 66.8%, to $0.6 million in fiscal 2010, from $1.9 million in fiscal 2009, due to lower average debt in fiscal 2010 and lower average interest rates. Average debt for the 52-week period ended January 30, 2010 was $15.3 million compared to $41.3 million for the 52-week period ended January 31, 2009. The decrease in average debt is attributable to higher share repurchases in fiscal 2009, reduced inventory levels and high accounts payable leverage in fiscal 2010.

The effective rate for income tax purposes was 34.2% for fiscal 2010 and 37.7% for fiscal 2009. The decrease in the effective tax rate was due to a lower effective state tax rate in fiscal 2010, as well as the impact of favorable depreciation adjustments.

The Company closed one store in fiscal 2010 in a market where the Company does not expect to retain the closed store's customers at another store in the same market. The financial impact of this closing was not reported as discontinued operations in the financial statements as the impact was immaterial. The Company did not close any stores in fiscal 2009 in a market where the Company does not expect to retain the closed stores’ customers at another store in the same market.

Fiscal 2009 Compared to Fiscal 2008

Consolidated net revenue decreased $20.7 million, or 3.9%, to $515.4 million for the 52-week period ended January 31, 2009 from $536.1 million for the 52-week period ended February 2, 2008.

Comparable store sales for the 52-week period ended January 31, 2009 decreased 7.2% when compared to the same 52-week period in the prior fiscal year. The decrease in comparable store sales was attributable to severe macro-economic conditions and the positive impact of the release of Harry Potter and the Deathly Hallows on sales in the prior year.

Our core book department business was down for fiscal 2009. However, several categories performed well. Teen, faith based titles and election related titles demonstrated strength. The teen category was positively impacted by the success of Stephanie Meyer’s Twilight series. Titles such as William Young’s The Shack and Glenn Beck’s The Christmas Sweater also had a positive impact. Bargain books and gifts continued to increase year over year driven by the broader economic climate and better assortments.

The Company opened sixteen new stores during fiscal 2009 resulting in partial year sales of $13.9 million and closed four stores during fiscal 2009 with partial year sales of $1.4 million. The Company also converted one traditional store to a superstore during fiscal 2009 with partial year sales of $1.3 million.

20

Net sales for the retail trade segment decreased $19.2 million, or 3.6%, to $510.3 million in the 52-week period ended January 31, 2009, from $529.5 million in the 52-week period ended February 2, 2008. The decrease is due to the 7.2% decrease in comparable store sales as described above, partially offset by the impact of sales from new stores opened in fiscal 2008 and fiscal 2009.

Net sales for the electronic commerce segment decreased $1.8 million, or 6.8%, to $25.2 million in the 52-week period ended January 31, 2009, from $27.0 million in the 52-week period ended February 2, 2008. The decrease in net sales for the electronic commerce segment was due to severe macro-economic conditions and decreased business-to-business sales.